UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09102

iShares, Inc.

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

100 Summer Street, 4th Floor, Boston, MA 02110

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 670-2000

Date of fiscal year end: April 30, 2018

Date of reporting period: April 30, 2018

| Item 1. | Reports to Stockholders. |

Copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are attached.

APRIL 30, 2018

| 2018 ANNUAL REPORT |

|

iShares, Inc.

| Ø | iShares Asia/Pacific Dividend ETF | DVYA | NYSE Arca |

| Ø | iShares Emerging Markets Dividend ETF | DVYE | NYSE Arca |

| 5 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 13 | ||||

| 17 | ||||

| 20 | ||||

| 22 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 39 | ||||

| 43 |

Management’s Discussion of Fund Performance

iSHARES® TRUST

GLOBAL EQUITY MARKET OVERVIEW

Global equity markets advanced for the 12 months ended April 30, 2018 (“reporting period”). The MSCI ACWI, a broad global equity index that includes both developed and emerging markets, returned 14.16% in U.S. dollar terms for the reporting period.

The primary factor behind the positive performance of global stocks was improving global economic growth, particularly in the U.S., Europe, Japan, and China. With the exception of the U.S. Federal Reserve Bank (“Fed”), many of the world’s central banks maintained accommodative monetary policies, which helped set the stage for increased global economic activity. In addition, several key developing economies, including Brazil, Russia, and Argentina, emerged from recession during the reporting period.

Strengthening global economic growth led to rising corporate profits across most regions of the world in 2017, which was also supportive for global equity markets. Global earnings estimates for 2018 accelerated at their fastest pace in more than a decade.

However, volatility in global equity markets increased in early 2018, leading to declines in many markets during the last three months of the reporting period. Rising global interest rates, a response to the improving economic environment, and signs of higher inflation weighed on global stocks. Concerns about escalating trade tensions between the U.S. and China, and the potential for a broader trade war, also contributed to the increased volatility in global equity markets.

Stocks in emerging markets returned approximately 22% in U.S. dollar terms for the reporting period, outperforming equities in developed markets. Emerging economies generally benefited from rising global trade, in addition to lower stock valuations and higher corporate earnings growth compared with developed market stocks. Emerging markets in Asia were the best performers, led by China and Thailand, while equity markets in the Middle East and Turkey trailed amid continued geopolitical conflict in the region.

Among developed markets, the Asia-Pacific region posted the best returns, gaining more than 17% in U.S. dollar terms for the reporting period. Singapore was the top-performing market in the region, benefiting from a continued recovery in the Singaporean economy. Japanese stocks also posted strong returns as the nation’s economic expansion reached eight consecutive quarters, its longest period of sustained economic growth in more than 20 years. Other Asian markets were supported by strong domestic and international demand for electronics and computer-related products.

European equity markets advanced by approximately 16% in U.S. dollar terms for the reporting period. European stocks benefited from robust corporate profit growth, outpacing the earnings growth of U.S. companies for the first time in a decade. Stock markets in Austria and Norway posted the strongest returns in Europe, while markets in Sweden and Switzerland declined slightly in U.S. dollar terms.

The U.S. stock market returned approximately 13% during the reporting period. U.S. stocks benefited from a stronger domestic economy, driven by healthy employment growth and a meaningful increase in manufacturing activity. In addition, U.S. income tax reform legislation, which lowered corporate tax rates, contributed to record profit growth for U.S. companies. Nonetheless, the U.S. market trailed most other regions of the world as the U.S. dollar depreciated against most foreign currencies, enhancing returns for non-U.S. markets when translated into U.S. dollar terms. The U.S. dollar’s depreciation occurred despite a series of interest rate increases by the Fed, which increased its short-term interest rate target to its highest level in a decade.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

5 |

Management’s Discussion of Fund Performance

iSHARES® ASIA/PACIFIC DIVIDEND ETF

Performance as of April 30, 2018

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | |||||||||||||||||||||||

| 1 Year |

2.19% | 1.17% | 2.48% | 2.19% | 1.17% | 2.48% | ||||||||||||||||||||||

| 5 Years |

(0.44)% | (0.66)% | (0.21)% | (2.17)% | (3.28)% | (1.06)% | ||||||||||||||||||||||

| Since Inception |

3.56% | 3.42% | 3.86% | 24.20% | 23.12% | 26.40% | ||||||||||||||||||||||

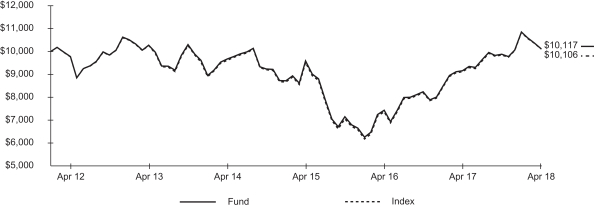

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/23/12. The first day of secondary market trading was 2/24/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 10 for more information.

| Shareholder Expenses | ||||||||||||||||||||||||||

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||

| Beginning Account Value (11/1/17) |

Ending Account Value (4/30/18) |

Expenses Paid During Period a |

Beginning Account Value (11/1/17) |

Ending Account Value (4/30/18) |

Expenses Paid During Period a |

Annualized Expense Ratio |

||||||||||||||||||||

| $ | 1,000.00 | $ | 988.10 | $ | 2.42 | $ | 1,000.00 | $ | 1,022.40 | $ | 2.46 | 0.49% | ||||||||||||||

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 10 for more information. |

| 6 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® ASIA/PACIFIC DIVIDEND ETF

The iShares Asia/Pacific Dividend ETF (the “Fund”) seeks to track the investment results of an index composed of relatively high dividend paying equities in Asia/Pacific developed markets, as represented by the Dow Jones Asia/Pacific Select Dividend 30 IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month reporting period ended April 30, 2018, the total return for the Fund was 2.19%, net of fees, while the total return for the Index was 2.48%.

On a country-specific basis, high dividend-paying stocks in Hong Kong were strong contributors to the Index’s return for the reporting period, driven by considerable inflows from investors in mainland China. Many stocks in the region are dual listed, meaning they are available on both mainland China and Hong Kong exchanges. But stocks on the Hong Kong exchange have traditionally sold at a discount to their mainland prices, which attracted investors during the reporting period. The market for initial public offerings in Hong Kong was particularly robust, evidenced by an 82% annualized increase in the first quarter of 2018. Additionally, dividend stocks of companies tied to Hong Kong’s export-driven economy were buoyed by the country’s 8% year-over-year increase in export growth and its lowest jobless rate in 20 years.

