| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

☒ | |||

| Post-Effective Amendment No. 524 | ☒ | |||

| and/or | ||||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

☒ | |||

| Amendment No. 526 | ☒ |

| MARGERY K. NEALE BENJAMIN J. HASKIN, ESQ. ANNE C. CHOE, ESQ. WILLKIE FARR & GALLAGHER LLP 787 SEVENTH AVENUE NEW YORK, NY 10019-6099 |

MARISA ROLLAND, ESQ. BLACKROCK FUND ADVISORS 400 HOWARD STREET SAN FRANCISCO, CA 94105 |

| ☐ | Immediately upon filing pursuant to paragraph (b) |

| ☒ | On |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | On (date) pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | On (date) pursuant to paragraph (a)(2) |

| ☐ | The post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

|

|

|

2022 Prospectus |

| • | iShares Core MSCI Emerging Markets ETF | IEMG | NYSE ARCA |

| Ticker: IEMG | Stock Exchange: NYSE Arca |

| (ongoing expenses that you pay each year as a percentage of the value of your investments)1 | ||||||||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses 2 |

Acquired Fund Fees and Expenses2 |

Total Annual Fund Operating Expenses |

Fee Waiver2 | Total Annual Fund Operating Expenses After Fee Waiver | ||||||

| ( |

||||||||||||

| 1 | |

| 2 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

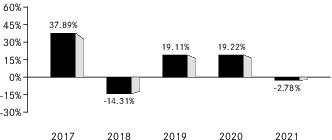

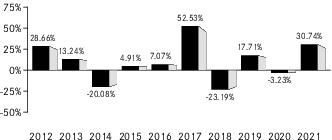

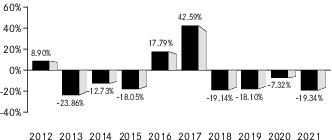

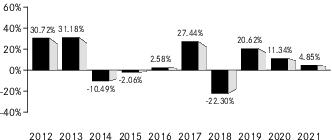

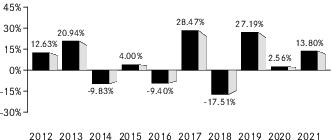

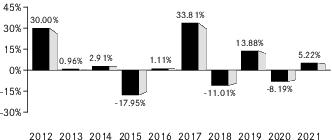

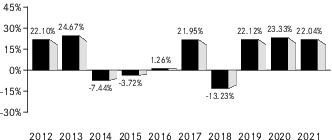

| One Year | Five Years | Since Fund Inception | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions1 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

||||

| MSCI Emerging Markets IMI (Index returns do not reflect deductions for fees, expenses or taxes) | - |

| 1 | |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through fraud or negligence because ownership in shares of Russian companies is recorded by the companies themselves and by registrars, rather than by a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

| ■ | creates rights, or obligations, which are not ordinarily created between persons dealing at arm's length; |

| ■ | results, directly or indirectly, in the misuse, or abuse, of the provisions of IT Act; |

| ■ | lacks commercial substance; or |

| ■ | is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona fide purposes. |

| ■ | An FPI who has not availed itself of any benefit under a tax treaty and has made investment in accordance with the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019; |

| ■ | An investment made by a non-resident, directly or indirectly, in an FPI; and |

| ■ | Any arrangement where the aggregate tax benefit to all the parties of the arrangement in the relevant financial year does not exceed INR 30 million. |

| ■ | Dividend: Dividend income earned by the Fund will be subject to Indian income-tax at the specified tax rate of 20%1, under the IT Act. The applicable tax is withheld by the dividend-paying issuer at the time of payment. The Fund being a resident of USA, may claim the benefit of the India-USA Double Taxation Avoidance Agreement (“DTAA”), which provides a beneficial rate of 15%, subject to the Fund holding at least 10% of the share capital carrying voting power of the Indian company distributing dividend. |

| 1 | All tax rates mentioned in this Indian Tax Disclosure section are exclusive of the applicable surcharge and health and education cess, unless otherwise specified. |

| ■ | Interest: Interest paid to the Fund with respect to debt obligations of Indian issuers will be subject to Indian income tax. A 5% tax rate applies to certain types of interest paid to a nonresident: |

| ■ | Securities Transaction Tax: All transactions entered on a recognized stock exchange in India are subject to a Securities Transaction Tax (“STT”). STT has been introduced under Section 98 of the Finance (No.2) Act, 2004 on transactions relating to sale, purchases and redemption of shares made by purchasers or sellers of Indian securities. The current STT is levied on the transaction value as follows: |

| ■ | 0.1% payable by the buyer and 0.1% by the seller on the value of transactions of delivery-based transfer of an equity share in an Indian company entered in a recognized stock exchange; |

| ■ | 0.025% on the value of transactions of non-delivery-based sale of an equity share in an Indian company, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.05% on the value of transactions of sale of options, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.01% on the value of transactions of sale of futures, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.125% on the value of transactions of sale of options where the option is exercised, entered in a recognized stock exchange and payable by the buyer; and |

| ■ | 0.2% on the value of transactions of the sale of unlisted shares by existing shareholders in an initial public offer. |

| ■ | Capital Gains: The taxation of capital gains is as follows. Long-term capital gains (i.e., gains on the sale of shares held for more than 12 months) from the sale of equity shares of an Indian company listed on a recognized stock exchange are taxable in India at a rate of 10% provided any applicable STT has been paid, both on acquisition and sale of such shares (subject to certain transactions, to which the provisions of applicability and payment of STT upon acquisition do not apply). The tax on these capital gains is calculated on gains exceeding INR 100,000 (without any indexation and foreign exchange fluctuation benefits). Long term capital gains arising from sale of listed shares, not executed on a recognized stock exchange, will be taxed at a rate of 10%. |

