Exhibit 99.1

Issued on behalf of RELX PLC and RELX NV

15 February 2018

RESULTS FOR THE YEAR TO DECEMBER 2017

RELX Group, the global professional information and analytics company, reports another year of underlying growth in revenue, operating profit and earnings in 2017.

Highlights

| • | Underlying revenue growth +4%; full year reported total £7,355m/€8,385m |

| • | Underlying adjusted operating profit growth +6%; full year total £2,284m/€2,604m |

| • | Adjusted EPS growth constant currency +7%; in sterling +12% to 81.0p (72.2p); in euro +5% to €0.923 (€0.880) |

| • | Reported operating profit £1,905m (£1,708m); €2,172m (€2,084m) |

| • | Reported EPS 82.2p (56.3p); €0.936 (€0.687) |

| • | Proposed full year dividend growth: +10% to 39.4p for RELX PLC; +6% to €0.448 for RELX NV |

| • | Return on invested capital up 0.1 percentage points to 13.1% |

| • | Strong financial position & cash flow; leverage 2.2x EBITDA, pensions & lease adjusted (1.9x unadjusted) |

| • | £700m of share buybacks completed in 2017; announcing total of £700m for 2018 |

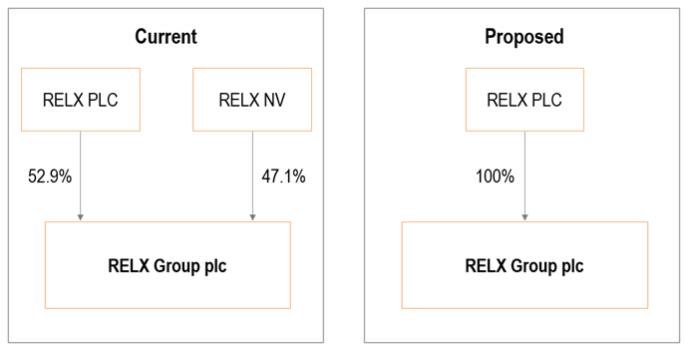

Further simplification of corporate structure

| • | Dual parent holding company structure to be simplified into a single parent company |

| • | RELX NV shareholders to receive one RELX PLC share in exchange for each RELX NV share held |

| • | Single parent to be listed in London, Amsterdam and New York |

| • | No impact on RELX Group headquarters or business unit locations, activities or staffing levels |

| • | No change to strategy; cost and profit neutral, before and after tax |

| • | New structure to be implemented in Q3 2018, subject to shareholder approval |

Commenting on the results, Sir Anthony Habgood, Chairman, said:

“RELX Group continued to execute well on its strategic priorities in 2017. Adjusted earnings per share in constant currencies grew +7%, and +12% and +5% in sterling and euros respectively. We are recommending a full year dividend increase of +10% for RELX PLC and +6% for RELX NV. We are proposing a set of measures that will further simplify our corporate structure into a single parent company. We believe this is a natural next step for RELX, removing complexity and increasing transparency.”

Chief Executive Officer, Erik Engstrom, commented:

“We achieved good underlying revenue growth in 2017, and continued to generate underlying operating profit growth ahead of revenue growth. Key business trends in the early part of 2018 are consistent with 2017.”

“Our strategy is unchanged: Our number one priority remains the organic development of increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to our customers. We believe that the systematic evolution of our business has driven an improvement in our business profile and the quality of our earnings, with more predictable revenues, a higher growth profile, and improving returns.”

RELX Group 2017 I Results 2

Operating and financial review

FINANCIAL RESULTS

Revenue of £7,355m/€8,385m; underlying growth +4%: The underlying growth rate reflects good growth in electronic and face-to-face revenues (89% of the total), and the further development of our analytics and decision tools, partially offset by continued print revenue declines.

Adjusted operating profit of £2,284m/€2,604m; underlying growth +6%: Including the effects of portfolio changes and cycling, growth expressed in sterling was +8%, and expressed in euros was +1%.

Reported operating profit: Reported operating profit, including amortisation of acquired intangible assets, was £1,905m (£1,708m) or €2,172m (€2,084m).

Interest and tax: Adjusted net interest expense was £166m (£180m) or €189m (€220m), with the reduction reflecting lower average interest rates. Adjusted tax was £475m (£438m) or €542m (€534m). The adjusted effective tax rate was 22.5%. Reported tax was £67m (£304m) or €76m (€371m) including an exceptional non-cash credit from a deferred tax balance sheet adjustment of £346m (€394m) arising from the US Tax Cuts and Jobs Act. Overall, we assess the impact of tax changes in the US and other relevant jurisdictions to be a small net positive for RELX Group going forward, although not significant to the adjusted effective tax rate or to cash taxes paid.

Adjusted EPS growth in constant currencies +7%: Adjusted EPS expressed in sterling was 81.0p (+12%), or €0.923 (+5%) expressed in euros. The difference in growth rates between the sterling and euro EPS reflects the movement in exchange rates.

Reported EPS: Reported EPS expressed in sterling was 82.2p (56.3p) and expressed in euros was €0.936 (€0.687), and includes the one-off non-cash deferred tax credit referenced above.

Dividend: We are proposing a full year dividend increase of +10% to 39.4p for RELX PLC and +6% to €0.448 for RELX NV. The difference in growth rates between the two dividends reflects movement in the £/€ exchange rate since the payments a year earlier. The long-term dividend policy is unchanged. We will continue to grow the dividend broadly in line with adjusted earnings per share, subject to exchange rate considerations, whilst maintaining cover of at least two times over the longer term.

ROIC: Return on invested capital increased by 0.1 percentage points to 13.1%.

Net debt/EBITDA 2.2x on a pensions and lease adjusted basis (unadjusted 1.9x): Net debt was £4.7bn/€5.3bn at 31 December 2017, with the adjusted net debt/EBITDA ratio unchanged on the prior year. The adjusted cash flow conversion rate was 96% (95%), with capital expenditure as a percentage of revenues unchanged at 5%.

Portfolio development: We completed 8 acquisitions of small content, data analytics and exhibition assets for a total consideration of £123m, and disposed of 17 assets for a total of £87m. Since the year end we have entered into an agreement to acquire ThreatMetrix, a leader in the global risk-based authentication sector, for £580m.

Share buybacks: In 2017 we deployed £700m on share buybacks. In 2018 we intend to deploy a total of £700m, of which £100m has already been completed.

2018 OUTLOOK

Key business trends in the early part of 2018 are consistent with 2017, and we are confident that, by continuing to execute on our strategy, we will deliver another year of underlying growth in revenue and in adjusted operating profit, together with growth in adjusted earnings per share on a constant currency basis.

RELX Group 2017 I Results 3

Operating and financial review

FURTHER SIMPLIFICATION OF CORPORATE STRUCTURE

We are proposing to implement a further simplification of our corporate structure, moving from the current dual parent holding company structure to a single parent company. This simplification follows the significant measures which were completed in 2015 and is a natural next step for RELX, removing complexity and increasing transparency.

There will be no changes to the locations, activities or staffing levels of RELX Group or its four business areas. Elsevier, the global Science, Technical & Medical business, will continue to be headquartered in Amsterdam. RELX Group headquarters will remain in London, with no changes to operations or staffing levels.

The simplification will be implemented through a cross-border merger between RELX PLC and RELX NV.

RELX NV shareholders will receive one new RELX PLC share in exchange for each RELX NV share held.

The changes do not impact the economic interests of any shareholder, and in particular, ownership, dividend and capital distribution rights are unaffected.

Our strategy is unchanged. Our number one priority remains the organic development of increasingly sophisticated information-based analytics and decision tools that deliver enhanced value to our customers.

The changes will be cost and profit neutral, before and after tax. The total number of shares outstanding will be unchanged, and all per share ratios will be unaffected.

RELX PLC will continue to be incorporated in the UK and will remain UK tax resident. Financial results for the group will continue to be presented in sterling, with supplemental financial information presented in euros and US dollars.

RELX PLC will continue to have a premium listing on the London Stock Exchange, and we will be applying for an additional listing of RELX PLC shares on Euronext Amsterdam. Existing RELX PLC ADRs will continue to be listed on the New York Stock Exchange. RELX NV ADRs will be exchanged for RELX PLC ADRs and we will be applying for a listing of the newly issued RELX PLC ADRs.

