|

I

|

|||

|

V

|

|||

|

1

|

|||

|

Item 1.

|

1

|

||

|

Item 2.

|

1

|

||

|

Item 3.

|

1

|

||

|

Item 4.

|

52

|

||

|

Item 4A.

|

114

|

||

|

Item 5.

|

115

|

||

|

Item 6.

|

148

|

||

|

Item 7.

|

162

|

||

|

Item 8.

|

169

|

||

|

Item 9.

|

175

|

||

|

Item 10.

|

178

|

||

|

Item 11.

|

201

|

||

|

Item 12.

|

201 | ||

|

203

|

|||

|

Item 13.

|

203 | ||

|

Item 14.

|

203

|

||

|

Item 15.

|

203 | ||

|

Item 16.

|

204 | ||

|

Item 16A.

|

204 | ||

|

Item 16B.

|

204

|

||

|

Item 16C.

|

204 | ||

|

Item 16D.

|

205 | ||

|

Item 16E.

|

205 | ||

|

Item 16F.

|

207 | ||

|

Item 16G.

|

207 | ||

|

Item 16H.

|

209 | ||

|

Item 16I.

|

209 | ||

| Item 16J |

Insider Trading Policies |

210 | |

| 210 | |||

|

Item 17.

|

210

|

||

|

Item 18.

|

210 | ||

|

Item 19.

|

210

|

||

Certain Defined Terms

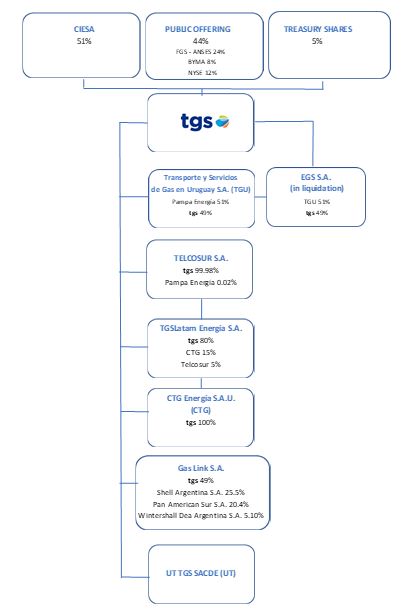

In this annual report on Form 20-F (“Annual Report”), unless otherwise indicated or the context requires otherwise: (i) references

to “we,” “us,” “our” and the “Company” mean Transportadora de Gas

del Sur S.A. (“tgs”) and its consolidated subsidiaries, Telcosur S.A. (“Telcosur”), TGSLatam Energía S.A. (“TGSLatam”) and CTG Energía S.A.U. (“CTG”), (ii) references to “Argentina” are to the Republic of Argentina, (iii) references to the “United

States” or “U.S.” are to the United States of America, (iv) references to “pesos” or “Ps.” are to Argentine pesos,

the legal currency of Argentina, (v) references to “U.S. dollars,” “dollars” or “U.S.$” are to United States dollars, the

legal currency of the United States, (vi) a “billion” is a thousand million, (vii) references to “cf” are to cubic feet, (viii) references to “MMcf” are to millions of cubic feet, (ix) references to “Bcf” are to billions of cubic feet, (x) references to “m3” are to cubic

meters, (xi) references to “d” are to days, and (xii) references to “HP” are to horsepower.

Financial Statements and Basis of Preparation

We maintain our financial books and records and publish our consolidated Financial Statements (as defined below) in pesos, which is our functional currency. This Annual Report includes our

audited consolidated statements of financial position as of December 31, 2022 and 2021, and our audited consolidated statements of comprehensive income, changes in equity and cash flows, and the related explanatory notes for the years ended

December 31, 2022, 2021 and 2020 (our “Financial Statements”). Our Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”)

as issued by the International Accounting Standards Board (“IASB”) and as in effect on the date of preparation of the Financial Statements. IFRS have been adopted by the Federación

Argentina de Consejos Profesionales de Ciencias Económicas (“FACPCE”) as its professional accounting standards and are required to be adopted by certain public companies in Argentina (entidades incluidas en el régimen de oferta pública de la Ley de Mercado de Capitales) pursuant to the rules of the Comisión Nacional de Valores (“CNV”), compiled under General Resolution No. 622/2013 (as amended by General Resolution No. 668/2016 and as further amended, the “CNV Rules”).

At our shareholders’ meeting held on April 26, 2017, as a result of a proposal by our controlling shareholder, Compañía de Inversiones de Energía S.A. (“CIESA”),

our shareholders voted in favor of having a joint audit on our consolidated financial statements commencing with fiscal year ended December 31, 2017, even though there is currently no legal requirement in Argentina for a joint audit. As a result,

our Financial Statements were jointly audited by Price Waterhouse & Co. S.R.L., Buenos Aires, Argentina (“PwC”), member firm of PricewaterhouseCoopers International Limited, and Pistrelli, Henry Martin

y Asociados S.R.L. (“EY”), member firm of Ernst & Young Global Limited. The joint report of PwC and EY, dated April 25, 2023, is included elsewhere in this Annual Report. Each of PwC and EY is an

independent registered public accounting firm, as stated in the joint report appearing herein.

International Accounting Standard 29 (“IAS 29”) “Financial reporting in hyperinflationary economies” requires

that the financial statements of an entity whose functional currency is one of a hyperinflationary economy be expressed in terms of the current unit of measurement at the closing date of the reporting period, regardless of whether such financial

statements are based on the historical cost method or the current cost method. This requirement also comprises the restatement of comparative information of the financial statements to be presented in the current currency as of December 31, 2022,

without modifying the statutory decisions made based on the financial information corresponding to those fiscal years.

IAS 29 describes characteristics that may indicate that an economy is hyperinflationary. However, it states that it is a matter of judgement by management when restatement of financial statements

becomes necessary. Among other factors, an economy is “hyperinflationary” in accordance with IAS 29 when it has a cumulative inflation rate over three years that approaches, or exceeds, 100%, also taking into consideration other qualitative

factors related to the macroeconomic environment.

The IASB does not identify specific economies that satisfy the requirements to be deemed hyperinflationary. The International Practices Task Force (“IPTF”)

of the Center for Audit Quality monitors the status of “highly inflationary” countries. The criteria of IPTF for identifying such countries are similar to those for identifying “hyperinflationary economies” under IAS 29. From time to time, the

IPTF issues reports of its discussions with the staff of the Securities and Exchange Commission (“SEC”) on the IPTF’s recommendations of which countries should be considered highly inflationary, and which

countries are on the IPTF’s inflation “watch list.” The IPTF’s discussion document for its November 9, 2022 meeting states that in the view of the IPTF, Argentina had a three-year cumulative inflation rate exceeding 100%.

Inflation in Argentina significantly increased during 2022, 2021 and 2020, which resulted in an accumulated inflation rate for each of the three-year periods ended December 31, 2022, 2021 and

2020, in excess of 100%. In addition, the rest of the indicators do not contradict the conclusion that Argentina should be considered a hyperinflationary economy for accounting purposes. As a result, our management considers that there is

sufficient evidence to conclude that Argentina is a hyperinflationary economy in terms of IAS 29, effective as from July 1, 2018.

The Financial Statements and the other financial information included in this Annual Report for all the periods reported are presented on the basis of constant pesos as of December 31, 2022 (“Current Currency”). Thus, our audited consolidated statements of financial position as of December 31, 2021, and our audited consolidated statements of comprehensive income, changes in equity and cash flows,

and the related explanatory notes for each of the years ended December 31, 2021 and 2020, included elsewhere in this Annual Report have been restated in accordance with IAS 29 for comparative purposes from the original figures reported and

supersede any previously disclosed consolidated financial statements relating to such periods.

