|

☐

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☐

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

American Depositary Shares (“ADS”), representing Class “B” Shares

|

TGS

|

New York Stock Exchange

|

|

Class “B” Shares, par value Ps.1.00 per share

|

n/a

|

New York Stock Exchange*

|

|

Class “A” Shares, par value Ps.1.00 each

|

405,192,594

|

|||

|

Class “B” Shares, par value Ps.1.00 each

|

347,568,464

|

|||

|

Total(1)

|

752,761,058

|

|

Yes

|

☒

|

No

|

☐

|

|

Yes

|

☐

|

No

|

☒

|

|

Yes

|

☒

|

No

|

☐

|

|

Yes

|

☒

|

No

|

☐

|

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Emerging growth company

|

☐

|

|

Yes

|

☒

|

No

|

☐

|

|

☐

|

U.S. GAAP

|

|

|

☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

|

|

☐

|

Other

|

|

Item 17

|

☐

|

Item 18

|

☐

|

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

|

Yes

|

☐

|

No

|

☒

|

|

Page

|

|||

|

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

|

i

|

||

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTORS SUMMARY

|

iv

|

||

|

PART I

|

1

|

||

|

Item 1.

|

1

|

||

|

Item 2.

|

1

|

||

|

Item 3.

|

1

|

||

|

Item 4.

|

62

|

||

|

Item 4A.

|

120

|

||

|

Item 5.

|

120

|

||

|

Item 6.

|

160

|

||

|

Item 7.

|

175

|

||

|

Item 8.

|

181

|

||

|

Item 9.

|

184

|

||

|

Item 10.

|

187

|

||

|

Item 11.

|

210

|

||

|

Item 12.

|

214

|

||

|

Part II

|

215 | ||

|

Item 13.

|

215

|

||

|

Item 14.

|

215

|

||

|

Item 15.

|

215

|

||

|

Item 16.

|

216

|

||

|

Item 16A.

|

216

|

||

|

Item 16B.

|

216

|

||

|

Item 16C.

|

216

|

||

|

Item 16D.

|

217

|

||

|

Item 16E.

|

217

|

||

|

Item 16F.

|

220

|

||

|

Item 16G.

|

220

|

||

|

Item 16H.

|

222

|

||

|

Part III

|

223 | ||

|

Item 17.

|

223

|

||

|

Item 18.

|

223

|

||

|

Item 19.

|

223

|

||

| • |

statements regarding changes in general economic, business, political or other conditions in Argentina and globally, including changes from actions taken by the Government and changes due to natural and

human-induced disasters (including the current COVID-19 virus (“COVID”) pandemic), and the impact of the foregoing;

|

| • |

estimates relating to future energy demand (including demand for fossil fuels), tariffs and volumes for our natural gas transportation services and future prices and volumes for our natural gas liquid products

such as propane and butane (also referred to as liquid petroleum gas or “LPG”), ethane and natural gasoline (collectively “Liquids”) and for products and services

respectively produced and provided in our other nonregulated businesses;

|

| • |

statements regarding future political developments in Argentina and future developments regarding the license granted to us by the Argentine government (the “Government”)

to provide natural gas transportation services through the exclusive use of the southern natural gas transportation system in Argentina (“License”), the impact of the adoption of the new revised scheme of

tariffs resulting from the renegotiation process of our License with the Government regulatory actions by Ente Nacional Regulador del Gas (“ENARGAS”) and other

agencies of the Government, the legal framework established by the Federal Energy Bureau and any other applicable governmental authority that may affect us and our business;

|

| • |

risks and uncertainties with respect to relations with our employees in Argentina;

|

| • |

statements and estimates regarding future pipeline expansion and other projects and the cost of, or return to us from, any such expansion or projects;

|

| • |

estimates of our future level of capital expenditures and delays in such capital expenditures, including those required by ENARGAS or other governmental authorities for the expansion of our pipeline system or

other purposes, and unscheduled and unexpected expenditures for the repair and maintenance of our fixed or capital assets;

|

| • |

statements regarding the ability of companies engaged in the upstream business in the region where we operate to identify drilling locations and prospects for future drilling opportunities, and drill and develop

such locations (such as the Vaca Muerta formation), as well as the Government’s regulations and policies affecting such companies and projects; and

|

| • |

the risk factors discussed under “Item 3. Key Information—D. Risk Factors.”

|

| • |

risks and uncertainties resulting from Government regulations and other actions of or involvement by the Government that have affected or may affect our business, financial condition or results of operations,

such as the prohibition on tariff increases (or tariff reductions) for our natural gas transportation segment, restrictions on payments outside of Argentina and exchange controls;

|

| • |

risks and uncertainties resulting from general economic, business, political or other conditions in Argentina and globally, as well as disruptions to commercial activities due to natural and human-induced

disasters, such as weather conditions, earthquakes, terrorist activities, social unrest and violence, armed conflicts and health epidemics and pandemics, including the current COVID pandemic, all of which may negatively impact demand for our

services or could create a regulatory response from the Government;

|

| • |

risks and uncertainties related to changes in the peso/U.S. dollar exchange rate and the Argentine domestic inflation rate, which may materially adversely affect our revenues, expenses and the comparability of

our historical financial information;

|

| • |

risks and uncertainties associated with our nonregulated business, including those related to international and local prices of Liquids, taxes, cost and restrictions on the supply of natural gas and other

restrictions imposed on Liquids exports, our ability to renegotiate our agreements with customers and possible adverse changes in the regulation of the Liquids industry;

|

| • |

capital expenditures required by ENARGAS or other governmental authorities for the expansion of our pipeline system or other purposes, including the risk that we may be forced by ENARGAS or other governmental

authorities to make investments that are not profitable or not as profitable as other investment opportunities identified by our management, or to take any other action not consistent with our business plan and strategy;

|

| • |

risks and uncertainties associated with unscheduled and unexpected expenditures for the repair and maintenance of our fixed or capital assets;

|

| • |

developments in legal and administrative proceedings involving us and our affiliates;

|

| • |

changes to, or revocation of, our License and the tariffs we are allowed to charge; and

|

| • |

risks and uncertainties impacting us as a whole, including changes in general economic, political and social conditions, changes in the Argentine laws and regulations to which we are subject, including tax,

environmental and employment laws and regulations, and the cost and effects of legal and administrative claims and proceedings against us.

|

| Item 1. |

Identity of Directors, Senior Management and Advisers

|

| Item 2. |

Offer Statistics and Expected Timetable

|

| Item 3. |

Key Information

|

|

For the year ended December 31,

|

||||||||||||||||||||

|

2020

|

2019(3)

|

2018(3)

|

2017(3)

|

2016(3)

|

||||||||||||||||

|

(in thousands of pesos)(1)

|

||||||||||||||||||||

|

Consolidated Statement of Comprehensive Income Data:

|

||||||||||||||||||||

|

Revenues

|

55,871,438

|

66,111,903

|

71,336,882

|

41,787,793

|

30,671,848

|

|||||||||||||||

|

Gas transportation net revenues

|

23,501,610

|

30,795,577

|

32,381,937

|

15,615,086

|

8,716,868

|

|||||||||||||||

|

Liquids production and commercialization net revenues

|

27,596,696

|

31,500,457

|

34,822,547

|

23,401,470

|

19,696,302

|

|||||||||||||||

|

Other services (midstream and telecommunications) net revenues

|

4,773,132

|

3,815,869

|

4,132,398

|

2,771,237

|

2,258,679

|

|||||||||||||||

|

Operating profit

|

20,640,970

|

26,899,485

|

29,858,321

|

12,994,649

|

6,100,264

|

|||||||||||||||

|

Net financial results

|

(12,971,658

|

)

