0000930420DEF 14AFALSE00009304202023-01-012023-12-310000930420kfrc:MrLiberatoreMember2023-01-012023-12-31iso4217:USD0000930420kfrc:MrLiberatoreMember2022-01-012022-12-310000930420kfrc:MrDunkelMember2021-01-012021-12-310000930420kfrc:MrDunkelMember2020-01-012020-12-3100009304202021-01-012021-12-3100009304202022-01-012022-12-3100009304202020-01-012020-12-3100009304202023-12-31iso4217:USDxbrli:shares00009304202022-12-310000930420kfrc:AdjustmentDeductionsMemberecd:PeoMember2023-01-012023-12-310000930420ecd:PeoMemberkfrc:AdjustmentAdditionsMember2023-01-012023-12-310000930420kfrc:AdjustmentDeductionsMemberecd:PeoMember2022-01-012022-12-310000930420ecd:PeoMemberkfrc:AdjustmentAdditionsMember2022-01-012022-12-310000930420kfrc:AdjustmentDeductionsMemberecd:PeoMember2021-01-012021-12-310000930420ecd:PeoMemberkfrc:AdjustmentAdditionsMember2021-01-012021-12-310000930420kfrc:AdjustmentDeductionsMemberecd:PeoMember2020-01-012020-12-310000930420ecd:PeoMemberkfrc:AdjustmentAdditionsMember2020-01-012020-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentDeductionsMember2023-01-012023-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentAdditionsMember2023-01-012023-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentDeductionsMember2022-01-012022-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentAdditionsMember2022-01-012022-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentDeductionsMember2021-01-012021-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentAdditionsMember2021-01-012021-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentDeductionsMember2020-01-012020-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentAdditionsMember2020-01-012020-12-310000930420kfrc:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310000930420ecd:PeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2023-01-012023-12-310000930420kfrc:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2022-01-012022-12-310000930420ecd:PeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2022-01-012022-12-310000930420kfrc:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2021-01-012021-12-310000930420ecd:PeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2021-01-012021-12-310000930420kfrc:AdjustmentEquityAwardsReportedValueMemberecd:PeoMember2020-01-012020-12-310000930420ecd:PeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2020-01-012020-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardsReportedValueMember2023-01-012023-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2023-01-012023-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardsReportedValueMember2022-01-012022-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2022-01-012022-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardsReportedValueMember2021-01-012021-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2021-01-012021-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardsReportedValueMember2020-01-012020-12-310000930420ecd:NonPeoNeoMemberkfrc:AdjustmentEquityAwardAdjustmentsMember2020-01-012020-12-31000093042012023-01-012023-12-31000093042022023-01-012023-12-31000093042032023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a party other than the Registrant ¨

Check the appropriate box: | | | | | | | | |

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

KFORCE INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box): | | | | | | | | | | | | | | |

| ý | | No fee required |

| ¨ | | Fee paid previously with preliminary materials |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

You are cordially invited to attend the 2024 Annual Meeting of Kforce Inc. Shareholders (the Annual Meeting) that will be held on Wednesday, April 24, 2024, at 1150 Assembly Drive, Suite 500, Tampa, Florida 33607, commencing at 8:00 a.m., eastern time.

We are holding this meeting to:

1.Elect three Class III directors to hold office for a three-year term expiring in 2027;

2.Ratify the appointment of Deloitte & Touche LLP as Kforce’s independent registered public accountants for 2024;

3.Conduct an advisory vote on executive compensation; and

4.Attend to other business properly presented at the meeting.

Kforce’s Board of Directors (the Board) has selected February 16, 2024 as the record date (the Record Date) for determining shareholders entitled to vote at the meeting.

The proxy statement, proxy card and Kforce’s 2023 Annual Report to Shareholders are being mailed on or about March 15, 2024. Regardless of whether or not you plan to attend the annual meeting, we encourage you to vote your shares by using the internet, phone, or by signing, dating and returning the enclosed proxy card.

If you need further assistance, please contact Kforce Investor Relations at (813) 552-5000. Thank you for your continuing support.

BY ORDER OF THE BOARD OF DIRECTORS

David M. Kelly

Corporate Secretary

Tampa, Florida

March 15, 2024

| | |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 24, 2024. This proxy statement and our 2023 Annual Report to Shareholders are available at https://investor.kforce.com/financials/annual-reports/default.aspx. |

1 Kforce 2024 Proxy Statement

LETTER TO OUR SHAREHOLDERS

Kforce is grounded and united as a Firm through our core values as well as our vision, mission and brand promise, which are:

| | | | | | | | | | | | | | |

| | | | |

Vision To Have a Meaningful Impact on All the Lives We Serve® | | Mission Uniting Professionals to Achieve Success Through Lasting Personal Relationships® | | Brand Promise Great Results Through Strategic Partnerships and Knowledge Sharing® |

At Kforce, we value life-long learning. It’s what drives innovation and empowers people in their careers. Whether we’re novices or experts, there is always more to discover—a vast world of knowledge to tap into. Each new discovery encourages us to become better versions of ourselves.

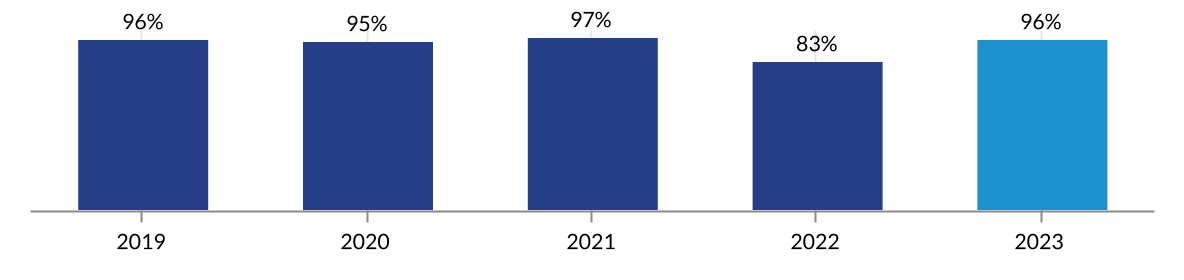

Supporting our people remains our number one priority—from hybrid work to leadership development and pay equity, we focus on making Kforce the best environment for each associate. We are proud to say we earned several top workplace awards in 2023 highlighting our commitment to an empowering culture, which include Fortune’s Best Workplaces in Consulting and Professional Services, Fortune’s Best Workplaces for Women, and Forbes’ America’s Best Recruiting Firms.

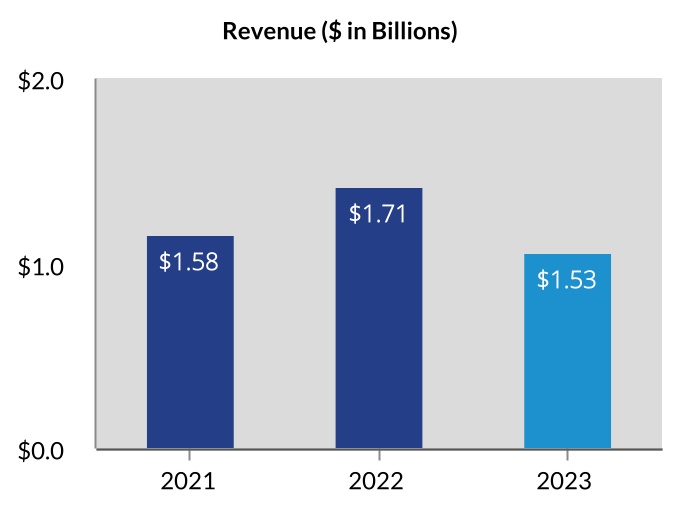

We are blessed to have a tenured Executive Leadership team that has been through multiple economic cycles together and can quickly adjust to changing market conditions. Our message to our people in 2023 was simple and, frankly, it is no different as we begin 2024. There are many factors that affect our business, which are uncontrollable. We must control what we can control, stay close to our associates, support our consultants, and continue listening to our clients while maintaining a long-term view in our decision-making. Our teams executed well in 2023 in an environment that proved to be more challenging than originally expected. Our results in 2023, which were driven by solid execution and a focused business model, allowed us to continue allocating significant capital towards our strategic priorities and in our people and tools. As a result, we believe we enter 2024 well positioned to take additional market share and continue creating significant long-term returns for our shareholders.

As to our strategic priorities, in 2023 we meaningfully advanced our integrated strategy, which capitalizes on the strong relationships we have with world-class companies by utilizing our existing sales, recruiters, and consultants to provide higher value teams and project solutions that effectively and cost efficiently address our clients’ challenges. Also, we made significant progress in our multi-year back office transformation efforts with the selection of Workday as our future state enterprise cloud application for human capital management and financial reporting, which will complement our Microsoft front-end applications and create a unified and streamlined technology suite for the Firm once fully implemented over the next few years. We believe we are incredibly fortunate to be partnering with Workday and Microsoft, two companies at the forefront of investing in artificial intelligence. As we look ahead to 2024, we expect to continue making the necessary investments in our strategic priorities to sustain our long-term growth ambitions and achieve our financial objective of attaining double-digit operating margins at slightly greater than $2 billion in annual revenues.

