| 2016 Prospectus |

|

| ► | iShares MSCI Canada ETF | EWC | NYSE ARCA |

|

|

S-1 |

|

|

1 |

|

|

2 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

16 |

|

|

25 |

|

|

26 |

|

|

27 |

|

|

27 |

|

|

29 |

| Ticker: EWC | Stock Exchange: NYSE Arca |

| Annual

Fund Operating Expenses (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management

Fees |

Distribution

and Service (12b-1) Fees |

Other

Expenses |

Total

Annual Fund Operating Expenses | |||

| 0.48% | None | None | 0.48% | |||

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $49 | $154 | $269 | $604 |

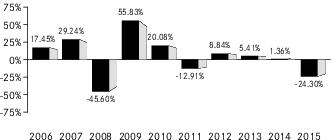

| 1 | The Fund’s year-to-date return as of September 30, 2016 was 20.51%. |

| One Year | Five Years | Ten Years | |||

| (Inception Date: 3/12/1996) | |||||

| Return Before Taxes | -24.30% | -5.18% | 1.71% | ||

| Return After Taxes on Distributions1 | -24.46% | -5.28% | 1.68% | ||

| Return After Taxes on Distributions and Sale of Fund Shares1 | -13.15% | -3.39% | 1.81% | ||

| MSCI Canada Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 | -24.16% | -4.99% | 1.94% | ||

| MSCI Canada Custom Capped Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 | N/A | N/A | N/A |

| 1 | After-tax returns in the table above are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). Fund returns after taxes on distributions and sales of Fund shares are calculated assuming that an investor has sufficient capital gains of the same character from other investments to offset any capital losses from the sale of Fund shares. As a result, Fund returns after taxes on distributions and sales of Fund shares may exceed Fund returns before taxes and/or returns after taxes on distributions. |

| 2 | On September 1, 2017, the Fund's Underlying Index changed from the MSCI Canada Index to the MSCI Canada Custom Capped Index. The inception date of the MSCI Canada Custom Capped Index was May 12, 2017. |

| ■ | Lower levels of liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ and/or may not be as extensive or protective as those that apply in the United States. |

| Approximate

Value of a Creation Unit |

Creation

Unit Size |

Standard

Creation/ Redemption Transaction Fee |

Maximum

Additional Charge for Creations* |

Maximum

Additional Charge for Redemptions* | ||||

| $2,561,000 | 100,000 | $1,900 | 3.0% | 2.0% |

| * | As a percentage of the net asset value per Creation Unit, inclusive, in the case of redemptions, of the standard redemption transaction fee. |

(For a share outstanding throughout each period)

| Year

ended Aug. 31, 2016 |

Year

ended Aug. 31, 2015 |

Year

ended Aug. 31, 2014 |

Year

ended Aug. 31, 2013 |

Year

ended Aug. 31, 2012 | |||||

| Net asset value, beginning of year | $ 24.02 | $ 32.93 | $ 27.34 | $ 27.52 | $ 29.89 | ||||

| Income from investment operations: | |||||||||

| Net investment incomea | 0.51 | 0.54 | 0.59 | 0.60 | 0.53 | ||||

| Net realized and unrealized gain (loss)b | 1.29 | (8.85) | 5.62 | (0.10) | (2.33) | ||||

| Total from investment operations | 1.80 | (8.31) | 6.21 | 0.50 | (1.80) | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.49) | (0.60) | (0.62) | (0.68) | (0.57) | ||||

| Total distributions | (0.49) | (0.60) | (0.62) | (0.68) | (0.57) | ||||

| Net asset value, end of year | $ 25.33 | $ 24.02 | $ 32.93 | $ 27.34 | $ 27.52 | ||||

| Total return | 7.73% | (25.48)% | 23.00% | 1.84% | (5.87)% | ||||

| Ratios/Supplemental data: | |||||||||

| Net assets, end of year (000s) | $3,097,794 | $1,931,454 | $3,786,906 | $3,428,223 | $4,254,544 | ||||

| Ratio of expenses to average net assets | 0.48% | 0.48% | 0.48% | 0.51% | 0.53% | ||||

| Ratio of net investment income to average net assets | 2.18% | 1.92% | 1.97% | 2.12% | 1.94% | ||||

| Portfolio turnover ratec | 4% | 5% | 6% | 7% | 5% |

| a | Based on average shares outstanding throughout each period. |

| b | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| c | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||

| Greater than 1.5% and Less than 2.0% | 2 | 0.45% | ||

| Greater than 1.0% and Less than 1.5% | 3 | 0.68 | ||

| Greater than 0.5% and Less than 1.0% | 19 | 4.31 | ||

| Between 0.5% and -0.5% | 400 | 90.70 | ||

| Less than -0.5% and Greater than -1.0% | 16 | 3.63 | ||

| Less than -1.0% and Greater than -1.5% | 1 | 0.23 | ||

| 441 | 100.00% |

| Average Annual Total Returns | Cumulative Total Returns | ||||||

| NAV | MARKET | INDEX* | NAV | MARKET | INDEX* | ||

| 1 Year | 7.73% | 6.62% | 7.88% | 7.73% | 6.62% | 7.88% | |

| 5 Years | (1.09)% | (1.07)% | (0.93)% | (5.34)% | (5.23)% | (4.55)% | |

| 10 Years | 2.23% | 2.18% | 2.44% | 24.68% | 24.12% | 27.32% | |

| * | Index performance reflects the performance of the MSCI Canada Index. Effective September 1, 2017, the Fund’s Underlying Index was changed to the MSCI Canada Custom Capped Index. |

| Call: | 1-800-iShares

or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o

BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

| 2016 Prospectus |

|

| ► | iShares MSCI Netherlands ETF | EWN | NYSE ARCA |

|

|

S-1 |

|

|

1 |

|

|

2 |

|

|

11 |

|

|

12 |

|

|

12 |

|

|

16 |

|

|

25 |

|

|

26 |

|

|

27 |

|

|

27 |

|

|

29 |

| Ticker: EWN | Stock Exchange: NYSE Arca |

| Annual

Fund Operating Expenses (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management

Fees |

Distribution

and Service (12b-1) Fees |

Other

Expenses |

Total

Annual Fund Operating Expenses | |||

| 0.48% | None | None | 0.48% | |||

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $49 | $154 | $269 | $604 |

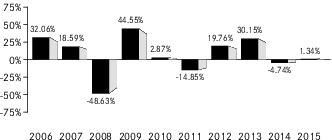

| 1 | The Fund’s year-to-date return as of September 30, 2016 was 6.19%. |

| One Year | Five Years | Ten Years | |||

| (Inception Date: 3/12/1996) | |||||

| Return Before Taxes | 1.34% | 5.08% | 4.36% | ||

| Return After Taxes on Distributions1 | 1.18% | 4.97% | 4.31% | ||

| Return After Taxes on Distributions and Sale of Fund Shares1 | 1.43% | 4.33% | 3.96% | ||

| MSCI Netherlands IMI (Index returns do not reflect deductions for fees, expenses, or taxes)2 | 1.71% | 5.32% | 4.71% | ||

| MSCI Netherlands IMI 25/50 Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 | N/A | N/A | N/A |

| 1 | After-tax returns in the table above are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). Fund returns after taxes on distributions and sales of Fund shares are calculated assuming that an investor has sufficient capital gains of the same character from other investments to offset any capital losses from the sale of Fund shares. As a result, Fund returns after taxes on distributions and sales of Fund shares may exceed Fund returns before taxes and/or returns after taxes on distributions. |

| 2 | Index returns through January 31, 2008 reflect the performance of the MSCI Netherlands Index. Index returns beginning on February 1, 2008 reflect the performance of the MSCI Netherlands IMI, which, effective as of February 1, 2008, replaced the MSCI Netherlands Index as the Underlying Index of the Fund. On September 1, 2017, the Fund's Underlying Index changed from MSCI Netherlands IMI to MSCI Netherlands IMI 25/50 Index. The inception date of the MSCI Netherlands IMI 25/50 Index was July 20, 2016. |

| ■ | Lower levels of liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ and/or may not be as extensive or protective as those that apply in the United States. |

| Approximate

Value of a Creation Unit |

Creation

Unit Size |

Standard

Creation/ Redemption Transaction Fee |

Maximum

Additional Charge for Creations* |

Maximum

Additional Charge for Redemptions* | ||||

| $1,253,500 | 50,000 | $1,000 | 3.0% | 2.0% |

| * | As a percentage of the net asset value per Creation Unit, inclusive, in the case of redemptions, of the standard redemption transaction fee. |

