Form 497 for iShares Inc.

|

|

|

|

|

September 1, 2012 (as revised April 15, 2013) |

2012 Prospectus

iShares Asia/Pacific Dividend 30 Index Fund

DVYA • NYSE ARCA

The Securities and Exchange Commission

(“SEC”) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Table of Contents

S&P is a registered trademark

of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC

(“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by BlackRock Fund Advisors or its affiliates. The “Dow Jones Asia/Pacific Select Dividend 30 IndexSM” is a product of S&P Dow Jones Indices LLC or its affiliates, and has been licensed for use by BlackRock Fund Advisors or its affiliates. iShares® is a registered trademark of BlackRock Fund Advisors or its affiliates. The Fund is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow

Jones, S&P, their respective affiliates, and none of S&P Dow Jones Indices LLC, Dow Jones, S&P nor their respective affiliates makes any representation regarding the advisability of investing in such product(s).

i

[THIS PAGE INTENTIONALLY LEFT BLANK]

iSHARES® ASIA/PACIFIC DIVIDEND 30 INDEX FUND

|

|

|

| Ticker: DVYA |

|

Stock Exchange: NYSE Arca |

Investment Objective

The

iShares Asia/Pacific Dividend 30 Index Fund (the “Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Dow Jones Asia/Pacific Select Dividend 30 Index (the

“Underlying Index”).

Fees and Expenses

The following table describes the fees and expenses that you will incur if you own shares of the Fund. The investment advisory agreement between iShares, Inc. (the

“Company”) and BlackRock Fund Advisors (“BFA”) (the “Investment Advisory Agreement”) provides that BFA will pay all operating expenses of the Fund, except interest expenses, taxes, brokerage expenses, future

distribution fees or expenses, and extraordinary expenses.

You may also incur usual and customary brokerage commissions when buying or selling shares of

the Fund, which are not reflected in the example that follows:

|

|

|

|

|

|

|

| Annual Fund Operating Expenses

(ongoing expenses that

you pay each year as a

percentage of the value of your investments) |

| Management

Fees |

|

Distribution and

Service (12b-1)

Fees |

|

Other

Expenses |

|

Total Annual

Fund

Operating

Expenses |

| 0.49% |

|

None |

|

None |

|

0.49% |

Example. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in

other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the

Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

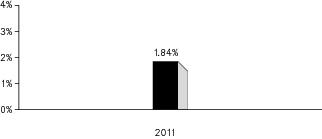

Portfolio Turnover. The Fund may pay transaction costs, such as commissions, when it buys and sells securities (or

“turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund

Operating Expenses or in the Example, affect the Fund’s performance. From inception, February 23, 2012, to the most recent fiscal year end, the Fund’s portfolio turnover rate was 1% of the average value of its portfolio.

S-1

Principal Investment Strategies

The Underlying Index measures the stock performance of high dividend paying companies listed in Australia, China, Hong Kong, Japan, New Zealand and Singapore. The Underlying Index measures the performance of a

selected group of equity securities issued by companies that have provided relatively high dividend yields on a consistent basis over time. Dividend yield is calculated using a stock’s unadjusted indicated annual dividend (not including any

special dividends) divided by its unadjusted price.

The Underlying Index universe is defined as all companies in the Dow Jones

Global IndexesSM (“DJGI”) country indexes for the represented

markets that pass the following screens for dividend quality: (i) the company must have paid dividends in each of the previous three years; (ii) the company’s previous-year dividend-per-share ratio must be greater than or equal to its

three-year average annual dividend per-share ratio; (iii) the company’s five-year average payout ratio must be less than 1.5 times the five-year average payout ratio of the corresponding DJGI country index, or less than 85%, whichever is

smaller; and (iv) the company must have an average daily trading volume of at least $3 million over the past three months. A DJGI country index’s components are included in the index universe regardless of their dividend payout ratio or

trading volume. Components primarily include consumer services, financial and telecommunications companies. The components of the Underlying Index, and the degree to which these components represent certain industries, may change over time.

BFA uses a “passive” or indexing approach to try to achieve the Fund’s investment objective. Unlike many investment companies, the Fund

does not try to “beat” the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued.

Indexing

may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Indexing seeks to achieve lower costs and better after-tax

performance by keeping portfolio turnover low in comparison to actively managed investment companies.

BFA uses a representative sampling indexing

strategy to manage the Fund. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to the Underlying Index. The securities

selected are expected to have, in the aggregate, investment characteristics (based on factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar

to those of the Underlying Index. The Fund may or may not hold all of the securities in the Underlying Index.

The Fund generally invests at least 90% of

its assets in securities of the Underlying Index or in depositary receipts representing securities in the Underlying Index. The Fund may invest the remainder of its assets in securities not included in the Underlying Index, but which BFA believes

will help the Fund track the Underlying Index, and in other investments, including futures

S-2

contracts, options on futures contracts, options, and swaps related to its Underlying Index, as well as cash and cash equivalents, including shares of money market funds advised by BFA or its

affiliates.

The Fund may lend securities representing up to one-third of the value of the Fund’s total assets (including the value of the

collateral received).

The Underlying Index is sponsored by an organization (the “Index Provider”) that is independent of the Fund and BFA. The

Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. The Fund’s Index Provider is S&P Dow Jones Indices

LLC.

Industry Concentration Policy. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular

industry or group of industries, which may include large-, mid- or small-capitalization companies, to approximately the same extent that the Underlying Index is concentrated. For purposes of this limitation, securities of the U.S. government

(including its agencies and instrumentalities) and repurchase agreements collateralized by U.S. government securities are not considered to be issued by members of any industry.

Summary of Principal Risks

As with any investment, you could lose all or part of your investment in the Fund,

and the Fund’s performance could trail that of other investments. The Fund is subject to the principal risks noted below, any of which may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total

return and ability to meet its investment objective.

Asset Class Risk. Securities in the Underlying Index or in the Fund’s

portfolio may underperform in comparison to the general securities markets or other asset classes.

Concentration Risk. To the extent that

the Fund’s investments are concentrated in a particular issuer or issuers in a particular country, group of countries, region, market, industry, group of industries, sector or asset class, the Fund may be susceptible to loss due to adverse

occurrences affecting that issuer or issuers, country, group of countries, region, market, industry, group of industries, sector or asset class.

Consumer Services Sector Risk. The consumer services sector may be affected by changes in the domestic and international economy, exchange rates,

competition, consumers’ disposable income and consumer preferences.

Currency Risk. Because the Fund’s NAV is determined

in U.S. dollars, the Fund’s NAV could decline if the currency of a non-U.S. market in which the Fund invests depreciates against the U.S. dollar.

Custody Risk. Less developed markets are more likely to experience problems with the clearing and settling of trades and the holding of

securities by local banks, agents and depositories.