|

(3,944,565

|

)

|

(5,960,872

|

)

|

(1,106,502

|

)

|

(1,485,547

|

)

|

||||||||||

|

Net income before income tax

|

7,690,622

|

22,911,548

|

23,935,579

|

11,933,469

|

4,625,375

|

|||||||||||||||

|

Net income and total comprehensive income for the year

|

3,286,199

|

17,432,963

|

23,907,996

|

12,044,628

|

2,316,895

|

|||||||||||||||

|

Net income and total comprehensive for the year attributable to:

|

||||||||||||||||||||

|

Owners of the Company

|

3,286,190

|

17,432,945

|

23,907,988

|

12,044,624

|

2,316,891

|

|||||||||||||||

|

Non-controlling interest

|

9

|

18

|

8

|

4

|

4

|

|||||||||||||||

|

Per Share Data:(2)

|

||||||||||||||||||||

|

Net income per share

|

4.31

|

22.46

|

30.32

|

15.17

|

2.72

|

|||||||||||||||

|

Net income per ADS

|

21.55

|

112.31

|

151.60

|

75.85

|

13.60

|

|||||||||||||||

|

(1)

|

Except per share and per ADS amounts or as otherwise indicated.

|

|

(2)

|

Net income per share and ADS under IFRS has been calculated using the weighted average shares outstanding. Each ADS represents five shares.

|

|

(3)

|

Comparatives figures as of December 31, 2019, 2018, 2017 and 2016 have been restated for hyperinflation accounting and are presented in terms of Current Currency.

|

|

As of December 31,

|

||||||||||||||||

|

2020

|

2019(3)

|

2018(3)

|

2017(3)

|

|||||||||||||

|

(in thousands of pesos)(1)

|

||||||||||||||||

|

Consolidated Statement of Financial Position Data:

|

||||||||||||||||

|

Total current assets

|

15,799,305

|

28,507,744

|

48,510,547

|

22,175,939

|

||||||||||||

|

Property, plant and equipment, net

|

98,873,425

|

101,946,521

|

81,018,439

|

71,542,203

|

||||||||||||

|

Total non-current assets

|

112,795,061

|

101,644,461

|

81,215,704

|

71,759,847

|

||||||||||||

|

Total assets

|

128,594,366

|

130,152,205

|

129,726,251

|

93,935,786

|

||||||||||||

|

Total current liabilities

|

8,109,673

|

10,826,170

|

14,966,504

|

14,445,721

|

||||||||||||

|

Total non-current liabilities

|

54,458,049

|

53,864,917

|

49,951,509

|

26,547,442

|

||||||||||||

|

Total liabilities

|

62,567,722

|

64,691,087

|

64,918,013

|

40,993,163

|

||||||||||||

|

Non-controlling interest

|

31

|

38

|

22

|

25

|

||||||||||||

|

Shareholders’equity

|

66,026,644

|

65,461,118

|

64,808,238

|

52,942,623

|

||||||||||||

|

Other Data:

|

||||||||||||||||

|

Common stock (nominal value)

|

752,761

|

784,608

|

780,894

|

794,495

|

||||||||||||

|

Additions to property, plant and equipment

|

6,687,083

|

25,646,624

|

14,463,972

|

4,809,817

|

||||||||||||

|

Depreciation

|

6,161,233

|

5,031,234

|

4,655,763

|

4,230,905

|

||||||||||||

|

Impairment charge

|

3,114,056

|

-

|

-

|

-

|

||||||||||||

|

Number of outstanding shares(2)

|

752,761,058

|

784,608,528

|

780,894,503

|

794,495,283

|

||||||||||||

| (1) |

Except number of outstanding shares or as otherwise indicated.

|

| (2) |

Number of ordinary shares outstanding at year-end (excludes 41,734,225 and 9,886,755 treasury shares, representing 5.25% and 1.24% of the total share capital for the years ended on December 31, 2020 and 2019, respectively).

|

| (3) |

Comparatives figures as of December 31, 2019, 2018 and 2017 have been restated for hyperinflation accounting and are presented in terms of Current Currency.

|

|

Dividends declared and paid

|

||||||||||||||||||||

|

Year ended

December 31,

|

(in millions of Ps.)(1)

|

(in millions of U.S.$)(2)

|

(Ps.per share)(1)

|

(U.S.$ per share)(2)

|

(U.S.$ per ADS)(2)

|

|||||||||||||||

|

2016(3)

|

475

|

7.1

|

0.60

|

0.009

|

0.045

|

|||||||||||||||

|

2017

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

2018(4)

|

9,067

|

114.6

|

11.41

|

0.142

|

0.708

|

|||||||||||||||

|

2019(5)(6)

|

17,683

|

222.4

|

22.78

|

0.286

|

1.432

|

|||||||||||||||

|

2020

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

| (1) |

Stated in Ps.at Current Currency.

|

| (2) |

Stated in U.S. dollars translated from pesos at the exchange rate in effect on the payment date.

|

| (3) |

At a General Annual Shareholders’ Meeting held on April 23, 2015, our shareholders resolved to create a future dividends payment reserve in an amount equal to Ps. 518 million. At its meeting held on January 13, 2016, our Board of Directors

approved to release such reserve in full to our shareholders in the form of cash dividend payments up to an amount equal to the aggregate amount of such reserve.

|

| (4) |

At the General and Special Annual Shareholders’ Meeting held on April 10, 2018, our shareholders resolved to create a future dividends payment reserve in an amount equal to Ps. 7,882 million. At its meetings held on July 6, August 8 and

September 6, 2018, our Board of Directors approved to release such reserve in full to our shareholders in the form of cash dividend payments up to an amount equal to the aggregate amount of such reserve.

|

| (5) |

At the General Annual Shareholders’ Meeting held on April 11, 2019, our shareholders resolved to create a voluntary reserve for capital expenditures, stock buyback and/or dividends in an amount equal to Ps. 12,462 million and a cash dividend

payment of Ps. 12,506 million. At its meetings held on April 11 and October 31, 2019, our Board of Directors approved the partial distribution of such reserve to our shareholders in an amount equal to Ps. 783 million the form of a cash

dividend.

|

| (6) |

Includes the dividend in kind approved by the General and Special Shareholders’ Meeting held on October 17, 2019 and our Board of Directors’ meeting held on October 31, 2019 consisting in 29,444,795 shares (0.052 shares per share or 0.262

per ADS) at a price of Ps. 139.20, calculated by reference to the closing price of our shares in BYMA as of November 12, 2019, the day immediately preceding the date of distribution of such shares to our shareholders.

