Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09102

iShares, Inc.

(Exact name of Registrant as specified in charter)

c/o: State Street Bank and Trust Company

200 Clarendon Street, Boston, MA 02116

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-670-2000

Date of fiscal year end: April 30, 2013

Date of reporting period: April 30, 2013

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

APRIL 30, 2013

| 2013 ANNUAL REPORT |

|

iShares, Inc.

| Ø | iShares Asia/Pacific Dividend 30 Index Fund | DVYA | NYSE Arca |

| Ø | iShares Emerging Markets Dividend Index Fund | DVYE | NYSE Arca |

Table of Contents

| 5 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 15 | ||||

| 18 | ||||

| 20 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES®, INC.

MARKET OVERVIEW

Global stocks posted double-digit gains for the 12 months ended April 30, 2013 (the “reporting period”). Global equity markets were volatile in the first half of the reporting period as uncertain outcomes in the U.S. presidential election and the “fiscal cliff” (the expiration of certain federal tax cuts and the implementation of automatic U.S. government spending reductions set to take place in early 2013), along with concerns about the lingering European sovereign debt crisis and a broad deceleration in global economic activity, weighed on investor confidence. However, global equity markets rallied sharply over the last six months of the reporting period as the U.S. presidential election maintained the status quo, the fiscal cliff was temporarily resolved, and global economic conditions improved as central banks around the world took more aggressive actions to stimulate economic growth.

Stocks in the Asia/Pacific region generated strong returns, gaining more than 20% for the reporting period. Stocks in this region benefited from improving economic growth in many countries, led by Australia and New Zealand. The Australian economy grew by 3.1% in 2012, up from 2.3% in 2011, while New Zealand’s economy grew by 2.5% in 2012, up from 1.9% the previous year. The positive economic trends provided a lift to the stock markets in these two countries, with each gaining more than 25% for the reporting period.

The main exception to the improving economic conditions in the Asia/Pacific region was Japan, which continued to struggle with a long-dormant economy. However, the Bank of Japan’s new governor took meaningful steps to revive the stagnant Japanese economy by implementing aggressive quantitative easing measures in early 2013, and the country’s stock market rallied in response to these efforts.

In contrast to developed markets, emerging markets stocks produced more modest gains for the reporting period, returning approximately 4%. Emerging economies continued to weaken for much of the reporting period as exports to developed countries slowed. For example, China’s economy grew by 7.7% for the reporting period, down from 8.1% for the prior 12 months, while Brazil’s economy grew by 1.4%, unchanged from the prior 12 months but down from a peak of 9.3% in 2010.

Although economic conditions improved in many developed regions of the globe over the last six months of the reporting period, it wasn’t enough to generate meaningful growth in exports from emerging markets. Consequently, emerging markets stock performance was muted for the reporting period.

On a regional basis, Asian stocks produced the best returns within the emerging markets. The leading markets in this region included the Philippines (which gained more than 40% for the reporting period), Thailand, and Indonesia, while South Korea was the only Asian emerging market to decline for the reporting period. Emerging markets in Eastern Europe and the Middle East also advanced for the reporting period. Turkey (the best-performing emerging market) and Poland gained the most, while markets in Russia and the Czech Republic declined. Latin American markets declined overall as Brazil, Chile, and Peru all posted losses. The sole exception in Latin America was Mexico, which posted double-digit gains for the reporting period.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

5 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® ASIA/PACIFIC DIVIDEND 30 INDEX FUND

Performance as of April 30, 2013

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | |||||||||||||||||||||

| 1 Year |

22.87% | 22.88% | 23.59% | 22.87% | 22.88% | 23.59% | ||||||||||||||||||||

| Since Inception |

22.34% | 22.62% | 22.98% | 26.95% | 27.30% | 27.75% | ||||||||||||||||||||

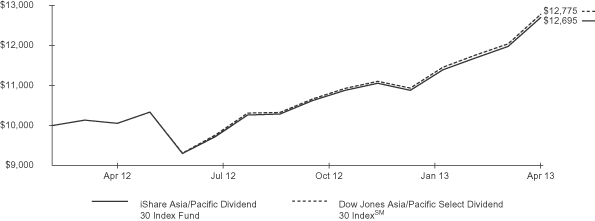

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/23/12. The first day of secondary market trading was 2/24/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 10 for more information.

| Shareholder Expenses | ||||||||||||||||||||||||||

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||

| Beginning Account Value (11/1/12) |

Ending Account Value (4/30/13) |

Expenses Paid During Period a |

Beginning Account Value (11/1/12) |

Ending Account Value (4/30/13) |

Expenses Paid During Period a |

Annualized Expense Ratio |

||||||||||||||||||||

| $ | 1,000.00 | $ | 1,166.80 | $ | 2.63 | $ | 1,000.00 | $ | 1,022.40 | $ | 2.46 | 0.49% | ||||||||||||||

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 10 for more information. |

| 6 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® ASIA/PACIFIC DIVIDEND 30 INDEX FUND

The iShares Asia/Pacific Dividend 30 Index Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Dow Jones Asia/Pacific Select Dividend 30 IndexSM (the “Index”). The Index measures the stock performance of high dividend paying companies in Australia, China, Hong Kong, Japan, New Zealand and Singapore. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month reporting period ended April 30, 2013, the total return for the Fund was 22.87%, net of fees, while the total return for the Index was 23.59%.

As represented by the Index, dividend-paying stocks in the Asia/Pacific region returned more than 20% for the reporting period and modestly outperformed the region’s broad equity indices. Dividend-paying stocks in Asia generally tracked the pattern of the region’s equity markets during the reporting period — they declined early in the reporting period amid economic, fiscal, and political uncertainty, and then rebounded over the last six months as global economic conditions improved.

The outperformance of dividend-paying stocks versus the regional stock indices resulted primarily from continued investor demand for higher-yielding investments in a low interest rate environment. As of April 30, 2013, the average dividend yield of the constituents in the Index was 5.26%, notably higher than the dividend yields of broad Asia/Pacific stock indices.

Dividend-paying stocks are typically companies with healthy cash flows and solid balance sheets. Stocks in the Asia/Pacific region with these characteristics fared well during the reporting period, particularly during the first six months as generally weaker economic growth led investors to favor companies with stronger financial positions.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

7 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® EMERGING MARKETS DIVIDEND INDEX FUND

Performance as of April 30, 2013

| Average Annual Total Returns | Cumulative Total Returns | |||||||||||||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | |||||||||||||||||||||

| 1 Year |

5.09% | 5.20% | 5.05% | 5.09% | 5.20% | 5.05% | ||||||||||||||||||||

| Since Inception |

2.28% | 2.91% | 2.22% | 2.71% | 3.45% | 2.63% | ||||||||||||||||||||

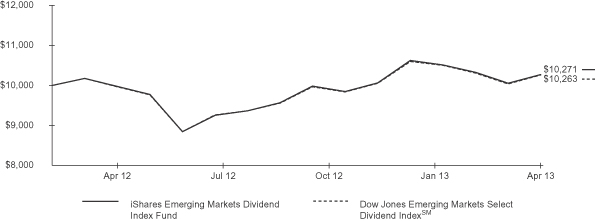

GROWTH OF $10,000 INVESTMENT

(SINCE INCEPTION AT NET ASSET VALUE)

The inception date of the Fund was 2/23/12. The first day of secondary market trading was 2/24/12.

