United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

|

Attention:

|

William H. Thompson.

|

Accounting Branch Chief

|

Re:

|

Dutch Gold Resources, Inc.

|

Form 10-K for the Fiscal Year Ended December 31, 2009

Filed April 15, 2010

Form 10-Q for the Fiscal Quarter Ended September 30, 2010

Filed November 12, 2010

Form 8-K filed February 1, 2010

File No. 333-72163

Dear Mr. Thompson:

This letter is in response to the comments of the staff of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the above-referenced filings provided in your letter dated February 7, 2011 (the “Comment Letter”). In response to these comments, Dutch Gold Resources, Inc. (the “Company”) has caused to be filed Amendment No. 2 on Form 10-K for the fiscal year ended December 31, 2009, the Form 10-K/A for the fiscal year ended December 31, 2010, the Form 10-Q/A for the period ending September 30, 2010 and Amendment No.2 on Form 8-K. The purpose of this correspondence is to provide explanation, where necessary of our responses. Our responses follow the text of each Staff comment reproduced consecutively for your convenience.

General

|

1.

|

Please make conforming revisions to your filings on Form 10-K for the fiscal year ended December 31, 2010, and Form 10-Q for the fiscal quarter ended March 31, 2011 to address the applicable comments below.

|

The Company has made conforming changes to the Form 10-K for the fiscal year ended December 31, 2010, and Form 10-Q for the fiscal quarter ended March 31, 2011 to address the applicable comments below. In addition, the Form 10-K/A for the fiscal year ending December 31, 2010 has been conformed accordingly.

Form 10-K/A for Fiscal Year Ended December 31, 2009

|

2.

|

We note your response to comments 10, 16, 17, 18 and 21 and your intent to include the additional disclosures in all amended and future filings, but we could not locate the disclosures in the amended Form 10-K filed May 24, 2011, the amended Form 10-Q filed May 27, 2011 Or in the new Form 10-K filed April 1,2011 and new Form 10-Q filed May 16, 2011. Please revise to provide these disclosures.

|

United States Securities and Exchange Commission

September 9, 2011

Page 2

We have amended our Form 10-K for the year ended 2009 and 2010 to include the followings description of the Jungo project in response to comments 10, 16, 17, 18 and 21:

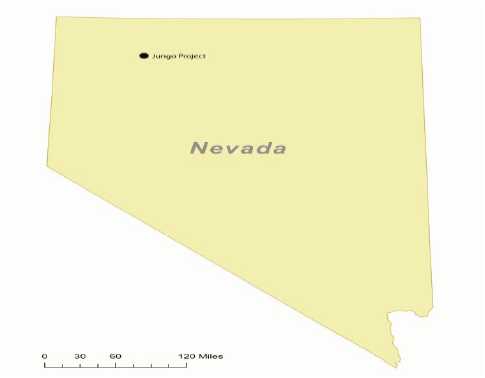

Jungo Project The Jungo gold exploration project is located approximately 50 miles northwest of the town of Winnemucca, in Humboldt County, Nevada. It is accessed by excellent county-maintained gravel roads west from Winnemucca then north from Jungo junction. The last three miles to the property are by poor quality dirt roads. The property is situated on the eastern margin of the Jackson Mountains.

The following map illustrates the general location of the Jungo gold exploration project in Nevada:

Geologic Setting:

The Jungo property is underlain by Pretertiary metasedimentary and metadiorite rocks that have locally been covered and intruded by younger, possibly Miocene, volcanic units. These units are largely covered by unconsolidated gravels from the adjacent mountainside, and by Pleistocene lake beds. A series of range-front normal faults offsets these units and is probably associated with mineralization on the property. A key player in mineralization is likely an apparent volcanic vent that was intersected in trenching and drilling, and appears associated with the range-front faulting.

Property:

The property is on BLM land and is held by 95 unpatented lode mining claims. Twenty five of the claims have a two percent net smelter return royalty to William (Bill) Hansen. The other 70 claims are owned by DGRI.

United States Securities and Exchange Commission

September 9, 2011

Page 3

The property was acquired by DGRI by the transaction with Aultra Gold in January 2010. Mr. Hansen originally showed the property to Aultra Gold (“AGI”), which acquired it and staked additional claims.

Work on the Property:

AGI Exploration:

Mr. Hansen told AGI that he had several years earlier drilled three holes on the property, but the earlier records were lost. AGI surface sampled the property and completed two trenches in 2007. AGI’s sampling and trenching produced encouraging results. Among the promising results was a twenty-foot interval in the first of two trenches that assayed 0.042 opt gold and more than 0.5 opt silver. A select sample of trench rock assayed 0.6 opt gold and 4.44 opt silver.

An isolated pit to bedrock almost 2,000 feet to the northwest assayed 0.11 opt gold and 3.80 opt silver.

