¨ | Preliminary Proxy Statement | |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material Pursuant to Rule 14a-12 | |

ý | No fee required | ||||

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1 | ) | Title of each class of securities to which transaction applies: | |||

(2 | ) | Aggregate number of securities to which transaction applies: | |||

(3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4 | ) | Proposed maximum aggregate value of transaction: | |||

(5 | ) | Total fee paid: | |||

¨ | Fee paid previously with preliminary materials. | ||||

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1 | ) | Amount Previously Paid: | |||

(2 | ) | Form, Schedule or Registration Statement No.: | |||

(3 | ) | Filing Party: | |||

(4 | ) | Date Filed: | |||

2019 | Proxy Statement |

1. | Elect three Class I directors to hold office for a three-year term expiring in 2022; |

2. | Ratify the appointment of Deloitte & Touche LLP as Kforce’s independent registered public accountants for 2019; |

3. | Conduct an advisory vote on executive compensation; |

4. | Approve the Kforce Inc. 2019 Stock Incentive Plan; and |

5. | Attend to other business properly presented at the meeting. |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on April 23, 2019. This proxy statement and our 2018 Annual Report to Shareholders are available at http://investor.kforce.com/investor-relations/financial-information/annual-reports-and-proxy. |

|  |

David L. Dunkel Chairman and Chief Executive Officer | Ralph E. Struzziero Lead Independent Director |

Class | Age | Position | Director Since | Current Term Expires | Expiration of Term for Which Nominated | Independent | Audit Comm | Comp. Comm | Nomin. Comm | Corp. Gov. Comm | Exec. Comm | |

Directors with Terms Expiring at the Annual Meeting/Nominees | ||||||||||||

Randall A. Mehl (1) | III | 51 | Director | 2017 | 2021 | 2022 | ü |   |  | |||

Elaine D. Rosen | I | 66 | Director | 2003 | 2019 | 2022 | ü |  |  |  | ||

Ralph E. Struzziero (2) | I | 74 | Director | 2000 | 2019 | 2022 | þ |  |  | |||

Continuing Directors | ||||||||||||

John N. Allred | II | 72 | Director | 1998 | 2020 | N/A | ü |  |  |  | ||

Richard M. Cocchiaro | II | 64 | Director | 1994 | 2020 | N/A |  | |||||

Ann E. Dunwoody | II | 66 | Director | 2016 | 2020 | N/A | ü |  |  | |||

A. Gordon Tunstall | II | 75 | Director | 1995 | 2020 | N/A | ü |  |  |  |  | |

David L. Dunkel | III | 65 | Chairman, CEO Director | 1994 | 2021 | N/A |  | |||||

Mark F. Furlong | III | 61 | Director | 2001 | 2021 | N/A | ü |   |  |  | ||

N. John Simmons | III | 63 | Director | 2014 | 2021 | N/A | ü |   |  | |||

Non-Continuing Directors | ||||||||||||

Howard W. Sutter (1) | I | 70 | Director | 1994 | 2019 | N/A |  | |||||

Legend: | þ | Lead Independent Director |  | Chair |  | Member |  | Financial Expert |

Randall A. Mehl | |||

| Mr. Mehl is President and Chief Investment Officer of Stewardship Capital Advisors, LLC, which manages an equity fund focused on making investments in business and technology services. He also currently serves on the Board of Directors of two public companies, Insperity, Inc. and ICF International, Inc., as well as Stowell Associates Inc., a privately held home care agency. He previously served as a Managing Director and a partner with Baird Capital, a middle market private equity group, leading a team focused on the business and technology services sector from 2005 to 2016. From 1996 to 2005, Mr. Mehl was a senior equity research analyst with Robert W. Baird & Company, covering various areas within the broader business and technology services sector, including staffing. Mr. Mehl is an Audit Committee financial expert. Mr. Mehl has also previously served on various boards of directors, including Workforce Insight LLC, Myelin Communications, Vitalyst LLC, MedData, LLC, now a subsidiary of MEDNAX, American Auto Auction, LLC, Accume Partners, Inc, and Harris Research Inc. Mr. Mehl has previously served on the investment committee for several funds, and has expertise analyzing, acquiring and selling businesses. | ||

Director since 2017 | Other Current Public Company Board(s): ICF International, Inc. (NASDAQ: ICFI); Insperity, Inc. (NYSE: NSP) | Kforce Board Committee(s): Audit and Corporate Governance | |

Age | 51 | ||

Elaine D. Rosen | |||

| Ms. Rosen has served as a director of Assurant, Inc., a provider of specialized insurance and insurance-related products and services since March 2009 and became the non-executive Chair of the Board in November 2010. Ms. Rosen has also served as the Chair of the Board of The Kresge Foundation since January 2007. Ms. Rosen serves as trustee or director of several non-profit organizations, is a past Chair of the Board of Preble Street, a homeless collaborative in Portland, Maine, and has served as a trustee of the Foundation for Maine’s Community Colleges since 2008. Ms. Rosen was a director of the Elmina B. Sewall Foundation from 2008 to 2012 and Downeast Energy Corp., a privately-held company that provides heating products and building supplies, from 2003 until its sale in April 2012. From 1975 to March 2001, Ms. Rosen held a number of positions with Unum Life Insurance Company of America, including President. Ms. Rosen has extensive experience as a senior executive in the insurance industry and as a director of several companies, as well as substantial experience with charitable organizations, particularly as the Chair of one of the largest private foundations in the country. With her background and experience as Chair of the Compensation Committee of Kforce; on the Board of Assurant, Inc., where she currently serves as the non-executive Chair and serves on the compensation committee, she has considerable expertise in, among other things, executive compensation, which is a subject matter that is undergoing dynamic change. | ||

Director since 2003 | Other Current Public Company Board(s): Assurant, Inc. (NYSE: AIZ) | Kforce Board Committee(s): Compensation (Chair); Nomination; and Corporate Governance | |

Age | 66 | ||

Ralph E. Struzziero | |||

| Since 1995, Mr. Struzziero has operated an independent business consulting practice, providing interim executive-level advisory and professional services to a variety of organizations. In addition, he served as an adjunct professor at the University of Southern Maine from 1997 to 2006. Mr. Struzziero previously served as Chairman (1990-1994) and President (1980-1994) of Romac & Associates, Inc., one of Kforce’s predecessors. Mr. Struzziero is also currently a director of Automobile Club of Southern California, a travel club and property and casualty insurer in California, AAA of Northern New England, a travel club serving Maine, New Hampshire and Vermont, and Auto Club Enterprise, a holding company of these two companies. Mr. Struzziero previously served on the Board of Directors of Prism Medical Ltd., a publicly traded corporation on the TSX Venture Exchange in Canada and manufacturer and distributor of moving and handling equipment for the mobility challenged, from July 2011 until its sale in August 2016, and Downeast Energy Corp., a privately-held company that provides heating products and building supplies, from January 2001 until its sale in April 2012. Mr. Struzziero has extensive experience in the staffing industry. The Board believes this gives Mr. Struzziero, in his capacity as Lead Independent Director, a unique insight among the non-employee directors relating to Kforce’s business and operations. | ||

Director since 2000 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Compensation; and Corporate Governance (Chair) | |

Age | 74 | ||

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 1. |

John N. Allred | |||

| Mr. Allred has served as President of A.R.G., Inc., a provider of temporary and permanent physicians located in the Kansas City area since January 1994. He was a director at Source Services Corporation (Source) prior to its merger with Kforce in 1998 and served in various capacities with Source from 1976 to 1993 including Vice President (1987-1993), Regional Vice President (1983-1987) and Kansas City Branch Manager (1976-1983). Mr. Allred has extensive experience in the staffing industry and is particularly knowledgeable in the area of healthcare. His staffing industry experience (other than his directorship in Kforce) is with companies other than Kforce, which the Board believes allows him to address operational issues from a different perspective. | ||

Director since 1998 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Audit; Nomination (Chair); and Corporate Governance | |

Age | 72 | ||

Richard M. Cocchiaro | |||

| Mr. Cocchiaro served as a Vice Chairman of Kforce from 2004 through his retirement in January 2016, during which time he oversaw Customer First, our customer loyalty program, and served on both Kforce’s internal executive committee and innovation council. Previously, Mr. Cocchiaro served as Vice President of Strategic Accounts for Kforce (2000–2004), Vice President of Strategic Alliances for Kforce.com Interactive (1999) and National Director of Strategic Solutions within Kforce’s emerging technologies group (1994-1999). Mr. Cocchiaro has served in numerous leadership roles within Kforce including, among others, the financial services group, leading the Chicago market, the emerging technologies group, strategic alliances, national accounts and most recently leading Customer First, our customer loyalty program. He has extensive experience with Kforce’s field operations on a national basis, bringing an important perspective to the Board. | ||

Director since 1994 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Executive | |

