Table of Contents

PRELIMINARY PROXY MATERIALS – SUBJECT TO COMPLETION

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 | |

Stillwater Mining Company

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| 2. | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| 4. | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| 5. | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

|

| ||||

| 2. | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| 3. | Filing Party:

| |||

|

| ||||

| 4. | Date Filed:

| |||

|

| ||||

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Stillwater Mining Company

March —, 2013

Dear Fellow Stillwater Mining Company Shareholder:

You are cordially invited to attend our Annual Meeting of Shareholders on [—] at [—] a.m. (Mountain Daylight Time) at the Stillwater Mine, Nye, Montana.

Your Board of Directors is recommending a highly qualified, experienced and diverse slate of director nominees for election to our Board of Directors at the Annual Meeting. At the Annual Meeting, we will ask you to: (1) elect eight directors; (2) ratify the appointment of KPMG, LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2013; (3) cast an advisory vote to approve named executive officer compensation; (4) to vote on a shareholder-proposed By-law amendment requiring supermajority voting for certain Board actions; and (5) take action upon any other business as may properly come before the Annual Meeting.

Your management team will further elaborate at the Annual Meeting on our strategy to deliver enhanced shareholder value. We also will review our progress during the past year and answer your questions. Additionally, shareholders will have the opportunity to personally visit the Stillwater Mine operations site of the Far West and Blitz projects, and participate in a brief underground tour of the Blitz tunnel-boring machine area. If you intend to participate in the mine tour, please wear casual clothing.

The accompanying materials include the Notice of Annual Meeting of Shareholders and Proxy Statement. The Proxy Statement describes the business that we will conduct at the Annual Meeting. It also provides information about us that you should consider when you vote your shares.

This year’s Annual Meeting will be a particularly important one, and YOUR vote is extremely important.

Whether or not you will be able to attend the Annual Meeting, it is very important that your shares be represented. We urge you to read the accompanying Proxy Statement carefully and to use the enclosed WHITE proxy card to vote for the Board’s nominees, and in accordance with the Board’s recommendations on the other proposals, as soon as possible. You may vote your shares by signing and dating the enclosed WHITE proxy card and returning it in the postage–paid envelope provided, whether or not you plan to attend the Annual Meeting. For your convenience, you may also vote your shares via the Internet or by a toll–free telephone number by following the instructions on the enclosed WHITE proxy card.

i

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Please note, you may receive solicitation materials from a dissident shareholder, Clinton Relational Opportunity Master Fund, L.P. (together with certain of its affiliates, the “Clinton Group”), seeking your proxy to vote for nominees to become members of the Board of Directors and a proposal calling for a supermajority voting requirement for the Board of Directors to take certain action. THE BOARD OF DIRECTORS URGES YOU NOT TO SIGN OR RETURN ANY [COLOR] PROXY CARD SENT TO YOU BY THE CLINTON GROUP. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE BOARD’S NOMINEES.

YOUR VOTE IS EXTREMELY IMPORTANT THIS YEAR IN LIGHT OF THE PROXY CONTEST BEING CONDUCTED BY THE CLINTON GROUP.

Whether or not you plan to attend the meeting, and whatever the number of shares you own, please complete, sign, date and promptly return the enclosed WHITE proxy card. Please vote by telephone, the Internet or by signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. If you own shares in “street name” through a bank, broker or other nominee, you may vote your shares by telephone or Internet by following the instructions on the enclosed proxy card. Please note, however, that if you wish to vote at the meeting and your shares are held of record by a broker, bank or other nominee, you must obtain a “legal” proxy issued in your name from that record holder.

THE BOARD URGES YOU NOT TO SIGN ANY [COLOR] PROXY CARD SENT TO YOU BY THE CLINTON GROUP. IF YOU HAVE PREVIOUSLY SIGNED AND RETURNED A [COLOR] PROXY CARD SENT TO YOU BY THE CLINTON GROUP, YOU CAN REVOKE IT BY SIGNING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

Thank you for your continued support. If you have any questions, please contact Innisfree M&A Incorporated, our proxy solicitor assisting us in connection with the Annual Meeting. Shareholders may call toll–free at (877) 825–8906.

| Very truly yours, |

|

| Francis R. McAllister |

| Chairman and Chief Executive Officer |

ii

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Stillwater Mining Company

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| Time and Date | [—] a.m. (Mountain Daylight Time), on [—], 2013 | |

| Place | Stillwater Mine, 2526 Nye Road Nye, Montana 59061 | |

| Items of Business | (1) To elect the eight nominees named in the attached proxy. | |

| (2) To ratify the appointment of KPMG LLP as the Company’s independent registered accounting firm for 2013. | ||

| (3) To conduct an advisory vote to approve named executive officer compensation. | ||

| (4) To vote on a shareholder-proposed By-law amendment requiring supermajority voting for certain Board actions. | ||

| (5) To conduct such other business properly presented at the meeting or any postponements or adjournments thereof. | ||

| Adjournments and Postponements | Any actions on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. | |

| Record Date | You are entitled to vote only if you were a Stillwater Mining Company shareholder as of the close of business on [—]. | |

| Meeting Admission | You are entitled to attend the annual meeting only if you were a Stillwater Mining Company shareholder as of the close of business on [—] or hold a valid proxy for the annual meeting. In addition, if you are a shareholder of record, your ownership as of the record date will be verified prior to admittance into the meeting. If you are not a shareholder of record but hold shares “in street name” through a broker, trustee or nominee, you must provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to [—] or similar evidence of ownership. If you do not comply with the other procedures outlined above, you will not be admitted to the annual meeting. | |

iii

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

| The annual meeting will begin promptly at [—] a.m., local time. Check-in will begin thirty minutes prior to the meeting time, and you should allow ample time for the check-in procedures. Parking at the meeting location is limited. The Company will provide transportation to the meeting site from our offices in Columbus, Montana. Additional information will be provided on our corporate website. | ||

| Voting | Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. If you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by voting by phone, the internet, or by signing, dating and returning your proxy in the postage-paid envelope provided. | |

| By order of the Board of Directors, | ||

| ||

| Brent R. Wadman | ||

| Deputy General Counsel & Corporate Secretary | ||

iv

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

This notice of annual meeting and proxy statement and form of proxy are being distributed

and made available on or about March , 2013.

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| Certain Information Regarding Participants in the Solicitation of Proxies |

19 | |||

| 20 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 |

v

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

vi

Table of Contents

PRELIMINARY PROXY MATERIALS – SUBJECT TO COMPLETION

Stillwater Mining Company

PROXY STATEMENT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON [—], 2013

This Proxy Statement is being furnished to the shareholders of Stillwater Mining Company (the “Company”) in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be voted at the Annual Meeting of Shareholders of the Company and any postponements or adjournments thereof. The meeting will be held on [—], 2013, at [—] a.m. (Mountain Daylight Time) at the Stillwater Mine, 2526 Nye Road, Nye, Montana 59061.

