UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-13270

FLOTEK INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 90-0023731 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

10603 W. Sam Houston Parkway N. #300 Houston, TX | 77064 | |

(Address of principal executive offices) | (Zip Code) | |

(713) 849-9911

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.0001 par value | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark:

• if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

• if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

• whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

• whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

• if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

• whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ý Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

• whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2015 (based on the closing market price on the NYSE Composite Tape on June 30, 2015) was approximately $495,092,000. At January 15, 2016, there were 53,598,974 outstanding shares of the registrant’s common stock, $0.0001 par value.

DOCUMENTS INCORPORATED BY REFERENCE

The information required in Part III of the Annual Report on Form 10-K is incorporated by reference to the registrant’s definitive proxy statement to be filed pursuant to Regulation 14A for the registrant’s 2016 Annual Meeting of Stockholders.

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”), and in particular, Part II, Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains “forward-looking statements” within the meaning of the safe harbor provisions, 15 U.S.C. § 78u-5, of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts but instead represent the Company’s current assumptions and beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside the Company’s control. The forward-looking statements contained in this Annual Report are based on information available as of the date of this Annual Report. The forward looking statements relate to future industry trends and economic conditions, forecast performance or results of current and future initiatives and the outcome of contingencies and other uncertainties that may have a significant impact on the Company’s business, future operating results and liquidity. These forward-looking statements generally are identified by words such as “anticipate,” “believe,” “estimate,” “continue,”“intend,” “expect,” “plan,” “forecast,” “project”

and similar expressions, or future-tense or conditional constructions such as “will,” “may,” “should,” “could” and “would,” or the negative thereof or other variations thereon or comparable terminology. The Company cautions that these statements are merely predictions and are not to be considered guarantees of future performance. Forward-looking statements are based upon current expectations and assumptions that are subject to risks and uncertainties that can cause actual results to differ materially from those projected, anticipated or implied. A detailed discussion of potential risks and uncertainties that could cause actual results and events to differ materially from forward-looking statements include, but are not limited to, those discussed in Part I, Item 1A – “Risk Factors” of this Annual Report and periodically in future reports filed with the Securities and Exchange Commission (the “SEC”).

The Company has no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events, except as required by law.

ii

PART I

Item 1. Business.

General

Flotek Industries, Inc. (“Flotek” or the “Company”) is a global diversified, technology-driven company that develops and supplies oilfield products, services, and equipment to the oil, gas, and mining industries, and high value compounds to companies that make cleaning products, cosmetics, food and beverages, and other products that are sold in consumer and industrial markets.

The Company was originally incorporated in the Province of British Columbia on May 17, 1985. In October 2001, the Company moved the corporate domicile to Delaware and effected a 120 to 1 reverse stock split by way of a reverse merger with CESI Chemical, Inc. (“CESI”). Since then, the Company has grown through a series of acquisitions and organic growth.

In December 2007, the Company’s common stock began trading on the New York Stock Exchange (“NYSE”) under the stock ticker symbol “FTK.” Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, (the “Exchange Act”) are posted to the Company’s website, www.flotekind.com, as soon as practicable subsequent to electronically filing or furnishing to the SEC. Information contained in the Company’s website is not to be considered as part of any regulatory filing. As used herein, “Flotek,” the “Company,” “we,” “our” and “us” refers to Flotek Industries, Inc. and/or the Company’s wholly owned subsidiaries. The use of these terms is not intended to connote any particular corporate status or relationship.

Recent Developments

In January 2015, the Company acquired 100% of the assets of International Artificial Lift, LLC (“IAL”) for $1.3 million in cash consideration and 60,024 shares of the Company’s common stock. IAL is a development-stage company that specializes in the design, manufacturing and service of next-generation hydraulic pumping units that serve to increase and maximize production for oil and natural gas wells.

In May 2014, the Company launched its FracMax® software technology as a customer marketing tool. This software allows the Company to demonstrate the benefits associated with the use of the Company’s patented and proprietary Complex nano-Fluid® chemistries. The Company has integrated the use of the FracMax® software technology into its sales and marketing activities resulting in a significant increase in customer interest in the Company’s Complex nano-Fluid® chemistries.

In April 2014, the Company acquired 100% of the membership interests in SiteLark, LLC (“SiteLark”) for $0.4 million and 5,327 shares of the Company’s common stock. SiteLark provides reservoir engineering and modeling

services for a variety of hydrocarbon applications. Its services include proprietary software which assists engineers with reservoir simulation, reservoir engineering and waterflood optimization.

In January 2014, the Company acquired 100% of the membership interest in Eclipse IOR Services, LLC (“EOGA”), a leading Enhanced Oil Recovery (“EOR”) design and injection firm. The Company paid $5.3 million, net of cash received, in cash consideration and 94,354 shares of the Company’s Common Stock. EOGA’s enhanced oil recovery processes and its use of polymers to improve the performance of EOR projects has been combined with the Company’s existing EOR products and services.

In November 2013, the Company signed a shareholder agreement with Tasneea Oil and Gas Technologies, LLC (“Tasneea”) an Omani Limited Liability Company, to form Omani based Flotek Gulf, LLC (“Flotek Gulf”) and Flotek Gulf Research, LLC (“Flotek Gulf Research”). During the fourth quarter of 2014, Flotek and Tasneea transferred initial capital into Flotek Gulf and Flotek Gulf Research. The Company continues to evaluate opportunities within the region which may involve the Flotek Gulf and Flotek Gulf Research companies.

