Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-13270

|

|

FLOTEK INDUSTRIES, INC. (Exact name of registrant as specified in its charter) |

|

| | |

Delaware | | 90-0023731 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

10603 W. Sam Houston Parkway N., Suite 300 Houston, TX | | 77064 |

(Address of principal executive offices) | | (Zip Code) |

(713) 849-9911

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | | | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| | | | | | |

| | | | Emerging growth company | | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of April 30, 2018, there were 56,862,935 outstanding shares of Flotek Industries, Inc. common stock, $0.0001 par value.

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

|

| | | | | | | |

| March 31, 2018 | | December 31, 2017 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 2,865 |

| | $ | 4,584 |

|

Accounts receivable, net of allowance for doubtful accounts of $694 and $733 at March 31, 2018 and December 31, 2017, respectively | 45,331 |

| | 46,018 |

|

Inventories, net | 82,085 |

| | 75,759 |

|

Income taxes receivable | 2,809 |

| | 2,826 |

|

Other current assets | 7,972 |

| | 9,264 |

|

Total current assets | 141,062 |

| | 138,451 |

|

Property and equipment, net | 73,108 |

| | 73,833 |

|

Goodwill | 56,660 |

| | 56,660 |

|

Deferred tax assets, net | 20,373 |

| | 12,713 |

|

Other intangible assets, net | 47,619 |

| | 48,231 |

|

TOTAL ASSETS | $ | 338,822 |

| | $ | 329,888 |

|

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 23,233 |

| | $ | 22,048 |

|

Accrued liabilities | 8,629 |

| | 14,589 |

|

Interest payable | 6 |

| | 43 |

|

Long-term debt, classified as current | 39,741 |

| | 27,950 |

|

Total current liabilities and total liabilities | 71,609 |

| | 64,630 |

|

Commitments and contingencies |

| |

|

Equity: | | | |

Cumulative convertible preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding | — |

| | — |

|

Common stock, $0.0001 par value, 80,000,000 shares authorized; 61,161,291 shares issued and 56,784,694 shares outstanding at March 31, 2018; 60,622,986 shares issued and 56,755,293 shares outstanding at December 31, 2017 | 6 |

| | 6 |

|

Additional paid-in capital | 338,137 |

| | 336,067 |

|

Accumulated other comprehensive income (loss) | (1,063 | ) | | (884 | ) |

Retained earnings (accumulated deficit) | (37,158 | ) | | (37,225 | ) |

Treasury stock, at cost; 3,599,267 and 3,621,435 shares at March 31, 2018 and December 31, 2017, respectively | (33,067 | ) | | (33,064 | ) |

Flotek Industries, Inc. stockholders’ equity | 266,855 |

| | 264,900 |

|

Noncontrolling interests | 358 |

| | 358 |

|

Total equity | 267,213 |

| | 265,258 |

|

TOTAL LIABILITIES AND EQUITY | $ | 338,822 |

| | $ | 329,888 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

3

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Revenue | $ | 60,516 |

| | $ | 79,954 |

|

Costs and expenses: | | | |

Cost of revenue (excluding depreciation and amortization) | 45,701 |

| | 51,625 |

|

Corporate general and administrative | 8,493 |

| | 12,272 |

|

Segment selling and administrative | 7,124 |

| | 10,309 |

|

Depreciation and amortization | 3,002 |

| | 3,032 |

|

Research and development | 2,924 |

| | 3,141 |

|

Loss on disposal of long-lived assets | 57 |

| | 198 |

|

Total costs and expenses | 67,301 |

| | 80,577 |

|

Loss from operations | (6,785 | ) | | (623 | ) |

Other (expense) income: | | | |

Interest expense | (516 | ) | | (594 | ) |

Other (expense) income, net | (285 | ) | | 154 |

|

Total other expense | (801 | ) | | (440 | ) |

Loss before income taxes | (7,586 | ) | | (1,063 | ) |

Income tax benefit | 7,653 |

| | 320 |

|

Income (loss) from continuing operations | 67 |

| | (743 | ) |

Loss from discontinued operations, net of tax | — |

| | (11,235 | ) |

Net income (loss) | $ | 67 |

| | $ | (11,978 | ) |

| | | |

Basic earnings (loss) per common share: | | | |

Continuing operations | $ | — |

| | $ | (0.01 | ) |

Discontinued operations, net of tax | — |

| | (0.19 | ) |

Basic earnings (loss) per common share | $ | — |

| | $ | (0.20 | ) |

Diluted earnings (loss) per common share: | | | |

Continuing operations | $ | — |

| | $ | (0.01 | ) |

Discontinued operations, net of tax | — |

| | (0.19 | ) |

Diluted earnings (loss) per common share | $ | — |

| | $ | (0.20 | ) |

Weighted average common shares: | | | |

Weighted average common shares used in computing basic earnings (loss) per common share | 57,259 |

| | 57,673 |

|

Weighted average common shares used in computing diluted earnings (loss) per common share | 57,259 |

| | 57,673 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

4

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Income (loss) from continuing operations | $ | 67 |

| | $ | (743 | ) |

Loss from discontinued operations, net of tax | — |

| | (11,235 | ) |

Net income (loss) | 67 |

| | (11,978 | ) |

Other comprehensive income (loss): | | | |

Foreign currency translation adjustment | (179 | ) | | (8 | ) |

Comprehensive income (loss) | $ | (112 | ) | | $ | (11,986 | ) |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

5

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Cash flows from operating activities: | | | |

Net income (loss) | $ | 67 |

| | $ | (11,978 | ) |

Loss from discontinued operations, net of tax | — |

| | (11,235 | ) |

Income (loss) from continuing operations | 67 |

| | (743 | ) |

Adjustments to reconcile income (loss) from continuing operations to net cash used in operating activities: | | | |

Depreciation and amortization | 3,002 |

| | 3,032 |

|

Amortization of deferred financing costs | 96 |

| | 130 |

|

Provision for excess and obsolete inventory | 1,175 |

| | 89 |

|

Loss on sale of assets | 57 |

| | 198 |

|

Stock compensation expense | 1,963 |

| | 3,011 |

|

Deferred income tax benefit | (7,662 | ) | | (7,403 | ) |

Reduction in tax benefit related to share-based awards | 3 |

| | 66 |

|

Changes in current assets and liabilities: | | | |

Accounts receivable, net | 668 |

| | (15,788 | ) |

Inventories | (7,548 | ) | | (6,462 | ) |

Income taxes receivable | (1 | ) | | 332 |

|

Other current assets | 350 |

| | 13,923 |

|

Accounts payable | 1,132 |

| | 5,671 |

|

Accrued liabilities | (5,018 | ) | | 1,265 |

|

Income taxes payable | — |

| | 97 |

|

Interest payable | (37 | ) | | 25 |

|

Net cash used in operating activities | (11,753 | ) | | (2,557 | ) |

Cash flows from investing activities: | | | |

Capital expenditures | (1,787 | ) | | (1,877 | ) |

Proceeds from sale of assets | 80 |

| | 158 |

|

Purchase of patents and other intangible assets | (137 | ) | | (84 | ) |

Net cash used in investing activities | (1,844 | ) | | (1,803 | ) |

Cash flows from financing activities: | | | |

Repayments of indebtedness | — |

| | (750 | ) |

Borrowings on revolving credit facility | 76,266 |

| | 98,863 |

|

Repayments on revolving credit facility | (64,475 | ) | | (96,826 | ) |

Debt issuance costs | (8 | ) | | (106 | ) |

Purchase of treasury stock related to share-based awards | (3 | ) | | (102 | ) |

Proceeds from sale of common stock | 146 |

| | 251 |

|

Proceeds from exercise of stock options | — |

| | 7 |

|

Net cash provided by financing activities | 11,926 |

| | 1,337 |

|

Discontinued operations: | | | |

Net cash used in operating activities | — |

| | (353 | ) |

Net cash provided by investing activities | — |

| | 353 |

|

Net cash flows provided by discontinued operations | — |

| | — |

|

Effect of changes in exchange rates on cash and cash equivalents | (48 | ) | | 26 |