(For a share outstanding throughout each period)

| Year

ended Aug. 31, 2016 |

Year

ended Aug. 31, 2015 |

Year

ended Aug. 31, 2014 |

Year

ended Aug. 31, 2013 |

Year

ended Aug. 31, 2012 | |||||

| Net asset value, beginning of year | $ 24.48 | $ 24.64 | $ 22.52 | $ 18.23 | $ 18.45 | ||||

| Income from investment operations: | |||||||||

| Net investment incomea | 0.71 | 0.50 | 0.45 | 0.44 | 0.39 | ||||

| Net realized and unrealized gain (loss)b | 0.08 | (0.27) | 2.22 | 4.19 | (0.08) | ||||

| Total from investment operations | 0.79 | 0.23 | 2.67 | 4.63 | 0.31 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.49) | (0.39) | (0.55) | (0.34) | (0.53) | ||||

| Total distributions | (0.49) | (0.39) | (0.55) | (0.34) | (0.53) | ||||

| Net asset value, end of year | $ 24.78 | $ 24.48 | $ 24.64 | $ 22.52 | $ 18.23 | ||||

| Total return | 3.32% | 0.87% | 11.80% | 25.57% | 1.96% | ||||

| Ratios/Supplemental data: | |||||||||

| Net assets, end of year (000s) | $184,587 | $176,282 | $165,092 | $253,390 | $78,397 | ||||

| Ratio of expenses to average net assets | 0.48% | 0.48% | 0.48% | 0.50% | 0.53% | ||||

| Ratio of net investment income to average net assets | 2.97% | 2.01% | 1.78% | 2.09% | 2.21% | ||||

| Portfolio turnover ratec | 24% | 6% | 7% | 11% | 10% |

| a | Based on average shares outstanding throughout each period. |

| b | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| c | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||

| Greater than 2.0% | 1 | 0.23% | ||

| Greater than 1.5% and Less than 2.0% | 2 | 0.45 | ||

| Greater than 1.0% and Less than 1.5% | 12 | 2.72 | ||

| Greater than 0.5% and Less than 1.0% | 55 | 12.47 | ||

| Between 0.5% and -0.5% | 334 | 75.74 | ||

| Less than -0.5% and Greater than -1.0% | 31 | 7.03 | ||

| Less than -1.0% and Greater than -1.5% | 3 | 0.68 | ||

| Less than -1.5% and Greater than -2.0% | 2 | 0.45 | ||

| Less than -2.0% and Greater than -2.5% | 1 | 0.23 | ||

| 441 | 100.00% |

| Average Annual Total Returns | Cumulative Total Returns | ||||||

| NAV | MARKET | INDEX* | NAV | MARKET | INDEX* | ||

| 1 Year | 3.32% | 3.57% | 3.77% | 3.32% | 3.57% | 3.77% | |

| 5 Years | 8.33% | 8.39% | 8.61% | 49.17% | 49.59% | 51.12% | |

| 10 Years | 3.02% | 3.01% | 3.45% | 34.62% | 34.55% | 40.37% | |

| * | Index performance through January 31, 2008 reflects the performance of the MSCI Netherlands Index. Index performance beginning on February 1, 2008 reflects the performance of the MSCI Netherlands IMI, which effective as of February 1, 2008, replaced the MSCI Netherlands Index as the underlying index of the Fund. Effective September 1, 2017, the Fund’s Underlying Index was changed to the MSCI Netherlands IMI 25/50 Index. |

| Call: | 1-800-iShares

or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o

BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

| 2016 Prospectus |

|

| ► | iShares MSCI South Africa ETF | EZA | NYSE ARCA |

|

|

S-1 |

|

|

1 |

|

|

2 |

|

|

13 |

|

|

16 |

|

|

16 |

|

|

19 |

|

|

28 |

|

|

29 |

|

|

30 |

|

|

30 |

|

|

32 |

| Ticker: EZA | Stock Exchange: NYSE Arca |

| Annual

Fund Operating Expenses (ongoing expenses that you pay each year as a percentage of the value of your investments) | ||||||

| Management

Fees |

Distribution

and Service (12b-1) Fees |

Other

Expenses |

Total

Annual Fund Operating Expenses | |||

| 0.64% | None | None | 0.64% | |||

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $65 | $205 | $357 | $798 |

| 1 | The Fund’s year-to-date return as of September 30, 2016 was 22.26%. |

| One Year | Five Years | Ten Years | |||

| (Inception Date: 2/3/2003) | |||||

| Return Before Taxes | -25.92% | -6.23% | 2.61% | ||

| Return After Taxes on Distributions1 | -26.12% | -6.52% | 2.20% | ||

| Return After Taxes on Distributions and Sale of Fund Shares1 | -13.93% | -4.17% | 2.41% | ||

| MSCI South Africa Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 | -25.45% | -5.65% | 3.43% | ||

| MSCI South Africa 25/50 Index (Index returns do not reflect deductions for fees, expenses, or taxes)2 | N/A | N/A | N/A |

| 1 | After-tax returns in the table above are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to tax-exempt investors or investors who hold shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). Fund returns after taxes on distributions and sales of Fund shares are calculated assuming that an investor has sufficient capital gains of the same character from other investments to offset any capital losses from the sale of Fund shares. As a result, Fund returns after taxes on distributions and sales of Fund shares may exceed Fund returns before taxes and/or returns after taxes on distributions. |

| 2 | On September 1, 2017, the Fund's Underlying Index changed from the MSCI South Africa Index to the MSCI South Africa 25/50 Index. The inception date of the MSCI South Africa 25/50 Index was May 12, 2017. |

| ■ | Lower levels of liquidity and market efficiency; |

| ■ | Greater securities price volatility; |

| ■ | Exchange rate fluctuations and exchange controls; |

| ■ | Less availability of public information about issuers; |

| ■ | Limitations on foreign ownership of securities; |

| ■ | Imposition of withholding or other taxes; |

| ■ | Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| ■ | Higher transaction and custody costs and delays in settlement procedures; |

| ■ | Difficulties in enforcing contractual obligations; |

| ■ | Lower levels of regulation of the securities markets; |

| ■ | Weaker accounting, disclosure and reporting requirements; and |

| ■ | Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund invests may differ and/or may not be as extensive or protective as those that apply in the United States. |

| Approximate

Value of a Creation Unit |

Creation

Unit Size |

Standard

Creation/ Redemption Transaction Fee |

Maximum

Additional Charge for Creations* |

Maximum

Additional Charge for Redemptions* | ||||

| $5,580,000 | 100,000 | $1,200 | 3.0% | 2.0% |

| * | As a percentage of the net asset value per Creation Unit, inclusive, in the case of redemptions, of the standard redemption transaction fee. |

