UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07239

Name of Registrant: Vanguard Horizon Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2017 – March 31, 2018

Item 1: Reports to Shareholders

|

| Semiannual Report | March 31, 2018 |

| Vanguard Strategic Equity Fund |

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| CEO’s Perspective. | 2 |

| Advisor’s Report. | 4 |

| Results of Proxy Voting. | 6 |

| Fund Profile. | 8 |

| Performance Summary. | 9 |

| Financial Statements. | 10 |

| About Your Fund’s Expenses. | 24 |

| Trustees Approve Advisory Arrangement. | 26 |

| Glossary. | 28 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Nautical images have been part of Vanguard’s rich heritage since its start in 1975. For an incoming ship, a lighthouse offers a beacon and safe path to shore. You can similarly depend on Vanguard to put you first––and light the way––as you strive to meet your financial goals. Our client focus and low costs, stemming from our unique ownership structure, assure that your interests are paramount.

Your Fund’s Performance at a Glance

• Vanguard Strategic Equity Fund returned about 6% for the six months ended March 31, 2018. It outperformed its benchmark, the MSCI US Small + Mid Cap 2200 Index, and its peer-group average.

• The fund seeks long-term capital appreciation by investing in mid- and small-capitalization domestic stocks, using a quantitative approach.

• During the period, growth stocks outperformed their value counterparts, and large-cap stocks topped their mid- and small-cap peers. U.S. stocks outpaced those of developed markets but trailed those of emerging markets.

• Four of the fund’s 11 sectors produced positive relative returns for the period.

Consumer discretionary and financials contributed most to the fund’s relative performance; energy, consumer staples, industrials, and real estate stocks detracted most from it.

| Total Returns: Six Months Ended March 31, 2018 | ||

| Total | ||

| Returns | ||

| Vanguard Strategic Equity Fund | 6.06% | |

| MSCI US Small + Mid Cap 2200 Index | 5.67 | |

| Mid-Cap Core Funds Average | 4.24 | |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | ||

| Expense Ratios | ||

| Your Fund Compared With Its Peer Group | ||

| Peer Group | ||

| Fund | Average | |

| Strategic Equity Fund | 0.18% | 1.15% |

The fund expense ratio shown is from the prospectus dated January 25, 2018, and represents estimated costs for the current fiscal year. For the six months ended March 31, 2018, the fund’s annualized expense ratio was 0.18%. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2017.

Peer group: Mid-Cap Core Funds.

1

CEO’s Perspective

Tim Buckley

President and Chief Executive Officer

Dear Shareholder,

I feel extremely fortunate to have the chance to lead a company filled with people who come to work every day passionate about Vanguard’s core purpose: to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.

When I joined Vanguard in 1991, I found a mission-driven team focused on improving lives—helping people retire more comfortably, put their children through college, and achieve financial security. I also found a company with purpose in an industry ripe for improvement.

It was clear, even early in my career, that the cards were stacked against most investors. Hidden fees, performance-chasing, and poor advice were relentlessly eroding investors’ dreams.

We knew Vanguard could be different and, as a result, could make a real difference. We have lowered the costs of investing for our shareholders significantly. And we’re proud of the performance of our funds.

Vanguard is built for Vanguard investors—we focus solely on you, our fund shareholders. Everything we do is designed to give our clients the best chance for investment success. In my role as CEO, I’ll keep this priority

2

front and center. We’re proud of what we’ve achieved, but we’re even more excited about what’s to come.

Steady, time-tested guidance

Our guidance for investors, as always, is to stay the course, tune out the hyperbolic headlines, and focus on your goals and what you can control, such as costs and how much you save. This time-tested advice has served our clients well over the decades.

Regardless of how the markets perform in the short term, I’m incredibly optimistic about the future for our investors. We have a dedicated team serving you, and we will never stop striving to make

Vanguard the best place for you to invest through our high-quality funds and services, advice and guidance to help you meet your financial goals, and an experience that makes you feel good about entrusting us with your hard-earned savings.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

President and Chief Executive Officer

April 13, 2018

| Market Barometer | |||

| Total Returns | |||

| Periods Ended March 31, 2018 | |||

| Six | One | Five Years | |

| Months | Year | (Annualized) | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 5.85% | 13.98% | 13.17% |

| Russell 2000 Index (Small-caps) | 3.25 | 11.79 | 11.47 |

| Russell 3000 Index (Broad U.S. market) | 5.65 | 13.81 | 13.03 |

| FTSE All-World ex US Index (International) | 4.03 | 16.45 | 6.30 |

| Bonds | |||

| Bloomberg Barclays U.S. Aggregate Bond Index | |||

| (Broad taxable market) | -1.08% | 1.20% | 1.82% |

| Bloomberg Barclays Municipal Bond Index | |||

| (Broad tax-exempt market) | -0.37 | 2.66 | 2.73 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.63 | 1.07 | 0.30 |

| CPI | |||

| Consumer Price Index | 1.11% | 2.36% | 1.40% |

3

Advisor’s Report

For the six months ended March 31, 2018, Vanguard Strategic Equity Fund returned 6.06%, outperforming its benchmark, the MSCI US Small + Mid Cap 2200 Index, as well as the average return of its peers.

Over the period, the broad U.S. equity market (as measured by the Russell 3000 Index) returned 5.65%. U.S. stock market performance was mixed; seven of 11 market sectors advanced, led by information technology and consumer discretionary. Growth stocks outperformed their value counterparts, and large-capitalization stocks topped small-caps.

Investment environment

The period opened with global equities posting positive returns for the seventh consecutive quarter. In the United States, encouraging economic fundamentals, tax-law changes, and low inflation boosted investor sentiment. The European economy continued on a path of broad improvement, including record-high employment and manufacturing activity and elevated consumer confidence. Developed markets in the Asia-Pacific region also rallied, helped by economic and business activity in Japan and Singapore.

As 2018 began, positive global economic momentum continued against a backdrop of rising volatility and a hawkish tone from the major central banks. In the United States, companies began to respond to new tax laws, and strong earnings announcements moved the S&P 500 Index to a record high at the end of January. Developed Europe and Asia-Pacific equities also rose, fueled by improvement in macroeconomic fundamentals.

February brought a sudden change in market sentiment, and investors saw the return of volatility after an unusually long period of calm. From a macroeconomic perspective, it seems the markets finally realized that the U.S. tax cuts and large government spending package posed upside risks to inflation and could speed up the Federal Reserve’s timetable for raising the target interest rate. (This is on top of pro-growth deregulation.) Against a backdrop of strong economic fundamentals, these stimulus efforts spurred some of the spike in volatility, as inflation and interest rate concerns grew.

