UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08788

Templeton Russia and East European Fund, Inc.

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500

Date of fiscal year end: _3/31__

Date of reporting period: 9/30/14___

Item 1. Reports to Stockholders.

Semiannual Report

September 30, 2014

Templeton Russia and East European Fund, Inc.

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/13. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| Contents | |

| Semiannual Report | |

| Templeton Russia and East European | |

| Fund, Inc. | 1 |

| Performance Summary | 5 |

| Important Notice to Shareholders | 7 |

| Financial Highlights and | |

| Statement of Investments | 8 |

| Financial Statements | 12 |

| Notes to Financial Statements | 15 |

| Annual Meeting of Shareholders | 21 |

| Dividend Reinvestment and | |

| Cash Purchase Plan | 22 |

| Shareholder Information | 24 |

Semiannual Report

Templeton Russia and East European Fund, Inc.

Dear Shareholder:

This semiannual report for Templeton Russia and East European Fund covers the period ended September 30, 2014.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in investments that are tied economically to Russia or East European countries.

Economic and Market Overview

Russia’s gross domestic product growth rate slowed to 0.8% year-over-year in the second quarter of 2014 from 0.9% in the first quarter, hurt by sanctions imposed on the country by the U.S. and the European Union (EU) amid the Ukraine crisis.1 Rising food prices, driven partly by the government’s ban on food imports from the U.S. and the EU, as well as the Russian ruble’s weakness, pushed inflation to a three-year high of 8.0% in September, well above the Central Bank of Russia’s (CBR’s) 2014 target of 5%.1 The CBR raised the key rate twice during the period for a total of 100 basis points (1.0%) to 8.0% to curb inflationary pressures resulting from higher import prices, weak ruble and heightened geopolitical tensions.

During the period, Russia continued to advance its economic relationship with certain emerging market countries. In May, Russia signed a landmark agreement to supply gas to China for 30 years and a treaty with Kazakhstan and Belarus to create the Eurasian Economic Union, which aims to build an integrated common market and remove non-tariff barriers. In Latin America, Russia signed various agreements with Argentina and Cuba to boost economic ties. In July, Brazil, Russia, India, China and South Africa agreed to establish a New Development Bank to support their economies during a financial crisis. In September, Chinese President Xi Jinping proposed to develop an economic corridor linking China, Mongolia and Russia.

Russian stocks fell sharply in April, as violence in Ukraine’s Donetsk and Luhansk regions drew threats of more economic sanctions from the U.S. and the EU. Independent credit rating agency Standard & Poor’s downgraded Russia’s foreign currency rating from BBB to BBB- with a negative outlook, citing increased capital outflows that could weaken external financing, and cautioned that further downgrades were possible as a result of weaker economic growth or less flexible monetary policy.2 From May through early July, Russia’s stock market benefited from an apparent cooling of tensions between Russia and Ukraine, as well as news that Russia could hold talks with the newly elected Ukrainian president and that the two countries could

1. Source: Federal State Statistics Service, Russia.

2. This does not indicate Standard & Poor’s rating of the Fund.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund's Statement of Investments (SOI). The SOI begins on page 9.

franklintempleton.com Semiannual Report | 1

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

approve a gas deal. However, the market fell again in July, as eastern Ukraine’s continued destabilization led the U.S. and the EU to impose new sanctions on Russia, particularly targeting the country’s finance, energy and defense sectors. The shooting down of a passenger plane over Ukraine further intensified instability in the region. In August, Russia banned imports of food and other agricultural products from countries that imposed sanctions on it. Russia sought to increase agricultural imports from Argentina, Brazil, Chile, Ecuador and Uruguay and relaxed restrictions on importing meat, fish and produce from certain Latin American countries. Russian stocks rallied in early September amid hopes for a lasting ceasefire agreement between pro-Russian rebels and Ukraine, but stocks declined

later in the month because of additional sanctions by the U.S. and the EU on Russia. Consistent with our long-term approach of finding what we consider to be bargain opportunities while seeking to minimize risk, we continue to monitor events in the region.

Eastern European stocks, as measured by the MSCI Emerging Markets (EM) Eastern Europe Index, underperformed their emerging market peers, as measured by the MSCI EM Index. For the six months ended September 30, 2014, the MSCI EM Eastern Europe Index had a -4.72% total return in U.S. dollar terms, resulting partly from weaker currencies.3 The Czech Republic posted positive returns, while Hungary and Poland posted losses. Russia underperformed its Eastern European peers, as measured by the MSCI Russia Index’s -5.86% total return.3

Investment Strategy

Our investment strategy employs a company-specific, value-oriented, long-term approach. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. As we look for investments, we consider specific companies in the context of their sector and country. We perform in-depth research to construct an Action List from which we construct the portfolio. Our emphasis is on value and not attempting to match or beat an index. During our analysis, we also consider a company’s position in its sector, the economic framework and political environment.

Performance Overview

The Fund had cumulative total returns of -4.26% based on market price and -2.85% based on net asset value for the six months ended September 30, 2014. For the 10-year period ended September 30, 2014, the Fund delivered cumulative total returns of +39.55% in market price terms and +66.87% in net asset value terms. You can find more of the Fund’s performance data in the Performance Summary on page 5.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

3. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

2 | Semiannual Report franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

| Top 10 Sectors/Industries | ||

| Based on Total Net Assets as of 9/30/14 | ||

| Oil, Gas & Consumable Fuels | 25.1 | % |

| Banks | 13.0 | % |

| Food & Staples Retailing | 10.0 | % |

| Internet Software & Services | 9.7 | % |

| IT Services | 6.6 | % |

| Food Products | 6.1 | % |

| Road & Rail | 5.3 | % |

| Wireless Telecommunication Services | 4.6 | % |

| Real Estate Management & Development | 3.7 | % |

| Hotels, Restaurants & Leisure | 2.0 | % |

Manager’s Discussion

During the six months under review, key contributors to the Fund’s absolute performance included DIXY Group, one of Russia’s leading retailers of food and everyday products; EPAM Systems, a leading software engineering solutions provider in Central and Eastern Europe; and Kcell, Kazakhstan’s leading mobile telecommunication services provider.