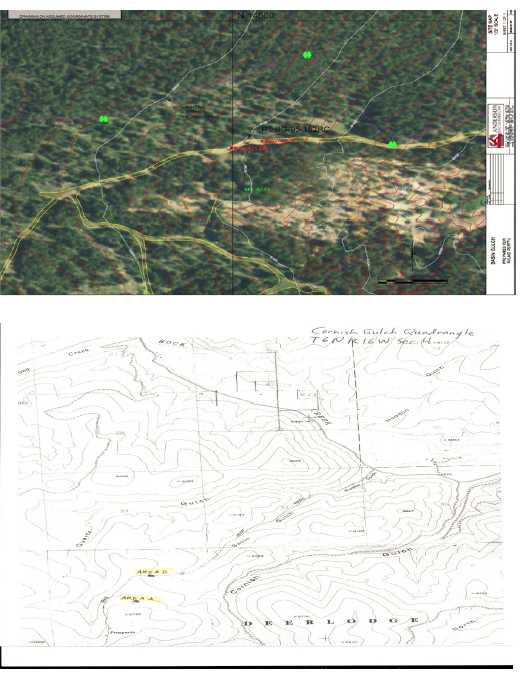

2010 Trenching Program by Dutch

During the spring of 2010, DGRI completed three new trenches at Jungo. The 2010 Trench JTP-3 was sited 1020 feet north of the northern 2007 trench and was dug in an easterly down-slope orientation to cut across the base of the eastern hillside of the Jackson Mountains. Trench JTP-3 exposed altered Pretertiary metamorphosed sedimentary and igneous rocks that have been locally intruded by younger sialic shallow igneous rocks. All of the rocks have been fundamentally shattered and sheared, with the appearance of volcanic venting. Trench JTP-3 exposed the apparent continuation of the silicic gold-bearing volcanic vent rocks that were seen in the northern 2007 trench. The interval from 140 feet to 270 feet in Trench JTP-3 had the appearance of a volcanic vent zone. It contained erratic blocks of altered older metamorphic rocks and visibly copper-bearing rocks from an earlier mineralizing event, mixed with and locally dominated by younger highly silicic gassy volcanics. The zone is gold bearing. The trench interval from 200 to 210 feet assayed 0.048 opt gold and 0.5 opt silver. The interval from 240 to 250 feet contained 0.076 opt gold and 2.6 ounces silver. The adjacent interval from 250 to 260 feet assayed 0.017 opt gold and a half-ounce silver.

The eastern margin of trench JTP-2, located 400 feet north of Trench JTP-3, averaged 0.028 opt gold and 0.67 opt silver from 10 to 60 feet. Within this zone, the interval from 50 to 60 foot assayed 0.087 opt gold and .71 opt silver.

New information from Kernow Resources

During the summer of 2010, DGRI was able to track down information on the historic exploration done on the property. Key information, including historic drill cuttings and core, with partial assaying, was graciously given to DGRI by Kernow Resources. DGRI was told that eleven of approximately 20 permitted holes in the Jungo area were actually drilled during the 1990’s. DGRI is reviewing these cores and cuttings. Most of these holes were drilled to the west and east of DGRI’s target area because they were targeted on geophysical anomalies. DGRI is focused on apparently younger silicified volcanic vent materials that appear to be low in sulfides, and unlikely to form a strong geophysical signature. It appears that the previous explorers didn’t recognize the vent structures while they were focused on drilling the sulfide-related geophysical targets and a visibly copper-stained vein system.

DGRI believes that at least two stages of mineralization occurred in the area. An earlier high-temperature period of mineralization was copper-rich, with limited gold and zinc accessory mineralization. This stage of mineralization had locally strong sulfides, and is likely associated with the geophysical targets. A later apparently lower temperature period of mineralization contains more gold and silver with lower sulfide content that was all oxidized in Dutch’s trenches.

United States Securities and Exchange Commission

September 9, 2011

Page 4

The earlier exploration was conducted during a time of lower, and dropping gold prices, and Kernow reportedly had money constraints for continued exploration. Nevertheless, the company had encouraging results, as described in their web site:

“Sulphide mineralization sampled from outcrop and trenches contains anomalous gold, silver, mercury, copper and zinc values. Gold assays from trenching and outcrop range between 0.1 g/t Au and 37 g/t Au. The “sulphide” zone which trends north northeast across the property has been intersected in several drill holes containing in one instance 2.71% copper, 0.048 opt gold and 1.7 opt (ounces per ton) silver over 14 feet. (Hole SH-6C, a diamond drill hole).”

The Company also intersected several other mineralized zones in the overall very shallow drilling. Only three of the holes were core holes, and a comparison of two nearby holes, SH-3, a reverse-circulation (RC) hole, and SH-6C, a core hole, shows the mineralization could be better than suggested by the RC holes. A comparison of two key shallow zones in the two holes shows 0.034 opt gold, 1.02 opt silver, and 2.72% copper in the upper zone of the RC hole, versus 0.049 opt gold, 1.72 opt silver, and 2.83% copper in the core hole. The lower compared zone shows 0.004 opt gold, 0.06 opt silver and 0.07 percent copper in the RC hole, versus 0.052 opt gold, 1.76 opt silver and 0.12% copper in the core hole. Reduced values often occur in RC holes because of cuttings loss, gravity separation during the blowing of cuttings out of the hole, and from “floating” of the gold and sulfides in drill fluids. Although these holes did not intersect Dutch’s target zone, they show extensive mineralization across the area drilled, which is considered very encouraging. Kernow’s information also shows a steeply-west dipping zone containing 56 feet of 0.026 opt gold that is not Dutch’s target zone, nor has it been drill-tested.

