Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09102

iShares, Inc.

(Exact name of registrant as specified in charter)

c/o: State Street Bank and Trust Company

200 Clarendon Street, Boston, MA 02116

(Address of principal executive offices) (Zip code)

The Corporation Trust Incorporated

351 West Camden Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-474-2737

Date of fiscal year end: August 31, 2011

Date of reporting period: August 31, 2011

Table of Contents

| Item 1. Reports to Stockholders. |

|

August 31, 2011 | |

2011 Annual Report

iShares, Inc.

iShares MSCI Austria Investable Market Index Fund | EWO | NYSE Arca

iShares MSCI Belgium Investable Market Index Fund | EWK | NYSE Arca

iShares MSCI Emerging Markets Eastern Europe Index Fund | ESR | NYSE Arca

iShares MSCI EMU Index Fund | EZU | NYSE Arca

iShares MSCI France Index Fund | EWQ | NYSE Arca

iShares MSCI Germany Index Fund | EWG | NYSE Arca

iShares MSCI Italy Index Fund | EWI | NYSE Arca

iShares MSCI Netherlands Investable Market Index Fund | EWN | NYSE Arca

iShares MSCI Spain Index Fund | EWP | NYSE Arca

iShares MSCI Sweden Index Fund | EWD | NYSE Arca

iShares MSCI Switzerland Index Fund | EWL | NYSE Arca

iShares MSCI United Kingdom Index Fund | EWU | NYSE Arca

Table of Contents

| 5 | ||||

| 39 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 52 | ||||

| 55 | ||||

| 57 | ||||

| 59 | ||||

| 61 | ||||

| 63 | ||||

| 65 | ||||

| 67 | ||||

| 70 | ||||

| 84 | ||||

| 96 | ||||

| 109 | ||||

| 110 | ||||

| Board Review and Approval of Investment Advisory Contract (Unaudited) |

111 | |||

| 114 | ||||

| 126 |

Table of Contents

Management’s Discussion of Fund Performance

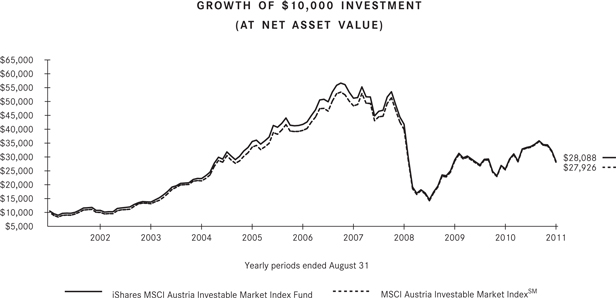

iSHARES® MSCI AUSTRIA INVESTABLE MARKET INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.92% | 11.43% | 11.17% | (6.61)% | (6.74)% | (7.48)% | 10.88% | 10.80% | 10.82% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.92% | 11.43% | 11.17% | (28.95)% | (29.44)% | (32.22)% | 180.88% | 178.99% | 179.26% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 5 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI AUSTRIA INVESTABLE MARKET INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Austria Investable Market Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Austria Investable Market IndexSM (the “Index”). The Index consists of stocks traded primarily on the Vienna Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 10.92%, net of fees, while the total return for the Index was 11.17%.

The Austrian stock market, as represented by the Index, climbed steadily from the beginning of the reporting period through mid-May 2011. However, heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index declined. Despite a sharp sell-off in August, the Index still posted double-digit returns for the reporting period.

During the reporting period, the Austrian economy was among the healthiest in the euro zone, with unemployment at just 4%. During the second quarter of 2011, gross domestic product (“GDP”) rose 3.7% compared to the second quarter of 2010. GDP in the first quarter of 2011 was up 4.2% over the first quarter of 2010. GDP growth for calendar 2010 was 2.1%. However, inflation increased sharply in the first half of 2011 to 3.5%, exceeding inflation in the euro zone during the same period by one percentage point.

Because Austria relies on its European neighbors for the preponderance of its exports, a downturn in the economic health of these countries causes investor concern. Austria’s exports were showing signs of weakness in the second quarter of 2011, as April’s exports were down more than 10% compared to the prior month. In particular, Austria is affected by the health of Germany’s economy, where GDP rose 2.8% in the second quarter of 2011 versus the same period in the prior year. Germany’s economic data was mixed during the reporting period. Exports, factory orders and industrial production showed strength as the reporting period came to a close. However, some major Germany companies reported disappointing second quarter earnings.

Meanwhile, investors continued to face uncertainty in the region. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece which also strengthened the region’s bailout mechanism to offer protection to other euro-region nations in an effort to stop contagion from the debt crisis. Still, Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s

| 6 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI AUSTRIA INVESTABLE MARKET INDEX FUND

debt crisis would spread to more countries. The International Monetary Fund, in its annual review of Austria’s economy, called for Austria to pay down its government debt, currently at 70% of GDP, through a combination of tax increases and spending cuts.

