|

|

| (as revised |

|

2020 Prospectus |

| • | iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ |

(ongoing expenses that you pay each year as a percentage of the value of your investments) 1 | ||||||||||||

Management Fees |

Distribution and Service (12b-1) Fees |

Other Expenses 2 |

Acquired Fund Fees and Expenses |

Total Annual Fund Operating Expenses |

Fee Waiver |

Total Annual Fund Operating Expenses After Fee Waiver | ||||||

| ( |

||||||||||||

1 |

|

2 |

The amount rounded to 0.00%. |

1 Year |

3 Years |

5 Years |

10 Years | |||

| $ |

$ |

$ |

$ |

1 |

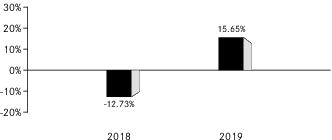

One Year |

Since Fund Inception | ||

(Inception Date: |

|||

| Return Before Taxes | |||

| Return After Taxes on Distributions 1 |

|||

| Return After Taxes on Distributions and Sale of Fund Shares 1 |

|||

MSCI Emerging Markets ex China Index (Index returns do not reflect deductions for fees, expenses or taxes) |

1 |

| ■ | General Impact. This outbreak has resulted in travel restrictions, closed international borders, enhanced health screenings at ports of entry and elsewhere, disruption of and delays in healthcare service preparation and delivery, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, temporary closures of stores, restaurants and other commercial establishments, layoffs, defaults and other significant economic impacts, as well as general concern and uncertainty. |

| ■ | Market Volatility. The outbreak has also resulted in extreme volatility, severe losses, and disruptions in markets which can adversely impact the Fund and its investments, including impairing hedging activity to the extent a Fund engages in such activity, as expected correlations between related markets or instruments may no longer apply. In addition, to the extent the Fund invests in short-term instruments that have negative yields, the Fund’s value may be impaired as a result. Certain issuers of equity securities have cancelled or announced the suspension of dividends. The outbreak has, and may continue to, negatively affect the credit ratings of some fixed income securities and their issuers. |

| ■ | Market Closures. Certain local markets have been or may be subject to closures, and there can be no assurance that trading will continue in any local markets in which the Fund may invest, when any resumption of trading will occur or, once such markets resume trading, whether they will face further closures. Any suspension of |

| trading in markets in which the Fund invests will have an impact on the Fund and its investments and will impact the Fund’s ability to purchase or sell securities in such markets. | |

| ■ | Operational Risk. The outbreak could also impair the information technology and other operational systems upon which the Fund’s service providers, including BFA, rely, and could otherwise disrupt the ability of employees of the Fund’s service providers to perform critical tasks relating to the Fund, for example, due to the service providers’ employees performing tasks in alternate locations than under normal operating conditions or the illness of certain employees of the Fund’s service providers. |

| ■ | Governmental Interventions. Governmental and quasi-governmental authorities and regulators throughout the world have responded to the outbreak and the resulting economic disruptions with a variety of fiscal and monetary policy changes, including direct capital infusions into companies and other issuers, new monetary policy tools, and lower interest rates. An unexpected or sudden reversal of these policies, or the ineffectiveness of such policies, is likely to increase market volatility, which could adversely affect the Fund’s investments. |

| ■ | Pre-Existing Conditions. Public health crises caused by the outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. |

| ■ | A lack of market liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ from and/or may not be as extensive or protective as those that apply in the U.S. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in Russia; |

| ■ | Risks in connection with the maintenance of the Fund’s portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund’s ownership rights in portfolio securities could be lost through fraud or negligence because ownership in shares of Russian companies is recorded by the companies themselves and by registrars, rather than by a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because Russian banking institutions and registrars are not guaranteed by the Russian government; and |

| ■ | The risk that various responses by other nation-states to alleged Russian cyber activity will impact Russia’s economy and Russian issuers of securities in which the Fund invests. |

| ■ | creates rights, or obligations, which are not ordinarily created between persons dealing at arm's length; |

| ■ | results, directly or indirectly, in the misuse, or abuse, of the provisions of IT Act; |

| ■ | lacks commercial substance; or |

| ■ | is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona fide purposes. |

| ■ | An FPI who has not availed itself of any benefit under a tax treaty and has made investment in accordance with the Securities and Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019; |

| ■ | An investment made by a non-resident, directly or indirectly, in an FPI; and |

| ■ | Any arrangement where the aggregate tax benefit to all the parties of the arrangement in the relevant financial year does not exceed INR 30 million. |

| ■ | The risk of delays in settling portfolio transactions and the risk of loss arising out of the system of share registration and custody used in certain Eastern European countries; |

| ■ | Risks in connection with the maintenance of the Fund's portfolio securities and cash with foreign sub-custodians and securities depositories, including the risk that appropriate sub-custody arrangements will not be available to the Fund; |

| ■ | The risk that the Fund's ownership rights in portfolio securities could be lost through fraud or negligence as a result of the fact that ownership in shares of certain Eastern European companies is recorded by the companies themselves and by registrars, rather than a central registration system; |

| ■ | The risk that the Fund may not be able to pursue claims on behalf of its shareholders because of the system of share registration and custody, and because certain Eastern European banking institutions and registrars are not guaranteed by their respective governments; and |

| ■ | Risks in connection with Eastern European countries' dependence on the economic health of Western European countries and the EU as a whole. |

| ■ | Dividend: Dividend income earned by the Fund will be subject to Indian income-tax at the specified tax rate of 20% 1 , under the IT Act. The applicable tax is withheld by |

1 |

All tax rates mentioned in this Indian Tax Disclosure section are exclusive of the applicable surcharge and health and education cess, unless otherwise specified. |

| ■ | Interest: Interest paid to the Fund with respect to debt obligations of Indian issuers will be subject to Indian income tax. A 5% tax rate applies to certain types of interest paid to a nonresident: |

| ■ | Securities Transaction Tax: All transactions entered on a recognized stock exchange in India are subject to a Securities Transaction Tax (“STT”). STT has been introduced under Section 98 of the Finance (No.2) Act, 2004 on transactions relating to sale, purchases and redemption of shares made by purchasers or sellers of Indian securities. The current STT is levied on the transaction value as follows: |

| ■ | 0.1% payable by the buyer and 0.1% by the seller on the value of transactions of delivery-based transfer of an equity share in an Indian company entered in a recognized stock exchange; |

| ■ | 0.025% on the value of transactions of non-delivery-based sale of an equity share in an Indian company, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.05% on the value of transactions of sale of options, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.01% on the value of transactions of sale of futures, entered in a recognized stock exchange and payable by the seller; |

| ■ | 0.125% on the value of transactions of sale of options where the option is exercised, entered in a recognized stock exchange and payable by the buyer; and |

| ■ | 0.2% on the value of transactions of the sale of unlisted shares by existing shareholders in an initial public offer. |

| ■ | Capital Gains : The taxation of capital gains is as follows. Long-term capital gains ( i.e., gains on the sale of shares held for more than 12 months) from the sale of equity shares of an Indian company listed on a recognized stock exchange are taxable in India at a rate of 10% provided any applicable STT has been paid, both on acquisition and sale of such shares (subject to certain transactions, to which the provisions of applicability and payment of STT upon acquisition do not apply). The tax on these capital gains is calculated on gains exceeding INR 100,000 (without any indexation and foreign exchange fluctuation benefits). Long term capital gains arising from sale of listed shares, not executed on a recognized stock exchange, will be taxed at a rate of 10%. |