These proxy solicitation materials were first mailed on or about [—], 2013, to all shareholders entitled to vote at the meeting. The meeting is being held:

| 1. | To elect the eight nominees named in this proxy statement to the Company’s Board. |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered accounting firm for 2013. |

| 3. | To conduct an advisory vote to approve named executive officer compensation. |

| 4. | To vote on a shareholder-proposed By-law amendment requiring supermajority voting for certain Board actions. |

| 5. | To conduct such other business properly presented at the meeting or any postponements or adjournments thereof. |

The enclosed proxy is being solicited by the Board on behalf of the Company. The cost of this solicitation will be borne by the Company. In addition to solicitation by mail, the officers, directors and employees of the Company may solicit proxies by telephone, telegraph, facsimile, electronic means or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Common Stock of the Company (the “Common Stock”) registered in the names of nominees. The Company will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

Holders of shares of Common Stock at the close of business on [—], 2013 (the “Record Date”) are entitled to notice of and to vote at the meeting. On the Record Date, [—] shares of Common Stock were issued, outstanding and entitled to vote. The holders of at least 50% of the shares of Common Stock issued, outstanding and entitled to vote at the meeting, present in person or by proxy, constitutes a quorum.

1

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

On December 13, 2010, MMC Norilsk Nickel, the Company’s then largest shareholder completed the sale of 49.8 million shares of Common Stock owned by its wholly owned subsidiary, Norimet Limited. In connection with this transaction, Credit Suisse Capital LLC acquired 3,600,000 shares of Common Stock and UBS AG acquired 5,400,000 shares of Common Stock. On December 13, 2010, the Company entered into Voting Agreements with UBS AG and Credit Suisse Capital LLC. Pursuant to the Voting Agreements, UBS AG and Credit Suisse Capital LLC, agreed, subject to certain conditions, to cause all of these shares (to the extent they are still beneficially owned by them) to be counted as present at any meeting of the Company’s shareholders, including the Annual Meeting, and to vote these shares in the same proportion as all of the outstanding shares of Common Stock are actually voted.

Each share of Common Stock outstanding on the Record Date is entitled to one vote.

The vote of the holders of (i) a plurality of votes cast by the shares present in person or represented by proxy is required to elect eight nominees standing for the election of directors, (ii) a majority of the shares present in person or represented by proxy is required to approve Proposal 2, regarding the ratification of the selection of KPMG LLP as the Company’s independent registered accounting firm, Proposal 3, the advisory vote on the compensation of our named executive officers and Proposal 4, the shareholder-proposed By-law amendment.

If a shareholder abstains from voting on any matter, the Company intends to count such shareholder as present for purposes of determining whether a quorum is present at the meeting for the transaction of business. If you sign and return the WHITE proxy card, unless contrary instructions are indicated, the shares of Common Stock represented by such proxy will be voted FOR the election as directors of the nominees named in this proxy statement, FOR ratification of the selection of KPMG LLP as the Company’s independent registered accounting firm, FOR the advisory vote on executive compensation, and AGAINST the shareholder-proposed By-law amendment. Additionally, the Company intends to count broker “non-votes” as present for purposes of determining the presence or absence of a quorum for the transaction of business but broker non-votes, if any, will have the effect of a vote against any matter. A non-vote occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Abstentions will have the effect of a vote against Proposals 2, 3, and 4.

If you are a participant in the Company’s 401(k) plan, the enclosed WHITE proxy card will serve to direct Reliance Trust Company, as trustee of our 401(k) plan, how to vote the shares of our common stock attributable to your individual account. Computershare will vote shares as instructed by participants prior to 11:59 PM (EDT) on [—], 2013. If you do not provide voting directions to Reliance Trust Company by that time, the shares attributable to your account will be voted proportionally to the voting instructions received from the other voting participants of the Company’s 401(k) plan.

Neither management nor the Board knows of any other matters to be brought before the meeting. If other matters are presented properly to the shareholders for action at the meeting or postponements or adjournments thereof, then the proxy holders named in the proxy have advised that they intend to vote in their discretion on all matters in which the shares of Common Stock represented by such proxy are entitled to vote.

2

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Receipt of Multiple Proxy Cards

Many of our shareholders hold their shares in more than one account and may receive separate proxy cards or voting instructions forms for each of those accounts. To ensure that all of your shares are represented at the annual meeting, we recommend that you vote every WHITE proxy card you receive.

Additionally, please note that the Clinton Group has indicated its intent to nominate alternative nominees for election at the annual meeting and to present a proposal calling for a supermajority voting requirement for certain Board action. In connection with the Clinton Group’s alternative nominations and proposal, you may receive proxy solicitation materials from the Clinton Group, including an opposition proxy statement and a [color] proxy card. Your Board unanimously recommends that you disregard and do not return any [color] proxy card you receive from the Clinton Group.

If you have already voted using the Clinton Group’s [color] proxy card, you have every right to change your vote and revoke your prior proxy which is done by signing and dating the enclosed WHITE proxy card and returning it in the postage–paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only the latest dated proxy you submit will be counted. If you withhold your vote on any Clinton Group nominee using the Clinton Group’s [color] proxy card, your vote will not be counted as a vote for the Board’s nominees and will result in the revocation of any previous vote you may have cast on our WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of our Board, you should disregard any proxy card that you receive that is not a WHITE proxy card.

Any proxy may be revoked at any time before it is voted by (i) written notice to the Company’s Corporate Secretary, (ii) receipt of a proxy properly signed and dated subsequent to an earlier proxy, or (iii) by revoking in person at the meeting or voting in person at the meeting. If not revoked, the shares of Common Stock represented by a proxy will be voted according to the proxy.

If you have previously signed a [color] proxy card sent to you by the Clinton Group, you may change your vote and revoke your prior proxy by signing and dating the enclosed WHITE proxy card and returning it in the postage–paid envelope provided or by voting via the Internet or by telephone by following the instructions on the enclosed WHITE proxy card. Submitting a Clinton Group [color] proxy card—even if you withhold your vote on the Clinton Group nominees—will revoke any votes you previously made via our WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of our Board, you should disregard any proxy card that you receive that is not a WHITE proxy card and do not return any [color] proxy card that you may receive from the Clinton Group, even as a protest vote against the Clinton Group.

3

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on [—], 2013.

The proxy statement, proxy card, and the Annual Report on Form 10-K for the year ended December 31, 2012, are available on our website at www.stillwatermining.com under the heading “Investor Relations”. You may obtain directions to attend the annual meeting on our website at www.stillwatermining.com under the heading “Investor Relations”.

ELECTION OF DIRECTORS

The following Directors have agreed to stand for re-election as Directors at this year’s annual meeting and have been approved by the Nominating Committee of the Board.

