UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended March 31, 2022

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ____________ to ____________

Commission File No.: 1-14880

LIONS GATE ENTERTAINMENT CORP.

(Exact name of registrant as specified in its charter)

| N/A | |||||||||||||||||||||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||||||||||||||||||||

| (877) 848-3866 | (310) 449-9200 | ||||||||||||||||||||||

(Address of Principal Executive Offices, Zip Code)

Registrant’s telephone number, including area code:

(877 ) 848-3866

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☑ | Accelerated filer | ☐ | |||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||||||||

| Emerging growth company | |||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of September 30, 2021 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $2,474,675,945 , based on the closing sale price of such shares as reported on the New York Stock Exchange.

As of May 20, 2022, 83,272,113 shares of the registrant’s no par value Class A voting common shares were outstanding, and 142,462,033 shares of the registrant's no par value Class B non-voting common shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| Page | |||||

2

FORWARD-LOOKING STATEMENTS

This report includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “potential,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “may,” “will,” “could,” “would” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those discussed under Part I, Item 1A. “Risk Factors.” These risk factors should not be construed as exhaustive and should be read with the other cautionary statements and information in this report. These factors may also be increased or intensified as a result of (i) continuing events related to the coronavirus (COVID-19) global pandemic (including as a result of potential resurgences of COVID-19 in certain parts of the world), and the spread of new variants of the virus which could result in the re-imposition of restrictions to reduce its spread and (ii) Russia's invasion of Ukraine, including indirect impacts as a result of sanctions and economic disruptions. The extent to which the COVID-19 global pandemic or Russia's invasion of Ukraine ultimately impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted.

We caution you that forward-looking statements made in this report or anywhere else are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially and adversely from those made in or suggested by the forward-looking statements contained in this report as a result of various important factors, including, but not limited to: the potential effects of the COVID-19 global pandemic on the Company, and economic and business conditions; the potential effects of Russia's invasion of Ukraine on the Company, and economic and business conditions; the substantial investment of capital required to produce and market films and television series; budget overruns; limitations imposed by our credit facilities and notes; unpredictability of the commercial success of our motion pictures and television programming; risks related to acquisition and integration of acquired businesses; the effects of dispositions of businesses or assets, including individual films or libraries; the cost of defending our intellectual property; technological changes and other trends affecting the entertainment industry; potential adverse reactions or changes to business or employee relationships; and the other risks and uncertainties discussed under Part I, Item 1A. Risk Factors herein.

Any forward-looking statements which we make in this report speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

This Annual Report on Form 10-K contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

Unless otherwise indicated or the context requires, all references to the “Company,” “Lionsgate,” “we,” “us,” and “our” refer to Lions Gate Entertainment Corp., a corporation organized under the laws of the province of British Columbia, Canada, and its direct and indirect subsidiaries.

3

PART I

ITEM 1. BUSINESS.

Overview

Lionsgate (NYSE: LGF.A, LGF.B) encompasses world-class motion picture and television studio operations aligned with the STARZ premium global subscription platform to bring a unique and varied portfolio of entertainment to consumers around the world. Our film, television, subscription and location-based entertainment businesses are backed by a 17,000-title library and a valuable collection of iconic film and television franchises.

We manage and report our operating results through three reportable business segments: Motion Picture, Television Production and Media Networks. We refer to our Motion Picture and Television Production segments collectively as our Studio Business. Financial information for our segments is set forth in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in this Annual Report.

COVID-19 Global Pandemic

Since fiscal 2020, the economic, social and regulatory impacts associated with the ongoing COVID-19 global pandemic (including its variants), continued measures to prevent its spread, and the resulting economic uncertainty, have affected our business in a number of ways.

We experienced delays in theatrical distribution of our films, both domestically and internationally, as well as delays in the production of film and television content (resulting in continued changes in future release dates for some titles and series). Although film and television production have generally resumed, we continue to see disruption of production activities depending on local circumstances. We also cannot predict whether productions that have resumed will be paused again, or the impact of incremental costs required to adhere to health and safety protocols. Additionally, although the lifting of quarantines have enabled many theaters to reopen, we are unable to predict how shifting government mandates or guidance regarding COVID-19 restrictions will impact patronage and theater capacity. In turn, production delays (and fewer theatrical releases) have limited the availability of film content to be sold in distribution windows subsequent to the theatrical release, and have resulted in delays of release of new television content, including on our STARZ platform.

The impact of these disruptions and the extent of their adverse impact on our financial and operating results will be dictated by the length of time that such disruptions continue, which will, in turn, depend on the currently unknowable duration and severity of the impacts of COVID-19 and its variants, and among other things, the impact of governmental actions imposed in response to COVID-19 and individuals’ and companies’ responses regarding health matters going forward. We have incurred and will continue to incur additional costs to address government regulations and the safety of our employees and talent.

For additional information regarding the impact of COVID-19 on our operating results, cash flows and financial position, and the other risks and uncertainties see Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations in this Annual Report.

Studio Business

Motion Picture: Our Motion Picture segment includes revenues derived from the following:

•Theatrical. Theatrical revenues are derived from the domestic theatrical release of motion pictures licensed to theatrical exhibitors on a picture-by-picture basis (distributed by us directly in the United States and through a sub-distributor in Canada).

•Home Entertainment. Home entertainment revenues are derived from the sale or rental of our film productions and acquired or licensed films and certain television programs (including theatrical and direct-to-video releases) on packaged media and through digital media platforms (including pay-per-view and video-on-demand platforms, electronic sell through, and digital rental). In addition, we have revenue sharing arrangements with certain digital media platforms which generally provide that, in exchange for a nominal or no upfront sales price, we share in the rental or sales revenues generated by the platform on a title-by-title basis.

4

•Television. Television revenues are primarily derived from the licensing of our theatrical productions and acquired films to the linear pay, basic cable and free television markets. In addition, when a license in our traditional pay television window is made to a subscription video-on-demand ("SVOD") or other digital platform, the revenues are included here.

•International. International revenues are derived from (i) licensing of our productions, acquired films, our catalog product and libraries of acquired titles to international distributors, on a territory-by-territory basis, and (ii) the direct distribution of our productions, acquired films, and our catalog product and libraries of acquired titles in the United Kingdom.

•Other. Other revenues are derived from, among others, the licensing of our film and television and related content (e.g., games, music, location-based entertainment royalties, etc.) to other ancillary markets.

Television Production: Our Television Production segment includes revenues derived from the following:

•Television. Television revenues are derived from the licensing to domestic markets (linear pay, basic cable, free television and syndication) of scripted and unscripted series, television movies, mini-series and non-fiction programming. Television revenues include fixed fee arrangements as well as arrangements in which we earn advertising revenue from the exploitation of certain content on television networks. Television revenues also include revenue from licenses to SVOD platforms in which the initial license of a television series is to an SVOD platform.

•International. International revenues are derived from the licensing and syndication to international markets of scripted and unscripted series, television movies, mini-series and non-fiction programming.

•Home Entertainment. Home Entertainment revenues are derived from the sale or rental of television production movies or series on packaged media and through digital media platforms.

•Other. Other revenues are derived from, among others, the licensing of our television programs to other ancillary markets, the sales and licensing of music from the television broadcasts of our productions, and from commissions and executive producer fees earned related to talent management.

Media Networks

Our Media Networks segment includes revenues derived from the following:

•Starz Networks. Starz Networks’ revenues are derived from the domestic distribution of our STARZ branded premium subscription video services through over-the-top ("OTT") platforms and U.S. multichannel video programming distributors (“MVPDs”) including cable operators, satellite television providers and telecommunications companies (collectively, “Distributors”) on a direct-to-consumer basis through the Starz App.

