Exhibit 99.1

UGI TO ACQUIRE 100% OF THE PUBLICLY HELD UNITS OF AMERIGAS PARTNERS, L.P.

Proposed acquisition of third party common units follows comprehensive strategic review of AmeriGas

Transaction beneficial to both companies

Unitholders of AmeriGas to receive cash and stock consideration representing a premium of 13.5% to AmeriGas’ current trading price

UGI announces cumulative 25% dividend increase

UGI and AmeriGas update fiscal 2019 guidance

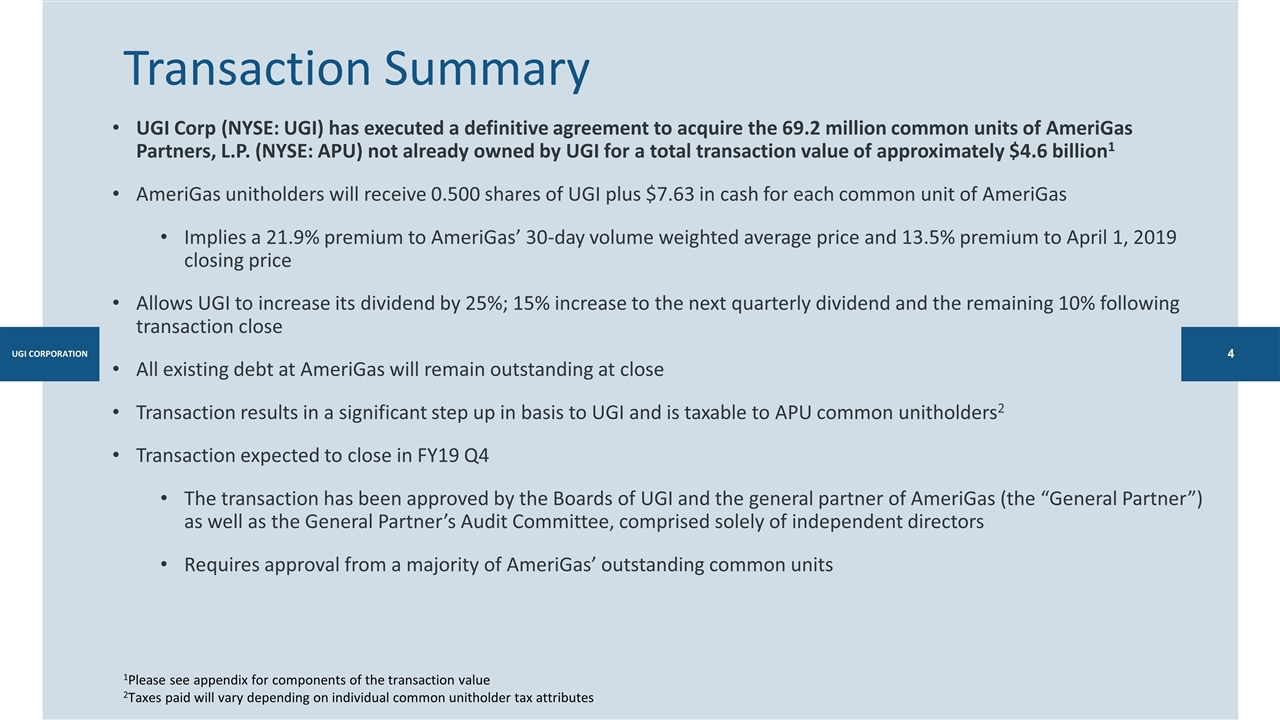

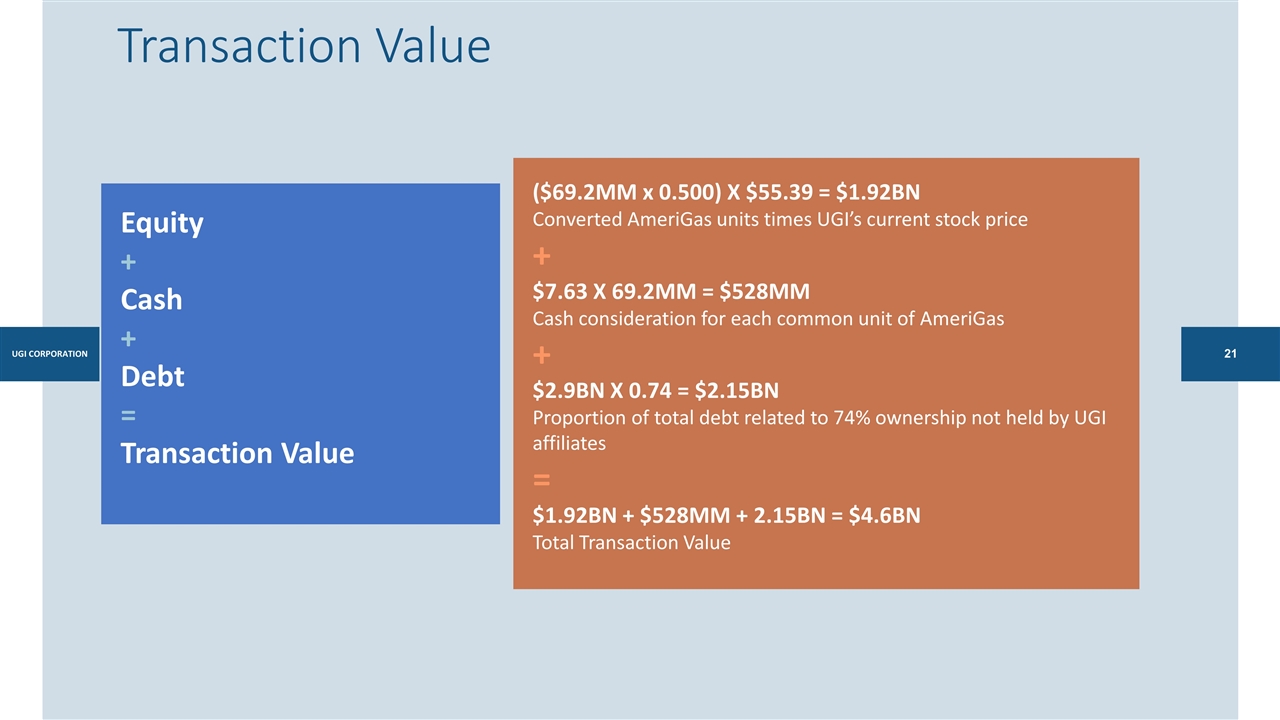

VALLEY FORGE, Pa., April 2, 2019 – UGI Corporation (NYSE: UGI) and AmeriGas Partners, L.P. (NYSE: APU; “AmeriGas”) announced today that they have entered into a merger agreement under which UGI will fully consolidate its ownership of AmeriGas, the nation’s largest retail propane marketer, by acquiring the 69.2 million publicly held common units it does not already own. Under the terms of the agreement, AmeriGas unitholders will receive 0.50 shares of UGI common stock plus $7.63 in cash consideration for each common unit of AmeriGas, representing a premium of 21.9% to AmeriGas’ 30-day volume weighted average price and a 13.5% premium to the April 1, 2019 closing price of $31.13. AmeriGas unitholders will continue to receive a $0.95 per unit distribution for each quarter completed prior to the closing of the merger.