|

|

Pesos per U.S. dollar

|

||||||||||||||||

|

High

|

Low

|

Average

|

Period end

|

|||||||||||||

|

Most recent six months:

|

||||||||||||||||

|

November 2020

|

81.3100

|

78.6900

|

79.9411

|

81.3100

|

||||||||||||

|

December 2020

|

84.1500

|

81.4300

|

82.6383

|

84.1500

|

||||||||||||

|

January 2021

|

87.3300

|

84.7000

|

85.9755

|

87.3300

|

||||||||||||

|

February 2021

|

89.8200

|

87.6000

|

88.6744

|

89.8200

|

||||||||||||

|

March 2021

|

92.0000

|

90.0900

|

91.0659

|

92.0000

|

||||||||||||

|

April 2021 (through April 26, 2021)

|

93.2700 |

92.2400 |

92.7156 |

93.27 |

||||||||||||

|

Year ended December 31,

|

||||||||||||||||

|

2016

|

16.0300

|

13.2000

|

14.7807

|

15.8900

|

||||||||||||

|

2017

|

19.2000

|

15.1900

|

16.5717

|

18.6490

|

||||||||||||

|

2018

|

41.2500

|

18.4100

|

28.1313

|

37.7000

|

||||||||||||

|

2019

|

60.4000

|

36.9000

|

48.2340

|

59.8900

|

||||||||||||

|

2020

|

84.1500

|

59.8150

|

70.7795

|

84.1500

|

||||||||||||

| • |

Risks Relating to Argentina

|

| ‒ |

Argentina’s public debt;

|

| ‒ |

high levels of public spending in Argentina;

|

| ‒ |

risks inherent to any investment in a company operating in an emerging market such as Argentina;

|

| ‒ |

economic volatility in Argentina;

|

| ‒ |

the ongoing political instability in Argentina;

|

| ‒ |

the impact of reforms and measures taken or to be taken by the Fernandez administration, including the Solidarity Law;

|

| ‒ |

failure by Argentina to comply with the terms of the agreement with the IMF;

|

| ‒ |

public health threats;

|

| ‒ |

high levels of inflation and the lack of credibility regarding Argentina’s official inflation statistics;

|

| ‒ |

restrictions on transfers of foreign currency;

|

| ‒ |

fluctuations in the value of the peso;

|

| ‒ |

lack of a transparent and rigorous framework for awarding and managing public contracts in Argentina and corruption allegations;

|

| ‒ |

Government intervention in the Argentine economy;

|

| ‒ |

Impact on the Argentine economy of economic developments in other markets;

|

| ‒ |

Argentina’s past default and litigation with holdout bondholders;

|

| ‒ |

a sustained deterioration in the terms of trade given a decline in the global prices for Argentina’s main commodity exports or an increase in the global prices for Argentina’s main commodity imports;

|

| ‒ |

further downgrades in the credit rating or rating outlook of Argentina; and

|

| ‒ |

the Argentine government may mandate salary increases for private sector employees.

|

| • |

Risks Relating to Our Business

|

| ‒ |

failure or delay in the implementation of tariff increases and our inability to obtain tariff adjustments reflecting the increase in operating cost;

|

| ‒ |

our operations are subject to extensive regulation;

|

| ‒ |

failure to maintain our relationships with labor unions;

|

| ‒ |

our ability to maintain our License for our regulated business;

|

| ‒ |

our creditors may not be able to enforce their claims against us in Argentina;

|

| ‒ |

the Government's strategies, measures and programs with respect to the natural gas transportation industry;

|

| ‒ |

Government-mandated interruption of contracted firm transportation services;

|

| ‒ |

a significant portion of our revenues is generated under natural gas transportation contracts that must be renegotiated and/or extended periodically;

|

| ‒ |

our business may require substantial capital expenditures;

|

| ‒ |

our Liquids production depends on the natural gas that arrives at the Cerri Complex through three main pipelines from the Neuquina, Austral and San Jorge natural gas basins;

|

| ‒ |

measures taken by the Government on the supply of natural gas to the Cerri Complex;

|

| ‒ |

fluctuations in market prices and the enactment of new taxes or regulations limiting the sales price of LPG and natural gasoline;

|

| ‒ |

the continued spread of the COVID;

|

| ‒ |

our ethane sales depend on the capacity of PBB Polisur S.R.L. (“PBB”), as the sole purchaser of our ethane production;

|

| ‒ |

the delay in the collection of our sales receivables with customers and/or subsidies owed by the Government for the supply of LPG in the domestic market;

|

| ‒ |

our failure to renew firm transportation contracts;

|

| ‒ |

our Other services business depends significantly on the need of Vaca Muerta fields gas producers to evacuate untreated natural gas;

|

| ‒ |

the affirmative and restrictive covenants in our currently outstanding indebtedness;

|

| ‒ |

our insurance policies may not fully cover damage or we may not be able to obtain insurance against certain risks;

|

| ‒ |

changes in the interpretation by the courts of labor laws that tend to favor employees;

|

| ‒ |

risks related to litigation and administrative proceedings;

|

| ‒ |

impact of environmental, occupational health and safety regulations;

|

| ‒ |

we may face competition;

|

| ‒ |

downgrades in our credit ratings;

|

| ‒ |

cyberattacks or other risks related to new technologies;

|

| ‒ |

mechanical or electrical failures and any resulting unavailability;

|

| ‒ |

risks arising from natural disasters, catastrophic accidents and terrorist attacks;

|

| ‒ |

failure to comply with anti-trust, anti-corruption, anti-bribery and anti-money laundering laws; and

|

| ‒ |

inability to retain our employees or attract other skilled employees or contractors.

|

| • |

Risks Relating to Our Shares and ADSs

|

| ‒ |

shareholders outside Argentina may face additional investment risk from currency exchange rate fluctuations in connection with their holding of our shares or ADSs represented by ADRs;

|

| ‒ |

our principal shareholders exercise significant control over matters affecting us, and may have interests that differ from those of our other shareholders;

|

| ‒ |

sales of a substantial number of shares could decrease the market prices of our shares and the ADRs;

|

| ‒ |

under Argentine law, shareholder rights may be fewer or less well defined than in other jurisdictions;

|

| ‒ |

as a foreign private issuer we are exempt from certain rules that apply to domestic U.S. issuers;

|

| ‒ |

changes in Argentine tax laws may adversely affect the tax treatment of our Class B Shares or ADSs;

|

| ‒ |

holders of ADRs may be unable to exercise voting rights with respect to our Class B Shares underlying the ADRs at our shareholders' meetings;

|

| ‒ |

holders of ADRs may be unable to exercise preemptive, accretion or other rights with respect to the Class B shares underlying the ADSs;

|

| ‒ |

the NYSE and/or the Buenos Aires Stock Exchange (by delegated authority of BYMA) may suspend trading and/or delist our ADSs and common shares, respectively;

|

| ‒ |

the price of our Class B Shares and the ADSs may fluctuate substantially; and

|

| ‒ |

the relative volatility and illiquidity of the Argentine securities markets.

|

| • |

inflation, which remains high, and may continue to be high in the future;

|

| • |

volatility in real GDP, which according to the restated information released by INDEC grew by 2.7% in 2015, decreased by 2.1% in 2016, grew by 2.7% in 2017, decreased by 2.5% in 2018, decreased by 2.2% and 9.9%

in 2019 and 2020, respectively;

|

| • |

Argentina’s public debt as a percentage of GDP, which remains high, and as of September 30, 2020, represented approximately 100.7% of the GDP;

|

| • |

the discretionary increase in public expenditures that has resulted (and continues to result) in a fiscal deficit;

|

| • |

high unemployment and informal employment rates;

|

| • |

high exchange rate volatility;

|

| • |

high fiscal and trade deficits;

|

| • |

an inability to pay public debt and the reperfilation of debt maturities;

|

| • |

limited access to funding in the local and international capital markets;

|

| • |

agricultural exports, which fueled the economic recovery, have been affected by drought and lower prices than in prior years;

|

| • |

fluctuations in international oil prices;

|

| • |

unavailability of long-term credit to the private sector;

|

| • |

the effects of a restrictive U.S. monetary policy, which could generate an increase in financial costs for Argentina;

|

| • |

fluctuations in the BCRA’s foreign currency reserves;

|

| • |

uncertainty with respect to the imposition of exchange and capital controls;

|

| • |

the abrupt fall in the value of sovereign bonds and a decline in consumer confidence or foreign direct investment;

|

| • |

the public health concerns derived from COVID and its scale and duration discussed below, which remain uncertain, but could impact our earnings, cash flow, liquidity, and financial condition; and

|

| • |

other political, social and economic events outside of Argentina that adversely affect the current growth of the Argentine economy.