In analyzing the provisions of IAS 29, our management used the inflation rates stated in the official statistics published by the Instituto Nacional de

Estadística y Censos (“INDEC”), similar to the criteria adopted by the accounting profession and corporate regulatory bodies in Argentina. In order to restate the financial statements referred in

the immediately preceding paragraph, the CNV has established that the series of indexes to be used for the application of IAS 29 is determined by the FACPCE. This series of indexes combines the National Consumer Price Index (“CPI”) as of January 2020 (base month December 2019) with the Domestic Wholesale Price Index (“WPI”), both published by INDEC until that date. According to information

from FACPCE, inflation was 94.5%, 50.9%, and 36.1% in the years ended December 31, 2022, 2021 and 2020, respectively.

For more information, see note 4(d) to the Financial Statements and “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Factors Affecting

Our Consolidated Results of Operations.” Also, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Argentina—High levels of inflation could negatively affect our business, results of

operations and financial condition, the value of our securities, and our ability to meet our financial obligations.”

Currency

Solely for the convenience of the reader, certain amounts presented in pesos in this Annual Report as of and for the year ended December 31, 2022, have been converted into U.S. dollars at

specified exchange rates. Unless otherwise specified, all exchange rate information contained in this Annual Report has been derived from information published by Banco de la Nación Argentina (“Banco Nación”) on December 31, 2022, without any independent verification by us. As a result of fluctuations in the peso/U.S. dollar exchange rate, the exchange rate

at such date may not be indicative of current or future exchange rates. Such fluctuations may affect the U.S. dollar equivalent of peso amounts included in this Annual Report. Consequently, these translations should not be construed as a

representation that the peso amounts represent, or have been, or could be converted, into, U.S. dollars at that or any other rate.

Fluctuations in the exchange rate between pesos and U.S. dollars would affect the U.S. dollar equivalent of the peso price of our Class “B” shares, par value Ps.1 each (the “Class B Shares”), on the Buenos Aires Stock Exchange (Bolsas y Mercados Argentinos (“BYMA”)) and, as a result, the market price

of our American Depositary Shares (“ADSs”) on the New York Stock Exchange (“NYSE”) as well.

Historically, Argentina has been subject to several restrictions imposed on the foreign exchange market. In the recent years, the Central Bank of the Republic of Argentina (Banco Central de la República Argentina or the “BCRA”) issued several communications which introduced several changes to the then existing foreign exchange control

regime. For additional information, see “Item 10. Additional Information—D. Exchange Controls.”

The following table sets forth, for the periods indicated, high, low, average and period-end exchange rates between the peso and the U.S. dollar, as reported by Banco Nación. The Federal Reserve

Bank of New York does not publish a buying rate for the peso. The average rate is calculated by using the average of Banco Nación reported exchange rates on each day during the relevant monthly period and on the last day of each month during the

relevant annual period.

|

Pesos per U.S. dollar

|

||||||||||||||||

|

High

|

Low

|

Average

|

Period end

|

|||||||||||||

|

Most recent six months:

|

||||||||||||||||

|

November 2022

|

167.28

|

157.28

|

162.12

|

167.28

|

||||||||||||

|

December 2022

|

177.16

|

167.72

|

172.90

|

177.16

|

||||||||||||

|

January 2023

|

187.00

|

178.15

|

182.24

|

187.00

|

||||||||||||

|

February 2023

|

197.15

|

187.29

|

191.89

|

197.15

|

||||||||||||

|

March 2023

|

209.10

|

197.57

|

203.11

|

209.01

|

||||||||||||

|

Year ended December 31,

|

||||||||||||||||

|

2018

|

41.25

|

18.41

|

28.13

|

37.70

|

||||||||||||

|

2019

|

60.40

|

36.90

|

48.23

|

59.89

|

||||||||||||

|

2020

|

84.15

|

59.81

|

70.78

|

84.15

|

||||||||||||

|

2021

|

102.72

|

84.70

|

95.16

|

102.72

|

||||||||||||

|

2022

|

177.16

|

103.00

|

130.81

|

177.16

|

||||||||||||

Our results of operations and financial condition are highly sensitive to changes in the peso-U.S. dollar exchange rate because a significant portion of our revenues (65% of our total

consolidated revenues from sales for the year ended December 31, 2022), most of our capital expenditures, almost all of our debt obligations and the cost of natural gas used in our Liquids business are denominated in U.S. dollars, but

substantially all of our assets are located in Argentina, and our functional currency is the peso.

Currency fluctuations would also affect the U.S. dollar amounts received by holders of our ADSs upon conversion (by us or by Citibank N.A. (the “Depositary”),

pursuant to the deposit agreement for the issuance of the ADSs entered into between the Depositary and us (the “Deposit Agreement”)) of the cash dividends paid in pesos on the underlying Class “B” Shares.

Rounding

Certain figures included in this Annual Report have been rounded for ease of presentation. Percentage figures included in this Annual Report have not, in all cases, been

calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this Annual Report may vary from those obtained by performing the same calculations using the figures in

our Financial Statements. Certain numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them due to rounding.

Available Information

The SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and

other information regarding issuers that file electronically with the SEC. Our telephone number is (54-11) 4865-9050, and our principal executive offices are located at Don Bosco 3672, 5th Floor, C1206ABF City of Buenos Aires, Argentina. Our

internet address is www.tgs.com.ar. This URL is intended to be an inactive textual reference only. It is not intended to be an active hyperlink to our website. The information included in our website or which may be accessed through our

website is not part of this Annual Report, is not incorporated by reference herein or otherwise and should not be relied upon in determining whether to make an investment in any securities issued by us.

Some of the information in this Annual Report, including information incorporated by reference herein, may constitute estimates and forward-looking statements within the meaning of Section 27A of

the U.S. Securities Act of 1933 (the “Securities Act”) and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These estimates and forward-looking statements can be identified by the use of forward-looking

terminology such as “anticipate,” “believe,” “can,” “continue,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan” “potential,” “predict,” “projection,” “should,” “will,” “will likely result,” “would” or other similar words. These estimates

and statements appear in a number of places in this Annual Report and include statements regarding our intent, belief or current expectations, and those of our officers, with respect to (among other things) our business, financial condition and

results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties and are based on information available to us as of the date

of this Annual Report.

When considering forward-looking statements, you should keep in mind the factors described in “Item 3. Key Information—D. Risk Factors” and other

cautionary statements appearing in “Item 5. Operating and Financial Review and Prospects.” These factors and statements, as well as other statements contained herein, describe circumstances that could

cause actual results to differ materially from those expressed in or implied by any forward-looking statement.