In May 2013, the Company acquired Florida Chemical Company, Inc. (“Florida Chemical”) for a total purchase price of $106.4 million. Florida Chemical is one of the world’s largest processors of citrus oils and is a pioneer in solvent, chemistry synthesis, and flavor and fragrance applications from citrus oils. Florida Chemical has been an innovator in creating high performance, bio-based products for a variety of industries, including applications in the oil and gas industry. This acquisition brought a portfolio of high performance renewable and sustainable chemistries that perform well in the oil and gas industry as well as non-energy related markets. The acquisition expanded the Company’s business into consumer and industrial chemistry technologies which provide products for the flavor and fragrance industry and the specialty chemical industry. These technologies are used by food and beverage companies, fragrance companies, and companies providing household and industrial cleaning products.

Description of Operations and Segments

Flotek operates in over 20 domestic and international markets, including the Gulf Coast, Southwest, West Coast, Rocky Mountains, Northeastern, and Mid-Continental regions of the United States (the “U.S.”), Canada, Mexico, Central America, South America, Europe, Africa, Middle East, and Asia-Pacific.

The Company has four strategic business segments: Energy Chemistry Technologies (previously referred to as Energy Chemical Technologies), Consumer and Industrial Chemistry

1

Technologies (previously referred to as Consumer and Industrial Chemical Technologies), Drilling Technologies, and Production Technologies. The Company offers competitive products and services derived from technological advances, some of which are patented, that are responsive to industry demands in both domestic and international markets.

Financial information about operating segments and geographic concentration is provided in Note 18 – “Segment and Geographic Information” in Part II, Item 8 – “Financial Statements and Supplementary Data” of this Annual Report.

Information about the Company’s four operating segments is below.

Energy Chemistry Technologies

(previously referred to as Energy Chemical Technologies)

The Energy Chemistry Technologies (“ECT”) segment designs, develops, manufactures, packages, and markets chemistries for use in oil and gas (“O&G”) well drilling, cementing, completion, stimulation, and production activities designed to maximize recovery in both new and mature fields, including enhanced and improved oil recovery markets. These specialty chemistries possess enhanced performance characteristics and are manufactured to withstand a broad range of downhole pressures, temperatures and other well-specific conditions to be compliant with customer specifications. This segment has technical services laboratories and a research and innovation laboratory that focus on design improvements, development and viability testing of new chemistry formulations, and continued enhancement of existing products. Chemistries branded Complex nano-Fluid® technologies (“CnF® products”) are patented both domestically and internationally and are proven strategically cost-effective performance additives within both oil and natural gas markets. The CnF® product mixtures are environmentally friendly, stable mixtures of oil, water, and surface active agents which organize molecules into nano structures. The combined advantage of solvents, surface active agents and water, and the resultant nano structures, improve well treatment results as compared to the independent use of solvents and surface active agents. CnF® products are composed of renewable, plant derived, cleaning ingredients and oils that are certified as biodegradable. CnF® chemistries help achieve improved operational and financial results for the Company’s customers in low permeability sand and shale reservoirs.

The Logistics division of the Company’s ECT segment designs, operates, and manages automated bulk material handling and loading facilities. The bulk facilities handle dry cement and additives for oil and natural gas well cementing and supply materials used in oilfield operations.

Consumer and Industrial Chemistry Technologies(previously referred to as Consumer and Industrial Chemical Technologies)

The Consumer and Industrial Chemistry Technologies (“CICT”) segment, was added in conjunction with the acquisition of Florida Chemical in May 2013. This segment sources citrus oil domestically and internationally and is one of the largest processors of citrus oils in the world. Products produced from processed citrus oil include (1) high value compounds used as additives by companies in the flavors and fragrances markets and (2) environmentally friendly chemistries for use in the oil & gas industry and numerous other industries around the world. The CICT segment designs, develops, and manufactures products that are sold to companies in the flavor and fragrance industry and specialty chemical industry. These technologies are used within food and beverage, fragrance, and household and industrial cleaning products industries.

Drilling Technologies

The Drilling Technologies segment is a leading provider of downhole drilling tools for use in energy and mining activities. This segment manufactures, rents, sells, inspects, and markets specialized equipment used in drilling, completion, production, and work-over activities. Established tool rental operations are strategically located throughout the United States (the “U.S.”) and in a number of international markets. Rental tools include stabilizers, drill collars, reamers, wipers, jars, shock subs, wireless survey, measurement while drilling (“MWD”) tools, Stemulator® tools, and mud-motors. Equipment sold primarily includes mining equipment, cementing accessories, and drilling motor components. The Company remains focused on product marketing for this segment in all regions of the U.S., as well as in select international markets through both direct and agent-based sales.

Production Technologies

The Production Technologies segment provides pumping system components, electric submersible pumps (“ESPs”), gas separators, production valves, and complementary services. Through the Company’s acquisition of IAL, the Company provides a line of next generation hydraulic pumping units that serve to increase and maximize production for oil and natural gas wells. The Company’s line of artificial lift products satisfy the requirements of traditional oil and natural gas production and coal bed methane markets by assisting natural gas, oil, and other fluids movement from the producing horizon to the surface. The Company’s products are sourced internationally and domestically, assembled at domestic locations, and distributed globally.

2

Seasonality

Overall, operations are not significantly affected by seasonality. While certain working capital components build and recede throughout the year in conjunction with established purchasing and selling cycles that can impact operations and financial position, these cycles have not been significant to date. The performance of certain services within each of the Company’s segments, however, is susceptible to both weather and naturally occurring phenomena, including, but not limited to, the following:

• | the severity and duration of winter temperatures in North America, which impacts natural gas storage levels, drilling activity, and commodity prices; |

• | the timing and duration of the Canadian spring thaw and resulting restrictions that impact activity levels; |

• | the timing and impact of hurricanes upon coastal and offshore operations; |

• | certain Federal land drilling restrictions during identified breeding seasons of protected bird species in key Rocky Mountain coal bed methane producing regions. These restrictions generally have a negative impact on Production Technologies operations in the first or second quarters of the year; and |

• | adverse weather in Florida and Brazil can impact the availability of citrus oils for the CICT business unit. |

Product Demand and Marketing

Demand for the Company’s products and services is dependent on levels of conventional and non-conventional oil and natural gas well drilling and production, both domestically and internationally. Products are marketed directly to customers through the Company’s direct sales force and through certain contractual agency arrangements. Established customer relationships provide repeat sales opportunities within all segments. While the Company’s primary marketing efforts remain focused in North America, a growing amount of resources and effort are focused on emerging international markets, especially in the Middle East and North Africa (“MENA”) as well as South America. In addition to direct marketing and relationship development, the Company also markets products and services through the use of third party agents in Mexico, Central America, South America, Europe, Africa, the Middle East, and Asia-Pacific.