Australian stocks with high dividend payments, which comprised approximately 50% of the Index on average, contributed modestly to its performance. Australian companies posted their highest corporate profits since the financial crisis, and paid the highest dividend yields of any developed country. However, the performance of the nation’s financials sector declined amid allegations of misconduct by its four largest banks. New Zealand was the only country to detract from the Index’s return, as the country’s banks were hindered by ties to Australian lenders. New Zealand media companies were another source of weakness for the Index’s performance.

On a sector basis, the real estate sector was a major contributor to the Index’s performance. The performance of real estate stocks in the region was supported by an accelerating global economy, thriving merger-and-acquisition activity, and low stock valuations relative to their history. In the industrials sector, construction and engineering stocks performed well, reporting significant revenue growth on rising global demand for infrastructure projects. The materials sector also contributed, as metals and mining stocks rose in conjunction with higher prices for commodities during the reporting period. Consumer discretionary stocks detracted from the Index’s return, due primarily to a major media company that cut its interim dividend in half while its subscriber base eroded.

| * | Excludes money market funds. |

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

7 |

Management’s Discussion of Fund Performance

iSHARES® EMERGING MARKETS DIVIDEND ETF

Performance as of April 30, 2018

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | |||||||||||||||||||||||

| 1 Year |

10.50% | 8.91% | 10.92% | 10.50% | 8.91% | 10.92% | ||||||||||||||||||||||

| 5 Years |

(0.30)% | (0.66)% | (0.31)% | (1.49)% | (3.27)% | (1.54)% | ||||||||||||||||||||||

| Since Inception |

0.19% | 0.01% | 0.17% | 1.17% | 0.07% | 1.06% | ||||||||||||||||||||||

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/23/12. The first day of secondary market trading was 2/24/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 10 for more information.

| Shareholder Expenses | ||||||||||||||||||||||||||

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||

| Beginning Account Value (11/1/17) |

Ending Account Value (4/30/18) |

Expenses Paid During Period a |

Beginning Account Value (11/1/17) |

Ending Account Value (4/30/18) |

Expenses Paid During Period a |

Annualized Expense Ratio |

||||||||||||||||||||

| $ | 1,000.00 | $ | 1,024.40 | $ | 2.46 | $ | 1,000.00 | $ | 1,022.40 | $ | 2.46 | 0.49% | ||||||||||||||

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 10 for more information. |

| 8 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Management’s Discussion of Fund Performance (Continued)

iSHARES® EMERGING MARKETS DIVIDEND ETF

The iShares Emerging Markets Dividend ETF (the “Fund”) seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging markets, as represented by the Dow Jones Emerging Markets Select Dividend IndexTM (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month reporting period ended April 30, 2018, the total return for the Fund was 10.50%, net of fees, while the total return for the Index was 10.92%.

From a country perspective, dividend paying stocks in China were the largest contributors to the Index’s return during the reporting period, driven by solid economic growth, domestic consumption, and property sales. Growth in exports remained resilient despite escalating trade tensions with the U.S. Although investors remained concerned about an economic slowdown, the Chinese government provided reassurance that it could shift monetary policy in an effort to control such deceleration.

Dividend stocks in Taiwan were solid contributors to the Index’s performance. The export-driven economy benefited from solid demand for technology-related exports and machinery, as well as rising domestic consumption and government spending. Thailand and South Africa also contributed meaningfully to the Index’s return. Thailand’s stock market reached an all-time high as tourism and manufacturing drove economic expansion. South African equities advanced on a stronger South African rand, optimism surrounding the election of a pro-business leader, and growing investment from abroad.

Brazil was the largest detractor from the Index’s return, as the impact of economic recession, political uncertainty, and corruption continued to weigh on performance. However, signs of economic growth, rising business confidence, and an increase in the price of commodities helped Brazilian equities begin to recover in the second half of the reporting period, as the country’s lengthy recession came to an end.

On a sector basis, financials was the strongest contributor to the Index’s return for the reporting period. Bank stocks drove sector performance, as economic growth generally improved and governments worked to reduce risk in banking systems. The real estate sector also contributed meaningfully to the Index’s performance. In China, real estate management and development stocks advanced on an increase in construction, industry consolidation, and optimism that local governments may ease restrictions designed to slow the rapid growth in housing prices. On the downside, the consumer staples sector detracted from the Index’s performance, driven largely by select tobacco stocks, which faced increased international regulations and strong illegal cigarette sales.

| * | Excludes money market funds. |

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

9 |

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.ishares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment advisory fees. Without such a waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Certain funds may have a NAV which is determined prior to the opening of regular trading on its listed exchange and their market returns are calculated using the midpoint of the bid/ask spread as of the opening of regular trading on the exchange. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on November 1, 2017 and held through April 30, 2018, is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number corresponding to your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 10 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

iSHARES® ASIA/PACIFIC DIVIDEND ETF

April 30, 2018

| SCHEDULES OF INVESTMENTS |

11 |

Schedule of Investments (Continued)

iSHARES® ASIA/PACIFIC DIVIDEND ETF

April 30, 2018

Affiliates (Note 2)

Investments in issuers considered to be affiliates of the Fund during the year ended April 30, 2018, for purposes of Section 2(a)(3) of the 1940 Act were as follows:

| Affiliated issuer | Shares held at 04/30/17 |

Shares purchased |

Shares sold |

Shares held at 04/30/18 |

Value at 04/30/18 |

Income | Net realized gain (loss) a |

Change in unrealized appreciation (depreciation) |

||||||||||||||||||||||||

| BlackRock Cash Funds: Institutional, |

1,459,016 | — | (1,088,828 | )b | 370,188 | $ | 370,225 | $ | 17,311 | c | $ | (569 | ) | $ | (150 | ) | ||||||||||||||||

| BlackRock Cash Funds: Treasury, |

7,107 | — | (1,751 | )b | 5,356 | 5,356 | 262 | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| $ | 375,581 | $ | 17,573 | $ | (569 | ) | $ | (150 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| a | Includes realized capital gain distributions from an affiliated fund, if any. |

| b | Net of purchases and sales. |

| c | Includes securities lending income earned from the reinvestment of cash collateral from loaned securities (excluding collateral investment fees), net of fees and other payments to and from borrowers of securities, and less fees paid to BTC as securities lending agent. |

Fair Value Measurements

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, see Note 1.