From a sector perspective, industrials, energy and materials posted the strongest contributions to the Index’s return for the reporting period, while health care and telecommunications services produced negative contributions.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 7 |

Table of Contents

Management’s Discussion of Fund Performance

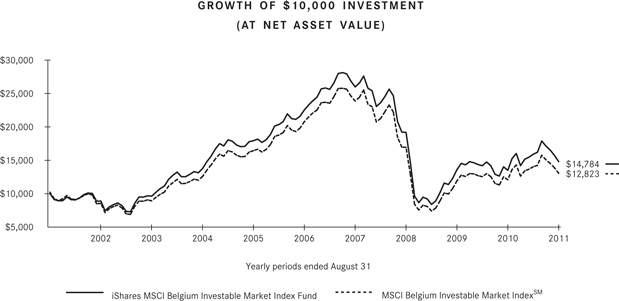

iSHARES® MSCI BELGIUM INVESTABLE MARKET INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 9.59% | 10.00% | 8.09% | (8.06)% | (8.19)% | (9.00)% | 3.99% | 3.97% | 2.52% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 9.59% | 10.00% | 8.09% | (34.29)% | (34.77)% | (37.58)% | 47.84% | 47.53% | 28.23% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 8 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI BELGIUM INVESTABLE MARKET INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Belgium Investable Market Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Belgium Investable Market IndexSM (the “Index”). The Index consists of stocks traded primarily on the Brussels Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 9.59%, net of fees, while the total return for the Index was 8.09%.

The Belgium stock market, as represented by the Index, climbed from the beginning of the reporting period through November 2010, declining for a few weeks before resuming its ascent over the next several months. However, heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index fell along with other European markets. Despite a sharp sell-off in August, the Index still posted high single-digit returns for the reporting period.

The Belgian economy has generally outperformed the euro zone as a whole. According to the National Bank of Belgium, growth in gross domestic product (“GDP”) was 2.4% during the reporting period, slightly higher than the euro zone growth rate of approximately 1.8% over the same period. Unemployment ranged between 7-8%, significantly below the euro zone’s 10% rate. In addition, industrial production experienced steady growth through the reporting period, with monthly percentage gains ranging from 4 to 11% over the prior year period.

Because Belgium relies on its European neighbors for the preponderance of its exports, a downturn in the economic health of these countries can negatively impact the health of the Belgian economy. In particular, Belgium is affected by the health of Germany’s economy, where GDP rose 2.8% in the second quarter of 2011 versus the prior year period. Germany’s economic data was mixed during the reporting period. Exports, factory orders and industrial production showed strength as the reporting period came to a close. However, some major Germany companies reported disappointing second quarter earnings.

Meanwhile, investors continued to face uncertainty in the region. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece which also strengthened the region’s bailout mechanism to offer protection to other euro-region nations in an effort to stop contagion from the debt crisis. Still, Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 9 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI BELGIUM INVESTABLE MARKET INDEX FUND

debt crisis would spread to more countries. The International Monetary Fund, in its annual review of Belgium’s economy, commended efforts to stabilize the country’s banking system as well as to pay down public debt relative to GDP.

From a sector perspective, consumer staples, materials and health care posted the strongest contributions to the Index’s return for the reporting period, while financials, energy and utilities produced negative contributions.

| 10 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance

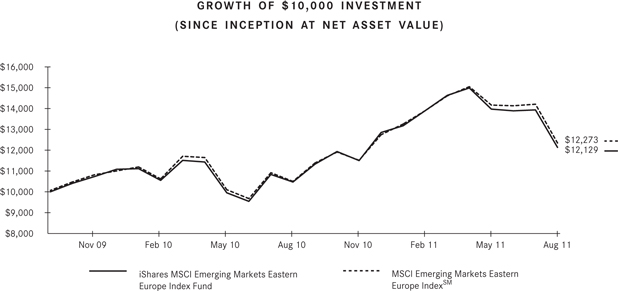

iSHARES® MSCI EMERGING MARKETS EASTERN EUROPE INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | Cumulative Total Return | |||||||||||||||

| Year Ended 8/31/11 | Inception to 8/31/11 | Inception to 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 15.86% | 14.95% | 17.66% | 10.57% | 9.96% | 11.28% | 21.29% | 20.00% | 22.73% | ||||||||

Total returns for the period since inception are calculated from the inception date of the Fund (9/30/09). “Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (10/2/09), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 11 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI EMERGING MARKETS EASTERN EUROPE INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Emerging Markets Eastern Europe Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Emerging Markets Eastern Europe IndexSM (the “Index”). The Index is a free-float adjusted market capitalization index designed to measure equity market performance of the following four emerging market countries: the Czech Republic, Hungary, Poland and Russia. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 15.86%, net of fees, while the total return for the Index was 17.66%.

