FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

For the month of June 2013 No. 7

TOWER SEMICONDUCTOR LTD.

(Translation of registrant's name into English)

Ramat Gavriel Industrial Park

P.O. Box 619, Migdal Haemek, Israel 23105

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F S Form 40-F £

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes £ No S

On June 24, 2013, the registrant is attaching hereto its Rights Offering Israeli road show presentation, as was presented to the Israeli Capital Market.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

TOWER SEMICONDUCTOR LTD.

|

|||

|

Date: June 24, 2013

|

By:

|

/s/ Nati Somekh

|

|

|

Name: Nati Somekh

|

|||

|

Title: Corporate Secretary

|

|||

Corporate Overview

June 2013

Disclaimers

The information presented herein contains forward-looking statements that relate to anticipated future operating results.

Those statements are based on management’s current expectations and assumptions, which may be affected by subsequent

developments and business conditions, and necessarily involve risks and uncertainties. Therefore, there can be no assurance

that actual future results will not differ materially from anticipated results. Please refer to Tower disclosure documents filed

with the Securities and Exchange Commission, including the corporation’s Annual Reports on Form 20-F and Quarterly Reports

on Form 6-K for a more complete discussion of some of the important factors that might affect these trends. Further, this

presentation is non-binding; Please read the prospectus that was recently filed with the SEC for complete information with

respect to the fundraising. This presentation contains forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current

expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to

differ materially from those described in the forward-looking statements. All statements other than statements of historical

fact are statements that could be deemed forward-looking statements. For example, statements of expected synergies from

Tower’s merger with Jazz, customer benefits, costs savings, financial guidance, industry ranking, execution of integration plans

and management and organizational structure are all forward-looking statements. The potential risks and uncertainties

include, among others, that expected customer benefits, synergies and costs savings will not be achieved or that the

companies are unable to successfully execute their integration strategies, as well as other risks applicable to both Tower and

Jazz’s business described in the reports filed by Tower and Jazz with the Securities and Exchange Commission (the “SEC”) and,

in the case of Tower, the Israel Securities Authority. These filings identify and address other important factors that could

cause Tower and Jazz's respective financial and operational results to differ materially from those contained in the forward-

looking statements set forth in this document. Accordingly, no assurances can be given that any of the events anticipated by

the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of

operations or financial condition of Tower or Jazz. Tower and Jazz are providing this information as of the date of this

presentation and neither Tower nor Jazz undertakes any obligation to update any forward-looking statements contained in

this document as a result of new information, future events or otherwise. A more complete discussion of risks and

uncertainties that may affect the accuracy of forward-looking statements included in this presentation or which may

otherwise affect Tower or Jazz’s business is included under the heading "Risk Factors" in Tower’s most recent filings on Forms

20-F, F-4, F-3 and 6-K, as were filed with the SEC and the Israel Securities Authority and Jazz’s most recent filings on Forms 10-

K and 10-Q, as were filed with the SEC. Actual results may differ materially from those projected or implied by such forward-

looking statements. Tower and Jazz do not intend to update, and expressly disclaim any obligation to update, the information

contained in this release.

Those statements are based on management’s current expectations and assumptions, which may be affected by subsequent

developments and business conditions, and necessarily involve risks and uncertainties. Therefore, there can be no assurance

that actual future results will not differ materially from anticipated results. Please refer to Tower disclosure documents filed

with the Securities and Exchange Commission, including the corporation’s Annual Reports on Form 20-F and Quarterly Reports

on Form 6-K for a more complete discussion of some of the important factors that might affect these trends. Further, this

presentation is non-binding; Please read the prospectus that was recently filed with the SEC for complete information with

respect to the fundraising. This presentation contains forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current

expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to

differ materially from those described in the forward-looking statements. All statements other than statements of historical

fact are statements that could be deemed forward-looking statements. For example, statements of expected synergies from

Tower’s merger with Jazz, customer benefits, costs savings, financial guidance, industry ranking, execution of integration plans

and management and organizational structure are all forward-looking statements. The potential risks and uncertainties

include, among others, that expected customer benefits, synergies and costs savings will not be achieved or that the

companies are unable to successfully execute their integration strategies, as well as other risks applicable to both Tower and

Jazz’s business described in the reports filed by Tower and Jazz with the Securities and Exchange Commission (the “SEC”) and,

in the case of Tower, the Israel Securities Authority. These filings identify and address other important factors that could

cause Tower and Jazz's respective financial and operational results to differ materially from those contained in the forward-

looking statements set forth in this document. Accordingly, no assurances can be given that any of the events anticipated by

the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of

operations or financial condition of Tower or Jazz. Tower and Jazz are providing this information as of the date of this

presentation and neither Tower nor Jazz undertakes any obligation to update any forward-looking statements contained in

this document as a result of new information, future events or otherwise. A more complete discussion of risks and

uncertainties that may affect the accuracy of forward-looking statements included in this presentation or which may

otherwise affect Tower or Jazz’s business is included under the heading "Risk Factors" in Tower’s most recent filings on Forms

20-F, F-4, F-3 and 6-K, as were filed with the SEC and the Israel Securities Authority and Jazz’s most recent filings on Forms 10-

K and 10-Q, as were filed with the SEC. Actual results may differ materially from those projected or implied by such forward-

looking statements. Tower and Jazz do not intend to update, and expressly disclaim any obligation to update, the information

contained in this release.

