|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

|

|

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

|

|

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

|

|

☒

|

☐ Accelerated filer

|

☐ Non-accelerated filer

|

|

|

☒

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

|

Other ☐

|

| • |

Other foundries may bid against us to acquire potential targets. This competition may result in decreased availability of, or increased

prices for, suitable acquisition candidates; |

| • |

We may not be able to obtain the necessary regulatory or other approvals, and as a result, or for other reasons, we may fail to consummate

certain acquisitions; |

| • |

Potential acquisitions and execution of an expansion plan may require the dedication of substantial management effort, time and resources

which may divert management from our existing business operations or other strategic opportunities; |

| • |

We may not be able to retain experienced management and skilled employees from the businesses we acquire and, if we cannot retain

such personnel, we may not be able to attract new skilled employees and experienced management to replace them; |

| • |

We may purchase a company with excessive unknown contingent liabilities and/or a cost structure that is not as beneficial as anticipated

from the preliminary evaluation or that includes high cost that may result in losses incurred by us if we do not succeed in maintaining

high utilization levels to cover the cost; |

| • |

We may not be able to obtain sufficient financing which could limit our ability to engage in certain acquisitions and strategic engagements;

and |

| • |

The amount or terms of financing actually required before and after acquisitions considering our current liquidity and cash position

may vary from our expectations, resulting in a need for more funding that may not be available to us in order to finance acquisitions,

the operations of the target acquired and/or the acquisition of additional equipment that may be required to increase and/or adjust the

target’s operations to address our customer demand and specific technology flows, which may adversely affect our liquidity and balance

sheet position. |

| • |

JPY and NIS fluctuations against the USD – see the risk factor below entitled: “Our

exposure to currency exchange and interest rate fluctuations may impact our costs and financial results”; |

| • |

the burden and cost of compliance with foreign government regulation, as well as compliance with a variety of foreign laws, and the

imposition of regulatory requirements, tariffs, import and export restrictions and other trade barriers and restrictions, including the

timing and availability of export licenses and permits; |

| • |

general geopolitical risks, such as political and economic instability, international terrorism, potential hostilities and changes

in diplomatic and trade relationships; |

| • |

adverse foreign and international tax rules and regulations, such as withholding taxes deducted from amounts due to us

and not refunded to us by the tax authorities since we are not entitled to foreign tax credit in Israel; |

| • |

weak protection of our intellectual property rights in certain foreign countries; |

| • |

delays in wafer shipments due to local customs restrictions; |

| • |

laws and business practices favoring local companies; |

| • |

difficulties in collecting accounts receivable; and |

| • |

difficulties and costs of staffing and managing foreign operations. |

| • |

limiting our ability to fulfill our debt obligations and other liabilities; |

| • |

requiring the use of a portion of our cash to service our indebtedness rather than investing our cash to fund our strategic growth

opportunities and plans, working capital and capital expenditures; |

| • |

increasing our vulnerability to adverse economic and industry conditions; |

| • |

limiting our ability to obtain additional financing; |

| • |

limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; |

| • |

placing us at a competitive disadvantage with respect to less leveraged competitors and competitors that have better access to capital

resources; |

| • |

volatility in our non-cash financing expenses due to increases in the fair value of our debt obligations; |

| • |

fluctuations of the payable amounts in USD of the JPY-denominated loans and capital lease agreements or other expenses denominated

in JPY; and |

| • |

potential enforcement by the lenders of their liens against our respective assets, as applicable, if an event of default occurs.

|

| • |

fluctuations in the level of revenues from our operating activities; |

| • |

fluctuations in the collection of receivables; |

| • |

timing and size of payables; |

| • |

the timing and size of capital expenditures; |

| • |

the net impact of JPY/ USD fluctuations on our JPY income and JPY cost; |

| • |

the impact of capital market conditions on our marketable securities; |

| • |

the repayment schedules of our debt obligations; |

| • |

our ability to fulfill our obligations and meet performance milestones under our agreements; |

| • |

fluctuations in the USD to NIS exchange rate; and |

| • |

the inflation rates in Israel, Japan and the United States. |

| • |

changes in the volume and mix of profits earned across jurisdictions with varying tax rates; |

| • |

changes in our business or legal entity operating model; |

| • |

the resolution of issues, including transfer pricing implementation, arising from tax audits; |

| • |

changes in the valuation of our deferred tax assets and liabilities, and in deferred tax valuation allowances; |

| • |

increases in expenses not deductible for tax purposes, or deductible for extended period; |

| • |

changes in available tax credits, including, research and development credits; |

| • |

changes in income tax codes or foreign tax laws or their interpretation; |

| • |

changes, reduction, cancellation or discontinuation of the tax benefits provided to a “Preferred Enterprise” and its

applicability to Tower’s income under the Israeli Law for the Encouragement of Capital Investments, 5719-1959 (the “Investment

Law”) (see “Item 10. Additional Information—E. Taxation—Israeli Taxation—Law for the Encouragement of Capital

Investments, 5719-1959”); and |

| • |

the global implementation of a minimum corporate tax rate under Pillar Two of the Organization for Economic

Cooperation and Development (“OECD”) Base Erosion and Profit Shifting (“BEPS”) initiative, which may cause an

increase of the income tax rate that applies to Tower’s taxable income from 7.5% to a higher rate for periods commencing not before

2026 (see “Item 10. Additional Information—E. Taxation—Israeli Taxation—Law for the Encouragement of Capital Investments,

