form10k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

For the fiscal year ended December 31, 2014

OR

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

For the transition period from to

|

Commission file number 0-24960

COVENANT TRANSPORTATION GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

88-0320154

|

|

(State / other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

400 Birmingham Hwy.

|

|

|

|

Chattanooga, TN

|

|

37419

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant's telephone number, including area code:

|

423 - 821-1212

|

| |

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

$0.01 Par Value Class A Common Stock – The NASDAQ Global Select Market

|

| |

(Title of class)

|

| |

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "accelerated filer, "large accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2014, was approximately $107.0 million (based upon the $12.88 per share closing price on that date as reported by NASDAQ). In making this calculation the registrant has assumed, without admitting for any purpose, that all executive officers, directors, and affiliated holders of more than 10% of a class of outstanding common stock, and no other persons, are affiliates.

As of March 2, 2015, the registrant had 15,790,902 shares of Class A common stock and 2,350,000 shares of Class B common stock outstanding.

Portions of the materials from the registrant's definitive proxy statement for the 2015 Annual Meeting of Stockholders to be held on May 14, 2015, have been incorporated by reference into Part III of this Form 10-K.

|

Part I

|

|

|

| |

Item 1.

|

Business

|

|

| |

Item 1A.

|

Risk Factors

|

|

| |

Item 1B.

|

Unresolved Staff Comments

|

|

| |

Item 2.

|

Properties

|

|

| |

Item 3.

|

Legal Proceedings

|

|

| |

Item 4.

|

Mine Safety Disclosures

|

|

| |

|

|

|

|

Part II

|

|

|

| |

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

| |

Item 6.

|

Selected Financial Data

|

|

| |

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

|

| |

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

|

| |

Item 8.

|

Financial Statements and Supplementary Data

|

|

| |

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

| |

Item 9A.

|

Controls and Procedures

|

|

| |

Item 9B.

|

Other Information

|

|

| |

|

|

|

|

Part III

|

|

|

| |

Item 10.

|

Directors, Executive Officers, and Corporate Governance

|

|

| |

Item 11.

|

Executive Compensation

|

|

| |

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

| |

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

|

| |

Item 14.

|

Principal Accounting Fees and Services

|

|

| |

|

|

|

|

Part IV

|

|

|

| |

Item 15.

|

Exhibits and Financial Statement Schedules

|

|

|

Signatures

|

|

| |

|

|

Report of Independent Registered Public Accounting Firm

|

|

| |

|

|

Financial Data

|

|

| |

Consolidated Balance Sheets

|

|

| |

Consolidated Statements of Operations

|

|

| |

Consolidated Statements of Comprehensive Income

|

|

| |

Consolidated Statements of Stockholders' Equity

|

|

| |

Consolidated Statements of Cash Flows

|

|

| |

Notes to Consolidated Financial Statements

|

|

PART I

This Annual Report on Form 10-K contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of earnings, revenues, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; and any statements of belief and any statement of assumptions underlying any of the foregoing. In this Annual Report, statements relating to the ability of our infrastructure to support future growth, our ability to recruit and retain qualified drivers, our ability to react to market conditions, our ability to gain market share, future tractor and trailer prices, expected functioning of our information technology systems, expected liquidity and methods for achieving sufficient liquidity, future fuel prices, future inflation, future third-party service provider relationships and availability, future compensation arrangements with independent contractors and drivers, expected owner operator usage, future driver market, planned allocation of capital, future equipment costs, expected settlement of operating lease obligations, future asset sales, future tax expense and deductions, future effectiveness of fuel surcharge programs and price hedges, expected capital expenditures (including the future mix of lease and purchase obligations), future asset utilization, future trucking capacity, expected freight demand and volumes, future rates, future depreciation and amortization, and future purchased transportation expense, among others, are forward-looking statements. Such statements may be identified by their use of terms or phrases such as "believe," "may," "could," "expects," "estimates," "projects," "anticipates," "plans," "intends," and similar terms and phrases. Forward-looking statements are based on currently available operating, financial, and competitive information. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled "Item 1A. Risk Factors," set forth below. Readers should review and consider the factors discussed in "Item 1A. Risk Factors," along with various disclosures in our press releases, stockholder reports, and other filings with the Securities and Exchange Commission.

All such forward-looking statements speak only as of the date of this Annual Report. You are cautioned not to place undue reliance on such forward-looking statements. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in the events, conditions, or circumstances on which any such statement is based.

References in this Annual Report to "we," "us," "our," or the "Company" or similar terms refer to Covenant Transportation Group, Inc. and its subsidiaries.

GENERAL

Background and Strategy

We were founded in 1986 as a provider of expedited long haul freight transportation, primarily using two-person driver teams in transcontinental lanes. Since that time, we have grown from 25 trucks to approximately 2,700 trucks and expanded our services from predominantly long haul dry van to include refrigerated, dedicated, cross-border, regional, brokerage, and other offerings. The expansion of our fleet and service offerings have placed us among the nation's largest truckload transportation companies.

Generally, we transport full trailer loads of freight from origin to destination without intermediate stops or handling. We provide truckload transportation services throughout the continental United States, into and out of Mexico, and into and out of portions of Canada. Our truckload freight services utilize equipment we own or lease or equipment owned by independent contractors for the pick-up and delivery of freight. In most of our truckload business, we transport freight over nonroutine routes. Our dedicated freight service offering provides similar transportation services, but does so pursuant to agreements whereby we make our equipment available to a specific customer for shipments over particular routes at specified times. To complement our truckload operations, we provide freight brokerage services and accounts receivable factoring services. Through our asset based and non-asset based capabilities, we transport many types of freight for a diverse customer base.

We concentrate on market sectors where we believe our capacity in relation to sector size and our operating proficiency can make a meaningful difference to customers. The primary sectors in which we operate are as follows:

● Expedited / Long haul: In our expedited / long haul business, we operate approximately 1,070 tractors, approximately 690 of which are driven by two-person driver teams. Our expedited operations primarily involve high service freight with delivery standards, such as 1,000 miles in 22 hours, or 15-minute delivery windows, that are difficult for competitors to satisfy with solo-driven tractors or rail-intermodal service. Our expedited services often involve high value, high security, or time-definite loads for integrated global freight companies, less-than-truckload carriers, manufacturers, and retailers. We believe we are one of the five largest team expedited providers, and that growth in omni-channel, organic food, manufacturing, and e-commerce freight make this an attractive sector.

● Temperature-Controlled: In our temperature-controlled business, we operate approximately 970 tractors, approximately 200 of which are driven by two-person driver teams, and also offer intermodal service in longer haul lanes. The temperature-controlled sector includes fresh and frozen foods, pharmaceuticals, cosmetics, and other freight where extreme heat or cold could cause damage. We believe we are among the ten largest temperature-controlled providers, and that factors such as United States population growth, increasing consumer preference for fresh and organic produce, and demographic trends requiring more pharmaceuticals make this an attractive sector.