2

Outline

§ Company Introduction

§ Industry Mega Trends

§ Specific Requirements/ TowerJazz Solutions

§ Growth drivers to the $1B and net profit targets

– SOI, Power, India, CIS, MEMS

§ Financial Review

§ Summary

3

Company Introduction

4

Internal Fab

Pure Play Foundry

Foundry Fab

TowerJazz

WW Design Center

Digital “Moore’s

law” foundries

law” foundries

Specialty Analog

Foundry

Foundry

5

Assembly

& Test

Packaged

Device

Pure Play Foundry

6

7

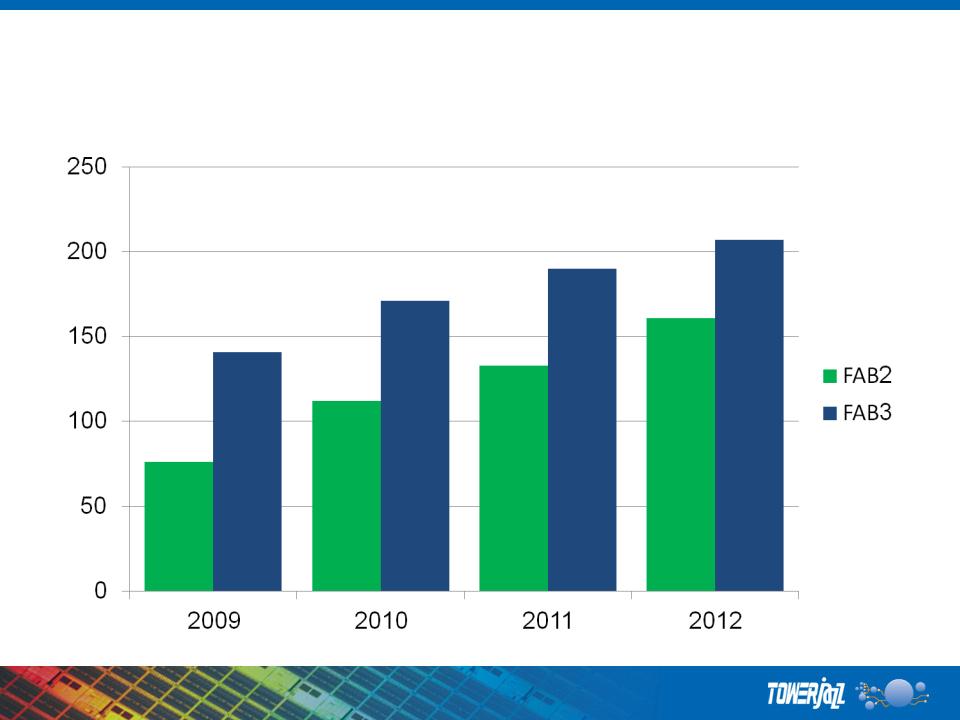

Total 8” Equivalent Capacity of up to ~1.7M WPY

8

Delivered Strong Revenue Annual Growth 2005-2012

9

Note

1. Source: IC Insights, Company reports, SemiMD January 2012

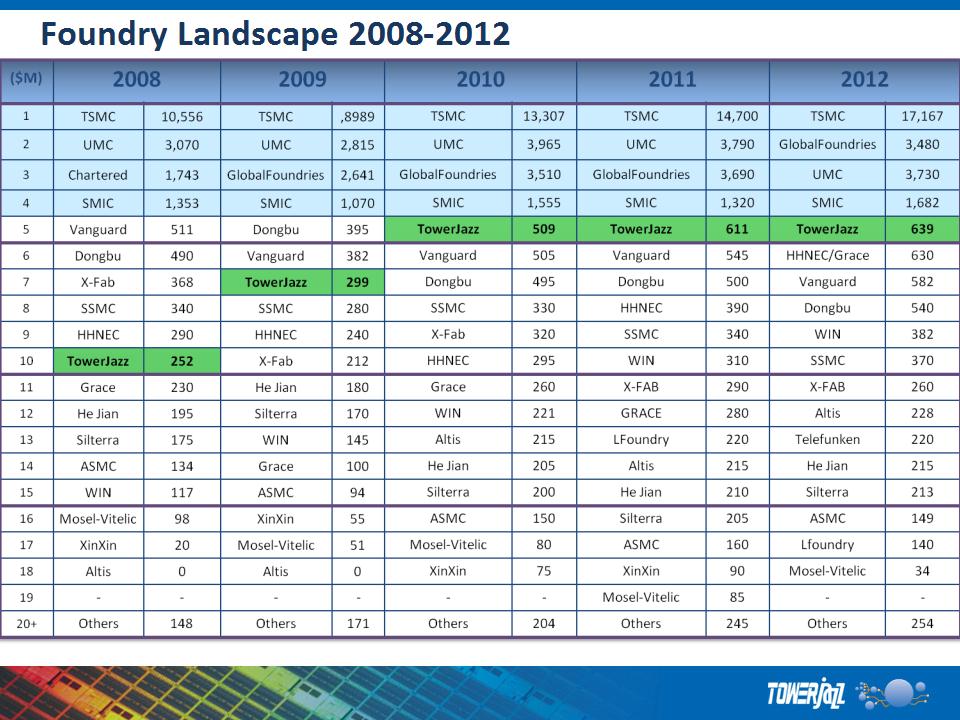

Foundry Revenue Landscape: Consistent superior performance

10

Source: IC Insights, EE Times, Company Reports

11

Orders Summary, Full-Mask-Sets - 2009 vs. 2012

Q1 - All Fabs, # of Masks Y over Y

TowerJazz

§ #1 pure-play specialty foundry*

– $639M Revenue in 2012

– Fastest growth foundry over the past 7 years

§ Growth fueled by innovation

14

* Source: IC Insights, EE Times

Wireless

RF / HPA

CMOS Image

Sensor

Sensor

Power

Management

Management

TOPS

IDM Transfer

Service

Service

TOPS

External

Service

Service

MEMS

Mega Trends

(1) ”Green” Energy

(2) Seamless Connectivity

(3) Multi-function Systems

(2) Seamless Connectivity

(3) Multi-function Systems

15

Megatrend 1: Green Everything (Energy Efficiency)

Everything in the Future will Require Power Management for Efficiency, Portability

and Power Density

and Power Density

Source: TI

1

16

Megatrend 2: Wireless Everything (Seamless

Connectivity)

Connectivity)

Everything in the Future will Require Wireless Connectivity to Other Device(s)

Source: New Paradigm Resources, 2012

2

17

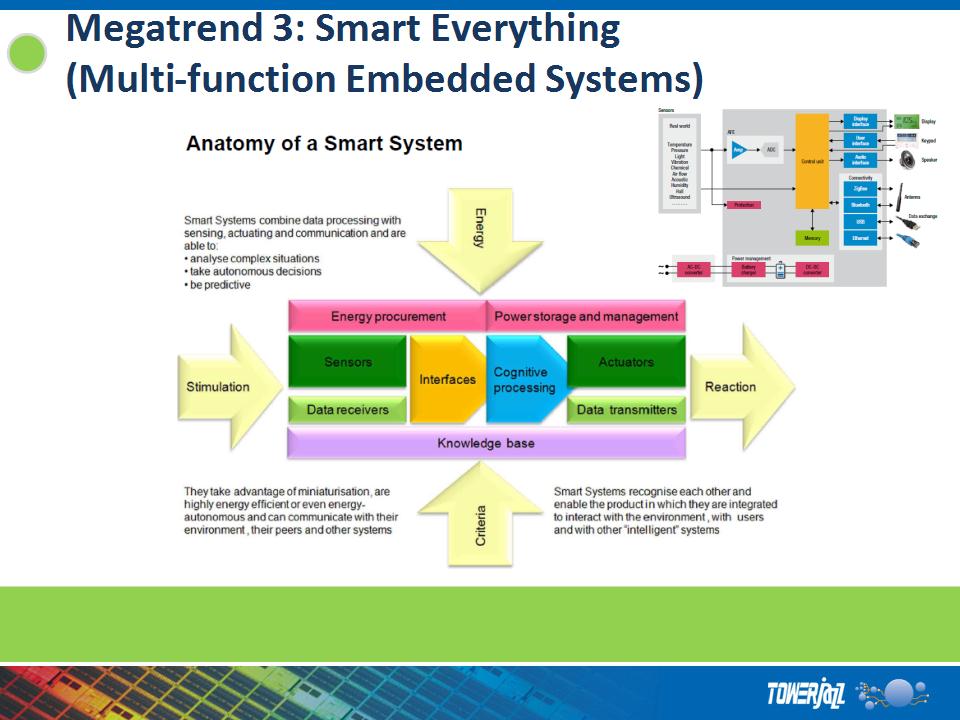

Everything in the Future will Require Multiple Embedded Functions to Impart

Smartness to Systems

Smartness to Systems

3

Source: smart-systems-integration.org

Example from Healthcare (STMicro)

18

Analog Market Segment is Expected Grow

Rapidly in Coming Years

Rapidly in Coming Years

|

Segment

|

2009 ($ Mil)