Forward-looking statements include, but are not limited to, the following:

| • |

statements regarding changes in general economic, business, political or other conditions in Argentina and globally, including changes from actions taken by the Argentine government (the “Government”) and changes due to natural and human-induced disasters (including the COVID-19 virus (“COVID”) pandemic and the invasion of Ukraine by Russia), and

the impact of the foregoing;

|

| • |

estimates relating to future energy demand (including demand for fossil fuels), tariffs and volumes for our natural gas transportation services and future prices and volumes for our natural gas liquid

products such as propane and butane (also referred to as liquid petroleum gas or “LPG”), ethane and natural gasoline (collectively “Liquids”) and for

products and services provided in the Other Services business segment;

|

| • |

statements regarding future political developments in Argentina and future developments regarding the license granted to us by Government to provide natural gas transportation services through the exclusive

use of the southern natural gas transportation system in Argentina (“License”), the impact of the adoption of the new revised scheme of tariffs resulting from the renegotiation process of our

License with the Government, regulatory actions by Ente Nacional Regulador del Gas (“ENARGAS”) and other agencies of the Government, the legal framework established by the Federal Energy Bureau and

any other applicable governmental authority that may affect us and our business;

|

| • |

with our employees in Argentina;

|

| • |

statements and estimates regarding future pipeline expansion and other projects and the cost of, or return to us from, any such expansion or projects;

|

| • |

estimates of our future level of capital expenditures and delays in such capital expenditures, including those required by ENARGAS or other governmental authorities for the expansion of our pipeline system

or other purposes, and unscheduled and unexpected expenditures for the repair and maintenance of our fixed or capital assets;

|

| • |

statements regarding the ability of companies engaged in the upstream business in the region where we operate to identify drilling locations and prospects for future drilling opportunities, and drill and

develop such locations (such as the Vaca Muerta formation), as well as the Government’s regulations and policies affecting such companies and projects; and

|

| • |

the risk factors discussed under “Item 3. Key Information—D. Risk Factors.”

|

Estimates and forward-looking statements speak only as of the date of this Annual Report and we do not undertake any obligation to update any forward-looking statement or other information

contained in this Annual Report to reflect events or circumstances occurring after the date of this Annual Report or to reflect the occurrence of unanticipated events. Additional factors affecting our business emerge from time to time and it is

not possible for us to predict all of those factors, nor can we assess the impact of all such factors on our business, operations or financial condition, or the extent to which any factors, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking statement. Estimates and forward-looking statements involve risks and uncertainties and do not guarantee future performance, as actual results or developments may be substantially

different from the expectations described in the forward-looking statements. In light of the risks and uncertainties described above, the events referred to in the estimates and forward-looking statements included in this Annual Report may or may

not occur, and our business performance, financial condition and results of operations may differ materially from those expressed in our estimates and forward-looking statements, due to factors that include but are not limited to those mentioned

above. Investors are warned not to place undue reliance on any estimates or forward-looking statements in making any investment decision.

| Item 1. |

Identity of Directors, Senior Management and Advisers

|

Not applicable.

| Item 2. |

Offer Statistics and Expected Timetable

|

Not applicable.

| Item 3. |

Key Information

|

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the following risks and uncertainties, and any other information appearing elsewhere in this Annual Report. The risks and uncertainties described

below are intended to highlight risks and uncertainties that are specific to us. Additional risks and uncertainties, including those generally affecting Argentina and the industry in which we operate, risks and uncertainties that we currently

consider immaterial or risks and uncertainties generally applicable to similar companies in Argentina may also impair our business, results of operations, financial condition, the value of our securities and our ability to meet our financial

obligations.

The information in this Risk Factors section includes forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those

anticipated in these forward-looking statements as a result of numerous factors, including those described in “Cautionary Statement Regarding Forward-Looking Statements” above.

The following summarizes some, but not all, of the risks provided below. The following summary of material risk factors could materially and adversely affect our business,

financial condition and results of operation, and our ability to meet our financial obligations. Consequently, such risk factors may cause historical results to differ materially from any results projected, forecasted, estimated or budgeted by us

in our forward-looking statements. Please carefully consider all of the information discussed in this “Item 3. Key Information—D. Risk Factors” in this Annual Report for a more thorough description of these and other risks:

| • |

Risks Relating to Our Business

|

| ‒ |

Failure or delay in the implementation of tariff increases could have a material adverse effect on our business, results of operations and financial condition, the value of our securities, and our ability

to meet our financial obligations.

|

| ‒ |

Under the Decree 1020 tariffs were frozen until the new RTI concludes. Since that moment we have received only one tariff increase since

March 1, 2022 amounting to 60%. "Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework —Tarrif

situation."

|

| ‒ |

Our operations are subject to extensive regulation.

|

| ‒ |

Failure to maintain our relationships with labor unions may have an adverse effect on our business, financial condition, results of operations and prospects.

|

| ‒ |

Our regulated business is dependent on our ability to maintain our License, which is subject to revocation under some circumstances.

|

| ‒ |

Our creditors may not be able to enforce their claims against us in Argentina.

|

| ‒ |

The Government’s strategies, measures and programs with respect to the natural gas transportation industry could materially adversely affect our business, results of operations, financial condition, the

value of our securities and our ability to meet our financial obligations.

|

| ‒ |

A significant portion of our revenues is generated under natural gas transportation contracts that must be renegotiated and/or extended periodically.

|

| ‒ |

Our business may require substantial capital expenditures for ongoing maintenance requirements and the expansion of our installed transportation capacity; we could be unable to make such expenditures due to

the lack of financing.

|

| ‒ |

Our Liquids production depends on the natural gas that arrives at the Cerri Complex through three main pipelines from the Neuquina, Austral and San Jorge natural gas basins. The flow and heating value of

this natural gas are subject to risks that could materially adversely affect our Liquids and midstream business segment.

|

| ‒ |

Measures taken by the Government may have an adverse effect on the supply of natural gas to the Cerri Complex and the margins we are able to obtain from our Liquids business, which may adversely affect the

results in our Liquids Production and Commercialization segment and, as a result, our overall business and results of operations.

|

| ‒ |

Fluctuations in market prices and the enactment of new taxes or regulations limiting the sales price of LPG and natural gasoline may affect our Liquids business.

|

| ‒ |

Our business, financial condition and results of operations have been, and may continue to be, adversely affected by the ongoing COVID pandemic and the emergence of a pandemic-level disease or threat to

public health.

|

| ‒ |

Our ethane sales depend on the capacity of PBB, as the sole purchaser of our ethane production.

|

| ‒ |

The affirmative and restrictive covenants in our currently outstanding indebtedness could adversely restrict our financial and operating flexibility and subject us to other risks.

|

| ‒ |

Our insurance policies may not fully cover damage or we may not be able to obtain insurance against certain risks.

|

| ‒ |

Changes in the interpretation by the courts of labor laws that tend to favor employees could adversely affect our business, results operations and financial condition, the value of our securities, and our

ability to meet our financial obligations.

|

| ‒ |

We may be exposed to risks related to litigation and administrative proceedings that could materially and adversely affect our business, results of operations and financial condition, the value of our

securities, and our ability to meet our financial obligations in the event of an unfavorable ruling.

|

| ‒ |

Our operations are subject to environmental, occupational health and safety regulations.

|

| ‒ |

Our operations could cause environmental risks and any change in environmental laws could increase our operating costs.

|

| ‒ |

We may face competition.

|

| ‒ |

Downgrades in our credit ratings could have negative effects on our funding costs and business operations.

|

| ‒ |

Our business has become dependent on digital technologies to conduct day-to-day operations and we may be subject to cyberattacks or other risks related to new technologies.

|

| ‒ |

Our natural gas transportation systems and processing facilities are subject to the risk of mechanical or electrical failures and any resulting unavailability may affect our ability to fulfill our

contractual and other commitments and thus adversely affect our business, results of operations and financial condition, the value of our securities, and our ability to meet our financial obligations.

|

| ‒ |

Our business is subject to risks arising from natural disasters, catastrophic accidents and terrorist attacks.

|

| ‒ |

We are subject to anti-trust, anti-corruption, anti-bribery and anti-money laundering laws. Failure to comply with these laws could result in penalties, which could harm our reputation and have an adverse

effect on our business.

|

| ‒ |

Our ability to operate our business may suffer if we are unable to retain our employees or attract other skilled employees or contractors.