DIXY Group reported solid corporate results in the first two quarters of 2014, driven by robust sales growth and efficient cost management. Company management’s planned new store openings and strong sales growth outlook further boosted investor sentiment.

EPAM Systems is ranked among the top software and technology outsourcing service providers globally. Headquartered in the U.S., EPAM has offshore development centers primarily in Belarus, Hungary, Ukraine and Russia. Despite investor concerns about the instability in Ukraine, EPAM’s share price rose as the company delivered strong corporate results in the first half of 2014, driven by robust revenue growth.

Kcell, through its dual brand strategy, maintained its leadership in the high-value and mass-market segments. Kcell’s high profit margins and return on equity, decline in expenses and financing costs, and plan to launch a fourth GSM (global system for mobile communications) network supported the company’s share price.4

In contrast, key detractors from the Fund’s absolute performance included Sberbank of Russia, the country’s largest bank; Globaltrans Investment, Russia’s largest private rail transportation company; and LUKOIL Holdings, a leading Russian oil producer.

Sberbank reported a record quarterly net profit for 2014’s second quarter. However, its share price declined as many investors grew concerned about the Russian banking sector’s exposure to potential losses in Ukraine resulting from the country’s instability, as well as the economic sanctions imposed on Russia by the U.S. and the EU. Taking a longer term view, we believe Sberbank’s strong brand recognition, attractive valuations and large domestic deposit base could potentially support the bank’s growth.

Railroad freight transport and logistics services provider Globaltrans Investment reported weaker-than-expected first-half 2014 corporate results. The Russian ruble’s depreciation against the U.S. dollar and the rail transportation industry’s generally weak pricing environment pressured earnings. In our longer term view, the company could benefit from its solid position in the rail transportation industry, strong cash flow generation, high dividend yield and defensive business model.

LUKOIL Holdings’ share price was negatively affected by lower oil prices and a general sell-off in the Russian market, resulting from investor concerns about Ukraine’s instability. Recognizing the short-term price weakness as an investment opportunity, we increased the Fund’s holding in the company because of its strong market position and fundamentals we considered attractive.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended September 30, 2014, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

During the six-month period, our continued search for investment opportunities with fundamentals we considered attractive led us to initiate positions in a number of companies. In Russia, new Fund holdings included QIWI, a major provider of next-generation online payment services primarily in Russia, Kazakhstan, Moldova and Belarus; Aeroflot – Russian Airlines, Russia’s flagship passenger and cargo air carrier; and Uralkali, Russia’s largest potash fertilizer producer. We also opened

4. Return on equity is an amount, expressed as a percentage, earned on a company’s common stock investment for a given period. Return on equity tells common shareholders how effectually their money is being employed. Comparing percentages for current and prior periods also reveals trends, and comparison with industry composites reveals how well a company is holding its own against its competitors.

franklintempleton.com

Semiannual Report | 3

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

| Top 10 Equity Holdings | ||

| 9/30/14 | ||

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Sberbank of Russia | 8.7 | % |

| Banks, Russia | ||

| ROMGAZ (Societatea Nationala de Gaze Naturale | ||

| ROMGAZ) SA, ord. & 144A | 6.7 | % |

| Oil, Gas & Consumable Fuels, Romania | ||

| LUKOIL Holdings, ADR | 6.5 | % |

| Oil, Gas & Consumable Fuels, Russia | ||

| MHP SA, GDR, 144A & Reg S | 6.0 | % |

| Food Products, Ukraine | ||

| DIXY Group OJSC | 5.8 | % |

| Food & Staples Retailing, Russia | ||

| Globaltrans Investment PLC, GDR, Reg S | 5.3 | % |

| Road & Rail, Russia | ||

| Yandex NV, A | 5.3 | % |

| Internet Software & Services, Russia | ||

| Kcell JSC, GDR | 4.4 | % |

| Wireless Telecommunication Services, Kazakhstan | ||

| Mail.ru Group Ltd., GDR, Reg S | 4.4 | % |

| Internet Software & Services, Russia | ||

| Magnit OJSC | 3.8 | % |

| Food & Staples Retailing, Russia |

positions in two U.S.-listed companies with significant operations in Russia: the aforementioned EPAM Systems and Luxoft Holding, a high-end business information technology (IT) solutions provider with major Central and Eastern European onsite operations and global clients consisting of multinational corporations. Additionally, we initiated exposure to Georgia with our investment in TBC Bank, one of the country’s largest banks. Furthermore, we added to the Fund’s holdings in several companies, including the aforementioned LUKOIL Holdings; Mail.ru Group, a leading Russian Internet communications products and entertainment services company; Yandex, an Internet and technology company that operates Russia’s largest Internet search engine; and Magnit, one of Russia’s biggest food retailers.

Conversely, we undertook some sales as certain stocks reached their sale targets and as we sought to invest in companies we considered to be more attractively valued within our investment universe. Key sales included closing the Fund’s positions in a number of Polish, Russian and Turkish companies, including Gazprom, a Russian gas explorer and producer; Warsaw Stock

Exchange, Poland’s stock exchange operator; PKO Bank Polski (Powszechna Kasa Oszczednosci Bank Polski), a Polish bank; and Ulker Biskuvi Sanayi, a Turkish biscuit and chocolate producer. Additionally, we reduced the Fund’s holdings in several companies, including the aforementioned Kcell and Globaltrans Investment, as well as KTK (Kuzbasskaya Toplivnaya Kompaniya), a Russian coal producer.

As a result of our purchases, the Fund’s holdings increased largely in the IT and materials sectors.5 Conversely, our sales resulted in reductions of investments primarily in the energy, telecommunication services and financials sectors.6 Geographically, we initiated investment in Georgia and increased holdings largely in Russia. Conversely, we reduced holdings largely in Turkey and Poland.

Thank you for your continued participation in Templeton Russia and East European Fund. We look forward to serving your future investment needs.

Sincerely,

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

5. The IT sector comprises Internet software and services, IT services, and software in the SOI. The materials sector comprises chemicals in the SOI.

6. The energy sector comprises energy equipment and services; and oil, gas and consumable fuels in the SOI. The telecommunication services sector comprises wireless

telecommunication services in the SOI. The financials sector comprises banks and real estate management and development in the SOI.