(TowerJazz Born)

|

2015 ($Mil)

|

Y-to-Y Growth

Rate |

|

Total Semiconductor

|

230,194

|

400,806

|

74%

|

|

Sensors/Actuators

|

3,970

|

9,832

|

148%

|

|

Optical

|

17,463

|

35,988

|

106%

|

|

Discretes

|

15,454

|

31,253

|

102%

|

|

Analog

|

36,073

|

72,113

|

100%

|

|

Microcomponents

|

48,463

|

80,243

|

66%

|

|

Memory

|

44,189

|

73,068

|

65%

|

|

Logic

|

64,582

|

98,309

|

52%

|

Below

average

growth

average

growth

Above

average

growth

average

growth

Sources: Nikkei, iSuppli, PwC

19

Specific Requirements/ TowerJazz Solutions

20

SiGe BiCMOS and RF CMOS

§ Mature technologies for high reliability

§ Wide range of options for integration

§ Design Enablement fast time-to-market

High Performance SiGe

§ Strong market presence

§ Best SiGe performance

RF Front-End Technology: SOI / SiGe PA

§ SOI for Antenna Switch

§ SiGe Power Amplifier

§ SOI/MEMS Antenna Tuning

Sensor, WiFi, and Analog Technology

§ WiFi Front-End Module

§ C-BiCMOS for Analog

§ MEMS for Sensors

RF/HPA Growth Driver: Our Solutions

21

Best-in-class SiGe, RF CMOS, RF models and Design Enablement

Wireless Infrastructure

Smartphones and Tablets

Internet-of-things

21

High Speed Data Distribution

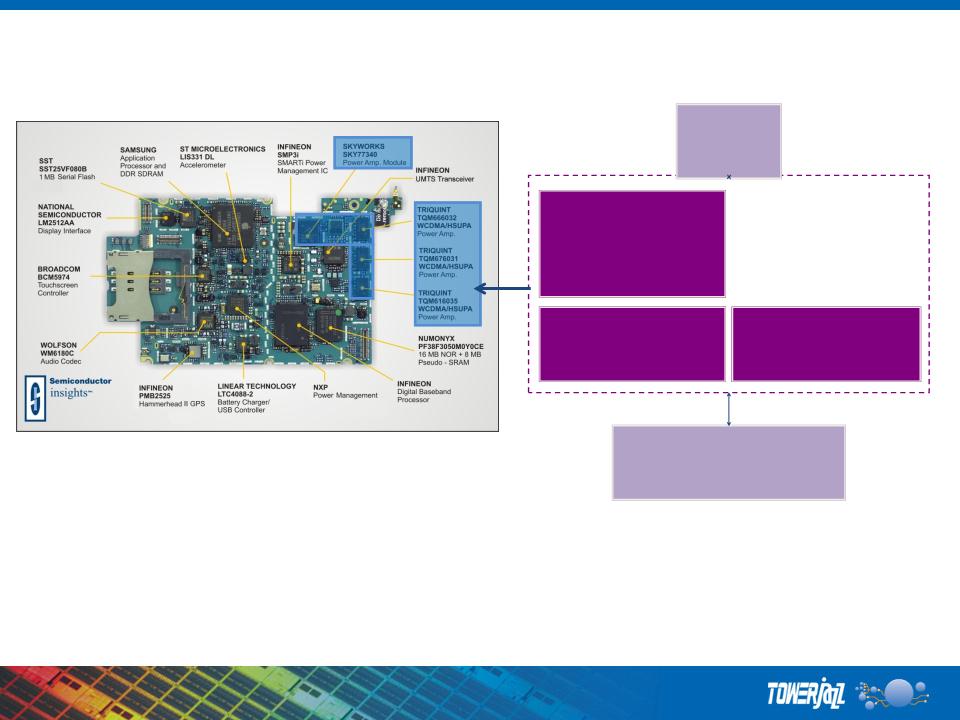

Front-End-Module Case Study: Smartphones (and

4G) multiply the needed FEM chips

4G) multiply the needed FEM chips

PA

GaAs -> SiGe

PA Control

RF CMOS

Switch

GaAs or SOS,

-> SOI CMOS

Front End

Module

Transceiver: RF CMOS

3G iPhone

Antenna

FEM:

The heart of every mobile

communication platform

communication platform

22

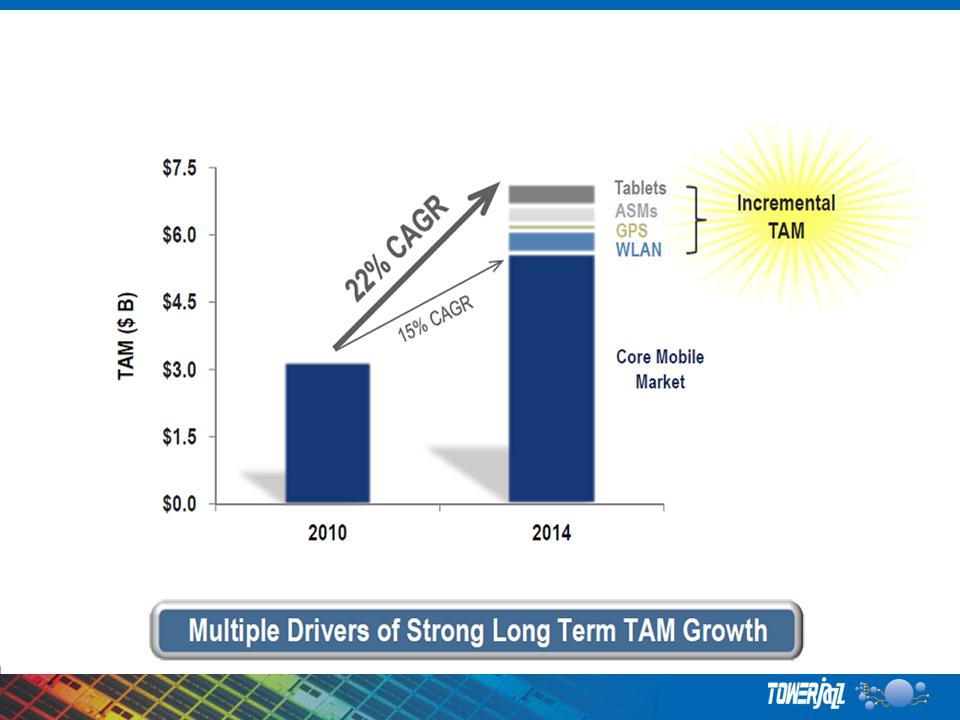

Front-End Module Growth Significantly Outpacing

the Semi Industry Average

the Semi Industry Average

23

TowerJazz Engaged with FEM Market Leaders

PA

GaAs or SiGe

PA Control

RF CMOS

Switch

GaAs or SOS,

or SOI CMOS

or SOI CMOS

Front End

Module

Transceiver: RF

CMOS

CMOS

3G iPhone

Antenn

a

a

Example: Skyworks

o “Foundry and/or Supplier of the Year” 2008, 2009, 2010 & 12

o 2011 Innovation Award

o 2012 “Quality Iron Man Award”

24

TowerJazz Recognized by Skyworks Solutions as 2012 Foundry Supplier

of the Year, Receives Quality Iron Man Partner Award

of the Year, Receives Quality Iron Man Partner Award

Skyworks is a FEM market leader and a top 5 customer of TowerJazz

MIGDAL HAEMEK, Israel, and NEWPORT BEACH, Calif., March 11, 2013 - TowerJazz, the

global specialty foundry leader, today announced it has received the 2012 Foundry Supplier of the

Year Award and the Quality Iron Man Award from Skyworks Solutions, Inc., an innovator of high

reliability analog and mixed-signal semiconductors enabling a broad range of end markets.