(For a share outstanding throughout each period)

iShares MSCI Emerging Markets ex China ETF | |||||||

Year Ended 08/31/20 |

Year Ended 08/31/19 |

Year Ended 08/31/18 |

Period From 07/18/17 (a) to 08/31/17 | ||||

Net asset value, beginning of period |

$46.25 | $49.59 | $51.14 | $50.22 | |||

| Net investment income (b) |

1.46 | 1.62 | 1.10 | 0.13 | |||

| Net realized and unrealized gain (loss) (c) |

(0.05) | (3.83) | (1.80) | 0.79 | |||

| Net increase (decrease) from investment operations | 1.41 | (2.21) | (0.70) | 0.92 | |||

Distributions (d) |

|||||||

| From net investment income | (1.66) | (1.13) | (0.85) | — | |||

| Total distributions | (1.66) | (1.13) | (0.85) | — | |||

Net asset value, end of period |

$46.00 | $46.25 | $49.59 | $51.14 | |||

Total Return |

|||||||

| Based on net asset value | 2.87% | (4.42)% | (1.41)% | 1.83% (e) | |||

Ratios to Average Net Assets |

|||||||

| Total expenses (f) |

0.36% | 0.49% | 0.49% | 0.49% (g) | |||

| Total expenses after fees waived (f) |

0.16% | 0.26% | 0.41% | 0.41% (g) | |||

| Net investment income | 3.24% | 3.38% | 2.09% | 2.07% (g) | |||

Supplemental Data |

|||||||

| Net assets, end of period (000) | $73,606 | $27,748 | $9,919 | $10,227 | |||

| Portfolio turnover rate (h)(i) |

18% | 10% | 9% | 0% (e)(j) | |||

(a) Commencement of operations. | |||||||

(b) Based on average shares outstanding. | |||||||

(c) The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. | |||||||

(d) Distributions for annual periods determined in accordance with U.S. federal income tax regulations. | |||||||

(e) Not annualized. | |||||||

(f) The Fund indirectly bears its proportionate share of fees and expenses incurred by the underlying fund in which the Fund is invested. This ratio does not include these indirect fees and expenses. | |||||||

(g) Annualized. | |||||||

(h) Portfolio turnover rate excludes in-kind transactions. | |||||||

(i) Portfolio turnover rate excludes the portfolio activity of the underlying fund in which the Fund is invested. See the underlying fund's financial highlights for its respective portfolio turnover rates. | |||||||

(j) Rounds to less than 1%. | |||||||

| Call: | 1-800-iShares or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

(as revised May 17, 2021)

| Fund | Ticker | Listing Exchange | ||

| iShares MSCI Emerging Markets ex China ETF (the “Fund”) | EMXC | NASDAQ |

| • | Communications of Data Files: The Fund may make available through the facilities of the National Securities Clearing Corporation (“NSCC”) or through posting on the www.iShares.com, prior to the opening of trading on each business day, a list of the Fund’s holdings (generally pro-rata) that Authorized Participants could deliver to the Fund to settle purchases of the Fund (i.e. Deposit Securities) or that Authorized Participants would receive from the Fund to settle redemptions of the Fund (i.e. Fund Securities). These files are known as the Portfolio Composition File and the Fund Data File (collectively, “Files”). The Files are applicable for the next trading day and are provided to the NSCC and/or posted on www.iShares.com after the close of markets in the U.S. |

| • | Communications with Authorized Participants and Liquidity Providers: Certain employees of BFA are responsible for interacting with Authorized Participants and liquidity providers with respect to discussing custom basket proposals as described in the Custom Baskets section of this SAI. As part of these discussions, these employees may discuss with an Authorized Participant or liquidity provider the securities the Fund is willing to accept for a creation, and securities that the Fund will provide on a redemption. |

| • | Communications with Listing Exchanges: From time to time, employees of BFA may discuss portfolio holdings information with the applicable primary listing exchange for the Fund as needed to meet the exchange listing standards. |

| • | Communications with Other Portfolio Managers: Certain information may be provided to employees of BFA who manage funds that invest a significant percentage of their assets in shares of an underlying fund as necessary to manage the fund’s investment objective and strategy. |

| • | Communication of Other Information: Certain explanatory information regarding the Files is released to Authorized Participants and liquidity providers on a daily basis, but is only done so after the Files are posted to www.iShares.com. |

| • | Third-Party Service Providers: Certain portfolio holdings information may be disclosed to Fund Directors and their counsel, outside counsel for the Fund, auditors and to certain third-party service providers (i.e., fund administrator, custodian, proxy voting service) for which a non-disclosure, confidentiality agreement or other obligation is in place with such service providers, as may be necessary to conduct business in the ordinary course in a manner consistent with applicable policies, agreements with the Fund, the terms of the current registration statements and federal securities laws and regulations thereunder. |

| • | Liquidity Metrics: “Liquidity Metrics” which seek to ascertain the Fund’s liquidity profile under BlackRock’s global liquidity risk methodology which include but are not limited to: (a) disclosure regarding the number of days needed to liquidate a portfolio or the portfolio’s underlying investments; and (b) the percentage of the Fund’s NAV invested in a particular liquidity tier under BlackRock’s global liquidity risk methodology. The dissemination of position-level liquidity metrics data and any non-public regulatory data pursuant to the Liquidity Rule (including SEC liquidity tiering) is not permitted unless pre-approved. Disclosure of portfolio-level liquidity metrics prior to 60 calendar days after calendar quarter-end requires a non-disclosure or confidentiality agreement and CCO approval. Portfolio-level liquidity metrics disclosure subsequent to 60 calendar days after calendar quarter-end requires the approval of portfolio management and must be disclosed to all parties requesting the information if disclosed to any party. |

| • | Selection Criteria. MSCI's index construction process involves: (i) defining the equity universe; (ii) determining the market investable equity universe for each market; (iii) determining market capitalization size segments for each market; (iv) applying final size segment investability requirements; and (v) applying index continuity rules for the MSCI Global Standard Index. |