4 | Semiannual Report franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Performance Summary as of September 30, 2014

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not reflect any sales charges paid at inception or brokerage commissions paid on secondary market purchases. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

| Share Price | ||||||

| Symbol: TRF | Change | 9/30/14 | 3/31/14 | |||

| Net Asset Value (NAV) | -$ | 0.42 | $ | 14.33 | $ | 14.75 |

| Market Price (NYSE) | -$ | 0.56 | $ | 12.60 | $ | 13.16 |

| Performance1 | ||||||||||||

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||||||

| Based on | Based on | |||||||||||

| Based on NAV3 | market price4 | Based on NAV3 | market price4 | |||||||||

| 6-Month | -2.85 | % | -4.26 | % | -2.85 | % | -4.26 | % | ||||

| 1-Year | -12.02 | % | -13.00 | % | -12.02 | % | -13.00 | % | ||||

| 5-Year | -6.11 | % | -31.53 | % | -1.25 | % | -7.29 | % | ||||

| 10-Year | + | 66.87 | % | + | 39.55 | % | + | 5.25 | % | + | 3.39 | % |

| Performance data represent past performance, which does not guarantee future results. Investment return and principal value will | ||||||||||||

| fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. | ||||||||||||

franklintempleton.com Semiannual Report | 5

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency volatility, economic instability, and social and political developments of countries where the Fund invests. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity. Investments in Russian and East European securities involve significant additional risks, including political and social uncertainty (for example, regional conflicts and risk of war), currency exchange rate volatility, pervasiveness of corruption and crime in the Russian and East European economic systems, delays in settling portfolio transactions, and risk of loss arising out of the system of share registration and custody used in Russia and East European countries.

The U.S. and other nations have imposed and could impose additional sanctions on certain issuers in Russia due to regional conflicts. These sanctions could result in the devaluation of Russia’s currency, a downgrade in Russian issuers’ credit ratings, or a decline in the value and liquidity of Russian stocks or other securities. The Fund may be prohibited from investing in securities issued by companies subject to such sanctions. In addition, if the Fund holds the securities of an issuer that is subject to such sanctions, an immediate freeze of that issuer’s securities could result, impairing the ability of the Fund to buy, sell, receive or deliver those securities. There is also the risk that countermeasures could be taken by Russia’s government, which could involve the seizure of the Fund’s assets. Such sanctions could adversely affect Russia’s economy, possibly forcing the economy into a recession. These risks could impair the Fund’s ability to meet its investment objective.

Because the Fund invests its assets primarily in companies in a specific region, the Fund is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of securities held by the Fund. Also, as a nondiversified investment company investing in Russia and East European countries, the Fund may invest in a relatively small number of issuers and, as a result, may be subject to greater risk of loss with respect to its portfolio securities. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the periods indicated. Six-month returns have not been

annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on the dividend reinvestment and cash purchase plan.

6 | Semiannual Report franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Important Notice to Shareholders

Share Repurchase Program

The Fund’s Board previously authorized the Fund to repurchase up to 10% of the Fund’s outstanding shares in open-market transactions, at the discretion of management. This authorization remains in effect.

In exercising its discretion consistent with its portfolio management responsibilities, the investment manager will take into account various other factors, including, but not limited to, the level of the discount, the Fund’s performance, portfolio holdings, dividend history, market conditions, cash on hand, the availability of other attractive investments and whether the sale of certain portfolio securities would be undesirable because of liquidity concerns or because the sale might subject the Fund to adverse tax consequences. Any repurchases would be made on a national securities exchange at the prevailing market price,

subject to exchange requirements, Federal securities laws and rules that restrict repurchases, and the terms of any outstanding leverage or borrowing of the Fund. If and when the Fund’s 10% threshold is reached, no further repurchases could be completed until authorized by the Board. Until the 10% threshold is reached, Fund management will have the flexibility to commence share repurchases if and when it is determined to be appropriate in light of prevailing circumstances. The share repurchase program is intended to benefit shareholders by enabling the Fund to repurchase shares at a discount to net asset value, thereby increasing the proportionate interest of each remaining shareholder in the Fund.

In the Notes to Financial Statements section, please see note 2 (Capital Stock) for additional information regarding shares repurchased.

franklintempleton.com

Semiannual Report | 7

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

| Financial Highlights | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| September 30, 2014 | Year Ended March 31, | |||||||||||||||||

| (unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 14.75 | $ | 16.23 | $ | 17.79 | $ | 24.38 | $ | 20.75 | $ | 7.48 | ||||||

| Income from investment operations: | ||||||||||||||||||

| Net investment income (loss)a | 0.44 | 0.29 | 0.19 | 0.04 | (0.11 | ) | (0.08 | ) | ||||||||||

| Net realized and unrealized gains (losses) | (0.93 | ) | (1.64 | ) | (1.54 | ) | (6.63 | ) | 3.85 | 13.35 | ||||||||

| Total from investment operations | (0.49 | ) | (1.35 | ) | (1.35 | ) | (6.59 | ) | 3.74 | 13.27 | ||||||||

| Less distributions from: | ||||||||||||||||||

| Net investment income | — | (0.19 | ) | (0.16 | ) | — | — | — | ||||||||||

| Net realized gains | — | — | (0.07 | ) | — | (0.11 | ) | — | ||||||||||

| Total distributions | — | (0.19 | ) | (0.23 | ) | — | (0.11 | ) | — | |||||||||

| Repurchase of shares | 0.07 | 0.06 | 0.02 | — | — | — | ||||||||||||

| Net asset value, end of period | $ | 14.33 | $ | 14.75 | $ | 16.23 | $ | 17.79 | $ | 24.38 | $ | 20.75 | ||||||

| Market value, end of periodb | $ | 12.60 | $ | 13.16 | $ | 14.79 | $ | 16.44 | $ | 23.96 | $ | 20.44 | ||||||

| Total return (based on market value per | ||||||||||||||||||

| share)c | (4.26 | )% | (9.93 | )% | (8.65 | )% | (31.39 | )% | 17.76 | % | 129.66 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expenses before waiver and payments by | ||||||||||||||||||

| affiliates | 1.59 | % | 1.54 | % | 1.57 | % | 1.59 | % | 1.79 | % | 1.80 | % | ||||||

| Expenses net of waiver and payments by | ||||||||||||||||||

| affiliates | 1.58 | % | 1.54 | %e | 1.57 | % | 1.59 | % | 1.75 | % | 1.80 | % | ||||||

| Net investment income (loss) | 5.68 | % | 1.82 | % | 1.16 | % | 0.19 | % | (0.55 | )% | (0.55 | )% | ||||||

| Supplemental data | ||||||||||||||||||

| Net assets, end of period (000’s) | $ | 75,472 | $ | 81,006 | $ | 92,235 | $ | 102,226 | $ | 140,055 | $ | 119,216 | ||||||

| Portfolio turnover rate | 20.96 | % | 69.70 | % | 36.32 | % | 7.63 | % | 10.81 | % | 19.14 | % | ||||||

aBased on average daily shares outstanding.