Age | 64 | ||

Ann E. Dunwoody | |||

| General (Ret.) Dunwoody was the first woman in U.S. military history to achieve the rank of four-star general. From 2008 until her retirement in 2012, she led and ran the largest global logistics command in the Army comprising 69,000 military and civilian individuals, located in all 50 states and over 140 countries with a budget of $60 billion dollars. General (Ret.) Dunwoody also served as a strategic planner for the Chief of Staff of the Army. During her 38-year military career, she was decorated for distinguished service and has received many major military and honorary awards. General (Ret.) Dunwoody currently serves on the Board of Directors of L-3 Communications and Logistics Management Institute and previously served on the Board of Directors of Republic Services, Inc. She also serves on the Council of Trustees for the Association of the United States Army and the Board of Trustees for the Florida Institute of Technology and she is the president of First 2 Four LLC, a leadership mentoring and strategic advisory services company that offers visionary insights for managing large organizations to posture them for the future. She authored “A Higher Standard: Leadership Strategies from the First Female Four Star General” and is a recipient of The Ellis Island Medal of Honor. General (Ret.) Dunwoody brings to the Board extensive military and management experience, including managing a significant portion of the United States Army’s budget as Commanding General, U.S. Army Materiel Command. General (Ret.) Dunwoody is also certified as an NACD Governance Fellow. She serves as a member of the Board of Directors on another publicly traded company and is also engaged in numerous charitable and civic activities, which the Board believes allows her to provide valuable and varied perspective. | ||

Director since 2016 | Other Current Public Company Board(s): L-3 Communications (NYSE: LLL) | Kforce Board Committee(s): Nomination and Corporate Governance | |

Age | 66 | ||

A. Gordon Tunstall | |||

| Mr. Tunstall is the founder, and for more than 30 years has served as President, of Tunstall Consulting, Inc., a provider of strategic consulting and financial planning services. He has also served as a director of Tabula Rasa Healthcare, Inc., a medication risk management and distribution pharmacy, since March 2012. Mr. Tunstall previously served as a director for JLM Industries, Inc., Orthodontics Center of America, Inc., Discount Auto Parts, Inc., Advanced Lighting Technologies Inc., Health Insurance Innovations, Horizon Medical Products Inc., and L.A.T. Sportswear. Mr. Tunstall also qualifies as an Audit Committee financial expert and stands willing to assume this role if for any reason the current Audit Committee financial experts cease to serve on the Board. He provides the Board a unique point of view regarding strategy given his background as a successful strategic consultant for over 30 years advising a large number of companies in a variety of industries. | ||

Director since 1995 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Nomination; Corporate Governance; and Executive | |

Age | 75 | ||

David L. Dunkel | |||

| Mr. Dunkel has served as Kforce’s Chairman, Chief Executive Officer and a director since the Firm’s incorporation in 1994 and possesses a deep and unique understanding of the Firm’s business and operations. The Board believes that this experience, coupled with his extensive knowledge of the staffing industry, provides strong, consistent leadership and allows him to serve as a highly effective bridge between the Board and management. In addition, in his capacity as CEO, Mr. Dunkel frequently meets with shareholders, clients and other Firm stakeholders to communicate our business and strategy and to understand their various perspectives and insights, which he is then able to relay to the full Board for consideration and assessment. | ||

Director since 1994 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Executive (Chair) | |

Age | 65 | ||

Mark F. Furlong | |||

| Mr. Furlong has served as a director of Heska Corporation, a manufacturer of veterinary and animal health diagnostic and specialty products, since March 2019 and of Boston Private Financial Holdings, Inc., a provider of wealth management, trust and private banking services, since September 2016; he has also served as a director of Antares Capital, a provider of financing solutions for middle market, private equity-backed transactions, since December 2015. He served as the President and Chief Executive Officer of BMO Harris Bank, N.A. from July 2011 to June 2015. Mr. Furlong served as a director of BMO Harris Bank, N.A. and BMO Financial Corporation from July 2011 to June 2015. Prior to its acquisition by BMO Harris Bank, N.A. in 2011, he served as Chairman of Marshall & Ilsley Corporation from October 2010, Chief Executive Officer from April 2007 and as President from July 2004. He also served as Chief Financial Officer of Marshall & Ilsley Corporation from April 2001 to October 2004. Mr. Furlong’s prior experience also includes service as an audit partner with Deloitte & Touche LLP. Mr. Furlong is an Audit Committee financial expert. Kforce believes his considerable expertise, including his experience as President and Chief Executive Officer of BMO Harris Bank, N.A., the former Chairman, President and Chief Executive Officer of Marshall & Ilsley Corporation and a former audit partner with Deloitte & Touche LLP, brings unique insight to the Board concerning capital allocation strategies and banking issues, in addition to his overall management and financial expertise. | ||

Director since 2001 | Other Current Public Company Board(s): Boston Private Financial Holdings, Inc. (NASDAQ: BPFH); Heska Corporation (NASDAQ: HSKA) | Kforce Board Committee(s): Audit (Chair); Compensation; and Corporate Governance | |

Age | 61 | ||

N. John Simmons | |||

| Mr. Simmons is the Chief Operating Officer and Chief Financial Officer of DeMert Brands, Inc., a designer, manufacturer and distributor of haircare products. He previously served as the Chief Executive Officer of Growth Advisors, LLC, a provider of C-level advisory services to high-growth companies. He has served on various boards of directors, including Bonds.com Group, Inc. from 2013 to 2014, Loyola University New Orleans Board of Trustees from 2009 to 2015, during which he was Chairman of the Audit Committee and an Executive Committee member; Lifestyle Family Fitness, Inc. from 2001 to 2012; Technology Research Corporation as Chairman of the Compensation Committee from 2010 to 2011 and as Lead Director and Chairman of the Governance and Nominating Committee from 2009 to 2010; Medquist, Inc. as Chairman of the Audit Committee from 2005 to 2007; and SRI Surgical Express, Inc. as Lead Director, then Chairman of the Board from 2001 to 2008. He served as the CEO and President of Lifestyle Family Fitness, Inc. from 2008 to 2012. Mr. Simmons’ prior experience also includes service as President of New Homes Realty, a Florida-based residential real estate company operating in 35 states for two years, President of Quantum Capital Partners, a privately held venture capital firm for 14 years, Vice President and Controller for Eckerd Corporation for three years, Chief Financial Officer of Checkers Drive-In Restaurants for two years and as an audit partner with KPMG Peat Marwick. Mr. Simmons is an Audit Committee financial expert; he has extensive financial, accounting, management and director experience in several different industries. As a result, the Board believes that he brings valuable insight due to his extensive and varied experiences as a chief executive officer, chief financial officer, audit partner and director. | ||

Director since 2014 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Audit and Corporate Governance | |

Age | 63 | ||

Howard W. Sutter | |||

| Mr. Sutter has served as Kforce’s SVP, Leader Development since January 2017 and previously served as Vice Chairman since 2005; he also participates in Kforce’s mergers, acquisitions and divestitures. Prior to August 1994, Mr. Sutter served as Vice President of Romac-FMA (1984-1994) and Division President of Romac-FMA’s South Florida location (1982-1994). Mr. Sutter led Kforce’s merger, acquisition, and divestiture efforts for 19 years and, over this time, has led the effort on a significant number of acquisitions, including those of two public companies, and several divestitures. Mr. Sutter also has extensive experience in staffing operations. The Board believes that Mr. Sutter’s knowledge of the staffing industry, and more specifically the mergers and acquisition market, brings an important expertise to the Board. | ||

Director since 1994 | Other Current Public Company Board(s): None | Kforce Board Committee(s): Executive | |

Age | 70 | ||

• | oversee management performance on behalf of our shareholders; |

• | advocate on behalf of the long-term interests of our shareholders; |

• | discuss and consider the Firm’s strategic and executive succession planning; |

• | be actively involved in the oversight of risk that could affect Kforce; |

• | promote the exercise of sound corporate governance; and |

• | carry out other duties and responsibilities as may be required by state and federal laws, as well as the NASDAQ rules. |

At each Board meeting our Board receives: | On a monthly basis our Board receives: | ||

l | an executive summary that includes, among other items, a risk factors section; | l | a description of certain significant events and risk factors, if any, that have occurred in each period; |

l | Kforce’s financial and operational performance, including progress against its strategies; | l | a financial update from management; and |

l | management’s assessment of the current state of the capital markets and macro-economic environment; | l | any other necessary items requiring the attention of the Board. |

l | management’s analysis on the current state of the staffing industry and corporate development activities; | ||

l | a claims, litigation and ethics hotline summary; | ||

l | a report on the Firm’s Enterprise Risk Management (ERM) program; and | ||

l | reports on other matters that may arise from time to time, that require reporting to the Board. | ||

Audit Committee | |

Members: | Roles and Responsibilities of the Committee: |

Mark F. Furlong (Chair) | The Audit Committee oversees the accounting and financial reporting processes of the Firm and the audits of the Firm’s financial statements. In discharging this oversight role, the Audit Committee is empowered to investigate any matter brought to its attention, with full access to all books, records, facilities and personnel of Kforce, and the power to retain outside counsel or other experts. This committee also has the responsibility for selecting, evaluating, compensating, and monitoring the independence and performance of the Firm’s independent auditors, reviewing and approving related party transactions and overseeing the Firm’s internal audit function and ERM program, including cybersecurity risk assessment. At each quarterly meeting, and more frequently as needed, the members of the Audit Committee meet in executive session. The Audit Committee also meets regularly in separate executive sessions with the Firm’s Vice President of Internal Audit, General Counsel, and Deloitte & Touche LLP, our independent registered public accountants. The Board has determined that Messrs. Furlong, Mehl and Simmons, who are all members of the Audit Committee, as well as Mr. Tunstall are considered an “audit committee financial expert,” as defined by SEC Rules. |