● Dedicated: In our dedicated contract business, we operate approximately 510 tractors, approximately 20 of which are driven by two-person driver teams, primarily for manufacturers located in the southeastern United States. The dedicated sector typically involves longer-term contracts that allocate a specified number of tractors and trailers to a specific customer, with fixed and variable compensation. Many of our dedicated contract customers are automotive companies or tier one suppliers to the auto industry, with high service standards. We believe this sector is growing because of an improved manufacturing environment in the United States, particularly in the Southeast, customer concerns about trucking capacity, and a need for dependable service at plants.

● Capacity Provider Solutions and Services / Equipment Sales and Leasing: We primarily provide freight brokerage capacity to customers when the freight does not fit our network or profitability requirements. In addition, we participate in the market for used equipment sales and leasing through our 49% ownership of Transport Enterprise Leasing, LLC ("TEL"), and we assist current and potential capacity providers with improving their cash flows through secure invoice factoring services. We believe this suite of services links our interests with those of our customers and current and potential third party capacity providers. We intend to expand our presence in these sectors, which we believe offer attractive growth opportunities with a lower capital investment than our asset-based truckload operations.

As our fleet has grown over three decades and our service platform matured, several important trends dramatically affected the truckload industry and our business. First, supply chain patterns became more fluid in response to dynamic changes in labor and transportation costs, ocean freight and rail-intermodal service standards, retail distribution center networks, governmental regulations, and other industry-wide factors. Second, the cost structure of the truckload business, particularly equipment and fuel prices, rose dramatically, impacting us and our customers' freight decisions. Third, customers used technology to constantly optimize their supply chains, which necessitated expanding our own technological capability to optimize our asset allocation, manage yields, and drive operational efficiency. Fourth, a confluence of regulatory constraints, safety and security demands, and scarcity of qualified applicants, negatively impacted our asset productivity and reinforced what a precious resource professional truck drivers are (and we believe increasingly will be) in our industry.

In the fourth quarter of 2011, we began examining the key components of each of our business units, including: market trends and our relative positioning in the market; leadership and our personnel's ability to execute; financial results, investment returns, and capital requirements; importance of our service to our customers; and growth prospects.

As a result of the assessment process, we developed the Company's first formal strategic plan. Each year since, we have updated the plan via formal process, selecting initiatives and setting goals that both our Board of Directors and management believe are key to ensuring "continuous improvement" for our shareholders, customers, employees, vendors and the motoring public.

The key elements of our current strategic plan are:

● Organizational Excellence and Entrepreneurial Spirit. We have re-aligned our management team, added talent, and implemented best practices in part through using Franklin Covey's Four Disciplines of Execution® to bring a new focus to metrics, accountability, and incentive compensation. Through multiple programs recognizing individual initiative, we have also been instilling an ownership culture throughout our company. We also implemented a single enterprise management system across all subsidiaries to improve visibility and coordination of customers, operations, and financial activities.

● Focus on the Driver. Drivers are the lifeblood of our company and our industry. We employ a broad range of safety, lifestyle, compensation, equipment technology, and personal recognition methods to convey our respect and appreciation for our drivers and to improve their careers. A portion of these techniques involve sophisticated analytics to identify likely candidates, match teams, evaluate recruiting spending, deliver training content to drivers, and design tractor specifications. Over the past three years, our driver turnover percentage has improved toward the industry average after starting significantly higher.

● Focus on the Customer Experience. Our mission statement begins: "CTG's mission is to be a problem solver for every customer…" We offer premium service in sectors where we can make a difference, and we use our brokerage subsidiary, Covenant Transport Solutions, Inc., to cover loads that do not meet our requirements. With each interaction, we seek to enhance the value we bring to the customer relationship.

● Rigorous Capital Allocation Process and Reduce Leverage. Our senior management annually ranks capital investment opportunities against available capital and debt reduction goals, and material investments must pass return on investment and capital investment committee approval processes. In addition, reducing our total leverage has been a primary strategic goal. We believe our disciplined investment review has contributed to our improved results by allocating capital to more profitable business units and downsizing other units into greater profitability.

● Risk Management—Assess and Mitigate. We consistently evaluate risk areas with significant volatility, as well as the costs and benefits associated with mitigating the volatility. Diesel fuel prices, insurance and claims cost, and used equipment prices are all areas where we identified significant risk and volatility for our business. To manage these risks, we have employed fuel hedging contracts on a portion of our fuel usage not covered by customer fuel surcharges, lowered our self-insured accident liability retention, and expanded our ability to sell our used equipment to increase bargaining power with the tractor and trailer manufacturers.

● Technology. We purchase and deploy technology that we believe will allow us to operate more safely, securely, and efficiently. Our information systems are integrated into a single platform that represents a multi-year investment to upgrade the hardware and software of our information systems. This technology was purchased off the shelf, which minimizes our fixed cost investment, and enables us to stay current with the latest developments.

We believe the ongoing execution of our strategic plan has contributed to the substantial improvement in operating results and profitability we have generated over the past several years. In 2014, the results of our strategic plan are evident in that we successfully completed a follow-on stock offering that helped significantly deleverage our balance sheet; enhanced our recruiting, retention, and business intelligence; further upgraded our information technology; focused on service and on time delivery; and enhanced cross-marketing opportunities between our subsidiaries. Each of these accomplishments positively impacted the success of the key initiatives identified above, our overarching financial goals, and ultimately, the Company.

Fiscal 2014 marks the best annual results we have experienced since 1999. Additionally, fiscal 2014 is our third consistent year of profitability, noting only one year between fiscal 2006-2011 produced a profit. We believe the return to profitability on a consistent basis is the result of certain initiatives we put in place that are providing positive results. However, we still have significant work ahead to achieve our goals, deliver a strong and stable product for our customers, provide a bright future for our employees and owner-operators, and create meaningful value for our stockholders.

The Company

We operate a relatively new tractor fleet and employ sophisticated truck technology that enhances our operational efficiencies and our drivers' safety. Our company-owned tractor fleet has an average age of approximately 1.6 years, which compares favorably to an average U.S. Class 8 tractor age of approximately 6.5 years in 2013. Some of the technologies we employ include the following: (1) freight optimization software that can perform sophisticated analyses of profitability and other measures on each customer, route, and load; (2) routing software that selects the best route, identifies fuel stops, and warns of deviations from routing instructions; (3) a tracking and communications system that permits direct communication between drivers and fleet managers, as well as constant location and delivery updates; (4) electronic logging devices in all of our tractors; (5) aerodynamics and other fuel efficiency systems that have significantly improved fuel mileage; and (6) safety technology, including rollover stability control, collision mitigation, and lane-change warning. We believe our modern fleet lowers maintenance costs, improves fuel mileage, improves safety, contributes to better customer service, and assists with driver retention.

Business Units

We have one reportable segment, our asset-based truckload services ("Truckload").

The Truckload segment consists of three asset-based operating fleets that are aggregated because they have similar economic characteristics and meet the aggregation criteria. The three operating fleets that comprise our Truckload segment are as follows: (i) Covenant Transport, Inc. ("Covenant Transport"), our historical flagship operation, which provides expedited long haul, dedicated, temperature-controlled, and regional solo-driver service; (ii) Southern Refrigerated Transport, Inc. ("SRT"), which provides primarily long haul and regional temperature-controlled service; and (iii) Star Transportation, Inc. ("Star"), which provides regional solo-driver and dedicated services, primarily in the southeastern United States.