•STARZPLAY International. STARZPLAY International revenues are primarily derived from OTT distribution of the Company's STARZ branded premium subscription video services outside of the U.S.

Segment Revenue

For the year ended March 31, 2022, contributions to the Company’s consolidated revenues from its reporting segments included Motion Picture 32.9%, Television Production 42.5% and Media Networks 42.6%, and intersegment revenue eliminations represented (18.0)% of consolidated revenues.

Within the Motion Picture segment, revenues were generated from the following:

•Theatrical, 5.5%;

•Home Entertainment, 51.6%;

•Television, 21.8%;

•International, 19.8%; and

•Motion Picture-Other, 1.3%.

5

Within the Television Production segment, revenues were generated from the following:

•Television, 71.5%;

•International, 16.8%;

•Home Entertainment, 6.0%; and

•Television Production-Other, 5.6%.

Within the Media Networks segment, revenues were generated from the following:

•Starz Networks, 93.0%;

•STARZPLAY International, 7.0%

Corporate Strategy

We grow and diversify our portfolio of content to capitalize on demand from streaming and traditional platforms throughout the world. We maintain a disciplined approach to acquisition, production and distribution of content by balancing our financial risks against the probability of commercial success for each project. We also continue to invest in new programming and support the growth of STARZ’s direct-to-consumer offering and expansion of STARZPLAY, our international premium branded SVOD service. We believe that our strategic focus on content, alignment of our content creation and distribution platforms, and creation of other innovative content distribution strategies will enhance our competitive position in the industry, ensure optimal use of our capital, build a diversified foundation for future growth and create significant incremental long-term value for our shareholders.

STUDIO BUSINESS: MOTION PICTURE

Motion Picture - Theatrical

Production and Acquisition

We take a disciplined approach to theatrical production, with the goal of producing content that can be distributed through various domestic and international platforms. In doing so, we may mitigate the financial risk associated with production by, among other things:

•Negotiating co-financing development and co-production agreements which may provide for cost-sharing with one or more third-party companies;

•Pre-licensing international distribution rights on a selective basis, including through international output agreements (which license rights to distribute a film in one or more media generally for a limited term, and in one or more specific territories prior to completion of the film);

•Structuring agreements that provide for talent participation in the financial success of the film in exchange for reduced guaranteed “up-front payments” that would be paid regardless of the film's success; and

•Utilizing governmental incentives, programs and other structures from state and foreign countries (e.g., sales tax refunds, transferable tax credits, refundable tax credits, low interest loans, direct subsidies or cash rebates, calculated based on the amount of money spent in the particular jurisdiction in connection with the production).

Our approach to acquiring films complements our theatrical production strategy - we typically seek to limit our financial exposure while adding films with high potential for commercial box office success, critical recognition and successful monetization across a broad array of platforms.

Distribution

The economic life of a motion picture may consist of its exploitation in theaters, on packaged media and on various digital and television platforms in territories around the world. We generally distribute motion pictures directly to movie theaters in the U.S. whereby the exhibitor retains a portion of the gross box office receipts and the balance is remitted to the distributor. Concurrent with their release in the U.S., films are generally released in Canada and may also be released in one or more other foreign markets. We construct release schedules taking into account moviegoer attendance patterns and competition from other studios' scheduled theatrical releases. After the initial theatrical release, distributors seek to maximize revenues by releasing films in sequential release date windows, which may be exclusive against other non-theatrical distribution platforms. As a result of the COVID-19 global pandemic, in certain circumstances, our distribution strategy has and may continue to change, and certain films intended for theatrical release may be licensed to other platforms.

6

Producing, marketing and distributing films can involve significant risks and costs, and can cause our financial results to vary depending on the timing of a film’s release. For instance, marketing costs are generally incurred before and throughout the theatrical release of a film and, to a lesser extent, other distribution windows, and are expensed as incurred. Therefore, we typically incur losses with respect to a particular film prior to and during the film’s theatrical exhibition, and profitability for the film may not be realized until after its theatrical release window. Further, we may revise the release date of a film as the production schedule changes or in such a manner as we believe is likely to maximize revenues or for other business reasons. Additionally, there can be no assurance that any of the films scheduled for release will be completed and/or in accordance with the anticipated schedule or budget, or that the film will ever be released.

Theatrical Releases

In fiscal 2022 (i.e., the twelve-month period ended March 31, 2022), with continued closures and limited re-opening of theaters resulting from the COVID-19 global pandemic, we released sixteen (16) films theatrically in the U.S. across our labels (which include Lionsgate, Summit Entertainment, Good Universe and our partnership with Roadside Attractions). We also made changes to release dates as well as release strategies of several of our films by releasing solely and/or earlier on streaming platforms, initially releasing on premium video-on-demand ("PVOD"), premium electronic sell-through (“PEST”), or by licensing directly to streaming platforms. In fiscal 2022, such titles and their release patterns included the following:

Fiscal 2022 | |||||||||||

Film Releases via Lionsgate/Summit | |||||||||||

Title | Release Date | Release Pattern | Label/Partnership | ||||||||

Chaos Walking† | March 5, 2021 | Theatrical and PVOD | Lionsgate | ||||||||

Voyagers†† | April, 9, 2021 | Theatrical and PVOD | Summit | ||||||||

Spiral ††† | May 14, 2021 | Theatrical and PVOD | Lionsgate | ||||||||

The Hitman's Wife's Bodyguard | June 16, 2021 | Theatrical and Accelerated Home Entertainment | Summit | ||||||||

The Protege | August 20, 2021 | Theatrical and Accelerated Home Entertainment | Lionsgate | ||||||||

Ghost in the Shell (1995) | September 17, 2021 | Theatrical Re-release | Lionsgate | ||||||||

The Jesus Music | October 1, 2021 | Theatrical | Lionsgate | ||||||||

American Underdog | December 25, 2021 | Theatrical and Accelerated Home Entertainment | Lionsgate | ||||||||

Moonfall | February 4, 2022 | Theatrical and Accelerated Home Entertainment | Summit | ||||||||

† PVOD release on April 2, 2021

†† PVOD release on April 30, 2021

††† PVOD release on June 1, 2021

Fiscal 2022 | |||||||||||

Film Releases via Roadside Attractions | |||||||||||

Title | Release Date | Release Pattern | Label/Partnership | ||||||||

The Courier* | March 19, 2021 | Theatrical and PVOD | Roadside Attractions | ||||||||

Finding You | May 14, 2021 | Theatrical | Roadside Attractions | ||||||||

Rita Moreno: Just a Girl Who Decided to Go For It | June 18, 2021 | Theatrical | Roadside Attractions | ||||||||

Joe Bell** | July 23, 2021 | Theatrical, PVOD and PEST | Roadside Attractions | ||||||||

The Alpinist | September 10, 2021 | Theatrical | Roadside Attractions | ||||||||

Hard Luck Love Song*** | October 15, 2021 | Theatrical and PVOD | Roadside Attractions | ||||||||

Alice | March 18, 2022 | Theatrical | Roadside Attractions | ||||||||

* PVOD release on April 16, 2021

** PVOD and PEST release on August 13, 2021

*** PVOD release on November 11, 2021

7

With the continuation of theatrical production in fiscal 2022, we are capitalizing on increased optionality in distribution and maintain a platform agnostic approach to distribution to take full advantage of new windowing opportunities and alternative distribution strategies (while also continuing to work closely with our theatrical exhibition partners).

Nominations and Awards

Lionsgate and affiliated companies have distributed films that have earned 129 Academy Award® nominations and 32 wins, as well as numerous Golden Globe Awards®, Producers Guild Awards®, Screen Actors Guild Awards®, Directors Guild Awards®, BAFTA Awards and Independent Spirit Awards nominations and wins.