As part of the transaction, AmeriGas will no longer be a Master Limited Partnership (“MLP”) and will instead become a wholly owned subsidiary of UGI. UGI currently holds an approximate 26% ownership interest in AmeriGas. AmeriGas Propane, Inc., a wholly owned UGI subsidiary, has served as AmeriGas’ sole general partner since 1995 (the “General Partner”).

The General Partner’s Audit Committee, comprised entirely of independent directors, after consultation with its independent legal and financial advisors, unanimously approved the merger agreement and determined it to be fair and reasonable to, and in the best interests of, AmeriGas and the unitholders unaffiliated with UGI. Subsequently, the transaction was approved by the Boards of both UGI and the General Partner.

“Our two companies have a long and successful history of working together, spanning 60 years,” said John L. Walsh, President and Chief Executive Officer of UGI. “A consolidation of AmeriGas’ ownership maximizes value for both companies and our respective stakeholders, as we will be better positioned to invest and grow. In particular, we welcome AmeriGas’ current unitholders and look forward to being exceptional stewards of their capital.”

The closing of the merger is subject to satisfaction of customary conditions. Under the partnership agreement, the merger is required to be approved by a majority of the outstanding AmeriGas common units. Affiliates of UGI own approximately 26% of the outstanding common units and have entered into a support agreement with AmeriGas whereby they have agreed to vote their common units in favor of the transaction.

1

Compelling Financial and Strategic Benefits

The transaction offers compelling financial and strategic benefits for both UGI and AmeriGas in the near and long term.

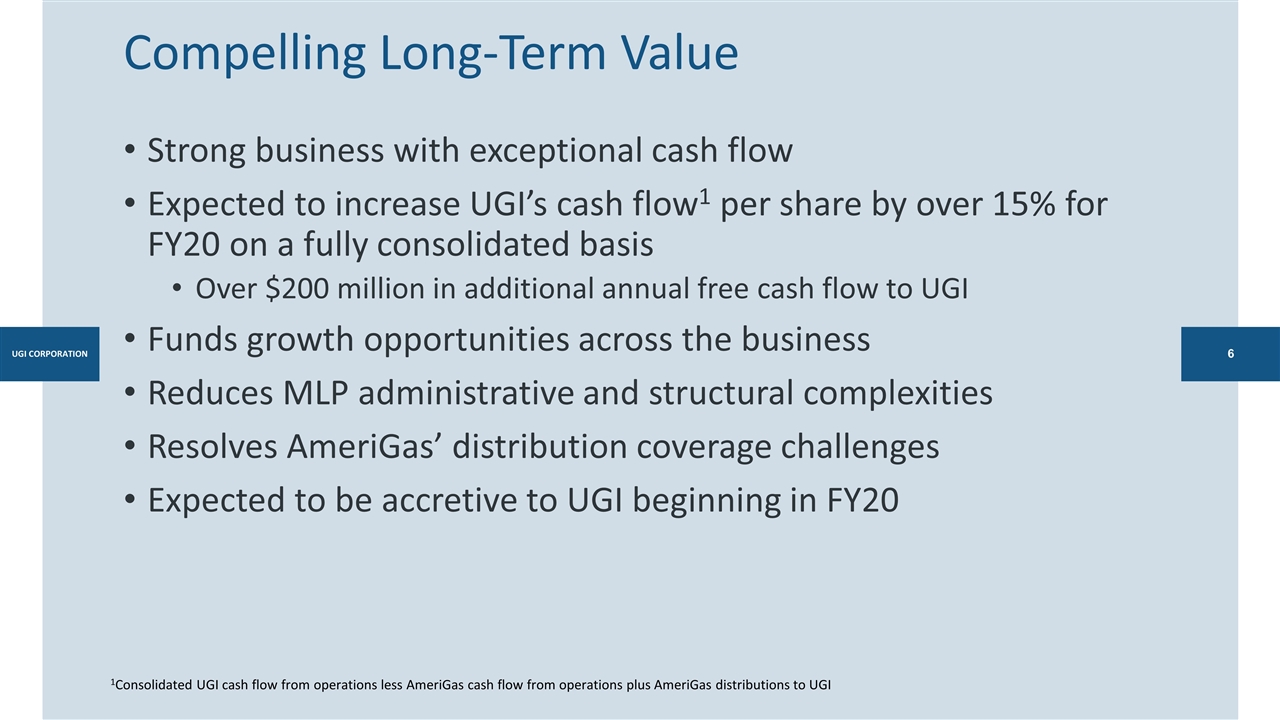

For UGI, the transaction is expected to:

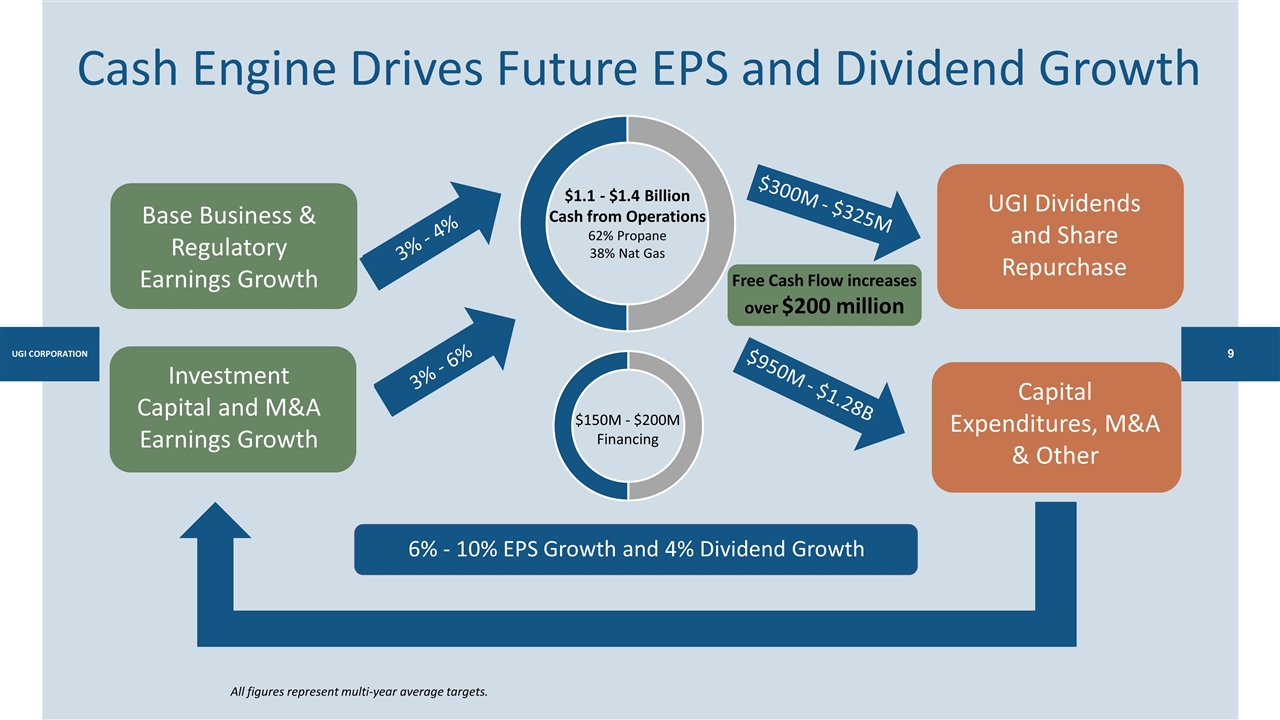

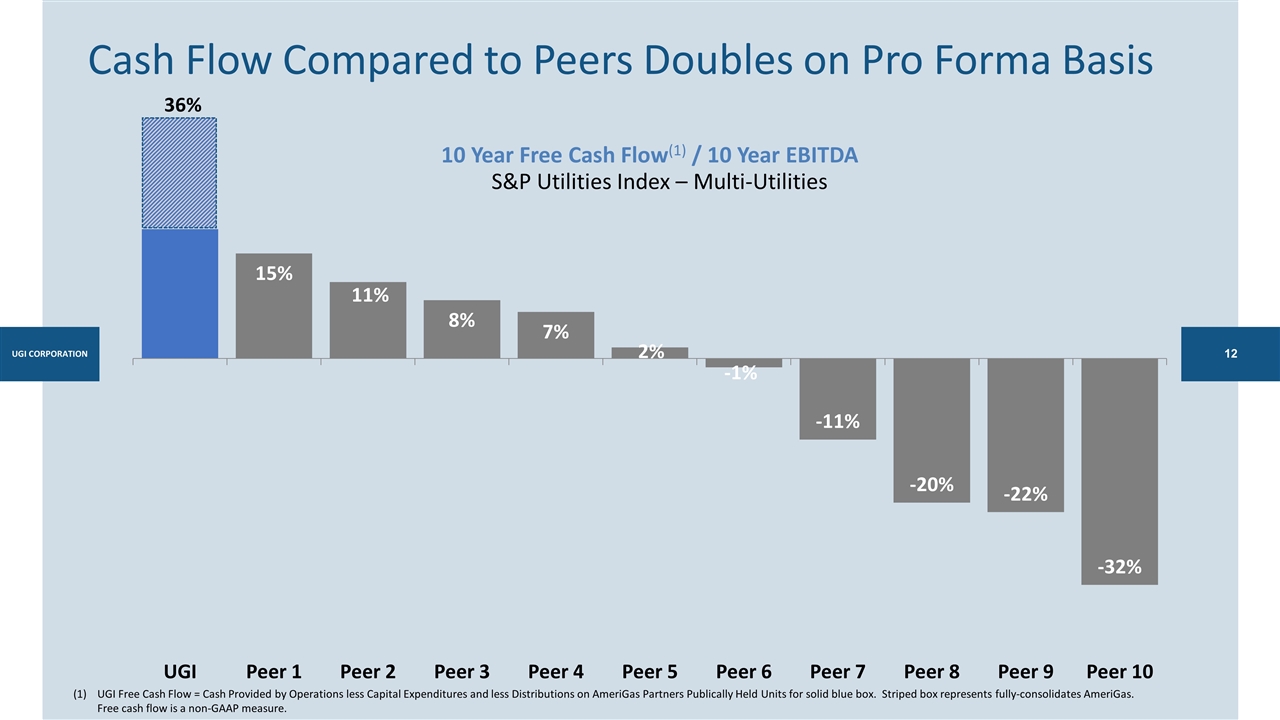

| • | Increase UGI’s cash flow per share by over 15% for fiscal 2020 on a fully consolidated basis. |

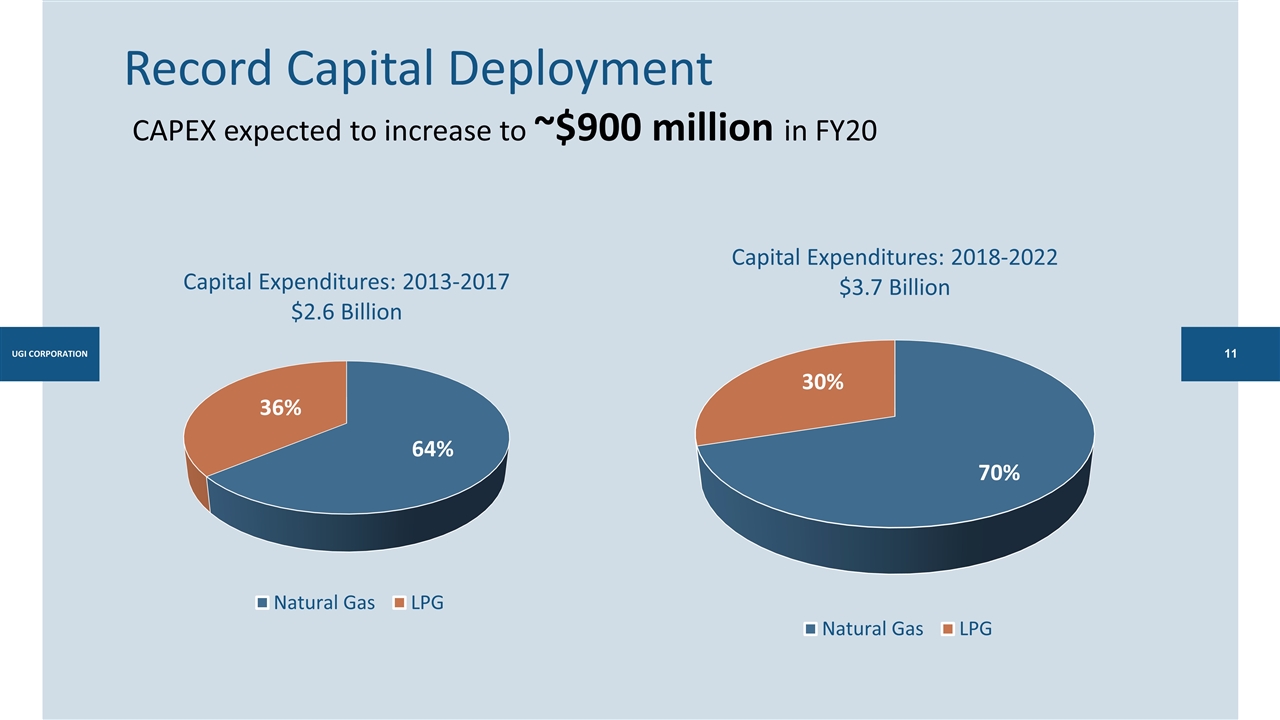

| • | Provide over $200 million in additional annual cash flow, increasing its capability to make diversified investments across all business segments to further the company’s growth strategy. |

