KFRC-12.31.2014-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________________________________________________

FORM 10-K

________________________________________________________

(MARK ONE)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 000-26058

_________________________________________________________________

KFORCE INC.

(Exact name of Registrant as specified in its charter)

_________________________________________________________________

|

| | |

FLORIDA | | 59-3264661 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

|

| | |

1001 EAST PALM AVENUE, TAMPA, FLORIDA | | 33605 |

(Address of principal executive offices) | | (Zip Code) |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (813) 552-5000

_______________________________________________________

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

TITLE OF EACH CLASS | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

None | | None |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Common Stock, $0.01 par value

(Title of class)

_____________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | |

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | x |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.): Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2014, was approximately $583,008,954. For purposes of this determination, common stock held by each officer and director and by each person who owns 10% or more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock as of February 24, 2015 was 29,515,188.

DOCUMENTS INCORPORATED BY REFERENCE:

|

| | |

Document | | Parts Into Which Incorporated |

Portions of Proxy Statement for the Annual Meeting of Shareholders scheduled to be held April 21, 2015 (“Proxy Statement”) | | Part III |

KFORCE INC.

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

|

| | |

| |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| |

Item 15. | | |

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

References in this document to “the Registrant,” “Kforce,” “we,” “the Firm,” “our” or “us” refer to Kforce Inc. and its subsidiaries, except where the context otherwise requires or indicates.

This report, particularly Item 1. Business, Item 1A. Risk Factors, and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), and the documents we incorporate into this report, contains certain statements that are, or may be deemed to be, forward-looking statements within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are made in reliance upon the protections provided by such acts for forward-looking statements. Such statements may include, but may not be limited to, projections of revenue, income, losses, cash flows, capital expenditures, future prospects, our beliefs regarding potential government actions, anticipated costs and benefits of proposed (or future) acquisitions, integration of acquisitions, transition of divestitures, the efficacy of our disclosure and internal controls, plans for future operations, capabilities of business operations, effects of interest rate variations, our ability to obtain financing and favorable terms, financing needs or plans, plans relating to services of Kforce, estimates concerning the effects of litigation or other disputes, estimates concerning our ability to collect on our accounts receivable, expectations of the overall economic outlook, developments within the staffing sector including, but not limited to, the penetration rate (the percentage of temporary staffing to total employment) and growth in temporary staffing, our ability to recruit qualified individuals, estimates concerning goodwill impairment, as well as assumptions as to any of the foregoing and all statements that are not based on historical fact but rather reflect our current expectations concerning future results and events. For a further list and description of various risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in our forward-looking statements, see the Risk Factors and MD&A sections. In addition, when used in this discussion, the terms “anticipate,” “estimate,” “expect,” “intend,” “plan,” “believe,” “will,” “may,” “could,” “should” and variations thereof and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted. Future events and actual results could differ materially from those set forth in or underlying the forward-looking statements. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this report, which speak only as of the date of this report. Kforce undertakes no obligation to publicly publish the results of any adjustments to these forward-looking statements that may be made to reflect events on or after the date of this report or to reflect the occurrence of unexpected events.

PART I

Item 1. Business.

Company Overview

We are a provider of professional and technical specialty staffing services and solutions and operate through our corporate headquarters in Tampa, Florida, 62 field offices located throughout the United States and one office in Manila, Philippines. Kforce was incorporated in 1994 but its predecessor companies, Romac & Associates, Inc. and Source Services Corporation have been providing staffing services since 1962. Kforce completed its Initial Public Offering in August 1995.

We provide our clients staffing services and solutions through three operating segments: Technology (“Tech”), Finance and Accounting (“FA”) and Government Solutions (“GS”). Our Tech segment includes the results of Kforce Global Solutions, Inc. (“Global”), a wholly-owned subsidiary, which has an office in the Philippines. The GS segment is organized and managed by specialty because of the unique operating characteristics of the business.

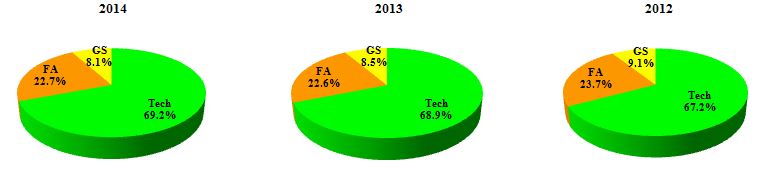

The following charts depict the percentage of our total revenues for each of our segments for the years ended December 31, 2014, 2013 and 2012 (the charts for 2013 and 2012 have been reconfigured to exclude our former Health Information Management ("HIM") segment which we sold in 2014):

Tech

Our Tech segment provides both temporary staffing and permanent placement services to our clients, focusing primarily on areas of information technology such as systems/applications programmers and developers, senior-level project managers, systems analysts, enterprise data management and e-business and networking technicians. The average bill rate for our Tech segment for 2014 was approximately $68 per hour. Our Tech segment provides service to clients in a variety of industries with a strong footprint in the healthcare, financial services and government sectors. An IT growth update published by Staffing Industry Analysts (“SIA”) during September 2014, states that temporary technology staffing is projected to experience growth of 7% in 2015. We believe the sustained high growth is due to the continuing use of temporary staffing as a solution during uncertain economic cycles, the increasing cost of employment driving the systemic use of temporary staffing, particularly in project-based work such as technology, and an increasing influence of technology in business driving the overall demand for talent in the temporary technology staffing sector. The SIA report also acknowledges that notable skill shortages in certain technology skill sets will continue, which we believe will result in strong future growth in our Tech segment.

FA

Our FA segment provides both temporary staffing and permanent placement services to our clients in areas such as general accounting, business analysis, accounts payable, accounts receivable, financial analysis and reporting, taxation, budget preparation and analysis, mortgage and loan processing, cost analysis, professional administration, credit and collections, audit services, and systems and controls analysis and documentation. Our FA segment provides service to clients in a variety of industries with a strong footprint in the healthcare, financial services and government sectors. The average bill rate for our FA segment for 2014 was approximately $32 per hour. In its September 2014 update, the SIA report indicated that the market for temporary finance/accounting work is expected to expand 5% during 2015.

GS

Our GS segment provides Tech and FA professionals to the Federal Government as both a prime contractor and a subcontractor. The GS contracts are concentrated on customers that we believe are less impacted by sequestration threats, such as healthcare. GS offers integrated business solutions to its customers in areas such as: information technology, healthcare informatics, data and knowledge management, research and development, financial management and accounting, among other areas. Substantially all GS services are supplied to the Federal Government through field offices located in the Washington, D.C. metropolitan area, San Antonio, Texas and Austin, Texas.