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. See “About Fund Performance” on page 10 for more information.

| Shareholder Expenses | ||||||||||||||||||||||||||

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||

| Beginning Account Value (11/1/12) |

Ending Account Value (4/30/13) |

Expenses Paid During Period a |

Beginning Account Value (11/1/12) |

Ending Account Value (4/30/13) |

Expenses Paid During Period a |

Annualized Expense Ratio |

||||||||||||||||||||

| $ | 1,000.00 | $ | 1,043.50 | $ | 2.48 | $ | 1,000.00 | $ | 1,022.40 | $ | 2.46 | 0.49% | ||||||||||||||

| a | Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days) and divided by the number of days in the year (365 days). See “Shareholder Expenses” on page 10 for more information. |

| 8 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® EMERGING MARKETS DIVIDEND INDEX FUND

The iShares Emerging Markets Dividend Index Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Dow Jones Emerging Markets Select Dividend IndexSM (the “Index”). The Index measures the performance of a group of equity securities issued by companies in emerging market countries that have provided relatively high dividend yields on a consistent basis over time. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month reporting period ended April 30, 2013, the total return for the Fund was 5.09%, net of fees, while the total return for the Index was 5.05%.

As represented by the Index, dividend-paying stocks in emerging market countries posted modestly positive returns and slightly outperformed the broad emerging market equity indices. Dividend-paying stocks in emerging markets generally tracked the pattern of the broad emerging markets during the reporting period—they declined early in the reporting period amid global economic uncertainty, rebounded in late 2012, then fell back in early 2013 as investors shifted into developed markets, where economic conditions had begun to improve.

The outperformance of dividend-paying stocks versus the broad emerging market stock indices resulted primarily from continued investor demand for higher-yielding investments in a low interest rate environment. As of April 30, 2013, the average dividend yield of the constituents in the Index was 5.78%, compared with a dividend yield of less than 2% on broad emerging market stock indices.

Dividend-paying stocks are typically companies with healthy cash flows and solid balance sheets. Emerging markets stocks with these characteristics fared well during the reporting period as generally weaker growth in emerging economies led investors to favor companies with stronger financial positions.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE |

9 |

Table of Contents

About Fund Performance (Unaudited)

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available at www.iShares.com. Performance results assume reinvestment of all dividends and capital gain distributions and do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The investment return and principal value of shares will vary with changes in market conditions. Shares may be worth more or less than their original cost when they are redeemed or sold in the market. Performance for certain funds may reflect a waiver of a portion of investment management fees. Without such waiver, performance would have been lower.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of a fund may not have traded in the secondary market until after the fund’s inception, for the period from inception to the first day of secondary trading, the NAV of the fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower.

Shareholder Expenses (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares and (2) ongoing costs, including management fees and other fund expenses. The expense example, which is based on an investment of $1,000 invested on November 1, 2012 and held through April 30, 2013, is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses — The table provides information about actual account values and actual expenses. To estimate the expenses that you paid on your account over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number for your Fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes — The table also provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the hypothetical examples are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 10 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

iSHARES® ASIA/PACIFIC DIVIDEND 30 INDEX FUND

April 30, 2013

| SCHEDULES OF INVESTMENTS |

11 |

Table of Contents

Schedule of Investments

iSHARES® EMERGING MARKETS DIVIDEND INDEX FUND

April 30, 2013

| 12 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Schedule of Investments (Continued)

iSHARES® EMERGING MARKETS DIVIDEND INDEX FUND

April 30, 2013

| SCHEDULES OF INVESTMENTS |

13 |

Table of Contents

Schedule of Investments (Continued)

iSHARES® EMERGING MARKETS DIVIDEND INDEX FUND

April 30, 2013

| 14 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Statements of Assets and Liabilities

iSHARES®, INC.

April 30, 2013

| iShares Asia/Pacific Dividend 30 Index Fund |

iShares Emerging Markets Dividend Index Fund |

|||||||

| ASSETS |

||||||||

| Investments, at cost: |

||||||||

| Unaffiliated |

$ | 37,909,161 | $ | 131,332,627 | ||||

| Affiliated (Note 2) |

2,241,303 | 5,218,836 | ||||||

|

|

|

|

|

|||||

| Total cost of investments |

$ | 40,150,464 | $ | 136,551,463 | ||||

|

|

|

|

|

|||||

| Investments in securities, at fair value (including securities on loana) (Note 1): |

||||||||

| Unaffiliated |

$ | 42,988,803 | $ | 131,089,656 | ||||

| Affiliated (Note 2) |

2,241,303 | 5,218,836 | ||||||

|

|

|

|

|

|||||

| Total fair value of investments |

45,230,106 | 136,308,492 | ||||||

| Foreign currency, at valueb |

25,345 | 258,393 | ||||||

| Cash |

— | 4,182 | ||||||

| Receivables: |

||||||||

| Dividends and interest |

206,825 | 414,316 | ||||||

|

|

|

|

|

|||||

| Total Assets |

45,462,276 | 136,985,383 | ||||||

|

|

|

|

|

|||||

| LIABILITIES |

||||||||

| Payables: |

||||||||

| Investment securities purchased |

23,602 | — | ||||||

| Collateral for securities on loan (Note 5) |

2,193,471 | 5,130,739 | ||||||

| Investment advisory fees (Note 2) |

16,230 | 49,000 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

2,233,303 | 5,179,739 | ||||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 43,228,973 | $ | 131,805,644 | ||||

|

|

|

|

|

|||||

| Net assets consist of: |

||||||||

| Paid-in capital |

$ | 38,422,400 | $ | 132,650,050 | ||||

| Undistributed net investment income |

126,222 | 701,298 | ||||||

| Accumulated net realized loss |

(398,684 | ) | (1,305,597 | ) | ||||

| Net unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies |

5,079,035 | (240,107 | ) | |||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 43,228,973 | $ | 131,805,644 | ||||

|

|

|

|

|

|||||

| Shares outstandingc |

700,000 | 2,450,000 | ||||||

|

|

|

|

|

|||||

| Net asset value per share |

$ | 61.76 | $ | 53.80 | ||||

|

|

|

|

|

|||||

| a | Securities on loan with values of $2,084,816 and $4,844,215, respectively. See Note 5. |

| b | Cost of foreign currency: $24,926 and $257,746, respectively. |

| c | $0.001 par value, number of shares authorized: 500 million and 500 million, respectively. |

See notes to financial statements.

| FINANCIAL STATEMENTS |

15 |

Table of Contents

Statements of Operations

iSHARES®, INC.