5719-1959”). |

| • |

attempting to negotiate cross-license agreements, which we might not succeed in negotiating or consummating; |

| • |

acquiring licenses to the allegedly infringed patents, which may not be available on commercially reasonable terms, if at all;

|

| • |

discontinuing use of certain process technologies, architectures, or designs, which could cause us to halt a portion of our operations

if we are unable to design around the allegedly infringed patents; |

| • |

litigating the matter in court, which may result in substantial legal fees and paying substantial monetary damages in the event we

lose; or |

| • |

developing non-infringing technologies, which may be costly or may not be feasible. |

| • |

technical evaluation; |

| • |

wafer design to our specifications, including integration of third party intellectual property; |

| • |

photomask–- design and order third-party photomask ; |

| • |

silicon prototyping; |

| • |

assembly and test; |

| • |

validation and qualification; and |

| • |

production. |

| Year ended December 31, | ||||||||||||

|

2023 |

2022 |

2021 |

||||||||||

|

United States |

46 |

% |

49 |

% |

41 |

% | ||||||

|

Japan |

17 |

% |

16 |

% |

22 |

% | ||||||

|

Asia, excluding Japan |

27 |

% |

26 |

% |

30 |

% | ||||||

|

Europe |

10 |

% |

9 |

% |

7 |

% | ||||||

|

Total |

100 |

% |

100 |

% |

100 |

% | ||||||

| • |

technology offering and future roadmap; |

| • |

wafer performance; |

| • |

system level technical expertise; |

| • |

research and development capabilities; |

| • |

access to intellectual property; |

| • |

customer technical support; |

| • |

design services; |

| • |

product development kits (PDKs); |

| • |

operational performance; |

| • |

quality systems; |

| • |

wafer quality; |

| • |

operational yields; |

| • |

customer support and service; |

| • |

pricing; |

| • |

management expertise; |

| • |

strategic customer relationships; |

| • |

capacity availability; and |

| • |

stability and reliability of supply. |

|

Year ended December 31, |

||||||||

|

2023 |

2022 |

|||||||

|

Statement of Operations Data: |

||||||||

|

Revenues |

100 |

% |

100 |

% | ||||

|

Cost of revenues |

75.2 |

72.2 |

||||||

|

Gross Profit |

24.8 |

27.8 |

||||||

|

Research and development expense |

5.6 |

5.0 |

||||||

|

Marketing, general and administrative expense |

5.1 |

4.8 |

||||||

|

Restructuring gain from sale of machinery and equipment, net |

(3.7 |

) |

(1.2 |

) | ||||

|

Restructuring expense |

1.3 |

0.6 |

||||||

|

Merger-contract termination fee, net |

(22.0 |

) |

-- |

|||||

|

Operating profit |

38.5 |

18.6 |

||||||

|

Financing income (expense), net |

2.1 |

(0.8 |

) | |||||

|

Other income (expense), net |

0.5 |

(0.4 |

) | |||||

|

Profit before income tax |

41.1 |

17.4 |

||||||

|

Income tax expense, net |

(4.6 |

) |

(1.5 |

) | ||||

|

Net profit |

36.5 |

15.9 |

||||||

|

Net income attributable to non-controlling interest |

(0.1 |

) |

(0.1 |

) | ||||

|

Net profit attributable to the Company |

36.4 |

% |

15.8 |

% | ||||

|

Officer |

Senior Management Name |

Age |

Title(s) | |||

|

A |

Russell C. Ellwanger |

69 |

Chief Executive Officer and Director of Tower, and Chairman of the Board of Directors

of its subsidiaries Tower Semiconductor USA, Inc., Tower US Holdings, Inc., Tower Semiconductor NPB Holdings, Inc., Tower Semiconductor

Newport Beach, Inc., Tower Partners Semiconductor Co., Ltd., Tower Semiconductor San Antonio, Inc. and Tower Semiconductor Italy, S.r.l.

| |||

|

B |

Oren Shirazi |

54 |

Chief Financial Officer, Senior Vice President of Finance | |||

|

C |

Rafi Mor |

60 |

Chief Operating Officer | |||

|

D |

Dr. Marco Racanelli |

57 |

President | |||

|

E |

Dr. Avi Strum |

61 |

Chief Technology Officer | |||

|

Director’s Name(*) |

Age |

Title | ||||

|

F |

Amir Elstein |

68 |

Chairman of the Board of Directors | |||

|

G |

Kalman Kaufman |

78 |

Director | |||

|

H |

Dana Gross |

56 |

Director | |||

|

I |

Ilan Flato |

67 |

Director | |||

|

J |

Yoav Z. Chelouche |

70 |

Director | |||

|

K |

Iris Avner |

59 |

Director | |||

|

L |

Michal Vakrat Wolkin |

52 |

Director | |||

|

M |

Avi Hasson |

53 |

Director |

| • |

the education, skills, expertise and achievements of the relevant office holder; |

| • |

the role and responsibilities of the office holder, and prior compensation arrangements with the office holder; |

| • |

the ratio of the cost of the terms of employment of an office holder to the cost of compensation of the other employees of the company

(including any employees employed through manpower companies), specifically to the cost of the average and median salaries of such employees

and the impact of the disparities between them upon work relationships in the company; |

| • |

with respect to variable compensation, the possibility of reducing variable compensation at the discretion of the board of directors,

and the possibility of setting a limit on the exercise value of non-cash variable equity-based compensation; and |

| • |

with respect to severance compensation, the period of employment or service of the office holder, the terms of his or her compensation

during such period, the company’s performance during such period, the person’s contribution towards the company’s achievement

of its goals and the maximization of its profits, and the circumstances under which the person is leaving the company. |

| • |

The company does not have a controlling shareholder; and |

| • |

The company complies with the requirements of the securities laws and stock exchange regulations in the foreign jurisdiction where

its shares are listed relating to the appointment of independent directors and composition of the audit and compensation committees as

applicable to companies that are incorporated under the laws of such foreign jurisdiction. |

| • |

retaining and terminating our independent auditors, subject to the ratification of the board of directors, and in the case of retention,

to that of the shareholders, as applicable in accordance with the Companies Law; |

| • |

pre-approving of audit and non-audit services and related fees and terms, to be provided by the independent auditors; |

| • |

overseeing the accounting and financial reporting processes of our company and audits of our financial statements and the effectiveness

of our internal control over financial reporting; |

| • |

reviewing with management and our independent auditor our annual and quarterly financial statements prior to publication or filing