Motion Picture - Home Entertainment

Our U.S. home entertainment distribution operation exploits our film and television content library of nearly 17,000 motion picture titles and television episodes and programs, consisting of titles from, among others, Lionsgate, our subsidiaries, affiliates and joint ventures (such as STARZ, Summit Entertainment, Anchor Bay Entertainment, Artisan Entertainment, Grindstone Entertainment Group, Trimark and Roadside Attractions), as well as titles from third parties such as A24, A&E, AMC, Entertainment Studios, Saban Entertainment, StudioCanal, and Tyler Perry Studios. Home entertainment revenue consists of packaged media and digital revenue.

Packaged Media

Packaged media distribution involves the marketing, promotion, sale and/or lease of DVDs/Blu-ray discs to wholesalers and retailers who then sell or rent the DVDs/Blu-ray discs to consumers for private viewing. Fulfillment of physical distribution services are substantially licensed to Twentieth Century Fox Home Entertainment. We distribute or sell content directly to retailers such as Wal-Mart, Best Buy, Target, Amazon and others who buy large volumes of our DVDs/Blu-ray discs to sell directly to consumers. We also directly distribute content to the rental market through Redbox, Netflix and others.

Digital Media

Lionsgate directly distributes content (including certain titles not distributed theatrically or on physical media) across a wide range of global distribution platforms and networks on an on-demand basis (whereby the viewer controls the timing of playback) through dozens of transactional (transactional video-on-demand and electronic-sell-through), subscription, ad-supported and free video-on-demand platforms. We also directly distribute content on a linear distribution basis (i.e., whereby the programmer controls the timing of playback) through various linear pay, basic cable, and free, over-the-air television platforms worldwide. Subscription video-on demand services to which we license our content include, among others, Netflix, Hulu, Amazon Prime, Peacock, Paramount+ and HBO Max; ad-supported video-on-demand services to which we license our content include, among others, The Roku Channel, Tubi TV, YouTube, IMDb, and Pluto; and linear networks to which we distribute our content include, among others, pay television networks such as STARZ, EPIX, HBO and Showtime, and basic cable network groups such as NBCUniversal Cable Entertainment, Paramount Global Domestic Media Networks, Disney Media & Entertainment Distribution Networks, Turner Entertainment Networks, A+E Networks and AMC Networks, as well as Bounce, Telemundo and UniMás.

Fiscal 2022, like fiscal 2021, saw a continued shift in our release strategies due to a combination of the COVID-19 global pandemic and acceleration of secular trends already underway in the windowing of our motion picture product. With many theatres operating at limited capacity due to various state-by-state health restrictions, we leaned into hybrid theatrical/streaming, early PVOD models for some of our films and other dynamic windowing distribution models. Coupled with the surge in content demand across all home entertainment platforms, digital media consumption increased with three (3) of our titles, The Hitman’s Wife’s Bodyguard, The Courier and City of Lies, all reaching number one (1) on the iTunes movie charts, and three (3) of our titles, The Hitman’s Wife’s Bodyguard, City of Lies and Midnight on the Switchgrass, all debuting at number one (1) on the Comscore On-Demand Chart.

Motion Picture - Television

We license our theatrical productions and acquired films to the domestic linear pay, basic cable and free television markets. For additional information regarding such distribution, see Motion Picture-Home Entertainment - Digital Media above.

8

Motion Picture - International

Our international sales operations are headquartered at our offices in London, England. The primary components of our international business are, on a territory-by-territory basis through third parties or directly through our international divisions:

•The licensing of rights in all media of our in-house feature film product and third party acquisitions on an output basis;

•The licensing of rights in all media of our in-house product and third party acquisitions on a sales basis for non-output territories;

•The licensing of third party feature films on an agency basis; and

•Direct distribution of theatrical and/or ancillary rights licensing.

We license rights in all media on a territory-by-territory basis (other than the territories where we self-distribute) of (i) our in-house Lionsgate and Summit Entertainment feature film product, and (ii) films produced by third parties such as Silver Reel, Buzzfeed, Gold Circle Films, Ace Entertainment and other independent producers. Films licensed and/or released by us internationally in fiscal 2022 included such in-house productions as About My Father, American Underdog, Barb and Star Go to Vista Del Mar, Borderlands, Christmas is Canceled, John Wick: Chapter 4, Shotgun Wedding, Spiral, and Unbearable Weight of Massive Talent. Third party films for which we were engaged as exclusive sales agent and/or released by us internationally in fiscal 2022 included Paradise Highway.

Through our territory-by-territory sales and output arrangements, we generally cover a substantial portion of the production budget or acquisition cost of new theatrical releases which we license and distribute internationally. Our output agreements for Lionsgate and Summit feature films currently cover Scandinavia and France. These output agreements generally include all rights for all media (including home entertainment and television rights). We also distribute theatrical titles in Latin America through our partnership with International Distribution Company, as well as theatrical rights in Canada through our partnership with Mongrel Media and Cineplex.

We also self-distribute motion pictures in the United Kingdom and Ireland through Lions Gate International UK (“Lionsgate UK”). Lionsgate UK has established a reputation in the United Kingdom as a leading producer, distributor and acquirer of commercially successful and critically acclaimed product. After a limited theatrical slate in fiscal 2021 due to the closure and limited re-opening of cinemas as a result of the COVID-19 pandemic, we were able to release more titles theatrically in fiscal 2022, as the industry began to recover and cinemas began to re-open in May 2021. We also, however, continued with our revised strategies for our titles, releasing on PVOD streaming platforms or by licensing directly to streaming services. Such titles and their release patterns included the following:

Fiscal 2022 Releases Lionsgate UK | |||||

| Title | Release Date | ||||

| Antebellum* | April 2, 2021 | ||||

| Wild Mountain Thyme** | April 30, 2021 | ||||

| Spiral: From the Book of Saw | May 17, 2021 | ||||

| Ammonite | May 17, 2021 | ||||

| The Outpost* | June 4, 2021 | ||||

| The Father | June 11, 2021 | ||||

| Made In Italy* | June 11, 2021 | ||||

| The Hitman’s Wife’s Bodyguard | June 18, 2021 | ||||

| The Courier | August 13, 2021 | ||||

| Ghost In The Shell (1995) (Re: 2021) | September 17, 2021 | ||||

| Dune (1984) (Re: 2021) | September 24, 2021 | ||||

| Mothering Sunday | November 12, 2021 | ||||

| Wrath of Man* | December 10, 2021 | ||||

* Released on PVOD.

** Sold to streaming service.

9

Additionally, our office in India manages operations and growth opportunities in the South Asian/Indian sub-continent. Through our local office in Mumbai, we manage the following activities:

•License our feature films, television series, library content to local linear and digital platforms;

•Appoint and work closely with theatrical distribution partners to maximize box office for our films;

•Partner with local production companies, as well as develop in-house, Indian local language television series and feature films for distribution across other media platforms;

•Continue to expand our STARZ’s offering in the region and across emerging Asian markets (branded as Lionsgate Play), through our direct-to-consumer launch and in collaboration with telco partners, Amazon and Apple TV; and

•Explore investment opportunities throughout the South Asian and South East Asian media market.

Motion Picture - Other

Global Live, Interactive and Location Based Entertainment

Our Global Live, Interactive and Location Based Entertainment division drives incremental revenue and builds consumer engagement across our entire portfolio of properties via licensing and launching live shows and experiences, location-based entertainment destinations, games, physical and digital merchandise, and through select strategic partnerships and investments.

