|

Very truly yours,

|

||

| /s/ Cravath, Swaine & Moore LLP | ||

|

1.

|

Underwriting Agreement, dated May 18, 2020, among RELX Capital Inc., RELX PLC and ABN AMRO Securities (USA) LLC, HSBC Securities (USA) Inc., ING Financial Markets LLC and UBS Securities LLC, as representatives of the several underwriters

named in Schedule 1 thereto.

|

|

2.

|

Form of 3.000% Note due 2030.

|

|

3.

|

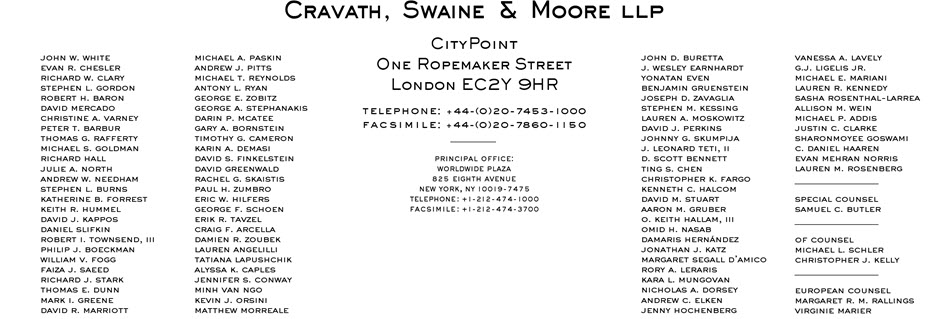

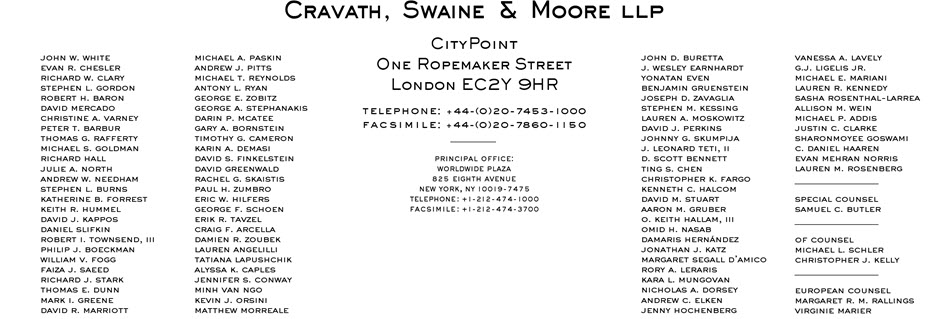

Opinion of Cravath, Swaine & Moore LLP.

|

|

4.

|

Consent of Cravath, Swaine & Moore LLP (included in Exhibit 3).

|

|

5.

|

Opinion of Freshfields Bruckhaus Deringer LLP.

|

|

6.

|

Consent of Freshfields Bruckhaus Deringer LLP (included in Exhibit 5).

|

| RELX PLC | |||

|

Date: May 22, 2020

|

By:

|

/s/ Simon Pereira |

|

| Name: Simon Pereira | |||

| Title: Deputy Secretary | |||

|

Exhibit

Number

|

Exhibit Description

|

|

|

5.1

|

Opinion of Cravath, Swaine & Moore LLP.

|

|

|

5.2

|

Opinion of Freshfields Bruckhaus Deringer LLP as to the law of England and Wales.

|

|

|

23.1

|

Consent of Cravath, Swaine & Moore LLP (included in Exhibit 5.1).

|

|

|

23.2

|

Consent of Freshfields Bruckhaus Deringer LLP as to the law of England and Wales (included in Exhibit 5.2).

|

|

|

99.1

|

Underwriting Agreement, dated May 18, 2020, among RELX Capital Inc., RELX PLC and ABN AMRO Securities (USA) LLC, HSBC Securities (USA) Inc., ING Financial Markets LLC and UBS Securities LLC, as representatives of the several underwriters

named in Schedule 1 thereto.

|

|

|

99.2

|

Form of 3.000% Note due 2030.

|

|

|

Very truly yours,

|

||

| /s/ Cravath, Swaine & Moore LLP | ||

|

LONDON

|

|||

|

65 Fleet Street

|

|||

|

London EC4Y 1HS

|

|||

|

RELX PLC

|

T

|

+

|

44 20 7936 4000

|

|

1-3 Strand

|

Direct T

|

+

|

|

|

London WC2N 5JR

|

F

|

+

|

44 20 7832 7001

|

|

England

|

Direct F

|

+

|

|

|

LDE No 23

|

|||

|

E

|

peter.allen@freshfields.com

|

||

|

W

|

freshfields.com

|

||

|

DOC ID

|

LON55923040

|

||

|

OUR REF

|

PPA/TC

|

||

|

YOUR REF

|

|||

|

CLIENT MATTER NO

|

103037-0174

|

|

5.(a)

|

This opinion is confined to matters of English law (including case law) as at the date of this opinion. We express no opinion with regard to any system of law other than the laws of England as currently

applied by the English courts, and in particular, we express no opinion on European Union law as it affects any jurisdiction other than England.