Our 2023 Sustainability Report, which was published in February 2024, outlines the considerable progress we made in our overall Environmental, Social and Governance (ESG) efforts in 2023. We continued to prioritize investing in our people as our number one priority and strengthened our governance and environmental processes—starting with the formal inclusion of ESG oversight and governance in each of our board committee charters. Our 2023 Sustainability Report discloses our full value chain emissions for 2023, which have declined 55% over our 2019 baseline primarily as a result of our intentional focus on reducing our real estate footprint to align with our Office Occasional® work environment. There is always more to be done, and our desire to learn and evolve has us eager to discover the next best steps in our ESG journey. Our goals for 2024 have us pushing for even greater equity and inclusion throughout the Firm.

The beautiful thing about life, and business, is that there is always more to discover and accomplish. Our journey is never complete. At Kforce, we promise to keep pushing ourselves and achieving new levels of understanding and success. We are committed to serving as stewards of the community, reimagining how work gets done and investing in an inclusive workforce for all. Together, let’s keep shaping a world in which we all want to live. | | | | | | | | |

| | |

David L. Dunkel, Chairman | Elaine D. Rosen, Lead Independent Director | Joseph J. Liberatore, President and Chief Executive Officer, Director |

2 Kforce 2024 Proxy Statement

TABLE OF CONTENTS

| | | | | | | | | | | |

BOARD AND CORPORATE GOVERNANCE | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Proposal 1 | | |

| | |

| | |

| | |

| | |

| | |

| Proposal 2 | | |

| | | |

EXECUTIVE COMPENSATION | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Proposal 3 | | |

| | | |

| | | |

OTHER MATTERS | | | |

| | |

| | |

| | |

| | |

| | |

3 Kforce 2024 Proxy Statement

BOARD AND CORPORATE GOVERNANCE

ROLE OF THE BOARD OF DIRECTORS

The primary functions of our Board of Directors (the Board) are to:

•oversee the performance of management on behalf of our shareholders;

•advocate on behalf of the long-term interests of our shareholders;

•discuss and consider the Firm’s strategic planning and executive succession activities;

•review and approve the Firm’s long-term strategic plan developed by management;

•monitor adherence to the Firm’s established procedures, standards and policies;

•provide active oversight of risks that could affect Kforce, including cybersecurity and artificial intelligence (AI) risks;

•provide oversight of the Firm’s ESG program;

•promote sound corporate governance policies and practices; and

•carry out other duties and responsibilities as may be required by state and federal laws, as well as the NASDAQ rules.

We believe that sound corporate governance is fundamental to the overall success of Kforce. Our key governance documents, including our Corporate Governance Guidelines, are available at http://investor.kforce.com/governance/governance-documents.

In conjunction with management reports and dialogue with executive leadership, the Board reviews various operational, strategic, financial, capital markets and legal compliance areas, business and sector trends, as well as the Firm’s progress against established objectives and risks. At each quarterly Board meeting, our Board receives:

•an executive summary that includes, among other items, a risk factors section;

•the Firm’s financial and operational performance, including progress against our expectations and plans;

•an update on the Firm’s accomplishments and near-term objectives associated with each strategic priority;

•an update on the Firm’s continued innovation (both technological and process) and transformation efforts;

•management’s assessment of the current state of the capital markets and macro-economic environment;

•management’s analysis on the current state of the staffing and solutions industries and corporate development activities;

•insights on human capital trends, productivity metrics and, as part of our ESG program, specifically highlighting Diversity, Equity and Inclusion (DE&I) efforts;

•a report on the Firm’s Enterprise Risk Management (ERM) program;

•a claims, litigation and ethics hotline summary;

•updates on key regulatory changes and potential impact on our business;

•updates on relevant matters arising from each of the committees of the Board; and

•reports on other matters that may arise from time to time, which require reporting to the Board, including a quarterly update from the Audit Committee on any significant cybersecurity related items.

On a monthly basis, our Board receives:

•a description of certain significant events and risk factors, if any, that have occurred in each period;

•a financial update from management, including operating trends against expectations; and

•any other necessary items requiring the attention of the Board.

On an annual basis, executive management and our Board discuss the Firm’s near-term and longer-term strategic objectives, management’s progress towards its objectives and any necessary changes based on our position and the evolving external landscape. Over the last several years, management has engaged in dedicated sessions with the Board related to the Firm’s cybersecurity program and ESG program. In addition, the full Board participates in annual education sessions on matters deemed pertinent by the Nomination Committee and full Board. The Board education topics have varied among Generative AI (GenAI), shareholder activism, ESG programs, as well as other topics, and are usually facilitated by independent subject matter experts.

LEADERSHIP STRUCTURE

Our Board continues to be led by its Chairman, David L. Dunkel, who served as our CEO for more than 40 years and retired from the CEO position in 2021. Kforce continued to employ Mr. Dunkel on a limited, part-time basis, while he also remained as Board Chairman. Due to the successful completion of the CEO transition, Mr. Dunkel’s part-time employment agreement ended effective July 31, 2023, and Mr. Dunkel has continued to serve Kforce solely as its non-executive Board Chairman. This role is coupled with, and balanced by, a lead independent director as well as independent Audit, Compensation, Nomination and Corporate Governance Committees and a majority of independent directors. The Board believes that this structure provides the most effective, efficient and appropriate framework for board oversight and governance. Mr. Dunkel possesses a deep and unique understanding of the Firm’s business and operations. The Board continues to believe that his in-depth knowledge and experience places him in the best position to both guide and implement the Board’s direction.

Our commitment to Board independence is further supported by the independent directors, a lead independent director and independent directors who chair each of the Audit, Compensation, Nomination and Corporate Governance Committees. As a result, the oversight of the critical issues within the purview of these Committees is entrusted to the independent directors and serves to further uphold effective governance standards. All continuing directors are independent, with the exception of Mr. Dunkel and Mr. Liberatore.

4 Kforce 2024 Proxy Statement

The Board and executive management remain open to, and regularly seek, shareholder feedback with regard to governance topics, such as the Board leadership structure, and consider the feedback provided as part of its assessment process. Aspects of our shareholder engagement efforts are summarized in the “Consideration of Shareholder Feedback” section of this Proxy Statement.

COMMITTEE STRUCTURE

Our Board has established four standing committees consisting of an Audit Committee, Compensation Committee, Nomination Committee and Corporate Governance Committee. These Committees facilitate a more in-depth assessment of certain important areas than can be addressed during each quarterly Board meeting. The Board has determined that the chair and each of the members of its Audit, Compensation, Nomination and Corporate Governance Committees are independent within the meaning of NASDAQ and SEC Rules. The Committee members and independent directors meet regularly in executive session without management. Each Committee has the authority to retain or obtain the advice of legal counsel, accountants and other advisors. Each of our Committees has a written charter, which are available at http://investor.kforce.com/governance/governance-documents. Additional information regarding the composition and responsibilities of each Committee is described below.

| | | | | |

| Corporate Governance Committee |

| Members: | Roles and Responsibilities of the Committee: |

| Elaine D. Rosen (Chair) | The functions of the Corporate Governance Committee are to: encourage and enhance communication among independent directors; provide a forum for independent directors to meet separately from management; provide leadership and oversight related to ethical standards and governance practices (including ESG); and provide a channel for communication with the CEO. The Corporate Governance Committee also coordinates a formal, written annual evaluation of the performance of the Board, each of its committees and the CEO. Each member of the Board who is independent (as determined under the NASDAQ Rules) serves on the Corporate Governance Committee. This committee is designed to fulfill the requirements of NASDAQ Rule 5605(b)(2) (i.e., through the meetings of this committee, our independent directors meet at least once annually in executive session without any of our management present). The Firm’s Lead Independent Director serves as the Chair of the Corporate Governance Committee.