In addition, our Covenant Transport Solutions, Inc. ("Solutions") subsidiary has service offerings ancillary to our Truckload operations, including: freight brokerage service through freight brokerage agents, who are paid a commission for the freight they provide, and accounts receivable factoring. These operations consist of several operating segments, which neither individually nor in the aggregate meet the quantitative or qualitative reporting thresholds.

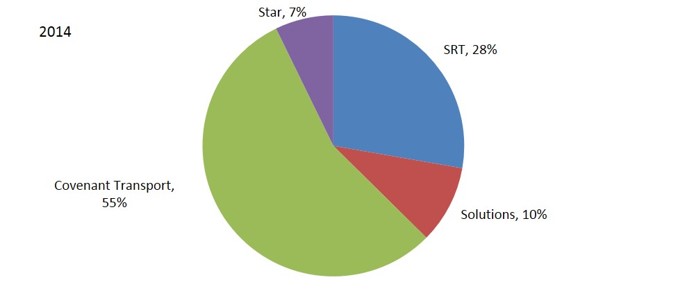

The following charts reflect the size of each of our subsidiaries measured by 2014 total revenue, net of fuel surcharge revenue, which we refer to as "freight revenue":

|

Distribution of Freight Revenue

Among Subsidiaries

|

|

Covenant Transport

|

55%

|

|

SRT

|

28%

|

|

Star

|

7%

|

|

Solutions

|

10%

|

Our Truckload segment comprised approximately 90%, 93%, and 95% of our total freight revenue in 2014, 2013, and 2012, respectively.

In our Truckload segment, we primarily generate revenue by transporting freight for our customers. Generally, we are paid a predetermined rate per mile for our truckload services. We enhance our truckload revenue by charging for tractor and trailer detention, loading and unloading activities, and other specialized services, as well as through the collection of fuel surcharges to mitigate the impact of increases in the cost of fuel. The main factors that affect our Truckload revenue are the revenue per mile we receive from our customers, the percentage of miles for which we are compensated, and the number of shipments and miles we generate. These factors relate, among other things, to the general level of economic activity in the United States, inventory levels, specific customer demand, the level of capacity in the trucking industry, and driver availability.

The main expenses that impact the profitability of our Truckload segment are the variable costs of transporting freight for our customers. These costs include fuel expenses, driver-related expenses, such as wages, benefits, training, and recruitment, and purchased transportation expenses, which primarily include compensating independent contractors. Expenses that have both fixed and variable components include maintenance and tire expense and our total cost of insurance and claims. These expenses generally vary with the miles we travel, but also have a controllable component based on safety, self-insured retention versus insurance premiums, fleet age, efficiency, and other factors. Our main fixed costs include rentals and depreciation of long-term assets, such as revenue equipment and terminal facilities, and the compensation of non-driver personnel.

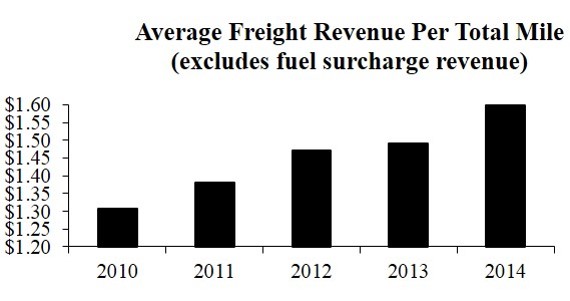

We measure the productivity of our Truckload segment with three key performance metrics: average freight revenue per total mile (excluding fuel surcharges), average miles per tractor, and average freight revenue per tractor per week (excluding fuel surcharges). A description of each follows:

|

Average Freight Revenue Per Total Mile. Our average freight revenue per total mile is primarily a function of 1) the allocation of assets among our subsidiaries and 2) the macro U.S. economic environment including supply/demand of freight and carriers. The year-over-year increase from 2010 to 2014 is a result of allocating more tractors to our niche/specialized service offerings that provide higher rates (including expedited/critical freight, high-value/constant security, temperature-controlled, and cross border service). Also, tighter capacity in the truckload freight market, especially for expedited/team transit, and shipper concerns about the prospect of tighter capacity considering the regulatory and driver market, afforded an environment more conducive to rate increases.

|

|

|

Average Freight Revenue Per Total Mile (excludes fuel surcharge revenue)

|

2010

|

2011

|

2012

|

2013

|

|

2014

|

|

$1.31

|

$1.38

|

$1.47

|

$1.49

|

|

$1.60

|

|

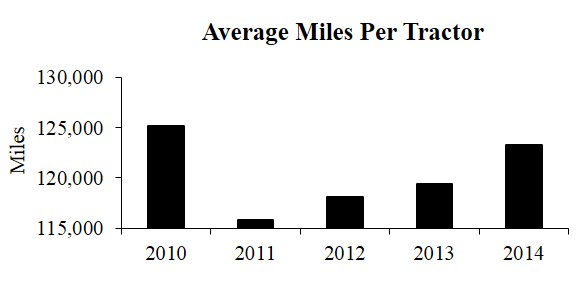

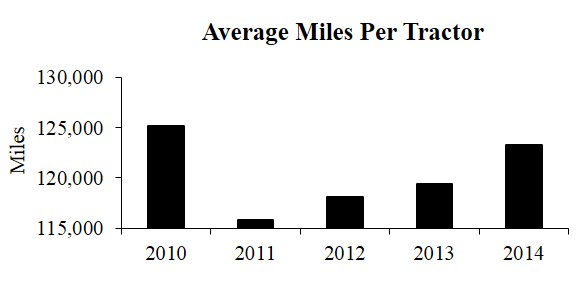

Average Miles Per Tractor. Average miles per tractor reflect economic demand, driver availability, regulatory constraints, and the allocation of tractors among the service offerings. Utilization in 2014 improved from that of 2013 primarily due to an increase on the number of team-driven tractors as a percentage of our fleet partially offset by a lower seated truck percentage. All years were an improvement as compared to 2011, when we experienced issues with the system conversion and were lower than 2010, which benefited from fewer regulations and better driver availability.

|

|

|

Average Miles Per Tractor

|

2010

|

2011

|

2012

|

2013

|

2014

|

|

|

125,178

|

115,775

|

118,103

|

119,375

|

123,275

|

|

|

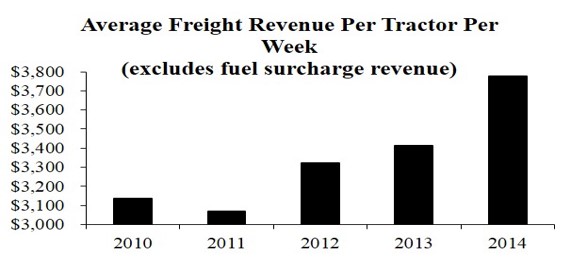

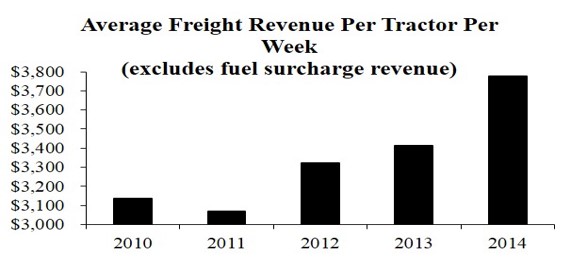

Average Freight Revenue Per Tractor Per Week. We use average freight revenue per tractor per week as our main measure of asset productivity. This operating metric takes into account the effects of freight rates, non-revenue miles, and miles per tractor. In addition, because we calculate average freight revenue per tractor using all of our trucks, it takes into account the percentage of our fleet that is unproductive due to lack of drivers, repairs, and other factors. The increase in average freight revenue per tractor per week in 2014 is primarily due to increased rate and allocation of tractors to more productive service offerings, which further contributed to higher rates and utilization.