John N. Allred | |

Randall A. Mehl | |

N. John Simmons | |

Number of Meetings: | |

5 | |

Compensation Committee | |

Members: | Roles and Responsibilities of the Committee: |

Elaine D. Rosen (Chair) | The Compensation Committee is responsible for development of the compensation principles to guide the design of the Firm’s executive compensation program. It is also responsible for reviewing and approving the executive compensation and benefit policies and practices of the Firm, approving any new or amended employment agreements for executive management including grants or awards to executive management under the Firm’s long-term incentive program and preparing an annual report on the Firm’s executive compensation policies and practices as required by SEC Rules. In the discharge of its duties, the Compensation Committee also has the authority to select and utilize a compensation consultant to assist in the evaluation of director and executive officer compensation. |

Mark F. Furlong | |

Ralph E. Struzziero | |

Number of Meetings: | |

6 | |

Nomination Committee | |

Members: | Roles and Responsibilities of the Committee: |

John N. Allred (Chair) | The Nomination Committee is responsible for providing assistance to the Board in the selection of director candidates for election. In addition to identifying and recommending candidates for election to the Board, this committee also makes recommendations to the Board regarding the size and composition of the Board and establishes procedures for the nomination process. The Nomination Committee has the authority to retain a search firm to be used to identify director candidates and to approve the search firm’s fees and other retention terms. The Nomination Committee has not established “minimum qualifications” for director nominees because it is the view of this committee that the establishment of rigid “minimum qualifications” might preclude the consideration of otherwise desirable candidates for election to the Board. The Nomination Committee will consider director candidates recommended by shareholders. Refer to the section titled “Shareholder Communications, Proposals and Other Matters” below. |

Ann E. Dunwoody | |

Elaine D. Rosen | |

A. Gordon Tunstall | |

Number of Meetings: | |

4 | |

Corporate Governance Committee | |

Members: | Roles and Responsibilities of the Committee: |

Ralph E. Struzziero (Chair) | The functions of the Corporate Governance Committee are to: encourage and enhance communication among independent directors; provide a forum for independent directors to meet separately from management; provide leadership and oversight related to ethical standards; and provide a channel for communication with the CEO. The Corporate Governance Committee also coordinates a formal, written annual evaluation of the performance of the Board and each of its committees. Each member of the Board who is independent, within the meaning of these rules, serves on the Corporate Governance Committee. This committee is designed to fulfill the requirements of NASDAQ Rule 5605(b)(2) (i.e., through the meetings of this committee, our “independent” directors (as determined under the NASDAQ Rules) meet at least once annually in executive session without any of our management present). The Firm’s Lead Independent Director serves as the Chair of the Corporate Governance Committee. |

John N. Allred | |

Ann E. Dunwoody | |

Mark F. Furlong | |

Randall A. Mehl | |

Elaine D. Rosen | |

N. John Simmons | |

A. Gordon Tunstall | |

Number of Meetings: | |

4 | |

Executive Committee | |

Members: | Roles and Responsibilities of the Committee: |

David L. Dunkel (Chair) | The Executive Committee has the authority to act in place of the Board on all matters that would otherwise come before the Board, except for such matters that are required by law or by our Articles of Incorporation or Bylaws to be acted upon exclusively by the Board. |

Richard M. Cocchiaro | |

Howard W. Sutter | |

A. Gordon Tunstall | |

Number of Meetings: | |

None | |

Audit | Compensation | Nomination | Corporate Governance | ||||

l | Responsible for the Firm’s risk assessment and ERM program | l | Oversees executive compensation risk | l | Oversees director succession risk | l | Leadership and oversight of ethical standards |

l | Monitors risk relating to the Firm’s financial statements, systems, reporting process and compliance | l | Responsible for preparation and required disclosures regarding compensation practices | l | Establishes procedures for the Board’s nomination process | l | Provides a forum for Board independent directors to meet separately from management |

l | Reviews and approves related party transactions and relationships involving directors and executive officers | l | Responsible for review of the overall compensation and benefits policies and practices of the Firm, including determining whether such policies and practices are reasonably likely to have a material adverse effect on the Firm | l | Recommends candidates for election to the Board | l | Reviews and recommends to the Board any changes to the corporate governance guidelines |

l | Monitors and receives reports on the Firm’s cyber- security risks and incidents | l | Oversees the Board’s evaluation process | ||||

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | Unvested Restricted Stock (4) | Deferred Restricted Stock Units (4) | ||||||||||

John N. Allred | $ | 107,000 | $ | 99,987 | $ | 2,348 | $ | 209,335 | 3,769 | — | ||||||

Richard M. Cocchiaro | $ | 50,000 | $ | 99,987 | $ | 4,494 | $ | 154,481 | 3,769 | 4,566 | ||||||

Ann E. Dunwoody | $ | 77,000 | $ | 99,987 | $ | 4,494 | $ | 181,481 | 3,769 | 4,566 | ||||||

Mark F. Furlong | $ | 107,000 | $ | 99,987 | $ | 2,348 | $ | 209,335 | 3,769 | — | ||||||

Randall A. Mehl | $ | 77,000 | $ | 99,987 | $ | 2,348 | $ | 179,335 | 3,769 | — | ||||||

Elaine D. Rosen | $ | 107,000 | $ | 99,987 | $ | 7,826 | $ | 214,813 | 3,769 | 10,144 | ||||||

N. John Simmons | $ | 77,000 | $ | 99,987 | $ | 2,348 | $ | 179,335 | 3,769 | — | ||||||

Ralph E. Struzziero | $ | 92,000 | $ | 99,987 | $ | 7,826 | $ | 199,813 | 3,769 | 10,144 | ||||||

Howard W. Sutter (5) | $ | — | $ | 150,006 | $ | 446,726 | $ | 596,732 | 3,973 | — | ||||||

A. Gordon Tunstall | $ | 77,000 | $ | 99,987 | $ | 2,348 | $ | 179,335 | 3,769 | — | ||||||

(1) | Fees earned or paid in cash consisted of: (a) annual retainer for each director of $30,000; (b) annual retainers for each committee chairperson of $15,000; (c) quarterly fees for each quarter of board service of $5,000; and (d) quarterly fees for each quarter of committee service of $3,750 for each of the Audit Committee, Compensation Committee and Nomination Committee and $3,000 for the Corporate Governance Committee. |

(2) | The amounts in this column represent the aggregate grant date fair value in accordance with FASB ASC 718. The amounts for all directors, except for Mr. Sutter, reflect a grant of 3,717 shares of restricted stock with a closing stock price on the grant date of $26.90. For Mr. Sutter, the amount represents compensation for his employment at Kforce, which included a grant of 3,932 shares of restricted stock with a closing stock price on the grant date of $38.15. Mr. Sutter was not compensated for his service on the Board. |

(3) | The amounts reported in this column for all directors, except Mr. Sutter, represent the dollar value of dividend equivalents credited on unvested restricted stock and deferred restricted stock units in the form of additional restricted stock. For Mr. Sutter, the amount in this column represents employment compensation, which consisted of: $300,000 in salary, $137,850 in bonus, $7,456 in matching contributions made by Kforce attributable to defined contribution plans, and $1,420 in dividend equivalents credited on unvested restricted stock. Mr. Sutter was not compensated for his service on the Board. |

(4) | The beneficial ownership of common shares as of the Record Date for each of our directors is presented below under the heading of “Security Ownership of Certain Beneficial Owners and Management.” |

(5) | On January 31, 2019, Howard W. Sutter informed Kforce that due to his long tenure as a member of the Board and consistent with the Board’s refreshment initiatives, he would not stand for re-election as a Class I Director at the Annual Meeting. |

David L. Dunkel | Age: | 65 | |

Chairman and Chief Executive Officer | Mr. Dunkel has served as Kforce’s Chairman, Chief Executive Officer and a director since its incorporation in 1994. He previously served as President and Chief Executive Officer of Romac-FMA, one of Kforce’s predecessors, for 14 years. | ||

Michael R. Blackman | Age: | 64 | |

Chief Corporate Development Officer | Mr. Blackman has served as Kforce’s Chief Corporate Development Officer since December 2009, prior to which he served as the Firm’s Senior Vice President of Investor Relations from 1999 to 2009 and Director of Selection and Senior Consultant in the healthcare services specialty from 1992 to 1999. | ||

Jeffrey B. Hackman | Age: | 40 | |

Senior Vice President, Finance and Accounting | Mr. Hackman has served as Kforce’s Principal Accounting Officer since October 2015 and as Senior Vice President of Finance and Accounting since March 2015. He is responsible for overseeing Kforce's finance, accounting, SEC reporting, tax, treasury, procurement, real estate and business operations (time capture, billing, accounts receivable and cash applications) functions. He previously served as the Firm’s Chief Accounting Officer and Principal Accounting Officer from February 2009 until September 2013 and as Kforce’s SEC Reporting Director from September 2007 to February 2009. Mr. Hackman served as the Global Chief Accounting Officer of Cunningham Lindsey from September 2013 until he rejoined Kforce in March 2015. Prior to 2007, he was an Audit Senior Manager with Grant Thornton LLP. | ||