|

Net decrease in cash and cash equivalents | (1,719 | ) | | (2,997 | ) |

Cash and cash equivalents at the beginning of period | 4,584 |

| | 4,823 |

|

Cash and cash equivalents at the end of period | $ | 2,865 |

| | $ | 1,826 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

6

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF EQUITY

(in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings (Accumulated Deficit) | | Non-controlling Interests | | Total Equity |

| Shares Issued | | Par Value | | Shares | | Cost | |

Balance, December 31, 2017 | 60,623 |

| | $ | 6 |

| | 3,621 |

| | $ | (33,064 | ) | | $ | 336,067 |

| | $ | (884 | ) | | $ | (37,225 | ) | | $ | 358 |

| | $ | 265,258 |

|

Net income | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 67 |

| | — |

| | 67 |

|

Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | — |

| | (179 | ) | | — |

| | — |

| | (179 | ) |

Stock issued under employee stock purchase plan | — |

| | — |

| | (28 | ) | | — |

| | 146 |

| | — |

| | — |

| | — |

| | 146 |

|

Restricted stock granted | 538 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Restricted stock forfeited | — |

| | — |

| | 5 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Treasury stock purchased | — |

| | — |

| | 1 |

| | (3 | ) | | — |

| | — |

| | — |

| | — |

| | (3 | ) |

Stock compensation expense | — |

| | — |

| | — |

| | — |

| | 1,924 |

| | — |

| | — |

| | — |

| | 1,924 |

|

Balance, March 31, 2018 | 61,161 |

| | $ | 6 |

| | 3,599 |

| | $ | (33,067 | ) | | $ | 338,137 |

| | $ | (1,063 | ) | | $ | (37,158 | ) | | $ | 358 |

| | $ | 267,213 |

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

7

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Organization and Significant Accounting Policies

Organization and Nature of Operations

Flotek Industries, Inc. (“Flotek” or the “Company”) is a global, diversified, technology-driven company that develops and supplies chemistries and services to the oil and gas industries, and high value compounds to companies that make food and beverages, cleaning products, cosmetics, and other products that are sold in consumer and industrial markets.

The Company’s oilfield business includes specialty chemistries and logistics which enable its customers in pursuing improved efficiencies in the drilling and completion of their wells. The Company also provides automated bulk material handling, loading facilities, and blending capabilities. The Company processes citrus oil to produce (1) high value compounds used as additives by companies in the flavors and fragrances markets and (2) environmentally friendly chemistries for use in numerous industries around the world, including the oil and gas (“O&G”) industry.

Flotek operates in over 20 domestic and international markets. Customers include major integrated O&G companies, oilfield services companies, independent O&G companies, pressure-pumping service companies, national and state-owned oil companies, and international supply chain management companies. The Company also serves customers who purchase non-energy-related citrus oil and related products, including household and commercial cleaning product companies, fragrance and cosmetic companies, and food manufacturing companies.

Flotek was initially incorporated under the laws of the Province of British Columbia on May 17, 1985. On October 23, 2001, Flotek changed its corporate domicile to the state of Delaware.

Basis of Presentation

The accompanying Unaudited Condensed Consolidated Financial Statements and accompanying footnotes (collectively the “Financial Statements”) reflect all adjustments, in the opinion of management, necessary for fair presentation of the financial condition and results of operations for the periods presented. All such adjustments are normal and recurring in nature. The Financial Statements, including selected notes, have been prepared in accordance with applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting and do not include all information and disclosures required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) for comprehensive financial statement reporting. These interim Financial Statements should be read in conjunction with the audited consolidated financial statements and notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (“Annual Report”). A copy of the Annual Report is available on the SEC’s website, www.sec.gov, under the Company’s ticker symbol (“FTK”) or on Flotek’s website, www.flotekind.com. The results of operations for the three months ended March 31, 2018 are not necessarily indicative of the results to be expected for the year ending December 31, 2018.

During the fourth quarter of 2016, the Company classified the Drilling Technologies and Production Technologies segments as held for sale based on management’s intention to sell these businesses. The Company’s historical financial statements have been revised to present the operating results of the Drilling Technologies and Production Technologies segments as discontinued operations. The results of operations of Drilling Technologies and Production Technologies are presented as “Loss from discontinued operations” in the statement of operations and the related cash flows of these segments has been reclassified to discontinued operations for all periods presented. The assets and liabilities of the Drilling Technologies and Production Technologies segments have been reclassified to “Assets held for sale” and “Liabilities held for sale,” respectively, in the consolidated balance sheets for all periods presented.

During 2017, the Company completed the sale or disposal of the assets and transfer or liquidation of liabilities and obligations of each of the Drilling Technologies and Production Technologies segments.

Revenue Recognition

The Company recognizes revenues to depict the transfer of control of promised goods or services to its customers in an amount that reflects the consideration to which it expects to be entitled in exchange for those goods or services. Refer to Note 4 — “Revenue from Contracts with Customers” for further discussion on Revenue.

The Company recognizes revenue based on the Accounting Standards Codification (“ASC”) 606 five-step model when all of the following criteria have been met: (i) a contract with a customer exists, (ii) performance obligations have been identified, (iii) the price to the customer has been determined, (iv) the price to the customer has been allocated to the performance obligations, and (v) performance obligations are satisfied.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Products and services are sold with fixed or determinable prices. Certain sales include right of return provisions, which are considered when recognizing revenue and deferred accordingly. Deposits and other funds received in advance of delivery are deferred until the transfer of control is complete.

For certain contracts, the Company recognizes revenue under the percentage-of-completion method of accounting, measured by the percentage of “costs incurred to date” to the “total estimated costs of completion.” This percentage is applied to the “total estimated revenue at completion” to calculate proportionate revenue earned to date. For the three months ended March 31, 2018 and March 31, 2017, the percentage-of-completion revenue accounted for less than 0.1% of total revenue during the respective time periods. This resulted in immaterial unfulfilled performance obligations and immaterial contract assets and/or liabilities for which the Company did not record adjustments to opening retained earnings as of December 31, 2015 or for any periods previously presented.

As an accounting policy election, the Company excludes from the measurement of the transaction price all taxes assessed by a governmental authority that are both imposed on and concurrent with a specific revenue-producing transaction and collected by the entity from a customer.

Shipping and handling costs associated with outbound freight after control over a product has transferred to a customer are accounted for as a fulfillment cost and are included in cost of revenues.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported amounts of revenue and expenses. Actual results could differ from these estimates.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. The reclassifications did not impact net income (loss).

