Use these links to rapidly review the document

Table of contents

As filed with the Securities and Exchange Commission on April 2, 2013

Registration No. 333-187323

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

LIN Television Corporation

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

4833 (Primary Standard Industrial Classification Number) |

13-3581627 (I.R.S. Employer Identification Number) |

Guarantors Listed on Schedule A Hereto

(Exact name of Registrant as Specified in its charter)

One West Exchange Street, Suite 5A Providence, Rhode Island 02903 (401) 454-2880 (Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices) |

Richard J. Schmaeling Senior Vice President and Chief Financial Officer LIN TV Corp. One West Exchange Street, Suite 5A Providence, Rhode Island 02903 (401) 454-2880 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

With a copy to:

William F. Schwitter, Esq.

Paul Hastings LLP

75 East 55th Street

New York, NY 10022

(212) 318-6000

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to Be Registered |

Amount to Be Registered |

Proposed Maximum Offering Price per Security |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

63/8% Senior Notes due 2021 |

$290,000,000 | 100% | $290,000,000(1) | $39,556(2) | ||||

Guarantees of 63/8% Senior Notes due 2021 |

N/A | N/A | N/A | (3) | ||||

|

||||||||

- (1)

- Estimated

solely for the purposes of calculating the registration fee in accordance with Rule 457(f)(2) under the Securities Act of 1933.

- (2)

- Calculated

based upon the book value of the securities to be received by the Registrant in the exchange in accordance with Rule 457(f)(2).

- (3)

- In accordance with Rule 457(n), no separate fee is payable with respect to the guarantees of the securities being registered.

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Exact Name of Co-Registrant Guarantor as Specified in Its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Number |

I.R.S. Employer Identification Number |

||||||

|---|---|---|---|---|---|---|---|---|---|

LIN TV Corp. |

Delaware | 4833 | 05-0501252 | ||||||

Indiana Broadcasting, LLC |

Delaware | 4833 | 05-0496718 | ||||||

KXAN, Inc. |

Delaware | 4833 | 13-2670260 | ||||||

KXTX Holdings, Inc. |

Delaware | 4833 | 05-0481599 | ||||||

LIN of Alabama, LLC |

Delaware | 4833 | 20-3347776 | ||||||

LIN of Colorado, LLC |

Delaware | 4833 | 20-3347854 | ||||||

LIN of New Mexico, LLC |

Delaware | 4833 | 20-3347886 | ||||||

LIN of Wisconsin, LLC |

Delaware | 4833 | 20-3347936 | ||||||

LIN Television of Texas, Inc. |

Delaware | 4833 | 05-0481602 | ||||||

LIN Television of Texas, L.P. |

Delaware | 4833 | 05-0481606 | ||||||

North Texas Broadcasting Corporation |

Delaware | 4833 | 13-2740621 | ||||||

Primeland, Inc. |

Delaware | 4833 | 37-1023233 | ||||||

TVL Broadcasting, Inc. |

Delaware | 4833 | 75-2676358 | ||||||

TVL Broadcasting of Rhode Island, LLC |

Delaware | 4833 | 52-2368799 | ||||||

WAVY Broadcasting, LLC |

Delaware | 4833 | 05-0496719 | ||||||

WDTN Broadcasting, LLC |

Delaware | 4833 | 52-2368795 | ||||||

WIVB Broadcasting, LLC |

Delaware | 4833 | 05-0496720 | ||||||

WOOD License Co., LLC |

Delaware | 4833 | 05-0496721 | ||||||

WOOD Television, Inc. |

Delaware | 4833 | 06-1506282 | ||||||

WTNH Broadcasting, Inc. |

Delaware | 4833 | 05-0481600 | ||||||

WUPW Broadcasting, LLC |

Delaware | 4833 | 52-2368784 | ||||||

LIN License Company, LLC |

Delaware | 4833 | 05-0615511 | ||||||

WWLP Broadcasting, LLC |

Delaware | 4833 | 52-7115298 | ||||||

LIN Mobile, LLC |

Delaware | 4833 | 46-1360248 | ||||||

- *

- Each Guarantor has the same principal executive office and agent for service as LIN Television Corporation.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission relating to these securities is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated April 2, 2013

PROSPECTUS

LIN Television Corporation

Offer to Exchange $290,000,000 63/8% Senior Notes due 2021

We are offering to exchange, on the terms and subject to the conditions described in this prospectus and the accompanying letter of transmittal, 63/8% Senior Notes due 2021 that we have registered under the Securities Act of 1933, as amended (the "Securities Act"), for all of our outstanding unregistered 63/8% Senior Notes due 2021. We refer to these registered notes as the "new notes" and all outstanding unregistered 63/8% Senior Notes due 2021 as the "old notes".

We are offering the new notes in order to satisfy our obligations under the registration rights agreement entered into in connection with the private placement of the old notes. In the exchange offer, we will exchange an equal principal amount of new notes that are freely tradable for all old notes that are validly tendered and not validly withdrawn. The exchange offer expires at 5:00 p.m., Eastern time, on , 2013, unless extended. You may withdraw tenders of outstanding old notes at any time prior to the expiration of the exchange offer. We will accept for exchange any and all old notes validly tendered and not withdrawn prior to the expiration of the exchange offer.

The exchange offer is subject to the conditions discussed under "The exchange offer—Conditions to the exchange offer," including, among other things, the effectiveness of the registration statement of which this prospectus forms a part.

The exchange of old notes for new notes in the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. We will not receive any proceeds from the exchange offer.

The old notes are, and the new notes will be, guaranteed by our parent, LIN TV Corp., and all of our direct and indirect 100% owned domestic restricted subsidiaries that are not immaterial subsidiaries. The old notes and related guarantees are, and the new notes and related guarantees will be, our and the guarantors' senior unsecured obligations, ranking equally in right of payment with our and the guarantors' existing and future senior indebtedness, including our 83/8% Senior Notes due 2018 (the "2018 Senior Notes") and indebtedness outstanding under our senior secured credit facility, and ranking senior to all of our and the guarantors' existing and future subordinated indebtedness. The new notes and related guarantees will be structurally subordinated to all of the liabilities and preferred stock of any of our subsidiaries that do not in the future guarantee the new notes.

The terms of the new notes are identical in all material respects to the terms of the old notes, except that the new notes are registered under the Securities Act and, therefore, the transfer restrictions applicable to the old notes will not apply to the new notes, except in limited circumstances, and the new notes will not have rights to additional interest or registration rights.

The new notes will not be listed on any national securities exchange. Currently, there is no public market for the old notes. As of the date of this prospectus, $290.0 million in aggregate principal amount of old notes are outstanding.

See "Risk factors" beginning on page 12 for a discussion of certain risks that you should consider in connection with an investment in the new notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the new notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013.

We are incorporating by reference into this prospectus important business and financial information that is not included in or delivered with this prospectus. In making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it.

We are offering to sell the new notes only in places where offers and sales are permitted.