(For a share outstanding throughout each period)

| Year

ended Aug. 31, 2016 |

Year

ended Aug. 31, 2015 |

Year

ended Aug. 31, 2014 |

Year

ended Aug. 31, 2013 |

Year

ended Aug. 31, 2012 | |||||

| Net asset value, beginning of year | $ 57.44 | $ 70.77 | $ 58.88 | $ 64.65 | $ 69.06 | ||||

| Income from investment operations: | |||||||||

| Net investment incomea | 1.02 | 1.28 | 1.57 | 1.32 | 2.10 | ||||

| Net realized and unrealized gain (loss)b | (3.24) | (13.24) | 11.86 | (5.31) | (4.41) | ||||

| Total from investment operations | (2.22) | (11.96) | 13.43 | (3.99) | (2.31) | ||||

| Less distributions from: | |||||||||

| Net investment income | (2.44) | (1.37) | (1.54) | (1.78) | (2.10) | ||||

| Total distributions | (2.44) | (1.37) | (1.54) | (1.78) | (2.10) | ||||

| Net asset value, end of year | $ 52.78 | $ 57.44 | $ 70.77 | $ 58.88 | $ 64.65 | ||||

| Total return | (3.64)% | (17.07)% | 23.13% | (6.35)% | (3.17)% | ||||

| Ratios/Supplemental data: | |||||||||

| Net assets, end of year (000s) | $406,443 | $373,346 | $587,396 | $547,569 | $471,922 | ||||

| Ratio of expenses to average net assets | 0.64% | 0.62% | 0.62% | 0.61% | 0.61% | ||||

| Ratio of net investment income to average net assets | 1.96% | 1.94% | 2.40% | 2.08% | 3.26% | ||||

| Portfolio turnover ratec | 12% | 9% | 6% | 5% | 4% |

| a | Based on average shares outstanding throughout each period. |

| b | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| c | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||

| Greater than 4.0% | 2 | 0.45% | ||

| Greater than 3.5% and Less than 4.0% | 1 | 0.23 | ||

| Greater than 3.0% and Less than 3.5% | 1 | 0.23 | ||

| Greater than 2.5% and Less than 3.0% | 2 | 0.45 | ||

| Greater than 2.0% and Less than 2.5% | 7 | 1.59 | ||

| Greater than 1.5% and Less than 2.0% | 12 | 2.72 | ||

| Greater than 1.0% and Less than 1.5% | 36 | 8.16 | ||

| Greater than 0.5% and Less than 1.0% | 76 | 17.23 | ||

| Between 0.5% and -0.5% | 197 | 44.68 | ||

| Less than -0.5% and Greater than -1.0% | 61 | 13.83 | ||

| Less than -1.0% and Greater than -1.5% | 28 | 6.35 | ||

| Less than -1.5% and Greater than -2.0% | 8 | 1.81 | ||

| Less than -2.0% and Greater than -2.5% | 4 | 0.91 | ||

| Less than -2.5% and Greater than -3.0% | 3 | 0.68 | ||

| Less than -3.0% | 3 | 0.68 | ||

| 441 | 100.00% |

| Average Annual Total Returns | Cumulative Total Returns | ||||||

| NAV | MARKET | INDEX* | NAV | MARKET | INDEX* | ||

| 1 Year | (3.64)% | (4.17)% | (3.03)% | (3.64)% | (4.17)% | (3.03)% | |

| 5 Years | (2.25)% | (2.29)% | (1.62)% | (10.78)% | (10.94)% | (7.85)% | |

| 10 Years | 4.15% | 3.99% | 4.97% | 50.15% | 47.88% | 62.38% | |

| * | Index performance reflects the performance of the MSCI South Africa Index. Effective September 1, 2017, the Fund’s Underlying Index was changed to the MSCI South Africa 25/50 Index. |

| Call: | 1-800-iShares

or 1-800-474-2737 (toll free) Monday through Friday, 8:30 a.m. to 6:30 p.m. (Eastern time) |

| Email: | iSharesETFs@blackrock.com |

| Write: | c/o

BlackRock Investments, LLC 1 University Square Drive, Princeton, NJ 08540 |

(as revised September 1, 2017)

| Funds | Ticker | Listing Exchange | ||

| iShares MSCI Australia ETF | EWA | NYSE Arca | ||

| iShares MSCI Austria Capped ETF | EWO | NYSE Arca | ||

| iShares MSCI Belgium Capped ETF | EWK | NYSE Arca | ||

| iShares MSCI Canada ETF | EWC | NYSE Arca | ||

| iShares MSCI Eurozone ETF | EZU | BATS | ||

| iShares MSCI France ETF | EWQ | NYSE Arca | ||

| iShares MSCI Germany ETF | EWG | NYSE Arca | ||

| iShares MSCI Global Gold Miners ETF | RING | NYSE Arca | ||

| iShares MSCI Global Silver Miners ETF | SLVP | NYSE Arca | ||

| iShares MSCI Hong Kong ETF | EWH | NYSE Arca | ||

| iShares MSCI Israel Capped ETF | EIS | NYSE Arca | ||

| iShares MSCI Italy Capped ETF | EWI | NYSE Arca | ||

| iShares MSCI Japan ETF | EWJ | NYSE Arca | ||

| iShares MSCI Japan Small-Cap ETF | SCJ | NYSE Arca | ||

| iShares MSCI Mexico Capped ETF | EWW | NYSE Arca | ||

| iShares MSCI Netherlands ETF | EWN | NYSE Arca | ||

| iShares MSCI Pacific ex Japan ETF | EPP | NYSE Arca | ||

| iShares MSCI Russia Capped ETF | ERUS | NYSE Arca | ||

| iShares MSCI Singapore Capped ETF | EWS | NYSE Arca | ||

| iShares MSCI South Africa ETF | EZA | NYSE Arca | ||

| iShares MSCI Spain Capped ETF | EWP | NYSE Arca | ||

| iShares MSCI Sweden Capped ETF | EWD | NYSE Arca | ||

| iShares MSCI Switzerland Capped ETF | EWL | NYSE Arca | ||

| iShares MSCI Thailand Capped ETF | THD | NYSE Arca | ||

| iShares MSCI Turkey ETF | TUR | NYSE Arca | ||

| iShares MSCI USA Equal Weighted ETF | EUSA | NYSE Arca | ||

| iShares MSCI World ETF | URTH | NYSE Arca |

| • | iShares MSCI Australia ETF |

| • | iShares MSCI Austria Capped ETF |

| • | iShares MSCI Belgium Capped ETF |

| • | iShares MSCI Canada ETF |

| • | iShares MSCI Eurozone ETF |

| • | iShares MSCI France ETF |

| • | iShares MSCI Germany ETF |

| • | iShares MSCI Global Gold Miners ETF |

| • | iShares MSCI Global Silver Miners ETF |

| • | iShares MSCI Hong Kong ETF |

| • | iShares MSCI Israel Capped ETF |

| • | iShares MSCI Italy Capped ETF |

| • | iShares MSCI Japan ETF |

| • | iShares MSCI Japan Small-Cap ETF |

| • | iShares MSCI Mexico Capped ETF |

| • | iShares MSCI Netherlands ETF |

| • | iShares MSCI Pacific ex Japan ETF |

| • | iShares MSCI Russia Capped ETF1 |

| • | iShares MSCI Singapore Capped ETF2 |

| • | iShares MSCI South Africa ETF |

| • | iShares MSCI Spain Capped ETF |

| • | iShares MSCI Sweden Capped ETF3 |

| • | iShares MSCI Switzerland Capped ETF |

| • | iShares MSCI Thailand Capped ETF |

| • | iShares MSCI Turkey ETF |

| • | iShares MSCI USA Equal Weighted ETF |

| • | iShares MSCI World ETF |

| 1 | The iShares MSCI Russia Capped ETF previously operated as a series of iShares MSCI Russia Capped ETF, Inc. (the “Predecessor Fund”). Before the Fund commenced operations, all of the assets and liabilities of the Predecessor Fund were transferred to the Fund in a reorganization (the “Reorganization”), which was tax-free for U.S. federal income tax purposes. The Reorganization occurred on January 26, 2015. As a result of the Reorganization, the Fund assumed the performance and accounting history of the Predecessor Fund. A portion of the financial and performance information included in this SAI is that of the Predecessor Fund. |

| 2 | On December 1, 2016, the name of the Fund changed from iShares MSCI Singapore ETF to iShares MSCI Singapore Capped ETF, and the Fund’s Underlying Index changed from MSCI Singapore Index to MSCI Singapore 25/50 Index. |

| 3 | On December 1, 2016, the name of the Fund changed from iShares MSCI Sweden ETF to iShares MSCI Sweden Capped ETF, and the Fund’s Underlying Index changed from MSCI Sweden Index to MSCI Sweden 25/50 Index. |