(For a share outstanding throughout each period)

| iShares Core MSCI Emerging Markets ETF (Consolidated) | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $64.18 | $53.34 | $48.31 | $52.27 | $53.91 | ||||

| Net investment income(a) | 1.67 | 1.33 | 1.46 | 1.40 | 1.39 | ||||

| Net realized and unrealized gain (loss)(b) | (15.13) | 10.70 | 5.21 | (4.01) | (1.61) | ||||

| Net increase (decrease) from investment operations | (13.46) | 12.03 | 6.67 | (2.61) | (0.22) | ||||

| Distributions from net investment income(c) | (1.97) | (1.19) | (1.64) | (1.35) | (1.42) | ||||

| Net asset value, end of year | $48.75 | $64.18 | $53.34 | $48.31 | $52.27 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (21.40)% | 22.67% | 13.97% | (4.93)%(e) | (0.52)% | ||||

| Ratios to Average Net Assets(f) | |||||||||

| Total expenses | 0.10% | 0.12% | 0.14% | 0.14% | 0.14% | ||||

| Total expenses after fees waived | 0.10% | 0.12% | 0.14% | 0.14% | 0.14% | ||||

| Total expenses excluding professional fees for foreign withholding tax claims | 0.10% | 0.11% | 0.14% | 0.14% | N/A | ||||

| Net investment income | 2.97% | 2.12% | 2.97% | 2.79% | 2.48% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $65,232,083 | $80,599,322 | $54,628,381 | $53,020,298 | $49,079,726 | ||||

| Portfolio turnover rate(g) | 7% | 9% | 15% | 15% | 6% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Reflects the one-time, positive effect of foreign withholding tax claims, net of the associated professional fees, which resulted in the following increases for the year ended August 31, 2019: ● Total return by 0.01%. | |||||||||

| (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares Currency Hedged MSCI Emerging Markets ETF | HEEM | CBOE BZX |

| |

S-1 |

| |

1 |

| |

2 |

| |

27 |

| |

33 |

| |

33 |

| |

34 |

| |

38 |

| |

47 |

| |

48 |

| |

49 |

| |

49 |

| Ticker: HEEM | Stock Exchange: Cboe BZX |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses 1 |

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Fee Waiver | Total Annual Fund Operating Expenses After Fee Waiver | ||||||

| ( |

||||||||||||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

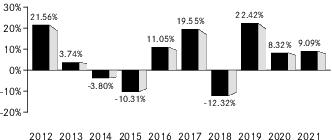

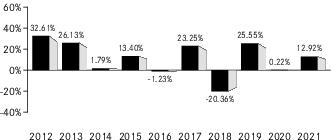

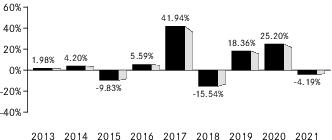

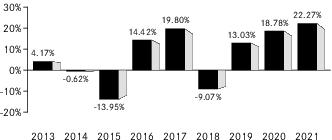

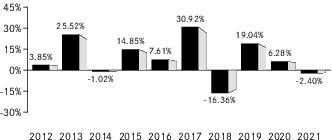

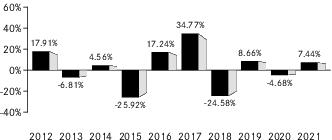

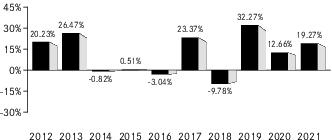

| One Year | Five Years | Since Fund Inception | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions1 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

||||

| MSCI Emerging Markets 100% Hedged to USD Index (Index returns do not reflect deductions for fees, expenses or taxes) | - |

| 1 | |

Currency forward contracts, including NDFs, do not eliminate movements in the value of non-U.S. currencies and securities but rather allow the Fund to establish a fixed rate of exchange for a future point in time. Exchange rates may be volatile and may change quickly and unpredictably in response to both global economic developments and economic conditions in a geographic region in which the Fund or the Underlying Fund invests. In addition, in order to minimize transaction costs, or for other reasons, the Fund’s exposure to the non-U.S. dollar component currencies may not be fully hedged at all times or the hedge may not be effective due to counterparty failures or otherwise. At certain times, the Fund may use an optimized hedging strategy and will hedge a smaller number of non-U.S. dollar component currencies to reduce hedging costs. Governments from time to time may intervene in the currency markets to influence prices and may adopt policies designed to influence foreign exchange rates with respect to their currency. Because the Fund’s currency hedge is reset on a monthly basis, currency risk can develop or increase intra-month. Furthermore, while the Fund is designed to hedge against currency fluctuations, it is possible that a degree of currency exposure may remain even at the time a hedging transaction is implemented. As a result, the Fund may not be able to structure its hedging transactions as anticipated or its hedging transactions may not successfully reduce the currency risk included in the Fund’s portfolio in a way that tracks the Underlying Index. Because currency forwards are over-the-counter instruments, the Fund is subject to counterparty risk as well as market or liquidity risk with respect to the hedging transactions the Fund enters into. Currency hedging activity exposes the Fund to credit risk due to counterparty exposure. This risk will be higher to the extent that the Fund trades with a single counterparty or small number of counterparties. In addition, the Fund’s currency hedging activities may involve frequent trading of currency instruments, which may increase transaction costs and cause the Fund’s return to deviate from the Underlying Index.

