UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | |

¨ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |

x | Definitive Proxy Statement | |

¨ | Definitive Additional Materials | |

¨ | Soliciting Material Pursuant to Section 240.14a-12 | |

FLOTEK INDUSTRIES, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

FLOTEK INDUSTRIES, INC.

10603 W. Sam Houston Parkway N., Suite 300

Houston, Texas 77064

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 22, 2016

To the Stockholders of Flotek Industries, Inc.:

At the direction of the Board of Directors of Flotek Industries, Inc. (“Flotek” or the “Company”), a Delaware corporation, NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of the Company will be held at the Flotek Corporate Office, 10603 W. Sam Houston Parkway N., Suite 300, Houston, Texas 77064, on Friday, April 22, 2016, at 2:00 p.m. (local time), for the purpose of considering and voting upon the following matters:

1. | The election of seven directors to serve until the next annual meeting of stockholders of the Company or until their successors are duly elected and qualified, or until their earlier resignation or removal. |

2. | The approval of the Amended and Restated Flotek Industries, Inc. 2014 Long-Term Incentive Plan. |

3. | The approval of a non-binding advisory vote on executive compensation. |

4. | The ratification of the selection of the independent registered public accounting firm for the year ending December 31, 2016. |

5. | Any other business which may be properly brought before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on March 3, 2016 are entitled to vote at the meeting.

By order of the Board of Directors

Casey Doherty

Corporate Secretary

March 23, 2016

YOUR VOTE IS IMPORTANT

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY AS PROMPTLY AS POSSIBLE. AN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES, IS ENCLOSED FOR THIS PURPOSE.

TABLE OF CONTENTS

i

FLOTEK INDUSTRIES, INC.

10603 W. Sam Houston Parkway N., Suite 300

Houston, Texas 77064

PROXY STATEMENT

This Proxy Statement and the accompanying form of proxy are being sent to the stockholders of Flotek Industries, Inc. (“Flotek” or the “Company”), a Delaware corporation, in connection with the solicitation by the Board of Directors of the Company (the “Board”) of proxies to be voted at the Annual Meeting of Stockholders of the Company (the “Meeting”) to be held at 2:00 p.m. (local time) on Friday, April 22, 2016, at the corporate offices of the Company at 10603 W. Sam Houston Parkway N., Suite 300, Houston, Texas 77064 and at any adjournment thereof.

The Notice of Meeting, this Proxy Statement, and the accompanying form of proxy are first being mailed to the stockholders on or about March 23, 2016. The 2015 Annual Report of the Company has been furnished to the stockholders with this Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on April 22, 2016. The proxy statement and annual report to security holders are available at www.flotekind.com/proxymaterials.

You may obtain directions to attend the Meeting and vote in person by contacting our investor relations department at (713) 849-9911.

At the Meeting, stockholders will be asked (i) to consider and vote upon the election of seven nominees to serve on the Board; (ii) to consider and vote upon the Amended and Restated Flotek Industries, Inc. 2014 Long-Term Incentive Plan; (iii) to consider and provide an advisory vote upon our executive compensation; (iv) to consider and vote upon the ratification of the selection of the independent registered public accounting firm; and (v) to consider and take action upon such other matters as may properly come before the Meeting.

VOTING SECURITIES

The Board has fixed the close of business on March 3, 2016, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Meeting. At the close of business on such date, there were outstanding and entitled to vote 54,847,737 shares of common stock, $0.0001 par value per share (“Common Stock”) of the Company, which

is the Company’s only authorized and outstanding class of stock entitled to vote at the Meeting.

Holders of at least one-third of the outstanding shares of Common Stock are required to be represented at the Meeting, in person or by proxy, to constitute a quorum. Abstentions and broker non-votes represented by submitted proxies will be included in the calculation of the number of the shares present at the Meeting for the purposes of determining a quorum. “Broker non-votes” means shares held of record by a broker that are not voted on a matter because the broker has not received voting instructions from the beneficial owner of the shares and either lacks or declines to exercise the authority to vote the shares in its discretion.

Each outstanding share of Common Stock as of the record date is entitled to one vote. There will be no cumulative voting of shares for any matter voted upon at the Meeting.

Proposal 1: Election of Directors

Directors are elected by a majority of the votes cast at the Meeting. A director will be elected if the number of shares voted “FOR” the director’s election exceeds the number of votes “AGAINST” that director’s election, excluding abstentions. If an incumbent director who is nominated for re-election does not receive sufficient “FOR” votes to be elected, the director is required to promptly tender his or her resignation to the Board following certification of the vote. The Corporate Governance and Nominating Committee shall then make a recommendation to the Board on whether to accept or reject the resignation. The Board will act on the tendered resignation, taking into account the recommendation of the Corporate Governance and Nominating Committee, and publicly disclose its decision on whether to accept or reject the resignation. Under New York Stock Exchange (“NYSE”) rules, your brokerage firm or other nominee may not vote your shares with respect to Proposal 1 without specific instructions from you as to how to vote with respect to the election of each of the seven nominees for director, because the election of directors is considered a “non-routine” matter under the NYSE rules. Abstentions and broker non-votes represented by submitted proxies will not be taken into account in determining the outcome of the election of directors.

1

Proposal 2: Approval of the Amended and Restated Flotek Industries, Inc. 2014 Long-Term Incentive Plan

To be approved, this proposal regarding the amendment and restatement of the Company’s 2014 Long-Term Incentive Plan must receive an affirmative vote of a majority of the total votes cast with respect to this proposal at the Meeting. This means that the votes that our stockholders cast “FOR” this proposal must exceed the votes that our stockholders cast “AGAINST” this proposal at the Meeting. Proposal 2 is considered a “non-routine” matter under the NYSE rules and, therefore, brokerage firms and nominees that are members of the NYSE do not have the authority under those rules to vote their customers’ unvoted shares on Proposal 2 if their customers have not furnished voting instructions within a specified period of time prior to the Meeting. Accordingly, broker non-votes represented by submitted proxies will not be taken into account in determining the outcome of this proposal; abstentions will be counted as a vote against this proposal.

Proposal 3: Advisory Vote to Approve Executive Compensation

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required for the advisory approval of the Company’s executive compensation. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will not be counted and will have the same effect as a vote against the proposal. Broker non-votes will have no effect for the purpose of determining whether the proposal has been approved. This proposal is advisory in nature, which means that it is not binding on the Board or the Compensation Committee. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm

To be approved, the proposal regarding ratification of the selection of our independent registered public accounting firm must receive an affirmative vote of a majority of the

total votes cast with respect to this proposal at the Meeting. This means that the votes that our stockholders cast “FOR” this proposal must exceed the votes that our stockholders cast “AGAINST” this proposal at the Meeting. However, your vote will not be binding on the Board or the Company. Proposal 4 is considered a “routine” matter under the NYSE rules and, therefore, brokerage firms and nominees that are members of the NYSE have the authority under those rules to vote their customers’ unvoted shares on Proposal 4 if their customers have not furnished voting instructions within a specified period of time prior to the Meeting. Accordingly, broker non-votes represented by submitted proxies will be taken into account in determining the outcome of this proposal; abstentions will be counted as a vote against this proposal.

If the enclosed form of proxy is properly executed and returned to the Company prior to or at the Meeting and is not revoked prior to its exercise, all shares of Common Stock represented thereby will be voted at the Meeting and, where instructions have been given by a stockholder, will be voted in accordance with such instructions.

Any stockholder executing a proxy which is solicited hereby has the power to revoke it prior to its exercise. Revocation may be made by attending the Meeting and voting the shares of Common Stock in person or by delivering to the Secretary of the Company at the principal executive offices of the Company located at 10603 W. Sam Houston Parkway N., Suite 300, Houston, Texas 77064, prior to exercise of the proxy, a written notice of revocation or a later-dated, properly executed proxy.