| Diversified Funds | Non-Diversified Funds | |

| iShares MSCI Canada ETF | iShares MSCI Australia ETF | |

| iShares MSCI Eurozone ETF | iShares MSCI Austria Capped ETF | |

| iShares MSCI Japan ETF | iShares MSCI Belgium Capped ETF | |

| iShares MSCI Japan Small-Cap ETF | iShares MSCI France ETF | |

| iShares MSCI Pacific ex Japan ETF | iShares MSCI Germany ETF | |

| iShares MSCI USA Equal Weighted ETF | iShares MSCI Global Gold Miners ETF | |

| iShares MSCI World ETF | iShares MSCI Global Silver Miners ETF | |

| iShares MSCI Hong Kong ETF | ||

| iShares MSCI Israel Capped ETF | ||

| iShares MSCI Italy Capped ETF | ||

| iShares MSCI Mexico Capped ETF | ||

| iShares MSCI Netherlands ETF | ||

| iShares MSCI Russia Capped ETF | ||

| iShares MSCI Singapore Capped ETF | ||

| iShares MSCI South Africa ETF | ||

| iShares MSCI Spain Capped ETF | ||

| iShares MSCI Sweden Capped ETF | ||

| iShares MSCI Switzerland Capped ETF | ||

| iShares MSCI Thailand Capped ETF | ||

| iShares MSCI Turkey ETF |

| • | MSCI Global Standard Indexes cover all investable large- and mid-cap securities by including approximately 85% of each market's free float-adjusted market capitalization. |

| • | MSCI Global Small Cap Indexes provide coverage to all companies with a market capitalization below that of the companies in the MSCI Global Standard Indexes by including above and beyond the coverage of the MSCI Global Standard Indexes. |

| • | Achieving global size integrity by ensuring that companies of comparable and relevant sizes are included in a given size segment across all markets in a composite index; and |

| • | Achieving consistent market coverage by ensuring that each market's size segment is represented in its proportional weight in the composite universe. |

| • | Semi-Annual Index Reviews (“SAIRs”), conducted on a fixed semi-annual timetable that systematically reassess the various dimensions of the equity universe for all markets; |

| • | Quarterly Index Reviews (“QIRs”), aimed at promptly reflecting other significant market events; and |

| • | Ongoing event-related changes, such as mergers, acquisitions, spin-offs, bankruptcies, reorganizations and other similar corporate events, which generally are implemented in the indexes as they occur. |

| 1. | Lend any funds or other assets except through the purchase of all or a portion of an issue of securities or obligations of the type in which it is permitted to invest (including participation interests in such securities or obligations) and except that a Fund may lend its portfolio securities in an amount not to exceed 33 1/3% of the value of its total assets; |

| 2. | Issue senior securities or borrow money, except borrowings from banks for temporary or emergency purposes in an amount up to 33 1/3% of the value of the Fund’s total assets (including the amount borrowed), valued at the lesser of cost or market, less liabilities (not including the amount borrowed) valued at the time the borrowing is made, and the Fund will not purchase securities while borrowings in excess of 5% of the Fund’s total assets are outstanding, provided, that for purposes of this restriction, short-term credits necessary for the clearance of transactions are not considered borrowings; |

| 3. | Pledge, hypothecate, mortgage or otherwise encumber its assets, except to secure permitted borrowings. (The deposit of underlying securities and other assets in escrow and collateral arrangements with respect to initial or variation margin for currency transactions and futures contracts will not be deemed to be pledges of the Fund’s assets); |

| 4. | Purchase a security (other than obligations of the U.S. government, its agencies or instrumentalities) if as a result 25% or more of its total assets would be invested in a single issuer. (This restriction applies to the iShares MSCI Singapore Capped ETF only); |

| 5. | Purchase, hold or deal in real estate, or oil, gas or mineral interests or leases, but a Fund may purchase and sell securities that are issued by companies that invest or deal in such assets; |

| 6. | Act as an underwriter of securities of other issuers, except to the extent the Fund may be deemed an underwriter in connection with the sale of securities in its portfolio; |

| 7. | Purchase securities on margin, except for such short-term credits as are necessary for the clearance of transactions, except that a Fund may make margin deposits in connection with transactions in currencies, options, futures and options on futures; |

| 8. | Sell securities short; or |

| 9. | Invest in commodities or commodity contracts, except that a Fund may buy and sell currencies and forward contracts with respect thereto, and may transact in futures contracts on securities, stock indices and currencies and options on such futures contracts and make margin deposits in connection with such contracts. |

| 1. | Make loans, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time; |

| 2. | Issue any senior security, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time; |

| 3. | Pledge, hypothecate, mortgage or otherwise encumber its assets, except to secure permitted borrowings. (The deposit of underlying securities and other assets in escrow and collateral arrangements with respect to initial or variation margin for currency transactions and futures contracts will not be deemed to be pledges of the Fund’s assets); |

| 4. | Purchase, hold or deal in real estate, or oil, gas or mineral interests or leases, but a Fund may purchase and sell securities that are issued by companies that invest or deal in such assets; |

| 5. | Act as an underwriter of securities of other issuers, except to the extent the Fund may be deemed an underwriter in connection with the sale of securities in its portfolio; |

| 6. | Purchase securities on margin, except for such short-term credits as are necessary for the clearance of transactions, except that a Fund may make margin deposits in connection with transactions in currencies, options, futures and options on futures; |

| 7. | Sell securities short; or |

| 8. | Invest in commodities or commodity contracts, except that a Fund may buy and sell currencies and forward contracts with respect thereto, and may transact in futures contracts on securities, stock indices and currencies and options on such futures contracts and make margin deposits in connection with such contracts. |

| 1. | Concentrate its investments (i.e., invest 25% or more of its total assets in the securities of a particular industry or group of industries), except that a Fund will concentrate to approximately the same extent that its Underlying Index concentrates in the securities of such particular industry or group of industries. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities), repurchase agreements collateralized by U.S. government securities, and securities of state or municipal governments and their political subdivisions are not considered to be issued by members of any industry; |

| 2. | Borrow money, except that (i) each Fund may borrow from banks for temporary or emergency (not leveraging) purposes, including the meeting of redemption requests which might otherwise require the untimely disposition of securities, and (ii) each Fund may, to the extent consistent with its investment policies, enter into repurchase agreements, reverse repurchase agreements, forward roll transactions and similar investment strategies and techniques. To the extent that it engages in transactions described in (i) and (ii), each Fund will be limited so that no more than 33 1/3% of the value of its total assets (including the amount borrowed) is derived from such transactions. Any borrowings which come to exceed this amount will be reduced in accordance with applicable law; |

| 3. | Issue any senior security, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time; |

| 4. | Make loans, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time; |

| 5. | Purchase or sell real estate unless acquired as a result of ownership of securities or other investments (but this restriction shall not prevent each Fund from investing in securities of companies engaged in the real estate business or securities or other instruments backed by real estate or mortgages), or commodities or commodity contracts (but this |

| restriction shall not prevent each Fund from trading in futures contracts and options on futures contracts, including options on currencies to the extent consistent with each Fund's investment objectives and policies); or | |

| 6. | Engage in the business of underwriting securities issued by other persons, except to the extent that each Fund may technically be deemed to be an underwriter under the 1933 Act, the disposing of portfolio securities. |

| 1. | Concentrate its investments (i.e., invest 25% or more of its total assets in the securities of a particular industry or group of industries), except that each Fund will concentrate to approximately the same extent that its Underlying Index concentrates in the securities of a particular industry or group of industries. For purposes of this limitation, securities of the U.S. government (including its agencies and instrumentalities), repurchase agreements collateralized by U.S. government securities, and securities of state or municipal governments and their political subdivisions are not considered to be issued by members of any industry. |

| 2. | Borrow money, except that (i) each Fund may borrow from banks for temporary or emergency (not leveraging) purposes, including the meeting of redemption requests which might otherwise require the untimely disposition of securities, and (ii) each Fund may, to the extent consistent with its investment policies, enter into repurchase agreements, reverse repurchase agreements, forward roll transactions and similar investment strategies and techniques. To the extent that it engages in transactions described in (i) and (ii), each Fund will be limited so that no more than 33⅓% of the value of its total assets (including the amount borrowed) is derived from such transactions. Any borrowings which come to exceed this amount will be reduced in accordance with applicable law. |

