FIRST QUARTER OF 2019

CONSOLIDATED RESULTS

Santiago, Chile, May 30, 2019 - Viña Concha y Toro S.A. (“The Company” or “Concha y Toro”) (IPSA: Conchatoro), global leading winery and the main producer and exporter of Chilean wine, announced today consolidated financial results, stated under IFRS, for the period ended March 31, 2019.

Consolidated figures of the following analysis are expressed in Chilean pesos, in accordance with reporting standards of the Financial Markets Commission of Chile. For a better understanding of results, we also disclose some variations on constant currency basis, i.e. where figures for 2018 were translated into Chilean pesos using exchange rates recorded in the same period of 2019.

In 2019 and 2018, the Company recorded non-recurring expenses and costs (NRI) related to the internal restructuring process. For a better understanding of results, we also present in a comparative form, information of results excluding the aforementioned items. Thus, throughout this document, references to “Adjusted” data should not be understood as the reported data, but the one in which the referred costs and expenses have been isolated.

1Q19 Highlights

| · | Consolidated revenue was Ch$130,686 million, increasing 5.0%. |

| · | Wine sales increased 10.2%, driven by higher average price, mix improvement and favorable f/x. |

| · | Positive performance of Casillero del Diablo and line extensions, increasing 10% in volume and 15% in value. |

| · | EBITDA was Ch$14,825 million and adjusted EBITDA was Ch$15,840 million, with declines of 1.9% and 1.6% respectively, mainly on higher wine costs and higher SG&A in the quarter. |

| · | Net profit was Ch$5,328 million, down 17.6%, mainly reflecting lower exchange differences. |

CEO Comments

In the first quarter of the year, we have continued to make progress following our new commercial strategy guidelines, with focus on value and profitability growth.

In this context, we highlight that sales of wine grew 10.2%, with increases in most of our markets. The largest expansion was seen in Export Markets, which grew 12.9%, with higher volume, a better mix, and a positive f/x impact.

A positive performance was recorded by such markets as the United Kingdom, Brazil, and Mexico, where the integration of the distribution business has favored the execution of the new commercial strategy and strong growth in sales. Moreover, total exports from Argentina showed an increase of 74%, mainly explained by the sales through our distribution offices.

In this quarter, double-digit growth rates were posted in our Principal brand, Casillero del Diablo, in volume and value, as well as in Invest brands as Trivento Reserve, the upper extensions of Casillero del Diablo, and 1000 Stories.

In the USA market, Fetzer Vineyards continues to work in the integration of the imported portfolio from Chile and Argentina. While the integration process has concluded and all the logistics and distribution activities are already managed by Fetzer Vineyards, volumes have been impacted, according to what was expected for this phase.

In the domestic market of Chile, wine sales grew 6.2%, with a higher average price and a slightly lower volume, in line with the industry trend. We highlight the positive performance of the Premium category, which was driven by Casillero del Diablo brand and its upper brand extensions.

In the quarter, EBITDA declined 1.9%, mainly reflecting a higher cost of wine, an increase in SG&A and lower dilution of expenses, in a context of lower volume.

| 2 |

First Quarter of 2019 Results

| 1. | Revenue |

Revenue totaled Ch$130,686 million, increasing 5.0% YoY. This expansion was led by a 10.2% increase in wine sales. The company’s sales increased in most of its markets: Chile’s domestic market, Export markets, the US and Argentina exports. The top line reflects a favorable currency effect, mix improvement with an increase in priority brands, and the integration of the distribution in USA.