The eight (8) persons set forth below have been nominated to serve as directors of the Company until the next annual meeting of shareholders or until their respective successors are elected and each person has consented to being named as a nominee. All of the nominees are currently directors of the Company.

Directors are elected by a plurality of the votes cast by shareholders who are present in person or represented by proxy and entitled to vote at a meeting at which a quorum is present. Brokers and other nominees will not have discretionary authority to vote your shares if you hold your shares in street name and do not provide instructions as to how your shares should be voted on this proposal.

The Board of Directors unanimously recommends that you vote FOR all of the Board’s nominees.

It is anticipated that proxies will be voted for the nominees listed below, and the Board has no reason to believe any nominee will not continue to be a candidate or will not be able to serve as a director if elected. In the event that any nominee named below is unable to serve as a director, the proxy holders named in the proxies have advised that they will vote for the election of such substitute or additional nominees as the Board may propose. Should the Company lawfully identify or nominate substitute or additional nominees before the Annual Meeting, we will file supplemental proxy materials that identifies such nominee(s), discloses whether such nominee(s) have consented to being named in the proxy material and to serve if elected and includes the relevant required disclosures with respect to such nominee(s).

The name and age of each nominee, his or her principal occupation for at least the past five (5) years and certain additional information is set forth below. Such information is as of the date hereof and is based upon information furnished to the Company by each nominee.

Background on the Solicitation

On December 20, 2012, the Clinton Group, Inc. sent, and publicly disclosed, a letter to the Company’s Board of Directors outlining several issues and concerns regarding, among other things, the Company’s operations, acquisition strategy, and governance and stating Clinton Group’s belief that the Company “should augment the board with new directors and the long-serving incumbents should resign”. In particular, the Clinton Group raised concerns regarding the Company’s spending on marketing, its acquisition of Marathon and Altar, its recent issuance of convertible debt and the need for succession planning.

4

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

On January 16, 2013, certain of the Board’s independent directors and the Company’s Chief Executive Officer met with representatives of the Clinton Group to discuss the issues raised in the December 20, 2012 letter as described above.

On February 25, 2013, the Clinton Group, which on that date beneficially owned approximately a 1.1% of the Company’s shares, delivered a notice to the Company indicating its intent to nominate eight alternative candidates to stand for election to the Board of Directors at the 2013 Annual Meeting of Shareholders and notified the Company that it would present a proposal calling for a supermajority voting requirement for the Board of Directors to take certain action.

Francis R. McAllister (age 70). Francis R. McAllister became a director of the Company on January 9, 2001 and the Chairman of the Board and Chief Executive Officer of the Company on February 12, 2001. Prior to his appointment to the Board, Mr. McAllister was with ASARCO Incorporated from 1966 to 1999, serving as Chairman and Chief Executive Officer in 1999, Chief Operating Officer from 1998 to 1999, Executive Vice President — Copper Operations from 1993 to 1998, Chief Financial Officer from 1982 to 1993 and in various professional and management positions from 1966 to 1982. He currently serves on the Board of Directors of Cliffs Natural Resources (f/k/a Cleveland Cliffs, Inc.), an iron ore and coal mining company.

The Board believes that Mr. McAllister should continue to serve on the Board of Directors based on his leadership of the Board and as Chief Executive Officer of the Company through 12 years of significant challenges and growth, and his significant knowledge and deep understanding of the Company and the mining industry.

Craig L. Fuller (age 62). Craig L. Fuller was appointed a director of the Company on June 16, 2003. Mr. Fuller has been the President and Chief Executive Officer of the Aircraft Owners and Pilots Association (AOPA) since January 1, 2009. AOPA is the largest general aviation membership organization in the world.

From 2007 to 2009, Mr. Fuller was Executive Vice President of APCO Worldwide and he remains a member of the APCO Worldwide International Advisory Council.

From 1999 to 2007, Mr. Fuller was the President and Chief Executive Officer of the National Association of Chain Drug Stores (NACDS). NACDS is a leading consulting organization focused on major health care policy issues.

From 1981 to 1989, Mr. Fuller served in the White House as assistant to President Ronald Reagan for cabinet affairs and then as Chief of Staff to Vice President George H.W. Bush. From 1988 to 1989, he served as co-director of President-elect Bush’s transition team.

Upon leaving the White House to enter the private sector, Mr. Fuller joined The Wexler Group, later acquired by Hill & Knowlton, where, from 1989 to 1992 he served as President of its U.S. operations and head of worldwide public affairs. From 1992 to 1996 he was Senior Vice President for Corporate Affairs at Philip Morris Companies. From 1996 to 1999 he led the board of directors practice at Korn/Ferry International and in 1995 and 1996 served as Vice Chairman of Burson-Marsteller.

5

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

With regular interviews on politics and public affairs, as well as weekly and monthly online columns, Mr. Fuller is a frequent commentator and speaker on a wide range of topics. He is a director of the United States Chamber of Commerce and the National Chamber Foundation. Additionally, he is a trustee of the George Bush Presidential Library Foundation, and served for 10 years as a trustee of the John F. Kennedy Center for the Performing Arts.

Mr. Fuller earned his Bachelor of Science in Political Science from the University of California at Los Angeles and a master’s degree in Urban Affairs from Occidental College.

The Board believes Mr. Fuller should continue to serve on the Board of Directors based on his extensive management and leadership experience in the private and public sectors and his deep understanding of our Company and the issues affecting our industry.

Steven S. Lucas (age 47). Steven S. Lucas was appointed a director of the Company on June 23, 2003. Mr. Lucas is a partner in the law firm of Nielsen Merksamer Parrinello Gross & Leoni LLP, a law firm based in California specializing in political, election and government law, and has practiced there since 1995.

Mr. Lucas is a Lecturer in Law at Stanford Law School, teaching “Law and Politics” and “Election Law” for second and third year law students. He has also served on the faculty of, and an author for, the Practising Law Institute’s “Advanced Compliance and Ethics Workshop.” Mr. Lucas is the author of “Designing a Political Law Compliance System for Broker-Dealers and Advisors” which appears in PLI’s treatise “Broker-Dealer Regulation.”

Mr. Lucas previously served at the appointment of the Governor of California as Chairman of the Bipartisan Commission on the Political Reform Act. He is a past president of the California Political Attorneys Association. He has also served on the California Secretary of State’s Task Force on Online Disclosure as well as the California Fair Political Practice Commission Chairman’s Advisory Task Force.

After graduating from law school he clerked for Chief Justice Malcolm Lucas (no relation) of the California Supreme Court, and served as Counsel to the Webster Commission, appointed by the Los Angeles Police Commission to investigate the LAPD’s preparedness for and response to the Los Angeles riots. Mr. Lucas was an attorney at Sullivan & Cromwell from 1991 to 1995.