Year ended April 30, 2013

| iShares Asia/Pacific Dividend 30 Index Fund |

iShares Emerging Markets Dividend Index Fund |

|||||||

| NET INVESTMENT INCOME |

||||||||

| Dividends — unaffiliateda |

$ | 1,248,703 | $ | 2,363,446 | ||||

| Interest — affiliated (Note 2) |

12 | 55 | ||||||

| Securities lending income — affiliated (Note 2) |

34,765 | 51,028 | ||||||

|

|

|

|

|

|||||

| Total investment income |

1,283,480 | 2,414,529 | ||||||

|

|

|

|

|

|||||

| EXPENSES |

||||||||

| Investment advisory fees (Note 2) |

114,712 | 382,587 | ||||||

|

|

|

|

|

|||||

| Total expenses |

114,712 | 382,587 | ||||||

| Less investment advisory fees waived (Note 2) |

— | (106,899 | ) | |||||

|

|

|

|

|

|||||

| Net expenses |

114,712 | 275,688 | ||||||

|

|

|

|

|

|||||

| Net investment income |

1,168,768 | 2,138,841 | ||||||

|

|

|

|

|

|||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) |

||||||||

| Net realized gain (loss) from: |

||||||||

| Investments — unaffiliated |

(441,034 | ) | (1,220,572 | ) | ||||

| In-kind redemptions — unaffiliated |

978,477 | 836,525 | ||||||

| Foreign currency transactions |

872 | (18,705 | ) | |||||

|

|

|

|

|

|||||

| Net realized gain (loss) |

538,315 | (402,752 | ) | |||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation/depreciation on: |

||||||||

| Investments |

4,874,500 | 281,460 | ||||||

| Translation of assets and liabilities in foreign currencies |

(1,283 | ) | 4,202 | |||||

|

|

|

|

|

|||||

| Net change in unrealized appreciation/depreciation |

4,873,217 | 285,662 | ||||||

|

|

|

|

|

|||||

| Net realized and unrealized gain (loss) |

5,411,532 | (117,090 | ) | |||||

|

|

|

|

|

|||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 6,580,300 | $ | 2,021,751 | ||||

|

|

|

|

|

|||||

| a | Net of foreign withholding tax of $44,575 and $316,470, respectively. |

See notes to financial statements.

| 16 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Statements of Changes in Net Assets

iSHARES®, INC.

| iShares Asia/Pacific Dividend 30 Index Fund |

iShares Emerging Markets Dividend Index Fund |

|||||||||||||||

| Year ended April 30, 2013 |

Period from to April 30, 2012 |

Year ended April 30, 2013 |

Period from to April 30, 2012 |

|||||||||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||||||||||

| OPERATIONS: |

||||||||||||||||

| Net investment income |

$ | 1,168,768 | $ | 102,610 | $ | 2,138,841 | $ | 164,052 | ||||||||

| Net realized gain (loss) |

538,315 | (3,568 | ) | (402,752 | ) | (42,401 | ) | |||||||||

| Net change in unrealized appreciation/depreciation |

4,873,217 | 205,818 | 285,662 | (525,769 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from operations |

6,580,300 | 304,860 | 2,021,751 | (404,118 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||||||||||

| From net investment income |

(1,041,458 | ) | (108,951 | ) | (1,597,355 | ) | (28,496 | ) | ||||||||

| From net realized gain |

— | (1,344 | ) | — | — | |||||||||||

| Return of capital |

— | (3,727 | ) | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

(1,041,458 | ) | (114,022 | ) | (1,597,355 | ) | (28,496 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||||||||||

| Proceeds from shares sold |

32,603,051 | 12,994,965 | 118,206,938 | 16,402,791 | ||||||||||||

| Cost of shares redeemed |

(8,098,723 | ) | — | (2,795,867 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in net assets from capital share transactions |

24,504,328 | 12,994,965 | 115,411,071 | 16,402,791 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| INCREASE IN NET ASSETS |

30,043,170 | 13,185,803 | 115,835,467 | 15,970,177 | ||||||||||||

| NET ASSETS |

||||||||||||||||

| Beginning of period |

13,185,803 | — | 15,970,177 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period |

$ | 43,228,973 | $ | 13,185,803 | $ | 131,805,644 | $ | 15,970,177 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed (distributions in excess of) net investment income included in net assets at end of period |

$ | 126,222 | $ | (6,607 | ) | $ | 701,298 | $ | 128,137 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SHARES ISSUED AND REDEEMED |

||||||||||||||||

| Shares sold |

600,000 | 250,000 | 2,200,000 | 300,000 | ||||||||||||

| Shares redeemed |

(150,000 | ) | — | (50,000 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase in shares outstanding |

450,000 | 250,000 | 2,150,000 | 300,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| a | Commencement of operations. |

See notes to financial statements.

| FINANCIAL STATEMENTS |

17 |

Table of Contents

iSHARES®, INC.

(For a share outstanding throughout each period)

iShares Asia/Pacific Dividend 30 Index Fund

| Year ended Apr. 30, 2013 |

Period from to Apr. 30, 2012 |

|||||||

| Net asset value, beginning of period |

$ | 52.74 | $ | 51.62 | ||||

|

|

|

|

|

|||||

| Income from investment operations: |

||||||||

| Net investment incomeb |

2.71 | 0.55 | ||||||

| Net realized and unrealized gainc |

8.86 | 1.14 | ||||||

|

|

|

|

|

|||||

| Total from investment operations |

11.57 | 1.69 | ||||||

|

|

|

|

|

|||||

| Less distributions from: |

||||||||

| Net investment income |

(2.55 | ) | (0.54 | ) | ||||

| Net realized gain |

— | (0.01 | ) | |||||

| Return of capital |

— | (0.02 | ) | |||||

|

|

|

|

|

|||||

| Total distributions |

(2.55 | ) | (0.57 | ) | ||||

|

|

|

|

|

|||||

| Net asset value, end of period |

$ | 61.76 | $ | 52.74 | ||||

|

|

|

|

|

|||||

| Total return |

22.87 | % | 3.32 | %d | ||||

|

|

|

|

|

|||||

| Ratios/Supplemental data: |

||||||||

| Net assets, end of period (000s) |

$ | 43,229 | $ | 13,186 | ||||

| Ratio of expenses to average net assetse |

0.49 | % | 0.49 | % | ||||

| Ratio of net investment income to average net assetse |

4.99 | % | 5.76 | % | ||||

| Portfolio turnover ratef |

32 | % | 1 | % | ||||

| a | Commencement of operations. |

| b | Based on average shares outstanding throughout each period. |

| c | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| d | Not annualized. |

| e | Annualized for periods of less than one year. |

| f | Portfolio turnover rates exclude portfolio securities received or delivered as a result of processing capital share transactions in Creation Units. |

See notes to financial statements.

| 18 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Financial Highlights (Continued)

iSHARES®, INC.