|

|

|

Average Freight Revenue Per Tractor Per Week (excludes fuel surcharge revenue)

|

2010

|

2011

|

2012

|

2013

|

2014

|

|

|

$3,137

|

$3,069

|

$3,320

|

$3,411

|

$3,777

|

|

Our Solutions subsidiary comprised approximately 10%, 7%, and 5% of our total operating revenue in 2014, 2013, and 2012, respectively. Solutions derives revenue from arranging transportation services for customers through relationships with thousands of third-party carriers and integration with our Truckload segment. Solutions provides freight brokerage services through freight brokerage agents, who are paid a commission for the freight brokerage service they provide and accounts receivable factoring. The main factors that impact profitability in terms of expenses are the variable costs of outsourcing the transportation freight for our customers and managing fixed costs, including salaries and selling, general, and administrative expenses. Our brokerage loads decreased to 34,091 in 2014, from 37,884 in 2013, while average revenue per load increased approximately 49% to $1,575 in 2014, from $1,060 in 2013, primarily due to additional peak-season freight opportunities during the fourth quarter of 2014, improved coordination with our Truckload segment, and additional business from new customers added during the year partially offset by the discontinuation of an underperforming location in June of 2014. Additionally, revenue from Solutions' accounts receivable factoring improved by more than 30% year-over-year to $2.3 million in 2014 from $1.7 million in 2013.

In May 2011, we acquired a 49.0% interest in TEL. TEL is a tractor and trailer equipment leasing company and used equipment reseller. We have accounted for our investment in TEL using the equity method of accounting and thus our financial results include our proportionate share of TEL's net income since May 2011, or $3.7 million in 2014, $2.8 million in 2013, and $1.9 million in 2012. As a result, TEL's results and growth are significant to our current year results and, in our estimation, to our longer-term vision.

Refer to Note 16, "Segment Information," of the accompanying consolidated financial statements for further information about our reporting segment's operating and financial results for 2014, 2013, and 2012.

Customers and Operations

We focus on targeted markets throughout the United States where we believe our service standards can provide a competitive advantage. We are a major carrier for transportation companies such as freight forwarders, less-than-truckload carriers, and third-party logistics providers that require a high level of service to support their businesses, as well as for traditional truckload customers such as manufacturers, retailers, and food and beverage shippers. All of our asset-based subsidiaries are truckload carriers and as such we generally dedicate an entire trailer to one customer from origin to destination. We also generate revenue through providing ancillary services, including freight brokerage services and accounts receivable factoring.

In 2014, one customer accounted for more than 10% of our consolidated revenue. UPS, our largest customer, was serviced by both our Truckload segment and our Solutions subsidiary providing for $82.5 million of total revenue. No customer accounted for more than 10% of our consolidated revenue in 2013 or 2012. Our top five customers accounted for approximately 29%, 25%, and 24% of our total revenue in 2014, 2013, and 2012, respectively.

We operate tractors driven by a single driver and also tractors assigned to two-person driver teams. Our single driver tractors generally operate in shorter lengths of haul, generate fewer miles per tractor, and experience more non-revenue miles, but the lower productive miles are expected to be offset by generally higher revenue per loaded mile and the reduced employee expense of compensating only one driver. In contrast, our two-person driver tractors generally operate in longer lengths of haul, generate greater miles per tractor, and experience fewer non-revenue miles, but we typically receive lower revenue per loaded mile and incur higher employee expenses of compensating both drivers. We expect operating statistics and expenses to shift with the mix of single and team operations.

We operate throughout the U.S. and in parts of Canada and Mexico, with substantially all of our revenue generated from within the U.S. All of our tractors are domiciled in the U.S., and we have generated less than two percent of our revenue in Canada and Mexico in 2014, 2013 and 2012. We do not separately track domestic and foreign revenue from customers, and providing such information would not be meaningful. All of our long-lived assets are, and have been for the last three fiscal years, located within the United States.

In 2009, we began a multi-year project to upgrade the hardware and software of our information systems. The goal upon completion of the project was to have uniform operational and financial systems across the entire Company as we believe this provides improved customer service, utilization, and enhances our visibility into and across the organization. All of our operating subsidiaries are now operating on the new system. We encountered difficulties when we converted our Covenant Transport subsidiary to the new system in the third quarter of 2011, which disrupted our operations and impacted our customer service, driver relations, and results of operations. All significant problems associated with the Covenant Transport conversion were addressed by the end of January 2012 and efficiencies from the new system were realized by Covenant Transport in 2012. We implemented the new operating system at SRT in February 2014. As expected with any large conversion project, SRT experienced inefficiencies that resulted in a reduction in average miles per tractor in February and March of this year. As a result of the system conversion, SRT experienced a year-over-year reduction in first quarter profitability; however, by the second quarter of 2014 those inefficiencies were largely resolved. We are excited to have all subsidiaries on one operating platform and are evaluating where we can leverage the system to add efficiencies across the Company.

Drivers and Other Personnel

Driver recruitment, retention, and satisfaction are essential to our success, and we have made each of these factors a primary element of our strategy. We recruit both experienced and student drivers as well as independent contractor drivers who own and drive their own tractor and provide their services to us under contract. We conduct recruiting and/or driver orientation efforts from five of our locations, and we offer ongoing training throughout our terminal network. We emphasize driver-friendly operations throughout our organization. We have implemented automated programs to signal when a driver is scheduled to be routed toward home, and we assign fleet managers specific tractor units, regardless of geographic region, to foster positive relationships between the drivers and their principal contact with us.

The truckload industry has periodically experienced difficulty in attracting and retaining enough qualified truck drivers. It is also common for the driver turnover rate of individual carriers to exceed 100% in a year. At times, there are driver shortages in the trucking industry. In past years, when there were driver shortages, the number of qualified drivers had not kept pace with freight growth because of (i) changes in the demographic composition of the workforce; (ii) alternative employment opportunities other than truck driving that became available in a growing economy; and (iii) individual drivers' desire to be home more often.

Driver retention was challenging in 2014 as economic growth provided more employment opportunities that attracted professional drivers, especially during the first half of the year; however, due to certain of our initiatives during the second half of the year, we increased the number of drivers as of December 31, 2014 by approximately 3.0% year-over-year through improved recruiting and retention. Despite the increase in number of drivers as of December 31, 2014, our average truck count for the year was reduced as compared to December 31, 2013, as a result of open trucks, including wrecked units, averaging approximately 5.1% for the year ended December 31, 2014, compared to approximately 4.8% for the year ended December 31, 2013.

