10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For The Fiscal Year Ended December 31, 2015

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-12755

Dean Foods Company

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | | 75-2559681 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2711 North Haskell Avenue Suite 3400

Dallas, Texas 75204

(214) 303-3400

(Address, including zip code, and telephone number, including

area code, of Registrant’s principal executive offices)

Securities Registered Pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $.01 par value | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer ¬ | | Non-accelerated filer ¬ | | Smaller reporting company ¬ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant at June 30, 2015, based on the closing price for the registrant’s common stock on the New York Stock Exchange on June 30, 2015, was approximately $1.53 billion.

The number of shares of the registrant’s common stock outstanding as of February 17, 2016 was 91,686,411

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on or about May 11, 2016, which will be filed within 120 days of the registrant’s fiscal year end, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | |

Item | | Page |

PART I |

1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

1A | | |

1B | | |

2 | | |

3 | | |

4 | | |

PART II |

5 | | |

6 | | |

7 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

7A | | |

8 | | |

9 | | |

9A | | |

PART III |

10 | | |

11 | | |

12 | | |

13 | | |

14 | | |

PART IV |

15 | | |

| S-1 |

Forward-Looking Statements

This Annual Report on Form 10-K (this “Form 10-K”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks, uncertainties and assumptions that are difficult to predict. Forward-looking statements are predictions based on expectations and projections about future events, and are not statements of historical fact. Forward-looking statements include statements concerning business strategy, among other things, including anticipated trends and developments in and management plans for our business and the markets in which we operate. In some cases, you can identify these statements by forward-looking words, such as “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “forecast,” “foresee,” “likely,” “may,” “should,” “goal,” “target,” “might,” “will,” "would," "can," “could,” “predict,” and “continue,” the negative or plural of these words and other comparable terminology. All forward-looking statements included in this Form 10-K are based upon information available to us as of the filing date of this Form 10-K, and we undertake no obligation to update any of these forward-looking statements for any reason. You should not place undue reliance on forward-looking statements. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include the matters discussed in the section entitled “Part I — Item 1A — Risk Factors” in this Form 10-K, and elsewhere in this Form 10-K. You should carefully consider the risks and uncertainties described in this Form 10-K.

PART I

We are a leading food and beverage company and the largest processor and direct-to-store distributor of fresh fluid milk and other dairy and dairy case products in the United States, with a vision to be the most admired and trusted provider of wholesome, great-tasting dairy products at every occasion.

We manufacture, market and distribute a wide variety of branded and private label dairy case products, including fluid milk, ice cream, cultured dairy products, creamers, ice cream mix and other dairy products to retailers, distributors, foodservice outlets, educational institutions and governmental entities across the United States. Our portfolio includes DairyPure®, our national white milk brand, and TruMoo®, the leading national flavored milk brand, along with well-known regional dairy brands such as Alta Dena ®, Berkeley Farms ®, Country Fresh ®, Dean’s ®, Garelick Farms ®, LAND O LAKES ® milk and cultured products (licensed brand), Lehigh Valley Dairy Farms ®, Mayfield ®, McArthur ®, Meadow Gold®, Oak Farms ®, PET ® (licensed brand), T.G. Lee ®, Tuscan ® and more. In all, we have more than 50 national, regional and local dairy brands, as well as private labels. Due to the perishable nature of our products, we deliver the majority of our products directly to our customers’ locations in refrigerated trucks or trailers that we own or lease. We believe that we have one of the most extensive refrigerated direct-to-store delivery systems in the United States. We sell our products primarily on a local or regional basis through our local and regional sales forces, although some national customer relationships are coordinated by a centralized corporate sales department.

Unless stated otherwise, any reference to income statement items in this Form 10-K refers to results from continuing operations. Each of the terms "we," "us," "our," "the Company," and "Dean Foods" refers collectively to Dean Foods Company and its wholly-owned subsidiaries unless the context indicates otherwise.

Our principal executive offices are located at 2711 North Haskell Avenue, Suite 3400, Dallas, Texas 75204. Our telephone number is (214) 303-3400. We maintain a web site at www.deanfoods.com. We were incorporated in Delaware in 1994.

Developments Since January 1, 2015

Launch of DairyPure® — In April 2015, we launched the first and largest fresh, white milk national brand - DairyPure®. We believe DairyPure® provides a number of clear benefits for the category, our retail customers, consumers and us. For the category, with its unprecedented scale, DairyPure® provides a national platform to educate consumers on the health and nutrition benefits of conventional white milk as a cost-effective source of protein in their diets. For our retail customers, DairyPure® enhances their efficiency and effectiveness and enables them to advertise the same branded features across the United States. For the consumer, DairyPure® is on trend with their desire for clean label, locally sourced, fresh, protein and nutrient packed products. DairyPure® is an easy transition for them, building on the regional brands they already know and value. For us, DairyPure® provides a national platform for advertising and promotional spending.

Management Changes — Effective October 1, 2015, the Board of Directors elected Ralph P. Scozzafava to serve as Executive Vice President, Chief Operating Officer of the Company. He had served as the Company’s Executive Vice President, Chief Commercial Officer since October 2014. As the Chief Operating Officer, Mr. Scozzafava oversees our Commercial, Operations, Procurement and Logistics functions.

Dean Foods Company Senior Notes due 2023 — On February 25, 2015, we issued $700 million in aggregate principal amount of 6.50% senior notes due 2023 (the “2023 Notes”) at an issue price of 100% of the principal amount of the 2023 Notes in a private placement for resale to “qualified institutional buyers” as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and in offshore transactions pursuant to Regulation S under the Securities Act. We used the net proceeds from the 2023 Notes to redeem all of our outstanding senior unsecured notes due 2016, as described below, and to repay a portion of the outstanding borrowings under our prior senior secured revolving credit facility and receivables-backed facility. See Note 9 to our Consolidated Financial Statements.

Senior Secured Revolving Credit Facility — In March 2015, we executed a new credit agreement (the "Credit Agreement") pursuant to which the lenders provided us with a five-year revolving credit facility in the amount of up to $450 million (the “Credit Facility”). Under the Credit Agreement, we have the right to request an increase of the aggregate commitments under the Credit Facility by up to $200 million without the consent of any lenders not participating in such increase, subject to specified conditions. The Credit Facility is available for the issuance of up to $75 million of letters of credit and up to $100 million of swing line loans. The Credit Facility will terminate in March 2020. See Note 9 to our Consolidated Financial Statements.

Dean Foods Receivables-Backed Facility — We have a $550 million receivables securitization facility pursuant to which certain of our subsidiaries sell their accounts receivable to two wholly-owned entities intended to be bankruptcy-remote. The entities then transfer the receivables to third-party asset-backed commercial paper conduits sponsored by major financial institutions. The assets and liabilities of these two entities are fully reflected in our Consolidated Balance Sheets, and the securitization is treated as a borrowing for accounting purposes. In March 2015, the receivables-backed facility was modified to, among other things, extend the liquidity termination date from June 2017 to March 2018 and modify the consolidated and senior secured net leverage ratio requirements to be consistent with those contained in the Credit Agreement described above. See Note 9 to our Consolidated Financial Statements.

