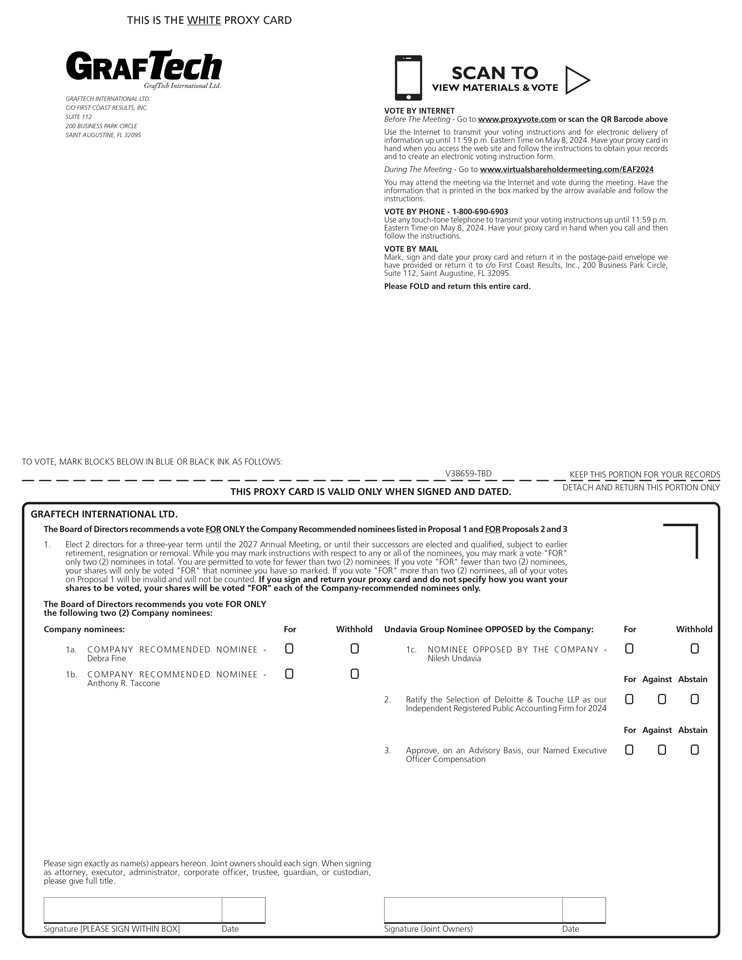

On February 2, 2024, the Company sent a letter to Mr. Undavia regarding outstanding deficiencies relating to his nomination of himself as a director candidate.

On February 2, 2024, Mr. Undavia notified the Company by letter that his nominees for director were Mr. Khoshaba and Ms. Petigny.

On February 5, 2024, Mr. Undavia sent a letter to the Company stating that he had withdrawn all of his submitted nominations other than the nominations of himself and Ms. Petigny, and supplementing his previously provided materials relating to those candidates.

On February 6, 2024, the Company sent a letter to Mr. Undavia requesting that he confirm which two nominees he was submitting for consideration, as his letter dated February 2, 2024 indicated that Mr. Khoshaba and Ms. Petigny were his nominees, while his letter dated February 5, 2024 stated that his nominees were Mr. Undavia and Ms. Petigny.

On February 6, 2024, Mr. Undavia sent a letter to the Company confirming that his two nominees for election to the Board were himself and Ms. Petigny.

On February 7, 2024, Mr. Undavia sent a letter to the Company stating that as of February 6, 2024, he beneficially owned 14,738,251 shares of the Company’s common stock and providing additional information required by the By-Laws relating to himself and Ms. Petigny.

On February 7, 2024, as part of its ordinary course process to consider and nominate candidates for election to the Board at the Annual Meeting, the Nominating and Corporate Governance Committee met to review the experience, skills, qualifications and other attributes of incumbent directors Ms. Fine and Mr. Taccone. Following discussion, the Nominating and Corporate Governance Committee recommended to the Board that the Board nominate and recommend Ms. Fine and Mr. Taccone for re-election at the Annual Meeting.

On February 8, 2024, the Company sent another letter to Mr. Undavia describing several deficiencies that remained outstanding relating to his nominations of Ms. Petigny and himself, including his failure to provide information that would be required to be set forth in a Schedule 13D if such a statement were required to be filed.

On February 8, 2024, the Board met at a regularly scheduled meeting to review the experience, skills, qualifications and other attributes of Ms. Fine and Mr. Taccone and the recommendation of the Nominating and Corporate Governance Committee relating to these candidates. Following discussion, the Board nominated and recommended Ms. Fine and Mr. Taccone for re-election at the Annual Meeting.

On February 9, 2024, Mr. Undavia and Ms. Petigny jointly sent a letter to the Company addressing the outstanding deficiencies in Mr. Undavia’s nominations, which included a copy of a pro forma Schedule 13D relating to Mr. Undavia’s ownership of the Company’s common stock.

On February 12, 2024, Mr. Undavia filed a Schedule 13D with the Securities and Exchange Commission (the “SEC”) that contained several pages of unreadable text.

On February 13, 2024, Mr. Undavia contacted Mr. Keizer stating that he had enjoyed his December 2023 conversation with Mr. Keizer and hoped that he would be invited to serve on the Board. On that same day, Mr. Keizer responded to Mr. Undavia, stating that he welcomes the opportunity to speak

|

|

|

|

|

|

GrafTech International Ltd. | 2024 Proxy Statement / 11 |