You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

The information incorporated herein by reference is available without charge to holders upon written or oral request. Requests should be directed to LIN Television Corporation, One West Exchange Street, Suite 5A, Providence, Rhode Island 02903, Attention: Secretary; Telephone: (401) 454-2880. In order to ensure timely delivery of such documents, holders must request this information no later than five business days before the date they must make their investment decision. Accordingly, any request for documents should be made by , 2013 to ensure timely delivery of the documents prior to the expiration of the exchange offer.

i

Market and industry related data

Market and industry data and forecasts used in this prospectus are estimates and have been obtained from a combination of our own internal company surveys, independent industry publications and reports by professional organizations, including Nielsen Media Research, Inc. ("Nielsen"). Although we believe these third-party sources and the related estimates to be reliable, we have not independently verified the data obtained from these sources and these sources have neither reviewed nor approved the data included in this prospectus. Accordingly, we cannot assure you of the accuracy or completeness of the data.

Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward- looking statements in this prospectus.

Special note about forward-looking statements

This prospectus and the documents we incorporate by reference in this prospectus contain certain forward-looking statements with respect to our financial condition, results of operations and business. All of these forward-looking statements are based on estimates and assumptions made by our management, which, although we believe them to be reasonable, are inherently uncertain. Therefore, you should not place undue reliance upon such forward-looking statements. We cannot assure you that any of such statements will be realized and it is likely that actual results may differ materially from those contemplated by such forward-looking statements. Factors that may cause such differences include:

- •

- volatility and disruption of the capital and credit markets and further adverse changes in the national and local

economies in which our stations operate;

- •

- volatility and periodic changes in our advertising revenues;

- •

- restrictions on our operations due to, and the effect of, our significant indebtedness;

- •

- our ability to continue to comply with financial debt covenants dependent on cash flows;

- •

- effects of complying with accounting standards, including with respect to the treatment of our intangible assets;

- •

- inability or unavailability of additional debt or equity capital;

- •

- increased competition, including from newer forms of entertainment and entertainment media, or changes in the popularity

or availability of programming;

- •

- increased costs, including increased news and syndicated programming costs and increased capital expenditures as a result

of acquisitions or necessary technological enhancements;

- •

- effects of our control relationships, including the control that HM Capital Partners I LP ("HMC") and its

affiliates have with respect to corporate transactions and activities we undertake;

- •

- adverse state or federal legislation or regulation or adverse determinations by regulators, including adverse changes in,

or interpretations of, the exceptions to the Federal Communications Commission ("FCC") duopoly rule, retransmission consent rules and allocation of broadcast spectrum;

- •

- softening in the domestic advertising market;

- •

- further consolidation of national and local advertisers;

- •

- global or local events that could disrupt television broadcasting;

ii

- •

- risks associated with acquisitions, including integration, or failure to meet performance expectations, of acquired

businesses including the television stations and digital channels acquired from New Vision Television;

- •

- changes in television viewing patterns, ratings and commercial viewing measurement;

- •

- changes in our television network affiliation agreements;

- •

- changes in our retransmission consent agreements;

- •

- seasonality of the broadcast business due primarily to political advertising revenues in even years;

- •

- tax impact of the joint venture sale transaction; and

- •

- effects of the merger transaction pursuant to which LIN TV Corp. will be merged with and into a wholly-owned subsidiary, LIN Media LLC, including the potential impact to the value of our stock price leading up to and as a result of the merger and the potential adverse effect on our liquidity if the merger is not consummated.

Many of these factors are beyond our control. Forward-looking statements contained herein speak only as of the date hereof. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements, to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. For further information or other factors which could affect our financial results and such forward-looking statements, see "Risk factors."

This prospectus includes through incorporation by reference certain of the reports and other information that we have filed with the SEC. This means that we are disclosing important information to you by referring you to those documents. The information that we later file with the SEC is incorporated by reference herein and will automatically update and supersede this information. We incorporate by reference the documents listed below that we have filed with or furnished to the SEC (excluding any information furnished under Item 2.02 or Item 7.01 on any Current Report on Form 8-K):

- •

- LIN TV Corp.'s and our 2012 Annual Report on Form 10-K (the "2012 Form 10-K"), filed

with the SEC on March 15, 2013;

- •

- LIN TV Corp.'s definitive proxy statement on Schedule 14A, filed with the SEC on April 12, 2012; and

- •

- our Current Reports on Form 8-K, filed with the SEC on May 7, 2012, May 25, 2012, October 17, 2012, December 27, 2012, February 15, 2013 and March 14, 2013.

You may request a copy of any documents incorporated by reference herein at no cost by writing or telephoning us at:

LIN

Television Corporation

One West Exchange Street, Suite 5A

Providence, Rhode Island 02903

Attention: Secretary

Telephone: (401) 454-2880

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus. In order to ensure timely delivery of documents, holders must request this information no later than five business days before the date they must make their investment decision. Accordingly, any request for documents should be made by , 2013 to ensure timely delivery of the documents prior to the expiration of the exchange offer.

iii

The following summary may not contain all of the information that you should consider before investing in our notes and should be read in conjunction with the more detailed information, financial statements and related notes appearing elsewhere in or incorporated by reference in this prospectus. References in this prospectus to "LIN Television," the "Company," "we," "us" or "our" are to LIN Television Corporation and its consolidated subsidiaries, including, unless otherwise indicated or the context otherwise requires, after giving effect to the acquisition (the "Acquisition") of the assets of television stations in eight markets (the "Acquired Stations") from NVT Networks, LLC, NVT License Company, LLC and their respective subsidiaries (collectively, "New Vision Television" or "NVT"), but other than as specifically referred to or as described and reflected in certain consolidated financial data included in this prospectus, not giving effect to our agreement to provide certain services to five separately owned network-affiliates (together with the Acquired Stations, the "Acquired or Serviced Stations") pursuant to sharing arrangements with Vaughan Acquisition LLC ("Vaughan"), a third-party licensee (the "Vaughan Transaction"), and, unless the context indicates otherwise, do not refer to our parent company, LIN TV Corp. ("LIN TV").

Company overview

We are a local multimedia company that currently owns, operates or services 43 television stations and seven digital channels in 23 U.S. markets, along with a diverse portfolio of web sites, apps and mobile products that make it more convenient to access our unique and relevant content on multiple screens. Our highly-rated television stations deliver superior local news, community service, and popular sports and entertainment programming to viewers, reaching 10.5% of U.S. television homes. All of our television stations are affiliated with a national broadcast network and are primarily located in the top 75 Designated Market Areas ("DMAs") as measured by Nielsen. Our digital media division operates from 28 markets across the country, including New York City, Los Angeles, Chicago and Austin, and delivers measurable results to some of the nation's most respected agencies and companies.

LIN TV is a Delaware corporation incorporated on February 11, 1998. LIN Television, a 100% owned subsidiary of LIN TV, is a Delaware corporation and was incorporated on June 18, 1990. Our Company (including its predecessors) has owned and operated television stations since 1966. On May 3, 2002, LIN TV completed its initial public offering and its class A common stock began trading on the NYSE. Our corporate offices are at One West Exchange Street, Suite 5A, Providence, Rhode Island 02903, and our web site address is at http://www.linmedia.com. The information on our web site is not deemed to be part of this prospectus.