We believe having a happy, healthy, and safe driver is the key to our success, both in the short term and over a longer period. As a result, we are actively working to enhance our drivers' experience in an effort to recruit and retain more drivers.

Independent contractors provide a tractor and a driver and are responsible for all operating expenses in exchange for a fixed payment per mile. We do not have the capital outlay of purchasing the tractor. The payments to independent contractors are recorded in revenue equipment rentals and purchased transportation. When independent contractor tractors are utilized, we avoid expenses generally associated with company-owned equipment, such as driver compensation, fuel, interest, and depreciation. Obtaining equipment from independent contractors and under operating leases effectively shifts financing expenses from interest to "above the line" operating expenses.

Internal education and evaluation of the Federal Motor Carrier Safety Administration ("FMCSA") Compliance Safety Accountability program ("CSA") (formerly Comprehensive Safety Analysis 2010) are priorities as we develop plans to keep our top talent and challenge those drivers that need improvement. Overall, we believe this regulation will bring challenges as well as opportunities for truckload carriers. CSA, in conjunction with the new U.S. Department of Transportation ("DOT") reductions in hours-of-service for drivers, has reduced and will likely continue to impact effective capacity in our industry as well as negatively impact equipment utilization. Nevertheless, for carriers that successfully manage the new environment with driver-friendly equipment, compensation, and operations, we believe opportunities to increase market share may be available. Driver pay may increase as a result of regulation and economic expansion, which could provide more alternative employment opportunities. If economic growth is sustained, however, we expect the supply/demand environment to be favorable enough for us to offset expected compensation increases with better freight pricing.

We use driver teams in a substantial portion of our tractors. Driver teams permit us to provide expedited service on selected long haul lanes because teams are able to handle longer routes and drive more miles while remaining within DOT hours-of-service rules. The use of teams contributes to greater equipment utilization of the tractors they drive than obtained with single drivers. The use of teams, however, increases the accumulation of miles on tractors and trailers as well as personnel costs as a percentage of revenue and the number of drivers we must recruit. At December 31, 2014 and 2013, teams operated approximately 32% of our tractors.

We are not a party to any collective bargaining agreement. At December 31, 2014, we employed approximately 3,600 drivers and approximately 800 non-driver personnel. At December 31, 2014, we also contracted with 195 independent contractors.

Revenue Equipment

At December 31, 2014, we operated 2,665 tractors and 6,722 trailers. Of these tractors, 2,320 were owned, 150 were financed under operating leases, and 195 were provided by independent contractors, who own and drive their own tractors. Of these trailers, 2,916 were owned, 2,904 were financed under operating leases, and 902 were financed under capital leases. Furthermore, at December 31, 2014, approximately 66% of our trailers were dry vans and the remaining trailers were refrigerated vans.

We believe that operating high quality, late-model equipment contributes to operating efficiency, helps us recruit and retain drivers, and is an important part of providing excellent service to customers. We operate a modern fleet of tractors, with the majority of units under warranty, to minimize repair and maintenance costs and reduce service interruptions caused by breakdowns. We also order most of our equipment with uniform specifications to reduce our parts inventory and facilitate maintenance. At December 31, 2014, our tractor fleet had an average age of approximately 1.6 years, and our trailer fleet had an average age of approximately 5.4 years. As of December 31, 2014, 100% of our tractor fleet had engines compliant with stricter regulations regarding emissions that became effective in 2007 and 97.4% of our tractor fleet had engines compliant with stricter regulations regarding emissions that became effective in 2010. We equip our tractors with a satellite-based tracking and communications system that permits direct communication between drivers and fleet managers. We believe that this system enhances our operating efficiency and improves customer service and fleet management. This system also updates the tractor's position every thirty minutes, which allows us and our customers to locate freight and accurately estimate pick-up and delivery times. We also use the system to monitor engine idling time, speed, performance, and other factors that affect operating efficiency. At December 31, 2014, 100% of our fleet was equipped with electronic on board recorders ("EOBRs," now referred to as electronic logging devices, or "ELDs"), which electronically monitor truck miles and enforce hours-of-service regulations.

Over the past decade, the price of new tractors has risen dramatically and there has been significant volatility in the used equipment market. This has substantially increased our costs of operation.

Industry and Competition

Truckload is the largest segment of the for-hire ground freight transportation market based on revenue, surpassing the combined market size of less-than-truckload, railroad, intermodal, and parcel delivery combined. The truckload market is further segmented into sectors such as regional dry van, temperature-controlled van, flatbed, dedicated contract, expedited, and irregular route.

The U.S. trucking industry is highly competitive and includes thousands of "for-hire" motor carriers, none of which dominate the market. Service and price are the principal means of competition in the trucking industry. We compete to some extent with railroads and rail-truck intermodal service but attempt to differentiate ourselves from our competition on the basis of service. Rail and rail-truck intermodal movements are more often subject to delays and disruptions arising from rail yard congestion, which reduce the effectiveness of such service to customers with time-definite pick-up and delivery schedules. In times of high fuel prices or decreased consumer demand, however, rail-intermodal competition becomes more significant.

Our industry is subject to dynamic factors that significantly affect our operating results. These factors include the availability of qualified truck drivers, the volume of freight in the sectors we serve, the price of diesel fuel, and government regulations that impact productivity and costs. Recently, our industry has experienced increased freight volumes, scarcity of qualified truck drivers, and new regulations that limit productivity. These factors have contributed to an environment of tight trucking capacity and rising freight rates for many trucking companies, including us. Based on our assessment of future regulatory changes, driver demographics, and expected growth rates of our major customers and sectors, we expect a favorable pricing environment to continue for the next several years, offset in part by higher driver pay and other inflationary costs. We believe large and diversified companies, like ourselves, are best positioned to capitalize on the current industry environment, because we can offer significant capacity commitments to major customers, safe and comfortable new equipment to drivers, and optimized routing and other business analytics to make the most of our drivers' federally limited operating hours.

We believe that the cost and complexity of operating trucking fleets are increasing and that economic and competitive pressures are likely to force many smaller competitors and private fleets to consolidate or exit the industry. As a result, we believe that larger, better-capitalized companies, like us, will have opportunities to increase profit margins and gain market share. In the market for dedicated services, we believe that truckload carriers, like us, have a competitive advantage over truck lessors, which are the other major participants in the market, because we can offer lower prices by utilizing back-haul freight within our network that traditional lessors may not have.

Regulation

Our operations are regulated and licensed by various U.S. agencies. Our Canadian business activities are subject to similar requirements imposed by the laws and regulations of Canada, as well as its provincial laws and regulations. We operate within Mexico by utilizing third-party carriers within that country. Our Company drivers and independent contractors also must comply with the safety and fitness regulations of the DOT, including those relating to drug and alcohol testing and hours-of-service. Such matters as weight and equipment dimensions are also subject to U.S. regulations. We also may become subject to new or more restrictive regulations relating to fuel emissions, drivers' hours-of-service, ergonomics, or other matters affecting safety or operating methods. Other agencies, such as the Environmental Protection Agency ("EPA") and the Department of Homeland Security ("DHS") also regulate our equipment, operations, and drivers.