| 3. | Issue any senior security, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by any regulatory authority having jurisdiction, from time to time. |

| 4. | Make loans, except as permitted under the 1940 Act, as interpreted, modified or otherwise permitted by regulatory authority having jurisdiction, from time to time. |

| 5. | Purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this restriction shall not prevent each Fund from investing in securities of companies engaged in the real estate business or securities or other instruments backed by real estate or mortgages), or commodities or commodity contracts (but this restriction shall not prevent each Fund from investing in securities of companies engaged in the production, ownership or distribution of commodities or in commodity-related businesses or from trading in futures contracts and options on futures contracts, including options on currencies to the extent consistent with each Fund’s investment objective and policies). |

| 6. | Engage in the business of underwriting securities issued by other persons, except to the extent that each Fund may technically be deemed to be an underwriter under the Securities Act, in disposing of portfolio securities. |

| Fund | Industry or Industries | |

| iShares MSCI Singapore ETF | Banks |

| Fund | Industry or Industries | |

| iShares MSCI Australia ETF | Banks | |

| iShares MSCI Canada ETF | Banks | |

| iShares MSCI Global Gold Miners ETF | Mining | |

| iShares MSCI Global Silver Miners ETF | Mining | |

| iShares MSCI Pacific ex Japan ETF | Banks | |

| iShares MSCI Russia Capped ETF | Oil & Gas | |

| iShares MSCI Spain Capped ETF | Banks | |

| iShares MSCI Switzerland Capped ETF | Pharmaceuticals | |

| iShares MSCI Turkey ETF | Banks |

| • | The frequency of trades and quotes for the security; |

| • | The number of dealers wishing to purchase or sell the security and the number of other potential purchasers; |

| • | Dealer undertakings to make a market in the security; and |

| • | The nature of the security and the nature of the marketplace in which it trades (e.g., the time needed to dispose of the security, the method of soliciting offers and the mechanics of transfer). |

| 1. | Invest in the securities of a company for the purpose of exercising management or control, or in any event purchase and hold more than 10% of the securities of a single issuer, provided that the Company may vote the investment securities owned by each Fund in accordance with its views; or |

| 2. | Hold illiquid assets in excess of 15% of its net assets. An illiquid asset is any asset which may not be sold or disposed of in the ordinary course of business within seven days at approximately the value at which the Fund has valued the investment. |

| 1. | The frequency of trades and quotes for the security; |

| 2. | The number of dealers wishing to purchase or sell the security and the number of other potential purchasers; |

| 3. | Dealer undertakings to make a market in the security; and |

| 4. | The nature of the security and the nature of the marketplace in which it trades (e.g., the time needed to dispose of the security, the method of soliciting offers and the mechanics of transfer). |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years |

Other

Directorships Held by Director | |||

| Robert

S. Kapito1 (59) |

Director

(since 2009). |

President, BlackRock, Inc. (since 2006); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock, Inc.’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002). | Director of BlackRock, Inc. (since 2006); Trustee of iShares Trust (since 2009); Trustee of iShares U.S. ETF Trust (since 2011). |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years |

Other

Directorships Held by Director | |||

| Mark

K. Wiedman2 (46) |

Director (since 2013). | Senior Managing Director, BlackRock, Inc. (since 2014); Managing Director, BlackRock, Inc. (2007-2014); Global Head of BlackRock’s ETF and Index Investments Business (since 2016); Global Head of iShares (2011-2016); Head of Corporate Strategy, BlackRock, Inc. (2009-2011). | Trustee of iShares Trust (since 2013); Trustee of iShares U.S. ETF Trust (since 2013); Director of PennyMac Financial Services, Inc. (since 2008). |

| 1 | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| 2 | Mark K. Wiedman is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years |

Other

Directorships Held by Director | |||

| Cecilia

H. Herbert (68) |

Director

(since 2005); Independent Board Chair (since 2016). |

Trustee and Member of the Finance, Technology and Quality Committee of Stanford Health Care (since 2016); Trustee and Member of the Investment Committee, WNET, a New York public media company (since 2011); Chair (1994-2005) and Member (since 1992) of the Investment Committee, Archdiocese of San Francisco; Director (1998-2013) and President (2007-2011) of the Board of Directors, Catholic Charities CYO; Trustee (2002-2011) and Chair of the Finance and Investment Committee (2006-2010) of the Thacher School. | Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust (since 2011); Independent Board Chair of iShares Trust and iShares U.S. ETF Trust (since 2016); Trustee of Forward Funds (14 portfolios) (since 2009); Trustee of Salient MF Trust (4 portfolios) (since 2015). | |||

| Jane

D. Carlin (60) |

Director

(since 2015); Risk Committee Chair (since 2016). |

Consultant (since 2012); Managing Director and Global Head of Financial Holding Company Governance & Assurance and the Global Head of Operational Risk Management of Morgan Stanley (2006-2012). | Trustee of iShares Trust (since 2015); Trustee of iShares U.S. ETF Trust (since 2015); Director of PHH Corporation (mortgage solutions) (since 2012); Director of The Hanover Insurance Group, Inc. (since 2016). | |||

| Richard

L. Fagnani (62) |

Director

(since 2017); Equity Plus Committee Chair (since 2017). |

Partner, KPMG LLP (2002-2016). | Trustee of iShares Trust (since 2017); Trustee of iShares U.S. ETF Trust (since 2017). |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years |

Other

Directorships Held by Director | |||

| Charles

A. Hurty (73) |

Director

(since 2005); Audit Committee Chair (since 2006). |

Retired; Partner, KPMG LLP (1968-2001). | Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust (since 2011); Director of SkyBridge Alternative Investments Multi-Adviser Hedge Fund Portfolios LLC (2 portfolios) (since 2002). | |||

| John

E. Kerrigan (61) |

Director

(since 2005); Securities Lending Committee Chair (since 2016). |

Chief Investment Officer, Santa Clara University (since 2002). | Trustee of iShares Trust (since 2005); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Drew

E. Lawton (58) |

Director

(since 2017); 15(c) Committee Chair (since 2017). |

Senior Managing Director of New York Life Insurance Company (2010-2015). | Trustee of iShares Trust (since 2017); Trustee of iShares U.S. ETF Trust (since 2017). | |||

| John

E. Martinez (56) |

Director

(since 2003); Fixed Income Plus Committee Chair (since 2016). |

Director of Real Estate Equity Exchange, Inc. (since 2005). | Trustee of iShares Trust (since 2003); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Madhav

V. Rajan (52) |

Director

(since 2011); Nominating and Governance Committee Chair (since 2017). |

Dean, and George Pratt Shultz Professor of Accounting, University of Chicago Booth School of Business (since 2017); Robert K. Jaedicke Professor of Accounting, Stanford University Graduate School of Business (2001-2017); Professor of Law (by courtesy), Stanford Law School (2005-2017); Senior Associate Dean for Academic Affairs and Head of MBA Program, Stanford University Graduate School of Business (2010-2016). | Trustee

of iShares Trust (since 2011); Trustee of iShares U.S. ETF Trust (since 2011); Director, Cavium, Inc. (since 2013). |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years | ||

| Martin

Small (41) |

President (since 2016). | Managing Director, BlackRock, Inc. (since 2010); Head of U.S. iShares (since 2015); Co-Head of the U.S. Financial Markets Advisory Group, BlackRock, Inc. (2008-2014). | ||

| Jack

Gee (57) |

Treasurer

and Chief Financial Officer (since 2008). |

Managing Director, BlackRock, Inc. (since 2009); Senior Director of Fund Administration of Intermediary Investor Business, BGI (2009). |