Customers

The Company’s customers primarily include major integrated oil and natural gas companies, oilfield service companies, independent oil and natural gas companies, pressure pumping service companies, international supply chain management companies, national and state-owned oil companies, household and commercial cleaning product companies, fragrance and cosmetic companies, and food manufacturing companies. The Company had two major customers for the year ended December 31, 2015, which accounted for 14% and 12% of consolidated revenue, and one major customer for the years ended December 31, 2014, and 2013, which accounted

for 16% and 16% of consolidated revenue, respectively. In aggregate, the Company’s largest three customers collectively accounted for 35%, 29%, and 30% of consolidated revenue for the years ended December 31, 2015, 2014, and 2013, respectively.

Research and Innovation

The Company is engaged in research and innovation activities focused on the design of reservoir specific, customized chemistries in the ECT segment and improvement of existing products and services, and development of new products, processes, and services throughout all segments. For the years ended December 31, 2015, 2014, and 2013, the Company incurred $7.5 million, $5.0 million, and $3.8 million, respectively, of research and innovation expense. In 2015, research and innovation expense was approximately 2.2% of consolidated revenue. The Company expects that its 2016 research and innovation investment will increase in anticipation of the growth of the business.

Backlog

Due to the nature of the Company’s contractual customer relationships and the way they operate, the Company has historically not had significant backlog order activity.

Intellectual Property

The Company’s policy is to protect its intellectual property, both within and outside of the U.S. The Company considers patent protection for all products and methods deemed to have commercial significance and that may qualify for patent protection. The decision to pursue patent protection is dependent upon several factors, including whether patent protection can be obtained, cost-effectiveness, and alignment with operational and commercial interests. The Company believes its patent and trademark portfolio, combined with confidentiality agreements, trade secrets, proprietary designs, and manufacturing and operational expertise, are necessary and appropriate to protect its intellectual property and ensure continued strategic advantages. The Company currently has 19 issued patents and over six dozen pending patent applications filed in the U.S. and abroad on various chemical compositions and methods, downhole tools, production technologies, and software methods. In addition, the Company currently has 41 registered trademarks and over four dozen pending trademark applications filed in the U.S. and abroad, covering a variety of its goods and services.

Competition

The ability to compete in the oilfield services industry and the consumer and industrial markets is dependent upon the Company’s ability to differentiate its products and services, provide superior quality and service, and maintain a competitive cost structure. Activity levels in the oil field services industry are impacted by current and expected oil and natural gas prices, oil and natural gas drilling activity, production levels, and customer drilling and production designated capital spending. Domestic and international

3

regions in which Flotek operates are highly competitive. The unpredictability of the energy industry and commodity price fluctuations create both increased risk and opportunity for the products and services of both the Company and its competitors.

Certain oil and natural gas service companies competing with the Company are larger and have access to more resources. Such competitors could be better situated to withstand industry downturns, compete on the basis of price, and acquire and develop new equipment and technologies, all of which could affect the Company’s revenue and profitability. Oil and natural gas service companies also compete for customers and strategic business opportunities. Thus, competition could have a detrimental impact upon the Company’s business.

The citrus-based terpene (d-limonene) is a major feedstock for many of the Company’s CnF® chemistries. In addition, the Company utilizes naturally derived terpenes from other sources and bio-based solvents from other natural sources when it determines the efficacy of such formulas is appropriate. The Company has the ability to purify these alternative solvents to remove trace amounts of “BTEX” (benzene, toluene, ethylbenzene, and xylene) and other contaminants to ensure they meet Flotek’s rigorous environmental standards.

The Company faces competition from other citrus processors and other solvent sources. Other terpenes can provide an effective substitute to the Company’s citrus-based terpenes, although, without refinement, are generally of lower quality. Such terpenes can be cheaper than citrus terpenes, but, as noted above, can contain “BTEX” compounds (benzene, toluene, ethylbenzene, and xylenes) and other compounds that have varying degrees of toxicity. The Company’s chemistries are intended to replace these undesirable qualities. Management believes that environmental constituents will continue to promote “BTEX” substitutes, which diminishes the threat of substitution in ecologically sensitive applications from these competitors.

Raw Materials

Materials and components used in the Company’s servicing and manufacturing operations, as well as those purchased for sale, are generally available on the open market from multiple sources. Collection and transportation of raw materials to Company facilities, however, could be adversely affected by extreme weather conditions. Additionally, certain raw materials used by the Chemistries segments are available from limited sources. Disruptions to suppliers could materially impact sales. The prices paid for raw materials vary based on energy, steel, citrus, and other commodity price fluctuations, tariffs, duties on imported materials, foreign currency exchange rates, business cycle position and global demand. Higher prices for chemistries, steel, citrus, and other raw materials could adversely impact future sales and contract fulfillments.

The Company is diligent in its efforts to identify alternate suppliers, in its contingency planning for potential supply shortages, and in its proactive efforts to reduce costs through competitive bidding practices. When able, the Company uses multiple suppliers, both domestically and internationally, to purchase raw materials on the open market.

Drilling Technologies maintains a three to six month supply of mud-motor inventory parts sourced from international and domestic suppliers, and Drilling Technologies and Production Technologies maintain parts necessary to meet forecast demand. The Company’s inventory levels are maintained to accommodate the lead time required to secure parts to avoid disruption of service to customers.