The Transactions

On May 4, 2012, we entered into a definitive agreement, as amended (the "Purchase Agreement") to acquire certain broadcast and other related assets for 13 network-affiliates (including 10 that are affiliated with ABC, CBS, FOX or NBC) owned by NVT in eight U.S. markets for $334.9 million, subject to post-closing adjustments, and the assumption of approximately $14.3 million of finance lease obligations. Pursuant to the terms of the acquisition agreement, we made a $33.5 million deposit into an escrow account using cash on hand, funded in part by $29.5 million of proceeds from the sales of WUPW-TV (a standalone FOX affiliate in Toledo, OH) and WWHO-TV (a standalone CW affiliate in Columbus, OH). This deposit was applied to the payment of the purchase price at closing. We funded the remaining purchase price of $301.4 million due at closing with the net proceeds of the old notes and with cash on hand.

Pursuant to sharing arrangements with Vaughan, we also agreed to provide certain services to five separately owned network-affiliates (the "Vaughan Acquired Stations" and together with the Acquired Stations, the "Acquired or Serviced Stations") which include three that are affiliated with ABC or FOX. The Vaughan Acquired Stations were previously owned by PBC Broadcasting, LLC ("PBC") and

1

operated by PBC with certain services from NVT. Under the services arrangements with Vaughan, we provide sales, administrative and technical services, supporting the business and operation of the Vaughan Acquired Stations in exchange for commissions and fees that provide us the benefit of certain returns from the business of the Vaughan Acquired Stations. Vaughan is considered a variable interest entity (a "VIE"), of which we are the primary beneficiary, and we consolidate the assets, liabilities, and results of operations of Vaughan and its consolidated subsidiaries.

The foregoing transactions are collectively referred to herein as the "Transactions".

Business of the Acquired or Serviced Stations

New Vision Television was a broadcast management company that maintained a broadcast group of eighteen network-affiliates and related television station web sites, which were located in the following markets: Portland, OR (DMA 22); Birmingham, AL (DMA 39); Wichita, KS (DMA 67); Honolulu, HI (DMA 71); Savannah, GA (DMA 92); Youngstown, OH (DMA 110); Topeka, KS (DMA 136); and Mason City, IA (DMA 153).

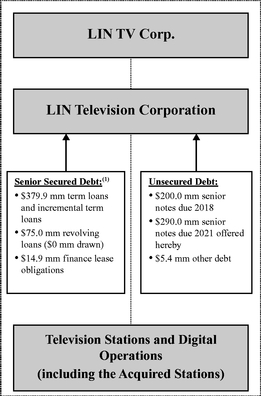

Corporate structure

The following chart provides an overview of our corporate structure as of December 31, 2012. As described below under "—Recent Developments," we recently announced the sale of our interest in the NBCUniversal joint venture and the termination of all of our obligations (funding or otherwise) related to such joint venture interest.

- (1)

- Senior Secured Debt does not include $60.0 million of tranche B-2 incremental term loans funded on February 12, 2013, and $5.0 million currently outstanding under our revolving credit facility which were incurred in connection with the JV Sale Transaction (as defined below).

2

Recent Developments

Joint Venture Sale Transaction

On February 12, 2013, we announced that we entered into, and simultaneously closed the transactions contemplated by a Transaction Agreement (the "Transaction Agreement"), by and among LIN TV, LIN Television, LIN Television of Texas, L.P., a Delaware limited partnership and indirect wholly owned subsidiary of ours ("LIN Texas" and together with LIN TV and LIN Television, the "LIN Parties"), NBC Telemundo License LLC, a Delaware limited liability company ("NBC"), NBCU New LLC I, a Delaware limited liability company, NBCU New LLC II, a Delaware limited liability company, General Electric Company, a New York corporation ("GE"), General Electric Capital Corporation, a Delaware corporation ("GECC" and together with GE, the "GE Parties"), National Broadcasting Company Holding, Inc., a Delaware corporation, Comcast Corporation, a Pennsylvania corporation ("Comcast"), NBCUniversal Media, LLC, a Delaware limited liability company ("NBCUniversal"), Lone Star SPV, LLC, a Delaware limited liability company and Station Venture Holdings, LLC, a Delaware limited liability company ("SVH"). The Transaction Agreement effected a series of transactions related to the ownership and sale of LIN Texas's 20.38% equity interest in SVH, a joint venture in which NBC, an affiliate of NBCUniversal, held the remaining 79.62% equity interest (collectively, the "JV Sale Transaction").

SVH is a limited partner in a business that operates an NBC affiliate in Dallas and an NBC affiliate in San Diego pursuant to a management agreement. At the time of LIN Texas's acquisition of its interest in SVH in 1998, GECC provided secured debt financing to SVH in the form of a $815.5 million non-amortizing senior secured note due 2023 to GECC (the "GECC Note"), and, in connection with SVH's assumption of the GECC Note, LIN TV guaranteed the payment of the full amount of principal and interest on the GECC Note (the "GECC Guarantee").

In addition, during 2009, 2010, 2011 and 2012, LIN Television entered into agreements with SVH, the GE Parties and NBCUniversal pursuant to which LIN Television, the GE Parties and NBCUniversal caused to be provided to SVH certain unsecured shortfall funding loans (the "Shortfall Funding Loans") on the basis of each party's percentage of equity interest in SVH in order to fund interest payments on the GECC Note.

Pursuant to the JV Sale Transaction, in exchange for LIN Television causing a $100 million capital contribution to be made to SVH (which was used to prepay a portion of the GECC Note), LIN TV was released from the GECC Guarantee and any further obligations related to any shortfall funding agreements. Further, LIN Texas sold its 20.38% equity interest in SVH to affiliates of NBCUniversal, and the LIN Parties transferred their rights to receivables related to the Shortfall Funding Loans for $1.00.

As a result of the JV Sale Transaction, neither we nor any of our direct or indirect subsidiaries have any further investment in or obligations (funding or otherwise) related to SVH, including, without limitation, to make any other unsecured shortfall loans or payments under the GECC Note or the GECC Guarantee. Although the JV Sale Transaction was completed on February 12, 2013, we accrued for and expensed the $100 million capital contribution to SVH and recorded the related tax effects of the JV Sale Transaction, which includes the recognition of a short-term deferred tax liability of approximately $163 million in our consolidated financial statements as of December 31, 2012. We accrued for the capital contribution as of December 31, 2012, because it was an obligation that was both probable and estimable as of the date we issued our consolidated financial statements for the year ended December 31, 2012.