Types of Staffing Services

Kforce’s staffing services consist of temporary staffing services (“Flex”) and permanent placement services (“Search”). For the three years ended December 31, 2014, 2013, and 2012, Flex represented 96.2%, 95.5% and 95.3% of total Kforce revenue, respectively.

We target clients and recruits for both Flex and Search services, which contributes to our objective of providing integrated solutions for all of our clients’ human capital needs.

Flex

We provide our clients with qualified individuals (“consultants”) on a temporary basis when it is determined that they have the appropriate skills and experience and are “the right match” for our clients. We recruit consultants from the job boards, Kforce.com, from social media networks and from passive candidates we identify who are currently employed and not actively seeking another position. Our success is dependent upon our employees’ (“associates”) ability to: (1) understand and acknowledge our clients’ needs; (2) determine and understand the capabilities of the consultants being recruited; and (3) deliver and manage the client-consultant relationship to the satisfaction of both our clients and our consultants. We believe proper execution by our associates and our consultants directly impacts the longevity of the assignments, increases the likelihood of being able to generate repeat business with our clients and fosters a better experience for our consultants, which has a direct correlation to their redeployment.

Flex revenue is driven by the number of total hours billed and established bill rates. Flex gross profit is determined by deducting consultant pay, benefits and other related costs from Flex revenues. Flex associate commissions, related taxes and other compensation and benefits, as well as field management compensation are included in selling, general and administrative expenses (“SG&A”), along with administrative and corporate compensation. The Flex business model involves attempting to maximize the number of consultant hours and bill rates, while managing consultant pay rates and benefit costs, as well as compensation and benefits for our core associates. Flex revenue also includes solutions provided through our GS segment. These revenues involve providing longer-term contract services to the customer primarily on a time-and-materials basis but also on a fixed-price and cost-plus basis.

Search

Our Search business is a significantly smaller, yet important, part of our business that involves locating qualified individuals (“candidates”) for permanent placement with our clients. We primarily perform these searches on a contingency basis; thus, fees are only earned if the candidates are ultimately hired by our clients. The typical structure for search fees is based upon a percentage of the placed individual’s annual compensation in their first year of employment, which is known at the time of placement. We recruit permanent employees from the job boards, from our associates’ networks, social media networks and from passive candidates we identify who are currently employed and not actively seeking another position. Also, there are occasions where consultants are initially assigned to a client on a Flex basis and later are converted to a permanent placement, for which we may also receive a Search fee (referred to as “conversion revenue”).

Search revenues are driven by placements made and the resulting fees billed and are recognized net of an allowance for “fallouts,” which occur when placements do not complete the applicable contingency period. Although the contingency period varies by contract, it is typically 90 days or less. This allowance for fallouts is estimated based upon historical experience with Search placements that did not complete the contingency period. There are no consultant payroll costs associated with Search placements, thus, all Search revenues increase gross profit by the full amount of the fee. Search associate commissions, compensation and benefits are included in SG&A.

Business Strategy

Our primary goal is to sustain long-term financial growth and outperform the industry while being a leading provider of domestic professional and staffing services in our focus segments. We believe the following strategies will help us achieve our goal.

Invest in Headcount of Revenue Generators. Given the current and expected future demand in the marketplace for the services provided by Kforce and the performance of our most tenured associates continuing to remain near peak levels, the Firm made significant investments beginning in the fourth quarter of 2012 in the hiring of associates that are responsible for generating revenue. The increase in revenue generator headcount from 2013 to 2014 was 6.3% and from 2012 to 2013 was 10.3%. New associates typically take six to twelve months to ramp up to a minimum acceptable standard and continue to ramp for up to four years. Accordingly, we expect that the investment in 2014 will result in more revenue growth during 2015 and beyond. Going forward, the Firm expects to continue to hire additional revenue generators in those lines of business, geographies and industries that we believe present the greatest opportunity.

Enhanced Customer Focus. During 2013, Kforce streamlined the Firm’s leadership and revenue enablers in an effort to align a higher percentage of roles closer to the customer, supporting our significant focus to provide more consistent and effective service to our clients and our consultants. The new alignment has resulted in a more significant focus on our revenue-generating activities and has resulted in more streamlined processes and tools that should enable us to simplify and improve how we do business with our clients and consultants.

A continued focus of Kforce is cultivating relationships with premier partners and strategic clients, both in terms of annual revenues and geographic dispersion. In order to achieve greater penetration within each of our largest accounts, we work to foster an understanding of our client’s needs holistically while building a consultative partnership rather than a transactional client relationship. We are increasingly concentrated on bringing our core employees closer to the customer, and with that in mind we have integrated our largest accounts leadership team into our field leadership team, enhancing our alignment to serve these clients. We believe that this strategy will allow us to more effectively drive expansion in our share of our clients’ staffing needs, as well as capturing additional overall market share.

We believe we have developed long-term relationships with our clients by repeatedly providing solutions to their specialty staffing requirements. We strive to differentiate ourselves by working closely with our clients to understand their needs and maximize their return on human capital. Finding the right match for both our clients and consultants is our ultimate priority. The placement of our highly skilled consultants requires operational and technical skill to effectively recruit and evaluate personnel, match them to client needs, and manage the resulting relationships. We believe the proper placements of consultants with the right clients will serve to balance the desire for optimal volume, rate, effort and duration of assignment, while ultimately maximizing the benefit for our clients, consultants and the Firm. In addition, Kforce’s ability to offer flexible staffing solutions, coupled with our permanent placement capability, offers the client a broad spectrum of specialty staffing services. We believe this ability enables Kforce to emphasize consultative rather than transactional client relationships, and therefore facilitates further client penetration and the expansion of our share of our clients’ staffing needs.

We concentrate resources among our segments and staffing services to the areas of highest anticipated demand to adapt to the ever-changing landscape within the staffing industry. We believe our historical focus in these markets, combined with our associates’ operating expertise, provides us with a competitive advantage.

Optimize Operating Margins. The optimization of operating margins remains an important goal for Kforce as we strive to deliver profitable revenue growth. We believe our revenue-focused alignment and streamlined infrastructure will allow us to meet the needs of our clients and consultants in the most cost effective manner possible.

Retain our Great People. A significant focus of Kforce is on the retention of our tenured and top performing associates. We ended fiscal 2014 with an even more highly tenured management team, field sales team and back office employees, which we believe will continue to enhance our ability to achieve future profitable growth.