Citrus greening disease has adversely affected the availability of citrus crops around the world, thereby negatively impacting the supply and increasing the price of citrus terpenes. The Company’s market position, inventory, and forward purchases helps ensure availability for its patented CnF® technologies, as well as its existing customer base within CICT. As mentioned previously, the Company has also developed new CnF® formulations utilizing alternative solvents. These new formulations not only diversify the Company’s dependence on citrus terpenes, but they also provide certain performance benefits necessary for specific customer and reservoir challenges.

Government Regulations

The Company is subject to federal, state, and local environmental, occupational safety, and health laws and regulations within the U.S. and other countries in which the Company does business. The Company strives to ensure full compliance with all regulatory requirements and is unaware of any material instances of noncompliance. In the U.S., the Company must comply with laws and regulations which include, among others:

• | the Comprehensive Environmental Response, Compensation and Liability Act; |

• | the Resource Conservation and Recovery Act; |

• | the Federal Water Pollution Control Act; |

• | the Toxic Substances Control Act; and |

• | the Affordable Care Act. |

In addition to U.S. federal laws and regulations, the Company does business in other countries which have extensive environmental, legal, and regulatory requirements. Laws and regulations strictly govern the manufacture, storage, handling, transportation, use, and sale of chemistry products. The Company evaluates the environmental impact of its actions and attempts to quantify the cost of remediating contaminated property in order to maintain compliance with regulatory requirements and identify and avoid potential liability. Several products of the Energy Chemistry Technologies’ and Consumer and Industrial Chemistry Technologies’ segments are considered hazardous or flammable. In the event of a leak

4

or spill in association with Company operations, the Company could be exposed to risk of material cost, net of insurance proceeds, to remediate any contamination.

From time to time, the Company may be party in environmental litigation and claims, including remediation of properties owned or operated. No environmental litigation or claims are currently being litigated. The Company does not expect that costs related to known remediation requirements will have a significant adverse effect on the Company’s consolidated financial position or results of operations.

Employees

At December 31, 2015, the Company had 534 employees, exclusive of existing worldwide agency relationships. None of the Company’s employees are covered by a collective bargaining agreement and labor relations are generally positive. Certain international locations have staffing or work arrangements that are contingent upon local work councils or other regulatory approvals.

Available Information and Website

The Company’s website is accessible at www.flotekind.com. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available (see the “Investor Relations” section of the Company’s website), as soon as reasonably practicable, subsequent to electronically filing or otherwise

providing reports to the SEC. Corporate governance materials, guidelines, by-laws, and code of business conduct and ethics are also available on the website. A copy of corporate governance materials is available upon written request to the Company.

All material filed with the SEC’s “Public Reference Room” at 100 F Street NE, Washington, DC 20549 is available to be read or copied. Information regarding the “Public Reference Room” can be obtained by contacting the SEC at 1-800-SEC-0330. Further, the SEC maintains the www.sec.gov website, which contains reports and other registrant information filed electronically with the SEC.

The 2015 Annual Chief Executive Officer Certification required by the NYSE was submitted on April 8, 2015. The certification was not qualified in any respect. Additionally, the Company has filed all principal executive officer and financial officer certifications as required under Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 with this Annual Report. Information with respect to the Company’s executive officers and directors is incorporated herein by reference to information to be included in the proxy statement for the Company’s 2016 Annual Meeting of Stockholders.

The Company has disclosed and will continue to disclose any changes or amendments to the Company’s code of business conduct and ethics as well as waivers to the code of ethics applicable to executive management by posting such changes or waivers on the Company’s website.

Item 1A. Risk Factors.

The Company’s business, financial condition, results of operations and cash flows are subject to various risks and uncertainties. Readers of this report should not consider any descriptions of these risk factors to be a complete set of all potential risks that could affect Flotek. These factors should be carefully considered together with the other information contained in this Report and the other reports and materials filed by us with the SEC. Further, many of these risks are interrelated and, as a result, the occurrence of certain risks could trigger and/or exacerbate other risks. Such a combination could materially increase the severity of the impact of these risks on our business, results of operations, financial condition, or liquidity.

This Annual Report contains “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements discuss Company prospects, expected revenue, expenses and profits, strategic and operational initiatives, and other activities. Forward-looking statements also contain suppositions regarding future oil and natural gas industry conditions within both domestic and international market economies. The Company’s results could differ materially from those anticipated in the forward-looking statements as a result of a variety of factors, including risks described below

and elsewhere. See “Forward-Looking Statements” at the beginning of this Annual Report.

Risks Related to the Company’s Business

The Company’s business is dependent upon domestic and international oil and natural gas industry spending. Spending could be adversely affected by industry conditions or by new or increased governmental regulations beyond the Company’s control.

The Company is dependent upon customers’ willingness to make operating and capital expenditures for exploration, development and production of oil and natural gas in both North American and global markets. Customers’ expectations of a decline in future oil and natural gas market prices could result in curtailed spending thereby reducing demand for the Company’s products and services. Industry conditions are influenced by numerous factors over which the Company has no control, including the supply of and demand for oil and natural gas, domestic and international economic conditions, political instability in oil and natural gas producing countries and merger and divestiture activity among oil and natural gas producers. The volatility of oil and natural gas prices and the consequential effect on exploration and production activity could adversely impact the activity levels of the Company’s

5

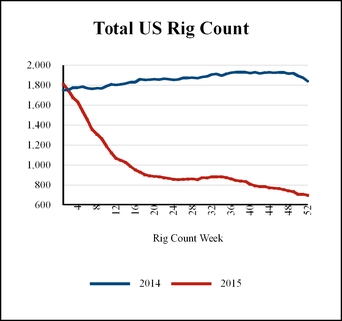

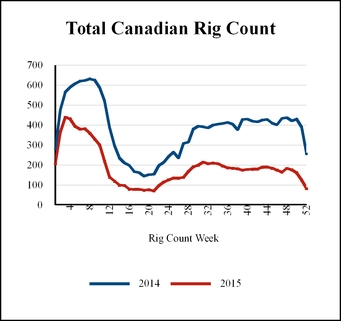

customers. One indicator of drilling and production spending is fluctuation in rig count, which the Company actively monitors to gauge market conditions and forecast product and service demand. A reduction in drilling activity could cause a decline in the demand for, or negatively affect the price of, some of the Company’s products and services. Domestic demand for oil and natural gas could also be uniquely affected by public attitude regarding drilling in environmentally sensitive areas, vehicle emissions and other environmental standards, alternative fuels, taxation of oil and gas, perception of “excess profits” of oil and gas companies, and anticipated changes in governmental regulation and policy.