| Name (Age) | Position | Principal

Occupation(s) During the Past 5 Years | ||

| Charles

Park (49) |

Chief Compliance Officer (since 2006). | Chief Compliance Officer of BlackRock Advisors, LLC and the BlackRock-advised Funds in the Equity-Bond Complex, the Equity-Liquidity Complex and the Closed-End Complex (since 2014); Chief Compliance Officer of BFA (since 2006). | ||

| Benjamin

Archibald (42) |

Secretary (since 2015). | Managing Director, BlackRock, Inc. (since 2014); Director, BlackRock, Inc. (2010-2013); Secretary of the BlackRock-advised mutual funds (since 2012). | ||

| Steve

Messinger (55) |

Executive

Vice President (since 2016). |

Managing Director, BlackRock, Inc. (2007-2014 and since 2016); Managing Director, Beacon Consulting Group (2014-2016). | ||

| Scott

Radell (48) |

Executive

Vice President (since 2012). |

Managing Director, BlackRock, Inc. (since 2009); Head of Portfolio Solutions, BlackRock, Inc. (since 2009). | ||

| Alan

Mason (56) |

Executive

Vice President (since 2016). |

Managing Director, BlackRock, Inc. (since 2009). |

| Name of Director | Fund | Dollar

Range of Equity Securities in the Fund |

Aggregate

Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| Robert S. Kapito | None | None | None | |||

| Mark Wiedman | iShares Core MSCI EAFE ETF | $50,001-$100,000 | Over $100,000 | |||

| iShares Core MSCI Emerging Markets ETF | $50,001-$100,000 |

| Name of Director | Fund | Dollar

Range of Equity Securities in the Fund |

Aggregate

Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| iShares Core S&P Total U.S. Stock Market ETF | Over $100,000 | |||||

| John E. Martinez | iShares Core MSCI Emerging Markets ETF | $50,001-$100,000 | Over $100,000 | |||

| iShares Core S&P 500 ETF | Over $100,000 | |||||

| iShares Core S&P Mid-Cap ETF | $10,001-$50,000 | |||||

| iShares Core S&P Small-Cap ETF | $10,001-$50,000 | |||||

| iShares Core S&P Total U.S. Stock Market ETF | $1-$10,000 | |||||

| iShares Global Consumer Staples ETF | Over $100,000 | |||||

| iShares MSCI All Country Asia ex Japan ETF | Over $100,000 | |||||

| iShares MSCI EAFE ETF | Over $100,000 | |||||

| iShares Russell 1000 ETF | Over $100,000 | |||||

| iShares Russell 1000 Value ETF | Over $100,000 | |||||

| iShares Russell 2000 ETF | Over $100,000 | |||||

| iShares TIPS Bond ETF | $50,001-$100,000 | |||||

| Cecilia H. Herbert | iShares China Large-Cap ETF | Over $100,000 | Over $100,000 | |||

| iShares Core Dividend Growth ETF | $10,001-$50,000 | |||||

| iShares Core High Dividend ETF | $1-$10,000 | |||||

| iShares Core MSCI Emerging Markets ETF | $10,001-$50,000 | |||||

| iShares Core MSCI Total International Stock ETF | $10,001-$50,000 | |||||

| iShares Core S&P Small-Cap ETF | $1-$10,000 | |||||

| iShares Core S&P Total U.S. Stock Market ETF | $10,001-$50,000 | |||||

| iShares Core S&P U.S. Growth ETF | $50,001-$100,000 | |||||

| iShares Core S&P U.S. Value ETF | $10,001-$50,000 | |||||

| iShares iBoxx $ High Yield Corporate Bond ETF | $10,001-$50,000 | |||||

| iShares International Select Dividend ETF | $1-$10,000 | |||||

| iShares MSCI EAFE ETF | $1-$10,000 | |||||

| iShares MSCI Emerging Markets ETF | $1-$10,000 | |||||

| iShares MSCI Japan ETF | $10,001-$50,000 | |||||

| iShares National Muni Bond ETF | $10,001-$50,000 | |||||

| iShares U.S. Preferred Stock ETF | $10,001-$50,000 | |||||

| Charles A. Hurty | iShares China Large-Cap ETF | $10,001-$50,000 | Over $100,000 | |||

| iShares Core Growth Allocation ETF | $50,001-$100,000 | |||||

| iShares Core High Dividend ETF | $10,001-$50,000 | |||||

| iShares Core Moderate Allocation ETF | $50,001-$100,000 | |||||

| iShares Core MSCI Emerging Markets ETF | $10,001-$50,000 |

| Name of Director | Fund | Dollar

Range of Equity Securities in the Fund |

Aggregate

Dollar Range of Equity Securities in all Registered Investment Companies Overseen by Director in Family of Investment Companies | |||

| iShares Core S&P 500 ETF | $10,001-$50,000 | |||||

| iShares Global Energy ETF | $10,001-$50,000 | |||||

| iShares Global Healthcare ETF | $10,001-$50,000 | |||||

| iShares Global Tech ETF | $10,001-$50,000 | |||||

| iShares MSCI EAFE ETF | $10,001-$50,000 | |||||

| iShares Russell 2000 ETF | $10,001-$50,000 | |||||

| iShares U.S. Basic Materials ETF | $10,001-$50,000 | |||||

| iShares U.S. Energy ETF | $10,001-$50,000 | |||||

| iShares U.S. Technology ETF | $50,001-$100,000 | |||||

| John E. Kerrigan | iShares MSCI ACWI ETF | $10,001-$50,000 | Over $100,000 | |||

| iShares MSCI ACWI ex U.S. ETF | Over $100,000 | |||||

| iShares Short-Term National Muni Bond ETF | Over $100,000 | |||||

| Madhav V. Rajan | iShares Core Dividend Growth ETF | Over $100,000 | Over $100,000 | |||

| iShares Core High Dividend ETF | Over $100,000 | |||||

| iShares Core MSCI Emerging Markets ETF | Over $100,000 | |||||

| iShares Core S&P 500 ETF | Over $100,000 | |||||

| iShares iBoxx $ High Yield Corporate Bond ETF | Over $100,000 | |||||

| iShares iBoxx $ Investment Grade Corporate Bond ETF | Over $100,000 | |||||

| iShares Russell 2000 ETF | Over $100,000 | |||||

| iShares Select Dividend ETF | Over $100,000 | |||||

| Jane D. Carlin | iShares Core MSCI EAFE ETF | $50,001-$100,000 | Over $100,000 | |||

| iShares Core S&P Small-Cap ETF | $10,001-$50,000 | |||||

| iShares Global Tech ETF | $10,001-$50,000 |

| Name of Director | iShares

MSCI Australia ETF |

iShares

MSCI Austria Capped ETF |

iShares

MSCI Belgium Capped ETF |

iShares

MSCI Canada ETF | ||||

| Independent Directors: | ||||||||

| Robert H. Silver1 | $ 349 | $ 13 | $28 | $651 | ||||

| John E. Martinez | 599 | 22 | 48 | 1,115 | ||||

| Cecilia H. Herbert | 645 | 24 | 51 | 1,201 | ||||

| Charles A. Hurty | 627 | 23 | 50 | 1,167 | ||||

| John E. Kerrigan | 599 | 22 | 48 | 1,115 | ||||

| Madhav V. Rajan | 599 | 22 | 48 | 1,115 | ||||

| Jane D. Carlin | 599 | 22 | 48 | 1,115 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Eurozone ETF |

iShares

MSCI France ETF |

iShares

MSCI Germany ETF |

iShares

MSCI Global Gold Miners ETF | ||||

| Independent Directors: | ||||||||

| Robert H. Silver1 | $ 1,462 | $ 69 | $ 653 | $56 | ||||

| John E. Martinez | 2,506 | 119 | 1,119 | 96 | ||||

| Cecilia H. Herbert | 2,699 | 128 | 1,205 | 104 | ||||

| Charles A. Hurty | 2,622 | 124 | 1,170 | 101 | ||||

| John E. Kerrigan | 2,506 | 119 | 1,119 | 96 | ||||

| Madhav V. Rajan | 2,506 | 119 | 1,119 | 96 | ||||

| Jane D. Carlin | 2,506 | 119 | 1,119 | 96 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Eurozone ETF |

