UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934

| ý | Filed by the Registrant |

| o | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-12 |

| Stillwater Mining Company |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

As filed with the Commission on March 23, 2012

Stillwater Mining Company

1321 Discovery Drive

Billings, Montana 59102

March 23, 2012

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Stillwater Mining Company to be held on April 26, 2012, at 2:00 p.m. (Mountain Daylight Time) in Room 117, MSU-B College of Technology, 3803 Central Avenue, Billings, Montana 59102. At this meeting, we will ask you to consider and vote upon the election of the Company's directors, approval of the Company’s 2012 Equity Incentive Plan, ratification of the Company's independent auditors and to make an advisory vote on executive compensation.

Your vote is important. Regardless of whether you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote by proxy over the Internet or by telephone, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether or not you attend in person.

Thank you for your ongoing support of, and continued interest in, Stillwater Mining Company.

Very truly yours,

Francis R. McAllister

Chairman and Chief Executive Officer

| i |

Stillwater Mining Company

1321 Discovery Drive

Billings, Montana 59102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 2:00 p.m. (Mountain Daylight Time), on April 26, 2012 | |

| Place | Room 117, MSU-B College of Technology, | |

| 3803 Central Avenue, Billings, Montana 59102 | ||

| Items of Business | (1) | To elect directors. |

| (2) | Approval of the Company’s 2012 Equity Incentive Plan. | |

| (3) | To ratify the appointment of KPMG LLP as the Company's independent registered accounting firm for 2012. |

| (4) | To conduct an advisory vote on executive compensation. |

| (5) | To attend to other business properly presented at the meeting. | |

| Adjournments and | ||

| Postponements | Any actions on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. | |

| Record Date | You are entitled to vote only if you were a Stillwater Mining Company stockholder as of the close of business on March 9, 2012. | |

| Meeting Admission | You are entitled to attend the annual meeting only if you were a Stillwater Mining Company stockholder as of the close of business on March 9, 2012 or hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, your ownership as of the record date will be verified prior to admittance into the meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you must provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to March 9, 2012 or similar evidence of ownership. If you do not provide photo identification and comply with the other procedures outlined above, you will not be admitted to the annual meeting. | |

| ii |

| The annual meeting will begin promptly at 2:00 p.m., local time. Check-in will begin at 1:30 p.m., local time, and you should allow ample time for the check-in procedures. | ||

| Voting | Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. If you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. | |

By order of the Board of Directors,

Brent R. Wadman

Deputy General Counsel & Corporate Secretary

This notice of annual meeting and proxy statement and form of proxy are being distributed and made available on or about March 23, 2012.

| iii |

Table of Contents

| GENERAL INFORMATION | 5 |

| Solicitation | 5 |

| Voting Rights | 5 |

| Voting | 6 |

| Revocability of Proxies | 7 |

| Important Notice | 7 |

| PROPOSAL 1: ELECTION OF DIRECTORS | 7 |

| Nominees for Election | 8 |

| BOARD OF DIRECTORS AND COMMITTEES | 11 |

| Director Independence | 11 |

| Committees | 11 |

| Candidate Selection Process | 14 |

| Nomination Process | 16 |

| Lead Independent Director | 16 |

| Board Oversight of Risk | 17 |

| Review of Compensation Risk | 17 |

| Stockholder Communication with Directors | 18 |

| Compensation Committee Interlocks and Insider Participation | 19 |

| Director Compensation | 19 |

| COMPENSATION DISCUSSION AND ANALYSIS | 21 |

| Executive Summary | 21 |

| The Compensation Committee | 24 |

| Compensation Philosophy & Objectives | 26 |

| Compensation Structure | 27 |

| Impact of Tax and Accounting | 36 |

| Stock Ownership Guidelines | 36 |

| Hedging Policy | 37 |

| Timing and Pricing of Equity Grants | 37 |

| Consideration of Prior Amounts Realized | 38 |

| COMPENSATION COMMITTEE REPORT | 39 |

| 2011 SUMMARY COMPENSATION TABLE | 40 |

| 2011 GRANTS OF PLAN BASED AWARDS | 41 |

| 2011 OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END | 42 |

| PENSION BENEFITS | 43 |

| 2011 NON-QUALIFIED DEFERRED COMPENSATION | 43 |

| POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE-IN-CONTROL | 45 |

| EXECUTIVE COMPENSATION, OTHER COMPENSATION AND POTENTIAL PAYMENTS INFORMATION | 50 |

| Employment Agreements | 50 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 56 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 56 |

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD | 57 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 60 |

| PROPOSAL 2: APPROVAL OF THE COMPANY'S 2012 EQUITY |

| INCENTIVE PLAN | 61 |

| PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM | 71 |

| PROPOSAL 4: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 72 |

| STOCKHOLDER PROPOSALS | 73 |

| ADDITIONAL INFORMATION | 73 |

| GENERAL | 74 |

| EXHIBIT A | A-1 |

Stillwater Mining Company

1321 Discovery Drive

Billings, Montana 59102

PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2012

__________________

This Proxy Statement is being furnished to the stockholders of Stillwater Mining Company (the "Company") in connection with the solicitation by the Company's Board of Directors (the "Board") of proxies to be voted at the Annual Meeting of Stockholders of the Company and any postponements or adjournments thereof. The meeting will be held on April 26, 2012, at 2:00 p.m. (Mountain Daylight Time) in Room 117, MSU-B College of Technology, 3803 Central Avenue, Billings, Montana 59102.

These proxy solicitation materials were first mailed on or about March 23, 2012, to all stockholders entitled to vote at the meeting. The meeting is being held:

| 1. | To elect seven directors to the Company's Board. |

| 2. | To approve the 2012 Equity Incentive Plan. |

| 3. | To ratify the appointment of KPMG LLP as the Company's independent registered accounting firm for 2012. |

| 4. | To conduct an advisory vote on executive compensation. |

| 5. | To attend to other business properly presented at the meeting or any postponements or adjournments thereof. |

GENERAL INFORMATION

Solicitation

The enclosed proxy is being solicited by the Board on behalf of the Company. The cost of this solicitation will be borne by the Company. In addition to solicitation by mail, the officers, directors and employees of the Company may solicit proxies by telephone, telegraph, electronic means or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Common Stock of the Company (the "Common Stock") registered in the names of nominees. The Company will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

Voting Rights

Holders of shares of Common Stock at the close of business on March 9, 2012 (the "Record Date") are entitled to notice of and to vote at the meeting. On the Record Date, 115,635,279 shares of Common Stock were issued, outstanding and entitled to vote. The holders of at least 50% of the shares of Common Stock issued, outstanding and entitled to vote at the meeting, present in person or by proxy, constitutes a quorum.

| 5 |

On December 13, 2010, MMC Norilsk Nickel, the Company’s then largest stockholder completed the sale of 49.8 million shares of Common Stock owned by its wholly owned subsidiary, Norimet Limited. In connection with these transactions, Credit Suisse Capital LLC acquired 3,600,000 shares of Common Stock and UBS AG acquired 5,400,000 shares of Common Stock. On December 13, 2010, the Company entered into Voting Agreements with UBS AG and Credit Suisse Capital LLC. Pursuant to the Voting Agreements, UBS AG and Credit Suisse Capital LLC, agreed, subject to certain conditions, to cause all of these shares (to the extent they are still beneficially owned by them) to be counted as present at any meeting of the Company’s stockholders, including the Annual Meeting, and to vote these shares in the same proportion as all of the outstanding shares of Common Stock are actually voted.