Note 2 — Recent Accounting Pronouncements

Application of New Accounting Standards

Effective January 1, 2018, the Company adopted the accounting guidance in Accounting Standards Update (“ASU”) No. 2014-09, “Revenue from Contracts with Customers.” This standard supersedes most of the existing revenue recognition requirements in U.S. GAAP under Accounting Standards Codification (“ASC”) 605 and establishes a new revenue standard, ASC 606. This new standard requires entities to recognize revenue at an amount that reflects the consideration to which the Company expects to be entitled in exchange for transferring goods or services to a customer. The new standard also requires significantly expanded disclosures regarding the qualitative and quantitative information of an entity’s nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The Company adopted ASC 606 using the full retrospective method. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements. Refer to Note 4 — “Revenue from Contracts with Customers” for further information surrounding adoption of this new standard.

Effective January 1, 2018, the Company adopted the accounting guidance in ASU No. 2016-15, “Classification of Certain Cash Receipts and Cash Payments.” This standard addressed eight specific cash flow issues with the objective of reducing the existing diversity in practice. Implementation of this standard did not have a material effect on the consolidated financial statements and related disclosures. The Company applied this standard prospectively, where applicable, as there were no historical transactions affected by this implementation.

Effective January 1, 2018, the Company adopted the accounting guidance in ASU No. 2017-01, “Clarifying the Definition of a Business.” This standard provided additional guidance on whether an integrated set of assets and activities constitutes a business. Implementation of this standard did not have a material effect on the consolidated financial statements and related disclosures. The Company applied this standard prospectively and, therefore, prior periods were not adjusted. In addition, the Company had no activity during the three months ended March 31, 2018 that was required to be treated differently under this ASU than previously issued guidance.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Effective January 1, 2018, the Company adopted the accounting guidance in ASU No. 2017-09, “Scope of Modification Accounting.” This standard provided guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting under Topic 718. Implementation of this standard did not have a material effect on the consolidated financial statements and related disclosures. The Company applied this standard prospectively and, therefore, prior periods presented were not adjusted. There were no changes to the terms or conditions of current share-based payment awards during the three months ended March 31, 2018.

New Accounting Requirements and Disclosures

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-02, “Leases.” This standard requires the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. The pronouncement is effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period and should be applied using a modified retrospective transition approach, with early application permitted. The Company is currently evaluating the impact the pronouncement will have on the consolidated financial statements and related disclosures.

In June 2016, the FASB issued ASU No. 2016-13, “Measurement of Credit Losses on Financial Instruments.” This standard replaces the incurred loss impairment methodology in current U.S. GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The pronouncement is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, with early adoption for the fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is currently evaluating the impact the pronouncement will have on the consolidated financial statements and related disclosures.

In February 2018, the FASB issued ASU No. 2018-02, “Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” This standard allows a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the 2017 Tax Cuts and Jobs Act. The pronouncement is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years, with early adoption permitted in any interim period. The Company is currently evaluating the impact the pronouncement will have on the consolidated financial statements and related disclosures.

Note 3 — Discontinued Operations

During the fourth quarter of 2016, the Company initiated a strategic restructuring of its business to enable a greater focus on its core businesses in energy chemistry and consumer and industrial chemistry. The Company executed a plan to sell or otherwise dispose of the Drilling Technologies and Production Technologies segments. An investment banking advisory services firm was engaged and actively marketed these segments.

Disposal of the Drilling Technologies and Production Technologies reporting segments represented a strategic shift that would have a major effect on the Company’s operations and financial results. The Company met all of the criteria to classify the Drilling Technologies and Production Technologies segments’ assets and liabilities as held for sale in the fourth quarter of 2016. Effective December 31, 2016, the Company classified the assets, liabilities, and results of operations for these two segments as “Discontinued Operations” for all periods presented.

On May 22, 2017, the Company completed the sale of substantially all of the assets and transfer of certain specified liabilities and obligations of the Company’s Drilling Technologies segment to National Oilwell Varco, L.P. (“NOV”) for $17.0 million in cash consideration, subject to normal working capital adjustments, with $1.5 million held back by NOV for up to 18 months to satisfy potential indemnification claims.

On May 23, 2017, the Company completed the sale of substantially all of the assets and transfer of certain specified liabilities and obligations of the Company’s Production Technologies segment to Raptor Lift Solutions, LLC (“Raptor Lift”) for $2.9 million in cash consideration, with $0.4 million held back by Raptor Lift to satisfy potential indemnification claims.

On August 16, 2017, the Company completed the sale of substantially all of the remaining assets of the Company’s Drilling Technologies segment to Galleon Mining Tools, Inc. for $1.0 million in cash consideration and a note receivable of $1.0 million due in one year.

The sale or disposal of the assets and transfer or liquidation of liabilities and obligations of these segments was completed in 2017. The Company has no continuing involvement with the discontinued operations.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following summarized financial information has been segregated from continuing operations and reported as Discontinued Operations for the three months ended March 31, 2017 (in thousands):

|

| | | |

Drilling Technologies | |

Revenue | $ | 6,797 |

|

Cost of revenue | (4,655 | ) |

Selling, general and administrative | (3,031 | ) |

Gain on disposal of long-lived assets | 73 |

|

Loss from operations | (816 | ) |

Other expense | (71 | ) |

Loss on write-down of assets held for sale | (6,560 | ) |

Loss before income taxes | (7,447 | ) |

Income tax benefit | 2,713 |

|

Net loss from discontinued operations | $ | (4,734 | ) |

| |

Production Technologies | |

Revenue | $ | 3,153 |

|

Cost of revenue | (2,483 | ) |

Selling, general and administrative | (873 | ) |

Research and development | (271 | ) |

Loss from operations | (474 | ) |

Other expense | (36 | ) |

Loss on write-down of assets held for sale | (9,717 | ) |

Loss before income taxes | (10,227 | ) |

Income tax benefit | 3,726 |

|

Net loss from discontinued operations | $ | (6,501 | ) |

| |

Drilling Technologies and Production Technologies | |

Loss from discontinued operations, net of tax | $ | (11,235 | ) |

At December 31, 2017, all remaining assets and liabilities of the discontinued operations were assumed by the Company’s continuing operations. These balances included $0.3 million of net accounts receivable, $1.4 million of sales price hold-back that will be received during 2018, and $1.4 million of accrued liabilities to be settled in 2018.

Note 4 — Revenue from Contracts with Customers

Effective January 1, 2018, the Company adopted ASC 606 using the full retrospective method applied to those contracts which were not completed as of December 31, 2015. As a result of electing the full retrospective adoption approach, results for reporting periods beginning after December 31, 2015 are presented under ASC 606.

There was no material impact upon the adoption of ASC 606. As revenue is primarily related to product sales accounted for at a point in time and service contracts that are primarily short-term in nature (typically less than 30 days), the Company did not record any adjustments to opening retained earnings at December 31, 2015 or for any periods previously presented.