Our Global Live Entertainment business focuses on licensing, developing, and producing live stage shows, concerts, and live immersive experiences and events based on our theatrical and television content. We have announced multiple live entertainment projects, including Wonder and Nashville for Broadway, as well as a live dance show inspired by our Step Up film franchise in partnership with Channing Tatum and Free Association.

Our Interactive Entertainment business focuses on growing a slate that includes games across PC/console, mobile, virtual reality and more, integration of our properties into with marquee games such as Call of Duty, Dead By Daylight and the upcoming Evil Dead: The Game, as well as NFT projects, including as part of a first look deal with Autograph.

Our Location Based Entertainment business licenses and produces our Lionsgate, theatrical, and television brands for theme parks, destinations, and stand-alone attractions and experiences. In January 2022, we opened an expansion of the Lionsgate zone at Motiongate Dubai which features two new roller coasters themed to our John Wick and Now You See Me franchises. Additionally, Escape Blair Witch opened in Las Vegas in August of 2021, and serves as an additional companion attraction to The Official Saw Escape, now in its fourth year of operation.

Music

Our music department creatively manages music for our theatrical and television slates, including overseeing songs, scores and soundtracks for all of our theatrical productions, co-productions and acquisitions, as well as music staffing, scores and soundtracks for all of our television productions. Music revenues are derived from the sales and licensing of music from our films, television, and other productions, and the theatrical exhibition of our films and the broadcast and webcast of our productions.

Ancillary Revenues

Ancillary revenues are derived from the licensing of films and television content at non-theatrical venues including educational and institutional facilities, U.S. military bases, oil rigs, hospitals, hotels, prisons, and on all forms of common carrier transportation, including airlines and ships.

STUDIO BUSINESS: TELEVISION PRODUCTION

Our television business consists of the development, production, syndication and distribution of television programming. We principally generate revenue from the licensing and distribution of such programming to broadcast television networks, pay and basic cable networks, digital platforms and syndicators of first-run programming, which license programs on a station-by-station basis and pay in cash or via barter (i.e., trade of programming for airtime). Each of these platforms may acquire a mix of original and library programming.

After initial exhibition, we distribute programming to subsequent buyers, both domestically and internationally, including basic cable network, premium subscription services or digital platforms (known as “off-network syndicated programming”).

10

Off-network syndicated programming can be sold in successive cycles of sales which may occur on an exclusive or non-exclusive basis. In addition, television programming is sold on home entertainment (packaged media and via digital delivery) and across all other applicable ancillary revenue streams including music publishing, touring and integration.

As with film production, we use tax credits, subsidies, and other incentive programs for television production in order to maximize our returns and ensure fiscally responsible production models.

Television Production - Television

Lionsgate Television

Despite initial production delays and changes to future network release dates as a result of the ongoing COVID-19 global pandemic, we completed production on a number of television series. We currently produce, syndicate and distribute nearly 80 television shows on more than 35 networks (including programming produced by Pilgrim Media Group, of which we own a majority interest).

In fiscal 2022, scripted and unscripted programming produced, co-produced or distributed by us and our affiliated entities (see Starz Original Programming below for original programming that appears on our STARZ services), as well as programming syndicated by our wholly-owned subsidiary, Debmar-Mercury, included the following:

| Fiscal 2022 | |||||

| Scripted - Lionsgate | |||||

| Title | Network | ||||

| Acapulco | Apple | ||||

| Black Mafia Family | Starz | ||||

| Blindspotting | Starz | ||||

| Dear White People | Netflix | ||||

| Ghosts | CBS | ||||

| Heels | Starz | ||||

| Hightown | Starz | ||||

| Home Economics | ABC | ||||

| Julia Child | HBO Max | ||||

| Love Life | HBO Max | ||||

| Macgyver | CBS | ||||

| Minx | HBO Max | ||||

| Mythic Quest | Apple | ||||

| Power Book II: Ghost | Starz | ||||

| Power Book III: Raising Kanan | Starz | ||||

| Power Book IV: Force | Starz | ||||

| P-Valley | Starz | ||||

| Run the World | Starz | ||||

| Santa Inc. | HBO Max | ||||

| Serpent Queen | Starz | ||||

| Step Up | Starz | ||||

| Swimming with Sharks | Roku | ||||

| The First Lady | Showtime | ||||

| Welcome to Flatch | Fox | ||||

| Zoey's Extraordinary Playlist | NBC | ||||

| Zoey's Extraordinary Christmas | Roku | ||||

11

| Fiscal 2022 | |||||

| Unscripted - Lionsgate | |||||

| Title | Network | ||||

| De Viaje con los Derbez | Pantaya | ||||

| Selling Sunset | Netflix | ||||

| The Real Dirty Dancing | Fox | ||||

| Fiscal 2022 | |||||

| Unscripted - Pilgrim Media Group | |||||

| Title | Network | ||||

| Ghost Hunters | Discovery | ||||

| Hoffman Family Gold | Discovery | ||||

| Horse for Dogs | Animal Planet | ||||

| My Big Fat Fabulous Life | TLC | ||||

| Renovation Impossible | Discovery | ||||

| Street Outlaws | Discovery | ||||

| Street Outlaws: America's List | Discovery | ||||

| Street Outlaws: Farm Truck & AZN | Discovery | ||||

| Street Outlaws: Fastest in America | Discovery | ||||

| Street Outlaws: Gone Girl | Discovery | ||||

| Street Outlaws: Memphis | Discovery | ||||

| Street Outlaws: No Prep Kings Grudge Night | Discovery | ||||

| The Ultimate Fighter | ESPN+ | ||||

| UFO Live | Discovery | ||||

| Wicked Tuna | Nat Geo | ||||

| Wicked Tuna Outer Banks | Nat Geo | ||||

| Zombie Flippers | A&E | ||||

| Fiscal 2022 | ||

| Syndication - Debmar-Mercury | ||

| Title | ||

| Central Ave | ||

| Family Feud | ||

| Nick Cannon | ||

| Schitt's Creek | ||

| Wendy Williams | ||

Starz Original Programming

For information regarding production of Starz original programming, see Media Networks - Starz Networks - Starz Original Programming.

Television Production- International

We continue to expand our television business through international sales and distribution of original Lionsgate television series, Starz original programming, third party television programming and format acquisitions via packaged media and various digital platforms. Lionsgate UK also continues to build a robust television business alongside its premier film brand through its various joint ventures and investments.

After the pause in television production in fiscal 2021 due to the COVID-19 global pandemic, Lionsgate UK television programming (developed in-house and through Lionsgate UK’s interest and partnerships) that continued, began production, was produced or was broadcast in fiscal 2022, included the following:

12

Fiscal 2022 Television - Lionsgate UK | ||||||||

| Title | Network | Partner(s) | ||||||

| The Pact | BBC Wales | Little Door | ||||||

| Motherland Series 3 | BBC | BBC, Merman | ||||||

| The Goes Wrong Show Series 2 | BBC | Mischief Screen, Big Talk, BBC | ||||||

| Son of a Critch | CBC | Project 10, CBC | ||||||

| The Pact Series 2 | BBC | Little Door | ||||||

Television Production - Home Entertainment

For information regarding television production home entertainment revenue, see Motion Picture - Home Entertainment above.

Television Production - Other

Other revenues are derived from, among others, the licensing of our television programs to other ancillary markets, the sales and licensing of music from the television broadcasts of our productions, and from our interest in 3 Arts Entertainment, a talent management company. 3 Arts Entertainment receives commission revenue from talent representation and are producers on a number of television shows and films where they receive an executive producer fee and back-end participations.

MEDIA NETWORKS

Media Networks - Starz Networks - United States

Starz Networks is a leading provider of premium subscription video programming to consumers in the U.S. We sell our services on a direct-to-consumer basis and through various other platforms, including OTT providers (such as Amazon, Apple, Google and Hulu), MVPDs, including cable operators (such as Comcast and Charter), satellite television providers (such as DIRECTV and DISH Network), and telecommunications companies (such as AT&T and Verizon).