Investment objective and strategy

Although overall performance is affected by macro factors, our approach to investing focuses on specific fundamentals. We believe that attractive stocks exhibit five key characteristics: high quality (healthy balance sheets and steady cash-flow generation), effective use of capital by management with sound investment policies that favor internal over external funding, consistent earnings growth with the ability to grow earnings year after year, strong market sentiment, and reasonable valuation.

Using these five themes, we generate a daily composite stock ranking, seeking to capitalize on market inefficiencies. We then monitor our portfolio and adjust when appropriate to maximize expected returns and minimize exposure to risks that our research indicates don’t improve returns (such as industry selection and other risks relative to the benchmark).

4

Our successes and shortfalls

Overall, the fund performed well. Our sentiment, quality, and valuation models helped the fund, but our growth and management decisions signals did not perform as expected.

Stock selection in the consumer discretionary, financials, and utilities sectors boosted performance most. Poor selection in energy, consumer staples, and industrials hurt performance.

Our most successful holdings included our overweighted positions in Square, XPO Logistics, Tailored Brands, Bloomin’ Brands, and Match Group. Results were dragged down by overweighted positions in Sanderson Farms, Meritor, Syneos Health, Advanced Micro Devices, and Cirrus Logic.

We believe that constructing a portfolio that focuses on the key fundamentals described above will benefit investors over the long term, while we recognize

that risk can reward or punish us in the

near term. We feel the fund offers a strong

mix of stocks with attractive valuation

and growth characteristics relative to its

benchmark.

We thank you for your investment and

look forward to the remainder of the

fiscal year.

Portfolio Managers:

James P. Stetler

Binbin Guo, Principal, Head of Alpha Equity Investments

Vanguard Quantitative Equity Group

April 9, 2018

5

Results of Proxy Voting

At a special meeting of shareholders on November 15, 2017, fund shareholders approved the following proposals:

Proposal 1—Elect trustees for the fund.*

The individuals listed in the table below were elected as trustees for the fund. All trustees with the exception of Ms. Mulligan, Ms. Raskin, and Mr. Buckley (each of whom already serves as a director of The Vanguard Group, Inc.) served as trustees to the funds prior to the shareholder meeting.

| Percentage | |||

| Trustee | For | Withheld | For |

| Mortimer J. Buckley | 390,898,841 | 14,469,177 | 96.4% |

| Emerson U. Fullwood | 390,414,071 | 14,953,947 | 96.3% |

| Amy Gutmann | 389,869,704 | 15,498,314 | 96.2% |

| JoAnn Heffernan Heisen | 391,161,541 | 14,206,477 | 96.5% |

| F. Joseph Loughrey | 390,797,905 | 14,570,113 | 96.4% |

| Mark Loughridge | 390,774,200 | 14,593,818 | 96.4% |

| Scott C. Malpass | 390,120,891 | 15,247,127 | 96.2% |

| F. William McNabb III | 390,915,854 | 14,452,164 | 96.4% |

| Deanna Mulligan | 390,950,137 | 14,417,881 | 96.4% |

| André F. Perold | 385,233,851 | 20,134,166 | 95.0% |

| Sarah Bloom Raskin | 390,673,444 | 14,694,574 | 96.4% |

| Peter F. Volanakis | 390,773,896 | 14,594,122 | 96.4% |

| * Results are for all funds within the same trust. |

Proposal 2—Approve a manager-of-managers arrangement with third-party investment advisors.

This arrangement enables the fund to enter into and materially amend investment advisory arrangements with third-party investment advisors, subject to the approval of the fund’s board of trustees and certain conditions imposed by the Securities and Exchange Commission, while avoiding the costs and delays associated with obtaining future shareholder approval.

| Broker | Percentage | ||||

| Vanguard Fund | For | Abstain | Against | Non-Votes | For |

| Strategic Equity Fund | 125,712,826 | 6,532,371 | 7,227,853 | 17,302,373 | 80.2% |

6

Proposal 3—Approve a manager-of-managers arrangement with wholly owned subsidiaries of Vanguard.

This arrangement enables Vanguard or the fund to enter into and materially amend investment advisory arrangements with wholly owned subsidiaries of Vanguard, subject to the approval of the fund’s board of trustees and any conditions imposed by the Securities and Exchange Commission (SEC), while avoiding the costs and delays associated with obtaining future shareholder approval. The ability of the fund to operate in this manner is contingent upon the SEC’s approval of a pending application for an order of exemption.

| Broker | Percentage | ||||

| Vanguard Fund | For | Abstain | Against | Non-Votes | For |

| Strategic Equity Fund | 127,200,520 | 6,300,984 | 5,971,546 | 17,302,373 | 81.1% |

7

Strategic Equity Fund

Fund Profile

As of March 31, 2018

| Portfolio Characteristics | |||

| MSCI US | DJ | ||

| Small + | U.S. Total | ||

| Mid Cap | Market | ||

| Fund | 2200 Index | FA Index | |

| Number of Stocks | 340 | 2,157 | 3,771 |

| Median Market Cap | $7.4B | $7.5B | $64.2B |

| Price/Earnings Ratio | 17.1x | 20.5x | 21.2x |

| Price/Book Ratio | 2.7x | 2.4x | 2.9x |

| Return on Equity | 12.1% | 10.7% | 15.0% |

| Earnings Growth | |||

| Rate | 16.8% | 9.6% | 8.4% |

| Dividend Yield | 1.3% | 1.5% | 1.8% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | |||

| (Annualized) | 87% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.18% | — | — |

| 30-Day SEC Yield | 1.23% | — | — |

| Short-Term Reserves | -0.4% | — | — |

| Sector Diversification (% of equity exposure) | |||

| MSCI US | DJ | ||

| Small + | U.S. Total | ||

| Mid Cap | Market | ||

| Fund | 2200 Index | FA Index | |

| Consumer | |||

| Discretionary | 14.0% | 13.8% | 12.9% |

| Consumer Staples | 2.9 | 2.8 | 6.8 |

| Energy | 4.5 | 4.4 | 5.5 |

| Financials | 16.1 | 15.9 | 15.1 |

| Health Care | 10.9 | 10.9 | 13.3 |

| Industrials | 15.3 | 15.6 | 10.9 |

| Information | |||

| Technology | 17.7 | 17.8 | 23.9 |

| Materials | 5.9 | 6.0 | 3.3 |

| Real Estate | 8.3 | 8.5 | 3.7 |

| Telecommunication | |||

| Services | 0.4 | 0.5 | 1.7 |

| Utilities | 4.0 | 3.8 | 2.9 |

Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

| Volatility Measures | ||

| MSCI US | DJ | |

| Small + | U.S. Total | |

| Mid Cap | Market | |

| 2200 Index | FA Index | |

| R-Squared | 0.94 | 0.82 |

| Beta | 1.06 | 1.09 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| Ten Largest Holdings (% of total net assets) | ||