Each share of Common Stock outstanding on the Record Date is entitled to one vote.

Voting

The vote of the holders of (i) a plurality of the shares present in person or represented by proxy is required to approve Proposal 1, regarding the election of directors, (ii) a majority of the shares present in person or represented by proxy is required to approve Proposal 2, regarding the approval of the Company’s 2012 Equity Incentive Plan and (iii) a majority of the shares present in person or represented by proxy is required to approve Proposal 3, regarding the ratification of the selection of KPMG LLP as the Company's independent registered accounting firm. The Company will also review and consider the votes for and against Proposal 4, regarding an advisory vote on executive compensation.

If a stockholder abstains from voting on any matter, the Company intends to count such stockholder as present for purposes of determining whether a quorum is present at the meeting for the transaction of business. Unless contrary instructions are indicated on a proxy, the shares of Common Stock represented by such proxy will be voted FOR the election as directors of the nominees named in this proxy statement, FOR approval of the 2012 Equity Incentive Plan and FOR ratification of the selection of KPMG LLP as the Company's independent registered accounting firm. Additionally, the Company intends to count broker "non-votes" as present for purposes of determining the presence or absence of a quorum for the transaction of business. A non-vote occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Abstentions and non-votes will not be counted as votes cast for or against items submitted for a vote of stockholders.

Neither management nor the Board knows of any other matters to be brought before the meeting. If other matters are presented properly to the stockholders for action at the meeting or postponements or adjournments thereof, then the proxy holders named in the proxy have advised that they intend to vote in their discretion on all matters in which the shares of Common Stock represented by such proxy are entitled to vote.

| 6 |

Revocability of Proxies

Any proxy may be revoked at any time before it is voted by (i) written notice to the Company's Corporate Secretary, (ii) receipt of a proxy properly signed and dated subsequent to an earlier proxy, or (iii) by request in person at the meeting. If not revoked, the shares of Common Stock represented by a proxy will be voted according to the proxy.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 26, 2012.

The proxy statement, proxy card, and the Annual Report on Form 10-K for the year ended December 31, 2011, are available on our website at www.stillwatermining.com under the heading “Investor Relations”.

PROPOSAL

1:

ELECTION OF DIRECTORS

All Directors have agreed to stand for re-election as Directors at this year's annual meeting and have been approved by the Nominating Committee of the Board.

The seven (7) persons set forth below have been nominated to serve as directors of the Company until the next annual meeting of stockholders or until their respective successors are elected and each person has consented to being named as a nominee. All of the nominees are currently directors of the Company.

Directors are elected by a plurality of the votes cast by stockholders who are present in person or represented by proxy and entitled to vote at a meeting at which a quorum is present. Brokers and other nominees will not have discretionary authority to vote your shares if you hold your shares in street name and do not provide instructions as to how your shares should be voted on this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF PROPOSAL 1.

It is anticipated that proxies will be voted for the nominees listed below, and the Board has no reason to believe any nominee will not continue to be a candidate or will not be able to serve as a director if elected. In the event that any nominee named below is unable to serve as a director, the proxy holders named in the proxies have advised that they will vote for the election of such substitute or additional nominees as the Board may propose.

The name and age of each nominee, his or her principal occupation for at least the past five (5) years and certain additional information is set forth below. Such information is as of the date hereof and is based upon information furnished to the Company by each nominee.

| 7 |

Nominees for Election

Francis R. McAllister (age 69). Francis R. McAllister became a director of the Company on January 9, 2001 and the Chairman of the Board and Chief Executive Officer of the Company on February 12, 2001. Prior to his appointment to the Board, Mr. McAllister was with ASARCO Incorporated from 1966 to 1999, serving as Chairman and Chief Executive Officer in 1999, Chief Operating Officer from 1998 to 1999, Executive Vice President -- Copper Operations from 1993 to 1998, Chief Financial Officer from 1982 to 1993 and in various professional and management positions from 1966 to 1982. He currently serves on the Board of Directors of Cliffs Natural Resources (f/k/a Cleveland Cliffs, Inc.), an iron ore and coal mining company.

The Board believes that Mr. McAllister should continue to serve on the Board of Directors based on his leadership of the Board and as Chief Executive Officer of the Company through 11 years of significant challenges and growth, and his significant knowledge and deep understanding of the Company and the mining industry.

Craig L. Fuller (age 61). Craig L. Fuller, was appointed a director of the Company on June 16, 2003. Mr. Fuller has been the President and Chief Executive Officer of the Aircraft Owners and Pilots Association (AOPA) since January 1, 2009. AOPA is the largest general aviation membership organization in the world.

From 2007 to 2009, Mr. Fuller was Executive Vice President of APCO Worldwide and he remains a member of the APCO Worldwide International Advisory Council.

From 1999 to 2007, Mr. Fuller was the President and Chief Executive Officer of the National Association of Chain Drug Stores (NACDS). NACDS is a leading trade organization focused on major health care policy issues.

From 1981 to 1989, Mr. Fuller served in the White House as assistant to President Ronald Reagan for cabinet affairs and then as Chief of Staff to Vice President George H.W. Bush. From 1988 to 1989, he served as co-director of President-elect Bush’s transition team.

Upon leaving the White House to enter the private sector, Mr. Fuller joined The Wexler Group, later acquired by Hill & Knowlton, where, from 1989 to 1992 he served as President of its U.S. operations and head of worldwide public affairs. From 1992 to 1996 he was Senior Vice President for Corporate Affairs at Philip Morris Companies. From 1996 to 1999 he led the board of director’s practice at Korn/Ferry International and in 1995 and 1996 he served as Vice Chairman of Burson-Marsteller.

With regular interviews on politics and public affairs, as well as weekly and monthly online columns, Mr. Fuller is a frequent commentator and speaker on a wide range of topics. He is a director of the United States Chamber of Commerce and the National Chamber Foundation. Additionally, he is a trustee of the George Bush Presidential Library Foundation, and served for 10 years as a trustee of the John F. Kennedy Center for the Performing Arts.

| 8 |

Mr. Fuller earned his Bachelor of Science in Political Science from the University of California at Los Angeles and a master’s degree in Urban Affairs from Occidental College.