The following table summarizes the value of the Fund’s investments according to the fair value hierarchy as of April 30, 2018. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investments |

||||||||||||||||

| Assets |

||||||||||||||||

| Common stocks |

$ | 39,649,047 | $ | — | $ | — | $ | 39,649,047 | ||||||||

| Money market funds |

375,581 | — | — | 375,581 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 40,024,628 | $ | — | $ | — | $ | 40,024,628 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to financial statements.

| 12 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments

iSHARES® EMERGING MARKETS DIVIDEND ETF

April 30, 2018

| SCHEDULES OF INVESTMENTS |

13 |

Schedule of Investments (Continued)

iSHARES® EMERGING MARKETS DIVIDEND ETF

April 30, 2018

| 14 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Schedule of Investments (Continued)

iSHARES® EMERGING MARKETS DIVIDEND ETF

April 30, 2018

Affiliates (Note 2)

Investments in issuers considered to be affiliates of the Fund during the year ended April 30, 2018, for purposes of Section 2(a)(3) of the 1940 Act were as follows:

| Affiliated issuer | Shares held at 04/30/17 |

Shares purchased |

Shares sold |

Shares held at 04/30/18 |

Value at 04/30/18 |

Income | Net realized gain (loss) a |

Change in unrealized appreciation (depreciation) |

||||||||||||||||||||||||

| BlackRock Cash Funds: Institutional, |

6,333,570 | 3,822,031 | b | — | 10,155,601 | $ | 10,156,616 | $ | 89,345 | c | $ | 1,066 | $ | (2,036 | ) | |||||||||||||||||

| BlackRock Cash Funds: Treasury, |

122,185 | 382,078 | b | — | 504,263 | 504,263 | 9,085 | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| $ | 10,660,879 | $ | 98,430 | $ | 1,066 | $ | (2,036 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| a | Includes realized capital gain distributions from an affiliated fund, if any. |

| b | Net of purchases and sales. |

| c | Includes securities lending income earned from the reinvestment of cash collateral from loaned securities (excluding collateral investment fees), net of fees and other payments to and from borrowers of securities, and less fees paid to BTC as securities lending agent. |

Futures Contracts (Note 5)

Futures contracts outstanding as of April 30, 2018 were as follows:

| Description | Number of contracts |

Expiration date |

Notional amount (000) |

Value / unrealized appreciation (depreciation) |

||||||||||||

| Long Contracts |

||||||||||||||||

| MSCI Emerging Markets E-Mini |

32 | Jun 2018 | $ | 1,844 | $ | (60,382 | ) | |||||||||

|

|

|

|||||||||||||||

| SCHEDULES OF INVESTMENTS |

15 |

Schedule of Investments (Continued)

iSHARES® EMERGING MARKETS DIVIDEND ETF

April 30, 2018

Fair Value Measurements

Various inputs are used in determining the fair value of financial instruments. For description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, see Note 1.

The following table summarizes the value of the Fund’s investments according to the fair value hierarchy as of April 30, 2018. The breakdown of the Fund’s investments into major categories is disclosed in the Schedule of Investments above.

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investments |

||||||||||||||||

| Assets |

||||||||||||||||

| Common stocks |

$ | 420,195,485 | $ | 17,108,606 | $ | — | $ | 437,304,091 | ||||||||

| Preferred stocks |

17,424,189 | — | — | 17,424,189 | ||||||||||||

| Money market funds |

10,660,879 | — | — | 10,660,879 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 448,280,553 | $ | 17,108,606 | $ | — | $ | 465,389,159 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Derivative financial instrumentsa |

||||||||||||||||

| Liabilities |

||||||||||||||||

| Futures contracts |

$ | (60,382 | ) | $ | — | $ | — | $ | (60,382 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | (60,382 | ) | $ | — | $ | — | $ | (60,382 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| a | Shown at the unrealized appreciation (depreciation) on the contracts. |

See notes to financial statements.

| 16 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Statements of Assets and Liabilities

iSHARES®, INC.

April 30, 2018

| iShares Asia/Pacific |

iShares Emerging Markets |

|||||||

| ASSETS |

| |||||||

| Investments in securities, at cost: |

| |||||||

| Unaffiliated |

$ | 43,041,523 | $ | 447,732,185 | ||||

| Affiliated (Note 2) |

375,545 | 10,660,824 | ||||||

|

|

|

|

|

|||||

| Total cost of investments in securities |

$ | 43,417,068 | $ | 458,393,009 | ||||

|

|

|

|

|

|||||

| Investments in securities, at fair value (including securities on loana) (Note 1): |

| |||||||

| Unaffiliated |

$ | 39,649,047 | $ | 454,728,280 | ||||

| Affiliated (Note 2) |

375,581 | 10,660,879 | ||||||

| Foreign currency, at valueb |

132,451 | 1,255,203 | ||||||

| Cash pledged to broker for futures contracts |

— | 85,000 | ||||||

| Receivables: |

| |||||||

| Dividends and interest |

112,108 | 1,071,881 | ||||||

|

|

|

|

|

|||||

| Total Assets |

40,269,187 | 467,801,243 | ||||||

|

|

|

|

|

|||||

| LIABILITIES |

| |||||||

| Payables: |

| |||||||

| Investment securities purchased |

79,707 | 629,625 | ||||||

| Collateral for securities on loan (Note 1) |

370,440 | 10,153,935 | ||||||

| Futures variation margin |

— | 15,200 | ||||||

| Investment advisory fees (Note 2) |

15,913 | 185,746 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

466,060 | 10,984,506 | ||||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 39,803,127 | $ | 456,816,737 | ||||

|

|

|

|

|

|||||

| Net assets consist of: |

| |||||||

| Paid-in capital |

$ | 50,466,861 | $ | 529,165,456 | ||||

| Undistributed of net investment income |

157,359 | 929,937 | ||||||

| Accumulated net realized loss |

(7,426,407 | ) | (80,074,179 | ) | ||||

| Net unrealized appreciation (depreciation) |

(3,394,686 | ) | 6,795,523 | |||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 39,803,127 | $ | 456,816,737 | ||||

|

|

|

|

|

|||||

| Shares outstandingc |

850,000 | 10,900,000 | ||||||

|

|

|

|

|

|||||

| Net asset value per share |

$ | 46.83 | $ | 41.91 | ||||

|

|

|

|

|

|||||

| a | Securities on loan with values of $352,831 and $5,295,858, respectively. See Note 1. |

| b | Cost of foreign currency: $133,035 and $1,381,484, respectively. |

| c | $0.001 par value, number of shares authorized: 500 million and 500 million, respectively. |

See notes to financial statements.

| FINANCIAL STATEMENTS |

17 |

Statements of Operations

iSHARES®, INC.