Kernow concluded: “There has been a considerable amount of work carried out on the Shawnee that has identified at least two phases of near surface mineralization which, for the most part, appears to be structurally controlled and associated with the range front faulting. Recent geophysical surveys and review of previous data infers that the mineralization continues at depth. Geochemistry infers that there is an upper and lower system or that there is metal zonation around an intrusive.

Compilation of all the data generated to date also indicates that the majority of the drilling has not adequately tested any of the geophysical targets generated by the either the gradient array survey or the di-pole di-pole survey.

Considering the strong indicator element geochemistry and the strength of the upper mineralized system the principal target at the Shawnee is now defined as being a wide, structurally prepared high silica, polymetallic multiple vein/stockwork system, the top of which gains strength and continuity approximately 400 feet below surface and continues at depth. This theory is reinforced by the real section I.P. and the Resistivity measurements that accompany it. Alteration exposed on surface and in drill holes confirms that the mineralization encountered to date is high in the system.”

In its evaluation of the new date, DGRI concluded that the newly identified volcanic vent had not been tested, nor had the deeper mineralization postulated by Kernow. The extensive shallow low-grade mineralization discovered in the earlier drilling and trenching, and in DGRI’s trenching, also encourage DGRI that the possibility exists that in-fill and step-out drilling will establish an open-pit gold deposit. Most of Nevada’s new mines were discovered and established over a series of exploration programs that progressively built an economic reserve.

United States Securities and Exchange Commission

September 9, 2011

Page 5

Planned drilling

Upon review, DGRI determined that the younger volcanic vent system had not been drill-tested. DGRI plans to drill an angled core hole to obtain more information on the vent zone during the second quarter of 2011.

DGRI’s Overview of Project

DGRI has been contacted by outside companies, at least one of which is actively exploring in the local area, regarding a possible farm-out or joint venture. DGRI believes the property has significant promise. DGRI believes the geology of the Jungo project has similarities to the geology of numerous other projects in the immediate area. The project’s proximity to other projects is also significant to DGRI, and, reportedly to a company operating in the area that has approached DGRI regarding the project.

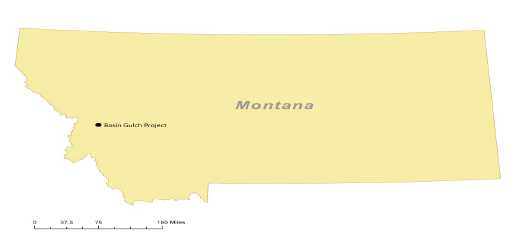

The following maps illustrates the general location of the Basin Gulch Project in Montana:

United States Securities and Exchange Commission

September 9, 2011

Page 6

Cautionary Note to United States Investors, page 2

|

3.

|

We note your response to prior comment five, indicating you will modify your future filings by removing all resource terminology; however, we note such terminology was not removed from the amended filing. Please revise to remove all resource terminology, definitions, and disclosure.

|

We have revised the note as follows:

United States Securities and Exchange Commission

September 9, 2011

Page 7

CAUTIONARY NOTE TO UNITED STATES INVESTORS

The United States Securities and Exchange Commission (SEC) Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Investors are urged to consider closely the disclosure in our Form 10-K which may be secured from us, or from the SEC’s website at http://www.sec.gov/edgar.shtml

We also note that drilling results are not indicative of mineralized material in other areas where we have mining interests. Furthermore, mineralized material identified on our properties does not and may never have demonstrated economic or legal viability.

Item I. Business History and. Organization, page 7

Overview of Business and Properties, page 7

|

4.

|

We note your response to comment 11 and have reviewed your filing in regard to your mineral rights for your Basin Gulch project. Please modify your filing and clarify that your patented and unpatented claims are placer or lode claims located in an historical placer mining district. In addition, please clarify if you own or lease property at your Grant Pass facilities.

|

We have amended our Form 10-K for 2009 and 2010 to include as follows:

“Basin Gulch consists of eleven patented mining claims, surrounded by the Deer Lodge National Forest, totaling about 217.9 acres and 45 unpatented claims totaling approximately 900 acres. A number of consultants, exploration companies, and Federal and State of Montana agencies prepared various geological and mineralogical models of Basin Gulch. The claims are all located at the head of Basin Gulch, on the northern slopes the West Fork Buttes, within the Sapphire Range of the Western Montana Rocky Mountains. The property is about 19 road miles west of the town of Philipsburg, Montana, within the Rock Creek Mining District of Granite County. The patented portion of the property is owned by a local Philipsburg family, and is under lease agreement to DGRI. The Basin Gulch area is historically a placer mining area lacking a historical association with a lode source for the placer gold. The local placers have been operated since before the turn of the 20th century up until just recently, although most of the work was conducted during the early 1900’s.”