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

Hong Kong Political Risk. Hong Kong reverted to Chinese sovereignty on July 1, 1997 as a Special Administrative Region (“SAR”) of the People's Republic of China (“PRC”) under the principle of “one country, two systems.” Although China is obligated to maintain the current capitalist economic and social system of Hong Kong through June 30, 2047, the continuation of economic and social freedoms enjoyed in Hong Kong is dependent on the government of China. Since 1997, there have been tensions between the Chinese government and many people in Hong Kong who perceive China as tightening control over Hong Kong’s semi-autonomous liberal political, economic, legal and social framework. Recent protests and unrest have increased tensions even further. Due to the interconnected nature of the Hong Kong and Chinese economies, this instability in Hong Kong may cause uncertainty in the Hong Kong and Chinese markets. In addition, the Hong Kong dollar trades at a fixed exchange rate in relation to (or is “pegged” to) the U.S. dollar, which has contributed to the growth and stability of the Hong Kong economy. However, it is uncertain how long the currency peg will continue or what effect the establishment of an alternative exchange rate system

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through fraud or negligence because ownership in shares of Russian companies is recorded by the companies themselves and by registrars, rather than by a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

(For a share outstanding throughout each period)

| iShares Currency Hedged MSCI Emerging Markets ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $31.31 | $27.41 | $24.38 | $25.70 | $25.57 | ||||

| Net investment income(a) | 0.67 | 0.44 | 0.71 | 0.55 | 0.60 | ||||

| Net realized and unrealized gain (loss)(b) | (6.12) | 3.92 | 3.03 | (1.27) | 0.12 | ||||

| Net increase (decrease) from investment operations | (5.45) | 4.36 | 3.74 | (0.72) | 0.72 | ||||

| Distributions from net investment income(c) | (0.66) | (0.46) | (0.71) | (0.60) | (0.59) | ||||

| Net asset value, end of year | $25.20 | $31.31 | $27.41 | $24.38 | $25.70 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (17.62)% | 15.96% | 15.49% | (2.72)% | 2.77% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.78% | 0.78% | 0.78% | 0.78% | 0.78% | ||||

| Total expenses after fees waived | 0.00% | 0.00%(f) | 0.00%(f) | 0.00% | 0.00% | ||||

| Net investment income | 2.38% | 1.41% | 2.84% | 2.22% | 2.25% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $153,993 | $203,180 | $183,626 | $180,376 | $344,328 | ||||

| Portfolio turnover rate(g) | 4% | 6% | 9% | 7% | 7% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Rounds to less than 0.01%. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ |

| Ticker: ESGE | Stock Exchange: Nasdaq |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

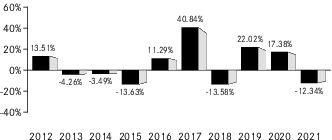

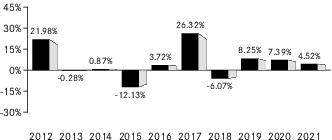

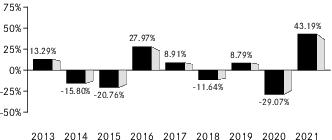

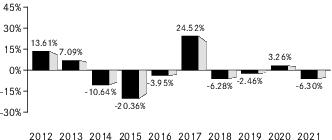

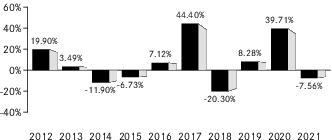

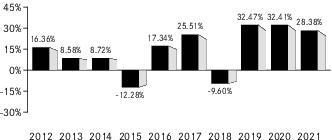

| One Year | Five Years | Since Fund Inception | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions1 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

||||

| MSCI Emerging Markets Extended ESG Focus Index2(Index returns do not reflect deductions for fees, expenses or taxes) | - |

| 1 | |

| 2 | |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

Sanctions have resulted in Russia taking counter measures or retaliatory actions, which has impaired the value and liquidity of Russian securities. These retaliatory measures include the immediate freeze of Russian assets held by the Fund. Due to the freeze of these assets, including depositary receipts, the Fund may need to liquidate non-restricted assets in order to satisfy any Fund redemption orders. The liquidation of Fund assets during this time may also result in the Fund receiving substantially lower prices for its securities. Russia may implement additional retaliatory measures, which may further impair the value and liquidity of Russian securities and the ability of the Fund to receive dividend payments. Recently, Russia has issued a number of countersanctions, some of which restrict the distribution of profits by limited liability companies (e.g., dividends), and prohibits Russian persons from entering into transactions with designated persons from “unfriendly states” as well as the export of raw materials or other products from Russia to certain sanctioned persons. Russian companies may be unable to pay dividends and, if they pay dividends, the Fund may be unable to receive them.