The DOT, through the FMCSA, imposes safety and fitness regulations on us and our drivers, including rules that restrict driver hours-of-service. In December 2011, the FMCSA published its 2011 Hours-of-Service Final Rule (the "2011 Rule"). The 2011 Rule requires drivers to take 30-minute breaks after eight hours of consecutive driving and reduces the total number of hours a driver is permitted to work during each week from 82 hours to 70 hours. The 2011 Rule also modified the requirements for when the weekly hours-of-service limit can be reset by having the driver refrain from working for a period of 34 hours, known as a "34-hour restart." The 2011 Rule also provides that the 34-hour restart may only be used once per week and must include two rest periods between one a.m. and five a.m. (together, the “2011 Restart Restrictions”). These rule changes became effective July 1, 2013. We believe the 2011 Rule has decreased productivity and caused some loss of efficiency, as drivers and shippers have needed supplemental training, computer programming has required modifications, additional drivers have been employed or engaged, additional equipment has been acquired, and shipping lanes have been reconfigured.

On December 13, 2014, Congress passed the 2015 Omnibus Appropriations bill, which was signed into law December 16, 2014. Among other things, the legislation provides relief from the 2011 Restart Restrictions, which essentially reverts back to the more straight forward 34-hour restart that was in effect before the 2011 Rule became effective.

The FMCSA also is considering revisions to the existing rating system and the safety labels assigned to motor carriers evaluated by the DOT. We currently have a "satisfactory" DOT rating, which is the highest available rating under the current safety rating scale. If we were to receive a conditional or unsatisfactory DOT safety rating, it could adversely affect our business because some of our customer contracts require a satisfactory DOT safety rating. Under the revised rating system being considered by the FMCSA, our safety rating would be evaluated more regularly, and our safety rating would reflect a more in-depth assessment of safety-based violations.

CSA introduced a new enforcement and compliance model that evaluates and ranks both fleets and individual drivers on certain safety-related standards. The methodology for determining a carrier's DOT safety rating has been expanded to include the on-road safety performance of the carrier's drivers. As a result, certain current and potential drivers may no longer be eligible to drive for us, our fleet could be ranked poorly as compared to our peer firms, and our safety rating could be adversely impacted. The occurrence of future deficiencies could affect driver recruiting and retention by causing high-quality drivers to seek employment with other carriers, or could cause our customers to direct their business away from us and to carriers with higher fleet safety rankings, either of which would adversely affect our results of operations and productivity. Additionally, we may incur greater than expected expenses in our attempts to improve our scores as a result of those scores.

Certain of our subsidiaries have exceeded the established intervention thresholds in several of the seven safety-related standards of CSA. Based on these unfavorable ratings, we may be prioritized for an intervention action or roadside inspection, either of which could adversely affect our results of operations. We have put new maintenance procedures in place in an attempt to address maintenance issues that were cited. Additionally, we have reduced the maximum speed on a large portion of our fleet and enhanced programs that reward drivers for positive safety behavior.

The FMCSA proposed new rules that would require nearly all carriers, including us, to install and use EOBRs in their tractors to electronically monitor truck miles and enforce hours-of-service. These rules were vacated by the Seventh Circuit Court of Appeals in August 2011. In July 2012, Congress passed a federal transportation bill that requires promulgation of rules mandating the use of EOBRs (now referred to as ELDs) by July 2013 with full adoption by all trucking companies no later than July 2015. It is uncertain if this adoption date will be challenged or extended. We believe the pending ELD mandate, together with the revised hours-of-service rules and other regulations, could result in a reduction in effective trucking capacity to service increased demand. We have proactively installed ELDs on 100% of our owned tractors.

In the aftermath of the September 11, 2001 terrorist attacks, the DHS and other federal, state, and municipal authorities implemented and continue to implement various security measures, including checkpoints and travel restrictions on large trucks. The U.S. Transportation Security Administration ("TSA") adopted regulations that require determination by the TSA that each driver who applies for or renews his or her license for carrying hazardous materials is not a security threat. This could reduce the pool of qualified drivers who are permitted to transport hazardous waste, which could require us to increase driver compensation, limit our fleet growth, or result in trucks sitting idle. These regulations also could complicate the matching of available equipment with hazardous material shipments, thereby increasing our response time on customer orders and our non-revenue miles. As a result, it is possible we could fail to meet the needs of our customers or could incur increased expenses to do so.

We are subject to various environmental laws and regulations dealing with the hauling and handling of hazardous materials, fuel storage tanks, air emissions from our vehicles and facilities, engine idling, and discharge and retention of storm water. Our truck terminals often are located in industrial areas where groundwater or other forms of environmental contamination could occur. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. Certain of our facilities have waste oil or fuel storage tanks and fueling islands. A small percentage of our freight consists of low-grade hazardous substances, which subjects us to a wide array of regulations. Additionally, increasing efforts to control emissions of greenhouse gases may have an adverse effect on us. Although we have instituted programs to monitor and control environmental risks and promote compliance with applicable environmental laws and regulations, if we are involved in a spill or other accident involving hazardous substances, if there are releases of hazardous substances we transport, if soil or groundwater contamination is found at our facilities or results from our operations, or if we are found to be in violation of applicable laws or regulations, we could be subject to cleanup costs and liabilities, including substantial fines or penalties or civil and criminal liability, any of which could have a materially adverse effect on our business and operating results.

The EPA adopted a series of emissions control regulations that require progressive reductions in exhaust emissions from new diesel engines manufactured on or after October 2002, January 2007, and January 2010. Compliance with these regulations increased our new tractor costs and operating expenses and reduced our fuel economy. In May 2010, President Obama signed an executive memorandum directing the National Highway Traffic Safety Administration ("NHTSA") and the EPA to develop new, stricter fuel efficiency standards for heavy tractors. In August 2011, the NHTSA and EPA adopted a new rule that established the first-ever fuel economy and greenhouse gas standards for medium- and heavy-duty vehicles, which include tractors we utilize. These standards apply to model years 2014 to 2018, which are required to achieve an approximate 20 percent reduction in fuel consumption by 2018, which equates to approximately four gallons of fuel for every 100 miles traveled. In addition, in February 2014 President Obama announced that his administration will begin developing the next phase of tighter fuel efficiency standards for medium and heavy-duty vehicles, including tractors we utilize, and directed the EPA and NHTSA to develop new fuel-efficiency and greenhouse gas standards by March 31, 2016. We believe that the foregoing requirements could result in increased new tractor prices and additional parts and maintenance costs incurred to retrofit our tractors with technology to achieve compliance with such standards, which could adversely affect our operating results and profitability, particularly if such costs are not offset by potential fuel savings. We cannot predict, however, the extent to which our operations and productivity will be impacted.