Sales of Other products decreased 38.0%, which is mainly explained by the end of the distribution contract for Diageo’s spirits in July of 2018.

| Sales(1) (Ch$ million) | 1Q19 | 1Q18 | Chg (%) | |||||||||||||

| Export Markets(2) | 79,815 | 70,670 | 12.9 | % | ||||||||||||

| Chile Domestic Market - Wine | 16,178 | 15,240 | 6.2 | % | ||||||||||||

| Argentina Domestic Market | 846 | 1,186 | (28.6 | %) | ||||||||||||

| Argentina Direct Exports(3) | 2,055 | 1,999 | 2.8 | % | ||||||||||||

| USA Domestic Market | 20,826 | 19,747 | 5.5 | % | ||||||||||||

| USA Direct Exports(3) | 2,672 | 2,226 | 20.0 | % | ||||||||||||

| Wine Operating Segment | 122,393 | 111,069 | 10.2 | % | ||||||||||||

| New Business(4) | 6,410 | 10,953 | (41.5 | %) | ||||||||||||

| Other Revenues | 1,884 | 2,421 | (22.2 | %) | ||||||||||||

| Other Operating Segment | 8,294 | 13,373 | (38.0 | %) | ||||||||||||

| Total Sales | 130,686 | 124,442 | 5.0 | % | ||||||||||||

| Volume(1) (thousand liters) | 1Q19 | 1Q18 | Chg (%) | |||||||||||||

| Export Markets(2) | 37,889 | 37,453 | 1.2 | % | ||||||||||||

| Chile Domestic Market - Wine | 13,430 | 13,608 | (1.3 | %) | ||||||||||||

| Argentina Domestic Market | 902 | 1,132 | (20.3 | %) | ||||||||||||

| Argentina Direct Exports(3) | 847 | 888 | (4.6 | %) | ||||||||||||

| USA Domestic Market | 7,058 | 8,689 | (18.8 | %) | ||||||||||||

| USA Direct Exports(3) | 612 | 575 | 6.4 | % | ||||||||||||

| Wine Operating Segment | 60,739 | 62,345 | (2.6 | %) | ||||||||||||

| New Business(4) | 3,659 | 5,830 | (37.2 | %) | ||||||||||||

| Other Operating Segment | 3,659 | 5,830 | (37.2 | %) | ||||||||||||

| Total Volume | 64,398 | 68,175 | (5.5 | %) | ||||||||||||

| Average Price(5) (per liter) | 1Q19 | 1Q18 | Chg (%) | |||||||||||||

| Export Markets(2) | US$ | 3.38 | 3.38 | (0.2 | %) | |||||||||||

| Chile Domestic Market - Wine | Ch$ | 1,162 | 1,120 | 3.7 | % | |||||||||||

| Argentina Domestic Market | US$ | 1.69 | 1.76 | (3.9 | %) | |||||||||||

| Argentina Exports(3) | US$ | 3.62 | 3.85 | (5.7 | %) | |||||||||||

| USA Domestic Market | US$ | 4.42 | 3.78 | 17.1 | % | |||||||||||

| USA Exports(3) | US$ | 6.59 | 6.58 | 0.1 | % | |||||||||||

(1) Includes bulk wine sales. (2) Includes exports to third parties from Chile, and sales through the Company’s distribution subsidiaries (UK, Nordics, Brazil, Singapore, Mexico) from Chile, Argentina, and USA. Excludes sales in the USA. (3) Excludes sales through the Company’s distribution subsidiaries. For a better understanding of sales by origin, in particular for Argentina, we provide a more complete disclosure, including direct exports and exports through distribution subsidiaries in sections 1.1.3 and 1.1.4. (4) Includes sales of beer and liquors. (5) Excludes bulk wine sales.

| 3 |

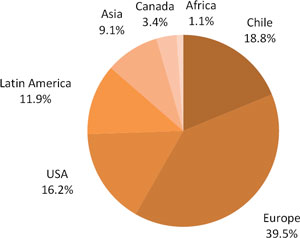

Consolidated Revenue by Geography

| 1.1. | Wine Operating Segment |

| 1.1.1. | Export Markets |

Export Market sales include export sales from Chile and sales of the distribution subsidiaries, excluding sales in the USA. Export Market sales totaled Ch$79,815 million, increasing 12.9%. This result was achieved through a mix improvement, an increase in volume and a favorable exchange rate impact. Overall, export volume increased 1.2%, driven by priority brands in line with the new commercial strategy in place.