Revenues are recognized when control of the promised goods or services is transferred to the customer, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services. In recognizing revenue for products and services, the Company determines the transaction price of purchase orders or contracts with customers, which may consist of fixed and variable consideration. Determining the transaction price may require significant judgment by management, which includes identifying performance obligations, estimating variable consideration to include in the transaction price, and determining whether promised goods or services can be distinguished in the context of the contract. Variable consideration typically consists of product returns and is estimated based on the amount of consideration the Company expects to receive. Revenue accruals are recorded on an ongoing basis to reflect updated variable consideration information.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For certain contracts, the Company recognizes revenue under the percentage-of-completion method of accounting, measured by the percentage of “costs incurred to date” to the “total estimated costs of completion.” This percentage is applied to the “total estimated revenue at completion” to calculate proportionate revenue earned to date. For the three months ended March 31, 2018 and March 31, 2017, the percentage-of-completion revenue accounted for less than 0.1% of total revenue during the respective time periods. This resulted in immaterial unfulfilled performance obligations and immaterial contract assets and/or liabilities, for which the Company did not record adjustments to opening retained earnings as of December 31, 2015 or for any periods previously presented.

The vast majority of the Company’s products are sold at a point in time and service contracts are short-term in nature. Sales are billed on a monthly basis with payment terms customarily 30 days from invoice receipt. In addition, sales taxes are excluded from revenues.

Disaggregation of Revenue

The Company has disaggregated revenues by product sales (point-in-time revenue recognition) and service revenue (over-time revenue recognition), where product sales accounted for over 95% of total revenue for the three months ended March 31, 2018 and March 31, 2017.

The Company differentiates revenue and cost of revenue (excluding depreciation and amortization) based on whether the source of revenue is attributable to products or services. Revenue and cost of revenue (excluding depreciation and amortization) disaggregated by revenue source are as follows (in thousands):

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Revenue: | | | |

Products | $ | 59,250 |

| | $ | 78,514 |

|

Services | 1,266 |

| | 1,440 |

|

| $ | 60,516 |

| | $ | 79,954 |

|

Cost of revenue (excluding depreciation and amortization): | | | |

Products | $ | 44,514 |

| | $ | 50,691 |

|

Services | 1,187 |

| | 934 |

|

| $ | 45,701 |

| | $ | 51,625 |

|

Arrangements with Multiple Performance Obligations

The Company’s contracts with customers may include multiple performance obligations. For such arrangements, the total transaction price is allocated to each performance obligation in an amount based on the estimated relative standalone selling prices of the promised goods or services underlying each performance obligation. Standalone selling prices are generally determined based on the prices charged to customers (“observable standalone price”) or an expected cost plus a margin approach. For combined products and services within a contract, the Company accounts for individual products and services separately if they are distinct (i.e. if a product or service is separately identifiable from other items in the contract and if a customer can benefit from it on its own or with other resources that are readily available to the customer). The consideration is allocated between separate products and services within a contract based on the prices at the observable standalone price. For items that are not sold separately, the expected cost plus a margin approach is used to estimate the standalone selling price of each performance obligation.

Contract Balances

Under revenue contracts for both products and services, customers are invoiced once the performance obligations have been satisfied, at which point payment is unconditional. Accordingly, no revenue contracts give rise to contract assets or liabilities under ASC 606.

Practical Expedients and Exemptions

The Company has elected to apply several practical expedients as discussed below:

| |

• | Sales commissions are expensed when incurred because the amortization period would have been one year or less. These costs are recorded within segment selling and administrative expenses. |

| |

• | The majority of the Company’s services are short-term in nature with a contract term of one year or less. For those contracts, the Company has utilized the practical expedient in ASC 606-10-50-14, exempting the Company from disclosure of the |

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

transaction price allocated to remaining performance obligations if the performance obligation is part of a contract that has an original expected duration of one year or less.

| |

• | The Company’s payment terms are short-term in nature with settlements of one year or less. The Company has utilized the practical expedient in ASC 606-10-32-18, exempting the Company from adjusting the promised amount of consideration for the effects of a significant financing component given that the period between when the Company transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or less. |

| |

• | In most service contracts, the Company has the right to consideration from a customer in an amount that corresponds directly with the value to the customer of the Company’s performance completed to date. For these contracts, the Company has utilized the practical expedient in ASC 606-10-55-18, allowing the Company to recognize revenue in the amount to which it has a right to invoice. |

Accordingly, the Company does not disclose the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less and (ii) contracts for which the Company recognizes revenue at the amount to which it has the right to invoice for services performed.

Note 5 — Supplemental Cash Flow Information

Supplemental cash flow information is as follows (in thousands):

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Supplemental non-cash investing and financing activities: | | | |

Value of common stock issued in payment of accrued liability | $ | — |

| | $ | 188 |

|

Exercise of stock options by common stock surrender | — |

| | 7 |

|

Supplemental cash payment information: | | | |

Interest paid | $ | 457 |

| | $ | 553 |

|

Income taxes paid, net of refunds (received, net of payments) | 71 |

| | (114 | ) |

Note 6 — Inventories

Inventories are as follows (in thousands):

|

| | | | | | | |

| March 31, 2018 | | December 31, 2017 |

Raw materials | $ | 44,754 |

| | $ | 42,750 |

|

Work-in-process | 3,459 |

| | 3,284 |

|

Finished goods | 35,415 |

| | 30,293 |

|

Inventories | 83,628 |

| | 76,327 |

|

Less reserve for excess and obsolete inventory | (1,543 | ) | | (568 | ) |

Inventories, net | $ | 82,085 |

| | $ | 75,759 |

|

Note 7 — Property and Equipment

Property and equipment are as follows (in thousands): |

| | | | | | | |

| March 31, 2018 | | December 31, 2017 |

Land | $ | 6,724 |

| | $ | 6,724 |

|

Buildings and leasehold improvements | 43,611 |

| | 43,899 |

|

Machinery and equipment | 41,506 |

| | 41,548 |

|

Fixed assets in progress | 5,605 |

| | 4,298 |

|

Furniture and fixtures | 1,719 |

| | 2,002 |

|

Transportation equipment | 2,364 |

| | 2,200 |

|

Computer equipment and software | 12,105 |

| | 12,181 |

|

Property and equipment | 113,634 |

| | 112,852 |

|

Less accumulated depreciation | (40,526 | ) | | (39,019 | ) |

Property and equipment, net | $ | 73,108 |

| | $ | 73,833 |

|

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Depreciation expense totaled $2.3 million and $2.3 million for the three months ended March 31, 2018 and 2017, respectively.

During the three months ended March 31, 2018 and 2017, no impairments were recognized related to property and equipment.

Note 8 — Goodwill

Changes in the carrying value of goodwill for each reporting unit are as follows (in thousands): |

| | | | | | | | | | | |

| Energy Chemistry Technologies | | Consumer and Industrial Chemistry Technologies | | Total |

Balance at December 31, 2017 | $ | 37,180 |

| | $ | 19,480 |

| | $ | 56,660 |

|

Goodwill impairment recognized | — |

| | — |

| | — |

|

Balance at March 31, 2018 | $ | 37,180 |

| | $ | 19,480 |

| | $ | 56,660 |

|

During the three months ended March 31, 2018 and 2017, no impairments of goodwill were recognized.