The Board believes that Mr. Fuller should continue to serve on the Board of Directors based on his extensive management and leadership experience in the private and public sectors and his deep understanding of our Company and the issues affecting our industry.

Steven S. Lucas (age 46). Steven S. Lucas was appointed a director of the Company on June 23, 2003. Mr. Lucas is a partner at Nielsen, Merksamer, Parrinello, Mueller & Naylor, as well as a Lecturer at Law for Stanford Law School. He joined Nielsen, Merksamer, Parrinello, Mueller & Naylor, a California based law firm, in 1995 and has been a partner since 1999. Previously, Mr. Lucas was an attorney at Sullivan & Cromwell from 1991 to 1995. He received his law degree, magna cum laude, from Harvard Law School in 1990, and a B.A. in economics/business, magna cum laude, from UCLA in 1987.

The Board believes that Mr. Lucas should continue to serve on the Board of Directors based on his strong legal background and understanding of our Company.

Michael Schiavone (age 71). Michael Schiavone was appointed a director of the Company on January 26, 2009. Mr. Schiavone has an extensive background in the metals recycling business, and since 2001, he has been involved in real estate and property investment. In 1963, Mr. Schiavone joined the family business, Michael Schiavone & Sons, Inc., a metals recycling business. He served as Chairman of the Board and Chief Executive Officer from 1972 to 1999. He previously owned Schiavone Metalli Europa, and served with Camden Iron & Metal, Inc. from 1969 until 1995. Mr. Schiavone was a director of New Haven Boys & Girls Club from 1980 until 1995. He holds a Bachelor of Arts degree from Boston University.

The Board believes that Mr. Schiavone should continue to serve on the Board of Directors based on his background and experience in the metal recycling industry.

Patrick M. James (age 66). Patrick M. James was appointed a director of the Company on January 9, 2001 and has served as the Company's lead independent director since July 24, 2002. Since March 2001, Mr. James has been an independent natural resource management consultant and professional corporate director. Mr. James was the President and Chief Executive Officer of Rio Algom Limited from June 1997 to March 2001. Prior to joining Rio Algom Limited, Mr. James spent 18 years with Santa Fe Pacific Gold Corporation, becoming President and Chief Operating Officer in 1994 and Chairman, President and Chief Executive Officer in 1995. Mr. James was a director of Dynatec Corporation, a Canadian nickel mining company from 2001 until its sale in 2007. He was Chairman, and later President, Chief Executive Officer and director of Constellation Copper Corporation, a Canadian base metal mining company from June, 2002 until December, 2008, when the company filed for bankruptcy protection. He also served on the advisory board for Resource Capital Funds III and IV from 2002 until 2008. From 2004 until the present he has been a director and Chairman of Centerra Gold Inc., a Canadian gold mining company. Since December 2010, Mr. James has also served as Chairman and a director of General Moly, Inc. Mr. James is a member of the Colorado School of Mines Foundation board of directors. He received a Masters of Management from the University of New Mexico in 1984, and an Engineer of Mines from Colorado School of Mines in 1968.

| 9 |

The Board believes that Mr. James should continue to serve on the Board of Directors based on his experience in the mining industry for more than 45 years, at levels ranging from underground miner to executive management. Mr. James’ national and international experience in mine development and production, and mergers and acquisitions in the mining industry contribute greatly to our Board.

Michael S. Parrett (age 60). Michael S. Parrett was elected to the Board on May 7, 2009. Mr. Parrett has been an independent consultant since 2002. During 2002, 2003 and the first quarter of 2004 Mr. Parrett served as a financial consultant to Stillwater Mining Company. From 1990 to 2001 he was Chief Financial Officer and President of Rio Algom and Chief Executive of Billiton Base Metals. From 1983 to 1989 Mr. Parrett performed various financial functions, including Controller, Chief Financial Officer, Treasurer, Controller Marketing and Director Internal Audit at Falconbridge Limited. He was on the Board of Directors of Gabriel Resources Ltd from 2003 through 2010 and was Chairman from December 2005 through June 2010. He is currently on the Board of Directors of Pengrowth Corporation since 2004. Mr. Parrett was appointed to the Board of Directors of Sunshine Silver Mines Corporation and Mongolia Minerals Corporation in 2011. Mr. Parrett is a Chartered Accountant and received his Bachelor of Arts from York University.

The Board believes that Mr. Parrett should continue to serve on the Board of Directors based on his more than 25 years of mining finance experience, his strong financial and accounting background and his in depth knowledge of financial issues affecting our industry.

Sheryl K. Pressler (age 61). Sheryl K. Pressler has been a director of the Company since May 9, 2002. Ms. Pressler has been an investment and strategy consultant in Atlanta, Georgia since 2001. From 2000 to 2001, she was Chief Executive Officer for Lend Lease Real Estate Investments -- United States, a subsidiary of Lend Lease Corporation, an Australian real estate services company. From 1994 to 2000, she was the Chief Investment Officer for the California Public Employees' Retirement System, the nation's largest public pension fund. From 1981 to 1994, she was responsible for the management of the Retirement Funds for the McDonnell Douglas Corporation. Ms. Pressler has served on the Board of Directors of ING Funds Unified since 2006 and on the Board of Directors of Centerra Gold since 2008. She is currently a member of the Audit Committee of both Boards of Directors. Previously, Ms. Pressler was a director of Nuevo Energy Company from 2002 until 2004. Ms. Pressler received her B.A. in philosophy from Webster University and her M.B.A. from Washington University.

The Board believes that Ms. Pressler should continue to serve on the Board of Directors based on her strong investment and strategy background and her deep knowledge of our Company and our industry.

| 10 |

BOARD OF DIRECTORS AND COMMITTEES

The Board met 24 times during 2011. Each director attended 95% or more of the total number of meetings of the Board and each of the committees on which he or she served in 2011. The non-employee directors regularly meet in executive session without management.

It is the Company's policy that directors are invited and encouraged to attend the Annual Meeting of Stockholders. All of the Company's directors attended last year's annual meeting of stockholders in person or by telephone.

Director Independence

The Board follows certain guidelines put in place for determining director independence, which meet or exceed the listing standards of the New York Stock Exchange (“NYSE”) with respect to director independence. These guidelines can be found on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Independence Criteria for Directors." A copy may also be obtained upon request from the Company's Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

These guidelines provide objective as well as subjective criteria that the Board will utilize in determining whether each director meets the independence standards of the Securities and Exchange Commission (the "SEC") and the NYSE applicable to the Company. Additionally, the Company complies with guidelines adopted pursuant to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

The Board undertook its annual review of director transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. The Board also examined transactions and relationships between directors or their affiliates and members of the Company's senior management or their affiliates.