David M. Kelly | Age: | 53 | |

Chief Financial Officer | Mr. Kelly has served as Kforce’s Senior Vice President and Chief Financial Officer since January 2013 and Corporate Secretary since February 2013. Mr. Kelly joined Kforce in 2000 and has served as Senior Vice President of Finance and Accounting from February 2009 to December 2012, Corporate Assistant Secretary from October 2010 to February 2013, Vice President of Finance from January 2005 to February 2009, Chief Accounting Officer from November 2000 to January 2005 and Group Financial Officer from January 2000 to November 2000. Before joining Kforce, Mr. Kelly served in various roles with different companies that included treasury director, vice president, and controller. | ||

Joseph J. Liberatore | Age: | 55 | |

President | Mr. Liberatore has served as Kforce’s President since January 2013. He previously served as Corporate Secretary from February 2007 to February 2013, Chief Financial Officer from October 2004 to December 2012, Executive Vice President from July 2008 to December 2012, Senior Vice President from 2000 to July 2008, Chief Talent Officer from 2001 to 2004 and Chief Sales Officer from September 2000 to August 2001. Mr. Liberatore has served in various other roles in Kforce (and its predecessors) since he joined the Firm in 1988. | ||

Kye L. Mitchell | Age: | 49 | |

Chief Operations Officer | Ms. Mitchell has served as Kforce’s Chief Operations Officer since March 2016. Before her appointment as Chief Operations Officer, Ms. Mitchell served as Chief Operations Officer for the East Region from January 2013 to March 2016, Field President from January 2009 through December 2012, Market President from February 2006 to December 2008, and Market Vice President from February 2005 through January 2006. Ms. Mitchell joined Kforce in 2005 when Kforce acquired VistaRMS where she served as President. | ||

Andrew G. Thomas | Age: | 52 | |

Chief Marketing Officer | Mr. Thomas has served as Kforce’s Chief Marketing Officer since July 2018. In his current role, he leads the Firm’s marketing, digital strategy, training and development, human resources, compensation and benefits organizations. Prior to this role, Mr. Thomas was the Firm’s Chief Field Services officer from December 2013 to July 2018. He has also served as the Executive Director of Kforce’s Finance and Accounting product offering where he oversaw strategy, operating model and critical activities, as well as various other roles in Kforce since he joined the Firm in 1997. | ||

Fee Type | 2018 | 2017 | |||||

Audit Fees (1) | $ | 879,827 | $ | 813,422 | |||

Audit-Related Fees (2) | $ | 11,500 | $ | 11,500 | |||

Tax Fees (3) | $ | 35,467 | $ | — | |||

All Other Fees (4) | $ | 1,895 | $ | 1,895 | |||

(1) | Represents fees associated with the annual audit and the review of our financial statements included in our Quarterly Reports on Form 10-Q. |

(2) | Includes assurance and related services by the independent auditors that are reasonably related to the performance of the audit or review of our financial statements, or other filings that are not captured under “Audit Fees” above. These services included consultations as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, and other regulatory or standard-setting bodies; internal control reviews, including consultation, under Section 404 of the Sarbanes-Oxley Act of 2002; due diligence services and audits and accounting consultations related to dispositions. |

(3) | Represents fees for tax advice, tax planning and tax consultation for contemplated transactions and state income tax notices. |

(4) | Represents fees for an annual subscription to a Deloitte & Touche LLP research database and continuing education courses. The Audit Committee considered whether Deloitte & Touche LLP’s provision of the above non-audit services is compatible with maintaining such firm’s independence and satisfied itself as to Deloitte & Touche LLP’s independence. |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR PROPOSAL 2. |

1. | The Audit Committee has reviewed and discussed the audited consolidated financial statements with Kforce Inc.’s management; |

2. | The Audit Committee has discussed with the independent auditors the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard 1301; |

3. | The Audit Committee has received the written disclosures and the letter from the independent auditors required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the audit committee concerning independence, and has discussed with the independent auditors the independent auditors’ independence; and |

4. | Based on the review and discussion referred to in the above paragraphs, the Audit Committee recommended to the Board that the audited financial statements be included in Kforce Inc.’s Annual Report on Form 10-K for the year ended December 31, 2018, for filing with the SEC. The Audit Committee has also selected Deloitte & Touche LLP, subject to ratification by shareholders, to audit our consolidated financial statements for the year ending December 31, 2019, and to provide review services for each of the quarters in the year ending December 31, 2019. |

Compensation Committee Report The Compensation Committee of Kforce (the Committee) has reviewed and discussed the Compensation Discussion and Analysis (CD&A) required by Item 402(b) of Regulation S-K with management and based on such review and discussions, the Committee recommended to the Board that the CD&A be included in this Proxy Statement and incorporated into Kforce’s Annual Report on Form 10-K for the year ended December 31, 2018. Submitted by the Compensation Committee Elaine D. Rosen (Chair) ¦ Mark F. Furlong ¦ Ralph E. Struzziero |

• | David L. Dunkel, Chairman and Chief Executive Officer |

• | Joseph J. Liberatore, President |

• | David M. Kelly, Chief Financial Officer |

• | Kye L. Mitchell, Chief Operations Officer |

• | Andrew G. Thomas, Chief Marketing Officer |

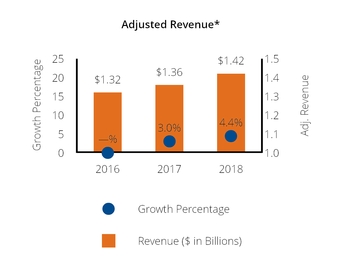

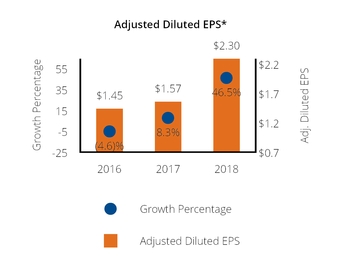

• | Attained 99.9% of our target revenue and 109% of our target diluted earnings per share (EPS). |

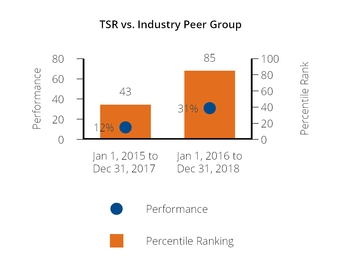

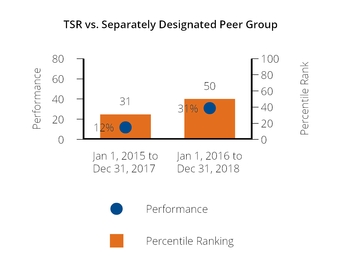

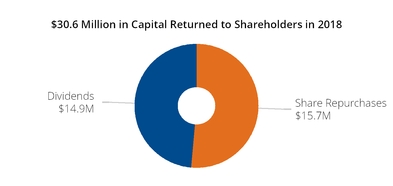

• | Attained above target performance for our long-term incentive (LTI) metric; Kforce’s relative total shareholder return (TSR) over the past three years (January 1, 2016 through December 31, 2018) of 31% ranked 2nd versus our industry peer group of 7 direct competitors, and attained a 50th percentile ranking versus our separately designated peer group. |

• | Continued to make progress on our strategic initiatives including implementing new and upgrading existing technologies, improving our alignment of revenue-generating talent, and executing a Kforce brand refresh. |

• | Above target annual incentive payouts, based on the performance against our financial metrics (payouts were slightly below target for revenue and above target for EPS) and on individual performance objectives (payouts were above target). |

• | LTI payouts for the CEO and the President at target based on median relative TSR performance versus our separately designated peer group, and LTI payouts for the other NEOs above target based on above median relative TSR performance versus our industry peer group. |

What We Do | What We Don’t Do | |||

l | Target Annual NEO Compensation at Market Median for Median Performance | l | Define Market Median by Comparison to Larger Companies | |

l | Provide Pay for Performance by Paying Higher Compensation for Above Median Performance and Lower Compensation for Below Median Performance | l | Set Easy Targets for Incentive Plans | |

l | Ensure Performance-Based Compensation is the Largest Part of Total Compensation | l | Provide Excessive Perquisites | |

l | Ensure Equity-Based LTI Compensation is a Significant Component of Performance-Based Compensation | l | Allow Repricing or Cash Buyouts of Previous Equity-Based LTI Grants | |

l | Require Share Ownership | l | Allow Hedging or Pledging of Company Stock or Other Related Activities | |

l | Maintain a Significant Clawback Policy | l | Create New Excise Tax Gross-ups | |

l | Create New or Materially Amend Executive Employment Agreements with Provisions for Severance Payouts Exceeding 1x Cash Compensation or Change in Control Severance Payouts Exceeding 2x Cash Compensation | |||

Attract and Retain Key Executives | Attracting and retaining key executive talent is critical to the success of a staffing firm in which people represent the true “assets” of such a company. The Committee believes an understanding of competitive market pay levels is essential to hiring and retaining qualified executives able to drive our long-term profitable growth and long-term shareholder value. The Committee further believes it is important to be knowledgeable concerning best practices and how comparable organizations compensate their executives. | |