The solicitation of proxies will be by mail, but proxies also may be solicited by telephone, telegram, or in person by directors, officers, and other employees of the Company. The Company will bear all costs of soliciting proxies. In order to solicit proxies, the Company will also request financial institutions, brokerage houses, custodians, nominees, and fiduciaries to forward proxy materials to the beneficial owners of shares of Common Stock as of the record date and will reimburse such persons for their reasonable expenses of forwarding the proxy materials in accordance with customary practice.

2

PROPOSAL 1: ELECTION OF DIRECTORS

Board of Directors

The members of the Board serve one-year terms. Directors are elected by a majority of the votes cast. A director will be elected if the number of shares voted “FOR” the director’s election exceeds the number of votes “AGAINST” that director’s election, excluding abstentions. If an incumbent director who is nominated for re-election does not receive sufficient “FOR” votes to be elected, the director is required to promptly tender his or her resignation to the Board following certification of the vote. The Corporate Governance and Nominating Committee shall then make a recommendation to the Board on whether to accept or reject the resignation. The Board will act on the tendered resignation, taking into account the recommendation of the Corporate Governance and Nominating Committee, and publicly disclose its decision on whether to accept or reject the resignation. Abstentions and broker non-votes will be disregarded and have no effect on the outcome of the election of directors.

Recommendation; Proxies

The Board recommends a vote “FOR” each of the nominees named below. The persons named in the enclosed proxy card will vote all shares over which they have discretionary authority “FOR” the election of the nominees named below. Although our Board does not anticipate that any of the nominees will be unable to serve, if such a situation should arise prior to the Meeting, the appointed persons will use their discretionary authority pursuant to the proxy and vote in accordance with their best judgment.

Number of Directors

The Board has nominated seven directors for election to the Board at the Meeting.

The Board believes that it is necessary for each of the Company’s directors to possess many qualities and skills that enable him or her to understand the complexities of the Company’s business and effectively guide the management and direction of the Company. When searching for new candidates, the Corporate Governance and Nominating Committee considers the evolving needs of the Board and searches for candidates that fill current or anticipated future vacancies.

The Board also believes that all directors must possess a considerable amount of business management and educational experience. The Corporate Governance and Nominating Committee first considers a candidate’s management experience and then considers issues of judgment, background, stature, conflicts of interest, integrity, ethics, and commitment to the goal of maximizing stockholder value when considering director candidates. The Corporate Governance and Nominating Committee also focuses on issues of diversity, such as diversity of gender,

race, and national origin, education, professional experience, and differences in viewpoints and skills. The Corporate Governance and Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Corporate Governance and Nominating Committee believe that it is essential that the Board members represent diverse viewpoints. In considering candidates for the Board, the Corporate Governance and Nominating Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election, the individual’s contributions to the Board are also considered.

All of our directors bring to our Board a wealth of executive leadership experience derived from their service as corporate executives. They also bring extensive board of director experience. Certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole are described in the following paragraphs.

Nominees

The following sets forth information regarding each nominee. Each nominee has consented to be named in this proxy statement and to serve as a director, if elected.

Name: Ted D. Brown

Age: 60

Director Since: 2013

Principal Occupation: Mr. Brown joined the Board as a Director in November 2013, became a member of the Corporate Governance and Nominating Committee in January 2014 and became a member of the Compensation Committee in May 2014. Mr. Brown was Senior Vice President and Advisor to the CEO and President of Noble Energy, Inc. (NYSE: NBL) until his retirement on January 31, 2015. Mr. Brown joined Noble Energy in 2005 in Noble Energy’s merger with Patina Oil and Gas. A lifelong oilman, he joined Amoco Production Company upon completion of his degree in mechanical engineering from the University of Wyoming. He has also worked in various capacities for Union Pacific Resources, Barrett Resources, and Williams Companies. Under Mr. Brown’s leadership, Noble Energy nearly tripled its production in Northern Colorado in nine years while drilling more than 3,300 new wells. During Mr. Brown’s tenure, Noble Energy became the largest oil producer in Colorado. Mr. Brown participated in numerous industry activities including Chairman and serving on the Executive Committee of the Colorado Oil & Gas Association and the board of the Western Energy Alliance where he has served as the organization’s Colorado Vice President. He was also Chairman of Coloradans for Responsible Energy Development and former board member of Colorado Concern. In recognition of Mr. Brown’s service to both the industry and his community, he was named the Western Energy Alliance 2013 Wildcatter of the Year, one of the highest honors available to oil and gas professionals. Mr.

3

Brown’s extensive experience in the energy industry brings significant additional operating and management experience to the Board.

Name: John W. Chisholm

Age: 61

Director Since: 1999

Principal Occupation: Mr. Chisholm was appointed Chief Executive Officer in March 2012 and has served as Flotek’s President since August 2010, and previously served as Flotek’s Interim President from August 2009 through August 2010. Mr. Chisholm has been a Director since November 1999, and has acted as Chairman of the Board since July 2010.

Mr. Chisholm founded Wellogix, Inc., a software development firm for the oil and gas industry that streamlines workflow, improves collaboration, expedites the inter-company exchange of enterprise data, and communicates complex engineered services. Mr. Chisholm also co-founded and served as President of ProTechnics, a service company dedicated to providing state-of-the-art completion diagnostic services to the energy industry, from 1985 until its sale to Core Laboratories in December of 1996. After leaving Core Laboratories as Senior Vice President of Global Sales and Marketing in 1998, he started Chisholm Energy Partners, an investment fund targeting mid-size energy service companies. Mr. Chisholm has served on the board of directors of NGSG, Inc. (NYSE:NGS), a company specializing in compression technology for the oil and gas industry, since December 2006. He serves on both the Compensation and Governance Committees of NGSG, Inc. Mr. Chisholm has also been selected to be on the editorial advisory board of Middle East Technology by the Oil and Gas Journal. Mr. Chisholm holds a Business Administration degree from Fort Lewis College. Mr. Chisholm’s experience related to two startup companies brings operating and financial expertise to the Board as well as innovative views of leadership.

Name: L. Melvin Cooper

Age: 62

Director Since: 2010

Principal Occupation: Mr. Cooper has been a Director, a member of the Audit Committee, and a member of the Corporate Governance and Nominating Committee since October 2010, and has been a member of the Compensation Committee since 2011. Currently, Mr. Cooper serves as the Senior Vice President and Chief Financial Officer of Forbes Energy Services Ltd. (NASDAQ Global Market: FES), a public company in the energy services industry. Prior to joining Forbes in 2007, Mr. Cooper served as the Chief Financial Officer or President of companies involved in site preparation for oil and gas exploration companies, supplying products and services to new home builders, and supply chain management. Mr. Cooper is a member of the board of directors for Par Petroleum Corporation (NYSE:PARR)

where he has served since August 2012. In 2014, Mr. Cooper was also elected to the Compensation and Corporate Governance Committees of Par Petroleum Corporation. In 2011, Mr. Cooper received the Board Leadership Fellow designation from the National Association of Corporate Directors (“NACD”) where he is also a member of the board of directors of the NACD Houston area Tri-City Chapter. Mr. Cooper earned a degree in accounting from Texas A&M University-Kingsville (formerly Texas A&I) in 1975. Mr. Cooper has been a Certified Public Accountant since May 1977. Mr. Cooper’s extensive experience in the energy industry and in corporate governance, as well as his financial background, brings significant additional operating, financial, and management experience to the Board.