The Board affirmatively determined that all of the directors being nominated for election at the annual meeting are independent of the Company and the Company's management under the standards set forth in the Corporate Governance Principles, a copy of which is available on the Company’s corporate website at www.stillwatermining.com, with the exception of Francis R. McAllister. Mr. McAllister is considered an inside director because he is the Chief Executive Officer of the Company.

Committees

Audit Committee. The Company has a standing Audit Committee as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Audit Committee held five (5) meetings during 2011. During 2011, the Audit Committee was composed of Sheryl K. Pressler (Chairperson), Steven S. Lucas, and Michael S. Parrett. The Board has determined that the members of the Audit Committee are "independent," as defined in Section 303A.02 of the NYSE's listing standards and Rule 10A-3(b)(1) of the General Rules and Regulations under the Exchange Act.

| 11 |

The Audit Committee reviews the accounting principles and procedures of the Company and its annual financial reports and statements, recommends to the Board the engagement of the Company's independent auditors, reviews with the independent auditors the plans and results of the auditing engagement and considers the independence of the Company's auditors. The Audit Committee is also responsible for reviewing the Company's finance matters.

The Audit Committee is governed by a written charter which is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Charters/Audit Committee Charter." Copies of this charter are also available in print to stockholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The Audit Committee also follows a written Audit and Non-Audit Services Pre-Approval Policy for services to be performed by the independent auditor. Proposed services may be either (i) pre-approved without consideration of specific case-by-case services by the Audit Committee ("General Pre-Approval") or (ii) require the specific pre-approval of the Audit Committee ("Specific Pre-Approval"). The Audit Committee believes that the combination of these two approaches results in an effective and efficient procedure to pre-approve services performed by the independent auditor to ensure the auditor's independence is not impaired. Unless a type of service has received General Pre-Approval, it requires Specific Pre-Approval by the Audit Committee if it is to be provided by the independent auditor. Any proposed specific individual project to provide an otherwise generally approved service whose expected fees exceed $25,000 requires an overriding Specific Pre-Approval by the Audit Committee.

For both types of pre-approval, the Audit Committee shall consider whether such services are consistent with the rules of the SEC on auditor independence. The Audit Committee also considers whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company's business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company's ability to manage or control risk or improve audit quality. All such factors are considered by the Audit Committee in its business judgment as a whole, and no one factor is determinative.

The term of any General Pre-Approval is 12 months from the date of pre-approval, unless the Audit Committee considers a different period and states otherwise. The Audit Committee may revise the list of General Pre-Approved services from time to time, based on subsequent determinations.

This policy is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Policies/Audit and Non-Audit Policy". Copies of this policy are also available in print to stockholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

| 12 |

SEC rules and NYSE listing standards require the Board to determine whether a member of its audit committee is an "audit committee financial expert" and disclose its determination. According to these requirements, an audit committee member can be designated an audit committee financial expert only when the audit committee member satisfies five specified qualification requirements, such as experience (or "experience actively supervising" others engaged in) preparing, auditing, analyzing, or evaluating financial statements presenting a level of accounting complexity comparable to what is encountered in connection with the Company's financial statements. SEC rules further require such qualifications to have been acquired through specified means of experience or education. The Board has determined that Michael S. Parrett, an Audit Committee member, qualifies as an audit committee financial expert. The Board believes that the current members of the Audit Committee are qualified to carry out the duties and responsibilities of the Audit Committee.

Compensation Committee. The Company has a Compensation Committee as required pursuant to Section 303A.05 of the NYSE's listing standards. The Compensation Committee held five (5) meetings during 2011. During 2011, the Compensation Committee was composed of Steven S. Lucas (Chairman), Craig L. Fuller and Patrick M. James. The Board has determined that all of the members of the Compensation Committee are "independent," as defined in Section 303A.02 of the NYSE's listing standards. The Company is in compliance with the requirement of the NYSE to have a compensation committee comprised entirely of independent directors. Additionally, the Company intends to fully comply with any further guidelines that may arise from the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act with respect to Compensation Committee member independence. The principal responsibilities of the Compensation Committee are to establish policies and determine matters involving executive compensation, recommend changes in employee benefit programs, approve the grant of stock options and stock awards under the Company's stock plans and provide assistance to management regarding key personnel selection. The Compensation Committee's written charter is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Charters/Compensation." A copy of the charter is also available in print to stockholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

Health, Safety and Environmental Committee. The Company has a Health, Safety and Environmental Committee. The principal responsibilities of this committee are (i) to review the Company's environmental and occupational health and safety policies and programs, (ii) to oversee the Company's environmental and occupational health and safety performance, and (iii) to monitor current and future regulatory issues. During 2011, the Health, Safety and Environmental Committee consisted of Michael Schiavone (Chairman), Sheryl K. Pressler, and Craig L. Fuller. This committee held two (2) meetings in 2011.

Committee on Ore Reserves. The Company has a Committee on Ore Reserves. The principal responsibilities of this committee are (i) to advise the Board on the appropriateness, accuracy and completeness of the Company's ore reserves, and (ii) to ensure that management appropriately presents the Company's ore reserves to regulatory agencies. During 2011, the Committee on Ore Reserves was composed of Michael S. Parrett (Chairman), Patrick M. James and Sheryl K. Pressler. This committee held three (3) meetings in 2011.

| 13 |

Corporate Governance and Nominating Committee. The Company has a Corporate Governance and Nominating Committee as required pursuant to Section 303A.04 of the NYSE's listing standards. The Corporate Governance and Nominating Committee held three (3) meetings during 2011. The Corporate Governance and Nominating Committee is composed of Craig L. Fuller (Chairman), Patrick M. James, and Michael Schiavone. The Board has determined that all of the members of the Corporate Governance and Nominating Committee were independent directors under the NYSE listing standards and applicable SEC rules. The Company complies with the requirement of the NYSE to have a Corporate Governance and Nominating Committee comprised entirely of independent directors.

The principal responsibilities of the Corporate Governance and Nominating Committee are (i) identifying and recommending to the Board individuals qualified to serve as directors of the Company and on committees of the Board, (ii) advising the Board as to the appropriate size, function and procedures of the committees of the Board, (iii) developing and recommending to the Board corporate governance principles, and (iv) overseeing evaluation of the Board and the Company's executive officers.