Demand for a significant number of the Company’s products and services is dependent on the level of expenditures within the oil and natural gas industry. If current global economic conditions and the availability of credit worsen or oil and natural gas prices weaken for an extended period of time, reductions in customers’ expenditures could have a significant adverse effect on revenue, margins and overall operating results.

The global economic environment could impact worldwide demand for energy. Crude oil and natural gas prices are inherently volatile. A substantial or extended decline in oil or natural gas prices could impact customers’ spending for the Company’s products and services. Demand for the Company’s products and services is dependent upon the level of expenditures within the oil and gas industry for exploration, development and production of crude oil and natural gas reserves. Expenditures are sensitive to oil and natural gas prices, as well as the industry’s outlook regarding future oil and natural gas prices.

The price for oil and natural gas is subject to a variety of factors, including, but not limited to:

• | Global demand for energy as a result of population growth, economic development, and general economic and business conditions; |

• | the ability of the Organization of Petroleum Exporting Countries (“OPEC”) to set and maintain production levels and the impact of non-OPEC producers on global supply; |

• | availability and quantity of natural gas storage; |

• | import and export volumes and pricing of liquefied natural gas; |

• | pipeline capacity to critical markets; |

• | political and economic uncertainty and socio-political unrest; |

• | cost of exploration, production and transport of oil and natural gas; |

• | technological advances impacting energy production and consumption; and |

• | weather conditions. |

Increased competition could also exert downward pressure on prices charged for the Company’s products and services.

Volatile economic conditions could weaken customer exploration and production expenditures, causing reduced demand for the Company’s products and services and a significant adverse effect on the Company’s operating results. It is difficult to predict the pace of industry growth, the direction of oil and natural gas prices, the direction and magnitude of economic activity, and to what extent these conditions could affect the Company. However, reduced cash flow and capital availability could adversely impact the financial condition of the Company’s customers, which could result in customer project modifications, delays or cancellations, general business disruptions, and delay in, or nonpayment of, amounts that are owed to the Company. This could cause a negative impact on the Company’s results of operations and cash flows.

Furthermore, if certain of the Company’s suppliers were to experience significant cash flow constraints or become insolvent as a result of such conditions, a reduction or interruption in supplies or a significant increase in the price of supplies could occur, adversely impacting the Company’s results of operations and cash flows.

The Company’s revolving credit facility and term loan have variable interest rates that could increase.

At December 31, 2015, the Company had a $75 million revolving credit facility commitment subject to collateral availability limits. The interest rate on advances under the revolving credit facility varies based on the level of borrowing. Rates range (a) between PNC Bank’s base lending rate plus 0.5% to 1.0% or (b) between the London Interbank Offered Rate (LIBOR) plus 1.5% to 2.0%. The Company is required to pay a monthly facility fee of 0.25% on any unused amount under the commitment based on daily averages. The current credit facility remains in effect until May 10, 2018.

The Company borrowed $50.0 million under a term loan on May 10, 2013. The interest rate on the term loan varies based on the level of borrowing under the revolving credit facility. Rates range (a) between PNC Bank’s base lending rate plus 1.25% to 1.75% or (b) between the London Interbank Lending Rate (LIBOR) plus 2.25% to 2.75%.

There can be no assurance that the revolving credit facility and the term loan will not experience significant interest rate increases.

Network disruptions, security threats and activity related to global cyber-crime pose risks to our key operational, reporting and communication systems.

The company relies on access to information systems for its operations. Failures of or interference with access to these systems, such as network communications disruptions could have an adverse effect on our ability to conduct operations or directly impact consolidated reporting. Security breaches pose a risk to confidential data and intellectual property which could result in damages to our competitiveness and reputation. The company has policies and procedures in place, including

6

system monitoring and data back-up processes, to prevent or mitigate the effects of these potential disruptions or breaches, however there can be no assurance that existing or emerging threats will not have an adverse impact on our systems or communications networks.

If the Company does not manage the potential difficulties associated with expansion successfully, the Company’s operating results could be adversely affected.

The Company has grown over the last several years through internal growth, strategic alliances, and strategic business and asset acquisitions. The Company believes future success will depend, in part, on the Company’s ability to adapt to market opportunities and changes and to successfully integrate the operations of any businesses acquired. Factors that could result in strategic business difficulties include, but are not limited to:

• | lack of experienced management personnel; |

• | increased administrative burdens; |

• | lack of customer retention; |

• | technological obsolescence; |

• | infrastructure, technological, communication and logistical problems associated with large, expansive operations; and |

• | failure to effectively integrate acquisitions, joint ventures or strategic alliances. |

If the Company fails to manage potential difficulties successfully, including increased costs associated with growth, the Company’s operating results could be adversely impacted.

The Company’s ability to grow and compete could be adversely affected if adequate capital is not available.