3

Merger

On February 12, 2013, we also announced that LIN TV entered into an Agreement and Plan of Merger (the "Merger Agreement") with LIN Media LLC, a newly formed Delaware limited liability company and wholly owned subsidiary of LIN TV ("LIN LLC"). Pursuant to the Merger Agreement, LIN TV will be merged with and into LIN LLC with LIN LLC continuing as the surviving entity (the "Merger"). In the Merger, holders of shares of each class of common stock of LIN TV will receive on a one for one basis common shares representing a corresponding series of limited liability interests in LIN LLC. The Merger is expected to enable the surviving entity to be classified as a partnership for federal income tax purposes and such change in classification would be treated as a liquidation of LIN TV for federal income tax purposes with the result that LIN TV would recognize gain or loss, as applicable, in its 100% equity interest in LIN Television.

The Merger will be submitted to a vote of the holders of outstanding common stock of LIN TV. Proxies will be solicited by LIN TV's board of directors pursuant to the Securities Exchange Act of 1934, as amended (the "Exchange Act") in order for LIN TV's stockholders to consider approving the Merger at a special meeting of stockholders and a registration statement will be filed under the Securities Act of 1933, as amended (the "Securities Act"), with respect to the class A common shares representing limited liability company interests in LIN LLC. This is not a solicitation of a proxy from any security holder of LIN TV. Holders of LIN TV common stock are urged to read the proxy statement/prospectus, registration statement and any other relevant documents when they become available because they will contain important information about LIN TV, LIN LLC and the Merger, including its terms and anticipated effect and risks to be considered by LIN TV's stockholders in connection with the Merger. The proxy statement/prospectus and other documents relating to the Merger (when they are available) can be obtained free of charge from the SEC's web site at www.sec.gov. The documents (when they are available) can also be obtained free of charge from LIN TV on its web site (www.linmedia.com) or upon written request to LIN TV Corp., Attention: Secretary, One West Exchange Street, Suite 5A, Providence, Rhode Island 02903. Information on LIN TV's web site does not constitute a part of this registration statement.

We expect that LIN LLC's common shares will be listed on the NYSE.

Incremental Facility

On February 12, 2013, LIN Television and Deutsche Bank Trust Company Americas ("Deutsche Bank"), signed an Incremental Term Loan Activation Notice tranche B-2 Term Facility creating an incremental term loan facility (the "Incremental Facility") pursuant to the Company's existing credit agreement, dated as of October 26, 2011, as amended on December 19, 2011, as further amended on December 24, 2012, by and among LIN Television, JPMorgan Chase Bank, N.A. ("JP Morgan"), as Administrative Agent, and the banks and other financial institutions party thereto (the "Credit Agreement").

The Incremental Facility is a five-year, $60 million term loan facility and is subject to the terms of the Credit Agreement. The proceeds of the Incremental Facility, as well as cash on hand and cash from revolving borrowings under the Credit Agreement, were used to fund the $100 million transferred to SVH by LIN TV pursuant to the JV Sale Transaction as described above.

For additional information regarding the JV Sale Transaction, the Merger or the Incremental Facility, see "Risk factors—Risks associated with the JV Sale Transaction and Merger."

4

Background |

On October 12, 2012, we completed a private placement of our outstanding, unregistered old notes. In connection with that private placement, we entered into a registration rights agreement in which we agreed to deliver this prospectus to you and to make an exchange offer. | |

The exchange offer |

We are offering to exchange up to $290.0 million aggregate principal amount of our new notes, which have been registered under the Securities Act, for up to $290.0 million aggregate principal amount of our old notes, on the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, which we refer to as the "exchange offer." You may tender old notes only in denominations of $2,000 and integral multiples of $1,000 in excess thereof. The old notes we are offering to exchange hereby were issued under an indenture dated as of October 12, 2012. |

|

Resale of new notes |

Based on interpretations of the SEC staff in no-action letters issued to third parties, we believe that you may resell and transfer the new notes issued pursuant to the exchange offer in exchange for old notes without compliance with the registration and prospectus delivery provisions of the Securities Act, if: |

|

|

• you are

acquiring the new notes in the ordinary course of your business, •

you have no arrangement or understanding with any person to participate in the distribution of the new notes within the meaning of the Securities Act, • you are not an affiliate, as defined in Rule 405 under the Securities Act,

of ours, and • if you are not a

broker-dealer, you are not engaged in and do not intend to engage in the distribution of the new notes. |

5

Consequences if you do not exchange your old notes |

Old notes that are not tendered in the exchange offer or are not accepted for exchange will continue to bear legends restricting their transfer. You will not be able to offer or sell the old notes unless: |

|

|

• an exemption

from the registration requirements of the Securities Act is available to you, • we register the resale of old notes under the Securities Act, or • the transaction requires neither an exemption from nor registration under the requirements of the Securities Act. |

|

Expiration date |

5:00 p.m., Eastern time, on , 2013, unless we extend the exchange offer. |

|

Conditions to the exchange offer |

Our obligation to consummate the exchange offer is conditioned upon: |

|

|

• the

effectiveness of the registration statement of which this prospectus forms a part, • no stop order suspending the effectiveness of the registration statement having been issued, • no proceedings for that purpose

having been instituted or be pending or, to our knowledge, be contemplated or threatened by the SEC, and • other limited, customary conditions, which we may waive. For example, we are not obligated to complete the exchange offer if: |

|

|

• the

exchange offer, or the making of any exchange by a holder, violates, in our reasonable judgment, any applicable law, rule or regulation or any applicable interpretation of the staff of the SEC, • any action or proceeding shall have

been instituted or threatened with respect to the exchange offer which, in our reasonable judgment, would impair our ability to proceed with the exchange offer, or • we have not obtained any governmental approval which we, in our reasonable judgment, consider necessary for the completion of the exchange offer as contemplated by this prospectus. |

|

Procedures for tendering old notes |

If you wish to accept the exchange offer, you must deliver to the exchange agent: |

|

|

• either a completed and signed letter of transmittal or, for old notes tendered electronically, an agent's message from The Depository Trust Company ("DTC"), stating that the tendering participant agrees to be bound by the letter of transmittal and the terms of the exchange offer, |

6

|

• your old

notes, either by tendering them in certificated form or by timely confirmation of book-entry transfer through DTC, and • all other documents required by the letter of transmittal. • you will be acquiring the new notes in the ordinary course of your business, • you have no arrangement or understanding with any person to participate in the

distribution of the new notes within the meaning of the Securities Act, • you are not an affiliate, as defined in Rule 405 under the Securities Act, of ours, and • if you are not a broker-dealer, you

are not engaged in and do not intend to engage in the distribution of the new notes. |

|

Guaranteed delivery procedures for tendering old notes |

If you cannot tender your old notes by the expiration date or you cannot deliver your old notes, the letter of transmittal or any other documentation to comply with the applicable procedures under DTC standard operating procedures for electronic tenders in a timely fashion, you may tender your notes according to the guaranteed delivery procedures set forth under "The exchange offer—Guaranteed delivery procedures." |

|

Special procedures for beneficial holders |

If you beneficially own old notes which are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should contact that registered holder promptly and instruct that person to tender on your behalf. If you wish to tender your old notes in the exchange offer on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your old notes, either arrange to have the old notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