Dividend-Paying Stock Risk. The Fund’s emphasis on dividend-paying stocks

involves the risk that such stocks may fall out of favor with investors and underperform the market. Also, a company may reduce or eliminate its dividend.

S-3

Equity Securities Risk. Equity securities are subject to changes in value and their values may be

more volatile than other asset classes.

Financial Sector Risk. Performance of companies in the financial sector may be adversely

impacted by many factors, including, among others, government regulations, economic conditions, credit rating downgrades, changes in interest rates, and decreased liquidity in credit markets. This sector has experienced significant losses in the

recent past, and the impact of more stringent capital requirements and of recent or future regulation on any individual financial company or on the sector as a whole cannot be predicted.

Geographic Risk. A natural or other disaster could occur in a geographic region in which the Fund invests, which could affect the economy or particular business operations of companies in the

specific geographic region, causing an adverse impact on the Fund’s investments in the affected region.

Issuer Risk. Fund

performance depends on the performance of individual securities to which the Fund has exposure. Changes to the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. There is no

guarantee that an issuer that paid dividends in the past will continue to do so in the future or will continue paying dividends at the same level.

Management Risk. As the Fund may not fully replicate the Underlying Index, it is subject to the risk that BFA’s investment management

strategy may not produce the intended results.

Market Risk. The Fund could lose money over short periods due to short-term market

movements and over longer periods during market downturns.

Market Trading Risk. The Fund faces numerous market trading risks,

including the potential lack of an active market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE

FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

Mid-Capitalization Companies Risk.

The Fund may invest in the securities of mid-capitalization companies. Compared to large-capitalization companies, mid-capitalization companies may be less stable

and more susceptible to adverse developments, and their securities may be more volatile and less liquid.

Non-Diversification Risk.

The Fund may invest a large percentage of its assets in securities issued by or representing a small number of issuers. As a result, the Fund’s performance may depend on the performance of a small number of issuers.

Non-U.S. Securities Risk. Investments in the securities of non-U.S. issuers are subject to the risks associated with investing in those

non-U.S. markets, such as heightened risks of inflation or nationalization. The Fund may lose money due to political, economic and geographic events affecting a non-U.S. issuer or market. The Fund is specifically exposed to Asian Economic Risk

and Australasian Economic Risk.

Passive Investment Risk. The Fund is not actively managed and BFA does not attempt to

take defensive positions under any market conditions, including declining markets.

S-4

Reliance on Trading Partners Risk.

The Fund invests in countries whose economies are heavily dependent upon trading with key partners. Any reduction in this trading may have an adverse impact on the

Fund’s investments. The Fund is specifically exposed to Asian Economic Risk and U.S. Economic Risk.

Risk of Investing in

Australia. The Fund’s investment in Australian issuers may subject the Fund to regulatory, political, currency, security, and economic risk specific to Australia. The Australian economy is heavily dependent on exports from the

agricultural and mining sectors. This makes the Australian economy susceptible to fluctuations in the commodity markets. Australia is also dependent on trading with key trading partners. Any reduction in this trading may cause an adverse impact on

the Australian economy. As result, such risks may adversely affect the value of the Fund’s investments.

Securities Lending Risk. The

Fund may engage in securities lending. Securities lending involves the risk that the Fund may lose money because the borrower of the Fund’s loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose

money in the event of a decline in the value of the collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund.

Telecommunications Sector Risk. Companies in the telecommunications sector may be affected by industry competition, substantial capital requirements,

government regulation and obsolescence of telecommunications products and services due to technological advancement.

Tracking Error

Risk. Tracking error is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of imperfect correlation between the Fund’s holdings of portfolio securities and those in

the Underlying Index, pricing differences, the Fund’s holding of cash, differences on timing of the accrual of dividends, changes to the Underlying Index or the need to meet various regulatory requirements. This risk may be heightened during

times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not.

Valuation Risk. The sales price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ

from the value used by the Underlying Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. In addition, the value of the securities in the Fund’s portfolio may change

on days when shareholders will not be able to purchase or sell the Fund’s shares.

Performance Information

As of the date of the Fund’s prospectus (the “Prospectus”), the Fund has been in operation for less than one full calendar year and therefore does

not report its performance information.

Management

Investment Adviser. BlackRock Fund Advisors.

S-5

Portfolio Managers. Rene Casis, Diane Hsiung, Jennifer Hsui and Greg Savage (the “Portfolio

Managers”) are primarily responsible for the day-to-day management of the Fund. Each Portfolio Manager supervises a portfolio management team. Mr. Casis, Ms. Hsiung, Ms. Hsui and Mr. Savage have been Portfolio Managers of

the Fund since 2012.

Purchase and Sale of Fund Shares

The Fund is an exchange-traded fund (commonly referred to as an “ETF”). Individual Fund shares may only be purchased and sold on a national securities exchange through a broker-dealer. The price of Fund

shares is based on market price, and because ETF shares trade at market prices rather than NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount). The Fund will only issue or redeem shares that have been

aggregated into blocks of 50,000 shares or multiples thereof (“Creation Units”) to authorized participants who have entered into agreements with the Fund’s distributor. The Fund generally will issue or redeem Creation Units in return

for a designated portfolio of securities (and an amount of cash) that the Fund specifies each day.

Tax Information

The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement

such as a 401(k) plan or an individual retirement account (“IRA”).

Payments to Broker-Dealers and other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), BFA or other related companies may pay

the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems or other services related to the sale or promotion of the Fund. These payments may

create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

S-6

More Information About the Fund

This Prospectus contains important information about investing in the Fund. Please read this Prospectus carefully before you make any investment decisions. Additional information regarding the Fund is available at

www.iShares.com.

BFA is the investment adviser to the Fund. Shares of the Fund are listed for trading on NYSE Arca, Inc. (“NYSE Arca”). The

market price for a share of the Fund may be different from the Fund’s most recent NAV.

ETFs are funds that trade like other publicly traded

securities. The Fund is designed to track an index. Similar to shares of an index mutual fund, each share of the Fund represents a partial ownership in an underlying portfolio of securities intended to track a market index. Unlike shares of a mutual

fund, which can be bought and redeemed from the issuing fund by all shareholders at a price based on NAV, shares of the Fund may be purchased or redeemed directly from the Fund at NAV solely by authorized participants. Also unlike shares of a mutual

fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day.

The Fund invests in a particular segment of the securities markets and seeks to track the performance of a securities index that generally is not representative of

the market as a whole. The Fund is designed to be used as part of broader asset allocation strategies. Accordingly, an investment in the Fund should not constitute a complete investment program.