(or submission, as the case may be); |

| • |

recommending to the board of directors the retention and termination of the internal auditor, and the internal auditor’s engagement

fees and terms, in accordance with the Companies Law as well as approving the yearly or multi-year plan proposed by the internal auditor,

and review the results and findings of internal audits; |

| • |

overseeing the Company’s risk assessment and reviewing regulatory compliance; |

| • |

determining whether to approve certain related party transactions (including transactions in which an office holder has a personal

interest) and whether any such transaction is extraordinary or material under Companies Law; |

| • |

determining whether a competitive process must be implemented for the approval of certain transaction(s) with controlling shareholder(s)

or its relative or in which a controlling shareholder has a personal interest (whether or not the transaction is an extraordinary transaction),

under the supervision of the audit committee or other party determined by the audit committee and in accordance with standards to be determined

by the audit committee, or whether a different process determined by the audit committee should be implemented for the approval of such

transaction(s); |

| • |

determining the process for the approval of certain transactions with controlling shareholders or in which a controlling shareholder

has a personal interest that the audit committee has determined are not extraordinary transactions but are not immaterial transactions;

and |

| • |

responsible for the handling of employees’ complaints as to the management of our business and the protection to be provided

to such employees. |

| • |

recommending to the Board of Directors for its approval (i) a compensation policy for officers and directors, (ii) once every three

years, extension of the compensation policy (either a new compensation policy or the continuation of an existing compensation policy must

in any case occur every three years); and (iii) periodic updates to the compensation policy. In addition, the compensation committee is

required to assess the implementation of the compensation policy; |

| • |

approving transactions relating to the terms of office and employment of office holders (within the meaning of the Companies Law),

which require the approval of the compensation committee pursuant to the Companies Law; and |

| • |

reviewing and approving equity grants to non-executive employees under our equity-based incentive plans. |

| • |

overseeing and assisting our board of directors in reviewing and recommending nominees for election as directors; |

| • |

assessing the performance of the members of our board of directors; |

| • |

reviewing and recommending to our board of directors the structure and members of committees of the board; |

| • |

assisting our board of directors in carrying out its responsibilities related to chief executive officer succession planning;

|

| • |

reviewing and overseeing our corporate governance practices and communication plans for shareholder meetings and to promote effective

communication for shareholder meetings; and |

| • |

overseeing our commitment to ESG matters and advising our board of directors on such matters. |

|

As of December 31, |

||||||||||||

|

2023 |

2022 |

2021 |

||||||||||

|

Process and product engineering, R&D and design |

887 |

1,067 |

1,045 |

|||||||||

|

Operations |

3,491 |

3,858 |

4,168 |

|||||||||

|

Operations support |

544 |

410 |

386 |

|||||||||

|

Sales and marketing, finance & administration |

293 |

278 |

288 |

|||||||||

|

Total |

5,215 |

5,613 |

5,887 |

|||||||||

|

Ordinary Shares Beneficially Owned |

||||||||

|

Name of Beneficial Owner |

Number |

Percent (1) |

||||||

|

Migdal Insurance & Financial Holdings Ltd (2) |

8,402,025 |

7.57 |

% | |||||

|

Harel Insurance Investments & Financial Services (3) |

8,216,838 |

7.40 |

% | |||||

|

Senvest Management, LLC (4) |

8,033,256 |

7.24 |

% | |||||

|

Clal Insurance Enterprises Holdings Ltd. (5) |

5,617,259 |

5.06 |

% | |||||

| (1) |

In accordance with the rules of the SEC, assumes (i) the holder’s beneficial ownership of outstanding ordinary shares and all

ordinary shares that the holder has a right to purchase within 60 days of March 31, 2024; and (ii) no other exercisable or convertible

securities held by other holders has been exercised or converted into ordinary shares. |

| (2) |

Based solely upon and qualified in its entirety with reference to, a notice provided to the Company by Migdal Insurance & Financial Holdings Ltd.

as of March 31, 2024. Based solely upon, and qualified in its entirety with reference to, information provided to the Company by Migdal

Insurance & Financial Holdings Ltd. and public filings, we believe the percentage of our ordinary shares beneficially owned by Migdal

Insurance & Financial Holdings Ltd. during the past three years has ranged between 3.8% and 7.6%, however, there is no assurance this

shareholder did not own fewer shares than the minimum point of this range on certain dates during this period, as this information is

not publicly available or otherwise provided to the Company. |

| (3) |

Based solely upon and qualified in its entirety with reference to, a notice provided to the Company by Harel Insurance Investments

& Financial Services Ltd. as of March 31, 2024. Based solely upon, and qualified in its entirety with reference to, information provided

to the Company by Harel Insurance Investments & Financial Services Ltd. and public filings, we believe the percentage of our ordinary

shares beneficially owned by Harel Insurance Investments & Financial Services Ltd. during the past three years has ranged between

4.7% and 7.4%, however there is no assurance this shareholder did not own fewer shares than the minimum point of this range on certain

dates during this period as this information is not publicly available or otherwise provided to the Company. |

| (4) |

Based solely upon and qualified in its entirety with reference to, a notice provided to the Company by Senvest Management, LLC as

of March 31, 2024. Based solely upon, and qualified in its entirety with reference to, information provided to the Company by Senvest

Management, LLC and public filings, we believe the percentage of our ordinary shares beneficially owned by Senvest Management, LLC during

the past three years has ranged between 3.8% and 7.9%, however there is no assurance this shareholder did not own fewer shares than the

minimum point of this range on certain dates during this period as this information is not publicly available or otherwise provided to

the Company. |

| (5) |

Based solely upon and qualified in its entirety with reference to, a notice provided to the Company by Clal Insurance Enterprises

Holdings Ltd. as of March 31, 2024. Based solely upon, and qualified in its entirety with reference to, information provided to the Company

by Clal Insurance Enterprises Holdings Ltd. and public filings, we believe the percentage of our ordinary shares beneficially owned by

Clal Insurance Enterprises Holdings Ltd. during the past three years has ranged between 3.5% and 6.1%, however there is no assurance this

shareholder did not own fewer shares than the minimum point of this range on certain dates during this period as this information is not

publicly available or otherwise provided to the Company. |

| • |

amendments to our Articles of Association; |

| • |

appointment, terms of engagement and termination of engagement of our independent auditors; |

| • |

appointment and dismissal of external directors (if applicable); |

| • |

approval of certain related party transactions and certain officer and director compensation; |

| • |

increase or reduction of authorized share capital in accordance with the provisions of the Companies Law; |

| • |

a merger; and |

| • |

the exercise of the Board of Directors’ powers by the general meeting, if the Board of Directors is unable to exercise its

powers and the exercise of any of its powers is essential for Tower’s proper management. |

| • |

Industrial companies meeting the criteria set out by the Investment Law for a “Preferred Income” of a “Preferred

Enterprise” (as defined below) will be eligible for reduced and flat corporate tax rates of 7.5% (currently, following the 2017

Amendment described below) or 16% in 2017 and thereafter, with the actual tax rates determined by the location of the enterprise in Israel.