| • | Achieving global size integrity by ensuring that companies of comparable and relevant sizes are included in a given size segment across all markets in a composite index; and |

| • | Achieving consistent market coverage by ensuring that each market's size segment is represented in its proportional weight in the composite universe. |

| • | MSCI Global Standard Indexes cover all investable large- and mid-cap securities by including the largest issuers comprising approximately 85% of each market’s free float-adjusted market capitalization. |

| • | MSCI Global Large Cap Indexes provide coverage of all investable large-cap securities by including the largest issuers comprising approximately 70% of each market’s free-float adjusted market capitalization. |

| • | MSCI Global Mid Cap Indexes provide coverage in each market by deriving the difference between the market coverage of the MSCI Global Standard Index and the MSCI Global Large Cap Index in that market. |

| • | MSCI Global Small Cap Indexes provide coverage of companies with a market capitalization below that of the companies in the MSCI Global Standard Indexes. |

| • | Semi-Annual Index Reviews (“SAIRs”), conducted on a fixed semi-annual timetable that systematically reassess the various dimensions of the equity universe for all markets; |

| • | Quarterly Index Reviews (“QIRs”), aimed at promptly reflecting other significant market events; and |

| • | Ongoing event-related changes, such as mergers, acquisitions, spin-offs, bankruptcies, reorganizations and other similar corporate events, which generally are implemented in the indexes as they occur. |

| 1. | Concentrate its investments in a particular industry, as that term is used in the Investment Company Act, except that the Fund will concentrate to approximately the same extent that its Underlying Index concentrates in the securities of a particular industry or group of industries. |

| 2. | Borrow money, except as permitted under the Investment Company Act. |

| 3. | Issue senior securities to the extent such issuance would violate the Investment Company Act. |

| 4. | Purchase or hold real estate, except the Fund may purchase and hold securities or other instruments that are secured by, or linked to, real estate or interests therein, securities of REITs, mortgage-related securities and securities of issuers engaged in the real estate business, and the Fund may purchase and hold real estate as a result of the ownership of securities or other instruments. |

| 5. | Underwrite securities issued by others, except to the extent that the sale of portfolio securities by the Fund may be deemed to be an underwriting or as otherwise permitted by applicable law. |

| 6. | Purchase or sell commodities or commodity contracts, except as permitted by the Investment Company Act. |

| 7. | Make loans to the extent prohibited by the Investment Company Act. |

| Name (Age) | Position | Principal Occupation(s) During the Past 5 Years |

Other Directorships Held by Director | |||

| Robert S. Kapito1 (63) |

Director (since 2009). |

President, BlackRock, Inc. (since 2006); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock, Inc.’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002). | Director of BlackRock, Inc. (since 2006); Trustee of iShares Trust (since 2009); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Salim Ramji2 (50) |

Director (since 2019). | Senior Managing Director, BlackRock, Inc. (since 2014); Global Head of BlackRock’s ETF and Index Investments Business (since 2019); Head of BlackRock’s U.S. Wealth Advisory Business (2015-2019); Global Head of Corporate Strategy, BlackRock, Inc. (2014-2015); Senior Partner, McKinsey & Company (2010-2014). | Trustee of iShares Trust (since 2019); Trustee of iShares U.S. ETF Trust (since 2019). |

| 1 | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| 2 | Salim Ramji is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| Name (Age) | Position | Principal Occupation(s) During the Past 5 Years |

Other Directorships Held by Director | |||

| Cecilia H. Herbert (71) |

Director (since 2005); Independent Board Chair (since 2016). |

Chair of the Finance Committee (since 2019) and Trustee and Member of the Finance, Audit and Quality Committees of Stanford Health Care (since 2016); Trustee of WNET, New York's public media company (since 2011) and Member of the Audit Committee (since 2018) and Investment Committee (since 2011); Chair (1994-2005) and Member (since 1992) of the Investment Committee, Archdiocese of San Francisco; Trustee of Forward Funds (14 portfolios) (2009-2018); Trustee of Salient MF Trust (4 portfolios) (2015-2018); Director (1998-2013) and President (2007-2011) of the Board of Directors, Catholic Charities CYO; Trustee (2002-2011) and Chair of the Finance and Investment Committee (2006-2010) of the Thacher School; Director of the Senior Center of Jackson Hole (since 2020). | Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust (since 2011); Independent Board Chair of iShares Trust and iShares U.S. ETF Trust (since 2016); Trustee of Thrivent Church Loan and Income Fund (since 2019). | |||

| Jane D. Carlin (64) |

Director (since 2015); Risk Committee Chair (since 2016). |

Consultant (since 2012); Member of the Audit Committee (2012-2018), Chair of the Nominating and Governance Committee (2017-2018) and Director of PHH Corporation (mortgage solutions) (2012-2018); Managing Director and Global Head of Financial Holding Company Governance & Assurance and the Global Head of Operational Risk Management of Morgan Stanley (2006-2012). | Trustee of iShares Trust (since 2015); Trustee of iShares U.S. ETF Trust (since 2015); Member of the Audit Committee (since 2016), Chair of the Audit Committee (since 2020) and Director of The Hanover Insurance Group, Inc. (since 2016). | |||

| Richard L. Fagnani (66) |

Director (since 2017); Audit Committee Chair (since 2019). |

Partner, KPMG LLP (2002-2016). | Trustee of iShares Trust (since 2017); Trustee of iShares U.S. ETF Trust (since 2017). | |||

| John E. Kerrigan (65) |

Director (since 2005); Nominating and Governance and Equity Plus Committee Chairs (since 2019). |

Chief Investment Officer, Santa Clara University (since 2002). | Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust (since 2011). |

| Name (Age) | Position | Principal Occupation(s) During the Past 5 Years |

Other Directorships Held by Director | |||

| Drew E. Lawton (61) |

Director (since 2017); 15(c) Committee Chair (since 2017). |

Senior Managing Director of New York Life Insurance Company (2010-2015). | Trustee of iShares Trust (since 2017); Trustee of iShares U.S. ETF Trust (since 2017). | |||

| John E. Martinez (59) |

Director (since 2003); Securities Lending Committee Chair (since 2019). |

Director of Real Estate Equity Exchange, Inc. (since 2005); Director of Cloudera Foundation (2017-2020); and Director of Reading Partners (2012-2016). | Trustee of iShares Trust (since 2003); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Madhav V. Rajan (56) |