An index is a theoretical financial calculation while the Fund is an actual investment portfolio. The performance of the Fund and the Underlying Index may vary due

to transaction costs, non-U.S. currency valuations, asset valuations, corporate actions (such as mergers and spin-offs), timing variances and differences between the Fund’s portfolio and the Underlying Index resulting from legal restrictions

(such as diversification requirements) that apply to the Fund but not to the Underlying Index or to the use of representative sampling. “Tracking error” is the divergence between the performance (return) of the Fund’s portfolio and

that of the Underlying Index. BFA expects that, over time, the Fund’s tracking error will not exceed 5%. Because the Fund uses a representative sampling indexing strategy, it can be expected to have a larger tracking error than if it used a

replication indexing strategy. “Replication” is an indexing strategy in which a fund invests in substantially all of the securities in its underlying index in approximately the same proportions as in the underlying index.

An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, BFA

or any of its affiliates.

The Fund’s investment objective and the Underlying Index may be changed without shareholder approval.

A Further Discussion of Principal Risks

The Fund is subject to various risks, including the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total

return and ability

1

to meet its investment objective. You could lose all or part of your investment in the Fund, and the Fund could underperform other investments.

Asian Economic Risk. Certain Asian economies have experienced over-extension of credit, currency devaluations and restrictions, high unemployment, high

inflation, decreased exports and economic recessions. Economic events in any one Asian country may have a significant economic effect on the entire Asian region, as well as on major trading partners outside Asia, and any adverse event in one Asian

market may have a significant adverse effect on other Asian economies.

Asset Class Risk. The securities in the Underlying Index or in the

Fund’s portfolio may underperform the returns of other securities or indexes that track other countries, groups of countries, regions, industries, groups of industries, markets, asset classes or sectors. Various types of securities or indexes

tend to experience cycles of outperformance and underperformance in comparison to the general securities markets.

Australasian Economic Risk. The

economies of Australasia, which include Australia and New Zealand, are dependent on exports from the agricultural and mining sectors. This makes Australasian economies susceptible to fluctuations in the commodity markets. Australasian economies are

also increasingly dependent on their growing service industries. Because the economies of Australasia are dependent on the economies of Asia, Europe and the United States as key trading partners and investors, reduction in spending by any of these

trading partners on Australasian products and services, or negative changes in any of these economies, may cause an adverse impact on some or all of the Australasian economies.

Concentration Risk. To the extent that the Fund’s portfolio reflects the Underlying Index’s concentration in the securities of a particular issuer or issuers in a particular country, group of

countries, region, market, industry, group of industries, sector or asset class, the Fund may be adversely affected by the performance of those securities, may be subject to increased price volatility and may be more susceptible to adverse economic,

market, political or regulatory occurrences affecting that issuer or issuers, country, group of countries, region, market, industry, group of industries, sector or asset class.

Consumer Services Sector Risk. The success of consumer product manufacturers and retailers (including food and drug retailers, general retailers, media, and travel and leisure) is tied closely to the

performance of the domestic and international economy, interest rates, exchange rates and consumer confidence. The consumer services sector depends heavily on disposable household income and consumer spending. Companies in the consumer services

sector may be subject to severe competition, which may also have an adverse impact on their profitability. Changes in consumer demographics and preferences may affect the success of consumer products.

Currency Risk. Because the Fund’s NAV is determined on the basis of the U.S. dollar, investors may lose money if the currency of a non-U.S. market in

which the Fund invests depreciates against the U.S. dollar, even if the local currency value of the Fund’s holdings in that market increases.

2

Custody Risk. Custody risk refers to the risks inherent in the process of clearing and settling trades and the

holding of securities by local banks, agents and depositories. Low trading volumes and volatile prices in less developed markets may make trades harder to complete and settle, and governments or trade groups may compel local agents to hold

securities in designated depositories that may not be subject to independent evaluation. Local agents are held only to the standards of care of their local markets. In general, the less developed a country’s securities market is, the greater

the likelihood of custody problems.

Dividend-Paying Stock Risk. The Fund’s strategy of investing in dividend-paying stocks involves the risk

that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend-paying stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies

could reduce or eliminate the payment of dividends in the future or the anticipated acceleration of dividends could not occur. Depending upon market conditions, dividend-paying stocks that meet the Fund’s investment criteria may not be widely

available and/or may be highly concentrated in only a few market sectors.

Equity Securities Risk. The Fund invests in equity securities, which

are subject to changes in value that may be attributable to market perception of a particular issuer or to general stock market fluctuations that affect all issuers. Investments in equity securities may be more volatile than investments in other

asset classes.

Financial Sector Risk. Companies in the financial sector of an economy are often subject to extensive governmental regulation and,

recently, government intervention and the potential for additional regulation, which may adversely affect the scope of their activities, the prices they can charge and the amount of capital they must maintain. Governmental regulation may change

frequently and may have significant adverse consequences for companies in the financial sector, including effects not intended by such regulation. The impact of recent or future regulation in various countries on any individual financial company or

on the sector as a whole cannot be predicted. Certain risks may impact the value of investments in the financial sector more severely than investments outside this sector, including the risks associated with companies that operate with substantial

financial leverage. Companies in the financial sector may also be adversely affected by increases in interest rates and loan losses, decreases in the availability of money or asset valuations, credit rating downgrades and adverse conditions in other

related markets. Insurance companies, in particular, may be subject to severe price competition and/or rate regulation, which may have an adverse impact on their profitability. Over the past few years, the deterioration of the credit markets has

affected a broad range of mortgage, asset-backed, auction rate, sovereign debt and other securities markets, including U.S. and non-U.S. credit and interbank money markets, thereby affecting a wide range of financial institutions and markets. A

number of large financial institutions have failed, have merged with other companies or have had significant government infusions of capital. This situation has created instability in the financial markets and caused certain financial companies to

incur large losses. Some financial companies have experienced declines in the valuations of their assets, taken actions to raise capital (such as the issuance of debt or equity securities), or even ceased operations. Some financial companies have

borrowed significant

3

amounts of capital from government sources and may face future government-imposed restrictions on their businesses or increased government intervention. Those actions have caused the securities

of many financial companies to decline in value. The financial sector is particularly sensitive to fluctuations in interest rates.

Geographic Risk.

Some markets in which the Fund invests are located in parts of the world that have historically been prone to natural disasters, such as earthquakes, volcanoes, droughts, floods, hurricanes and tsunamis, and are economically sensitive to

environmental events. Any natural or other disaster could have a significant adverse impact on the economies of these geographic areas, causing an adverse impact on the Fund’s investments in the affected region.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. Any issuer of these securities

may perform poorly, causing the value of its securities to decline. Poor performance may be caused by poor management decisions, competitive pressures, changes in technology, expiration of patent protection, disruptions in supply, labor problems or

shortages, corporate restructurings, fraudulent disclosures or other factors. Issuers may, in times of distress or at their own discretion, decide to reduce or eliminate dividends, which may also cause their stock prices to decline.