Mr. Lucas has published numerous opinion-editorial columns relating to constitutional and other legal issues in the Los Angeles Times as well as other California newspapers, and has experience working for federal and state public officials and political campaigns.

Mr. Lucas received his law degree, magna cum laude, from Harvard Law School in 1990, and a B.A. in economics/business, magna cum laude, from UCLA in 1987.

6

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

The Board believes Mr. Lucas should continue to serve on the Board of Directors based on his strong legal background and understanding of our Company.

Patrick M. James (age 67). Patrick M. James was appointed a director of the Company on January 9, 2001 and has served as the Company’s lead independent director since July 24, 2002. Since March 2001, Mr. James has been an independent natural resource management consultant and professional corporate director. Mr. James was the President, Chief Executive Officer, and Director of Rio Algom Limited from June 1997 to March 2001, following the sale of the company in 2000. Prior to joining Rio Algom Limited, Mr. James spent 18 years with Santa Fe Pacific Gold Corporation, becoming President and Chief Operating Officer in 1994 and Chairman, Director, President and Chief Executive Officer in 1995 until the sale of the company in 1997. He served a year on the Newmont Mining, and Newmont Gold Boards during 1997-1998. Mr. James was a Director of Dynatec Corporation, a Canadian nickel mining company from 2001 until its sale in 2007. He was Chairman; Interim President and Chief Executive Officer; and Director of Constellation Copper Corporation, a Canadian base metal mining company from 2002 until December, 2008; when the company filed for bankruptcy protection. Mr. James has been on the Board of General Moly Inc., a company developing a molybdenum mine in Nevada, since December, 2010 as a Director and Chairman. He also served on the Advisory Board for Resource Capital Funds III and IV until 2008. He was Chairman and a Director of Centerra Gold Inc., a Canadian gold mining company from June, 2004, to May, 2012, when he retired from the company. Mr. James is a member of the Colorado School of Mines Foundation Board of Governors.

He received a Masters of Management from the University of New Mexico in 1984, and an Engineer of Mines from Colorado School of Mines in 1968. Mr. James has received several mining industry awards.

The Board believes that Mr. James should continue to serve on the Board of Directors based on his experience in the mining industry for more than 45 years, at levels ranging from underground miner to executive management. Mr. James’ national and international experience in mine development and production and mergers and acquisitions in the mining industry contribute greatly to our Board.

Michael S. Parrett (age 61). Michael S. Parrett was elected to the Board on May 7, 2009. He has been an independent consultant and corporate director since 2002. During 2002, 2003 and the first quarter of 2004, Mr. Parrett served as a financial consultant to Stillwater Mining Company. From 1990 to 2001 he was Chief Financial Officer, President of Rio Algom and Chief Executive of Billiton Base Metals. From 1983 to 1989 Mr. Parrett performed various financial functions, including Controller, Chief Financial Officer, Treasurer, Controller Marketing and Director of Internal Audit at Falconbridge Limited. He has been on the Board of Directors of Pengrowth Energy Corporation since 2004. Since 2010 he has been Chairman of Mongolia Minerals Corporation (a private corporation) and a member of the Board of Directors of Sunshine Silver Mines Corporation (a private corporation). Mr. Parrett was on the Board of Directors of Gabriel Resources Ltd from 2003 to 2010 and was Chairman since December 2005. He was also a Trustee and on the Board of Directors of Fording Canadian Coal Trust from 2003-2008. Mr. Parrett is a Chartered Accountant and received his Bachelor of Arts from York University.

7

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

The Board believes Mr. Parrett should continue to serve on the Board of Directors based on his more than 25 years of mining finance experience, his strong financial and accounting background and his in depth knowledge of financial issues affecting our industry.

Sheryl K. Pressler (age 62). Sheryl K. Pressler has been a director of the Company since May 9, 2002. Ms. Pressler has been an investment and strategy consultant in Atlanta, Georgia since 2001. From 2000 to 2001, she was Chief Executive Officer for Lend Lease Real Estate Investments — United States, a subsidiary of Lend Lease Corporation, an Australian real estate services company. From 1994 to 2000, she was the Chief Investment Officer for the California Public Employees’ Retirement System (CalPERS), the nation’s largest public pension fund. From 1981 to 1994, she was responsible for the management of the Retirement Funds for the McDonnell Douglas Corporation. Ms. Pressler has served on the Board of Directors of ING Funds Unified since 2006 and on the Board of Directors of Centerra Gold since 2008. She is currently a member of the Audit Committee of Centerra Gold Board of Directors. Previously, Ms. Pressler was a director of Nuevo Energy Company from 2002 until 2004 when the company was sold. While on the Nuevo Energy Company Board of Directors, Ms. Pressler served on their Audit Committee. Ms. Pressler received her B.A. in philosophy from Webster University and her M.B.A. from Washington University.

The Board believes Ms. Pressler should continue to serve on the Board of Directors based on her strong investment and strategy background and her deep knowledge of our Company and our industry.

Gary A. Sugar (age 64). Gary A. Sugar has been a director of the Company since August 29, 2012. Mr. Sugar retired in 2011 from RBC Capital Markets after a distinguished 32-year career. Mr. Sugar holds a Bachelor of Science degree in Geology and an M.B.A. from the University of Toronto.

Mr. Sugar initially worked in the mining industry in exploration and corporate development for companies including Cominco, Rio Algom, and Imperial Oil (Exxon). Mr. Sugar joined a predecessor company to RBC Capital Markets in 1979, was appointed a managing director in 1987 and led the mining practice for many years. At RBC Capital Markets he was involved in many significant merger and acquisition transactions, debt and equity financings, advisory assignments and oversight of corporate banking relationships for leading Canadian and international mining companies including Barrick Gold, BHP, Cameco, Caminco, Falconbridge, Inco, Placer Dome, Potash Corp., Rio Algom and Teck. Notable transactions include the acquisitions at Homestake and Placer Dome by Barrick, the sale of Inco to Vale, the acquisition of Cominco by Teck, initiating a three-way merger to form Placer Dome, the initial public offering of Cameco and a $4 billion equity financing by Barrick. He is currently on the Boards of Directors of Osisko Mining Corporation and Romarco Minerals Inc.

8

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

The Board believes Mr. Sugar should continue to serve on the Board of Directors based on his wealth of transactional experience in the mining industry across a broad range of commodities and geographies

George M. Bee (age 54). George Bee has been a director of the Company since November 24, 2012. Mr. Bee served as the President and Chief Executive Officer of Andina Minerals Inc. until the successful sale of the company to Hochschild Mining Ltd. in January 2013. Currently he sits on the board of Stillwater Mining Company and Sandspring Resources Ltd as an independent director. Prior to his current role, he has held various senior management and operational positions at Aurelian Resources, Inc., Kinross Gold Corporation, Palabora Mining Company in South Africa, and at Barrick Gold Corporation. At Barrick his extensive career included managing the teams that developed two large gold mines — Veladero and Pierina. Mr. Bee served briefly on the board of directors of Peregrine Metals Ltd., which was acquired by Stillwater in 2011. He received a Bachelor of Science degree from the Camborne School of Mines in Cornwall, United Kingdom.