|

|

(b)

|

By giving this opinion, we do not assume any obligation to notify you of future changes in law which may affect the opinions expressed in this opinion, or otherwise to update this opinion in any respect.

|

|

(c)

|

To the extent that the laws of the State of New York, the General Corporation Law of the State of Delaware and any applicable federal laws of the United States of America (upon all of which you have received

the advice of Cravath, Swaine & Moore LLP) may be relevant, we have made no independent investigation of such laws and our opinion is subject to the effect of such laws including the matters contained in the opinion of Cravath, Swaine

& Moore LLP. We express no views on the validity of the matters set out in such opinions.

|

|

(d)

|

We should also like to make the following observations:

|

|

(i)

|

Factual Statements: we have not been responsible for verifying whether statements of fact (including foreign law), opinion or intention in the

Documents, the Registration Statement or any related documents are accurate, complete or reasonable;

|

||

|

(ii)

|

Nature of Role: we have not been involved in the preparation or negotiation of the Documents, and have

reviewed them only for the limited purpose of giving this opinion in relation to the Debt Securities. Accordingly, we express no view as to the suitability of the Documents or of their provisions or their general compliance with market

practice or any commercial aspects of the Documents;

|

||

|

(iii)

|

Formulae and Cash flows: we have not been responsible for verifying the accuracy or correctness of any formula or ratio (whether expressed in words

or symbols) or financial schedule contained in any of the Documents, or any cash flow model used or to be used in connection with the Debt Securities, or whether such formula, ratio, financial schedule or cash flow model appropriately

reflects the commercial arrangements between the parties;

|

||

|

(iv)

|

Tax: we express no opinion in respect of the tax treatment of the Documents or the Debt Securities; you have not relied on us in relation to the tax

implications of the Debt Securities or the Documents for you or any other person, whether in the United Kingdom or in any other jurisdiction, or the suitability of any tax provisions in the Documents;

|

||

|

(v)

|

Operational Licences: we have not investigated whether REPLC has obtained any of the operational licences, permits and consents which it may require

for the purpose of carrying on its business (including the entry into the Documents); and

|

||

|

(vi)

|

Anti-trust: we have not considered whether the Debt Securities or the Documents comply with civil or criminal antitrust, cartel, competition, public

procurement or state aid laws, nor whether any filings, clearances, notifications or disclosures are required or advisable under such laws.

|

|

(a)

|

Corporate Existence: REPLC has been duly incorporated in the United Kingdom and registered in England and Wales, and the Company Search and

Winding-up Enquiry revealed no application, petition, order or resolution for the administration or winding-up of REPLC and no notice of appointment of, or intention to appoint, a receiver or administrator in respect of REPLC;

|

|

(b)

|

Corporate Power: REPLC has the requisite corporate capacity to enter into the Documents and to perform its obligations under them;

|

|

(c)

|

Corporate Authorisation: the entry into the Documents has been duly authorised by all necessary corporate action on the part of REPLC; and

|

|

(d)

|

Valid/Enforceable Obligations: on the assumption and to the extent that the obligations of REPLC under the Documents constitute legal, valid and

binding obligations of REPLC enforceable in accordance with all applicable laws (including the laws of the State of New York) other than the laws of England, the obligations of REPLC under the Documents, when executed and delivered by REPLC

as provided in the Indenture, will be recognised by, and enforceable in, the English courts subject to and in accordance with the provisions set out below.

|

|

/s/ Freshfields Bruckhaus Deringer LLP

|

|

|

Freshfields Bruckhaus Deringer LLP

|

|

(a)

|

a copy of the indenture (as amended and supplemented, the Indenture) between the Issuer, REPLC, as guarantor, and The Bank of New York Mellon, as

trustee, principal paying agent and registrar, dated as of 9 May 1995, and a copy of each supplemental indenture thereto (being the Supplemental Indenture No 1 executed and delivered on March 2, 1998, the Supplemental Indenture No 2 executed

and delivered on May 26, 1998, the Third Supplemental Indenture executed and delivered on February 21, 2001, the Fourth Supplemental Indenture executed and delivered on July 25, 2001, the Fifth Supplemental Indenture executed and delivered on

January 16, 2009, the Sixth Supplemental Indenture executed and delivered on 12 May 2015, the Seventh Supplemental Indenture executed and delivered on 30 April 2018 and the Eighth Supplemental Indenture executed and delivered on 8 September