Director (since 2011); Fixed Income Plus Committee Chair (since 2019). |

Dean, and George Pratt Shultz Professor of Accounting, University of Chicago Booth School of Business (since 2017); Advisory Board Member (since 2016) and Director (since 2020) of C.M. Capital Corporation; Chair of the Board for the Center for Research in Security Prices, LLC (since 2020); Robert K. Jaedicke Professor of Accounting, Stanford University Graduate School of Business (2001-2017); Professor of Law (by courtesy), Stanford Law School (2005-2017); Senior Associate Dean for Academic Affairs and Head of MBA Program, Stanford University Graduate School of Business (2010-2016). | Trustee of iShares Trust (since 2011); Trustee of iShares U.S. ETF Trust (since 2011). |

| Name (Age) | Position | Principal Occupation(s) During the Past 5 Years | ||

| Armando Senra (49) |

President (since 2019). | Managing Director, BlackRock, Inc. (since 2007); Head of U.S., Canada and Latam iShares, BlackRock, Inc. (since 2019); Head of Latin America Region, BlackRock, Inc. (2006-2019); Managing Director, Bank of America Merrill Lynch (1994-2006). |

| Name (Age) | Position | Principal Occupation(s) During the Past 5 Years | ||

| Trent Walker (46) |

Treasurer and Chief Financial Officer (since 2020). |

Managing Director of BlackRock, Inc. (since September 2019); Executive Vice President of PIMCO (2016-2019); Senior Vice President of PIMCO (2008-2015); Treasurer (2013-2019) and Assistant Treasurer (2007-2017) of PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series, PIMCO Equity Series VIT, PIMCO Managed Accounts Trust, 2 PIMCO-sponsored interval funds and 21 PIMCO-sponsored closed-end funds. | ||

| Charles Park (53) |

Chief Compliance Officer (since 2006). | Chief Compliance Officer of BlackRock Advisors, LLC and the BlackRock-advised Funds in the Equity-Bond Complex, the Equity-Liquidity Complex and the Closed-End Complex (since 2014); Chief Compliance Officer of BFA (since 2006). | ||

| Deepa Damre Smith (45) |

Secretary (since 2019). | Managing Director, BlackRock, Inc. (since 2014); Director, BlackRock, Inc. (2009-2013). | ||

| Scott Radell (52) |

Executive Vice President (since 2012). |

Managing Director, BlackRock, Inc. (since 2009); Head of Portfolio Solutions, BlackRock, Inc. (since 2009). | ||

| Alan Mason (60) |

Executive Vice President (since 2016). |

Managing Director, BlackRock, Inc. (since 2009). | ||

| Marybeth Leithead (57) |

Executive Vice President (since 2019). |

Managing Director, BlackRock, Inc. (since 2017); Chief Operating Officer of Americas iShares (since 2017); Portfolio Manager, Municipal Institutional & Wealth Management (2009-2016). |

| Name | Fund | Dollar Range of Equity Securities in Named Fund |

Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| Robert S. Kapito | None | None | None | |||

| Salim Ramji | iShares Commodities Select Strategy ETF | $10,001-$50,000 | Over $100,000 | |||

| iShares Core MSCI Emerging Markets ETF | Over $100,000 | |||||

| iShares Core MSCI Total International Stock ETF | $1-$10,000 | |||||

| iShares Core S&P 500 ETF | $1-$10,000 | |||||

| iShares Core S&P Total U.S. Stock Market ETF | $1-$10,000 | |||||

| iShares Expanded Tech Sector ETF | $1-$10,000 | |||||

| iShares Expanded Tech-Software Sector ETF | $1-$10,000 | |||||

| iShares MSCI USA ESG Select ETF | $1-$10,000 | |||||

| iShares North American Natural Resources ETF | $10,001-$50,000 | |||||

| iShares Robotics and Artificial Intelligence Multisector ETF | $1-$10,000 | |||||

| iShares TIPS Bond ETF | $10,001-$50,000 | |||||

| Cecilia H. Herbert | iShares California Muni Bond ETF | Over $100,000 | Over $100,000 | |||

| iShares China Large-Cap ETF | $50,001-$100,000 | |||||

| iShares Core Dividend Growth ETF | $50,001-$100,000 |

| Name | Fund | Dollar Range of Equity Securities in Named Fund |

Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| iShares Core MSCI Emerging Markets ETF | $1-$10,000 | |||||

| iShares Core MSCI Total International Stock ETF | $10,001-$50,000 | |||||

| iShares Core S&P 500 ETF | Over $100,000 | |||||

| iShares Core S&P U.S. Growth ETF | $50,001-$100,000 | |||||

| iShares Core S&P U.S. Value ETF | $50,001-$100,000 | |||||

| iShares iBoxx $ High Yield Corporate Bond ETF | $10,001-$50,000 | |||||

| iShares International Select Dividend ETF | $1-$10,000 | |||||

| iShares MSCI EAFE ETF | $1-$10,000 | |||||

| iShares MSCI Japan ETF | $10,001-$50,000 | |||||

| iShares National Muni Bond ETF | $10,001-$50,000 | |||||

| iShares Preferred and Income Securities ETF | $10,001-$50,000 | |||||

| Jane D. Carlin | iShares 1-3 Year Treasury Bond ETF | $50,001-$100,000 | Over $100,000 | |||

| iShares Core MSCI Emerging Markets ETF | $10,001-$50,000 | |||||

| iShares Core MSCI Total International Stock ETF | Over $100,000 | |||||

| iShares Core S&P Mid-Cap ETF | $10,001-$50,000 | |||||

| iShares Core S&P Small-Cap ETF | Over $100,000 | |||||

| iShares Core U.S. Aggregate Bond ETF | Over $100,000 | |||||

| iShares MSCI USA Min Vol Factor ETF | $50,001-$100,000 | |||||

| iShares Global Tech ETF | $10,001-$50,000 | |||||

| iShares MSCI ACWI ETF | Over $100,000 | |||||

| iShares MSCI ACWI ex U.S. ETF | $50,001-$100,000 | |||||

| iShares MSCI EAFE Small-Cap ETF | $10,001-$50,000 | |||||

| iShares MSCI Emerging Markets Small-Cap ETF | $10,001-$50,000 | |||||

| iShares Select Dividend ETF | $10,001-$50,000 | |||||

| BlackRock Ultra Short-Term Bond ETF | Over $100,000 | |||||

| Richard L. Fagnani | iShares Core MSCI EAFE ETF | $10,001-$50,000 | Over $100,000 | |||

| iShares Core S&P 500 ETF | $10,001-$50,000 | |||||

| iShares Core S&P Small-Cap ETF | $10,001-$50,000 | |||||

| iShares MSCI Emerging Markets Multifactor ETF | $10,001-$50,000 | |||||

| iShares MSCI USA Value Factor ETF | $10,001-$50,000 | |||||

| iShares Exponential Technologies ETF | $10,001-$50,000 | |||||

| iShares Global Clean Energy ETF | $10,001-$50,000 | |||||

| iShares MSCI EAFE Value ETF | $10,001-$50,000 | |||||

| iShares MSCI Emerging Markets Small-Cap ETF | $10,001-$50,000 |

| Name | Fund | Dollar Range of Equity Securities in Named Fund |

Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| iShares Robotics and Artificial Intelligence Multisector ETF | $10,001-$50,000 | |||||