(For a share outstanding throughout each period)

iShares Emerging Markets Dividend Index Fund

| Year ended Apr. 30, 2013 |

Period from to Apr. 30, 2012 |

|||||||

| Net asset value, beginning of period |

$ | 53.23 | $ | 54.61 | ||||

|

|

|

|

|

|||||

| Income from investment operations: |

||||||||

| Net investment incomeb |

2.02 | 0.74 | ||||||

| Net realized and unrealized gain (loss)c |

0.56 | (1.98 | ) | |||||

|

|

|

|

|

|||||

| Total from investment operations |

2.58 | (1.24 | ) | |||||

|

|

|

|

|

|||||

| Less distributions from: |

||||||||

| Net investment income |

(2.01 | ) | (0.14 | ) | ||||

|

|

|

|

|

|||||

| Total distributions |

(2.01 | ) | (0.14 | ) | ||||

|

|

|

|

|

|||||

| Net asset value, end of period |

$ | 53.80 | $ | 53.23 | ||||

|

|

|

|

|

|||||

| Total return |

5.09 | % | (2.27 | )%d | ||||

|

|

|

|

|

|||||

| Ratios/Supplemental data: |

||||||||

| Net assets, end of period (000s) |

$ | 131,806 | $ | 15,970 | ||||

| Ratio of expenses to average net assetse |

0.49 | % | 0.49 | % | ||||

| Ratio of expenses to average net assets prior to waived feese |

0.68 | % | 0.68 | % | ||||

| Ratio of net investment income to average net assetse |

3.80 | % | 7.51 | % | ||||

| Portfolio turnover ratef |

41 | % | 2 | % | ||||

| a | Commencement of operations. |

| b | Based on average shares outstanding throughout each period. |

| c | The amounts reported for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period due to the timing of capital share transactions in relation to the fluctuating market values of the Fund’s underlying securities. |

| d | Not annualized. |

| e | Annualized for periods of less than one year. |

| f | Portfolio turnover rates exclude portfolio securities received or delivered in Creation Units but includes portfolio transactions that are executed as a result of the Fund processing capital share transactions in Creation Units partially for cash in U.S. dollars. Excluding such cash transactions, the portfolio turnover rate for the year ended April 30, 2013 was 41%. See Note 4. |

See notes to financial statements.

| FINANCIAL HIGHLIGHTS |

19 |

Table of Contents

iSHARES®, INC.

iShares, Inc. (the “Company”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Company was incorporated under the laws of the State of Maryland on September 1, 1994 pursuant to amended and restated Articles of Incorporation.

These financial statements relate only to the following funds (each, a “Fund,” and collectively, the “Funds”):

| iShares Index Fund | Diversification Classification | |

| Asia/Pacific Dividend 30 |

Non-diversified | |

| Emerging Markets Dividend |

Non-diversified |

Non-diversified funds generally hold securities of fewer issuers than diversified funds and may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers.

The investment objective of each Fund is to seek investment results that correspond generally to the price and yield performance, before fees and expenses, of its underlying index. The investment adviser uses a “passive” or index approach to try to achieve each Fund’s investment objective.

Each Fund may invest in securities of non-U.S. issuers that may trade in non-U.S. markets. This may involve certain considerations and risks not typically associated with securities of U.S. issuers. Such risks include, but are not limited to: generally less liquid and less efficient securities markets; generally greater price volatility; exchange rate fluctuations and exchange controls; imposition of restrictions on the expatriation of funds or other assets of the Funds; less publicly available information about issuers; the imposition of withholding or other taxes; higher transaction and custody costs; settlement delays and risk of loss attendant in settlement procedures; difficulties in enforcing contractual obligations; less regulation of securities markets; different accounting, disclosure and reporting requirements; more substantial governmental involvement in the economy; higher inflation rates; greater social, economic and political uncertainties; the risk of nationalization or expropriation of assets; and the risk of war.

Pursuant to the Company’s organizational documents, the Funds’ officers and directors are indemnified against certain liabilities that may arise out of the performance of their duties to the Funds. Additionally, in the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred.

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

The following significant accounting policies are consistently followed by the Funds in the preparation of their financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

SECURITY VALUATION

Each Fund’s investments are valued at fair value each day that the Fund’s listing exchange is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the Fund’s listing exchange is not open. U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between

| 20 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

market participants at the measurement date. The BlackRock Global Valuation Methodologies Committee (the “Global Valuation Committee”) provides oversight of the valuation of investments for the Funds. The investments of each Fund are valued pursuant to policies and procedures developed by the Global Valuation Committee and approved by the Board of Directors of the Company (the “Board”).

| • | Equity investments traded on a recognized securities exchange are valued at that day’s last reported trade price or the official closing price, as applicable, on the exchange where the stock is primarily traded. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last traded price. |

| • | Open-end U.S. mutual funds are valued at that day’s published net asset value (NAV). |

In the event that application of these methods of valuation results in a price for an investment which is deemed not to be representative of the fair value of such investment or if a price is not available, the investment will be valued based upon other available factors deemed relevant by the Global Valuation Committee, in accordance with policies approved by the Board. These factors include but are not limited to (i) attributes specific to the investment; (ii) the principal market for the investment; (iii) the customary participants in the principal market for the investment; (iv) data assumptions by market participants for the investment, if reasonably available; (v) quoted prices for similar investments in active markets; and (vi) other factors, such as future cash flows, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and/or other default rates. Valuations based on such factors are reported to the Board on a quarterly basis.

The Global Valuation Committee employs various methods for calibrating valuation approaches for investments where an active market does not exist, including regular due diligence of the Company’s pricing vendors, a regular review of key inputs and assumptions, transactional back-testing or disposition analysis to compare unrealized gains and losses to realized gains and losses, reviews of missing or stale prices, reviews of large movements in market values, and reviews of market related activity.

Fair value pricing could result in a difference between the prices used to calculate a Fund’s net asset value and the prices used by the Fund’s underlying index, which in turn could result in a difference between the Fund’s performance and the performance of the Fund’s underlying index.

Various inputs are used in determining the fair value of financial instruments. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for a financial instrument within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The categorization of a value determined for a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and is not necessarily an indication of the risk associated with investing in the instrument. The three levels of the fair value hierarchy are as follows:

| • | Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities; |

| • | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| • | Level 3 — Unobservable inputs for the asset or liability, including the Global Valuation Committee’s assumptions used in determining the fair value of investments. |

| NOTES TO FINANCIAL STATEMENTS |

21 |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. In accordance with the Company’s policy, transfers between different levels of the fair value hierarchy are deemed to have occurred as of the beginning of the reporting period.

As of April 30, 2013, the value of each of the Funds’ investments was classified as Level 1. The breakdown of each Fund’s investments into major categories is disclosed in its respective schedule of investments.

SECURITY TRANSACTIONS AND INCOME RECOGNITION

Security transactions are accounted for on trade date. Dividend income is recognized on the ex-dividend date, net of any foreign taxes withheld at source. Any taxes withheld that are reclaimable from foreign tax authorities as of April 30, 2013 are reflected in dividends receivable. Non-cash dividends received in the form of stock in an elective dividend, if any, are recorded as dividend income at fair value. Distributions received by the Funds may include a return of capital that is estimated by management. Such amounts are recorded as a reduction of the cost of investments or reclassified to capital gains. Interest income is accrued daily. Realized gains and losses on investment transactions are determined using the specific identification method.