The ability of the Company to grow and be competitive in the market place is dependent on the availability of adequate capital. Access to capital is dependent, in large part, on the Company’s cash flows and the availability of and access to equity and debt financing. The Company’s term and revolving loan agreements with its bank require approval and place limits on certain capital transactions and various business acquisitions and combinations. The Company cannot guarantee that cash flows will be sufficient, or that the Company will continue to be able to obtain equity or debt financing on acceptable terms, or at all. As a result, the Company may not be able to finance strategic growth plans, take advantage of business opportunities, or to respond to competitive pressures.

The Company’s inability to develop and/or introduce new products or differentiate existing products could have an adverse effect on its ability to be responsive to customers’ needs and could result in a loss of customers, as well as adversely affecting the Company’s future success and profitability.

The oil and natural gas industry is characterized by technological advancements that have historically resulted in, and will likely continue to result in, substantial improvements in the scope and quality of oilfield chemistries, drilling and artificial lift products and services function and performance. Consequently, the Company’s future success is dependent, in part, upon the Company’s continued ability to timely develop innovative products and services. Increasingly sophisticated customer needs and the ability to anticipate and respond to technological and operational advances in the oil and natural gas industry is critical. If the Company fails to successfully develop and introduce innovative products and services that appeal to customers, or if existing or new market competitors develop superior products and services, the Company’s revenue and profitability could deteriorate.

Consumer and industrial chemistry markets that purchase the Company’s citrus-based products are largely influenced by consumer preference and regulatory requirements. While citrus-based beverage flavorings, retail cleaning products, and fine fragrances perpetually rank high in consumer surveys, the Company’s continued success requires new product innovation to keep pace with consumer trends and regulatory issues. If the Company fails to provide innovative products and services to its customers or to introduce performance products that comply with new environmental regulations, the Company’s financial performance could be impacted.

The Company may pursue strategic acquisitions, which could have an adverse impact on the Company’s business.

The Company’s past and potential future acquisitions involve risks that could adversely affect the Company’s business. Negotiations of potential acquisitions or integration of newly acquired businesses could divert management’s attention from other business concerns as well as be cost prohibitive and time consuming. Acquisitions could also expose the Company to unforeseen liabilities or risks associated with new markets or businesses. Unforeseen operational difficulties related to acquisitions could result in diminished financial performance or require a disproportionate amount of the Company’s management’s attention and resources. Additionally, acquisitions could result in the commitment of capital resources without the realization of anticipated returns.

Unforeseen contingencies such as litigation could adversely affect the Company’s financial condition.

The Company is, and from time to time may become, a party to legal proceedings incidental to the Company’s business involving alleged injuries arising from the use of Company products, exposure to hazardous substances, patent infringement, employment matters, commercial disputes, and shareholder lawsuits. The defense of these lawsuits may require significant expenses, divert management’s attention, and may require the Company to pay damages that could adversely affect the Company’s financial condition. In addition, any insurance or indemnification rights that the Company may have may be insufficient or unavailable to protect against potential loss exposures.

7

The Company’s current insurance policies may not adequately protect the Company’s business from all potential risks.

The Company’s operations are subject to risks inherent in the oil and natural gas industry, such as, but not limited to, accidents, blowouts, explosions, fires, severe weather, oil and chemical spills, and other hazards. These conditions can result in personal injury or loss of life, damage to property, equipment and the environment, as well as suspension of customers’ oil and gas operations. These events could result in damages requiring costly repairs, the interruption of Company business, including the loss of revenue and profits, and/or the Company being named as a defendant in lawsuits asserting large claims. The Company maintains insurance coverage it believes is adequate and customary to the oil and natural gas services industry to mitigate liabilities associated with these potential hazards. The Company does not have insurance against all foreseeable risks, either because insurance is not available or is cost-prohibitive. Consequently, losses and liabilities arising from uninsured or underinsured events could have an adverse effect on the Company’s business, financial condition, and results of operations.

The Company is subject to complex foreign, federal, state and local environmental, health and safety laws and regulations, which expose the Company to liabilities that could adversely affect the Company’s business, financial condition, and results of operations.

The Company’s operations are subject to foreign, federal, state, and local laws and regulations related to, among other things, the protection of natural resources, injury, health and safety considerations, waste management, and transportation of waste and other hazardous materials. The Company’s operations expose the Company to risks of environmental liability that could result in fines, penalties, remediation, property damage, and personal injury liability. In order to remain compliant with laws and regulations, the Company maintains permits, authorizations and certificates as required from regulatory authorities. Sanctions for noncompliance with such laws and regulations could include assessment of administrative, civil and criminal penalties, revocation of permits, and issuance of corrective action orders.

The Company could incur substantial costs to ensure compliance with existing and future laws and regulations. Laws protecting the environment have generally become more stringent and are expected to continue to evolve and become more complex and restrictive into the future. Failure to comply with applicable laws and regulations could result in material expense associated with future environmental compliance and remediation. The Company’s costs of compliance could also increase if existing laws and regulations are amended or reinterpreted. Such amendments or reinterpretations of existing laws or regulations, or the adoption of new laws or regulations, could curtail exploratory or developmental drilling for, and production of, oil and natural gas which, in turn, could limit demand for the Company’s products and services. Some environmental laws and regulations could also

impose joint and strict liability, meaning that the Company could be exposed in certain situations to increased liabilities as a result of the Company’s conduct that was lawful at the time it occurred or conduct of, or conditions caused by, prior operators or other third parties. Remediation expense and other damages arising as a result of such laws and regulations could be substantial and have a material adverse effect on the Company’s financial condition and results of operations.

Material levels of the Company’s revenue are derived from customers engaged in hydraulic fracturing services, a process that creates fractures extending from the well bore through the rock formation to enable natural gas or oil to flow more easily through the rock pores to a production well. Some states have adopted regulations which require operators to publicly disclose certain non-proprietary information. These regulations could require the reporting and public disclosure of the Company’s proprietary chemistry formulas. The adoption of any future federal or state laws or local requirements, or the implementation of regulations imposing reporting obligations on, or otherwise limiting, the hydraulic fracturing process, could increase the difficulty of oil and natural gas well production activity and could have an adverse effect on the Company’s future results of operations.