The location of Tower's facilities in Israel (also referred to as “Zone A”) entitles it to benefit from a tax rate of 7.5%

on its Preferred Income. According to the 2011 Amendment, the tax incentives offered by the Investment Law are no longer dependent neither

on minimum qualified investments nor on foreign ownership. |

| • |

A company can enjoy both government grants and tax benefits concurrently. Governmental grants will not necessarily be dependent on

the extent of enterprise’s investment in assets and/or equipment. |

| • |

an individual citizen or resident of the United States; |

| • |

a corporation created or organized in or under the laws of the United States or of any state of the United States or the District

of Columbia; |

| • |

an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

| • |

a trust if the trust has elected validly to be treated as a United States person for U.S. federal income tax purposes or if a U.S.

court is able to exercise primary supervision over the trust’s administration and one or more United States persons have the authority

to control all of the trust’s substantial decisions. |

| • |

insurance companies; |

| • |

dealers in stocks, securities or currencies; |

| • |

financial institutions and financial services entities; |

| • |

real estate investment trusts; |

| • |

regulated investment companies; |

| • |

persons that receive ordinary shares as compensation for the performance of services; |

| • |

tax-exempt organizations; |

| • |

persons that hold ordinary shares as a position in a straddle or as part of a hedging, conversion or other integrated instrument;

|

| • |

individual retirement and other tax-deferred accounts; |

| • |

expatriates of the United States; |

| • |

persons (other than Non-U.S. Holders) having a functional currency other than the U.S. dollar; and |

| • |

direct, indirect or constructive owners of 10% or more, by voting power or value, of us. |

| • | (a) | the stock of that corporation with respect to which the dividends are paid is readily tradable on an established securities market in the U.S., or |

| • | (b) | that corporation is eligible for benefits of a comprehensive income tax treaty with the U.S. which includes an information exchange program and is determined to be satisfactory by the U.S. Secretary of the Treasury. The Internal Revenue Service has determined that the U.S.-Israel Tax Treaty is satisfactory for this purpose. |

| • |

that gain is effectively connected with the conduct by the Non-U.S. Holder of a trade or business in the United States, or

|

| • |

in the case of any gain realized by an individual Non-U.S. Holder, that holder is present in the United States for 183 days or more

in the taxable year of the sale or exchange, and other conditions are met. |

| • | (1) | a U.S. person; |

| • | (2) | the government of the U.S. or the government of any state or political subdivision of any state (or any agency or instrumentality of any of these governmental units); |

| • | (3) | a controlled foreign corporation; |

| • | (4) | a foreign partnership that is either engaged in a U.S. trade or business or whose United States partners in the aggregate hold more than 50% of the income or capital interests in the partnership; |

| • | (5) | a foreign person that derives 50% or more of its gross income for certain periods from the conduct of a trade or business in the U.S.; or |

| • | (6) | a U.S. branch of a foreign bank or insurance company. |

|

2023 |

2022 |

|||||||

|

(US dollars in Thousands) |

||||||||

|

Audit Fees (1) |

816 |

819 |

||||||

|

Audit-Related Fees (2) |

0 |

58 |

||||||

|

Tax Fees (3) |

77 |

1 |

||||||

|

All Other Fees (4) |

11 |

-- |

||||||

|

904 |

878 |

|||||||

| • |

Distribution of certain reports to shareholders. As opposed to Nasdaq Listing Rule

5250(d), which requires listed issuers to make annual reports available to shareholders in one of a number of specific manners, Israeli

law does not require that we distribute annual reports, including our financial statements. As such, the generally accepted business practice

in Israel is to distribute such reports to shareholders through a public regulated distribution website. In addition to making such reports

available on a public regulated distribution website, our audited financial statements are available to our shareholders at our offices

and will only mail such reports to shareholders upon request. |

| • |

Independent director meetings. Our Board has not adopted a policy of conducting regularly

scheduled meetings at which only our independent directors are present, as permitted by Israeli law. We do not follow the requirements

of Nasdaq Listing Rule 5605(b)(2). |

| • |

Compensation of officers. We follow Israeli law and practice with respect to the approval

of compensation for our chief executive officer and other executive officers. While our compensation committee currently complies with

the provisions of the Nasdaq Listing Rules relating to composition requirements, Israeli law generally requires that the compensation

of the chief executive officer and all other executive officers be approved, or recommended to the board for approval, by the compensation

committee (with respect to the compensation of the chief executive officer and in certain other instances, shareholder approval is also

required). Israeli law may differ from the provisions provided for in Nasdaq Listing Rule 5605(d) (see Exhibit 2.1 to this annual report,

“Description of Securities”). |

| • |

Director nomination process. While our corporate governance and nominating committee

currently complies with the provisions of the Nasdaq Listing Rules relating to composition requirements, the process under which director

nominees are selected, or recommended for the Board of Directors selection, may not be in full compliance with the applicable Nasdaq Listing

Rule 5605(e). Furthermore, although we have adopted a formal written corporate governance and nominating committee charter, there is no

requirement under the Companies Law to do so and the charter as adopted may not be in full compliance with the requirements under Nasdaq

Listing Rule 5605(e)(2). |

| • |

Audit Committee Charter. Although we have adopted a formal written audit committee

charter, there is no requirement under the Companies Law to do so and the charter as adopted may not specify all the items enumerated

in Nasdaq Listing Rule 5605(c)(1). |

| • |

Compensation Committee Charter. Although we have adopted a formal written compensation

committee charter, there is no requirement under the Companies Law to do so and the charter as adopted may not specify all the items enumerated

in Nasdaq Listing Rule 5605(d)(1). |

| • |

Quorum requirements. Under our articles of association and as permitted under the Companies