2018;

|

|

(b)

|

a copy of the executed Guarantee, endorsed on the executed global notes representing the Debt Securities, dated 22 May 2020;

|

|

(c)

|

a copy of the prospectus dated 28 February 2019 and prospectus supplement relating to the Debt Securities dated 18 May 2020 (the Prospectus); and

|

|

(d)

|

a secretary’s certificate of REPLC dated 22 May 2020 (the Secretary’s Certificate).

|

|

(a)

|

Authenticity: (A) the genuineness of all signatures, (B) that a signatory has personally signed the Document either (i) by hand (a wet ink

signatory); or (ii) by adding an image or their signature to an electronic version of the Document; or (iii) by adding their signature to an electronic version of the Document on an approved web-based electronic signing platform (e-platform) contemplated by the parties and their legal advisors in correspondence; or (iv) by using a mouse, finger, stylus or similar to sign their name in an electronic version of the

Document on a touchscreen device such as an iPad (each signature referred to in (ii) to (iv) an e-signature, and each signatory referred to in (ii) to (iv) an e-signatory), and (C) the genuineness of all stamps and seals on, and the authenticity, accuracy and completeness of, all documents submitted to us (whether as originals or copies);

|

|

(b)

|

Copies: the conformity to originals of all documents supplied to us as photocopies, portable document format (PDF) copies, facsimile copies or e-mail

conformed copies;

|

|

(c)

|

Virtual signings using email and/or PDFs: that the parties have complied with the

procedures for counterpart signature and delivery of the Documents contemplated by the parties and their legal advisers in correspondence and that the parties have validly authorised the attachment of their respective signature pages to the

final texts of the Documents;

|

|

(d)

|

Virtual signing by e-signature of Documents on an e-platform: that where all the parties are signing a Document by an e-signatory, these have complied

with the procedures for signature and delivery of the relevant Document contemplated by the parties and their legal advisers in correspondence, and each e-signatory has, in the order required by such correspondence, personally added his or

her e-signature into an electronic version of the final text of such Document;

|

|

(e)

|

Signing of Documents involving a combination of methods: that, in relation to each Document, the procedures for counterpart signature and delivery of

the relevant Document contemplated by the parties and their legal advisers in correspondence have been complied with in the order required by such correspondence by (i) any wet ink signatory; (ii) any party that has authorised the attachment

of its signature page to the final text of the Document (and that such authorisation is valid); and (ii) any e-signatory that has personally added his or her e-signature to an electronic version of the final text of the Document;

|

|

(f)

|

Constitutional Documents and Responsible Officer’s Certificates: the Memorandum and Articles of Association of REPLC which we have examined are those

in force and the resolutions of the Board of Directors of REPLC and the committee of the Board of Directors of REPLC which we have examined were passed at meetings duly convened and held, have not been amended, rescinded, modified or revoked

and are in full force and effect and the certifications in the Responsible Officer’s Certificate are true and accurate as at the date hereof;

|

|

(g)

|

Directors’ Duties: that the directors of REPLC, in authorising execution of the Guarantee, the Indenture and the Underwriting Agreement, have

exercised their powers in accordance with their duties under all applicable laws and the Memorandum and Articles of Association of REPLC;

|

|

(h)

|

Other Parties - Corporate Capacity/Approval: that each of the parties to the Documents (other than REPLC) has the necessary capacity and corporate

power to execute, deliver and perform the Documents, and that the Documents have been or will be duly authorised, executed and delivered by each of the parties thereto in accordance with all applicable laws (other than, in the case of REPLC,

the laws of England);

|

|

(i)

|

Validity under Other Laws: that the Documents constitute legal, valid and binding obligations of each of the parties thereto enforceable under all

applicable laws (including the laws of the State of New York by which each of the Documents is expressed to be governed and the laws of the State of Delaware but in this regard noting any qualifications as to enforceability of obligations set

out in the opinion of Cravath, Swaine & Moore LLP) (other than, in the case of REPLC, the laws of England) and that insofar as the laws or regulations of any other jurisdiction may be relevant to (i) the obligations or rights of any of

the parties under any of the Documents, or (ii) any of the transactions contemplated by any of the Documents, such laws and regulations do not prohibit, and are not inconsistent with, the entering into and performance of any of such

obligations, rights or transactions;

|

|

(j)

|

Filings under Other Laws: that all consents, licences, approvals, notices, filings, recordations, publications and registrations which are necessary

under any applicable laws (other than, in the case of REPLC, the laws of England) in order to permit the execution, delivery or performance of the Documents or to perfect, protect or preserve any of the interests created by the Documents,

have been made or obtained, or will be made or obtained within the period permitted or required by such laws or regulations;

|

|

(k)

|

Unknown Facts: that there are no facts or circumstances (and no documents, agreements, instruments or correspondence, nor any course of dealings)

which are not apparent from the face of the Documents or which have not been disclosed to us that may affect the validity or enforceability of the Documents or any obligation therein or otherwise affect the opinions expressed in this opinion.