In Europe, sales increased 14.2% in value, fostered by the United Kingdom (+29.1%), principal destination of the Company’s exports. Central America and the Caribbean grew 28.8%, driven by Mexico and Panama. South America increased 4.4%, with an important recovery in Brazil (+9.0%). Asia recorded an increase of 6.3%, led by South Korea and Singapore. In Canada, sales declined 9.3%.

Regarding the exchange rate effect, in the quarter the average Chilean peso depreciated against the US dollar (9.8%), Sterling pound (3.5%), Euro (2.3%), Norwegian krone (1.2%), Canadian dollar (5.1%), and Mexican peso (7.5%). The Chilean peso appreciated against the Brazilian Real (4.7%), and Swedish krona (2.1%).1

1 Based on data provided by the Central Bank of Chile.

| 4 |

| 1.1.2. | Chile Domestic Market – Wine |

In a challenging scenario for the domestic market, volume declined 1.3%, in line with the industry, but sales grew 6.2%, totaling Ch$16,178 million as a result of higher average price of bottled wine (+3.7%).

Premium sales increased 7.0% in value, led by the upper extensions of Casillero del Diablo Reserva Especial, and the successful launch of Diablo. Non-Premium sales did not variate, on a higher average price offset by a lower volume.

| 1.1.3. | Argentina |

Revenue from the operation in Argentina reflect its reorientation towards key markets, the exit from products with a low profitability, and exchange rates fluctuations impacting domestic sales.

Total exports from Argentina, comprising direct exports and exports through distribution subsidiaries grew 73.6%, as result of an increase of 132% in exports through distribution subsidiaries and an increase of 2.8% in direct exports. Sales volume grew 50.9%, reflecting an increase of 76.6% in distribution offices, led by United Kingdom, and a decrease of 4.6% in direct exports. Trivento Reserve showed a positive performance increasing 26% in volume and 35% in value (in Chilean pesos).

In the domestic market, that represents 0.5% of consolidated sales, sales declined 28.6% in Chilean pesos (average CLP/ARS dropped 44% YoY) and the volume decreased 20.3%.

| Argentina Sales (Ch$ million) | 1Q19 | 1Q18 | Chg (%) | |||||||||

| Exports | 7,662 | 4,413 | 73.6 | % | ||||||||

| Third parties | 2,055 | 1,999 | 2.8 | % | ||||||||

| Distribution offices | 5,607 | 2,414 | 132.2 | % | ||||||||

| Domestic Market | 846 | 1,186 | (28.6 | %) | ||||||||

| Total Argentina | 8,508 | 5,599 | 52.0 | % | ||||||||

| Argentina Volume (th. liters) | 1Q19 | 1Q18 | Chg (%) | |||||||||

| Exports | 4,236 | 2,807 | 50.9 | % | ||||||||

| Third parties | 847 | 888 | (4.6 | %) | ||||||||

| Distribution offices | 3,389 | 1,919 | 76.6 | % | ||||||||

| Domestic Market | 902 | 1,132 | (20.3 | %) | ||||||||

| Total Argentina | 5,138 | 3,940 | 30.4 | % | ||||||||

| 5 |

| 1.1.4. | USA Sales |

USA sales business line includes sales of Fetzer Vineyards and sales of imported wines from Chile and Argentina, currently commercialized by Fetzer Vineyards, following the integration of the distribution business in the US market (acquisition of Excelsior Wine Company in July 2018).

In the domestic market of USA sales increased 5.5%, reflecting higher prices, favorable f/x, and a lower sales volume. The average price was US$4.42 per liter, with an increase of 17.1%. The integration process of the imported Chilean and Argentine portfolio had a negative impact on volume and a positive effect on the average price.