Law, a quorum for any meeting of shareholders shall be the presence of at least two shareholders holding a combined 33% of our outstanding

ordinary shares, instead of 33 1/3% of the issued share capital required under Nasdaq Listing Rule 5620(c). If the meeting was adjourned

for lack of a quorum, if a quorum is not present at the adjourned meeting within half an hour of the time fixed for the commencement of

the adjourned meeting, the shareholders present, in person or by proxy, shall constitute a quorum. |

| • |

Related Party Transactions. We review and approve all related party transactions in

accordance with the requirements and procedures for approval of related party acts and transactions set forth in Sections 268 to 275 the

Companies Law, which may not fully reflect the requirements of Nasdaq Listing Rule 5630. |

| • |

Shareholder Approval. We seek shareholder approval for all corporate actions requiring

such approval under the requirements of the Companies Law, rather than seeking approval for corporate actions in accordance with Nasdaq

Listing Rule 5635. Under the Companies Law, shareholder approval is required (subject to certain limited exceptions) for, among other

things: (a) transactions with directors concerning the terms of their service (including indemnification, exemption, and insurance for

their service or for any other position that they may hold at a company), for which approvals of the compensation committee, board of

directors, and shareholders are all required (subject to exceptions) (see Exhibit 2.1 to this annual report, “Description of Securities”);

(b) extraordinary transactions with controlling shareholders of publicly held companies; (c) terms of office and employment or other engagement

of a controlling shareholder, if any, or such controlling shareholder’s relative; (d) approval of transactions with the chief executive

officer with respect to his or her compensation, or transactions with officers not in accordance with the approved compensation policy

(see Exhibit 2.1 to this annual report, “Description of Securities”); and (e) approval of the compensation policy for office

holders (within the meaning of the Companies Law) (see “Item 6 Directors, Senior Management and Employees–B. Compensation”).

In addition, under the Companies Law, a merger requires the approval of the shareholders of each of the merging companies. |

|

Page

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PCAOB ID

|

F-2 - F-4

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

|

F-8

|

|

|

F-9 - F-10

|

|

|

F-11 - F-53

|

| • |

We obtained the taxable income allocation used in calculating the income tax provision and tested that the taxable income allocation between Israel and corporate operations and the other subsidiaries is appropriate based on the specified services and margins determined in the Company's transfer pricing studies.

|

| • |

We tested the effectiveness of controls over the Company’s process to allocate its taxable income between the different subsidiaries based on the Company's transfer pricing studies.

|

| • |

We read and evaluated management’s documentation, including information obtained by management from external tax specialists that detailed the basis of the uncertain tax positions.

|

| • |

With the assistance of our income tax specialists, we evaluated:

|

| • |

The appropriateness of the transfer pricing analysis, including the transfer pricing methods and profit level indicators and ranges provided within the transfer pricing studies conducted by the Company’s external tax specialists.

|

| • |

The appropriateness of the transfer pricing methodology implemented by management as provided in the transfer pricing studies.

|

| • |

The relevant facts by reading the Company’s correspondence with the relevant tax authorities and any third-party advice obtained by the Company.

|

| • |

The Company’s measurement of uncertain tax positions related to transfer pricing based on our knowledge of international and local income tax laws, as well as historical settlement activity from income tax authorities.

|

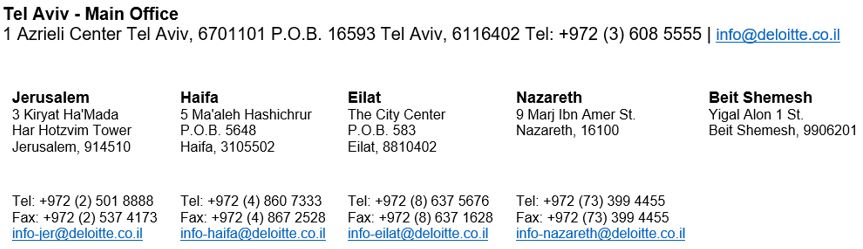

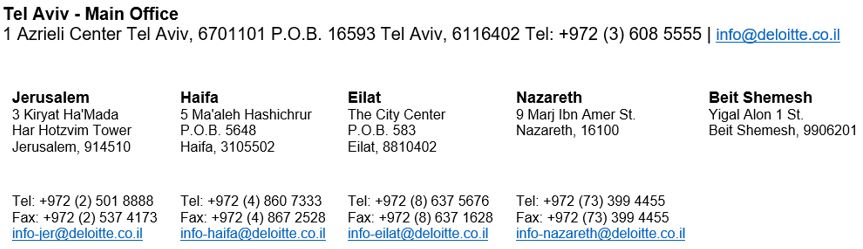

Certified Public Accountants

A Firm in the Deloitte Global Network

February 29, 2024

We have served as the Company's auditor since 1993.

Certified Public Accountants

A Firm in The Deloitte Global Network

February 29, 2024

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(dollars and shares in thousands)

|

|

As of

|

||||||||

|

December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Short-term deposits

|

|

|

||||||

|

Marketable securities (*)

|

|

|

||||||

|

Trade accounts receivable

|

|

|

||||||

|

Inventories

|

|

|

||||||

|

Other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

LONG-TERM INVESTMENTS

|

|

|

||||||

|

PROPERTY AND EQUIPMENT, NET

|

|

|

||||||

|

INTANGIBLE ASSETS, NET

|

|

|

||||||

|

GOODWILL

|

|

|

||||||

|

DEFERRED TAX AND OTHER LONG-TERM ASSETS, NET

|

|

|

||||||

|

TOTAL ASSETS

|

$

|

|

$

|

|

||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Current maturities of long-term debt