|

| Derrick D. Brooks |

| Catherine H. Cloudman |

| Ann E. Dunwoody |

| Mark F. Furlong |

| Randall A. Mehl |

| N. John Simmons |

| Number of Meetings: |

| 4 |

| |

| Audit Committee |

| Members: | Roles and Responsibilities of the Committee: |

| Mark F. Furlong (Chair) | The Audit Committee oversees the accounting and financial reporting processes of the Firm and the Firm’s ERM program. The Board also delegated responsibility for the Firm’s cybersecurity program and data privacy practices to the Audit Committee. In discharging this oversight role, the Audit Committee is empowered to investigate any matter brought to its attention, with full access to all books, records, facilities and personnel of Kforce, and the power to retain outside counsel or other experts. The Audit Committee also has the responsibility for selecting, evaluating, compensating and monitoring the independence and performance of the Firm’s independent auditors in conducting its audits and reviews, reviewing and approving related party transactions, and overseeing the Firm’s internal audit function and ERM program, including cybersecurity, data privacy and ESG disclosures. At each quarterly meeting, or more frequently as needed, the members of the Audit Committee meet in executive session and meet regularly in separate executive sessions with the Firm’s Vice President of Internal Audit, General Counsel and independent registered public accountants, Deloitte & Touche LLP. The Board has determined that Mr. Furlong, Ms. Cloudman and Mr. Simmons are considered audit committee financial experts, as defined by SEC Rules. |

| Catherine H. Cloudman |

| N. John Simmons |

| Number of Meetings: |

| 6 |

|

|

| | | | | |

| Compensation Committee |

| Members: | Roles and Responsibilities of the Committee: |

| Randall A. Mehl (Chair) | The Compensation Committee is responsible for the development of the compensation principles that guide the design of the Firm’s named executive officer compensation program, which includes: reviewing and approving the named executive officer compensation plans; approving any new or amended employment agreements for the Firm’s named executive officers; issuing grants or awards to the Firm’s named executive officers under its long-term incentive program; and preparing an annual report on the Firm’s executive compensation policies and practices as required by SEC Rules. In the discharge of its duties, the Compensation Committee also has the authority to select and utilize an independent compensation consultant to assist in the evaluation of director and named executive officer compensation. |

| Mark F. Furlong |

| Elaine D. Rosen |

| Number of Meetings: |

| 5 |

5 Kforce 2024 Proxy Statement

| | | | | |

| Nomination Committee |

| Members: | Roles and Responsibilities of the Committee: |

Ann E. Dunwoody

(Chair) | The Nomination Committee is responsible for: identifying and recommending candidates to establish board diversity; assessing the size and composition of the Board; establishing procedures for the nomination process; and overseeing board education and training. The Nomination Committee has the authority to retain a search firm to be used to identify director candidates and to approve the search firm’s fees and other retention terms. The Nomination Committee has not established minimum qualifications for director nominees because it is the view of this committee that the establishment of rigid minimum qualifications might preclude the consideration of otherwise desirable and qualified candidates for election to the Board. The Nomination Committee will consider director candidates recommended by shareholders. Refer to the section titled “Shareholder Communications, Proposals and Other Matters” in this Proxy Statement. |

| Derrick D. Brooks |

| Randall A. Mehl |

| Number of Meetings: |

| 4 |

During 2023, the Board held five meetings, and the four committees of the Board held a total of 19 meetings. Each director attended 100% of the Board meetings, and all of the directors attended 100% of the committee meetings on which he or she served. Our Corporate Governance Guidelines invite, but do not require, our directors to attend our annual meeting of shareholders.

DIRECTORS’ TIME COMMITMENTS

Kforce’s Corporate Governance Guidelines limit non-employee directors of Kforce to serve on no more than four public-company boards (including Kforce). In the context of reviewing our directors’ continued ability to dedicate sufficient time to our Board, Kforce assesses each director’s compliance with this policy. Each of our directors is currently compliant with this policy.

6 Kforce 2024 Proxy Statement

BOARD’S ROLE IN RISK OVERSIGHT

Identifying, assessing and managing potential impacts of risks to our business, including any ESG-related risks, is critical to our long-term success and, thus, generating long-term shareholder value. The Board, as a whole and at the committee level, has an active role in overseeing the management of the Firm’s risks. The Board’s primary mechanism for assessing overall risk to the Firm as well as management’s actions to address and mitigate those risks is through a comprehensive, integrated ERM program.

Enterprise Risk Management

Our ERM program is committed to regularly assessing risks and testing plans to prepare for the possibility of the occurrence of a range of events, including severe weather, threats to our systems and data security, financial fraud or loss, and other matters. All potential and actual risks are ranked and prioritized into one of the following categories:

| | | | | |

| FINANCIAL | OPERATIONAL |

Traditional monetary risks covering cash and treasury management activities, risks inherent in achieving our profitability objectives, meeting regulatory reporting requirements, and susceptibility to fraudulent activities. | Risks associated with general execution of the business, including key core processes and strategies for areas such as payroll and business continuity; cybersecurity and data privacy risks; and risks of evolving, disruptive or enabling technologies. |

CLIENT | LEGAL & HUMAN RESOURCES |

Risks associated with the capture, development and retention of our clients with a specific focus on contractual compliance and any concentration risks; and retention risks associated with our associates who support our clients, candidates and consultants. | Compliance risks associated with areas including, but not limited to, worker classification and associated claims, hiring practices, other employment related risks and foreign worker compliance, which are derived from local, state and federal regulations. |

Our Vice President of Internal Audit, in collaboration with our General Counsel, facilitates our ERM process. Each of the four categories above contains specific risks that could impact Kforce. Each category is highlighted during one quarter per year, allowing for an in-depth analysis of all risks at least annually. During this in-depth analysis, the team engages the appropriate stakeholders, including key members of senior management, to measure the business impact and residual risk likelihood, consider external factors and current mitigation efforts and ultimately determine whether further action plans are needed. Our internal audit team, which reports directly to the Audit Committee, uses the ERM program to develop a risk-based audit plan, which is approved by the Audit Committee annually. In addition, the program is evaluated annually with the assistance of our third-party partners to benchmark and implement enhancements as needed.

To assist the Audit Committee with its role of compliance and risk oversight, the Vice President of Internal Audit provides the Committee with a quarterly report covering the applicable quarter’s ERM category. This engagement also allows the Audit Committee to provide guidance on current and future action plans. The Board also receives a summary of the ERM report each quarter.

Cybersecurity and Other

The Board is actively engaged in the oversight of cybersecurity and data privacy, and additional risks such as artificial intelligence. The Audit Committee assists the Board in meeting its responsibility to oversee cybersecurity and data privacy strategies and practices. On a quarterly basis, the Audit Committee receives updates on (a) our progress meeting objectives established in our cybersecurity maturity roadmap, (b) relevant reported cybersecurity events in the overall market and evolving risks, (c) results of work performed by our information security organization (ex. penetration tests, cybersecurity program maturity assessments) and (d) detailed reports of cybersecurity trends within the Firm. We engage subject matter experts in conducting independent assessments of our cybersecurity program maturity, penetration tests, and other tests and assessments.

Senior management, including our CIO and Chief Information Security Officer (CISO), brief the Board on an annual basis on our cybersecurity and information security posture and as needed for cybersecurity incidents deemed to have a moderate or higher business impact, even if it is considered immaterial to us. Annually, the Board and management participate in a comprehensive strategy discussion on cybersecurity.

To further enhance the Board and Audit Committee’s role in overseeing cybersecurity risks, the Board formed a special working group that is comprised of Ms. Cloudman and Mr. Simmons to have more frequent and detailed dialogue with executive management (including our COO, CFO, CIO, CISO and VP of Internal Audit) on all areas pertaining to cybersecurity. This working group provides updates on a quarterly basis, or more frequently if necessary, to the Audit Committee. As a result of the steps taken by the Firm with respect to our cybersecurity program, we have not experienced a material breach to date.

Management also provides the Audit Committee with an annual overview of Kforce’s various lines of insurance that we maintain, including our cybersecurity insurance policy. The Audit Committee provides the Board with quarterly reports on the Firm’s risks and ERM program findings, including cybersecurity risk and data privacy practices.

7 Kforce 2024 Proxy Statement

In addition, the Board is responsible for the oversight of our ESG policies and strategy. The Board delegates certain aspects to Board committees who inherently play an active role and are jointly responsible for ESG compliance and oversight.

The individual Committees also consider risk within their areas of responsibility as summarized below. The Committee chairs provide reports of their activities to the Board at each quarterly Board meeting including apprising the Board of any significant risks within their areas of responsibility and management’s response to those risks.

| | | | | | | | | | | | | | | | | | | | | | | |

| Audit | | Compensation | | Nomination | | Corporate Governance |

| | | | | | | |

| Oversees risk assessment activities, ERM program (including cybersecurity, data privacy and ESG disclosures) and annual internal audit plan | | Oversees executive compensation plan design in light of evolving trends and best practices | | Oversees Board refreshment activities including director succession risk | | Leadership and oversight of ethical standards and governance practices |

| | | | | | | |

| Monitors and receives reports on the Firm’s cybersecurity risks and incidents and ensures data privacy practices are appropriately followed and in compliance with rules and regulations | | Responsible for the preparation of required disclosures regarding executive compensation practices | | Establishes procedures for the Board’s nomination process | | Provides a forum for the Board’s independent directors to meet separately from the Firm’s management |

| | | | | | | |

| Monitors risk relating to the Firm’s financial statements, systems, reporting process and compliance | | Responsible for reviewing executive compensation and benefits policies and practices | | Recommends candidates for election to the Board | | Reviews and recommends to the Board any changes to the Corporate Governance Guidelines |

| | | | | | | |

| Reviews and approves related party transactions and relationships involving directors and executive officers | | Determines whether executive compensation and benefits policies and practices are reasonably likely to have a material adverse effect on the Firm | | Oversees education and training (including ESG), recommends appropriate board diversity and establishes an appropriate mix of directors to evaluate ESG-related issues | | Conducts and oversees the evaluation of the CEO and Board’s performance and sufficiency of their respective responsibilities |