Fetzer Vineyards’ direct exports increased 20.0% and exports to distribution offices declined 43.0%, reflecting strategic sourcing changes and the exit from less-profitable products. Average price was US$6.59 per liter (+0.1%).

| Fetzer Vineyards Sales (Ch$ million) | 1Q19 | 1Q18 | Chg (%) | |||||||||

| Exports | 3,482 | 3,647 | (4.5 | %) | ||||||||

| Third parties | 2,672 | 2,226 | 20.0 | % | ||||||||

| Distribution offices | 810 | 1,421 | (43.0 | %) | ||||||||

| Domestic Market | 20,826 | 19,747 | 5.5 | % | ||||||||

| Total Fetzer Vineyards | 24,308 | 23,395 | 3.9 | % | ||||||||

| Fetzer Vineyards Volume (th. liters) | 1Q19 | 1Q18 | Chg (%) | |||||||||

| Exports | 798 | 1,505 | (47.0 | %) | ||||||||

| Third parties | 612 | 575 | 6.4 | % | ||||||||

| Distribution offices | 186 | 930 | (80.0 | %) | ||||||||

| Domestic Market | 7,058 | 8,689 | (18.8 | %) | ||||||||

| Total Fetzer Vineyards | 7,856 | 10,194 | (22.9 | %) | ||||||||

| 1.2. | Other Operating Segment |

Other operating segment decreased 38.0% in the quarter, reflecting lower revenues at the New Business segment and at Other Revenues. Liquors sales declined 41.5%, following the end of the distribution agreement with Diageo. This was partly offset by higher revenues of Premium beer Kross (+29.0%) and the recently launched Estrella Damm.

| 6 |

| 2. | Cost of Sales |

The Cost of sales increased 2.9% to Ch$87,525 million. This is mainly explained by a higher cost of wine, related to the 2018 vintage, and f/x impact on US dollar-denominated costs. The ratio Cost of sales to sales was 67.0%, 140bp lower than in 1Q18, reflecting the distribution integration in the USA and favorable exchange rate impact, among others.

In the quarter, the Company recognized extraordinary costs for Ch$57 million, mainly consultancies related to the ongoing restructuring process2. The comparable figure was Ch$243 million in 1Q18.

| 3. | Selling, General and Administrative Expenses (SG&A) |

Selling, general and administrative expenses (distribution costs and administrative expenses) were Ch$33,442 million in the quarter, as compared to Ch$30,074 million in 1Q18, representing an increase of 11.2%. This increase mainly reflects the integration of the distribution in the USA, which contributed with Ch$1,661 million to SG&A, equivalent to 1.3% of sales, and larger expenses in the distribution subsidiaries in Mexico, UK, and Argentina. In the latter, a new export tax of $3 ARS per dollar was introduced in September 2018, which contributed an increase of Ch$575 million in SG&A. As a percentage of sales, SG&A represented 25.6% as compared to 24.2% of sales in 1Q18.

In 1Q19 the Company recognized extraordinary restructuring expenses (consultancy fees and severance payments) for Ch$515 million, equivalent to 0.4% of sales.

| 4. | Other Income and Expense |

Other income and expense recorded a loss for Ch$313 million in 1Q19 as compared to a gain of Ch$344 million in 1Q18.

In 1Q19 the company registered expenses related to the closure of the Lo Espejo bottling plant, amounting Ch$442 million, and a gain of Ch$278 million related to the sale of a real estate property located in Osorno, Chile. In 1Q18, the Company recorded other income related to insurance payments for Ch$187 million.

| 5. | Operating Profit |

Profit from operating activities was Ch$9,406 million, decreasing 2.7% from Ch$9,671 million registered in 1Q19. This is mainly explained by an increase in the cost of wine and higher SG&A. In addition, the Company recorded non-recurring expenses from the closing of Lo Espejo Plant.