Note 9 — Other Intangible Assets

Other intangible assets are as follows (in thousands):

|

| | | | | | | | | | | | | | | |

| March 31, 2018 | | December 31, 2017 |

| Cost | | Accumulated Amortization | | Cost | | Accumulated Amortization |

Finite-lived intangible assets: | | | | | | | |

Patents and technology | $ | 17,457 |

| | $ | 5,850 |

| | $ | 17,310 |

| | $ | 5,586 |

|

Customer lists | 30,877 |

| | 8,509 |

| | 30,877 |

| | 8,127 |

|

Trademarks and brand names | 1,545 |

| | 1,129 |

| | 1,549 |

| | 1,117 |

|

Total finite-lived intangible assets acquired | 49,879 |

| | 15,488 |

| | 49,736 |

| | 14,830 |

|

Deferred financing costs | 1,791 |

| | 193 |

| | 1,791 |

| | 96 |

|

Total amortizable intangible assets | 51,670 |

| | $ | 15,681 |

| | 51,527 |

| | $ | 14,926 |

|

Indefinite-lived intangible assets: | | | | | | | |

Trademarks and brand names | 11,630 |

| | | | 11,630 |

| | |

Total other intangible assets | $ | 63,300 |

| | | | $ | 63,157 |

| | |

| | | | | | | |

Carrying value: | | | | | | | |

Other intangible assets, net | $ | 47,619 |

| | | | $ | 48,231 |

| | |

Finite-lived intangible assets acquired are amortized on a straight-line basis over two to 20 years. Amortization of finite-lived intangible assets acquired totaled $0.7 million and $0.7 million for the three months ended March 31, 2018 and 2017, respectively.

Amortization of deferred financing costs totaled $0.1 million and $0.1 million for the three months ended March 31, 2018 and 2017, respectively.

Note 10 — Long-Term Debt and Credit Facility

Long-term debt is as follows (in thousands):

|

| | | | | | | |

| March 31, 2018 | | December 31, 2017 |

Long-term debt, classified as current: | | | |

Borrowings under revolving credit facility | $ | 39,741 |

| | $ | 27,950 |

|

Borrowing under the revolving credit agreement is classified as current debt as a result of the required lockbox arrangement and the subjective acceleration clause.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Credit Facility

On May 10, 2013, the Company and certain of its subsidiaries (the “Borrowers”) entered into an Amended and Restated Revolving Credit, Term Loan and Security Agreement (as amended, the “Credit Facility”) with PNC Bank, National Association (“PNC Bank”). The Company may borrow under the Credit Facility for working capital, permitted acquisitions, capital expenditures and other corporate purposes. The Credit Facility continues in effect until May 10, 2022. Under terms of the Credit Facility, the Company has total borrowing availability of $75 million under a revolving credit facility. A term loan was repaid in May 2017 and may not be re-borrowed.

The Credit Facility is secured by substantially all of the Company’s domestic real and personal property, including accounts receivable, inventory, land, buildings, equipment and other intangible assets. The Credit Facility contains customary representations, warranties, and both affirmative and negative covenants. The Company was in compliance with all debt covenants at March 31, 2018. In the event of default, PNC Bank may accelerate the maturity date of any outstanding amounts borrowed under the Credit Facility.

The Credit Facility contains financial covenants to maintain a fixed charge coverage ratio and a leverage ratio, as well as establishes an annual limit on capital expenditures. The fixed charge coverage ratio is the ratio of (a) earnings before interest, taxes, depreciation, and amortization (“EBITDA”), adjusted for non-cash stock-based compensation and the loss from discontinued operations, less cash paid for taxes during the period to (b) all debt payments during the period. The fixed charge coverage ratio requirement began for the quarter ended March 31, 2017 at 1.00 to 1.00 and increased to 1.10 to 1.00 for the year ended December 31, 2017, and for each fiscal quarter thereafter. The leverage ratio (funded debt to adjusted EBITDA) requirement began for the six months ended June 30, 2017, at not greater than 5.50 to 1.00 and reduces to not greater than 3.00 to 1.00 for the year ending September 30, 2018, and thereafter. The annual limit on capital expenditures for 2018 and each fiscal year thereafter is $26 million. The annual limit on capital expenditures is reduced if the undrawn availability under the revolving credit facility falls below $15 million at any month-end.

The Credit Facility restricts the payment of cash dividends on common stock and limits the amount that may be used to repurchase common stock and preferred stock.

Beginning with fiscal year 2017, the Credit Facility includes a provision that 25% of EBITDA minus cash paid for taxes, dividends, debt payments, and unfunded capital expenditures, not to exceed $3.0 million for any fiscal year, be paid on the outstanding balance within 75 days of the fiscal year end. For the year ended December 31, 2017, there was no additional payment required based on this provision.

Each of the Company’s domestic subsidiaries is fully obligated for Credit Facility indebtedness as a borrower or as a guarantor.

(a) Revolving Credit Facility

Under the revolving credit facility, the Company may borrow up to $75 million through May 10, 2022. This includes a sublimit of $10 million that may be used for letters of credit. The revolving credit facility is secured by substantially all of the Company’s domestic accounts receivable and inventory.

At March 31, 2018, eligible accounts receivable and inventory securing the revolving credit facility provided total borrowing capacity of $74.9 million under the revolving credit facility. Available borrowing capacity, net of outstanding borrowings, was $35.2 million at March 31, 2018.

The interest rate on advances under the revolving credit facility varies based on the fixed charge coverage ratio. Rates range (a) between PNC Bank’s base lending rate plus 1.5% to 2.0% or (b) between the London Interbank Offered Rate (LIBOR) plus 2.5% to 3.0%. PNC Bank’s base lending rate was 4.75% at March 31, 2018. The Company is required to pay a monthly facility fee of 0.25% per annum, on any unused amount under the commitment based on daily averages. At March 31, 2018, $39.7 million was outstanding under the revolving credit facility, with $0.7 million borrowed as base rate loans at an interest rate of 6.25% and $39.0 million borrowed as LIBOR loans at an interest rate of 4.38%.

(b) Term Loan

The amount borrowed under the term loan was reset to $10 million effective as of September 30, 2016. Monthly principal payments of $0.2 million were required. On May 22, 2017, the Company repaid the outstanding balance of the term loan. No additional amount may be re-borrowed under the term loan.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 11 — Earnings (Loss) Per Share

Basic earnings (loss) per common share is calculated by dividing net income (loss) by the weighted average number of common shares outstanding for the period. Diluted earnings (loss) per common share is calculated by dividing net income (loss) by the weighted average number of common shares outstanding combined with dilutive common share equivalents outstanding, if the effect is dilutive.

Potentially dilutive securities were excluded from the calculation of diluted loss per share for the three months ended March 31, 2017, since including them would have an anti-dilutive effect on loss per share due to the net loss incurred during the period. Securities convertible into shares of common stock that were not considered in the diluted loss per share calculation were 0.7 million stock options and 1.2 million restricted stock units for the three months ended March 31, 2017.