After the combination of the two parent companies the RELX PLC share count will broadly double, and we expect that RELX PLC shares will continue to be included in the FTSE 100 index. Following listing of RELX PLC shares on Euronext Amsterdam, we expect RELX PLC shares to be included in the AEX index. We also expect RELX PLC shares to continue to be included in the STOXX Europe 600 index and other relevant pan-European indices.

Dividends will be declared in sterling with an option for payment in euros. Our long-term dividend policy remains unchanged.

The simplification is subject to certain conditions, including the approval of both RELX PLC and RELX NV shareholders. We expect a circular and a prospectus to be made available to shareholders in Q2 2018, with implementation of the simplification expected in Q3 2018.

Details of the measures have been set out in an attachment (page 35) to this press release.

RELX Group 2017 I Results 4

Operating and financial review

RELX GROUP FINANCIAL SUMMARY

| £ | € | |||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | |||||||||||||||||||||||

| Revenue |

7,355 | 6,895 | +7 | % | 8,385 | 8,412 | 0 | % | +4% UL | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted operating profit |

2,284 | 2,114 | +8 | % | 2,604 | 2,579 | +1 | % | +6% UL | |||||||||||||||||||

| Adjusted operating margin |

31.1 | % | 30.7 | % | 31.1 | % | 30.7 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Reported operating profit |

1,905 | 1,708 | +12 | % | 2,172 | 2,084 | +4 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted net interest expense |

(166 | ) | (180 | ) | (189 | ) | (220 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted profit before tax |

2,118 | 1,934 | +10 | % | 2,415 | 2,359 | +2 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted tax |

(475 | ) | (438 | ) | (542 | ) | (534 | ) | ||||||||||||||||||||

| Non-controlling interests |

(8 | ) | (8 | ) | (9 | ) | (10 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted net profit |

1,635 | 1,488 | +10 | % | 1,864 | 1,815 | +3 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Reported net profit |

1,659 | 1,161 | +43 | % | 1,891 | 1,416 | +34 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Reported net margin |

22.6 | % | 16.8 | % | 22.6 | % | 16.8 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Adjusted earnings per share |

81.0p | 72.2p | +12 | % | € | 0.923 | € | 0.880 | +5 | % | +7% CC | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Reported earnings per share |

82.2p | 56.3p | +46 | % | € | 0.936 | € | 0.687 | +36 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net borrowings |

4,732 | 4,700 | 5,300 | 5,499 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| PARENT COMPANIES |

||||||||||||||||||||||||||||

| RELX PLC | RELX NV | |||||||||||||||||||||||||||

| Ordinary dividend per share |

39.4p | 35.95p | +10 | % | € | 0.448 | € | 0.423 | +6 | % | ||||||||||||||||||

| UL: | underlying |

| CC: | constant currency |

RELX Group uses adjusted and underlying figures as additional performance measures. These measures are used by management, alongside the comparable GAAP measures, in evaluating the business performance. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. In 2017, we have excluded the exceptional tax credit arising as a result of the US Tax Cuts and Jobs Act. Reconciliations between the reported and adjusted figures are set out on page 31. Underlying growth rates are calculated at constant currencies, and exclude the results of all acquisitions and disposals made in both the year and prior year and of assets held for sale. Underlying revenue growth rates also exclude exhibition cycling effects. Constant currency growth rates are based on 2016 full year average and hedge exchange rates.

| ENQUIRIES: | Colin Tennant (Investors) +44 (0)20 7166 5751 |

Paul Abrahams (Media) +44 (0)20 7166 5724 |

DISCLAIMER REGARDING FORWARD-LOOKING STATEMENTS

This Announcement contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to a number of risks and uncertainties that could cause actual results or outcomes to differ materially from those currently being anticipated. The terms “outlook”, “estimate”, “project”, “plan”, “intend”, “expect”, “should be”, “will be”, “believe”, “trends” and similar expressions identify forward-looking statements. Factors which may cause future outcomes to differ from those foreseen in forward-looking statements include, but are not limited to: current and future economic, political and market forces; changes in law and legal interpretations affecting the RELX Group intellectual property rights; regulatory and other changes regarding the collection, transfer or use of third party content and data; demand for the RELX Group products and services; competitive factors in the industries in which the RELX Group operates; compromises of our data security systems and interruptions in our information technology systems; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC and RELX N.V. with the US Securities and Exchange Commission.

RELX Group 2017 I Results 5

Operating and financial review

BUSINESS AREA ANALYSIS

| £ | € | |||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | Underlying growth rates |

||||||||||||||||||||||

| REVENUE |

||||||||||||||||||||||||||||

| Scientific, Technical & Medical |

2,478 | 2,320 | +7 | % | 2,825 | 2,831 | 0 | % | +2 | % | ||||||||||||||||||

| Risk & Business Analytics |

2,076 | 1,906 | +9 | % | 2,367 | 2,325 | +2 | % | +8 | % | ||||||||||||||||||

| Legal |

1,692 | 1,622 | +4 | % | 1,929 | 1,979 | -3 | % | +2 | % | ||||||||||||||||||

| Exhibitions |

1,109 | 1,047 | +6 | % | 1,264 | 1,277 | -1 | % | +6 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

7,355 | 6,895 | +7 | % | 8,385 | 8,412 | 0 | % | +4 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| ADJUSTED OPERATING PROFIT |

||||||||||||||||||||||||||||

| Scientific, Technical & Medical |

913 | 853 | +7 | % | 1,041 | 1,041 | 0 | % | +3 | % | ||||||||||||||||||

| Risk & Business Analytics |

759 | 686 | +11 | % | 865 | 837 | +3 | % | +8 | % | ||||||||||||||||||

| Legal |

332 | 311 | +7 | % | 379 | 379 | 0 | % | +11 | % | ||||||||||||||||||

| Exhibitions |

285 | 269 | +6 | % | 325 | 328 | -1 | % | +2 | % | ||||||||||||||||||

| Unallocated items |

(5 | ) | (5 | ) | (6 | ) | (6 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total |

2,284 | 2,114 | +8 | % | 2,604 | 2,579 | +1 | % | +6 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

RELX Group 2017 I Results 6

Operating and financial review

Scientific, Technical & Medical

| £ | € | |||||||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | Change at constant currencies |

Underlying growth rates |

|||||||||||||||||||||||||

| Revenue |

2,478 | 2,320 | +7 | % | 2,825 | 2,831 | 0 | % | +2 | % | +2 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted operating profit |

913 | 853 | +7 | % | 1,041 | 1,041 | 0 | % | +2 | % | +3 | % | ||||||||||||||||||||

| Adjusted operating margin |

36.8 | % | 36.8 | % | 36.8 | % | 36.8 | % | ||||||||||||||||||||||||

81% of revenue electronic and face-to-face

Key business trends remained positive in 2017, with underlying profit growth slightly exceeding underlying revenue growth.

Underlying revenue growth was +2%. The difference between the reported and underlying growth rates primarily reflects the impact of exchange rate movements and portfolio changes, including the acquisitions of Plum Analytics and bepress, and the disposal of certain international pharma promotion assets.

Underlying adjusted operating profit growth of +3% was slightly ahead of revenue growth, with an underlying margin improvement offset by portfolio effects.

Electronic revenues saw continued good growth, partially offset by further print declines. In primary research we continued to enhance customer value by providing broader content sets across our research offering, increasing the sophistication of our analytics, and evolving our technology platforms. Databases & tools continued to drive growth across market segments through the launch of enhanced functionality and content development.

Print books, which now represent around 10% of divisional revenues, saw continued sales declines with return rates at historical levels, following higher than average return rates in the prior year. Print pharma promotion revenues, which represent less than 5% of the divisional total, returned to historical rates of decline after a stronger prior year.

2018 outlook: Our customer environment remains largely unchanged. Overall we expect another year of modest underlying revenue growth, with underlying operating profit growth continuing to exceed underlying revenue growth.