8 Kforce 2024 Proxy Statement

OUR BOARD OF DIRECTORS

The Board currently consists of three nominees and six continuing directors. The directors are divided into three classes serving staggered three-year terms. The following table sets forth (as of the date of this filing) the names, ages and certain other information for each of our directors (including those who are nominees for election at the Annual Meeting).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | Independent | Audit Comm | Comp. Comm | Nomin. Comm | Corp. Gov. Comm |

| Board of Director Nominees for Election |

| Class III | Catherine H. Cloudman | | 54 | Director | 2020 | 2024 | 2027 | ü | | | | |

| David L. Dunkel | | 70 | Chairman | 1994 | 2024 | 2027 | | | | |

|

| Mark F. Furlong | | 66 | Director | 2001 | 2024 | 2027 | ü | | | | |

| Continuing Directors |

| Class I | Joseph J. Liberatore | | 61 | CEO Director | 2021 | 2025 | N/A | | | | | |

| Randall A. Mehl | | 56 | Director | 2017 | 2025 | N/A | ü | | | | |

| Elaine D. Rosen | | 71 | Director | 2003 | 2025 | N/A | þ | | | | |

| Class II | Derrick D. Brooks | | 50 | Director | 2021 | 2026 | N/A | ü | | | | |

| Ann E. Dunwoody | | 71 | Director | 2016 | 2026 | N/A | ü |

| | | |

| N. John Simmons | | 68 | Director | 2014 | 2026 | N/A | ü | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Legend: | þ | Lead Independent Director | | Chair | | Member | | Financial Expert |

The Class III nominees identified above have been nominated to serve as directors for a three-year term expiring at the 2027 annual meeting of shareholders. All of the nominees are currently directors of Kforce and were previously elected by our shareholders.

9 Kforce 2024 Proxy Statement

BIOGRAPHICAL INFORMATION FOR OUR DIRECTOR NOMINEES

The biographies for each of our director nominees are set forth below, along with a description of the experiences, qualifications, attributes or skills that caused the Nomination Committee and the Board to determine that they should serve as a director of Kforce.

NOMINEES FOR ELECTION, CLASS III DIRECTORS - TERMS EXPIRE IN 2027 | | | | | | | | | | | |

| | | |

| Catherine H. Cloudman |

| Ms. Cloudman is a board member and chairs the Personnel and Compensation Committees of both Hussey Seating Company, a manufacturer of telescopic and stadium seating, and Systems Engineering, an ESOP owned IT managed services provider, since 2015. Additionally, she has been a board member since 2019 of Gorham Savings Bank, a 150-year-old community bank, where she chairs the Director’s Loan Committee and the Director’s Loan Risk Committee. She is also a member of the Audit, Risk Management and Technology Committees of the bank. At the beginning of 2023, Ms. Cloudman joined the advisory board of Zachau Construction, a third-generation commercial construction firm. She also serves on the board of Waynflete School, an independent K-12 day school, where she is the President and Board Chair. Ms. Cloudman was also a board member of private equity backed Village Fertility Pharmacy until 2020. Prior to becoming a board member, she was a founder and CFO at Apothecary by Design and its successor company, Village Fertility Pharmacy, both of which are national specialty pharmacies. Ms. Cloudman is an Audit Committee financial expert. The Board believes her considerable expertise, including her experience as CFO at Apothecary by Design and its successor company, Village Fertility Pharmacy, brings unique insight to the Board concerning in-depth knowledge of various ownership structures and her entrepreneurial background, in addition to her being a CPA and management consultant, and her overall financial and strategic management expertise. |

| Director since 2020 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Audit and Corporate Governance |

| Age | 54 |

| | | |

| David L. Dunkel |

| Mr. Dunkel has served as Kforce’s Chairman, CEO and director since the Firm’s incorporation in 1994 and possesses a deep and unique understanding of the Firm’s business and operations. Prior to 1994, he previously served as President and CEO of Romac-FMA, one of Kforce’s predecessors, for 14 years. Mr. Dunkel retired from his position as CEO in 2021, and entered into a part-time employment agreement to provide support, on a limited basis, to the Firm in a non-executive employee role, in addition to continuing his role as Chairman of Kforce’s Board of Directors. Due to the successful completion of the CEO transition, Mr. Dunkel’s part-time employment agreement ended effective July 31, 2023, and Mr. Dunkel has continued to serve Kforce solely as its non-executive Board Chairman. The Board believes that Mr. Dunkel’s experience, coupled with his extensive knowledge of the staffing industry, provides strong, consistent leadership. |

| Director since 1994 | Other Current Public Company Board(s): None |

|

| Age | 70 |

| | | |

| Mark F. Furlong |

| Mr. Furlong has served as a director of Heska Corporation, a provider of advanced veterinary diagnostic and specialty products, from 2019 to June 2023 when it was sold, and director of Antares Capital, a provider of financing solutions for middle market, private equity-backed transactions, from 2015 to April 2023. In September 2023, he joined ALTi Global, a global wealth and asset manager specializing in alternative investments, as a Board member, member of the Human Capital and Compensation Committee and as Chair of the Audit/Risk Committee. He served as the President and CEO of BMO Harris Bank, N.A. from 2011 to 2015. Mr. Furlong also served as a director of BMO Harris Bank, N.A. and BMO Financial Corporation from 2011 to 2015. Prior to its acquisition by BMO Harris Bank, N.A. in 2011, he served as Chairman of Marshall & Ilsley Corporation from 2010, as CEO from 2007 and as President from 2004. He also served as CFO of Marshall & Ilsley Corporation from 2001 to 2004 and was formerly an audit partner with Deloitte & Touche LLP. Mr. Furlong is an Audit Committee financial expert. The Board believes his considerable expertise, including his experience as President and CEO of BMO Harris Bank, N.A., the former Chairman, President and CEO of Marshall & Ilsley Corporation and a former audit partner with Deloitte & Touche LLP, brings unique insight to the Board concerning capital allocation strategies and banking and accounting issues, in addition to his overall management and financial expertise. |

| Director since 2001 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Audit (Chair), Compensation and Corporate Governance |

| Age | 66 |

| | | |

10 Kforce 2024 Proxy Statement

PROPOSAL 1. ELECTION OF DIRECTORS

NOMINEES

The Nomination Committee has recommended, and our Board has approved, each of Catherine H. Cloudman, David L. Dunkel and Mark F. Furlong as nominees for election as Class III directors at the Annual Meeting. If elected, the Class III directors will serve until our 2027 annual meeting of shareholders and until their successors are duly elected and qualified. Each of the nominees is currently a director of the Firm and was previously elected by our shareholders. For information concerning the nominees, please see the section titled “Biographical Information for our Director Nominees.” Each of the nominees is willing and able to stand for election at the Annual Meeting, and we do not know of any reason why any of the nominees would be unable to serve as a director. If any nominee becomes unable or unwilling to stand for election, the Board may reduce its size or designate a substitute. If a substitute is designated, proxies voting for the original nominee will be cast for the substituted nominee.

VOTE REQUIRED

We use a majority voting standard for uncontested elections. The election of directors at this year’s Annual Meeting is an uncontested election, and thus, the majority voting standard applies. To be elected, the votes for a director must exceed 50% of the votes actually cast with respect to the director’s election. Votes actually cast excludes abstentions and broker non-votes. | | |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 1. |

11 Kforce 2024 Proxy Statement

BIOGRAPHICAL INFORMATION FOR OUR CONTINUING DIRECTORS

| | | | | | | | | | | |

CLASS I DIRECTORS - TERMS EXPIRES IN 2025 |

| Joseph J. Liberatore |

| Mr. Liberatore became the Chief Executive Officer of Kforce on January 1, 2022. He joined the Board as a director in November 2021, and was elected by shareholders in April 2022. He has served as Kforce’s President since January 2013 and previously served as Corporate Secretary from February 2007 to February 2013, Chief Financial Officer from October 2004 to December 2012, Executive Vice President from July 2008 to December 2012, Senior Vice President from 2000 to July 2008, Chief Talent Officer from 2001 to 2004 and Chief Sales Officer from September 2000 to August 2001. Mr. Liberatore has served in various other roles in Kforce (and its predecessors) since he joined the Firm in 1988. The Board believes that this experience, coupled with his extensive knowledge of the staffing industry, provides strong, consistent leadership and allows him to serve as a highly effective bridge between the Board and management. In addition, in his capacity as CEO, Mr. Liberatore frequently meets with shareholders, clients and other Firm stakeholders to communicate our business and strategy and to understand their various perspectives and insights, which he is then able to relay to the Board for consideration and assessment. |

| Director since 2021 | Other Current Public Company Board(s): None | |

| Age | 61 |

| | | | | | | | | | | |

| Randall A. Mehl |

| Mr. Mehl is the President and Chief Investment Officer of Stewardship Capital Advisors, LLC, which manages a family office fund focused on making investments in various technology and services sectors. In January 2024, he joined the board of KI, a furniture manufacturer. He also currently serves on the Board of Directors of two other public companies, Insperity, Inc. and ICF International, Inc., where he chairs the Human Capital Committee. Mr. Mehl previously served as Managing Director and as a partner with Baird Capital, a middle market private equity group, leading a team focused on business and technology services sectors from 2005 to 2016. From 1996 to 2005, Mr. Mehl was a senior equity research analyst with Robert W. Baird & Company, covering various areas within the technology and services universe, including staffing. Mr. Mehl has also previously served on several boards of directors of private technology and services companies, and has served on the investment committee for several private equity funds. He is an Audit Committee financial expert. Mr. Mehl brings unique insight to the Board with his domain expertise in technology services and staffing, experience in evaluating and supporting executive leadership and governance practices, and experience in evaluating, acquiring and selling services-oriented businesses. |