Regulation of greenhouse gases and/or climate change could have a negative impact on the Company’s business.

Certain scientific studies have suggested that emissions of certain gases, commonly referred to as “greenhouse gases,” which include carbon dioxide and methane, may be contributory to the warming effect of the Earth’s atmosphere and other climatic changes. In response to such studies, the issue of climate change and the effect of greenhouse gas emissions, in particular emissions from fossil fuels, is attracting increasing worldwide attention. Legislative and regulatory measures to address greenhouse gas emissions have not yet been finalized as of the date of this Annual Report but remain impactive across international, national, regional, and state levels.

Existing or future laws, regulations, treaties, or international agreements related to greenhouse gases and climate change, including energy conservation or alternative energy incentives, could have a negative impact on the Company’s operations, if regulations resulted in a reduction in worldwide demand for oil and natural gas or global economic activity. Other results could be increased compliance costs and additional operating restrictions, each of which could have a negative impact on the Company’s operations.

Changes in regulatory compliance obligations of critical suppliers may adversely impact our operations.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), signed into law on July 21, 2010, includes Section 1502, which requires the Securities and Exchange Commission to adopt additional disclosure requirements related to certain minerals sourced from the Democratic Republic of Congo and surrounding countries, or

8

“conflict minerals,” for which such conflict minerals are necessary to the functionality of a product manufactured, or contracted to be manufactured, by an SEC-reporting company. The metals covered by these rules, which were adopted on August 22, 2012, include tin, tantalum, tungsten and gold. The Company and Company suppliers use some of these materials in their production processes.

In 2014, the Company established management systems and processes and completed due diligence in compliance with the requirements of Section 1502. In May 2014 the Company filed its first annual Conflict Minerals Report with the SEC. Future requirements for conducting Conflict Minerals due diligence may result in significant increased costs to the Company. Furthermore, failure of key suppliers to provide evidence of conflict free materials could impact the Company’s ability to acquire key raw materials and/or result in higher costs for those raw materials.

If the Company is unable to adequately protect intellectual property rights or is found to infringe upon the intellectual property rights of others, the Company’s business is likely to be adversely affected.

The Company relies on a combination of patents, trademarks, copyrights, trade secrets, non-disclosure agreements, and other security measures to establish and protect the Company’s intellectual property rights. Although the Company believes that existing measures are reasonably adequate to protect intellectual property rights, there is no assurance that the measures taken will prevent misappropriation of proprietary information or dissuade others from independent development of similar products or services. Moreover, there is no assurance that the Company will be able to prevent competitors from copying, reverse engineering, modifying, or otherwise obtaining and/or using the Company’s technology and proprietary rights to create competitive products or services. The Company may not be able to enforce intellectual property rights outside of the U.S. Furthermore, the laws of certain countries in which the Company’s products and services are manufactured or marketed may not protect the Company’s proprietary rights to the same extent as do the laws of the U.S. Finally, other third parties may infringe, challenge, invalidate, or circumvent the Company’s patents, trademarks, copyrights and trade secrets. In each case, the Company’s ability to compete could be significantly impaired.

A portion of the Company’s products and services are without patent protection. The issuance of a patent does not guarantee validity or enforceability. The Company’s patents may not necessarily be valid or enforceable against third parties. The issuance of a patent does not guarantee that the Company has the right to use the patented invention. Third parties may have blocking patents that could be used to prevent the Company from marketing the Company’s own patented products and services and utilizing the Company’s patented technology.

The Company is exposed and may be exposed to allegations of patent and other intellectual property infringement from

others. The Company may allege infringement of its patents and other intellectual property rights against others. Under either scenario, the Company could become involved in costly litigation or other legal proceedings regarding its patent or other intellectual property rights, from both an enforcement and defensive standpoint. Even if the Company chooses to enforce its patent or other intellectual property rights against a third party, there may be risk that the Company’s patent or other intellectual property rights become invalidated or otherwise unenforceable through legal proceedings. If intellectual property infringement claims are asserted against the Company, the Company could defend itself from such assertions or could seek to obtain a license under the third party’s intellectual property rights in order to mitigate exposure. In the event the Company cannot obtain a license, third parties could file lawsuits or other legal proceedings against the Company, seeking damages (including treble damages) or an injunction against the manufacture, use, sale, offer for sale, or importation of the Company’s products and services. These could result in the Company having to discontinue the use, manufacture, and sale of certain products and services, increase the cost of selling certain products and services, or result in damage to the Company’s reputation. An award of damages, including material royalty payments, or the entry of an injunction order against the use, manufacture, and sale of any of the Company’s products and services found to be infringing, could have an adverse effect on the Company’s results of operations and ability to compete.

The Company and the Company’s customers are subject to risks associated with doing business outside of the U.S., including political risk, foreign exchange risk and other uncertainties.

Revenue from the sale of products to customers outside the U.S. has been steadily increasing. The Company and its customers are subject to risks inherent in doing business outside of the U.S., including, but not limited to:

• | governmental instability; |

• | corruption; |

• | war and other international conflicts; |

• | civil and labor disturbances; |

• | requirements of local ownership; |

• | partial or total expropriation or nationalization; |

• | currency devaluation; and |

• | foreign laws and policies, each of which can limit the movement of assets or funds or result in the deprivation of contractual rights or appropriation of property without fair compensation. |

Collections and recovery of rental tools from international customers and agents could also prove difficult due to inherent uncertainties in foreign law and judicial procedures. The Company could experience significant difficulty with collections or recovery due to the political or judicial climate in foreign countries where Company operations occur or in which the Company’s products are used.