As represented by the Index, stock markets in Eastern Europe posted a double-digit gain for the reporting period. Despite some interim volatility, the Index enjoyed an extended rally from the beginning of the period through April 2011 as steadily improving economic data boosted investor confidence in a global economic recovery. Strong demand in Europe for exports from Eastern Europe helped boost equity markets in the region. From the beginning of the reporting period through its peak in mid-April 2011, the Index surged by more than 40%.

The Index gave back some ground during the last four months of the reporting period as an accumulation of global events – heightened political turmoil in the Middle East and North Africa, a worsening sovereign debt crisis in Europe, an earthquake and tsunami in Japan, and government infighting about the federal debt ceiling in the U.S. – cast doubts on the sustainability of the global recovery. The Index’s decline was especially severe in August 2011 as increasingly risk-averse investors shifted away from many emerging markets, causing the Index to fall by approximately 13% for the month.

The Index benefited from a decline in the U.S. dollar, which boosted international equity returns for U.S. investors. The dollar depreciated by 6% versus the Russian ruble, 9.5% against the Polish zloty, 15% versus the Czech koruna, and 17% against the Hungarian forint for the reporting period. The U.S. dollar’s decline resulted mainly from historically low U.S. interest rates and intensifying fiscal deficit concerns.

Russia, the largest country weighting in the Index (comprising more than 70% of the Index as of August 31, 2011), generated the best returns, advancing by nearly 20% for the reporting period. Russia’s economy benefited from a broad rise in commodity prices; in particular, Russia is a major energy exporter, and the price of oil increased by nearly 25% for the reporting period. Poland’s stock market, which made up approximately 18% of the Index, also posted solid gains thanks to improving economic conditions. The two smaller Index components, the

| 12 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI EMERGING MARKETS EASTERN EUROPE INDEX FUND

Czech Republic and Hungary, produced mixed results. The Czech stock market rallied as exports to Europe provided a lift to economic growth, but Hungarian stocks declined for the reporting period amid uncertainty regarding the country’s relatively high public debt levels.

Within the Index, the best-performing sector by far was the materials sector, which gained more than 50% for the reporting period thanks to a strong increase in demand for commodities and higher commodity prices. The energy and financials sectors, the two largest sector weightings in the Index (together comprising approximately two-thirds of the Index as of August 31, 2011), were also among the better-performing segments of the Index. The weaker-performing sectors were the smallest Index weightings – industrials, information technology, and health care.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 13 |

Table of Contents

Management’s Discussion of Fund Performance

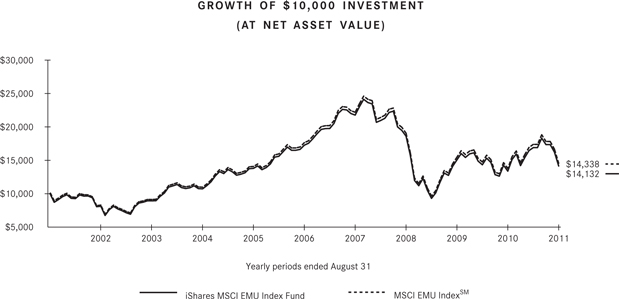

iSHARES® MSCI EMU INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 5.78% | 6.46% | 5.89% | (3.90)% | (3.97)% | (3.81)% | 3.52% | 3.45% | 3.67% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 5.78% | 6.46% | 5.89% | (18.04)% | (18.32)% | (17.64)% | 41.32% | 40.40% | 43.38% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 14 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI EMU INDEX FUND

The iShares MSCI EMU Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI EMU IndexSM (the “Index”). The Index consists of stocks from Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal and Spain. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 5.78%, net of fees, while the total return for the Index was 5.89%.

The stock markets of the European Monetary Union (“EMU”), as represented by the Index, were volatile during the reporting period, declining between May and August, 2011. Heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index fell along with other international markets. Despite the declines near the end of the reporting period and a sell-off in August, the Index still posted a positive return for the reporting period.

EMU member countries are those members of the European Union that have adopted the euro as its currency. Despite Europe’s economic difficulties, its currency strengthened against the dollar during the reporting period. One euro equaled $1.47 on August 31, 2011, up from $1.27 at September 1, 2010.

From a country perspective, France, Germany and the Netherlands posted the strongest contributions to the Index’s return, while Greece and Italy produced negative contributions. After posting modest growth earlier in the reporting period, France, Germany and the Netherlands saw economic growth flatten to virtually zero in the second quarter of 2011. Meanwhile, in mid-July, European Union leaders reached an agreement on a second rescue package for Greece which also strengthened protection to other euro-region nations in an effort to stop contagion from the debt crisis. Still, Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries.

In the midst of Europe’s struggle to contain its government debt crisis, European policy makers focused on strengthening the region’s banking system, as European bank shares fell to their lowest levels since March 2009. The European Central Bank (“ECB”) has opened new credit lines for banks that need funds, while the proposed Greek bailout would provide loans to countries that need to recapitalize their banks. In addition, the ECB bought Italian and Spanish government bonds from European banks, allowing them to reduce their portfolios of troubled assets.