iShares

MSCI France ETF |

iShares

MSCI Germany ETF |

iShares

MSCI Global Gold Miners ETF | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Global Silver Miners ETF |

iShares

MSCI Hong Kong ETF |

iShares

MSCI Israel Capped ETF |

iShares

MSCI Italy Capped ETF | ||||

| Independent Directors: | ||||||||

| Robert H. Silver1 | $ 19 | $ 335 | $ 20 | $96 | ||||

| John E. Martinez | 32 | 574 | 34 | 164 | ||||

| Cecilia H. Herbert | 35 | 618 | 36 | 177 | ||||

| Charles A. Hurty | 34 | 600 | 35 | 172 | ||||

| John E. Kerrigan | 32 | 574 | 34 | 164 | ||||

| Madhav V. Rajan | 32 | 574 | 34 | 164 | ||||

| Jane D. Carlin | 32 | 574 | 34 | 164 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Japan ETF |

iShares

MSCI Japan Small-Cap ETF |

iShares

MSCI Mexico Capped ETF |

iShares

MSCI Netherlands ETF | ||||

| Independent Directors: | ||||||||

| Robert H. Silver1 | $2,848 | $ 35 | $277 | $39 | ||||

| John E. Martinez | 4,882 | 59 | 476 | 67 | ||||

| Cecilia H. Herbert | 5,258 | 64 | 512 | 72 | ||||

| Charles A. Hurty | 5,107 | 62 | 498 | 70 | ||||

| John E. Kerrigan | 4,882 | 59 | 476 | 67 | ||||

| Madhav V. Rajan | 4,882 | 59 | 476 | 67 | ||||

| Jane D. Carlin | 4,882 | 59 | 476 | 67 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Pacific ex Japan ETF |

iShares

MSCI Russia Capped ETF |

iShares

MSCI Singapore Capped ETF |

iShares

MSCI South Africa ETF | ||||

| Independent Directors: |

| Name of Director | iShares

MSCI Pacific ex Japan ETF |

iShares

MSCI Russia Capped ETF |

iShares

MSCI Singapore Capped ETF |

iShares

MSCI South Africa ETF | ||||

| Robert H. Silver1 | $497 | $ 65 | $ 119 | $86 | ||||

| John E. Martinez | 852 | 112 | 203 | 147 | ||||

| Cecilia H. Herbert | 917 | 121 | 219 | 158 | ||||

| Charles A. Hurty | 891 | 117 | 213 | 154 | ||||

| John E. Kerrigan | 852 | 112 | 203 | 147 | ||||

| Madhav V. Rajan | 852 | 112 | 203 | 147 | ||||

| Jane D. Carlin | 852 | 112 | 203 | 147 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Spain Capped ETF |

iShares

MSCI Sweden Capped ETF |

iShares

MSCI Switzerland Capped ETF |

iShares

MSCI Thailand Capped ETF | ||||

| Independent Directors: | ||||||||

| Robert H. Silver1 | $ 123 | $ 60 | $229 | $95 | ||||

| John E. Martinez | 211 | 103 | 393 | 163 | ||||

| Cecilia H. Herbert | 227 | 111 | 423 | 176 | ||||

| Charles A. Hurty | 221 | 108 | 411 | 171 | ||||

| John E. Kerrigan | 211 | 103 | 393 | 163 | ||||

| Madhav V. Rajan | 211 | 103 | 393 | 163 | ||||

| Jane D. Carlin | 211 | 103 | 393 | 163 | ||||

| Interested Directors: | ||||||||

| Robert S. Kapito | $ 0 | $ 0 | $ 0 | $0 | ||||

| Mark K. Wiedman | 0 | 0 | 0 | 0 | ||||

| Advisory Board Members: | ||||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | iShares

MSCI Turkey ETF |

iShares

MSCI USA Equal Weighted ETF |

iShares

MSCI World ETF | |||

| Independent Directors: | ||||||

| Robert H. Silver1 | $ 78 | $ 16 | $61 | |||

| John E. Martinez | 133 | 27 | 104 | |||

| Cecilia H. Herbert | 143 | 29 | 112 |

| Name of Director | iShares

MSCI Turkey ETF |

iShares

MSCI USA Equal Weighted ETF |

iShares

MSCI World ETF | |||

| Charles A. Hurty | 139 | 28 | 109 | |||

| John E. Kerrigan | 133 | 27 | 104 | |||

| Madhav V. Rajan | 133 | 27 | 104 | |||

| Jane D. Carlin | 133 | 27 | 104 | |||

| Interested Directors: | ||||||

| Robert S. Kapito | $ 0 | $ 0 | $0 | |||

| Mark K. Wiedman | 0 | 0 | 0 | |||

| Advisory Board Members: | ||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | |||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable |

| Name of Director | Pension

or Retirement Benefits Accrued As Part of Company Expenses4 |

Estimated

Annual Benefits Upon Retirement4 |

Total

Compensation From the Funds and Fund Complex5 | |||

| Independent Directors: | ||||||

| Robert H. Silver1 | Not Applicable | Not Applicable | $350,000 | |||

| John E. Martinez | Not Applicable | Not Applicable | 326,764 | |||

| Cecilia H. Herbert | Not Applicable | Not Applicable | 341,764 | |||

| Charles A. Hurty | Not Applicable | Not Applicable | 340,000 | |||

| John E. Kerrigan | Not Applicable | Not Applicable | 315,000 | |||

| Madhav V. Rajan | Not Applicable | Not Applicable | 315,000 | |||

| Jane D. Carlin | Not Applicable | Not Applicable | 300,000 6 | |||

| Interested Directors: | ||||||

| Robert S. Kapito | Not Applicable | Not Applicable | $0 | |||

| Mark K. Wiedman | Not Applicable | Not Applicable | 0 | |||

| Advisory Board Members: | ||||||

| Drew E. Lawton2 | Not Applicable | Not Applicable | Not Applicable | |||

| Richard L. Fagnani3 | Not Applicable | Not Applicable | Not Applicable |

| 1 | Served as an Independent Director through March 31, 2016. |

| 2 | Compensation is not shown for Drew E. Lawton because he was appointed to serve as an Advisory Board Member effective October 18, 2016. |

| 3 | Compensation is not shown for Richard L. Fagnani because he was appointed to serve as an Advisory Board Member effective April 1, 2017. |

| 4 | No Director or officer is entitled to any pension or retirement benefits from the Company. |

| 5 | Includes compensation for service on the Boards of Trustees for iShares Trust and iShares U.S. ETF Trust and the Board of Directors of iShares MSCI Russia Capped ETF, Inc. |

| 6 | Total compensation is shown for Jane D. Carlin for the period from February 3, 2015 to December 31, 2015 because she was appointed to serve as an Independent Director of the Company effective February 3, 2015. |

| Fund | Name | Percentage

of Ownership | ||

| iShares MSCI Australia ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

15.00% | ||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

7.98% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

7.89% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

6.91% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

6.18% | |||

| iShares MSCI Austria Capped ETF | The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

9.77% | ||

| TD

Ameritrade Clearing, Inc. 1005 N. Ameritrade Place Bellevue, NE 68005 |

7.71% | |||

| CIBC

World Markets Inc./CDS 161 Bay Street 10th Floor Toronto ON Ontario M5J 258 CA |

7.53% | |||

| Mellon

Trust of New England, National Association Three Mellon Bank Center Floor 1533700 Pittsburgh, PA 15259 |

7.03% | |||

| Merrill

Lynch, Pierce Fenner & Smith Safekeeping 101 Hudson Street 8th Floor Jersey City, NJ 07302 |

6.69% |

| Fund | Name | Percentage

of Ownership | ||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

5.90% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

5.88% | |||

| Wells

Fargo Securities, LLC 8739 Research Drive Charlotte, NC 28262-0675 |

5.51% | |||

| iShares MSCI Belgium Capped ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