However, we confirm that we have examined all documents, agreements and other materials known to us that we consider necessary for the purposes of issuing this opinion;

|

|

(l)

|

Arm’s Length Terms: that the Documents have been entered into for bona fide commercial reasons and on arm’s length terms by each of the parties

thereto;

|

|

(m)

|

Company Search: that the information revealed by the Company Search (i) was accurate in all respects and has not since the time of such searches been

altered, and (ii) was complete and included any and all relevant information which had been properly submitted to the Registrar of Companies;

|

|

(n)

|

Winding-up Enquiry: that the information revealed by the Winding-up Enquiry was accurate in all respects and has not since the time of such enquiry

been altered;

|

|

(o)

|

Bad Faith, Fraud, Duress: the absence of bad faith, breach of duty, breach of trust, fraud, coercion, duress or undue influence on the part of any of

the parties to the Documents and their respective directors, employees, agents and advisers (excepting, of course, ourselves);

|

|

(p)

|

Representations: that the representations and warranties by the respective parties in the Documents (other than as to matters of law on which we opine

in this opinion) are or were, as applicable, true, correct, accurate and complete in all respects on the date such representations and warranties were expressed to be made, and that the terms of the Documents have been and will be observed

and performed by the parties thereto;

|

|

(q)

|

Financial crime, antitrust and criminal cartel, sanctions and human rights, etc.: that the parties to the Documents and all persons representing them

have complied (and will continue to comply) with all applicable anti-terrorism, anti-corruption, anti-money laundering, anti-tax evasion, other financial crime, civil or criminal antitrust, cartel, competition, public procurement, state aid,

sanctions and human rights laws and regulations which may affect the Documents, and that performance and enforcement of the Documents is, and will continue to be, consistent with all such laws and regulations;

|

|

(r)

|

Secondary Legislation: that all UK secondary legislation relevant to

this opinion is valid, effective and enacted within the scope of the powers of the relevant rule-making authorities; and

|

|

(s)

|

New York law: satisfactory evidence of the laws of the State of New York (by which each of the Documents is expressed to be governed) which is

required to be pleaded and proved as a fact in any proceedings before the English Courts with respect to the Documents, could and would be so pleaded and proved.

|

|

(a)

|

Company Search: the Company Search is not capable of revealing conclusively whether or not:

|

|

(i)

|

a winding up order has been made or a resolution passed for the winding up of a company;

|

||

|

(ii)

|

an administration order has been made;

|

||

|

(iii)

|

a receiver, administrative receiver, administrator or liquidator has been appointed; or

|

||

|

(iv)

|

a court order has been made under the Cross-Border Insolvency Regulations 2006,

|

|

since notice of these matters may not be filed with the Registrar of Companies immediately and, when filed, may not be entered on the public microfiche of the relevant company immediately.

|

|

|

In addition, the Company Search is not capable of revealing, prior to the making of the relevant order or the appointment of an administrator otherwise taking effect, whether or

not a winding up petition or an application for an administration order has been presented or notice of intention to appoint an administrator under paragraphs 14 or 22 of Schedule B1 to the Insolvency Act 1986 has been filed with the court;

|

|

|

(b)

|

Winding up Enquiry: the Winding up Enquiry relates only to the presentation of: (i) a petition for the making of a winding up order or the making of

a winding up order by the Court, (ii) an application to the High Court of Justice in London for the making of an administration order and the making by such court of an administration order, and (iii) a notice of intention to appoint an

administrator or a notice of appointment of an administrator filed at the High Court of Justice in London. It is not capable of revealing conclusively whether or not such a winding up petition, application

for an administration order, notice of intention or notice of appointment has been presented or winding up or administration order granted, because

|

|

(i)

|

details of a winding up petition or application for an administration order may not have been entered on the records of the Central Registry of Winding-up Petitions immediately;

|

||

|

(ii)

|

in the case of an application for the making of an administration order and such order and the presentation of a notice of intention to appoint or notice of appointment, if such application is made to, order

made by or notice filed with, a Court other than the High Court of Justice in London, no record of such application, order or notice will be kept by the Central Registry of Winding-up Petitions;

|

||

|

(iii)

|

a winding up order or administration order may be made before the relevant petition or application has been entered on the records of the Central Registry, and the making of such order may not have been entered

on the records immediately;

|

|

(iv)