The Board believes Mr. Bee should continue to serve on the Board of Directors based on his strong mining background and industry knowledge.

BOARD OF DIRECTORS AND COMMITTEES

The Board met 13 times during 2012. Each director attended 95% or more of the total number of meetings of the Board and each of the committees on which he or she served in 2012. The non-employee directors regularly meet in executive session without management.

It is the Company’s policy that directors are invited and encouraged to attend the Annual Meeting of Shareholders. All of the Company’s directors attended last year’s annual meeting of shareholders in person or by telephone.

The Board follows the standards set forth in the Company’s Corporate Governance Principles when determining director independence, which meet or exceed the listing standards of the New York Stock Exchange (“NYSE”) with respect to director independence. These guidelines can be found on the Company’s corporate website at www.stillwatermining.com, under the heading “Corporate Governance/Independence Criteria for Directors.” A copy may also be obtained upon request from the Company’s Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

These guidelines provide objective as well as subjective criteria that the Board will utilize in determining whether each director meets the independence standards of the Securities and Exchange Commission (the “SEC”) and the NYSE applicable to the Company. Additionally, the Company complies with guidelines adopted pursuant to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

The Board undertook its annual review of director transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. The Board also examined transactions and relationships between directors or their affiliates and members of the Company’s senior management or their affiliates.

9

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

The Board affirmatively determined that all of the directors being nominated for election at the annual meeting are independent of the Company and the Company’s management under the standards set forth in the Corporate Governance Principles, with the exception of Francis R. McAllister. Mr. McAllister is considered not independent because he serves as the Company’s Chief Executive Officer.

Audit Committee. The Company has a standing Audit Committee as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held four (4) meetings during 2012. The members of the Audit Committee in 2012 were Sheryl K. Pressler (Chairperson), Steven S. Lucas, and Michael S. Parrett. Each of whom is “independent” and satisfies the additional independence requirements of Section 303A.02 of the NYSE’s listing standards and Rule 10A-3 of the Exchange Act and the NYSE requirements for audit committee members.

The Audit Committee reviews the accounting principles and procedures of the Company and its annual financial reports and statements, recommends to the Board the engagement of the Company’s independent auditors, reviews with the independent auditors the plans and results of the auditing engagement and considers the independence of the Company’s auditors. The Audit Committee is also responsible for reviewing the Company’s finance matters.

The Audit Committee is governed by a written charter which is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Corporate Governance/Committee Charters/Audit Committee.” Copies of this charter are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The Audit Committee also follows a written Audit and Non-Audit Services Pre-Approval Policy for services to be performed by the independent auditor. Proposed services may be either (i) pre-approved without consideration of specific case-by-case services by the Audit Committee (“General Pre-Approval”) or (ii) require the specific pre-approval of the Audit Committee (“Specific Pre-Approval”). The Audit Committee believes that the combination of these two approaches results in an effective and efficient procedure to pre-approve services performed by the independent auditor to ensure the auditor’s independence is not impaired. Unless a type of service has received General Pre-Approval, it requires Specific Pre-Approval by the Audit Committee if it is to be provided by the independent auditor. Any proposed specific individual project to provide an otherwise generally approved service whose expected fees exceed $25,000 requires an overriding Specific Pre-Approval by the Audit Committee.

For both types of pre-approval, the Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence. The Audit Committee also considers whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture,

10

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. Using its business judgment, the Audit Committee considers all relevant factors (with no one factor being decisive) when determining whether pre-approval is appropriate.

A General Pre-Approval expires 12 months from the date of pre-approval, unless the Audit Committee states otherwise. From time-to-time the Audit Committee may revise the list of services that are covered by a General Pre-Approval based on subsequent determinations.

This policy is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Governance/Governance Documents/Audit and Non-Audit Policy”. Copies of this policy are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

SEC rules and NYSE listing standards require the Board to determine whether a member of its audit committee is an “audit committee financial expert” and disclose its determination. According to these requirements, an audit committee member can be designated an audit committee financial expert only when the audit committee member satisfies specified qualification requirements, such as experience (or “experience actively supervising” others engaged in) preparing, auditing, analyzing, or evaluating financial statements presenting a level of accounting complexity comparable to what is encountered in connection with the Company’s financial statements. SEC rules further require such qualifications to have been acquired through specified means of experience or education. The Board has determined that Michael S. Parrett, qualifies as an audit committee financial expert under SEC rules. The Board believes that the current members of the Audit Committee are qualified to carry out the duties and responsibilities of the Audit Committee.

Compensation Committee. The Company has a separate Compensation Committee as required under the NYSE listing standards. The Compensation Committee held seven (7) meetings during 2012. During 2012, the members of the Compensation Committee were Steven S. Lucas (Chairman), Craig L. Fuller and Patrick M. James. The Board has determined that all of the members of the Compensation Committee are “independent” under the applicable NYSE listing standards. The principal responsibilities of the Compensation Committee are to establish policies and determine matters involving executive compensation, recommend changes in employee benefit programs, approve the grant of stock options and stock awards under the Company’s stock plans and provide assistance to management regarding key personnel selection. The Compensation Committee’s written charter is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Governance/Committee Charters/Compensation Committee.” Copies of the charter are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

Health, Safety and Environmental Committee. The Company has a Health, Safety and Environmental Committee. The principal responsibilities of this committee are (i) to review the Company’s environmental and occupational health and safety policies and programs, (ii) to oversee the Company’s environmental and occupational health and safety performance, and (iii)

11

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

to monitor current and future regulatory issues. During 2012, the Health, Safety and Environmental Committee consisted of Michael Schiavone (Chairman), Sheryl K. Pressler, and Craig L. Fuller. This committee held three (3) meetings in 2012.

Committee on Ore Reserves. The Company has a Committee on Ore Reserves. The principal responsibilities of this committee are (i) to advise the Board on the appropriateness, accuracy and completeness of the Company’s ore reserves, and (ii) to ensure that management appropriately presents the Company’s ore reserves to regulatory agencies. During 2012, the Committee on Ore Reserves was composed of Michael S. Parrett (Chairman), Patrick M. James and Sheryl K. Pressler. This committee held three (3) meetings in 2012.

Corporate Governance and Nominating Committee. The Company has a Corporate Governance and Nominating Committee as required pursuant to Section 303A.04 of the NYSE’s listing standards. The Corporate Governance and Nominating Committee held seven (7) meetings during 2012. The Corporate Governance and Nominating Committee is composed of Craig L. Fuller (Chairman), Patrick M. James, and Michael Schiavone. The Board has determined that all of the members of the Corporate Governance and Nominating Committee are independent directors under the applicable NYSE listing standards. The Company complies with the requirement of the NYSE to have a Corporate Governance and Nominating Committee comprised entirely of independent directors.