RELX Group 2017 I Results 7

Operating and financial review

Risk & Business Analytics

| £ | € | |||||||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | Change at constant currencies |

Underlying growth rates |

|||||||||||||||||||||||||

| Revenue |

2,076 | 1,906 | +9 | % | 2,367 | 2,325 | +2 | % | +4 | % | +8 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted operating profit |

759 | 686 | +11 | % | 865 | 837 | +3 | % | +6 | % | +8 | % | ||||||||||||||||||||

| Adjusted operating margin |

36.6 | % | 36.0 | % | 36.6 | % | 36.0 | % | ||||||||||||||||||||||||

97% of revenue electronic and face-to-face

Underlying revenue growth remained strong across all key segments in 2017. Underlying profit growth broadly matched underlying revenue growth.

Underlying revenue growth was +8%. The difference between the reported and underlying growth rates primarily reflects the impact of exchange rate movements and portfolio changes including the disposal of New Scientist and other magazines, and the sale of our majority stake in a property title services joint venture to our partner.

Underlying adjusted operating profit growth broadly matched underlying revenue growth as we continued to pursue our organic development strategy. The margin improvement reflects a positive effect from portfolio changes.

In Insurance we continued to drive growth through enhanced analytics, the extension of datasets, and by further expansion in adjacent verticals. The US market environment returned to historical trends in the fourth quarter, having been not quite as favourable earlier in the year. The international initiatives continued to progress well.

In Business Services, further development of analytics that help our customers to detect and prevent fraud and to manage risk across the financial and corporate sectors continued to drive growth, in a positive US and international market environment.

Growth in the government and healthcare segments was driven by continued development of sophisticated analytics, and other Data Services continued to drive growth through organic development.

2018 outlook: The fundamental growth drivers of Risk & Business Analytics remain strong, and we expect underlying operating profit growth to continue to broadly match underlying revenue growth.

RELX Group 2017 I Results 8

Operating and financial review

Legal

| £ | € | |||||||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | Change at constant currencies |

Underlying growth rates |

|||||||||||||||||||||||||

| Revenue |

1,692 | 1,622 | +4 | % | 1,929 | 1,979 | -3 | % | -1 | % | +2 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted operating profit |

332 | 311 | +7 | % | 379 | 379 | 0 | % | +1 | % | +11 | % | ||||||||||||||||||||

| Adjusted operating margin |

19.6 | % | 19.2 | % | 19.6 | % | 19.2 | % | ||||||||||||||||||||||||

83% of revenue electronic and face-to-face

Underlying revenue growth in 2017 was in line with the prior year, with continued efficiency gains driving strong underlying operating profit growth.

Underlying revenue growth was +2%. The difference between the reported and underlying growth rates reflects the impact of exchange rate movements and portfolio changes including the acquisition of Ravel Law, the disposal of several print and services assets, and the final exit from the Martindale Hubbell joint venture.

Underlying adjusted operating profit growth was +11%. The increase in operating profit margin reflects ongoing organic process improvement and decommissioning of systems which, together with currency movements, more than offset a lower profit contribution from joint ventures and other portfolio effects.

Electronic revenues saw continued growth, partially offset by print declines. The roll-out of new platform releases across our US and international markets continued, with broader datasets and the continued expansion of early stage legal analytics. The usage migration of US legal customers onto Lexis Advance is now substantially complete.

US and European markets remained stable. Other international markets continued to grow well.

2018 outlook: Trends in our major customer markets are unchanged, continuing to limit the scope for underlying revenue growth. We expect underlying profit growth to remain strong.

RELX Group 2017 I Results 9

Operating and financial review

Exhibitions

| £ | € | |||||||||||||||||||||||||||||||

| Year ended 31 December | Year ended 31 December | |||||||||||||||||||||||||||||||

| 2017 £m |

2016 £m |

Change | 2017 €m |

2016 €m |

Change | Change at constant currencies |

Underlying growth rates |

|||||||||||||||||||||||||

| Revenue |

1,109 | 1,047 | +6 | % | 1,264 | 1,277 | -1 | % | +1 | % | +6 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Adjusted operating profit |

285 | 269 | +6 | % | 325 | 328 | -1 | % | +1 | % | +2 | % | ||||||||||||||||||||

| Adjusted operating margin |

25.7 | % | 25.7 | % | 25.7 | % | 25.7 | % | ||||||||||||||||||||||||

100% of revenue face-to-face and electronic

Underlying revenue growth rates exclude exhibition cycling effects

Exhibitions achieved strong underlying revenue growth in 2017, a slight acceleration from the prior year, with underlying operating profit growth reflecting cycling-out effects.

Underlying revenue growth was +6%. After portfolio changes and six percentage points of cycling-out effects, constant currency revenue growth was +1%. The difference between the reported and constant currency growth rates reflects the impact of exchange rate movements and portfolio changes, including the acquisition of MCM Comic Con (UK), Cafe Seoul (South Korea) and Fitness (Australia), and the disposal of a number of small events.

Underlying adjusted operating profit growth was +2% reflecting cycling-out effects.

We continued to pursue organic growth opportunities, launching 36 new events, and piloting several data analytics opportunities.

Overall growth remained good in Europe and strong in Japan and China. The US continued to see differentiated growth rates by industry sector. Revenues in Brazil continued to reflect the general weakness of the wider economy. Most other markets continued to grow strongly.

2018 outlook: We expect underlying revenue growth trends to continue. In 2018 we expect cycling-in effects to increase the reported revenue growth rate by four to five percentage points.

RELX Group 2017 I Results 10

Operating and financial review

FINANCIAL REVIEW: REPORTED AND ADJUSTED FIGURES

| £ | ||||||||||||||||

| Year ended 31 December | ||||||||||||||||

| 2017 £m |

2016 £m |

Change | ||||||||||||||

| Reported figures |

||||||||||||||||

| Revenue |

7,355 | 6,895 | +7 | % | ||||||||||||

| Operating profit |

1,905 | 1,708 | +12 | % | ||||||||||||

| Profit before tax |

1,734 | 1,473 | +18 | % | ||||||||||||

| Net profit attributable to RELX PLC and RELX NV shareholders |

1,659 | 1,161 | +43 | % | ||||||||||||

| Net margin |

22.6 | % | 16.8 | % | ||||||||||||

| Earnings per share |

82.2p | 56.3p | +46 | % | ||||||||||||

| Adjusted figures |

||||||||||||||||

| Revenue |

7,355 | 6,895 | +7 | % | +4 | %UL | ||||||||||

| Operating profit |

2,284 | 2,114 | +8 | % | +6 | %UL | ||||||||||

| Operating margin |

31.1 | % | 30.7 | % | ||||||||||||

| Profit before tax |

2,118 | 1,934 | +10 | % | ||||||||||||

| Net profit attributable to RELX PLC and RELX NV shareholders |

1,635 | 1,488 | +10 | % | ||||||||||||

| Net margin |

22.2 | % | 21.6 | % | ||||||||||||

| Earnings per share |

81.0p | 72.2p | +12 | % | +7 | %CC | ||||||||||

| UL: Underlying CC: Constant currency | ||||||||

The Group’s condensed consolidated financial information is presented in sterling. Summary financial information is presented in euros and US dollars on pages 32 and 33 respectively.

RELX Group uses adjusted and underlying figures as additional performance measures. These measures are used by management, alongside the comparable GAAP measures, in evaluating the business performance. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. In 2017, we have excluded the exceptional tax credit arising as a result of the US Tax Cuts and Jobs Act. Reconciliations between the reported and adjusted figures are set out on page 31. Underlying growth rates are calculated at constant currencies, and exclude the results of all acquisitions and disposals made in both the year and prior year and of assets held for sale. Underlying revenue growth rates also exclude exhibition cycling effects. Constant currency growth rates are based on 2016 full-year average and hedge exchange rates.

Revenue

Underlying growth of revenue was 4%, with all four market segments contributing to underlying growth. The underlying growth rate reflects good growth in electronic and face-to-face revenues, partially offset by continued print revenue declines. Exhibition cycling effects reduced revenue growth by 1%, and the net impact of acquisitions and disposals reduced revenue growth by 1%. The impact of currency movements was to increase revenue by 5%, principally due to the US dollar and euro being stronger against sterling on average during 2017.