| • | Support the increase of UGI’s annualized dividend to its shareholders, by $0.16 for the July dividend and another $0.10 following the transaction’s close. |

| • | Be accretive to Adjusted EPS beginning in fiscal 2020. |

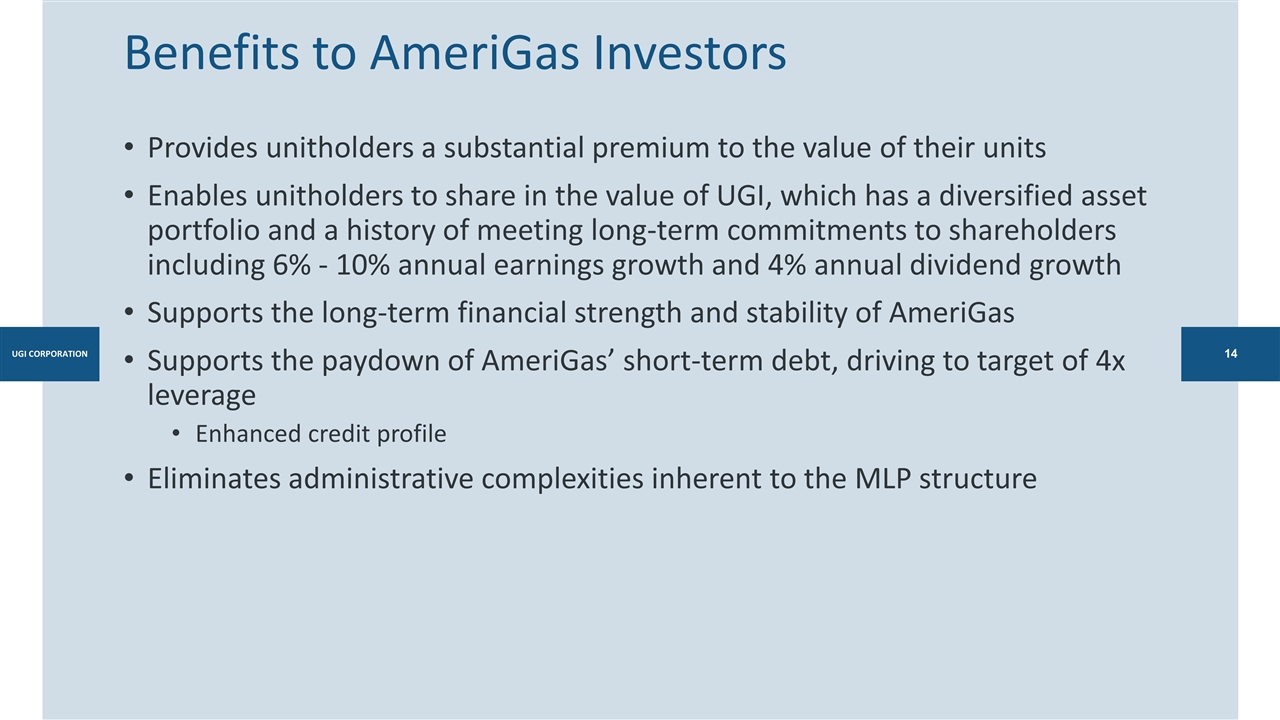

For AmeriGas and its current investors, the transaction is expected to:

| • | Provide unitholders an immediate 13.5% premium to the value of their units. |

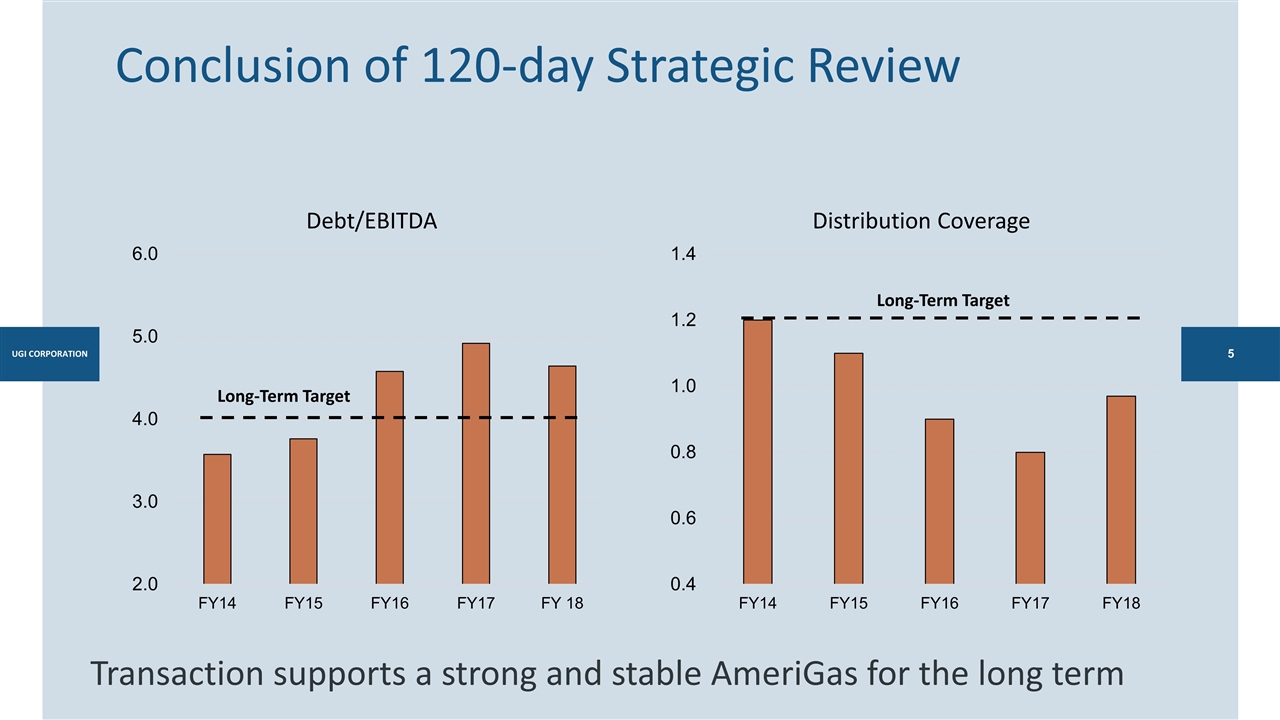

| • | Improve AmeriGas’ cost of capital through the elimination of incentive distribution rights payable to the General Partner and support the long-term strength and stability of AmeriGas. |