“The Company maintains a milling and storage operation at the Rendata Industrial Park in Grants Pass, OR, under a rental arrangement, which is the process of being renegotiated as of the time of this filing.”

|

5.

|

We have reviewed your response to comment 13 and request the description you have provided be included in your amended filing without the term predevelopment. In addition, we do not find any reference to your Grant Pass operational facilities which is used for your milling operations, equipment maintenance and other uses. Please include this additional disclosure in your amended filing.

|

The Company included the following disclosure under the Properties disclosure:

The Company maintains a milling and storage operation at the Rendata Industrial Park in Grants Pass, OR, under a rental arrangement, which is the process of being renegotiated as of the time of this filing.

United States Securities and Exchange Commission

September 9, 2011

Page 8

|

6.

|

We note your response to comment 14 and have reviewed the maps provided. Please modify your filing and include an index map showing where your property is located in relationship to the appropriate state or province.

|

The filings have been revised to include the appropriate maps.

|

7.

|

We note your response to comment 15 in which you will make the requested changes in both amended and future filings. Please revise your filing as indicated to provide a statement regarding each of your properties that they are without known reserves and your proposed programs are exploratory in nature.

|

|

|

The Company has revised its filings accordingly to the nature of the properties and proposed programs throughout the description of the projects, which are too lengthy to reproduce in their entirety.

|

|

8.

|

We note your response to comment 20 regarding your annual production which you propose to include in future filings. Please include this disclosure in your amended filing. Additional information that should be included are your concentrate tonnage, concentrate grade, metallurgical recovery, terms and conditions of your refinery contract and the quantities and prices for payable metals for which you received revenue.

|

We have amended our Form 10-K for 2009 and 2010 to include as follows:

“There has been no production from any company projects since 2008. If and when there is production, the Company will report tons of ore mined, ore concentrate tonnage, concentrate grade, metallurgical recovery, terms and conditions of our refinery contracts and the quantities and prices payable for metal for which the Company receives revenue.”

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities, page 19

Recent Sales of Unregistered Securities, page 19

|

9.

|

We reviewed your response to comment 22 in our letter dated December 10, 2010. Please show us how to reconcile your disclosure regarding securities exempt from registration requirements for the last three fiscal years to your statements of stockholders' equity (deficit) as of and for the years ended December 31, 2007, December 31, 2008 and December 31, 2009.

|

We have revised all documents to include all unregistered sales of securities during the required periods.

Financial Statements, page 23

Consolidated Statements of Stockholders' Equity (Deficit). page 28

|

10.

|

We reviewed your responses to comments 29 and 35 in our letter dated December 10, 2010. Please reconcile for us the amounts provided in the detailed schedules in your correspondence to the amounts included in the restated statements of stockholders' equity (deficit). Tell us whether further revisions to your statements of stockholders' equity are necessary.

|

United States Securities and Exchange Commission

September 9, 2011

Page 9

The Company has revised and restated these amounts as a result of transaction errors discovered. We do not anticipate future revisions.

Note 14 - Subsequent Events. page 41

|

11.

|

In your response to comment 40 in our letter dated December 10, 2010, you indicate that you have filed complete copies of the asset purchase and stock purchase agreements for Aultra Gold, Inc. Please tell us where you filed these documents, or if they have not been filed, please promptly file the fully executed agreements.

|

We have amended our Form 10-K for the year ended 2009 and 2010 to include the asset purchase agreement and stock purchase agreement are attached as Exhibit 10.1 and exhibit 10.2 of the Form 8-K filed on January 12, 2010.

|

12.

|

We note your response to comment 43 that you have removed all references to the National Instrument 43-10 I report for your property, but note you continue to reference the NI 43-101 reports on pages 14, 15, 41, and 49. Please remove all references to this report from your amended filing.

|

The Company has removed all references to such reports.

Note 15 -Mining Lease and Option to Purchase, page 41

13. Please address comment 45 in our letter dated December 10, 2010.

The Note was revised to disclose royalties as follows:

NOTE 15 – MINING LEASE AND OPTION TO PURCHASE

GOLD BUG MINE

In 1995, the Company purchased the mining property known as Mineral Lot No. 351 Final Certificate No. 83, consisting of the Gold Bug, Silver State, Silver Dollar, Oregonian, Bimetallist and U.S. Lode Claims in Josephine County, Oregon. These claims are collectively referred to as the Gold Bug, which had gold production until 1942, when mining ceased as a result of World War II. Historic production and current geochemical studies indicate the presence of minerals associated with gold formations. There are no current plans to advance the Gold Bug project.

BASIN GULCH

Dutch Gold Resources, Inc. was granted an assignment of the Basin Gulch Mine lease between Aultra Gold, Inc. and Strategic Minerals, Inc. in 2010 as a result of the Asset Purchase agreement with Aultra as discussed in Note 2.

On May 31, 2006, AGDI entered into a Mining Lease Agreement with Strategic Minerals, Inc. (“Strategic”) whereby Strategic granted AGDI the exclusive right to explore, evaluate, develop, and mine the Basin Gulch Property, Montana. The advanced exploration and test mining project consists of eleven patented mineral claims, surrounded by the Deer Lodge National Forest, totaling about 217.9 acres. The claims are all located at the head of Basin Gulch, on the northern slopes of the West Fork Buttes, within the Sapphire Range of the Western Montana Rocky Mountains.