The California Air Resources Board ("CARB") also adopted emission control regulations that will be applicable to all heavy-duty tractors that pull 53-foot or longer box-type trailers within the State of California. The tractors and trailers subject to these CARB regulations must be either EPA SmartWay certified or equipped with low-rolling, resistance tires and retrofitted with SmartWay-approved aerodynamic technologies. Enforcement of these CARB regulations for model year 2011 equipment began in January 2010 and will be phased in over several years for older equipment. In order to comply with the CARB regulations, we submitted a large fleet compliance plan to CARB in 2010. We will continue monitoring our compliance with the CARB regulations. As of January 1, 2014, CARB regulations require certain drayage trucks with 2006 or older model year engines to upgrade to 2007 or newer model year engines. We believe some industry participants may have difficulty complying with this new requirement, which may tighten drayage freight capacity and decrease drayage competition in California. Federal and state lawmakers also are considering a variety of climate-change proposals. Compliance with such regulations could increase the cost of new tractors and trailers, impair equipment productivity, and increase operating expenses. These effects, combined with the uncertainty as to the operating results that will be produced by the newly designed diesel engines and the residual values of these vehicles, could increase our costs or otherwise adversely affect our business or operations.

In order to reduce exhaust emissions, some states and municipalities have begun to restrict the locations and amount of time where diesel-powered tractors, such as ours, may idle. These restrictions could force us to alter our drivers' behavior, purchase on-board power units that do not require the engine to idle, or face a decrease in productivity.

Beginning October 2013, any entity acting as a broker or a freight forwarder is required to obtain authority from the FMCSA, and is subject to a minimum $75,000 financial security requirement, increased from the previous requirement of $10,000. We are licensed by the FMCSA as a property broker and are in compliance with the financial security requirement. This new requirement may limit entry of new brokers into the market or cause current brokers to exit the market. Such persons may seek agent relationships with companies such as us to avoid this increased cost. If they do not seek out agent relationships, the number of brokers in the industry could decrease.

Fuel Availability and Cost

The cost of fuel trended lower in 2014, compared to 2013 and 2012, as demonstrated by a decrease in the Department of Energy ("DOE") national average for diesel of approximately 9.7 cents per gallon for 2014 compared to 2013. Our fuel cost was further decreased in 2014 due to an increase in our average fuel miles per gallon during 2014 as a result of purchasing equipment with more fuel-efficient engines.

We actively manage our fuel costs by routing our drivers through fuel centers with which we have negotiated volume discounts and through jurisdictions with lower fuel taxes, where possible. We have also reduced the maximum speed of many of our trucks, implemented strict idling guidelines for our drivers, purchased technology to enhance our management and monitoring of out-of-route miles, encouraged the use of shore power units in truck stops, and imposed standards for accepting broker freight that includes minimum rates and fuel surcharges. These initiatives have contributed to significant improvements in fleet wide average fuel mileage. Moreover, we have a fuel surcharge program in place with the majority of our customers, which has historically enabled us to recover some of the higher fuel costs. However, even with the fuel surcharges, the price of fuel has affected our profitability. Our fuel surcharges are billed on a lagging basis, meaning we typically bill customers in the current week based on a previous week's applicable index. Therefore, in times of increasing fuel prices, we do not recover as much as we are currently paying for fuel. In periods of declining prices, the opposite is true. In addition, we incur additional costs when fuel prices rise that cannot be fully recovered due to our engines being idled during cold or warm weather, empty or out-of-route miles, and for fuel used by refrigerated trailer units that generally is not billed to customers. In addition, from time-to-time customers attempt to modify their surcharge programs, some successfully, which can result in recovery of a smaller portion of fuel price increases. Rapid increases in fuel costs or shortages of fuel could have a materially adverse effect on our operations or future profitability.

To reduce the variability of the ultimate cash flows associated with fluctuations in diesel fuel prices, we periodically enter into various derivative instruments, including forward futures swap contracts. Historically diesel fuel has not been a traded commodity on the futures market so heating oil has been used as a substitute, as prices for both generally move in similar directions. Recently, however, we have been able to enter into hedging contracts with respect to both heating oil and ultra low sulfur diesel ("ULSD"). Under these contracts, we pay a fixed rate per gallon of heating oil or ULSD and receive the monthly average price of New York heating oil per the New York Mercantile Exchange ("NYMEX") and Gulf Coast ULSD, respectively. Because the fixed price is determined based on market prices at the time we enter into the hedge, in times of increasing fuel prices the hedge contracts become more valuable, whereas in times of decreasing fuel prices the opposite is true. At December 31, 2014, we had forward futures swap contracts on approximately 12.6 million, 12.1 million, and 3.0 million gallons of diesel to be purchased in 2015, 2016, and 2017, respectively, or approximately 23%, 22%, and 5% of our projected annual 2015, 2016, and 2017 fuel requirements, respectively. Due to declining petroleum prices in 2014, the fair value of our fuel hedging contracts at December 31, 2014, represented a $22.7 million liability.

Seasonality

In the trucking industry, revenue generally decreases as customers reduce shipments following the winter holiday season and as inclement weather impedes operations. At the same time, operating expenses generally increase, with fuel efficiency declining because of engine idling and weather, creating more physical damage equipment repairs. For the reasons stated, first quarter results historically have been lower than results in each of the other three quarters of the year, excluding charges. Over the past several years, we have seen increases in demand at varying times, specifically May through October, based primarily on restocking required to replenish inventories that have been held significantly lower than historical averages. Additionally, we have seen surges between Thanksgiving and Christmas resulting from holiday shopping trends toward delivery of gifts purchased over the internet, as well as the impact of shorter holiday seasons.

Additional Information

At December 31, 2014, our corporate structure included Covenant Transportation Group, Inc., a Nevada holding company organized in May 1994, and its wholly owned subsidiaries: Covenant Transport, Inc., a Tennessee corporation; Southern Refrigerated Transport, Inc., an Arkansas corporation; Star Transportation, Inc., a Tennessee corporation; Covenant Transport Solutions, Inc., a Nevada corporation; Covenant Logistics, Inc., a Nevada corporation; Covenant Asset Management, Inc., a Nevada corporation; CTG Leasing Company, a Nevada corporation; and IQS Insurance Retention Group, Inc., a Vermont corporation.

Our headquarters is located at 400 Birmingham Highway, Chattanooga, Tennessee 37419, and our website address is www.ctgcompanies.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all other reports we file with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") are available free of charge through our website. Information contained in or available through our website is not incorporated by reference into, and you should not consider such information to be part of, this Annual Report on Form 10-K.

Additionally, you may read all of the materials that we file with the SEC by visiting the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. If you would like information about the operation of the Public Reference Room, you may call the SEC at 1-800-SEC-0330. You may also visit the SEC's website at www.sec.gov. This site contains reports, proxy and information statements and other information regarding the Company and other companies that file electronically with the SEC.

Our future results may be affected by a number of factors over which we have little or no control. The following discussion of risk factors contains forward-looking statements as discussed in Item 1 above. The following issues, uncertainties, and risks, among others, should be considered in evaluating our business and growth outlook.

Our business is subject to general economic and business factors affecting the trucking industry that are largely out of our control, any of which could have a materially adverse effect on our operating results.