2 In order to facilitate analysis, in page 11 an Adjusted Income Statement is provided. Adjustments comprise restructuring costs and expenses, and other non-recurring expenses (NRI).

| 7 |

The operating margin was 7.2%, versus 7.8% in 1Q18, reflecting lower dilution of expenses in a context of lower sales volume. Excluding NRI, the operating profit was Ch$10,420 million in 1Q19, and operating margin was 8.0%.

| 6. | EBITDA |

EBITDA (profit from operating activities plus depreciation and amortization expenses) was Ch$14,825 million in 1Q19, 1.9% below the figure of 1Q18. EBITDA margin was 11.3%, 80bp below the figure in 1Q18. Excluding NRI, adjusted EBITDA reached Ch$15,840 million, 1.6% below the adjusted figure in 1Q18. Adjusted EBITDA margin was 12.1% in 1Q19 (-80 bp).

| 7. | Non-Operating Profit |

In 1Q19, Non-operating profit was a Ch$1,862 million loss, which compares to a loss of Ch$689 million in 1Q18. This is mainly explained by lower exchange differences, for Ch$913 million in the quarter, compared with Ch$2,065 million in 1Q18.

Financial costs, net of financial income and adjustment units was Ch$2,694 million, with a decrease of 6.4%, and reflecting higher adjustment units.

| 8. | Income Tax Expense |

In the period, Income tax expense was Ch$2,137 million, lower than the figure of Ch$2,396 million in 1Q18, on a lower income before tax.

| 9. | Profit and Earnings per Share (EPS) |

Profit attributable to owners was of parent was Ch$5,328 million, a decline of 17.5% from the Ch$6,464 million reported in 1Q18, mainly explained by a decrease of Ch$1,152 million in exchange differences. Net margin was 4.1% in 1Q19, below the figure of 5.2% in 1Q18 (-110bp).

Excluding extraordinary items, Profit was Ch$6,343 million, with a decline of 14.8%, and net margin was 4.9%, 110 bps below the figure of 6.0% in 1Q18.

Based on 747,005,982 weighted average shares, Viña Concha y Toro’s earnings per share totaled Ch$7.13, below the Ch$8.65 per share recorded in the same period of the previous year.

| 8 |

Statement of Financial Position as of March 31, 2019

Assets

As of March 31, 2019, Viña Concha y Toro’s assets totaled Ch$1,108,318 million, 3.3% below the figure as of December 31, 2018.

Liabilities

As of March 31, 2019, Net financial debt amounted Ch$258,407 million, decreasing Ch$306 million, 0.1% when compared to the figure as of December 31, 2018.

Net Financial Debt is calculated as Other current financial liabilities + Other non-current financial liabilities - Cash and cash equivalents - Derivatives.

* * * * *

About Viña Concha y Toro

Founded in 1883, Viña Concha y Toro is the leading Latin American wine maker, and a one of the world’s largest wine company. It holds around 12,000 hectares of vineyards in Chile, Argentina, and United States, and its wine portfolio includes iconic brands, such as Don Melchor and Almaviva, its flagship brand Casillero del Diablo, Trivento from Argentina, and Fetzer and Bonterra brands from California.

Forward Looking Statements

This press release may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. With respect to the financial condition, results of operations and business of the Company and certain plans and objectives of the Company with respect to these items. Forward-looking statements may be identified by the use of words such as “anticipate”, “continue”, “estimate”, “expect”, “intend”, “may”, “believe” and similar expressions. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that occur in the future. There is a number of factors that could cause results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include: levels of consumer spending in major economies, changes in consumer tastes and preferences, the levels of marketing and promotional expenditures by the Company and its competitors, raw materials costs, future exchange and interest rates, as well as other risk factors referred in the Company’s filings with the Securities and Exchange Commission.

| 9 |

Income Statement

| (Ch$ thousand) | 1Q19 | 1Q18 | Chg (%) | |||||||||

| Revenue | 130,686,431 | 124,442,020 | 5.0 | % | ||||||||

| Cost of sales | (87,525,328 | ) | (85,040,972 | ) | 2.9 | % | ||||||

| Gross profit | 43,161,103 | 39,401,048 | 9.5 | % | ||||||||

| Gross margin | 33.0 | % | 31.7 | % | 140 | bp | ||||||

| Other income | 363,105 | 507,794 | (28.5 | %) | ||||||||

| Distribution costs | (25.927.493 | ) | (22,384,983 | ) | 15.8 | % | ||||||

| Administrative expense | (7.514.420 | ) | (7,688,765 | ) | (2.3 | %) | ||||||

| Other expense by function | (676,598 | ) | (164,280 | ) | 311.9 | % | ||||||

| Profit (loss) from operating activities | 9,405,697 | 9,670,814 | (2.7 | %) | ||||||||