Dean Foods Company Senior Notes due 2016 — In March 2015, we redeemed the remaining $476.2 million principal amount of our outstanding senior notes due 2016 for a total redemption price of approximately $521.8 million. As a result, we recorded a $38.3 million pre-tax loss on early retirement of long-term debt in the first quarter of 2015, which consisted of debt redemption premiums and unpaid interest of $37.3 million, a write-off of unamortized long-term debt issue costs of $0.8 million and a write-off of the remaining bond discount and interest rate swaps of approximately $0.2 million. See Note 9 to our Consolidated Financial Statements.

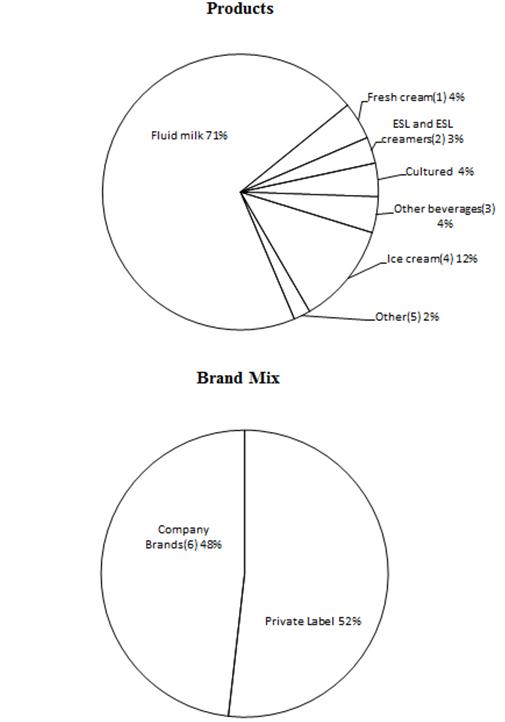

Overview

We manufacture, market and distribute a wide variety of branded and private label dairy and dairy case products, including milk, ice cream, cultured dairy products, creamers, juices and teas to retailers, foodservice outlets, distributors, educational institutions and governmental entities across the United States. Our consolidated net sales totaled $8.1 billion in 2015. The following charts depict our 2015 net sales by product and product sales mix between company branded versus private label.

| |

(1) | Includes half-and-half and whipping cream. |

| |

(2) | Includes creamers and other extended shelf-life fluids. |

| |

(3) | Includes fruit juice, fruit flavored drinks, iced tea and water. |

| |

(4) | Includes ice cream, ice cream mix and ice cream novelties. |

| |

(5) | Includes items for resale such as cream, butter, cheese, eggs and milkshakes. |

| |

(6) | Includes all national, regional and local brands. |

We sell our products under national, regional and local proprietary or licensed brands. Products not sold under these brands are sold under a variety of private labels. We sell our products primarily on a local or regional basis through our local and regional sales forces, although some national customer relationships are coordinated by a centralized corporate sales department. Our largest customer is Wal-Mart Stores, Inc., including its subsidiaries such as Sam’s Club, which accounted for approximately 16% of our net sales for the year ended December 31, 2015.

Our brands include DairyPure®, our national fresh white milk brand, and TruMoo®, the leading national flavored milk brand. As of December 31, 2015, our national, local and regional proprietary and licensed brands included the following:

|

| | |

Alta Dena® | Jilbert™ | Pog® (licensed brand) |

Arctic Splash® | Knudsen® (licensed brand) | Price’s™ |

Barbers Dairy® | LAND O LAKES® (licensed brand) | Purity™ |

Barbe’s® | Land-O-Sun & design® | ReadyLeaf® |

Berkeley Farms® | Lehigh Valley Dairy Farms® | Reiter™ |

Broughton™ | Louis Trauth Dairy Inc.® | Robinson™ |

Brown Cow® | Mayfield® | Saunders™ |

Brown’s Dairy® | McArthur® | Schepps® |

Chug® | Meadow Brook® | Shenandoah’s Pride® |

Country Fresh® | Meadow Gold® | Stroh’s® |

Country Love® | Mile High Ice Cream™ | Swiss Dairy™ |

Creamland™ | Model Dairy® | Swiss Premium™ |

Dairy Ease® | Morning Glory® | TruMoo® |

DairyPure® | Nature’s Pride® | T.G. Lee® |

Dean’s® | Nurture® | Tuscan® |

Fieldcrest® | Nutty Buddy® | Turtle Tracks® |

Fruit Rush® | Oak Farms® | Verifine® |

Gandy’s™ | Orchard Pure® | Viva® |

Garelick Farms® | Over the Moon® | |

Hygeia® | PET® (licensed brand) | |

We currently operate 67 manufacturing facilities in 32 states located largely based on customer needs and other market factors, with distribution capabilities across all 50 states. For more information about our facilities, see “Item 2. Properties.” Due to the perishable nature of our products, we deliver the majority of our products directly to our customers’ locations in refrigerated trucks or trailers that we own or lease. This form of delivery is called a “direct-to-store delivery” or “DSD” system. We believe that we have one of the most extensive refrigerated DSD systems in the United States.

The primary raw material used in our products is conventional milk (which contains both raw milk and butterfat) that we purchase primarily from farmers’ cooperatives, as well as from independent farmers. The federal government and certain state governments set minimum prices for raw milk and butterfat on a monthly basis. Another significant raw material we use is resin, which is a fossil fuel-based product used to make plastic bottles. The price of resin fluctuates based on changes in crude oil and natural gas prices. Other raw materials and commodities used by us include diesel fuel, used to operate our extensive DSD system, and juice concentrates and sweeteners used in our products. We generally increase or decrease the prices of our fluid dairy products on a monthly basis in correlation with fluctuations in the costs of raw materials, packaging supplies and delivery costs. However, we continue to balance our product pricing with the execution of our strategy to improve net price realization and, in some cases, we are subject to the terms of sales agreements with respect to the means and/or timing of price increases.

We have several competitors in each of our major product and geographic markets. Competition between dairy processors for shelf-space with retailers is based primarily on price, service, quality and the expected or historical sales performance of the product compared to its competitors’ products. In some cases we pay fees to customers for shelf-space. Competition for consumer sales is based on a variety of factors such as brand recognition, price, taste preference and quality. Dairy products also compete with many other beverages and nutritional products for consumer sales.

The fluid milk category enjoys a number of attractive attributes. This category’s size and pervasiveness, plus the limited shelf life of the product, make it an important category for retailers and consumers, as well as a large long-term opportunity for

the best positioned dairy processors. However, the dairy industry is not without some well documented challenges. It is a mature industry that has traditionally been characterized by slow to flat growth and low profit margins. According to the U.S. Department of Agriculture ("USDA"), per capita consumption of fluid milk continues to decline.