TowerJazz has been recognized as the Foundry Supplier of the Year for the fourth time, providing

excellent quality, performance and solid alignment with Skyworks’ supply chain requirements.

global specialty foundry leader, today announced it has received the 2012 Foundry Supplier of the

Year Award and the Quality Iron Man Award from Skyworks Solutions, Inc., an innovator of high

reliability analog and mixed-signal semiconductors enabling a broad range of end markets.

TowerJazz has been recognized as the Foundry Supplier of the Year for the fourth time, providing

excellent quality, performance and solid alignment with Skyworks’ supply chain requirements.

TowerJazz has received significant supplier awards from Skyworks every year for the past five

years - including Foundry Supplier of the Year, Innovation Partner of the Year, Overall Supplier of

the Year, and now Quality Iron Man Partner of the Year - all signaling TowerJazz and Skyworks’

continued alignment and growth as long-term partners.

years - including Foundry Supplier of the Year, Innovation Partner of the Year, Overall Supplier of

the Year, and now Quality Iron Man Partner of the Year - all signaling TowerJazz and Skyworks’

continued alignment and growth as long-term partners.

TowerJazz Gaining Sizeable Share of Multi-Billion Dollar Front-End Module (FEM)

Market; Silicon Radio Platform Replacing GaAs

Customer engagements with over 50 design wins; TowerJazz poised to manufacture

major portion of devices serving multi-billion dollar FEM market

Handset FEM market is forecast to double to $10 Billion by 2017

MIGDAL HAEMEK, Israel and NEWPORT BEACH, Calif., March 11, 2013 - TowerJazz, the global specialty

foundry leader, today announced significant customer engagements and market share gain in the fast growing

Front-End Module (FEM) market, providing its Silicon Radio Platform (SRP) for smartphones and other mobile

systems. TowerJazz’s SRP allows integration of the radio in mobile devices including components such as

antenna switches, antenna tuners, diversity switches, controllers, low-noise-amplifiers (LNAs) and power

amplifiers (PAs) eliminating the need for expensive discrete GaAs devices. The SRP includes a state of the art

RF SOI technology and a SiGe PA technology together with 0.18um RF CMOS for integration of control and MIPI

(Mobile Industry Processor Interface) interface functions.

foundry leader, today announced significant customer engagements and market share gain in the fast growing

Front-End Module (FEM) market, providing its Silicon Radio Platform (SRP) for smartphones and other mobile

systems. TowerJazz’s SRP allows integration of the radio in mobile devices including components such as

antenna switches, antenna tuners, diversity switches, controllers, low-noise-amplifiers (LNAs) and power

amplifiers (PAs) eliminating the need for expensive discrete GaAs devices. The SRP includes a state of the art

RF SOI technology and a SiGe PA technology together with 0.18um RF CMOS for integration of control and MIPI

(Mobile Industry Processor Interface) interface functions.

TowerJazz’s latest RF SOI technology offers the industry’s best figure of merit for antenna switch and

antenna tuning applications with Ron-Coff of only 217fs. The technology is quickly replacing GaAs

implementations and has already been adopted by multiple customers worldwide with over 50 separate designs

taped-in with initial designs ramping to production.

antenna tuning applications with Ron-Coff of only 217fs. The technology is quickly replacing GaAs

implementations and has already been adopted by multiple customers worldwide with over 50 separate designs

taped-in with initial designs ramping to production.

Power Markets: Our Solutions

Flat Panel TV / Display / Audio

Driving the need for power components

Automotive and Communication

Driving the need for more integrated PMICs

LED Lighting

Replacing commercial lighting

Industrial and Infrastructure

Growing the motor-driver market

• 0.35um modular BCD

• Low Rdson for small die

• Design enablement fast time-to-market

• 700V Production Technology

• Low mask count for cost-sensitive market

• Extensions to 900V to cover all standards

• Feature-rich 0.18um modular BCD

• High digital density

• High-side 700V platform

• Gate driver for IGBT

• Will mirror growth of IGBT / Motor Drivers

27

Modular power management platform with best-in class performance and

design enablement (scalable models, PDK, IP and Design Services)

Power

Metal Options

Thick Al, 3.3um Cu

Higher Performance

28

Case Study: modular 0.18um Power Platform to efficiently

serve a wide range of markets from Components to PMICs

serve a wide range of markets from Components to PMICs

“Isolated Platform”

(TS18PM-SI/DI)

N+ Buried Layer, EPI growth and Sinkers

(3-4 additional layers + EPI)

Higher Power

PMICs

Samsung Selects TowerJazz’s “unrivaled” 700V Power Technology

Platform for its Next Generation High Voltage Products

Platform for its Next Generation High Voltage Products

Power Management IC Market Estimated at $14.6B in 2013 according to iSuppli

Samsung Electro-Mechanics Vice President Dr. Jae Shin Lee

and TowerJazz Chief Executive Officer, Mr. Russell Ellwanger

MIGDAL HAEMEK, Israel and SEOUL, Korea, September 5, 2011 - TowerJazz, the global

specialty foundry leader, and Samsung Electro-Mechanics, today announced they have

signed a Memorandum of Understanding (MOU) to develop and volume produce a variety of

product families based on TowerJazz’s 700V (TS100PM) power management process.

specialty foundry leader, and Samsung Electro-Mechanics, today announced they have

signed a Memorandum of Understanding (MOU) to develop and volume produce a variety of

product families based on TowerJazz’s 700V (TS100PM) power management process.

“We chose to work with TowerJazz on our next-generation

of high voltage products because of their superior 700V

technology which is unrivaled by other foundries. We

were looking for a true partner who would be committed to

our success and provide excellent support and the required

manufacturing capacity,” said Samsung Vice President

Dr. Jae Shin Lee. “TowerJazz is well-known in Korea,

especially in the power management market, and we are

looking forward to our collaboration on many high volume

products.”

of high voltage products because of their superior 700V

technology which is unrivaled by other foundries. We

were looking for a true partner who would be committed to

our success and provide excellent support and the required

manufacturing capacity,” said Samsung Vice President

Dr. Jae Shin Lee. “TowerJazz is well-known in Korea,

especially in the power management market, and we are

looking forward to our collaboration on many high volume

products.”