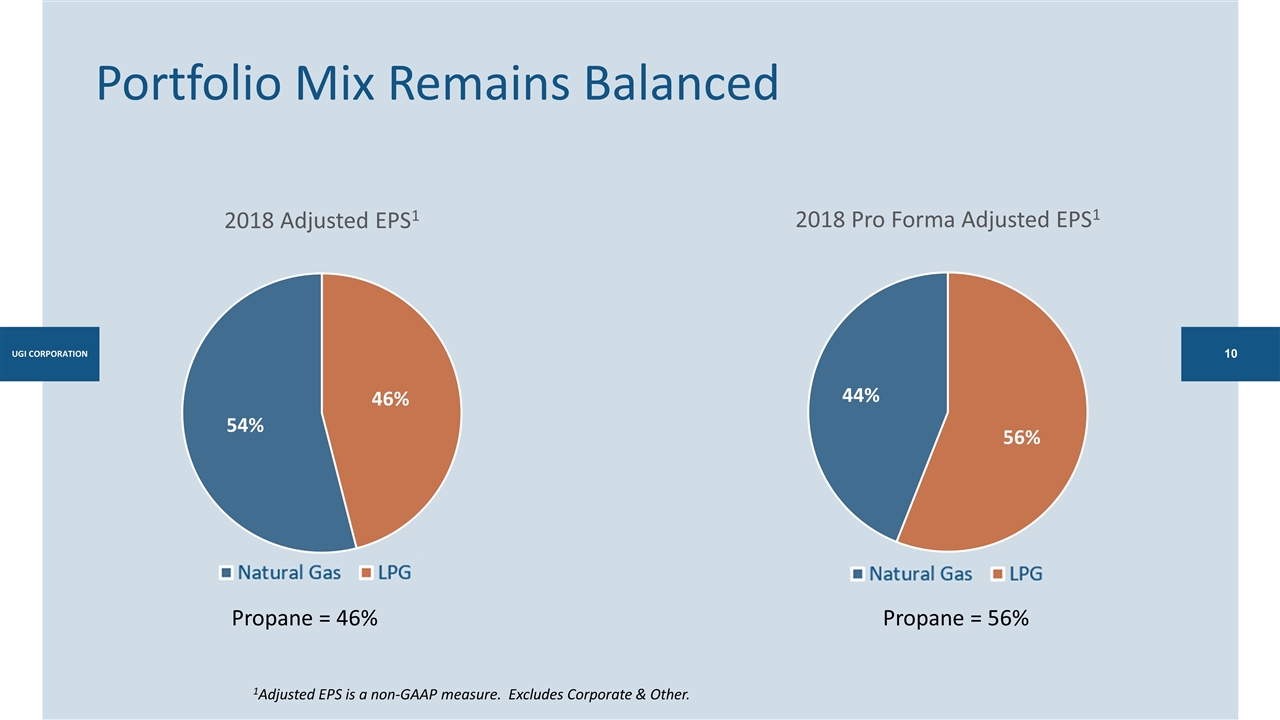

| • | Enable unitholders to share in the value of UGI, which has a diversified asset portfolio and a history of meeting long-term commitments to shareholders including 6% - 10% annual earnings growth and 4% annual dividend growth. |

| • | Support the paydown of AmeriGas’ short-term debt as a means of reducing leverage resulting in an enhanced credit profile. |

| • | Eliminate administrative complexities and costs inherent to the MLP structure and resolve distribution coverage challenges. |

“After conducting a comprehensive review of strategic alternatives, both the AmeriGas and UGI Boards determined that a merger of AmeriGas was the most compelling next step in our development. The transaction with UGI supports a strong and stable AmeriGas and empowers a focus on growth opportunities,” said Hugh J. Gallagher, President and Chief Executive Officer of AmeriGas.

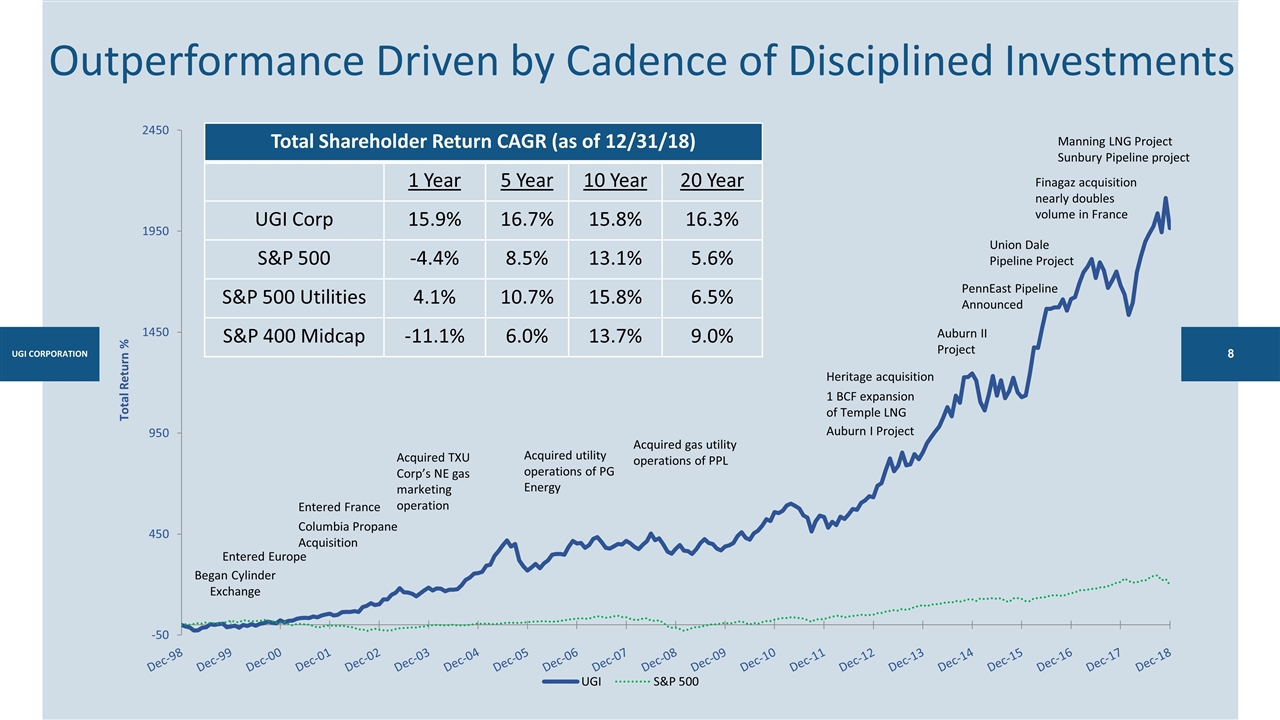

Roger Perreault, Executive Vice President, Global LPG, added, “This transaction provides an opportunity to further align AmeriGas and UGI International’s LPG distribution operations to drive efficiencies, support strategic initiatives, and accelerate growth. Additionally, AmeriGas unitholders will share in the value of a company with an outstanding track record of enhancing shareholder value.”

John L. Walsh concluded, “We are pleased to increase our ownership of AmeriGas. This merger offers a compelling premium for AmeriGas unitholders and creates a platform for future cash flow and earnings growth for UGI. Our dividend increases represent our confidence in that future outlook.”