Year ended April 30, 2018

| iShares Asia/Pacific |

iShares Dividend ETF |

|||||||

| NET INVESTMENT INCOME |

| |||||||

| Dividends — unaffiliateda |

$ | 2,183,841 | $ | 18,772,373 | ||||

| Dividends — affiliated (Note 2) |

262 | 9,085 | ||||||

| Securities lending income — affiliated — net (Note 2) |

17,311 | 89,345 | ||||||

|

|

|

|

|

|||||

| 2,201,414 | 18,870,803 | |||||||

| Less: Other foreign taxes (Note 1) |

— | (1,288 | ) | |||||

|

|

|

|

|

|||||

| Total investment income |

2,201,414 | 18,869,515 | ||||||

|

|

|

|

|

|||||

| EXPENSES |

| |||||||

| Investment advisory fees (Note 2) |

206,821 | 1,881,171 | ||||||

| Proxy fees |

1,000 | 6,523 | ||||||

| Commitment fees (Note 8) |

— | 139 | ||||||

|

|

|

|

|

|||||

| Total expenses |

207,821 | 1,887,833 | ||||||

|

|

|

|

|

|||||

| Net investment income |

1,993,593 | 16,981,682 | ||||||

|

|

|

|

|

|||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) |

| |||||||

| Net realized gain (loss) from: |

| |||||||

| Investments — unaffiliated |

510,398 | 9,419,340 | ||||||

| Investments — affiliated (Note 2) |

(569 | ) | 1,066 | |||||

| In-kind redemptions — unaffiliated |

334,840 | 12,590,118 | ||||||

| Futures contracts |

— | 103,492 | ||||||

| Foreign currency transactions |

2,428 | (14,721 | ) | |||||

|

|

|

|

|

|||||

| Net realized gain |

847,097 | 22,099,295 | ||||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation/depreciation on: |

||||||||

| Investments — unaffiliated |

(1,915,191 | ) | (8,090,674 | ) | ||||

| Investments — affiliated (Note 2) |

(150 | ) | (2,036 | ) | ||||

| Futures contracts |

— | (60,382 | ) | |||||

| Translation of assets and liabilities in foreign currencies |

(1,620 | ) | (155,874 | ) | ||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation/depreciation |

(1,916,961 | ) | (8,308,966 | ) | ||||

|

|

|

|

|

|||||

| Net realized and unrealized gain (loss) |

(1,069,864 | ) | 13,790,329 | |||||

|

|

|

|

|

|||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 923,729 | $ | 30,772,011 | ||||

|

|

|

|

|

|||||

| a | Net of foreign withholding tax of $85,878 and $2,410,314, respectively. |

See notes to financial statements.

| 18 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Statements of Changes in Net Assets

iSHARES®, INC.

| iShares Asia/Pacific Dividend ETF |

iShares Emerging Markets Dividend ETF |

|||||||||||||||

| Year ended April 30, 2018 |

Year ended April 30, 2017 |

Year ended April 30, 2018 |

Year ended April 30, 2017 |

|||||||||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||||||||||

| OPERATIONS: |

||||||||||||||||

| Net investment income |

$ | 1,993,593 | $ | 3,308,931 | $ | 16,981,682 | $ | 9,644,028 | ||||||||

| Net realized gain |

847,097 | 4,255,598 | 22,099,295 | 997,527 | ||||||||||||

| Net change in unrealized appreciation/depreciation |

(1,916,961 | ) | 616,706 | (8,308,966 | ) | 33,293,861 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets resulting from operations |

923,729 | 8,181,235 | 30,772,011 | 43,935,416 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||||||||||

| From net investment income |

(2,084,792 | ) | (3,170,341 | ) | (17,865,271 | ) | (9,244,146 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

(2,084,792 | ) | (3,170,341 | ) | (17,865,271 | ) | (9,244,146 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||||||||||

| Proceeds from shares sold |

— | 87,683,305 | 177,446,391 | 188,728,446 | ||||||||||||

| Cost of shares redeemed |

(4,766,094 | ) | (103,206,971 | ) | (32,468,568 | ) | (76,898,000 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets from capital share transactions |

(4,766,094 | ) | (15,523,666 | ) | 144,977,823 | 111,830,446 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCREASE (DECREASE) IN NET ASSETS |

(5,927,157 | ) | (10,512,772 | ) | 157,884,563 | 146,521,716 | ||||||||||

| NET ASSETS |

||||||||||||||||

| Beginning of year |

45,730,284 | 56,243,056 | 298,932,174 | 152,410,458 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of year |

$ | 39,803,127 | $ | 45,730,284 | $ | 456,816,737 | $ | 298,932,174 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income included in net assets at end of year |

$ | 157,359 | $ | 105,631 | $ | 929,937 | $ | 172,204 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SHARES ISSUED AND REDEEMED |

||||||||||||||||

| Shares sold |

— | 1,900,000 | 4,150,000 | 5,150,000 | ||||||||||||

| Shares redeemed |

(100,000 | ) | (2,250,000 | ) | (750,000 | ) | (2,150,000 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in shares outstanding |

(100,000 | ) | (350,000 | ) | 3,400,000 | 3,000,000 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to financial statements.

| FINANCIAL STATEMENTS |

19 |

iSHARES®, INC.

(For a share outstanding throughout each period)

| iShares Asia/Pacific Dividend ETF | ||||||||||||||||||||

| Year ended Apr. 30, 2018 |

Year ended Apr. 30, 2017 |

Year ended Apr. 30, 2016 |

Year ended Apr. 30, 2015 |

Year ended Apr. 30, 2014 |

||||||||||||||||

| Net asset value, beginning of year |

$ | 48.14 | $ | 43.26 | $ | 50.11 | $ | 57.27 | $ | 61.76 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from investment operations: |

| |||||||||||||||||||

| Net investment incomea |

2.30 | 2.46 | 2.13 | 2.38 | 2.61 | |||||||||||||||

| Net realized and unrealized gain (loss)b |

(1.21 | ) | 4.38 | (6.69 | ) | (6.85 | ) | (4.04 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

1.09 | 6.84 | (4.56 | ) | (4.47 | ) | (1.43 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

| |||||||||||||||||||

| Net investment income |

(2.40 | ) | (1.96 | ) | (2.23 | ) | (2.69 | ) | (3.06 | ) | ||||||||||

| Return of capital |

— | — | (0.06 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

(2.40 | ) | (1.96 | ) | (2.29 | ) | (2.69 | ) | (3.06 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$ | 46.83 | $ | 48.14 | $ | 43.26 | $ | 50.11 | $ | 57.27 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

2.19 | % | 16.13 | % | (8.74 | )% | (8.04 | )% | (1.78 | )% | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios/Supplemental data: |

| |||||||||||||||||||

| Net assets, end of year (000s) |

$ | 39,803 | $ | 45,730 | $ | 56,243 | $ | 55,120 | $ | 48,676 | ||||||||||

| Ratio of expenses to average net assets |

0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

| Ratio of net investment income to average net assets |

4.72 | % | 5.38 | % | 5.03 | % | 4.47 | % | 4.77 | % | ||||||||||

| Portfolio turnover ratec |

21 | % | 37 | % | 32 | % | 40 | % | 33 | % | ||||||||||

| a | Based on average shares outstanding throughout each period. |

| b | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| c | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

See notes to financial statements.

| 20 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Financial Highlights (Continued)

iSHARES®, INC.