|

| ‒ |

Climate change could impact our operating results, access to capital and strategy.

|

| ‒ |

Our activities are subject to social and reputational risks, including the potential for protests by members of the local communities.

|

| ‒ |

The failure of any bank in which we deposit our funds could have an adverse effect on our financial condition.

|

| • |

Risks Relating to Argentina

|

| ‒ |

Argentina’s public debt may not be sustainable in the near future.

|

| ‒ |

Argentina’s fiscal situation could limit the country’s access to the capital market and adversely affect the Argentine economy.

|

| ‒ |

Certain risks inherent to any investment in a company operating in an emerging market such as Argentina.

|

| ‒ |

Economic volatility in Argentina has adversely affected and may continue to adversely affect our business, results of operations, financial condition, the value of our securities and our ability to meet our

financial obligations.

|

| ‒ |

The ongoing political instability in Argentina may adversely affect the Argentine economy.

|

| ‒ |

The Solidarity Law and the measures that the new administration has implemented could adversely affect our results of operations and financial condition.

|

| ‒ |

Public health threats could have an adverse effect on the Argentine economy and on our business, financial condition or results of operations.

|

| ‒ |

High levels of inflation could negatively affect our business, results of operations and financial condition, the value of our securities, and our ability to meet our financial obligations.

|

| ‒ |

Restrictions on transfers of foreign currency and the repatriation of capital from Argentina may impair our ability to pay dividends or imports and investors may face restrictions on their ability collect

capital and interest payments in connection with corporate bonds issued by Argentine companies.

|

| ‒ |

Fluctuations in the value of the peso may also adversely affect the Argentine economy, our financial condition and results of operations.

|

| ‒ |

The impossibility of addressing the actual and potential risks of institutional deterioration and corruption, the economy and the financial situation of Argentina has been affected negatively and could

continue to be.

|

| ‒ |

Government intervention in the Argentine economy could adversely affect our business, results of operations and financial condition, the value of our securities, and our ability to meet our financial

obligations.

|

| ‒ |

The Argentine economy may be adversely affected by economic developments in other markets and by more general effects, which could have a material adverse effect on Argentina’s economic growth.

|

| ‒ |

Argentina’s past default and litigation with holdout bondholders may limit our ability to access international markets.

|

| ‒ |

A sustained deterioration in the terms of trade given a decline in the global prices for Argentina’s main commodity exports or an increase in the global prices for Argentina’s main commodity imports, as

well as adverse weather conditions affecting the production of Argentina’s main commodity exports, could have an adverse effect on Argentina’s economic growth.

|

| ‒ |

Further downgrades in the credit rating or rating outlook of Argentina could impact the rating of our securities or adversely affect the market price of our securities.

|

| ‒ |

The Argentine government may mandate salary increases for private sector employees, which would increase our operating costs.

|

| ‒ |

Argentine corporations may be restricted from making payments in foreign currencies or from importing certain products.

|

| ‒ |

Argentina’s ability to obtain financing from international markets could be limited, which may impair its ability to implement reforms and foster economic growth and, consequently, affect our business,

results of our operations and growth prospects.

|

| ‒ |

The conflict between Russia and Ukraine could adversely affect the global economy, the Argentine economy and our operational results and financial condition.

|

| ‒ |

We continue operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability since the ongoing military conflict between Russia

and Ukraine, poor global economic performance, a potential recession looming in the U.S. and Europe and China showing weak growth.

|

| • |

Risks Relating to Our Shares and ADSs

|

| ‒ |

shareholders outside Argentina may face additional investment risk from currency exchange rate fluctuations in connection with their holding of our shares or ADSs represented by ADRs. Exchange controls

imposed by the Government may limit our ability to make payments to the Depositary in U.S. dollars, and thereby limit ADR holders´ability to receive cash dividends in U.S. dollars.

|

| ‒ |

Our principal shareholders exercise significant control over matters affecting us, and may have interests that differ from those of our other shareholders.

|

| ‒ |

Sales of a substantial number of shares could decrease the market prices of our shares and the ADRs.

|

| ‒ |

Under Argentine law, shareholder rights may be fewer or less well defined than in other jurisdictions.

|

| ‒ |

As a foreign private issuer we are exempt from certain rules that apply to domestic U.S. issuers.

|

| ‒ |

Changes in Argentine tax laws may adversely affect the tax treatment of our Class B Shares or ADSs.

|

| ‒ |

Holders of ADRs may be unable to exercise voting rights with respect to our Class B Shares underlying the ADRs at our shareholders’ meetings.

|

| ‒ |

Holders of ADRs may be unable to exercise preemptive, accretion or other rights with respect to the Class B shares underlying the ADSs.

|

| ‒ |

The NYSE and/or BYMA may suspend trading and/or delist our ADSs and common shares, respectively, upon occurrence of certain events relating to our financial situation.

|

| ‒ |

The price of our Class B Shares and the ADSs may fluctuate substantially, and your investment may decline in value; and

|

| ‒ |

The relative volatility and illiquidity of the Argentine securities markets may substantially limit the ability to sell the Class B Shares underlying the ADSs on the BYMA at the price and time desired by

the shareholder.

|

Risks Relating to Our Business

Failure or delay in the implementation of tariff increases could have a material adverse effect on our business, results of operations and financial

condition, the value of our securities, and our ability to meet our financial obligations.

All of our net revenues from the Natural Gas Transportation public service (which represented 25% of total revenues during 2022) are attributable to contracts, which are subject to Government

regulation. Prior to the enactment of the Public Emergency Law and Foreign Exchange System Reform Law No. 25,561 (the “Public Emergency Law”), our tariffs were stated in U.S. dollars, adjusted on a

semiannual basis by reference to the U.S. Producer Price Index (“PPI”), and further adjusted every five years, based on the efficiency of, and investments in, our gas transportation business. The Public

Emergency Law, however, eliminated tariff indexation, and public service tariffs were converted into pesos and fixed at an exchange rate of Ps.1.00 per US$1.00, even though the peso was devaluating significantly against the U.S. dollar.

Sustained inflation in Argentina since 2002, without any corresponding increase in our natural gas transportation tariffs until recently, has adversely affected, and continued inflation would

continue to adversely affect, our Natural Gas Transportation revenues and financial condition. During the last few years, we have monitored our operating costs in order to minimize the impact of the insufficient adjustment of our tariffs on our

activities. These measures have had no negative impact on the reliability and efficiency tasks carried out on the pipeline system.

On March 30, 2017, ENARGAS issued Resolution No. 4362/2017 (“Resolution 4362”), which approved a staged tariff increase which contemplates an aggregate

transportation tariff increase of 214.2% and an aggregate access and use charge (“CAU”) increase of 37%. This staged increase is structured to provide the same economic benefits to us as if the increases

had been fully effective on April 1, 2017. Pursuant to this resolution, we must also execute a capital expenditures program for a five-year period (from April 1, 2017, to March 31, 2022), which contemplates investments of Ps.6,786 million (in

nominal value on December 31, 2016) to improve the operation and maintenance of the pipeline system (the “Five-Year Plan”). In addition, Resolution 4362 contemplates a non-automatic semiannual adjustment

mechanism for the natural gas transportation tariff to reflect changes in WPI, which must be approved by ENARGAS evaluating the evolution of the economic circumstances.

On March 27, 2018, through Decree No. 250/2018 (“Decree 250”), the Executive Branch ratified the tariff structure under Resolution 4362, following the

approval of several governmental authorities, including the Argentine Congress. Decree 250 concluded the renegotiation process of our License with the Government, which lasted more than 17 years. After the conclusion of the RTI mentioned above,

we received the semiannual tariff increase corresponding for the period August 2018–February 2019 beginning on April 2019.