For more information on factors that could impact our business, see “— Government Regulation — Milk Industry Regulation” and “Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties — Prices of Conventional Raw Milk and Other Inputs.” See Note 19 to our Consolidated Financial Statements for segment, geographic and customer information.

Current Business Strategy

Dean Foods has evolved over the past 20 years through periods of rapid acquisition, consolidation, integration and, most recently, the separation of our operations following the spin-off of The WhiteWave Foods Company ("WhiteWave") and sale of Morningstar Foods ("Morningstar") in 2013. Today, we are a leading food and beverage company and the largest processor and direct-to-store distributor of fresh fluid milk and other dairy and dairy case products in the United States.

Our vision is to be the most admired and trusted provider of wholesome, great-tasting dairy products at every occasion. Our strategy is to invest and grow our portfolio of brands while strengthening our operations and capabilities to achieve a more profitable core business. Our strategy is anchored by the following five pillars and is underscored by our commitments to safety, quality and service, and delivering sustainable profit growth and total shareholder return:

Enhance Future Capabilities:

| |

• | Foster an engaged and aligned organization that has a consumer mindset. |

| |

• | Improve processes and technology to enable cross-functional decision-making that creates opportunities to build our business. |

Drive Operational Excellence:

| |

• | Increase plant and transportation efficiencies, simplify our portfolio and standardize processes. |

| |

• | Optimize our network for efficiency and flexibility to deliver new products and routes to market. |

Transform Go To Market:

| |

• | Expand our reach and ability to meet evolving consumer needs. |

| |

• | More profitably serve customers through new delivery and production capabilities. |

| |

• | Drive efficiency through standardized business principles and customer collaboration. |

Strengthen Private Label Business:

| |

• | Enhance our profitability by lowering our internal costs, partnering with our customers and driving standard practices across our business. |

| |

• | Enhance our profitability by strategically targeting key customers and channels. |

Build and Buy Strong Brands:

| |

• | Build our existing brands with consumer-led innovation, marketing, and logistical excellence. |

| |

• | Evaluate and consider strategic opportunities. |

Corporate Responsibility

Within our business strategies, a sense of corporate responsibility remains an integral part of our efforts. As we work to strengthen our business, we are committed to do it in a way that is right for our employees, shareholders, consumers, customers, suppliers and the environment. We intend to realize savings by reducing waste and duplication while we continue to support programs that improve our local communities. We believe that our customers, consumers and suppliers value our efforts to operate in an ethical, environmentally sustainable, and socially responsible manner.

Seasonality

Our business is affected by seasonal changes in the demand for dairy products. Sales volumes are typically higher in the fourth quarter due to increased dairy consumption during seasonal holidays. Fluid milk volumes tend to decrease in the second and third quarters of the year primarily due to the reduction in dairy consumption associated with our school customers, partially offset by the increase in ice cream and ice cream mix consumption during the summer months. Because certain of our operating expenses are fixed, fluctuations in volumes and revenue from quarter to quarter may have a material effect on operating income for the respective quarters.

Intellectual Property

We are continually developing new technology and enhancing existing proprietary technology related to our dairy operations. Six U.S. and four international patents have been issued to us and three U.S. and four international patent applications are pending or published. Our U.S. patents are expected to expire at various dates between February 2019 and May 2029. If the pending U.S. patent applications are granted, those patents would be expected to expire at various dates between June 2035 and December 2035. Our international patents are expected to expire at various dates between February 2028 and March 2030. If the pending international patent applications are granted, those patents would be expected to expire in March 2030.

We primarily rely on a combination of trademarks, copyrights, trade secrets, confidentiality procedures and contractual provisions to protect our technology and other intellectual property rights. Despite these protections, it may be possible for unauthorized parties to copy, obtain or use certain portions of our proprietary technology or trademarks.

Research and Development

Our total research and development ("R&D") expense was $2.3 million, $1.9 million and $1.8 million for 2015, 2014 and 2013, respectively. Our R&D activities primarily consist of generating and testing new product concepts, new flavors of products and packaging.

Employees

As of December 31, 2015, we had 16,960 employees. Approximately 38% of our employees participate in a multitude of collective bargaining agreements of varying duration and terms.

Government Regulation

Food-Related Regulations

As a manufacturer and distributor of food products, we are subject to a number of food-related regulations, including the Federal Food, Drug and Cosmetic Act and regulations promulgated thereunder by the U.S. Food and Drug Administration (“FDA”). This comprehensive regulatory framework governs the manufacture (including composition and ingredients), labeling, packaging and safety of food in the United States. The FDA:

| |

• | regulates manufacturing practices for foods through its current good manufacturing practices regulations; |

| |

• | specifies the standards of identity for certain foods, including many of the products we sell; and |

| |

• | prescribes the format and content of certain information required to appear on food product labels. |

We are also subject to the Food Safety Modernization Act of 2011, which, among other things, mandates the FDA to adopt preventative controls to be implemented by food facilities in order to minimize or prevent hazards to food safety. In addition, the FDA enforces the Public Health Service Act and regulations issued thereunder, which authorizes regulatory activity necessary to prevent the introduction, transmission or spread of communicable diseases. These regulations require, for example, pasteurization of milk and milk products. We are subject to numerous other federal, state and local regulations involving such matters as the licensing and registration of manufacturing facilities, enforcement by government health agencies of standards for our products, inspection of our facilities and regulation of our trade practices in connection with the sale of food products.

We use quality control laboratories in our manufacturing facilities to test raw ingredients. In addition, all of our facilities have achieved Safety Quality Food Level 3. Product quality and freshness are essential to the successful distribution of our products. To monitor product quality at our facilities, we maintain quality control programs to test products during various processing stages. We believe our facilities and manufacturing practices are in material compliance with all government regulations applicable to our business.

Employee Safety Regulations

We are subject to certain safety regulations, including regulations issued pursuant to the U.S. Occupational Safety and Health Act. These regulations require us to comply with certain manufacturing safety standards to protect our employees from accidents. We believe that we are in material compliance with all employee safety regulations applicable to our business.

Environmental Regulations

We are subject to various state and federal environmental laws, regulations and directives, including the Food Quality Protection Act of 1996, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Federal Insecticide, Fungicide and Rodenticide Act and the Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended. Our plants use a number of chemicals that are considered to be “extremely” hazardous substances pursuant to applicable environmental laws due to their toxicity, including ammonia, which is used extensively in our operations as a refrigerant. Such chemicals must be handled in accordance with such environmental laws. Also, on occasion, certain of our facilities discharge biodegradable wastewater into municipal waste treatment facilities in excess of levels allowed under local regulations. As a result, certain of our facilities are required to pay wastewater surcharges or to construct wastewater pretreatment facilities. To date, such wastewater surcharges have not had a material effect on our financial condition or results of operations.