Case Study: 700V Technology Leadership

29

Specialty CIS Market and Tech Requirements

§ Cinematography

§ Broadcasting

§ Full Frame DSLR

§ Mirror-less DSLR

Professional Photography

§ Intra and Extra Oral Dental

§ Medical

X-Ray

§ High speed

§ Machine vision

Industrial

§ Rear view

§ Front Near IR view

§ Gesture control

Automotive and 3D

Requirements:

high dynamic range, low dark current (metallic contamination), large-die

stitching, low optical stack height, global shutter operation, high frame rate

stitching, low optical stack height, global shutter operation, high frame rate

30

Specialty CIS Growth Markets

Technology, Flexibility, Experience and Commitment allows our

customers to bring to the market the best in class products

customers to bring to the market the best in class products

§ Best in class pixels

§ Low dark current

§ Accurate stitching

Professional Photography

§ Excellent flexible pixels

§ Stitching for 1 DPW

§ Very high yields

X-Ray

§ Special fast pixels

§ Unique features: Bathtub

§ Network of leading customers

Industrial

§ Unique near IR sensitive pixels

§ High QE

§ Very fast pixels

§ High DR

Automotive and 3D

31

4/3”

1”

35 mm

APS (3:2)

2/3”

1/4”

1/3”

1/2”

1/10”

48x36

Consumer

Prosumer

Photography

Professional

Photography

Studio & High End Photography

Large Industrial, Scientific, Space

Industrial,

Machine Vision,

Bar-Code

“Cameras” application range

8” wafer size

Small Medical

Medical (X-ray)

6” Wafer Size

645

32

33

Enabling Customer Innovation

CULTURE and TRUST

Ensure the sustainability of customer’s IP

ENGINEERING

Short time to revenue

with reduced risk

& uncertainty

Dedicated Business Unit

Strong base with multiple

platforms for transfer

synergies

platforms for transfer

synergies

Secure Fab / Process IP

protection

protection

Process and integration

expertise/ Program

Management expertise

expertise/ Program

Management expertise

34

Customer Technology Transfer: Needs & Solution

TowerJazz Was Chosen by Vishay Intertechnology for High

Volume Manufacturing Engagement Through 2018

Volume Manufacturing Engagement Through 2018

35

India Fab Project

§ Advanced 0.18 Semi Lab

– Transition a 150mm to a 200mm

factory

factory

– Transfer 0.18um technology

– Train and establish flow

§ $135M revenue @ high margins

36

37

India Government Sponsored 300mm Factory

§ Signed binding MOU with Jaypee Group, leading Indian

infrastructure conglomerate, to build and operate a 300mm

facility in India.

infrastructure conglomerate, to build and operate a 300mm

facility in India.

– Roadmap to long term 300mm wafer size, 90nm analog technology

– Enables companion chips in deep submicron technologies (90nm-20nm)

– Very high $$ revenue stream

§ Presented to empowered government committee as 3-way

consortium with Jaypee, TowerJazz and IBM as digital platform

technology provider.

consortium with Jaypee, TowerJazz and IBM as digital platform

technology provider.

§ We believe our consortium is strong, but cannot predict

outcome of government selection.

outcome of government selection.

38

Recent Press Releases

39

TowerJazz and CMOSIS Announce Ramp to Volume Production for

CMOSIS’ 12-megapixel CMV12000

CMOSIS’ 12-megapixel CMV12000

ANTWERP, Belgium and MIGDAL HAEMEK, Israel, June 11, 2013 - CMOSIS, a leading independent

developer and supplier of high end CMOS image sensors for professional imaging applications, and TowerJazz,

the global specialty foundry leader, today announced the ramp to volume production for CMOSIS’ 12-megapixel

CMV12000, following the very successful volume production of its CMV products. In 2010, CMOSIS and

TowerJazz announced collaboration on the CMV product line, the flagship product family of CMOSIS. Since its

introduction, the CMV product family has been very successful in gaining market share.

developer and supplier of high end CMOS image sensors for professional imaging applications, and TowerJazz,

the global specialty foundry leader, today announced the ramp to volume production for CMOSIS’ 12-megapixel

CMV12000, following the very successful volume production of its CMV products. In 2010, CMOSIS and

TowerJazz announced collaboration on the CMV product line, the flagship product family of CMOSIS. Since its

introduction, the CMV product family has been very successful in gaining market share.

CMOSIS continues to apply TowerJazz’s advanced CMOS image sensor technology to meet the market’s

growing demands and to expand its relationship with TowerJazz to collaborate on its next generation of CMOS

image sensors. CMOSIS addresses the need for image sensors used in consumer, industrial, medical and

automotive applications such as those used in movie and TV, traffic monitoring and motion control, among others.

growing demands and to expand its relationship with TowerJazz to collaborate on its next generation of CMOS

image sensors. CMOSIS addresses the need for image sensors used in consumer, industrial, medical and

automotive applications such as those used in movie and TV, traffic monitoring and motion control, among others.

“We have enjoyed a very fruitful relationship with TowerJazz for several years. TowerJazz has an expert team

that can customize the CIS process to our needs and create, together with us, new pixels that outperform our

competitors. Our ability to offer innovative imaging products with highly reliable performance is based on our

collaboration with TowerJazz and their mature process technology, extensive R&D investment and excellent

customer support. By combining our companies’ expertise, we are able to offer a rich solution for various digital

imaging applications,” said Lou Hermans, Chief Operating Officer, CMOSIS.

that can customize the CIS process to our needs and create, together with us, new pixels that outperform our

competitors. Our ability to offer innovative imaging products with highly reliable performance is based on our

collaboration with TowerJazz and their mature process technology, extensive R&D investment and excellent

customer support. By combining our companies’ expertise, we are able to offer a rich solution for various digital

imaging applications,” said Lou Hermans, Chief Operating Officer, CMOSIS.

40

TowerJazz and Cavendish Kinetics Collaborate to Deliver High Volume

Tunable RF MEMS Products for Fast Growing 4G Mobile Market

Tunable RF MEMS Products for Fast Growing 4G Mobile Market

Industry analyst forecasts MEMS market to reach $21 billion by 2017; predicts some new

MEMS devices such as RF MEMS for mobile devices could see CAGR > 90%

MEMS devices such as RF MEMS for mobile devices could see CAGR > 90%

NEWPORT BEACH, Calif. and SAN JOSE, Calif., June 6, 2013 - TowerJazz and Cavendish Kinetics, today

announced their collaboration to bring MEMS tunable RF solutions to the consumer mobile wireless market. The

process technology combines the Cavendish NanoMech™ MEMS technology with the TowerJazz power CMOS

process and custom RF interconnect in a single chip solution. Designed specifically for radio frequency (RF)

applications, the Cavendish NanoMech™ MEMS technology has passed rigorous reliability testing and enables

products boasting advantages in size and performance compared to other technologies. NanoMech™ MEMS

technology can be combined with other TowerJazz technologies such as SOI CMOS, SiGe BiCMOS and Through

-Silicon Vias (TSVs) to service a wide variety of emerging applications.

announced their collaboration to bring MEMS tunable RF solutions to the consumer mobile wireless market. The

process technology combines the Cavendish NanoMech™ MEMS technology with the TowerJazz power CMOS

process and custom RF interconnect in a single chip solution. Designed specifically for radio frequency (RF)

applications, the Cavendish NanoMech™ MEMS technology has passed rigorous reliability testing and enables

products boasting advantages in size and performance compared to other technologies. NanoMech™ MEMS

technology can be combined with other TowerJazz technologies such as SOI CMOS, SiGe BiCMOS and Through

-Silicon Vias (TSVs) to service a wide variety of emerging applications.

“We have aligned with a strong manufacturing partner with an established track record and known capabilities to

deliver robust and reliable products in a high volume manufacturing environment,” said Dennis Yost, President

and CEO of Cavendish Kinetics. “TowerJazz has proven its ability to quickly transfer process technologies and

we are now in a position to supply tens of millions of devices per month to support the large and rapidly growing

4G/LTE mobile device market,” Yost added.

deliver robust and reliable products in a high volume manufacturing environment,” said Dennis Yost, President

and CEO of Cavendish Kinetics. “TowerJazz has proven its ability to quickly transfer process technologies and

we are now in a position to supply tens of millions of devices per month to support the large and rapidly growing

4G/LTE mobile device market,” Yost added.