(For a share outstanding throughout each period)

| iShares ESG Aware MSCI EM ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18(a) | |||||

| Net asset value, beginning of year | $43.35 | $35.93 | $32.03 | $33.65 | $34.58 | ||||

| Net investment income(b) | 0.83 | 0.75 | 0.89 | 0.91 | 0.94 | ||||

| Net realized and unrealized gain (loss)(c) | (11.51) | 7.23 | 3.89 | (1.85) | (1.17) | ||||

| Net increase (decrease) from investment operations | (10.68) | 7.98 | 4.78 | (0.94) | (0.23) | ||||

| Distributions from net investment income(d) | (1.11) | (0.56) | (0.88) | (0.68) | (0.70) | ||||

| Net asset value, end of year | $31.56 | $43.35 | $35.93 | $32.03 | $33.65 | ||||

| Total Return(e) | |||||||||

| Based on net asset value | (25.08)% | 22.30% | 15.11% | (2.76)% | (0.72)% | ||||

| Ratios to Average Net Assets(f) | |||||||||

| Total expenses | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% | ||||

| Net investment income | 2.20% | 1.76% | 2.75% | 2.76% | 2.63% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $4,251,525 | $7,105,443 | $3,654,480 | $672,543 | $329,753 | ||||

| Portfolio turnover rate(g) | 41% | 41% | 46% | 34% | 45% | ||||

(a) Per share amounts reflect a two-for-one stock split effective after the close of trading on May 24, 2018. | |||||||||

| (b) Based on average shares outstanding. | |||||||||

| (c) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (d) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (e) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Australia ETF | EWA | NYSE ARCA |

| Ticker: EWA | Stock Exchange: NYSE Arca |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

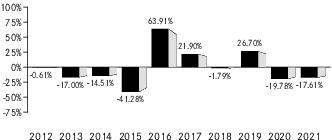

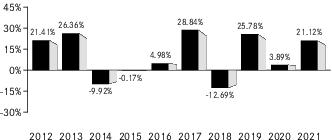

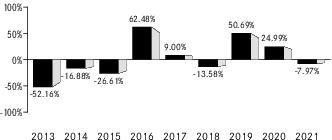

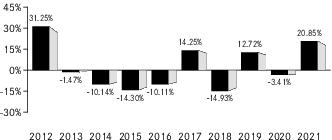

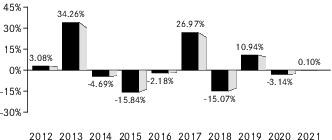

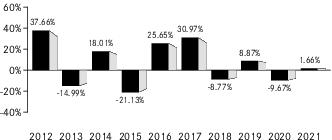

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

|||||

| Return After Taxes on Distributions1 |

|||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

|||||

| MSCI Australia Index (Index returns do not reflect deductions for fees, expenses, or taxes) |

| 1 | |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Australia ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $25.96 | $21.12 | $21.67 | $22.56 | $22.58 | ||||

| Net investment income(a) | 0.93 | 0.65 | 0.67 | 1.00 | 0.90 | ||||

| Net realized and unrealized gain (loss)(b) | (3.31) | 4.77 | (0.48) | (0.70) | 0.07 | ||||

| Net increase (decrease) from investment operations | (2.38) | 5.42 | 0.19 | 0.30 | 0.97 | ||||

| Distributions from net investment income(c) | (1.63) | (0.58) | (0.74) | (1.19) | (0.99) | ||||

| Net asset value, end of year | $21.95 | $25.96 | $21.12 | $21.67 | $22.56 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (9.53)% | 25.69% | 0.99% | 1.75% | 4.43% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.50% | 0.50% | 0.51% | 0.50% | 0.47% | ||||

| Net investment income | 3.86% | 2.69% | 3.23% | 4.68% | 3.95% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $1,615,410 | $1,505,880 | $1,263,259 | $1,399,590 | $1,362,770 | ||||

| Portfolio turnover rate(f) | 15% | 4% | 8% | 9% | 3% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Austria ETF | EWO | NYSE ARCA |

| Ticker: EWO | Stock Exchange: NYSE Arca |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

|||||

| Return After Taxes on Distributions1 |

|||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

|||||

| MSCI Austria IMI 25/50 (Index returns do not reflect deductions for fees, expenses, or taxes)2 |

| 1 |

| 2 |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Austria ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $25.28 | $15.67 | $18.89 | $22.88 | $22.87 | ||||

| Net investment income(a) | 0.97 | 0.54 | 0.06 | 0.48 | 0.58 | ||||

| Net realized and unrealized gain (loss)(b) | (8.01) | 9.50 | (3.16) | (3.69) | 0.11 | ||||

| Net increase (decrease) from investment operations | (7.04) | 10.04 | (3.10) | (3.21) | 0.69 | ||||

| Distributions from net investment income(c) | (0.88) | (0.43) | (0.12) | (0.78) | (0.68) | ||||

| Net asset value, end of year | $17.36 | $25.28 | $15.67 | $18.89 | $22.88 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (28.58)% | 64.50% | (16.58)% | (14.07)% | 3.03% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.50% | 0.50% | 0.51% | 0.49% | 0.47% | ||||

| Net investment income | 4.32% | 2.55% | 0.32% | 2.34% | 2.37% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $62,502 | $89,752 | $43,104 | $54,767 | $146,463 | ||||