We believe our consultants are a significant component in delivering value to our clients. We are focused on efficient and effective consultant care processes, such as onboarding, frequent and ongoing communication and programs to redeploy our consultants in a timely fashion. We strive to increase the tenure and loyalty of our consultants and be their “Employer of Choice”, thus enabling us to deliver the highest quality talent to our clients.

Continue to Develop and Optimize our National Recruiting Center (“NRC”). We believe our centralized NRC offers us a competitive advantage. The NRC is particularly effective at increasing the quality and speed of delivery services to our clients with demands for high volume staffing. The NRC identifies and interviews active candidates from nationally contracted job boards, Kforce.com, as well as other sources, then forwards qualified candidates to Kforce field offices to be matched to available positions. The NRC has continued to evolve throughout 2014, and supports all of our operating segments. There continues to be a significant demand for its resources. In 2014, we reallocated a portion of the NRC resources to a facility in Phoenix, Arizona with a goal to create greater efficiency in serving our clients in the western U.S.

We continue to focus on job order prioritization, which places greater attention on orders that we believe present the greatest opportunity and streamlining the NRC’s focus to more specific industries, customer segments and skill sets to create leverage. A continued focus for 2015 will be to enhance the performance of the NRC in meeting demand, and enhance our efforts to support future growth by building a pipeline of qualified candidates, as well as evolving its international talent solution strategy. The Firm will continue to utilize the NRC as a training ground for field sales as top performers in the NRC with a strong knowledge of the delivery system will move into field sales roles.

Leverage Infrastructure. A significant focus for Kforce is to more effectively leverage the functionality built over the last several years with its front-end and back office technology infrastructure. We believe our back office system software provides a competitive advantage through the enhancement of the efficiency and performance of our sales and delivery functions. We will continue to selectively improve our front-end systems and our back office systems, including our ERP and time collection and billing systems, in areas that we believe will generate additional operating leverage. In 2014, Kforce adopted and implemented an Agile software development methodology (whereby requirements and solutions evolve through cross-functional teams), and underwent an organizational transformation with a goal to maximize the responsiveness and timeliness by which value is delivered through our technology investments.

Enhance Shareholder Value. Kforce is committed to enhancing shareholder value. In 2014, the Firm executed a significant share repurchase program, completed four quarterly dividends, and continued to focus on reducing expenses. We increased the quarterly dividend amount by 10% in December 2014. Kforce expects to continue these initiatives through 2015.

Industry Overview

We serve Fortune 1000 companies, the Federal Government, state and local governments, local and regional companies, and small to mid-sized companies. Our 10 largest clients represented approximately 25% of revenues and no single customer accounted for more than 5% of revenues for the year ended December 31, 2014. The specialty staffing industry is made up of thousands of companies, most of which are small local firms providing limited service offerings to a relatively small local client base. We believe Kforce is one of the 10 largest publicly-traded specialty staffing firms in the United States. According to a report published by the SIA in July 2014, 124 companies reported at least $100 million in U.S. staffing revenues in 2013 and these 124 companies represented an estimated 54.5% of the total market. Competition in a particular market can come from many different companies, both large and small. We believe, however, that our geographic presence, diversified service offerings, NRC, focus on consistent service and delivery and effective job order prioritization all provide a competitive advantage, particularly with clients that have operations in multiple geographic markets. In addition, we believe that our service offerings are primarily concentrated in areas with significant growth opportunities in both the short and long term.

Based upon previous economic cycles experienced by Kforce, we believe that times of sustained economic recovery generally stimulate demand for substantial additional U.S. workers and, conversely, an economic slowdown results in a contraction in demand for additional U.S. workers. From an economic standpoint, temporary employment figures and trends are important indicators of staffing demand, which improved during 2014 at a greater rate than 2013 based on data published by the Bureau of Labor Statistics (“BLS”). Total temporary employment increased 7.8% and the penetration rate increased 3.4% from December 2013 to December 2014, bringing the rate to 2.13% in December 2014, an all-time high. While the macro-employment picture remains uncertain, it has continuously improved, with the unemployment rate at 5.6% as of December 2014, and non-farm payroll expanding an average of 246,000 jobs per month in 2014. Also, the college-level unemployment rate, which we believe serves as a proxy for professional employment and is more closely aligned with the Firm’s business strategy, was at 2.9% in December 2014. Management believes that uncertainty in the overall U.S. economic outlook related to the political landscape, potential tax changes, geo-political risk and impact of health care reform, will continue to fuel growth in temporary staffing as employers may be reluctant to increase full-time hiring. Additionally, we believe the increasing costs of employment may be driving a systemic shift to an increased use of temporary staff as a percentage of total workforce, which is creating reduced cyclicality in the business. If the penetration rate of temporary staffing continues to experience growth in the coming years, we believe that our Flex revenues can grow significantly even in a relatively modest growth macro-economic environment. Kforce remains optimistic about the growth prospects of the temporary staffing industry, the penetration rate, and in particular, our revenue portfolio. Of course, no reliable predictions can be made about the general economy, the staffing industry as a whole, or specialty staffing in particular.

According to an industry forecast published by SIA in September 2014, the U.S. temporary staffing industry generated estimated revenues of $92.5 billion in 2011, $99.0 billion in 2012 and $103.3 billion in 2013; with projected revenues of $108.8 billion in 2014 and $115.0 billion in 2015. Based on projected revenues of $108.8 billion for the U.S. temporary staffing industry, this would put the Firm’s market share at approximately 1%. Therefore, our previously discussed business strategies are sharply focused around expanding our share of the U.S. temporary staffing market and further penetrating our existing clients’ staffing needs.

Over the last several years, our GS segment’s operations have been adversely impacted by the (1) continued uncertainty of funding levels of various Federal Government programs and agencies; (2) uncertain macro-economic and political environment; and (3) unexpected significant delays in the start-up of already executed and funded projects, which we believe were due to acute shortages of acquisition and contracting personnel within certain Federal Government agencies. GS management remains cautiously optimistic as it cannot predict the outcome of past, current and future efforts to reduce federal spending and whether these efforts will materially impact the future budgets of federal agencies that are clients of our GS segment. Our GS segment will be facing a number of re-competes in 2015 that could materially impact that segment's performance, especially given the recent emphasis by the Federal Government on awarding contracts to the lowest bidder and a de-emphasis of overall funding of services.

Trade Names and Trademark

The Kforce trade names, and derivatives thereof, and GS’s “Data Confidence” trademark is important to our business. Our primary trade names and trademark are registered with the United States Patent and Trademark Office. In the 2014 Temporary Workers Survey published by SIA, Kforce was ranked third in a name recognition survey, and ranked first among IT temporary workers.