The Corporate Governance and Nominating Committee is governed by a written charter. The Board also follows written corporate governance guidelines for the Company and a written policy for stockholder nomination of directors. These documents set forth the criteria and methodology the Board will use when considering individuals as nominees to the Board. Current copies of these documents are available on the Company's corporate website at www.stillwatermining.com under the headings "Corporate Governance/Charters/Corporate Governance/Nominating", "Corporate Governance/Governance Principles" and "Corporate Governance/Policies/Stockholder Nomination of Directors", respectively. Copies of these documents are also available in print to stockholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

The Company has a Business Ethics and Code of Conduct policy applicable to its officers, directors, employees and agents, which is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Policies/Business Ethics." The purpose of this policy is to provide legal, ethical and moral standards for the conduct of the Company's officers, directors, employees and agents. The Board has also adopted a written Code of Ethics for its Chief Executive and Senior Financial Officers which is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Policies/Code of Ethics for Senior Financial Officers." This document sets forth specific policies to guide the Chief Executive Officer, Chief Financial Officer and Controller in the performance of their duties. Copies of these documents are also available in print to stockholders upon request, addressed to the Corporate Secretary at Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102.

Candidate Selection Process

The minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board's oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. In addition, the Corporate Governance and Nominating Committee examines a candidate's specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. The Corporate Governance and Nominating Committee seeks to have the Board represent a diversity of backgrounds and experiences.

| 14 |

The Corporate Governance and Nominating Committee identifies potential nominees by asking current directors and executive officers to notify the committee if they become aware of persons meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the Board, including retirement as a Chief Executive Officer or Chief Financial Officer of a public company or exiting government or military service. The Corporate Governance and Nominating Committee also, from time to time, may engage firms that specialize in identifying director candidates. As described below, the Corporate Governance and Nominating Committee will also consider candidates recommended by stockholders.

Once a person has been identified by the Corporate Governance and Nominating Committee as a potential candidate, the committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Corporate Governance and Nominating Committee determines that the candidate warrants further consideration, the Chairman or another member of the committee contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Corporate Governance and Nominating Committee requests information from the candidate, reviews the candidate's accomplishments and qualifications, including in light of any other candidates that the committee might be considering, and conducts one or more interviews with the candidate. In certain instances, committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate's accomplishments. The Corporate Governance and Nominating Committee's evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

Under the Company's Corporate Governance Principles, the Corporate Governance and Nominating Committee will present a list of candidates to the Board for nomination. The Chief Executive Officer will be included in the process on a non-voting basis. Taking into account the factors outlined above, the Corporate Governance and Nominating Committee will make a recommendation to the Board and the Board will determine which of the recommended candidates to approve for nomination.

| 15 |

Nomination Process

Nominations of persons for election as directors of the Company may be made at a meeting of stockholders, (a) by or at the direction of the Board, (b) by the Corporate Governance and Nominating Committee or persons appointed by the Board or (c) by any stockholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in Section 3.3 of the Company's By-Laws. Such nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the Company's Corporate Secretary. To be timely, a stockholder's notice shall be delivered to or mailed and received at the principal executive office of the Company not less than fifty days nor more than seventy-five days prior to the meeting; provided, however, that in the event that less than sixty days' notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. Such stockholder's notice to the Company's Corporate Secretary shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company which are beneficially owned by the person, and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to the Exchange Act, as now or hereafter amended; and (b) as to the stockholder giving the notice, (i) the name and record address of such stockholder and (ii) the class and number of shares of capital stock of the Company which are beneficially owned by such stockholder. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company. No person shall be eligible for election by the stockholders as a director of the Company unless nominated in accordance with the procedures set forth herein. The Chairman of the meeting of the stockholders shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedure and if he or she should so determine, he or she shall so declare to the meeting and the defective nomination shall be disregarded.

Lead Independent Director

In accordance with the Company's Corporate Governance Principles and By-Laws, the independent directors will designate a lead independent director who will preside at the executive sessions of the Board. Patrick M. James is currently designated as the lead independent director. The lead independent director's duties include coordinating the activities of the independent directors, coordinating the agenda for and moderating sessions of the Board's independent directors, facilitating communications between the independent directors and the other member(s) of the Board and conducting the annual CEO evaluation.

Currently, the Company has a combined CEO and Chairman position. Taking into account the role of our lead independent director, we believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our Board of Directors' leadership structure supports this approach. The Board has adopted governance policies and practices to ensure a strong and independent board that provides balance to the combined CEO and Chairman position as well as a required lead independent director.

| 16 |

Board Oversight of Risk

Ultimately, the full Board has responsibility for risk oversight, but our committees help oversee risk in areas over which they have responsibility. The full Board receives regular updates related to various risks for both our company and our industry. The Audit Committee receives and discusses reports regularly from members of management, who are involved in the risk assessment and risk management functions on a daily basis. In addition, the Compensation Committee annually reviews, with the assistance of management, the overall structure of the Company’s compensation program and policies for all employees as they relate to the Company’s risk management practices.

The Board oversees the management of risks inherent in the Company’s businesses and the implementation of its strategic plan. The Board performs this oversight role by implementing multiple levels of review. In connection with its reviews of the operations of the Company’s business units and corporate functions, the Board addresses the primary risks associated with those units and functions. In addition, the Board reviews the risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company. The Board also unilaterally considers other risk topics at its meetings, including risks associated with our capital structure, strategic plan, and development activities. Further, the Board is routinely informed by management of developments that could affect our risk profile. The Board’s current role in risk oversight is complemented by our leadership structure.

Each of the Board’s Committees also manages Company risks that fall within the Committee’s areas of responsibility. In performing this function, each Committee has full access to management, as well as the ability to engage advisors.

As part of its oversight of the Company’s executive compensation program, the Compensation Committee considers the impact of the Company’s executive compensation program, and the incentives created by the compensation awards that it administers, on the Company’s risk profile, as more fully discussed below. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company. Based on this review, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

Review of Compensation Risk

| · | The Compensation Committee annually reviews the overall structure of the Company’s executive compensation program and policies to ensure they are consistent with effective management of key enterprise risks and that they do not encourage executives to take unnecessary or excessive risks that could threaten the value of the enterprise. | |

| · | With respect to the programs and policies that apply to our named executive officers, this review includes: |

| 17 |

| Ÿ | analysis of how different elements of compensation may increase or mitigate risk-taking; | ||

| Ÿ | analysis of performance metrics used for short-term and long-term incentive programs and the relation of such incentives to the objectives of a particular position or business unit; | ||

| Ÿ | analysis of whether the performance measurement periods for short-term and long-term incentive compensation are appropriate; | ||

| Ÿ | analysis of the overall structure of compensation programs as related to business risks; and | ||

| Ÿ | an annual review of the Company’s share ownership guidelines, including share ownership levels and retention practices. |

| · | Based on this review, we believe the Company’s well-balanced mix of salary and short-term and long-term incentives are appropriate and consistent with the Company’s risk management practices and overall strategies. We also reviewed compensation plans generally as they apply to all employees and have determined that they are not likely to encourage or incentivize unnecessary risk-taking. |

Stockholder Communication with Directors

The Board has a written policy on stockholder and interested party communications with directors, a copy of which is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Stockholder Communication with Directors."