Basic and diluted earnings (loss) per common share are as follows (in thousands, except per share data):

|

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Income (loss) from continuing operations | $ | 67 |

| | $ | (743 | ) |

Loss from discontinued operations, net of tax | — |

| | (11,235 | ) |

Net income (loss) - Basic and Diluted | $ | 67 |

| | $ | (11,978 | ) |

| | | |

Weighted average common shares outstanding - Basic | 57,259 |

| | 57,673 |

|

Assumed conversions: | | | |

Incremental common shares from stock options | — |

| | — |

|

Incremental common shares from restricted stock units | — |

| | — |

|

Weighted average common shares outstanding - Diluted | 57,259 |

| | 57,673 |

|

| | | |

Basic earnings (loss) per common share: | | | |

Continuing operations | $ | — |

| | $ | (0.01 | ) |

Discontinued operations, net of tax | — |

| | (0.19 | ) |

Basic earnings (loss) per common share | $ | — |

| | $ | (0.20 | ) |

Diluted earnings (loss) per common share: | | | |

Continuing operations | $ | — |

| | $ | (0.01 | ) |

Discontinued operations, net of tax | — |

| | (0.19 | ) |

Diluted earnings (loss) per common share | $ | — |

| | $ | (0.20 | ) |

Note 12 — Fair Value Measurements

Fair value is defined as the amount that would be received for selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Company categorizes financial assets and liabilities into the three levels of the fair value hierarchy. The hierarchy prioritizes the inputs to valuation techniques used to measure fair value and bases categorization within the hierarchy on the lowest level of input that is available and significant to the fair value measurement.

| |

• | Level 1 — Quoted prices in active markets for identical assets or liabilities; |

| |

• | Level 2 — Observable inputs other than Level 1, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and |

| |

• | Level 3 — Significant unobservable inputs that are supported by little or no market activity or that are based on the reporting entity’s assumptions about the inputs. |

Fair Value of Other Financial Instruments

The carrying amounts of certain financial instruments, including cash and cash equivalents, accounts receivable, accounts payable, and accrued expenses, approximate fair value due to the short-term nature of these accounts. The Company had no cash equivalents at March 31, 2018 or December 31, 2017.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The carrying amount and estimated fair value of the Company’s long-term debt are as follows (in thousands):

|

| | | | | | | | | | | |

| March 31, 2018 | | December 31, 2017 |

| Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

Borrowings under revolving credit facility | 39,741 |

| | 39,741 |

| | 27,950 |

| | 27,950 |

|

The carrying amount of borrowings under the revolving credit facility approximates its fair value because the interest rates are variable.

Assets Measured at Fair Value on a Nonrecurring Basis

The Company’s non-financial assets, including property and equipment, goodwill, and other intangible assets are measured at fair value on a non-recurring basis and are subject to fair value adjustment in certain circumstances. No impairments of any of these assets were recognized during the three months ended March 31, 2018 and 2017.

Note 13 — Income Taxes

A reconciliation of the U.S. federal statutory tax rate to the Company’s effective income tax rate is as follows:

|

| | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

U.S. federal statutory tax rate | (21.0 | )% | | (35.0 | )% |

State income taxes, net of federal benefit | (37.0 | ) | | (2.2 | ) |

Non-U.S. income taxed at different rates | 102.0 |

| | 0.5 |

|

Reduction in tax benefit related to stock-based awards | (217.7 | ) | | 6.2 |

|

Non-deductible expenses | (44.2 | ) | | (0.7 | ) |

Research and development credit | 132.1 |

| | 1.1 |

|

Other | (15.1 | ) | | — |

|

Effective income tax rate | (100.9 | )% | | (30.1 | )% |

Fluctuations in effective tax rates have historically been impacted by permanent tax differences with no associated income tax impact, changes in state apportionment factors, including the effect on state deferred tax assets and liabilities, and non-U.S. income taxed at different rates.

Comprehensive tax reform legislation enacted in December 2017, commonly referred to as the Tax Cuts and Jobs Acts (“2017 Tax Act”), made significant changes to U.S. federal income tax laws. The 2017 Tax Act, among other things, reduced the corporate income tax rate from 35% to 21%, partially limited the deductibility of business interest expense and net operating losses, provided additional limitations on the deductibility of executive compensation, imposed a one-time tax on unrepatriated earnings from certain foreign subsidiaries, taxed offshore earnings at reduced rates regardless of whether they are repatriated, and allowed the immediate deduction of certain new investments instead of deductions for depreciation expense over time. The Company has not completed its determination of the impacts of the 2017 Tax Act and recorded provisional amounts in its financial statements as of December 31, 2017. The Company has continued to evaluate the 2017 Tax Act and will adjust the provisional amounts as additional information is obtained. The ultimate impact of the 2017 Tax Act may differ from the provisional amounts recorded due to additional information becoming available, changes in interpretation of the 2017 Tax Act, and additional regulatory guidance that may be issued. No adjustments to the provisional amounts were recorded during the three months ended March 31, 2018.

In January 2017, the Internal Revenue Service notified the Company that it will examine the Company’s federal tax returns for the year ended December 31, 2014. No adjustments have been asserted, and management believes that sustained adjustments, if any, would not have a material effect on the Company’s financial position, results of operations, or liquidity.

Note 14 — Common Stock

The Company’s Certificate of Incorporation, as amended November 9, 2009, authorizes the Company to issue up to 80 million shares of common stock, par value $0.0001 per share, and 100,000 shares of one or more series of preferred stock, par value $0.0001 per share.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

A reconciliation of changes in common shares issued during the three months ended March 31, 2018 is as follows:

|

| | |

Shares issued at December 31, 2017 | 60,622,986 |

|

Issued as restricted stock award grants | 538,305 |

|

Shares issued at March 31, 2018 | 61,161,291 |

|

Stock Repurchase Program

In November 2012, the Company’s Board of Directors authorized the repurchase of up to $25 million of the Company’s common stock. Repurchases may be made in the open market or through privately negotiated transactions. Through March 31, 2018, the Company has repurchased all $25.0 million of its common stock under this authorization.

In June 2015, the Company’s Board of Directors authorized the repurchase of up to an additional $50 million of the Company’s common stock. Repurchases may be made in the open market or through privately negotiated transactions. Through March 31, 2018, the Company has repurchased $0.3 million of its common stock under this authorization.

During the three months ended March 31, 2018 and 2017, the Company did not repurchase any shares of its outstanding common stock.

At March 31, 2018, the Company has $49.7 million remaining under its share repurchase programs. A covenant under the Company’s Credit Facility limits the amount that may be used to repurchase the Company’s common stock. At March 31, 2018, this covenant limits additional share repurchases to $9.7 million.

Note 15 — Business Segment, Geographic and Major Customer Information

Segment Information

Operating segments are defined as components of an enterprise for which separate financial information is available that is regularly evaluated by chief operating decision-makers in deciding how to allocate resources and assess performance. The operations of the Company are categorized into two reportable segments: Energy Chemistry Technologies and Consumer and Industrial Chemistry Technologies.

| |

• | Energy Chemistry Technologies designs, develops, manufactures, packages, and markets specialty chemistries used in oil and natural gas well drilling, cementing, completion, and stimulation. In addition, the Company’s chemistries are used in specialized enhanced and improved oil recovery markets. Activities in this segment also include construction and management of automated material handling facilities and management of loading facilities and blending operations for oilfield services companies. |

| |

• | Consumer and Industrial Chemistry Technologies designs, develops, and manufactures products that are sold to companies in the flavor and fragrance industry and the specialty chemical industry. These technologies are used by beverage and food companies, fragrance companies, and companies providing household and industrial cleaning products. |

The Company evaluates performance based upon a variety of criteria. The primary financial measure is segment operating income. Various functions, including certain sales and marketing activities and general and administrative activities, are provided centrally by the corporate office. Costs associated with corporate office functions, other corporate income and expense items, and income taxes are not allocated to reportable segments.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Summarized financial information of the reportable segments is as follows (in thousands):

|

| | | | | | | | | | | | | | | |

For the three months ended March 31, | Energy Chemistry Technologies | | Consumer and Industrial Chemistry Technologies | | Corporate and Other | | Total |