(For a share outstanding throughout each period)

| iShares Emerging Markets Dividend ETF | ||||||||||||||||||||

| Year ended Apr. 30, 2018 |

Year ended Apr. 30, 2017 |

Year ended Apr. 30, 2016 |

Year ended Apr. 30, 2015 |

Year ended Apr. 30, 2014 |

||||||||||||||||

| Net asset value, beginning of year |

$ | 39.86 | $ | 33.87 | $ | 45.99 | $ | 48.33 | $ | 53.80 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from investment operations: |

| |||||||||||||||||||

| Net investment incomea |

1.86 | 1.52 | 1.83 | 2.00 | 1.96 | |||||||||||||||

| Net realized and unrealized gain (loss)b |

2.24 | 6.06 | (12.13 | ) | (2.45 | ) | (5.18 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

4.10 | 7.58 | (10.30 | ) | (0.45 | ) | (3.22 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions from: |

| |||||||||||||||||||

| Net investment income |

(2.05 | ) | (1.59 | ) | (1.76 | ) | (1.89 | ) | (2.25 | ) | ||||||||||

| Return of capital |

— | — | (0.06 | ) | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions |

(2.05 | ) | (1.59 | ) | (1.82 | ) | (1.89 | ) | (2.25 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$ | 41.91 | $ | 39.86 | $ | 33.87 | $ | 45.99 | $ | 48.33 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return |

10.50 | % | 23.22 | % | (22.45 | )% | (0.91 | )% | (5.86 | )% | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios/Supplemental data: |

| |||||||||||||||||||

| Net assets, end of year (000s) |

$ | 456,817 | $ | 298,932 | $ | 152,410 | $ | 211,562 | $ | 178,838 | ||||||||||

| Ratio of expenses to average net assets |

0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | 0.49 | % | ||||||||||

| Ratio of expenses to average net assets prior to waived fees |

0.49 | % | 0.52 | % | 0.68 | % | 0.68 | % | 0.68 | % | ||||||||||

| Ratio of net investment income to average net assets |

4.42 | % | 4.23 | % | 5.31 | % | 4.42 | % | 4.01 | % | ||||||||||

| Portfolio turnover ratec |

55 | % | 68 | % | 67 | % | 59 | % | 44 | % | ||||||||||

| a | Based on average shares outstanding throughout each period. |

| b | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| c | Portfolio turnover rates exclude portfolio securities received or delivered in Creation Units but include portfolio transactions that are executed as a result of the Fund processing capital share transactions in Creation Units partially for cash in U.S. dollars. Excluding such cash transactions, the portfolio turnover rates for the years ended April 30, 2018, April 30, 2017, April 30, 2016, April 30, 2015 and April 30, 2014 were 54%, 54%, 55%, 43% and 39%, respectively. See Note 4. |

See notes to financial statements.

| FINANCIAL HIGHLIGHTS |

21 |

iSHARES®, INC.

iShares, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of the State of Maryland on September 1, 1994 pursuant to Articles of Incorporation as subsequently amended and restated.

These financial statements relate only to the following funds (each, a “Fund,” and collectively, the “Funds”):

| iShares ETF | Diversification Classification | |

| Asia/Pacific Dividend |

Non-diversified | |

| Emerging Markets Dividend |

Diversified |

The investment objective of each Fund is to seek investment results that correspond generally to the price and yield performance, before fees and expenses, of its underlying index. The investment adviser uses a “passive” or index approach to try to achieve each Fund’s investment objective.

Pursuant to the Company’s organizational documents, the Funds’ officers and directors are indemnified against certain liabilities that may arise out of the performance of their duties to the Funds. Additionally, in the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred.

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

The following significant accounting policies are consistently followed by each Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Each Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies.

SECURITY VALUATION

Each Fund’s investments are valued at fair value each day that the Fund’s listing exchange is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the Fund’s listing exchange is not open. U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) provides oversight of the valuation of investments for the Funds. The investments of each Fund are valued pursuant to policies and procedures developed by the Global Valuation Committee and approved by the Board of Directors of the Company (the “Board”).

| • | Equity investments traded on a recognized securities exchange are valued at that day’s last reported trade price or the official closing price, as applicable, on the exchange where the stock is primarily traded. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last traded price. |

| • | Open-end U.S. mutual funds (including money market funds) are valued at that day’s published net asset value (“NAV”). |

| • | Futures contract notional values are determined based on that day’s last reported settlement price on the exchange where the contract is traded. |

| 22 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES®, INC.

In the event that application of these methods of valuation results in a price for an investment which is deemed not to be representative of the fair value of such investment or if a price is not available, the investment will be valued by the Global Valuation Committee, in accordance with policies approved by the Board. The fair valuation approaches that may be utilized by the Global Valuation Committee to determine fair value include market approach, income approach and the cost approach. The valuation techniques used under these approaches take into consideration inputs that include but are not limited to (i) attributes specific to the investment; (ii) the principal market for the investment; (iii) the customary participants in the principal market for the investment; (iv) data assumptions by market participants for the investment, if reasonably available; (v) quoted prices for similar investments in active markets; and (vi) other inputs, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and/or default rates. Valuations based on such inputs are reported to the Board on a quarterly basis.

The Global Valuation Committee employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Company’s pricing vendors, a regular review of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices, reviews of large movements in market values, and reviews of market related activity.

Fair value pricing could result in a difference between the prices used to calculate a Fund’s NAV and the prices used by the Fund’s underlying index, which in turn could result in a difference between the Fund’s performance and the performance of the Fund’s underlying index.

Various inputs are used in determining the fair value of financial instruments. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows:

| • | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities; |

| • | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| • | Level 3 — Unobservable inputs for the asset or liability based on the best information available in the circumstances, to the extent observable inputs are not available, including the Global Valuation Committee’s assumptions used in determining the fair value of investments. |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgement exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The fair value hierarchy for each Fund’s investments is included in its schedule of investments.

Changes in valuation techniques may result in transfers in or out of an assigned level within the fair value hierarchy. In accordance with the Company’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of values determined for financial instruments are based on the pricing transparency of the financial instruments and are not necessarily an indication of the risks associated with investing in those securities.

| NOTES TO FINANCIAL STATEMENTS |

23 |

Notes to Financial Statements (Continued)

iSHARES®, INC.