Name: Carla S. Hardy

Age: 50

Director Since: 2013

Principal Occupation: Ms. Hardy joined the Board as a Director, a member of the Corporate Governance and Nominating Committee, and a member of the Compensation Committee in May 2013. Ms. Hardy has served as the Chairman of the Compensation Committee since May 2014. Ms. Hardy, a member of the founding family of Florida Chemical Company, Inc., served as non-executive Chairman of the Board of Florida Chemical Company, Inc. Founded by Ms. Hardy’s father more than 70 years ago, Florida Chemical (now a wholly-owned subsidiary of Flotek) is one of the largest processors of citrus oils in the world, producing citrus terpenes, including d-Limonene, and Flavor and Fragrance compounds. Ms. Hardy’s active participation as a shareholder and non-executive board chairman of Florida Chemical from 2006 until 2013 reflects her strong interest in the industry and markets served by Florida Chemical. Ms. Hardy has been a champion for the renewable and sustainable value of citrus oils in their many commercial applications. While serving as non-executive Chair of Florida Chemical, Ms. Hardy was a strategic leader in the evolution of the company from a family-run business to an international specialty citrus-focused chemical company with a professional and collaborative governance structure.

Ms. Hardy was instrumental in the merger of Florida Chemical into Flotek, creating the leading international bio-based specialty chemical company focused on renewable and sustainable chemistry for applications across multiple industries, including energy, industrial, and consumer products. A graduate of the University of Central Florida, Ms. Hardy, her husband and three children reside in Orlando and are engaged members of the central Florida community. Ms. Hardy is a volunteer with Grace Medical Home Inc., a not-for-profit medical practice serving working, uninsured individuals in Orange County, Florida. Ms. Hardy is an active member and an Elder of First Presbyterian Church of Orlando. Ms. Hardy’s experience in directing an international specialty chemical company contributes positively to the effectiveness of the Board.

4

Name: Kenneth T. Hern

Age: 78

Director Since: 2009

Principal Occupation: Mr. Hern has been a Director, a member of the Compensation Committee, a member of the Audit Committee, and the Chairman of the Corporate Governance and Nominating Committee since November 2009. Furthermore, Mr. Hern has served as the Lead Director of the Board since January 2011. Mr. Hern has been a member of the board of directors of Armada Oil and Gas, Inc. and the Chairman of its Governance Committee since its combination with Mesa Energy Holdings, Inc. in March 2013. Prior to this combination, Mr. Hern was a member of the board of directors of Mesa Energy Holdings, Inc. since February 2010. Mr. Hern served as the Chairman and CEO of Nova Biosource Fuels, Inc. (“Nova”), an energy company that refined and marketed ASTM standard biodiesel and related co-products through the deployment of proprietary, patented process technology which enabled broader range use of lower cost feedstock from March 2006 until April 2010. Nova filed for financial reorganization under Chapter 11 of the United States Bankruptcy Code in March 2009. Upon the sale of substantially all of Nova’s assets under Chapter 11 of the U.S. Bankruptcy Code, the case was resolved by a controlled and structured dismissal ordered by the Delaware Bankruptcy Court in April 2009. Mr. Hern retired from Texaco, Inc. (“Texaco”) in 1994 after 25 years of service. During his tenure with Texaco, Mr. Hern served as President of Texaco Brazil, President of Texaco Saudi Inc., and Vice Chairman and Managing Director of Texaco Nigeria Limited. Mr. Hern’s experience as a public company Chairman and CEO, as well as his associated management skills attributable to the aforementioned positions, contributes positively to the effectiveness of the Board.

Name: L.V. “Bud” McGuire

Age: 73

Director Since: 2010

Principal Occupation: Mr. McGuire has been a Director since August 2010, and a member of the Compensation Committee and a member of the Corporate Governance and Nominating Committee since October 2010. Mr. McGuire served as the Chairman of the Compensation Committee from December 2010 until May 2014. Mr. McGuire is a co-founder of Alpha Petroleum Services, a provider of management-related consulting services to the energy industry. Prior to co-founding Alpha Petroleum Services, Mr. McGuire served as a director of the board and Senior Vice President of Mariner Energy Inc. from 1998 to 2001. Prior to joining Mariner Energy, from 1997 to 1998, Mr. McGuire served as the Vice President-Operations for Enron Oil & Gas International, Inc. Mr. McGuire served, from 1991 to 1996, as the Senior Vice President responsible for worldwide production operations of the Kerr-McGee Corporation (“Kerr-McGee”). Prior to his position with Kerr-

McGee, from 1981 to 1991, Mr. McGuire served as Vice President of Operations and as Vice-President of Production for Hamilton Brothers Oil & Gas Ltd. Mr. McGuire began his career with Conoco in 1966. Mr. McGuire received a Bachelor of Science degree in Industrial Engineering from LeTourneau University and has served on the Board of Trustees of LeTourneau University since 2002. Mr. McGuire’s extensive experience in the energy industry, as well as his experience in founding a successful company, brings significant additional operating and management experience to the Board.

Name: John S. Reiland

Age: 66

Director Since: 2009

Principal Occupation: Mr. Reiland has been a Director, a member of the Compensation Committee, a member of the Corporate Governance and Nominating Committee, and Chairman of the Audit Committee since November 2009. Mr. Reiland is a Certified Public Accountant, and served as the Chief Financial Officer of The Kabbalah Centre from October 2011 until his retirement on December 31, 2015. Mr. Reiland served as the Chief Financial Officer of SingerLewak, LLP, from January 2008 until August 2011, an accounting services firm headquartered in Los Angeles, California. Mr. Reiland has significant experience in corporate leadership and financing alternatives attributable to his prior roles as Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer for a myriad of companies in the telecommunications, computer software, and retail industries. Mr. Reiland also brings significant turnaround and restructurings experience. In particular, Mr. Reiland served as the Chief Financial Officer of Starvox Communications (“Starvox”), a telecommunications company, of Ronco Corporation (“Ronco”), a housewares manufacturer and housewares marketing company, and of US Dataworks, Inc. (“Dataworks”), a computer software firm. Mr. Reiland served as Chief Financial Officer of Starvox from August 2007 until its Chapter 7 liquidation filing; Chief Executive Officer and Chief Restructuring Officer of Ronco, from 2006 to 2007, during Ronco’s United States Bankruptcy Chapter 11 financial restructuring; and Chief Financial Officer of Dataworks from 2003 until 2006. Mr. Reiland served on the board of directors of both Ronco and Dataworks. From July 2007 until October 2009, Mr. Reiland served as a director of the board and Chairman of the Audit Committee for Nova Biosource Fuels, Inc. (“Nova”). Nova and certain affiliated entities filed for Chapter 11 financial restructuring under the United States Bankruptcy Code in March 2009. Mr. Reiland also served as Chief Financial Officer of NEON Systems, Inc., (“NEON”), a computer software company, from 1996 until 2000, and was instrumental in spearheading NEON’s initial public offering (“IPO”) in 1999. Mr. Reiland’s education and extensive experience as a financial expert qualifies him to serve in his current role as Chairman of the Audit Committee.

5

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS AND DIRECTORS

AND CERTAIN BENEFICIAL OWNERS

The following table provides the beneficial ownership of Common Stock as of March 3, 2016, for (i) each named executive officer set forth in the Summary Compensation Table, (ii) each of the Company’s directors (including each nominee), (iii) all of the Company’s executive officers and directors as a group, and (iv) each other person known by the Company to be a beneficial owner of more than 5% of our outstanding Common Stock.