bBased on the last sale on the New York Stock Exchange.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

8 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

| Statement of Investments, September 30, 2014 (unaudited) | ||||

| Country | Shares | Value | ||

| Common Stocks 94.4% | ||||

| Airlines 1.1% | ||||

| Aeroflot - Russian Airlines OJSC | Russia | 775,700 | $ | 847,121 |

| Banks 13.0% | ||||

| Sberbank of Russia | Russia | 3,460,833 | 6,599,453 | |

| a,bTBC Bank JSC, GDR, 144A | Georgia | 100,000 | 1,590,000 | |

| Turkiye Halk Bankasi AS | Turkey | 266,720 | 1,604,842 | |

| 9,794,295 | ||||

| Chemicals 1.2% | ||||

| cUralkali OJSC, GDR, Reg S | Russia | 49,900 | 885,725 | |

| Construction & Engineering 0.5% | ||||

| Mostotrest | Russia | 159,770 | 362,758 | |

| Energy Equipment & Services 1.3% | ||||

| a,cIG Seismic Services PLC, GDR, Reg S | Russia | 15,672 | 423,144 | |

| cTMK OAO, GDR, Reg S | Russia | 59,099 | 537,801 | |

| 960,945 | ||||

| Food & Staples Retailing 10.0% | ||||

| aDIXY Group OJSC | Russia | 413,326 | 4,341,512 | |

| Magnit OJSC | Russia | 11,472 | 2,873,533 | |

| cO’Key Group SA, GDR, Reg S | Russia | 50,145 | 366,059 | |

| 7,581,104 | ||||

| Food Products 6.1% | ||||

| bMHP SA, GDR, 144A | Ukraine | 76,380 | 908,922 | |

| cMHP SA, GDR, Reg S | Ukraine | 303,950 | 3,617,005 | |

| Pinar Sut Mamulleri Sanayii AS | Turkey | 11,580 | 119,009 | |

| 4,644,936 | ||||

| Health Care Technology 1.7% | ||||

| aSynektik SA | Poland | 182,668 | 1,299,451 | |

| Hotels, Restaurants & Leisure 2.0% | ||||

| Fortuna Entertainment Group NV | Czech Republic | 128,000 | 713,822 | |

| Olympic Entertainment Group A.S. | Estonia | 305,329 | 786,624 | |

| 1,500,446 | ||||

| Internet Software & Services 9.7% | ||||

| a,cMail.ru Group Ltd., GDR, Reg S | Russia | 117,989 | 3,316,671 | |

| aYandex NV, A | Russia | 143,500 | 3,988,582 | |

| 7,305,253 | ||||

| IT Services 6.6% | ||||

| aEPAM Systems Inc. | United States | 52,587 | 2,302,785 | |

| aLuxoft Holding Inc. | United States | 34,048 | 1,266,586 | |

| QIWI PLC, ADR | Russia | 44,094 | 1,392,929 | |

| 4,962,300 |

franklintempleton.com

Semiannual Report | 9

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. |

| STATEMENT OF INVESTMENTS (UNAUDITED) |

| Country | Shares | Value | ||

| Common Stocks (continued) | ||||

| Oil, Gas & Consumable Fuels 23.8% | ||||

| Dragon Oil PLC | Turkmenistan | 91,453 | $ | 884,447 |

| Kuzbasskaya Toplivnaya Kompaniya OAO | Russia | 407,250 | 586,140 | |

| dLUKOIL Holdings, ADR | Russia | 26,600 | 1,356,600 | |

| dLUKOIL Holdings, ADR (London Stock Exchange) | Russia | 70,200 | 3,580,200 | |

| aNostrum Oil & Gas LP | Kazakhstan | 186,450 | 2,282,300 | |

| OMV Petrom SA | Romania | 15,786,500 | 2,125,780 | |

| Societatea Nationala de Gaze Naturale ROMGAZ SA | Romania | 261,177 | 2,692,122 | |

| bSocietatea Nationala de Gaze Naturale ROMGAZ SA, 144A | Romania | 231,000 | 2,381,068 | |

| Transgaz SA Medias | Romania | 30,499 | 2,060,017 | |

| 17,948,674 | ||||

| Pharmaceuticals 0.0%† | ||||

| a,eOTCPharm | Russia | 25,108 | 34,870 | |

| Real Estate Management & Development 3.7% | ||||

| cEtalon Group Ltd., GDR, Reg S | Russia | 756,252 | 2,760,320 | |

| Road & Rail 5.3% | ||||

| cGlobaltrans Investment PLC, GDR, Reg S | Russia | 480,050 | 4,032,420 | |

| Software 1.5% | ||||

| Asseco Poland SA | Poland | 82,813 | 1,165,711 | |

| Specialty Retail 1.7% | ||||

| M Video OJSC | Russia | 155,060 | 786,976 | |

| Silvano Fashion Group AS, A | Estonia | 247,264 | 512,122 | |

| 1,299,098 | ||||

| Transportation Infrastructure 0.6% | ||||

| cNovorossiysk Commercial Sea Port PJSC, GDR, Reg S | Russia | 150,404 | 430,155 | |