| Freeport-McMoRan Inc. Copper | 1.1% | |

| Citizens Financial Group | ||

| Inc. | Regional Banks | 1.0 |

| Best Buy Co. Inc. | Computer & | |

| Electronics Retail | 1.0 | |

| SBA Communications | ||

| Corp. | Specialized REITs | 1.0 |

| E*TRADE Financial | Investment Banking | |

| Corp. | & Brokerage | 1.0 |

| Lincoln National Corp. | Life & Health | |

| Insurance | 1.0 | |

| FirstEnergy Corp. | Electric Utilities | 1.0 |

| Entergy Corp. | Electric Utilities | 0.9 |

| United Rentals Inc. | Trading Companies & | |

| Distributors | 0.9 | |

| Lear Corp. | Auto Parts & | |

| Equipment | 0.9 | |

| Top Ten | 9.8% | |

The holdings listed exclude any temporary cash investments and equity index products.

Investment Focus

1 The expense ratio shown is from the prospectus dated January 25, 2018, and represents estimated costs for the current fiscal year. For the six months ended March 31, 2018, the annualized expense ratio was 0.18%.

8

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

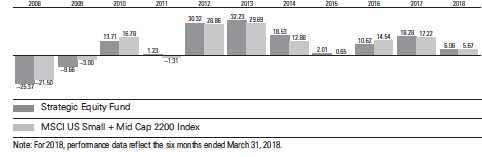

Fiscal-Year Total Returns (%): September 30, 2007, Through March 31, 2018

| Average Annual Total Returns: Periods Ended March 31, 2018 | ||||

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| Strategic Equity Fund | 8/14/1995 | 10.96% | 13.46% | 10.35% |

See Financial Highlights for dividend and capital gains information.

9

Strategic Equity Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Common Stocks (99.5%)1 | |||

| Consumer Discretionary (14.0%) | |||

| Best Buy Co. Inc. | 1,066,379 | 74,636 | |

| Lear Corp. | 357,732 | 66,570 | |

| Ralph Lauren Corp. | |||

| Class A | 549,946 | 61,484 | |

| Wynn Resorts Ltd. | 316,693 | 57,752 | |

| Bloomin’ Brands Inc. | 2,311,457 | 56,122 | |

| * | NVR Inc. | 17,225 | 48,230 |

| * | Liberty Media Corp- | ||

| Liberty SiriusXM | |||

| Class A | 1,128,472 | 46,380 | |

| Tailored Brands Inc. | 1,796,191 | 45,013 | |

| Children’s Place Inc. | 326,542 | 44,165 | |

| H&R Block Inc. | 1,485,384 | 37,744 | |

| *,^ | RH | 382,561 | 36,450 |

| * | Michael Kors Holdings | ||

| Ltd. | 558,095 | 34,647 | |

| * | Deckers Outdoor Corp. | 375,285 | 33,787 |

| KB Home | 967,276 | 27,519 | |

| MGM Resorts | |||

| International | 695,229 | 24,347 | |

| * | Live Nation | ||

| Entertainment Inc. | 519,036 | 21,872 | |

| PetMed Express Inc. | 507,866 | 21,203 | |

| * | MSG Networks Inc. | 920,966 | 20,814 |

| * | Burlington Stores Inc. | 146,482 | 19,504 |

| Kohl’s Corp. | 286,491 | 18,768 | |

| News Corp. Class B | 1,156,551 | 18,620 | |

| * | Taylor Morrison Home | ||

| Corp. Class A | 641,507 | 14,934 | |

| Toll Brothers Inc. | 341,064 | 14,751 | |

| New York Times Co. | |||

| Class A | 563,169 | 13,572 | |

| * | Visteon Corp. | 119,021 | 13,121 |

| * | Norwegian Cruise Line | ||

| Holdings Ltd. | 202,348 | 10,718 | |

| Domino’s Pizza Inc. | 45,038 | 10,519 | |

| Thor Industries Inc. | 88,208 | 10,159 | |

| * | Sleep Number Corp. | 247,764 | 8,709 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Liberty Media Corp- | ||

| Liberty SiriusXM | |||

| Class C | 189,855 | 7,756 | |

| MDC Holdings Inc. | 266,119 | 7,430 | |

| * | Chegg Inc. | 358,816 | 7,413 |

| Winnebago Industries | |||

| Inc. | 176,441 | 6,634 | |

| Abercrombie & Fitch | |||

| Co. | 260,306 | 6,302 | |

| * | Grand Canyon | ||

| Education Inc. | 59,892 | 6,284 | |

| Vail Resorts Inc. | 26,927 | 5,970 | |

| *,^ | Weight Watchers | ||

| International Inc. | 82,856 | 5,280 | |

| * | Cooper-Standard | ||

| Holdings Inc. | 42,124 | 5,173 | |

| ILG Inc. | 138,342 | 4,304 | |

| Strayer Education Inc. | 40,609 | 4,104 | |

| Boyd Gaming Corp. | 128,703 | 4,101 | |

| * | Dave & Buster’s | ||

| Entertainment Inc. | 95,328 | 3,979 | |

| * | ServiceMaster Global | ||

| Holdings Inc. | 70,439 | 3,582 | |

| * | Planet Fitness Inc. | ||

| Class A | 93,639 | 3,537 | |

| BorgWarner Inc. | 66,991 | 3,365 | |

| * | Eldorado Resorts Inc. | 93,983 | 3,101 |

| ^ | Big Lots Inc. | 69,936 | 3,044 |

| Nutrisystem Inc. | 91,616 | 2,469 | |

| 1,005,938 | |||

| Consumer Staples (2.9%) | |||

| Sanderson Farms Inc. | 439,241 | 52,279 | |

| Nu Skin Enterprises Inc. | |||

| Class A | 517,627 | 38,154 | |

| National Beverage Corp. | 272,330 | 24,243 | |

| * | Pilgrim’s Pride Corp. | 793,088 | 19,518 |

| * | HRG Group Inc. | 1,103,774 | 18,201 |

| Conagra Brands Inc. | 383,259 | 14,135 | |

| Lamb Weston | |||

| Holdings Inc. | 184,058 | 10,716 | |

10

Strategic Equity Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Sprouts Farmers Market | ||