Target Annual NEO Compensation at Market Median | The executive compensation plan is designed to target the total pay level for our NEOs at the median of comparable companies. To effectively accomplish this, the Committee annually reviews compensation data from several independent sources. Our competitive market for executive talent is primarily staffing organizations; however, the Committee also reviews pay data for other professional service and consulting organizations of comparable size and similar business models. | |

Provide Pay-for-Performance by Paying Higher Compensation for Above Median Performance and Lower Compensation for Below Median Performance | The Committee believes executive compensation should align with our revenue, profit and TSR performance and provide superior cash and equity compensation opportunities for superior performance. The Committee also believes the design of our compensation programs provides incentives for our NEOs to exceed targeted performance, which results in significant relative shareholder value creation and creates a positive perception of Kforce in the highly competitive market for executive talent. Accordingly, the opposite is true for below median performance resulting in lower compensation. | |

Ensure Performance-Based Compensation is the Largest Part of Total Compensation | The Committee designs the compensation framework with significant emphasis on performance-based compensation over fixed compensation to motivate our NEOs to drive operational performance without encouraging unreasonable risk. Performance-based compensation at target comprised 73% of target total direct compensation for our CEO and between 64% to 73% for our other NEOs in 2018. | |

Ensure Equity-Based LTI Compensation is a Significant Component of Performance-Based Compensation | The Committee believes equity-based LTI compensation should be a significant component of performance-based compensation to further focus executive efforts on long-term shareholder returns. Target equity LTI ranged from 60% to 67% of target total performance-based compensation for our NEOs in 2018. We believe the opportunity to earn the designated equity LTI performance objectives motivates the achievement of higher relative TSR; it also serves to retain our executives for the long-term, given the denomination of earned equity LTIs as time-based restricted stock. | |

Require Share Ownership | The Committee believes our executives should have a personal financial stake in Kforce’s ongoing future success, primarily driven by a desire to match their interests with those of our shareholders. In addition to equity-based LTIs playing a significant role in our executive compensation program, all employees, including the NEOs, are eligible to purchase stock through the Kforce Inc. 2009 Employee Stock Purchase Plan. To further align the interests of executives and long-term shareholders, our Board has adopted formal ownership guidelines, set forth below. | |

Consider Tax Deductibility in Compensation Plan Design | The Committee considers all possible tax consequences in the design of our executive compensation programs. Our NEO compensation framework was structured so that our performance-based annual incentive and LTI awards would be deductible under Section 162(m) of the Internal Revenue Code (the Code). The enactment of the 2017 Tax Cuts and Jobs Act (TCJA) resulted in the elimination of performance-based compensation exemptions, except with respect to certain grandfathered arrangements granted prior to November 2, 2017. As a result, this has limited the tax deductibility of NEO compensation beginning in 2018. Although the use of the Kforce Inc. Amended and Restated Performance Incentive Plan previously approved by our shareholders was not historically the exclusive method of making annual incentives, its use has been discontinued as a result of the elimination of the compensation exemptions. Despite the changes to Section 162(m), we expect the structure of our NEO compensation program will continue to include a significant portion of performance-based compensation, which is consistent with our compensation philosophy of linking pay to performance and aligning executive interests with those of our shareholders. | |

Set Challenging Performance Objectives | We work to set difficult but attainable financial growth performance objectives for our NEOs in the context of the annual incentive plan as evidenced by the fact that threshold and target goals and objectives have not been met in every plan year. | |

Minimum Required Share Ownership Guidelines | Our Corporate Governance Guidelines include a stock ownership policy for our directors and executives. The minimum level of holdings for each position is as follows: | |||||

Target Holding Level (Lesser Of) | ||||||

Position | Annual Retainer / Salary | OR | Shares | |||

Director | 3x | 5,000 | ||||

Chief Executive Officer | 5x | 200,000 | ||||

President | 3x | 100,000 | ||||

Chief Financial Officer | 2x | 50,000 | ||||

Chief Operations Officer | 2x | 30,000 | ||||

Other members of Kforce’s Executive Leadership Team | 0.5x | 10,000 | ||||

As of the Record Date, all directors, NEOs and other members of our executive leadership were in compliance with the policy. In accordance with the policy, directors have three years from the effective date of joining the Board, and executives have two years from the effective date of a promotion or salary increase, to attain the ownership level. | ||||||

Clawback Policy | Our Corporate Governance Guidelines include a clawback policy applicable to all executive officers. Accordingly, in the event of a restatement of our financial statements because of a material noncompliance with any financial reporting requirements under the federal securities laws, the Board will, if determined appropriate, recover from current executives any incentive-based compensation paid for any applicable performance periods beginning after March 30, 2012. | |

Equity Plan Features | The Committee believes Kforce’s equity plans are structured to avoid problematic pay practices and features that could be detrimental to shareholder interests. None of our Stock Incentive Plans (as approved by shareholders in 2013, 2016 and 2017 and pending approval of Proposal 4 in 2019) permit repricing or cash buyouts of underwater options or stock appreciation rights without shareholder approval. The 2017 and 2019 Plans require a minimum vesting period of one year on all award types. In addition, the 2019 Plan requires a minimum holding period of one year after exercise of any options and stock appreciation rights for all NEOs; we will also apply this policy to any awards granted outside of this plan. | |

Insider Trading, Anti-Pledging and Anti-Hedging | Our Insider Trading Policy governs the trading in our securities by directors, officers and employees and other persons who have or may have access to material, nonpublic information. The policy has the following restrictions: | ||

s | No trading while in the possession of material, nonpublic information | ||

s | No trading during designated black-out periods | ||

s | No trading without pre-approval (certain insiders) | ||

s | No margin accounts | ||

s | No pledging | ||

s | No hedging (including, but not limited to, prepaid variable forwards, equity swaps, collars and exchange funds) | ||

s | No trading in any interest or position relating to future stock price, such as a puts, calls or short sales | ||

Elimination of Excise Tax Gross-Up | In 2009, the Committee resolved to not enter into any new employment agreements, or materially amend any existing employment agreements with its executives that contain excise tax gross-up provisions in the event of a change-in-control event going forward. Since the Committee’s resolution, all new or amended executive employment agreements have excluded excise tax gross-up provisions. As a result, the only remaining employment agreements which continue to include excise tax gross-up provisions are with Messrs. Dunkel and Liberatore; both of these agreements were most recently amended in 2008. | |

• | staying informed of current issues and emerging trends; |

• | ensuring Kforce’s executive compensation program remains aligned with best practices and are in the best interest of the shareholders; and |

• | establishing and maintaining a pay-for-performance executive compensation program consistent with our shareholders’ interests while providing appropriate incentives to our executives. |

ASGN Incorporated | Kelly Services, Inc. | Resources Connection, Inc. | TrueBlue, Inc. |

Computer Task Group, Inc. | ManpowerGroup, Inc. | Robert Half International Inc. | |

Revenue | Market Capitalization | |||||||

25th Percentile | $ | 1,244,655 | $ | 716,351 | ||||

Median | $ | 2,949,494 | $ | 856,225 | ||||

75th Percentile | $ | 5,585,493 | $ | 3,130,578 | ||||

Kforce Inc. | $ | 1,418,353 | $ | 804,971 | ||||

Percentile Rank | 28 | 28 | ||||||

ASGN Incorporated | Huron Consulting Group Inc. | Resources Connection, Inc. |

Barrett Business Services, Inc. | ICF International, Inc. | TriNet Group, Inc. |

CBIZ, Inc. | Insperity, Inc. | TrueBlue, Inc. |

FTI Consulting, Inc. | Korn/Ferry International | Volt Information Sciences, Inc. |

Heidrick & Struggles International, Inc. | Navigant Consulting, Inc. | |

Revenue | Market Capitalization | |||||||

25th Percentile | $ | 900,001 | $ | 520,833 | ||||

Median | $ | 1,418,353 | $ | 992,616 | ||||

75th Percentile | $ | 2,263,542 | $ | 2,391,524 | ||||

Kforce Inc. | $ | 1,418,353 | $ | 804,971 | ||||

Percentile Rank | 50 | 35 | ||||||

• | Implementing new and upgrading existing technologies that we believe will allow us to more effectively and efficiently serve our clients, consultants and candidates and improve the scalability of our organization. We completed the deployment of a new time and expense application for our consultants and clients as well as a new expense application for our associates. In addition, we continue to make enhancements to our business and data intelligence capabilities as well as our customer relationship management system. We expect these initiatives to benefit us in 2019 and beyond. |

• | Improving our alignment of revenue-generating talent to the markets, products, industries and clients that present the greatest opportunity for profitable revenue growth. |

• | Executing a Kforce brand refresh to reinforce our core values with a consistent message and identity. |

• | Performance-based annual incentive compensation is primarily measured on revenue and EPS growth targets, which we believe serve to drive shareholder returns and, to a lesser extent, on individual performance objectives. |

• | LTI compensation is 100% performance-based, and is measured on Kforce’s TSR performance over a three-year measurement period relative to the specified peer groups. |

2018 COMPENSATION AT TARGET |

• | The payment of above target annual incentive levels, driven by performance against our financial metrics and individual performance objectives for 2018. |

• | The payment of target LTI for the CEO and the President based on attaining median relative TSR performance versus the Separately Designated Peer Group for the 2016-2018 measurement period, and payment of above target LTI for the other NEOs due to attaining above median relative TSR performance versus the Industry Peer Group for the 2016-2018 measurement period. |