SECURITY TRANSACTIONS AND INCOME RECOGNITION

Security transactions are accounted for on trade date. Realized gains and losses on investment transactions are determined using the specific identification method. Dividend income and capital gain distributions, if any, are recognized on the ex-dividend date, net of any foreign taxes withheld at source. Any taxes withheld that are reclaimable from foreign tax authorities as of April 30, 2018 are reflected in tax reclaims receivable. Upon notification from issuers, some of the dividend income received from a real estate investment trust may be re-designated as a return of capital or capital gain. Non-cash dividends, if any, are recognized on the ex-dividend date and recorded as non-cash dividend income at fair value. Distributions received by the Funds may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Interest income is accrued daily.

FOREIGN CURRENCY TRANSLATION

The accounting records of the Funds are maintained in U.S. dollars. Foreign currencies, as well as investment securities and other assets and liabilities denominated in foreign currencies, are translated into U.S. dollars using prevailing market rates as quoted by one or more data service providers. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars on the respective dates of such transactions.

Each Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market prices of securities. Such fluctuations are reflected by the Funds as a component of realized and unrealized gains and losses from investments for financial reporting purposes. Each Fund reports realized currency gains (losses) on foreign currency related transactions as components of net realized gain (loss) for financial reporting purposes, whereas such components are generally treated as ordinary income for U.S. federal income tax purposes.

FOREIGN TAXES

The Funds may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, capital gains on investments, or certain foreign currency transactions. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Funds invest. These foreign taxes, if any, are paid by the Funds and are reflected in their statements of operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on securities lending income are presented as a reduction of securities lending income, foreign taxes on stock dividends are presented as “other foreign taxes”, and foreign taxes on capital gains from sales of investments and foreign taxes on foreign currency transactions are included in their respective net realized gain (loss) categories. Foreign taxes payable or deferred as of April 30, 2018, if any, are disclosed in the Funds’ statements of assets and liabilities.

DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions paid by each Fund are recorded on the ex-dividend dates. Distributions are determined on a tax basis and may differ from net investment income and net realized capital gains for financial reporting purposes. Dividends and distributions are paid in U.S. dollars and cannot be automatically reinvested in additional shares of the Funds.

LOANS OF PORTFOLIO SECURITIES

Each Fund may lend its investment securities to approved borrowers, such as brokers, dealers and other financial institutions. The borrower pledges and maintains with the Fund collateral consisting of cash, an irrevocable letter of credit issued by an approved bank, or securities issued or guaranteed by the U.S. government. The initial collateral received by each Fund is required to have a value of at least 102% of the current value of the loaned securities for securities traded on U.S. exchanges and

| 24 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES®, INC.

a value of at least 105% for all other securities. The collateral is maintained thereafter at a value equal to at least 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the close of each business day of the Funds. Any additional required collateral is delivered to the Funds and any excess collateral is returned by the Funds on the next business day. During the term of the loan, each Fund is entitled to all distributions made on or in respect of the loaned securities but does not receive interest income on securities received as collateral. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

Cash received as collateral for securities on loan may be reinvested in certain short-term instruments either directly on behalf of a fund or through one or more joint accounts or money market funds, including those managed by BlackRock Fund Advisors (“BFA”), the Funds’ investment adviser, or its affiliates. As of April 30, 2018, any securities on loan were collateralized by cash and/or U.S. government obligations. Cash collateral received was invested in money market funds managed by BFA and is disclosed in the schedules of investments. Any non-cash collateral received cannot be sold, re-invested or pledged by the Fund, except in the event of borrower default. The securities on loan for each Fund are also disclosed in its schedule of investments. The total value of any securities on loan as of April 30, 2018 and the total value of the related cash collateral are disclosed in the statements of assets and liabilities. Income earned by the Funds from securities lending is disclosed in the statements of operations.

The risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks, the Funds benefit from a borrower default indemnity provided by BlackRock, Inc. (“BlackRock”). BlackRock’s indemnity allows for full replacement of securities loaned if the collateral received does not cover the value of the securities loaned in the event of borrower default. Each Fund could incur a loss if the value of an investment purchased with cash collateral falls below the value of the loaned securities or if the value of an investment purchased with cash collateral falls below the value of the original cash collateral received.

Securities lending transactions are entered into by the Funds under Master Securities Lending Agreements (“MSLA”) which provide the right, in the event of default (including bankruptcy or insolvency) for the non-defaulting party to liquidate the collateral and calculate a net exposure to the defaulting party or request additional collateral. In the event that a borrower defaults, a Fund, as lender, would offset the market value of the collateral received against the market value of the securities loaned. The value of the collateral is typically greater than that of the market value of the securities loaned, leaving the lender with a net amount payable to the defaulting party. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of an MSLA counterparty’s bankruptcy or insolvency. Under the MSLA, the borrower can resell or re-pledge the loaned securities, and a Fund can reinvest cash collateral, or, upon an event of default, resell or re-pledge the collateral.

| NOTES TO FINANCIAL STATEMENTS |

25 |

Notes to Financial Statements (Continued)

iSHARES®, INC.

The following table is a summary of securities lending agreements which are subject to offset under an MSLA as of April 30, 2018:

| iShares ETF and Counterparty |

Market Value of Securities on Loan |

Cash Collateral Received a |

Net Amount |

|||||||||

| Asia/Pacific Dividend |

||||||||||||

| Morgan Stanley & Co. LLC |

$ | 352,831 | $ | 352,831 | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| Emerging Markets Dividend |

||||||||||||

| Barclays Capital Inc. |

$ | 1,183,491 | $ | 1,183,491 | $ | — | ||||||

| Credit Suisse Securities (USA) LLC |

51,523 | 51,523 | — | |||||||||

| Deutsche Bank AG |

553,842 | 553,842 | — | |||||||||

| Deutsche Bank Securities Inc. |

614,846 | 614,846 | — | |||||||||

| Goldman Sachs & Co. |

263,493 | 263,493 | — | |||||||||

| JPMorgan Securities LLC |

1,126,871 | 1,126,871 | — | |||||||||

| Morgan Stanley & Co. LLC |

85,947 | 85,947 | — | |||||||||

| Morgan Stanley & Co. LLC (U.S. Equity Securities Lending) |

569,245 | 569,245 | — | |||||||||

| SG Americas Securities LLC |

846,600 | 846,600 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 5,295,858 | $ | 5,295,858 | $ | — | |||||||

|

|

|

|

|

|

|

|||||||

| a | Collateral received in excess of the market value of securities on loan is not presented in this table. The total cash collateral received by each Fund is disclosed in the Fund’s statement of assets and liabilities. |

| 2. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Pursuant to an Investment Advisory Agreement with the Company, BFA manages the investment of each Fund’s assets. BFA is a California corporation indirectly owned by BlackRock. Under the Investment Advisory Agreement, BFA is responsible for substantially all expenses of the Funds, except (i) interest and taxes; (ii) brokerage commissions and other expenses connected with the execution of portfolio transactions; (iii) distribution fees; (iv) the advisory fee payable to BFA; and (v) litigation expenses and any extraordinary expenses (in each case as determined by a majority of the independent directors).