| Inc. | 383,780 | 9,007 | |

| * | US Foods Holding Corp. | 254,106 | 8,327 |

| SUPERVALU Inc. | 429,697 | 6,544 | |

| * | Central Garden & Pet Co. | 107,568 | 4,625 |

| Ingles Markets Inc. | |||

| Class A | 96,099 | 3,253 | |

| * | Central Garden & Pet | ||

| Co. Class A | 55,030 | 2,180 | |

| 211,182 | |||

| Energy (4.5%) | |||

| HollyFrontier Corp. | 1,276,774 | 62,383 | |

| Cabot Oil & Gas Corp. | 2,273,146 | 54,510 | |

| Delek US Holdings | |||

| Inc. | 798,357 | 32,493 | |

| ^ | RPC Inc. | 1,640,939 | 29,586 |

| PBF Energy Inc. | |||

| Class A | 714,836 | 24,233 | |

| Marathon Oil Corp. | 1,244,589 | 20,075 | |

| * | Newfield Exploration | ||

| Co. | 770,157 | 18,807 | |

| * | Denbury Resources | ||

| Inc. | 5,976,678 | 16,376 | |

| * | McDermott | ||

| International Inc. | 2,655,393 | 16,171 | |

| * | Laredo Petroleum Inc. | 1,825,590 | 15,901 |

| * | ProPetro Holding Corp. | 863,831 | 13,726 |

| Peabody Energy Corp. | 118,119 | 4,312 | |

| * | REX American | ||

| Resources Corp. | 46,131 | 3,358 | |

| * | Unit Corp. | 157,451 | 3,111 |

| Murphy Oil Corp. | 112,134 | 2,898 | |

| * | Renewable Energy | ||

| Group Inc. | 191,530 | 2,452 | |

| *,^ | Resolute Energy Corp. | 66,798 | 2,315 |

| 322,707 | |||

| Financials (16.1%) | |||

| Citizens Financial | |||

| Group Inc. | 1,780,811 | 74,758 | |

| * | E*TRADE Financial | ||

| Corp. | 1,268,014 | 70,261 | |

| Lincoln National Corp. | 941,705 | 68,801 | |

| Zions Bancorporation | 1,234,807 | 65,111 | |

| MSCI Inc. Class A | 434,622 | 64,963 | |

| Regions Financial | |||

| Corp. | 3,357,285 | 62,378 | |

| Unum Group | 1,249,290 | 59,479 | |

| Primerica Inc. | 596,456 | 57,618 | |

| * | MGIC Investment | ||

| Corp. | 4,175,597 | 54,283 | |

| Fifth Third Bancorp | 1,613,334 | 51,223 | |

| * | Essent Group Ltd. | 943,706 | 40,164 |

| Walker & Dunlop Inc. | 615,094 | 36,549 | |

| Market | ||

| Value• | ||

| Shares | ($000) | |

| LPL Financial Holdings | ||

| Inc. | 518,985 | 31,694 |

| World Acceptance Corp. | 280,697 | 29,557 |

| Assured Guaranty Ltd. | 805,686 | 29,166 |

| Credit Acceptance Corp. | 86,612 | 28,618 |

| Green Dot Corp. | ||

| Class A | 405,957 | 26,046 |

| Washington Federal | ||

| Inc. | 741,394 | 25,652 |

| Ally Financial Inc. | 756,956 | 20,551 |

| Torchmark Corp. | 237,658 | 20,004 |

| FNF Group | 483,765 | 19,360 |

| Comerica Inc. | 171,039 | 16,408 |

| Synovus Financial Corp. | 321,931 | 16,077 |

| Reinsurance Group of | ||

| America Inc. Class A | 96,167 | 14,810 |

| Principal Financial | ||

| Group Inc. | 190,365 | 11,595 |

| CNO Financial Group | ||

| Inc. | 523,704 | 11,349 |

| Universal Insurance | ||

| Holdings Inc. | 331,869 | 10,587 |

| CIT Group Inc. | 201,188 | 10,361 |

| SEI Investments Co. | 135,626 | 10,160 |

| NMI Holdings Inc. | ||

| Class A | 548,936 | 9,085 |

| Federated Investors | ||

| Inc. Class B | 265,512 | 8,868 |

| First American | ||

| Financial Corp. | 140,124 | 8,223 |

| Federal Agricultural | ||

| Mortgage Corp. | 90,415 | 7,868 |

| Legg Mason Inc. | 187,835 | 7,636 |

| Santander Consumer | ||

| USA Holdings Inc. | 431,301 | 7,030 |

| New York Community | ||

| Bancorp Inc. | 521,872 | 6,800 |

| People’s United | ||

| Financial Inc. | 301,507 | 5,626 |

| Flagstar Bancorp Inc. | 153,471 | 5,433 |

| Texas Capital | ||

| Bancshares Inc. | 49,145 | 4,418 |

| Radian Group Inc. | 207,215 | 3,945 |

| Bank of the Ozarks | 81,272 | 3,923 |

| Western Alliance | ||

| Bancorp | 66,992 | 3,893 |

| Umpqua Holdings | ||

| Corp. | 181,728 | 3,891 |

| Cullen/Frost Bankers | ||

| Inc. | 35,825 | 3,800 |

| BankUnited Inc. | 94,440 | 3,776 |

| Nelnet Inc. Class A | 70,621 | 3,701 |

| Wintrust Financial Corp. | 42,991 | 3,699 |

| Webster Financial Corp. | 66,431 | 3,680 |

11

Strategic Equity Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| TCF Financial Corp. | 160,707 | 3,666 | |