Reported revenue, including the effects of exhibition cycling, portfolio changes and currency movements, was £7,355m (2016: £6,895m), up 7%.

Profit

Underlying adjusted operating profit grew ahead of revenue at 6%, reflecting the benefit of tight cost control across the Group. Total adjusted operating profit, including the impact of acquisitions and disposals and currency effects, was £2,284m (2016: £2,114m), up 8%. Acquisitions and disposals decreased adjusted operating profit by 3%. Currency effects increased adjusted operating profit by 5%, in line with the impact on revenue.

Reported operating profit, after amortisation of acquired intangible assets and acquisition-related costs, was £1,905m (2016: £1,708m). The amortisation charge in respect of acquired intangible assets, including the share of amortisation in joint ventures, decreased to £314m (2016: £346m), primarily reflecting certain assets becoming fully amortised, partially offset by currency effects and acquisitions. Acquisition-related costs were £56m (2016: £51m).

RELX Group 2017 I Results 11

Operating and financial review

Underlying operating cost growth was 2%, reflecting investment in global technology platforms and the launch of new products and services, partly offset by continued process innovation. Actions continue to be taken across our businesses to improve cost-efficiency. Total operating costs, including the impact of acquisitions, disposals and currency effects, increased by 6%.

The overall adjusted operating margin of 31.1% was 0.4 percentage points higher than in the prior year. On an underlying basis, including cycling effects, the margin improved by 0.7 percentage points. Acquisitions and disposals reduced the margin by 0.4 percentage points and currency effects increased the margin by 0.1 percentage points.

Adjusted interest expense, excluding the net pension financing charge of £15m (2016: £14m) and including finance income in joint ventures of £1m (2016: £1m), was £166m (2016: £180m). The decrease primarily reflects a lower average interest rate on borrowings, partly offset by currency translation effects. Reported net finance costs were £182m (2016: £195m). Net pre-tax disposal gains were £11m (2016: £40m loss) arising largely from the sale of Risk & Business Analytics businesses and revaluation of investments held. These gains are offset by an associated tax charge of £16m (2016: £34m credit).

Adjusted profit before tax was £2,118m (2016: £1,934m), up 10%. The reported profit before tax was £1,734m (2016: £1,473m).

The adjusted effective tax rate on adjusted profit before tax was 22.5%, 0.2 percentage points lower than the prior year rate of 22.7%. The adjusted effective tax rate excludes movements in deferred taxation assets and liabilities related to goodwill and acquired intangible assets, but includes the benefit of tax amortisation where available on those items. Adjusted operating profits and taxation are grossed up for the equity share of taxes in joint ventures.

The reported tax charge was £67m (2016: £304m). The decrease in the tax charge is due to the US Tax Cuts and Jobs Act, which includes a reduction in the federal corporate tax rate from 35% to 21% from January 2018. Consequently, the Group has measured its US deferred tax assets and liabilities at the end of the reporting period at a combined tax rate (including state taxes) of 26%. This resulted in the recognition of an exceptional tax credit of £346m in the income statement.

The adjusted net profit attributable to RELX PLC and RELX NV shareholders of £1,635m (2016: £1,488m) was up 10%. Adjusted earnings per share were up 12% at 81.0p (2016: 72.2p) when expressed in sterling and 5% at €0.923 (2016: €0.880) when expressed in euros. At constant rates of exchange, adjusted earnings per share increased by 7%.

The reported net profit attributable to RELX PLC and RELX NV shareholders was £1,659m (2016: £1,161m).

The reported earnings per share was 82.2p (2016: 56.3p) in sterling and €0.936 (2016: €0.687) when expressed in euros. The growth in the year reflects the impact of the exceptional tax credit recognised as a result of the US Tax Cuts and Jobs Act.

RELX Group 2017 I Results 12

Operating and financial review

Cash flows

| £ | ||||||||

| Year ended 31 December |

||||||||

| 2017 £m |

2016 £m |

|||||||

| Adjusted cash flow conversion |

||||||||

| Adjusted operating profit |

2,284 | 2,114 | ||||||

| Capital expenditure |

(354 | ) | (333 | ) | ||||

| Depreciation and amortisation of internally developed intangible assets |

272 | 257 | ||||||

| Working capital and other items |

(10 | ) | (22 | ) | ||||

|

|

|

|

|

|||||

| Adjusted cash flow |

2,192 | 2,016 | ||||||

|

|

|

|

|

|||||

| Cash flow conversion |

96 | % | 95 | % | ||||

|

|

|

|

|

|||||

Adjusted cash flow was £2,192m (2016: £2,016m), up 9% compared with the prior year and up 3% at constant currencies. The rate of conversion of adjusted operating profit to adjusted cash flow was 96% (2016: 95%).

Capital expenditure was £354m (2016: £333m), including £303m (2016: £282m) in respect of capitalised development costs. This reflects sustained investment in new products and related infrastructure across the business. Depreciation and the amortisation of internally developed intangible assets was £272m (2016: £257m). Capital expenditure was 4.8% of revenue (2016: 4.8%). Depreciation and amortisation was 3.7% of revenue (2016: 3.7%).

| £ | ||||||||

| Year ended 31 December |

||||||||

| 2017 £m |

2016 £m |

|||||||

| Free cash flow |

||||||||

| Adjusted cash flow |

2,192 | 2,016 | ||||||

| Cash interest paid |

(148 | ) | (152 | ) | ||||

| Cash tax paid |

(472 | ) | (423 | ) | ||||

| Acquisition-related costs* |

(28 | ) | (27 | ) | ||||

|

|

|

|

|

|||||

| Free cash flow before dividends |

1,544 | 1,414 | ||||||

| Dividends |

(762 | ) | (683 | ) | ||||

|

|

|

|

|

|||||

| Free cash flow after dividends |

782 | 731 | ||||||

|

|

|

|

|

|||||

| * | Including cash tax relief |

Free cash flow before dividends was £1,544m (2016: £1,414m). Ordinary dividends paid to shareholders in the year, being the 2016 final and 2017 interim dividends, amounted to £762m (2016: £683m). Free cash flow after dividends was £782m (2016: £731m).

Tax paid, excluding tax relief on acquisition-related costs and on disposals, of £472m (2016: £423m) increased as a result of improved profits and movements in exchange rates. Interest paid was £148m (2016: £152m).

RELX Group 2017 I Results 13

Operating and financial review

| £ | ||||||||

| Year ended 31 December |

||||||||

| 2017 £m |

2016 £m |

|||||||

| Reconciliation of net debt |

||||||||

| Net debt at 1 January |

(4,700 | ) | (3,782 | ) | ||||

|

|

|

|

|

|||||

| Free cash flow post dividends |

782 | 731 | ||||||

| Net disposal proceeds/(payments) |

34 | (13 | ) | |||||

| Acquisition cash spend |

(141 | ) | (367 | ) | ||||

| Share repurchases |

(700 | ) | (700 | ) | ||||

| Purchase of shares by the Employee Benefit Trust |

(39 | ) | (29 | ) | ||||

| Other* |

— | (31 | ) | |||||

| Currency translation |

32 | (509 | ) | |||||

|

|

|

|

|

|||||

| Movement in net debt |

(32 | ) | (918 | ) | ||||

|

|

|

|

|

|||||

| Net debt at 31 December |

(4,732 | ) | (4,700 | ) | ||||

|

|

|

|

|

|||||

| * | Cash tax relief on disposals, distributions to non-controlling interests, pension deficit payments, finance leases and share option exercise proceeds |

Total consideration on acquisitions completed in the year was £123m (2016: £338m). Cash spent on acquisitions was £141m (2016: £367m), including deferred consideration of £13m (2016: £24m) on past acquisitions and spend on venture capital investments of £10m (2016: £6m).

Total consideration for the disposal of non-strategic assets in 2017 was £87m (2016: £16m). Net cash inflow after timing differences and separation and transaction costs was £34m (2016: £13m outflow).

Share repurchases by RELX PLC and RELX NV in 2017 were £700m (2016: £700m), with a further £100m repurchased in 2018 as at 14 February. During 2017, 23.1m RELX PLC shares were acquired at an average price of 1,604p, and 21.4m RELX NV shares were acquired at an average price of €17.57. In addition, the Employee Benefit Trust purchased shares of RELX PLC and RELX NV to meet future obligations in respect of share based remuneration totalling £39m (2016: £29m). Proceeds from the exercise of share options were £32m (2016: £23m).