The principal responsibilities of the Corporate Governance and Nominating Committee are (i) identifying and recommending to the Board individuals qualified to serve as directors of the Company and on committees of the Board, (ii) advising the Board as to the appropriate size, function and procedures of the committees of the Board, (iii) developing and recommending to the Board corporate governance principles, and (iv) overseeing evaluation of the Board and the Company’s executive officers.

The Corporate Governance and Nominating Committee is governed by a written charter. The Board also follows written corporate governance guidelines for the Company and a written policy for shareholder nomination of directors. These documents set forth the criteria and methodology the Board will use when considering individuals as nominees to the Board. Current copies of these documents are available on the Company’s corporate website at www.stillwatermining.com under the headings “Governance/Committee Charters/Corporate Governance & Nominating Committee”, “Governance/Governance Principles” and “Governance/Governance Documents/Stockholder Nomination of Directors”, respectively. Copies of these documents are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The Company has a Business Ethics and Code of Conduct policy applicable to its officers, directors, employees and agents, including the Chief Executive Officer and all senior financial officers, including our principle financial officer and controller. A current copy of this policy is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Governance/Governance Documents/Code of Conduct.” The purpose of this policy is to provide legal, ethical and moral standards for the conduct of the Company’s officers, directors,

12

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

employees and agents. In addition, waivers from and amendments to, our Code of Business Conduct and Ethics that apply to our directors and executive officers, including our principle executive officer, principle financial officer, principle accounting officer, or persons performing similar functions, will be timely posted in the governance section of our website at www.stillwatermining.com. The Board has also adopted a written Code of Ethics for its Chief Executive and Senior Financial Officers which is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Governance/Governance Documents/Code of Ethics for Senior Financial Officers.” This document sets forth specific policies to guide the Chief Executive Officer, Chief Financial Officer and Corporate Controller in the performance of their duties. Copies of these documents are also available in print to shareholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honest ethical conduct in both his or her professional and personal activities. In addition, the Corporate Governance and Nominating Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. While the Corporate Governance and Nominating Committee has not adopted a formal diversity policy with respect to the selection of director nominees, the committee seeks to have the Board represent a diversity of backgrounds and experiences. As part of this process, the committee evaluates how a particular candidate would strengthen and increase the diversity of the Board and contribute to the Board’s overall balance of perspectives, backgrounds, knowledge, experience and expertise in areas relevant to the Company’s business. The committee assesses its achievement of diversity through review of Board composition as part of the Board’s annual self-assessment process.

The Corporate Governance and Nominating Committee identifies potential nominees by asking current directors and executive officers to notify the committee if they become aware of persons meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the Board, including retirement as a Chief Executive Officer or Chief Financial Officer of a public company or exiting government or military service. The Corporate Governance and Nominating Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described below, the Corporate Governance and Nominating Committee will also consider candidates recommended by shareholders.

Once a person has been identified by the Corporate Governance and Nominating Committee as a potential candidate, the committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Corporate Governance and Nominating Committee determines that the candidate warrants further consideration, the Chairman or another member of the committee contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Corporate Governance and Nominating Committee requests information from the candidate, reviews the candidate’s accomplishments and qualifications, including any other candidates that the committee might be considering, and conducts one or more interviews with the candidate.

13

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

In certain instances, committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Corporate Governance and Nominating Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a shareholder, although, the Board may take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held.

Under the Company’s Corporate Governance Principles, the Corporate Governance and Nominating Committee will present a list of candidates to the Board for nomination. The Chief Executive Officer will be included in the process on a non-voting basis. Taking into account the factors outlined above, the Corporate Governance and Nominating Committee will make a recommendation to the Board and the Board will determine which of the recommended candidates to approve for nomination.

Messrs. Sugar and Bee were identified by Board members and vetted through the use of a third-party search firm. The Corporate Governance and Nominating Committee provided the search firm with the preferred search criteria and later interviewed a list of nominees. The Committee recommended their nominations to the Board who subsequently unanimously approved the nominations.

Nominations of persons for election as directors of the Company may be made at a meeting of shareholders, (a) by or at the direction of the Board, (b) by the Corporate Governance and Nominating Committee or persons appointed by the Board or (c) by any shareholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in Section 3.3 of the Company’s By-Laws. Such nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the Company’s Corporate Secretary. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the principal executive office of the Company not less than fifty days nor more than seventy-five days prior to the meeting; provided, however, that in the event that less than sixty days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. Such shareholder’s notice to the Company’s Corporate Secretary shall set forth (a) as to each person whom the shareholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company which are beneficially owned by the person, and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to the Exchange Act, as now or hereafter amended; and (b) as to the shareholder giving the notice, (i) the name and record address of such shareholder and (ii) the class and number of shares of capital stock of the Company which are beneficially owned by such shareholder.

14

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company. No person shall be eligible for election by the shareholders as a director of the Company unless nominated in accordance with the procedures set forth herein. The Chairman of the meeting of the shareholders shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedure and if he or she should so determine, he or she shall so declare to the meeting and the defective nomination shall be disregarded.

In accordance with the Company’s Corporate Governance Principles and By-Laws, the independent directors will designate a lead independent director who will preside at the executive sessions of the Board. Patrick M. James is currently designated as the lead independent director. The lead independent director’s duties include coordinating the activities of the independent directors, coordinating the agenda for and moderating sessions of the Board’s independent directors, facilitating communications between the independent directors and the other member(s) of the Board and conducting the annual CEO evaluation.

Currently, the Company has a combined CEO and Chairman position. Taking into account the role of our lead independent director, we believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our Board of Directors’ leadership structure supports this approach. The Board has adopted governance policies and practices to ensure a strong and independent board that provides balance to the combined CEO and Chairman position as well as a required lead independent director.

Ultimately, the full Board has responsibility for risk oversight, but our committees help oversee risk in areas over which they have responsibility. The full Board receives regular updates related to various risks for both our company and our industry. The Audit Committee receives and discusses reports regularly from members of management, who are involved in the risk assessment and risk management functions on a daily basis. In addition, the Compensation Committee annually reviews, with the assistance of management, the overall structure of the Company’s compensation program and policies for all employees as they relate to the Company’s risk management practices.

The Board oversees the management of risks inherent in the Company’s businesses and the implementation of its strategic plan. The Board performs this oversight role by implementing multiple levels of review. In connection with its reviews of the operations of the Company’s business units and corporate functions, the Board addresses the primary risks associated with those units and functions. In addition, the Board reviews the risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company. The Board also unilaterally

15

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

considers other risk topics at its meetings, including risks associated with our capital structure, strategic plan, and development activities. Further, the Board is routinely informed by management of developments that could affect our risk profile. The Board’s current role in risk oversight is complemented by our leadership structure.