| Commerce Bancshares | |||

| Inc. | 60,646 | 3,633 | |

| * | BofI Holding Inc. | 89,484 | 3,627 |

| Hancock Holding Co. | 70,064 | 3,622 | |

| 1,157,426 | |||

| Health Care (10.8%) | |||

| * | WellCare Health Plans | ||

| Inc. | 325,626 | 63,051 | |

| * | Charles River | ||

| Laboratories | |||

| International Inc. | 545,545 | 58,232 | |

| Chemed Corp. | 200,022 | 54,578 | |

| * | Align Technology Inc. | 213,217 | 53,545 |

| * | PRA Health Sciences | ||

| Inc. | 631,117 | 52,358 | |

| * | Array BioPharma Inc. | 3,120,614 | 50,928 |

| * | Nektar Therapeutics | ||

| Class A | 467,940 | 49,723 | |

| * | Veeva Systems Inc. | ||

| Class A | 645,393 | 47,127 | |

| * | Centene Corp. | 401,453 | 42,903 |

| * | Tivity Health Inc. | 906,823 | 35,956 |

| Agilent Technologies | |||

| Inc. | 485,352 | 32,470 | |

| Perrigo Co. plc | 318,660 | 26,557 | |

| * | IQVIA Holdings Inc. | 256,142 | 25,130 |

| * | Mettler-Toledo | ||

| International Inc. | 43,021 | 24,738 | |

| * | Masimo Corp. | 171,817 | 15,111 |

| * | Myriad Genetics Inc. | 483,444 | 14,286 |

| * | Laboratory Corp. of | ||

| America Holdings | 76,139 | 12,316 | |

| Bruker Corp. | 303,397 | 9,078 | |

| Quest Diagnostics Inc. | 90,099 | 9,037 | |

| Universal Health | |||

| Services Inc. Class B | 72,631 | 8,600 | |

| * | Arena Pharmaceuticals | ||

| Inc. | 213,150 | 8,420 | |

| * | ImmunoGen Inc. | 699,634 | 7,360 |

| * | OraSure Technologies | ||

| Inc. | 427,998 | 7,229 | |

| * | Molina Healthcare Inc. | 88,505 | 7,185 |

| * | Exelixis Inc. | 302,802 | 6,707 |

| * | Halozyme Therapeutics | ||

| Inc. | 330,133 | 6,467 | |

| Hill-Rom Holdings Inc. | 73,096 | 6,359 | |

| * | Varian Medical Systems | ||

| Inc. | 50,007 | 6,133 | |

| * | Lantheus Holdings Inc. | 339,550 | 5,399 |

| * | Tenet Healthcare Corp. | 208,040 | 5,045 |

| * | Halyard Health Inc. | 107,165 | 4,938 |

| * | Prestige Brands | ||

| Holdings Inc. | 134,317 | 4,529 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Encompass Health Corp. | 65,681 | 3,755 | |

| * | Sangamo Therapeutics | ||

| Inc. | 191,956 | 3,647 | |

| * | Haemonetics Corp. | 48,620 | 3,557 |

| * | Immunomedics Inc. | 236,523 | 3,456 |

| * | AnaptysBio Inc. | 31,908 | 3,321 |

| 779,231 | |||

| Industrials (15.2%) | |||

| * | United Rentals Inc. | 389,427 | 67,266 |

| Spirit AeroSystems | |||

| Holdings Inc. Class A | 752,993 | 63,026 | |

| Owens Corning | 742,854 | 59,725 | |

| Huntington Ingalls | |||

| Industries Inc. | 229,612 | 59,185 | |

| ManpowerGroup Inc. | 510,068 | 58,709 | |

| Allison Transmission | |||

| Holdings Inc. | 1,440,673 | 56,273 | |

| ^ | Greenbrier Cos. Inc. | 1,067,501 | 53,642 |

| SkyWest Inc. | 878,456 | 47,788 | |

| Wabash National | |||

| Corp. | 2,139,626 | 44,526 | |

| * | Meritor Inc. | 2,158,365 | 44,376 |

| * | TransUnion | 740,848 | 42,065 |

| GATX Corp. | 612,952 | 41,981 | |

| Oshkosh Corp. | 537,301 | 41,517 | |

| * | XPO Logistics Inc. | 381,197 | 38,810 |

| Pentair plc | 500,713 | 34,114 | |

| * | TriNet Group Inc. | 681,454 | 31,565 |

| Harris Corp. | 161,735 | 26,085 | |

| Brink’s Co. | 363,433 | 25,931 | |

| Graco Inc. | 543,396 | 24,844 | |

| Quad/Graphics Inc. | 876,976 | 22,231 | |

| WW Grainger Inc. | 77,681 | 21,927 | |

| Terex Corp. | 458,114 | 17,138 | |

| Hawaiian Holdings Inc. | 407,253 | 15,761 | |

| * | Cimpress NV | 85,922 | 13,292 |

| Old Dominion Freight | |||

| Line Inc. | 87,446 | 12,852 | |

| Herman Miller Inc. | 394,054 | 12,590 | |

| * | Harsco Corp. | 575,499 | 11,884 |

| * | Avis Budget Group Inc. | 241,254 | 11,300 |

| * | Rush Enterprises Inc. | ||

| Class A | 241,532 | 10,263 | |

| * | HD Supply Holdings Inc. | 243,326 | 9,232 |

| Global Brass & Copper | |||

| Holdings Inc. | 271,880 | 9,094 | |

| KBR Inc. | 471,201 | 7,629 | |

| * | SPX Corp. | 219,585 | 7,132 |

| * | Continental Building | ||

| Products Inc. | 247,993 | 7,080 | |

| Ennis Inc. | 230,985 | 4,550 | |

| * | Copart Inc. | 82,311 | 4,192 |

| Ryder System Inc. | 56,883 | 4,140 | |

| HEICO Corp. | 44,701 | 3,880 | |

12

| Strategic Equity Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Applied Industrial | |||

| Technologies Inc. | 50,985 | 3,717 | |

| * | Aerojet Rocketdyne | ||

| Holdings Inc. | 128,614 | 3,597 | |

| * | Hertz Global Holdings | ||

| Inc. | 177,999 | 3,533 | |

| Dover Corp. | 35,832 | 3,519 | |

| * | TrueBlue Inc. | 132,900 | 3,442 |

| Regal Beloit Corp. | 46,909 | 3,441 | |

| Triumph Group Inc. | 112,406 | 2,833 | |

| Brady Corp. Class A | 68,336 | 2,539 | |

| ACCO Brands Corp. | 182,826 | 2,294 | |

| ICF International Inc. | 32,793 | 1,917 | |

| 1,098,427 | |||

| Information Technology (17.6%) | |||

| * | Red Hat Inc. | 430,083 | 64,302 |

| CDW Corp. | 911,665 | 64,099 | |

| *,^ | Square Inc. | 1,296,248 | 63,775 |

| * | ON Semiconductor | ||

| Corp. | 2,542,077 | 62,179 | |

| Booz Allen Hamilton | |||

| Holding Corp. Class A | 1,551,797 | 60,086 | |

| SYNNEX Corp. | 489,643 | 57,974 | |

| * | Cadence Design | ||

| Systems Inc. | 1,571,821 | 57,796 | |

| Total System Services | |||

| Inc. | 569,845 | 49,155 | |

| * | TTM Technologies | ||

| Inc. | 3,046,256 | 46,577 | |

| *,^ | Advanced Micro | ||

| Devices Inc. | 4,566,472 | 45,893 | |

| * | CACI International | ||

| Inc. Class A | 283,858 | 42,962 | |

| * | Aspen Technology | ||

| Inc. | 535,154 | 42,218 | |

| *,^ | Match Group Inc. | 924,252 | 41,074 |

| Science Applications | |||

| International Corp. | 520,732 | 41,034 | |

| Seagate Technology | |||

| plc | 632,638 | 37,022 | |

| * | Nutanix Inc. | 737,957 | 36,241 |

| Broadridge Financial | |||

| Solutions Inc. | 269,881 | 29,603 | |

| * | RingCentral Inc. | ||

| Class A | 417,766 | 26,528 | |

| * | First Solar Inc. | 360,305 | 25,575 |

| * | Etsy Inc. | 849,561 | 23,839 |

| Teradyne Inc. | 447,107 | 20,437 | |

| MAXIMUS Inc. | 251,723 | 16,800 | |

| * | Amkor Technology | ||

| Inc. | 1,655,408 | 16,769 | |

| * | Extreme Networks | ||

| Inc. | 1,478,132 | 16,363 | |

| NetApp Inc. | 256,457 | 15,821 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Hortonworks Inc. | 755,718 | 15,394 |