Name | Shares Owned (a) | Right to Acquire (b) | Total Shares | Percent of Class (c) | |||||||

Named Executive Officers and Directors | |||||||||||

John W. Chisholm | 891,880 | 400,000 | 1,291,880 | 2.36% | |||||||

Steven A. Reeves (d) (e) | 267,514 | 200,000 | 467,514 | * | |||||||

Joshua A. Snively, Sr. (f) | 316,119 | — | 316,119 | * | |||||||

Robert M. Schmitz | 83,327 | — | 83,327 | * | |||||||

H. Richard Walton | 174,167 | — | 174,167 | * | |||||||

Kenneth T. Hern | 77,674 | 9,047 | 86,721 | * | |||||||

John S. Reiland | 40,382 | 9,047 | 49,429 | * | |||||||

L.V. “Bud” McGuire | 99,010 | 9,047 | 108,057 | * | |||||||

L. Melvin Cooper | 63,316 | 37,618 | 100,934 | * | |||||||

Carla S. Hardy (g) | 394,976 | — | 394,976 | * | |||||||

Ted D. Brown | 18,774 | — | 18,774 | * | |||||||

All executive officers and directors as a group (11 persons) | 2,427,139 | 664,759 | 3,091,898 | 5.64% | |||||||

5% Beneficial Owners | |||||||||||

T. Rowe Price Associates, Inc. (h) | 6,188,951 | — | 6,188,951 | 11.28% | |||||||

Gates Capital Management, Inc. (i) | 7,466,931 | — | 7,466,931 | 13.61% | |||||||

BlackRock, Inc. (j) | 5,045,569 | — | 5,045,569 | 9.20% | |||||||

The Vanguard Group (k) | 3,928,766 | — | 3,928,766 | 7.16% | |||||||

Millennium Management LLC (l) | 4,106,420 | — | 4,106,420 | 7.49% | |||||||

* Less than 1%.

(a) | Except as otherwise disclosed, the persons named in the table have sole voting and investment power of all shares of Common Stock which are beneficially owned by them. Includes the following number of unvested shares of restricted stock for the persons indicated: Mr. Chisholm - 251,084; Mr. Reeves -77,886; Mr. Snively, Sr. - 70,851; Mr. Schmitz - 51,941;Mr. Walton - 64,565; Mr. Hern - 8,535; Mr. Reiland - 8,535; Mr. McGuire - 8,535; Mr.Cooper - 8,535; Ms. Hardy - 8,535; and Mr. Brown - 8,535. None of the named executive officers or directors have pledged shares. |

(b) | Shares subject to options granted pursuant to the Company’s incentive plans and exercisable within 60 days of March 3, 2016. This assumes that all options beneficially owned by the person are exercised for shares of Common Stock. |

(c) | Based on an aggregate of 54,847,737 shares of Common Stock outstanding and entitled to vote as of March 3, 2016. |

(d) | Includes shares previously acquired through the Company’s 401(k) Plan. |

(e) | Mr. Reeves’ holdings include 120,992 shares of Common Stock held in trust, for which Mr. Reeves is a trustee and beneficiary. |

(f) | Mr. Snively’s holdings include 114,345 shares of Common Stock held in trust, for which Mr. Snively is a trustee and beneficiary, and 128,916 shares of Common Stock held in trust, for which Mr. Snively’s spouse is a trustee and beneficiary. |

(g) | Ms. Hardy’s holdings include 182,040 shares of Common Stock held in trust, for which Ms. Hardy is a trustee and beneficiary, and 200,021 shares of Common Stock held in trusts for which members of Ms. Hardy’s immediate family are beneficiaries. |

(h) | The address of T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, MD 21202. These securities are owned by various individual and institutional investors which T. Rowe Price Associates, Inc. (“Price Associates”) serves as an investment adviser with power to direct investment and/or sole power to vote the securities. For the purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. Ownership information originated from the Schedule 13G/A filed with the Securities and Exchange Commission by Price Associates on February 11, 2016. |

(i) | The address of Gates Capital Management, Inc. (“Gates”) is 1177 Avenue of Americas, 46th Floor, New York, NY 10036. Gates Capital Management, Inc., which is controlled by Jeffrey L. Gates, is the managing member of Gates Capital Management GP, LLC, which is the general partner of Gates Capital Management, LP., which is the investment manager of certain Gates Capital Funds. Jeffrey L. Gates exercises voting and dispositive power over the securities held by each of the funds listed above (collectively, the “Funds”). Gates may be deemed to be the beneficial owner of the securities held by the Funds, although all reported securities are owned by the Funds. Ownership information originated from the Schedule 13G/A filed with the Securities and Exchange Commission by Gates on February 10, 2016. |

(j) | The address of BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. Spencer Fleming exercises voting and dispositive power over the securities held by BlackRock, Inc. Ownership information originated from the Schedule 13G/A filed with the Securities and Exchange Commission by BlackRock, Inc. on January 26, 2016. |

(k) | The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. Ownership information originated from the Schedule 13G/A filed with the Securities and Exchange Commission by The Vanguard Group on February 10, 2016. |

(l) | The address of Millennium Management LLC is 666 Fifth Avenue, New York, NY 10103. Israel A. Englander is the managing member of Millennium International Management GP LLC, which is the general partner of Millennium International Management, which is the investment manager to Integrated Assets, Ltd., and Millennium Management LLC, which is the general partner of the managing member of Integrated Core Strategies (US) LLC. Israel A. Englander exercises voting and dispositive power over the securities held by each of the funds listed above (collectively, the “Funds”). Ownership information originated from the Schedule 13G/A filed with the Securities and Exchange Commission by Millennium Management LLC on January 15, 2016. |

6

EXECUTIVE OFFICERS

The following table provides certain information with respect to the named executive officers of the Company.

Name and Age | Positions | Position Held Since | ||

John W. Chisholm (61) | Chief Executive Officer | 2012 | ||

President and Chairman of the Board | 2010 | |||

Interim President | 2009 | |||

Steven A. Reeves (65) | Executive Vice President, Operations | 2011 | ||

Executive Vice President, Operations, Business Development and Special Projects | 2010 | |||

Executive Vice President, Business Development and Special Projects | 2009 | |||

Executive Vice President and Chief Operating Officer | 2008 | |||

President Downhole Tool Division | 2007 | |||

Joshua A. Snively, Sr. (51) | Executive Vice President, Research and Innovation | 2013 | ||

President of Florida Chemical Company, Inc., a wholly-owned subsidiary of the Company | 2013 | |||

Robert M. Schmitz (61) | Executive Vice President and Chief Financial Officer | 2015 | ||

H. Richard Walton (67) | Chief Financial Officer Emeritus | 2015 | ||

Executive Vice President and Chief Financial Officer | 2013 | |||

Chief Financial Officer (Interim) | 2013 | |||

Steven A. Reeves serves as Executive Vice President, Operations beginning in May 2011. Previously, Mr. Reeves served as Vice President of Flotek’s Turbeco Division from April 2005 until January 2007 and President of Flotek’s Downhole Tool Division from January 2007 until May 2008. Beginning in May 2008 until October 2009, Mr. Reeves served as Executive Vice President and Chief Operating Officer. Beginning in October 2009, Mr. Reeves served as Executive Vice President, Business Development and Special Projects. Beginning in May 2010, Mr. Reeves served as Executive Vice President, Operations, Business Development and Special Projects. Prior to joining Flotek, Mr. Reeves served in various positions over a 30 year career with Halliburton Energy Services, Inc. (“Halliburton”), from which he retired in May 2002. Mr. Reeves’ responsibilities ranged from field engineer, logging and perforating, to global operations manager for formation evaluation to oversight of Halliburton Energy Services’ worldwide formation evaluation operations. Mr. Reeves spent his last two years with Halliburton Energy Services as the general manager of Jet Research Center (“JRC”) in Alvarado, Texas. JRC originated the jet shaped charge for oil and gas formation stimulation and develops shaped charges for the oil and gas industry. Mr. Reeves holds a Bachelor of Science in Math with minor degrees in Physics and Spanish from East Central University.