Regulatory Environment

Staffing firms are generally subject to one or more of the following types of government regulations: (1) regulation of the employer/employee relationship between a firm and its staff; such as wage and hour regulations, tax withholding and reporting, social security and other retirement, anti-discrimination, employee benefits and workers’ compensation regulations; (2) registration, licensing, recordkeeping and reporting requirements and (3) substantive limitations on their operations. Staffing firms are governed by laws regulating the employer/employee relationship.

In providing staffing and solution services to the Federal Government, we must comply with complex laws and regulations relating to the formation, administration, and performance of Federal Government contracts. These laws and regulations create compliance risk and affect how we do business with our federal agency clients, and may impose added costs on our business.

In the increasingly stringent regulatory environment, one of our top priorities is compliance. As we continue to evolve our infrastructure, compliance remains a primary focus. For more discussion of the potential impact that the regulatory environment could have on Kforce’s financial results, please see Item 1A. Risk Factors below.

Competition

We operate in a highly competitive and fragmented specialty staffing services industry within each of our operating segments. Within temporary staffing, the working capital requirements can be a barrier to entry, because most employees are paid weekly and customers may take 30 to 45 days or more to pay. We face substantial competition from large national firms and local specialty staffing firms. The local firms are typically operator-owned, and each market generally has one or more significant competitors. We also face competition from national clerical and light industrial staffing firms, and national and regional accounting firms that also offer certain specialty staffing services.

In addition, many companies utilize Managed Service Providers (“MSP”) or Vendor Management Organizations ("VMO") for the management and purchase of staffing services. Generally, MSPs and VMOs are organizations that standardize processes through the use of Vendor Management Systems (“VMS”), which are tools used to aggregate, spend and measure supplier performance. VMSs can also be provided through independent providers. Typically, MSPs, VMOs and/or VMS providers charge staffing firms administrative fees of 1% to 3% of total service revenues, and these fees are usually recorded by staffing firms as a cost of services, thereby compressing profit margins. While Kforce does not currently provide MSP or VMO services directly to its clients, our strategy is to work with specific MSPs, VMOs and VMS providers to enable us to extend our Flex staffing services to the widest customer base possible within the sectors we serve.

As stated previously, there are 124 staffing firms with more than $100 million in U.S. staffing revenues in operation and thousands of smaller organizations compete to varying degrees at local levels. Several similar companies – global, national, and local – compete in foreign markets. Our peer group for 2014, which is comprised of some of our largest competitors, included: CDI Corp., CIBER, Inc., Computer Task Group Inc., Manpower Inc., On Assignment, Inc., Resources Connection, Inc., Robert Half International Inc., and TrueBlue Inc.

Kforce believes that the availability and quality of associates and consultants, level of service, effective monitoring of job performance, scope of geographic service, and price are the principal elements of competition in our industry. We believe that availability of quality associates and consultants is especially important. In order to attract candidates, we place emphasis upon our ability to provide competitive compensation and benefits, quality and varied assignments, scheduling flexibility, and permanent placement opportunities, all of which are important to Kforce being the “Employer of Choice.” Because personnel pursue other employment opportunities on a regular basis, it is important that we respond to market conditions affecting these individuals, and focus on our consultant care objectives. Additionally, in certain markets and in response to economic softening, we have experienced significant pricing pressure from some of our competitors. Although we believe we compete favorably with respect to these factors, we expect competition and pricing pressure to continue, and there can be no assurance that we will remain competitive.

Seasonality of Operating Results

Our quarterly operating results are affected by the number of billing days in a quarter and the seasonality of our customers’ businesses. The majority of our reporting segments are significantly impacted by the increase in the number of holidays and vacation days taken during the fourth quarter of the calendar year. In addition, we experience an increase in direct costs of services and a corresponding decrease in gross profit in the first fiscal quarter of each year, as a result of certain annual U.S. state and federal employment tax resets that occur at the beginning of each year.

Insurance

Kforce maintains a number of insurance policies including general liability, automobile liability and employers’ liability; each with excess liability coverage. We also maintain workers’ compensation, fidelity, fiduciary, directors and officers, professional liability, and employment practices liability policies. These policies provide coverage subject to their terms, conditions, limits of liability, and deductibles, for certain liabilities that may arise from Kforce’s operations. There can be no assurance that any of the above policies will be adequate for our needs or that we will maintain all such policies in the future.

Financial Information about Foreign and Domestic Operations

Substantially all of Kforce’s revenues are derived from domestic operations with customers located in the United States and substantially all long-lived assets were located in the United States for the three years ended December 31, 2014. One of our subsidiaries, Global, provides outsourcing services internationally through an office in Manila, Philippines. Our international operations comprised less than 2% of net service revenues for each of the three years ended December 31, 2014, 2013 and 2012.

Financial Information about Business Segments

We provide our clients staffing services and solutions through three reporting segments: Tech, FA and GS. For segment financial data see Note 16 – “Reportable Segments” in the Notes to Consolidated Financial Statements.

Operating Employees and Personnel

As of December 31, 2014, Kforce employed approximately 2,600 associates and had more than 11,000 consultants on assignment (“Flexible Consultants”) providing flexible staffing services and solutions to our clients. Approximately 91% of the Flexible Consultants are employed directly by Kforce (“Flexible Employees”); the balance consists of individuals who are employed by other entities (“Independent Contractors”) that provide their employees as subcontractors to Kforce for assignment to its clients. As the employer, Kforce is responsible for the operating employees’ and Flexible Employees’ payrolls and the employer’s share of applicable social security taxes (“FICA”), federal and state unemployment taxes, workers’ compensation insurance, and other direct labor costs relating to our employees. We offer access to various health, life and disability insurance programs and other benefits for operating employees and Flexible Employees. We have no collective bargaining agreements covering any of our operating employees or Flexible Employees, have never experienced any material labor disruption, and are unaware of any current efforts or plans to organize any of our employees.

Availability of Reports and Other Information

We make available, free of charge, through the Investor Relations page on our website, and by responding to requests addressed to Michael Blackman, our Chief Corporate Development Officer, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically submit such materials to the SEC. Our corporate website address is http://www.kforce.com. The information contained on our website, or on other websites linked to our website, is not part of this document. The SEC makes available on its website, free of charge, reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the SEC. The SEC’s website is http://www.sec.gov. Information provided on the SEC’s website is not part of this Annual Report on Form 10-K.

Item 1A. Risk Factors.

Kforce faces significant employment-related legal risk.