American money market funds, a historically reliable source of funding, sharply cut their exposure to European banks. The ten largest U.S. money market funds cut their exposure to European banks by 9% in July 2011 after a reduction of 20% in June.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 15 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI FRANCE INDEX FUND

Performance as of August 31, 2011

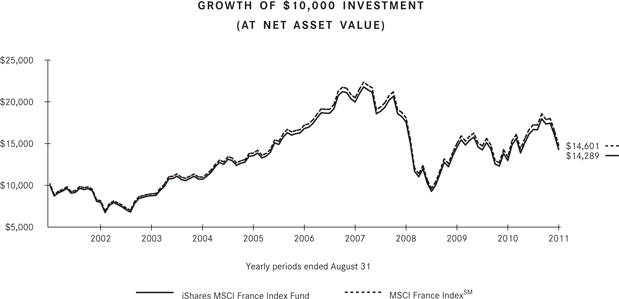

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.24% | 11.06% | 10.37% | (3.18)% | (3.25)% | (3.02)% | 3.63% | 3.59% | 3.86% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.24% | 11.06% | 10.37% | (14.90)% | (15.23)% | (14.23)% | 42.89% | 42.29% | 46.01% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 16 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI FRANCE INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI France Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI France IndexSM (the “Index”). The Index consists of stocks traded primarily on the Paris Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 10.24%, net of fees, while the total return for the Index was 10.37%.

Despite the slumping European economy, the stock market in France posted positive returns during the reporting period. The market, as represented by the Index, climbed from the beginning of the reporting period through November 2010. After pausing for a few weeks, the market resumed its mostly uninterrupted ascent over the next several months. However, heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index fell along with other European markets. Despite a sell-off in August, the Index still posted double-digit returns for the reporting period.

After showing a 4% annualized rate of growth in gross domestic product (“GDP”) during the first quarter of 2011, the French economy showed no growth in GDP during the second quarter of 2011, making it more difficult for the government to cut its substantial budget deficit.

Still, France’s economy had some positive fundamentals during the reporting period. France’s housing market was relatively healthy compared to other European countries. After a modest decline, home prices rebounded in mid-2009 and were near their pre-crisis peak at the end of the reporting period. Few houses have been built in recent years because of a scarcity of buildable land in metropolitan areas as well as regulatory barriers to new housing construction.

Meanwhile, investors continued to face uncertainty in the euro zone. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece. Still, Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries. The International Monetary Fund, in its annual review of France’s economy, said the Greece situation underlines the importance for France to continue to reduce its public debt relative to GDP.

From a sector perspective, consumer discretionary, industrials and health care posted the strongest contributions to the Index’s return for the reporting period, while financials and telecommunication services produced negative contributions.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 17 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI GERMANY INDEX FUND

Performance as of August 31, 2011

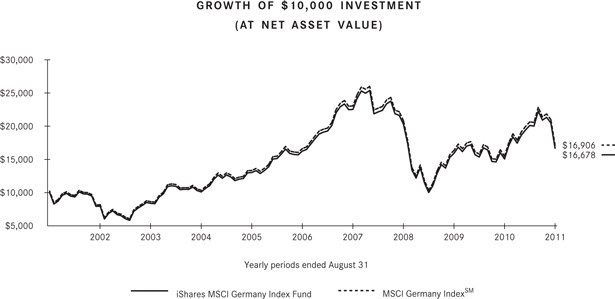

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.84% | 11.08% | 10.83% | 0.53% | 0.36% | 0.60% | 5.25% | 5.20% | 5.39% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 10.84% | 11.08% | 10.83% | 2.69% | 1.79% | 3.06% | 66.78% | 65.97% | 69.06% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 18 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI GERMANY INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Germany Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Germany IndexSM (the “Index”). The Index consists of stocks traded primarily on the Frankfurt Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 10.84%, net of fees, while the total return for the Index was 10.83%.

Despite the slumping European economy, the stock market in Germany posted positive returns during the reporting period. The market, as represented by the Index, climbed from the beginning of the reporting period through May 2011. However, heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index fell along with other European markets. Despite a sharp sell-off in August, the Index still posted double-digit returns for the reporting period.

Germany’s economy slowed in the second quarter of 2011 amidst rising energy prices, with annualized growth in gross domestic product (“GDP”) at only 0.5%, down from 5.5% in the first quarter of 2011. The country’s finance ministry warned that Germany faced an “obvious slowdown” and that its economic recovery in the summer of 2011 was below expectations. The Japanese earthquake and tsunami, a spike in oil prices and the slowing U.S. economy were cited as reasons for the weaker performance.

Another factor that may have slowed growth was higher interest rates. The European Central Bank (“ECB”) raised interest rates twice during the reporting period. The ECB raised rates from 1% to 1.25% in April 2011, and then to 1.5% in July of 2011.