United States Securities and Exchange Commission

September 9, 2011

Page 10

The three-stage Mining Lease Agreement for Basin Gulch is structured as follows:

Stage 1 initial payment:

ADGI paid its initial cash payment of $10,000 and prior to July 30, 2006 satisfied its reporting obligations to Strategic regarding all the exploration and studies conducted on the premises of Basin Gulch Property. This initial payment was expensed when paid.

Stage 2 advance production royalties:

To further evaluate and develop the minerals, AGDI fulfilled the following obligations:

i) By June 10, 2006, it paid a cash payment of $15,000 directly to the underlying property owner;

ii) By September 10, 2006 made cash payment of $25,000 directly to the underlying property owner, and at the end of each following six month period to date.

iii) Since 2008, Dutch Gold Resources, Inc. made such payments under an agreement with Aultra Gold, which granted a security interest in all the claims to the AGDI. Since 2008, DGRI has made semi- annual cash payments of $25,000 to the underlying land owner. No further payments have been or will be made to Strategic based on subsequent agreements between Strategic and the Company.

Stage 3 production royalties:

Upon commencement of production, the Company must pay the greater of:

i) A twice annual cash payment of $25,000 due on March 10 and September 10 of each year; or

ii) 3% of the gross sales receipts of the gold and silver sold, due semi-annually on March 10 and September 10 of each year;

Should production be suspended for a period of 6 months or longer, the twice annual advance production royalty of $25,000 listed above resumes. Upon the completion of payments totaling $8,000,000, the Company will have purchased the mineral rights to this property. As of December 31, 2010, production had not commenced and, therefore, the Stage 3 related production royalties were not owed.

JUNGO

On June 1, 2007, the Company entered into a formal binding Agreement of Purchase and Sale (the "Agreement") with W.R. Hansen, an individual (the “Seller”), pursuant to which the Company acquired from the Seller certain mining claims together with all improvements and all equipment owned by the Seller located thereon, located in Humboldt County, State of Nevada (the “Property”). In consideration of the purchase of the Property, the Company agreed to: (i) reimburse the Seller for all staking and filing costs related to the Property, (ii) issue to the Seller 50,000 restricted shares of the Company’s common stock, $0.001 par value per share (the “Common Stock”), valued at $0.50 per share, (iii) upon its sole determination of sufficient mineralization to place the Property in production, to further issue to the Seller an additional 50,000 restricted shares of the Company’s Common Stock, such that the Company shall make such a determination not later than 30 days following the acquisition of the data contemplated by paragraph 3.3 of the Agreement, (iv) not later than 10 days following the date the Property is placed into development for production of metals, to issue to the Seller an additional 100,000 restricted shares of the Company’s Common Stock, and (v) as further consideration after the Property is placed in production, to direct to the Seller a monthly Net Smelter Royalty of 2% upon all gold, silver, copper, or other metals (the “Metals”) produced and sold from the Property (each royalty payment shall be paid not later than 30 days following the last day of the month in which the metals were produced and sold). Closing of the sale and purchase of the Property occurred on the same date, as under the Agreement both the Company and the Seller have performed their mutual obligations under paragraph 2.2 and Section 4 thereof. As of December 31, 2010, the Jungo property was not in production.

United States Securities and Exchange Commission

September 9, 2011

Page 11

Item 9A(T). Controls and Procedures, page 47

|

14.

|

Please clarify the status of the material weaknesses and their components disclosed here. Please disclose whether or not the company has remediated the material weaknesses. If the material weaknesses have not been remediated, please disclose more fully when and how the company expects to do so. Please explain in detail the steps you have taken (or plan to take) and procedures you implemented (or plan to implement) to correct the material weaknesses you identified.

|

The Company revised its disclosure pertaining to Item 9A(T) in our 2009 Form 10-K/A filed on May 24, 2011 in order to properly disclose the material weaknesses pertaining to a lack of formal policies and procedures necessary to adequately review significant accounting transactions which includes a lack in segregation of duties along with a material weakness pertaining to the Company’s lack of having a formal audit committee with a financial expert.

In addition, the required Item 9A(T) disclosures were made in our 2010 Form 10-K indicating the 2009 material weaknesses had not been remediated and were still present at December 31, 2010.

Quarterly, as required, the Company discloses whether there are any changes in internal control over financial reporting that has materially affected, or is reasonable likely to materially affect, internal control over financial reporting. These required disclosures were made in Item 4 in our Form 10-Q for the quarterly period ended March 31, 2011filed on May 16, 2011 and in such filing, we disclosed that the material weaknesses that were disclosed in the 2010 Form 10-K still existed at March 31, 2011 and there were no significant changes in internal control that occurred during the quarterly period ended March 31, 2011. Therefore, these material weaknesses have not been remediated as disclosed in our Form 10-Q quarterly filing.

Management has already taken initial steps to remediate these control deficiencies including the hiring of additional qualified financial professionals (CFO Tom Leahey and Controller Oswald Gayle). Mr. Leahey has been at the center of the capital markets for the past 25 years. Prior to his service as Chief Financial Officer and from 2007 to 2009, Mr. Leahey served in a business development and investor role for New York City based Galtere International Fund. Prior thereto and from 2004, Mr. Leahey served as the Chief Financial Officer of NetworkD Corporation of Newport Beach, California a leading provider of infrastructure management software offices in France, Russia, the United Kingdom and Germany.