2018 ACTUAL COMPENSATION PAYOUTS |

Name | 2017 Salary | 2018 Salary | Percentage Increase | |||||

David L. Dunkel | $ | 800,000 | $ | 875,000 | 9 | % | ||

Joseph J. Liberatore | $ | 600,000 | $ | 660,000 | 10 | % | ||

David M. Kelly | $ | 480,000 | $ | 480,000 | — | % | ||

Kye L. Mitchell | $ | 480,000 | $ | 480,000 | — | % | ||

Andrew G. Thomas | $ | 350,000 | $ | 350,000 | — | % | ||

1. | A financial metric incentive (the Financial Performance Incentive). The 2018 Financial Performance Incentive represented 80% (50% for Mr. Thomas) of the total target incentive award and required attainment of annual year-over-year revenue growth and year-over-year diluted EPS growth performance goals. |

2. | An objectives-based incentive for individual accomplishments and management business objectives (the MBO Incentive). The MBO Incentive represented 20% (50% for Mr. Thomas) of the total target incentive award. |

2018 Target Annual Incentive | 2018 Target Annual Incentive Allocations | |||||||||||||||||||

Name | 2018 Salary | % | $ | Revenue (40%; 25% for Mr. Thomas) | EPS (40%; 25% for Mr. Thomas) | MBO (20%; 50% for Mr. Thomas) | ||||||||||||||

David L. Dunkel | $ | 875,000 | 100 | % | $ | 875,000 | $ | 350,000 | $ | 350,000 | $ | 175,000 | ||||||||

Joseph J. Liberatore | $ | 660,000 | 90 | % | $ | 594,000 | $ | 237,600 | $ | 237,600 | $ | 118,800 | ||||||||

David M. Kelly | $ | 480,000 | 90 | % | $ | 432,000 | $ | 172,800 | $ | 172,800 | $ | 86,400 | ||||||||

Kye L. Mitchell | $ | 480,000 | 90 | % | $ | 432,000 | $ | 172,800 | $ | 172,800 | $ | 86,400 | ||||||||

Andrew G. Thomas (1) | ||||||||||||||||||||

Jan. to Aug. 2018 | $ | 233,450 | 50 | % | $ | 116,725 | $ | 29,181 | $ | 29,181 | $ | 58,362 | ||||||||

Sept. to Dec. 2018 | $ | 116,550 | 90 | % | $ | 104,895 | $ | 26,224 | $ | 26,224 | $ | 52,448 | ||||||||

Total | $ | 350,000 | $ | 221,620 | $ | 55,405 | $ | 55,405 | $ | 110,810 | ||||||||||

(1) | The Annual Incentive for Mr. Thomas was modified beginning in September 2018 due to his additional responsibilities of leading the human resources, compensation and benefits organizations. |

Revenue (in millions) | Year-over-Year Growth | Payout % of Target (1) | Diluted EPS | Year-over-Year Growth | Payout % of Target (1) | |||

Threshold | $1,378 | 1% | 25% | $1.91 | 22% | 25% | ||

Target | $1,419 | 4% | 100% | $2.11 | 35% | 100% | ||

Maximum | $1,487 | 9% | 200% | $2.48 | 58% | 200% | ||

(1) | The incentive payout ranges for Mr. Thomas were modified beginning in September 2018 due to his additional responsibilities of leading the human resources, compensation and benefits organizations. For the first eight months of 2018, the interpolated payout percentages between Threshold and Target varied slightly from the last four months of 2018. |

2018 Attainment as a % of Target | 2018 Incentive Payouts | ||||||||||||||||||||

Name | Target Annual Incentive | Revenue (40%; 25% for Mr. Thomas) | EPS (40%; 25% for Mr. Thomas) | MBO (20%; 50% for Mr. Thomas) | Revenue | EPS | MBO | Total | |||||||||||||

David L. Dunkel | $ | 875,000 | 81% | 150% | 200% | $ | 283,500 | $ | 525,000 | $ | 350,000 | $ | 1,158,500 | ||||||||

Joseph J. Liberatore | $ | 594,000 | 81% | 150% | 200% | $ | 192,456 | $ | 356,400 | $ | 237,600 | $ | 786,456 | ||||||||

David M. Kelly | $ | 432,000 | 81% | 150% | 160% | $ | 139,968 | $ | 259,200 | $ | 138,240 | $ | 537,408 | ||||||||

Kye L. Mitchell | $ | 432,000 | 81% | 150% | 160% | $ | 139,968 | $ | 259,200 | $ | 138,240 | $ | 537,408 | ||||||||

Andrew G. Thomas (1) | |||||||||||||||||||||

Jan. to Aug. 2018 | $ | 116,725 | 88% | 150% | 170% | $ | 25,680 | $ | 43,772 | $ | 99,216 | $ | 168,668 | ||||||||

Sept. to Dec. 2018 | $ | 104,895 | 81% | 150% | 160% | $ | 21,240 | $ | 39,336 | $ | 83,916 | $ | 144,492 | ||||||||

Total | $ | 221,620 | $ | 46,920 | $ | 83,108 | $ | 183,132 | $ | 313,160 | |||||||||||

(1) | For the first eight months of 2018, the interpolated payout percentages between Threshold and Target for Mr. Thomas varied slightly from the last four months of 2018; therefore, both attainment percentages are presented. |

1. | For all NEOs, LTI performance objectives are based on Kforce’s TSR performance over a three-year measurement period relative to the Industry Peer Group; |

2. | For only the CEO and the President, LTI performance objectives are also based on Kforce’s TSR performance over a three-year measurement period relative to the Separately Designated Peer Group. |

Industry Peer Group Relative TSR Rank: | 1 | 2 | 3 | 4 | 5 | 6-7 | 8 |

Industry Peer Group Relative TSR Percentile Rank: | 100 | 85 | 71 | 57 | 42 | 28-14 | 0 |

Total Value of LTI Pool ($ in Millions): | $13 | $12 | $11 | $10 | $9 | $8 | None |

% of LTI Pool Based on TSR Rank/Percentile Ranking | |||||||

David L. Dunkel | 16.7% | 16.7% | 16.7% | 16.7% | 16.7% | 15.0% | —% |

Joseph J. Liberatore | 13.3% | 13.3% | 13.3% | 13.3% | 13.3% | 12.0% | —% |

David M. Kelly | 8.3% | 8.2% | 8.2% | 8.1% | 8.1% | 7.5% | —% |

Kye L. Mitchell | 8.1% | 7.9% | 7.7% | 7.5% | 7.2% | 6.6% | —% |

Andrew G. Thomas | 3.8% | 3.9% | 4.0% | 4.2% | 4.4% | 3.8% | —% |

Separately Designated Peer Group Relative TSR Percentile Ranking | Performance Multiplier | LTI Compensation Impact | ||

0-25 | 50% | Reduction in Restricted Stock Award | ||

26-50 | 75% | Reduction in Restricted Stock Award | ||

51-75 | 100% | Full Restricted Stock Award | ||

76-100 | 150% | Full Restricted Stock Award Plus Cash LTI Payout | ||

Measurement Period | TSR Performance | Industry Peer Group Relative TSR Rank | Separately Designated Peer Group Relative TSR Percentile Ranking | Resulting LTI Pool | Grant Date of Restricted Stock Award | Grant Date Closing Stock Price |

2016-2018 | 31% | 2nd | 50th | $12 million | December 31, 2018 | $30.92 |

Name | # of Shares | Grant Date Fair Value | |||||

David L. Dunkel | 48,512 | $ | 1,499,991 | ||||

Joseph J. Liberatore | 38,810 | $ | 1,200,005 | ||||

David M. Kelly | 31,937 | $ | 987,492 | ||||

Kye L. Mitchell | 30,724 | $ | 949,986 | ||||

Andrew G. Thomas | 15,201 | $ | 470,015 | ||||

• | The values from pension and other compensation columns of the SCT are not performance-based and change based on factors unrelated to performance such as changes in long-term interest rates (a key factor in calculating pension values). |

• | For 2016, the LTI restricted stock grants historically occurred on the first business day of each fiscal year and were based on our relative TSR performance for a measurement period ending in the prior year. As a result, the value of the awards were reflected as compensation in the SCT in the year of grant rather than in the performance year the award was earned. In order to rectify the misalignment created by our historical grant date practices and to create a more clear and transparent picture of our NEO compensation, the Committee approved a change in the timing of the grant date for the LTI restricted stock awards during 2016, which resulted in two LTI award grants in 2016, one on the first business day of the year (old method) and one on the last business day of the year (new method designed to match the performance year with the grant year). 2016 is the only year for such an occurrence and this misalignment no longer exists in 2017 and 2018. |

Earned Compensation for Corresponding Year of Performance | Financial and Shareholder Performance | |||||||||||||||||||||||

Name and Principal Position | Year | Salary | Annual Incentive | Long-term Incentive (1) | Total Direct Compensation (2) | Adjusted Revenue (3) | Adjusted EPS (3) | 3 Year TSR Performance | TSR Rank in Industry Peer Group | |||||||||||||||