Since Germany makes up 30% of the GDP of the euro-zone countries, a weaker Germany has negative implications for the rest of the region and its ability to outgrow its debt woes. Countries such as Greece, Spain, Portugal and Ireland were still fragile, putting pressure on Germany to extend loans to crisis-hit countries. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece. Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 19 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI GERMANY INDEX FUND

At the end of the reporting period, Reuters reported that approximately 75% of German voters oppose the expansion of Europe’s bailout fund, as Germany funds more than a quarter of the total amount. In another poll, more than two-thirds of German voters indicated that they thought parliament should not ratify more money for the bailout fund.

From a sector perspective, consumer discretionary, materials and industrials posted the strongest contributions to the Index’s return for the reporting period, while utilities and financials produced negative contributions.

| 20 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI ITALY INDEX FUND

Performance as of August 31, 2011

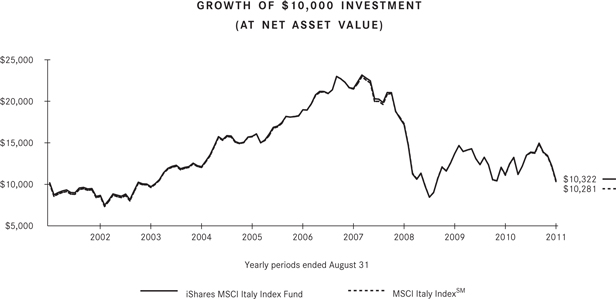

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| (6.80)% | (5.75)% | (6.46)% | (11.44)% | (11.46)% | (11.36)% | 0.32% | 0.30% | 0.28% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| (6.80)% | (5.75)% | (6.46)% | (45.52)% | (45.60)% | (45.27)% | 3.22% | 3.08% | 2.81% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 21 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI ITALY INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Italy Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Italy IndexSM (the “Index”). The Index consists of stocks traded primarily on the Milan Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was (6.80)%, net of fees, while the total return for the Index was (6.46)%.

The Italian stock market, as represented by the Index, rose gradually from the beginning of the reporting period through May 2011. However, it declined sharply over the next several months as the stalled global economic recovery, Europe’s re-emerging debt crisis as well as Italy’s fiscal problems came into focus. Because of a sharp sell-off during the summer, the Index posted a loss for the reporting period.

Italy’s economic growth was sluggish during the reporting period due to slowing exports and weak domestic demand. In the second quarter of 2011, the economy expanded 0.8% as compared to the second quarter of 2010. Meanwhile, gross domestic product (“GDP”) grew only 0.3% in the second quarter of 2011 versus the first quarter of 2011 after growing just 0.1% in the first quarter of 2011 versus the fourth quarter of 2010.

During the summer of 2011, investors feared that Italy could become engulfed in the European debt crisis that started with Greece and spread to Spain, Portugal and Ireland. As a result, bond yields on Italian government debt surged as the reporting period came to a close, as investors demanded more income to compensate for the additional risk. In response, the Italian government considered an austerity package aimed at balancing Italy’s budget. Italy’s national debt is 120% of GDP. In contrast, Germany’s debt is only 15% of GDP.

According to the International Monetary Fund, Italy’s economic growth has been consistently below the euro zone for the past ten years. Italian businesses are subject to high taxes and regulation, including tenured employees who receive generous benefits. In addition, because of the country’s high level of public debt, it was not able to provide fiscal stimulus to offset declining consumer demand. On the plus side, the Italian banking system remained relatively stable, primarily because it avoided some of the products and services, such as complex derivatives, that have plagued banks in other countries.

| 22 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI ITALY INDEX FUND

Meanwhile, investors continued to face uncertainty elsewhere in the euro zone region. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece while Spain, Portugal and Ireland’s debt were downgraded.

From a sector perspective, financials and industrials contributed the most to the Index’s negative return for the reporting period, mitigated by the modest but positive contributions of the energy and consumer discretionary sectors.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | 23 |

Table of Contents

Management’s Discussion of Fund Performance

iSHARES® MSCI NETHERLANDS INVESTABLE MARKET INDEX FUND

Performance as of August 31, 2011

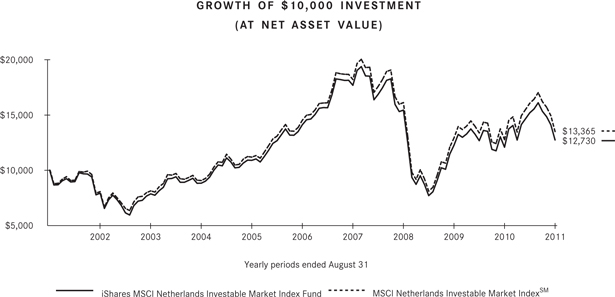

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 5.44% | 6.17% | 5.80% | (2.03)% | (2.10)% | (1.46)% | 2.44% | 2.44% | 2.94% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 5.44% | 6.17% | 5.80% | (9.75)% | (10.06)% | (7.11)% | 27.30% | 27.21% | 33.65% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 24 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI NETHERLANDS INVESTABLE MARKET INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Netherlands Investable Market Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Netherlands Investable Market IndexSM (the “Index”). The Index consists of stocks traded primarily on the Amsterdam Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 5.44%, net of fees, while the total return for the Index was 5.80%.