We maintain above-ground and under-ground petroleum storage tanks at many of our facilities. We periodically inspect these tanks to determine whether they are in compliance with applicable regulations and, as a result of such inspections, we are required to make expenditures from time to time to ensure that these tanks remain in compliance. In addition, upon removal of the tanks, we are sometimes required to make expenditures to restore the site in accordance with applicable environmental laws. To date, such expenditures have not had a material effect on our financial condition or results of operations.

We believe that we are in material compliance with the environmental regulations applicable to our business. We do not expect the cost of our continued compliance to have a material impact on our capital expenditures, earnings, cash flows or competitive position in the foreseeable future. In addition, any asset retirement obligations are not material.

Milk Industry Regulation

The federal government establishes minimum prices that we must pay to producers in federally regulated areas for raw milk. Raw milk primarily contains raw skim milk in addition to a small percentage of butterfat. Raw milk delivered to our facilities is tested to determine the percentage of butterfat and other milk components, and we pay our suppliers for the raw milk based on the results of these tests.

The federal government’s minimum prices for Class I milk vary depending on the processor’s geographic location or sales area and the type of product manufactured. Federal minimum prices change monthly. Class I butterfat and raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class I products such as fluid milk) and Class II raw skim milk prices (which are the minimum prices we are required to pay for raw milk that is processed into Class II products such as cottage cheese, creams, creamers, ice cream and sour cream) for each month are announced by the federal government the immediately preceding month. Class II butterfat prices are announced either at the end of the month or the first week of the following month in which the price is effective. Some states have established their own rules for determining minimum prices for raw milk. In addition to the federal or state minimum prices, we also may pay producer premiums, procurement costs and other related charges that vary by location and supplier.

Labeling Regulations

We are subject to various labeling requirements with respect to our products at the federal, state and local levels. At the federal level, the FDA has authority to review product labeling, and the U.S. Federal Trade Commission (“FTC”) may review labeling and advertising materials, including online and television advertisements, to determine if advertising materials are misleading. Similarly, many states review dairy product labels to determine whether they comply with applicable state laws. We believe we are in material compliance with all labeling laws and regulations applicable to our business.

We are also subject to various state and local consumer protection laws.

Where You Can Get More Information

Our fiscal year ends on December 31. We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission.

You may read and copy any reports, statements or other information that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. You can request copies of these documents, upon payment of a duplicating fee, by writing to the Securities and Exchange Commission. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

We file our reports with the Securities and Exchange Commission electronically through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. The Securities and Exchange Commission maintains an Internet site that contains reports, proxy and information statements and other information regarding companies that file electronically with the Securities and Exchange Commission through EDGAR. The address of this Internet site is http://www.sec.gov.

We also make available free of charge through our website at www.deanfoods.com our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating such information by reference into, this Form 10-K.

Our Code of Ethics is applicable to all of our employees and directors. Our Code of Ethics is available on our corporate website at www.deanfoods.com, together with the Corporate Governance Principles of our Board of Directors and the charters of the Audit, Compensation and Nominating/Corporate Governance Committees of our Board of Directors. Any waivers that we may grant to our executive officers or directors under the Code of Ethics, and any amendments to our Code of Ethics, will be posted on our corporate website. If you would like hard copies of any of these documents, or of any of our filings with the Securities and Exchange Commission, write or call us at:

Dean Foods Company

2711 North Haskell Avenue, Suite 3400

Dallas, Texas 75204

(214) 303-3400

Attention: Investor Relations

Business, Competitive and Strategic Risks

Our results of operations and financial condition depend heavily on commodity prices and the availability of raw materials and other inputs. Our failure or inability to respond to high or fluctuating input prices could adversely affect our profitability.

Our results of operations and financial condition depend heavily on the cost and supply of raw materials and other inputs including conventional raw milk, butterfat, cream and other dairy commodities, many of which are determined by constantly changing market forces of supply and demand over which we have limited or no control. Cost increases in raw materials and other inputs could cause our profitability to decrease significantly compared to prior periods, as we may be unwilling or unable to increase our prices or unable to achieve cost savings to offset the increased cost of these raw materials and other inputs.

Although we generally pass through the cost of dairy commodities to our customers, we believe demand destruction can occur at certain price levels, and we may be unwilling or unable to pass through the cost of dairy commodities, which could materially and adversely affect our profitability. Dairy commodity prices can be affected by adverse weather conditions (including the impact of climate change) and natural disasters, such as floods, droughts, frost, fires, earthquakes and pestilence, which can lower crop and dairy yields and reduce supplies of these ingredients or increase their prices.

Our profitability also depends on the cost and supply of non-dairy raw materials and other inputs, such as sweeteners, petroleum-based products, diesel fuel, resin and other non-dairy food ingredients.

Our dairy and non-dairy raw materials are generally sourced from third parties, and we are not assured of continued supply, pricing or sufficient access to raw materials from any of these suppliers. Distribution or damage to our suppliers manufacturing, transportation or distribution capabilities could impair our ability to make transport, distribute or sell our products. Other events that adversely affect our suppliers and that are out of our control could also impair our ability to obtain the raw materials and other inputs that we need in the quantities and at the prices that we desire. Such events include adverse weather conditions (including climate change) or natural disasters, government action, or problems with our suppliers’ businesses, finances, labor relations, costs, production, insurance, reputation and international demand and supply characteristics.

If we are unable to obtain raw materials and other inputs for our products or offset any increased costs for such raw materials and inputs, our business could be negatively affected. While we may enter into forward purchase contracts and other purchase arrangements with suppliers and may purchase over-the-counter contracts with our qualified banking partners or exchange-traded commodity futures contracts for raw materials, these arrangements do not eliminate the risk of negative impacts on our business, financial condition and results of operations from commodity price changes.

We may not realize anticipated benefits from our accelerated cost reduction efforts.

We have implemented a number of cost reduction initiatives that we believe are necessary to position our business for future success and growth. In order to mitigate continued volume softness in our business, we accelerated our cost reduction activities during 2013 and 2014. Between 2013 and 2015, we completed the closure of 13 plants as a part of our accelerated cost reduction initiative. Going forward, we expect to return to more historical levels of network optimization. Our future success and earnings growth depend upon our ability to realize the benefit of our cost reduction activities and rationalization plans. In addition, certain of our cost reduction activities have led to increased costs in other aspects of our business such as increased conversion or distribution costs. For example, in connection with our plant closures, our cost of distribution on a per gallon basis has increased as we have changed distribution routes and transported product into areas previously serviced by closed plants. If we fail to properly anticipate and mitigate the ancillary cost increases related to our plant closures, we may not realize the benefits of our cost reduction efforts. We must be efficient in executing our plans to achieve a lower cost structure and operate efficiently in the highly competitive food and beverage industry, particularly in an environment of increased competitive activity and reduced profitability. To capitalize on our cost reduction efforts, it will be necessary to carefully evaluate future investments in our business, and concentrate on those areas with the most potential return on investment. If we are unable to realize the anticipated benefits from our cost cutting efforts, we could be cost disadvantaged in the marketplace, and our competitiveness and our profitability could decrease.