As a consequence of Argentina’s economic condition, and together with other measures taken by the Government, on September 3, 2019, the Secretary of Hydrocarbon Resources (“SHR”) (formerly the Federal Energy Bureau) issued Resolution No. 521/2019 (“Resolution 521”), which defers the subsequent semiannual adjustment.

Under the Decree 1020 tariffs were frozen until the new RTI concludes. Since that moment we have received only one tariff increase since March 1, 2022 amounting to 60%. “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework—Tariff situation.”

On December 6, 2022, by means of Decree No. 815/2022 (“Decree 815”), the term for the completion of the RTI established in Decree 1020 was extended until

December 18, 2023. Within this framework, on January 4, 2023, a public hearing was held to consider a new transitory tariff adjustment for the public natural gas transportation service.

On March 15, 2023 ENARGAS submitted a proposal to us for an addendum to the RTI.

On March 16, 2023, our Board of Directors approved the proposed addendum to the renegotiation transitory agreement (the “2023 Transition Agreement”) sent

by ENARGAS. As of the date of this Annual Report the Executive Branch has not ratified the 2023 transition agreement.

The 2023 Transition Agreement has similar conditions to the 2022 Transition Agreement. The 2023 Transition Agreement includes:

| - |

A transitional tariff increase of 95% on the natural gas transportation tariff and the Access and Use Charge.

|

| - |

With prior authorization from the Ministry of Economy, we are allowed to distribute dividends and to directly or indirectly prepay financial and commercial debts contracted with shareholders, which were previously prohibited by the

2022 Transition 9Agreement.

|

In the past, we have suffered from our inability to receive tariff increases, which meant the deterioration of our financial and economic condition. Also, we have received insufficient tariff

increases to compensate for the increases in our operating costs due to inflation. For additional information about the prior RTI processes and failure by ENARGAS to increase tariffs, and the status of the ongoing RTI see “Item 4. Our Information—B. Business Overview—Natural Gas Transportation—Regulatory Framework—Tariff situation.”

We cannot assure you that the current negotiations with the Government will provide us with a tariff schedule that permits us to compensate the increases in our operating costs. Failure by the

Government to timely comply with agreements resulting from the new RTI process could negatively affect our results of operations and financial condition.

Moreover, as of the date of this Annual Report, we are unable to predict which permanent measures will be taken by the Government in connection with the tariff system, or if such system will be

amended, adversely affecting our financial situation and our results of operations.

Further, we cannot assure you that the current negotiations with the Government under the framework of the Solidarity Law will provide us with a tariff schedule that permits us to compensate the

increases in our operating costs. Failure by the Government to timely comply with agreements resulting from the RTI process could negatively affect our results of operations and financial condition.

In addition, we cannot predict whether additional operating restrictions or mandatory investments could be imposed on us in the future nor the outcome from the renegotiation process of the

current RTI stated by the Solidarity Law. If such outcome is adverse to us, our results of operations and financial condition could be negatively affected.

Our operations are subject to extensive regulation.

The Argentine oil and gas industry is subject to extensive government regulation and control. As a result, our business is to a large extent dependent upon regulatory and political conditions

prevailing in Argentina and our business, results of operations and financial condition, the value of our securities, and our ability to meet our financial obligations may be adversely affected by regulatory and political changes in Argentina.

Therefore, we face risks and challenges relating to government regulation and control of the energy sector, including those set forth below and elsewhere in these risk factors:

| • |

limitations on our ability to increase prices or to reflect the effects of higher domestic taxes, increases in operating costs or increases in international prices of natural gas and other hydrocarbon fuels

and exchange rate fluctuations on our domestic prices;

|

| • |

risks in connection with the former and current incentive programs established by the Government for the oil and gas industry, such as the natural gas additional injection stimulus program and cash

collection of balances with the Government;

|

| • |

legislation and regulatory initiatives relating to hydraulic stimulation and other drilling activities for non-conventional oil and gas hydrocarbons, which could increase our cost of doing business or cause

delays and adversely affect our operations; and

|

| • |

the implementation or imposition of stricter quality requirements for hydrocarbon products in Argentina.

|

In recent years, the Government has made certain changes in regulations and policies governing the energy sector to give absolute priority to domestic supply at stable prices in order to sustain

economic recovery. As a result of the above-mentioned changes, for example, on days during which a gas shortage occurs, exports of natural gas (which are also affected by other government curtailment orders) and the provision of gas supplies to

industries, electricity generation plants and service stations selling compressed natural gas are interrupted to prioritize residential consumers at lower prices. The Expropriation Law of Argentina has declared the achievement of self-sufficiency

in the supply of hydrocarbons, as well as in the exploitation, industrialization, transportation and sale of hydrocarbons, is in the national public interest and a priority for Argentina. In addition, its stated goal is to guarantee socially

equitable economic development, the creation of jobs, the increase of the competitiveness of various economic sectors and the equitable and sustainable growth of the Argentine provinces and regions. We cannot assure you that these and other

changes in applicable laws and regulations, or adverse judicial or administrative interpretations of such laws and regulations, will not adversely affect our business, results of operations, financial condition, the value of our securities and

our ability to meet our financial obligations.

Failure to maintain our relationships with labor unions may have an adverse effect on our business, financial condition, results of operations and

prospects.

A significant portion of our workforce is represented by labor unions, and most of our non-unionized employees have the same employment benefits as unionized employees. While we believe we have

enjoyed satisfactory relationships with all the labor organizations that represent our associates, and we believe our relationships with labor organizations will continue to be satisfactory, labor-related disputes may still arise. Labor lawsuits

are common in the energy sector in Argentina, and industry-wide organized actions by unionized employees in the industry, such as blockages in the access to facilities and route cuts have occurred in the past. We have suffered interruptions as a

result of our employees joining such organized activities. We cannot assure you that future business interruptions resulting from strikes and other organized activities by our employees would not have a significant adverse effect on our business,

financial condition, results of operations and prospects.

The collective bargaining agreements with our unions are valid for one year. Currently, we have a collective bargaining agreement in effect for the period from April 2023 to April 2024.

However, we cannot assure you that we will not suffer business interruptions or strikes in the future as a result of collective actions by our employees. We have insurance that covers terrorism

and organized actions against our assets, among other items, for a total insured amount of US$50,000,000 with a deductible per event of US$500,000, but we cannot assure you that our insurance coverage will be sufficient to cover damages and

losses caused by the organized actions of our employees.

In addition, in the past, the Government has enacted laws and regulations forcing private companies to maintain certain wage levels and to provide additional benefits to their employees. We

cannot assure you that in the future the Government will not increase wages or require additional benefits for workers or employees or that unions will not pressure the Government to demand such measures. All wage increases, as well as any

additional benefits, could result in increased costs and adversely affect our results of operations.

Our regulated business is dependent on our ability to maintain our License, which is subject to revocation under some circumstances.

We conduct our Natural Gas Transportation business pursuant to the License, which authorizes us to provide natural gas transportation services through the exclusive use of the southern natural

gas transportation system in Argentina. Our License may be revoked in certain circumstances based on the recommendation of ENARGAS. Revocation of our license would require an administrative proceeding, which would be subject to judicial review.