|

| • |

Alleviation measures. On August 14, 2019, in order to reduce the effects of the worsening economic situation, the Government took the following measures: (i) a minimum wage

increase of 20% and a special deduction for retirees and formal employees, together with an increase in the minimum income amount for federal income taxes, now at Ps.55,376 for “single” filing status and Ps.70,274 for “married with children”;

(ii) a deduction of 50% in taxable fees for self-employed workers; (iii) an exemption from employee contributions for salaried employees with a net salary below Ps.60,000 (personal contributions 11% of net salary) during September and October,

with a maximum of Ps.2,000 monthly; (iv) an exemption from tax contributions for simplified filers (Monotributistas) during September; (v) an increase of Ps.1,000 per child during September and October

for beneficiaries of the universal child allowance (asignación universal por hijo); (vi) the establishment by the Administración Federal de Ingresos Públicos, of

a 10-year moratorium for small- and medium-sized companies (as well as for self-employed workers and simplified filers); and (vii) a 90-day freeze on gas prices. The fiscal cost of these measures reaches Ps.40,000 million.

|

| • |

Rate of 0% on the value-added tax of “basic food basket.” By Decree No. 567/2019 published in the Official Gazette on August 16, 2019, the

Government enacted that the sale of items in the “basic food basket” (canasta básica de alimentos) would be exempt from value added tax to

final consumers. The products that are part of this basic food basket are: sunflower oil, corn and mix, rice, sugar, preserved fruits, vegetables and beans, corn flour, wheat flour, eggs, whole milk,

skim milk, bread, bread-crumbs, dry pasta, yerba mate, mate cocido, tea, whole yoghurt and non-fat yoghurt. The exemption was in place until December 31, 2019.

|

| • |

Public Debt Reprofiling. On August 29, 2019, the Executive Branch published Decree No. 598/2019, pursuant to which certain exceptional measures were adopted to relieve

tension in the financial and foreign exchange markets. The measures consist of (i) an extension on the payment term for short-term local bonds, only for institutional investors that will receive the full payments in terms of three and six

months (15% on original maturity date, 25% and 60% at 3rd and 6th month of the original maturity date, respectively) and not for natural persons who acquired the bonds before July 31, 2019, who will receive full payment on the maturity date;

(ii) a proposal to the Argentine Congress of a bill to extend the maturity dates of other local bonds, without reduction on the capital or interest; (iii) a proposal to extend the maturity dates of foreign bonds; and (iv) after achieving fiscal

goals, the start of talks with the IMF in order to reprofile the deadlines to reduce the default risk in 2020 and 2023.

|

| • |

Exchange control restrictions. The Executive Branch reinstated restrictions on the foreign exchange market through the Emergency Decree No. 609/2019 (“Decree 609”), published in the Official Gazette on September 1, 2019, and since then has enacted subsequent exchange control restrictions. These exchange control restrictions remain in place. For additional

information see “—Restrictions on transfers of foreign currency and the repatriation of capital from Argentina may impair our ability to pay dividends and distributions and investors may face restrictions on

their ability collect capital and interest payments in connection with corporate bonds issued by Argentine companies” and “Item 10. Additional Information—D. Exchange Controls.”

|

| • |

Occupational Emergency. Through Decree No. 34/2019 (“Decree 34”), on December 13, 2019, the Government of Alberto Fernández declared

a public emergency in occupational matters for a term of 180 days. In case of dismissal without cause during said period, the affected worker will have the right to receive double compensation in accordance with current legislation. The

Government went a step further amid the COVID pandemic, extending this measure on several occasions, most recently by Decree no. 39/2021, effective until December 31, 2021.

|

| • |

Solidarity Law. On December 23, 2019, the National Congress enacted the Solidarity Law. This law declared a public emergency in economic, financial, fiscal, administrative,

pension, tariff, energy, health and social matters, and, pursuant to the Argentine Constitution, the Solidarity Law delegates legislative powers to the Executive Branch. For additional information, see “Item 5.

Operating and Financial Review and Prospects—A. Operating Results—Factors affecting our consolidated results of operations.”

|

| • |

Emergency Assistance Program for Work and Production. Pursuant Decree No. 332/2020 of April 1, 2020 (“Decree 332”), the Fernández administration created the Emergency

Assistance Program for Work and Production for employers and workers affected by the COVID health emergency. This program includes: (i) the postponement or reduction of up to 95% of the payment of certain employer contributions; (ii) a

compensatory salary assignment; and (iii) a comprehensive unemployment benefit system. Decree No. 376/2020 of April 20, 2020 expands the subjects entitled to, and the benefits included in Decree 332, including: (i) zero rate credit facilities

for certain eligible small taxpayers, workers and self-employed workers, with a subsidy of 100% of the total financial cost; (ii) expanding the scope of the compensatory salary assignment paid by the Government to all workers in the private

sector; (iii) the authorization of the Argentine Guarantee Fund (FoGAR) to guarantee the credit facilities referred in (i); and (iv) an increase in the amount of unemployment insurance between Ps.6,000 and Ps.10,000. Decree No. 624/2020 of July

27, 2020 further amends the criteria to determine eligibility to the benefits of such assistance program. We have not taken advantage of this assistance program.

|

| • |

- Legal Regime of the Telework Contract. On August 14, 2020, Law No. 27,555 was published, the purpose of which is to establish the minimum legal

requirements for the regulation of the telework modality in those activities that, due to their nature and particular characteristics, allow it. This law incorporates to the employment contract regime approved by Law No. 20,744 certain

provisions related to teleworking, such as working hours, work elements, and the rights and obligations of the worker, among other matters. The law will enter into force after the expiration of 90 days from the end of the period of validity

of the social, preventive and mandatory isolation provided by Decree No. 297/2020 as amended. On January 20, 2021, Decree No. 27/2021 was published in the Official Gazette, which partially regulates Law No. 27,555. Said Decree delegates to

the Ministry of Labor, Employment and Social Security the issuance of the resolution that will determine the starting date of the 90-day period for the above mentioned Law to become effective.

|

| • |

Amendments to the Information and Communications Technology ("ICT") regime. By means of Decree No. 690/2020 dated August 21, 2020, the Argentine Government introduced a

series of amendments to the ICT Law No. 27,078. First, ICT services and access to telecommunications networks were assigned the character of public service in competition. Likewise, the regime for determining prices was modified. It is

established that ICT service licensees will set their prices, which must be fair and reasonable, covering operating costs, aiming at an efficient provision and a reasonable operating margin. At the same time, prices will be regulated by the

enforcement authority in the case of essential and strategic ICT public services in competition, providers based on the Universal Service and those determined by the enforcement authority for reasons of public interest. Also, the prices of ICT

services - including subscription broadcasting and fixed or mobile telephony services - were frozen from July 31, 2020 until December 31, 2020. On December 18, 2020, the National Communications Entity (ENACOM) issued Resolution No. 1466/2020,

which provided for an increase limited to services. Likewise, ENACOM issued Resolution No. 1467/2020 on December 21, 2020, whereby "Mandatory Universal Basic Services" were approved for the Basic Telephone Service, Mobile Communications

Services, Internet Access Value Added Service, Pay TV services by subscription through physical, radioelectric or satellite link and Radio Broadcasting services by subscription through physical or radioelectric link (SRSVR) or satellite link,

aimed at users who comply with certain conditions, essentially aimed at the most vulnerable sectors.