| Jabil Inc. | 505,846 | 14,533 | |

| * | Five9 Inc. | 484,302 | 14,427 |

| * | IPG Photonics Corp. | 60,079 | 14,021 |

| * | Cirrus Logic Inc. | 329,832 | 13,401 |

| ManTech International | |||

| Corp. Class A | 207,786 | 11,526 | |

| * | Blucora Inc. | 429,241 | 10,559 |

| CSG Systems | |||

| International Inc. | 215,967 | 9,781 | |

| * | Box Inc. | 451,617 | 9,281 |

| Motorola Solutions Inc. | 86,585 | 9,117 | |

| * | Tech Data Corp. | 105,393 | 8,972 |

| MKS Instruments Inc. | 75,823 | 8,769 | |

| Travelport Worldwide | |||

| Ltd. | 534,738 | 8,738 | |

| * | Sykes Enterprises Inc. | 300,933 | 8,709 |

| DXC Technology Co. | 79,954 | 8,038 | |

| * | Anixter International | ||

| Inc. | 102,546 | 7,768 | |

| * | Synaptics Inc. | 168,785 | 7,719 |

| Lam Research Corp. | 35,821 | 7,277 | |

| * | Flex Ltd. | 442,733 | 7,230 |

| * | ePlus Inc. | 85,860 | 6,671 |

| * | Stamps.com Inc. | 32,425 | 6,519 |

| * | Zebra Technologies | ||

| Corp. | 46,826 | 6,518 | |

| Avnet Inc. | 145,647 | 6,082 | |

| * | Pure Storage Inc. | ||

| Class A | 259,706 | 5,181 | |

| * | Advanced Energy | ||

| Industries Inc. | 66,457 | 4,247 | |

| * | Kulicke & Soffa | ||

| Industries Inc. | 158,094 | 3,954 | |

| * | SMART Global | ||

| Holdings Inc. | 72,118 | 3,594 | |

| * | Alarm.com Holdings | ||

| Inc. | 93,303 | 3,521 | |

| Brooks Automation Inc. | 127,228 | 3,445 | |

| * | Conduent Inc. | 184,795 | 3,445 |

| * | SolarEdge Technologies | ||

| Inc. | 65,292 | 3,434 | |

| * | Unisys Corp. | 297,261 | 3,196 |

| * | Paycom Software Inc. | 28,010 | 3,008 |

| * | Yelp Inc. Class A | 60,297 | 2,517 |

| * | Alpha & Omega | ||

| Semiconductor Ltd. | 120,595 | 1,863 | |

| * | Teradata Corp. | 44,634 | 1,771 |

| * | FireEye Inc. | 91,208 | 1,544 |

| 1,269,892 | |||

| Materials (5.8%) | |||

| * | Freeport-McMoRan | ||

| Inc. | 4,414,654 | 77,565 | |

| Huntsman Corp. | 1,943,996 | 56,862 | |

13

| Strategic Equity Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Louisiana-Pacific Corp. | 1,844,500 | 53,066 | |

| * | Alcoa Corp. | 1,032,850 | 46,437 |

| Chemours Co. | 914,994 | 44,569 | |

| Westlake Chemical | |||

| Corp. | 352,190 | 39,146 | |

| Avery Dennison Corp. | 202,381 | 21,503 | |

| * | Owens-Illinois Inc. | 948,608 | 20,547 |

| Greif Inc. Class A | 286,821 | 14,986 | |

| CF Industries Holdings | |||

| Inc. | 333,981 | 12,601 | |

| Trinseo SA | 107,166 | 7,936 | |

| * | Berry Global Group Inc. | 135,995 | 7,454 |

| Rayonier Advanced | |||

| Materials Inc. | 326,575 | 7,012 | |

| * | Koppers Holdings Inc. | 136,234 | 5,599 |

| Eastman Chemical Co. | 36,388 | 3,842 | |

| 419,125 | |||

| Real Estate (8.2%) | |||

| * | SBA Communications | ||

| Corp. Class A | 432,473 | 73,918 | |

| Hospitality Properties | |||

| Trust | 2,004,594 | 50,796 | |

| Ryman Hospitality | |||

| Properties Inc. | 541,957 | 41,975 | |

| Gaming and Leisure | |||

| Properties Inc. | 1,044,368 | 34,955 | |

| Senior Housing | |||

| Properties Trust | 2,000,711 | 31,331 | |

| Extra Space Storage | |||

| Inc. | 332,798 | 29,073 | |

| Lexington Realty Trust | 3,366,923 | 26,498 | |

| * | CBRE Group Inc. | ||

| Class A | 548,496 | 25,900 | |

| CoreSite Realty Corp. | 257,781 | 25,845 | |

| Pebblebrook Hotel Trust | 722,112 | 24,805 | |

| Xenia Hotels & Resorts | |||

| Inc. | 977,133 | 19,269 | |

| Equity LifeStyle | |||

| Properties Inc. | 210,255 | 18,454 | |

| CubeSmart | 643,097 | 18,135 | |

| MGM Growth | |||

| Properties LLC Class A | 501,281 | 13,304 | |

| Ashford Hospitality | |||

| Trust Inc. | 1,610,724 | 10,405 | |

| Government Properties | |||

| Income Trust | 742,447 | 10,142 | |

| Sunstone Hotel | |||

| Investors Inc. | 644,181 | 9,804 | |

| National Health | |||

| Investors Inc. | 144,780 | 9,742 | |

| Spirit Realty Capital Inc. | 1,248,987 | 9,692 | |

| SL Green Realty Corp. | 96,654 | 9,359 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Select Income REIT | 477,093 | 9,294 | |