The Netherlands stock market, as represented by the Index, generally climbed from the beginning of the reporting period through mid-May 2011. However, heading into the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index declined. Despite a sharp sell-off in August, the Index still posted single-digit returns for the reporting period.

During the reporting period, the economy in the Netherlands started strong but flattened in the second quarter of 2011, with gross domestic product (“GDP”) advancing just 0.1% over the first quarter of 2011. In contrast, the first quarter of 2011 and fourth quarter of 2010 posted GDP advances of 0.8% and 0.7%, respectively over the prior quarter. During the first half of the reporting period, a surge in residential and commercial building projects took place, aided by mild winter weather and pent-up demand.

However, as the economy throughout the euro zone was slowing, the European Central Bank increased short-term interest rates – from 1.0% to 1.25% in April 2011 and from 1.25% to 1.50% in July 2011 – in the second half of the reporting period.

Because the Netherlands relies on its European neighbors for the preponderance of its exports, a downturn in the economic health of these countries negatively impacts its own economic health. GDP growth in Europe slowed sharply in the second half of the reporting period. During the second quarter of 2011, GDP for the 17-member euro zone rose 0.2% versus the previous quarter while household consumption was down slightly, the first such decline since the third quarter of 2009. Inflation hit 2.8% in April 2011, the highest rate since October 2008.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | 25 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI NETHERLANDS INVESTABLE MARKET INDEX FUND

Meanwhile, investors continued to face uncertainty from the weaker countries in the euro zone. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece. In addition, Spain, Portugal and Ireland’s debts were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries.

From a sector perspective, consumer staples and information technology posted the strongest positive contributions to the Index’s return for the reporting period, while industrials and financials produced negative contributions.

| 26 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance

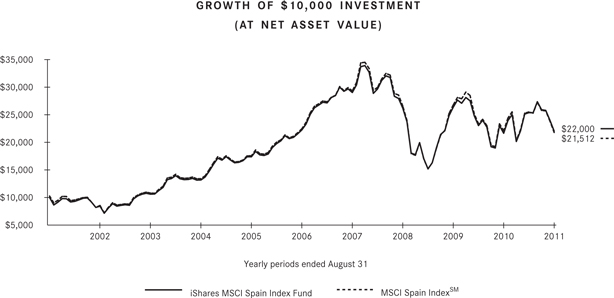

iSHARES® MSCI SPAIN INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 1.78% | 2.60% | (1.37)% | (0.20)% | (0.23)% | (0.61)% | 8.20% | 8.21% | 7.96% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 1.78% | 2.60% | (1.37)% | (1.00)% | (1.15)% | (3.00)% | 120.00% | 120.14% | 115.12% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | 27 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SPAIN INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Spain Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Spain IndexSM (the “Index”). The Index consists of stocks traded primarily on the Madrid Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 1.78%, net of fees, while the total return for the Index was (1.37)%.

The Spain stock market, as represented by the Index, rose from the beginning of the reporting period through November 2010 before declining sharply by the end of 2010. It rebounded through May but once again declined sharply over the next several months as the stalled global economic recovery, Europe’s re-emerging debt crisis and Spain’s fiscal problems came into focus. Because of a sharp sell-off during the summer, the Index posted a slight loss for the reporting period.

Spain’s modest economic recovery lost steam as the reporting period came to a close. The euro zone’s fourth largest economy grew at a quarterly rate of 0.2% during the second quarter of 2011 compared to the first quarter of 2011, down slightly from an increase of 0.3% in the first quarter of 2011 versus the fourth quarter of 2010. Consumer demand fell at an annual rate of 1.9% in the second quarter of 2011 compared to the prior quarter, as Spain grappled with a collapsed housing market. Among developed countries, Spain’s 21% unemployment rate is the highest in the world.

During the reporting period, investor attention focused on the ongoing European sovereign debt crisis, in particular a possible default by Greece, but also the potential that the crisis would spread to Italy and Spain. In July of 2011, European leaders reached an agreement on a second rescue package for Greece. Meanwhile, the credit ratings of Portugal, Ireland and Spain were downgraded.