Joshua A. Snively, Sr. serves as Executive Vice President, Research and Innovation for Flotek Industries, Inc. beginning in November 2013 and as President of Florida Chemical Company, Inc., a wholly-owned subsidiary of the Company, beginning in May 2013. Florida Chemical is a leading manufacturer and supplier of citrus oils to global markets and was acquired by Flotek in May 2013. Mr. Snively joined

Florida Chemical in 1995 and was instrumental in transforming the company from its origin as a family run business to a multinational citrus-based specialty chemical company with manufacturing facilities in metropolitan Orlando and Houston. In addition to his role in developing growth and execution strategies, Mr. Snively is responsible for Florida Chemical’s commodity supply chain strategy, a task for which he is uniquely qualified given his background growing up in a prominent Florida citrus family. Combined with his formal training and financial experience, Mr. Snively has become known globally as an expert in citrus commodity markets. Prior to his position as President, he was VP and General Manager, as well as VP of Procurement and Business Development, with Florida Chemical. Before joining Florida Chemical, Mr. Snively was Vice President of Commercial Agriculture Finance at SunTrust Bank. He graduated with a degree in Finance and Citrus Management from Florida Southern College. Mr. Snively currently serves on the board of CenterState Bank and is acting chairman of the Bank’s loan committee and is a member of the Bank’s compensation committee.

Robert M. Schmitz serves as Executive Vice President and Chief Financial Officer beginning in May 2015. Previously, Mr. Schmitz served as Flotek’s Vice President and Corporate Controller since June 2013. Prior to joining Flotek, Mr. Schmitz served as Vice President and Chief Accounting Officer at Champion Technologies Inc., a major supplier of production chemicals to the oil and gas industry, from October 2005 through May 2013. Mr. Schmitz also worked at Shell Oil Company, ultimately serving as Chief Financial Officer of the Shell Energy Services division. He also worked as Accounting Director at Dynegy. Mr. Schmitz holds a

7

Bachelor’s degree in Business Administration from Kansas State University and is a certified public accountant.

H. Richard Walton serves as Chief Financial Officer Emeritus beginning in May 2015. Previously, Mr. Walton served as Executive Vice President and Chief Financial Officer from March 2013 through May 2015 and Interim Chief Financial Officer from January 2013 through March 2013. Prior to joining Flotek, Mr. Walton spent his entire 30 year career in public accounting, including 20 years as an audit partner at KPMG. His experience includes financial statement audits

and registration of securities with the SEC. Following his retirement from KPMG, LLP in 2003, Mr. Walton served as a consultant to public companies, including Flotek since 2010. Mr. Walton is a certified public accountant and has served as an officer in the United States Army. He holds a Bachelor’s degree from Westminster College in Economics and Business Administration. He currently serves as a member of the board of directors of Houston Hospice, DePelchin Children’s Center and Pennies for Education and Health, and as a member of the board of trustees of the Retina Research Foundation.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board consists of three directors who are independent, as defined by the standards of the New York Stock Exchange and the rules of the Securities and Exchange Commission. Under the charter approved by the Board, the Committee assists the Board in overseeing matters relating to the accounting and financial reporting practices of the Company, the adequacy of its internal controls, and the quality and integrity of its financial statements and is responsible for selecting and retaining the independent auditors. The Company’s management is responsible for preparing the financial statements of the Company, and the independent auditors are responsible for auditing those financial statements. The Audit Committee’s role under the charter is to oversee management. The Committee is not providing any expert or special assurance as to the Company’s financial statements or any professional certification as to the independent auditors’ work. The Committee met 5 times during the year ended December 31, 2015.

The independent auditors provided the Committee with a written statement describing all the relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Committee also discussed with the auditors any relationships that may impact the independence of the auditors.

The Committee reviewed and discussed with the independent auditors all communications required to be discussed by Standards of the Public Company Accounting Oversight Board, including those described in Auditing Standard No. 16, “Communications with Audit Committees.”

The Committee reviewed the Company’s audited financial statements as of and for the year ended December 31, 2015, and discussed them with management and the independent auditors. Based on such review and discussions, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2015, for filing with the Securities and Exchange Commission.

John S. Reiland, Chairman

Kenneth T. Hern

L. Melvin Cooper

March 23, 2016

This report of the Audit Committee shall not be deemed “soliciting material,” or to be “filed” with the Securities and Exchange Commission or subject to Regulation 14A or 14C or to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically request that the information be treated as soliciting material or specifically incorporate it by reference into a document filed under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act. Further, this report will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act except to the extent that we specifically incorporate this information by reference.

8

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion of executive compensation contains descriptions of various employment-related agreements and employee benefit plans. These descriptions are qualified in their entirety by reference to the full text of the referenced agreements and plans, which have been filed by us as exhibits to our reports on Forms 10-K, 10-Q, and 8-K filed with the U.S. Securities and Exchange Commission.

Introduction

Flotek is a global diversified, technology-driven company that develops and supplies oilfield products, services, and equipment to the oil, gas, and mining industries and high value compounds to companies that make cleaning products, cosmetics, food and beverages, and other products that are sold in consumer and industrial markets.

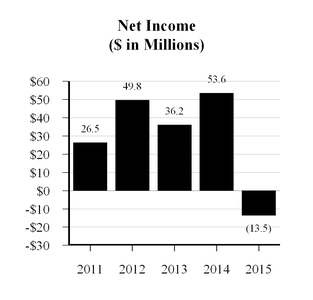

Following the cyclical downturn that impacted the entire energy services business in 2008 and 2009, the Company undertook an aggressive rebuilding campaign that focused on the potential of the Company’s product offerings, in particular, its patented chemistries business. The Company experienced losses in 2008 through 2010, and then saw significant and increasing success in 2011 through 2014. Beginning in the second half of 2014 and continuing throughout 2015, the price of crude oil and the North American rig count declined dramatically, ending 2015 at levels not seen since 2009.

Crude oil prices peaked at approximately $106/barrel in June 2014 and began the descent to the current levels ranging between $30 to $40 per barrel. As a result, total U.S. rig count decreased from 1,929 rigs on November 21, 2014 to 698 rigs as of December 31, 2015, representing a 63.8% decline. The Canadian rig count had a similar response, lagging normal levels by almost 200 rigs during peak drilling seasons.

As a result of this cyclical downturn, North American exploration and production companies - many of which are Flotek clients - significantly reduced their exploration and drilling activity. The reduction in activity led to the Company’s financial results declining in 2015, as the downturn in the oil and gas industry continued.

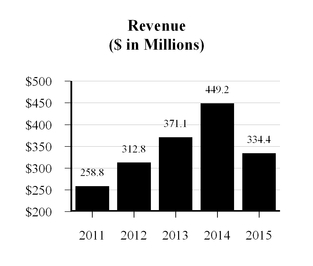

• | The Company reported revenue for the year ended December 31, 2015 of $334.4 million, a decrease of $114.8 million, or 25.6%, compared to $449.2 million for the year ended December 31, 2014. The decline in revenue, however, was not as drastic as the 47.8% decline in average North American active rig count during the same period. |

• | During the second quarter of 2015, as a result of decreased rig activity and its impact on management’s |

expectations for future market activity, the Company refocused the Drilling Technologies segment to businesses and markets that have the best opportunity for profitable growth in the future. Additionally, the Company shifted the focus of the Production Technologies segment towards oil production markets and away from the less opportunistic coal bed methane markets. As a result of these changes in focus and projected declines in asset utilization, the Company recorded an impairment charge of $20.4 million in the second quarter of 2015.