Our business is predominantly in the United States fluid dairy industry and as such is susceptible to adverse events and trends in the fluid dairy industry and in the United States generally.

In January 2013, we completed the disposition of Morningstar, which at the time of the disposition was a leading manufacturer of dairy and non-dairy extended shelf-life and cultured products, including creams and creamers, ice cream mixes, whipping cream, aerosol whipped toppings, iced coffee, half and half, value-added milks, sour cream and cottage cheese. In May 2013, we effected the tax-free spin-off of WhiteWave, our former branded plant-based foods and beverages, coffee creamers and beverages, and premium dairy products business, which operated in the United States and Europe. In July 2013, we disposed of our remaining interest in WhiteWave. As part of a more diversified, international food and beverage company, we were partially insulated against adverse events and trends in particular product lines and regions. Following the dispositions of Morningstar and WhiteWave, however, our business is predominantly in the United States fluid dairy industry and as such, we are susceptible to adverse regulations, economic climate, consumer trends, market fluctuations and other adverse events that are specific to the dairy category and the United States.

The loss of, or a material reduction in sales volumes purchased by, any of our largest customers could negatively impact our sales and profits.

Wal-Mart Stores, Inc. and its subsidiaries, including Sam’s Club, accounted for approximately 16% of our consolidated net sales in both 2015 and 2014, and our top five customers, including Wal-Mart, collectively accounted for approximately 29% and 30% of our consolidated net sales in 2015 and 2014, respectively. In addition, we are indirectly exposed to the financial and business risks of our significant customers because, as their business declines, they may correspondingly decrease the volumes purchased from us. The loss of, or further declines in sales volumes purchased by, any of our largest customers could negatively impact our sales and profits, particularly due to our significant fixed costs and assets, which are difficult to rapidly reduce in response to significant volume declines.

Price concessions to large-format retailers have negatively impacted, and could continue to negatively impact, our operating margins and profitability.

Many of our customers, such as supermarkets, warehouse clubs and food distributors, have experienced industry consolidation in recent years and this consolidation is expected to continue. These consolidations have produced large, more sophisticated customers with increased buying power, and they have increased our dependence on key large-format retailers and discounters. In addition, some of these customers are vertically integrated and have re-dedicated key shelf-space currently occupied by our regionally branded products for their private label products. Additionally, higher levels of price competition and higher resistance to price increases have had a significant impact on our business. In the past, retailers have at times required price concessions that have negatively impacted our margins, and continued pressures to make such price concessions could negatively impact our profitability in the future. If we are not able to lower our cost structure adequately in response to customer pricing demands, and if we are not able to attract and retain a profitable customer mix and a profitable product mix, our profitability could continue to be adversely affected.

Volume softness in the dairy category has had a negative impact on our sales and profits.

Industry-wide volume softness across dairy product categories continued in 2015. In particular, the fluid milk category has experienced declining volumes over the past several years. Decreasing dairy category volume has increased the impact of declining margins on our business. Periods of declining volumes limit the cost and price increases that we can seek to recapture. We expect this trend to continue for the foreseeable future, which could further negatively affect our business. In addition, in recent years, we have experienced a decline in historical volumes from some of our largest customers, which has negatively impacted our sales and profitability and which will continue to have a negative impact in the future if we are not able to attract and retain a profitable customer and product mix.

Our sales and profits have been, and may continue to be, negatively impacted by the outcome of competitive bidding.

Many of our retail customers have become increasingly price sensitive, which has intensified the competitive environment in which we operate. As a result, we have been subject to a number of competitive bidding situations, both formal and informal, which have materially reduced our sales volumes and profitability on sales to several customers. We expect this trend of competitive bidding to continue. During 2013, as a result of a request for proposal, a significant customer transferred a material portion of its business to other suppliers, which resulted in a decline in our fluid milk volumes of approximately 7% during 2013. The loss of this volume had a negative effect on our sales and profits. In the event we experience a similar loss, we may have to replace the lost volume with lower margin business, which could also negatively impact our profitability. Additionally, this competitive environment may result in us serving an increasing number of small format customers, which may raise the costs of production and distribution, and negatively impact the profitability of our business. If we are unable to structure our business to appropriately respond to the pricing demands of our customers, we may lose customers to other processors that are willing to sell product at a lower cost, which could negatively impact our sales and profits.

If we fail to anticipate and respond to changes in consumer preferences, demand for our products could decline.

Consumer tastes, preferences and consumption habits evolve over time and are difficult to predict. Demand for our products depends on our ability to identify and offer products that appeal to these shifting preferences. Factors that may affect consumer tastes and preferences include:

| |

• | dietary trends and increased attention to nutritional values, such as the sugar, fat, protein or calorie content of different foods and beverages; |

| |

• | concerns regarding the health effects of specific ingredients and nutrients, such as dairy, sugar and other sweeteners, vitamins and minerals; |

| |

• | concerns regarding the public health consequences associated with obesity, particularly among young people; and |

| |

• | increasing awareness of the environmental and social effects of product production. |

If consumer demand for our products declines, our sales volumes and our business could be negatively affected.

We may incur liabilities or harm to our reputation, or be forced to recall products, as a result of real or perceived product quality or other product-related issues.

We sell products for human consumption, which involves a number of risks. Product contamination, spoilage, other adulteration, misbranding, mislabeling, or product tampering could require us to recall products. We also may be subject to liability if our products or operations violate applicable laws or regulations, including environmental, health and safety requirements, or in the event our products cause injury, illness or death. In addition, our product advertising could make us the target of claims relating to false or deceptive advertising under U.S. federal and state laws, including the consumer protection statutes of some states, or laws of other jurisdictions in which we operate. A significant product liability, consumer fraud or other legal judgment against us or a widespread product recall may negatively impact our sales, brands, reputation and profitability. Moreover, claims or liabilities of this sort might not be covered by insurance or by any rights of indemnity or contribution that we may have against others. Even if a product liability, consumer fraud or other claim is found to be without merit or is otherwise unsuccessful, the negative publicity surrounding such assertions regarding our products or processes could materially and adversely affect our reputation and brand image, particularly in categories that consumers believe as having strong health and wellness credentials. In addition, consumer preferences related to genetically modified foods, animal proteins, or the use of certain sweeteners could result in negative publicity and adversely affect our reputation. Any loss of consumer confidence in our product ingredients or in the safety and quality of our products would be difficult and costly to overcome.

Disruption of our supply or distribution chains or transportation systems could adversely affect our business.