| Director since 2017 | Other Current Public Company Board(s): ICF International, Inc. (NASDAQ: ICFI); Insperity, Inc. (NYSE: NSP) | Kforce Board Committee(s): Compensation (Chair), Nomination and Corporate Governance

|

| Age | 56 |

| | | | | | | | | | | |

| Elaine D. Rosen |

| Ms. Rosen has served as a director of Assurant, Inc., a provider of specialized insurance and insurance-related products and services since March 2009 and became the non-executive Chair of the Board of Directors of Assurant, Inc., in November 2010. Ms. Rosen served as the Chair of the Board of The Kresge Foundation from January 2007 up until her retirement in June 2022. Ms. Rosen serves as trustee or director of several non-profit organizations, is a past Chair of the Board of Preble Street, a homeless collaborative in Portland, Maine, and has served as a trustee of the Foundation for Maine’s Community Colleges since 2008. Ms. Rosen was a director of the Elmina B. Sewall Foundation from 2008 to 2012 and Downeast Energy Corp., a privately-held company that provides heating products and building supplies, from 2003 until its sale in April 2012. From 1975 to March 2001, Ms. Rosen held a number of positions with Unum Life Insurance Company of America, including President. Ms. Rosen has extensive experience as a senior executive in the insurance industry and as a director of several companies, including charitable organizations, particularly as the Chair of one of the largest private foundations in the country. With her background and experience as the prior Chair of the Compensation Committee of Kforce, the Board of Assurant, Inc., where she currently serves as the non-executive Chair, and as the Lead Independent Director at Kforce, she has considerable expertise in overall Board leadership, governance matters and executive compensation. |

| Director since 2003 | Other Current Public Company Board(s): Assurant, Inc. (NYSE: AIZ)

| Kforce Board Committee(s): Lead Independent Director, Corporate Governance (Chair) and Compensation |

| Age | 71 |

12 Kforce 2024 Proxy Statement

| | | | | | | | | | | |

CLASS II DIRECTORS - TERMS EXPIRES IN 2026 |

| Derrick D. Brooks |

| Mr. Brooks, is the Executive Vice President of Corporate and Community Development of Vinik Sports Group since 2019, and also serves as an on-field appeals officer for the National Football League. He previously served as the President of Tampa Bay Sports & Football Entertainment LLC and was the owner of the Tampa Bay Storm Arena Football Team from 2011 to 2019. Mr. Brooks served as the Managing Member of Brooks 55 Labor Enterprises, L.L.C., a full-service temporary and direct hire staffing company that provided staffing, administrative solutions and on-time labor needs, from 2006 to 2012. He also served as an NFL analyst for ESPN from 2009 to 2011. From 1995 to 2009, Mr. Brooks played for the Tampa Bay Buccaneers, was a Super Bowl Champion and a nine time All-Pro. In 2014, Mr. Brooks was inducted into the Pro Football Hall of Fame and the Capital One Academic All-America Hall of Fame and was named the 2000 Walter Payton NFL Man of the Year Award Winner. Mr. Brooks has a long history of community leadership. Among his other activities and services, Mr. Brooks is the President and Founder of the Derrick Brooks Charities, Inc. since 2003, and currently serves on the board of Brooks Debartolo Charities, Inc. since 2006. He previously served on the board of the Florida State Fair Authority from 2017 to 2022. He served as a member of the board of trustees of Florida State University from 2003 to 2011. He has also served on the boards of the Florida Department of Education Foundation from 2004 to 2010, St. Leo's University from 2007 to 2010, and the Florida Governor's Council on Physical Fitness from 2007 to 2010.

|

| Director since 2021 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Nomination and Corporate Governance |

| Age | 50 |

| | | |

| | | | | | | | | | | |

| Ann E. Dunwoody |

| General (Ret.) Dunwoody was the first woman in U.S. military history to achieve the rank of four-star general. From 2008 until her retirement in 2012, she led and ran the largest global logistics command in the Army comprising 69,000 military and civilian individuals, located in all 50 states and over 140 countries with a budget of $60 billion. General (Ret.) Dunwoody served on the Board of Directors of Republic Services, Inc., L-3 Communications and was the President of First 2 Four LLC. She currently serves on the Fidelity Fixed Income Asset Allocation (FIAA) Board of Trustees, Automattic, Florida Institute of Technology and Noble Reach Foundation, a not for profit, which was formerly part of Logistics Management Institute. She authored “A Higher Standard: Leadership Strategies from the First Female Four Star General”, is a recipient of The Theodore Roosevelt NCAA award, The Ellis Island Medal of Honor, Orde National Du Merite and was West Point’s US Military Academy 2019 recipient of the Thayer Award. General (Ret.) Dunwoody brings to the Board extensive military and management experience, including managing a significant portion of the United States Army’s budget as Commanding General, U.S. Army Materiel Command. General (Ret.) Dunwoody is also certified as an NACD Governance Fellow. She has also served as a member of the Board of Directors on other publicly traded, private and not for profit companies. She is engaged in numerous charitable and civic activities, which the Board believes allows her to provide a valuable and varied perspective. |

| Director since 2016 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Nomination (Chair) and Corporate Governance

|

| Age | 71 |

| | | | | | | | | | | |

| N. John Simmons |

| Mr. Simmons is the CEO of Growth Advisors, LLC, an advisory firm for high-growth companies. He previously served as the COO and CFO of DeMert Brands, Inc., a manufacturer and distributor of haircare products. He has served on various boards of directors, including Bonds.com Group, Inc. from 2013 to 2014; Loyola University New Orleans Board of Trustees from 2009 to 2015, during which he was Chairman of the Audit Committee and an Executive Committee member; Lifestyle Family Fitness, Inc. from 2001 to 2012; Technology Research Corporation as Chairman of the Compensation Committee from 2010 to 2011 and Lead Director and Chairman of the Governance and Nominating Committee from 2009 to 2010; Medquist, Inc. as Chairman of the Audit Committee from 2005 to 2007; and SRI Surgical Express, Inc. as Lead Director, then Chairman of the Board from 2001 to 2008. Mr. Simmons’ prior experience includes service as the CEO and President of Lifestyle Family Fitness, Inc.; President of New Homes Realty, a residential real estate company; President of Quantum Capital Partners, a venture capital firm; VP and Controller of Eckerd Corporation; CFO of Checkers Drive-In Restaurants; and audit partner for KPMG Peat Marwick. Mr. Simmons is an Audit Committee financial expert. He has extensive financial, accounting, management and director experience in several different industries. As a result, the Board believes that he brings valuable insight due to his extensive and varied experiences as a chief executive officer, chief financial officer, audit partner and director. |

| Director since 2014 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Audit and Corporate Governance |

| Age | 68 |

13 Kforce 2024 Proxy Statement

COMPOSITION AND DIVERSITY

Our diverse Board exhibits a wide range of backgrounds, skills, attributes, experiences and tenure. Our directors have served in senior leadership, executive management or directorship positions across fields such as banking, executive compensation, investment management, strategic advisory, insurance, government, military, professional sports and staffing. These fields provide valuable and diverse insights into our business and promote a broad understanding of the markets, products and industries of our client base. The Nomination Committee periodically reviews the composition of the Board and its Committees to ensure a well-functioning mix of diverse backgrounds and expertise.

The Nomination Committee strives to identify directors who will: (1) bring to the Board diversity in thought and insights by leveraging their different skills and backgrounds; (2) bring substantial senior management experience, strategic insight, financial expertise and other skills that would enhance the Board’s effectiveness; and (3) represent the balanced, best interests of our shareholders and stakeholders, as a whole. In selecting individual nominees, the Nomination Committee assesses each nominee’s independence, character and integrity, potential conflicts of interest, experience, diversity and the willingness to devote sufficient time to carrying out the responsibilities of a director.

While the Board has not adopted a formal policy on diversity, the Nomination Committee is committed to achieving diversity, including but not limited to diversity of thought, gender, race and ethnic background, during the director nomination process with the goal of creating a Board that best serves Kforce and the interests of its shareholders.

The Nomination Committee has established a detailed director recruitment process by which the Firm’s independent directors and key management play a role in the identification, review, screening and interviewing of director candidates and, as necessary, would consider engaging an independent qualified director search firm. The Nomination Committee’s process for identifying and selecting director candidates is designed to ensure each candidate is evaluated for qualifications, independence, potential conflicts and other issues of importance to the Firm and composition of the Board. When identifying candidates, the Nomination Committee takes into account overall board composition. The priorities for recruiting new directors are based on the overall Board’s composition, the Firm’s strategic needs, diversity and desired skills at the time of recruitment.