|

details of a notice of intention to appoint an administrator or a notice of appointment of an administrator under paragraphs 14 and 22 of Schedule B1 of the Insolvency Act 1986 may not be entered on the records

immediately (or, in the case of a notice of intention to appoint, at all); and

|

||

|

(v)

|

with regard to winding up petitions, the Central Registry of Winding-up Petitions may not have records of winding up petitions issued prior to 1994;

|

|

(c)

|

Choice of Law: the choice of the laws of the State of New York to govern the Documents would not be recognised or upheld by the English courts where

to do so would be inconsistent with Regulation (EC) No. 593/2008 on the law applicable to contractual obligations and Regulation (EC) No. 864/2007 on the law applicable to non-contractual obligations;

|

|

(d)

|

Jurisdiction: we express no opinion as to whether or not the chosen court will take jurisdiction, or whether the English courts would grant a stay of

any proceedings commenced in England, or whether the English courts would grant any ancillary relief in relation to proceedings commenced in a foreign court;

|

|

(e)

|

Service of Process: an English court will only assume jurisdiction over a dispute and give judgment if the defendant has been properly served with

legal process;

|

|

(f)

|

Foreign Courts: we express no opinion as to whether or not a foreign court (applying its own conflict of laws rules) will act in accordance with the

parties’ agreement as to jurisdiction and/or choice of law;

|

|

(g)

|

Foreign Currencies: English courts can give judgments in currencies other than pounds sterling if, subject to the terms of the contract, it is the

currency which most fairly expresses the claimant’s loss, but such judgments may be required to be converted into pounds sterling for enforcement purposes;

|

|

(h)

|

Security for Costs: under the rules of procedure applicable, an English court may, in certain circumstances, order a claimant in an action, to provide

security for costs;

|

|

(i)

|

Stamp Duty Indemnities: any undertakings or indemnities in relation to United Kingdom stamp duties given by REPLC may be void under the provisions of

Section 117 of the Stamp Act 1891;

|

|

(j)

|

Penalties: any provision in the Documents providing for the payment of additional moneys by any party, withholding of moneys, transfer of assets,

forfeiture or other provisions which set out the consequences of such a party’s breach, whether expressed by way of, or having the effect of, additional interest, liquidated damages or otherwise, would be unenforceable if such provision was

held to constitute a penalty. We express no opinion as to whether any such provision is a penalty;

|

|

(k)

|

Amendments to Guaranteed Contracts: an English court may interpret restrictively any provision purporting to allow the beneficiary of a guarantee or

other suretyship to make a material amendment to the obligations to which the guarantee or suretyship relates without further reference to the guarantor or surety. In relation to the Guarantee, we would advise obtaining the confirmation of

the guarantor or surety in respect of such amendments to the guaranteed obligations;

|

|

(l)

|

Severability: in some circumstances an English court would not give effect to any provision of the Documents which provides that in the event of any

invalidity, illegality or unenforceability of any provision of any such document, the remaining provisions thereof shall not be affected or impaired, in particular if to do so would not accord with public policy or would involve the court in

making a new contract for the parties;

|

|

(m)

|

Conditionality: where we express an opinion on the enforceability of the obligations of the Company, such opinion relates to enforceability of those

obligations subject to the terms of the relevant Documents. For example, where any Document is expressed to be subject to conditions precedent, obligations under that Document may not be enforceable until all such conditions have been

satisfied and the Documents are unconditional in all respects;

|

|

(n)

|

Enforcement Limitations: an English court may refuse to give effect to any provision in an agreement: (i) for the payment of costs and expenses (A) in

respect of enforcement (actual or contemplated), or (B) in respect of unsuccessful litigation brought before an English court, or (C) where the court has itself made an order in respect of those costs and expenses; or (ii) which would involve

the enforcement of penal revenue or other public laws of a foreign state; or (iii) which would be inconsistent with English public policy;

|

|

(o)

|

“Enforceable”: the term “enforceable” as used in this opinion means that the obligations assumed by the relevant party under the relevant document are

of the type which the English courts enforce. This opinion is not to be taken to imply that any obligation would necessarily be capable of enforcement in all circumstances in accordance with its terms. In particular:

|

|

(i)

|

an English court will not necessarily grant any remedy the availability of which is subject to equitable considerations, or which is otherwise in the discretion of the court. In particular, orders for specific

performance and injunctions are, in general, discretionary remedies under English law and specific performance is not available where damages are considered by the court to be an adequate alternative remedy;

|

||

|

(ii)

|

claims may become barred under the Limitation Act 1980 or the Foreign Limitation Periods Act 1984 or may be or become subject to the defence of set-off or to counterclaim;

|

||

|

(iii)

|

where obligations are to be performed in a jurisdiction outside England, they may not be enforceable in England to the extent that performance would be illegal under the laws, or contrary to the exchange