15.90% | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

12.12% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

10.82% | |||

| Morgan

Stanley Smith Barney LLC 1300 Thames Street 6th Floor Baltimore, MD 21231 |

10.29% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

6.14% | |||

| First

Clearing, LLC 901 East Byrd Street Richmond, VA 23219 |

5.71% | |||

| iShares MSCI Canada ETF | Northern

Trust Company (The) 801 South Canal Street Chicago, IL 60612 |

11.80% | ||

| BNP

Paribas, New York Branch/Custody Services 525 Washington BLVD. Jersey City, NJ 07310 |

9.36% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

9.08% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

9.06% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

8.51% |

| Fund | Name | Percentage

of Ownership | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

6.72% | |||

| Merrill

Lynch, Pierce Fenner & Smith Safekeeping 101 Hudson Street 8th Floor Jersey City, NJ 07302 |

5.93% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

5.53% | |||

| iShares MSCI Eurozone ETF | Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

18.00% | ||

| BlackRock

Institutional Trust Company, N.A. 400 Howard Street San Francisco, CA 94105 |

15.68% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

13.73% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

10.79% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

8.94% | |||

| Deutsche

Bank Securities Inc./Cedear 1251 Avenue of the Americas New York, NY 10020 |

6.63% | |||

| iShares MSCI France ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

15.22% | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

9.24% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

9.04% | |||

| Deutsche

Bank Securities Inc./Cedear 1251 Avenue of the Americas New York, NY 10020 |

8.60% |

| Fund | Name | Percentage

of Ownership | ||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

8.24% | |||

| First

Clearing, LLC 901 East Byrd Street Richmond, VA 23219 |

6.62% | |||

| iShares MSCI Germany ETF | Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

28.25% | ||

| BlackRock

Institutional Trust Company, N.A. 400 Howard Street San Francisco, CA 94105 |

11.56% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

8.55% | |||

| Bank

of America NA/Client Assets 135 S LaSalle St Chicago, IL 60603 |

7.95% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

6.64% | |||

| iShares MSCI Global Gold Miners ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

38.76% | ||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

13.02% | |||

| Bank

of America NA/Client Assets 135 S LaSalle St Chicago, IL 60603 |

8.52% | |||

| iShares MSCI Global Silver Miners ETF | National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

27.99% | ||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

8.55% | |||

| Goldman,

Sachs & Co. 30 Hudson Street 16th Floor Jersey City, NJ 07302 |

6.95% |

| Fund | Name | Percentage

of Ownership | ||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

6.29% | |||

| TD

Ameritrade Clearing, Inc. 1005 N. Ameritrade Place Bellevue, NE 68005 |

5.16% | |||

| iShares MSCI Hong Kong ETF | Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

20.97% | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

12.37% | |||

| Bank

of America NA/Client Assets 135 S LaSalle St Chicago, IL 60603 |

11.36% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

6.80% | |||

| iShares MSCI Israel Capped ETF | Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

12.00% | ||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

8.96% | |||

| BNP

Paribas, New York Branch/Custody Services 525 Washington BLVD. Jersey City, NJ 07310 |

8.24% | |||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

8.00% | |||

| Morgan

Stanley Smith Barney LLC 1300 Thames Street 6th Floor Baltimore, MD 21231 |

5.68% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

5.02% | |||

| iShares MSCI Italy Capped ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

26.83% |

| Fund | Name | Percentage

of Ownership | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

14.68% | |||

| Northern

Trust Company (The) 801 South Canal Street Chicago, IL 60612 |

7.78% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

6.56% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

5.37% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

5.09% | |||

| iShares MSCI Japan ETF | Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

18.73% | ||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

11.56% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

10.12% | |||

| JPMorgan

Chase Bank, National Association 14201 Dallas Pkwy 12th Floor Dallas, TX 75240 |

8.38% | |||

| Morgan

Stanley Smith Barney LLC 1300 Thames Street 6th Floor Baltimore, MD 21231 |

6.36% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

6.24% | |||

| iShares MSCI Japan Small-Cap ETF | Morgan

Stanley Smith Barney LLC 1300 Thames Street 6th Floor Baltimore, MD 21231 |

12.09% | ||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

8.55% |

| Fund | Name | Percentage

of Ownership | ||

| JPMorgan

Chase Bank, National Association 14201 Dallas Pkwy 12th Floor Dallas, TX 75240 |

8.49% | |||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

8.04% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

7.85% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

7.77% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

6.49% | |||

| iShares MSCI Mexico Capped ETF | Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

11.98% | ||

| Northern

Trust Company (The) 801 South Canal Street Chicago, IL 60612 |

10.13% | |||

| Merrill

Lynch, Pierce, Fenner & Smith Incorporated 101 Hudson Street 9th Floor Jersey City, NJ 07302-3997 |

7.62% | |||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

6.62% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

5.60% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

5.01% | |||

| iShares MSCI Netherlands ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

22.78% | ||

| Mellon

Trust of New England, National Association Three Mellon Bank Center Floor 1533700 Pittsburgh, PA 15259 |

20.17% |

| Fund | Name | Percentage

of Ownership | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

5.02% | |||

| iShares MSCI Pacific ex Japan ETF | Merrill

Lynch, Pierce Fenner & Smith Safekeeping 101 Hudson Street 8th Floor Jersey City, NJ 07302 |

18.33% | ||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

10.19% | |||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

7.19% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

7.15% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

5.53% | |||

| iShares MSCI Russia Capped ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

16.93% | ||

| JPMorgan

Chase Bank, National Association 14201 Dallas Pkwy 12th Floor Dallas, TX 75240 |

16.50% | |||

| Deutsche

Bank Securities Inc./Cedear 1251 Avenue of the Americas New York, NY 10020 |

7.86% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

6.43% | |||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

6.18% | |||

| iShares MSCI Singapore Capped ETF | Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

10.31% | ||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

9.92% |

| Fund | Name | Percentage

of Ownership | ||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

8.36% | |||

| First

Clearing, LLC 901 East Byrd Street Richmond, VA 23219 |

7.99% | |||

| iShares MSCI South Africa ETF | State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

44.96% | ||

| The

Bank of New York Mellon 401 Salina Street 2nd Floor Syracuse, NY 13202 |

8.26% | |||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

7.77% | |||

| iShares MSCI Spain Capped ETF | Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

12.18% | ||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

10.15% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

7.68% | |||

| First

Clearing, LLC 901 East Byrd Street Richmond, VA 23219 |

6.75% | |||

| Deutsche

Bank Securities Inc./Cedear 1251 Avenue of the Americas New York, NY 10020 |

6.71% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

5.91% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

5.26% | |||

| iShares MSCI Sweden Capped ETF | Merrill

Lynch, Pierce Fenner & Smith Safekeeping 101 Hudson Street 8th Floor Jersey City, NJ 07302 |

25.21% |

| Fund | Name | Percentage

of Ownership | ||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

9.37% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

5.76% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

5.35% | |||

| iShares MSCI Switzerland Capped ETF | Merrill

Lynch, Pierce Fenner & Smith Safekeeping 101 Hudson Street 8th Floor Jersey City, NJ 07302 |

22.94% | ||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

9.97% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

9.28% | |||

| National

Financial Services LLC 200 Liberty Street 5th Floor New York, NY 10281 |

8.79% | |||

| Charles

Schwab & Co., Inc. 111 Pavonia Avenue Jersey City, NJ 07310 |

6.86% | |||

| Brown

Brothers Harriman & Co. 525 Washington Blvd. 11th Floor Jersey City, NJ 07310 |

5.89% | |||

| iShares MSCI Thailand Capped ETF | Northern

Trust Company/ United Nations Joint Staff Pension Fund 50 South LaSalle Street Chicago, IL 60675 |

21.35% | ||

| State

Street Bank and Trust Company 1776 Heritage Drive North Quincy, MA 02171 |

16.28% | |||

| Citibank,

N.A. 3800 CitiBank Center Tampa Building A/Floor 2 Tampa, FL 33610 |

5.93% |

| Fund | Name | Percentage

of Ownership | ||

| Mellon

Trust of New England, National Association Three Mellon Bank Center Floor 1533700 Pittsburgh, PA 15259 |