2018 | | | | | | | |

Net revenue from external customers | $ | 41,069 |

| | $ | 19,447 |

| | $ | — |

| | $ | 60,516 |

|

Income (loss) from operations | (166 | ) | | 2,438 |

| | (9,057 | ) | | (6,785 | ) |

Depreciation and amortization | 1,769 |

| | 669 |

| | 564 |

| | 3,002 |

|

Capital expenditures | 1,011 |

| | 410 |

| | 366 |

| | 1,787 |

|

| | | | | | | |

2017 | | | | | | | |

Net revenue from external customers | $ | 60,765 |

| | $ | 19,189 |

| | $ | — |

| | $ | 79,954 |

|

Income (loss) from operations | 8,548 |

| | 3,705 |

| | (12,876 | ) | | (623 | ) |

Depreciation and amortization | 1,849 |

| | 579 |

| | 604 |

| | 3,032 |

|

Capital expenditures | 514 |

| | 500 |

| | 863 |

| | 1,877 |

|

Assets of the Company by reportable segments are as follows (in thousands):

|

| | | | | | | |

| March 31, 2018 | | December 31, 2017 |

Energy Chemistry Technologies | $ | 169,170 |

| | $ | 177,797 |

|

Consumer and Industrial Chemistry Technologies | 130,702 |

| | 116,600 |

|

Corporate and Other | 38,950 |

| | 35,491 |

|

Total assets | $ | 338,822 |

| | $ | 329,888 |

|

Geographic Information

Revenue by country is based on the location where services are provided and products are used. No individual country other than the United States (“U.S.”) accounted for more than 10% of revenue. Revenue by geographic location is as follows (in thousands): |

| | | | | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

U.S. | $ | 46,044 |

| | $ | 64,649 |

|

Other countries | 14,472 |

| | 15,305 |

|

Total | $ | 60,516 |

| | $ | 79,954 |

|

Long-lived assets held in countries other than the U.S. are not considered material to the consolidated financial statements.

Major Customers

Revenue from major customers, as a percentage of consolidated revenue, is as follows:

|

| | | | |

| Three months ended March 31, |

| 2018 | | 2017 |

Customer A | * | | 12.1 | % |

* This customer did not account for more than 10% of revenue.

Over 95% of the revenue from this customer was for sales in the Energy Chemistry Technologies segment in 2017.

FLOTEK INDUSTRIES, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 16 — Commitments and Contingencies

Class Action Litigation

On March 30, 2017, the U.S. District Court for the Southern District of Texas granted the Company’s motion to dismiss the four consolidated putative securities class action lawsuits that were filed in November 2015, against the Company and certain of its officers. The lawsuits were previously consolidated into a single case, and a consolidated amended complaint had been filed. The consolidated amended complaint asserted that the Company made false and/or misleading statements, as well as failed to disclose material adverse facts about the Company’s business, operations, and prospects. The complaint sought an award of damages in an unspecified amount on behalf of a putative class consisting of persons who purchased the Company’s common stock between October 23, 2014 and November 9, 2015, inclusive. The lead plaintiff has appealed the District Court’s decision granting the motion to dismiss.

In January 2016, three derivative lawsuits were filed, two in the District Court of Harris County, Texas (which have since been consolidated into one case) and one in the United States District Court for the Southern District of Texas, on behalf of the Company against certain of its officers and its current directors. The lawsuits allege violations of law, breaches of fiduciary duty, and unjust enrichment against the defendants.

The Company believes the lawsuits are without merit and intends to vigorously defend against all claims asserted. Discovery has not yet commenced. At this time, the Company is unable to reasonably estimate the outcome of this litigation.

In addition, as previously disclosed, the U.S. Securities and Exchange Commission had opened an inquiry related to similar issues to those raised in the above-described litigation. On August 21, 2017, the Company received a letter from the staff of the SEC stating that the inquiry has been concluded and that the staff does not intend to recommend an enforcement action against the Company.

Other Litigation

The Company is subject to routine litigation and other claims that arise in the normal course of business. Management is not aware of any pending or threatened lawsuits or proceedings that are expected to have a material effect on the Company’s financial position, results of operations or liquidity.

Concentrations and Credit Risk

The majority of the Company’s revenue is derived from the oil and gas industry. Customers include major oilfield services companies, major integrated oil and natural gas companies, independent oil and natural gas companies, pressure pumping service companies, and state-owned national oil companies. This concentration of customers in one industry increases credit and business risks.

The Company is subject to concentrations of credit risk within trade accounts receivable, as the Company does not generally require collateral as support for trade receivables. In addition, the majority of the Company’s cash is maintained at a major financial institution and balances often exceed insurable amounts.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This Quarterly Report on Form 10-Q (“Quarterly Report”), and in particular, Part I, Item 2 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains “forward-looking statements” within the meaning of the safe harbor provisions, 15 U.S.C. § 78u-5, of the Private Securities Litigation Reform Act of 1995 (“Reform Act”). Forward-looking statements are not historical facts, but instead represent Flotek Industries, Inc.’s (“Flotek” or “Company”) current assumptions and beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside the Company’s control. Such statements include estimates, projections, and statements related to the Company’s business plan, objectives, expected operating results, and assumptions upon which those statements are based. The forward-looking statements contained in this Quarterly Report are based on information available as of the date of this Quarterly Report.

The forward-looking statements relate to future industry trends and economic conditions, forecast performance or results of current and future initiatives and the outcome of contingencies and other uncertainties that may have a significant impact on the Company’s business, future operating results and liquidity. These forward-looking statements generally are identified by words including, but not limited to, “anticipate,” “believe,” “estimate,” “continue,” “intend,” “expect,” “plan,” “forecast,” “project,” and similar expressions, or future-tense or conditional constructions such as “will,” “may,” “should,” “could,” etc. The Company cautions that these statements are merely predictions and are not to be considered guarantees of future performance. Forward-looking statements are based upon current expectations and assumptions that are subject to risks and uncertainties that can cause actual results to differ materially from those projected, anticipated, or implied.

A detailed discussion of potential risks and uncertainties that could cause actual results and events to differ materially from forward-looking statements is included in Part I, Item 1A — “Risk Factors” of the Annual Report on Form 10-K for the year ended December 31, 2017 (“Annual Report”) and periodically in subsequent reports filed with the Securities and Exchange Commission (“SEC”). The Company has no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events, except as required by law.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with the unaudited condensed consolidated financial statements and the related notes thereto of this Quarterly Report, as well as the Annual Report. Phrases such as “Company,” “we,” “our,” and “us” refer to Flotek Industries, Inc. and its subsidiaries.

Basis of Presentation

During the fourth quarter of 2016, the Company classified the Drilling Technologies and Production Technologies segments as held for sale based on management’s intention to sell these businesses. The Company’s historical financial statements have been revised to present the operating results of the Drilling Technologies and Production Technologies segments as discontinued operations. The results of operations of Drilling Technologies and Production Technologies are presented as “Loss from discontinued operations” in the statement of operations and the related cash flows of these segments has been reclassified to discontinued operations for all periods presented. The assets and liabilities of the Drilling Technologies and Production Technologies segments have been reclassified to “Assets held for sale” and “Liabilities held for sale,” respectively, in the consolidated balance sheets for all periods presented. During 2017, the Company completed the sale or disposal of the assets and transfer or liquidation of liabilities and obligations of these segments.