7

Withdrawal rights |

You may withdraw your tender of old notes at any time prior to 5:00 p.m., Eastern time, on the expiration date for the exchange offer. Any withdrawn old notes will be credited to the tendering holder's account at DTC or, if the withdrawn old notes are held in certificated form, will be returned to the tendering holder. We will accept for exchange any and all old notes validly tendered and not withdrawn prior to the expiration of the exchange offer. |

|

Appraisal rights |

You do not have any appraisal or dissenters' rights in connection with the exchange offer. |

|

Tax considerations |

The exchange of old notes for new notes pursuant to the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. See "Certain U.S. federal income tax considerations." |

|

Use of proceeds |

We will not receive any proceeds from the exchange or the issuance of new notes in connection with the exchange offer. |

|

Exchange agent |

The Bank of New York Mellon Trust Company, N.A. is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are set forth below under "The exchange offer—Exchange agent." |

The form and terms of the new notes are the same as the form and terms of the old notes, except that:

- •

- the new notes will be registered under the Securities Act and will therefore not bear legends restricting their transfer,

and

- •

- specified rights under the registration rights agreement, including the provisions providing for registration rights and the payment of additional interest in specified circumstances, will be limited or eliminated.

The new notes will evidence the same indebtedness as the old notes and will rank equally with the old notes. The same indenture will govern both the old notes and the new notes. We refer to the old notes and the new notes together in this prospectus as the "notes." Unless the context otherwise requires, when we refer to the old notes, we also refer to the guarantees associated with the old notes, and when we refer to the new notes, we also refer to the guarantees associated with the new notes.

8

The following is a brief summary description of the material terms of the new notes. For a more complete description of the terms of the new notes, see "Description of notes" below.

Issuer |

LIN Television Corporation, a Delaware corporation. | |

New notes offered |

Up to $290.0 million aggregate principal amount of 63/8% Senior Notes due 2021. The new notes we are offering hereby will be issued under an indenture dated as of October 12, 2012. |

|

Maturity |

January 15, 2021. |

|

Interest payment dates |

January 15 and July 15, commencing on January 15, 2013. Interest accrued through the expiration date of the exchange offer on old notes that are exchanged will be paid to holders of record of the new notes on the next regular payment date. |

|

Guarantees |

The new notes will be guaranteed, jointly and severally, on a senior unsecured basis, by our parent, LIN TV, and

our direct and indirect, existing and future domestic restricted subsidiaries that are not immaterial subsidiaries. The subsidiary guarantors and LIN TV also guarantee all of our obligations under our senior secured credit facility and our 2018

Senior Notes. As of the issue date for the new notes, all of our 100% owned direct and indirect subsidiaries will be guarantors of the new notes. |

|

Ranking |

The new notes will be unsecured and will rank senior in right of payment to any existing and future subordinated indebtedness will rank pari passu in right of payment with all of our existing and future senior indebtedness, including our senior secured credit facility and our existing 2018 Senior Notes, and will be structurally subordinated to all existing and future indebtedness and other liabilities of our non-guarantor subsidiaries (other than indebtedness and liabilities owed to us or one of our guarantor subsidiaries). The new notes will also be effectively subordinated to our senior secured indebtedness, including debt outstanding under our senior secured credit facility, to the extent of the value of our assets securing such indebtedness. |

9

|

As of December 31, 2012, the aggregate principal amount of our outstanding senior secured indebtedness was $394.8 million, which consisted of approximately $379.9 million outstanding under our senior secured credit facility (and had $75.0 million of revolving borrowing capacity under our senior secured credit facility) and $14.9 million of finance lease obligations, and the aggregate principal amount of our outstanding senior unsecured indebtedness consisted of $200.0 million aggregate principal amount outstanding under our 2018 Senior Notes, $290.0 million under the notes and $5.4 million of other debt. As of December 31, 2012, liabilities reflected on our consolidated balance sheet, including indebtedness and other liabilities such as trade payables and accrued expenses, were approximately $1,330 million, of which $12.1 million are comprised of liabilities of our non-guarantor subsidiaries. |

|

Optional redemption |

On or after January 15, 2017, we may redeem some or all of the new notes at any time at the redemption

prices specified under "Description of notes—Optional redemption" plus accrued and unpaid interest, if any, to the date of redemption. |

|

Change of control, asset sales |

Upon the occurrence of a change of control, we may be required to make an offer to repurchase the new notes at a price equal to 101% of the principal amount thereof, together with accrued and unpaid interest, if any, to the date of purchase. See "Description of notes—Change of control." |

|

|

If we sell assets under certain circumstances, we will be required to make an offer to purchase the new notes at their face amount, plus accrued and unpaid interest, if any, to the purchase date. See "Description of notes—Certain covenants—Limitation on asset sales." |

10

Certain covenants |

The indenture governing the new notes will restrict our ability and the ability of our restricted subsidiaries to, among other things: |

|

|

• incur

certain additional indebtedness and issue preferred stock; • make certain dividends, distributions, investments and other restricted payments; • sell certain assets; • agree to any restrictions on the ability of

restricted subsidiaries to make payments to us; • create certain liens; |

|

|

• merge,

consolidate or sell substantially all of our assets; and • enter into certain transactions with affiliates. |

|

No prior market |

The new notes will be new securities for which there is no market. The new notes will not be listed on any securities exchange or included in any automated quotation statement. No assurance can be given as to the liquidity of or trading market for the new notes. For more information, see "Risk factors—Risks related to the new notes—If an active trading market does not develop for the new notes, you may be unable to sell the new notes or to sell them at a price you deem sufficient." |

Prospective investors should carefully consider all of the information set forth, or incorporated by reference, in this prospectus and, in particular, should evaluate the specific factors set forth under "Risk factors" for risks involved with an investment in the new notes.

11

You should consider carefully the following risk factors, in addition to the other information included or incorporated by reference into this prospectus, in evaluating us, our business and your participation in the exchange offer, which could materially affect our business, financial condition or future results.

Risks related to the exchange offer

If you fail to exchange your old notes, they will continue to be restricted securities and may become less liquid.

Because we anticipate that most holders of old notes will elect to exchange their old notes, we expect that the liquidity of the market for any old notes remaining after the completion of the exchange offer may be substantially limited. Any old note tendered and exchanged in the exchange offer will reduce the aggregate principal amount of the old notes outstanding. Following the exchange offer, if you did not validly tender your old notes you generally will not have any further registration rights and your old notes will continue to be subject to transfer restrictions. Old notes which you do not tender or we do not accept will, following the exchange offer, continue to be restricted securities. You may not offer or sell any old notes you own following the exchange offer except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. Accordingly, the liquidity of the market for any old notes could be adversely affected.

You may not receive new notes in the exchange offer if the procedures for the exchange offer are not followed.