|

| • |

Judicial Reform Bill. On July 29, 2020, the Executive Branch announced a judicial reform bill which consists of increasing the number of federal courts by creating 23 new

federal courts and merging the federal criminal circuit with the federal economic criminal circuit. In addition, the proposed bill seeks the appointment of an advisory committee composed of legal experts to advise the executive branch on the

operation of the judicial branch. The bill was approved by the Senate on August 28, 2020 and, as of the date of this Supplement, is pending discussion in the House of Representatives.

|

| • |

Oil&Gas upstream industry. Certain measures were established in order to encourage oil and gas production. The most prominent refers to the establishment of the

Argentine Natural Gas Production Promotion Plan - Supply and Demand Scheme 2020-2024 through Decree No. 892/2020 published on November 16, 2020. Further on May 19, 2020, Decree 488/2020 was published, through which a base price of US $ 45 was

set for the commercialization of a barrel of Medanito-type crude oil in the local market, containing also provisions relating to the aliquots applicable to export duties relating to products from the hydrocarbon industry.

|

| • |

The situation generated by COVID could cause a decrease in our revenues (ie. A reduction in the demand of our Liquids products) or an increase in our operating costs. As a result of financial turmoil in Argentina

caused by disruptions in supply chains and public debt restructuring, we may experience difficulties in our ability to pay off our debts and other financial obligations as they become due. We could also face difficulties in accessing debt and

capital markets and may be forced to refinance our indebtedness;

|

| • |

An extended period of remote work by our employees could deplete our technological resources and result in or exacerbate certain operational risks, including an increased risk of cybersecurity. Remote work

environments may be less secure and more susceptible to hacking attacks, including phishing and social engineering attempts to exploit the COVID pandemic; and

|

| • |

COVID poses a threat to the well-being and morale of our employees. While we have implemented a business continuity plan to protect the health of our employees and we have contingency plans for key employees or

executive officers who may become ill or unable to perform their duties for an extended period of time, such plans cannot anticipate all scenarios, and we may experience a possible loss of productivity or a delay in the deployment of certain

strategic plans.

|

| • |

limitations on our ability to increase prices or to reflect the effects of higher domestic taxes, increases in operating costs or increases in international prices of natural gas and other hydrocarbon fuels and

exchange rate fluctuations on our domestic prices;

|

| • |

risks in connection with the former and current incentive programs established by the Government for the oil and gas industry, such as the natural gas additional injection stimulus program and cash collection of

balances with the Government;

|

| • |

legislation and regulatory initiatives relating to hydraulic stimulation and other drilling activities for non-conventional oil and gas hydrocarbons, which could increase our cost of doing business or cause

delays and adversely affect our operations; and

|

| • |

the implementation or imposition of stricter quality requirements for hydrocarbon products in Argentina.

|

| • |

repeated failure to comply with the obligations of our License and failure to remedy a significant breach of an obligation in accordance with specified procedures;

|

| • |

total or partial interruption of service for reasons attributable to us that affects transportation capacity during the periods stipulated in our License;

|

| • |

sale, assignment or transfer of our essential assets or the placing of encumbrances thereon without ENARGAS’ prior authorization, unless such encumbrances serve to finance extensions and improvements to the gas

pipeline system;

|

| • |

our bankruptcy, dissolution or liquidation;

|

| • |

cessation and abandonment of the provision of the licensed service, an attempt to assign or unilaterally transfer our License in full or in part without the prior authorization of ENARGAS, or relinquishing our

License, other than in the cases permitted therein; and

|

| • |

delegation of the functions granted in such contract without the prior authorization of ENARGAS, or the termination of such agreement without regulatory approval of a new contract.

|

| • |

Argentine natural gas transportation regulations;

|

| • |

international oil and gas prices;

|

| • |

timing, volume and location of new market demand;

|

| • |

competition from alternative energy sources;

|

| • |

supply and price of natural gas in Argentina;

|

| • |

demand for natural gas in the markets we serve; and

|

| • |

availability and competitiveness of alternative gas transportation infrastructure in the markets we serve.

|

| • |

incur or permit to exist certain liens;

|

| • |

incur additional indebtedness;

|

| • |

pay dividends or make other restricted payments;

|

| • |

make capital investments and other investments;

|

| • |

enter into sale and lease-back transactions;

|

| • |

enter into transactions with affiliates;

|

| • |

sell, transfer or otherwise dispose of assets; and

|

| • |

consolidate, amalgamate, merge or sell all or substantially all of our assets.

|

| • |

fluctuations in our periodic operating results;

|

| • |

changes in financial estimates, recommendations or projections by securities analysts;

|

| • |

changes in conditions or trends in our industry;

|

| • |

events affecting equities markets in Argentina;

|

| • |

legal or regulatory measures affecting our financial conditions;

|

| • |

departures of management and key personnel; or

|

| • |

potential litigation or the adverse resolution of pending litigation against us or our subsidiaries.

|

| Item 4. |

Our Information

|

|

Company

|

Annual

deliveries

(Bcf) |

Volume of market

served (in %)

|

No. of end users

(in millions)

|

Deliveries received from us (in %)

|

||||||||||||

|

Metrogas (1)

|

217.6

|

21.0

|

%

|

2.4

|

87

|

%

|

||||||||||

|

Camuzzi Pampeana (1)

|

227.0

|

22.0

|

%

|

1.4

|

95

|

%

|

||||||||||

|

Camuzzi Sur

|

167.0

|

16.2

|

%

|

0.7

|

100

|

%

|

||||||||||

|

Naturgy Argentina (1)

|

109.1

|

10.6

|

%

|

1.7

|

67

|

%

|

||||||||||

|

69.7

|

%

|

6.2

|

||||||||||||||

| (1) |

Also connected to the TGN system.

|

|

For the years ended December 31,

|

||||||||||||||||||||||||

|

2020

|

2019

|

2018

|

||||||||||||||||||||||

|

Average firm contracted capacity (MMcf/d)

|

Net revenues (millions of pesos)

|

Average firm contracted capacity (MMcf/d)

|

Net revenues (millions of pesos)

|

Average firm contracted capacity (MMcf/d)

|

Net revenues (millions of pesos)

|

|||||||||||||||||||

|

Firm:

|

||||||||||||||||||||||||

|

Metrogas

|

590

|

5,889

|

590

|

7,960

|

590

|

8,156

|

||||||||||||||||||

|

Camuzzi Pampeana

|

558

|

4,306

|

558

|

5,823

|

558

|

5,944

|

||||||||||||||||||

|

Naturgy Argentina

|

417

|

3,510

|

417

|

4,743

|

417

|

4,867

|

||||||||||||||||||

|

Camuzzi Sur

|

388

|

883

|

388

|

1,195

|

388

|

1,219

|

||||||||||||||||||

|

Pampa Energía

|

152

|

895

|

162

|

1,079

|

92

|

888

|

||||||||||||||||||

|

Others

|

809

|

3,604

|

802

|

4,415

|

840

|

4,567

|

||||||||||||||||||

|

Total firm

|

2,914

|

19,087

|

2,917

|

25,215

|

2,885

|

25,641

|

||||||||||||||||||

|

Interruptible and others:

|

-

|

4,415

|

-

|

5,581

|

-

|

6,740

|

||||||||||||||||||

|

Total

|

2,914

|

23,502

|

2,917

|

30,796

|

2,885

|

32,381

|

||||||||||||||||||

|

For the year ended December 31,

|

||||||||||||

|

2020

|

2019

|

2018

|

||||||||||

|

Firm:

|

Average daily deliveries

(MMcf/d)

|

Average daily deliveries (MMcf/d)

|

Average daily deliveries (MMcf/d)

|

|||||||||

|

Metrogas

|

427

|

494

|

487

|

|||||||||

|

Camuzzi Pampeana

|

328

|

350

|

371

|

|||||||||

|

Camuzzi Sur

|

240

|

233

|

244

|

|||||||||

|

Naturgy Argentina

|

215

|

240

|

223

|

|||||||||

|

Others

|

544

|

547

|

569

|

|||||||||

|

Subtotal firm

|

1,755

|

1,864

|

1,893

|

|||||||||

|

Subtotal interruptible

|

512

|

498

|

569

|

|||||||||

|

Total

|

2,267

|

2,362

|

2,462

|

|||||||||

|

Average annual load factor (1)

|

78

|

%

|

81

|

%

|

85

|

%

|

||||||

|

Average winter heating season load factor (1)

|

86

|

%

|

90

|

%

|

98

|

%

|

||||||

| (1) |

Average daily deliveries for the period divided by average daily firm contracted capacity for the period, expressed as a percentage.