Debt

Gross borrowings at 31 December 2017 amounted to £4,886m (2016: £4,843m). The fair value of related derivative net assets was £43m (2016: net liabilities of £19m). Cash and cash equivalents totalled £111m (2016: £162m). In aggregate, these give the net borrowings figure of £4,732m (2016: £4,700m).

The effective interest rate on gross borrowings was 3.2% in 2017, 0.6 percentage points lower than the prior year, reflecting the benefit of refinancing historical bonds that had higher rates of interest. As at 31 December 2017, gross borrowings had a weighted average life remaining of 4.6 years and a total of 44% of them were at fixed rates, after taking into account interest rate derivatives.

The ratio of net debt to 12-month trailing EBITDA (adjusted earnings before interest, tax, depreciation and amortisation) was 1.9x (2016: 1.8x), calculated in US dollars. Incorporating the capitalisation of operating leases and the net pension deficit, in line with the approach taken by credit rating agencies, the ratio was 2.2x (2016: 2.2x).

Pensions

Net pension obligations, i.e. pension obligations less pension assets, decreased to £328m (2016: £636m). There was a net deficit of £89m (2016: £393m) in respect of funded schemes, which were on average 98% funded at the end of the year on an IFRS basis. The lower deficit mainly reflects strong asset performance in both the UK and the US schemes, and changes to the UK scheme resulting in a £42m credit and corresponding reduction in the liability.

RELX Group 2017 I Results 14

Operating and financial review

Liquidity

The Group has a $2.0bn committed bank facility, maturing in July 2020, which provides security of funding for short-term debt. At 31 December 2017, this facility was undrawn. In March 2017, €1.0bn in total of euro denominated fixed rate term debt was issued with coupons of 0.375% and 1.000% and maturities of four years and seven years, respectively. The Group has ample liquidity and access to debt capital markets, providing the ability to repay or refinance borrowings as they mature and to fund ongoing requirements.

Invested capital and returns

The post-tax return on average invested capital in the year was 13.1% (2016: 13.0%).

| £ | ||||||||

| Year ended 31 December | ||||||||

| 2017 £m |

2016 £m |

|||||||

| Adjusted operating profit |

2,284 | 2,114 | ||||||

| Tax at effective rate |

(514 | ) | (480 | ) | ||||

| Effective tax rate |

22.5 | % | 22.7 | % | ||||

| Adjusted operating profit after tax |

1,770 | 1,634 | ||||||

| Average invested capital* |

13,501 | 12,538 | ||||||

| Return on invested capital |

13.1 | % | 13.0 | % | ||||

| * | Average of invested capital at the beginning and the end of the year, retranslated at average exchange rates for the year. Invested capital is calculated as net capital employed, adjusted to add back accumulated amortisation and impairment of acquired intangible assets and goodwill and to exclude the gross up to goodwill in respect of deferred tax liabilities. |

Alternative performance measures

The Group uses adjusted figures, which are not defined by generally accepted accounting principles (“GAAP”) such as IFRS. Adjusted figures and underlying growth rates are presented as additional performance measures used by management, as they provide relevant information in assessing the Group’s performance, position and cash flows. We believe that these measures enable investors to more clearly track the core operational performance of the Group, by separating out items of income or expenditure relating to acquisitions, disposals and capital items, while providing our investors with a clear basis for assessing our ability to raise debt and invest in new business opportunities. In 2017, we have excluded the exceptional tax credit arising as a result of the US Tax Cuts and Jobs Act from our adjusted measures.

Our management uses these financial measures, along with IFRS financial measures, in evaluating the operating performance of the Group as a whole and the individual business segments.

Dividends

The final dividends proposed by the respective Boards are 27.7p per share for RELX PLC and €0.316 per share for RELX NV, +8% and +5% higher respectively compared with the prior year final dividends. This gives total dividends for the year of 39.4p (2016: 35.95p) and €0.448 (2016: €0.423). The difference in growth rates in the final dividends reflects changes in the euro:sterling exchange rate since the prior year final dividend announcement date.

Dividend cover, based on adjusted earnings per share and the total interim and proposed final dividends for the year, is 2.1x. The dividend policy of RELX PLC and RELX NV is, subject to currency considerations, to grow dividends broadly in line with adjusted earnings per share whilst maintaining dividend cover (defined as the number of times the annual dividend is covered by the adjusted earnings per share) of at least two times over the longer term.

RELX Group 2017 I Results 15

Operating and financial review

PRINCIPAL RISKS

The principal risks facing RELX Group arise from the highly competitive and rapidly changing nature of our markets, the increasing technological nature of our products and services, the international nature of our operations, legislative, fiscal and regulatory developments and economic conditions in our markets. Certain businesses could also be affected by the impact on publicly funded and other customers of changes in funding and by cyclical pressures on advertising and promotional spending or through the availability of free sources of information.

The principal risks and uncertainties that have been identified are summarised below:

| • | Demand for our products and services may be adversely impacted by factors beyond our control, such as the economic environment in the United States, Europe and other major economies, political uncertainties (including the potential consequences of the United Kingdom’s withdrawal from the European Union under Article 50 of the Treaty of Lisbon), acts of war, terrorism and civil unrest as well as levels of government and private funding provided to academic and research institutions. |

| • | Our products and services include and utilise intellectual property. We rely on trademark, copyright, patent and other intellectual property laws to establish and protect our proprietary rights in this intellectual property. There is a risk that our proprietary rights could be challenged, limited, invalidated or circumvented, which may impact demand for and pricing of our products and services. Copyright laws are subject to national legislative initiatives, as well as cross border initiatives such as those from the European Commission, and increased judicial scrutiny in several jurisdictions in which we operate. This creates additional challenges for us in protecting our proprietary rights in content delivered through the internet and electronic platforms. |

| • | A number of our businesses rely extensively upon content and data from external sources. Data is obtained from public records, governmental authorities, customers and other information companies, including competitors. Legal regulations, such as the European Union’s General Data Protection Regulation (“GDPR”), relating to internet communications, privacy and data protection, e-commerce, information governance and use of public records, are becoming more prevalent worldwide. The disruption or loss of data sources, either because of changes in the law or because data suppliers decide not to supply them, may impose limits on our collection and use of certain kinds of information about individuals and our ability to communicate such information effectively with our customers. |

| • | Our Scientific, Technical & Medical (STM) primary research content, like that of most of our competitors, is sold largely on a paid subscription basis. There is continued debate in government, academic and library communities, which are the principal customers for our STM content, regarding to what extent such content should be funded instead through fees charged to authors or authors’ funders and/or made freely available in some form after a period following publication. Some of these methods, if widely adopted, could adversely affect our revenue from paid subscriptions. |

| • | Our businesses are dependent on the continued acceptance by our customers of our products and services and the value placed on them. Failure to meet evolving customer needs could impact demand for our products and services and consequently adversely affect our revenue or the long-term returns from our investment in electronic product and platform initiatives. |

| • | Our businesses operate in highly competitive markets, and the means of delivering our products and services, and the products and services themselves, continue to change in response to rapid technological innovations, legislative and regulatory changes, the entrance of new competitors and other factors. Failure to anticipate and quickly adapt to these changes could impact the competitiveness of our products and services and consequently adversely affect our revenue. |

RELX Group 2017 I Results 16

Operating and financial review

| • | We supplement our organic development with selected acquisitions. If we are unable to generate the anticipated benefits such as revenue growth and/or cost savings associated with these acquisitions this could adversely affect return on invested capital and financial condition, or lead to an impairment of goodwill. |

| • | Our businesses are dependent on electronic platforms and networks, primarily the internet, for delivery of our products and services. These could be adversely affected if our electronic delivery platforms or networks experience a significant failure, interruption or security breach. |

| • | Our businesses maintain online databases and information, including public records and other personal information. As part of maintaining this information and delivering our products and services, we rely on and provide data to third parties, including customers and service providers. These databases and information are a target for compromise and face a risk of unauthorised access and use by unauthorised parties. |

Our cyber security measures, and the measures used by our third-party service providers, may not detect or prevent all attempts to compromise our systems, which may jeopardise the security of the data we maintain or may disrupt our systems. Failures of our cyber security measures could result in unauthorised access to our systems, misappropriation of our or our users’ data, deletion or modification of stored information or other interruption to our business operations. As techniques used to obtain unauthorised access to or to sabotage systems change frequently, and may not be known until launched against us or our third-party service providers, we may be unable to anticipate or implement adequate measures to protect against these attacks and our service providers and customers may likewise be unable to do so.