We will issue the new notes in exchange for your old notes only if you tender the old notes and deliver a properly completed and duly executed letter of transmittal and consent or the electronic transmittal through DTC's Automated Tender Offer Program, which binds holders of the old notes to the terms of the letter of transmittal and consent, and other required documents before expiration of the exchange offer. You should allow sufficient time to ensure timely delivery of the necessary documents. Neither the exchange agent nor we are under any duty to give notification of defects or irregularities with respect to the tenders of old notes for exchange. If you are the beneficial owner of old notes that are registered in the name of your broker, dealer, commercial bank, trust company or other nominee, and you wish to tender in the exchange offer, you should promptly contact the person in whose name your old notes are registered and instruct that person to tender on your behalf.

We may repurchase any old notes that are not tendered in the exchange offer on terms that are more favorable to the holders of the old notes than the terms of the exchange offer.

Although we do not currently intend to do so, we may, to the extent permitted by applicable law, purchase old notes in the open market, in privately negotiated transactions, through subsequent tender or exchange offers or otherwise. Any other purchases may be made on the same terms or on terms that are more or less favorable to holders than the terms of this exchange offer. We also reserve the right to repurchase any existing notes not tendered. If we decide to repurchase old notes on terms that are more favorable than the terms of the exchange offer, those holders who decide not to participate in the exchange offer could be better off than those that participated in the exchange offer.

Risks related to the new notes

We have a substantial amount of indebtedness which could adversely affect our financial position and prevent us from fulfilling our obligations under the new notes.

We currently have, and following this exchange offer will continue to have, a substantial amount of indebtedness. As of December 31, 2012, we had total debt of approximately $890.2 million reflected on our consolidated balance sheet, consisting of approximately $290.0 million of notes, $200.0 million

12

outstanding of our 2018 Senior Notes, $379.9 million of borrowings under our senior secured credit facility, $14.9 million of finance lease obligations, and $5.4 million of other debt, and we had $75.0 million of revolving borrowing capacity remaining under our senior secured credit facility. In addition, on February 12, 2013, in order to finance the JV Sale Transaction, we used a combination of cash on hand, $25.0 million of borrowings under our revolving credit facility and $60.0 million of borrowings under our new incremental term loan facility. As a result, giving effect to the JV Sale Transaction, we have total debt of approximately $975.2 million. Subject to the limitations in our senior secured credit facility and the indentures governing our 2018 Senior Notes and the notes, we may also incur significant additional indebtedness in the future. Our substantial indebtedness may:

- •

- make it difficult for us to satisfy our financial obligations, including making scheduled principal and interest payments

on the new notes and our other indebtedness;

- •

- limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions or other general

business purposes;

- •

- limit our ability to use our cash flow or obtain additional financing for future working capital, capital expenditures,

acquisitions or other general business purposes;

- •

- require us to use a substantial portion of our cash flow from operations to make debt service payments;

- •

- limit our flexibility to plan for, or react to, changes in our business and industry;

- •

- place us at a competitive disadvantage compared to our less leveraged competitors; and

- •

- increase our vulnerability to the impact of adverse economic and industry conditions.

Further, our borrowings under our senior secured credit facility are, and are expected to continue to be, at variable rates of interest and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income would decrease.

Despite our current level of indebtedness, we may still be able to incur substantial additional indebtedness in the future, which could increase the risks described above.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of our senior secured credit facility, the indenture governing our 2018 Senior Notes and the indenture governing the old notes limit, but do not prohibit, us or our subsidiaries from incurring additional indebtedness. If any such additional indebtedness is secured by our assets or the assets of the guarantors, the indebtedness evidenced by the new notes would be effectively subordinated to such secured indebtedness. See "—The new notes and the guarantees will be unsecured and effectively subordinated to our and the guarantors' existing and future secured indebtedness" below. If we incur any additional indebtedness that ranks equally with the new notes and the guarantees, the holders of that indebtedness will be entitled to share ratably with the holders of the new notes and the guarantees in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you in the event we are subject to any insolvency, bankruptcy or similar event. If new indebtedness is added to our current debt levels, the related risks that we and our subsidiaries now face could increase.

We may not be able to refinance all or a portion of our indebtedness or obtain additional financing on satisfactory terms.

The outstanding non-extended revolving credit loans, extended revolving credit loans, term loans and incremental term loans under our senior secured credit facility are due October 26, 2016, October 26, 2017, October 26, 2017 and December 21, 2018, respectively, and our outstanding 2018

13

Senior Notes are due on April 15, 2018. If we do not refinance, redeem or discharge our 2018 Senior Notes on or prior to January 15, 2018, then, in such event, the maturity of our incremental term loan facility will be accelerated from December 21, 2018 to January 15, 2018. While we expect to refinance, redeem, or discharge all of our outstanding 2018 Senior Notes prior to January 15, 2018, we can provide no assurances that this will occur. Our inability to refinance our 2018 Senior Notes prior to January 15, 2018, and the resulting acceleration of the incremental term loans would have a material adverse effect on our business, liquidity and results of operations.

The new notes and the guarantees will be unsecured and effectively subordinated to our and the guarantors' existing and future secured indebtedness.

The new notes and the guarantees will be general unsecured obligations ranking effectively junior in right of payment to all of our existing and future secured indebtedness and that of each guarantor, including indebtedness under our senior secured credit facility. Additionally, the indenture governing the new notes permits us to incur additional secured indebtedness in the future, subject to the limitations described under "Description of notes—Certain covenants—Limitation on incurrence of additional indebtedness and issuance of capital stock." In the event that we or a guarantor is declared bankrupt, becomes insolvent or is liquidated or reorganized, any indebtedness that is effectively senior to the new notes and the guarantees will be entitled to be paid in full from our assets or the assets of the guarantor, as applicable, securing such indebtedness before any payment may be made with respect to the new notes or the affected guarantees. Holders of the new notes will participate ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as the new notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets.

As of December 31, 2012, the new notes and the guarantees were effectively subordinated to $394.8 million of senior secured indebtedness, including $379.9 million under our senior secured credit facility and we had $75.0 million of revolving borrowing capacity under our senior secured credit facility, subject to compliance with financial covenants in the credit facility, all of which would have also been effectively senior to the notes and the guarantees. After giving effect to the borrowings of $60.0 million of tranche B-2 incremental term loans and $25.0 million of borrowings under our revolving credit facility on February 12, 2013 in connection with the JV Sale Transaction, the new notes and guarantees were effectively subordinated to $479.8 million of senior secured indebtedness, including $464.9 million under our senior secured credit facility and we had $50.0 million of revolving borrowing capacity under our senior secured credit facility.

Claims of noteholders will be structurally subordinate to claims of creditors of our subsidiaries that do not guarantee the new notes.

The new notes will be guaranteed by all of our 100% owned subsidiaries as of the issue date. The new notes will not be guaranteed, however, by our non-wholly owned subsidiaries and certain of our future subsidiaries that we designate as "unrestricted" in accordance with the terms of the indenture. Accordingly, claims of holders of the new notes will be structurally subordinated to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. Further, although all of our 100% owned direct and indirect domestic restricted subsidiaries that are not immaterial subsidiaries will guarantee the new notes, the guarantees are subject to release under certain circumstances and in the future we may have subsidiaries that are not guarantors. In the event of the liquidation, dissolution, reorganization, bankruptcy or similar proceeding of the business of a subsidiary that is not a guarantor, creditors of that subsidiary would generally have the right to be paid in full before any distribution is made to us, a guarantor or the holders of the new notes. In any of these events, we may not have sufficient assets to pay amounts due on the new notes with respect to the assets of that subsidiary. As

14

of December 31, 2012, approximately $5.5 million of our indebtedness was comprised of liabilities of our non-guarantor subsidiaries.