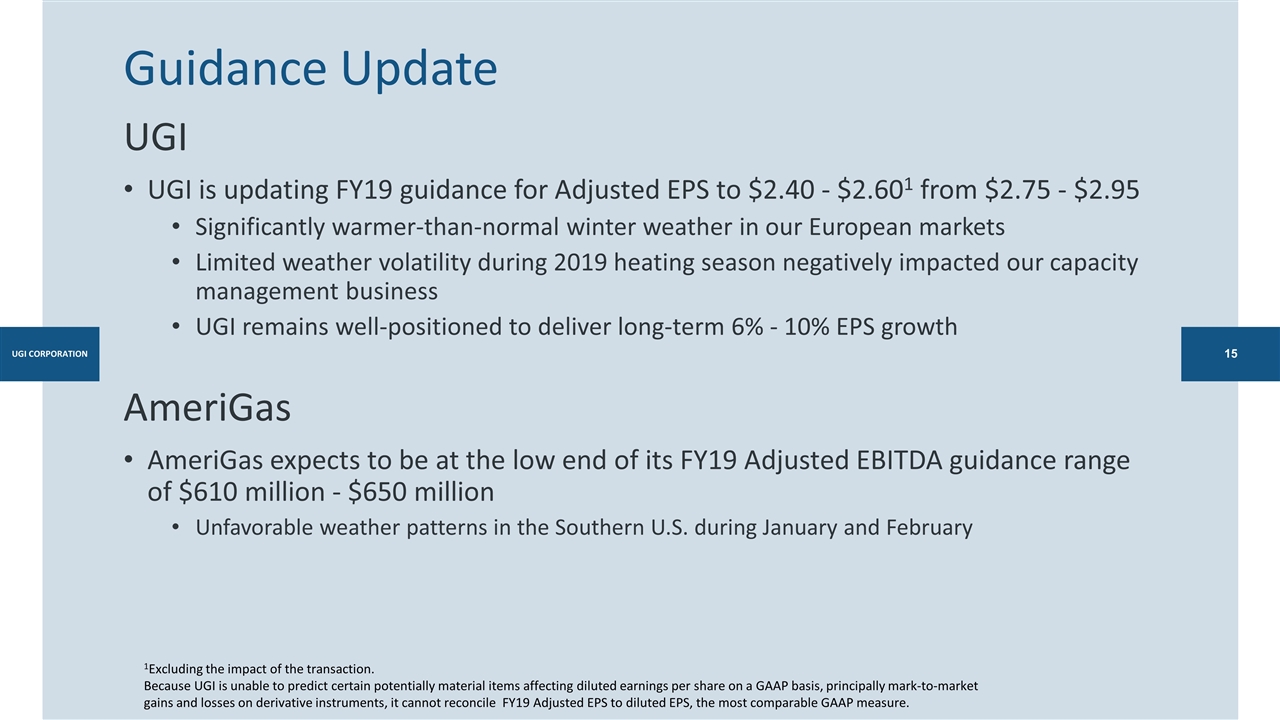

Guidance Update1

As the heating season concludes, UGI is updating its fiscal 2019 adjusted EPS guidance to $2.40 - $2.60 from $2.75 - $2.95, due to significantly warmer-than-normal winter weather in its European markets, as well as the impact of limited weather volatility during the fiscal 2019 heating season on its capacity management business. This updated guidance excludes the impact of the proposed merger described above.

2

AmeriGas expects to be at the low end of its fiscal 2019 Adjusted EBITDA guidance range of $610mm - $650mm due in large part to unfavorable weather patterns in the Southern U.S. during January and February.

Dividend Increase

UGI plans to increase its second fiscal quarter dividend by 15% (an increase from $0.26 to $0.30) and an additional 10% (an increase from $0.30 to $0.325) following the closing of the transaction.

Financing

UGI, which does not currently have debt at the corporate level, plans to finance the cash portion of the transaction by entering into a bank term loan of approximately $500 million. The merger is not, however, subject to any financing condition.

Closing Details

This transaction is subject to the approval of AmeriGas’ unitholders, as well as the satisfaction of customary closing conditions. The transaction is expected to close in the fourth quarter of fiscal 2019.

Advisors

J.P. Morgan Securities LLC is serving as UGI’s financial advisor and Latham & Watkins LLP is serving as legal counsel.

Tudor, Pickering, Holt & Co. is serving as financial advisor to AmeriGas’ Audit Committee. Potter Anderson & Corroon LLP is serving as legal counsel to AmeriGas’ Audit Committee and Baker Botts L.L.P. is serving as legal counsel to AmeriGas.

In connection with the transaction, the financial advisors provided fairness opinions to both UGI’s Board and AmeriGas’ Audit Committee. The fairness opinions referred to herein are, in each case, subject to certain assumptions made, matters considered, procedures followed, and other qualifications and limitations described in such opinions.

Investment Community Call

UGI and AmeriGas will hold a live Internet Audio Webcast of its conference call to discuss the proposed merger of AmeriGas at 9:00 AM ET on Tuesday, April 2, 2019. Interested parties may listen to the audio webcast both live and in replay on the Internet at http://www.ugicorp.com/investor-relations/events-and-presentations/default.aspx or at the company website at http://www.ugicorp.com under Investor Relations. A telephonic replay will be available from 12:00 PM ET on April 2, 2019 through 11:59 PM ET on April 9, 2019. The replay may be accessed at (800) 585-8367, and internationally at (416) 621-4642, conference ID 8689186.

About UGI Corporation

UGI Corporation is a distributor and marketer of energy products and services. Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation

3

assets in Pennsylvania, and engages in energy marketing in ten states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK. UGI, through subsidiaries, is the sole general partner and owns approximately 26% of AmeriGas, the nation’s largest retail propane distributor.

About AmeriGas Partners, L.P.

AmeriGas Partners, L.P. is the nation’s largest retail propane marketer, serving over 1.7 million customers in all 50 states from approximately 1,900 distribution locations. UGI, through subsidiaries, is currently the sole general partner and owns approximately 26% of AmeriGas, with the public owning the remaining 74%. Comprehensive information about AmeriGas is available on the Internet at http://www.amerigas.com.