For its investment advisory services to the iShares Asia/Pacific Dividend ETF, BFA is entitled to an annual investment advisory fee of 0.49%, accrued daily and paid monthly by the Fund, based on the average daily net assets of the Fund.

For its investment advisory services to the iShares Emerging Markets Dividend ETF, BFA is entitled to an annual investment advisory fee of 0.49%, accrued daily and paid monthly by the Fund, based on the average daily net assets of the Fund. In addition, a fund may incur its pro rata share of fees and expenses attributable to its investments in other investment companies (“acquired fund fees and expenses”). The total of the investment advisory fee and acquired fund fees and expenses are a fund’s total annual operating expenses. BFA has contractually agreed to waive a portion of its investment advisory fees for the Fund through August 31, 2022 in an amount equal to the acquired fund fees and expenses, if any, attributable to the Fund’s investments in other iShares funds.

The U.S. Securities and Exchange Commission has issued an exemptive order which permits BlackRock Institutional Trust Company, N.A. (“BTC”), an affiliate of BFA, to serve as securities lending agent for the Funds, subject to applicable conditions. As securities lending agent, BTC bears all operational costs directly related to securities lending. Each Fund is responsible for fees in connection with the investment of cash collateral received for securities on loan in a money market fund managed by BFA, however, BTC has agreed to reduce the amount of securities lending income it receives in order to effectively limit the collateral investment fees each Fund bears to an annual rate of 0.04% (the “collateral investment fees”). Securities lending income is equal

| 26 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES®, INC.

to the total of income earned from the reinvestment of cash collateral (excluding collateral investment fees), net of fees and other payments to and from borrowers of securities. The Funds retain a portion of securities lending income and remit the remaining portion to BTC as compensation for its services as securities lending agent.

Pursuant to a securities lending agreement, each Fund retains 80% of securities lending income and the amount retained can never be less than 70% of the total of securities lending income plus the collateral investment fees. In addition, commencing the business day following the date that the aggregate securities lending income plus the collateral investment fees generated across all 1940 Act iShares exchange-traded funds (the “iShares ETF Complex”) in a given calendar year exceeds the aggregate securities lending income generated across the iShares ETF Complex in the calendar year 2013, each Fund, pursuant to a securities lending agreement, will retain for the remainder of that calendar year 85% of securities lending income and the amount retained can never be less than 70% of the total of securities lending income plus the collateral investment fees.

For the year ended April 30, 2018, the total of securities lending agent services and collateral investment fees paid were as follows:

| iShares ETF | Fees Paid to BTC |

|||

| Asia/Pacific Dividend |

$ | 4,622 | ||

| Emerging Markets Dividend |

21,994 | |||

BlackRock Investments, LLC, an affiliate of BFA, is the distributor for each Fund. Pursuant to the distribution agreement, BFA is responsible for any fees or expenses for distribution services provided to the Funds.

Cross trading is the buying or selling of portfolio securities between funds to which BFA (or an affiliate) serves as investment adviser. At its regularly scheduled quarterly meetings, the Board reviews such transactions as of the most recent calendar quarter for compliance with the requirements and restrictions set forth by Rule 17a-7.

For the year ended April 30, 2018, the purchase and sales transactions executed by the iShares Emerging Markets Dividend ETF pursuant to Rule 17a-7 under the 1940 Act were $704,764 and $8,012,734, respectively.

Each Fund may invest its positive cash balances in certain money market funds managed by BFA or an affiliate. The income earned on these temporary cash investments is included in “Dividends — affiliated” in the statements of operations.

The PNC Financial Services Group, Inc. is the largest stockholder of BlackRock and is considered to be an affiliate of the Funds for 1940 Act purposes.

The iShares Emerging Markets Dividend ETF, in order to improve its portfolio liquidity and its ability to track its underlying index, may invest in shares of other iShares funds that invest in securities in the Fund’s underlying index.

Certain directors and officers of the Company are also officers of BTC and/or BFA.

| NOTES TO FINANCIAL STATEMENTS |

27 |

Notes to Financial Statements (Continued)

iSHARES®, INC.

| 3. | INVESTMENT PORTFOLIO TRANSACTIONS |

Purchases and sales of investments (excluding in-kind transactions and short-term investments) for the year ended April 30, 2018 were as follows:

| iShares ETF | Purchases | Sales | ||||||

| Asia/Pacific Dividend |

$ | 8,850,031 | $ | 9,173,404 | ||||

| Emerging Markets Dividend |

304,473,949 | 207,777,929 | ||||||

In-kind transactions (see Note 4) for the year ended April 30, 2018 were as follows:

| iShares ETF | In-kind Purchases |

In-kind Sales | ||||||

| Asia/Pacific Dividend |

$ | — | $ | 4,530,007 | ||||

| Emerging Markets Dividend |

78,231,556 | 30,190,555 | ||||||

| 4. | CAPITAL SHARE TRANSACTIONS |

Capital shares are issued and redeemed by each Fund only in aggregations of a specified number of shares or multiples thereof (“Creation Units”) at NAV. Except when aggregated in Creation Units, shares of each Fund are not redeemable. Transactions in capital shares for each Fund are disclosed in detail in the statements of changes in net assets.

The consideration for the purchase of Creation Units of a fund in the Company generally consists of the in-kind deposit of a designated portfolio of securities and a specified amount of cash. Certain funds in the Company may be offered in Creation Units solely or partially for cash in U.S. dollars. Investors purchasing and redeeming Creation Units may pay a purchase transaction fee and a redemption transaction fee directly to State Street Bank and Trust Company, the Company’s administrator, to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units, including Creation Units for cash. Investors transacting in Creation Units for cash may also pay an additional variable charge to compensate the relevant fund for certain transaction costs (i.e., stamp taxes, taxes on currency or other financial transactions, and brokerage costs) and market impact expenses relating to investing in portfolio securities. Such variable charges, if any, are included in “Proceeds from shares sold” in the statements of changes in net assets.

| 5. | FUTURES CONTRACTS |

Each Fund’s use of futures contracts is generally limited to cash equitization. This involves the use of available cash to invest in index futures contracts in order to gain exposure to the equity markets represented in or by the Fund’s underlying index and is intended to allow the Fund to better track its underlying index. Futures contracts are standardized, exchange-traded agreements to buy or sell a financial instrument at a set price on a future date. Upon entering into a futures contract, a fund is required to pledge to the executing broker which holds segregated from its own assets, an amount of cash, U.S. government securities or other high-quality debt and equity securities equal to the minimum initial margin requirements of the exchange on which the contract is traded.