Our ability to make, move and sell our products is critical to our success. Damage or disruption to our manufacturing or distribution capabilities due to weather (including the impact of climate change), natural disaster, fire, environmental incident, terrorism (including eco-terrorism and bio-terrorism), pandemic, strikes, the financial or operational instability of key suppliers, distributors, warehousing and transportation providers, or other reasons could impair our ability to manufacture or distribute our products. If we are unable, or it is not financially feasible, to mitigate the likelihood or potential impact of such events, our business and results of operations could be negatively affected and additional resources could be required to restore our supply chain. In addition, we are subject to federal motor carrier regulations, such as the Federal Motor Carrier Safety Act, with which our extensive DSD system must comply. Failure to comply with such regulations could result in our inability to deliver product to our customers in a timely manner, which could adversely affect our reputation and our results.

Failure to maintain sufficient internal production capacity or to enter into co-packing agreements on terms that are beneficial for us may result in our inability to meet customer demand and/or increase our operating costs.

The success of our business depends, in part, on maintaining a strong production platform and we rely on internal production resources and third-party co-packers to fulfill our manufacturing needs. As part of our ongoing cost reduction efforts, we have closed or announced the closure of a number our plants since late 2012. It is possible that we may need to increase our reliance on third parties to provide manufacturing and supply services, commonly referred to as “co-packing” agreements, for a number of our products. In particular, there is increasing consumer preference for certain sized extended shelf life (“ESL”) products in certain categories and, as a result of the Morningstar divestiture, we are contractually limited in our ability to manufacture ESL products. In such case, we must rely on our co-packers. A failure by our co-packers to comply with food safety, environmental, or other laws and regulations may disrupt our supply of products and cause damage to the reputation of our brand. If we need to enter into additional co-packing agreements in the future, we can provide no assurance that we would be able to find acceptable third-party providers or enter into agreements on satisfactory terms. Our inability to establish satisfactory co-packing arrangements could limit our ability to operate our business and could negatively affect our sales volumes and results of operations. If we cannot maintain sufficient production capacity, either internally or through third-party agreements, we may be unable to meet customer demand and/or our manufacturing costs may increase, which could negatively affect our business.

Our business operations could be disrupted and the liquidity and market price of our securities could decline if our information technology systems fail to perform adequately or experience a security breach.

We maintain a large database of confidential information and sensitive data in our information technology systems, including confidential employee, supplier and customer information, and accounting, financial and other data on which we rely for internal and external financial reporting and other purposes. The efficient operation of our business depends on our information technology systems. We rely on our information technology systems, including those of third parties, to effectively manage our business data, communications, supply chain, logistics, accounting and other business processes. If we do not allocate and effectively manage the resources necessary to build and sustain an appropriate technology environment, our business or financial results could be negatively impacted. In addition, our information technology systems and those of third

parties are vulnerable to damage or interruption from circumstances beyond our control, including systems failures, viruses, security breaches or cyber incidents such as intentional cyber attacks aimed at theft of sensitive data or inadvertent cyber-security compromises. A security breach of such information or failure of our information technology systems could result in damage to our reputation, negatively impact our relations with our customers or employees, and expose us to liability and litigation. Moreover, a security breach or failure of our information systems could also result in the alteration, corruption or loss of the accounting, financial or other data on which we rely for internal and external financial reporting and other purposes and, depending on the severity of the security breach or systems failure, could prevent the audit of our financial statements or our internal control over financial reporting from being completed on a timely basis or at all, or could negatively impact the resulting audit opinions. Any such damage or interruption, or alternation, corruption or loss, could have a material adverse effect on our business or could cause our securities to become less liquid and the market price of our securities to decline.

If we are unable to hire, retain and develop our leadership bench, or fail to develop and implement an adequate succession plan for current leadership positions, it could have a negative impact on our business.

Our continued and future success depends partly upon our ability to hire, retain and develop our leadership bench. Effective succession planning is also a key factor in our long-term success. Any unplanned turnover or failure to develop or implement an adequate succession plan to backfill key leadership positions could deplete our institutional knowledge base and erode our competitive advantage. Our failure to enable the effective transfer of knowledge or to facilitate smooth transitions with regard to key leadership positions could adversely affect our long-term strategic planning and execution and negatively affect our business, financial condition, results of operations.

Our ability to generate positive cash flow and profits will depend partly on our successful execution of our business strategy.

Our ability to generate positive cash flow and profits will depend partly on our successful execution of our business strategy. Our business strategy may require significant capital investment and management attention, which may result in the diversion of these resources from other business issues and opportunities. Additionally, the successful implementation of our current business strategy is subject to our ability to manage costs and expenses, our ability to develop new and innovative products, the success of continuing improvement initiatives, our ability to leverage processing and logistical efficiencies, our consumers’ demand for our brands and products, the effectiveness of our advertising and targeting of consumers and channels, the availability of favorable acquisition opportunities and our ability to attract and retain qualified management and other personnel. There can be no assurance that we will be able to successfully implement our business strategy. If we cannot successfully execute our business strategy, our business, financial condition and results of operations may be adversely impacted.

Our existing debt and other financial obligations may restrict our business operations and we may incur even more debt.

We have substantial debt and other financial obligations and significant unused borrowing capacity. We may incur additional debt in the future. In addition to our other financial obligations, on December 31, 2015, we had approximately $842.4 million in outstanding debt obligations and we had the ability to borrow up to a combined additional $821.7 million of combined future borrowing capacity under our senior secured revolving credit facility and receivables-backed facility.

We have pledged substantially all of our assets to secure our senior secured revolving credit facility. Our debt and related debt service obligations could:

| |

• | require us to dedicate significant cash flow to the payment of principal and interest on our debt, which reduces the funds we have available for other purposes, including for funding working capital, capital expenditures, and acquisitions and for other general corporate purposes; |

| |

• | may limit our flexibility in planning for or reacting to changes in our business and market conditions; |

| |

• | impose on us additional financial and operational restrictions, including restrictions on our ability to, among other things, incur additional indebtedness, create liens, guarantee obligations, undertake acquisitions or sales of assets, declare dividends and make other specified restricted payments, and make investments; |

| |

• | impose on us additional financial and operational restrictions, including restrictions on our ability to, among other things, incur additional indebtedness, create liens, guarantee obligations, undertake acquisitions or sales of assets, declare dividends and make other specified restricted payments, and make investments; |

| |

• | place us at a competitive disadvantage compared to businesses in our industry that have less debt or that are debt-free. |

To the extent that we incur additional indebtedness in the future, these limitations would likely have a greater impact on our business. Failure to make required payments on our debt or comply with the financial covenants or any other non-financial or restrictive covenants set forth in the agreements governing our debt could create a default and cause a downgrade to our credit rating. Upon a default, our lenders could accelerate the indebtedness, foreclose against their collateral or seek other remedies, which would jeopardize our ability to continue our current operations. In those circumstances, we may be required to amend the agreements governing out debt, refinance all or part of our existing debt, sell assets, incur additional indebtedness or raise equity. Our ability to make scheduled payments on our debt and other financial obligations and comply with financial covenants depends on our financial and operating performance, which in turn, is subject to various factors such as prevailing economic conditions and to financial, business and other factors, some of which are beyond our control. See “Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Current Debt Obligations” below for more information.