| Portfolio turnover rate(f) | 19% | 14% | 16% | 17% | 19% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Belgium ETF | EWK | NYSE ARCA |

| Ticker: EWK | Stock Exchange: NYSE Arca |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

|||||

| Return After Taxes on Distributions1 |

|||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

|||||

| MSCI Belgium IMI 25/50 (Index returns do not reflect deductions for fees, expenses, or taxes)2 |

| 1 |

| 2 |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Belgium ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $22.28 | $17.76 | $18.48 | $19.70 | $20.59 | ||||

| Net investment income(a) | 0.44 | 0.31 | 0.24 | 0.44 | 0.50 | ||||

| Net realized and unrealized gain (loss)(b) | (5.80) | 4.64 | (0.60) | (1.22) | (0.77) | ||||

| Net increase (decrease) from investment operations | (5.36) | 4.95 | (0.36) | (0.78) | (0.27) | ||||

| Distributions from net investment income(c) | (0.99) | (0.43) | (0.36) | (0.44) | (0.62) | ||||

| Net asset value, end of year | $15.93 | $22.28 | $17.76 | $18.48 | $19.70 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (24.77)% | 27.96%(e) | (2.02)% | (3.80)% | (1.34)% | ||||

| Ratios to Average Net Assets(f) | |||||||||

| Total expenses | 0.50% | 0.50% | 0.51% | 0.49% | 0.47% | ||||

| Net investment income | 2.22% | 1.52% | 1.34% | 2.43% | 2.40% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $17,845 | $41,002 | $32,685 | $47,305 | $59,903 | ||||

| Portfolio turnover rate(g) | 7% | 16% | 18% | 11% | 13% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Includes payment received from a settlement of litigation, which impacted the Fund' total return. Excluding the payment from a settlement of litigation, the Fund’s total return is 22.73%. | |||||||||

| (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI BIC ETF | BKF | NYSE ARCA |

| Ticker: BKF | Stock Exchange: NYSE Arca |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions1 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

||||

| MSCI BIC Index (Index returns do not reflect deductions for fees, expenses or taxes)2 | - |

| 1 | |

| 2 | |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through fraud or negligence because ownership in shares of Russian companies is recorded by the companies themselves and by registrars, rather than by a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

| ■ | creates rights, or obligations, which are not ordinarily created between persons dealing at arm's length; |

| ■ | results, directly or indirectly, in the misuse, or abuse, of the provisions of IT Act; |

| ■ | lacks commercial substance; or |

| ■ | is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona fide purposes. |

| ■ | An FPI who has not availed itself of any benefit under a tax treaty and has made |

| ■ | An investment made by a non-resident, directly or indirectly, in an FPI; and |

| ■ | Any arrangement where the aggregate tax benefit to all the parties of the arrangement in the relevant financial year does not exceed INR 30 million. |

| ■ | Dividend: Dividend income earned by the Fund will be subject to Indian income-tax at the specified tax rate of 20%1, under the IT Act. The applicable tax is withheld by |

| 1 | All tax rates mentioned in this Indian Tax Disclosure section are exclusive of the applicable surcharge and health and education cess, unless otherwise specified. |

| ■ | Interest: Interest paid to the Fund with respect to debt obligations of Indian issuers will be subject to Indian income tax. A 5% tax rate applies to certain types of interest paid to a nonresident: |

| ■ | Securities Transaction Tax: All transactions entered on a recognized stock exchange in India are subject to a Securities Transaction Tax (“STT”). STT has been introduced under Section 98 of the Finance (No.2) Act, 2004 on transactions relating to sale, purchases and redemption of shares made by purchasers or sellers of Indian securities. The current STT is levied on the transaction value as follows: |

| ■ | 0.1% payable by the buyer and 0.1% by the seller on the value of transactions of delivery-based transfer of an equity share in an Indian company entered in a recognized stock exchange; |

| ■ | 0.025% on the value of transactions of non-delivery-based sale of an equity share in an Indian company, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.05% on the value of transactions of sale of options, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.01% on the value of transactions of sale of futures, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.125% on the value of transactions of sale of options where the option is exercised, entered in a recognized stock exchange and payable by the buyer; and |

| ■ | 0.2% on the value of transactions of the sale of unlisted shares by existing shareholders in an initial public offer. |

| ■ | Capital Gains: The taxation of capital gains is as follows. Long-term capital gains (i.e., gains on the sale of shares held for more than 12 months) from the sale of equity shares of an Indian company listed on a recognized stock exchange are taxable in India at a rate of 10% provided any applicable STT has been paid, both on acquisition and sale of such shares (subject to certain transactions, to which the provisions of applicability and payment of STT upon acquisition do not apply). The tax on these capital gains is calculated on gains exceeding INR 100,000 (without any indexation and foreign exchange fluctuation benefits). Long term capital gains arising from sale of listed shares, not executed on a recognized stock exchange, will be taxed at a rate of 10%. |