| iShares S&P Small-Cap 600 Value ETF | $10,001-$50,000 | |||||

| iShares Select Dividend ETF | $10,001-$50,000 | |||||

| iShares U.S. Financials ETF | $10,001-$50,000 | |||||

| John E. Kerrigan | iShares MSCI ACWI ex U.S. ETF | Over $100,000 | Over $100,000 | |||

| Drew E. Lawton | iShares 0-5 Year High Yield Corporate Bond ETF | Over $100,000 | Over $100,000 | |||

| iShares Core Dividend Growth ETF | $50,001-$100,000 | |||||

| iShares Core MSCI Total International Stock ETF | $50,001-$100,000 | |||||

| iShares Core S&P Total U.S. Stock Market ETF | Over $100,000 | |||||

| iShares Exponential Technologies ETF | Over $100,000 | |||||

| iShares MSCI Frontier 100 ETF | $1-$10,000 | |||||

| iShares Nasdaq Biotechnology ETF | $50,001-$100,000 | |||||

| BlackRock Short Maturity Bond ETF | Over $100,000 | |||||

| BlackRock Ultra Short-Term Bond ETF | Over $100,000 | |||||

| John E. Martinez | iShares 5-10 Year Investment Grade Corporate Bond ETF | Over $100,000 | Over $100,000 | |||

| iShares Core 5-10 Year USD Bond ETF | Over $100,000 | |||||

| iShares Core International Aggregate Bond ETF | Over $100,000 | |||||

| iShares Global Consumer Staples ETF | Over $100,000 | |||||

| iShares Interest Rate Hedged Long-Term Corporate Bond ETF | Over $100,000 | |||||

| iShares MSCI EAFE ETF | Over $100,000 | |||||

| iShares Russell 1000 ETF | Over $100,000 | |||||

| iShares Russell 1000 Value ETF | Over $100,000 | |||||

| iShares Russell 2000 ETF | Over $100,000 | |||||

| Madhav V. Rajan | iShares 1-5 Year Investment Grade Corporate Bond ETF | Over $100,000 | Over $100,000 | |||

| iShares Broad USD High Yield Corporate Bond ETF | Over $100,000 | |||||

| iShares Core Dividend Growth ETF | Over $100,000 | |||||

| iShares Core High Dividend ETF | Over $100,000 | |||||

| iShares Core MSCI EAFE ETF | Over $100,000 | |||||

| iShares Core S&P 500 ETF | Over $100,000 | |||||

| iShares Mortgage Real Estate ETF | Over $100,000 |

| Name | Fund | Dollar Range of Equity Securities in Named Fund |

Aggregate Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| iShares Preferred and Income Securities ETF | Over $100,000 | |||||

| iShares Russell 2000 ETF | Over $100,000 | |||||

| iShares Select Dividend ETF | Over $100,000 | |||||

| BlackRock Short Maturity Bond ETF | Over $100,000 | |||||

| BlackRock Ultra Short-Term Bond ETF | Over $100,000 |

| Name | iShares MSCI Emerging Markets ex China ETF |

Pension or Retirement Benefits Accrued As Part of Company Expenses3 |

Estimated Annual Benefits Upon Retirement3 |

Total Compensation From the Fund and Fund Complex4 | ||||

| Independent Directors: | ||||||||

| Jane D. Carlin | $28 | Not Applicable | Not Applicable | $395,000 | ||||

| Richard L. Fagnani | 31 | Not Applicable | Not Applicable | 421,764 | ||||

| Cecilia H. Herbert | 33 | Not Applicable | Not Applicable | 450,000 | ||||

| John E. Kerrigan | 31 | Not Applicable | Not Applicable | 420,000 | ||||

| Drew E. Lawton | 29 | Not Applicable | Not Applicable | 406,764 | ||||

| John E. Martinez | 29 | Not Applicable | Not Applicable | 395,000 | ||||

| Madhav V. Rajan | 29 | Not Applicable | Not Applicable | 395,000 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $0 | Not Applicable | Not Applicable | $0 | ||||

| Salim Ramji1 | 0 | Not Applicable | Not Applicable | 0 | ||||

| Mark K. Wiedman2 | 0 | Not Applicable | Not Applicable | 0 |

| 1 | Appointed to serve as an Interested Director effective June 19, 2019. |

| 2 | Served as an Interested Director through June 19, 2019. |

| 3 | No Director or officer is entitled to any pension or retirement benefits from the Company. |

| 4 | Also includes compensation for service on the Boards of Trustees for iShares Trust and iShares U.S. ETF Trust. |

| Name | Percentage of Ownership | |

| Charles Schwab & Co., Inc. 101 Montgomery Street San Francisco, CA 94014 |

24.67% | |

| National Financial Services LLC 499 Washington Blvd Jersey City, NJ 07310 |

23.14% | |

| TD Ameritrade Clearing, Inc. 4700 Alliance Gateway Freeway Fort Worth, TX 76177 |

14.06% | |

| LPL Financial Corporation 9785 Towne Centre Drive San Diego, CA 92121-1968 |

6.47% | |

| The Bank of New York Mellon 111 Sanders Creek Parkway 2nd Floor East Syracuse, NY 13057 |

6.27% | |

| Merrill Lynch, Pierce, Fenner & Smith Incorporated - TS Sub 101 Hudson Street 9th Floor Jersey City, NJ 07302-3997 |

5.32% |

| Management Fee for the Fiscal Year Ended August 31, 2020 |

Fund Inception Date |

Management Fees Paid Net of Waivers for Fiscal Year Ended August 31, 2020 |

Management Fees Paid Net of Waivers for Fiscal Year Ended August 31, 2019 |

Management Fees Paid Net of Waivers for Fiscal Year Ended August 31, 2018 | |||

| 0.25%1, 2 | 07/18/2017 | $59,241 | $40,662 | $42,965 |

| 1 | For the Fund, BFA has contractually agreed to waive a portion of its management fees in an amount equal to the Acquired Fund Fees and Expenses, if any, attributable to investments by the Fund in other series of iShares Trust and the Company through December 31, 2022. The contractual waiver may be terminated prior to December 31, 2022 only upon written agreement of the Company and BFA. For the fiscal years ended August 31, 2020, August 31, 2019 and August 31, 2018, BFA waived $74,549, $37,430 and $8,385, respectively, of its management fees. In addition, BFA may from time to time voluntarily waive and/or reimburse fees or expenses in order to limit total annual fund operating expenses (excluding acquired fund fees and expenses, if any). BFA has elected to implement a voluntary fee waiver in order to limit the Fund’s total annual operating expenses after fee waivers to twenty-four basis points and currently intends to keep such voluntary fee waiver for the Fund in place through December 31, 2020. The voluntary waiver will be discontinued after December 31, 2020. |