Risks Related to Our Common Stock

Our Board of Directors could change our dividend policy at any time.

In November 2013, our Board of Directors adopted a dividend policy under which we intend to pay quarterly cash dividends on our common stock. Under this policy, holders of our common stock will receive dividends when and as declared by our Board of Directors. Pursuant to this policy, we paid quarterly dividends of $0.07 per share ($0.28 per share annually) in 2014 and 2015. However, we are not required to pay dividends and our stockholders do not have contractual or other legal rights to receive them. Any determination to pay cash dividends on our common stock in the future may be affected by business conditions, our views on potential future capital requirements, the terms of our debt instruments, legal risks, changes in federal income tax law and challenges to our business model. Furthermore, our Board of Directors may decide at any time, in its discretion, not to pay a dividend, to decrease the amount of dividends or to change or revoke the dividend policy entirely. If we do not pay dividends, for whatever reason, shares of our common stock could become less liquid and the market price of our common stock could decline.

Our stock price is volatile and may decline regardless of our operating performance, and you could lose a significant part of your investment.

The market price of our common stock has historically been volatile and in the future may be influenced by many factors, some of which are beyond our control, including those described in this section and the following:

| |

• | changes in financial estimates by analysts or our inability to meet those financial estimates; |

| |

• | strategic actions by us or our competitors, such as acquisitions, restructurings, significant contracts, acquisitions, joint marketing relationships, joint ventures or capital commitments; |

| |

• | variations in our quarterly results of operations and those of our competitors; |

| |

• | general economic and stock market conditions; |

| |

• | changes in conditions or trends in our industry, geographies or customers; |

| |

• | activism by any large stockholder or group of stockholders; |

| |

• | perceptions of the investment opportunity associated with our common stock relative to other investment alternatives; |

| |

• | actual or anticipated growth rates relative to our competitors; and |

| |

• | speculation by the investment community regarding our business. |

In addition, the stock markets, including the New York Stock Exchange, have experienced price and volume fluctuations that have affected and continue to affect the market prices of equity securities issued by many companies, including companies in our industry. In the past, some companies that have had volatile market prices for their securities have been subject to class action or derivative lawsuits. The filing of a lawsuit against us, regardless of the outcome, could have a negative effect on our business, financial condition and results of operations, as it could result in substantial legal costs and a diversion of management’s attention and resources.

These market and industry factors may materially reduce the market price of our common stock, regardless of our operating performance. This volatility may increase the risk that our stockholders will suffer a loss on their investment or be unable to sell or otherwise liquidate their holdings of our common stock.

Capital Markets and General Economic Risks

Unfavorable economic conditions may adversely impact our business, financial condition and results of operations.

The dairy industry is sensitive to changes in international, national and local general economic conditions. Future economic decline or increased income disparity could have an adverse effect on consumer spending patterns. Increased levels of unemployment, increased consumer debt levels and other unfavorable economic factors could further adversely affect consumer demand for products we sell or distribute, which in turn could adversely affect our results of operations. Consumers may not return to historical spending patterns following any future reduction in consumer spending.

The costs of providing employee benefits have escalated, and liabilities under certain plans may be triggered due to our actions or the actions of others, which may adversely affect our profitability and liquidity.

We sponsor various defined benefit and defined contribution retirement plans, as well as contribute to various multiemployer plans on behalf of our employees. Changes in interest rates or in the market value of plan assets could affect the funded status of our pension plans. This could cause volatility in our benefits costs and increase future funding requirements of our plans. Pension and post-retirement costs also may be significantly affected by changes in key actuarial assumptions including anticipated rates of return on plan assets and the discount rates used in determining the projected benefit obligation and annual periodic pension costs. Recent changes in federal laws require plan sponsors to eliminate, over defined time periods, the underfunded status of plans that are subject to the Employee Retirement Income Security Act rules and regulations. Certain of our defined benefit retirement plans are less than fully funded. Facility closings may trigger cash payments or previously unrecognized obligations under our defined benefit retirement plans, and the costs of such liabilities may compromise our ability to close facilities or otherwise conduct cost reduction initiatives on time and within budget. A significant increase in future funding requirements could have a negative impact on our results of operations, financial condition and cash flows. In addition to potential changes in funding requirements, the costs of maintaining our pension plans are impacted by various factors including increases in healthcare costs and legislative changes such as the Patient Protection and Affordable Care Act and the Health Care Education Reconciliation Act of 2010.

Future funding requirements and related charges associated with multiemployer plans in which we participate could have a negative impact on our business.

In addition to our company-sponsored pension plans, we participate in certain multiemployer defined benefit pension plans that are administered by labor unions representing certain of our employees. We make periodic contributions to these multiemployer pension plans in accordance with the provisions of negotiated collective bargaining arrangements. Our required contributions to these plans could increase due to a number of factors, including the funded status of the plans and the level of our ongoing participation in these plans. In addition, through circumstances are entirely out of our control, the financial condition of other companies which participate in multiemployer plans may create financial obligations for us. In the event that we decide to withdraw from participation in one of these multiemployer plans, we could be required to make additional lump-sum contributions to the relevant plan. These withdrawal liabilities may be significant and could adversely affect our business and our financial results. Some of the plans in which we participate are reported to have significant underfunded liabilities, which could increase the amount of any potential withdrawal liability. Future funding requirements and related charges associated with multiemployer plans in which we participate could have a negative impact on our results of operations, financial condition and cash flows.

Changes in our credit ratings may have a negative impact on our future financing costs or the availability of capital.

Some of our debt is rated by Standard & Poor’s, Moody’s Investors Service and Fitch Ratings, and there are a number of factors beyond our control with respect to these ratings. Our credit ratings are currently considered to be below “investment grade.” Although the interest rate on our existing credit facilities is not affected by changes in our credit ratings, such ratings or any further rating downgrades may impair our ability to raise additional capital in the future on terms that are acceptable to us, if at all, may cause the value of our securities to decline and may have other negative implications with respect to our business. Ratings reflect only the views of the ratings agency issuing the rating, are not recommendations to buy, sell or hold our securities and may be subject to revision or withdrawal at any time by the ratings agency issuing the rating. Each rating should be evaluated independently of any other rating.

Legal and Regulatory Risks

Pending antitrust lawsuits may have a material adverse impact on our business.

We are the subject of two antitrust lawsuits, the outcomes of which we are unable to predict. Increased scrutiny of the dairy industry has resulted, and may continue to result, in litigation against us. Such lawsuits are expensive to defend, divert management’s attention and may result in significant judgments. In some cases, these awards would be trebled by statute and

successful plaintiffs might be entitled to an award of attorney’s fees. Depending on its size, such a judgment could materially and adversely affect our results of operations, cash flows and financial condition and impair our ability to continue operations. We may not be able to pay such judgment or to post a bond for an appeal, given our financial condition and our available cash resources. In addition, depending on its size, failure to pay such a judgment or failure to post an appeal bond could cause us to breach certain provisions of our credit facilities. In either of these circumstances, we may seek a waiver of or amendment to the terms of our credit facilities, but we may not be able to obtain such a waiver or amendment. Failure to obtain such a waiver or amendment would materially and adversely affect our results of operations, cash flows and financial condition and could impair our ability to continue operations.