| Operating margin | 7.2 | % | 7.8 | % | (60 | bp) | ||||||

| Financial income | 59,085 | 315,045 | (81.2 | %) | ||||||||

| Financial costs | (2,829,481 | ) | (2,801,355 | ) | 1.0 | % | ||||||

| Share of profit (loss) of associates and joint ventures using equity method | (80,287 | ) | 124,568 | |||||||||

| Exchange differences | 912,733 | 2,064,598 | (55.8 | %) | ||||||||

| Adjustment units | 76,262 | (392,163 | ) | |||||||||

| Non-operating profit (loss) | (1,861,688 | ) | (689,307 | ) | 170.1 | % | ||||||

| Profit (loss) before tax | 7,544,009 | 8,981,507 | (16.0 | %) | ||||||||

| Income tax expense continuing operations | (2,137,471 | ) | (2,395,973 | ) | (10.8 | %) | ||||||

| Profit (loss) | 5,406,538 | 6,585,534 | (17.9 | %) | ||||||||

| Profit (loss) attributable to noncontrolling interests | 78,262 | 123,464 | (36.6 | %) | ||||||||

| Profit (loss) attributable to owners of parent | 5,328,276 | 6,462,070 | (17.5 | %) | ||||||||

| Net margin | 4.1 | % | 5.2 | % | (110 | bp) | ||||||

| Basic earnings per share | 7.13 | 8.65 | (17.5 | %) | ||||||||

| Depreciation expense | 5,119,818 | 5,180,335 | (1.2 | %) | ||||||||

| Amortization expense | 299,747 | 265,927 | 12.7 | % | ||||||||

| EBITDA* | 14,825,262 | 15,117,076 | (1.9 | %) | ||||||||

| EBITDA margin* | 11.3 | % | 12.1 | % | (80 | bp) | ||||||

*EBITDA = Profit (loss) from operating activities + Depreciation & Amortization expenses.

| 10 |

1Q19

Reported and Adjusted Results3

| (Ch$ million) | 1Q19 Reported | 1Q18 Reported | Chg (%) | 1Q19

Adjusted | 1Q18 Adjusted | Chg (%) | ||||||||||||||||||

| Revenue | 130,686 | 124,442 | 5.0 | % | 130,686 | 124,442 | 5.0 | % | ||||||||||||||||

| Cost of sales | (87,525 | ) | (85,041 | ) | 2.9 | % | (87,468 | ) | (84,798 | ) | 3.1 | % | ||||||||||||

| Gross profit | 43,161 | 39,401 | 9.5 | % | 43,218 | 39,644 | 9.0 | % | ||||||||||||||||

| Gross margin | 33.0 | % | 31.7 | % | 140 | bp | 33.1 | % | 31.9 | % | 120 | bp | ||||||||||||

| SG&A* | (33,442 | ) | (30,074 | ) | 11.2 | % | (32,927 | ) | (29,336 | ) | 12.2 | % | ||||||||||||

| Other op. income, expense | (313 | ) | 344 | 129 | 344 | (62.5 | %) | |||||||||||||||||

| Profit (loss) from operating activities | 9,406 | 9,671 | (2.7 | %) | 10,420 | 10,652 | (2.2 | %) | ||||||||||||||||

| Operating margin | 7.2 | % | 7.8 | % | (60 | bp) | 8.0 | % | 8.6 | % | (60 | bp) | ||||||||||||

| Non-operating profit (loss) | (1,862 | ) | (689 | ) | 170.1 | % | (1,862 | ) | (689 | ) | 170.1 | % | ||||||||||||

| Profit (loss) before tax | 7,544 | 8,982 | (16.0 | %) | 8,559 | 9,962 | (14.1 | %) | ||||||||||||||||