• | The Company reported a net loss, including the impairment charge discussed above, for the year ended December 31, 2015 of $13.5 million, or $0.25 per share (fully diluted), compared to net income of $53.6 million, or $0.97 per share (fully diluted), for the year ended December 31, 2014. |

• | The Company is successfully expanding into foreign markets. Revenue from services and products used in foreign countries increased to 18.2% of consolidated revenue in 2015 compared to 13.9% of consolidated revenue in 2013. |

• | The Company continues to emphasize and expand its research and innovation activities. These activities focus on improvement of existing products and services, the design of reservoir specific, customized chemistries, and the development of new products, processes, and services. Research and innovation expense increased to $7.5 million in 2015 compared to $3.8 million in 2013. |

• | During 2015, the Company continued to promote the efficacy of its CnF® chemistries resulting in an 18.0% increase in CnF® sales volumes compared to 2014. CnF® volumes continued to increase throughout the year with the fourth quarter of 2015 having the highest quarterly volume of CnF® sales on record. The Company achieved this growth despite a 47.8% annual decline in general oilfield activity as measured by active rig count. |

• | During 2014, the Company acquired a company that is a leading Enhanced Oil Recovery design and injection firm and a company that provides reservoir engineering and modeling services for a variety of hydrocarbon applications. These acquisitions fit with the Company’s existing products and services and provide an opportunity to expand the Company’s customer base. In early 2015, the Company acquired the assets of a business that will allow the Company to control the manufacturing and service quality of next-generation hydraulic pumping units. |

9

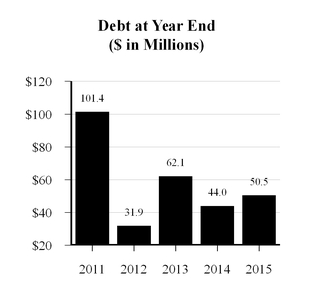

The charts below illustrate the magnitude of the Company’s success in 2011 through 2014, and the decline experienced in 2015.

Compensation Consultants

Hay Group serves as an independent advisor to management on executive compensation. The Compensation Committee engages Willis Towers Watson to provide independent advice to the Committee. Since 2014, these consultants have provided advice on matters including:

• | A thorough review of compensation strategies and objectives; |

• | A review of and recommended changes to the Chief Executive Officer’s employment agreement and other executive employment agreements, including adoption of “double-trigger” cash severance and equity acceleration following a change-in-control; |

• | Adoption of a claw-back policy; |

• | A review of policies and recommended changes relating to prohibited hedging transactions and the prohibition of pledging Company securities; |

• | Adoption of stock ownership guidelines for executives and directors; |

• | A review and update of the Peer Group composition; |

• | A restructuring and refinement of executive annual incentive compensation opportunities making amounts earned under the program primarily contingent on financial measures that drive shareholder returns; |

• | Adoption of an annual equity-based long-term incentive component to total compensation based on the Company’s total shareholder return and the Company’s performance relative to a peer group; and |

• | Extension of the performance period to two years for the equity-based long-term incentive component. |

10

The following discussion provides an overview of the Compensation Committee, the background and objectives of our compensation programs for current senior management, and the material elements of the compensation of each of the executive officers identified in the following table, to which we refer as our named executive officers.

Name | Title | |

John W. Chisholm (1) | Chairman of the Board, President and Chief Executive Officer | |

Steven A. Reeves (2) | Executive Vice President, Operations | |

Joshua A. Snively, Sr. (3) | Executive Vice President, Research and Innovation and President of Florida Chemical Co. | |

Robert M. Schmitz (4) | Executive Vice President and Chief Financial Officer | |

H. Richard Walton (5) | Chief Financial Officer Emeritus | |

(1) | Mr. Chisholm was appointed Interim President under the terms of a Service Agreement effective August 11, 2009, and became President on August 12, 2010. Mr. Chisholm was elected Chairman of the Board on July 13, 2010. Mr. Chisholm was appointed Chief Executive Officer effective March 5, 2012. |

(2) | Mr. Reeves was appointed Executive Vice President, Operations effective May 19, 2011. He previously served as Executive Vice President, Operations, Business Development and Special Projects, Executive Vice President, Business Development and Special Projects, and Executive Vice President and Chief Operating Officer. |

(3) | Mr. Snively was appointed President of Florida Chemical Company, Inc. effective May 10, 2013 and was appointed Executive Vice President, Research and Innovation, effective November 4, 2013. |

(4) | Mr. Schmitz was appointed Executive Vice President and Chief Financial Officer effective May 1, 2015. |

(5) | Mr. Walton was appointed Chief Financial Officer Emeritus effective May 29, 2015. He previously served as Executive Vice President and Chief Financial Officer. |

Compensation Committee

The Compensation Committee has overall responsibility for the approval, evaluation, and oversight of the Company’s compensation and benefit plans, policies, and programs. The primary function of the Compensation Committee is to assist the Board in fulfilling its responsibilities relating to the compensation of the Company’s named executive officers and outside directors. The primary responsibilities of the Compensation Committee include (i) annually reviewing the Company’s general compensation policies with respect to named executive officers and directors, (ii) annually reviewing and approving the corporate goals and objectives relevant to the compensation of our executive officers, evaluating our officers’ performance in light of these goals, and approving or recommending to the Board compensation levels based on these evaluations, (iii) producing a committee report on executive compensation as required by the SEC to be included or incorporated by reference in our proxy statement or other applicable SEC filings, and (iv) recommending the compensation program applicable to the Company’s outside directors. The Committee met 9 times during the year ended December 31, 2015.

The Company’s Board appoints Compensation Committee members and the Chairman annually, and these appointees continue to be members until their successors are elected and qualified or until their earlier resignation or removal. Any member of the Compensation Committee may be removed, with or without cause, by our Board. The Board appoints members to the Compensation Committee considering criteria such as experience in compensation matters, familiarity with our management and other key personnel, understanding of public company compensation issues, time availability necessary to fulfill committee responsibilities, and independence and other regulatory requirements.

Each member of the Compensation Committee is considered to be (1) “independent” under the currently applicable listing standards of the NYSE; (2) a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act; and (3) an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The Compensation Committee’s function is more fully described in its charter. The Compensation Committee will continue to review and assess the adequacy of the charter and recommend any proposed changes to the Board for approval on an annual basis.

The Compensation Committee establishes an agenda for each Committee meeting and prepares meeting materials. The Committee may request assistance or information that will be provided by management and may share and confirm information with the Chief Executive Officer. The Compensation Committee on occasion meets with the Company’s Chief Executive Officer and other executives to obtain recommendations with respect to the Company’s compensation programs, practices, and packages for executives, other employees, and directors. Although management makes recommendations to the Compensation Committee on executive compensation, the Compensation Committee is not bound by and does not always accept management’s recommendations. The Compensation Committee has historically sought input from an independent compensation consultant prior to making any final determinations. Our Chief Executive Officer attends some of the Compensation Committee meetings, but the Compensation Committee also regularly holds executive

11

sessions not attended by members of management or non-independent directors.

Outside corporate counsel, and other members of our management and outside advisors, may be invited to attend all or a portion of a Compensation Committee meeting depending on the nature of the matters to be discussed. Only members of the Compensation Committee may vote on items before the Compensation Committee.

Our Compensation Committee may retain, at our expense, independent compensation consultants to consider executive compensation matters. The Compensation Committee meets with the compensation consultants, both in and outside of the presence of our management, to review findings and recommendations regarding executive compensation and considers those findings and recommendations, as well as the results of the most recent shareholder advisory vote on executive compensation, in determining and making adjustments to our executive compensation program. The Compensation Committee has used a compensation consultant since 2011 to assist in fulfilling its responsibilities as assigned by the Chairman of the Compensation Committee. In July 2014, the Compensation Committee engaged Willis Towers Watson to serve as its compensation consultant. During its selection process, the Compensation Committee analyzed factors specified by the Securities and Exchange Commission and the NYSE that affect the independence of compensation advisers. Based on this analysis, the Compensation Committee concluded that there were no independence concerns related to Willis Towers Watson in its role as an independent adviser to the Compensation Committee.