FOREIGN CURRENCY TRANSLATION

The accounting records of the Funds are maintained in U.S. dollars. Foreign currencies, as well as investment securities and other assets and liabilities denominated in foreign currencies, are translated into U.S. dollars using exchange rates deemed appropriate by the investment adviser. Purchases and sales of securities, income receipts and expense payments are translated into U.S. dollars on the respective dates of such transactions.

Each Fund does not isolate the effect of fluctuations in foreign exchange rates from the effect of fluctuations in the market prices of securities. Such fluctuations are reflected by the Funds as a component of realized and unrealized gains and losses from investments for financial reporting purposes.

FOREIGN TAXES

The Funds may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, capital gains on investments, or certain foreign currency transactions. All foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Funds invest. These foreign taxes, if any, are paid by the Funds and are reflected in their statements of operations as follows: foreign taxes withheld at source are presented as a reduction of income, foreign taxes on securities lending income are presented as a reduction of securities lending income, foreign taxes on stock dividends are presented as “other foreign taxes,” and foreign taxes on capital gains from sales of investments and foreign taxes on foreign currency transactions are included in their respective net realized gain (loss) categories. Foreign taxes payable as of April 30, 2013, if any, are disclosed in the Funds’ statements of assets and liabilities.

DISTRIBUTIONS TO SHAREHOLDERS

Dividends and distributions paid by each Fund are recorded on the ex-dividend dates. Distributions are determined on a tax basis and may differ from net investment income and net realized capital gains for financial reporting purposes. Dividends and distributions are paid in U.S. dollars and cannot be automatically reinvested in additional shares of the Funds.

FEDERAL INCOME TAXES

Each Fund is treated as an entity separate from the Company’s other funds for federal income tax purposes. It is the policy of each Fund to qualify as a regulated investment company by complying with the provisions applicable to regulated investment

| 22 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

companies, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, and to annually distribute substantially all of its ordinary income and any net capital gains (taking into account any capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income and excise taxes. Accordingly, no provision for federal income taxes is required.

RECENT ACCOUNTING STANDARD

In December 2011, the Financial Accounting Standards Board issued guidance to enhance current disclosure requirements on offsetting of certain assets and liabilities and enable financial statement users to compare financial statements prepared under U.S. GAAP and International Financial Reporting Standards (IFRS). The new disclosures are required for investments and derivative financial instruments subject to master netting agreements or similar agreements and require an entity to disclose both gross and net information about such investments and transactions eligible for offset in the statement of assets and liabilities. In addition, the standard requires disclosure of collateral received and posted in connection with master netting agreements or similar agreements. The guidance is effective for financial statements for fiscal years beginning after January 1, 2013, and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Funds’ financial statements and disclosures.

| 2. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Pursuant to an Investment Advisory Agreement with the Company, BlackRock Fund Advisors (“BFA”) manages the investment of each Fund’s assets. BFA is a California corporation indirectly owned by BlackRock, Inc. (“BlackRock”). Under the Investment Advisory Agreement, BFA is responsible for substantially all expenses of the Funds, except interest, taxes, brokerage commissions and other expenses connected with the execution of portfolio transactions, distribution fees, litigation expenses and any extraordinary expenses.

For its investment advisory services to each Fund, BFA is entitled to an annual investment advisory fee based on the average daily net assets of each Fund as follows:

| iShares Index Fund | Investment Advisory Fee |

|||

| Asia/Pacific Dividend 30 |

0.49 | % | ||

| Emerging Markets Dividend |

0.68 | |||

BFA has contractually agreed to waive a portion of its investment advisory fees for the iShares Emerging Markets Dividend Index Fund through December 31, 2014 in an amount equal to the investment advisory fees payable on the amount of the Fund’s investment in other iShares funds. The Fund did not hold any iShares funds during the year ended April 30, 2013. In addition, BFA has contractually agreed to waive a portion of its investments advisory fee for the Fund through December 31, 2014 in an amount equal to 0.19%. After giving effect to the fee waiver, BFA received an investment advisory fee of 0.49% of the average daily net assets of the Fund.

The U.S. Securities and Exchange Commission has issued an exemptive order which permits BlackRock Institutional Trust Company, N.A. (“BTC”) to serve as securities lending agent for the Funds, subject to applicable conditions. BTC is an affiliate of BFA. Securities lending income is equal to the total of income earned from the reinvestment of cash collateral, and any fees or other payments to and from borrowers of securities. Each Fund retains 65% of securities lending income and pays a fee to BTC equal to 35% of such income. The Funds benefit from a borrower default indemnity provided by BlackRock. As securities lending agent, BTC bears all operational costs directly related to securities lending as well as the cost of borrower default indemnification.

| NOTES TO FINANCIAL STATEMENTS |

23 |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

BTC is also responsible for fees and expenses incurred by each Fund as a result of the investment of cash collateral received for securities on loan in a money market fund managed by BFA or an affiliate.

For the year ended April 30, 2013, BTC earned securities lending agent fees from the Funds as follows:

| iShares Index Fund | Securities Lending Agent Fees |

|||

| Asia/Pacific Dividend 30 |

$ | 18,719 | ||

| Emerging Markets Dividend |

27,476 | |||

BlackRock Investments, LLC, an affiliate of BFA, is the distributor for each Fund. Pursuant to the distribution agreement, BFA is responsible for any fees or expenses for distribution services provided to the Funds.

Each Fund may invest its positive cash balances in certain money market funds managed by BFA or an affiliate. The income earned on these temporary cash investments is included in “Interest – affiliated” in the statements of operations.

The PNC Financial Services Group, Inc. is the largest stockholder of BlackRock and is considered to be an affiliate of the Funds for 1940 Act purposes.

The iShares Emerging Markets Dividend Index Fund, in order to improve its portfolio liquidity and its ability to track its underlying index, may invest in shares of other iShares funds that invest in securities in the Fund’s underlying index.

Certain directors and officers of the Company are also officers of BTC and/or BFA.

| 3. | INVESTMENT PORTFOLIO TRANSACTIONS |

Purchases and sales of investments (excluding in-kind transactions and short-term investments) for the year ended April 30, 2013 were as follows:

| iShares Index Fund | Purchases | Sales | ||||||

| Asia/Pacific Dividend 30 |

$ | 7,993,022 | $ | 7,802,682 | ||||

| Emerging Markets Dividend |

86,625,615 | 24,106,946 | ||||||

In-kind transactions (see Note 4) for the year ended April 30, 2013 were as follows:

| iShares Index Fund | In-kind Purchases |

In-kind Sales |

||||||

| Asia/Pacific Dividend 30 |

$ | 32,301,768 | $ | 8,051,267 | ||||

| Emerging Markets Dividend |

55,516,273 | 2,709,077 | ||||||

| 4. | CAPITAL SHARE TRANSACTIONS |

Capital shares are issued and redeemed by each Fund only in aggregations of a specified number of shares or multiples thereof (“Creation Units”) at net asset value. Except when aggregated in Creation Units, shares of each Fund are not redeemable. Transactions in capital shares for each Fund are disclosed in detail in the statements of changes in net assets.