|

| • |

protect the health and safety of operating personnel;

|

| • |

ensure operational continuity in the event of contagion of key personnel;

|

| • |

ensure the proper functioning of equipment and facilities;

|

| • |

guarantee the quality of services to internal and external clients;

|

| • |

identify additional actions to be taken during and after an emergency; and

|

| • |

maintain fluid communication and monitoring of personnel and their condition.

|

| • |

From 12/28/2019 to 12/27/2020: 6.5%

|

| • |

From 12/28/2020 to 12/27/2021: 6%

|

| • |

From 12/28/2021 to 12/27/2022: 5.5%

|

| • |

From 12/28/2022 to 12/27/2023: 5%

|

| • |

From 12/28/2023 to 12/27/2024 and onwards: 4.5%.

|

| • |

creation of Integración Energética Argentina S.A. (“IEASA,” formerly ENARSA) in 2004 for the purposes of restoring levels of reserves, production and supply of natural gas

and meeting the infrastructure needs of the natural gas transportation and electricity industries;

|

| • |

creation of the Gas Plus Program (the “Gas Plus Program”) in 2008, which aims to encourage producers to make further

investments in natural gas infrastructure by allowing them to sell the resulting production of natural gas from new fields and fields that require more expensive extraction techniques at higher prices than the current authorized prices. In

2010, the Government increased the price paid to natural gas producers who invest in new fields, shale and tight natural gas under the Gas Plus Program;

|

| • |

hiring of two re-gasifying LNG tankers through IEASA, in Bahía Blanca (2008) and Escobar (2011), to inject natural gas into the pipeline. The tanker located at Bahía Blanca, which was retired in November 2018,

was connected to our pipeline, and the tanker at Escobar is connected to TGN’s pipeline;

|

| • |

establishment of a framework for the constitution of Gas Trusts to finance natural gas pipeline expansions;

|

| • |

the passage of Law No. 26,741, which declares that hydrocarbons self-sufficiency, as well as their production, industrialization, transport and marketing, are activities of public interest and primary goals of

Argentina, empowering the Government to take the necessary measures to achieve such goals;

|

| • |

creation of trust funds (Resolution No. 185/04 of the former MPFIPyS) in order to finance infrastructure works in transportation and distribution of natural gas;

|

| • |

importation of natural gas from Bolivia and Chile, which has increased significantly over the past two years;

|

| • |

importation of liquiefied natural gas (“LNG”) through vessels;

|

| • |

creation of tariff charges to be paid by all consumers other than residential consumers in order to finance natural gas and electricity expansions and the import of natural gas; and

|

| • |

under Law No. 26,741, a stimulus program was created to encourage new investments in exploration and exploitation.

|

| • |

the establishment of the 2020-2024 natural gas scheme through the Plan Gas.Ar.

|

| • |

the completion of the RTI processes were prioritized to provide a framework of certainty to the operation of public utility companies;

|

| • |

the Ministry of Energy and the Unidad de Renegociación y Análisis de Contratos de Servicios Públicos (“UNIREN”) were reorganized

in order to streamline the aforementioned efforts; and

|

| • |

the increase of the prices of natural gas at the supply point (“PIST”) and the tariffs of the public transport and distribution of natural gas service have been propitiated

in order to correct the deterioration in the supply of this fluid and to reduce the burden that the public subsidies have on the national budget.

|

| • |

fixes the natural gas prices in PIST;

|

| • |

provides that the total amount of natural gas prices in PIST shall not exceed certain limits according to the type of customer;

|

| • |

maintains the social tariff for the protection of the most vulnerable sectors;

|

| • |

establishes the new propane prices for the distribution of undiluted propane gas through networks, settling at Ps.800/Tn for residential users and general service P1 and P2, and Ps.2,100/Tn for general service P3

users; and

|

| • |

provides that adjustments will be implemented in the months of April and October of each year, until the total elimination of the subsidies, at which time PIST will be freely determined by the market.

|

| • |

an agreement with unions to amend current existing collective bargaining agreements for the sector;

|

| • |

the elimination of the obligation of repatriation of funds due to oil and gas exports currently regulated by Decree No. 1,722/11; and

|

| • |

the creation of a program (regulated by Resolution No. 46-E/2017), the Investment in Natural Gas Production from Non-Conventional Reservoirs Stimulus Program, which establishes a support price for the volume of

non-conventional natural gas production from concessions located in the Neuquina basin included in the program. This program, originally scheduled to be effective until December 31, 2021, included a sliding-scale schedule for the minimum price

to be paid per MMBtu: U.S.$7.50 for 2018, U.S.$7.00 for 2019, U.S.$6.50 for 2020 and U.S.$6.00 for 2021. In 2019, such program was modified by the Energy Secretary, and such decision of the Government resulted in conflicts between the

Government and natural gas producers which led to a sharp decline in the number of investments made by natural gas producers since the second half of 2019.

|

|

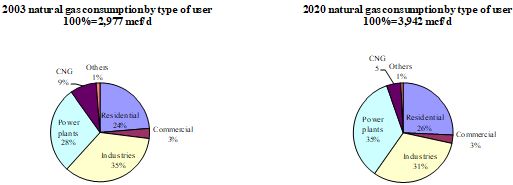

2003

|

2016

|

2017

|

2018

|

2019

|

2020

|

|||||||||||||||||||

|

Residential (1)

|

704.3

|

1,153.8

|

1,030.4

|

1,026.8

|

987.9

|

1,012.5

|

||||||||||||||||||

|

Commercial

|

98.8

|

132.4

|

123.0

|

121.6

|

140.9

|

106.9

|

||||||||||||||||||

|

Industries (2)

|

1,033.6

|

1,169.2

|

1,210.9

|

1,276.5

|

1,330.6

|

1,234.8

|

||||||||||||||||||

|

Power plants

|

846.7

|

1,548.3

|

1,671.7

|

1,663.1

|

1,461.5

|

1,375.9

|

||||||||||||||||||

|

CNG

|

255.4

|

273.5

|

246.9

|

232.3

|

238.2

|

180.8

|

||||||||||||||||||

|

Others (3)

|

37.7

|

46.3

|

43.1

|

41.8

|

41.5

|

30.8

|

||||||||||||||||||

|

Total

|

2,976.5

|

4,323.4

|

4,326.0

|

4,362.0

|

4,200.5

|

3,941.8

|

||||||||||||||||||

| (1) |

Includes subdistributors.

|

| (2) |

Includes shrinkage natural gas from the Cerri Complex, which is included in Others.

|

| (3) |

Includes governmental bodies.