| Wireless Telecommunication Services 4.6% | ||||

| bKcell JSC, GDR, 144A | Kazakhstan | 233,783 | 3,324,394 | |

| Sistema JSFC | Russia | 383,100 | 127,011 | |

| 3,451,405 | ||||

| Total Common Stocks (Cost $62,885,559) | 71,266,987 | |||

| Preferred Stocks (Cost $1,897,185) 1.3% | ||||

| Oil, Gas & Consumable Fuels 1.3% | ||||

| Bashneft OAO, pfd. | Russia | 47,227 | 948,270 | |

| Total Investments before Short Term Investments | ||||

| (Cost $64,782,744) | 72,215,257 |

10 | Semiannual Report

franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

STATEMENT OF INVESTMENTS (UNAUDITED)

| Country | Shares | Value | ||

| Short Term Investments (Cost $2,758,563) 3.6% | ||||

| Money Market Funds 3.6% | ||||

| a,fInstitutional Fiduciary Trust Money Market Portfolio | United States | 2,758,563 | $ | 2,758,563 |

| Total Investments (Cost $67,541,307) 99.3% | 74,973,820 | |||

| Other Assets, less Liabilities 0.7% | 497,864 | |||

| Net Assets 100.0% | $ | 75,471,684 |

See Abbreviations on page 20.

†Rounds to less than 0.1% of net assets.

aNon-income producing.

bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Directors. At

September 30, 2014, the aggregate value of these securities was $8,204,384, representing 10.87% of net assets.

cSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States.

Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption

from registration. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Directors. At September 30, 2014, the aggregate value of

these securities was $16,369,300, representing 21.69% of net assets.

dAt September 30, 2014, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading this security for a limited

or extended period of time.

eSecurity has been deemed illiquid because it may not be able to be sold within seven days.

fSee Note 3(c) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 11

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Financial Statements

Statement of Assets and Liabilities

September 30, 2014 (unaudited)

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 64,782,744 | |

| Cost - Sweep Money Fund (Note 3c) | 2,758,563 | ||

| Total cost of investments | $ | 67,541,307 | |

| Value - Unaffiliated issuers | $ | 72,215,257 | |

| Value - Sweep Money Fund (Note 3c) | 2,758,563 | ||

| Total value of investments | 74,973,820 | ||

| Receivables: | |||

| Investment securities sold | 583,126 | ||

| Dividends | 194,454 | ||

| Prepaid expenses | 54,559 | ||

| Total assets | 75,805,959 | ||

| Liabilities: | |||

| Payables: | |||

| Capital shares redeemed | 178,814 | ||

| Management fees | 86,309 | ||

| Director fees and expenses | 332 | ||

| Deferred tax | 43,500 | ||

| Accrued expenses and other liabilities | 25,320 | ||

| Total liabilities | 334,275 | ||

| Net assets, at value | $ | 75,471,684 | |

| Net assets consist of: | |||

| Paid-in capital | $ | 76,913,303 | |

| Undistributed net investment income | 3,794,983 | ||

| Net unrealized appreciation (depreciation) | 7,388,728 | ||

| Accumulated net realized gain (loss) | (12,625,330 | ) | |

| Net assets, at value | $ | 75,471,684 | |

| Shares outstanding | 5,266,842 | ||

| Net asset value per share | $ | 14.33 |

12 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. |

| FINANCIAL STATEMENTS |

Statement of Operations

for the six months ended September 30, 2014 (unaudited)

| Investment income: | |||

| Dividends (net of foreign taxes of $323,906) | $ | 3,042,612 | |

| Interest | 1,198 | ||

| Total investment income | 3,043,810 | ||

| Expenses: | |||

| Management fees (Note 3a) | 544,159 | ||

| Transfer agent fees | 14,939 | ||

| Custodian fees (Note 4) | 34,717 | ||

| Reports to shareholders | 11,429 | ||

| Registration and filing fees | 10,558 | ||

| Professional fees | 37,534 | ||

| Directors’ fees and expenses | 2,010 | ||

| Other | 7,576 | ||

| Total expenses | 662,922 | ||

| Expenses waived/paid by affiliates (Note 3c) | (794 | ) | |

| Net expenses | 662,128 | ||

| Net investment income | 2,381,682 | ||

| Realized and unrealized gains (losses): | |||

| Net realized gain (loss) from: | |||

| Investments | 646,794 | ||

| Foreign currency transactions | (34,213 | ) | |

| Net realized gain (loss) | 612,581 | ||

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (5,411,024 | ) | |

| Translation of other assets and liabilities denominated in foreign currencies | 16,075 | ||

| Change in deferred taxes on unrealized appreciation | (43,500 | ) | |

| Net change in unrealized appreciation (depreciation) | (5,438,449 | ) | |

| Net realized and unrealized gain (loss) | (4,825,868 | ) | |

| Net increase (decrease) in net assets resulting from operations | $ | (2,444,186 | ) |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 13

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. | ||||||

| FINANCIAL STATEMENTS | ||||||

| Statements of Changes in Net Assets | ||||||

| Six Months Ended | ||||||

| September 30, 2014 | Year Ended | |||||

| (unaudited) | March 31, 2014 | |||||

| Increase (decrease) in net assets: | ||||||

| Operations: | ||||||

| Net investment income | $ | 2,381,682 | $ | 1,626,097 | ||

| Net realized gain (loss) from investments and foreign currency transactions | 612,581 | (11,556,425 | ) | |||

| Net change in unrealized appreciation (depreciation) on investments, translation of other assets | ||||||

| and liabilities denominated in foreign currencies and deferred taxes | (5,438,449 | ) | 2,467,874 | |||

| Net increase (decrease) in net assets resulting from operations | (2,444,186 | ) | (7,462,454 | ) | ||

| Distributions to shareholders from: | ||||||

| Net investment income | — | (1,041,308 | ) | |||

| Capital share transactions – Repurchase of Shares: (Note 2) | (3,089,894 | ) | (2,725,027 | ) | ||

| Net increase (decrease) in net assets | (5,534,080 | ) | (11,228,789 | ) | ||

| Net assets: | ||||||

| Beginning of period | 81,005,764 | 92,234,553 | ||||

| End of period | $ | 75,471,684 | $ | 81,005,764 | ||

| Undistributed net investment income included in net assets: | ||||||

| End of period | $ | 3,794,983 | $ | 1,413,301 | ||

14 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Templeton Russia and East European Fund, Inc. (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as a closed-end management investment company and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP).