| 2 | Effective March 27, 2020, the management fee for the Fund is 0.25%. Prior to March 27, 2020, the management fee for the Fund was 0.49%. |

| Jennifer Hsui | ||||

| Types of Accounts | Number | Total Assets | ||

| Registered Investment Companies | 324 | $1,377,764,000,000 | ||

| Other Pooled Investment Vehicles | 55 | 76,139,000,000 | ||

| Other Accounts | 25 | 29,260,000,000 |

| Alan Mason | ||||

| Types of Accounts | Number | Total Assets | ||

| Registered Investment Companies | 328 | $1,378,582,000,000 | ||

| Other Pooled Investment Vehicles | 0 | N/A | ||

| Other Accounts | 2 | 776,000,000 |

| Greg Savage | ||||

| Types of Accounts | Number | Total Assets | ||

| Registered Investment Companies | 259 | $1,293,405,000,000 | ||

| Other Pooled Investment Vehicles | 30 | 1,975,000,000 | ||

| Other Accounts | 61 | 6,003,000,000 |

| Amy Whitelaw | ||||

| Types of Accounts | Number | Total Assets | ||

| Registered Investment Companies | 323 | $1,332,776,000,000 | ||

| Other Pooled Investment Vehicles | 89 | 36,550,000,000 | ||

| Other Accounts | 3 | 113,000,000 |

| Jennifer Hsui | ||||

| Types of Accounts | Number of Other Accounts with Performance Fees Managed by Portfolio Manager |

Aggregate of Total Assets | ||

| Registered Investment Companies | 0 | N/A | ||

| Other Pooled Investment Vehicles | 0 | N/A | ||

| Other Accounts | 0 | N/A |

| Alan Mason | ||||

| Types of Accounts | Number of Other Accounts with Performance Fees Managed by Portfolio Manager |

Aggregate of Total Assets | ||

| Registered Investment Companies | 0 | N/A | ||

| Other Pooled Investment Vehicles | 0 | N/A | ||

| Other Accounts | 0 | N/A |

| Greg Savage | ||||

| Types of Accounts | Number of Other Accounts with Performance Fees Managed by Portfolio Manager |

Aggregate of Total Assets | ||

| Registered Investment Companies | 0 | N/A | ||

| Other Pooled Investment Vehicles | 0 | N/A | ||

| Other Accounts | 0 | N/A |

| Amy Whitelaw | ||||

| Types of Accounts | Number of Other Accounts with Performance Fees Managed by Portfolio Manager |

Aggregate of Total Assets | ||

| Registered Investment Companies | 0 | N/A | ||

| Other Pooled Investment Vehicles | 0 | N/A | ||

| Other Accounts | 0 | N/A |

| Fund Inception Date |

Administration, Custodian, Transfer Agency Expenses Paid During Fiscal Year Ended August 31, 2020 |

Administration, Custodian, Transfer Agency Expenses Paid During Fiscal Year Ended August 31, 2019 |

Administration, Custodian, Transfer Agency Expenses Paid During Fiscal Year Ended August 31, 2018 | ||

| 07/18/2017 | $120,892 | $69,768 | $57,845 |

| Fund | iShares MSCI Emerging Markets ex China ETF |

|||

| Gross income from securities lending activities |

N/A | |||

| Fees and/or compensation for securities lending activities and related services |

||||

| Securities lending income paid to BTC for services as securities lending agent |

N/A | |||

| Cash collateral management expenses not included in securities lending income paid to BTC |

N/A | |||

| Administrative fees not included in securities lending income paid to BTC |

0 |

| Fund | iShares MSCI Emerging Markets ex China ETF |

|||

| Indemnification fees not included in securities lending income paid to BTC |

0 | |||

| Rebates (paid to borrowers) |

N/A | |||

| Other fees not included in securities lending income paid to BTC |

0 | |||

| Aggregate fees/compensation for securities lending activities |

N/A | |||

| Net income from securities lending activities |

N/A |

| Fund Inception Date |

Brokerage Commissions Paid During Fiscal Year Ended August 31, 2020 |

Brokerage Commissions Paid During Fiscal Year Ended August 31, 2019 |

Brokerage Commissions Paid During Fiscal Year Ended August 31, 2018 | ||

| 07/18/2017 | $28,551 | $10,121 | $983 |

| Fiscal Year ended August 31, 2020 |

Fiscal Year ended August 31, 2019 | |

| 18% | 10% |

| Shares Per Creation Unit |

Approximate Value Per Creation Unit (U.S.$) | |

| 100,000 | $4,571,000 |

| Standard Creation Transaction Fee |

Maximum Additional Charge* | |

| S17,325 | 7.0% |

| * | As a percentage of the net asset value per Creation Unit. |

| Standard Redemption Transaction Fee |

Maximum Additional Charge* | |

| $17,325 | 2.0% |

| * | As a percentage of the net asset value per Creation Unit, inclusive of the standard redemption transaction fee. |

Although the Company does not ordinarily permit cash redemptions of Creation Units (except that, as noted above, Creation Units of the Fund's generally will be redeemed partially for cash), in the event that cash redemptions are permitted or required by the Company, proceeds will be paid to the Authorized Participant redeeming shares as soon as practicable after the date of redemption (within seven calendar days thereafter). If the Fund includes a foreign investment in its basket, and if a local market holiday, or series of consecutive holidays, or the extended delivery cycles for transferring foreign investments to redeeming Authorized Participants prevents timely delivery of the foreign investment in response to a redemption request, the Fund may delay delivery of the foreign investment more than seven days if the Fund delivers the foreign investment as soon as practicable, but in no event later than 15 days.