Kforce employs people internally and in the workplaces of other businesses. An inherent risk of such activity includes possible discrimination and harassment claims; wrongful termination; violations of employment rights related to employment screening or privacy issues; classification of workers as employees or independent contractors; violations of wage and hour requirements; employment of illegal aliens; criminal activity; torts; or other claims. Such claims may result in negative publicity, injunctive relief, criminal investigations and/or charges, civil litigation, payment by Kforce of monetary damages or fines, or other material adverse effects on our business. To reduce our exposure, we maintain insurance coverage for professional malpractice liability, fidelity, employment practices liability, and general liability in amounts and with deductibles that we believe is appropriate for our operations. Our insurance coverage, however, may not cover all potential claims against us, may require us to meet a deductible or may not continue to be available to us at a reasonable cost. In this regard, we face various employment-related risks not covered by insurance, such as wage and hour laws and employment tax responsibility. U.S. Courts in recent years have been receiving large numbers of wage and hour class action claims alleging misclassification of overtime eligible workers and/or failure to pay overtime-eligible workers for all hours worked. In addition, there appears to be a heightened state and federal scrutiny of independent contractor relationships, which could adversely affect us given that we utilize a significant number of independent contractors to perform our services. An adverse determination of the independent contractor status of these firms could result in a substantial tax or other liabilities.

Kforce may be exposed to unforeseeable negative acts by our personnel that could have a material adverse effect on our business.

An inherent risk of employing people internally and in the workplace of other businesses is that many of these individuals have access to client information systems and confidential information. Such activity includes possible acts of errors and omissions; intentional misconduct; release, misuse or misappropriation of client intellectual property, confidential information, funds, or other property; cyber security breaches affecting our clients and/or us; or other acts. Such acts may result in negative publicity or other material adverse effects on our business. In addition, these occurrences may give rise to litigation, which could be time-consuming and expensive. To reduce our exposure, we maintain insurance coverage for types and amounts we believe are appropriate in light of the aforementioned exposures. There can be no assurance that the corporate policies and practices we have in place to help reduce our exposure to these risks will be effective or that we will not experience losses as a result of these risks.

Our business is significantly affected by fluctuations in general economic conditions.

Demand for staffing services is significantly affected by the general level of economic activity and employment in the United States. Based upon previous economic cycles experienced by Kforce, we believe that times of sustained economic recovery generally stimulate demand for additional U.S. workers and, conversely, an economic slowdown results in a contraction in demand for additional U.S. workers. As economic activity slows, companies may defer projects for which they utilize our services or reduce their use of temporary employees before laying off full-time employees. In addition, an economic downturn could result in a reduction in the temporary staffing penetration rate, an increase in the unemployment rate and a deceleration of growth in the segments in which we operate. We may also experience more competitive pricing pressures during periods of economic downturn. Approximately 98% of our revenue is generated by our business operations in the United States. Any substantial economic downturn in the United States could have a material adverse effect on our business, financial condition, and results of operations.

Kforce may be adversely affected by government regulation of the staffing business and of the workplace.

Our business is subject to regulation and licensing in many states. There can be no assurance that we will be able to continue to obtain all necessary licenses or approvals or that the cost of compliance will not prove to be material. If we fail to comply, such failure could materially adversely affect Kforce’s financial results.

A large part of our business entails employing individuals on a temporary basis and placing such individuals in clients’ workplaces. Increased government regulation of the workplace or of the employer-employee relationship could have a material adverse effect on Kforce.

Our collection, use and retention of personal information and personal health information create risks that may harm our business.

In the ordinary course of our business, we collect and retain personal information of our associates and Flexible Employees and their dependents including, without limitation, full names, social security numbers, addresses, birth dates, and payroll-related information. We use commercially available information security technologies to protect such information in digital format. We also use security and business controls to limit access to such information. However, employees or third parties (including third parties with substantially greater resources than our own; for example, foreign governments) may be able to circumvent these measures and acquire or misuse such information, resulting in breaches of privacy, and errors in the storage, use or transmission of such information. Privacy breaches may require notification and other remedies, which can be costly, and which may have other serious adverse consequences for our business, including regulatory penalties and fines, claims for breach of contract, claims for damages, adverse publicity, reduced demand for our services by clients and/or flex employment candidates, harm to our reputation, and regulatory oversight by state or federal agencies.

The possession and use of personal information and data in conducting our business subjects us to legislative and regulatory burdens. We may be required to incur significant expenses to comply with mandatory privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations.

Kforce may be adversely affected by immigration restrictions.

Our Tech business utilizes a significant number of foreign nationals employed by us on work visas, primarily under the H-1B visa classification. The H-1B visa classification that enables U.S. employers to hire qualified foreign nationals is subject to legislative and administrative changes, as well as changes in the application of standards and enforcement. Immigration laws and regulations can be significantly affected by political developments and levels of economic activity. Current and future restrictions on the availability of such visas could restrain our ability to employ the skilled professionals we need to meet our clients’ needs, which could have a material adverse effect on our business. In 2009, the United States Citizenship and Immigration Service (“USCIS”) significantly increased its scrutiny of companies seeking to sponsor, renew or transfer H-1B status, including Kforce and Kforce’s subcontractors. On January 8, 2010, the USCIS issued internal guidance to its field offices that appears to narrow the eligibility criteria for H-1B status in the context of staffing services. In addition to USCIS restrictions, certain aspects of the H-1B program are also subject to regulation and review by the U.S. Department of Labor and U.S. Department of State, which have recently increased enforcement activities in the program. A narrow interpretation and vigorous enforcement, or legislative action relating to immigration, including legislation intended to reform existing immigration law, could adversely affect our ability to obtain foreign national labor and/or renew existing foreign national consultants on assignment, and could subject us to fines, penalties and sanctions. There can be no assurance that we will be able to keep or replace all foreign nationals currently on assignment, or continue to hire foreign national talent at the same rates as in the past.

Kforce maintains debt which could impact operating flexibility and contains restrictive covenants that could trigger prepayment of obligations or additional costs.

We have a credit facility consisting of a revolving line of credit of up to $170 million. Borrowings under the credit facility are secured by substantially all of the assets of the Firm, excluding the real estate located at the Firm's corporate headquarters in Tampa, FL, unless the eligible real estate conditions are met.

Our level of debt and the limitations imposed on us by our credit agreement could have important consequences for investors including the following: (1) we will have to use a portion of our cash flow from operations for debt services rather than for our operations; (2) we may not be able to obtain additional financing for future working capital, capital expenditures or other corporate purposes or may have to pay more for such financing; (3) we could be less able to take advantage of significant business opportunities, such as acquisition opportunities, and to react to changes in market or industry conditions; and (4) we may be disadvantaged compared to competitors with less leverage.