Management Risk. The Fund may not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. As a result, the Fund is

subject to the risk that BFA’s investment management strategy, the implementation of which is subject to a number of constraints, may not produce the intended results.

Market Risk. The Fund could lose money due to short-term market movements and over longer periods during market downturns. Securities may decline in value due to factors affecting securities markets

generally or particular industries represented in the markets. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect

a particular industry or group of industries. During a general downturn in the securities markets, multiple asset classes may be negatively affected.

Market Trading Risk

Absence of Active Market.

Although shares of the Fund are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained.

Risk of Secondary Listings. The Fund’s shares may be listed or traded on U.S. and non-U.S. stock exchanges other than the U.S. stock exchange where the Fund’s primary listing is maintained. There

can be no assurance that the Fund’s shares will continue to trade on any such stock exchange or in any market or that the Fund’s shares will continue to meet the requirements for listing or trading on any exchange or in any market. The

Fund’s shares may be less actively traded in certain markets than others, and investors are subject to the execution and settlement risks and market standards of the market where they or their broker direct their trades for execution. Certain

information available to investors who trade Fund shares on a U.S. stock exchange during regular U.S. market hours may not be available to investors who trade in other markets, which may result in secondary market prices in such markets being less

efficient.

4

Secondary Market Trading Risk. Shares of the Fund may trade in the secondary market at times when the Fund does

not accept orders to purchase or redeem shares. At such times, shares may trade in the secondary market with more significant premiums or discounts than might be experienced at times when the Fund accepts purchase and redemption orders.

Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or other reasons. In addition, trading in Fund shares on a

stock exchange or in any market may be subject to trading halts caused by extraordinary market volatility pursuant to “circuit breaker” rules on the stock exchange or market. There can be no assurance that the requirements necessary to

maintain the listing or trading of Fund shares will continue to be met or will remain unchanged.

Shares of the Fund, similar to shares of other issuers

listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility associated with short selling.

Shares of

the Fund May Trade at Prices Other Than NAV. Shares of the Fund trade on stock exchanges at prices at, above or below their most recent NAV. The NAV of the Fund is calculated at the end of each business day and fluctuates with changes in the

market value of the Fund’s holdings since the most recent calculation. The trading prices of the Fund’s shares fluctuate continuously throughout trading hours based on market supply and demand rather than NAV. As a result, the trading

prices of the Fund’s shares may deviate significantly from NAV during periods of market volatility. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV. However, because shares

can be created and redeemed in Creation Units at NAV (unlike shares of many closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their NAVs), BFA believes that large discounts or premiums to the NAV

of the Fund are not likely to be sustained over the long-term. While the creation/ redemption feature is designed to make it likely that the Fund’s shares normally will trade on stock exchanges at prices close to the Fund’s next calculated

NAV, exchange prices are not expected to correlate exactly with the Fund’s NAV due to timing reasons as well as market supply and demand factors. In addition, disruptions to creations and redemptions or extreme market volatility may result in

trading prices for shares of the Fund that differ significantly from its NAV.

Costs of Buying or Selling Fund Shares. Buying or selling Fund

shares on an exchange involves two types of costs that apply to all securities transactions. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission or other charges imposed by brokers as determined

by that broker. In addition, you may incur the cost of the “spread,” that is, the difference between what investors are willing to pay for Fund shares (the “bid” price) and the price at which they are willing to sell Fund shares

(the “ask” price). Because of the costs inherent in buying or selling Fund shares, frequent trading may detract significantly from investment results and an investment in Fund shares may not be advisable for investors who anticipate

regularly making small investments.

Mid-Capitalization Companies Risk. Stock prices of mid-capitalization companies may be more volatile than

those of large-capitalization companies and, therefore, the

5

Fund’s share price may be more volatile than those of funds that invest a larger percentage of their assets in stocks issued by large-capitalization companies. Stock prices of

mid-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business or economic developments, and the stocks of mid-capitalization companies may be less liquid, making it difficult for the Fund to

buy and sell them. In addition, mid-capitalization companies generally have less diverse product lines than large-capitalization companies and are more susceptible to adverse developments related to their products.

Non-Diversification Risk. The Fund is classified as “non-diversified.” This means that the Fund may invest a large percentage of its assets in

securities issued by or representing a small number of issuers. As a result, the Fund may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers.

Non-U.S. Securities Risk. Investments in the securities of non-U.S. issuers are subject to all of the risks of investing in the markets where

such issuers are located, including heightened risks of inflation or nationalization and market fluctuations caused by economic and political developments. As a result of investing in non-U.S. securities, the Fund may be subject to increased risk of

loss caused by any of the factors listed below:

| n |

|

Lower levels of liquidity and market efficiency; |

| n |

|

Greater securities price volatility; |

| n |

|

Exchange rate fluctuations and exchange controls; |

| n |

|

Less availability of public information about issuers; |

| n |

|

Limitations on foreign ownership of securities; |

| n |

|

Imposition of withholding or other taxes; |

| n |

|

Imposition of restrictions on the expatriation of the funds or other assets of the Fund; |

| n |

|

Higher transaction and custody costs and delays in settlement procedures; |

| n |

|

Difficulties in enforcing contractual obligations; |

| n |

|

Lower levels of regulation of the securities market; |

| n |

|

Weaker accounting, disclosure and reporting requirements; and |

| n |

|

Legal principles relating to corporate governance, directors’ fiduciary duties and liabilities and stockholders’ rights in markets in which the Fund

invests may differ and/or may not be as extensive or protective as those that apply in the United States. |

Passive Investment Risk.

The Fund is not actively managed and may be affected by a general decline in market segments related to the Underlying Index. The Fund invests in securities included in, or representative of, the Underlying Index, regardless of their investment

merits. BFA generally does not attempt to take defensive positions under any market conditions, including declining markets.

6

Reliance on Trading Partners Risk. The economies of some countries in which the Fund invests are dependent on

trade with certain key trading partners. Reduction in spending on the products and services of these countries, institution of tariffs or other trade barriers by any of their key trading partners or a slowdown in the economies of any of their key

trading partners may cause an adverse impact on the economies of such countries.

Risk of Investing in Australia. Investment in Australian issuers

may subject the Fund to regulatory, political, currency, security, and economic risk specific to Australia. The Australian economy is heavily dependent on exports from the agricultural and mining sectors. As a result, the Australian economy is

susceptible to fluctuations in the commodity markets. The Australian economy is also becoming increasingly dependent on its growing service industry. The Australian economy is dependent on trading with key trading partners, including the United

States, China, Japan, Singapore and certain European countries. Reduction in spending on Australian products and services, or changes in any of the economies may cause an adverse impact on the Australian economy. As a result, such risks, among

others, may adversely affect the value of the Fund’s investments.