| Income tax expense continuing operations | (2,137 | ) | (2,396 | ) | (10.8 | %) | (2,137 | ) | (2,396 | ) | (10.8 | %) | ||||||||||||

| Profit (loss) attributable to noncontrolling interests | 78 | 123 | (36.6 | %) | 78 | 123 | (36.6 | %) | ||||||||||||||||

| Profit (loss) attributable to owners of parent | 5,328 | 6,462 | (17.5 | %) | 6,343 | 7,443 | (14.8 | %) | ||||||||||||||||

| Net margin | 4.1 | % | 5.2 | % | (110 | bp) | 4.9 | % | 6.0 | % | (110 | bp) | ||||||||||||

| EBITDA** | 14,825 | 15,117 | (1.9 | %) | 15,840 | 16,098 | (1.6 | %) | ||||||||||||||||

| EBITDA margin | 11.3 | % | 12.1 | % | (80 | bp) | 12.1 | % | 12.9 | % | (80 | bp) | ||||||||||||

* SG&A = Distribution costs + Administration expense.

** EBITDA= Profit from operating activities + Depreciation + Amortization.

3 Adjusted results are presented with the purpose of facilitating comparison, excluding restructuring costs and such expenses that are considered non-recurring items (NRI).

| 11 |

Statement of Financial Position*

| (Ch$ thousand) | March 31, 2019 | Dec. 31, 2018 | Chg (%) | |||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | 20,209,690 | 37,486,337 | (46.1 | %) | ||||||||

| Inventories | 280,486,663 | 277,389,786 | 1.1 | % | ||||||||

| Trade and other current receivables | 165,532,872 | 193,256,718 | (14.3 | %) | ||||||||

| Current biological assets | 12,839,385 | 20,782,597 | (38.2 | %) | ||||||||

| Other current assets | 39,508,634 | 38,930,431 | 1.5 | % | ||||||||

| Current assets | 518,577,244 | 567,845,869 | (8.7 | %) | ||||||||

| Property, plant and equipment | 402,501,338 | 391,263,749 | 2.9 | % | ||||||||

| Inv. accounted for using equity method | 21,418,617 | 21,262,939 | 0.7 | % | ||||||||

| Other non current assets | 165,820,322 | 165,795,550 | 0.0 | % | ||||||||

| Noncurrent assets | 589,740,277 | 578,322,238 | 2.0 | % | ||||||||

| Assets | 1,108,317,521 | 1,146,168,107 | (3.3 | %) | ||||||||

| Liabilities | ||||||||||||

| Other current financial liabilities | 120,980,277 | 129,222,021 | (6.4 | %) | ||||||||

| Other current liabilities | 156,284,722 | 184,045,658 | (15.1 | %) | ||||||||

| Current liabilities | 277,264,999 | 313,267,679 | (11.5 | %) | ||||||||

| Other noncurrent financial liabilities | 177,714,728 | 191,209,617 | (7.1 | %) | ||||||||

| Other noncurrent liabilities | 69,809,090 | 69,537,567 | 0.4 | % | ||||||||

| Noncurrent liabilities | 247,523,818 | 260,747,184 | (5.1 | %) | ||||||||

| Liabilities | 524,788,817 | 574,014,863 | (8.6 | %) | ||||||||

| Equity | ||||||||||||

| Issued capital | 84,178,790 | 84,178,790 | 0.0 | % | ||||||||

| Retained earnings | 487,075,751 | 481,812,864 | 1.1 | % | ||||||||

| Other reserves | 8,415,271 | 2,330,314 | 261.1 | % | ||||||||

| Equity attributable to owners of parent | 579,669,812 | 568,321,968 | 2.0 | % | ||||||||

| Non-controlling interests | 3,858,892 | 3,831,276 | 0.7 | % | ||||||||

| Equity | 583,528,704 | 572,153,244 | 2.0 | % | ||||||||

| Equity and liabilities | 1,108,317,521 | 1,146,168,107 | (3.3 | %) | ||||||||

*In order to facilitate analysis, some accounts have been grouped.

| 12 |