Management intends to complete the remediation of the identified material weaknesses by implementing the following controls and procedures:

|

●

|

Establish a formal review process of significant accounting transactions that includes participation of the Chief Executive Officer, the Chief Financial Officer and the Company’s corporate legal counsel.

|

|

●

|

Form an Audit Committee, which will operate under a board approved charter and will establish policies and procedures for such committee including a Board of Directors formal review and approval process for periodic filings, significant transactions, changes in control structures, communications with management and external auditors, as well as other policies to assure that management controls and procedures are in place and being maintained consistently.

|

United States Securities and Exchange Commission

September 9, 2011

Page 12

In addition to this remediation plan, management plans to add further resources in the corporate office accounting staff in order to ensure the appropriate level of segregation of duties.

The Company’s plan is to remediate the material weaknesses in late 2011, although certain aspects of the staffing changes necessary are dependent upon funding and may extend until early 2012. Additional funds provided by revenue generating activities will result in the hiring of additional accounting resources along with strengthening the current accounting department which will assist in the remediation of these material weaknesses.

Internal Control Over Financial Reporting, page 48

|

15.

|

As requested in comment 49 in our letter dated December 10,2010, please disclose any change in your internal control over financial reporting that occurred during your last fiscal quarter that has materially affected, or is reasonably likely to materially affect, your internal control over financial reporting. Refer to Item 308(c) of Regulation S-K.

|

As discussed in the previous comment and response, there have been no significant changes in internal control over financial reporting that have materially affected, or were reasonably likely to materially affect, our internal control over financial reporting during our Form 10-Q for the quarterly period ended March 31, 2011 from the most recent fiscal year end.

We disclosed this fact in Item 4 within our Form 10-Q for the quarterly period ended March 31, 2011 filed on May 16, 2011. Specifically, we stated that “There have not been any changes in the Company's internal control over financial reporting during the quarter ended March 31, 2011 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.” In addition, in the Form 10-Q/A for the quarter ended September 30, 2010 filed on May 27, 2011, we disclosed in Item 4 on Page 25 that “there have not been any changes in the Company's internal control over financial reporting during the quarter ended September 30, 2010, that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.” We will continue to reassess and will disclose any significant changes in internal control over financial reporting on a quarterly basis.

Item 15. Exhibits List and Reports on Form 8-K

|

16.

|

As requested in comment 52 in our letter dated December 10, 2010, please file the consent required by Item 601(b)(23) of Regulation S-K or tell us why you are not required to do so. In light of the fact that you have not yet filed an auditor's consent, tell us how this affects your use of the prospectus that is a part of each of your registration statements on Form S-8 that incorporate by reference your report on Form 10-K and the financial statements contained therein.

|

The financial statements for each audited period contain an report of the Company’s independent accountants.

United States Securities and Exchange Commission

September 9, 2011

Page 13

Signatures, page 61

|

17.

|

Since the report on Form 10-K did not contain the signatures required by General Instruction D(2) of Form 10-K, please revise to conform to the signature page in Form 10-K. As indicated in comment 53 in our letter dated December 10, 2010, the report must be signed not only by the registrant (the first signature block), but also on behalf of the registrant (in a second signature block) by the principal executive officer, principal financial officer, principal accounting officer and by at least the majority of the board of directors or persons performing similar functions.

|

We have amended our Form 10-K to provide for the appropriate signatures.

Exhibit 31.2

|

18.

|

The certifying individual identified in the introductory paragraph is not the sameindividual who signed the certification. Please revise to address this inconsistency.

|

We have amended our Form 10-K to identity the person who executing the certification.

Form 10-Q/A for Fiscal Quarter Ended September 30, 2010

Financial Statements, page 3

|

19.

|

We have reviewed your responses to the comments in our letter dated December 10, 2010 regarding the financial statements as of and for the three and nine month periods ended September 30, 2010. Please confirm to us in writing that in connection with filing future periodic reports, you will re-evaluate for compliance with GAAP your accounting and disclosures in the following areas, as it appears revisions to your accounting and disclosure may be warranted:

|

• Accounting for the acquisition of Aultra. Specifically, consider the accounting for the $1.283 million in consideration given to executives and whether these amounts represent compensation rather than purchase consideration. Refer to ASC 805-10-25-21 and paragraphs 24 through 26 of ASC 805-10-55.

• Accounting for your 9.9% interest in Shamika Gold Inc. You disclose that you account for this interest using the cost method, but it appears you are accounting for your interest as an available-for-sale investment, marked to fair value each period through other comprehensive income. Refer to ASC 325-20 and ASC 320. To the extent you conclude ASC 320 is the applicable authoritative guidance, consider whether a liquidity discount is applicable in determining the fair value of the investment.

• Accounting for and disclosures surrounding common stock warrants including both the classification and valuation of such warrants. Refer, as applicable, to ASC 470-20, ASC 815, and ASC 480.

• Computation of interest expense, which appears unusually low during the nine months ended September 30, 2010.

Additionally, please confirm you will disclose the basis in GAAP for your accounting in each of these areas in future filings.