control regulations, of the other jurisdiction;

|

||

|

(iv)

|

the enforcement of obligations may be limited by the provisions of English law applicable to agreements held to have been frustrated by events happening after their execution;

|

||

|

(v)

|

where a judgement is obtained against a State, the State may, even where it has submitted to the jurisdiction of the English courts in relation to the substantive dispute, be able to resist the enforcement of

the judgment on grounds of state immunity;

|

||

|

(vi)

|

enforcement of obligations may be invalidated by reason of fraud;

|

|

(vii)

|

the enforcement of obligations may be limited or excluded by the provisions of the Human Rights Act 1998; and

|

||

|

(viii)

|

there is doubt as to the enforceability in England and Wales of US judgments in respect of civil judgments predicated purely on US securities law;

|

|

(p)

|

Informal Amendments: a provision in the Documents requiring amendments or waivers to be in writing and signed by the parties may not be effective in

certain limited circumstances by virtue of oral variation or an implied course of conduct;

|

|

(q)

|

Other Contracts: to the extent that any operative provision in a Document is reliant on another contract or a provision in another contract, and such

other contract or provision is held to be void then such operative provision would also be unenforceable, to the extent of such reliance;

|

|

(r)

|

Exculpatory Provisions: the effectiveness of contractual terms exculpating a party from liabilities or duties otherwise owed is limited by law;

|

|

(s)

|

Confidentiality: provisions imposing confidentiality obligations may be overridden by the requirement of legal process;

|

|

(t)

|

Insolvency: this opinion is subject to all applicable laws relating to insolvency, bankruptcy, administration, reorganisation, liquidation or

analogous circumstances and other similar laws of general application relating to or affecting generally the enforcement of creditors’ rights and remedies from time to time;

|

|

(u)

|

Entire Agreement Clauses: an English court may not recognise the effectiveness of an entire agreement clause, particularly in circumstances where

pre-contractual representations have been made which are alleged to be fraudulent;

|

|

(v)

|

Indemnity: any indemnity obligations imposed under any of the Documents may not be legal, valid, binding or enforceable insofar as they relate to

fines and penalties arising out of matters of civil or criminal liability;

|

|

(w)

|

Exercise of Statutory Powers: any provision of the Documents which restricts the exercise of a statutory power by a party may be ineffective; and

|

|

(x)

|

Set-off: we express no opinion on whether a right of set-off against contingent, unascertained or unmatured obligations would be effective.

|

|

Very truly yours,

|

||

|

RELX CAPITAL INC.

|

||

|

By:

|

/s/ Kenneth E. Fogarty

|

|

|

Authorized Signatory

|

||

|

RELX PLC

|

||

|

By:

|

/s/ Nick Luff

|

|

|

Authorized Signatory

|

||

|

ABN AMRO Securities (USA) LLC

|

|

|

By:

|

/s/ Sander Spierings |

|

Authorized Signatory

|

|

|

Sander Spierings

Managing Director

|

|

|

By:

|

/s/ Nicholas Severyn

|

|

Authorized Signatory

|

|

|

Nicholas Severyn

Director

|

|

|

HSBC Securities (USA) Inc.

|

|

|

By:

|

/s/ Diane M. Kenna |

|

Authorized Signatory

|

|

|

ING Financial Markets LLC

|

|

|

By:

|

/s/ Ricardo Zemella |

|

Authorized Signatory

|

|

|

Ricardo Zemella

Managing Director

|

|

|

By:

|

/s/ Cefas van Tol |

|

Authorized Signatory

Cefas van Tol

Managing Director

|

|

|

UBS Securities LLC

|

|

|

By:

|

/s/ Todd Mahoney |

|

Authorized Signatory

Todd Mahoney

Managing Director

Head of DCM Syndicate Americas

|

|

|

By:

|

/s/ Igor Grinberg |

|

Authorized Signatory

Igor Grinberg

Executive Director

DCM Syndicate Americas

|

|

|

Underwriters

|

Aggregate Principal

Amount of Notes

|

|

ABN AMRO Securities (USA) LLC

|

$187,500,000

|

|

HSBC Securities (USA) Inc.

|

$187,500,000

|

|

ING Financial Markets LLC

|

$187,500,000

|

|

UBS Securities LLC

|

$187,500,000

|

|

Total

|

$750,000,000

|

|

PRICING TERM SHEET

RELX Capital Inc.

|

|

|

$750,000,000 3.000% Notes due 2030

|

|

|

Fully and unconditionally guaranteed by

RELX PLC

|

|

|

Issuer:

|

RELX Capital Inc.