Compromises of our or our third-party service providers’ systems, or failure to comply with applicable legislation or regulatory or contractual requirements could adversely affect our financial performance, damage our reputation and expose us to risk of loss, fines and penalties, litigation and increased regulation.

| • | Our organisational and operational structures depend on outsourced and offshored functions, including use of cloud service providers. Poor performance, failure or breach of third parties to whom we have outsourced activities could adversely affect our business performance, reputation and financial condition. |

| • | The implementation and execution of our strategies and business plans depend on our ability to recruit, motivate and retain skilled employees and management. We compete globally and across business sectors for talented management and skilled individuals, particularly those with technology and data analytics capabilities. An inability to recruit, motivate or retain talent could adversely affect our business performance. Failure to recruit and develop a diverse and inclusive workforce could adversely affect our reputation and business performance. |

| • | We operate a number of pension schemes around the world, including local versions of the defined benefit type in the UK and the United States. The assets and obligations associated with those pension schemes are sensitive to changes in the market values of the scheme’s investments and the market-related assumptions used to value scheme liabilities. Adverse changes to asset values, discount rates, longevity assumptions or inflation could increase future pension costs and funding requirements. |

| • | Our businesses operate globally and our profits are subject to taxation in many different jurisdictions and at differing tax rates. The Organisation for Economic Co-operation and Development (OECD)’s reports on Base Erosion and Profit Shifting suggest a range of new approaches that national governments might adopt when taxing the activities of multinational enterprises. The OECD continues to explore options around the taxation of the digital economy. As a result of the OECD’s work and other international initiatives, tax laws that currently apply to our businesses may be amended by the relevant authorities or interpreted differently by them, and these changes could adversely affect our reported results. |

RELX Group 2017 I Results 17

Operating and financial review

| • | The RELX Group consolidated financial statements are expressed in pounds sterling and are subject to movements in exchange rates on the translation of the financial information of businesses whose operational currencies are other than sterling. The United States is our most important market and, accordingly, significant fluctuations in the US dollar exchange rate could significantly affect our reported results. We also earn revenues and incur costs in a range of other currencies, including the euro and the yen, and significant fluctuations in these exchange rates could also significantly impact our reported results. |

| • | Macroeconomic, political and market conditions may adversely affect the availability and terms of short and long-term funding, volatility of interest rates, the credit quality of our counterparties, currency exchange rates and inflation. The majority of our outstanding debt instruments are, and any of our future debt instruments may be, publicly rated by independent rating agencies. Our borrowing costs and access to capital may be adversely affected if the credit ratings assigned to our debt are downgraded. |

| • | As a world-leading provider of professional information solutions to the STM, risk and business analytics, legal and exhibitions markets we, our employees and major suppliers are expected to adhere to high standards of independence and ethical conduct, including those related to anti-bribery and anti-corruption, promoting human rights and principled business conduct. A breach of generally accepted ethical business standards or applicable anti-bribery and anti-corruption or competition statutes could adversely affect our business performance, reputation and financial condition. |

| • | Our businesses have an impact on the environment, principally through the use of energy and water, waste generation and, in our supply chain, through paper use and print and production technologies. Failure to manage our environmental impact could adversely affect our reputation. |

RELX Group 2017 I Results 18

Condensed consolidated financial information

Condensed consolidated income statement

For the year ended 31 December

| £ | ||||||||||||

| Note | 2017 £m |

2016 £m |

||||||||||

| Revenue |

2 | 7,355 | 6,895 | |||||||||

| Cost of sales |

(2,631 | ) | (2,488 | ) | ||||||||

|

|

|

|

|

|||||||||

| Gross profit |

4,724 | 4,407 | ||||||||||

| Selling and distribution costs |

(1,163 | ) | (1,109 | ) | ||||||||

| Administration and other expenses |

(1,693 | ) | (1,627 | ) | ||||||||

| Share of results of joint ventures |

37 | 37 | ||||||||||

|

|

|

|

|

|||||||||

| Operating profit |

1,905 | 1,708 | ||||||||||

|

|

|

|

|

|||||||||

| Finance income |

4 | 8 | ||||||||||

| Finance costs |

(186 | ) | (203 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net finance costs |

(182 | ) | (195 | ) | ||||||||

|

|

|

|

|

|||||||||

| Disposals and other non-operating items |

11 | (40 | ) | |||||||||

|

|

|

|

|

|||||||||

| Profit before tax |

1,734 | 1,473 | ||||||||||

| Current tax |

(439 | ) | (374 | ) | ||||||||

| Deferred tax |

372 | 70 | ||||||||||

|

|

|

|

|

|||||||||

| Tax expense |

(67 | ) | (304 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net profit for the period |

1,667 | 1,169 | ||||||||||

|

|

|

|

|

|||||||||

| Attributable to: |

||||||||||||

| RELX PLC and RELX NV shareholders |

1,659 | 1,161 | ||||||||||

| Non-controlling interests |

8 | 8 | ||||||||||

|

|

|

|

|

|||||||||

| Net profit for the period |

1,667 | 1,169 | ||||||||||

|

|

|

|

|

|||||||||

| Earnings per share |

£ | |||||||||||

| 2017 | 2016 | |||||||||||

| Basic earnings per share |

||||||||||||

| RELX PLC |

3 | 82.2p | 56.3p | |||||||||

| RELX NV |

3 | 82.2p | 56.3p | |||||||||

|

|

|

|

|

|||||||||

| Diluted earnings per share |

||||||||||||

| RELX PLC |

3 | 81.5p | 55.8p | |||||||||

| RELX NV |

3 | 81.5p | 55.8p | |||||||||

|

|

|

|

|

|||||||||

Summary financial information is presented in euros and US dollars on pages 32 and 33 respectively.

RELX Group 2017 I Results 19

Condensed consolidated financial information

Condensed consolidated statement of comprehensive income

For the year ended 31 December

| £ | ||||||||||||

| Note | 2017 £m |

2016 £m |

||||||||||

| Net profit for the period |

1,667 | 1,169 | ||||||||||

|

|

|

|

|

|||||||||

| Items that will not be reclassified to profit or loss: |

||||||||||||

| Actuarial gains/(losses) on defined benefit pension schemes |

6 | 233 | (262 | ) | ||||||||

| Tax on items that will not be reclassified to profit or loss |

(59 | ) | 45 | |||||||||

|

|

|

|

|

|||||||||

| Total items that will not be reclassified to profit or loss |

174 | (217 | ) | |||||||||

|

|

|

|

|

|||||||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||||||

| Exchange differences on translation of foreign operations |

(507 | ) | 670 | |||||||||

| Fair value movements on cash flow hedges |

137 | (165 | ) | |||||||||

| Transfer to net profit from cash flow hedge reserve |

25 | 46 | ||||||||||

| Tax on items that may be reclassified to profit or loss |

(30 | ) | 19 | |||||||||

|

|

|

|

|

|||||||||

| Total items that may be reclassified to profit or loss |

(375 | ) | 570 | |||||||||

|

|

|

|

|

|||||||||

| Other comprehensive (loss)/income for the period |

(201 | ) | 353 | |||||||||

|

|

|

|

|

|||||||||

| Total comprehensive income for the period |

1,466 | 1,522 | ||||||||||

|

|

|

|

|

|||||||||

| Attributable to: |

||||||||||||

| RELX PLC and RELX NV shareholders |

1,458 | 1,514 | ||||||||||

| Non-controlling interests |

8 | 8 | ||||||||||

|

|

|

|

|

|||||||||

| Total comprehensive income for the period |

1,466 | 1,522 | ||||||||||

|

|

|

|

|

|||||||||

RELX Group 2017 I Results 20

Condensed consolidated financial information

Condensed consolidated statement of cash flows

For the year ended 31 December

| £ | ||||||||||||

| Note | 2017 £m |

2016 £m |

||||||||||

| Cash flows from operating activities |

||||||||||||

| Cash generated from operations |

5 | 2,445 | 2,236 | |||||||||

| Interest paid |

(152 | ) | (160 | ) | ||||||||

| Interest received |

4 | 8 | ||||||||||

| Tax paid (net) |

(449 | ) | (402 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net cash from operating activities |