If an active trading market does not develop for the new notes, you may be unable to sell the new notes or to sell them at a price you deem sufficient.

The new notes will constitute a new issue of securities with no established trading market, and we do not intend to apply for the listing or quotation of the new notes on any securities exchange or trading market. Despite our registration of the issuance of the new notes that we are offering in the exchange offer:

- •

- a public market for the new notes may not develop,

- •

- any public market that does develop may not offer sufficient liquidity for you to sell your notes,

- •

- you may not otherwise be able to sell your notes, and

- •

- the price at which you may be able to sell your notes, if any, may be substantially less than the price you paid for the old notes, depending upon prevailing interest rates, the market for similar notes, our performance and other factors.

The initial purchasers of the old notes have advised us that they intend to make a market in the new notes, as permitted by applicable laws and regulations; however, the initial purchasers are not obligated to make a market in the notes, and they may discontinue their market-making activities at any time without notice. Therefore, an active market for the new notes may not develop or, if developed, such a market may not continue. The liquidity of any market for the new notes will depend on a number of factors, including:

- •

- the number of holders of new notes;

- •

- our operating performance and financial condition;

- •

- our ability to complete the offer to exchange the notes for the exchange notes;

- •

- the market for similar securities;

- •

- the interest of securities dealers in making a market in the new notes; and

- •

- prevailing interest rates.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of these securities. We cannot assure you that the market for the new notes will be free from similar disruptions. Any such disruptions could have an adverse effect on holders of the new notes.

Finally, if a large number of holders of the old notes do not tender their old notes or tender their old notes improperly, the limited amount of new notes that would be issued and outstanding after we complete the exchange offer could adversely affect the development of a market for the notes.

A subsidiary guarantee could be voided if it constitutes a fraudulent transfer under U.S. bankruptcy or similar state law, which would prevent the holders of the new notes from relying on that subsidiary to satisfy claims.

Under U.S. bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee can be voided, or claims under the guarantee may be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee or, in some states, when payments become due under the guarantee, received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee and:

- •

- was insolvent or rendered insolvent by reason of such incurrence;

15

- •

- was engaged in a business or transaction for which the guarantor's remaining assets constituted unreasonably small

capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature.

A guarantee may also be voided, without regard to these factors, if a court finds that the guarantor entered into the guarantee with the actual intent to hinder, delay or defraud its creditors. A court would likely find that a guarantor did not receive reasonably equivalent value or fair consideration for its guarantee if the guarantor did not substantially benefit directly or indirectly from the issuance of the guarantees. If a court were to void a guarantee, you would no longer have a claim against the guarantor, and in that case, sufficient funds to repay the notes may not be available from other sources, including the remaining guarantors, if any.

The measures of insolvency for purposes of fraudulent transfer laws vary depending upon the governing law. Generally, a guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, were greater than the fair saleable value of all its assets;

- •

- the present fair saleable value of its assets is less than the amount that would be required to pay its probable liability

on its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

Each subsidiary guarantee will contain a provision intended to limit the guarantor's liability to the maximum amount that it could incur without causing the incurrence of obligations under its subsidiary guarantee to be a fraudulent transfer. As was demonstrated in a recent bankruptcy case originating in the State of Florida which was affirmed by the Eleventh Circuit Court of Appeals on other grounds, this provision may not be effective to protect the subsidiary guarantees from being voided under fraudulent transfer laws.

Upon a change of control, we may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture governing the new notes, which would violate the terms of the new notes.

Upon the occurrence of a change of control, holders of the new notes and the 2018 Senior Notes will have the right to require us to purchase all or any part of the new notes and the 2018 Senior Notes at a price equal to 101% of the principal amount, plus accrued and unpaid interest, if any, to the date of purchase. While we expect refinancing of existing indebtedness would be negotiated as part of a change of control transaction, we may not have sufficient financial resources available to satisfy all of our obligations under the new notes and the 2018 Senior Notes in the event of a change in control. Further, we will be contractually restricted under the terms of our senior secured credit facility from repurchasing all of the new notes tendered upon a change of control. Accordingly, we may be unable to satisfy our obligations to purchase the new notes and the 2018 Senior Notes unless we are able to refinance or obtain waivers under our senior secured credit facility. Our failure to purchase the new notes and the 2018 Senior Notes as required under the indenture would result in an event of default under the indenture, the indenture governing our 2018 Senior Notes and under our senior secured credit facility, each of which could have material adverse consequences for us and the holders of the new notes. In addition, our senior secured credit facility provides that a change of control is an event of default that permits lenders to accelerate the maturity of borrowings under the facility, and any such acceleration may result in an event of default under the indenture. See "Description of notes—Change of control."

16

Covenants in our debt agreements restrict our business in many ways.

The indenture that will govern the new notes, the indenture governing our outstanding 2018 Senior Notes and our senior secured credit facility contain various covenants that limit our ability and/or our restricted subsidiaries' ability to, among other things:

- •

- incur or assume liens or additional debt or provide guarantees in respect of obligations of other persons;

- •

- issue redeemable stock and preferred stock;

- •

- pay dividends or distributions or redeem or repurchase capital stock;

- •

- prepay, redeem or repurchase debt;

- •

- make loans, investments and capital expenditures;

- •

- enter into agreements that restrict distributions from our subsidiaries;

- •

- sell assets and capital stock of our subsidiaries;

- •

- enter into certain transactions with affiliates; and

- •

- consolidate or merge with or into, or sell substantially all of our assets to, another person.

A breach of any of these covenants could result in a default under our senior secured credit facility, our 2018 Senior Notes and/or the new notes. Upon the occurrence of an event of default under our senior secured credit facility, the lenders could elect to declare all amounts outstanding under our senior secured credit facility to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under our senior secured credit facility. If the lenders under our senior secured credit facility accelerate the repayment of borrowings, we may not have sufficient assets to repay our credit facility and our other indebtedness, including the new notes. See "Description of other indebtedness."

We could fail to comply with our financial covenants, which would adversely affect our financial condition.

Our senior secured credit facility requires us to comply with financial covenants, including, among others, leverage ratios and interest coverage tests. These covenants restrict the manner in which we conduct our business and may impact our operating results. A significant unanticipated decline in advertising or other revenues could decrease our Adjusted EBITDA and operating cash flows, and may make it harder for us to comply with such covenants. Our failure to comply with these covenants could result in events of default, which, if not cured or waived, would permit acceleration of our indebtedness under our debt agreements or under other instruments that contain cross-acceleration or cross-default provisions.