| 24 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

The consideration for the purchase of Creation Units of a fund in the Company generally consists of the in-kind deposit of a designated portfolio of securities, which constitutes an optimized representation of the securities of that fund’s underlying index, and a specified amount of cash. Certain funds in the Company may be offered in Creation Units solely or partially for cash in U.S. dollars. Investors purchasing and redeeming Creation Units may pay a purchase transaction fee and a redemption transaction fee directly to State Street Bank and Trust Company, the Company’s administrator, to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units, including Creation Units for cash. Investors transacting in Creation Units for cash may also pay an additional variable charge to compensate the relevant fund for certain transaction costs (i.e., stamp taxes, taxes on currency or other financial transactions, and brokerage costs) and market impact expenses relating to investing in portfolio securities.

| 5. | LOANS OF PORTFOLIO SECURITIES |

Each Fund may lend its investment securities to approved borrowers, such as brokers, dealers and other financial institutions. The borrower pledges and maintains with the Fund collateral consisting of cash, an irrevocable letter of credit issued by a bank, or securities issued or guaranteed by the U.S. government. The initial collateral received by each Fund is required to have a value of at least 102% of the current value of the loaned securities for securities traded on U.S. exchanges and a value of at least 105% for all other securities. The collateral is maintained thereafter, at a value equal to at least 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the close of each business day of the Funds and any additional required collateral is delivered to the Funds on the next business day. The risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks, the Funds benefit from a borrower default indemnity provided by BlackRock. BlackRock’s indemnity allows for full replacement of securities lent. Any securities lending cash collateral may be reinvested in certain short-term instruments either directly on behalf of a fund or through one or more joint accounts or money market funds, including those managed by BFA or its affiliates. Each Fund could suffer a loss if the value of an investment purchased with cash collateral falls below the value of the cash collateral received.

As of April 30, 2013, any securities on loan were collateralized by cash. The cash collateral received was invested in money market funds managed by BFA. The value of any securities on loan as of April 30, 2013 and the value of the related collateral are disclosed in the statements of assets and liabilities. Securities lending income, as disclosed in the statements of operations, represents the income earned from the investment of the cash collateral, net of fees and other payments to and from borrowers, and less the fees paid to BTC as securities lending agent.

| 6. | INCOME TAX INFORMATION |

U.S. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. The following permanent differences as of April 30, 2013, attributable to passive foreign investment companies, foreign currency transactions and realized gains (losses) from in-kind redemptions, were reclassified to the following accounts:

| iShares Index Fund | Paid-in Capital |

Undistributed Net Investment Income/Distributions in Excess of Net Investment Income |

Undistributed Net Realized Gain/Accumulated Net Realized Loss |

|||||||||

| Asia/Pacific Dividend 30 |

$ | 926,834 | $ | 5,519 | $ | (932,353 | ) | |||||

| Emerging Markets Dividend |

836,188 | 31,675 | (867,863 | ) | ||||||||

| NOTES TO FINANCIAL STATEMENTS |

25 |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

The tax character of distributions paid during the years ended April 30, 2013 and April 30, 2012 was as follows:

| iShares Index Fund | 2013 | 2012 | ||||||

| Asia/Pacific Dividend 30 |

||||||||

| Ordinary income |

$ | 1,041,458 | $ | 110,295 | ||||

| Return of captial |

— | 3,727 | ||||||

|

|

|

|

|

|||||

| $ | 1,041,458 | $ | 114,022 | |||||

|

|

|

|

|

|||||

| Emerging Markets Dividend |

||||||||

| Ordinary income |

$ | 1,597,355 | $ | 28,496 | ||||

|

|

|

|

|

|||||

As of April 30, 2013, the tax components of accumulated net earnings (losses) were as follows:

| iShares Index Fund | Undistributed Ordinary Income |

Capital Loss Carryforwards |

Net Unrealized Gains (Losses) a |

Qualified Late-Year Losses b |

Total | |||||||||||||||

| Asia/Pacific Dividend 30 |

$ | 267,206 | $ | (199,671 | ) | $ | 4,893,721 | $ | (154,683 | ) | $ | 4,806,573 | ||||||||

| Emerging Markets Dividend |

821,957 | (108,712 | ) | (1,486,579 | ) | (71,072 | ) | (844,406 | ) | |||||||||||

| a | The difference between book-basis and tax-basis unrealized gains (losses) was attributable primarily to the tax deferral of losses on wash sales and the realization for tax purposes of unrealized gains (losses) on investments in passive foreign investment companies. |

| b | The Funds have elected to defer certain qualified late-year losses and recognize such losses in the year ending April 30, 2014. |

As of April 30, 2013, the Funds had non-expiring capital loss carryforwards available to offset future realized capital gains as follows:

| iShares Index Fund |

Non- Expiring |

|||

| Asia/Pacific Dividend 30 |

$ | 199,671 | ||

| Emerging Markets Dividend |

108,712 | |||

The Funds may own shares in certain foreign investment entities, referred to, under U.S. tax law, as “passive foreign investment companies.” The Funds may elect to mark-to-market annually the shares of each passive foreign investment company and would be required to distribute to shareholders any such marked-to-market gains.

As of April 30, 2013, gross unrealized appreciation and gross unrealized depreciation based on cost for federal income tax purposes were as follows:

| iShares Index Fund | Tax Cost | Gross Unrealized Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation (Depreciation) |

||||||||||||

| Asia/Pacific Dividend 30 |

$ | 40,335,778 | $ | 5,399,567 | $ | (505,239 | ) | $ | 4,894,328 | |||||||

| Emerging Markets Dividend |

137,797,935 | 8,092,948 | (9,582,391 | ) | (1,489,443 | ) | ||||||||||

Management has reviewed the tax positions as of April 30, 2013, inclusive of the open tax return years, and has determined that no provision for income tax is required in the Funds’ financial statements.

| 26 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Notes to Financial Statements (Continued)

iSHARES®, INC.

| 7. | SUBSEQUENT EVENTS |

Management has evaluated the impact of all subsequent events on the Funds through the date the financial statements were available to be issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

| NOTES TO FINANCIAL STATEMENTS |

27 |

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

iShares, Inc.:

In our opinion, the accompanying statements of assets and liabilities, including the schedules of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the iShares Asia/Pacific Dividend 30 Index Fund and iShares Emerging Markets Dividend Index Fund (the “Funds”), at April 30, 2013, the results of each of their operations, the changes in each of their net assets and their financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Funds’ management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at April 30, 2013 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

June 21, 2013

| 28 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

iSHARES®, INC.