UGI and AmeriGas

Brendan Heck, 610-337-1000 ext. 6608

Alanna Zahora 610-337-1000 ext. 1004

Shelly Oates, 610-337-1000 ext. 3202

Media Contact

Daniel Yunger or Lindsay Gross

Kekst CNC

+1 (212) 521-4800

daniel.yunger@kekstcnc.com or lindsay.gross@kekstcnc.com

USE OF NON-GAAP MEASURES

UGI

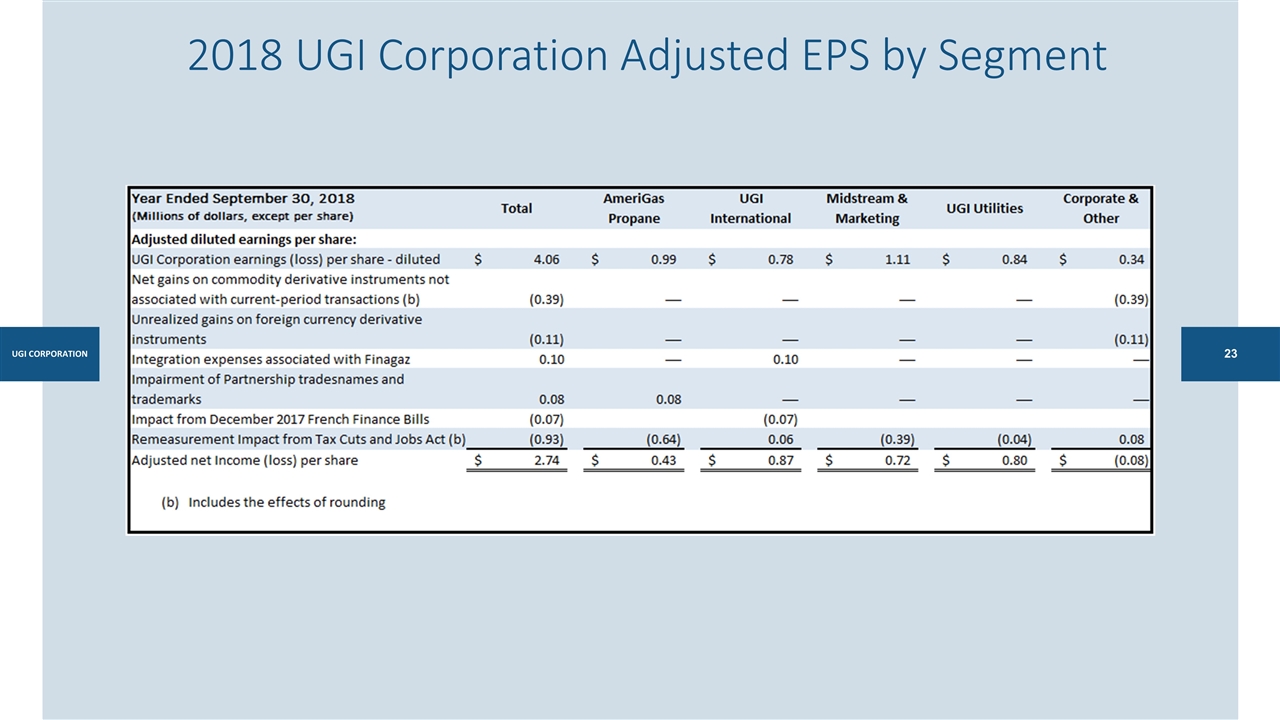

Management uses “adjusted diluted earnings per share,” which is derived from “adjusted net income attributable to UGI Corporation,” both of which are non-GAAP financial measures, when evaluating UGI’s overall performance. For the periods presented, adjusted net income attributable to UGI Corporation is net income attributable to UGI Corporation after excluding net after-tax gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions (principally comprising changes in unrealized gains and losses on such derivative instruments), losses associated with extinguishments of debt, and the impact on net deferred tax liabilities from a change in the French tax rate and U.S. tax reform legislation. Volatility in net income at UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles (“GAAP”).

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impact of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results.

4

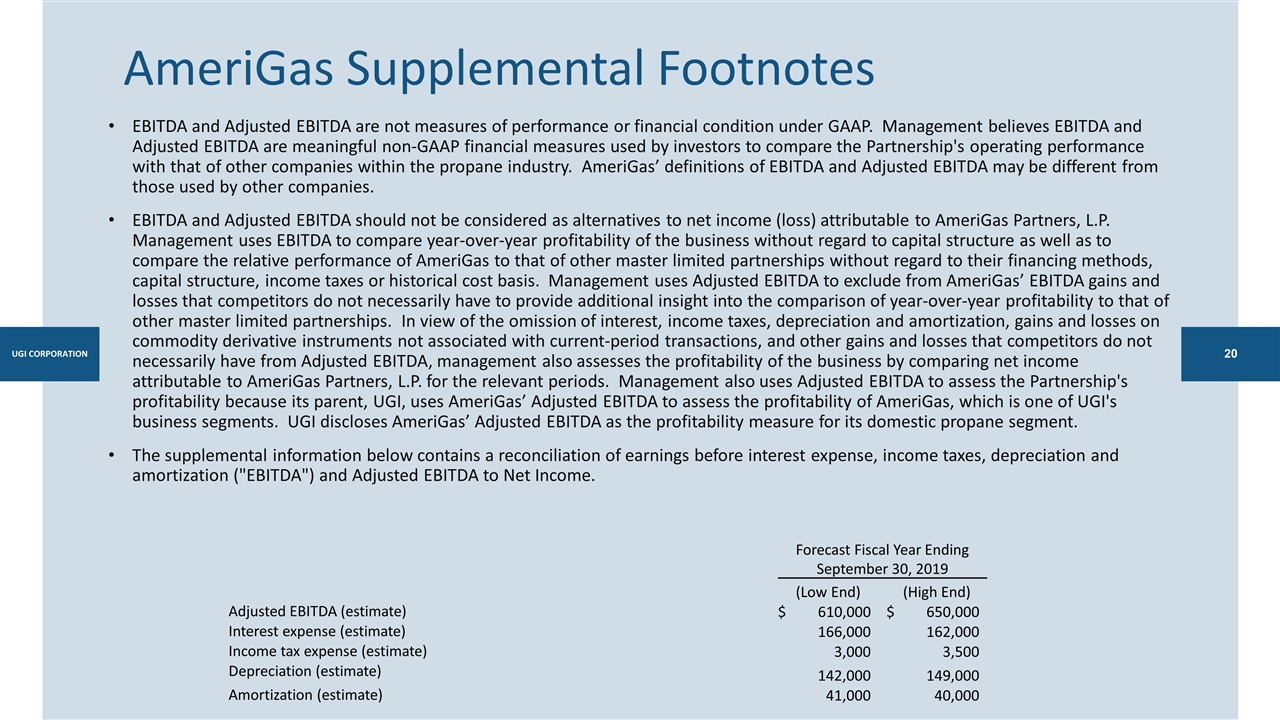

AmeriGas

AmeriGas’ management uses certain non-GAAP financial measures, including adjusted total margin, EBITDA, adjusted EBITDA and adjusted net income (loss) attributable to AmeriGas Partners, L.P., when evaluating AmeriGas’ overall performance. These financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

Management believes earnings before interest, income taxes, depreciation and amortization (“EBITDA”), as adjusted for the effects of gains and losses on commodity derivative instruments not associated with current-period transactions and other gains and losses that competitors do not necessarily have (“Adjusted EBITDA”), is a meaningful non-GAAP financial measure used by investors to (1) compare AmeriGas’ operating performance with that of other companies within the propane industry and (2) assess AmeriGas’ ability to meet loan covenants. AmeriGas’ definition of Adjusted EBITDA may be different from those used by other companies.