Our debt instruments also contain certain other restrictions on our business and operations, including, for example, covenants that restrict our ability to dispose of assets, incur additional indebtedness, pay dividends, make investments, make acquisitions and engage in mergers or consolidations.

17

Risks associated with the JV Sale Transaction and Merger

The Merger may not be completed, which would significantly increase our federal and state income tax liabilities in 2013 and may harm the market price of LIN TV class A common stock.

Although our board of directors has approved the Merger and has approved and adopted the Merger Agreement, which effects the Merger, the completion of the Merger is subject to a number of conditions, and there is no assurance that all of the conditions to closing will be met and that the Merger will be completed. In addition, we reserve the right to cancel or defer the Merger even if our stockholders vote to approve the Merger and the other conditions to the completion of the Merger are satisfied or waived.

While we currently expect the Merger to take place as soon as practicable after adoption of the Merger Agreement at the special meeting of our stockholders, our board of directors may defer the Merger for a significant time after the meeting or may abandon the Merger because of, among other reasons, an increase in the estimated cost of the Merger, including U.S. tax costs or other costs, changes in existing or proposed tax legislation, an increase in the trading price of LIN TV's class A common stock above approximately $20 per share (at which point LIN TV will no longer recognize a capital loss as a result of the Merger) (see "—We may not realize the anticipated benefits of the Merger because of, among other reasons, changes in tax laws or an increase in the trading price of LIN TV class A common stock prior to the effective time of the Merger" below in this section) or a determination by our board of directors that the Merger would not be in the best interests of our stockholders.

While we will continue our operations if the Merger is not completed for any reason, our operations may be harmed in such case in a number of ways, including the following:

- •

- At the time of LIN Texas's acquisition of its 20.38% interest in SVH in 1998, we recorded a deferred tax liability on

capital gains related to our equity interests in SVH that became a current tax payable upon the sale of such interests. Because the Merger is expected to have the effect of allowing us to use the

capital loss in LIN TV's equity in LIN Television to, in whole or in part, offset such deferred tax liability, if the sale of LIN Texas's interest in SVH is completed without promptly completing the

Merger it would cause a deferred tax liability of approximately $163 million to become payable beginning in 2013. If necessary, we would seek to fund any such current federal and state tax

liabilities and any interest and penalties for late payment of taxes, through cash generated from operations, amounts available under our revolving credit facility, and additional borrowings. However,

there can be no assurance that additional borrowings will be available on acceptable terms or at all. Should additional borrowings be unavailable, we would defer payment of this tax liability into

2014 and incur late payment interest and penalties, and we believe that there are cost and capital expenditure reduction initiatives we could take in 2013 and 2014 that, based on our current forecast

of operating results, would allow us to generate sufficient cash flows to fund our operations, the tax liabilities associated with the JV Sale Transaction, and related interest and penalties, and to

maintain compliance with the financial covenants under our debt obligations into 2014. However, there can be no assurance that we will be successful in reducing our expenditures and generating

sufficient cash from operations to fund the obligation in 2014.

- •

- The market price of LIN TV class A common stock may decline to the extent that the current market price of

such stock reflects a market assumption that the Merger will be completed.

- •

- An adverse reaction from investors and potential investors to, among other things, the Merger may reduce future debt or

equity financing opportunities for us and our subsidiaries.

- •

- Costs related to the Merger, including legal and accounting fees, must be paid even if the Merger is not completed.

18

We may not realize the anticipated benefits of the Merger because of, among other reasons, changes in tax laws or an increase in the trading price of LIN TV class A common stock prior to the effective time of the Merger.

Many factors could affect the outcome of the Merger, and some or all of the anticipated benefits of the Merger may not occur. The consequence of LIN TV's conversion of its form of organization from a corporation into a limited liability company structure in connection with the Merger will have the effect of classifying it as a partnership for federal income tax purposes. Such partnership classification will be treated as a liquidation of LIN TV for federal income tax purposes with the result that LIN TV will recognize gain or loss, as applicable, in its 100% equity interest in LIN Television (its sole asset at the time of the Merger).

The U.S. federal income tax rules are constantly under review by persons involved in the legislative process, the IRS and the U.S. Treasury Department, frequently resulting in revised interpretations of established concepts, statutory changes, revisions to regulations and other modifications and interpretations. The present U.S. federal income tax treatment of an investment in LIN LLC common shares may be modified by administrative, legislative or judicial interpretation at any time, possibly on a retroactive basis and changes to the U.S. federal income tax laws and interpretations thereof could make it more difficult or impossible for us to realize all or any of the anticipated benefits of the Merger.

Further, we will apply certain assumptions and conventions in an attempt to comply with applicable rules and to report income, gain, deduction, loss and credit to holders in a manner that reflects such holder's beneficial ownership of partnership items, taking into account variation in ownership interests during each taxable year because of trading activity. However, it is possible that our assumptions and conventions may not be in compliance with all aspects of applicable tax requirements. It is possible that the IRS may assert successfully that the conventions and assumptions used by us do not satisfy the technical requirements of the Internal Revenue Code and/or Treasury regulations and could require that items of income, gain, loss, deductions or credit, including interest deductions, be adjusted, reallocated or disallowed in a manner that adversely affects stockholders.

In addition, the amount of tax loss that LIN TV will be able to recognize as a result of the Merger is dependent on the value of its assets at the time of the Merger (i.e., its 100% equity interest in LIN Television), which value directly correlates to the trading price of shares of LIN TV class A common stock. As the trading price of LIN TV class A common stock increases, the amount of tax loss that LIN TV will be able to recognize in its ownership of the equity in LIN Television upon consummation of the Merger decreases and, if such trading price increases above a certain amount, LIN TV would not leave sufficient losses available from the Merger to offset the entire capital gain recognized in the JV Sale Transaction. In that event, LIN TV would be required to use cash on hand and/or some (or all) of its existing $273 million net operating losses to offset all or a substantial portion of any such remaining capital gain.

For example, if the trading price of LIN TV class A common stock is at or below approximately $10.75 per share at the time of the Merger, then, upon completion of the Merger, LIN TV expects to recognize a sufficient amount of capital loss to offset all of the capital gain recognized in the JV Sale Transaction. However, we have estimated that if the trading price of LIN TV class A common stock exceeds approximately $12.20 per share, we will be subject to cash tax liabilities in excess of our available net operating loss carry-forwards. In addition, it is possible that, if the trading price of LIN TV class A common stock significantly increases to a price greater than approximately $20 per share, LIN TV would not be able to recognize any tax losses as a result of the Merger to use to offset against the capital gain recognized in the JV Sale Transaction. Furthermore, at the time of the Merger, if LIN TV class A common stock is trading at a price greater than approximately $20 per share, it is probable that LIN TV's board of directors would not consummate the Merger because LIN TV would not be

19

able to recognize a tax loss and, as a result, LIN TV would be required to use all of its existing net operating losses and pay any resulting tax liabilities from the JV Sale Transaction with cash on hand and available borrowings (which may be insufficient).

Our board of directors may choose to defer or abandon the Merger at any time.