Securities Lending Risk. The Fund may engage in securities lending.

Securities lending involves the risk that the Fund may lose money because the borrower of the Fund’s loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the

value of the collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund.

Telecommunications Sector Risk. The telecommunications sector is subject to extensive government regulation. The costs of complying with governmental

regulations, delays or failure to receive required regulatory approvals, or the enactment of new adverse regulatory requirements may negatively affect the business of the telecommunications companies. Government actions around the world,

specifically in the area of pre-marketing clearance of products and prices, can be arbitrary and unpredictable. Companies in the telecommunications sector may encounter distressed cash flows due to the need to commit substantial capital to meet

increasing competition, particularly in formulating new products and services using new technology. Technological innovations may make the products and services of telecommunications companies obsolete.

Tracking Error Risk. Tracking error is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of

imperfect correlation between the Fund’s holdings of portfolio securities and those in the Underlying Index, pricing differences, the Fund’s holding of cash, differences on timing of the accrual of dividends, changes to the Underlying

Index or the need to meet various regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while

the Underlying Index does not.

U.S. Economic Risk. The United States is a significant trading partner of or foreign investor in certain countries

in which the Fund invests and the economies of these

7

countries may be particularly affected by changes in the U.S. economy. Decreasing U.S. imports, new trade regulations, changes in the U.S. dollar exchange rate or a recession in the United States

may have a material adverse effect on economies of the countries in which the Fund invests and, as a result, securities to which the Fund has exposure.

Valuation Risk. The sales price the Fund could receive for a security may differ from the Fund’s valuation of the security and may differ from the value

used by the Underlying Index, particularly for securities that trade in low volume or volatile markets or that are valued using a fair value methodology. Because non-U.S. exchanges may be open on days when the Fund does not price its shares, the

value of the securities in the Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares. In addition, for purposes of calculating the Fund’s NAV, the value of assets denominated in

non-U.S. currencies is converted into U.S. dollars using exchange rates deemed appropriate by BFA. This conversion may result in a difference between the prices used to calculate the Fund’s NAV and the prices used by the Underlying Index,

which, in turn, could result in a difference between the Fund’s performance and the performance of the Underlying Index.

A Further Discussion of Other Risks

The

Fund may also be subject to certain other risks associated with its investments and investment strategies.

Consumer Goods Sector Risk. The

consumer goods sector may be strongly affected by social trends, marketing campaigns and other factors affecting consumer demand. Governmental regulation affecting the use of various food additives may affect the profitability of certain consumer

goods companies represented in the Underlying Index. In addition, tobacco companies may be adversely affected by new laws, regulations and litigation. Many consumer goods in the United States may also be marketed globally, and such consumer goods

companies may be affected by the demand and market conditions in non-U.S. countries.

Industrials Sector Risk. The stock prices of companies in

the industrials sector may be affected by supply and demand, both for their specific product or service and for industrials sector products in general. The products of manufacturing companies may face obsolescence due to rapid technological

developments and frequent new product introduction. Government regulations, world events, economic conditions and exchange rates affect the performance of companies in the industrials sector. Companies in the industrials sector may be adversely

affected by liability for environmental damage and product liability claims. The industrials sector may also be adversely affected by changes or trends in commodity prices, which may be influenced by unpredictable factors.

Risk of Investing in Emerging Markets. Investments in emerging markets are subject to a greater risk of loss than investments in more developed markets. This

is due to, among other things, the potential for greater market volatility, lower trading volume, inflation, political and economic instability, greater risk of a market shutdown and more governmental limitations on foreign investments than

typically found in more developed markets. In addition, emerging markets often have less uniformity in accounting and reporting requirements, unreliable securities valuation and greater risks

8

associated with custody of securities. Certain emerging market countries may also lack the infrastructure necessary to attract large amounts of foreign trade and investment.

Structural Risk. Certain of the countries in which the Fund invests may be subject to risks relating to economic, labor and political risks. Any of these

risks, individually or in the aggregate, could adversely affect investments in the Fund:

Currency Risk. The Japanese yen has fluctuated widely at

times and any increase in its value may cause a decline in exports that could weaken the economy.

Labor Risk. Japan has an aging workforce. It is

a labor market undergoing fundamental structural changes, as traditional lifetime employment clashes with the need for increased labor mobility, which may adversely affect Japan’s economic competitiveness. In Singapore, rising labor costs and

increasing environmental consciousness have led some labor-intensive industries to relocate to countries with cheaper work forces, and continued labor outsourcing may adversely affect the Singaporean economy.

Large Government Debt Risk. The Japanese economy faces several concerns, including a financial system with large levels of nonperforming loans,

over-leveraged corporate balance sheets, extensive cross-ownership by major corporations, a changing corporate governance structure, and large government deficits.

Political Risk. Historically, Japan has been subject to unpredictable national politics and may experience frequent political turnover. Future political developments may lead to changes in policy that might

adversely affect the Fund’s investments.

Portfolio Holdings Information

A description of the Company’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available in the Fund’s Statement of Additional Information

(“SAI”). The top holdings of the Fund can be found at www.iShares.com. Fund fact sheets provide information regarding the Fund’s top holdings and may be requested by calling 1-800-iShares (1-800-474-2737).

Management

Investment Adviser. As investment adviser, BFA has overall responsibility for the general management and administration of the Company. BFA provides an

investment program for the Fund and manages the investment of the Fund’s assets. In managing the Fund, BFA may draw upon the research and expertise of its asset management affiliates with respect to certain portfolio securities. In seeking to

achieve the Fund’s investment objective, BFA uses teams of portfolio managers, investment strategists and other investment specialists. This team approach brings together many disciplines and leverages BFA’s extensive resources.

Pursuant to the Investment Advisory Agreement between BFA and the Company (entered into on behalf of the Fund), BFA is responsible for substantially all

expenses of the Fund, except interest expenses, taxes, brokerage expenses, future distribution fees or expenses and extraordinary expenses.

For its

investment advisory services to the Fund, BFA is entitled to receive a management fee from the Fund based on a percentage of the Fund’s average daily net

9

assets, at an annual rate of 0.49%. Because the Fund has been in operation for less than one full fiscal year, this percentage reflects the rate at which BFA will be paid.

BFA is located at 400 Howard Street, San Francisco, CA 94105. It is an indirect wholly owned subsidiary of BlackRock, Inc. (“BlackRock”). As of

June 30, 2012, BFA and its affiliates provided investment advisory services for assets in excess of $3.56 trillion. BFA and its affiliates deal, trade and invest for their own accounts in the types of securities in which the Fund may also

invest.