Management uses Adjusted EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of AmeriGas to that of other MLPs without regard to their financing methods, capital structure, income taxes, the effects of gains and losses on commodity derivative instruments not associated with current-period transactions or historical cost basis. In view of the omission of interest, income taxes, depreciation and amortization, gains and losses on commodity derivative instruments not associated with current-period transactions and other gains and losses that competitors do not necessarily have from adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant periods. Management also uses Adjusted EBITDA to assess AmeriGas’ profitability because its parent, UGI, uses AmeriGas’ Adjusted EBITDA to assess the profitability of AmeriGas, which is one of UGI’s industry segments. UGI discloses AmeriGas’ Adjusted EBITDA as the profitability measure for its domestic propane segment.

Management believes the presentation of other non-GAAP financial measures, comprised of adjusted total margin and adjusted net income (loss) attributable to AmeriGas Partners, L.P., provide useful information to investors to more effectively evaluate the period-over-period results of operations of the Partnership. Management uses these non-GAAP financial measures because they eliminate the impact of (1) gains and losses on commodity derivative instruments that are not associated with current-period transactions and (2) other gains and losses that competitors do not necessarily have to provide insight into the comparison of period-over-period profitability to that of other master limited partnerships.

A Note on Guidance1

UGI

Because UGI is unable to predict certain potentially material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity and certain foreign currency derivative instruments and impacts from tax reform in the U.S. and France, UGI cannot reconcile 2019 adjusted earnings per share guidance, a non-GAAP measure, to diluted earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in the rules of the U.S. Securities and Exchange Commission (“SEC”).

5

AmeriGas

Because AmeriGas is unable to predict certain potentially material items affecting net income on a GAAP basis, principally mark-to-market gains and losses on commodity derivative instruments, we cannot reconcile 2018 Adjusted EBITDA, a non-GAAP measure, to net income attributable to AmeriGas Partners, L.P., the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules. Adjustments that management can reasonably estimate are provided below.

The following table includes a quantification of interest expense, income tax expense, depreciation and amortization included in the calculation of forecasted Adjusted EBITDA guidance range for the fiscal year ending September 30, 2019:

| Forecast Fiscal Year Ending September 30, 2019 |

||||||||

| (Low End) | (High End) | |||||||

| Adjusted EBITDA (estimate) |

$ | 610,000 | $ | 650,000 | ||||

| Interest expense (estimate) |

166,000 | 162,000 | ||||||

| Income tax expense (estimate) |

3,000 | 3,500 | ||||||

| Depreciation (estimate) |

142,000 | 149,000 | ||||||

| Amortization (estimate) |

41,000 | 40,000 | ||||||

Forward-Looking Statements

All statements in this press release (and oral statements made regarding the subjects of this communication) other than historical facts are forward-looking statements. The safe harbor provisions under Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 do not apply to forward-looking statements made or referred to in this release. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside the control of UGI and AmeriGas, which could cause actual results to differ materially from such statements. Forward-looking information includes, but is not limited to: statements regarding the expected benefits of the proposed transaction to UGI and its shareholders and to AmeriGas and its unitholders; the anticipated completion of the proposed transaction and the timing thereof; the expected future growth, dividends and distributions of the combined company; and plans and objectives of management for future operations. While UGI believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: the failure to realize the anticipated costs savings, synergies and other benefits of the transaction; the possible diversion of management time on transaction-related issues; the risk that the requisite approvals to complete the transaction are not obtained; local, regional and national economic conditions and the impact they may have on UGI, AmeriGas and their customers; changes in tax laws that impact MLPs and the continued analysis of recent tax legislation; conditions in the energy industry, including cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil as well as increased customer conservation measures; adverse weather conditions; the financial condition of UGI’s and AmeriGas’ customers; any non-performance by customers of their contractual obligations; changes in customer, employee or supplier relationships;

6

changes in safety, health, environmental and other regulations; liability for uninsured claims and for claims in excess of insurance coverage; domestic and international political, regulatory and economic conditions in the U.S. and in foreign countries, including the current conflicts in the Middle East; foreign currency exchange rate fluctuations (particularly the euro); the timing of development of Marcellus Shale gas production; the results of any reviews, investigations or other proceedings by government authorities; addressing any reviews, investigations or other proceedings by government authorities or shareholder actions; the performance of AmeriGas; and the interruption, disruption, failure, malfunction or breach of UGI’s or AmeriGas’ information technology systems, including due to cyber-attack.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in each of UGI’s and AmeriGas’ Annual Reports on Form 10-K for the fiscal year ended September 30, 2018, and those set forth from time to time in each entity’s filings with the SEC, which are available at www.ugicorp.com and www.amerigas.com, respectively. Except as required by law, UGI and AmeriGas expressly disclaim any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

No Offer or Solicitation

This press release is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed transaction or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where You Can Find It

UGI and AmeriGas will each file with the SEC a Current Report on Form 8-K, which will contain, among other things, a copy of the merger agreement and the support agreement. In connection with the proposed transaction, UGI and AmeriGas, as applicable, will file a registration statement on Form S-4, including a proxy statement/prospectus, and other related documents, including a Schedule 13E-3, with the SEC. This press release is not a substitute for the merger agreement, proxy statement/prospectus, the Schedule 13E-3 or any other document that UGI or AmeriGas may file with the SEC in connection with the transaction. BEFORE MAKING ANY VOTING DECISION OR ELECTION, SECURITY HOLDERS OF AMERIGAS ARE ADVISED TO CAREFULLY READ THE MERGER AGREEMENT, THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO), THE SCHEDULE 13E-3, AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE RISKS ASSOCIATED WITH THE TRANSACTION. A definitive proxy statement/prospectus will be sent to AmeriGas unitholders in connection with the special meeting. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available), the Schedule 13E-3 (when available) and other relevant documents filed by UGI or AmeriGas with the SEC from the SEC’s website at www.sec.gov. Security holders and other interested parties will also be able to obtain, without charge, a copy of the proxy statement/prospectus, the Schedule 13E-3 and other relevant documents (when available) from www.ugicorp.com under the tab “Investor Relations” and then under the heading “SEC Filings.”

7

Participants in the Solicitation

UGI, AmeriGas, the General Partner and their respective directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of proxies from their respective security holders with respect to the transaction. Information about these persons is set forth in UGI’s proxy statement relating to its 2019 Annual Meeting of Shareholders, which was filed with the SEC on December 20, 2018, and AmeriGas’ Annual Report on Form 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 20, 2018, and subsequent statements of changes in beneficial ownership on file with the SEC. Security holders and investors may obtain additional information regarding the interests of such persons, which may be different than those of the respective companies’ security holders generally, by reading the joint proxy statement/prospectus and other relevant documents regarding the transaction, which will be filed with the SEC.

8