41

TowerJazz Announces New 700V Technology, Cuts Die Size in Half for

Drivers in Fast Growth LED Lighting Market

Drivers in Fast Growth LED Lighting Market

New device with on-resistance of 17 ohm-mm2 at 750V helps lower IC costs in the $13.3B

LED lighting market

LED lighting market

NISHIWAKI, Japan, May 28, 2013 - TowerJazz, the global specialty foundry leader, today announced the release

of a 17 ohm mm^2 750V device which will help customers reduce die size for AC to DC converters, required in

fast growing applications such as LED lighting, by a factor of two relative to its prior technology.

of a 17 ohm mm^2 750V device which will help customers reduce die size for AC to DC converters, required in

fast growing applications such as LED lighting, by a factor of two relative to its prior technology.

The market for power management ICs in AC to DC applications is expected to grow 6.3% over the next five

years while LED applications is the fastest growing market segment with an estimated 56% growth expected over

the next five years. TowerJazz’s new technology enables a cost advantage for customers building next-

generation ICs for AC to DC converters in applications such as power supplies and LED lights. The technology

integrates on the production 700V process which is today the most streamlined in the industry, requiring only 16

masking layers for a two layer metal process. The new technology does not add masking layers, preserving this

significant advantage over other solutions while reducing on-resistance and shrinking die size significantly.

years while LED applications is the fastest growing market segment with an estimated 56% growth expected over

the next five years. TowerJazz’s new technology enables a cost advantage for customers building next-

generation ICs for AC to DC converters in applications such as power supplies and LED lights. The technology

integrates on the production 700V process which is today the most streamlined in the industry, requiring only 16

masking layers for a two layer metal process. The new technology does not add masking layers, preserving this

significant advantage over other solutions while reducing on-resistance and shrinking die size significantly.

“This innovation will provide a significant advantage to our customers in the fast-growth but cost-sensitive LED

lighting market,” said Dr. Marco Racanelli SVP of Power, RF and HPA Business Units at TowerJazz. “This

innovation and 700V platform complements our broad power management offering that includes an industry

leading 0.18um, 60V BCD technology with embedded NVM now available in two 8-inch factories. We continue to

partner closely with our customers and strive to benefit them in the marketplace both through innovative process

technology and efficient and cost conscious supply chain.”

lighting market,” said Dr. Marco Racanelli SVP of Power, RF and HPA Business Units at TowerJazz. “This

innovation and 700V platform complements our broad power management offering that includes an industry

leading 0.18um, 60V BCD technology with embedded NVM now available in two 8-inch factories. We continue to

partner closely with our customers and strive to benefit them in the marketplace both through innovative process

technology and efficient and cost conscious supply chain.”

42

TowerJazz Recognized by International Rectifier as 2012 Foundry Supplier of the Year

MIGDAL HAEMEK, Israel and EL SEGUNDO, Calif., May 23, 2013 - TowerJazz, the global specialty foundry

leader, today announced it has received a Foundry Supplier of the Year 2012 Award from International Rectifier, a

world leader in power management technology. International Rectifier’s annual Supplier Summit recognizes the

valuable role its worldwide supplier base plays in the overall performance and success of the company. The event

was attended by approximately 140 companies from around the world. IR’s Supplier of the Year 2012 for Foundry

Manufacturing was awarded to TowerJazz based on criteria including cost/spend goals, manufacturing flexibility

and responsiveness.

leader, today announced it has received a Foundry Supplier of the Year 2012 Award from International Rectifier, a

world leader in power management technology. International Rectifier’s annual Supplier Summit recognizes the

valuable role its worldwide supplier base plays in the overall performance and success of the company. The event

was attended by approximately 140 companies from around the world. IR’s Supplier of the Year 2012 for Foundry

Manufacturing was awarded to TowerJazz based on criteria including cost/spend goals, manufacturing flexibility

and responsiveness.

“IR is a leading provider of power management technology and a valued customer of TowerJazz. We are pleased

IR is using our specialty technology transfer services and look forward to continuing to expand our relationship,”

said Zmira Shternfeld-Lavie, VP of Process Engineering R&D and GM of Transfer, Optimization and Development

Process Services (TOPS™) Business Unit. “We are honored to receive this award which further validates our

commitment to actively respond to our customers’ needs while retaining flexibility in manufacturing and increasing

our capacity.”

IR is using our specialty technology transfer services and look forward to continuing to expand our relationship,”

said Zmira Shternfeld-Lavie, VP of Process Engineering R&D and GM of Transfer, Optimization and Development

Process Services (TOPS™) Business Unit. “We are honored to receive this award which further validates our

commitment to actively respond to our customers’ needs while retaining flexibility in manufacturing and increasing

our capacity.”

“We value the successful business relationships we have built with each of our suppliers and we are pleased to

award TowerJazz with IR’s Supplier of the Year for Foundry Manufacturing 2012,” said K.S. Song, IR’s Vice

President Operational Effectiveness Group.

award TowerJazz with IR’s Supplier of the Year for Foundry Manufacturing 2012,” said K.S. Song, IR’s Vice

President Operational Effectiveness Group.

43

TowerJazz Gaining Sizeable Share of Multi-Billion Dollar Front-End Module (FEM)

Market; Silicon Radio Platform Replacing GaAs

Customer engagements with over 50 design wins; TowerJazz poised to manufacture

major portion of devices serving multi-billion dollar FEM market

Handset FEM market is forecast to double to $10 Billion by 2017

MIGDAL HAEMEK, Israel and NEWPORT BEACH, Calif., March 11, 2013 - TowerJazz, the global specialty

foundry leader, today announced significant customer engagements and market share gain in the fast growing

Front-End Module (FEM) market, providing its Silicon Radio Platform (SRP) for smartphones and other mobile

systems. TowerJazz’s SRP allows integration of the radio in mobile devices including components such as

antenna switches, antenna tuners, diversity switches, controllers, low-noise-amplifiers (LNAs) and power

amplifiers (PAs) eliminating the need for expensive discrete GaAs devices. The SRP includes a state of the art

RF SOI technology and a SiGe PA technology together with 0.18um RF CMOS for integration of control and MIPI

(Mobile Industry Processor Interface) interface functions.

foundry leader, today announced significant customer engagements and market share gain in the fast growing

Front-End Module (FEM) market, providing its Silicon Radio Platform (SRP) for smartphones and other mobile

systems. TowerJazz’s SRP allows integration of the radio in mobile devices including components such as

antenna switches, antenna tuners, diversity switches, controllers, low-noise-amplifiers (LNAs) and power

amplifiers (PAs) eliminating the need for expensive discrete GaAs devices. The SRP includes a state of the art

RF SOI technology and a SiGe PA technology together with 0.18um RF CMOS for integration of control and MIPI

(Mobile Industry Processor Interface) interface functions.