(For a share outstanding throughout each period)

| iShares MSCI BIC ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21(a) |

Year Ended 08/31/20(a) |

Year Ended 08/31/19(a) |

Year Ended 08/31/18(a) | |||||

| Net asset value, beginning of year | $50.27 | $47.46 | $40.23 | $41.01 | $42.21 | ||||

| Net investment income(b) | 0.91 | 0.62 | 0.55 | 0.69 | 0.68 | ||||

| Net realized and unrealized gain (loss)(c) | (13.74) | 2.74 | 7.34 | (0.59) | (1.13) | ||||

| Net increase (decrease) from investment operations | (12.83) | 3.36 | 7.89 | 0.10 | (0.45) | ||||

| Distributions from net investment income(d) | (1.45) | (0.55) | (0.66) | (0.88) | (0.75) | ||||

| Net asset value, end of year | $35.99 | $50.27 | $47.46 | $40.23 | $41.01 | ||||

| Total Return(e) | |||||||||

| Based on net asset value | (26.03)% | 7.09% | 19.78% | 0.35% | (1.16)% | ||||

| Ratios to Average Net Assets(f) | |||||||||

| Total expenses | 0.69% | 0.70% | 0.70% | 0.69% | 0.67% | ||||

| Net investment income | 2.15% | 1.20% | 1.29% | 1.69% | 1.51% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $89,980 | $158,342 | $147,123 | $160,926 | $205,064 | ||||

| Portfolio turnover rate(g) | 12% | 80% | 42% | 53% | 22% | ||||

(a) Consolidated Financial Highlights. | |||||||||

| (b) Based on average shares outstanding. | |||||||||

| (c) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (d) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (e) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Brazil ETF | EWZ | NYSE ARCA |

| Ticker: EWZ | Stock Exchange: NYSE Arca |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

- | |||

| Return After Taxes on Distributions1 |

- |

- |

- | ||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

- |

- | ||

| MSCI Brazil 25/50 Index (Index returns do not reflect deductions for fees, expenses or taxes)2 | - |

- |

| 1 |

| 2 |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Brazil ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $36.58 | $29.62 | $40.92 | $32.03 | $40.06 | ||||

| Net investment income(a) | 4.10 | 1.34 | 0.86 | 1.12 | 1.14 | ||||

| Net realized and unrealized gain (loss)(b) | (6.56) | 6.52 | (11.13) | 8.88 | (8.22) | ||||

| Net increase (decrease) from investment operations | (2.46) | 7.86 | (10.27) | 10.00 | (7.08) | ||||

| Distributions from net investment income(c) | (3.64) | (0.90) | (1.03) | (1.11) | (0.95) | ||||

| Net asset value, end of year | $30.48 | $36.58 | $29.62 | $40.92 | $32.03 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (6.05)% | 26.35% | (25.63)% | 31.36% | (17.87)% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.58% | 0.57% | 0.59% | 0.59% | 0.59% | ||||

| Net investment income | 13.01% | 3.84% | 2.35% | 2.75% | 2.86% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $5,236,173 | $5,044,685 | $5,312,367 | $8,205,744 | $5,501,031 | ||||

| Portfolio turnover rate(f) | 27%(g) | 17%(g) | 29%(g) | 16%(g) | 30%(g) | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Portfolio turnover rate includes portfolio transactions that are executed as a result of the Fund offering and redeeming Creation Units solely for cash in U.S. dollars (“cash creations”). | |||||||||

| (g) Portfolio turnover rate excluding cash creations was as follows: | 22% | 12% | 11% | 10% | 13% | ||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Canada ETF | EWC | NYSE ARCA |

| Ticker: EWC | Stock Exchange: NYSE Arca |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

in the

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

|||||

| Return After Taxes on Distributions1 |

|||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

|||||

| MSCI Canada Custom Capped Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 |

| 1 |

| 2 |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Canada ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $37.38 | $28.76 | $28.22 | $28.79 | $27.83 | ||||

| Net investment income(a) | 0.77 | 0.64 | 0.65 | 0.62 | 0.58 | ||||

| Net realized and unrealized gain (loss)(b) | (3.68) | 8.60 | 0.54 | (0.53) | 0.97 | ||||

| Net increase (decrease) from investment operations | (2.91) | 9.24 | 1.19 | 0.09 | 1.55 | ||||

| Distributions from net investment income(c) | (0.75) | (0.62) | (0.65) | (0.66) | (0.59) | ||||

| Net asset value, end of year | $33.72 | $37.38 | $28.76 | $28.22 | $28.79 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | (7.94)% | 32.41% | 4.32% | 0.56% | 5.61% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.50% | 0.50% | 0.51% | 0.49% | 0.47% | ||||

| Net investment income | 2.05% | 1.91% | 2.37% | 2.26% | 2.01% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $3,662,225 | $4,157,136 | $2,266,034 | $2,618,586 | $2,994,627 | ||||

| Portfolio turnover rate(f) | 5% | 8% | 9% | 6% | 3% | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Chile ETF | ECH | CBOE BZX |

| Ticker: ECH | Stock Exchange: Cboe BZX |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

- |

- | ||

| Return After Taxes on Distributions1 |

- |

- |

- | ||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

- |

- | ||

| MSCI Chile IMI 25/50 (Index returns do not reflect deductions for fees, expenses or taxes)2 | - |