The Nomination Committee also understands the importance of Board refreshment for the generation of new ideas and strategies and is committed to the process in a manner that promotes a balance of perspective, experience and continuity. We remain committed to engaging in Board refreshment activities to promote a balance of tenure, experience and independence across our Board. As a result of our refreshment efforts over the last five or so years, the Board has a significantly lower average tenure, a larger percentage of independent directors and greater diversity.

Directors’ Qualifications and Skills

The following chart summarizes the collective qualifications and skills in several areas that we believe are important to the long-term success of Kforce. Although all of our directors have experience in each of these categories, the chart below represents the number of directors whose expertise in each category is deemed to be particularly significant.

14 Kforce 2024 Proxy Statement

Board Diversity

The following table provides certain composition metrics for our Board:

| | | | | | | | | | | | | | | | | |

| BOARD DIVERSITY MATRIX |

| Total # of Directors | 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 3 | 3 | — | 3 |

| Part II: Demographic Background | | | | |

| African American or Black | — | 1 | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 3 | 2 | — | — |

| Two or More Races or Ethnicities | — | — | — | — |

| LGBTQ+ | — |

| Did Not Disclose Demographic Background | 3 |

ESG OVERSIGHT AND ACTIVITIES

Kforce set out on our environmental, social and governance journey several years ago. As our company evolves, so do our objectives. In 2023, we made public commitments to ensure we focus on our priorities and keep us accountable. We are proud of the progress we have made so far and our efforts to continue that progress. We continued to make information more accessible for our investors, clients and other stakeholders with the publishing of our comprehensive 2023 Sustainability Report, which is available on our website: https://www.kforce.com/about/kforce-corporate-social-responsibility. Our report includes a content index aligned to the Sustainability Accounting Standards Board’s (SASB) Professional Services Standard.

This section is intended to provide our shareholders with the key elements of our continued ESG efforts and highlight our 2023 accomplishments and certain 2024 commitments. For more details, please refer to our 2023 Sustainability Report.

Our core values, mission and vision are the foundation for how we aim to positively impact our communities, the environment and governance of our Firm. Our core values include:

15 Kforce 2024 Proxy Statement

We believe that at the heart of Kforce is a deep understanding of, and unwavering commitment to, our core values. Our core values guide us in every interaction, inspire us to shape a better world and support our overall ESG efforts.

Our Mission and Vision

We take a people-first approach to all aspects of our business. We understand that each day is an opportunity to build up our people and create a world in which we all want to live - one that is grounded in inclusion, empowerment and fulfillment. We believe that the services we provide impact peoples’ lives and careers while helping companies achieve success. This is reflected in our mission, Uniting Professionals to Achieve Success Through Lasting Personal Relationships®, and our vision, To Have a Meaningful Impact on All the Lives We Serve®.

For more than six decades, our Firm has served others and played a part in shaping a more sustainable world. When the COVID-19 pandemic hit, our Firm’s innate urge to serve others intensified. We stayed close to our people and listened to their experiences, desires and expectations. Together, we reimagined where and how work is performed. This response naturally dovetailed with an expansion and formalization of our ESG efforts. We built our foundational pillars to deepen the impact on everyone we serve, including our people, our partners, our communities and the environment.

Our people are the keystone of our success. As a people-focused solutions business, we dedicate significant energy to ensuring the well-being and fulfillment of each individual, which we believe helps us to deliver superior results to our shareholders.

This section includes our commitment to well-being, flexibility and balance; learning and development; and our ongoing efforts to create a diverse and inclusive workplace. We believe that these initiatives are a testament to how much we value and invest in our people.

Well-Being, Flexibility & Balance

We are committed to the health, safety and wellness of our associates and consultants. We provide our people and their families the tools and resources to improve and maintain their health, including access to a variety of flexible and convenient health and wellness programs. These programs include retirement savings plans, paid time off, employee support and the development of what we believe is a thoughtful and supportive remote-first work model that we refer to as Office Occasional®.

Office Occasional® - We believe our remote-first, hybrid work model provides maximum Flexibility and Choice Empowered by Trust and Technology®. We believe Office Occasional® is a differentiator for our Firm. It helps us attract and retain top talent. We believe Office Occasional® enhances life-work balance and elevates the ability of our people to provide exceptional service to our clients.

Employee Engagement - Kforce has a long history of conducting check-in surveys and gathering feedback to assess and understand employee well-being and best serve our people. In 2023, our internal survey provide insights into what our people believed were our biggest strengths, including prioritization, role clarity and authenticity. These surveys help us shape our Firm’s programs and strategies.

Our commitment to a strong people-first strategy resulted in several meaningful awards in 2023.

| | | | | | | | | | | | | | |

| | | | |

Great Place to Work Certification 92% of respondents called Kforce a great place to work compared to 57% at an average U.S.-based company | America’s Greatest Workplaces for Women Published by Newsweek, Kforce was recognized as a company that breaks down barriers and inequities for women | Best Workplace in Consulting & Professional Services Kforce’s exceptional job at attracting top talent earned the Firm a position on Fortune’s prestigious list for the second year in a row | Best Workplace for Women Recognizes organizations whose generous, caring and innovative cultures reflect a genuine commitment to meet the diverse needs of their people inside and outside the workplace | Top 5 Workplaces in Tampa Bay For the second consecutive year, Kforce’s headquarter location ranked in the Top 5 on the Tampa Bay Times’ Top Workplaces list |

16 Kforce 2024 Proxy Statement

Learning & Development

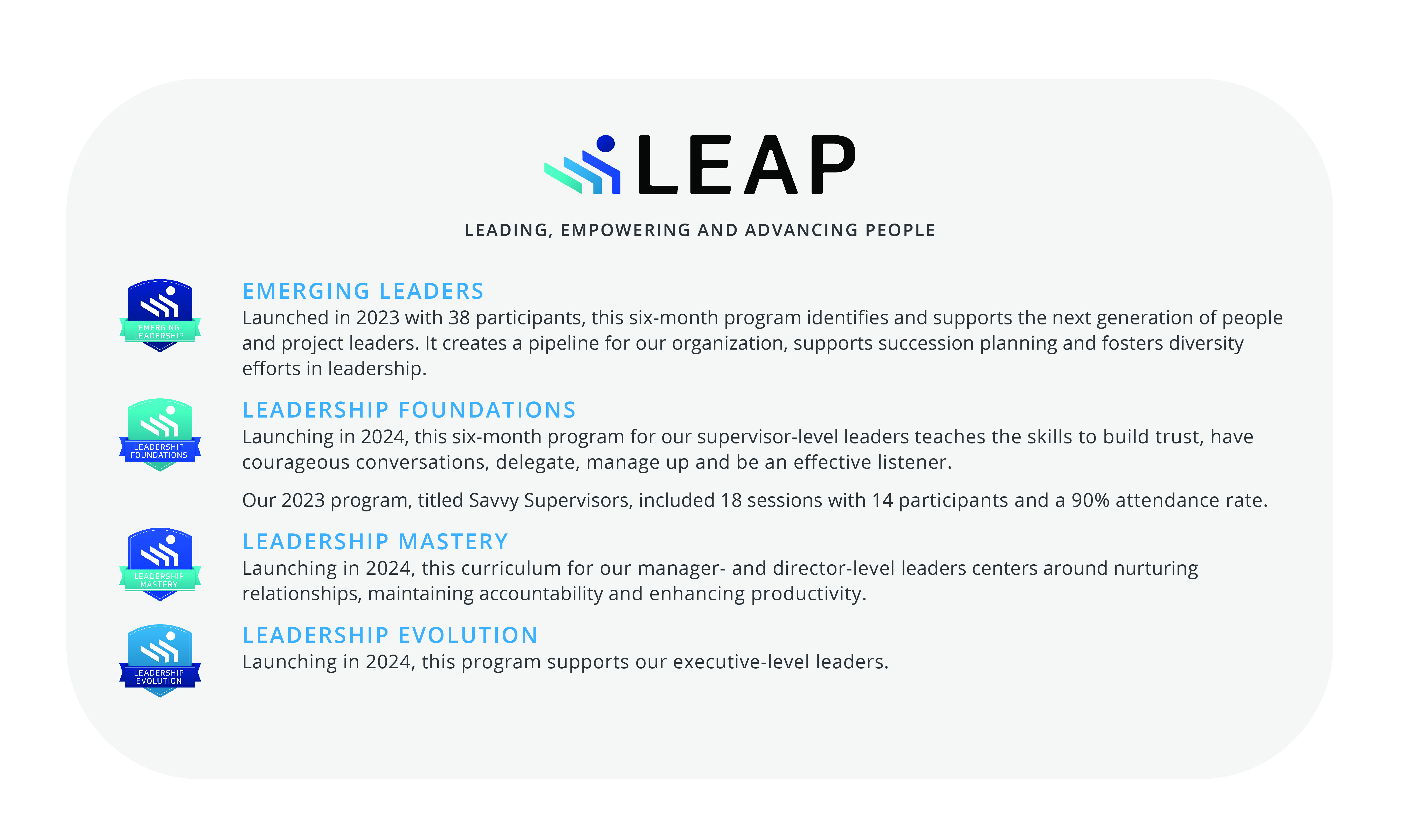

Our focus on learning and development is a vital part of our people-first strategy, supporting our efforts to develop talent from within and maintain a strong corporate culture. We are committed to investing in the tools, resources and trainings our people need to excel in all stages of their careers. The majority of our trainings are developed to increase the skills of individuals at each leadership level. We want to teach our leadership pipeline the skills necessary to perform well at each specified level. We also offer specialized trainings based on evolving current events and the needs of the constantly changing business landscape. These specialized trainings happen once a quarter for our director-and-above population.