| Host Hotels & Resorts | |||

| Inc. | 493,268 | 9,195 | |

| Life Storage Inc. | 92,335 | 7,712 | |

| Park Hotels & Resorts | |||

| Inc. | 267,251 | 7,221 | |

| Washington Prime | |||

| Group Inc. | 1,039,295 | 6,932 | |

| GEO Group Inc. | 308,407 | 6,313 | |

| Jones Lang LaSalle Inc. | 36,076 | 6,300 | |

| DCT Industrial Trust | |||

| Inc. | 103,179 | 5,813 | |

| Lamar Advertising Co. | |||

| Class A | 91,164 | 5,804 | |

| Outfront Media Inc. | 307,701 | 5,766 | |

| New Senior Investment | |||

| Group Inc. | 693,533 | 5,673 | |

| NorthStar Realty | |||

| Europe Corp. | 323,173 | 4,208 | |

| Sun Communities Inc. | 44,947 | 4,107 | |

| Summit Hotel | |||

| Properties Inc. | 295,335 | 4,020 | |

| ^ | Omega Healthcare | ||

| Investors Inc. | 134,866 | 3,647 | |

| Universal Health | |||

| Realty Income Trust | 58,866 | 3,538 | |

| *,^ | Forestar Group Inc. | 109,930 | 2,325 |

| 591,270 | |||

| Telecommunication Services (0.4%) | |||

| * | Zayo Group Holdings | ||

| Inc. | 496,588 | 16,963 | |

| * | Vonage Holdings | ||

| Corp. | 929,275 | 9,897 | |

| Shenandoah | |||

| Telecommunications Co. 46,018 | 1,657 | ||

| 28,517 | |||

| Utilities (4.0%) | |||

| FirstEnergy Corp. | 2,018,768 | 68,658 | |

| Entergy Corp. | 866,566 | 68,268 | |

| NRG Energy Inc. | 1,961,242 | 59,877 | |

| CenterPoint Energy | |||

| Inc. | 2,158,888 | 59,154 | |

| MDU Resources | |||

| Group Inc. | 457,393 | 12,880 | |

| * | Vistra Energy Corp. | 451,559 | 9,406 |

| PNM Resources Inc. | 96,682 | 3,698 | |

| National Fuel Gas Co. | 71,385 | 3,673 | |

| 285,614 | |||

| Total Common Stocks | |||

| (Cost $5,769,931) | 7,169,329 | ||

14

| Strategic Equity Fund | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Temporary Cash Investments (0.8%)1 | |||

| Money Market Fund (0.8%) | |||

| 2,3 | Vanguard Market Liquidity | ||

| Fund, 1.775% | 544,593 | 54,459 | |

| Face | |||

| Amount | |||

| ($000) | |||

| U. S. Government and Agency Obligations (0.0%) | |||

| 4 | United States Treasury Bill, | ||

| 1.391%, 5/3/18 | 600 | 599 | |

| 4 | United States Treasury Bill, | ||

| 1.602%, 5/24/18 | 1,000 | 998 | |

| 4 | United States Treasury Bill, | ||

| 1.849%, 8/16/18 | 300 | 298 | |

| 1,895 | |||

| Total Temporary Cash Investments | |||

| (Cost $56,351) | 56,354 | ||

| Total Investments (100.3%) | |||

| (Cost $5,826,282) | 7,225,683 | ||

| Amount | |||

| ($000) | |||

| Other Assets and Liabilities (-0.3%) | |||

| Other Assets | |||

| Investment in Vanguard | 390 | ||

| Receivables for Investment Securities Sold | 31,152 | ||

| Receivables for Accrued Income | 7,116 | ||

| Receivables for Capital Shares Issued | 2,560 | ||

| Variation Margin Receivable— | |||

| Futures Contracts | 324 | ||

| Other Assets | 13,990 | ||

| Total Other Assets | 55,532 | ||

| Liabilities | |||

| Payables for Investment Securities | |||

| Purchased | (11,803) | ||

| Collateral for Securities on Loan | (50,052) | ||

| Payables for Capital Shares Redeemed | (11,886) | ||

| Payables to Vanguard | (6,442) | ||

| Total Liabilities | (80,183) | ||

| Net Assets (100%) | |||

| Applicable to 211,007,520 outstanding | |||

| $.001 par value shares of beneficial | |||

| interest (unlimited authorization) | 7,201,032 | ||

| Net Asset Value Per Share | $34.13 | ||

| At March 31, 2018, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 5,621,978 |

| Undistributed Net Investment Income | 3,925 |

| Accumulated Net Realized Gains | 176,523 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 1,399,401 |

| Futures Contracts | (795) |

| Net Assets | 7,201,032 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $49,671,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 0.3%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $50,052,000 of collateral received for securities on loan.

4 Securities with a value of $1,696,000 have been segregated as initial margin for open futures contracts.

REIT—Real Estate Investment Trust.

15

| Strategic Equity Fund | ||||

| Derivative Financial Instruments Outstanding as of Period End | ||||

| Futures Contracts | ||||

| ($000) | ||||

| Value and | ||||

| Number of | Unrealized | |||

| Long (Short) | Notional | Appreciation | ||

| Expiration | Contracts | Amount | (Depreciation) | |

| Long Futures Contracts | ||||

| E-mini Russell 2000 Index | June 2018 | 286 | 21,896 | (565) |

| E-mini S&P Mid-Cap 400 Index | June 2018 | 54 | 10,169 | (230) |

| (795) | ||||

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

16

| Strategic Equity Fund | |

| Statement of Operations | |

| Six Months Ended | |

| March 31, 2018 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends | 39,139 |

| Interest1 | 197 |

| Securities Lending—Net | 543 |

| Total Income | 39,879 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 735 |

| Management and Administrative | 5,154 |

| Marketing and Distribution | 542 |

| Custodian Fees | 37 |

| Shareholders’ Reports and Proxy | 82 |

| Trustees’ Fees and Expenses | 3 |

| Total Expenses | 6,553 |

| Net Investment Income | 33,326 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold1 | 201,253 |

| Futures Contracts | 1,857 |

| Realized Net Gain (Loss) | 203,110 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities1 | 191,831 |

| Futures Contracts | (1,607) |

| Change in Unrealized Appreciation (Depreciation) | 190,224 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 426,660 |

1 Interest income, realized net gain (loss), and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $184,000, ($10,000), and ($2,000), respectively. Purchases and sales are for temporary cash investment purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

17

| Strategic Equity Fund | ||

| Statement of Changes in Net Assets | ||

| Six Months Ended | Year Ended | |

| March 31, | September 30, | |

| 2018 | 2017 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 33,326 | 103,003 |

| Realized Net Gain (Loss) | 203,110 | 488,417 |

| Change in Unrealized Appreciation (Depreciation) | 190,224 | 508,953 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 426,660 | 1,100,373 |

| Distributions | ||

| Net Investment Income | (92,114) | (101,097) |

| Realized Capital Gain1 | (479,773) | (99,945) |

| Total Distributions | (571,887) | (201,042) |

| Capital Share Transactions | ||

| Issued | 374,024 | 1,014,707 |

| Issued in Lieu of Cash Distributions | 537,684 | 188,875 |

| Redeemed | (616,038) | (1,098,154) |

| Net Increase (Decrease) from Capital Share Transactions | 295,670 | 105,428 |

| Total Increase (Decrease) | 150,443 | 1,004,759 |

| Net Assets | ||

| Beginning of Period | 7,050,589 | 6,045,830 |

| End of Period2 | 7,201,032 | 7,050,589 |

1 Includes fiscal 2018 and 2017 short-term gain distributions totaling $28,727,000 and $0, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $3,925,000 and $62,713,000.