1,848 | 1,682 | ||||||||||

|

|

|

|

|

|||||||||

| Cash flows from investing activities |

||||||||||||

| Acquisitions |

(131 | ) | (361 | ) | ||||||||

| Purchases of property, plant and equipment |

(51 | ) | (51 | ) | ||||||||

| Expenditure on internally developed intangible assets |

(303 | ) | (282 | ) | ||||||||

| Purchase of investments |

(10 | ) | (6 | ) | ||||||||

| Proceeds from disposals of property, plant and equipment |

1 | 1 | ||||||||||

| Gross proceeds from business disposals |

84 | 18 | ||||||||||

| Payments on business disposals |

(50 | ) | (31 | ) | ||||||||

| Dividends received from joint ventures |

38 | 44 | ||||||||||

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

(422 | ) | (668 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash flows from financing activities |

||||||||||||

| Dividends paid to shareholders of RELX PLC and RELX NV |

(762 | ) | (683 | ) | ||||||||

| Distributions to non-controlling interests |

(10 | ) | (9 | ) | ||||||||

| (Decrease)/increase in short term bank loans, overdrafts and commercial paper |

(148 | ) | 271 | |||||||||

| Issuance of term debt |

873 | 603 | ||||||||||

| Repayment of term debt |

(712 | ) | (474 | ) | ||||||||

| Repayment of finance leases |

(5 | ) | (7 | ) | ||||||||

| Repurchase of ordinary shares |

(700 | ) | (700 | ) | ||||||||

| Purchase of shares by the Employee Benefit Trust |

(39 | ) | (29 | ) | ||||||||

| Proceeds on issue of ordinary shares |

32 | 23 | ||||||||||

|

|

|

|

|

|||||||||

| Net cash used in financing activities |

(1,471 | ) | (1,005 | ) | ||||||||

|

|

|

|

|

|||||||||

| (Decrease)/increase in cash and cash equivalents |

5 | (45 | ) | 9 | ||||||||

|

|

|

|

|

|||||||||

| Movement in cash and cash equivalents |

||||||||||||

| At start of period |

162 | 122 | ||||||||||

| (Decrease)/increase in cash and cash equivalents |

(45 | ) | 9 | |||||||||

| Exchange translation differences |

(6 | ) | 31 | |||||||||

|

|

|

|

|

|||||||||

| At end of period |

111 | 162 | ||||||||||

|

|

|

|

|

|||||||||

RELX Group 2017 I Results 21

Condensed consolidated financial information

Condensed consolidated statement of financial position

As at 31 December

| £ | ||||||||||||

| Note | 2017 £m |

2016 £m |

||||||||||

| Non-current assets |

||||||||||||

| Goodwill |

5,965 | 6,392 | ||||||||||

| Intangible assets |

3,194 | 3,604 | ||||||||||

| Investments in joint ventures |

102 | 102 | ||||||||||

| Other investments |

141 | 137 | ||||||||||

| Property, plant and equipment |

209 | 242 | ||||||||||

| Deferred tax assets |

405 | 444 | ||||||||||

| Net pension assets |

6 | 22 | — | |||||||||

| Derivative financial instruments |

86 | 49 | ||||||||||

|

|

|

|

|

|||||||||

| 10,124 | 10,970 | |||||||||||

|

|

|

|

|

|||||||||

| Current assets |

||||||||||||

| Inventories and pre-publication costs |

197 | 209 | ||||||||||

| Trade and other receivables |

1,822 | 1,956 | ||||||||||

| Derivative financial instruments |

29 | 20 | ||||||||||

| Cash and cash equivalents |

111 | 162 | ||||||||||

|

|

|

|

|

|||||||||

| 2,159 | 2,347 | |||||||||||

|

|

|

|

|

|||||||||

| Assets held for sale |

— | 6 | ||||||||||

|

|

|

|

|

|||||||||

| Total assets |

12,283 | 13,323 | ||||||||||

|

|

|

|

|

|||||||||

| Current liabilities |

||||||||||||

| Trade and other payables |

3,237 | 3,425 | ||||||||||

| Derivative financial instruments |

32 | 85 | ||||||||||

| Borrowings |

5 | 678 | 1,159 | |||||||||

| Taxation |

560 | 612 | ||||||||||

| Provisions |

7 | 19 | 23 | |||||||||

|

|

|

|

|

|||||||||

| 4,526 | 5,304 | |||||||||||

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||

| Derivative financial instruments |

25 | 110 | ||||||||||

| Borrowings |

5 | 4,208 | 3,684 | |||||||||

| Deferred tax liabilities |

738 | 1,137 | ||||||||||

| Net pension obligations |

6 | 350 | 636 | |||||||||

| Provisions |

7 | 62 | 89 | |||||||||

|

|

|

|

|

|||||||||

| 5,383 | 5,656 | |||||||||||

|

|

|

|

|

|||||||||

| Liabilities associated with assets held for sale |

— | 5 | ||||||||||

|

|

|

|

|

|||||||||

| Total liabilities |

9,909 | 10,965 | ||||||||||

|

|

|

|

|

|||||||||

| Net assets |

2,374 | 2,358 | ||||||||||

|

|

|

|

|

|||||||||

| Capital and reserves |

||||||||||||

| Share capital |

8 | 224 | 226 | |||||||||

| Share premium |

8 | 3,104 | 3,003 | |||||||||

| Shares held in treasury |

8 | (1,631 | ) | (1,471 | ) | |||||||

| Translation reserve |

169 | 727 | ||||||||||

| Other reserves |

487 | (165 | ) | |||||||||

|

|

|

|

|

|||||||||

| Shareholders’ equity |

2,353 | 2,320 | ||||||||||

| Non-controlling interests |

21 | 38 | ||||||||||

|

|

|

|

|

|||||||||

| Total equity |

2,374 | 2,358 | ||||||||||

|

|

|

|

|

|||||||||

Approved by the Boards of RELX PLC and RELX NV, 14 February 2018.

RELX Group 2017 I Results 22

Condensed consolidated financial information

Condensed consolidated statement of changes in equity

| £ | ||||||||||||||||||||||||||||||||||||

| Note | Share capital £m |

Share premium £m |

Shares held in treasury £m |

Translation reserve £m |

Other reserves £m |

Shareholders’ equity £m |

Non- controlling interests £m |

Total equity £m |

||||||||||||||||||||||||||||

| Balance at 1 January 2016 |

224 | 2,748 | (1,393 | ) | 224 | 341 | 2,144 | 34 | 2,178 | |||||||||||||||||||||||||||

| Total comprehensive income for the period |

— | — | — | 670 | 844 | 1,514 | 8 | 1,522 | ||||||||||||||||||||||||||||

| Dividends paid |

4 | — | — | — | — | (683 | ) | (683 | ) | (9 | ) | (692 | ) | |||||||||||||||||||||||

| Issue of ordinary shares, net of expenses |

— | 23 | — | — | — | 23 | — | 23 | ||||||||||||||||||||||||||||

| Repurchase of ordinary shares |

— | — | (722 | ) | — | — | (722 | ) | — | (722 | ) | |||||||||||||||||||||||||

| Cancellation of shares |

(6 | ) | — | 713 | — | (707 | ) | — | — | — | ||||||||||||||||||||||||||

| Increase in share based remuneration reserve (net of tax) |

— | — | — | — | 44 | 44 | — | 44 | ||||||||||||||||||||||||||||

| Settlement of share awards |

— | — | 39 | — | (39 | ) | — | — | — | |||||||||||||||||||||||||||

| Exchange differences on translation of capital and reserves |

8 | 232 | (108 | ) | (167 | ) | 35 | — | 5 | 5 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Balance at 1 January 2017 |