During the summer, Spain saw its borrowing costs rise to a nine-year high, with yields on an 18-month bond reaching 3.9%. In response, the European Central Bank began buying government bonds of Italy and Spain in an effort to boost bond prices and reduce yields. Because Spain’s budget deficit as a percentage of GDP is among the highest in the world, the nation’s political leaders promised to pare public sector salaries and pensions. In addition, Spain’s government overwhelmingly approved a constitutional amendment to set maximum budget deficit levels and establish penalties for failure to comply.

| 28 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SPAIN INDEX FUND

From a sector perspective, financials contributed the most to the Index’s negative return for the reporting period, offset by small positive gains from the energy, consumer discretionary and industrials sectors.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 29 |

Table of Contents

Management’s Discussion of Fund Performance

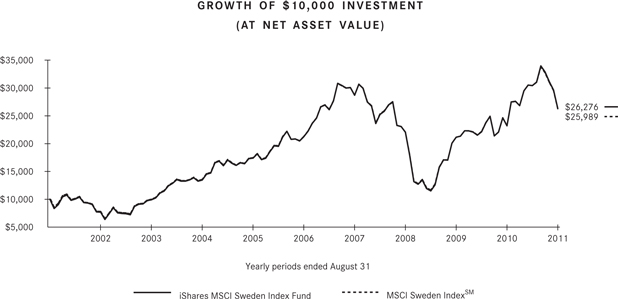

iSHARES® MSCI SWEDEN INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 13.40% | 13.96% | 13.38% | 4.37% | 4.35% | 4.35% | 10.14% | 10.15% | 10.02% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 13.40% | 13.96% | 13.38% | 23.83% | 23.75% | 23.75% | 162.76% | 162.83% | 159.89% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 30 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SWEDEN INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Sweden Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Sweden IndexSM (the “Index”). The Index consists of stocks traded primarily on the Stockholm Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 13.40%, net of fees, while the total return for the Index was 13.38%.

Sweden’s stock market, as represented by the Index, generally increased from the beginning of the reporting period through mid-May 2011. However, at the beginning of the summer of 2011, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index declined over the remainder of the reporting period. Despite a sharp sell-off in August, the Index still posted double-digit returns for the reporting period.

Sweden’s economy was relatively strong during the reporting period, with second quarter 2011 gross domestic product (“GDP”) growth at 5.3% versus the second quarter of 2010. Meanwhile, unemployment ended the period at 7.5%. Inflation was 3.3% in July 2011, driven by higher energy and commodity prices. Consumer spending grew 2.3% during the second quarter of 2011 versus the same period in 2010, due to increased consumption of durable goods such as automobiles.

From Sweden’s perspective, economic risks were primarily outside its own borders. These developments are of concern to Sweden, since its economy is dependent upon exports to these markets. Despite slowing economies in Europe, the European Central Bank increased short-term interest rates from 1.0% to 1.25% in April 2011 and from 1.25% to 1.50% in July 2011. During the second quarter of 2011, GDP for the 17-member euro zone rose just 0.2% versus the previous quarter. In Germany, GDP rose just 0.1% in the second quarter of 2011 versus the prior quarter, while France’s GDP was flat over the same period.

At its most recent meeting, Sweden’s central bank chose to keep short-term interest rates at 2%, postponing any increases and reflecting the global slowdown. The rate had been 1% at the beginning of the reporting period, rising by 0.25 percentage points in December 2010, February 2011, April 2011 and June 2011. The bank indicates that the Swedish economy has outperformed economies in the euro area, while government budget deficits are modest, requiring little in the way of fiscal cutbacks.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 31 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SWEDEN INDEX FUND

Meanwhile, investors continued to face uncertainty from the weaker countries in the euro zone. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece. In addition, Spain, Portugal and Ireland’s debts were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries.

From a sector perspective, industrials, financials and information technology posted the strongest positive contributions to the Index’s return for the reporting period, while consumer discretionary was the only sector to produce a negative contribution.

| 32 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance

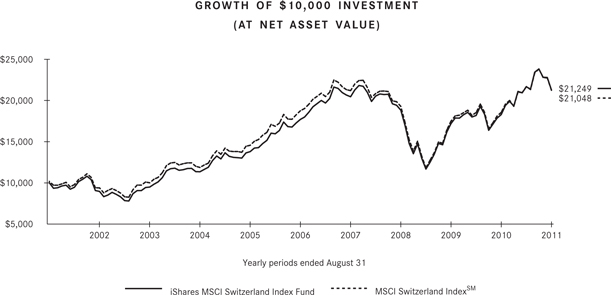

iSHARES® MSCI SWITZERLAND INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 16.30% | 16.63% | 14.59% | 3.74% | 3.66% | 2.54% | 7.83% | 7.81% | 7.73% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 16.30% | 16.63% | 14.59% | 20.16% | 19.67% | 13.38% | 112.49% | 112.15% | 110.48% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 33 |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SWITZERLAND INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |

The iShares MSCI Switzerland Index Fund (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Switzerland IndexSM (the “Index”). The Index consists of stocks traded primarily on the Zurich Stock Exchange. The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. Due to the use of representative sampling, the Fund may or may not hold all of the securities that are included in the Index. For the 12-month period ended August 31, 2011 (“the reporting period”), the total return for the Fund was 16.30%, net of fees, while the total return for the Index was 14.59%.