Pursuant to the contract, the fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in market value of the contract. Such receipts or payments are known as variation margin and are recorded by the fund as unrealized appreciation or depreciation. When the contract is closed, the fund records a realized gain or loss equal to the difference between the notional amount of the contract at the time it was opened and the notional amount at the time it was closed. Losses may arise if the notional value of a futures contract decreases due to an unfavorable change in the market rates or

| 28 | 2018 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Notes to Financial Statements (Continued)

iSHARES®, INC.

values of the underlying instrument during the term of the contract or if the counterparty does not perform under the contract. The use of futures contracts also involves the risk of an imperfect correlation in the movements in the price of futures contracts and the assets underlying such contracts.

The following table shows the value of futures contracts held by the iShares Emerging Markets Dividend ETF as of April 30, 2018 and the related locations in the statements of assets and liabilities, presented by risk exposure category:

| Liabilities | ||||

| Equity contracts: |

||||

| Variation margin/Net assets consist of – net unrealized appreciation (depreciation)a |

$ | 60,382 | ||

|

|

|

|||

| a | Represents cumulative appreciation of futures contracts as reported in the schedule of investments. Only current day’s variation margin is reported separately within the statement of assets and liabilities. |

The following table shows the realized and unrealized gains (losses) on futures contracts held by the iShares Emerging Markets Dividend ETF during the year ended April 30, 2018 and the related locations in the statements of operations, presented by risk exposure category:

| Net Realized Gain (Loss) |

Net Change in Unrealized Appreciation/Depreciation |

|||||||

| Equity contracts |

$ | 103,492 | $ | (60,382 | ) | |||

|

|

|

|

|

|||||

The following table shows the average quarter-end balances of open futures contracts for the iShares Emerging Markets Dividend ETF for the year ended April 30, 2018:

| Average notional value of contracts purchased | $729,230 |

| 6. | PRINCIPAL RISKS |

In the normal course of business, each Fund invests in securities or other instruments and may enter into certain transactions, and such activities subject the Fund to various risks, including, among others, fluctuations in the market (market risk) or failure of an issuer to meet all of its obligations. The value of securities or other instruments may also be affected by various factors, including, without limitation: (i) the general economy; (ii) the overall market as well as local, regional or global political and/or social instability; (iii) regulation, taxation or international tax treaties between various countries; or (iv) currency, interest rate or price fluctuations. Each Fund’s prospectus provides details of the risks to which the Fund is subject.

BFA uses a “passive” or index approach to try to achieve each Fund’s investment objective following the securities included in its underlying index during upturns as well as downturns. BFA does not take steps to reduce market exposure or to lessen the effects of a declining market. Divergence from the underlying index and the composition of the portfolio is monitored by BFA.

MARKET RISK

Market risk arises mainly from uncertainty about future values of financial instruments influenced by price, currency and interest rate movements. It represents the potential loss a fund may suffer through holding market positions in the face of market movements. A fund is exposed to market risk by its investment in equity, fixed income and/or financial derivative instruments or

| NOTES TO FINANCIAL STATEMENTS |

29 |

Notes to Financial Statements (Continued)

iSHARES®, INC.

by its investment in underlying funds. The fair value of securities held by a fund may decline due to general market conditions, economic trends or events that are not specifically related to the issuers of the securities including local, regional or global political, social or economic instability or to factors that affect a particular industry or group of industries. The extent of a fund’s exposure to market risk is the market value of the investments held as shown in the fund’s schedule of investments.

A diversified portfolio, where this is appropriate and consistent with a fund’s objectives, minimizes the risk that a price change of a particular investment will have a material impact on the NAV of a fund. The investment concentrations within each Fund’s portfolio are disclosed in its schedule of investments.

Investing in the securities of non-U.S. issuers involves certain considerations and risks not typically associated with securities of U.S. issuers. Such risks include, but are not limited to: differences in accounting, auditing and financial reporting standards; more substantial governmental involvement in the economy; higher inflation rates, greater social, economic and political uncertainties; possible nationalization or expropriation of assets; less availability of public information about issuers; imposition of withholding or other taxes; higher transaction and custody costs and delays in settlement procedures; and lower level of regulation of the securities markets and issuers. Non-U.S. securities may be less liquid, more difficult to value, and have greater price volatility due to exchange rate fluctuations. These and other risks are heightened for investments in issuers from countries with less developed capital markets.

The United States and the European Union, along with the regulatory bodies of a number of countries including Japan, Australia, Norway, Switzerland and Canada, have imposed economic sanctions, which consist of asset freezes and sectorial sanctions, on certain Russian individuals and Russian corporate entities. Broader sanctions on Russia could also be instituted. These sanctions, or even the threat of further sanctions, may result in the decline of the value and liquidity of Russian securities, a weakening of the ruble or other adverse consequences to the Russian economy. Current or future sanctions may result in Russia taking counter measures or retaliatory actions, which may further impair the value and liquidity of Russian securities. These retaliatory measures may include the immediate freeze of Russian assets held by a fund.

CREDIT RISK

Credit risk is the risk that an issuer or guarantor of debt instruments or the counterparty to a financial transaction, including derivatives contracts, repurchase agreements or loans of portfolio securities, is unable or unwilling to make timely interest and/or principal payments or to otherwise honor its obligations. BFA and its affiliates manage counterparty credit risk by entering into transactions only with counterparties that they believe have the financial resources to honor their obligations and by monitoring the financial stability of those counterparties. Financial assets, which potentially expose a fund to issuer and counterparty credit risks, consist principally of financial instruments and receivables due from counterparties. The extent of a fund’s exposure to credit and counterparty risks with respect to those financial assets is approximated by their value recorded in its statement of assets and liabilities.

| 7. | INCOME TAX INFORMATION |

Each Fund is treated as an entity separate from the Company’s other funds for federal income tax purposes. It is the policy of each Fund to qualify as a regulated investment company by complying with the provisions applicable to regulated investment companies, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, and to annually distribute substantially all of its ordinary income and any net capital gains (taking into account any capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Accordingly, no provision for federal income taxes is required.