|

$

|

|

$

|

|

||||

|

Trade accounts payable

|

|

|

||||||

|

Deferred revenue and customers' advances

|

|

|

||||||

|

Employee related liabilities

|

|

|

||||||

|

Other current liabilities

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

LONG-TERM DEBT

|

|

|

||||||

|

LONG-TERM CUSTOMERS' ADVANCES

|

|

|

||||||

|

EMPLOYEE RELATED LIABILITIES

|

|

|

||||||

|

DEFERRED TAX AND OTHER LONG-TERM LIABILITIES

|

|

|

||||||

|

TOTAL LIABILITIES

|

|

|

||||||

|

Ordinary shares of NIS

|

|

|

||||||

|

|

||||||||

|

|

||||||||

|

|

||||||||

|

Additional paid-in capital

|

|

|

||||||

|

Cumulative stock based compensation

|

|

|

||||||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

||||

|

Retained earnings (accumulated deficit)

|

|

(

|

)

|

|||||

|

|

|

|||||||

|

Treasury stock, at cost -

|

(

|

)

|

(

|

)

|

||||

|

THE COMPANY'S SHAREHOLDERS' EQUITY

|

|

|

||||||

|

Non-controlling interest

|

(

|

)

|

(

|

)

|

||||

|

TOTAL SHAREHOLDERS' EQUITY

|

|

|

||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

|

$

|

|

||||

F - 5

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(dollars and shares in thousands, except per share data)

|

|

Year ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

REVENUES

|

$

|

|

$

|

|

$

|

|

||||||

|

COST OF REVENUES

|

|

|

|

|||||||||

|

GROSS PROFIT

|

|

|

|

|||||||||

|

OPERATING COSTS AND EXPENSES:

|

||||||||||||

|

Research and development

|

|

|

|

|||||||||

|

Marketing, general and administrative

|

|

|

|

|||||||||

|

Restructuring gain from sale of machinery and equipment, net

|

(

|

)

|

(

|

)

|

|

|||||||

|

Restructuring expense

|

|

|

|

|||||||||

|

Merger-contract termination fee, net

|

(

|

)

|

|

|

||||||||

|

(

|

)

|

|

|

|||||||||

|

OPERATING PROFIT

|

|

|

|

|||||||||

|

FINANCING INCOME (EXPENSE), NET

|

|

(

|

)

|

(

|

)

|

|||||||

|

OTHER INCOME (EXPENSE), NET

|

|

(

|

)

|

|

||||||||

|

PROFIT BEFORE INCOME TAX

|

|

|

|

|||||||||

|

INCOME TAX EXPENSE, NET

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

NET PROFIT

|

|

|

|

|||||||||

|

Net income attributable to non-controlling interest

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

NET PROFIT ATTRIBUTABLE TO THE COMPANY

|

$

|

|

$

|

|

$

|

|

||||||

|

BASIC EARNINGS PER SHARE

|

||||||||||||

|

Earnings per share

|

$

|

|

$

|

|

$

|

|

||||||

|

Weighted average number of shares

|

|

|

|

|||||||||

|

DILUTED EARNINGS PER ORDINARY SHARE:

|

||||||||||||

|

Earnings per share

|

$

|

|

$

|

|

$

|

|

||||||

|

Net profit used for diluted earnings per share

|

|

$

|

|

$

|

|

|||||||

|

Weighted average number of ordinary shares outstanding

|

||||||||||||

|

used for diluted earnings per share

|

|

|

|

|||||||||

|

See notes to consolidated financial statements.

|

F - 6

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

|

(dollars in thousands)

|

|

Year ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

Net profit

|

$

|

|

$

|

|

$

|

|

||||||

|

Other comprehensive income, net of tax:

|

||||||||||||

|

Foreign currency translation adjustment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Change in employees plan assets and benefit obligations, net of taxes

|

(

|

)

|

(

|

)

|

|

|||||||

|

Unrealized gain (loss) on derivatives and marketable securities

|

|

(

|

)

|

(

|

)

|

|||||||

|

Comprehensive income

|

|

|

|

|||||||||

|

Comprehensive loss attributable to non-controlling interest

|

|

|

|

|||||||||

|

Comprehensive income attributable to the Company

|

$

|

|

$

|

|

$

|

|

||||||

|

See notes to consolidated financial statements.

|

F - 7

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

|

|

(dollars and share data in thousands)

|

|

THE COMPANY'S SHAREHOLDERS' EQUITY

|

||||||||||||||||||||||||||||||||||||||||||||

|

Accumulated

|

Foreign

|

Retained

|

||||||||||||||||||||||||||||||||||||||||||

|

Ordinary

|

Ordinary

|

Additional

|

other

|

currency

|

earnings

|

Non

|

||||||||||||||||||||||||||||||||||||||

|

shares

|

shares

|

paid-in

|

Unearned

|

comprehensive

|

translation

|

(accumulated

|

Treasury

|

Comprehensive

|

controlling

|

|||||||||||||||||||||||||||||||||||

|

issued

|

amount

|

capital

|

compensation

|

income (loss)

|

adjustments

|

deficit)

|

stock

|

income

|

interest

|

Total

|

||||||||||||||||||||||||||||||||||

|

BALANCE AS OF JANUARY 1, 2021

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

||||||||||||||||||||

|

Changes during the year ended December 31, 2021:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Exercise of options and RSUs

|

|

|

(

|

)

|

|

|||||||||||||||||||||||||||||||||||||||

|

Employee stock-based compensation

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

Other comprehensive income:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Profit

|

|

$

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

Foreign currency translation adjustments

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||

|

Change in employees plan assets and benefit obligations

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Unrealized loss on derivatives and marketable securities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||||

|

Comprehensive income

|

$

|

|

||||||||||||||||||||||||||||||||||||||||||

|

BALANCE AS OF DECEMBER 31, 2021

|

|

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

|

|||||||||||||||||||||||||||||

|

Changes during the year ended December 31, 2022:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Proceeds from an investment in a subsidiary

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

Exercise of options and RSUs

|

|

|

(

|

)

|

|

|||||||||||||||||||||||||||||||||||||||

|

Employee stock-based compensation

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

Other comprehensive income:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Profit

|

|

$

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

Foreign currency translation adjustments

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||

|

Change in employees plan assets and benefit obligations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||||

|

Unrealized loss on derivatives and marketable securities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||||

|

Comprehensive income

|

$

|

|

||||||||||||||||||||||||||||||||||||||||||

|

BALANCE AS OF DECEMBER 31, 2022

|

|

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

|

|||||||||||||||||||||||||||||

|

Changes during the year ended December 31, 2023:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Proceeds from an investment in a subsidiary