Moreover, these actions could expose us to negative publicity, which might adversely affect our brands, reputation and/or customer preference for our products. In addition, merger and acquisition activities are subject to these antitrust and competition laws, which have impacted, and may continue to impact, our ability to pursue strategic transactions. For more detail regarding these matters, please see “Part I — Item 3. Legal Proceedings.”

Litigation or legal proceedings could expose us to significant liabilities and have a negative impact on our reputation.

We are party to various litigation claims and legal proceedings. We evaluate these litigation claims and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the amount of potential losses. Based on these assessments and estimates, we establish reserves and/or disclose the relevant litigation claims or legal proceedings, as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from our current assessments and estimates.

Labor disputes could adversely affect us.

As of December 31, 2015, approximately 38% of our employees participated in collective bargaining agreements. Our collective bargaining agreements are scheduled to expire at various times over the next 3 to 5 years. At any given time, we may face a number of union organizing drives. When we negotiate collective bargaining agreements or terms, we and the union may disagree on important issues which, in turn, could possibly lead to a strike, work slowdown or other job actions at one or more of our locations. In the event of a strike, work slowdown or other labor unrest, or if we are unable to negotiate labor contracts on reasonable terms, our ability to supply our products to customers could be impaired, which could result in reduced revenue and customer claims, and may distract our management from focusing on our business and strategic priorities. In addition, our ability to make short-term adjustments to control compensation and benefits costs or otherwise to adapt to changing business requirements may be limited by the terms of our collective bargaining agreements.

Our business is subject to various environmental and health and safety laws and regulations, which may increase our compliance costs or subject us to liabilities.

Our business operations are subject to numerous requirements in the United States relating to the protection of the environment and health and safety matters, including the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response and the Compensation and Liability Act of 1980, as amended, as well as similar state and local statutes and regulations in the United States. These laws and regulations govern, among other things, air emissions and the discharge of wastewater and other pollutants, the use of refrigerants, the handling and disposal of hazardous materials, and the cleanup of contamination in the environment. The costs of complying with these laws and regulations may be significant, particularly relating to wastewater and ammonia treatment which are capital intensive. Additionally, we could incur significant costs, including fines, penalties and other sanctions, cleanup costs and third-party claims for property damage or personal injury as a result of the failure to comply with, or liabilities under, environmental, health and safety requirements. New legislation, as well as current federal and other state regulatory initiatives relating to these environmental matters, could require us to replace equipment, install additional pollution controls, purchase various emission allowances or curtail operations. These costs could negatively affect our results of operations and financial condition.

Changes in laws, regulations and accounting standards could have an adverse effect on our financial results.

We are subject to federal, state and local governmental laws and regulations, including those promulgated by the FDA, the USDA, U.S. Department of the Treasury, Internal Revenue Service ("IRS"), Environmental Protection Agency ("EPA"), FTC, Department of Transportation, Department of Labor, the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and numerous related regulations promulgated by the Securities and Exchange Commission and the Financial Accounting Standards Board. Changes in federal, state or local laws, or the interpretations of such laws and regulations, may negatively impact our financial results or our ability to market our products. Any or all of these risks could adversely impact our financial results.

Violations of laws or regulations related to the food industry, as well as new laws or regulations or changes to existing laws or regulations related to the food industry, could adversely affect our business.

The food production and marketing industry is subject to a variety of federal, state and local laws and regulations, including food safety requirements related to the ingredients, manufacture, processing, packaging, storage, marketing, advertising, labeling quality and distribution of our products, as well as those related to worker health and workplace safety. Our activities are subject to extensive regulation. We are regulated by, among other federal and state authorities, the FDA, the EPA, the FTC, and the U.S. Departments of Agriculture, Commerce, Labor and Transportation. Legislation at the state and federal level that would require the labeling of products containing or derived from genetically engineered organisms and FDA proposals to redesign the Nutrition Facts label may negatively impact our business. Governmental regulations also affect taxes and levies, healthcare costs, energy usage, immigration and other labor issues, all of which may have a direct or indirect effect on our business or those of our customers or suppliers.

In addition, our volumes may be impacted by the level of government spending that supports grocery purchases because such amounts may impact the level of consumer spending on fluid dairy products. As a meaningful portion of Supplemental Nutrition Assistance Program (“SNAP”) benefits are spent in the dairy category, we are cautious about the impact that any change or reduction in these benefits could have on consumer spending in the dairy category. Any reduction or change in SNAP benefits or if other government spending programs, such as the Special Supplemental Nutrition Program for Women, Infants, and Children, are suspended or expire, then it could have an adverse impact upon our volumes and our results of operations.

In addition, the marketing and advertising of our products could make us the target of claims relating to alleged false or deceptive advertising under federal and state laws and regulations, and we may be subject to initiatives that limit or prohibit the marketing and advertising of our products to children. Changes in these laws or regulations or the introduction of new laws or regulations could increase our compliance costs, increase other costs of doing business for us, our customers or our suppliers, or restrict our actions, which could adversely affect our results of operations. In some cases, increased regulatory scrutiny could interrupt distribution of our products or force changes in our production processes or procedures (or force us to implement new processes or procedures). For example, the FDA continues to enact regulation pursuant to the Food Safety Modernization Act of 2011 which requires, among other things, that food facilities conduct contamination hazard analysis, implement risk-based preventive controls and develop track-and-trace capabilities, and there could be unforeseen issues, requirements and costs that arise as the FDA promulgates such regulations. Further, if we are found to be in violation of applicable laws and regulations in these areas, we could be subject to civil remedies, including fines, injunctions or recalls, as well as potential criminal sanctions, any of which could have a material adverse effect on our business.

Risks Related to the Tax-Free Separation of WhiteWave

The WhiteWave separation transactions could result in significant tax liability to us.

In 2013, we received a private letter ruling from the IRS to the effect that, subject to certain conditions, the WhiteWave spin-off and our subsequent disposition of our remaining interests in WhiteWave would be tax-free to us and our stockholders. In addition, we received an opinion from our outside tax advisors on certain items in connection with the WhiteWave transactions not addressed in the private letter ruling. This tax opinion, however, is not binding on the IRS, and we may not be able to rely on the IRS private letter ruling if the factual representations or assumptions in the ruling request are determined to be untrue or incomplete in any material respect. If the IRS were to determine that the WhiteWave spin-off and subsequent disposition of our remaining ownership interest in WhiteWave do not qualify for tax-free treatment, then we and our stockholders would be subject to tax in connection with such transactions. It is expected that the amount of any such taxes to us and our stockholders would be substantial.

| |

Item 1B. | Unresolved Staff Comments |

None.