TowerJazz’s latest RF SOI technology offers the industry’s best figure of merit for antenna switch and

antenna tuning applications with Ron-Coff of only 217fs. The technology is quickly replacing GaAs

implementations and has already been adopted by multiple customers worldwide with over 50 separate designs

taped-in with initial designs ramping to production.

antenna tuning applications with Ron-Coff of only 217fs. The technology is quickly replacing GaAs

implementations and has already been adopted by multiple customers worldwide with over 50 separate designs

taped-in with initial designs ramping to production.

44

Financials

45

TowerJazz Balance Sheets (in millions of $)

46

|

|

March 31,

2013

|

Dec. 31,

2012

|

March 31,

2012

|

|

CURRENT ASSETS

Cash, short-term deposits & designated deposits

Trade accounts receivable

Other receivables

Inventories

Other current assets

|

120

80

8

61

17

|

133

79

5

66

15

|

158

88

4

63

17

|

|

Total Current Assets

Long-term investments

Property and equipment, net

Intangible assets, Net

Goodwill

Other assets, Net

|

286

13

408

44

7

13

|

298

13

435

48

7

14

|

330

13

477

54

7

16

|

|

TOTAL ASSETS

|

771

|

815

|

897

|

|

CURRENT LIABILITIES

Short-term debt

Trade accounts payable

Deferred revenue & customers’ advances

Other current liabilities

|

30

68

6

41

|

50

81

2

36

|

42

94

6

62

|

|

Total Current Liabilities

Long-term debt

Employees related liabilities

Deferred tax liability

Other long-term liabilities

|

145

306

73

27

30

|

169

289

78

27

32

|

204

385

97

20

34

|

|

TOTAL LIABILITIES

|

581

|

595

|

740

|

|

Shareholders’ Equity

|

190

|

220

|

157

|

|

TOTAL LIABILITIES & EQUITY

|

771

|

815

|

897

|

Financial Highlights

§ Net current assets continued its positive trend and increased from $125

million as of the end of March 2012 and $129 million as of December 31, 2012,

to $141 million as of March-end 2013.

million as of the end of March 2012 and $129 million as of December 31, 2012,

to $141 million as of March-end 2013.

§ Current ratio has increased from 1.61 times as of March 31, 2012, to 1.76

times as of the end of 2012 to 1.98 as of the end of the first quarter of 2013.

times as of the end of 2012 to 1.98 as of the end of the first quarter of 2013.

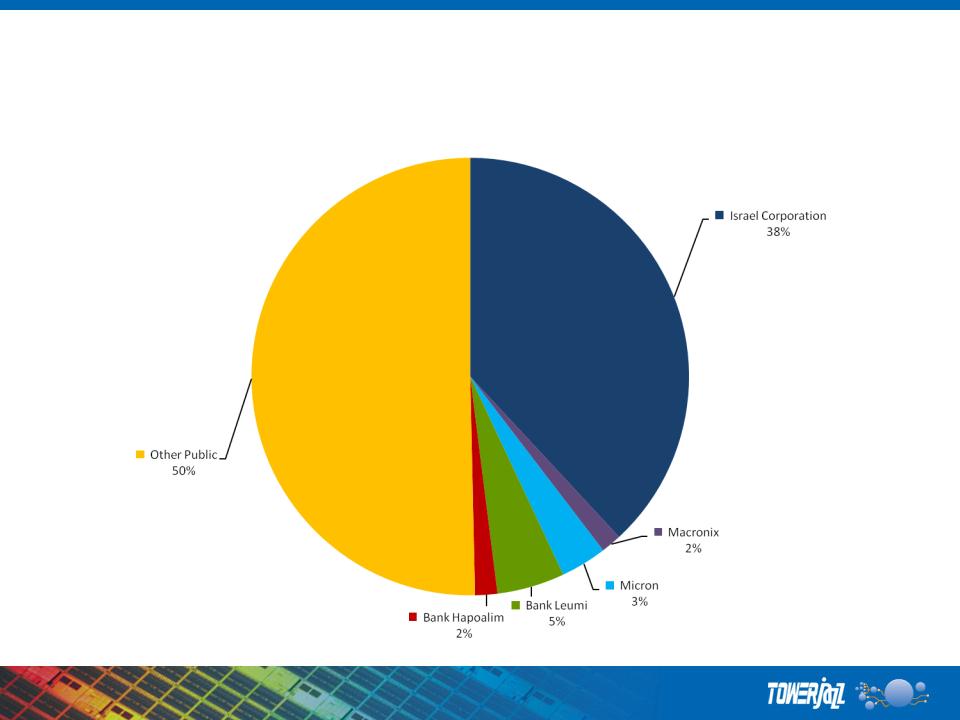

§ Israel Corporation, our major shareholder, had recently increased its holding in

the company’s ordinary shares from 5% to 38%, stating it has no intention to

trade or sell these shares.

the company’s ordinary shares from 5% to 38%, stating it has no intention to

trade or sell these shares.

– In addition, Israel Corporation announced it will invest an additional $17 million in

an up to $60 million equity fundraising, thereby exercising all its rights, expressing

its belief in the company.

an up to $60 million equity fundraising, thereby exercising all its rights, expressing

its belief in the company.

47

Financial Highlights (Cont.)

§ Net debt to EBITDA ratio, based on 2012 full year results, is 2.2X.

§ Shareholders’ equity was $190 million at the end of the quarter and our cash

balance as of this date includes $120 million of cash and deposits, and after the

currently executed rights offering, shareholders equity will be over $200 million.

balance as of this date includes $120 million of cash and deposits, and after the

currently executed rights offering, shareholders equity will be over $200 million.

§ Non-GAAP margins in FY 2012 improved, with non-GAAP gross, operating and net

margins at 37%, 26% and 21% for 2012, as compared to 36%, 25% and 20% in

2011.

margins at 37%, 26% and 21% for 2012, as compared to 36%, 25% and 20% in

2011.

§ Non-GAAP gross, operating and net profits had increased to $233 million, $165

million and $131 million in 2012, as compared to $219 million, $155 million and

$124 million in 2011.

million and $131 million in 2012, as compared to $219 million, $155 million and

$124 million in 2011.

§ During each of the last three full years (2010, 2011 and 2012), generated ~$100

million of positive cash flow from operations, maintained cash closing balance

above $100 million, and generated greater than $150 million of EBITDA per year.

million of positive cash flow from operations, maintained cash closing balance

above $100 million, and generated greater than $150 million of EBITDA per year.