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

Exercise of options and RSUs

|

|

|

(

|

)

|

|

|||||||||||||||||||||||||||||||||||||||

|

Employee stock-based compensation

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

Other comprehensive income:

|

||||||||||||||||||||||||||||||||||||||||||||

|

Profit

|

|

$

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

Foreign currency translation adjustments

|

(

|

)

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||

|

Change in employees plan assets and benefit obligations

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||||||||||||||||

|

Unrealized gain on derivatives and marketable securities

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Comprehensive income

|

$

|

|

||||||||||||||||||||||||||||||||||||||||||

|

BALANCE AS OF DECEMBER 31, 2023

|

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

||||||||||||||||||||||

|

OUTSTANDING SHARES, NET OF TREASURY STOCK AS OF DECEMBER 31, 2023

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

See notes to consolidated financial statements.

|

F - 8

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(dollars in thousands)

|

|

Year ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

CASH FLOWS - OPERATING ACTIVITIES

|

||||||||||||

|

Net profit for the period

|

$

|

|

$

|

|

$

|

|

||||||

|

Adjustments to reconcile net profit for the period

to net cash provided by operating activities:

|

||||||||||||

|

Income and expense items not involving cash flows:

|

||||||||||||

|

Depreciation and amortization

|

|

|

|

|||||||||

|

Effect of exchange rate differences and fair value adjustment

|

(

|

)

|

|

|

||||||||

|

Other expense (income), net

|

(

|

)

|

|

(

|

)

|

|||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

Trade accounts receivable

|

(

|

)

|

(

|

)

|

|

|||||||

|

Other current assets

|

(

|

)

|

|

(

|

)

|

|||||||

|

Inventories

|

|

(

|

)

|

(

|

)

|

|||||||

|

Trade accounts payable

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Deferred revenue and customers' advances

|

(

|

)

|

(

|

)

|

|

|||||||

|

Employee related liabilities and other current liabilities

|

(

|

)

|

|

|

||||||||

|

Long-term employee related liabilities

|

(

|

)

|

|

(

|

)

|

|||||||

|

Deferred tax, net and other long-term liabilities

|

|

|

(

|

)

|

||||||||

|

Net cash provided by operating activities

|

|

|

|

|||||||||

|

CASH FLOWS - INVESTING ACTIVITIES

|

||||||||||||

|

Investments in property and equipment, net

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Proceeds related to sale and disposal of property and equipment

|

|

|

|

|||||||||

|

Proceeds from investment realization

|

|

|

|

|||||||||

|

Investments in other assets

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Deposits and marketable securities, net

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash used in investing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

CASH FLOWS - FINANCING ACTIVITIES

|

||||||||||||

|

Proceeds from an investment in a subsidiary

|

|

|

|

|||||||||

|

Exercise of options, net

|

|

|

|

|||||||||

|

Proceeds from loans

|

|

|

|

|||||||||

|

Loans repayment

|

|

|

(

|

)

|

||||||||

|

Principal payments on account of capital lease obligation

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Debentures repayment

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net cash used in financing activities

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGE

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

(

|

)

|

|

(

|

)

|

|||||||

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

|

|

|

|||||||||

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

$

|

|

$

|

|

$

|

|

||||||

|

See notes to consolidated financial statements.

|

F - 9

|

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(dollars in thousands)

|

|

Year ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

NON-CASH ACTIVITIES:

|

||||||||||||

|

Investments in property and equipment

|

$

|

|

$

|

|

$

|

$

|

||||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

|

||||||||||||

|

Cash received during the period from interest

|

$

|

|

$

|

|

$

|

$

|

||||||

|

Cash paid during the period for interest

|

$

|

|

$

|

|

$

|

$

|

||||||

|

Cash paid for income taxes, net during the period

|

$

|

|

$

|

|

$

|

$

|

||||||

|

See notes to consolidated financial statements.

|

F - 10

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 11

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 12

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

F - 13

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

| • |

Buildings and building improvements, including facility infrastructure:

|

| • |

Machinery and equipment, software and hardware:

|

F - 14

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 15

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 16

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 17

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 18

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 19

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 20

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

2023

|

2022

|

||||||

|

Raw materials

|

$

|

|

$

|

|

||||

|

Work in process

|

|

|

||||||

|

Finished goods

|

|

|

||||||

|

$

|

|

$

|

|

|||||

F - 21

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

2023

|

2022

|

||||||

|

Direct and indirect tax receivables

|

$

|

|

$

|

|

||||

|

Prepaid expenses

|

|

|

||||||

|

Receivables from hedging transactions - see Notes 10, 12A and 12D

|

|

|

||||||

|

Other receivables

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

Details

|

2023

|

2022

|

||||||

|

Investments in privately held companies

|

$

|

|

$

|

|

||||

|

Severance-pay funds

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

Details

|

2023

|

2022

|

||||||

|

Original cost: (*)

|

||||||||

|

Land and buildings, including facility infrastructure

|

$

|

|

$

|

|

||||

|

Machinery and equipment

|

|

|

||||||

|

|

|

|||||||

|

Accumulated depreciation:

|

||||||||

|

Buildings, including facility infrastructure

|

(

|

)

|

(

|

)

|

||||

|

Machinery and equipment

|

(

|

)

|

(

|

)

|

||||

|

(

|

)

|

(

|

)

|

|||||

|

$

|

|

$

|

|

|||||

F - 22

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

Useful life

(years)

|

Cost

|

Accumulated Amortization

|

Net

|

||||||||||||

|

Facilities’ lease

|

|

$

|

|

$

|

(

|

)

|

$

|

|

||||||||

|

Technologies

|

|

|

(

|

)

|

|

|||||||||||

|

Customer relationships

|

|

|

(

|

)

|

|

|||||||||||

|

Total identifiable intangible assets

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||||

|

Details

|

Useful life

(years)

|

Cost

|

Accumulated Amortization

|

Net

|

||||||||||||

|

Facilities’ lease

|

|

$

|

|

$

|

(

|

)

|

$

|

|

||||||||

|

Technologies

|

|

|

(

|

)

|

|

|||||||||||

|

Customer relationships

|

|

|

(

|

)

|

|

|||||||||||

|

Total identifiable intangible assets

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||||

|

Details

|

2023

|

2022

|

||||||

|

Long-term prepaid expenses

|

$

|

|

$

|

|

||||

|

ROU - assets under operating leases

|

|

|

||||||

|

Prepaid long-term land lease, net

|

|

|

||||||

|

Deferred tax asset (see Note 19)