Each of the Board’s Committees also manages Company risks that fall within the Committee’s areas of responsibility. In performing this function, each Committee has full access to management, as well as the ability to engage advisors.

As part of its oversight of the Company’s executive compensation program, the Compensation Committee considers the impact of the Company’s executive compensation program, and the incentives created by the compensation awards that it administers, on the Company’s risk profile, as more fully discussed below. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company. Based on this review, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

| • | The Compensation Committee annually reviews the overall structure of the Company’s executive compensation program and policies to ensure they are consistent with effective management of key enterprise risks and that they do not encourage executives to take unnecessary or excessive risks that could threaten the value of the enterprise. |

| • | With respect to the programs and policies that apply to our named executive officers, this review includes: |

| • | analysis of how different elements of compensation may increase or mitigate risk-taking; |

| • | analysis of performance metrics used for short-term and long-term incentive programs and the relation of such incentives to the objectives of a particular position or business unit; |

| • | analysis of whether the performance measurement periods for short-term and long-term incentive compensation are appropriate; |

| • | analysis of the overall structure of compensation programs as related to business risks; and |

| • | an annual review of the Company’s share ownership guidelines, including share ownership levels and retention practices. |

| • | Based on this review, we believe the Company’s well-balanced mix of salary and short-term and long-term incentives are appropriate and consistent with the Company’s risk management practices and overall strategies. |

16

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Shareholder Communication with Directors

The Board has a written policy on shareholder and interested party communications with directors, a copy of which is available on the Company’s corporate website at www.stillwatermining.com, under the heading “Governance/Communication with Directors.”

Under the policy, shareholders and other interested parties may contact any member (or all members) of the Board (including, without limitation, the lead independent director, Patrick M. James, or the non-management directors as a group), any Board committee or any chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent to the Corporate Secretary, Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102. To communicate with any of our directors electronically, shareholders should go to our corporate website at www.stillwatermining.com. Under the heading “Governance/Communication with Directors,” you will find an on-line form that may be used for writing an electronic message to the Board, any individual director, or any group or committee of directors. Please follow the instructions on our website in order to send your message.

All communications received as set forth in the preceding paragraph will be opened by the office of our Corporate Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are identified under “Committees” above. No member of the Compensation Committee was, at any time during 2012, an officer or employee, or a former officer, of the Company.

Commencing on April 26, 2012, non-employee director retainers and meeting fees were increased to the following amounts: Each non-employee director receives a quarterly retainer of $16,250 which may be paid in cash or may be deferred in cash or Common Stock as described below. In addition, the Company pays each non-employee director and committee member $2,500 per meeting of the Board attended and $1,500 per telephonic meeting in which he or she participated. The Lead Independent Director and Audit Committee chair each receive an additional annual retainer of $20,000; the Compensation Committee chair receives an additional $15,000 annual retainer, and the other Committee chairs each receive additional annual retainers of $10,000. The Company also reimburses all directors for reasonable travel expenses. In February 2013, the Board approved a guideline that non-employee directors should own Common Stock having a value of at least two times their annual retainer. The previous Stock

17

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

ownership guideline for non-employee directors was $100,000. Pursuant to that guideline, each director is asked to comply with this new guideline by the fifth anniversary of his or her election to the Board. Based on the closing price of $14.31 on February 8, 2013, all Directors are in compliance with this guideline. With the exception of Messrs. Parrett, Sugar, and Bee, each of the Directors has over five years of service as a director for the Company.

On the date of each annual meeting of shareholders, each non-employee director will receive a grant of Restricted Stock Units valued at $70,000, with restrictions that lapse (vest) upon the earlier of six months following the date of grant or the director’s death, disability, retirement or a change in control of the Company. A non-employee director may elect to defer all, or a portion, of their vested Restricted Stock Unit grant into the 2005 Non-Employee Directors’ Deferral Plan, in which case, upon receiving deferred shares, the non-employee director is credited additional “matching” deferred shares in the amount of 20% of the non-employee director’s deferred shares. Matching shares are fully vested, and non-forfeitable. Any Restricted Stock Units which have not vested will result in forfeiture, unless otherwise provided under the terms of the Restricted Stock Unit Agreement. The minimum deferral period is two years.

Additionally, the 2005 Non-Employee Directors’ Deferral Plan allows non-employee directors to defer cash compensation for service as a director of the Company and later receive such compensation in the form of cash or shares of Common Stock. If a director elects to defer compensation and receive such compensation in the form of deferred shares of Common Stock, the number of shares such director will be entitled to receive will be determined by dividing the amount of compensation deferred during such quarter by the fair market value of one share of Common Stock on the last day that the stock traded before the end of such quarter. Upon receiving deferred shares of Common Stock, such director’s account will be credited additional “matching” deferred shares in an amount equal to 20% of the number of deferred shares to which he or she is entitled pursuant to the calculation described above.

18

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

2012 DIRECTOR COMPENSATION

| Name |

Fees Earned or Paid in Cash (1)($) |

Stock Awards (2)($) |

Option Awards (3)($) |

All Other Compensation (4) ($) |

Total ($) |

|||||||||||||

| George M. Bee (5) |

9,035 | 0 | 0 | 9,035 | ||||||||||||||

| Craig L. Fuller |

130,750 | 69,990 | 0 | 200,740 | ||||||||||||||

| Patrick M. James |

148,250 | 69,990 | 20,910 | 239,150 | ||||||||||||||

| Steven S. Lucas |

129,750 | 69,990 | 20,002 | 219,742 | ||||||||||||||

| Michael S. Parrett |

117,750 | 69,990 | 13,514 | 201,254 | ||||||||||||||

| Sheryl K. Pressler |

134,250 | 69,990 | 37,014 | 241,754 | ||||||||||||||

| Michael Schiavone |

117,250 | 69,990 | 0 | 187,240 | ||||||||||||||

| Gary A. Sugar (6) |

43,500 | 0 | 0 | 43,500 | ||||||||||||||

| (1) | Amounts include fees deferred in the form of Common Stock in the 2005 Non-Employee Directors’ Deferral Plan in the amount of $37,062.50 for Patrick M. James and $32,437.50 for Steven S. Lucas. |

| (2) | Value is based on the grant date fair value in accordance with FASB ASC Topic 718 for Restricted Stock Units issued in 2012. These awards were granted with a six month vesting period and vested on October 26, 2012 for Craig L. Fuller, Patrick M. James, Steven S. Lucas, Michael S. Parrett, Sheryl K. Pressler and Michael Schiavone; Patrick M. James, Steven S. Lucas, Michael S. Parrett and Sheryl K. Pressler deferred their entire Restricted Stock Unit grant into the 2005 Non-Employee Directors’ Deferral Plan. |