|

|

Guarantor:

|

RELX PLC

|

|

Title of Securities:

|

3.000% Notes due 2030 (the “Notes”)

|

|

Principal Amount Offered:

|

$750,000,000

|

|

Maturity Date:

|

May 22, 2030

|

|

Coupon (Interest Rate):

|

3.000% per annum

|

|

Interest Payment Dates:

|

Semi-annually on May 22 and November 22 of each year, beginning on November 22, 2020

|

|

Record Dates:

Day Count Fraction:

|

The 15th calendar day preceding each Interest Payment Date, whether or not such day is a Business Day

30/360

|

|

Price to Public (Issue Price):

|

99.342% of principal amount, plus accrued interest from the expected settlement date

|

|

Net Proceeds to the Issuer:

|

$741,690,000.00 (after underwriting discount and before other offering expenses)

|

|

Benchmark Treasury:

|

0.625% due May 15, 2030

|

|

Benchmark Treasury Price/Yield:

|

99-00+ / 0.727%

|

|

Spread to Benchmark Treasury:

|

+235 basis points

|

|

Yield to Maturity:

|

3.077%

|

|

Make-Whole Call:

|

Make-whole call at the applicable Treasury Rate plus 40 basis points (before February 22, 2030 (the date that is three months prior to the Maturity Date))

|

|

Par Call:

|

At any time on or after February 22, 2030 (the date that is three months prior to the Maturity Date), the Notes will be redeemable in whole or in part at 100% of the principal amount of the Notes being redeemed, plus accrued interest on

the principal amount being redeemed to the redemption date.

|

|

Trade Date:

|

May 18, 2020

|

|

Expected Settlement Date (T+4)*:

|

May 22, 2020

|

|

ISIN:

|

US74949LAD47

|

|

CUSIP:

|

74949L AD4

|

|

Listing / Trading:

|

Application will be made to the New York Stock Exchange for the Notes to be listed and traded thereon. There can be no assurance that any such application will be successful or that any such listing will be granted or maintained.

|

|

Denominations / Multiple:

|

$1,000 / $1,000

|

|

Delivery:

|

DTC

|

|

Ratings**:

|

Moody’s: Baa1 (stable); S&P: BBB+ (stable); Fitch: BBB+ (stable)

|

|

Joint Book-Running Managers:

|

ABN AMRO Securities (USA) LLC

HSBC Securities (USA) Inc.

ING Financial Markets LLC

UBS Securities LLC

|

| (a) |

it has not offered, sold or otherwise made available and will not offer, sell or otherwise make available any Notes which are the subject of the offering contemplated by the prospectus to any retail investor in the European Economic

Area or in the United Kingdom. For the purposes of this provision:

|

| (i) |

the expression “retail investor” means a person who is one (or more) of the following:

|

| (1) |

a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”) or

|

| (2) |

a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as

defined in point (10) of Article 4(1) of MiFID II; or

|

| (3) |

not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”); and

|

| (ii) |

the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the

Notes;

|

| (b) |

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in

connection with the issue or sale of any Notes in circumstances in which Section 21(1) of the FSMA does not apply to the Issuer; and

|

| (c) |

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to any Notes in, from or otherwise involving the United Kingdom.

|

|

Principal Amount

|

No. [●]

|

|

$[●]

|

ISIN: US74949LAD47

|

|

CUSIP: 74949L AD4

|

| RELX CAPITAL INC. | ||||

|

|

By:

|

|

||

| Name: | Kenneth E. Fogarty |

|||

| Title: | President, Treasurer and Assistant Secretary |

|||

|

|

Attested:

|

|

||

| Name: | Renee Simonton |

|||

| Title: | Assistant Secretary and Assistant Treasurer |

|||

| THE BANK OF NEW YORK MELLON, as Trustee | ||||

|

|

By:

|

|

||

| Authorized Officer | ||||

|

(a)

|

any tax, assessment, duty or other governmental charge which would not have been imposed but for:

|

|

(i)

|

the existence of any present or former connection (other than the mere acquisition, ownership or holding of, or the receipt of payment or the exercise or enforcement of rights in respect of, this Debt Security) between the Holder of this

Debt Security (or between a fiduciary, settlor, beneficiary, member of, shareholder of, or possessor of a power over that Holder, if that Holder is an estate, trust, partnership or corporation or any Person other than the Holder to which this

Debt Security or any amount payable on this Debt Security is attributable for the purpose of that tax, assessment or charge) and a Relevant Taxing Jurisdiction, including, without limitation, that Holder (or fiduciary, settlor, beneficiary,

member, shareholder or possessor or person other than the Holder) being or having been a citizen or resident of a Relevant Taxing Jurisdiction or being or having been present or engaged in a trade or business in a Relevant Taxing