Kforce is subject to certain affirmative and negative covenants under the credit facility. Our failure to comply with such restrictive covenants could result in an event of default, which, if not cured or waived, could result in Kforce being required to repay the outstanding balance before the due date. We may not be able to repay our debt or if forced to refinance on terms not acceptable to us could have a material adverse affect on our results of operations and financial condition.

Kforce’s temporary staffing business could be adversely impacted by health care reform.

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (PPACA) imposes new mandates on individuals and employers, requiring most individuals to have health insurance. Beginning in 2015, the PPACA assesses penalties on large employers that do not offer health insurance meeting certain coverage, value, or affordability standards. While we believe the costs associated with the law may have less of an impact on Kforce than many other staffing companies due to the level and scope of benefits we offer, a delay in or inability to increase bill rates charged to our customers could result in a reduction of our Flex gross profit. In addition, because the regulations governing the PPACA’s employer mandate are new and subject to interpretation, it is possible that Kforce may incur liability in the form of penalties, fines, or damages if the health plans we offer are subsequently found not to meet minimum essential coverage, affordability or minimum value standards, or if our method for determining eligibility for coverage is found inadequate or our clients seek indemnification for health care claims resulting from consultants working on client assignments. The cost of any such penalties, fines or damages could have a material adverse effect on Kforce’s financial and operating results.

We are exposed to intangible asset risk which could result in future impairment.

A significant and sustained decline in our stock price and market capitalization, a significant decline in our (or in one or more of our reporting units’) expected future cash flows, a significant adverse change in the business climate, slower growth rates, or changes in our business strategy have resulted, and could result in the future, in the need to perform an impairment analysis. If we were to conclude that a future write-down of our goodwill or other intangible assets is necessary, it could result in material charges that are adverse to our operating results and financial position. See Note 6 – “Goodwill and Other Intangible Assets” in the Notes to Consolidated Financial Statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates” for further details, including the details regarding the goodwill impairment losses within our GS reporting unit in recent years.

Significant legal actions could subject Kforce to substantial uninsured liabilities.

Professional service providers are subject to legal actions alleging malpractice, breach of contract and other legal theories. These actions may involve large claims and significant defense costs. We may also be subject to claims alleging violations of federal or state labor laws. In addition, we may be subject to claims related to torts, intentional acts, or crimes committed by our full-time employees or temporary staffing personnel. In some instances, we are contractually obligated to indemnify clients against such risks. A failure to observe the applicable standard of care, relevant Kforce or client policies and guidelines, or applicable federal, state, local or foreign laws, rules, and regulations could result in negative publicity, payment of fines, significant damage awards, or settlement expense. To reduce our exposure, we maintain insurance coverage for professional malpractice liability, fidelity, employment practices liability and general liability, in amounts and with deductibles that we believe are appropriate for our operations. Our insurance coverage, however, may not cover all claims against us or continue to be available to us at a reasonable cost.

Delays or defaults in collecting our trade accounts receivable could adversely affect our business.

We generate a significant amount of trade accounts receivable from our customers. Delays or defaults in payments owed to us could have a material adverse effect on our financial condition and results of operations. Factors that could cause a delay or default include business failures, turmoil in the financial and credit markets, sluggish or recessionary U.S. economic conditions, our exposure to customers in high-risk sectors such as the financial services industry, and declines in the credit worthiness of our customers. See Note 1 – “Summary of Significant Accounting Policies” in the Notes to Consolidated Financial Statements for further details.

Kforce’s success depends upon retaining the services of its management team and key operating employees.

Kforce is highly dependent on its management team and expects that continued success will depend largely upon their efforts and abilities. The loss of the services of any key executive for any reason could have a material adverse effect upon Kforce. Success also depends upon our ability to identify, develop, and retain qualified operating employees; particularly management, client servicing, and candidate recruiting employees. Kforce expends significant resources in the recruiting and training of its employees, as the pool of available applicants for these positions is limited. The loss of some of our key operating employees could have a material adverse effect on our business, including our ability to establish and maintain client and candidate, professional, and technical relationships.

The financial markets may experience significant turmoil, which may negatively impact our liquidity and our ability to obtain financing.

Kforce's liquidity is dependent in part on our revolving credit facility, which is provided by a syndicate of banks. Our liquidity may be negatively impacted if one of our lenders under our credit facility, or another financial institution, suffers liquidity issues. In such an event, we may not be able to draw on any of the amounts available under our credit facility, or a substantial portion thereof. If we attempt to obtain future financing in addition to, or as a replacement of, our credit facility, financial market turmoil could negatively impact our ability to obtain such financing on favorable terms.

Kforce depends on the proper functioning of its information systems.

Kforce is dependent on the proper functioning of information systems in operating its business. Critical information systems are used in every aspect of Kforce’s daily operations, most significantly, in the identification and matching of staffing resources to client assignments and in the customer billing and consultant or vendor payment functions. Kforce’s information systems are vulnerable to natural disasters (we are headquartered and our leased data center are located in a hurricane-prone area), fire or casualty theft, technical failures, terrorist acts, cyber security breaches, power loss, telecommunications failures, physical or software intrusions, computer viruses, and similar events. If our critical information systems fail or are otherwise unavailable, we would have to accomplish these functions manually, which could prove difficult or impossible, causing a material adverse effect on our business. Also, any theft or misuse of information resulting from a security breach could result in, among other things, loss of significant and/or sensitive information, litigation by affected parties, financial obligations resulting from such theft or misuse, higher insurance premiums, governmental investigations, negative reactions from current and potential future customers (including potential negative financial ramifications under certain customer contract provisions) and poor publicity and any of these could adversely affect our financial results. In addition, we depend on third-party vendors for certain functions (including the operations of our leased data center), whose future performance and reliability we cannot control.

Significant increases in payroll-related costs could adversely affect Kforce’s business.

Kforce is required to pay a number of federal, state, and local payroll and related costs, including unemployment taxes, workers’ compensation and insurance premiums and claims, FICA, and Medicare, among others, related to our employees. Significant increases in the effective rates of any payroll-related costs would likely have a material adverse effect on Kforce. Over the last few years, many of the states in which Kforce conducts business have continued to significantly increase their state unemployment tax rates in an effort to increase funding for unemployment benefits. Costs could also increase as a result of health care reforms or the possible imposition of additional requirements and restrictions related to the placement of personnel. We may not be able to increase the fees charged to our clients in a timely manner or in a sufficient amount to cover these potential cost increases.

Adverse results in tax audits could result in significant cash expenditures or exposure to unforeseen liabilities.