| (3) | The aggregate number of Option awards outstanding as of December 31, 2012, for each non-employee director is set forth below: |

| Name |

Options Vested & Outstanding |

|||

| George M. Bee |

— | |||

| Craig L. Fuller |

15,000 | |||

| Patrick M. James |

5,000 | |||

| Steven S. Lucas |

— | |||

| Michael Parrett |

— | |||

| Sheryl K. Pressler |

— | |||

| Michael Schiavone |

— | |||

| Gary A. Sugar |

— | |||

| (4) | Amounts include a 20% Company match, in the form of Company stock, on fees and stock awards deferred in the form of stock into the 2005 Non-Employee Directors’ Deferral Plan. The Company match is also deferred into the 2005 Non-Employee Directors’ Deferral Plan. In addition, for Sheryl K. Pressler the amount includes a payment on March 30, 2012, in the amount of $23,500 in respect of the expiration of certain options, exercise of which was inadvertently delayed by the Company. |

| (5) | George M. Bee was appointed to the Company’s board of directors, effective November 24, 2012. |

| (6) | Gary A. Sugar was appointed to the Company’s board of directors, effective August 29, 2012. |

Certain Information Regarding Participants in the Solicitation of Proxies

Under applicable SEC regulations, members of the Company’s board of directors are “participants” and certain executive officers and employees may be deemed to be “participants” in the Company’s solicitation of proxies in connection with the annual meeting. Certain required information regarding these “participants” is set forth in Annex A to this proxy statement.

19

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This section provides a detailed explanation of the objectives and principles that underlie our executive compensation program, its elements and the way performance is measured, evaluated and rewarded. It also describes our compensation decision-making process. Our executive compensation program is designed to pay for performance and plays an important role in the Company’s success by linking a significant amount of compensation to the achievement of performance goals.

Our program and processes generally apply to all of our officers, but this discussion and analysis focuses primarily on compensation for our named executive officers (our “NEOs”). During 2012, our NEOs were:

Frank R. McAllister – Chairman/Chief Executive Officer

Gregory A. Wing – Vice President/Chief Financial Officer

John R. Stark – Executive Vice President/Chief Commercial Officer/General Counsel (through September 4, 2012)

Terrell I. Ackerman – Vice President, Corporate Development

Kevin G. Shiell – Vice President, Mining Operations

Company Overview

The Company mines palladium and platinum from two underground mines located in south central Montana. The Company also operates a smelting and base metal refining complex in Columbus, Montana. In addition to processing the Company’s mine concentrates, these facilities recycle spent catalyst PGM containing materials from third parties.

The Company also owns the Marathon PGM-copper project located in north-western Ontario, which is a mine development project currently in the permitting and detailed engineering stage with the goal of constructing a conventional open pit mining and processing operation, and the Altar Project, an advanced stage exploration copper/gold project in Argentina. The Altar Project is a low-cost option on copper-gold with significant resource potential upside.

20

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Company Performance - 2012

The Company’s performance in 2012 exceeded the expectations of management by outperforming the business plan. Specific achievements included:

| • | The Company reported a net income of $55 million in 2012. |

| • | The Company’s safety performance was reflected in a 6.6% improvement in our incidence rate from 2011. |

| • | Mine production of palladium and platinum in 2012 was 513,700 ounces exceeding the Company’s 2012 guidance of 500,000 ounces. |

| • | Recycling volumes, which are price sensitive, had dipped during the middle part of 2012, but rebounded as PGM prices increased during the fourth quarter of 2012. Total recycling volumes for 2012 were 445,200 ounces of palladium, platinum and rhodium compared to 486,700 ounces for 2011. |

| • | Gross mining costs were up from 2011, however still within range for the 2012 business plan. |

| • | Progress according to plan on Graham Creek and Blitz, our Montana expansion projects. Additionally, late in 2012 we identified an opportunity for another Montana expansion project referred to as the Far West. |

The Marathon project 2012 performance target was established with the expectation that the Environmental Impact Statement (EIS) would be submitted in April 2012, but the filing was delayed until the end of July 2012.

During 2012, the Altar project completed 27,300 meters of drilling against a plan of 25,000 meters at a cost per meter 23% below plan.

2012 Compensation Decisions

As a result of the above events NEO compensation outcomes for 2012 included the following:

| • | Base salaries were generally increased so that executive compensation remained at market median levels consistent with our compensation philosophy; |

| • | Annual cash incentive awards are generally structured to deliver pay that is consistent with market median levels for achievement of target performance. Safety, production, cost and strategic initiatives are the key metrics for our NEOs’ annual cash incentive awards. These metrics provide for a balanced approach to measuring annual Company performance. The Company’s performance with respect to each of these metrics resulted in annual incentive payouts at approximately 142% of target levels; and |

| • | Long-term awards in the form of Performance Restricted Stock Units were made at approximately 120% of target levels as a result of achievement in safety, production, cost and strategic initiatives in 2012. |

21

Table of Contents

PRELIMINARY PROXY — SUBJECT TO COMPLETION

Relationship between Total Shareholder Return and CEO Compensation (Pay for Performance)

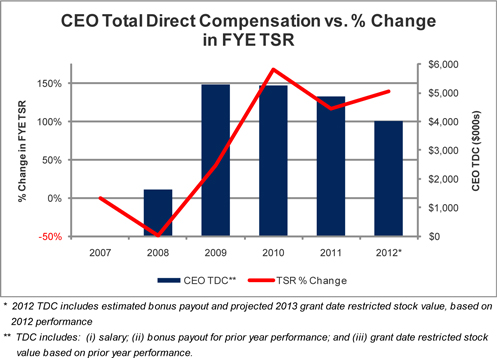

Our compensation philosophy emphasizes pay-for-performance. While there are many ways in which to test this relationship, many institutions have focused on CEO pay as compared to Total Shareholder Return (TSR). The following chart illustrates the relationship between the CEO’s Total Direct Compensation (TDC) and the Fiscal Year End TSR for a five-year period.

Best Compensation Practices & Good Governance

Key Changes for 2012

As a result of our annual and on-going review of our compensation program and policies, the Company has adopted some enhancements to our existing program to foster good governance and best practices, as follows:

| • | Stock Ownership Guidelines: We updated our Director stock ownership guidelines and implemented Officer stock ownership guidelines. |

| • | Recoupment: We implemented a claw-back policy in anticipation of and in advance of the finalization of the Dodd-Frank Act’s requirements. |

| • | Section 280G Gross-Ups: We have committed to providing no future gross-up provisions in any employment agreements. |

| • | Philosophy: We have updated our compensation philosophy to target long-term incentive opportunities between the 50th and 75th percentiles, effectively decreasing our CEO’s long-term incentive target opportunity from 400% to 300% of base salary, effective for fiscal year 2012. |

22

Table of Contents