Our flagship premium service STARZ had 21.0 million subscribers as of March 31, 2022 (not including subscribers who receive programming free as part of a promotional offer). STARZ offers premium original series and recently released and library movies without advertisements. Our other services, STARZ ENCORE and MOVIEPLEX, offer theatrical and independent library movies as well as original and classic television series also without advertisements. Our services include a stand-alone, direct-to-consumer app, 17 linear networks, and on-demand and online viewing platforms. Our app and online viewing platforms offer thousands of monthly movies and series episodes from studio partners, including first-run content, along with a growing line-up of successful original programming. Our services are offered directly to consumers via the STARZ app at www.starz.com or through our retail partners (such as Apple and Google) for a monthly fee, or by our distributors to their subscribers either at a fixed monthly price as part of a programming tier, package or bundle with other products or services, or on an a la carte basis.

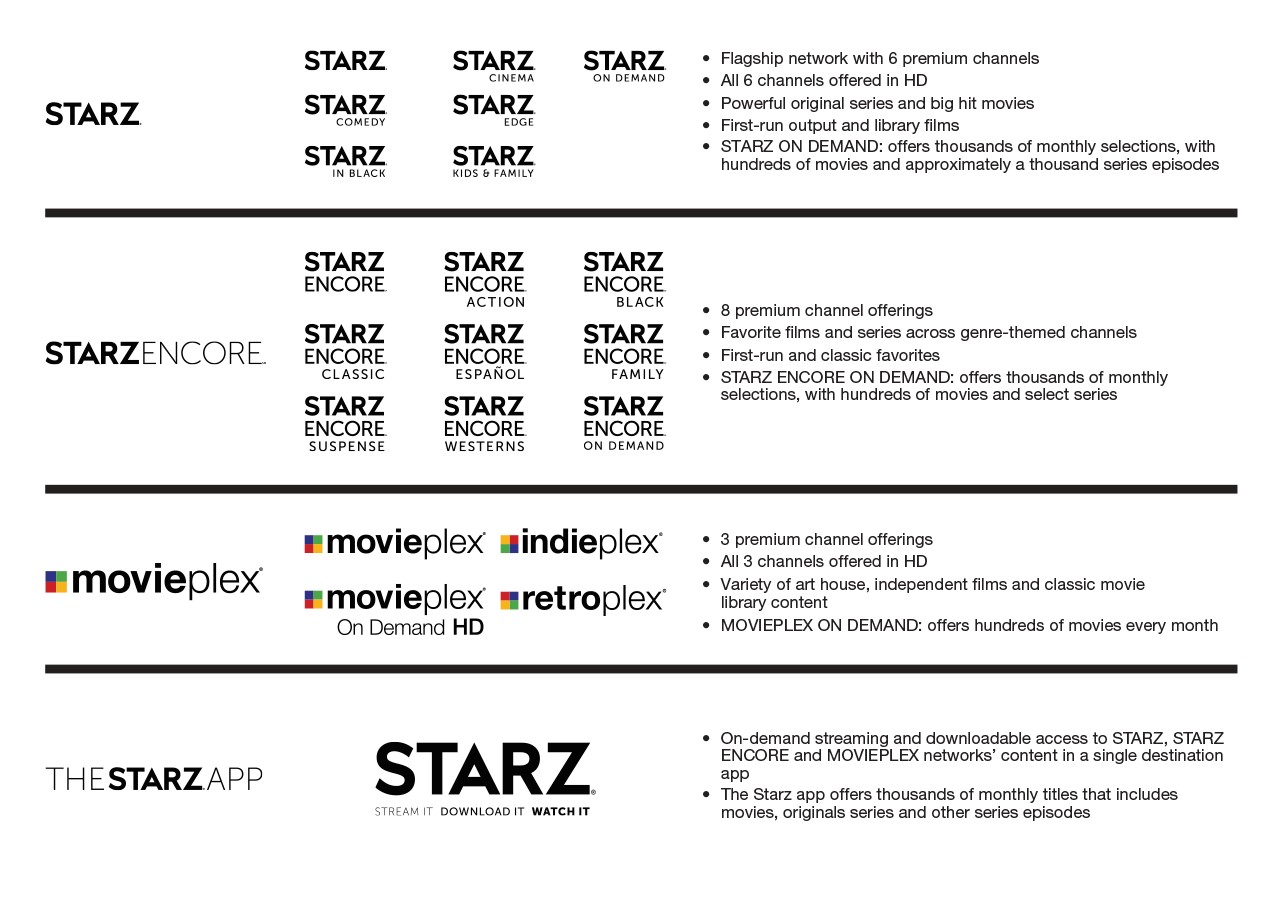

The table below depicts our 17 existing linear services, their respective on-demand services, and the STARZ app, and highlights some of their key attributes.

13

Demographics and Strategy

Designed to complement any basic television offering across both wholesale and retail OTT, as well as traditional MVPD distribution platforms, STARZ is a best-in-class subscription service delivering premium original series and hit movies with appeal to women and diverse audiences worldwide.

We are focused on developing and distributing authentic and engaging programming that resonates with women, African American, Latinx and LGBTQIA audiences, all of which have been traditionally underserved in the premium television space. Driven primarily by growing multiplatform viewership amongst these target audiences, Starz is positioned to continue to capture the digital television transition.

Across our digital platforms, the STARZ app provides an alternative for subscribers looking for a competitively priced option. Subscribers have access to a vast library of quality content and a top-rated user experience, along with the ability to download and watch STARZ original series, blockbuster theatricals and favorite classic TV series and movies without an internet connection.

This strategy, combined with a proven management team, will ensure Starz Networks’ services remain a “must have” for subscribers and a meaningful profit center for our distributors.

Affiliation agreements

Our services are distributed pursuant to affiliation agreements with our distributors. We earn revenue under these agreements either (i) based on amounts or rates tied to the total number of subscribers who receive our services or (ii) based on amounts or rates which are not tied solely to the total number of subscribers who receive our services. Our affiliation agreements expire at various dates through 2026.

14

We work with our distributors to increase the number of subscribers to our services. To accomplish this, we may help fund the distributors’ efforts to market our services or may permit distributors to offer limited promotional periods with discounted or no payment of subscriber fees. We believe these efforts enhance our relationship with distributors, improve the awareness of our services and maximize subscribers and revenue over the term of these affiliation agreements.

Distributors report the number of subscribers to our services and pay for services, generally, on a monthly basis. The agreements are generally structured to be multi-year agreements with staggered expiration dates and certain of the agreements provide for annual contractual rate increases.

STARZ App

The STARZ app is the single destination for both direct OTT subscribers and distributor authenticated subscribers to stream or download our original series and movie content. The STARZ app:

•Is available for purchase as a standalone OTT service for $8.99/month;

•Is available on a wide array of platforms and devices including Amazon Fire, iOS, Android and Roku, among others;

•Includes on-demand streaming and downloadable access for internet-free viewing;

•Offers instant access to thousands of selections each month (including STARZ original series and commercial free movies); and

•Is available as an additional benefit to paying MVPD subscribers of the Starz Networks’ linear premium services.

Starz Original Programming

Starz Networks contracts with our Television Production segment and other independent production companies to produce original programming that appears on our Starz services.