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

Details

|

2023

|

2022

|

||||||

|

Tax payables

|

$

|

|

$

|

|

||||

|

Hedging transactions related payables

|

|

|

||||||

|

Interest payable on debt

|

|

|

||||||

|

Proceeds on account of machinery and equipment to be sold in relation to restructuring (see also note 14B2)

|

|

|

||||||

|

Others

|

|

|

||||||

|

$

|

|

$

|

|

|||||

F - 23

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

2023

|

2022

|

||||||

|

Long-term JPY loans - principal amount - see Notes 11B and 11C below

|

$

|

|

$

|

|

||||

|

- see Note 11D below

|

|

|

||||||

|

Operating leases - see Note 11E below

|

|

|

||||||

|

Less - current maturities

|

(

|

)

|

(

|

)

|

||||

|

$

|

|

$

|

|

|||||

|

Details

|

Interest

Rate

|

2024

|

2025

|

2026

|

2027

|

Total

|

||||||||||||||||||

|

Long-term 2021 JPY loan

|

|

%

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||

|

Long-term 2023 JPY loan

|

|

%

|

|

|

|

|

|

|||||||||||||||||

|

Total long-term JPY loans

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||||||||

F - 24

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Fiscal Year

|

Amount ($)

|

|||

|

2024

|

$

|

|

||

|

2025

|

|

|||

|

2026

|

|

|||

|

2027

|

|

|||

|

2028

|

|

|||

|

2029 and on

|

|

|||

|

Total

|

|

|||

|

Less - imputed interest

|

(

|

)

|

||

|

Total

|

$

|

|

||

F - 25

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

Classification in the Consolidated Balance Sheets

|

December 31, 2023

|

December 31, 2022

|

|||||||

|

ROU - assets under operating leases

|

|

$

|

|

$

|

|

|||||

|

Lease liabilities:

|

||||||||||

|

Current operating lease liabilities

|

|

$

|

|

$

|

|

|||||

|

Long-term operating lease liabilities

|

|

|

|

|||||||

|

Total operating lease liabilities

|

$

|

|

$

|

|

||||||

|

Weighted average remaining lease term (years)

|

|

|

||||||||

|

Weighted average discount rate

|

|

%

|

|

%

|

||||||

|

Fiscal Year

|

Amount ($)

|

|||

|

2024

|

$

|

|

||

|

2025

|

|

|||

|

2026

|

|

|||

|

2027

|

|

|||

|

Total

|

|

|||

|

Less - imputed interest

|

(

|

)

|

||

|

Total

|

$

|

|

||

F - 26

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 27

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 28

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

F - 29

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

December 31, 2023

|

Quoted prices in active market

(Level 1)

|

Significant other observable inputs

(Level 2)

|

Significant unobservable inputs

(Level 3)

|

||||||||||||

|

Privately held companies

|

|

|

|

|

||||||||||||

|

Marketable securities held for sale

|

|

|

|

|

||||||||||||

|

Foreign exchange forward and cylinders - net asset position

|

|

|

|

|

||||||||||||

|

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||

|

Details

|

December 31, 2022

|

Quoted prices in active market

(Level 1)

|

Significant other observable inputs

(Level 2)

|

Significant unobservable inputs

(Level 3)

|

||||||||||||

|

Cross-currency swap - net asset position

|

$

|

|

$

|

|

$

|

|

$

|

|

||||||||

|

Privately held companies

|

|

|

|

|

||||||||||||

|

Marketable securities held for sale

|

|

|

|

|

||||||||||||

|

Foreign exchange forward and cylinders - net liability position

|

(

|

)

|

|

(

|

)

|

|

||||||||||

|

$

|

|

$

|

|

$

|

|

$

|

|

|||||||||

F - 30

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

Amortized

Cost (*)

|

Gross unrealized gains

|

Gross unrealized losses

|

Estimated fair value

|

||||||||||||

|

Corporate bonds

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||

|

Government bonds

|

|

|

(

|

)

|

|

|||||||||||

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

||||||||

|

Details

|

Amortized Cost

|

Estimated fair value

|

||||||

|

Due within one year

|

$

|

|

$

|

|

||||

|

Due within 2-5 years

|

|

|

||||||

|

Due after 5 years

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

Details

|

Amortized

Cost (*)

|

Gross unrealized gains

|

Gross unrealized losses

|

Estimated fair

value

|

||||||||||||

|

Corporate bonds

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||

|

Government bonds

|

|

|

(

|

)

|

|

|||||||||||

|

Municipal bonds

|

|

|

(

|

)

|

|

|||||||||||

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

||||||||

F - 31

TOWER SEMICONDUCTOR LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2023

(dollars in thousands, except per share data)

|

Details

|

Amortized Cost

|

Estimated fair value

|

||||||

|

Due within one year

|

$

|

|

$

|

|

||||

|

Due within 2-5 years

|

|

|

||||||

|

Due after 5 years

|

|

|

||||||

|

$

|

|

$

|

|

|||||

|

December 31, 2023

|

||||||||||||||||||||||||

|

Investments with continuous unrealized losses for less than twelve months

|

Investments with continuous unrealized losses for twelve months or more

|

Total investments with continuous unrealized losses

|

||||||||||||||||||||||

|

Details

|

Fair value

|

Unrealized losses

|

Fair value

|

Unrealized losses

|

Fair value

|

Unrealized losses

|

||||||||||||||||||

|

Corporate bonds

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

(

|

)

|

$

|

|