Reasons for which our License may be revoked include:

| • |

repeated failure to comply with the obligations of our License and failure to remedy a significant breach of an obligation in accordance with specified procedures;

|

| • |

total or partial interruption of service for reasons attributable to us that affects transportation capacity during the periods stipulated in our License;

|

| • |

sale, assignment or transfer of our essential assets or the placing of encumbrances thereon without ENARGAS’s prior authorization, unless such encumbrances serve to finance extensions and improvements to

the gas pipeline system;

|

| • |

our bankruptcy, dissolution or liquidation;

|

| • |

cessation and abandonment of the provision of the licensed service, an attempt to assign or unilaterally transfer our License in full or in part without the prior authorization of ENARGAS, or relinquishing

our License, other than in the cases permitted therein; and

|

| • |

delegation of the functions granted in such License without the prior authorization of ENARGAS, or the termination of such License without regulatory approval of a license.

|

If our License were revoked, we would be required to cease providing natural gas transportation services. The impact of a loss of our License on our business, financial condition and results of

operations would be material and adverse. Additionally, certain changes to the License could result in a default under our outstanding debt instruments.

Our creditors may not be able to enforce their claims against us in Argentina.

We are a stock corporation with limited liability (sociedad anónima), incorporated and organized under the laws of Argentina. Substantially all of our

assets are located in Argentina.

Under Argentine law, foreign judgments may be enforced by Argentine courts, provided that the requirements of Articles 517 through 519 of the Federal Code of Civil and Commercial Procedure are

met. Foreign judgments cannot violate principles of public policy (orden público) of Argentine law, as determined by Argentine courts. It is possible that an Argentine court would deem the enforcement of

foreign judgments ordering us to make a payment in a foreign currency outside of Argentina to be contrary to Argentine public policy if at that time there are legal restrictions prohibiting Argentine debtors from transferring foreign currency

outside of Argentina. Although currently there are no legal restrictions prohibiting Argentine debtors from transferring foreign currency outside of Argentina to satisfy principal or interest payments on outstanding debt that has been previously

reported to the BCRA, we cannot assure you that the Government or an Argentine court will not impose such restrictions in the future.

In addition, under Argentine law, attachment prior to execution and attachment in aid of execution will not be ordered by an Argentine court with respect to property located in Argentina and

determined by such courts to be utilized for the provision of essential public services. A significant portion of our assets may be considered by Argentine courts to be dedicated to the provision of an essential public service. If an Argentine

court were to make such a determination with respect to any of our assets, unless the Government ordered the release of such assets, such assets would not be subject to attachment, execution or other legal process if such determination stands,

and the ability of any of our creditors to realize a judgment against such assets may be adversely affected.

The Government’s strategies, measures and programs with respect to the natural gas transportation industry could materially adversely affect our business,

results of operations, financial condition, the value of our securities and our ability to meet our financial obligations.

Since 1992 and after the privatization of several state companies, until the economic crisis in 2002, the Government reduced its control over the natural gas transportation industry. After the

economic crisis in 2002 the Government increased its role in the energy sector implementing strict regulations and increasing its intervention. Intervention primarily included the expansion of our pipeline through the creation of trust funds and

the interruption and redirection of natural gas firm transportation services (including the diversification of natural gas supply from our liquids processing plant located at General Cerri Complex, in the Province of Buenos Aires (“Cerri Complex”).

In the past, natural gas distribution companies, including us, were prohibited from passing through price increases to consumers. Producers of natural gas, therefore, had difficulty implementing

wellhead natural gas price adjustments that would increase the costs of distribution companies, which caused such producers to suffer a sharp decline in their rate of return-on-investment activities. As a result, natural gas production was not

sufficient to meet the increasing demand. Likewise, the lack or insufficient tariff adjustments for natural gas transportation companies caused a decrease in the profitability of such companies.

Considering these events, the Government implemented a number of strategies, measures and programs aimed at mitigating the energy crisis and supporting the recovery of the Argentine economy

generally. These strategies, measures and programs included, among others, the expansion of our pipeline through the creation of financial trust funds used as vehicles to facilitate financing of those investments (“Gas Trusts”). Although the expansion projects described above have not adversely affected our results of operations or financial condition, we cannot assure you that future, or even present, expansion projects will not have such

adverse effects.

On December 20, 2019, the Argentine congress enacted Law No. 27541 (the “Solidarity Law”). The Solidarity Law establishes the restructuring of the energy

tariff scheme and froze the natural gas and electricity tariffs. In addition, the Solidarity Law entitles the Argentine Executive Branch to intervene the ENARGAS. On March 17, 2020, Decree No. 278/2020 was published in the Official Gazette, which

provides for the State intervention in ENARGAS until December 31, 2020. Afterwards, the intervention was extended until December 31, 2023, by means of Decree No. 815/2022.

Within the framework of the measures adopted as a result of the restrictions imposed to face the sanitary emergency arising from the COVID pandemic, the Government took a series of measures to

mitigate its impact on certain socioeconomic sectors. Within this framework, during 2020, service cuts to non-paying residential users were suspended, the “Gas.Ar Plan” was created with the purpose of promoting natural gas production and certain

limitations to tariff increases were imposed to keep pace with the evolution of inflation and cost increases.

We cannot predict what other measures or strategies will be adopted by the Government to mitigate in the natural gas industry, nor the effect that such measures may have on our business, results

of operations and financial condition, the value of our securities, and our ability to meet our financial obligations.

A significant portion of our revenues is generated under natural gas transportation contracts that must be renegotiated and/or extended periodically.

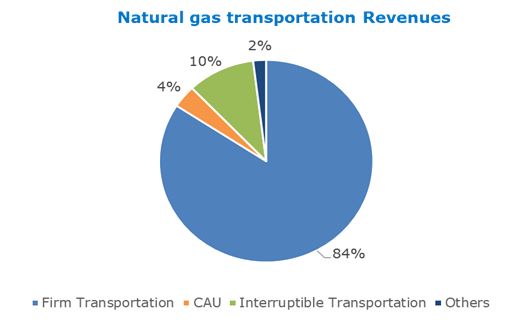

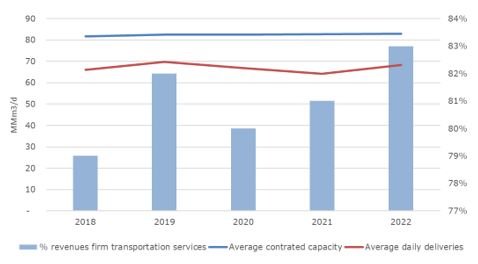

In 2022, 83% of our average daily natural gas deliveries were made under long-term firm transportation contracts. As of December 31, 2022, our long-term firm natural gas transportation contracts

had a remaining weighted average life of approximately 11 years; our long-term firm natural gas transportation contracts with our top five costumers had a remaining weighted average life of approximately eight years. We cannot assure you that we

will be able to extend or replace these contracts when they expire or that the terms of any renegotiated contracts will be as favorable as the existing contracts. In particular, our ability to extend and/or replace contracts could be adversely

affected by factors we cannot control, including:

| • |

Argentine natural gas transportation regulations;

|

| • |

international oil and gas prices;

|

| • |

timing, volume and location of new market demand;

|

| • |

competition from alternative energy sources;

|

| • |

supply and price of natural gas in Argentina;

|

| • |

demand for natural gas in the markets we serve; and

|

| • |

availability and competitiveness of alternative gas transportation infrastructure in the markets we serve.

|

Additionally, most of our transportation contracts include a clause allowing for the termination of the relevant contract before the expiration of its term by any of the parties, in case of (i)

breach of the other party, or (ii) an extended event of force majeure.

Our business may require substantial capital expenditures for ongoing maintenance requirements and the expansion of our installed transportation capacity;

we could be unable to make such expenditures due to the lack of financing.