David L. Dunkel, | 2018 | $ | 875,000 | $ | 1,158,500 | $ | 1,499,991 | $ | 3,533,491 | $ | 1,418,353 | $ | 2.30 | 31 | % | 2nd | ||||||||

Chief Executive Officer | 2017 | $ | 800,000 | $ | 435,200 | $ | 750,001 | $ | 1,985,201 | $ | 1,358,940 | $ | 1.57 | 12 | % | 5th | ||||||||

2016 | $ | 800,000 | $ | — | $ | 1,669,991 | $ | 2,469,991 | $ | 1,319,706 | $ | 1.45 | 20 | % | 4th | |||||||||

Joseph J. Liberatore, | 2018 | $ | 660,000 | $ | 786,456 | $ | 1,200,005 | $ | 2,646,461 | $ | 1,418,353 | $ | 2.30 | 31 | % | 2nd | ||||||||

President | 2017 | $ | 600,000 | $ | 293,760 | $ | 900,011 | $ | 1,793,771 | $ | 1,358,940 | $ | 1.57 | 12 | % | 5th | ||||||||

2016 | $ | 600,000 | $ | — | $ | 1,334,995 | $ | 1,934,995 | $ | 1,319,706 | $ | 1.45 | 20 | % | 4th | |||||||||

David M. Kelly, | 2018 | $ | 480,000 | $ | 537,408 | $ | 987,492 | $ | 2,004,900 | $ | 1,418,353 | $ | 2.30 | 31 | % | 2nd | ||||||||

Chief Financial Officer | 2017 | $ | 480,000 | $ | 235,008 | $ | 725,003 | $ | 1,440,011 | $ | 1,358,940 | $ | 1.57 | 12 | % | 5th | ||||||||

2016 | $ | 480,000 | $ | 172,800 | $ | 812,496 | $ | 1,465,296 | $ | 1,319,706 | $ | 1.45 | 20 | % | 4th | |||||||||

Kye L. Mitchell, | 2018 | $ | 480,000 | $ | 537,408 | $ | 949,986 | $ | 1,967,394 | $ | 1,418,353 | $ | 2.30 | 31 | % | 2nd | ||||||||

Chief Operations Officer | 2017 | $ | 480,000 | $ | 235,008 | $ | 650,011 | $ | 1,365,019 | $ | 1,358,940 | $ | 1.57 | 12 | % | 5th | ||||||||

2016 | $ | 480,000 | $ | 172,800 | $ | 750,011 | $ | 1,402,811 | $ | 1,319,706 | $ | 1.45 | 20 | % | 4th | |||||||||

Andrew G. Thomas, | 2018 | $ | 350,000 | $ | 313,160 | $ | 470,015 | $ | 1,133,175 | $ | 1,418,353 | $ | 2.30 | 31 | % | 2nd | ||||||||

Chief Marketing Officer | ||||||||||||||||||||||||

(1) | Reflects the realignment of equity LTI awards to the corresponding year of performance for 2016. The equity LTI awards made on the first business day of 2016 related to 2015, which corresponds to the performance period for those awards. No adjustment was made to the 2017 and 2018 amounts; thus, these amounts are consistent with the SCT. |

(2) | Total direct compensation is the sum of salary, annual incentive and LTI earned for the corresponding year of performance. |

(3) | Represents non-GAAP Adjusted Revenue for 2017 and Diluted EPS for 2017 and 2016. The calculation of Adjusted Revenue and Adjusted Diluted EPS, and the reconciliation to the applicable GAAP figures, for 2017 and 2016 are set forth in the Appendix B within this Proxy Statement. For 2018, there were no adjustments and balances noted above are reported in accordance with GAAP. |

Kforce Nonqualified Deferred Compensation Plan | Kforce maintains a nonqualified deferred compensation plan in which eligible management and highly compensated key employees, as defined by IRS regulations, may elect to defer all or part of their compensation to later years. Amounts deferred are indexed to investment options selected by the eligible employees and the increase or decrease in value is based upon the performance of the selected investments. Eligible employees are permitted to change investment options and scheduled distributions annually. Kforce has insured the lives of certain participants in the deferred compensation plan to assist in the funding of the deferred compensation liability. Employer matching contributions to the nonqualified deferred compensation plan are discretionary and are funded annually as approved by the Board. |

Kforce Inc. Supplemental Executive Retirement Plan | During 2006, Kforce adopted a Supplemental Executive Retirement Plan (SERP) for all NEOs. Of the NEOs, only Messrs. Dunkel and Liberatore participate in the SERP. The Committee previously decided to not allow any additional participants into the SERP. The primary goals of the SERP are to create an additional wealth accumulation opportunity, restore lost qualified pension benefits due to government limitations and retain our covered executive officers. The SERP will be funded entirely by Kforce, and benefits are taxable to the executive officer upon receipt and deductible by Kforce when paid. Benefits payable under the SERP upon the occurrence of a qualifying distribution event, as defined, are targeted at 45% of the covered executive officers’ average salary and annual incentive, as defined, from the three years in which the covered executive officer earned the highest salary and annual incentive during the last 10 years of employment, which is subject to adjustment for retirement prior to the normal retirement age and the participant’s vesting percentage. Benefits under the SERP are based on the lump sum present value but may be paid over the life of the covered executive officer or 10-year annuity, as elected by the covered executive officer upon commencement of participation in the SERP. Normal retirement age under the SERP is defined as age 65. Vesting under the plan is defined as 100% upon a participant’s attainment of age 55 and 10 years of service and 0% prior to a participant’s attainment of age 55 and 10 years of service. Full vesting also occurs if a participant with five years or more of service is involuntarily terminated by Kforce without cause or upon death, disability or a change in control. Certain conditions allow for early retirement as early as age 55. The benefits under the SERP are reduced for a participant who has not either reached age 62 and 10 years of service or age 55 and 25 years of service with a percentage reduction up to the normal retirement age. On each anniversary of the effective date, each NEO is credited with a year of service. The NEOs were not credited with any years of service prior to December 31, 2006, the effective date of the plan. The Committee believes the SERP provides significant retention benefits for the participants. |

Employment, Severance and Change in Control Agreements | Kforce has employment agreements with each of its NEOs, which provide for severance payments under certain termination circumstances, including termination following a change in control, as defined in the employment agreements. The Committee has determined it is in Kforce’s and its shareholders’ best interests to recognize the contributions of the NEOs to Kforce’s business and to retain the NEOs’ services. The specific amounts the NEOs would receive under the employment agreements are described in the “Potential Payments Upon Termination or Change in Control” section below. The Committee believes the employment agreements are an essential component of the executive compensation program and are helpful in attracting and retaining executive talent in a competitive market. The Committee periodically reviews the benefits provided under the employment agreements to determine that they continue to serve Kforce’s interests in providing significant retention benefits to these key executives, are consistent with market practice and are reasonable. In 2009, the Committee resolved to not enter into any new employment agreements or materially amend any existing employment agreements with its executives that contain excise tax gross-up provisions going forward. At this time, only Messrs. Dunkel and Liberatore have excise tax gross-up provisions in their existing employment agreements. In 2017, the Committee resolved to not enter into any new employment agreements or materially amend any existing employment agreements with its executives that contain provisions for severance payments that exceed 1x cash compensation or change in control severance payments that exceed 2x cash compensation. The amended and restated employment agreement for Mr. Thomas was effective January 1, 2013, but was publicly filed as a result of his NEO designation in 2018. Refer to Exhibit 10.21 to the Company's report on Form 10-K filed on February 22, 2019. There have been no amendments or modifications to his employment agreement since January 1, 2013 and he did not become party to any pre-existing arrangement as a result of becoming an NEO. |

Perquisites and Other Personal Benefits | Kforce does not generally provide any perquisites or other personal benefits to its NEOs. During 2017, Kforce provided for Ms. Mitchell’s relocation to our corporate headquarters in Tampa, Florida from the Washington D.C. area; the value of this relocation is included within the “All Other Compensation” column of the SCT. |

AMN Healthcare Services, Inc. | Heidrick & Struggles International, Inc. | Resources Connection, Inc. |

ASGN Incorporated | Huron Consulting Group Inc. | Robert Half International Inc. |

Cross Country Healthcare, Inc. | Kelly Services, Inc. | TrueBlue, Inc. |

Computer Task Group, Incorporated | Korn/Ferry International | Volt Information Sciences, Inc. |

The Hackett Group, Inc. | Manpower Group Inc. | |

• | All seven companies from the prior Industry Peer Group, which reflect prominence in the staffing industry; |

• | Four companies from the prior Separately Designated Peer Group, which are all of comparable size to Kforce and with similar business models to Kforce, including Korn/Ferry International, Volt Information Sciences, Inc., Huron Consulting Group Inc., and Heidrick & Struggles International, Inc.; and |

• | Three new companies, which are also of comparable size and business model, including AMN Healthcare Services, Inc., Cross Country Healthcare, Inc., and The Hackett Group, Inc. |

Revenue | Market Capitalization | |||||||

25th Percentile | $ | 776,070 | $ | 474,930 | ||||

Median | $ | 1,418,353 | $ | 821,248 | ||||

75th Percentile | $ | 2,949,494 | $ | 2,441,862 | ||||

Kforce Inc. | $ | 1,418,353 | $ | 804,971 | ||||

Percentile Rank | 50 | 42 | ||||||

Name and Principal Position | Year | Salary | Stock Awards (1) | Non-Equity Incentive Plan Compensation (2) | Change in Pension Value and Nonqualified Deferred Compensation Earnings (3) | All Other Compensation (4) | Total | ||||||||||||