Kforce is subject to periodic federal, state, and local tax audits for various tax years. Although Kforce attempts to comply with all taxing authority regulations, adverse findings or assessments made by taxing authorities as the result of an audit could have a material adverse effect on Kforce.

Due to inherent limitations, there can be no assurance that our system of disclosure and internal controls and procedures will be successful in preventing all errors and fraud, or in making all material information known in a timely manner to management.

Our management, including our CEO and CFO, does not expect that our disclosure controls and internal controls will prevent all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within Kforce have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control.

The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, a control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations, misstatements due to error or fraud may occur and not be detected.

Our business is dependent upon maintaining our reputation, our relationships, and our performance.

The reputation and relationships that we have established and currently maintain with our customers are important to maintaining existing business and identifying new business. If our reputation or relationships were damaged, it could have a material adverse effect on our operations. In addition, if our performance does not meet our customers’ expectations, our revenues and operating results could be materially harmed.

We rely on short-term engagements with most of our clients.

Because long-term engagements are not a significant part of our business, other than in our GS segment, future financial results cannot be reliably predicted by considering past trends or extrapolating past results.

Kforce’s current market share may decrease as a result of limited barriers to entry for new competitors and discontinuation of clients outsourcing their staffing needs.

We face significant competition in the markets we serve, and there are limited barriers to entry for new competitors. The competition among staffing services firms is intense. Kforce competes for potential clients with providers of outsourcing services, systems integrators, computer systems consultants, temporary personnel agencies, search firms, and other providers of staffing services. Some of our competitors possess substantially greater resources than we do. From time to time, we experience significant pressure from our clients to reduce price levels. During these periods, we may face increased competitive pricing pressures and may not be able to recruit the personnel necessary to fulfill our clients’ needs. We also face the risk that certain of our current and prospective clients will decide to provide similar services internally.

Competition for acquisition opportunities may restrict Kforce’s future growth by limiting our ability to make acquisitions at reasonable valuations.

Kforce has increased its market share and presence in the staffing industry partly through strategic acquisitions of companies that have complemented or enhanced its business. We have historically faced competition for acquisitions. In the future, this could limit our ability to grow through acquisitions or could raise the prices of acquisitions and make them less accretive or possibly non-accretive to us. In addition, Kforce may be limited by its ability to obtain financing to consummate desirable acquisitions.

Kforce may not be able to recruit and retain qualified personnel.

Kforce depends upon the abilities of its staff to attract and retain personnel, particularly technical, professional, and cleared government services personnel, who possess the skills and experience necessary to meet the staffing requirements of our clients. We must continually evaluate and upgrade our base of available qualified personnel to keep pace with changing client needs and emerging technologies. We expect significant competition for individuals with proven technical or professional skills for the foreseeable future. If qualified personnel are not available to us in sufficient numbers and upon economic terms acceptable to us, it could have a material adverse effect on our business.

Kforce may face significant risk arising from acquisitions or dispositions.

Kforce may face difficulties integrating future acquisitions into existing operations and acquisitions may be unsuccessful, involve significant cash expenditures, or expose Kforce to unforeseen liabilities.

These acquisitions involve numerous risks, including:

| |

• | potential loss of key employees or clients of acquired companies; |

| |

• | difficulties integrating acquired personnel and distinct cultures into a single business; |

| |

• | diversion of management attention from existing operations; and |

| |

• | assumption of liabilities and exposure to unforeseen liabilities of acquired companies. |

These acquisitions may also involve significant cash expenditures, debt incurrence, integration expenses, and exposure to unforeseen liabilities that could have a material adverse effect on our financial condition, results of operations, and cash flows. Any acquisition may ultimately have a negative impact on our business and financial condition. In addition, dispositions involve risks, which could have a material adverse effect on us including:

| |

• | we may not be able to identify acceptable buyers; |

| |

• | we may divest a business at a price or on terms that are less favorable than anticipated; |

| |

• | we may lose key employees; |

| |

• | divestitures could adversely affect our profitability and, under certain circumstances, require us to record impairment charges or a loss as a result of the transaction; |

| |

• | completing divestitures requires expenses and management effort; |

| |

• | we may become subject to indemnity obligations and/or remain liable or contingently liable for obligations related to the divested business or operations; |

| |

• | we may retain of certain continuing liabilities under contracts; |

| |

• | covenants not to compete could impair our ability to attract and retain customers; and |

| |

• | we may face difficulties in the separation of the divested operations, services, products and personnel. |

Provisions in Kforce’s articles and bylaws and under Florida law may have certain anti-takeover effects.

Kforce’s articles of incorporation and bylaws and Florida law contain provisions that may have the effect of inhibiting a non-negotiated merger or other business combination. In particular, our articles of incorporation provide for a staggered board of directors and permit the removal of directors only for cause. Additionally, the Board may issue up to 15 million shares of preferred stock, and fix the rights and preferences thereof, without a further vote of the shareholders. In addition, certain of our officers and managers have employment agreements containing certain provisions that call for substantial payments to be made to such employees in certain circumstances upon a change in control. Certain of these provisions may discourage a future acquisition of Kforce, including an acquisition in which shareholders might otherwise receive a premium for their shares. As a result, shareholders who might desire to participate in such a transaction may not have the opportunity to do so. Moreover, the existence of these provisions could have a negative effect on the market price of our common stock.

Kforce’s stock price may be volatile.

Kforce’s common stock is traded on The NASDAQ Global Select Market using the ticker symbol “KFRC.” The market price of our stock has fluctuated substantially in the past and could fluctuate substantially in the future, based on a variety of factors, including our operating results, changes in general conditions in the economy, the financial markets, the employment services industry, or other developments affecting us, our clients, or our competitors; some of which may be unrelated to our performance.

In addition, the stock market in general, especially The NASDAQ Global Select Market tier, along with market prices for staffing companies, has experienced volatility that has often been unrelated to the operating performance of these companies. These broad market and industry fluctuations may adversely affect the market price of our common stock, regardless of our operating results.

Among other things, volatility in our stock price could mean that investors will not be able to sell their shares at or above the prices they pay. The volatility also could impair our ability in the future to offer common stock as a source of additional capital or as consideration in the acquisition of other businesses.

RISKS RELATED TO OUR GOVERNMENT BUSINESS

Our GS segment is substantially dedicated to contracting with and serving U.S. Federal Government agencies (the “Federal Agency Business”). In addition, Kforce supplies services to the Federal Government. Federal contractors, including Kforce face a number of risks, including the following:

Our failure to comply with complex federal procurement laws and regulations could cause us to lose business, incur additional costs, and subject us to a variety of penalties, including suspension and debarment from doing business with the Federal Government.