Resolution 4362 stated that we should have executed he Five-Year Plan. Because of the beginning of the new RTI process the Five-Year Plan was suspended. Additionally, as part of the measures

adopted to reduce the impact of COVID and in order to adapt our business plan to the economic expectations of Argentina, we have implemented a reduction in the current investment plans, without compromising safety, which allows us to guarantee

continuity in the development of our activities.

The natural gas transportation service is an activity involving significant amounts of capital expenditures in order to improve the operation and maintenance of the pipeline system. Incremental

capital expenditures may be required to fund maintenance of our pipeline system. Furthermore, capital expenditures will be required to finance current and future expansions of our transportation capacity. If we are unable to finance any such

capital expenditures in terms satisfactory to us or at all, our business, results of operations and financial condition, the value of our securities, and our ability to meet our financial obligations may be adversely affected. In addition, our

financing ability may be limited by market restrictions on financing availability for Argentine companies. See “—Risks Relating to Argentina—Argentina’s past default and litigation with holdout bondholders may

limit our ability to access international markets.”

In the past, expansion projects by the Government have not had adverse effects over our results of operations and financial condition. However, we cannot assure you that future expansion projects

will not adversely affect our business.

Our Liquids production depends on the natural gas that arrives at the Cerri Complex through three main pipelines from the Neuquina, Austral and San Jorge

natural gas basins. The flow and heating value of this natural gas are subject to risks that could materially adversely affect our Liquids and midstream business segment.

More than 50% of the energy matrix in Argentina relies on natural gas. However, its natural gas reserves are declining. Despite the decline in 2015 and 2016, the volume of natural gas that has

been produced from the Neuquina basin has increased. More recently, natural gas production in Argentina has increased thanks to the development of Vaca Muerta, despite the decline of the basins where conventional gas predominates. Although

production volume increased in recent years, it had previously decreased between 2009 and 2013 and it is possible that natural gas production will again decrease in the future, which would adversely affect our Liquids business segment by reducing

the amount of natural gas flowing to the Cerri Complex and, therefore, the amount of Liquids we produce. In addition, the reduction in the production of natural gas could affect the flow of natural gas provided for our midstream services.

Since 2009, the quality and volume of natural gas injected from the Neuquina basin has been lower (because of the reduction of natural gas production in this basin) and not appropriate for

processing in the Cerri Complex, negatively impacting our level of output from this facility. Because of this lower output of natural gas from the Neuquina basin, we have had to buy natural gas at higher prices, causing an increase in the cost of

Liquids production and commercialization activities for our own account reducing our profit from these activities. In addition, competition might affect the volume and quality (i.e., gas with lower liquids content) of natural gas arriving at the

Cerri Complex.

In 2009, nonconventional natural gas was discovered in the Vaca Muerta field of the Neuquina basin by YPF. Exploration and exploitation of this natural gas reserve involved high extraction costs.

Argentina’s national natural gas production has steadily increased in the past three years, largely due to the increased production of shale from the Vaca Muerta formation. Because of the measures taken by the Government production levels

throughout the Neuquina basin has increased in recent years, except during 2020 which was affected by COVID pandemic and the effects of the preventive and mandatory lockdown measures, combined with a higher autumn temperature.

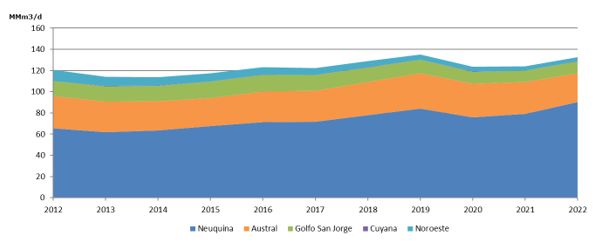

The Neuquén basin, with 68% of the national production, where most of the unconventional of non-conventional developments, explains the year-on-year increase. The rest of the basins decrease

their production in the twelve-month accumulated measurements (except for the Cuyana basin, which has a low representation in the national the Cuyana basin of low representativeness).

However, after the freezing of fuel prices and the current economic situation that Argentina is experiencing, there is uncertainty regarding the investments that natural gas producers can make in

that area. The Gas.Ar Plan establishes the need to guarantee the supply of natural gas demand while establishing incentives to make immediate investments for the maintenance and/or growth of production in the productive basins, where the natural

gas producers must commit themselves to achieve a production curve that guarantees the maintenance and/or increase of the current levels.

We cannot assure you, however, that this new natural gas resource at the Neuquina basin, or the Gas.Ar Plan, or any other measures taken by the Government to increase natural gas production and

supply (including pipeline expansion projects and the construction of new pipelines such as the Tratayén-Salliqueló-San Jerónimo pipeline), will be successful in increasing Argentine natural gas reserves or production and, if unsuccessful, our

midstream or Liquids Production and Commercialization businesses could be adversely affected.

Measures taken by the Government may have an adverse effect on the supply of natural gas to the Cerri Complex and the margins we are able to obtain from

our Liquids business, which may adversely affect the results in our Liquids Production and Commercialization segment and, as a result, our overall business and results of operations.

Due to regulatory, economic and government policy factors, domestic gasoline, diesel, natural gas, propane and butane, and other fuel prices and related services have differed substantially from

prevailing international and regional market prices for such products and services. Our ability to increase prices in connection with international price or domestic cost increases, including those resulting from the peso devaluation, has been

limited from time to time. The prices that we are able to obtain for our products and services affect the viability of investments in expansion capacity and processing facilities and, as a result, the timing and amount of our capital expenditures

for such purposes.

Although our Liquids production and commercialization activities are not subject to regulation by ENARGAS, with the aim to give priority to domestic supply, the Government has taken certain

regulatory actions in recent years that have affected our Liquids business. For example, in April 2005, the Government enacted Law No. 26,020, which set the framework by which the SHR may establish regulations to cause LPG suppliers to guarantee

sufficient supply of LPG in the domestic market at low prices. Law No. 26,020 creates a price regime pursuant to which the SHR periodically publishes reference prices for LPG sold in the local market. It also sets forth LPG volumes to be sold in

the local market.

We participate in two programs created by the Government under this framework, which provide for the payment of compensation based on the difference between the price set by the Government and

the export parity price. Over recent years, this compensation has been paid to us with significant delays. For further information, see “Item 4—Our Information—B. Business Overview—Liquids Production and

Commercialization.”

On March 25, 2020, after COVID pandemic, the Executive Branch issued Decree No. 311/2020, which determines that the maximum reference price for LPG sold in the domestic market will remain at

their values in force at such date for a 180-day period.

Beginning 2021, prices of the products sold under these programs slightly increased. In August 2021, within the framework of Plan Hogar, the Secretary of Energy through Res. No. 809/2021 provided

financial assistance to butane producers. The assistance was effective from August 2021 to December 2022 inclusive.

Also, we cannot assure you that we will be able to maintain or increase the domestic prices of our products, and limitations on our ability to do so would adversely affect our business, results

of operations and financial condition, the value of our securities, and our ability to meet our financial obligations. Similarly, we cannot assure you that LPG prices in Argentina will track increases or decreases in the international or regional

markets.

Our Liquids business is highly dependent on the supply of natural gas to the Cerri Complex at reasonable prices that allow for reasonable profit margins.

Since 2017, the Government has taken a series of necessary measures to initiate a convergence between the local price of natural gas and the international price. However, during 2018, due to a

combination of internal and external factors, the increase in natural gas and fuel prices was significant which meant that the intended liberalization was unsuccessful.