Under the direction of the Chairman of the Compensation Committee, the compensation consultant supports the Committee in fulfilling its responsibilities as outlined in the Compensation Committee Charter which can include preparing information regarding compensation trends in the energy services industry, relative compensation for similarly-situated executive officers in the industry, and the structure of our cash and equity incentive awards. At the Compensation Committee’s request, the compensation consultant worked with management to prepare materials for review by the Compensation Committee, made recommendations regarding the Compensation Committee’s calendar, and has provided assistance in the composition of this Compensation Discussion and Analysis.

Compensation Risk Assessment and Controls

The Compensation Committee strives to create an effective environment for its risk assessment of the Company’s overall compensation policies, practices, and programs through the following practices:

• | Compensation Committee chaired by an independent non-employee director. All Compensation Committee members are independent; |

• | Representation from the Audit Committee on the Compensation Committee; |

• | Review of executive compensation programs by the Compensation Committee’s independent compensation consultant; |

• | Robust review of compensation program elements and key performance drivers; and |

• | Detailed measurement of short- and long-term compensation elements to ensure balance. |

The role of the Compensation Committee in risk oversight includes review of risks arising from our compensation policies, practices, and programs, as well as the mitigating controls, to determine whether any such risks are material to the Company. The Compensation Committee has reviewed these matters and believes the mix of compensation elements and the design of those elements, along with sound governance practices, do not encourage employees to take excessive risks that might have a material adverse effect on the Company. These matters include the following:

• | The Company has strong internal financial controls that are assessed annually by the Company’s independent public accountants, in addition to their audits of the Company’s financial statements. |

• | Base salaries are generally consistent with market practice and the employees’ responsibilities, so employees are not motivated to take excessive risks to attain a reasonable level of financial security. |

• | The determination of incentive awards is based on well-defined financial measures. There is a maximum incentive opportunity for each named executive officer, and the Committee retains discretion to adjust bonuses to eliminate anomalous or inappropriate outcomes. |

• | Long-term incentives are designed to provide appropriate awards for successful outcomes, and effectively align realized compensation with returns realized by investors. |

• | Since December 31, 2012, the Company has had a claw-back policy that covers executive officers and other officers who participate in the Company’s incentive plans. This policy permits the Company to recover incentive compensation awarded or paid if there is a subsequent change to a performance measure and in instances where an officer engaged in intentional misconduct. |

• | All officers and directors are prohibited from purchasing or selling Company securities while in possession of material, non-public information. All officers and directors must pre-clear any transactions involving Flotek common stock with the Company’s Compliance Officer. |

• | In 2014, the Company clarified its Insider Trading Policy with respect to its hedging policy and its pledging policy. Hedging transactions are prohibited, and the pledging of Company securities to secure indebtedness is prohibited. |

12

• | The Company has established formal stock ownership guidelines. These guidelines, based on a multiple of base salary for executive officers and on the annual cash retainer for directors, help ensure that their interests are aligned with those of our stockholders. |

• | The Company has a Code of Business Conduct and Ethics. This Code requires each employee and director to sign a Compliance Certification. In addition, employees are required to complete annual anti-bribery training. |

Compensation Philosophy

We operate in a very competitive environment. Our principal competitors are larger, more established providers of services in our industry and, because of their size, generally have significantly more resources than we do. In order to successfully compete in this environment, we must be able to attract and retain highly skilled employees with well-developed management, operational, and marketing skills. The Company has been successful in developing and retaining a highly-qualified management team by offering compensation that is equitable, reasonably competitive with what we believe they might earn elsewhere based on our understanding of market practices, and closely tied to performance through our annual salary review process, our annual cash bonus plan, and grants of equity-based opportunities from our long-term incentive plans.

In general, our executive compensation programs are designed to achieve the following objectives:

• | Attract and retain talented and experienced executives with the skills necessary to run and grow our existing business segments; |

• | Align the interests of our executive officers with those of stockholders to increase the value of our enterprise; |

• | Motivate and reward executives whose knowledge, skills, and performance are critical to our success; |

• | Demonstrate fairness among the executive management team by recognizing the contributions each executive makes to our success; |

• | Provide that executives are accountable to the Board for their performance; and |

• | Encourage a shared commitment among executives by coordinating Company and individual business unit targets, goals, and objectives. |

As we endeavor to evaluate the adequacy of our overall executive compensation program, our Compensation Committee works with the compensation consultant to evaluate and compare certain elements of total compensation against a group of similar publicly-traded energy services companies (the “Peer Group”). We evaluate each element of compensation (base salary, annual incentive compensation, and long-term equity compensation), as well as the total of all compensation elements. While the compensation consultant’s information on peer practices is used to assess the competitiveness of the Company’s total compensation opportunities, the Compensation Committee does not target any percentile level of the peer data as a benchmark for setting pay opportunities.

In regard to the use of peer company data in setting compensation opportunities, we would prefer to define the market for our executive talent using a sizable group of companies that are comparable to us in both size and line of business. However, there are not a sufficient number of companies that compare to us in size and line of business to comprise such a peer group. Therefore, as we evaluate the adequacy of our compensation programs, the Compensation Committee considers data from our Peer Group, data from published survey sources, and information from our directors, management, and compensation consultant based on their collective understanding of industry practices.

The companies that comprised our Peer Group in 2015 were as follows:

Basic Energy Services, Inc. | Newpark Resources, Inc. | |

CARBO Ceramics Inc. | Parker Drilling Company | |

C&J Energy Services, Inc. | RPC, Inc. | |

Key Energy Services, Inc. | Tesco Corporation | |

Layne Christensen Company | TETRA Technologies, Inc. | |

Matrix Service Company | ||

The Peer Group was reviewed in June 2015 to ensure it was appropriate for purposes of supporting 2016 compensation decisions. The Compensation Committee concluded that a larger group was advisable. As a result, Helix Energy Solutions Group, Inc. and RigNet, Inc. were added to the Peer Group for 2016.

The Compensation Committee intends to continually monitor the composition of the Peer Group to assure that it provides a useful representation of the market for leadership talent in which the Company competes.

13

Policies, Guidelines and Practices Related to Executive Compensation

Stock Ownership Guidelines

To further promote sustained shareholder return and to ensure that the Company’s executives and directors remain focused on both short- and long-term objectives, the Company has established stock ownership guidelines. Each executive and director has five years from the date appointed or elected to his or her position (or, if later, within five years of the adoption of the guidelines) to achieve the level associated with the position.

Role | Guideline | |

Chief Executive Officer | 6 times base salary | |

Other executive officers | 2 times base salary | |

Directors | 5 times annual retainer | |

Executives and directors that are not in compliance with the stock ownership guidelines must hold the lesser of 25% of the net shares acquired from exercising stock options or vesting of shares, or the number of shares necessary to reach the applicable stock ownership guidelines.

All executives and directors with 5 years tenure in their current position meet or substantially exceed the guidelines.

Hedging and Pledging of Company Stock

None of the Company’s executive officers or directors have pledged any Flotek Common Stock. In addition, all of the Company’s officers and directors must pre-clear any transactions involving Flotek Common Stock with the Company’s Compliance Officer.

During 2014, the Company updated its Insider Trading Policy with respect to its hedging policy and its pledging policy. Pursuant to the Policy, Company directors, officers, and employees may not engage in hedging transactions with respect to Company securities. Prohibited hedging transactions include, but are not limited to: short-selling, options, puts or calls, as well as derivatives such as swaps, forwards, or futures. Company directors and executive officers are prohibited from pledging Company securities to secure indebtedness, including, but not limited to, engaging in margin transactions with Company securities.