| • | Boards and directors |

| • | Auditors and audit-related issues |

| • | Capital structure, mergers, asset sales and other special transactions |

| • | Compensation and benefits |

| • | Environmental and social issues |

| • | General corporate governance matters and shareholder protections |

| • | establishing an appropriate corporate governance structure |

| • | supporting and overseeing management in setting long -term strategic goals, applicable measures of value-creation and milestones that will demonstrate progress, and steps taken if any obstacles are anticipated or incurred |

| • | ensuring the integrity of financial statements |

| • | making independent decisions regarding mergers, acquisitions and disposals |

| • | establishing appropriate executive compensation structures |

| • | addressing business issues, including environmental and social issues, when they have the potential to materially impact company reputation and performance |

| • | current or former employment at the company or a subsidiary within the past several years |

| • | being, or representing, a shareholder with a substantial shareholding in the company |

| • | interlocking directorships |

| • | having any other interest, business or other relationship which could, or could reasonably be perceived to, materially interfere with the director’s ability to act in the best interests of the company |

| 1) | publish a disclosure in line with industry-specific SASB guidelines by year-end, if they have not already done so, or disclose a similar set of data in a way that is relevant to their particular business; and |

| 2) | disclose climate-related risks in line with the TCFD’s recommendations, if they have not already done so. This should include the company’s plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized, as expressed by the TCFD guidelines. |

| • | The company has already taken sufficient steps to address the concern |

| • | The company is in the process of actively implementing a response |

| • | There is a clear and material economic disadvantage to the company in the near-term if the issue is not addressed in the manner requested by the shareholder proposal |

| • | BlackRock clients who may be issuers of securities or proponents of shareholder resolutions |

| • | BlackRock business partners or third parties who may be issuers of securities or proponents of shareholder resolutions |

| • | BlackRock employees who may sit on the boards of public companies held in Funds managed by BlackRock |

| • | Significant BlackRock, Inc. investors who may be issuers of securities held in Funds managed by BlackRock |

| • | Securities of BlackRock, Inc. or BlackRock investment funds held in Funds managed by BlackRock |

| • | BlackRock, Inc. board members who serve as senior executives of public companies held in Funds managed by BlackRock |

| • | Adopted the Guidelines which are designed to protect and enhance the economic value of the companies in which BlackRock invests on behalf of clients. |

| • | Established a reporting structure that separates BIS from employees with sales, vendor management or business partnership roles. In addition, BlackRock seeks to ensure that all engagements with corporate issuers, dissident shareholders or shareholder proponents are managed consistently and without regard to BlackRock’s relationship with such parties. Clients or business partners are not given special treatment or differentiated access to BIS. BIS prioritizes engagements based on factors including but not limited to our need for additional information to make a voting decision or our view on the likelihood that an engagement could lead to positive outcome(s) over time for the economic value of the company. Within the normal course of business, BIS may engage directly with BlackRock clients, business partners and/or third parties, and/or with employees with sales, vendor management or business partnership roles, in discussions regarding our approach to stewardship, general corporate governance matters, client reporting needs, and/or to otherwise ensure that proxy-related client service levels are met. |

| • | Determined to engage, in certain instances, an independent fiduciary to vote proxies as a further safeguard to avoid potential conflicts of interest, to satisfy regulatory compliance requirements, or as may be otherwise required by applicable law. In such circumstances, the independent fiduciary provides BlackRock’s proxy voting agent with instructions, in accordance with the Guidelines, as to how to vote such proxies, and BlackRock’s proxy voting agent votes the proxy in accordance with the independent fiduciary’s determination. BlackRock uses an independent fiduciary to vote proxies of (i) any company that is affiliated with BlackRock, Inc., (ii) any public company that includes BlackRock employees on its board of directors, (iii) The PNC Financial Services Group, Inc., (iv) any public company of which a BlackRock, Inc. board member serves as a senior executive, and (v) companies when legal or regulatory requirements compel BlackRock to use an independent fiduciary. In selecting an independent fiduciary, we assess several characteristics, including but not limited to: independence, an ability to analyze proxy issues and vote in the best economic interest of our clients, reputation for reliability and integrity, and operational capacity to accurately deliver the assigned votes in a timely manner. We may engage more than one independent fiduciary, in part in order to mitigate potential or perceived conflicts of interest at an independent fiduciary. The Global Committee appoints and reviews the performance of the independent fiduciar(ies), generally on an annual basis. |

| Contents | |

| Introduction | A-16 |

| Voting guidelines | A-16 |

| Boards and directors | A-16 |

| - Director elections | A-16 |

| - Independence | A-16 |

| - Oversight | A-17 |

| - Responsiveness to shareholders | A-17 |

| - Shareholder rights | A-17 |

| - Board composition and effectiveness | A-18 |

| - Board size | A-19 |

| - CEO and management succession planning | A-19 |

| - Classified board of directors / staggered terms | A-19 |

| - Contested director elections | A-19 |

| - Cumulative voting | A-19 |

| - Director compensation and equity programs | A-19 |

| - Majority vote requirements | A-19 |

| - Risk oversight | A-20 |

| - Separation of chairman and CEO | A-20 |

| Auditors and audit-related issues | A-20 |

| Capital structure proposals | A-21 |

| - Equal voting rights | A-21 |

| - Blank check preferred stock | A-21 |

| - Increase in authorized common shares | A-21 |

| - Increase or issuance of preferred stock | A-21 |

| - Stock splits | A-22 |

| Mergers, asset sales, and other special transactions | A-22 |

| - Poison pill plans | A-22 |

| - Reimbursement of expenses for successful shareholder campaigns | A-22 |

| Executive Compensation | A-22 |

| - Advisory resolutions on executive compensation (“Say on Pay”) | A-23 |

| - Advisory votes on the frequency of Say on Pay resolutions | A-23 |

| - Claw back proposals | A-23 |

| - Employee stock purchase plans | A-23 |

| - Equity compensation plans | A-23 |

| - Golden parachutes | A-23 |

| - Option exchanges | A-24 |

| - Pay-for-Performance plans | A-24 |

| - Supplemental executive retirement plans | A-24 |

| Environmental and social issues | A-24 |

| - Climate risk | A-25 |

| - Corporate political activities | A-26 |

| General corporate governance matters | A-26 |

| - Adjourn meeting to solicit additional votes | A-26 |

| - Bundled proposals | A-26 |

| - Exclusive forum provisions | A-26 |

| - Multi-jurisdictional companies | A-26 |

| - Other business | A-27 |

| - Reincorporation | A-27 |

| - IPO governance | A-27 |

| Contents | |

| Shareholder Protections | A-27 |

| - Amendment to charter / articles / bylaws | A-27 |

| - Proxy access | A-28 |

| - Right to act by written consent | A-28 |

| - Right to call a special meeting | A-28 |

| - Simple majority voting | A-28 |

| • | Boards and directors |

| • | Auditors and audit-related issues |

| • | Capital structure |

| • | Mergers, asset sales, and other special transactions |

| • | Executive compensation |

| • | Environmental and social issues |

| • | General corporate governance matters |

| • | Shareholder protections |

| • | Employment as a senior executive by the company or a subsidiary within the past five years |

| • | An equity ownership in the company in excess of 20% |

| • | Having any other interest, business, or relationship which could, or could reasonably be perceived to, materially interfere with the director’s ability to act in the best interests of the company |

| • | Where the board has failed to exercise oversight with regard to accounting practices or audit oversight, we will consider voting against the current audit committee, and any other members of the board who may be responsible. For example, this may apply to members of the audit committee during a period when the board failed to facilitate quality, independent auditing if substantial accounting irregularities suggest insufficient oversight by that committee |