We must comply with complex laws and regulations relating to the formation, administration, and performance of Federal Government contracts. These laws and regulations create compliance risk, affect how we do business with our federal agency clients, and may impose added costs on our business. If a government review, audit or investigation uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, harm to our reputation, suspension of payments, fines, and suspension or debarment from doing business with Federal Government agencies.

The Federal Government also may reform its procurement practices or adopt new contracting rules and regulations, including cost accounting standards, that could be costly to satisfy or that could impact our ability to obtain new contracts. A failure to comply with all applicable laws and regulations could result in contract termination, price or fee reductions, or suspension or debarment from contracting with the Federal Government; each of which could lead to a material reduction in our revenues, cash flows and operating results.

Unfavorable government audit results could force us to refund previously recognized revenues and could subject us to a variety of penalties and sanctions.

Federal agencies can audit and review our performance on contracts, pricing practices, cost structure, incurred cost submissions and compliance with applicable laws, regulations, and standards. An audit of our work, including an audit of work performed by companies Kforce has acquired or may acquire, or subcontractors we have hired or may hire, could force us to refund previously recognized revenues.

If a government audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines, and suspension or debarment from doing business with Federal Government agencies. In addition, we could suffer serious harm to our reputation if allegations of impropriety were made against us, whether or not true.

We are dependent upon the ability of government agencies to administratively manage our contracts.

After we are awarded a contract and the contract is funded by the Federal Government, we are still dependent upon the ability of the relevant agency to administratively manage our contract. We can be adversely impacted by delays in the start-up of already awarded and funded projects, including delays due to shortages of acquisition and contracting personnel within the Federal Government agencies.

The failure by Congress to approve budgets, raise the U.S. debt ceiling or avoid sequestration on a timely basis for the federal agencies we support could delay, reduce or stop federal spending and cause us to lose revenue or impair our intangible assets.

On an annual basis, Congress must approve and the President must sign the appropriation bills that govern spending by each of the federal agencies we support. If Congress is unable to agree on budget priorities and is unable to appropriate funds or pass the annual budget on a timely basis, as has been the case in recent years, there may be delays, reductions or cessations of funding for our services and solutions. In addition, from time to time it has been necessary for Congress to raise the U.S. debt ceiling in order to allow for borrowing necessary to fund government operations. If that becomes necessary again and Congress fails to raise the debt ceiling on a timely basis, there may be delays, reductions or cessations of funding for our services and solutions. Furthermore, legislatively mandated cuts in federal programs, known as sequestration, could result in delays, reductions or cessation of funding for our services and solutions.

Changes in the spending policies or budget priorities of the Federal Government could cause us to lose revenue.

Changes in Federal Government fiscal or spending policies could materially adversely affect our Federal Agency Business; in particular, our business could be materially adversely affected by decreases in Federal Government spending.

Our Federal Agency Business is dependent upon maintaining our reputation, our relationships and our performance.

The reputation and relationships that we have established and currently maintain with government agencies are important to maintaining existing business and identifying new business. If our reputation or relationships were damaged, it could have a material adverse effect. In addition, if our performance does not meet agency expectations, our revenues and operating results could be materially harmed.

Competition is intense in the Federal Agency Business.

There is often intense competition to win federal agency contracts. Even when a contract is awarded to us, competitors may protest such awards. If we are unable to successfully compete for new business or win competitions to maintain existing business, our operations could be materially adversely affected. Many of our competitors are larger and have greater resources, larger client bases, and greater brand recognition than we do. Our larger competitors also may be able to provide clients with different or greater capabilities or benefits than we can provide.

Loss of our General Services Administration (“GSA”) Schedules or other contracting vehicles could impair our ability to win new business.

GSA Schedules constitute a significant percentage of revenues from our federal agency clients. If we were to lose one or more of these Schedules or other contracting vehicles, we could lose revenues and our operating results could be materially adversely affected. These Schedules or contracts typically have an initial term with multiple options that may be exercised by our government agency clients to extend the contract for successive periods of one or more years. We can provide no assurance that our clients will exercise these options.

Our failure to obtain and maintain necessary security clearances may limit our ability to perform classified work for government clients, which could cause us to lose business.

Some government contracts require us to maintain facility security clearances and require some of our employees to maintain individual security clearances. If our employees lose or are unable to timely obtain security clearances, or we lose a facility clearance, a government agency client may terminate the contract or decide not to renew it upon its expiration.

Our employees may engage in misconduct or other improper activities, which could harm our business.

Like all government contractors, we are exposed to the risk that employee fraud or other misconduct could occur. Misconduct by our employees could include intentional failures to comply with Federal Government procurement regulations, engaging in unauthorized activities, seeking reimbursement for improper expenses, or falsifying time records. Employee misconduct could also involve the improper use of our clients’ sensitive or classified information, which could result in regulatory sanctions against us and serious harm to our reputation. It is not always possible to deter employee misconduct, and precautions to prevent and detect this activity may not be effective in controlling such risks or losses, which could materially adversely affect our business.

Security breaches in sensitive government information systems could result in the loss of our clients and cause negative publicity.

Many of the systems we develop, install, and maintain involve managing and protecting information used in intelligence, national security, and other sensitive or classified government functions. A security breach in one of these systems could cause serious harm to our business, damage our reputation, and prevent us from being eligible for further work on sensitive or classified systems for Federal Government clients. We could incur losses from such a security breach that could exceed the policy limits under our insurance. Damage to our reputation or limitations on our eligibility for additional work resulting from a security breach in one of our systems could materially reduce our revenues.

We are the prime contractor on many of our contracts and if our subcontractors fail to appropriately perform their obligations, our performance and our ability to win future contracts could be harmed.

For many of our contracts where we are the prime contractor, we involve subcontractors, which we rely on to perform a portion of the services that we must provide to our customers. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of work performed or customer concerns about the subcontractor’s performance. In addition, the contracting parties on which we rely may be affected by changes in the economic environment and constraints on available financing to meet their performance requirements or provide needed supplies on a timely basis. A failure by one or more of those contracting parties to provide the agreed-upon supplies or perform the agreed-upon services on a timely basis may affect our ability to perform our obligations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

On May 27, 2010, we acquired our corporate headquarters in Tampa, Florida, which is approximately 128,000 square feet of space. Leases for our field offices, which are located throughout the U.S., range from three to five-year terms although a limited number of leases contain short-term renewal provisions that range from month-to-month to one year. We also lease an office in Manila, Philippines, which is approximately 17,000 square feet of space.