- |

- |

| 1 |

| 2 |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

(For a share outstanding throughout each period)

| iShares MSCI Chile ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21 |

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 | |||||

| Net asset value, beginning of year | $28.52 | $25.37 | $35.88 | $43.71 | $47.96 | ||||

| Net investment income(a) | 2.17 | 0.63 | 0.61 | 0.74 | 0.78 | ||||

| Net realized and unrealized gain (loss)(b) | (1.16) | 3.16 | (10.54) | (7.76) | (4.06) | ||||

| Net increase (decrease) from investment operations | 1.01 | 3.79 | (9.93) | (7.02) | (3.28) | ||||

| Distributions(c) | |||||||||

| From net investment income | (1.91) | (0.64) | (0.58) | (0.79) | (0.92) | ||||

| Return of capital | — | — | — | (0.02) | (0.05) | ||||

| Total distributions | (1.91) | (0.64) | (0.58) | (0.81) | (0.97) | ||||

| Net asset value, end of year | $27.62 | $28.52 | $25.37 | $35.88 | $43.71 | ||||

| Total Return(d) | |||||||||

| Based on net asset value | 4.03% | 14.90% | (27.72)% | (16.22)% | (7.03)% | ||||

| Ratios to Average Net Assets(e) | |||||||||

| Total expenses | 0.58% | 0.57% | 0.59% | 0.59% | 0.59% | ||||

| Net investment income | 8.30% | 2.17% | 2.10% | 1.74% | 1.55% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $493,079 | $476,286 | $441,423 | $330,140 | $393,351 | ||||

| Portfolio turnover rate(f) | 94%(g) | 62%(g) | 51%(g) | 75%(g) | 54%(g) | ||||

(a) Based on average shares outstanding. | |||||||||

| (b) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (c) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (d) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (e) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (f) Portfolio turnover rate includes portfolio transactions that are executed as a result of the Fund offering and redeeming Creation Units solely for cash in U.S. dollars (“cash creations”). | |||||||||

| (g) Portfolio turnover rate excluding cash creations was as follows: | 36% | 17% | 21% | 12% | 11% | ||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Emerging Markets Asia ETF | EEMA | NASDAQ |

ASIA ETF

| Ticker: EEMA | Stock Exchange: Nasdaq |

(ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Since Fund Inception | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions1 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares1 |

- |

||||

| MSCI EM Asia Custom Capped Index (Index returns do not reflect deductions for fees, expenses or taxes)2 | - |

| 1 |

| 2 |

| ■ | Government Control and Regulations. Governments of many Asian countries have implemented significant economic reforms in order to liberalize trade policies, promote foreign investment in their economies, reduce government control of the economy and develop market mechanisms. There can be no assurance these reforms will continue or that they will be effective. Despite recent reform and privatizations, significant regulation of investment and industry is still pervasive in many Asian countries and may restrict foreign ownership of domestic corporations and repatriation of assets, which may adversely affect Fund investments. |

| ■ | Political and Social Risk. Governments in some Asian countries are authoritarian in nature, have been installed or removed as a result of military coups or have periodically used force to suppress civil dissent. Disparities of wealth, the pace and success of democratization, and ethnic, religious and racial disaffection may exacerbate social turmoil, violence and labor unrest in some countries. Unanticipated or sudden political or social developments may result in sudden and significant investment losses. |

| ■ | Expropriation Risk. Investing in certain Asian countries involves risk of loss due to expropriation, nationalization, or confiscation of assets and property or the imposition of restrictions on foreign investments and on repatriation of capital invested. |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

| ■ | creates rights, or obligations, which are not ordinarily created between persons dealing at arm's length; |

| ■ | results, directly or indirectly, in the misuse, or abuse, of the provisions of IT Act; |

| ■ | lacks commercial substance; or |

| ■ | is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona fide purposes. |

| ■ | An FPI who has not availed itself of any benefit under a tax treaty and has made investment in accordance with the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019; |

| ■ | An investment made by a non-resident, directly or indirectly, in an FPI; and |

| ■ | Any arrangement where the aggregate tax benefit to all the parties of the arrangement in the relevant financial year does not exceed INR 30 million. |

| ■ | Dividend: Dividend income earned by the Fund will be subject to Indian income-tax at the specified tax rate of 20%1, under the IT Act. The applicable tax is withheld by the dividend-paying issuer at the time of payment. The Fund being a resident of USA, may claim the benefit of the India-USA Double Taxation Avoidance Agreement (“DTAA”), which provides a beneficial rate of 15%, subject to the Fund holding at least 10% of the share capital carrying voting power of the Indian company distributing dividend. |

| 1 | All tax rates mentioned in this Indian Tax Disclosure section are exclusive of the applicable surcharge and health and education cess, unless otherwise specified. |

| ■ | Interest: Interest paid to the Fund with respect to debt obligations of Indian issuers will be subject to Indian income tax. A 5% tax rate applies to certain types of interest paid to a nonresident: |

| ■ | Securities Transaction Tax: All transactions entered on a recognized stock exchange in India are subject to a Securities Transaction Tax (“STT”). STT has been introduced under Section 98 of the Finance (No.2) Act, 2004 on transactions relating to sale, purchases and redemption of shares made by purchasers or sellers of Indian securities. The current STT is levied on the transaction value as follows: |

| ■ | 0.1% payable by the buyer and 0.1% by the seller on the value of transactions of delivery-based transfer of an equity share in an Indian company entered in a recognized stock exchange; |

| ■ | 0.025% on the value of transactions of non-delivery-based sale of an equity share in an Indian company, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.05% on the value of transactions of sale of options, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.01% on the value of transactions of sale of futures, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.125% on the value of transactions of sale of options where the option is exercised, entered in a recognized stock exchange and payable by the buyer; and |