David L. Dunkel | 2018 | $ | 875,000 | $ | 1,499,991 | $ | 1,158,500 | $ | 653,336 | $ | 102,435 | $ | 4,289,262 | ||||||

Chief Executive Officer | 2017 | $ | 800,000 | $ | 750,001 | $ | 435,200 | $ | 1,005,233 | $ | 88,518 | $ | 3,078,952 | ||||||

2016 | $ | 800,000 | $ | 3,504,988 | $ | — | $ | 1,450,087 | $ | 67,289 | $ | 5,822,364 | |||||||

Joseph J. Liberatore | 2018 | $ | 660,000 | $ | 1,200,005 | $ | 786,456 | $ | 37,547 | $ | 98,012 | $ | 2,782,020 | ||||||

President | 2017 | $ | 600,000 | $ | 900,011 | $ | 293,760 | $ | 656,799 | $ | 92,056 | $ | 2,542,626 | ||||||

2016 | $ | 600,000 | $ | 2,798,335 | $ | — | $ | 197,109 | $ | 88,151 | $ | 3,683,595 | |||||||

David M. Kelly | 2018 | $ | 480,000 | $ | 987,492 | $ | 537,408 | $ | — | $ | 65,239 | $ | 2,070,139 | ||||||

Chief Financial Officer | 2017 | $ | 480,000 | $ | 725,003 | $ | 235,008 | $ | — | $ | 54,998 | $ | 1,495,009 | ||||||

2016 | $ | 480,000 | $ | 1,580,007 | $ | 172,800 | $ | — | $ | 50,220 | $ | 2,283,027 | |||||||

Kye L. Mitchell | 2018 | $ | 480,000 | $ | 949,986 | $ | 537,408 | $ | — | $ | 61,482 | $ | 2,028,876 | ||||||

Chief Operations Officer | 2017 | $ | 480,000 | $ | 650,011 | $ | 235,008 | $ | — | $ | 231,677 | $ | 1,596,696 | ||||||

2016 | $ | 480,000 | $ | 1,517,522 | $ | 172,800 | $ | — | $ | 50,220 | $ | 2,220,542 | |||||||

Andrew G. Thomas | 2018 | $ | 350,000 | $ | 470,015 | $ | 313,160 | $ | — | $ | 31,459 | $ | 1,164,634 | ||||||

Chief Marketing Officer | |||||||||||||||||||

(1) | As discussed in the CD&A above, the amounts reported for 2016 include two years’ worth of LTI restricted stock awards due to an administrative change in the timing of the annual grant date. |

(2) | Represents annual incentive compensation earned by the NEOs. |

(3) | For Messrs. Dunkel and Liberatore, the amounts in this column represent the aggregate change in the accumulated benefit obligation for the SERP using the same measurement dates used for reporting Kforce’s consolidated financial statements for fiscal years 2018, 2017 and 2016. There were no changes made to the plan during the year and no increases to the benefits provided to the NEOs. |

(4) | The “All Other Compensation” column includes: |

Name | Year | Dividends (a) | Defined Contribution Plans (b) | One-Time Payments (c) | Total | |||||||||||||

David L. Dunkel | 2018 | $ | 102,435 | $ | — | $ | — | $ | 102,435 | |||||||||

2017 | $ | 88,518 | $ | — | $ | — | $ | 88,518 | ||||||||||

2016 | $ | 67,289 | $ | — | $ | — | $ | 67,289 | ||||||||||

Joseph J. Liberatore | 2018 | $ | 98,012 | $ | — | $ | — | $ | 98,012 | |||||||||

2017 | $ | 92,056 | $ | — | $ | — | $ | 92,056 | ||||||||||

2016 | $ | 88,151 | $ | — | $ | — | $ | 88,151 | ||||||||||

David M. Kelly | 2018 | $ | 63,389 | $ | 1,850 | $ | — | $ | 65,239 | |||||||||

2017 | $ | 53,198 | $ | 1,800 | $ | — | $ | 54,998 | ||||||||||

2016 | $ | 48,420 | $ | 1,800 | $ | — | $ | 50,220 | ||||||||||

Kye L. Mitchell | 2018 | $ | 60,257 | $ | 1,225 | $ | — | $ | 61,482 | |||||||||

2017 | $ | 51,885 | $ | 1,800 | $ | 177,992 | $ | 231,677 | ||||||||||

2016 | $ | 48,420 | $ | 1,800 | $ | — | $ | 50,220 | ||||||||||

Andrew G. Thomas | 2018 | $ | 31,459 | $ | — | $ | — | $ | 31,459 | |||||||||

(a) | This column reflects the value of dividend equivalents issued on unvested restricted stock in the form of additional shares of restricted stock. |

(b) | This column reflects the value of employer matching contributions attributable to our defined contribution 401(k) plan. |

(c) | The amount included for Ms. Mitchell for 2017 represents reimbursements and payments in connection with her relocation to the Firm’s corporate headquarters in Tampa, Florida, including: $80,105 for real estate transaction costs and house-hunting, $59,156 for moving costs and $38,731 for a tax gross-up related to taxable relocation amounts. |

Restricted Stock Awards | |||||||

Name | Unvested Shares | Market Value of Unvested Shares ($)(1) | |||||

David L. Dunkel | 48,512 | (2) | $ | 1,499,991 | |||

20,161 | (3) | $ | 623,378 | ||||

45,175 | (4) | $ | 1,396,811 | ||||

32,767 | (5) | $ | 1,013,156 | ||||

16,554 | (6) | $ | 511,850 | ||||

Joseph J. Liberatore | 38,810 | (2) | $ | 1,200,005 | |||

29,032 | (3) | $ | 897,669 | ||||

36,116 | (4) | $ | 1,116,707 | ||||

26,129 | (5) | $ | 807,909 | ||||

13,260 | (6) | $ | 409,999 | ||||

6,881 | (7) | $ | 212,761 | ||||

David M. Kelly | 31,937 | (2) | $ | 987,492 | |||

23,387 | (3) | $ | 723,126 | ||||

21,981 | (4) | $ | 679,653 | ||||

13,706 | (5) | $ | 423,790 | ||||

6,926 | (6) | $ | 214,152 | ||||

7,714 | (7) | $ | 238,517 | ||||

Kye L. Mitchell | 30,724 | (2) | $ | 949,986 | |||

20,968 | (3) | $ | 648,331 | ||||

20,288 | (4) | $ | 627,305 | ||||

13,706 | (5) | $ | 423,790 | ||||

6,926 | (6) | $ | 214,152 | ||||

7,714 | (7) | $ | 238,517 | ||||

Andrew G. Thomas | 15,201 | (2) | $ | 470,015 | |||

12,904 | (3) | $ | 398,992 | ||||

11,225 | (4) | $ | 347,077 | ||||

6,548 | (5) | $ | 202,464 | ||||

3,311 | (6) | $ | 102,376 | ||||

3,104 | (8) | $ | 95,976 | ||||

(1) | This column represents a market value of $30.92 per share, which is the closing stock price on December 31, 2018. |

(2) | With respect to the restricted stock granted to Mr. Dunkel on December 31, 2018, 33% of the total shares granted vest on: December 27, 2019, 2020 and 2021. With respect to the restricted stock granted to Messrs. Liberatore, Kelly and Thomas and Ms. Mitchell on December 31, 2018, 25% of the total shares granted vest on: December 27, 2019, 2020, 2021 and 2022. |

(3) | With respect to the restricted stock granted to Mr. Dunkel on December 31, 2017, and the additional shares granted due to Kforce’s quarterly dividends, 33% of the total shares granted vest(ed) on: December 27, 2018, 2019 and 2020. With respect to the restricted stock granted to Messrs. Liberatore, Kelly and Thomas and Ms. Mitchell on December 31, 2017, and the additional shares granted due to Kforce’s quarterly dividends, 20% of the total shares granted vest(ed) on: December 27, 2018, 2019, 2020, 2021 and 2022. |

(4) | With respect to the restricted stock granted to Messrs. Dunkel, Liberatore, Kelly and Thomas and Ms. Mitchell on December 31, 2016, and the additional shares granted due to Kforce’s quarterly dividends, 20% of the total shares granted vest(ed) on: December 31, 2017 and December 27, 2018, 2019, 2020 and 2021. |

(5) | With respect to the restricted stock granted to Messrs. Dunkel, Liberatore, Kelly and Thomas and Ms. Mitchell on January 4, 2016, and the additional shares granted due to Kforce’s quarterly dividends, 20% of the total shares granted vest(ed) on: January 4, 2017, December 31, 2017 and December 27, 2018, 2019 and 2020. |

(6) | With respect to the restricted stock granted to Messrs. Dunkel, Liberatore, Kelly and Thomas and Ms. Mitchell on January 2, 2015, and the additional shares granted due to Kforce’s quarterly dividends, 20% of the total shares granted vest(ed) on: January 2, 2016 and 2017, December 31, 2017 and December 27, 2018 and 2019. |