Under the policy, stockholders and other interested parties may contact any member (or all members) of the Board (including, without limitation, the lead independent director, Patrick M. James, or the non-management directors as a group), any Board committee or any chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent to the Corporate Secretary, Stillwater Mining Company, 1321 Discovery Drive, Billings, Montana 59102. To communicate with any of our directors electronically, stockholders should go to our corporate website at www.stillwatermining.com. Under the heading "Corporate Governance/Stockholder Communication with Directors," you will find an on-line form that may be used for writing an electronic message to the Board, any individual director, or any group or committee of directors. Please follow the instructions on our website in order to send your message.

All communications received as set forth in the preceding paragraph will be opened by the office of our Corporate Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

| 18 |

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are identified under "Committees" above. No member of the Compensation Committee was, at any time during 2011, an officer or employee, or a former officer, of the Company. No executive officer of the Company, other than Francis R. McAllister, has served on the board or compensation committee of any other entity that has or has had one or more executive officers serving as a member of the Board or Compensation Committee.

Director Compensation

Commencing on May 3, 2011, non-employee director retainers and meeting fees were increased to the following amounts: Each non-employee director receives a quarterly retainer of $15,000 which may be paid in cash or may be deferred in cash or Common Stock as described below. In addition, the Company pays each non-employee director and committee member $2,500 per meeting of the Board attended and $1,500 per telephonic meeting in which he or she participated. The Lead Independent Director and Audit Committee chair each receive an additional annual retainer of $20,000; the Compensation Committee chair receives an additional $15,000 annual retainer, and the Committee chairs each receive additional annual retainers of $10,000. The Company also reimburses all directors for reasonable travel expenses. In December 2004, the Board approved a guideline that non-employee directors should own Common Stock having a value of at least $100,000. Pursuant to that guideline, each director is asked to comply with this new guideline by the fifth anniversary of his or her election to the Board. Based on the closing price of $13.26 on March 9, 2012, all Directors are in compliance with this guideline.

With the exception of Messrs. Schiavone and Parrett, each of the Directors has over five years of service as a director for the Company.

On the date of each annual meeting of stockholders, each non-employee director will receive a grant of Restricted Stock Units valued at $50,000, with restrictions that lapse (vest) upon the earlier of six months following the grant or the director's death, disability, retirement or a change in control of the Company. A non-employee director may elect to defer all, or a portion, of their vested Restricted Stock grant into the 2005 Non-Employee Directors’ Deferral Plan, in which case, upon receiving deferred shares, the non-employee director is credited additional “matching” deferred shares in the amount of 20% of the non-employee director’s deferred shares. Matching shares are fully vested, and non-forfeitable. Any Restricted Stock Units which have not vested will result in forfeiture, unless otherwise provided under the terms of the Restricted Stock Unit Agreement. The minimum deferral period is two years.

| 19 |

Additionally, the 2005 Non-Employee Director Deferral Plan allows non-employee directors to defer cash compensation for service as a director of the Company and later receive such compensation in the form of cash or shares of Common Stock. If a director elects to defer compensation and receive such compensation in the form of deferred shares of Common Stock, the number of shares such director will be entitled to receive will be determined by dividing the amount of compensation deferred during such quarter by the fair market value of one share of Common Stock on the last day that the stock traded before the end of such quarter. Upon receiving deferred shares of Common Stock, such director's account will be credited additional "matching" deferred shares in an amount equal to 20% of the number of deferred shares to which he or she is entitled pursuant to the calculation described above.

2011 DIRECTOR COMPENSATION

| Name | Fees

Earned or Paid in Cash (1)($) | Stock

Awards (2)($) |

Option Awards (3)($) | All

Other Compen-sation (4) ($) | Total ($) | ||||||||||||||

| Craig L. Fuller | 122,750 | 60,000 | 182,750 | ||||||||||||||||

| Patrick M. James | 134,000 | 60,000 | 11,383 | 205,383 | |||||||||||||||

| Steven S. Lucas | 130,500 | 60,000 | 12,908 | 203,408 | |||||||||||||||

| Ajay Paliwal (5) | 0 | ||||||||||||||||||

| Michael S. Parrett | 121,750 | 60,000 | 6,383 | 188,133 | |||||||||||||||

| Sheryl K. Pressler | 136,500 | 60,000 | 6,383 | 202,883 | |||||||||||||||

| Mark V. Sander (6) | 0 | ||||||||||||||||||

| Michael Schiavone | 117,750 | 60,000 | 177,750 |

| (1) | Amounts include fees deferred in the form of Common Stock in the Non-Employee Director Deferral Plan in the amount of $25,000 for Patrick M. James and $32,625 for Steven S. Lucas. |

| (2) | Value is based on the grant date fair value in accordance with FASB ASC Topic 718 for RSUs issued in 2011. These awards were granted with a 6 (six) month vesting period and vested on November 3, 2011. Patrick M. James, Steven S. Lucas, Michael S. Parrett, and Sheryl Pressler deferred their entire Common Stock grant into the Non-Employee Director Deferral Plan. |

| (3) | Stock and Option awards outstanding as of December 31, 2011, are as follows: |

| Name | Options Vested & Outstanding | |||

| Craig L. Fuller | 15,000 | |||

| Patrick M. James | 10,000 | |||

| Steven S. Lucas | - | |||

| Michael S. Parrett | - | |||

| Sheryl K. Pressler | 10,000 | |||

| Michael Schiavone | - | |||

| (4) | Amounts include a 20% Company match, in the form of Company stock, on fees and stock awards deferred in the form of stock into the Non-Employee Director Deferral Plan. The Company match is also deferred into the Non-Employee Director Deferral Plan. |

| (5) | Ajay Paliwal resigned from the Board of Directors on January 7, 2011. |

| (6) | Mark V. Sander resigned from the Board of Directors on January 7, 2011. |

| 20 |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

Company Performance

Stillwater Mining Company mines palladium and platinum from two underground mines located in south central Montana and operates a smelting and base metal refining complex in Columbus, Montana. In addition to processing the Company’s mine concentrates, these facilities recycle spent catalyst PGM containing materials from third parties.

The Company also owns the Marathon PGM-copper project located in north-western Ontario, which is a mine development project currently in the permitting and detailed engineering stage with the goal of constructing a conventional open pit mining and processing operation. The total Marathon project land position, including the Geordie Lake and Bermuda properties covers nearly sixty square miles.

In line with the Company’s long-term objective of positioning the Company for the future through growth and diversification, in the fall of 2011 the Company acquired Peregrine Metals, Ltd., whose principal asset is the Altar project, a large advanced stage copper-gold exploration property, located in the San Juan Province of Argentina.