| ■ | 0.2% on the value of transactions of the sale of unlisted shares by existing shareholders in an initial public offer. |

| ■ | Capital Gains: The taxation of capital gains is as follows. Long-term capital gains (i.e., gains on the sale of shares held for more than 12 months) from the sale of equity shares of an Indian company listed on a recognized stock exchange are taxable in India at a rate of 10% provided any applicable STT has been paid, both on acquisition and sale of such shares (subject to certain transactions, to which the provisions of applicability and payment of STT upon acquisition do not apply). The tax on these capital gains is calculated on gains exceeding INR 100,000 (without any indexation and foreign exchange fluctuation benefits). Long term capital gains arising from sale of listed shares, not executed on a recognized stock exchange, will be taxed at a rate of 10%. |

(For a share outstanding throughout each period)

| iShares MSCI Emerging Markets Asia ETF | |||||||||

| Year Ended 08/31/22 |

Year Ended 08/31/21(a) |

Year Ended 08/31/20(a) |

Year Ended 08/31/19(a) |

Year Ended 08/31/18(a) | |||||

| Net asset value, beginning of year | $88.19 | $75.48 | $62.82 | $69.38 | $69.15 | ||||

| Net investment income(b) | 1.25 | 1.28 | 1.12 | 1.26 | 1.16 | ||||

| Net realized and unrealized gain (loss)(c) | (20.98) | 12.32 | 12.79 | (6.52) | 0.42 | ||||

| Net increase (decrease) from investment operations | (19.73) | 13.60 | 13.91 | (5.26) | 1.58 | ||||

| Distributions from net investment income(d) | (2.02) | (0.89) | (1.25) | (1.30) | (1.35) | ||||

| Net asset value, end of year | $66.44 | $88.19 | $75.48 | $62.82 | $69.38 | ||||

| Total Return(e) | |||||||||

| Based on net asset value | (22.77)% | 18.11% | 22.31% | (7.52)% | 2.22% | ||||

| Ratios to Average Net Assets(f) | |||||||||

| Total expenses | 0.49% | 0.50% | 0.50% | 0.50% | 0.50% | ||||

| Net investment income | 1.62% | 1.46% | 1.68% | 1.94% | 1.58% | ||||

| Supplemental Data | |||||||||

| Net assets, end of year (000) | $571,381 | $881,929 | $558,558 | $452,328 | $440,538 | ||||

| Portfolio turnover rate(g) | 24% | 48% | 20% | 16% | 33% | ||||

(a) Consolidated Financial Highlights. | |||||||||

| (b) Based on average shares outstanding. | |||||||||

| (c) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||||

| (d) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||||

| (e) Where applicable, assumes the reinvestment of distributions. | |||||||||

| (f) Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. | |||||||||

| (g) Portfolio turnover rate excludes in-kind transactions. | |||||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

|

December 29, 2022 |

|

2022 Prospectus |

| • | iShares MSCI Emerging Markets ETF | EEM | NYSE ARCA |

| Ticker: EEM | Stock Exchange: NYSE Arca |

| (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses1 |

Total Annual Fund Operating Expenses | |||

| 1 | |

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $ |

$ |

$ |

$ |

| 1 |

| One Year | Five Years | Ten Years | |||

| (Inception Date: |

|||||

| Return Before Taxes |

- |

||||

| Return After Taxes on Distributions2 |

- |

||||

| Return After Taxes on Distributions and Sale of Fund Shares2 |

- |

||||

| MSCI Emerging Markets Index (Index returns do not reflect deductions for fees, expenses or taxes) | - |

| 2 | |

| ■ | Government intervention in issuers' operations or structure; |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements and the risk of being delisted from U.S. exchanges; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from or may not be as extensive or protective as those that apply in the U.S. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through fraud or negligence because ownership in shares of Russian companies is recorded by the companies themselves and by registrars, rather than by a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

| ■ | creates rights, or obligations, which are not ordinarily created between persons dealing at arm's length; |

| ■ | results, directly or indirectly, in the misuse, or abuse, of the provisions of IT Act; |

| ■ | lacks commercial substance; or |

| ■ | is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona fide purposes. |

| ■ | An FPI who has not availed itself of any benefit under a tax treaty and has made |

| ■ | An investment made by a non-resident, directly or indirectly, in an FPI; and |

| ■ | Any arrangement where the aggregate tax benefit to all the parties of the arrangement in the relevant financial year does not exceed INR 30 million. |

| ■ | Dividend: Dividend income earned by the Fund will be subject to Indian income-tax at the specified tax rate of 20%1, under the IT Act. The applicable tax is withheld by the dividend-paying issuer at the time of payment. The Fund being a resident of USA, may claim the benefit of the India-USA Double Taxation Avoidance Agreement (“DTAA”), which provides a beneficial rate of 15%, subject to the Fund holding at least 10% of the share capital carrying voting power of the Indian company distributing dividend. |

| 1 | All tax rates mentioned in this Indian Tax Disclosure section are exclusive of the applicable surcharge and health and education cess, unless otherwise specified. |

| ■ | Interest: Interest paid to the Fund with respect to debt obligations of Indian issuers will be subject to Indian income tax. A 5% tax rate applies to certain types of interest paid to a nonresident: |