|

|

Basin

|

Location by

province

|

Proved Gas

Reserves(Bcf)(1)(2)

|

Production (Bcf)

|

Reserve Life

(years)(3)

|

||||||||||||||||||||||

|

2019

|

2018

|

2019

|

2018

|

2019

|

2018

|

|||||||||||||||||||||

|

Neuquina

|

Neuquén, Río Negro, La Pampa, Mendoza (South)

|

8,239.0

|

7,001.2

|

1,085.4

|

1,002.7

|

8

|

7

|

|||||||||||||||||||

|

Austral

|

Tierra del Fuego, Santa Cruz (South), and offshore

|

1,451.9

|

3,545.9

|

165.3

|

406.9

|

9

|

9

|

|||||||||||||||||||

|

San Jorge Gulf

|

Chubut, Santa Cruz (North)

|

3,219.3

|

1,496.6

|

425.2

|

174.7

|

8

|

9

|

|||||||||||||||||||

|

Cuyo

|

Mendoza (North)

|

4.8

|

10.6

|

1.8

|

1.7

|

3

|

6

|

|||||||||||||||||||

|

Northwest

|

Salta, Jujuy, Formosa

|

388.4

|

452.6

|

65.2

|

74.5

|

6

|

6

|

|||||||||||||||||||

|

Total

|

13,303.3

|

12,506.9

|

1,742.9

|

1,660.5

|

8

|

8

|

||||||||||||||||||||

| (1) |

Estimated as of December 31, 2019 and 2018, respectively. There are numerous uncertainties inherent in estimating quantities of proved natural gas reserves. The accuracy of any reserve estimate is a function of the quality of available data,

and engineering and geological interpretation and judgment. Results of drilling, testing and production after the date of the estimate may require substantial upward or downward revisions. Accordingly, the reserve estimates could be materially

different from the quantity of natural gas that ultimately will be recovered.

|

| (2) |

Reserve figures do not include significant reserves located in certain Bolivian basins to which TGN is connected.

|

| (3) |

Weighted average reserve life for all basins, at the 2018 or 2017 production levels, respectively.

|

| • |

operating and safety standards;

|

| • |

terms of service, including general service conditions, such as specifications regarding the quality of gas transported, major equipment requirements, invoicing and payment procedures, imbalances and penalties,

and guidelines for dispatch management;

|

| • |

contract requirements, including the basis for the provision of service, e.g., “firm” or “interruptible”;

|

| • |

mandatory capital investments to be made over the first five years of the license term; and

|

| • |

applicable rates based on the type of transportation service and the area serviced.

|

| • |

repeated failure to comply with the obligations of our License and failure to remedy a significant breach of an obligation in accordance with specified procedures;

|

| • |

total or partial interruption of the service for reasons attributable to us, affecting completely or partially transportation capacity during the periods stipulated in our License;

|

| • |

sale, assignment or transfer of our essential assets or otherwise encumbering such assets without ENARGAS’s prior authorization, unless such encumbrances serve to finance expansions and improvements to the gas

pipeline system;

|

| • |

bankruptcy, dissolution or liquidation; and

|

| • |

ceasing and abandoning the provision of the licensed service, attempting to assign or unilaterally transfer our License in full or in part without the prior authorization of ENARGAS, or giving up our License,

other than in the cases permitted therein.

|

|

|

Between December 1, 2017 and March 31, 2018 | ||||||||||||||

|

Firm

|

Interruptible

|

||||||||||||||

|

Rate Zones

|

Reservation Charge(1)

(Ps.m3/d)

|

Minimum

Charge(2)

(Ps.1,000 m3)

|

Compression

Fuel and Losses(3)

(%)

|

||||||||||||

|

Receipt

|

Delivery

|

||||||||||||||

|

From Tierra del Fuego to:

|

Tierra del Fuego

|

1.178272

|

39.275298

|

0.49

|

|||||||||||

|

|

Santa Cruz Sur |

2.376029

|

79.201776

|

0.98

|

|||||||||||

|

|

Chubut Sur |

6.060905

|

202.030320

|

3.38

|

|||||||||||

|

|

Buenos Aires Sur |

7.140583

|

238.019383

|

5.60

|

|||||||||||

|

|

Bahía Blanca |

10.937683

|

364.589386

|

8.40

|

|||||||||||

|

|

La Pampa Norte |

10.898901

|

363.296426

|

8.60

|

|||||||||||

|

|

Buenos Aires |

12.797205

|

426.573433

|

10.35

|

|||||||||||

|

|

Greater Buenos Aires |

14.358459

|

478.615432

|

11.27

|

|||||||||||

|

From Santa Cruz Sur to:

|

Santa Cruz Sur

|

1.194161

|

39.805045

|

0.49

|

|||||||||||

|

|

Chubut Sur |

4.873723

|

162.457367

|

2.89

|

|||||||||||

|

|

Buenos Aires Sur |

5.955710

|

198.523493

|

5.11

|

|||||||||||

|

|

Bahía Blanca |

9.772503

|

325.749975

|

7.91

|

|||||||||||

|

|

La Pampa Norte |

9.770749

|

325.691329

|

8.11

|

|||||||||||

|

|

Buenos Aires |

11.638111

|

387.936804

|

9.86

|

|||||||||||

|

|

Greater Buenos Aires |

13.204167

|

440.139326

|

10.78

|

|||||||||||

|

From Chubut to:

|

Chubut Sur

|

1.184339

|

39.477749

|

0.49

|

|||||||||||

|

|

Buenos Aires Sur |

2.220658

|

74.020757

|

2.71

|

|||||||||||

|

|

Bahía Blanca |

5.921694

|

197.388697

|

5.51

|

|||||||||||

|

|

La Pampa Norte |

6.217779

|

207.258114

|

5.71

|

|||||||||||

|

|

Buenos Aires |

7.698187

|

256.605281

|

7.46

|

|||||||||||

|

|

Greater Buenos Aires |

9.178595

|

305.952447

|

8.38

|

|||||||||||

|

From Neuquén to:

|

Neuquén

|

1.052366

|

36.080973

|

0.49

|

|||||||||||

|

|

Bahía Blanca |

5.111469

|

170.332165

|

2.80

|

|||||||||||

|

|

La Pampa Norte |

5.505614

|

183.471269

|

3.15

|

|||||||||||

|

|

Buenos Aires |

6.922412

|

230.697053

|

3.91

|

|||||||||||

| Between December 1, 2017 and March 31, 2018 |

|||||||||||||||

| Firm |

Interruptible |

||||||||||||||

| Rate Zones |

Reservation Charge(1)

(Ps.m3/d)

|

Minimum

Charge(2)

(Ps.1,000 m3)

|

Compression

Fuel and Losses(3)

(%)

|

||||||||||||

|

Receipt

|

Delivery | ||||||||||||||

| Greater Buenos Aires |

8.478965

|

283.137219

|

4.86

|

||||||||||||

|

From Bahía Blanca to:

|

|

Bahía Blanca |

1.184334

|

39.477755

|

0.49

|

||||||||||

| La Pampa Norte |

0.296083

|

9.869416

|

0.20

|

||||||||||||

| Buenos Aires |

1.776485

|

59.216586

|

1.95

|

||||||||||||

| Greater Buenos Aires | 3.256902 |

108.563756 |

2.87 | ||||||||||||

| (1) |

Monthly charge for every cubic meter per day of reserved transportation capacity.

|

| (2) |

Minimum charge equal to the unit rate of the firm reservation charge at a 100% load factor.

|

| (3) |

Maximum percentage of total transported gas that customers are required to replace in-kind to make up for gas used by us for compressor fuel or losses in rendering transportation services.