During 2018, the Government introduced several changes to the process by which the natural gas is acquired for the electric energy generators. Among them, modifications were introduced to the

regulations through which Compañía Administradora del Mercado Mayorista Eléctrico S.A. (“CAMMESA”), a government-controlled company, had to provide this supply to the power plants. Finally, on November 6,

2018, the Secretary of Energy issued Resolution No. 70/2018, which returned to power generators the ability to purchase their own natural gas supply. Most of the power generators recovered the ability to do so, therefore, the price of natural gas

purchased under the bidding processes decreased further because of the competition for demand in the low consumption season and in an environment with oversupply and economic recession.

However, Secretary of Energy Resolution No. 12/2019 abrogated SGE Resolution No. 70/2018 and returned to CAMMESA centralized fuel supply scheme as established in Secretary of

Energy Resolution No. 95/2013, as amended.

The prices at which power plants or CAMMESA acquire natural gas can be considered a reference to determine the price of natural gas acquired by us as shrinkage gas (“RTP”), which is why any additional increase in the costs of our Liquids Production and Commercialization segment may adversely affect our business, results of operations, financial condition, the value of our securities and our

ability to meet our financial obligations.

As described above, actions taken by the Government during winter periods of recent years resulted in natural gas being redirected away from certain users, including the Cerri Complex, toward

priority users, including residential customers. See above “—The Government’s strategies, measures and programs with respect to the natural gas transportation industry could materially adversely affect our

business, results of operations, financial condition, the value of our securities and our ability to meet our financial obligations.” To a lesser extent, during the winter of 2016 and 2017, processing at the Cerri Complex was interrupted

because of continued governmental actions to ensure natural gas supply to the domestic market, but thanks to the development of the Vaca Muerta formation, during the five-year period ended December 31, 2022, we did not register any interruption

in the supply of natural gas in the Cerri Complex.

Additionally, in view of the scarcity of natural gas supply, the national government has resorted to importing liquefied natural gas (“LGN”) (which is

regasified in the ports located in the cities of Escobar and Bahía Blanca, in the province of Buenos Aires) and natural gas from Bolivia. The recent war between Ukraine and Russia resulted in a significant increase in natural gas prices. In view

of the country’s fiscal situation, it is not possible to guarantee that Argentina will be able to acquire all the natural gas and LGNs necessary to meet demand. Likewise, this situation caused difficulties in the negotiations between Argentina

and Bolivia to extend the agreement to import natural gas from Bolivia. More recently, Argentina and Bolivia agreed the extension of the agreement but reducing the quantity of natural gas offered by Bolivia.

In the event that Argentina is unable to meet the demand, it is highly likely that there will be scheduled natural gas outages during the winter to certain non-priority users (among them the

Cerri Complex).

In addition, regarding natural gas producers, the Government has recently introduced measures to moderate the impact of fuel prices in the economy. The prices

that natural gas producers are able to obtain for oil and natural gas affect the viability of investments in new exploration, development and refining and, as a result, the timing and amount of our projected capital expenditures for such

purposes. Any diversion of the supply of natural gas from the Cerri Complex may require us to purchase natural gas from third parties to supply our Liquids business, which may result in increased costs. If we are unable to purchase

natural gas from other sources, the volume of our Liquids productions may decrease.

After the first award of volumes and prices carried out on December 3, 2020, under the framework of Gas.Ar Plan, an increase in the natural gas price at the Point of Entry to the Transportation

System (the “PIST” after its acronym in Spanish) for thermal generation and for natural gas distributors was verified, which is highly likely to affect industrial users, which will ultimately impact the

costs of natural gas consumed in the Cerri Complex, thus affecting our operating margins. However, such plan would allow the drop in production levels that has been recorded in recent periods to be reversed in order to sustain our gas processing

business at the Cerri Complex.

It is uncertain whether in the future measures taken by the Government or other measures that could adversely affect our business, results of operations and ability to meet our financial

obligations will be implemented. It is also uncertain the impact of the Solidarity Law, regulations to be issued under its framework or whether our regulatory obligations may be increased, which could result in higher taxes, amendments to the

tariff structure, or any other obligations that could increase our costs and adversely affect our financial situation.

Fluctuations in market prices and the enactment of new taxes or regulations limiting the sales price of LPG and natural gasoline may affect our Liquids

business.

We extract LPG and natural gasoline from natural gas delivered to the Cerri Complex and sell LPG and natural gasoline. As a result of the deterioration of our Natural Gas Transportation segment,

operations relating to our Liquids production and commercialization have represented more than 50% of our total revenues between 2004 and 2017 and during fiscal years 2021 and 2022.

Over the last few years, the price of Liquids has experienced high levels of volatility. Factors affecting prices include weak demand levels from emerging markets, significant variations in

production and storage levels, and climate and geopolitical issues such as the Russia-Ukraine and Middle East conflicts, the ability of the OPEC and other crude oil producing nations to set and maintain crude oil production levels and prices;

macroeconomic conditions, including inflation and increase in interest rates. It is expected that volatility and fluctuations maintained in the future.

We cannot predict how these factors will influence LPG and natural gasoline prices and we have no control over them. Price volatility curtails the ability of industry participants to adopt

long-term investment decisions given that returns on investments become unpredictable. A substantial or extended downturn in the international prices of Liquids could have a material adverse effect on our business, operating results, and

financial condition, as well as the market value of our shares or ADSs.

In the past, the Argentine government has imposed duties on exports, including exports of natural gasoline and LPG products that we export. Currently, in

accordance with the Solidarity Law and Decree 488/2020 export duties on the Liquids products that we exported are 8%. For further information, see “Item 4. Our Information—B. Business Overview—Liquids

Production and Commercialization.”

In addition, after the issuance of Resolutions Nos. 1,982/11 and 1,991/11 (the “Gas Charge Resolutions”), the natural gas processing charge created by

Decree No. 2,067/08 (the “Natural Gas Processing Charge”) increased from Ps.0.049 to Ps.0.405 per cubic meter of natural gas effective from December 1, 2011, representing a significant increase in our

variable costs of natural gas processing.

In order to avoid an adverse effect on our Liquids business, we initiated legal proceedings against Decree No. 2,067/08 and the Gas Charge Resolutions, including the Government, ENARGAS and the

former Ministerio de Producción y de Planificación Federal, Inversión Pública y Servicios (the “MPFIPyS”) as defendants.

On March 28, 2016, the former Ministry of Energy issued Resolution No. 28 (“Resolution 28”), which instructs ENARGAS to take all the necessary measures to

reduce to zero the Natural Gas Processing Charge starting April 1, 2016. Since that date, we have not been required to pay for the Natural Gas Processing Charge. However, Resolution 28 did not invalidate the Natural Gas Processing Charge or Gas

Charge Resolutions for the period in which they were in force, for which reason the judicial action is still ongoing. On March 26, 2019, we were served notice of the first instance judgment rendered in the proceedings, which upholds the legal

action filed by us and declares the unconstitutionality of Executive Decree No. 2,067/08, MPFIPyS Resolution No. 1451/08 and the Gas Charge Resolutions, and Section 53 and 54 of Act No. 26,784 (General budget of the National Public Administration

for the fiscal year 2013), as well as of any other act aimed at enforcing Executive Decree No. 2,067/08, and therefore declares invalid said regulations. On March 29, 2019, the Secretary of Energy appealed the judgment, which appeal was granted

on April 3, 2019. On December 1, 2020, the judge resolved to extend the injunction (medida cautelar) for six months, or until the award becomes final. On May 14, 2021, we were notified that such judgment

(i) was revoked, and (ii) costs were imposed for both instances in the order caused. For additional information, see “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal

and Regulatory Proceedings—Tax Claims.”