Claw-back Policy

The Company has had a claw-back policy since 2012 that covers executive officers and other officers designated as participants in the Company’s incentive plans. The Company is entitled to recover, at the direction of the Compensation Committee, incentive compensation awarded or paid to an officer if the result of the performance measure upon which the award was made or paid is subsequently restated or otherwise adjusted in a manner that would reduce the award or payment. In addition, if an officer engaged in intentional

misconduct that resulted in additional compensation, the Company may take remedial and recovery action.

Tax Gross-Ups on Severance

There are no tax gross-ups on any payments to executives, including severance payments.

Equity Compensation Plan Information

Each of the Company’s equity compensation plans has been approved by our stockholders. At December 31, 2015, there were 1,090,837 shares of our Common Stock available for future issuance under our Long-Term Incentive Plans.

We are asking stockholders to approve an amendment and restatement of the current 2014 Long-Term Incentive Plan to increase the number of shares of our Common Stock available for the granting of awards under our equity compensation plans from 2,700,000 to 5,200,000.

Our 2014 Long-Term Incentive Plan was approved at our 2014 Annual Meeting of Stockholders. In connection with this approval by stockholders, the Company committed to cap its average annual burn rate at 2.85% over the next three fiscal years (2014, 2015 and 2016). In calculating compliance with this maximum burn rate commitment, “burn rate” is defined as the number of shares subject to stock awards granted in a fiscal year divided by the weighted average number of shares of common stock outstanding (basic) during the fiscal year. For purposes of calculating the number of awards granted in each fiscal year, (a) awards of stock options and stock appreciation rights will count as one share and (b) awards of restricted stock, restricted stock units, or other full value awards will count as 1.5 shares. Any awards that are assumed or substituted in acquisitions will be excluded from the burn rate calculation.

The Company has complied with its burn rate commitment for 2015 and 2014. The average annual burn rate was 2.20% for 2015 and 2.28% for 2014.

Executive Officer Compensation

Principal Elements of Compensation of Our Named Executive Officers

The principal elements of the compensation package offered to our executive officers consist of:

• | Base salary; |

• | Annual incentive opportunity; and |

• | Equity compensation under the long-term incentive plans. |

Some, but not all, of the named executive officers participate in certain limited perquisite programs, as described later in this discussion. Group insurance programs, the Company’s 401(k) Plan, and the Employee Stock Purchase Plan are available to all named executive officers on the same basis as all other employees of the Company.

14

Allocation of Compensation among the Principal Components

The Compensation Committee has not established formulas for allocating compensation between compensation elements at this time. Rather, the Compensation Committee reviews compensation structures of companies in our Peer Group, historical compensation for the participant, the participant’s responsibilities, the performance of the participant and the Company on goals approved by the Committee, and the

individual circumstances of senior executives when determining the mix of base salary, cash bonus percentages, and annual equity award opportunities. As a result, the Compensation Committee may apply a different mix of base salary, annual incentive compensation, and long-term equity compensation to different executive officer positions. The Company’s historical objectives have been to make executives’ overall compensation opportunity significantly contingent on operational and financial performance.

The following table provides the percentage allocation of 2015 compensation elements at target levels for the Company’s named executive officers.

Name | Base Salary | Annual Incentive at Target Amount | Long-Term Incentive at Target Value | Total | ||||

John W. Chisholm | 17.4% | 17.4% | 65.2% | 100% | ||||

Steven A. Reeves | 26.7% | 20.0% | 53.3% | 100% | ||||

Joshua A. Snively, Sr. | 28.6% | 17.1% | 54.3% | 100% | ||||

Robert M. Schmitz | 27.0% | 18.9% | 54.1% | 100% | ||||

H. Richard Walton | 27.0% | 18.9% | 54.1% | 100% | ||||

Base Salary

The Company reviews base salaries annually for the named executive officers to determine if changes are appropriate. In reviewing base salaries, several factors are considered, including a comparison to base salaries paid for comparable positions in the Peer Group, published survey data, the relationship among base salaries paid within the Company, and individual experience and performance. The Company’s intent is to set base salaries at levels consistent with comparable industry positions, Company performance, and remunerative objectives, including the ability to attract, motivate, and retain highly talented individuals in a competitive environment while retaining an appropriate balance between fixed and performance-contingent compensation elements.

President, Chief Executive Officer and Chairman of the Board

Mr. Chisholm is compensated under a Service Agreement that pays two entities controlled by Mr. Chisholm (the “Chisholm Companies”) as an independent contractor. In addition, Mr. Chisholm has a Letter Agreement with the Company under which he is also an employee of the Company. Effective January 4, 2015, the Compensation Committee of the Board approved an annual payment of $770,000 pursuant to the Service Agreement and an annual salary of $50,000.

Other Executive Officers

After a review of responsibilities, performance, and the Company’s understanding of salary levels typically available to officers filling comparable positions in other public energy services companies, the salary adjustments in the table below were approved during 2015.

Name | Title | Beginning Salary | New Salary | Percent Increase | ||||

Steven A. Reeves | EVP, Operations | $418,000 | $435,000 | 4.07% | ||||

Joshua A. Snively, Sr. | EVP, Research and Innovation | $392,600 | $409,000 | 4.18% | ||||

Robert M. Schmitz | EVP and Chief Financial Officer | * | $330,000 | * | ||||

H. Richard Walton | Chief Financial Officer Emeritus | $336,000 | $350,000 | 4.17% | ||||

* | Mr. Schmitz was appointed Executive Vice President and Chief Financial Officer effective May 1, 2015 and is now considered a named executive officer. |

15

Annual Incentive Compensation

Under the terms of the annual incentive program available to named executive officers and other leadership employees, participants had the opportunity to earn annual cash incentives based on the achievement of Company performance as measured by Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”).

Adjusted EBITDA is a Non-GAAP measure under which EBITDA results may be adjusted to recognize incentive compensation, including stock compensation, financing transaction costs (whether paid in cash or not), and other noncash or nonrecurring charges not directly related to the ongoing operations of the Company. Determination of Adjusted EBITDA is based solely on the judgment of the Audit Committee of the Board of Directors.

The Compensation Committee established 2015 target bonuses for each named executive officer, expressed as a percentage of base salary, as follows:

Percent of Base Salary | |

John W. Chisholm | 100% |

Steven A. Reeves | 75% |

Joshua A. Snively, Sr. | 60% |

Robert M. Schmitz | 70% |

H. Richard Walton | 70% |

If Adjusted EBITDA results achieved only a minimum-defined level, 50% of target bonuses would be earned, and if

Adjusted EBITDA results achieved a maximum defined

level, 200% of target bonuses would be earned. The bonus percentage earned between minimum and target and between target and maximum is determined on a linear basis. If Adjusted EBITDA is less than $45 million, no bonuses would be paid. In no event would any bonus paid exceed 200% of the target bonus.

2015 Cash Bonus Performance Measure | ||||

Adjusted EBITDA: | ||||

Minimum (50%) | Target (100%) | Maximum (200%) | ||

$45.0 million | $55.0 million | $75.0 million | ||

The Adjusted EBITDA range for 2015 was set below the Adjusted EBITDA achieved in 2014 due to the drastic decline in the price of crude oil and related industry activity during the second half of 2014 and continuing at the beginning of 2015.

Executives were given the opportunity to elect to receive 50% of their target bonus in restricted shares of the Company’s Common Stock awarded conditionally at the beginning of the year based on the fair market value of the Common Stock on the date of grant subject to the agreement that none of the shares would vest if minimum performance was not achieved and that any bonus earned in excess of 50% of the target amount would be paid in cash. All named executive officers covered by the annual incentive plan elected to receive 50% of their target award in equity, receiving a number of shares equal to 50% of the target bonus divided by $16.73, the fair market value of the Company’s Common Stock on March 2, 2015.

The table below shows the range of bonus opportunities available based on various Adjusted EBITDA results. Actual Adjusted EBITDA for 2015 was $42.4 million, resulting in no bonus for program participants under the annual incentive program.