For the fiscal year ended April 30, 2013, the Funds earned foreign source income and paid foreign taxes which they intend to pass through to their shareholders pursuant to Section 853 of the Internal Revenue Code (the “Code”) as follows:

| iShares Index Fund | Foreign Source Income Earned |

Foreign Taxes Paid |

||||||

| Asia/Pacific Dividend 30 |

$ | 1,293,278 | $ | 44,551 | ||||

| Emerging Markets Dividend |

2,679,916 | 306,716 | ||||||

Under Section 854(b)(2) of the Code, the Funds hereby designate the following maximum amounts as qualified dividend income for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended April 30, 2013:

| iShares Index Fund | Qualified Dividend Income |

|||

| Asia/Pacific Dividend 30 |

$ | 870,832 | ||

| Emerging Markets Dividend |

1,475,374 | |||

In February 2014, shareholders will receive Form 1099-DIV which will include their share of qualified dividend income distributed during the calendar year 2013. Shareholders are advised to check with their tax advisers for information on the treatment of these amounts on their income tax returns.

| TAX INFORMATION |

29 |

Table of Contents

Supplemental Information (Unaudited)

iSHARES®, INC.

Section 19(a) Notices

The amounts and sources of distributions reported are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon each Fund’s investment experience during the year and may be subject to changes based on the tax regulations. Shareholders will receive a Form 1099-DIV each calendar year that will inform them how to report distributions for federal income tax purposes.

| Total Cumulative Distributions for the Fiscal Year |

% Breakdown of the Total Cumulative Distributions for the Fiscal Year |

|||||||||||||||||||||||||||||||

| iShares Index Fund | Net Investment Income |

Net Realized Capital Gains |

Return of Capital |

Total Per Share |

Net Investment Income |

Net Realized Capital Gains |

Return of Capital |

Total Per Share |

||||||||||||||||||||||||

| Asia/Pacific Dividend 30 |

$ | 2.54062 | $ | — | $ | 0.01150 | $ | 2.55212 | 100 | % | — | % | 0 | %a | 100 | % | ||||||||||||||||

| Emerging Markets Dividend |

2.01067 | — | — | 2.01067 | 100 | — | — | 100 | ||||||||||||||||||||||||

| a | Rounds to less than 1%. |

Premium/Discount Information

The tables that follow present information about the differences between the daily market price on secondary markets for shares of a Fund and that Fund’s net asset value. Net asset value, or “NAV,” is the price per share at which each Fund issues and redeems shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of each Fund generally is determined using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of such Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Each Fund’s Market Price may be at, above or below its NAV. The NAV of each Fund will fluctuate with changes in the fair value of its portfolio holdings. The Market Price of each Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of a Fund on a given day, generally at the time NAV is calculated. A premium is the amount that a Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that a Fund is trading below the reported NAV, expressed as a percentage of the NAV.

The following information shows the frequency distributions of premiums and discounts for each of the Funds included in this report. The information shown for each Fund is for five calendar years (or for each full calendar quarter completed after the inception date of such Fund if less than five years) through the date of the most recent quarter-end. The specific periods covered for each Fund are disclosed in the table for such Fund.

| 30 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Supplemental Information (Unaudited) (Continued)

iSHARES®, INC.

Each line in the table shows the number of trading days in which the Fund traded within the premium/discount range indicated. The number of trading days in each premium/discount range is also shown as a percentage of the total number of trading days in the period covered by each table. All data presented here represents past performance, which cannot be used to predict future results.

iShares Asia/Pacific Dividend 30 Index Fund

Period Covered: April 1, 2012 through March 31, 2013

| Premium/Discount Range |

Number of Days |

Percentage of Total Days |

||||||

| Greater than 2.0% and Less than 2.5% |

1 | 0.40 | % | |||||

| Greater than 1.5% and Less than 2.0% |

10 | 4.03 | ||||||

| Greater than 1.0% and Less than 1.5% |

38 | 15.32 | ||||||

| Greater than 0.5% and Less than 1.0% |

87 | 35.08 | ||||||

| Between 0.5% and –0.5% |

99 | 39.93 | ||||||

| Less than –0.5% and Greater than –1.0% |

8 | 3.23 | ||||||

| Less than –1.0% and Greater than –1.5% |

4 | 1.61 | ||||||

| Less than –1.5% |

1 | 0.40 | ||||||

|

|

|

|

|

|||||

| 248 | 100.00 | % | ||||||

|

|

|

|

|

|||||

iShares Emerging Markets Dividend Index Fund

Period Covered: April 1, 2012 through March 31, 2013

| Premium/Discount Range |

Number of Days |

Percentage of Total Days |

||||||

| Greater than 2.5% |

2 | 0.81 | % | |||||

| Greater than 2.0% and Less than 2.5% |

1 | 0.40 | ||||||

| Greater than 1.5% and Less than 2.0% |

9 | 3.63 | ||||||

| Greater than 1.0% and Less than 1.5% |

45 | 18.15 | ||||||

| Greater than 0.5% and Less than 1.0% |

101 | 40.72 | ||||||

| Between 0.5% and –0.5% |

80 | 32.26 | ||||||

| Less than –0.5% and Greater than –1.0% |

6 | 2.42 | ||||||

| Less than –1.0% and Greater than –1.5% |

3 | 1.21 | ||||||

| Less than –1.5% and Greater than –2.0% |

1 | 0.40 | ||||||

|

|

|

|

|

|||||

| 248 | 100.00 | % | ||||||

|

|

|

|

|

|||||

| SUPPLEMENTAL INFORMATION |

31 |

Table of Contents

Director and Officer Information (Unaudited)

iSHARES®, INC.

The Board of Directors has responsibility for the overall management and operations of the Company, including general supervision of the duties performed by BFA and other service providers. Each Director serves until he or she resigns, is removed, dies, retires or becomes incapacitated. The President, Chief Compliance Officer, Treasurer and Secretary shall each hold office until their successors are chosen and qualified, and all other officers shall hold office until he or she resigns or is removed. Directors who are not interested persons of the Company (as defined in the 1940 Act) are referred to as Independent Directors.

The registered investment companies advised by BFA or its affiliates are organized into one complex of closed-end funds, two complexes of open-end funds and one complex of exchange-traded funds (“Exchange-Traded Fund Complex”) (each, a “BlackRock Fund Complex”). Each Fund is included in the BlackRock Fund Complex referred to as the Exchange-Traded Fund Complex. Each Director of iShares, Inc. also serves as a Trustee of iShares Trust, a Director of iShares MSCI Russia Capped Index Fund, Inc. and a Trustee of iShares U.S. ETF Trust and, as a result, oversees a total of 292 funds (as of April 30, 2013) within the Exchange-Traded Fund Complex. With the exception of Robert S. Kapito, the address of each Trustee and Officer is c/o BlackRock, Inc., 400 Howard Street, San Francisco, CA 94105. The address of Mr. Kapito is c/o BlackRock, Inc., Park Avenue Plaza, 55 East 52nd Street, New York, NY 10055. The Board has designated Robert H. Silver as its Independent Chairman. Additional information about the Funds’ Directors and Officers may be found in the Funds’ combined Statement of Additional Information, which is available without charge, upon request, by calling toll-free 1-800-iShares (1-800-474-2737).