A discussion regarding the basis for the Company’s Board of Directors’ (the “Board”) approval of the Investment Advisory

Agreement with BFA will be available in the Fund’s semi-annual report for the period ending October 31.

Portfolio Managers. Rene Casis,

Diane Hsiung, Jennifer Hsui and Greg Savage are primarily responsible for the day-to-day management of the Fund. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but not limited to, investing

cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio

management team that have more limited responsibilities.

Rene Casis has been employed by BFA (formerly, Barclays Global Fund Advisors

(“BGFA”)) and BlackRock Institutional Trust Company, N.A. (“BTC”) (formerly, Barclays Global Investors, N.A. (“BGI”)) as a senior portfolio manager since 2009. From 2005 to 2009, Mr. Casis was a trader at Barclays

Capital. Prior to that, Mr. Casis was a portfolio manager from 2000 to 2005 for BGFA and BGI. Mr. Casis has been a Portfolio Manager of the Fund since 2012.

Diane Hsiung has been employed by BFA and BTC as a senior portfolio manager since 2007. Prior to that, Ms. Hsiung was a portfolio manager from 2002 to 2006 for BGFA and BGI. Ms. Hsiung has been a

Portfolio Manager of the Fund since 2012.

Jennifer Hsui has been employed by BFA and BTC as a senior portfolio manager since 2007. Prior to that,

Ms. Hsui was a portfolio manager from 2006 to 2007 for BGFA and BGI. Ms. Hsui has been a Portfolio Manager of the Fund since 2012.

Greg Savage

has been employed by BFA and BTC as a senior portfolio manager since 2006. Prior to that, Mr. Savage was a portfolio manager from 2001 to 2006 for BGFA and BGI. Mr. Savage has been a Portfolio Manager of the Fund since 2012.

The Fund’s SAI provides additional information about the Portfolio Managers’ compensation, other accounts managed by the Portfolio Managers and the

Portfolio Managers’ ownership (if any) of shares in the Fund.

Administrator, Custodian and Transfer Agent. State Street Bank and Trust

Company (“State Street”) is the administrator, custodian and transfer agent for the Fund.

Conflicts of Interest. BFA wants you to know

that there are certain entities with which BFA has relationships that may give rise to conflicts of interest, or the appearance of conflicts of interest. These entities are BFA’s affiliates, including BlackRock and the

10

PNC Financial Services Group, Inc., and each of their affiliates, directors, partners, trustees, managing members, officers and employees (collectively, the “Affiliates”).

The activities of BFA and the Affiliates in the management of, or their interest in, their own accounts and other accounts they manage, may present conflicts of

interest that could disadvantage the Fund and its shareholders. BFA and the Affiliates provide investment management services to other funds and discretionary managed accounts that may follow an investment program similar to that of the Fund. BFA

and the Affiliates are involved worldwide with a broad spectrum of financial services and asset management activities and may engage in the ordinary course of business in activities in which their interests or the interests of their clients may

conflict with those of the Fund. BFA or one or more of the Affiliates acts, or may act, as an investor, investment banker, research provider, investment manager, financier, underwriter, advisor, market maker, trader, prime broker, lender, agent or

principal, and have other direct and indirect interests, in securities, currencies and other instruments in which the Fund may directly or indirectly invest. Thus, it is likely that the Fund will have multiple business relationships with and will

invest in, engage in transactions with, make voting decisions with respect to, or obtain services from, entities for which BFA or an Affiliate seeks to perform investment banking or other services.

BFA or one or more Affiliates may engage in proprietary trading and advise accounts and funds that have investment objectives similar to those of the Fund and/or

that engage in and compete for transactions in the same types of securities, currencies and other instruments as the Fund, including in securities issued by other open-end and closed-end investment management companies, including investment

companies that are affiliated with the Fund and BFA, to the extent permitted under the Investment Company Act of 1940, as amended (the “1940 Act”). The trading activities of BFA and these Affiliates are carried out without reference to

positions held directly or indirectly by the Fund and may result in BFA or an Affiliate having positions that are adverse to those of the Fund.

No

Affiliate is under any obligation to share any investment opportunity, idea or strategy with the Fund. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. As a result of this and several other factors, the

results of the Fund’s investment activities may differ from those of an Affiliate and of other accounts managed by an Affiliate, and it is possible that the Fund could sustain losses during periods in which one or more Affiliates and other

accounts achieve profits on their trading for proprietary or other accounts. The opposite result is also possible.

The Fund may, from time to time,

enter into transactions in which BFA or an Affiliate’s clients have an interest adverse to the Fund. Furthermore, transactions undertaken by Affiliate-advised clients may adversely impact the Fund. Transactions by one or more Affiliate-advised

clients or BFA may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund.

The Fund’s

activities may be limited because of regulatory restrictions applicable to one or more Affiliates, and/or their internal policies designed to comply with such restrictions. In addition, the Fund may invest in securities of companies with which an

Affiliate has developed or is trying to develop investment banking relationships or in which an Affiliate has significant debt or equity investments. The Fund also may invest in securities of companies for which an Affiliate provides or may someday

provide

11

research coverage. An Affiliate may have business relationships with, and purchase, distribute or sell services or products from or to, distributors, consultants or others who recommend the Fund

or who engage in transactions with or for the Fund, and may receive compensation for such services. The Fund may also make brokerage and other payments to Affiliates in connection with the Fund’s portfolio investment transactions.

Pursuant to a securities lending program approved by the Board, the Fund has retained an Affiliate of BFA to serve as the securities lending agent for the Fund to

the extent that the Fund participates in the securities lending program. For these services, the lending agent may receive a fee from the Fund, including a fee based on the returns earned on the Fund’s investment of the cash received as

collateral for any loaned securities. In addition, one or more Affiliates may be among the entities to which the Fund may lend its portfolio securities under the securities lending program.

The activities of BFA or the Affiliates may give rise to other conflicts of interest that could disadvantage the Fund and its shareholders. BFA has adopted policies and procedures designed to address these

potential conflicts of interest. See the Fund’s SAI for further information.