In 2023, we expanded and evolved our current program to establish sustainable leadership opportunities for every level within the organization.

Diversity, Equity & Inclusion (DE&I)

Our DE&I mission is to advocate for and support the inclusion, growth and success of all people connected to Kforce. The ultimate goal is to weave DE&I seamlessly into our overall Firm strategy using a variety of approaches, including:

| | | | | | | | | | | | | | |

| Creating and nurturing an inclusive culture | Ensuring an equitable talent journey for all | Establishing policies that support our people | Building and strengthening partnerships | Pursuing ongoing education and training |

In 2020, we set two goals to address equity, which were based on a comprehensive third-party analysis. We established these goals on a three-year timeline to help ensure systemic and sustainable impact. In 2023, we continued to advance our DE&I efforts, reduced our voluntary turnover rate among female leaders to that of overall Firm averages, implemented a Board of Director speaker series for leaders, and launched seven associate-led affinity groups supported by orientations, group leader trainings and communication tools. We continue to build trust and long-lasting relationships with our vendors as we invest in and expand our supplier diversity program. Wherever possible, Kforce includes diverse-owned businesses in our vendor and sourcing processes. Our supplier diversity policy lays out the guidelines for identifying, tracking and supporting supplier diversity efforts. In 2023, we maintained more than 30% direct supplier spend with diverse-owned businesses and continued to leverage tools, such as a diversity dashboard, to advance our strategy.

Our goals for 2024 have us pushing for even greater equity and inclusion throughout the Firm, including conducting a study to identify and continue to address barriers to equity. We intend to enhance our talent data platforms to improve accessibility for user experience and further evolve our affinity groups with development opportunities and resources.

17 Kforce 2024 Proxy Statement

Our Board of Directors and Executive Leadership Team guide our Corporate Governance activities. They set strategy and expectations with the highest standards, extending the culture and commitment throughout the Firm. Our Board is responsible for the oversight of our ESG program. The overall governance structure of our ESG program is comprised of members of our Executive Leadership Team that were assigned to (i) environmental, (ii) social, (iii) governance and (iv) reporting and communications aspects.

Our COO serves as the executive sponsor of all ESG activities and is accountable directly to our Board. Specific aspects of ESG oversight are delegated to Board Committees. In 2023, we updated all the Board Committee charters and Corporate Governance Guidelines to include ESG oversight responsibilities. The Board receives quarterly updates on ESG progress, periodic educational sessions with subject matter experts, as appropriate, and provides oversight of risks that could impact the Firm, including ESG-related risks.

During our more than 60 years in business, we established a foundation of trust, ethics and integrity - with each other, with our clients and with our communities. Our Commitment to Integrity - Kforce’s code of conduct - sets the highest ethical standards for how we do business. This commitment guides our actions and ensures we operate in compliance with applicable laws, rules and regulations. It is grounded in our core values and the principles of respect, honesty, transparency, well-being, fair dealing, compliance, speaking up without fear of retaliation and more. Everyone who works with us, from our directors and executives to our associates, consultants, suppliers and business partners, is trained on and expected to abide by our Code of Conduct.

Our directors, officers and employees are encouraged to report suspected violations of the Commitment to Integrity to our whistleblower hotline and can do so anonymously. In keeping with our stance on protecting anonymity of our whistleblowers, we clarified our reporting avenues within our Commitment to Integrity and Open Door Policy in 2023. Reports are reviewed by our internal audit team, which may engage legal, human resources and/or outside partners, as applicable. All investigations are reported to the Board of Directors. Additionally, the Audit Committee meets with the Firm’s General Counsel quarterly, without any other members of management present, to bring forward questions or concerns. Kforce does not tolerate retaliation in any form against an individual who makes a good faith report of a potential or actual violation of our Commitment to Integrity.

In 2023, we continued to invest in our cybersecurity program, and engaged a third-party to review our program maturity, effectiveness and resilience and to validate our roadmap of future initiatives. Our cybersecurity program is an area where we have continued to increase our investments. Please refer to the Board’s Role in Risk Oversight section of this report for additional details on the Board’s oversight of cybersecurity.

Our cybersecurity structure and processes include:

| | | | | | | | | | | |

| Defense in depth network security | Third-party risk management program | A threat and vulnerability management program | Monitoring, evaluating and addressing evolving threats |

| Regular engagement with the Audit Committee | A dedicated cybersecurity operations center | Encrypted regular backup of system | Ongoing security simulations |

| Annual cybersecurity awareness training | Around-the-clock email, network and system monitoring | Regular assessments and audits | Third-party monitoring of our security program |

We strive to serve as responsible stewards of the environment. Through Office Occasional® – our remote-first work model – we reduced our greenhouse gas (GHG) emissions as a result of significantly less office space, business travel, in-office electricity usage and employee commutes. We lease all of our offices and took a strategic approach to the design and selection of our real estate. In 2023, we modified the criteria for real-estate decisions to include locations that carry clean energy designations, such as LEED certifications, and locations that are purchasing renewable energy, resulting in renewable energy certifications (RECs). Our longer-term vision for Office Occasional® includes continuing to explore and invest in renewable energy opportunities.

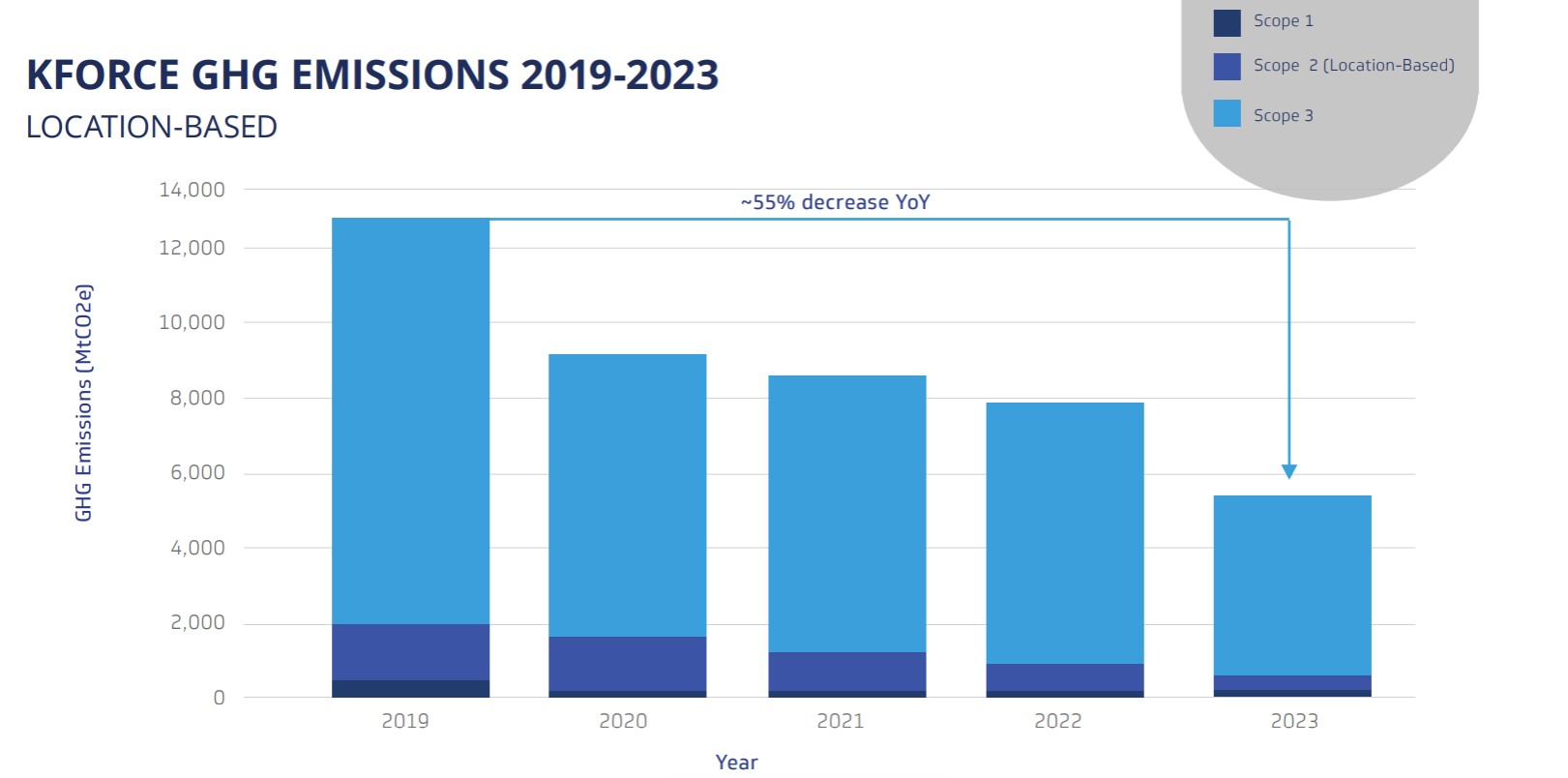

We recognize the importance of minimizing our impact on the environment and have continued to measure our efforts. Measuring our efforts provides us with the ability to understand where we have the most impact and help us create a strategy to yield significant results. Kforce drives sustained shareholder returns while continuing to reduce emissions and our impact on the environment. In 2023, we continued our partnership with a third-party to calculate our GHG emissions for Scope 1, 2 and 3 for 2023.