The Company reported consolidated net income of $144.3 million in 2011. The Company’s safety performance was reflected in a 9.7% improvement in our incident rate from 2010. Mine production of palladium and platinum in 2011 was up 6.8% at 517,900 ounces, exceeding both initial and revised guidance, as well as 2010 production of 485,100 ounces. Recycling volumes of palladium, platinum, and rhodium were up 21.9% at 486,700 ounces compared with 399,400 ounces in 2010. Gross mining costs were up from 2010, however still within range for the 2011 business plan. The Company is now listed on the Toronto Stock Exchange. The Marathon Project’s original performance targets were designed around a timetable expecting Environmental Assessment (EA) guidelines to be received early in the first quarter of 2011. Following delays due to a Provincial and Federal decision to seat a Joint Panel for the purpose of developing and future project reviews, the guidelines were received in August 2011. The project team has responded above expectation in developing appropriate work products for submittal. Not only have their efforts dealt with more in-depth guideline requirements versus past EA practices but they have been able to reduce the estimated work product development timeline.

2011 Compensation Decisions

As a result of the above events named executive officer compensation outcomes for 2011 included the following:

| · | Base salaries were generally increased so that executive compensation remained at market median levels consistent with our compensation philosophy; |

| 21 |

| · | Annual cash incentive awards are generally structured to deliver pay that is consistent with market median levels for achievement of target performance. Safety, production, cost and strategic initiatives are the key metrics for our named executive officers’ annual cash incentive awards. These metrics provide for a balanced approach to measuring annual Company performance. The Company’s performance with respect to each of these metrics resulted in annual incentive payouts at approximately 21.6% above target levels; and | |

| · | Long-term awards in the form of restricted stock units were made with a focus toward retention of the executives possessing the level of talent needed to attain the business objectives and strategic initiatives critical to our success, particularly in light of the intense competition for executive management in the industry and the fact that the Company does not maintain a pension plan. These awards were paid out at approximately 11% above target levels. |

Relationship between Total Shareholder Return and CEO Compensation

Our compensation philosophy emphasizes pay-for-performance. While there are many ways in which to test this relationship, many institutions have focused on CEO pay as compared to Total Share Holder Return. The following chart illustrates the relationship between the CEO’s Total Direct Compensation and the Fiscal Year End Total Shareholder Return for a five year period.

| * | 2011 TDC includes bonus payout and 2012 grant date restricted stock value, based on 2011 performance. |

| ** | TDC includes: (i) salary; (ii) bonus payout for prior year performance; and (iii) grant date restricted stock value based on prior year performance and issued in 2012. |

| 22 |

Best Compensation Practices

We believe that our compensation program builds upon the Company’s compensation governance framework and our overall pay-for-performance philosophy, which are demonstrated by the following:

| · | Our compensation programs are intended to be balanced between short and long-term awards, cash and equity, and fixed vs. variable compensation, with a focus on aligning long-term performance of the Company with executive compensation. | |

| · | Our short-term and long-term incentive plans are capped at maximum levels for each named executive officer. | |

| · | We award a significant portion of our long-term incentive compensation in the form of restricted stock units, which are only awarded based on achievement of certain Company performance goals. The restricted stock units vest in thirds over a three year period, which is intended to align our named executive officers’ incentives with the long-term interests of stockholders. | |

| · | We do not provide a defined benefit pension plan to our named executive officers. | |

| · | Our executives hold significant stock in the Company for long periods of time, and for that reason we do not currently have the need to maintain a policy regarding stock ownership guidelines. | |

| · | We maintain a policy that prohibits our directors, named executive officers, and other key executive officers from hedging the economic interest in the Company securities that they hold. | |

| · | We have a policy that prohibits Company personnel, including the named executive officers, from engaging in any short-term, speculative securities transactions, including purchasing securities on margin, engaging in short sales, buying or selling put or call options, and trading in options (other than those granted by the Company). | |

| · | We consider internal pay equity analyses when making compensation determinations with regard to the named executive officers. | |

| · | The Compensation Committee engages an independent compensation consultant that does not provide any services to management and that had no prior relationship with management prior to the engagement. | |

| · | We do not consider perquisites to be an important part of our compensation program and only provide de minimus benefits to our executives that are not offered to other employees of the Company. |

| 23 |

| · | We have a strong risk management program, which includes our Compensation Committee’s significant oversight of the ongoing evaluation of the relationship between our compensation programs and risk. |

Say-on-Pay Results

The Compensation Committee values the input of our stockholders regarding our executive compensation programs and practices. The vote results of our Annual Advisory Vote on Named Executive Officer Compensation (Say-on-Pay) are an important opportunity for stockholders to provide their input regarding executive compensation. Stockholder endorsement of the design and administration of our executive compensation programs was evidenced by an 87.7% vote of approval at our annual meeting held on May 3, 2011. As a result of this favorable vote regarding our named executive officers compensation, it was determined that no changes were necessary to our executive compensation design and administration.

The Compensation Committee continually evaluates best practices associated with good governance in executive compensation ensuring a proactive approach is maintained. Maintaining the level of stockholder support for our executive compensation is a priority, and we will continue to monitor stockholder perspectives and input on our Say-on-Pay vote, which will be held annually.

The Compensation Committee

General

The principal responsibilities of the Compensation Committee are to establish policies and determine matters involving executive compensation, recommend changes in employee benefit programs, approve the grant of stock options and stock awards under the Company's stock plans and provide assistance to management regarding key personnel selection. The Compensation Committee's written charter, which describes the specific duties of the Compensation Committee, is available on the Company's corporate website at www.stillwatermining.com, under the heading "Corporate Governance/Charters/ Compensation."

In making its decisions, the Committee routinely

examines the following important business factors, discussed in more detail throughout this Compensation Discussion and Analysis:

| * | financial reports on performance versus budget and compared to prior-year performance; |

| * | calculations and reports on levels of achievement of corporate performance objectives; |

| * | reports on the Company's strategic initiatives and budget for future periods; |

| * | information on the executive officers' stock ownership and option holdings; |

| 24 |

| * | information sheets setting forth the total compensation of the named executive officers, including base salary, cash incentives, equity awards, perquisites, if any, and other compensation and any amounts payable to the executives upon voluntary or involuntary termination, early or normal retirement or following a change-in-control of the Company; |

| * | information regarding incentives and possible impact on excessively risky behavior; and |

| * | information regarding compensation programs and compensation levels at groups of companies identified by our independent compensation consultant. |

Interaction with Management

In order to ensure that compensation programs are aligned with appropriate Company performance goals and strategic direction, management works with the Compensation Committee in the compensation-setting process. Specifically, management will provide the Compensation Committee with their evaluation of executive performance, recommend business performance targets and objectives, and recommend salary levels and restricted stock awards. However, all decisions regarding executive compensation are ultimately made by the Compensation Committee.