Legal Proceedings. On January 18, 2013, a lawsuit was

filed in the United States District Court for the Middle District of Tennessee by Laborers’ Local 265 Pension Fund and Plumbers and Pipefitters Local No. 572 Pension Fund against BFA, BTC, and the current members of the iShares Trust Board

of Trustees and the Board of Directors of iShares, Inc. (collectively, “Defendants”) for alleged violations of, among other things, Sections 36(a) and 36(b) of the 1940 Act. The complaint purports to be brought derivatively on behalf

of iShares Trust and iShares, Inc., as well as the following eight funds: iShares Russell MidCap Index Fund; iShares MSCI EAFE Index Fund; iShares MSCI Emerging Markets Index Fund; iShares Russell 2000 Growth Index Fund; iShares Russell

2000 Value Index Fund; iShares Core S&P Mid-Cap ETF; iShares Core S&P Small-Cap ETF; and iShares Dow Jones U.S. Real Estate Index Fund (the “Funds”). The complaint alleges, among other things, that BFA and BTC breached their

fiduciary duties under the 1940 Act by charging allegedly excessive fees in connection with the provision of securities lending services to the Funds, that the individual defendants breached their fiduciary duties under the 1940 Act by

approving those fee arrangements, and that the securities lending contracts are unenforceable under Section 47(b) of the 1940 Act. Plaintiffs seek injunctive relief, rescission of the securities lending contracts and, monetary damages of

an unspecified amount. Defendants believe the claims are without merit and intend to vigorously defend themselves against the allegations in the lawsuit. On March 11, 2013, the Defendants filed a motion to dismiss the lawsuit.

Shareholder Information

Additional

shareholder information, including how to buy and sell shares of the Fund, is available free of charge by calling toll-free: 1-800-iShares (1-800-474-2737) or visiting our website at www.iShares.com.

Buying and Selling Shares. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in

the Creations and Redemptions section of this Prospectus. Only an Authorized Participant (as defined in the Creations and Redemptions section) may engage in creation or redemption

12

transactions directly with the Fund. Once created, shares of the Fund generally trade in the secondary market in amounts less than a Creation Unit.

Shares of the Fund are listed on a national securities exchange for trading during the trading day. Shares can be bought and sold throughout the trading day like

shares of other publicly traded companies. The Company does not impose any minimum investment for shares of the Fund purchased on an exchange. The Fund’s shares trade under the trading symbol “DVYA.”

Buying or selling Fund shares on an exchange involves two types of costs that may apply to all securities transactions. When buying or selling shares of the Fund

through a broker, you will likely incur a brokerage commission or other charges determined by your broker. The commission is frequently a fixed amount and may be a significant proportional cost for investors seeking to buy or sell small amounts of

shares. In addition, you may incur the cost of the “spread,” that is, any difference between the bid price and the ask price. The spread varies over time for shares of the Fund based on the Fund’s trading volume and market liquidity,

and is generally lower if the Fund has a lot of trading volume and market liquidity, and higher if the Fund has little trading volume and market liquidity.

The Board has adopted a policy of not monitoring for frequent purchases and redemptions of Fund shares (“frequent trading”) that appear to attempt to take advantage of a potential arbitrage opportunity

presented by a lag between a change in the value of the Fund’s portfolio securities after the close of the primary markets for the Fund’s portfolio securities and the reflection of that change in the Fund’s NAV (“market

timing”), because the Fund generally sells and redeems its shares directly through transactions that are in-kind and/or for cash, subject to the conditions described below under Creations and Redemptions. The Board has not adopted a

policy of monitoring for other frequent trading activity because shares of the Fund are listed for trading on a national securities exchange.

The

national securities exchange on which the Fund’s shares are listed is open for trading Monday through Friday and is closed on weekends and the following holidays: New Year’s Day, Martin Luther King, Jr. Day, Presidents’ Day, Good

Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. The Fund’s primary listing exchange is NYSE Arca.

Section 12(d)(1) of the 1940 Act restricts investments by investment companies in the securities of other investment companies. Registered investment companies

are permitted to invest in the Fund beyond the limits set forth in Section 12(d)(1), subject to certain terms and conditions set forth in SEC rules or in an SEC exemptive order issued to the Company. In order for a registered investment company

to invest in shares of the Fund beyond the limitations of Section 12(d)(1) pursuant to the exemptive relief obtained by the Company, the registered investment company must enter into an agreement with the Company.

Book Entry. Shares of the Fund are held in book-entry form, which means that no stock certificates are issued. The Depository Trust Company (“DTC”)

or its nominee is the record owner of all outstanding shares of the Fund and is recognized as the owner of all shares for all purposes.

13

Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. DTC

serves as the securities depository for shares of the Fund. DTC participants include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship

with DTC. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. Therefore, to exercise any right

as an owner of shares, you must rely upon the procedures of DTC and its participants. These procedures are the same as those that apply to any other securities that you hold in book-entry or “street name” form.

Share Prices. The trading prices of the Fund’s shares in the secondary market generally differ from the Fund’s daily NAV and are affected by market

forces such as supply and demand, economic conditions and other factors. Information regarding the intraday value of shares of the Fund, also known as the “indicative optimized portfolio value” (“IOPV”), is disseminated every 15

seconds throughout the trading day by the national securities exchange on which the Fund’s shares are listed or by market data vendors or other information providers. The IOPV is based on the current market value of the securities and/or cash

required to be deposited in exchange for a Creation Unit. The IOPV does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time or the best possible valuation of the

current portfolio. Therefore, the IOPV should not be viewed as a “real-time” update of the Fund’s NAV, which is computed only once a day. The IOPV is generally determined by using both current market quotations and/or price quotations

obtained from broker-dealers that may trade in the portfolio securities held by the Fund. The quotations of certain Fund holdings may not be updated during U.S. trading hours if such holdings do not trade in the United States. The Fund is not

involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy.

Determination of Net Asset Value. The NAV of the Fund normally is determined once daily Monday through Friday, generally as of the regularly scheduled close

of business of the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time) on each day that the NYSE is open for trading, based on prices at the time of closing provided that (a) any Fund assets or liabilities denominated

in currencies other than the U.S. dollar are translated into U.S. dollars at the prevailing market rates on the date of valuation as quoted by one or more data service providers (as detailed below) and (b) U.S. fixed-income assets may be valued

as of the announced closing time for trading in fixed-income instruments in a particular market or exchange. The NAV of the Fund is calculated by dividing the value of the net assets of the Fund (i.e., the value of its total assets less total

liabilities) by the total number of outstanding shares of the Fund, generally rounded to the nearest cent.

The value of the securities and other assets

and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. The Fund’s assets and liabilities are valued primarily on the basis of market quotations.

14

Equity investments are valued at market value, which is generally determined using the last reported official closing

price or last trading price on the exchange or market on which the security is primarily traded at the time of valuation.

The Fund invests in non-U.S.

securities. Foreign currency exchange rates are generally determined as of 4:00 p.m., London time. Non-U.S. securities held by the Fund may trade on weekends or other days when the Fund does not price its shares. As a result, the Fund’s NAV may

change on days when Authorized Participants will not be able to purchase or redeem Fund shares.

Generally, trading in non-U.S. securities, U.S.

government securities, money market instruments and certain fixed-income securities is substantially completed each day at various times prior to the close of business on the NYSE. The values of such securities used in computing the NAV of the Fund

are determined as of such times.