Starz’s currently announced fiscal 2023 STARZ Originals line-up is as follows:

| Title | ||

Gaslit Season 1 | ||

Who Is Ghislaine Maxwell (limited series) | ||

Becoming Elizabeth Season 1 | ||

P-Valley Season 2 | ||

Power Book III: Raising Kanan Season 2 | ||

Dangerous Liaisons Season 1 | ||

Serpent Queen Season 1 | ||

| The BMF Documentary: Blowing Money Fast | ||

Step Up Season 3 | ||

BMF Season 2 | ||

| Party Down Season 3 | ||

| Power Book II: Ghost Season 3 | ||

| Total Episodes: 99 | ||

15

Starz’s fiscal 2022 STARZ Originals line-up was as follows:

| Title | ||

Confronting a Serial Killer Season 1 | ||

The Girlfriend Experience Season 3 | ||

Run the World Season 1 | ||

| Little Birds (limited series) | ||

Blindspotting Season 1 | ||

Power Book III: Raising Kanan Season 1 | ||

Heels Season 1 | ||

BMF Season 1 | ||

Hightown Season 2 | ||

Power Book II: Ghost Season 2 | ||

Power Book IV: Force Season 1 | ||

Shining Vale Season 1 | ||

Outlander Season 6 | ||

| Total Episodes: 109 | ||

Lionsgate and Starz television programming have earned 241 Emmy® Award nominations including 38 wins, as well as numerous Golden Globe ® Awards, NAACP Awards, GLAAD Awards, Screen Actors Guild Awards nomination and wins.

Output and Content License Agreements

The majority of content on our services consists of movies that have been released theatrically. Starz has an exclusive multiyear output licensing agreement with Lionsgate for Lionsgate label titles theatrically released in the U.S. starting January 1, 2022, and for Summit label titles theatrically released in the U.S. starting January 1, 2023. Starz also has an exclusive multiyear post pay-one output licensing agreement with Universal for live-action films theatrically released in the U.S. starting January 1, 2022. The Universal agreement provides Starz with rights to exhibit these films immediately following their pay-one windows. In addition, we continue to exhibit films under our exclusive Sony output agreement, which covers qualifying movies released theatrically in the U.S. by certain Sony labels through December 31, 2021.

Under these agreements, Starz has valuable exclusive rights to air these new movies on linear television services, on-demand or online during two separate windows, with at least one year between the first and second windows. Generally, except on a VOD or pay-per-view basis, no other linear service, online streaming or other video service may air or stream these recent releases during Starz’s windows.

Starz also licenses first-run independent feature films acquired through U.S. and international film festivals and other sources as well as library content comprised of older, previously released theatrical movies from many of Hollywood’s major studios. In addition to theatrical movies, Starz licenses television series and other content from studios, production companies or other rights holders. The rights agreements for library content are of varying duration and generally permit Starz’s services to exhibit these movies, series and other programming during certain window periods.

16

A summary of significant output and library programming agreements (including a library agreement with Lionsgate) are as follows:

| Significant output programming agreements | Significant library programming agreements | |||||||

| Studio | Studio | |||||||

| Lionsgate | Paramount | |||||||

| Sony | Warner Bros | |||||||

| Universal | Twentieth Century Fox | |||||||

| MGM | ||||||||

| Sony Pictures | ||||||||

| Lionsgate | ||||||||

| Universal | ||||||||

Our output agreements generally require us to pay for movies at rates calculated on a pricing grid that is based on each film’s domestic box office performance (subject to maximum amounts payable per movie and a cap on the number of movies that can be put to Starz each year). The amounts Starz pays for library content vary based on each specific agreement, but generally reflect an amount per movie, series or other programming commensurate with the quality (e.g., utility and perceived popularity) of the content being licensed.

Transmission

We currently uplink our programming for our linear services to non-pre-emptible, protected transponders on two satellites positioned in geo-synchronous orbit. These satellites feed our signals to various swaths of the Americas. We lease these transponders under agreements that have termination dates in 2023. We currently are evaluating our options regarding transponder leasing arrangements following the expiration of the current agreements. We transmit to these satellites from our uplink center in Englewood, Colorado. We have made arrangements at a vendor’s facility to uplink our linear channels to these satellites in the event we are unable to do so from our uplink center.

Regulatory Matters

In the U.S., the Federal Communications Commission (the “FCC”) regulates several aspects of our and our distribution ecosystem’s operations and programming. This includes FCC oversight in connection with communications satellites and related uplink/downlink equipment and transmissions, content-specific requirements such as closed captioning, messaging during children’s programming, loudness of commercials, and program access requirements in connection with certain distributors and programmer services with shared attributable interests.

Regulation

The regulation of programming services, cable television systems, direct broadcast satellite providers, broadcast television licensees and online services is subject to the political process and has been in constant flux historically. To the extent that our programming services are distributed through online platforms, we must comply with various federal and state laws and regulations applicable to online communications and commerce. Further material changes in the law and regulatory requirements that affect our business must be anticipated and there can be no assurance that we will not be materially adversely affected by future legislation, new regulation or deregulation.

Media Networks - Starz - International

Starz is available in 60+ countries outside the U.S. through our four (4) international branded services: STARZPLAY in Western Europe, Latin America and Japan; STARZ in Canada; LIONSGATE PLAY in India; and through our STARZPLAY Arabia joint venture in the Middle East and North Africa. These branded services are made available through OTT providers (such as Amazon and Apple), internet protocol television ("IPTV") providers (such as Airtel), PayTV companies (such as Izzi), on a direct-to-consumer basis, and cable and satellite providers in Canada only as a linear service. Across these services, Starz had 12.8 million subscribers as of March 31, 2022. The remainder of this section addresses the offerings operated by STARZPLAY in the 35-country footprint across Western Europe, Latin America and Japan.

17

International Strategy

STARPLAY is quickly growing its distribution by strategically positioning itself as a complementary pure-play premium content service offered at a competitive subscription price, made available through a diverse ecosystem of wholesale and retail distribution partners. Premium content that targets all adults is the foundation of our international content strategy. We believe this allows us to operate as a complementary service, not a direct competitor, with other higher priced, broad-based video services. STARZPLAY provides subscribers with access to STARZ original series, often airing day-and-date with the U.S., a rich and diverse library of television series, feature films and documentaries from Lionsgate and other Studios, and first-run, exclusive third-party programming, including locally produced television shows that align with the STARZ brand – STARZPLAY Originals. All content available on STARZPLAY is available with sub-titles and/or local language dubbing for each country.

Our distribution strategy is led with a wholesale model and supplemented through direct OTT retail sales. We expect to launch with additional wholesale partners and potentially deploy the STARZPLAY app in additional countries in the coming years.

Affiliation agreements

Our services are distributed pursuant to affiliation agreements with our distributors under a wholesale license, where STARZPLAY is sold as an a la carte channel or bundled within our distributors’ platforms, including Amazon and Apple, as well as local IPTV and Telco partners. Our wholesale distributors manage the technology and infrastructure associated with the exhibition of STARZPLAY in exchange for recurring license fees. Our affiliation agreements expire at various dates through 2026.

We work with distributors to increase the number of subscribers to our services. To accomplish this, we may help fund the distributors’ efforts to market these services or may permit distributors to offer limited promotional periods with discounted or no payment of subscriber fees. We believe these efforts enhance our relationship with distributors, improve the awareness of our services and ultimately increase subscribers and revenue over the term of these affiliation agreements.

Distributors report the number of subscribers to our services and pay for services, generally, on a monthly basis. The agreements are structured on a country-by-country basis, to be multi-year agreements with staggered expiration dates by distributor.

STARZPLAY App

To enhance our subscriber reach, we modified our domestic (U.S.) STARZ retail app for deployment internationally to include, among other new features, full European Union General Data Protection Regulation compliance, support for fourteen (14) languages, multiple audio/closed captioning options and a variety of potential carrier/billing integrations.