The truckload industry is highly cyclical, and our business is dependent on a number of factors that may have a negative impact on our results of operations, many of which are beyond our control. We believe that some of the most significant of these factors are economic changes that affect supply and demand in transportation markets, such as:

|

●

|

recessionary economic cycles, such as the period from 2007 through 2009;

|

| |

|

|

●

|

changes in customers' inventory levels and in the availability of funding for their working capital;

|

| |

|

|

●

|

excess tractor capacity in comparison with shipping demand; and

|

| |

|

|

●

|

downturns in customers' business cycles.

|

Economic conditions that decrease shipping demand or increase the supply of tractors and trailers can exert downward pressure on rates and equipment utilization, thereby decreasing asset productivity. The risks associated with these factors are heightened when the U.S. economy is weakened. Some of the principal risks during such times, which risks we experienced during prior recessionary times, are as follows:

|

●

|

we may experience a reduction in overall freight levels, which may impair our asset utilization;

|

| |

|

|

●

|

certain of our customers may face credit issues and could experience cash flow problems that may lead to payment delays, increased credit risk, bankruptcies, and other financial hardships that could result in even lower freight demand and may require us to increase our allowance for doubtful accounts;

|

| |

|

|

●

|

freight patterns may change as supply chains are redesigned, resulting in an imbalance between our capacity and our customers' freight demand;

|

| |

|

|

●

|

customers may solicit bids for freight from multiple trucking companies or select competitors that offer lower rates from among existing choices in an attempt to lower their costs, and we might be forced to lower our rates or lose freight; and

|

| |

|

|

●

|

we may be forced to accept more freight from freight brokers, where freight rates are typically lower, or may be forced to incur more non-revenue miles to obtain loads.

|

We also are subject to potential increases in various costs and other events that are outside of our control that could materially reduce our profitability if we are unable to increase our rates sufficiently. Such cost increases include, but are not limited to, fuel and energy prices, taxes and interest rates, tolls, license and registration fees, insurance premiums, revenue equipment and related maintenance costs, and healthcare and other benefits for our employees. We could be affected by strikes or other work stoppages at our service centers or at customer, port, border, or other shipping locations. Changing impacts of regulatory measures could impair our operating efficiency and productivity, decrease our revenues and profitability, and result in higher operating costs. In addition, declines in the resale value of revenue equipment can also affect our profitability and cash flows. From time to time, various federal, state, or local taxes may also increase, including taxes on fuels. We cannot predict whether, or in what form, any such cost increase or event could occur. Any such cost increase or event could adversely affect our profitability.

In addition, we cannot predict future economic conditions, fuel price fluctuations, or how consumer confidence could be affected by actual or threatened armed conflicts or terrorist attacks, government efforts to combat terrorism, military action against a foreign state or group located in a foreign state, or heightened security requirements. Enhanced security measures could impair our operating efficiency and productivity and result in higher operating costs.

We may not be successful in achieving our strategic plan.

Our current strategic plan includes instilling an enterprise-wide culture, allocating our available capital toward business units we expect to generate acceptable returns, improving the career and experience of our professional drivers, offering our customers significant value in markets and sectors where we can make a difference, and effectively managing the risks associated with our business. To this end, several of our initiatives include growing our expedited dry van and temperature-controlled teams, increasing the number of tractors and trailers allocated toward dedicated contract operations in targeted markets, effectively managing the attraction, development, and retention of qualified drivers, capitalizing on our enterprise management system including improving the performance at SRT, our most recent (and final) subsidiary to implement this technology, and continuing to manage our exposures to fluctuations in fuel prices, claims, interest rates, used truck prices, and other potentially volatile expenses through a variety of hedging, insurance, contractual, and other methods. Such initiatives will require time, management and financial resources, changes in our operations and sales functions, and monitoring and implementation of technology. We may be unable to effectively and successfully implement, or achieve sustainable improvement from, our strategic plan and initiatives or achieve these objectives. In addition, our operating margins could be adversely affected by future changes in and expansion of our business, including the expected expansion of expedited dry van and temperature-controlled teams. Further, our operating results may be negatively affected by a failure to further penetrate our existing customer base, cross-sell our services, pursue new customer opportunities, or manage the operations and expenses of new or growing services. There is no assurance that we will be successful in achieving our strategic plan and initiatives. If we are unsuccessful in implementing our strategic plan and initiatives, our financial condition, results of operations, and cash flows could be adversely affected.

We operate in a highly competitive and fragmented industry, and numerous competitive factors could impair our ability to improve our profitability.

|

●

|

we compete with many other truckload carriers of varying sizes and, to a lesser extent, with less-than-truckload carriers, railroads, intermodal companies, and other transportation companies, many of which have more equipment and greater capital resources than we do;

|

| |

|

|

●

|

many of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or maintain significant growth in our business;

|

| |

|

|

●

|

many of our customers, including several in our top ten, are other transportation companies, and they may decide to transport their own freight;

|

| |

|

|

●

|

many customers reduce the number of carriers they use by selecting "core carriers" as approved service providers, and in some instances we may not be selected;

|

| |

|

|

●

|

many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors;

|

| |

|

|

●

|

the trend toward consolidation in the trucking industry may create other large carriers with greater financial resources and other competitive advantages relating to their size;

|

| |

|

|

●

|

advances in technology require increased investments to remain competitive, and our customers may not be willing to accept higher freight rates to cover the cost of these investments; and

|

| |

|

|

●

|

competition from non-asset-based logistics and freight brokerage companies may adversely affect our customer relationships and freight rates.

|

We have a history of net losses and may be unsuccessful in improving our profitability.

We have generated a profit in only four of the last seven years and our aggregate net losses during the seven year period are significantly more than our aggregate net income. We may not be able to sustain or increase profitability in the future. Achieving profitability depends upon numerous factors, including our ability to effectively and successfully implement other strategic plans and initiatives, increase our average revenue per tractor, improve driver retention, and control expenses. If we are unable to improve our profitability, then our liquidity, financial position, and results of operations may be adversely affected.

We self-insure for a significant portion of our claims exposure, which could significantly increase the volatility of, and decrease the amount of, our earnings.

Our future insurance and claims expense could reduce our earnings and make our earnings more volatile. We self-insure for a significant portion of our claims exposure and related expenses. We accrue amounts for liabilities based on our assessment of claims that arise and our insurance coverage for the periods in which the claims arise, and we evaluate and revise these accruals from time to time based on additional information. Due to our significant self-insured amounts, we have significant exposure to fluctuations in the number and severity of claims and the risk of being required to accrue or pay additional amounts if our estimates are revised or the claims ultimately prove to be more severe than originally assessed. Historically, we have had to significantly adjust our reserves on several occasions, and future significant adjustments may occur. For example, in the third quarter of 2014, there was an unfavorable judgment against one of our subsidiaries for a cargo claim and we had to record a significant additional reserve of $7.5 million for this claim. Further, our self-insured retention levels could change and result in more volatility than in recent years.

We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe our aggregate insurance limits are sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed those limits. If any claim was to exceed our coverage, we would bear the excess, in addition to our other self-insured amounts. Our insurance and claims expense could increase, or we could find it necessary to again raise our self-insured retention or decrease our aggregate coverage limits when our policies are renewed or replaced. Our operating results and financial condition may be adversely affected if these expenses increase, if we experience a claim in excess of our coverage limits, if we experience a claim for which we do not have coverage, if we experience an increase in number of claims, or if we have to increase our reserves.