18 Kforce 2024 Proxy Statement

As indicated in the following graphic, we have successfully reduced Scope 1, 2 and 3 GHG emissions by more than 55% from 2019 to 2023.

Our environmental disclosures have been informed by the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD) framework.

In 2024, our commitments focus on crucial aspects such as GHG emissions reduction, the adoption of renewable energy sources and any necessary preparations to be ready for new regulations. Our ongoing efforts will continue to focus on reductions in Scope 2 GHG emissions as a result of our real-estate strategy. For more information regarding our GHG emissions, please refer to our 2023 Sustainability Report.

Plan of Action

We are very proud of the progress we made in 2023, but we recognize that our work related to ESG is never really done. We believe we met the objectives that we outlined for 2023 in our previous Proxy Statement. We are eager to make additional improvements in the lives our people, our Firm governance, our community and the environment. Change requires intent and dedication.

19 Kforce 2024 Proxy Statement

The following outlines our 2024 ESG objectives:

20 Kforce 2024 Proxy Statement

RELATED PARTY TRANSACTIONS, COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Audit Committee is responsible for reviewing and approving all related party transactions that Kforce is required to disclose in accordance with Item 404 of Regulation S-K. While the Board has not adopted a written policy, the Board believes that the Audit Committee’s practices and processes around the review, approval and ratification of transactions with related persons provides adequate evaluations of all potential related party transactions, including considerations on whether the transaction is on terms that are in the best interests of Kforce and our shareholders. There are no related party transactions that require disclosure for the year ended December 31, 2023.

The Firm’s Compensation Committee consists of Randall A. Mehl (Chair), Mark F. Furlong and Elaine D. Rosen. None of the members of the Compensation Committee is currently, or was formerly, an officer or an employee of Kforce or its subsidiaries, or had any relationship with Kforce, requiring disclosure under Item 404 of Regulation S-K. During 2023, none of the Firm’s executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee.

21 Kforce 2024 Proxy Statement

DIRECTOR COMPENSATION

The following table shows the annual compensation components for the year ended December 31, 2023, and the aggregate outstanding stock awards as of December 31, 2023, for our directors who served on the Board during 2023, except Mr. Liberatore: | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash ($)(1) | Stock

Awards ($)(2) | All Other

Compensation

($)(3)(4) | Total ($) | Unvested Restricted

Stock (5) | Deferred Restricted Stock Units (5) |

| Derrick D. Brooks | $ | 94,250 | | $ | 140,019 | | $ | 5,346 | | $ | 239,615 | | 2,538 | | 4,392 | |

| Catherine H. Cloudman | $ | 94,250 | | $ | 140,019 | | $ | 8,692 | | $ | 242,961 | | 2,538 | | 6,745 | |

| David L. Dunkel | $ | 53,000 | | $ | 879,994 | | $ | 566,527 | | $ | 1,499,521 | | 19,518 | | 1,784 | |

| Ann E. Dunwoody | $ | 109,250 | | $ | 140,019 | | $ | 6,202 | | $ | 255,471 | | 2,538 | | 4,392 | |

| Mark F. Furlong | $ | 124,250 | | $ | 140,019 | | $ | 3,350 | | $ | 267,619 | | 2,538 | | — | |

| Randall A. Mehl | $ | 124,250 | | $ | 140,019 | | $ | 24,256 | | $ | 288,525 | | 2,538 | | 17,750 | |

| Elaine D. Rosen | $ | 134,250 | | $ | 140,019 | | $ | 40,317 | | $ | 314,586 | | 2,538 | | 28,980 | |

| N. John Simmons | $ | 94,250 | | $ | 140,019 | | $ | 3,350 | | $ | 237,619 | | 2,538 | | — | |

|

| | | | | | |

(1)Fees earned or paid in cash consisted of: (a) annual retainer for each director of $45,000; (b) annual retainers for each committee chairperson of $15,000 and $40,000 for the Lead Independent Director; (c) quarterly fees for each quarter of board service of $5,000; and (d) quarterly fees for each quarter of committee service of $3,750. With Mr. Dunkel’s transition to sole Chairman on August 1, 2023, Mr. Dunkel received pro-rated fees related to his service on the Board of $53,000.

(2)The amounts in this column represent the aggregate grant date fair value in accordance with FASB ASC 718. The amounts for all directors, except Mr. Dunkel, reflect a grant of 2,495 shares of restricted stock on May 5, 2023, with a closing stock price on that day of $56.12 and vest on April 26, 2024. Mr. Dunkel was awarded a pro-rated grant in conjunction with his transition to a sole Board Chairman role of 1,764 shares of restricted stock on August 1, 2023 with a closing stock price of $59.53, which vests on April 26, 2024. Mr. Dunkel also received a grant of 12,216 shares of restricted stock on July 31, 2023, with a closing stock price of $63.44, which was immediately vested pursuant to his part-time employment agreement. This grant was related to Mr. Dunkel’s prior service as a part-time employee and was not associated with his service as Chairman beginning August 1, 2023.

(3)The amounts reported in this column for all directors, except Mr. Dunkel, represent the dollar value of dividend equivalents credited on unvested restricted stock and deferred restricted stock units in the form of additional restricted stock.

(4)On July 31, 2023, Mr. Dunkel ended his part-time employment agreement with Kforce and became solely non-executive Chairman of the Board. All Other Compensation for Mr. Dunkel includes the employment compensation provided for in his part-time employment agreement through July 31, 2023, including: $204,166 in salary; $54,250 in bonus; $184,775 for deferred compensation payments and $123,336 in dividend equivalents credited on unvested restricted stock.

(5)The beneficial ownership of common shares as of the Record Date for each of our directors is reported in the “Security Ownership of Certain Beneficial Owners and Management” section of this report.

22 Kforce 2024 Proxy Statement

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Our consolidated financial statements for the year ended December 31, 2023, have been audited by Deloitte & Touche LLP, independent auditors. The Audit Committee of the Board has selected Deloitte & Touche LLP, subject to ratification by shareholders, to audit our consolidated financial statements for the year ending December 31, 2024, to provide review services for each of the quarters in the year then ended, and to perform other appropriate services that may be necessary. A representative of Deloitte & Touche LLP is expected to be present at the Annual Meeting to respond to appropriate questions and to make any other statements deemed appropriate.

Deloitte & Touche LLP has audited Kforce’s financial statements since the fiscal year ended December 31, 2000.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS - FEE INFORMATION | | | | | | | | | | | |

| Fee Type | 2023 | | 2022 |

| Audit Fees (1) | $ | 956,237 | | | $ | 939,534 | |

| Tax Fees (2) | $ | 4,620 | | | $ | 2,445 | |

| All Other Fees (3) | $ | 1,895 | | | $ | 1,895 | |

(1)Relates to the annual audit of our financial statements and internal control over financial reporting, the review of our quarterly financial statements and audit services provided in connection with other statutory and regulatory filings.

(2)Relates to tax advice, tax planning and tax consultation services.

(3)Relates to annual subscription to a Deloitte & Touche LLP research database.

The Audit Committee considered whether Deloitte & Touche LLP’s provision of the above non-audit services is compatible with maintaining such firm’s independence and satisfied itself as to Deloitte & Touche LLP’s independence.

POLICY ON AUDIT COMMITTEE PRE-APPROVAL OF AUDIT AND PERMISSIBLE NON-AUDIT SERVICES OF INDEPENDENT AUDITORS

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors to ensure that the provision of such services does not impair the auditor’s independence. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific limit above which separate pre-approval is required. Management periodically reports to the Audit Committee the pre-approved services provided by the independent auditors as well as the fees for the services performed.

During the year ended December 31, 2023, 100% of services were pre-approved by the Audit Committee in accordance with this policy.

VOTE REQUIRED

Approval of this proposal requires the affirmative vote of a majority of the shares entitled to vote on the matter. An abstention is considered as present and entitled to vote and will have the effect of a vote against the proposal. A broker non-vote is considered not entitled to vote and will not affect the voting. | | |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 2. |

23 Kforce 2024 Proxy Statement

AUDIT COMMITTEE REPORT