Executive Summary

Flotek is a global, diversified, technology-driven company that develops and supplies chemistries and services to the oil and gas industries, and high value compounds to companies that make food and beverages, cleaning products, cosmetics, and other products that are sold in consumer and industrial markets. Flotek operates in over 20 domestic and international markets.

The Company’s oilfield business includes specialty chemistries and logistics. Flotek’s technologies enable its customers to pursue improved efficiencies in the drilling and completion of their wells. Customers include major integrated oil and gas (“O&G”) companies, oilfield services companies, independent O&G companies, pressure-pumping service companies, national and state-owned oil companies, and international supply chain management companies. The Company also produces non-energy-related citrus oil and related products including (1) high value compounds used as additives by companies in the flavors and fragrances markets and (2) environmentally friendly chemistries for use in numerous industries around the world, including the O&G industry. The Company sources citrus oil domestically and internationally and is one of the largest processors of citrus oil in the world. Additionally, the Company also provides automated bulk material handling, loading facilities, and blending capabilities.

Continuing Operations

The operations of the Company are categorized into two reportable segments: Energy Chemistry Technologies (“ECT”) and Consumer and Industrial Chemistry Technologies (“CICT”).

| |

• | Energy Chemistry Technologies designs, develops, manufactures, packages, and markets specialty chemistries used in O&G well drilling, cementing, completion, and stimulation. These technologies developed by Flotek’s Research and Innovation team enable customers to pursue improved efficiencies in the drilling and completion of wells. |

| |

• | Consumer and Industrial Chemistry Technologies designs, develops, and manufactures products that are sold to companies in the flavor and fragrance industries and specialty chemical industry. These technologies are used by beverage and food companies, fragrance companies, and companies providing household and industrial cleaning products. |

Discontinued Operations

The Drilling Technologies and Production Technologies segments are classified as discontinued operations.

| |

• | Drilling Technologies assembles, rents, sells, inspects, and markets downhole drilling equipment used in energy, mining, and industrial drilling activities. |

| |

• | Production Technologies assembles and markets production-related equipment, including pumping system components, electric submersible pumps (“ESP”), gas separators, valves, and services that support natural gas and oil production activities. |

Market Conditions

The Company’s success is sensitive to a number of factors, which include, but are not limited to, drilling and well completion activity, customer demand for its advanced technology products, market prices for raw materials, and governmental actions.

Drilling and well completion activity levels are influenced by a number of factors, including the number of rigs in operation and the geographical areas of rig activity. Additional factors that influence the level of drilling and well completion activity include:

| |

• | Historical, current, and anticipated future O&G prices, |

| |

• | Federal, state, and local governmental actions that may encourage or discourage drilling activity, |

| |

• | Customers’ strategies relative to capital funds allocations, |

| |

• | Technological changes to drilling and completion methods and economics. |

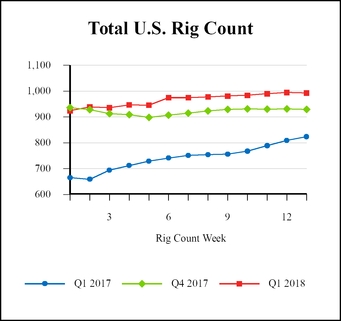

Historical North American drilling activity is reflected in “TABLE A” on the following page.

Customers’ demand for advanced technology products and services provided by the Company are dependent on their recognition of the value of:

| |

• | Chemistries that improve the economics of their O&G operations, |

| |

• | Chemistries that meet the need of consumer product markets, and |

| |

• | Chemistries that are economically viable, socially responsible, and ecologically sound. |

Market prices for commodities, including citrus oils and guar, can be influenced by:

| |

• | Historical, current, and anticipated future production levels of the global citrus (primarily orange) and guar crops, |

| |

• | Health and condition of citrus trees and guar plants (e.g., disease and pests), and |

| |

• | International competition and pricing pressures resulting from natural and artificial pricing influences. |

Governmental actions may restrict the future use of hazardous chemicals, including, but not limited to, the following industrial applications:

| |

• | O&G drilling and completion operations, |

| |

• | O&G production operations, and |

| |

• | Non-O&G industrial solvents. |

|

| | | | | | | | |

TABLE A | Three months ended March 31, |

| 2018 | | 2017 | | % Change |

|

Average North American Active Drilling Rigs | | | | | |

U.S. | 966 |

| | 742 |

| | 30.2 | % |

Canada | 269 |

| | 295 |

| | (8.8 | )% |

Total | 1,235 |

| | 1,037 |

| | 19.1 | % |

Average U.S. Active Drilling Rigs by Type | | | | | |

Vertical | 63 |

| | 69 |

| | (8.7 | )% |

Horizontal | 833 |

| | 610 |

| | 36.6 | % |

Directional | 70 |

| | 63 |

| | 11.1 | % |

Total | 966 |

| | 742 |

| | 30.2 | % |

Average North American Drilling Rigs by Product | | | | | |

Oil | 959 |

| | 754 |

| | 27.2 | % |

Natural Gas | 276 |

| | 283 |

| | (2.5 | )% |

Total | 1,235 |

| | 1,037 |

| | 19.1 | % |

Source: Rig counts are per Baker Hughes, Inc. (www.bakerhughes.com). Rig counts are the averages of the weekly rig count activity.

Completions are per the U.S. Energy Information Administration (https://www.eia.gov/petroleum/drilling/) as of April 16, 2018.

Average U.S. rig activity increased by 30.2% for the three months ended March 31, 2018, when compared to the same period of 2017, and sequentially, increased by 4.9% when compared to the fourth quarter of 2017.

According to data collected by the U.S. Energy Information Administration (“EIA”) as reported on April 16, 2018, completions in the seven most prolific areas in the lower 48 states increased 47.8% for the three months ended March 31, 2018, when compared to the same period of 2017. Sequentially, completions increased 9.0% when compared to the fourth quarter of 2017.

Company Outlook

After a continuous decline in U.S. drilling rig activity beginning in mid-2014, the market began to gradually recover in the second quarter of 2016. Although the oil and gas markets have improved, the level of drilling and completion activity remains lower than previous levels experienced before the downturn in 2014. Assuming the price for crude oil remains relatively stable and regulatory impediments are limited, the Company expects U.S. oilfield activity to remain stable.

During the first quarter of 2018, the Company continued to promote the efficacy of its Complex nano-Fluid® (“CnF®”) chemistries and its Prescriptive Chemistry Management® (“PCM®”) platform. Although quarter to quarter performance may vary, the Company

expects to continue to penetrate the market over time by demonstrating the efficacy of its CnF® chemistries and full fluid chemistry treatment via PCM® through comparative analysis of wells with and without Flotek chemistries and field validation results conducted by exploration and production (“E&P”) companies. Flotek is experiencing a notable shift in purchasing behaviors in which E&P companies are focusing more on sourcing consumables, including chemistry, directly from manufacturers and providers of these products. This trend has created significant changes in Flotek’s customer base, product portfolio, and sales efforts and continues to influence changes in capital allocation and the business model.