The STARZPLAY app is the single destination for direct OTT subscribers to stream on-demand or download our original series and movie content. The STARZPLAY app:

•Is currently available in eighteen (18) countries across Europe and Latin America, including France, Germany, Spain, the UK, Netherlands, Mexico, and Brazil, Argentina, etc.;

•Is offered directly via the STARZPLAY website or via retail storefronts such as the Apple Store, Play Store, Roku Channels, LG, and Amazon Fire;

•Includes a language toggle allowing users to select their preferred language for viewing;

•Offers instant access to approximately 1,000 selections each month (including original series and commercial free movies); and

•Is available for purchase as a standalone OTT service for £5.99 in the UK, €4.99 in Europe and ~$4.50 in Latin America.

STARZPLAY Programming

STARZPLAY contracts with our Television Production segment and other major content licensors to acquire first-run original scripted series and library films that appear on STARZPLAY.

18

STARZPLAY’s currently expected fiscal 2023 first-run STARZ Originals programming, which will be available to STARZPLAY across its footprint in Canada, Western Europe, Latin America and Japan, is as follows:

| Title | ||

Gaslit Season 1 | ||

Becoming Elizabeth Season 1 | ||

P-Valley Season 2 | ||

Power Book III: Raising Kanan Season 2 | ||

Dangerous Liaisons Season 1 | ||

Serpent Queen Season 1 | ||

| BMF Documentary: Blowing Money Fast | ||

Step Up Season 3 | ||

BMF Season 2 | ||

Party Down Season 3 | ||

Power Book II: Ghost Season 3 | ||

| Total Episodes: 96 | ||

STARZPLAY’s currently expected fiscal 2023 first-run third-party programming and country availability is as follows:

| Title | Countries Available | Distributor | ||||||

Tokyo Vice Season 1 | UK, Germany ("DE") | Endeavor | ||||||

| The Girl from Plainville | All markets ex. Canada ("CA") | NBCU | ||||||

Sisi Season 1 | Latin America ("LatAm") | Betafilm | ||||||

| Evil by Design | UK, DE, LatAm, Spain ("ES") | Blue Ant | ||||||

Das Boot Season 3 | France ("FR"), LatAm | NBCU | ||||||

| Faking Hitler | ES, Nordics | Fremantle | ||||||

| Euer Ehren | Nordics | SquareOne | ||||||

Ramy Season 3 | All markets ex. LatAm, Nordics | Lionsgate | ||||||

Queer as Folk Season 1 | All markets ex. Japan ("JP"), CA | NBCU | ||||||

Doom Patrol Season 4 | UK | WB | ||||||

The Capture Season 2 | DE, FR, Benelux, LatAm, Italy ("IT"), ES | NBCU | ||||||

Gangs of London Season 2 | FR, Benelux, LatAm, ES, JP | Pulse | ||||||

The Head Season 2 | UK, DE | MediaPro | ||||||

Pennyworth Season 3 | UK, DE, IT | WB | ||||||

The Great Season 3 | All markets ex. JP, Nordics, CA | Paramount | ||||||

| Total Episodes: 131 | ||||||||

19

STARZPLAY’s currently expected fiscal 2023 first-run STARZPLAY Originals programming and country availability is as follows:

| Title | Countries Available | Distributor | ||||||

El Refugio Season 1 | LatAm, ES | Fremantle | ||||||

Toda la Sangre Season 1 | LatAm | Spiral | ||||||

| All Those Things We Never Said | All markets ex. FR, JP, Nordics | StudioCanal | ||||||

Nacho Season 1 | LatAm, ES | Bambu | ||||||

| Yellow | LatAm, ES | The Immigrant | ||||||

| Total Episodes: 39 | ||||||||

STARZPLAY’s fiscal 2022 first-run STARZ Originals programming was as follows:

| Title | ||

Confronting a Serial Killer Season 1 | ||

The Girlfriend Experience Season 3 | ||

Run the World Season 1 | ||

Blindspotting Season 1 | ||

Power Book III: Raising Kanan Season 1 | ||

Heels Season 1 | ||

BMF Season 1 | ||

Hightown Season 2 | ||

Power Book II: Ghost Season 2 | ||

Power Book IV: Force Season 1 | ||

Shining Vale Season 1 | ||

| Total Episodes: 95 | ||

STARZPLAY’s fiscal 2022 first-run STARZPLAY Originals programming and country availability was as follows:

| Title | Countries Available | Distributor | ||||||

| Mala Yerba | LatAm, ES | Sony | ||||||

Express Season 1 | LatAm, ES, FR, IT | MediaPro | ||||||

Senorita ’89 Season 1 | LatAm, ES | Fremantle | ||||||

| Total Episodes: 26 | ||||||||

20

STARZPLAY’s fiscal 2022 first-run third-party programming and country availability was as follows:

| Title | Countries Available | Distributor | ||||||

Godfather of Harlem Season 2 | UK, FR | Disney | ||||||

| It’s A Sin | DE, IT | All3Media | ||||||

Love Life Season 1 | DE | Lionsgate | ||||||

Dr. Death Season 1 | All markets ex. DE, CA | NBCU | ||||||

Gigantes Season 1 | Brazil | About Premium Content | ||||||

Gigantes Season 2 | Brazil | About Premium Content | ||||||

| Dr. Death: The Undoctored Story | UK, FR, Benelux, LatAm, ES | NBCU | ||||||

| Une Affaire Francaise | DE, ES | Federation | ||||||

Vigil Season 1 | CA | ITV | ||||||

Doom Patrol Season 3 | UK | WB | ||||||

The Great Season 2 | All markets ex. JP, CA | Paramount | ||||||

| Station Eleven | UK, DE | Paramount | ||||||

Baptiste Season 2 | DE, FR, LatAm | All3Media | ||||||

Outlander Season 6 | UK | Sony | ||||||

Love Life Season 2 | DE | Lionsgate | ||||||

Killing Eve Season 4 | DE | Endeavor | ||||||

| Total Episodes: 123 | ||||||||

Significant multi-country library programming agreements include those with Studio Canal, Tele München Group, Sony, Universal and Lionsgate.

Regulatory Matters

Distribution of our programming services in non-U.S. jurisdictions may be subject to the laws of the jurisdictions in which they operate. The applicability and enforcement of laws in some non-U.S. jurisdictions can be inconsistent and unpredictable. As a result, our ability to generate revenue and our expenses in non-U.S. jurisdictions could be impacted. There may be further material changes in the law and regulatory requirements.

JOINT VENTURES, PARTNERSHIPS AND OWNERSHIP INTERESTS

Our joint ventures, partnerships and ownership interests support our strategy of being a multiplatform global industry leader in entertainment. We regularly evaluate our existing properties, libraries and other assets and businesses in order to determine whether they continue to enhance our competitive position in the industry, have the potential to generate significant long-term returns, represent an optimal use of our capital, and are aligned with our goals. When appropriate, we discuss potential strategic transactions with third parties for purchase of our properties, libraries or other assets or businesses that factor into these evaluations. As a result, we may, from time to time, determine to sell individual properties, libraries or other assets or businesses or enter into additional joint ventures, strategic transactions and similar arrangements for individual properties, libraries or other assets or businesses. Our more significant joint ventures, partnerships and ownership interests include the following:

| 3 Arts Entertainment | We hold a majority interest in 3 Arts Entertainment, a leading talent management and television/film production company. | ||||

| Pilgrim Media Group | We hold a majority interest in Pilgrim Media Group, a leader in unscripted programming. | ||||

| Roadside Attractions | We hold an interest in Roadside Attractions, an independent theatrical distribution company. | ||||

21

Intellectual Property

We currently use and own or license a number of trademarks, service marks, copyrights, domain names and similar intellectual property in connection with our businesses and own registrations and applications to register them both domestically and internationally. We believe that ownership of, and/or the right to use, such trademarks, service marks, copyrights, domain names and similar intellectual property is an important factor in our businesses and that our success depends, in part, on such ownership.