The Swiss stock market, as represented by the Index, generally climbed from the beginning of the reporting period through May 2011. However, at the beginning of the summer, the stalled global economic recovery as well Europe’s debt crisis re-emerged as investor concerns, and the Index declined. Despite a sharp sell-off in August, the Index still posted double-digit returns for the reporting period.

Switzerland’s economy was relatively strong during the reporting period, with second quarter 2011 gross domestic product (“GDP”) growth at 2.3% versus the same period in the prior year. The unemployment rate declined from 3.8% to 2.8% during the reporting period, while inflation was under 1%. A strong Swiss franc crimped exports during the second quarter of 2011, resulting in a decline of 1.3%, reversing the first quarter’s gain of 3.4%, of total exports. Still, Switzerland posted a trade surplus (i.e., exports exceeded imports) during the reporting period. The countries in the European Union are its largest trading partners, accounting for about 62% of exports and 79% of imports.

From Switzerland’s perspective, economic risks were primarily outside its own borders. Despite slowing economies in Europe, the European Central Bank increased short-term interest rates from 1.0% to 1.25% in April 2011 and from 1.25% to 1.50% in July 2011. During the second quarter of 2011, GDP for the 17-member euro zone rose just 0.2% versus the previous quarter. In Germany, GDP rose just 0.1% in the second quarter of 2011 versus the prior quarter, while France’s GDP was flat over the same period.

At its most recent meeting, Switzerland’s central bank chose to cut the country’s short-term interest rate target from 0-0.75% to 0-0.25% in an effort to stem the rise in the value of the country’s currency. A lower interest rate makes Swiss francs less desirable as a savings vehicle for investors outside the country.

| 34 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI SWITZERLAND INDEX FUND

Meanwhile, investors continued to face uncertainty from the weaker countries in the euro zone. In mid-July, European Union leaders reached an agreement on a second rescue package for Greece. In addition, Spain, Portugal and Ireland’s debt were downgraded and investors continued to fear that Europe’s debt crisis would spread to more countries.

From a sector perspective, health care, consumer staples and consumer discretionary posted the strongest positive contributions to the Index’s return for the reporting period, while financials, energy and information technology produced negative contributions.

| MANAGEMENT’S DISCUSSIONS OF FUND PERFORMANCE | 35 |

Table of Contents

Management’s Discussion of Fund Performance

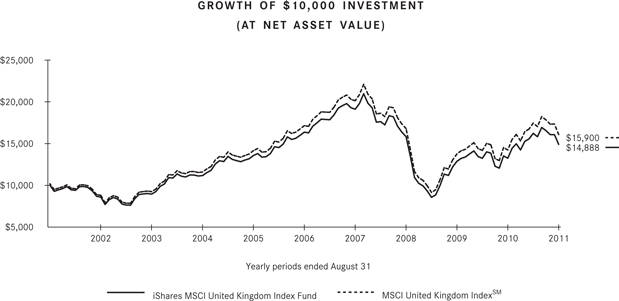

iSHARES® MSCI UNITED KINGDOM INDEX FUND

Performance as of August 31, 2011

| Average Annual Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 12.50% | 12.59% | 13.15% | (1.86)% | (2.04)% | (1.29)% | 4.06% | 3.98% | 4.75% | ||||||||

| Cumulative Total Returns | ||||||||||||||||

| Year Ended 8/31/11 | Five Years Ended 8/31/11 | Ten Years Ended 8/31/11 | ||||||||||||||

| NAV | MARKET | INDEX | NAV | MARKET | INDEX | NAV | MARKET | INDEX | ||||||||

| 12.50% | 12.59% | 13.15% | (8.95)% | (9.79)% | (6.27)% | 48.88% | 47.71% | 59.00% | ||||||||

“Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

The Fund’s per share net asset value or “NAV” is the value of one share of the Fund as calculated in accordance with the standard formula for valuing mutual fund shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The performance shown above assumes reinvestment of all dividends and capital gain distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption or sale of fund shares. The investment return and principal value of shares of the Fund will vary with changes in market conditions. Shares of the Fund may be worth more or less than their original cost when they are redeemed or sold in the market. The Fund’s past performance is no guarantee of future results.

| 36 | 2011 iSHARES ANNUAL REPORT TO SHAREHOLDERS |

Table of Contents

Management’s Discussion of Fund Performance (Continued)

iSHARES® MSCI UNITED KINGDOM INDEX FUND

| * | Sector classifications used to describe the Fund’s portfolio allocation may differ from sector classifications used to describe the Fund’s corresponding index in management’s commentary. As a result, sector allocation percentages for the Fund may differ from those referenced for the Index in the commentary. |