See accompanying Notes, which are an integral part of the Financial Statements.

18

| Strategic Equity Fund | ||||||

| Financial Highlights | ||||||

| Six Months | ||||||

| Ended | ||||||

| For a Share Outstanding | March 31, | Year Ended September 30, | ||||

| Throughout Each Period | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $34.89 | $30.41 | $30.82 | $32.02 | $27.34 | $21.02 |

| Investment Operations | ||||||

| Net Investment Income | .1601 | .5041 | . 624 | .466 | . 361 | .426 2 |

| Net Realized and Unrealized Gain (Loss) | ||||||

| on Investments | 1.933 | 4.988 | 2.440 | .207 | 4.679 | 6.244 |

| Total from Investment Operations | 2.093 | 5.492 | 3.064 | .673 | 5.040 | 6.670 |

| Distributions | ||||||

| Dividends from Net Investment Income | (. 460) | (. 509) | (. 507) | (. 354) | (. 360) | (. 350) |

| Distributions from Realized Capital Gains | (2.393) | (.503) | (2.967) | (1.519) | — | — |

| Total Distributions | (2.853) | (1.012) | (3.474) | (1.873) | (.360) | (.350) |

| Net Asset Value, End of Period | $34.13 | $34.89 | $30.41 | $30.82 | $32.02 | $27.34 |

| Total Return3 | 6.06% | 18.28% | 10.62% | 2.01% | 18.53% | 32.23% |

| Ratios/Supplemental Data | ||||||

| Net Assets, End of Period (Millions) | $7,201 | $7,051 | $6,046 | $5,739 | $5,392 | $4,239 |

| Ratio of Total Expenses to | ||||||

| Average Net Assets | 0.18% | 0.18% | 0.18% | 0.21% | 0.27% | 0.28% |

| Ratio of Net Investment Income to | ||||||

| Average Net Assets | 1.10% | 1.53% | 2.09% | 1.41% | 1.19% | 1.75%2 |

| Portfolio Turnover Rate | 87% | 81% | 74% | 70% | 60% | 64% |

The expense ratio, net investment income ratio, and turnover rate for the current period have been annualized.

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.043 and 0.18%, respectively, resulting from a special dividend received in connection with a merger between T-Mobile US Inc. and Metro PCS Communications Inc. in May 2013.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the six months ended March 31, 2018, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2014–2017), and for the period ended March 31, 2018, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

20

Strategic Equity Fund

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at March 31, 2018, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

21

Strategic Equity Fund

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At March 31, 2018, the fund had contributed to Vanguard capital in the amount of $390,000, representing 0.01% of the fund’s net assets and 0.16% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments as of March 31, 2018, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 7,169,329 | — | — |

| Temporary Cash Investments | 54,459 | 1,895 | — |

| Futures Contracts—Assets1 | 324 | — | — |

| Total | 7,224,112 | 1,895 | — |

| 1 Represents variation margin on the last day of the reporting period. |

22

Strategic Equity Fund

D. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes. The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year.

At March 31, 2018, the cost of investment securities for tax purposes was $5,826,282,000. Net unrealized appreciation of investment securities for tax purposes was $1,399,401,000, consisting of unrealized gains of $1,518,994,000 on securities that had risen in value since their purchase and $119,593,000 in unrealized losses on securities that had fallen in value since their purchase.

E. During the six months ended March 31, 2018, the fund purchased $3,152,649,000 of investment securities and sold $3,383,911,000 of investment securities, other than temporary cash investments.

| F. Capital shares issued and redeemed were: | ||

| Six Months Ended | Year Ended | |

| March 31, 2018 | September 30, 2017 | |

| Shares | Shares | |

| (000) | (000) | |

| Issued | 10,700 | 30,675 |

| Issued in Lieu of Cash Distributions | 15,880 | 5,767 |

| Redeemed | (17,634) | (33,176) |

| Net Increase (Decrease) in Shares Outstanding | 8,946 | 3,266 |

G. Management has determined that no material events or transactions occurred subsequent to March 31, 2018, that would require recognition or disclosure in these financial statements.

23

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

| Six Months Ended March 31, 2018 | |||

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| Strategic Equity Fund | 9/30/2017 | 3/31/2018 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,060.63 | $0.92 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,024.03 | 0.91 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.18%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (182/365).

25

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard Strategic Equity Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Quantitative Equity Group. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made monthly presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received monthly reports, which included a Market and Economic Report, a Fund Dashboard Monthly Summary, and a Fund Performance Report.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than three decades. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance compared with a relevant benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory expenses were also well below its peer-group average. Information about the fund’s expenses appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section.

26

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s at-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

27

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share.

For a fund, the weighted average price/book ratio of the stocks it holds.

28

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

29

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

30

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 208 Vanguard funds.

Information for each trustee and executive officer of the fund appears below. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

Interested Trustees1

F. William McNabb III

Born in 1957. Trustee since July 2009. Principal occupation(s) during the past five years and other experience: chairman of the board (January 2010–present) of Vanguard and of each of the investment companies served by Vanguard, trustee (2009–present) of each of the investment companies served by Vanguard, and director (2008–present) of Vanguard. Chief executive officer and president (2008–2017) of Vanguard and each of the investment companies served by Vanguard, managing director (1995–2008) of Vanguard, and director (1997–2018) of Vanguard Marketing Corporation. Director (2018–present) of UnitedHealth Group.

Mortimer J. Buckley

Born in 1969. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: chief executive officer (January 2018–present) of Vanguard; chief executive officer, president, and trustee (January 2018–present) of each of the investment companies served by Vanguard; president and director (2017–present) of Vanguard; and president (February 2018–present) of Vanguard Marketing Corporation. Chief investment officer (2013–2017), managing director (2002–2017), head of the Retail Investor Group (2006–2012), and chief information officer (2001–2006) of Vanguard. Chairman of the board (2011–2017) of the Children’s Hospital of Philadelphia.

Independent Trustees