Motion picture and television piracy is extensive in many parts of the world, including South America, Asia and certain Eastern European countries, and is made easier by technological advances and the conversion of content into digital formats. This trend facilitates the creation, transmission and sharing of high quality unauthorized copies of content on packaged media and through digital formats. The proliferation of unauthorized copies of these products has had and will likely continue to have an adverse effect on our business, because these products may reduce the revenue we receive from our products. Our ability to protect and enforce our intellectual property rights is subject to certain risks and, from time to time, we encounter disputes over rights and obligations concerning intellectual property. We cannot provide assurance that we will prevail in any intellectual property disputes.

Competitive Conditions

Our businesses operate in highly competitive markets. We compete with companies within the entertainment and media business and from alternative forms of leisure entertainment, such as travel, sporting events, outdoor recreation and other cultural related activities. We compete with the major studios, numerous independent motion picture and television production companies, television networks, pay television services and digital media platforms for the acquisition of literary, film and television properties, the services of performing artists, directors, producers and other creative and technical personnel and production financing, all of which are essential to the success of our businesses. In addition, our motion pictures compete for audience acceptance and exhibition outlets with motion pictures produced and distributed by other companies. Likewise, our television product faces significant competition from independent distributors as well as major studios. Moreover, our networks compete with other programming networks for viewing and subscribership by each distributor’s customer base, as well as for carriage by such distributors. As a result, the success of any of our motion picture, television or media networks business is dependent not only on the quality and acceptance of a particular film or program, but also on the quality and acceptance of other competing content released into the marketplace at or near the same time as well as on the ability to license and produce content for the networks that is adequate in quantity and quality and will generate satisfactory subscriber levels.

Human Capital Management

Employees

As of May 20, 2022, we had 1,448 full-time employees in our worldwide operations. We also utilize many consultants in the ordinary course of our business and hire additional employees on a project-by-project basis in connection with the production of our motion pictures and television programming.

Diversity Equity & Inclusion

We believe that embracing diversity, promoting a culture of inclusivity and accelerating the representation of women and historically excluded groups in our workforce is crucial to our success. Our Chief Diversity Officer partners with our leadership team across all of our businesses to effect changes in recruitment, hiring, promotions, policies and culture, and to orchestrate our Company-wide response to issues of inequality and workforce disparity.

We also maintain the following recruitment and hiring initiatives:

•Internship Programs: We maintain an internship program designed to increase inclusion across the entertainment industry by placing qualifying students in positions at Lionsgate and various other studios.

•Targeted Recruitment: We continue recruitment efforts that include collaborating with diverse partner organizations, college campus diversity organizations for underrepresented groups, as well as historically black colleges in our search for new employees and interns.

•Inclusive Hiring Process: We implement inclusive hiring practices to ensure that we are attracting the best talent in the industry through a more equitable, inclusive, and accessible approach. Key components of the framework

22

include bias free job descriptions, inclusive hiring training, external diversity partners, diverse candidate slates, and diverse, cross-functional interview panels.

•Supplier Diversity Program: The mission of our Supplier Diversity Program is to actively establish relationships with diverse businesses and to continuously strive to increase spend with diverse suppliers, while delivering more competitive pricing, quality, service, innovation and creativity in procurement of services. We believe that this initiative increases the breadth of our vendor pool, while also encouraging the growth of diverse businesses.

Employee Resource Groups

We are proud to provide our employees with an array of Employee Resource Groups (“ERGs”) which offer them the chance to establish a greater presence at Lionsgate and an opportunity to enhance cross-cultural awareness, develop leadership skills and network across the Company’s various business units and levels. The ERGs are voluntary, employee-led groups that foster a diverse, engaging, and inclusive workplace.

•Lionsgate Early Career Group aims to inspire curiosity and networking to foster growth for professionals in early stages of their careers.

•Lionsgate Multicultural Employee Resource Group advocates for a more inclusive workplace and entertainment landscape through programs that educate, activate and celebrate multicultural diversity and its global impact.

•Lionsgate Parents Group aims to bring together parents, expecting parents, caregivers, and allies to ensure our community fosters an environment that supports all families.

•Lionsgate Pride supports, develops and inspires future LGBTQIA leaders within the Company and the industry.

•Lionsgate Vets creates a community of veterans and their supporters working together to enhance veteran presence and engage the industry from the unique perspective of a military background.

•Lionsgate Women’s Empowerment Group creates a community that improves the prominence of female leaders and empowers women at all levels within the Company and the industry.

Lionshares

We are committed to acting responsibly and making a positive difference in the local and global community through Lionshares, the umbrella for our companywide commitment to our communities. Lionshares is a volunteer program that seeks to provide opportunities for employees within the Lionsgate family to partner with a diverse range of charitable organizations. The program not only enriches the Lionsgate work experience through cultural and educational outreach, but also positively interacts and invests in the local and global community.

Other Employee Benefits and Programs

We understand the importance of well-rounded and inclusive benefits and programs and are dedicated to providing our employees with unique offerings that meet their individual needs. With respect to benefits, we offer a comprehensive benefits package which includes family forming benefits, mental health support, resources for caregiving (children and adult family), online fitness and meditation classes, and new parent coaching. With respect to learning and engagement, we offer programs to develop and enrich the employee experience with offerings such as tuition reimbursement, leadership development program, mentorship, and additional programs to help support specific populations (e.g., minorities, women, parents, LGBTQ+) such as frequently hosting internal forums and expert panels in order to foster meaningful conversations and highlight diverse voices at Lionsgate and in the industry. We received the designation as a “Best Place to Work for LGBTQ Equality” for 2022.

Corporate History

We are a corporation organized under the laws of the Province of British Columbia, resulting from the merger of Lions Gate Entertainment Corp. and Beringer Gold Corp. on November 13, 1997. Beringer Gold Corp. was incorporated under the Business Corporation Act (British Columbia) on May 26, 1986 as IMI Computer Corp. Lions Gate Entertainment Corp. was incorporated under the Canada Business Corporations Act using the name 3369382 Canada Limited on April 28, 1997, amended its articles on July 3, 1997 to change its name to Lions Gate Entertainment Corp., and on September 24, 1997, continued under the Business Corporations Act (British Columbia).

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act, are available, free of charge, on our website at investors.lionsgate.com as soon as reasonably practicable after we electronically file such material

23

with, or furnish it to, the Securities and Exchange Commission (the “SEC”). The Company's Disclosure Policy, Corporate Governance Guidelines, Standards for Director Independence, Code of Business Conduct and Ethics for Directors, Officers and Employees, Policy on Shareholder Communications, Related Person Transaction Policy, Charter of the Audit & Risk Committee, Charter of the Compensation Committee and Charter of the Nominating and Corporate Governance Committee and any amendments thereto are also available on the Company's website, as well as in print to any shareholder who requests them. The information posted on our website is not incorporated into this Annual Report on Form 10-K. We will disclose on our website waivers of, or amendments to, our Code of Business Conduct and Ethics that applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer or persons performing similar functions.

The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.

ITEM 1A. RISK FACTORS.

You should carefully consider the following risks as well as other information included in, or incorporated by reference into this Form 10-K. The risk and uncertainties described below are not the only ones facing the Company; additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business. If any of these risks and uncertainties occur, they could adversely affect our business, financial condition, operating results, liquidity and prospects.

Risks Related to Our Business

The impact of the COVID-19 global pandemic could continue to materially and adversely affect our business, financial condition, and results of operations.