United States Securities and Exchange Commission

September 9, 2011

Page 14

Regarding, “Accounting for the acquisition of Aultra. Specifically, consider the accounting for the $1.283 million in consideration given to executives and whether these amounts represent compensation rather than purchase consideration. Refer to ASC 805-10-25-21 and paragraphs 24 through 26 of ASC 805-10-55””:

We stated the following related to the Aultra Asset Purchase Agreement in Footnote 2 to our 2010 Form 10-K:

In connection with the Asset Purchase Agreement, the Company issued a Dutch Gold Resources, Inc. executive and an Aultra Gold executive collectively 9,505,000 Dutch Gold common shares for a total value of $1,283,175 based on the $0.135 per share market price of Dutch Gold’s common stock. The purpose for issuing these shares was to incentivize these executives that were instrumental in the transaction and to ensure that these key executives would continue to be involved with the acquired projects.

We determined that the $1.283 million was part of the purchase consideration and therefore we accounted for this amount utilizing the acquisition method of accounting.

We understand that based on our review of ASC 805 that parties directly involved in the negotiations of an impending business combination may take on the characteristics of related parties. Therefore, parties may be willing to enter into other agreements or include as part of the business combination agreement some arrangements that are designed primarily for the benefit of the acquirer or the combined entity; for example, to achieve more favorable financial reporting outcomes after the business combination. We also are aware that because of concerns that such arrangements might be accounted for as part of the business combination, we understand that we needed to ensure that each component of the transaction was accounted for in accordance with its economic substance; that is, to determine whether a particular transaction or arrangement entered into by the parties to the combination is part of what the acquirer and acquiree exchange in the business combination or is a separate transaction.

Management does not believe that the $1.283 consideration should be accounted for separately from the business combination as a compensatory arrangement. The shares were granted to one executive of the acquired business (Ron Perttu) and one executive of the acquiring company (Dan Hollis) and the shares were issued contingent upon the deal closing (i.e. if the deal did not close, the shares would not have been issued). Without the collaboration and future input of these executives, the deal would not be successful and therefore providing such shares as part of the deal was considered a necessary part of the purchase. Accordingly, management does not believe the substance of the consideration provided arrangement was to provide compensation for these executives. Therefore, we believe that we have properly accounted for the consideration in accordance with the acquisition method.

Regarding, “ Accounting for your 9.9% interest in Shamika Gold Inc. You disclose that you account for this interest using the cost method, but it appears you are accounting for your interest as an available-for-sale investment, marked to fair value each period through other comprehensive income. Refer to ASC 325-20 and ASC 320. To the extent you conclude ASC 320 is the applicable authoritative guidance, consider whether a liquidity discount is applicable in determining the fair value of the investment.”:

United States Securities and Exchange Commission

September 9, 2011

Page 15

We have incorrectly referenced accounting for the Shamika shares held using the cost method and as an available-for-sale investment in Footnote 2 in our 2010 Form 10-K through the following disclosure:

“Subsequent to the transaction date, the Company utilizes the cost method to account for its investment in Shamika Gold as Dutch Gold no longer has a controlling interest in Aultra nor does management have the ability to exercise significant influence over Shamika’s operating and financial policies. The Company has classified the fair value of its investment in Shamika as an available-for-sale security.”

Dutch Gold was issued 4,950,000 shares (9.9% ownership) of Shamika Gold Inc. The Company determined the fair value of the 4,950,000 common shares received as $1,237,500 which approximated the value of the shares on the first day that Shamika’s common shares were publicly traded. Securities to be held for indefinite periods of time, but not necessarily to be held to maturity or on a long-term basis, are classified as available for sale and carried at fair value with unrealized gains or losses reported as a separate component of shareholders' deficit in accumulated other comprehensive income in the consolidated balance sheet. Based on management’s current intent of holding the majority of the shares in Shamika 2 Gold equity security, the investment was classified as a short term investment in available for sale securities.

Thus, we believe that we have properly accounted for this investment as an available-for-sale investment and the appropriate available-for-sale disclosures were made in Footnote 3 to in our 2010 Form 10-K. In all future filings, we will remove any erroneous wording referencing the investment accounted for under the cost method. We did not apply a liquidity discount on our $1,237,500 investment because the shares acquired resulting from the transaction were freely trading shares available for sale (shortly after the acquisition date of the shares) containing no sale restrictions or vesting terms.

Regarding “Accounting for and disclosures surrounding common stock warrants including both the classification and valuation of such warrants. Refer, as applicable, to ASC 470-20, ASC 815, and ASC 480.”:

We responded on April 15, 1010 to your inquiry on our accounting for warrants issued in response to your comment #36 and #37 pertaining to your December 10, 2010 comment letter. As noted in our responses, we were previously incorrectly accounting for warrants issued. Therefore, we restated our fiscal 2009 results and filed an amended Form 10-K on May 24, 2011 which disclosed the restatement, the effect of the error, and provided additional disclosures related to the accounting for warrants in Footnote 10. We believe that the financials and disclosures as presented in our 2010 Form 10-K and in our Q1 2011 Form 10-Q are materially correct. The common stock warrants have been recorded at their relative fair values at issuance and will continue to be recorded at fair value each subsequent reporting period. Any change in value between reporting periods will be recorded as other income (expense) each reporting date. The warrants will continue to be reported as a liability until such time as they are exercised or are otherwise modified to remove the provisions that require this treatment, at which time the warrants will be adjusted to fair value and reclassified from liabilities to stockholders' deficit. The fair value of the warrants is estimated using the Black-Scholes option-pricing model. We will continue to make the appropriate disclosures related to our warrants in our quarterly filings going forward along with disclosing the change in fair value in accordance with GAAP. In addition, we restated our Q1 2010 results as presented in the Q1 2011 10-Q filed in order to correct the error in accounting for the warrants. We plan to restate the Q2 2010 results presented in the Q2 2011 Form 10-Q that we will file shortly to correct for the error also. The Q3 2010 results have been restated to correct the warrant accounting error in the Q3 2010 Form 10-Q/A that was filed on May 27, 2011.

United States Securities and Exchange Commission

September 9, 2011

Page 16

Regarding “Computation of interest expense, which appears unusually low during the nine months ended September 30, 2010”:

The Company has reported $3,378 in interest expense for the three and nine-months ended September 30, 2010. The Company realized in connection with the performance of our fiscal 2010 audit, that interest expense was understated for the first three quarters in 2010. This understatement of interest expense and the related errors were analyzed and corrected resulting from the 2010 audit. Total interest expense recorded for the 2010 fiscal year was disclosed in the 2010 Form 10-K as $338,262 (which includes the correction of the interest expense error). Of this amount, the Company determined that approximately $115,683 in interest expense should have been recorded for the nine month period ending September 30, 2010 (vs. $3,378) which resulted in an interest expense error of $112,305. Management analyzed the effect of this error in accordance with SAB 108 on our Q3 2010 three month and nine month results (as well as the impact of the error on prior 2010 quarters) and concluded that the error in interest expense that should have been recorded in Q1, Q2 and Q3 2010 was not material to restate these respective period financial statements when analyzing the error on both a qualitative and quantitative basis. For example, the Q3 2010 year to date interest expense error for Q3 2010 of $112,305 would not change the reported Q3 2010 YTD $0.01 net loss per share amount or the $0.00 net loss per share amount reported for the Q3 2010 QTD period. As the error when analyzing quantitative factors (using both the iron curtain and rollover approach) was not material to the 2010 quarter or year to date results for Q1-Q3 2010, management did not believe that restating interest expense for these periods was required due to the immateriality of the effect the correction of the errors would have on the interim financial statements.

We also concluded, that we did not need to restate our prior 2010 quarter filings to correct this error after analyzing the following quantitative factors:

|

o

|

The Company’s performance is not currently measured by its investors based on net loss or earnings. Management believes that its current investors are focused more on acquisitions and developing current properties in order to generate cash flow. The net loss per share has historically been $0.00 or $0.01 due to the large number of shares outstanding. Therefore, even if an error changed net loss by $0.01 or more (which in this case it does not), we do not believe this immaterial change in our net loss per share would be meaningful to our investors.

|

|

o

|

The Company does not have debt covenants and therefore the error if corrected would have no impact on the Company’s interim debt position.

|

|

o

|

The error if corrected would not result in a change from net loss to net income.

|

|

o

|

There are no financial measures or financing sources in place that we believe would change our financing position if a larger immaterial interim loss was reported.

|

Based on the factors above and when considering the interest expense error that related to the 2010 interim periods disclosed was corrected in our 2010 audited financial statements, and when considering the immateriality of the errors noted, we believe that our investors have an accurate picture of our financial position as of and for the year ended December 31, 2010 along with the 2010 quarter periods. We also concluded while drafting our 2010 Form 10-K that the correction of the error was not material enough to specifically disclose the correction of the error in our 2010 Form 10-K report.

United States Securities and Exchange Commission

September 9, 2011

Page 17

Regarding “ Additionally, please confirm you will disclose the basis in GAAP for your accounting in each these areas in future filings.”:

We believe that we have appropriate responded to each item for Comment #19 as noted above and will make any changes to our disclosures in future filings based on our responses above.

Form 8-K Filed February 1, 2010

20. We note your response to comment 71 in which you will revise your form 8-K to conform to our guidance. Please file the amended Form 8-K on Edgar for our review. As a related matter, we note your response to prior comment two indicating your consultant Mr. Brown had spoken to the commission regarding the reserve estimation procedures on two occasions. The Commission's two mining engineers have not discussed the reserve estimation methodology and/or procedures with Mr. Brown or company representatives to date. A review of your report furnished to the commission does not support the existence of proven and/or probable reserves.

The Company filed an amended Form 8-K on September 9, 2011 to disclose that the report was not compliant with National Instrument (NI 43-101) requirements.

Further, please note that the Company acknowledges:

|

·

|

the company is responsible for the adequacy and accuracy of the disclosures in the filing;

|

|

·

|

staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

|

|

·

|

the company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

Should you have any questions or require any further information, please do not hesitate to contact us.

|

Sincerely,

|

|||

|

DUTCH GOLD RESOURCES, INC.

|

|||

|

|

By:

|

/s/ Daniel W. Hollis

|

|

|

Name: Daniel W. Hollis

|

|||

| Title: Chief Executive Office | |||