226 | 3,003 | (1,471 | ) | 727 | (165 | ) | 2,320 | 38 | 2,358 | ||||||||||||||||||||||||||

| Total comprehensive income for the period |

— | — | — | (507 | ) | 1,965 | 1,458 | 8 | 1,466 | |||||||||||||||||||||||||||

| Dividends paid |

4 | — | — | — | — | (762 | ) | (762 | ) | (10 | ) | (772 | ) | |||||||||||||||||||||||

| Issue of ordinary shares, net of expenses |

— | 32 | — | — | — | 32 | — | 32 | ||||||||||||||||||||||||||||

| Repurchase of ordinary shares |

— | — | (737 | ) | — | — | (737 | ) | — | (737 | ) | |||||||||||||||||||||||||

| Cancellation of shares |

(4 | ) | — | 570 | — | (566 | ) | — | — | — | ||||||||||||||||||||||||||

| Increase in share based remuneration reserve (net of tax) |

— | — | — | — | 42 | 42 | — | 42 | ||||||||||||||||||||||||||||

| Settlement of share awards |

— | — | 37 | — | (37 | ) | — | — | — | |||||||||||||||||||||||||||

| Acquisitions |

— | — | — | — | — | — | 1 | 1 | ||||||||||||||||||||||||||||

| Disposal of business |

— | — | — | — | — | — | (15 | ) | (15 | ) | ||||||||||||||||||||||||||

| Exchange differences on translation of capital and reserves |

2 | 69 | (30 | ) | (51 | ) | 10 | — | (1 | ) | (1 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Balance at 31 December 2017 |

224 | 3,104 | (1,631 | ) | 169 | 487 | 2,353 | 21 | 2,374 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

RELX Group 2017 I Results 23

Notes to the condensed consolidated financial information

| 1 | Basis of preparation |

RELX PLC and RELX NV are separate, publicly-held entities. RELX PLC’s ordinary shares are listed in London and, through a depositary receipt, in New York, and RELX NV’s ordinary shares are listed in Amsterdam and, through a depositary receipt, in New York. RELX PLC and RELX NV jointly own RELX Group plc, which holds all the Group’s operating businesses and financing activities. RELX PLC, RELX NV, RELX Group plc and its subsidiaries, joint ventures and associates are together known as “the Group”.

The Governing Agreement determines the equalisation ratio between RELX PLC and RELX NV shares. One RELX PLC ordinary share confers an equivalent economic interest to one RELX NV ordinary share.

As a result of these arrangements, all shareholders can be regarded as having interests in a single economic entity. Consequently, the Directors have concluded that the Group forms a single reporting entity for the presentation of consolidated financial information. Accordingly, the Group consolidated financial information represents the interests of both sets of shareholders and is presented by both RELX PLC and RELX NV as their respective consolidated financial information.

The consolidated financial information, presented in condensed form, has been abridged from the audited RELX Group Annual Reports and Financial Statements 2017 for which unqualified audit reports were given. This summary financial information does not constitute statutory accounts as defined in Section 434 of the Companies Act 2006.

The condensed consolidated financial information has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union and as issued by the International Accounting Standards Board. The accounting policies, including valuation techniques applied to fair value measurement, are the same as those set out within the relevant notes on pages 119 to 167 of the RELX Group Annual Reports and Financial Statements 2016. Financial information is presented in sterling, unless otherwise stated.

The directors of RELX PLC and RELX NV, having made appropriate enquiries, consider that adequate resources exist for the Group to continue in operational existence for the foreseeable future and that, therefore, it is appropriate to adopt the going concern basis in preparing the condensed consolidated financial information for the year ended 31 December 2017.

Standards, amendments and interpretations not yet effective

New accounting standards and amendments and their expected impact on the future accounting policies and reporting of the Group are set out below.

IFRS 9 – Financial Instruments (effective for the 2018 financial year). The standard replaces the existing classification and measurement requirements in IAS 39 – Financial Instruments: Recognition and Measurement. Adoption of the standard is not expected to have a significant impact on the measurement, presentation or disclosure of financial assets and liabilities in the consolidated financial statements. The most notable impact for the Group relates to cash flow hedge accounting, which will result in additional disclosure in respect of the costs of hedging reserve balance and movements from 2018 onwards.

IFRS 15 – Revenue from Contracts with Customers (effective for the 2018 financial year). The new standard provides a single point of reference for revenue recognition, including guidance in relation to identification of the contract and licensing arrangements. RELX Group will adopt IFRS 15 on a fully retrospective basis. Management have performed a full assessment of the impact of IFRS 15. The adoption of IFRS 15 will not result in a material change to the 2017 reported or 2018 income statement numbers.

IFRS 16 – Leases (early adoption so as to be effective for the 2018 financial year). The new standard eliminates the distinction between operating and finance leases and requires lessees to recognise all leases with a lease term of greater than 12 months in the statement of financial position. RELX Group will adopt this standard a year earlier than the mandatory effective date of 1 January 2019. IFRS 16 will be adopted on a fully retrospective basis. The majority of the RELX Group lease portfolio relates to property leases. Management have performed a full assessment of the impact of IFRS 16.

RELX Group 2017 I Results 24

Notes to the condensed consolidated financial information

| 1 | Basis of preparation (continued) |

The table below sets out the expected impact on the income statement and the most significantly impacted statement of financial position accounts.

| 2017 as reported £m |

IFRS 9 impact £m |

IFRS 15 impact £m |

IFRS 16 impact £m |

2017 as restated £m |

||||||||||||||||

| Income statement |

||||||||||||||||||||

| Revenue |

7,355 | — | (14 | ) | — | 7,341 | ||||||||||||||

| Adjusted operating profit |

2,284 | — | (11 | ) | 11 | 2,284 | ||||||||||||||

| Reported operating profit |

1,905 | — | (11 | ) | 11 | 1,905 | ||||||||||||||

| Net finance costs |

(182 | ) | (2 | ) | — | (15 | ) | (199 | ) | |||||||||||

| Adjusted net profit attributable to RELX PLC and RELX NV shareholders |

1,635 | (2 | ) | (9 | ) | (4 | ) | 1,620 | ||||||||||||

| Reported net profit attributable to RELX PLC and RELX NV shareholders |

1,659 | (2 | ) | (9 | ) | — | 1,648 | |||||||||||||

| Adjusted EPS |

81.0p | (0.1p | ) | (0.5p | ) | (0.2p | ) | 80.2p | ||||||||||||

| Reported EPS |

82.2p | (0.1p | ) | (0.5p | ) | — | 81.6p | |||||||||||||

| Statement of financial position |

||||||||||||||||||||

| Right of use asset |

16 | — | — | 272 | 288 | |||||||||||||||

| Borrowings (including lease liability) |

(4,886 | ) | 14 | — | (381 | ) | (5,253 | ) | ||||||||||||

| Finance lease receivable |

— | — | — | 56 | 56 | |||||||||||||||

| Deferred income |

(1,834 | ) | — | (76 | ) | — | (1,910 | ) | ||||||||||||

Additionally, a number of amendments and interpretations have been issued which are not expected to have any significant impact on the Group’s accounting policies and reporting.

| 2 | Segment analysis |

RELX Group is a global provider of information and analytics for professional and business customers across industries operating in four major market segments: Scientific, Technical & Medical is a global information and analytics business helps institutions and professionals advance healthcare, open science, and improve performance for the benefit of humanity; Risk & Business Analytics provides customers with solutions and decision tools that combine public and industry specific content with advanced technology and analytics to assist them in evaluating and predicting risk and enhancing operational efficiency; Legal is a leading global provider of legal, regulatory and business information and analytics that helps customers increase productivity, improve decision making and outcomes and advance the rule of law around the world; and Exhibitions is the world’s leading events business, enhancing the power of face-to-face through data and digital tools at over 500 events, in 30 countries, attracting more than 7m participants.

The Group’s reported segments are based on the internal reporting structure and financial information provided to the Boards.

Adjusted operating profit is the key segmental profit measure used by the Group in assessing performance. Adjusted operating profit is reconciled to operating profit on page 31.

RELX Group 2017 I Results 25

Notes to the condensed consolidated financial information