The Company’s Chairman and Chief Executive Officer and Vice President - Human Resources and Safety work with the Compensation Committee Chair to establish the agenda for Compensation Committee meetings. The Compensation Committee may also request that the CEO attend and participate in Committee meetings, at which the CEO provides background information regarding the Company's strategic objectives, evaluation of the performance of the senior executive officers, and compensation recommendations as to senior executive officers (other than himself). The Committee also seeks input from the Vice President – Human Resources and Safety as necessary and appropriate to carry out its duties. The Committee regularly meets in executive session without management in order to review recommendations and make compensation decisions.

Interaction with Compensation Consultants

In making its determinations with respect to executive compensation, the Compensation Committee has historically engaged the services of a compensation consultant. Since 2001, the Compensation Committee has retained the services of Pearl Meyer & Partners – an independent compensation consultant, to assist with its review of the compensation package of the named executive officers. In addition, in 2011 Pearl Meyer & Partners assisted the Committee with several special projects, including analysis of the ISS 2012 Pay-for-Performance Policy changes, review of our annual Compensation Risk Assessment and preparation of this proxy statement. Pearl Meyer & Partners performs no services for the Company other than executive and director compensation consulting.

The Committee retains Pearl Meyer & Partners, although in carrying out assignments, Pearl Meyer & Partners may also interact with Company management when necessary and appropriate. Specifically, the Vice President – Human Resources and Safety interacts with the consultants in order to provide compensation and performance data for the executives and the Company. In addition, Pearl Meyer & Partners may, at its discretion, seek input and feedback from the Vice President – Human Resources and Safety regarding its consulting work product prior to presentation to the Compensation Committee in order to confirm alignment with the Company's business strategy and identify data questions or other similar issues, if any, prior to presentation to the Compensation Committee.

| 25 |

Compensation Philosophy & Objectives

Our compensation philosophy is to provide executives with market-competitive compensation that is aligned with Company and individual performance, as well as long-term stockholder value. The overall principle guiding executive compensation at the Company is to reward executives for delivering superior performance. The extent to which each executive reaches any particular level of compensation will vary based on Company performance, individual performance and experience. The specific objectives of our program are to:

| · | motivate the Company’s management team to continually meet or exceed its operating targets without sacrificing long-term performance and growth; |

| · | support the Company's core values and strategic goals; |

| · | ensure that the Company is able to attract and retain the highest caliber executives; |

| · | ensure that compensation-related risk is balanced; and |

| · | promote the alignment of management's interests with those of its shareholders. |

The following principles govern how the Company makes compensation decisions to foster the above objectives:

Focus on Results and Strategic Objectives

Our compensation analysis always begins with an examination of the Company's Business Plan and Strategic Objectives. Our compensation decisions are intended to attract and retain leaders and reward them for achieving the Company's strategic initiatives and objective measures of success.

Pay for Performance Culture

At the core of our compensation philosophy is our guiding belief that pay should be linked to performance. A significant portion of executive officer compensation is contingent upon, and variable with, achievement of objective Corporate and/or individual performance objectives.

| 26 |

Compensation and Performance Pay Reflective of Position and Responsibility

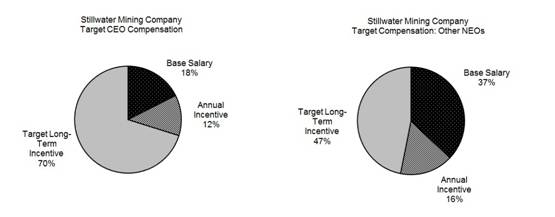

As a result of our pay-for-performance culture our named executive officers are only paid based on achievement of performance results. The Compensation Committee believes that compensation and accountability should generally increase with advances in position and enlarged responsibilities. Consistent with this philosophy, total target compensation is higher for individuals with greater responsibility and greater ability to influence the Company's achievement of targeted results and strategic initiatives. In addition, as position advances and responsibilities are enlarged, a greater portion of the executive officer's total compensation is performance-based pay contingent on the achievement of performance objectives. Finally, equity-based compensation is higher for persons with higher levels of responsibility, making a significant portion of their total compensation dependent on long-term stock appreciation. It should also be noted that the long-term incentive awards have a cap and a floor as to potential payouts. The compensation package of our CEO has the largest portion of pay at risk, with 73% of his targeted total direct compensation based on performance of the Company. Other officers range from 47% to 56% of targeted total direct compensation at risk.

Compensation Decisions That Promote the Interests of Shareholders

Compensation should focus management on achieving strong short-term (annual) performance in a manner that supports and ensures the Company's long-term success and profitability. The Annual Incentive Program creates incentives for meeting annual performance targets, while equity grants encourage the achievement of longer-term objectives and retention, and vest in thirds over a three-year period. The Compensation Committee believes that restricted stock unit grants create long-term incentives that align the interest of management with the long-term shareholders.

Compensation Should be Reasonable and Responsible

We believe that compensation should be set at responsible levels. Our executive compensation programs are intended to be consistent with the Company’s primary focus on the safety of our employees, production, controlling costs, improving the state of development at the mines, continuing to grow the recycling business, Company growth and diversification and increasing the demand for palladium. Compensation must also be competitive as mining industry executives are in high demand and short supply and we expect this trend to continue.

Compensation Structure

Pay Levels and Benchmarking

The Compensation Committee believes that it is appropriate to establish compensation levels based primarily on benchmarking against similar companies, both in terms of compensation practices as well as levels of compensation. In this way, we can gauge if our compensation is competitive in the marketplace for our talent, as well as ensure that our compensation is reasonable.

The Compensation Committee reviews compensation levels for the named executive officers against compensation levels at the Comparator Group, which is developed by the Compensation Committee in conjunction with the Compensation Committee’s independent compensation consultant.

| 27 |

The eleven (11) metal mining companies in our Comparator Group used for our 2011 compensation analysis are:

Cliffs Natural Resources, Inc.

Coeur d’Alene Mines Corporation

Gold Fields Limited

Goldcorp, Inc.

Golden Star Resources Ltd.

Hecla Mining Company

IAMGOLD Corporation

Kinross Gold Corporation

North American Palladium Ltd

Quadra FNX Mining Ltd.

Randgold Resources Limited

As in the past, sales for the most recent fiscal year and market capitalization at year end were used to establish comparability. This Comparator Group data is supplemented with survey compensation data to develop market compensation figures. None of the individual companies participating in such surveys were relied upon or relevant to Compensation Committee decision making. In addition, we also consider data points and trends from two additional, significantly larger, metal mining companies (Freeport-McMoRan Copper & Gold Inc. and Newmont Mining Corporation) for comparison purposes, although such data is not considered when the various statistical data points discussed below are calculated.

For consistency, the Committee currently intends to use the same Comparator Group as part of the annual marketplace study from year to year. The specific companies included in the Comparator Group may change, however, if there is a change in their size, relevance or other pertinent factor that impacts the comparability between our Company and theirs.