When market quotations are not readily available or are believed by BFA to be unreliable, the Fund’s investments

are valued at fair value. Fair value determinations are made by BFA in accordance with policies and procedures approved by the Fund’s Board. BFA may conclude that a market quotation is not readily available or is unreliable if a security or

other asset or liability does not have a price source due to its lack of liquidity, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or

liability is thinly traded, or where there is a significant event subsequent to the most recent market quotation. A “significant event” is an event that, in the judgment of BFA, is likely to cause a material change to the closing market

price of the asset or liability held by the Fund. Non-U.S. securities whose values are affected by volatility that occurs in U.S. markets on a trading day after the close of non-U.S. securities markets may be fair valued.

Fair value represents a good faith approximation of the value of an asset or liability. The fair value of an asset or liability held by the Fund is the amount the

Fund might reasonably expect to receive from the current sale of that asset or the cost to extinguish that liability in an arm’s-length transaction. Valuing the Fund’s investments using fair value pricing will result in prices that may

differ from current market valuations and that may not be the prices at which those investments could have been sold during the period in which the particular fair values were used. Use of fair value prices and certain current market valuations

could result in a difference between the prices used to calculate the Fund’s NAV and the prices used by the Underlying Index, which, in turn, could result in a difference between the Fund’s performance and the performance of the Underlying

Index.

The value of assets or liabilities denominated in non-U.S. currencies will be converted into U.S. dollars using exchange rates deemed appropriate

by BFA as investment adviser. Use of a rate different from the rate used by the Index Provider may adversely affect the Fund’s ability to track the Underlying Index.

Dividends and Distributions

General Policies. Dividends from net investment income, if any, generally

are declared and paid quarterly by the Fund. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Company may make distributions

15

on a more frequent basis for the Fund. The Company reserves the right to declare special distributions if, in its reasonable discretion, such action is necessary or advisable to preserve its

status as a regulated investment company (“RIC”) or to avoid imposition of income or excise taxes on undistributed income or realized gains.

Dividends and other distributions on shares of the Fund are distributed on a pro rata basis to beneficial owners of such shares. Dividend payments are made

through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund.

Dividend Reinvestment

Service. No dividend reinvestment service is provided by the Company. Broker-dealers may make available the DTC book-entry Dividend Reinvestment Service for use by beneficial owners of the Fund for reinvestment of their dividend distributions.

Beneficial owners should contact their broker to determine the availability and costs of the service and the details of participation therein. Brokers may require beneficial owners to adhere to specific procedures and timetables. If this service is

available and used, dividend distributions of both income and realized gains will be automatically reinvested in additional whole shares of the Fund purchased in the secondary market.

Taxes. As with any investment, you should consider how your investment in shares of the Fund will be taxed. The tax information in this Prospectus is provided as general information, based on current law.

You should consult your own tax professional about the tax consequences of an investment in shares of the Fund.

Unless your investment in Fund shares is

made through a tax-exempt entity or tax-deferred retirement account, such as an IRA, you need to be aware of the possible tax consequences when the Fund makes distributions or you sell Fund shares.

Taxes on Distributions. Distributions from the Fund’s net investment income (other than qualified dividend income), including distributions of income

from securities lending and distributions out of the Fund’s net short-term capital gains, if any, are taxable to you as ordinary income. Distributions by the Fund of net long-term capital gains in excess of net short-term capital losses

(capital gain dividends) are taxable to you as long-term capital gains, generally at a 15% tax rate (0% at certain income levels), regardless of how long you have held the Fund’s shares. Distributions by the Fund that qualify as qualified

dividend income are taxable to you at long-term capital gain rates for taxable years beginning on or before December 31, 2012. The 15% and 0% tax rates expire for taxable years beginning after December 31, 2012. Maximum long-term capital

gain income tax rates are scheduled to rise to 20% in 2013. Beginning in 2013, a 3.8% U.S. federal Medicare contribution tax will be imposed on “net investment income,” including interest, dividends, and capital gains, of U.S. individuals

with income exceeding $200,000 (or $250,000 if married and filing jointly), and of estates and trusts.

Dividends will be qualified dividend income to

you if they are attributable to qualified dividend income received by the Fund. Generally, qualified dividend income includes dividend income from taxable U.S. corporations and qualified non-U.S. corporations, provided that the Fund satisfies

certain holding period requirements in respect of the stock of such corporations and has not hedged its position in the stock in certain ways.

16

Substitute dividends received by the Fund with respect to dividends paid on securities lent out will not be qualified dividend income. For this purpose, a qualified non-U.S. corporation means any

non-U.S. corporation that is eligible for benefits under a comprehensive income tax treaty with the United States, which includes an exchange of information program or if the stock with respect to which the dividend was paid is readily tradable on

an established United States securities market. The term excludes a corporation that is a passive foreign investment company.

Dividends received by the

Fund from a real estate investment trust (“REIT”) or another RIC generally are qualified dividend income only to the extent the dividend distributions are made out of qualified dividend income received by such REIT or RIC. It is expected

that dividends received by the Fund from a REIT and distributed to a shareholder generally will be taxable to the shareholder as ordinary income.

For a

dividend to be treated as qualified dividend income, the dividend must be received with respect to a share of stock held without being hedged by the Fund, and with respect to a share of the Fund held without being hedged by you, for 61 days during

the 121-day period beginning at the date which is 60 days before the date on which such share becomes ex-dividend with respect to such dividend or, in the case of certain preferred stock, 91 days during the 181-day period beginning 90 days before

such date.

If your Fund shares are loaned out pursuant to a securities lending arrangement, you may lose the ability to use foreign tax credits passed

through by the Fund or to treat Fund dividends paid while the shares are held by the borrower as qualified dividend income.

In general, your

distributions are subject to U.S. federal income tax for the year when they are paid. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year.

If the Fund’s distributions exceed current and accumulated earnings and profits, all or a portion of the distributions made in the taxable year may be

recharacterized as a return of capital to shareholders. A return of capital distribution generally will not be taxable but will reduce the shareholder’s cost basis and result in a higher capital gain or lower capital loss when those shares on

which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets.

If you are neither a resident nor a citizen of the United States or if you are a non-U.S. entity, the Fund’s ordinary income dividends (which include

distributions of net short-term capital gains) will generally be subject to a 30% U.S. withholding tax, unless a lower treaty rate applies, provided that withholding tax will generally not apply to any gain or income realized by a non-U.S.

shareholder in respect of any distributions of long-term capital gains or upon the sale or other disposition of shares of the Fund.

A 30% withholding

tax will be imposed on dividends paid after December 31, 2013, and redemption proceeds paid after December 31, 2014, to (i) foreign financial institutions including non-U.S. investment funds unless they agree to collect and disclose