Interested Directors and Officers

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| Robert S. Kapitoa (56) |

Director (since 2009). | President and Director, BlackRock, Inc. (since 2006 and 2007, respectively); Vice Chairman of BlackRock, Inc. and Head of BlackRock’s Portfolio Management Group (since its formation in 1998) and BlackRock’s predecessor entities (since 1988); Trustee, University of Pennsylvania (since 2009); President of Board of Directors, Hope & Heroes Children’s Cancer Fund (since 2002); President of the Board of Directors, Periwinkle Theatre for Youth (since 1983). | Director of BlackRock, Inc. (since 2007); Trustee of iShares Trust (since 2009); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| Michael Lathamb (47) |

Director (since 2010); President (since 2007). | Chairman of iShares, BlackRock (since 2011); Global Chief Executive Officer of iShares, BlackRock (2010-2011); Managing Director, BlackRock (since 2009); Head of Americas iShares, Barclays Global Investors (“BGI”) (2007-2009); Director and Chief Financial Officer of Barclays Global Investors International, Inc. (2005-2009); Chief Operating Officer of the Intermediary Investor and Exchange-Traded Products Business, BGI (2003-2007). | Trustee of iShares Trust (since 2010); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| a | Robert S. Kapito is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. |

| b | Michael Latham is deemed to be an “interested person” (as defined in the 1940 Act) of the Company due to his affiliations with BlackRock, Inc. and its affiliates. |

| 32 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Director and Officer Information (Unaudited) (Continued)

iSHARES®, INC.

Independent Directors

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| Robert H. Silver (57) |

Director (since 2007); Independent Chairman (since 2012). | President and Co-Founder of The Bravitas Group, Inc. (since 2006); Director and Vice Chairman of the YMCA of Greater NYC (2001-2011); Broadway Producer (2006-2011); Co-Founder and Vice President of Parentgiving Inc. (since 2008); Director and Member of the Audit and Compensation Committee of EPAM Systems, Inc. (2006-2009); President and Chief Operating Officer of UBS Financial Services Inc. (formerly Pain Webber Inc.) (2003-2005) and various executive positions with UBS and its affiliates (1988-2005); CPA and Audit Manager of KPMG, LLP (formerly Peat Marwick Mitchell) (1977-1983). | Trustee of iShares Trust (since 2007); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011); Independent Chairman of iShares, Trust, iShares MSCI Russia Capped Index Fund, Inc. and iShares U.S. ETF Trust (since 2012). | |||

| Cecilia H. Herbert (64) |

Director (since 2005); Nominating and Governance Committee Chair and Equity Plus Committee Chair (since 2012). | Trustee and Member (since 2011) of the Investment Committee, WNET, the New York public broadcasting company; Director (since 1998) and President (2007-2011) of the Board of Directors, Catholic Charities CYO; Trustee (2002-2011) and Chair of the Finance and Investment Committee (2006-2010), the Thacher School; Member (since 1994) and Chair (1994-2005) of the Investment Committee, Archdiocese of San Francisco. | Trustee of iShares Trust (since 2005); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011); Director of Forward Funds (34 portfolios) (since 2009). | |||

| Charles A. Hurty (69) |

Director (since 2005); Audit Committee Chair (since 2006). | Retired; Partner, KPMG LLP (1968-2001). |

Trustee of iShares Trust (since 2005); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011); Director of GMAM Absolute Return Strategy Fund (1 portfolio) (since 2002); Director of SkyBridge Alternative Investments Multi-Adviser Hedge Fund Portfolios LLC (2 portfolios) (since 2002). | |||

| John E. Kerrigan (57) |

Director (since 2005); Fixed Income Plus Committee Chair (since 2012). | Chief Investment Officer, Santa Clara University (since 2002). | Trustee of iShares Trust (since 2005); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| DIRECTOR AND OFFICER INFORMATION |

33 |

Table of Contents

Director and Officer Information (Unaudited) (Continued)

iSHARES®, INC.

Independent Directors (Continued)

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years |

Other Directorships Held | |||

| John E. Martinez (51) |

Director (since 2003); Securities Lending Committee Chair (since 2012). | Director of FirstREX Agreement Corp. (formerly EquityRock, Inc.) (since 2005). | Trustee of iShares Trust (since 2003); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| George G.C. Parker (74) |

Director (since 2002). | Dean Witter Distinguished Professor of Finance, Emeritus, Stanford University Graduate School of Business (Professor since 1973; Emeritus since 2006). | Trustee of iShares Trust (since 2000); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2010); Trustee of iShares U.S. ETF Trust (since 2011);

Director of Tejon Ranch Company (since 1999); Director of Threshold Pharmaceuticals (since 2004); Director of Colony Financial, Inc. (since 2009); Director of First Republic Bank (since 2010). | |||

| Madhav V. Rajan (48) |

Director (since 2011); 15(c) Committee Chair (since 2012). | Robert K. Jaedicke Professor of Accounting and Senior Associate Dean for Academic Affairs and Head of MBA Program, Stanford University Graduate School of Business (since 2001); Professor of Law (by courtesy), Stanford Law School (since 2005); Visiting Professor, University of Chicago (2007-2008). | Trustee of iShares Trust (since 2011); Director of iShares MSCI Russia Capped Index Fund, Inc. (since 2011); Trustee of iShares U.S. ETF Trust (since 2011). | |||

| 34 | 2013 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Director and Officer Information (Unaudited) (Continued)

iSHARES®, INC.

Officers

| Name (Age) | Position(s) (Length of Service) |

Principal Occupation(s) During the Past 5 Years | ||

| Edward B. Baer (44) |

Vice President and Chief Legal Officer (since 2012). |

Managing Director of Legal & Compliance, BlackRock (since 2006); Director of Legal & Compliance, BlackRock (2004-2006). | ||

| Eilleen M. Clavere (60) |

Secretary (since 2007). |

Director of Global Fund Administration, BlackRock (since 2009); Director of Legal Administration of Intermediary Investor Business, BGI (2006-2009); Legal Counsel and Vice President of Atlas Funds, Atlas Advisers, Inc. and Atlas Securities, Inc. (2005-2006); Counsel of Kirkpatrick & Lockhart LLP (2001-2005). | ||

| Jack Gee (53) |

Treasurer and Chief Financial Officer (since 2008). |

Managing Director, BlackRock (since 2009); Senior Director of Fund Administration of Intermediary Investor Business, BGI (2009); Director of Fund Administration of Intermediary Investor Business, BGI (2004-2009). | ||

| Scott Radell (44) |

Executive Vice President (since 2012). |

Managing Director, BlackRock (since 2009); Head of Portfolio Solutions, BlackRock (since 2009); Head of Portfolio Solutions, BGI (2007-2009); Credit Portfolio Manager, BGI (2005-2007); Credit Research Analyst, BGI (2003-2005). | ||

| Amy Schioldager (50) |

Executive Vice President (since 2007). |

Senior Managing Director, BlackRock (since 2009); Global Head of Index Equity, BGI (2008-2009); Global Head of U.S. Indexing, BGI (2006-2008); Head of Domestic Equity Portfolio Management, BGI (2001-2006). | ||

| Ira P. Shapiro (50) |