Jurisdiction, or having or having had a permanent establishment in a Relevant Taxing Jurisdiction; or

|

||

|

(ii)

|

the presentation of this Debt Security (where presentation is required) for payment on a date more than 30 days after the date on which payment became due and payable or the date on which payment was duly provided for, whichever occurred

later, except to the extent that the Holder would have been entitled to Additional Amounts on presenting this Debt Security for payment on or before the thirtieth day;

|

|

(b)

|

any estate, inheritance, gift, sale, transfer or personal property tax, assessment or other governmental charge of a similar nature;

|

|

|

(c)

|

any tax, assessment, duty or other governmental charge that is imposed or withheld by reason of the failure by that Holder or any other Person mentioned in (a) above to comply, after reasonable notice (at least 30 days before any such

withholding would be payable), with a request of the Company or the Guarantor, as the case may be, addressed to that Holder or that other Person to provide information concerning the nationality, residence or identity of that Holder or that

other Person, or to make any declaration or other similar claim or satisfy any reporting requirement, which is, in either case, required by a statute, treaty or regulation of the Relevant Taxing Jurisdiction, as a precondition to exemption

from or reduction of that tax, assessment or other governmental charge;

|

|

|

(d)

|

any tax, assessment, duty or other governmental charge imposed by reason of such Holder’s past or present status as a passive foreign investment company, a controlled foreign corporation or personal holding company with respect to the

United States, or as a corporation which accumulates earnings to avoid United States federal income tax;

|

|

|

(e)

|

any tax, assessment, duty or other governmental charge imposed on interest received by:

|

|

(i)

|

a 10% shareholder (as defined in Section 871(h)(3)(B) of the United States Internal Revenue Code of 1986, as amended (the “Code”), and the regulations that may be promulgated thereunder) of the Company;

|

||

|

(ii)

|

a controlled foreign corporation related to the Company within the meaning of Section 864(d)(4) of the Code; or

|

||

|

(iii)

|

a bank receiving interest described in Section 881(c)(3)(A) of the Code;

|

|

(f)

|

any Debt Security that is presented for payment by or on behalf of a resident of a member state of the European Union who would have been able to avoid any withholding or deduction by presenting the relevant Debt Security to another Paying

Agent in a member state of the European Union;

|

|

|

(g)

|

any tax, assessment, duty or other governmental charge required to be withheld or deducted under Sections 1471 through 1474 of the Code (or any amended or successor version of such Sections) (“FATCA”), any regulations or other

guidance thereunder, any agreement (including any intergovernmental agreement) entered into in connection therewith, or any law, regulation or other official guidance enacted in any jurisdiction implementing FATCA or an intergovernmental

agreement in respect of FATCA; or

|

|

|

(h)

|

any combination of items (a) through (g) above,

|

|

●

|

any tax, assessment, duty or other governmental charge that is payable other than by deduction or withholding from payments on this Debt Security; or

|

|

|

●

|

any payment to any Holder which is a fiduciary or a partnership or other than the sole beneficial owner of this Debt Security to the extent a beneficiary or settlor with respect to that

|

| fiduciary or a member of that partnership or the beneficial owner would not have been entitled to those Additional Amounts had it been the Holder of this Debt Security. |

|

●

|

100% of the principal amount of this Debt Security; and

|

|

|

●

|

the present value of the Remaining Scheduled Payments (as defined below) on this Debt Security, discounted to the Redemption Date, on a semi-annual basis, at the Treasury Rate plus 40 basis points.

|

|

●

|

100% of the principal amount of this Debt Security; and

|

|

|

●

|

the present value of the Remaining Scheduled Payments (as defined below) on this Debt Security, discounted to the Redemption Date, on a semi-annual basis, at the Treasury Rate plus 40 basis points;

|

|

●

|

accept for payment all Debt Securities or portions of Debt Securities properly tendered pursuant to the Change of Control Offer on the Change of Control Payment Date; and

|

|

|

●

|

deliver or cause to be delivered to the Trustee the Debt Securities properly accepted together with an Officer’s Certificate stating the aggregate principal amount of Debt Securities or portions of Debt Securities being purchased by the

Company.

|

| RELX PLC | ||||

|

|

By:

|

|

||

| Name: | Nick Luff |

|||

| Title: | Chief Financial Officer |

|||

;$XNIM\28:,(XCW+-*_

MG.)92H&0"U>^!-1OC*LUZ[F34;:\2Y4B*:-8+3REPD<8BW+.%8(5,0#E9=9\+QPI<,ULT4BIL*QE]R.$OE8!$8E!NCN2V-L9978J6Y +3ZGX>BO

M%A;R/M!5]KB(LNV['GR+YX0Q?Z2$$A3S,S84[6.* (!-X:\/) JI;VT=SFXA

M*0MMVE%B:8LB$1IY