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Directors (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded or as of the NYSE close, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing net asset value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily NYSE close. In addition, trading in certain foreign markets may not take place on every NYSE business day. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

Also, when the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the NYSE is closed, which could result in differences between the value of the Fund’s portfolio securities on the last business

franklintempleton.com

Semiannual Report | 15

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (UNAUDITED) |

1. Organization and Significant Accounting

Policies (continued)

a. Financial Instrument Valuation (continued)

day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable

income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of September 30, 2014, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

16 | Semiannual Report

franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

e. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and directors are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. Capital Stock

At September 30, 2014, there were 100 million shares authorized ($0.01 par value). During the periods ended September 30, 2014 and March 31, 2014 there were no shares issued; all reinvested distributions were satisfied with previously issued shares purchased in the open market.

The Board previously authorized an open-market share repurchase program pursuant to which the Fund may purchase, from time to time, Fund shares in open-market transactions, at the discretion of management. This authorization remains in effect. Since the inception of the program, the Fund had repurchased a total of 478,332 shares. Transactions in the Fund’s shares for the periods ended September 30, 2014 and March 31, 2014, were as follows:

| Period Ended | Year Ended | |||||||

| September 30, 2014 | March 31, 2014 | |||||||

| Shares | Amount | Shares | Amount | |||||

| Shares repurchased | 223,271 | $ | 3,089,894 | 192,061 | $ | 2,725,027 | ||

| Weighted average discount of market price to net asset | ||||||||

| value of shares repurchased | 10.37 | % | 10.58 | % | ||||

| 3. Transactions with Affiliates | |

| Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton | |

| Investments. Certain officers and directors of the Fund are also officers and/or directors of the following subsidiaries: | |

| Subsidiary | Affiliation |

| Templeton Asset Management Ltd. (TAML) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

franklintempleton.com Semiannual Report | 17

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (UNAUDITED) |

3. Transactions with Affiliates (continued)

a. Management Fees

The Fund pays an investment management fee to TAML based on the average weekly net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 1.300 | % | Up to and including $1 billion |

| 1.250 | % | Over $1 billion, up to and including $5 billion |

| 1.200 | % | Over $5 billion, up to and including $10 billion |

| 1.150 | % | Over $10 billion, up to and including $15 billion |

| 1.100 | % | Over $15 billion, up to and including $20 billion |

| 1.050 | % | In excess of $20 billion |

b. Administrative Fees

Under an agreement with TAML, FT Services provides administrative services to the Fund. The fee is paid by TAML based on the Fund’s average weekly net assets, and is not an additional expense of the Fund.

c. Investments in Institutional Fiduciary Trust Money Market Portfolio

The Fund invests in Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an affiliated open-end management investment company. Management fees paid by the Fund are waived on assets invested in the Sweep Money Fund, as noted on the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by the Sweep Money Fund.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended September 30, 2014, there were no credits earned.

5. Income Taxes

For tax purposes, capital losses may be carried over to offset future capital gains, if any.

| At March 31, 2014, capital loss carryforwards were as follows: | ||

| Capital loss carryforwards: | ||

| Short term | $ | 404,212 |

| Long term | 12,833,699 | |

| Total capital loss carryforwards | $ | 13,237,911 |

At September 30, 2014, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| Cost of investments | $ | 67,460,671 | |

| Unrealized appreciation | $ | 13,792,136 | |

| Unrealized depreciation | (6,278,987 | ) | |

| Net unrealized appreciation (depreciation) | $ | 7,513,149 | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of passive foreign investment company shares and corporate actions.

18 | Semiannual Report

franklintempleton.com

| TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (UNAUDITED) |

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the period ended September 30, 2014, aggregated $21,083,772 and $16,645,567, respectively.

7. Concentration of Risk

Investing in equity securities of Russian companies may include certain risks not typically associated with investing in countries with more developed securities markets, such as political, economic and legal uncertainties, delays in settling portfolio transactions and the risk of loss from Russia’s underdeveloped systems of securities registration and transfer.

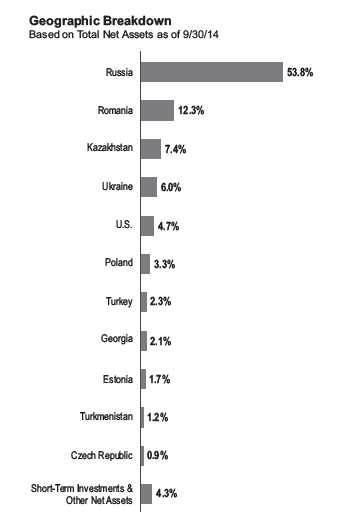

The United States and other nations have imposed and could impose additional sanctions on certain issuers in Russia due to regional conflicts. These sanctions could result in the devaluation of Russia’s currency, a downgrade in Russian issuers’ credit ratings, or a decline in the value and liquidity of Russian stocks or other securities. Such sanctions could also adversely affect Russia’s economy, possibly forcing the economy into a recession. The Fund may be prohibited from investing in securities issued by companies subject to such sanctions. In addition, if the Fund holds the securities of an issuer that is subject to such sanctions, an immediate freeze of that issuer’s securities could result, impairing the ability of the Fund to buy, sell, receive or deliver those securities. There is also the risk that countermeasures could be taken by Russia’s government, which could involve the seizure of the Fund’s assets. These risks could affect the value of the Fund’s portfolio. While the Fund holds securities of certain companies recently impacted by the financial and energy sectorial sanctions, the restrictions do not impact the existing investments in those issuers. At September 30, 2014, the Fund had 53.8% of its net assets invested in Russia.

8. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments)

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

franklintempleton.com

Semiannual Report | 19

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

| 8. Fair Value Measurements (continued) | ||||||||

| A summary of inputs used as of September 30, 2014, in valuing the Fund’s assets carried at fair value, is as follows: | ||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||

| Assets: | ||||||||

| Investments in Securities: | ||||||||

| Equity Investments:a | ||||||||

| Banks | $ | 8,204,295 | $ | 1,590,000 | $ | — | $ | 9,794,295 |

| Oil, Gas & Consumable Fuels | 17,540,344 | 1,356,600 | — | 18,896,944 | ||||

| Pharmaceuticals | — | — | 34,870 | 34,870 | ||||

| Other Equity Investmentsb | 43,489,148 | — | — | 43,489,148 | ||||

| Short Term Investments | 2,758,563 | — | — | 2,758,563 | ||||

| Total Investments in Securities | $ | 71,992,350 | $ | 2,946,600 | $ | 34,870 | $ | 74,973,820 |

| alncludes common and preferred stocks. | ||||||||

| bFor detailed categories, see the accompanying Statement of Investments. | ||||||||

A reconciliation of assets in which Level 3 inputs are used in determining fair value is presented when there are significant Level 3 financial instruments at the end of the period.

9. New Accounting Pronouncements

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The ASU is effective for interim and annual reporting periods beginning after December 15, 2014. Management is currently evaluating the impact, if any, of applying this provision.

10. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

| Abbreviations | |

| Selected Portfolio | |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

20 | Semiannual Report franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Annual Meeting of Shareholders, August 25, 2014 (unaudited)

The Annual Meeting of Shareholders of the Fund was held at the Fund’s offices, 300 S.E. 2nd Street, Fort Lauderdale, Florida, on August 25, 2014. The purpose of the meeting was to elect four Directors of the Fund and to ratify the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund for the fiscal year ending March 31, 2015. At the meeting, the following persons were elected by the shareholders to serve as Directors of the Fund: Harris J. Ashton, J. Michael Luttig, Larry D. Thompson and Constantine D. Tseretopoulos.* Shareholders also ratified the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund for the fiscal year ending March 31, 2015. No other business was transacted at the meeting.

| The results of the voting at the Annual Meeting are as follows: | ||||||||||

| 1. The election of four Directors: | ||||||||||

| % of | % of Shares | % of | % of Shares | |||||||

| Outstanding | Present and | Outstanding | Present and | |||||||

| Term Expiring 2017 | For | Shares | Voting | Withheld | Shares | Voting | ||||

| Harris J. Ashton | 3,122,816 | 58.18 | % | 75.59 | % | 1,008,222 | 18.79 | % | 24.41 | % |

| J. Michael Luttig | 3,126,229 | 58.25 | % | 75.68 | % | 1,004,809 | 18.72 | % | 24.32 | % |

| Larry D. Thompson | 3,129,376 | 58.31 | % | 75.75 | % | 1,001,662 | 18.66 | % | 24.25 | % |

| Constantine D. Tseretopoulos | 3,124,210 | 58.21 | % | 75.63 | % | 1,006,828 | 18.76 | % | 24.37 | % |

There were approximately 77,454 broker non-votes received with respect to this item.

2. The ratification of the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Fund for the fiscal year ending March 31, 2015:

| % of | % of Shares | ||||

| Shares | Outstanding | Present and | |||

| Voted | Shares | Voting | |||

| For | 4,171,458 | 77.72 | % | 99.12 | % |

| Against | 21,827 | 0.41 | % | 0.52 | % |

| Abstain | 15,207 | 0.28 | % | 0.36 | % |

| Total | 4,208,492 | 78.41 | % | 100.00 | % |

* Ann Torre Bates, Frank J. Crothers, Edith E. Holiday, Gregory E. Johnson, Rupert H. Johnson, Jr., David W. Niemiec, Frank A. Olson and Robert E. Wade are Directors of the Fund who are currently serving and whose terms of office continued after the Annual Meeting of Shareholders.

franklintempleton.com

Semiannual Report | 21

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Dividend Reinvestment and Cash Purchase Plan

The Fund offers a Dividend Reinvestment and Cash Purchase Plan (the “Plan”) with the following features:

If shares of the Fund are held in the shareholder’s name, the shareholder will automatically be a participant in the Plan unless he elects to withdraw. If the shares are registered in the name of a broker-dealer or other nominee (i.e., in “street name”), the broker-dealer or nominee will elect to participate in the Plan on the shareholder’s behalf unless the shareholder instructs them otherwise, or unless the reinvestment service is not provided by the broker-dealer or nominee.

Participants should contact Computershare Shareowner Services, LLC, P.O. Box 30170, College Station, TX, 77842-3170, to receive the Plan brochure.

To receive dividends or distributions in cash, the shareholder must notify Computershare Trust Company, N.A. (formerly, The Bank of New York Mellon) (the “Plan Administrator”) at the address above or the institution in whose name the shares are held. The Plan Administrator must receive written notice ten business days before the record date for the distribution.

Whenever the Fund declares dividends in either cash or common stock of the Fund, if the market price is equal to or exceeds net asset value at the valuation date, the participant will receive the dividends entirely in new shares at a price equal to the net asset value, but not less than 95% of the then current market price of the Fund’s shares. If the market price is lower than net asset value or if dividends and/or capital gains distributions are payable only in cash, the participant will receive shares purchased on the New York Stock Exchange or otherwise on the open market.

A participant has the option of submitting additional cash payments to the Plan Administrator, in any amounts of at least $100 each, up to a maximum of $5,000 per month, for the purchase of Fund shares for his or her account. These payments can be made by check payable to Computershare Trust Company, N.A. and sent to Computershare Shareowner Services, LLC, P.O. Box 30170, College Station, TX, 77842-3170, Attention: Templeton Russia and East European Fund, Inc. The Plan Administrator will apply such payments (less a $5.00 service charge and less a pro rata share of trading fees) to purchases of Fund shares on the open market.

The automatic reinvestment of dividends and/or capital gains does not relieve the participant of any income tax that may be payable on dividends or distributions.

Whenever shares are purchased on the New York Stock Exchange or otherwise on the open market, each participant will pay a pro rata portion of trading fees. Trading fees will be deducted from amounts to be invested. The Plan Administrator’s fee for a sale of shares through the Plan is $15.00 per transaction plus a $0.12 per share trading fee.