48

Ordinary Shares: 39 Million

49

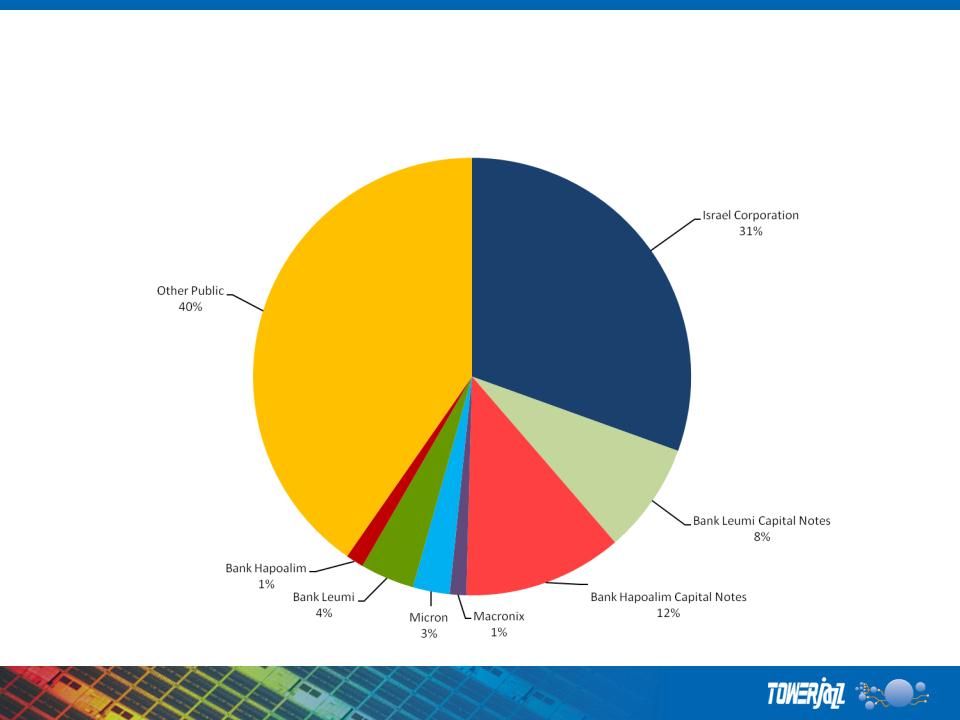

Ordinary Shares & Banks Capital Notes : 48 Million

50

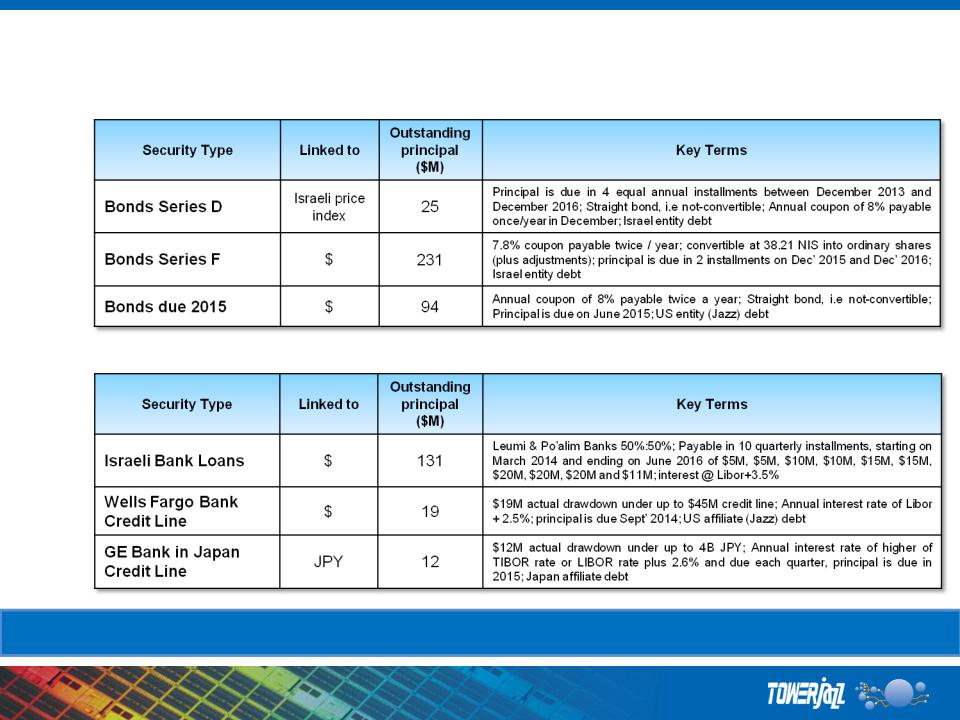

TowerJazz Debt | As of March 2013

Bonds Debt Summary

Banks Debt Summary

Cash closing balance, March 31, 2013: $121 million

51

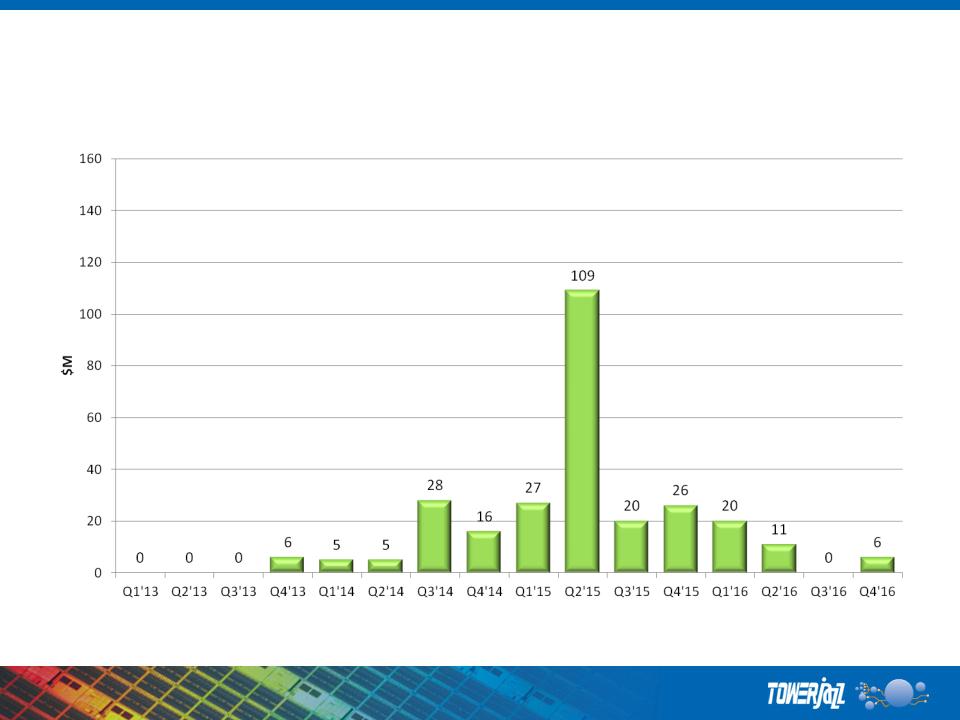

Future Debt Payment

Assuming no conversion of any bond series

Assuming no conversion of any bond series

52

Future Debt Payment

Assuming conversion of all bond series

Assuming conversion of all bond series

53

Future Debt Payment

Assuming conversion of all bond series

Assuming conversion of all bond series

54

Summary

55

Summary

§ Connectivity, Energy Efficiency and Multi-Function

systems are key industry trends and served to a

great part through analog technology.

systems are key industry trends and served to a

great part through analog technology.

§ Normal foundry model within the analog space can

be well served within the TowerJazz manufacturing

family.

be well served within the TowerJazz manufacturing

family.

§ Wafer based revenue forecasted to increase quarter

over quarter.

over quarter.

§ Several special models in play; we expect decision on

Indian government approval in the short term.

Indian government approval in the short term.

56

Thank You

www.TowerJazz.com

www.TowerJazz.com

Purchase rights on

June 24th on TASE trading day

Exercise your rights

by June 27, 2013

by June 27, 2013

6 series 8 Warrants

@ $5 each

by July 22, 2013

For $20 you will get:

4 shares

@ $5 each

5 series 9 Warrants

@ $7.33 each

by June 27, 2017

Any rights not sold or any rights purchased on June 24th may be exercised by June 27th.