|

|

Between April 1, 2018 and September 30, 2018

|

|||||||||||||||

|

Firm

|

Interruptible

|

||||||||||||||

|

Rate Zones

|

Reservation Charge(1)

(Ps.m3/d)

|

Minimum

Charge(2)

(Ps.1,000 m3)

|

Compression

Fuel and Losses(3)

(%)

|

||||||||||||

|

Receipt

|

|

Delivery

|

|||||||||||||

|

From Tierra del Fuego to:

|

|

Tierra del Fuego |

1.767514

|

58.916471

|

0.49

|

||||||||||

|

|

Santa Cruz Sur |

3.564256

|

118.809770

|

0.98

|

|||||||||||

|

|

Chubut Sur |

9.091901

|

303.063605

|

3.38

|

|||||||||||

|

|

Buenos Aires Sur |

10.711516

|

357.050429

|

5.60

|

|||||||||||

|

|

Bahía Blanca |

16.407506

|

546.916789

|

8.40

|

|||||||||||

|

|

La Pampa Norte |

16.349329

|

544.977233

|

8.60

|

|||||||||||

|

Buenos Aires

|

19.196955

|

639.898420

|

10.35

|

||||||||||||

|

|

Greater Buenos Aires |

21.538977

|

717.966088

|

11.27

|

|||||||||||

|

From Santa Cruz Sur to:

|

|

Santa Cruz Sur |

1.791349

|

59.711139

|

0.49

|

||||||||||

|

|

Chubut Sur |

7.311021

|

243.700626

|

2.89

|

|||||||||||

|

|

Buenos Aires Sur |

8.934100

|

297.803051

|

5.11

|

|||||||||||

|

|

Bahía Blanca |

14.659632

|

488.654189

|

7.91

|

|||||||||||

|

|

La Pampa Norte |

14.657000

|

488.566215

|

8.11

|

|||||||||||

|

|

Buenos Aires |

17.458211

|

581.940011

|

9.86

|

|||||||||||

|

|

Greater Buenos Aires |

19.807436

|

660.248478

|

10.78

|

|||||||||||

|

From Chubut to:

|

|

Chubut Sur |

1.776614

|

59.220165

|

0.49

|

||||||||||

|

Buenos Aires Sur

|

3.331187

|

111.037777

|

2.71

|

||||||||||||

|

|

Bahía Blanca |

8.883072

|

296.100754

|

5.51

|

|||||||||||

|

|

La Pampa Norte |

9.327226

|

310.905767

|

5.71

|

|||||||||||

|

|

Buenos Aires |

11.547971

|

384.930944

|

7.46

|

|||||||||||

|

|

Greater Buenos Aires |

13.768715

|

458.956121

|

8.38

|

|||||||||||

|

From Neuquén to:

|

|

Neuquén |

1.578643

|

54.124697

|

0.49

|

||||||||||

|

|

Bahía Blanca |

7.667662

|

255.513529

|

2.80

|

|||||||||||

|

|

La Pampa Norte |

8.258915

|

275.223364

|

3.15

|

|||||||||||

|

|

Buenos Aires |

10.384239

|

346.066277

|

3.91

|

|||||||||||

|

|

Greater Buenos Aires |

12.719209

|

424.731232

|

4.86

|

|||||||||||

|

From Bahía Blanca to:

|

|

Bahía Blanca |

1.776607

|

59.220174

|

0.49

|

||||||||||

|

|

La Pampa Norte |

0.444152

|

14.805009

|

0.20

|

|||||||||||

|

|

Buenos Aires |

2.664887

|

88.830192

|

1.95

|

|||||||||||

|

|

Greater Buenos Aires |

4.885645

|

162.855375

|

2.87

|

|||||||||||

| (1) |

Monthly charge for every cubic meter per day of reserved transportation capacity.

|

| (2) |

Minimum charge equal to the unit rate of the firm reservation charge at a 100% load factor.

|

| (3) |

Maximum percentage of total transported gas which customers are required to replace in-kind to make up for gas used by us for compressor fuel or losses in rendering transportation services.

|

|

Between October 1, 2018 and March 31, 2019

|

|||||||||||||||

|

Firm

|

Interruptible

|

||||||||||||||

|

Rate Zones

|

Reservation Charge(1)

(Ps.m3/d)

|

Minimum

Charge(2)

(Ps.1,000 m3)

|

Compression

Fuel and Losses(3)

(%)

|

||||||||||||

|

Receipt

|

Delivery

|

||||||||||||||

|

From Tierra del Fuego to:

|

Tierra del Fuego

|

2.115187

|

70.505443

|

0.49

|

|||||||||||

|

|

Santa Cruz Sur |

4.265351

|

142.179858

|

0.98

|

|||||||||||

|

|

Chubut Sur |

10.880293

|

362.676743

|

3.38

|

|||||||||||

|

|

Buenos Aires Sur |

12.818489

|

427.282869

|

5.60

|

|||||||||||

|

|

Bahía Blanca |

19.634891

|

654.496272

|

8.40

|

|||||||||||

|

|

La Pampa Norte |

19.565270

|

652.175202

|

8.60

|

|||||||||||

|

|

Buenos Aires |

22.973029

|

765.767552

|

10.35

|

|||||||||||

|

|

Greater Buenos Aires |

25.775731

|

859.191266

|

11.27

|

|||||||||||

|

From Santa Cruz Sur to:

|

Santa Cruz Sur

|

2.143710

|

71.456424

|

0.49

|

|||||||||||

|

|

Chubut Sur |

8.749112

|

291.636962

|

2.89

|

|||||||||||

|

|

Buenos Aires Sur |

10.691453

|

356.381429

|

5.11

|

|||||||||||

|

|

Bahía Blanca |

17.543207

|

584.773317

|

7.91

|

|||||||||||

|

|

La Pampa Norte |

17.540057

|

584.668038

|

8.11

|

|||||||||||

|

|

Buenos Aires |

20.892272

|

696.408622

|

9.86

|

|||||||||||

|

|

Greater Buenos Aires |

23.703593

|

790.120501

|

10.78

|

|||||||||||

|

From Chubut to:

|

Chubut Sur

|

2.126078

|

70.868874

|

0.49

|

|||||||||||

|

|

Buenos Aires Sur |

3.986437

|

132.879101

|

2.71

|

|||||||||||

|

|

Bahía Blanca |

10.630388

|

354.344287

|

5.51

|

|||||||||||

|

|

La Pampa Norte |

11.161907

|

372.061471

|

5.71

|

|||||||||||

|

|

Buenos Aires |

13.819476

|

460.647529

|

7.46

|

|||||||||||

|

|

Greater Buenos Aires |

16.477046

|

549.233587

|

8.38

|

|||||||||||

|

From Neuquén to:

|

Neuquén

|

1.889165

|

64.771119

|

0.49

|

|||||||||||

|

|

Bahía Blanca |

9.175905

|

305.773484

|

2.80

|

|||||||||||

|

|

La Pampa Norte |

9.883458

|

329.360278

|

3.15

|

|||||||||||

|

|

Buenos Aires |

12.426836

|

414.138116

|

3.91

|

|||||||||||

|

|

Greater Buenos Aires |

15.221099

|

508.276603

|

4.86

|

|||||||||||

|

From Bahía Blanca to:

|

Bahía Blanca

|

2.126068

|

70.868885

|

0.49

|

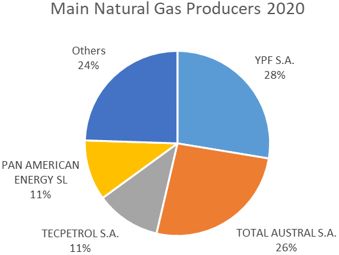

|||||||||||