The participant may withdraw from the Plan without penalty at any time by written notice to the Plan Administrator sent to Computershare Shareowner Services, LLC, P.O. Box 30170, College Station, TX, 77842-3170. Upon withdrawal, the participant will receive, without charge, share certificates issued in the participant’s name for all full shares held by the Plan Administrator; or, if the participant wishes, the Plan Administrator will sell the participant’s shares and send the proceeds to the participant, less a service charge of $15.00 and less trading fees of $0.12 per share. The Plan Administrator will convert any fractional shares held at the time of withdrawal to cash at current market price and send a check to the participant for the net proceeds.

Direct Deposit Service for Registered Shareholders

Cash distributions can now be electronically credited to a checking or savings account at any financial institution that participates in the Automated Clearing House (“ACH”) system. The Direct Deposit service is provided for registered shareholders at no charge. To enroll in the service, access your account online by going to www.computershare.com/investor or dial (800) 416-5585 (toll free) and follow the instructions. Direct Deposit will begin with the next scheduled distribution payment date following enrollment in the service.

22 | Semiannual Report

franklintempleton.com

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Transfer Agent

Computershare Shareowner Services, LLC

P.O. Box 30170

College Station, TX 77842-3170

Overnight Address:

211 Quality Circle, Suite 210

College Station, TX 77845

(800) 416-5585

www.computershare.com/investor

Direct Registration

If you are a registered shareholder of the Fund, purchases of shares of the Fund can be electronically credited to your Fund account at Computershare Shareowner Services, LLC through Direct Registration. This service provides shareholders with a convenient way to keep track of shares through book entry transactions, electronically move book-entry shares between broker-dealers, transfer agents and DRS eligible issuers, and eliminate the possibility of lost certificates. For additional information, please contact Computershare Shareowner Services, LLC at (800) 416-5585.

Shareholder Information

Shares of Templeton Russia and East European Fund, Inc. are traded on the New York Stock Exchange under the symbol “TRF.” Information about the net asset value and the market price is published each Monday in the Wall Street Journal, weekly in Barron’s and each Saturday in The New York Times and other newspapers. Daily market prices for the Fund’s shares are published in “New York Stock Exchange Composite Transactions” section of newspapers.

For current information about distributions and shareholder accounts, call (800) 416-5585. Registered shareholders can now access their Fund account on-line with the Investor ServiceDirect™ website. For information go to Computershare Shareowner Services, LLC’s website at www.computershare.com/investor and follow the instructions.

The daily closing net asset value as of the previous business day may be obtained when available by calling Franklin Templeton Fund Information after 7 a.m. Pacific time any business day at (800) DIAL BEN/342-5236. The Fund’s net asset value and dividends are also listed on the NASDAQ Stock Market, Inc.’s Mutual Fund Quotation Service (“NASDAQ MFQS”).

Shareholders not receiving copies of the reports to shareholders because their shares are registered in the name of a broker or a custodian can request that they be added to the Fund’s mailing list by writing Templeton Russia and East European Fund, Inc., 100 Fountain Parkway, P.O. Box 33030, St. Petersburg, FL, 33733-8030.

franklintempleton.com Semiannual Report | 23

TEMPLETON RUSSIA AND EAST EUROPEAN FUND, INC.

Shareholder Information

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Certifications

The Fund’s Chief Executive Officer – Finance and Administration is required by the New York Stock Exchange’s Listing Standards to file annually with the Exchange a certification that she is not aware of any violation by the Fund of the Exchange’s Corporate Governance Standards applicable to the Fund. The Fund has filed such certification.

In addition, the Fund’s Chief Executive Officer – Finance and Administration and Chief Financial Officer and Chief Accounting Officer are required by the rules of the U.S. Securities and Exchange Commission to provide certain certifications with respect to the Fund’s Form N-CSR and Form N-CSRS (which include the Fund’s annual and semiannual reports to shareholders) that are filed semiannually with the Commission. The Fund has filed such certifications with its Form N-CSR for the 12 months ended March 31, 2014. Additionally, the Fund expects to file, on or about November 28, 2014, such certifications with its Form N-CSRS for the six months ended September 30, 2014.

24 | Semiannual Report

franklintempleton.com

Semiannual Report

Templeton Russia and East European Fund, Inc.

Investment Manager

Templeton Asset Management Ltd.

Transfer Agent

Computershare Shareowner Services, LLC

P.O. Box 30170

College Station, TX 77842-3170

Toll free number: (800) 416-5585

Hearing Impaired phone number: (800) 231-5469

Foreign Shareholders phone number: (201) 680-6578

www.computershare.com/investor

Fund Information

(800) DIAL BEN®/342-5236

Investors should be aware that the value of investments made for the Fund may go down as well as up. Like any investment in securities, the value of the Fund’s portfolio will be subject to the risk of loss from market, currency, economic, political and other factors. The Fund and its investors are not protected from such losses by the investment manager. Therefore, investors who cannot accept this risk should not invest in shares of the Fund.

To help ensure we provide you with quality service, all calls to and from our service areas are monitored and/or recorded.

| © 2014 Franklin Templeton Investments. All rights reserved. | TLTRF S 11/14 |

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is David W. Niemiec and he is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants.

Members of the Audit Committee are: Ann Torre Bates, Frank J. Crothers, David W. Niemiec and Constantine D. Tseretopoulos.

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The board of directors of the Fund has delegated the authority to vote proxies related to the portfolio securities held by the Fund to the Fund’s investment manager Templeton Asset Management Ltd. in accordance with the Proxy Voting Policies and Procedures (Policies) adopted by the investment manager.

The investment manager has delegated its administrative duties with respect to the voting of proxies for equity securities to the Proxy Group within Franklin Templeton Companies, LLC (Proxy Group), an affiliate and wholly owned subsidiary of Franklin Resources, Inc. All proxies received by the Proxy Group will be voted based upon the investment manager’s instructions and/or policies. The investment manager votes proxies solely in the best interests of the Fund and its shareholders.

To assist it in analyzing proxies, the investment manager subscribes to Institutional Shareholder Services, Inc. (ISS), an unaffiliated third-party corporate governance research service that provides in-depth analyses of shareholder meeting agendas, vote recommendations, vote execution services, ballot reconciliation services, recordkeeping and vote disclosure services. In addition, the investment manager subscribes to Glass, Lewis & Co., LLC (Glass Lewis), an unaffiliated third-party analytical research firm, to receive