| • | Members of the compensation committee during a period in which executive compensation appears excessive relative to performance and peers, and where we believe the compensation committee has not already substantially addressed this issue |

| • | The chair of the nominating / governance committee, or where no chair exists, the nominating / governance committee member with the longest tenure, where the board is not comprised of a majority of independent directors. However, this would not apply in the case of a controlled company |

| • | Where it appears the director has acted (at the company or at other companies) in a manner that compromises his / her reliability to represent the best long-term economic interests of shareholders |

| • | Where a director has a pattern of poor attendance at combined board and applicable key committee meetings. Excluding exigent circumstances, BlackRock generally considers attendance at less than 75% of the combined board and applicable key committee meetings by a board member to be poor attendance |

| • | Where a director serves on an excess number of boards, which may limit his / her capacity to focus on each board’s requirements. The following illustrates the maximum number of boards on which a director may serve, before he / she is considered to be over-committed: |

| Public Company CEO |

# Outside Public Boards* |

Total # of Public Boards | |||

| Director A | x | 1 | 2 | ||

| Director B | 3 | 4 |

| * | In addition to the company under review |

| • | The independent chair or lead independent director, members of the nominating / governance committee, and / or the longest tenured director(s), where we observe a lack of board responsiveness to shareholders, evidence of board entrenchment, and / or failure to promote adequate board succession planning |

| • | The chair of the nominating / governance committee, or where no chair exists, the nominating / governance committee member with the longest tenure, where board member(s) at the most recent election of directors have received withhold votes from more than 30% of shares voted and the board has not taken appropriate action to respond to shareholder concerns. This may not apply in cases where BlackRock did not support the initial withhold vote |

| • | The independent chair or lead independent director and / or members of the nominating / governance committee, where a board fails to implement shareholder proposals that receive a majority of votes cast at a prior shareholder meeting, and the proposals, in our view, have a direct and substantial impact on shareholders’ fundamental rights or long-term economic interests |

| • | The independent chair or lead independent director and members of the governance committee, where a board implements or renews a poison pill without shareholder approval |

| • | The independent chair or lead independent director and members of the governance committee, where a board amends the charter / articles / bylaws such that the effect may be to entrench directors or to significantly reduce shareholder rights |

| • | Members of the compensation committee where the company has repriced options without shareholder approval |

| • | If a board maintains a classified structure, it is possible that the director(s) with whom we have a particular concern may not be subject to election in the year that the concern arises. In such situations, if we have a concern regarding a committee or committee chair that is not up for re-election, we will generally register our concern by withholding votes from all available members of the relevant committee |

| • | The mix of competencies, experience, and other qualities required to effectively oversee and guide management in light of the stated long-term strategy of the company |

| • | The process by which candidates are identified and selected, including whether professional firms or other sources outside of incumbent directors’ networks have been engaged to identify and / or assess candidates |

| • | The process by which boards evaluate themselves and any significant outcomes of the evaluation process, without divulging inappropriate and / or sensitive details |

| • | The consideration given to board diversity, including, but not limited to, gender, ethnicity, race, age, experience, geographic location, skills, and perspective in the nomination process |

| Combined Chair / CEO Model |

Separate Chair Model | ||||

| Chair / CEO | Lead Director | Chair | |||

| Board Meetings | Authority to call full meetings of the board of directors | Attends full meetings of the board of directors Authority to call meetings of independent directors Briefs CEO on issues arising from executive sessions |

Authority to call full meetings of the board of directors | ||

| Agenda | Primary responsibility for shaping board agendas, consulting with the lead director | Collaborates with chair / CEO to set board agenda and board information | Primary responsibility for shaping board agendas, in conjunction with CEO | ||

| Board Communications | Communicates with all directors on key issues and concerns outside of full board meetings | Facilitates discussion among independent directors on key issues and concerns outside of full board meetings, including contributing to the oversight of CEO and management succession planning | Facilitates discussion among independent directors on key issues and concerns outside of full board meetings, including contributing to the oversight of CEO and management succession planning | ||

| • | Appears to have a legitimate financing motive for requesting blank check authority |

| • | Has committed publicly that blank check preferred shares will not be used for anti-takeover purposes |

| • | Has a history of using blank check preferred stock for financings |

| • | Has blank check preferred stock previously outstanding such that an increase would not necessarily provide further anti-takeover protection but may provide greater financing flexibility |

| • | The degree to which the proposed transaction represents a premium to the company’s trading price. We consider the share price over multiple time periods prior to the date of the merger announcement. In most cases, business combinations should provide a premium. We may consider comparable transaction analyses provided by the parties’ financial advisors and our own valuation assessments. For companies facing insolvency or bankruptcy, a premium may not apply |

| • | There should be clear strategic, operational, and / or financial rationale for the combination |

| • | Unanimous board approval and arm’s-length negotiations are preferred. We will consider whether the transaction involves a dissenting board or does not appear to be the result of an arm’s-length bidding process. We may also consider whether executive and / or board members’ financial interests in a given transaction appear likely to affect their ability to place shareholders’ interests before their own |

| • | We prefer transaction proposals that include the fairness opinion of a reputable financial advisor assessing the value of the transaction to shareholders in comparison to recent similar transactions |

| • | Whether we believe that the triggering event is in the best interest of shareholders |

| • | Whether management attempted to maximize shareholder value in the triggering event |

| • | The percentage of total premium or transaction value that will be transferred to the management team, rather than shareholders, as a result of the golden parachute payment |

| • | Whether excessively large excise tax gross-up payments are part of the pay-out |

| • | Whether the pay package that serves as the basis for calculating the golden parachute payment was reasonable in light of performance and peers |

| • | Whether the golden parachute payment will have the effect of rewarding a management team that has failed to effectively manage the company |

| • | The company has experienced significant stock price decline as a result of macroeconomic trends, not individual company performance |

| • | Directors and executive officers are excluded; the exchange is value neutral or value creative to shareholders; tax, accounting, and other technical considerations have been fully contemplated |

| • | There is clear evidence that absent repricing, the company will suffer serious employee incentive or retention and recruiting problems |

| • | Publish disclosures in line with industry specific SASB guidelines by year-end, if they have not already done so, or disclose a similar set of data in a way that is relevant to their particular business; and |

| • | Disclose climate-related risks in line with the TCFD’s recommendations, if they have not already done so. This should include the company’s plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized, as expressed by the TCFD guidelines. |

| • | The company has already taken sufficient steps to address the concern |

| • | The company is in the process of actively implementing a response |

| • | There is a clear and material economic disadvantage to the company in the near-term if the issue is not addressed in the manner requested by the shareholder proposal |