9

The Company’s international operations must be compliant with the Foreign Corrupt Practices Act (the “FCPA”) and other applicable U.S. laws. The Company could become liable under these laws for actions taken by employees or agents. Compliance with international laws and regulations could become more complex and expensive thereby creating increased risk as the Company’s international business portfolio grows. Further, the U.S. periodically enacts laws and imposes regulations prohibiting or restricting trade with certain nations. The U.S. government could also change these laws or enact new laws that could restrict or prohibit the Company from doing business in identified foreign countries. The Company conducts, and will continue to conduct business in currencies other than the U.S. dollar. Historically, the Company has not hedged against foreign currency fluctuations. Accordingly, the Company’s profitability could be affected by fluctuations in foreign exchange rates.

The Company has no control over, and can provide no assurances that future laws and regulations will not materially impact the Company’s ability to conduct international business.

The loss of key customers could have an adverse impact on the Company’s results of operations and could result in a decline in the Company’s revenue.

The Company has critical customer relationships which are dependent upon production and development activity related to a handful of customers. Revenue derived from the Company’s three largest customers as a percentage of consolidated revenue for the years ended December 31, 2015, 2014, and 2013, totaled 35%, 29%, and 30%, respectively. Customer relationships are historically governed by purchase orders or other short-term contractual obligations as opposed to long-term contracts. The loss of one or more key customers could have an adverse effect on the Company’s results of operations and could result in a decline in the Company’s revenue.

Failure to collect for goods and services sold to key customers could have an adverse effect on the Company’s financial results, liquidity and cash flows.

The Company performs credit analysis on potential customers; however credit analysis does not provide full assurance that customers will be willing and/or able to pay for goods and services purchased from the Company. Furthermore, collectability of international sales can be subject to the laws of foreign countries which may provide more limited protection to the Company in the event of a dispute over payment. Since sales to domestic and international customers are generally made on an unsecured basis, there can be no assurance of collectability. If one or more major customers are unwilling or unable to pay its debts to the Company, it could have an adverse effect of the Company’s financial results, liquidity and cash flows.

Loss of key suppliers, the inability to secure raw materials on a timely basis, or the Company’s inability to pass

commodity price increases on to customers could have an adverse effect on the Company’s ability to service customer’s needs and could result in a loss of customers.

Materials used in servicing and manufacturing operations as well as those purchased for sale are generally available on the open market from multiple sources. Acquisition costs and transportation of raw materials to Company facilities have historically been impacted by extreme weather conditions. Certain raw materials used by the Energy Chemistries Technologies segment are available only from limited sources; accordingly, any disruptions to critical suppliers’ operations could adversely impact the Company’s operations. Prices paid for raw materials could be affected by energy, steel and other commodity prices; tariffs and duties on imported materials; foreign currency exchange rates; phases of the general business cycle and global demand. The Drilling Technologies and Production Technologies segments purchase critical raw materials on the open market and, where able, from multiple suppliers, both domestically and internationally.

The Company maintains a three- to six-month supply of critical mud-motor inventory parts that the Company sources from China. This inventory stock position approximates the lead time required to secure these parts in order to avoid disruption of service to the Company’s customers. The Company’s inability to secure reasonably priced critical inventory parts in a timely manner would adversely affect the Company’s ability to provide service to potential customers. The Company sources the vast majority of motor parts from a national supplier. The Company is actively managing and developing relationships with back-up parts and service suppliers.

The Company currently does not hedge commodity prices. The Company may be unable to pass along price increases to its customers, which could result in a decline in revenue or operating profits.

If the Company loses the services of key members of management, the Company may not be able to manage operations and implement growth strategies.

The Company depends on the continued service of the Chief Executive Officer and President, the Chief Financial Officer, the Executive Vice President, Operations, the Executive Vice President, Research and Development, and other key members of the executive management team, who possess significant expertise and knowledge of the Company’s business and industry. Furthermore, the Chief Executive Officer and President serves as Chairman of the Board of Directors. The Company has entered into employment agreements with all of these key members; however, at December 31, 2015 the Company only carries key man life insurance for the Chief Executive Officer and the Executive Vice President of Operations. Any loss or interruption of the services of key members of the Company’s management could significantly reduce the Company’s ability to manage operations effectively and implement strategic business initiatives. The Company

10

can provide no assurance that appropriate replacements for key positions could be found should the need arise.

Failure to maintain effective disclosure controls and procedures and internal controls over financial reporting could have an adverse effect on the Company’s operations and the trading price of the Company’s common stock.

Effective internal controls are necessary for the Company to provide reliable financial reports, effectively prevent fraud and operate successfully as a public company. If the Company cannot provide reliable financial reports or effectively prevent fraud, the Company’s reputation and operating results could be harmed. If the Company is unable to maintain effective disclosure controls and procedures and internal controls over financial reporting, the Company may not be able to provide reliable financial reports, which in turn could affect the Company’s operating results or cause the Company to fail to meet its reporting obligations. Ineffective internal controls could also cause investors to lose confidence in reported financial information, which could negatively affect the trading price of the Company’s common stock, limit the ability of the Company to access capital markets in the future, and require additional costs to improve internal control systems and procedures.

The Company’s tax returns are subject to audit by tax authorities. Taxing authorities may make claims for back taxes, interest, and penalties.

The Company is subject to income, property, excise, employment, and other taxes in the U.S. and a variety of other jurisdictions around the world. Tax rules and regulations in the U.S. and around the world are complex and subject to interpretation. From time to time, taxing authorities conduct audits of the Company’s tax filings and may make claims for increased taxes and, in some case, assess interest and penalties. The assessments for back taxes, interest, and penalties could be significant. If the Company is unsuccessful in contesting these claims, the resulting payments could result in a drain on the Company’s capital resources and liquidity.

Risks Related to the Company’s Industry

General economic declines (recessions) and limits to credit availability could have an adverse effect on exploration and production activity and result in lower demand for the Company’s products and services.

Continued worldwide financial and credit uncertainty can reduce the availability of liquidity and credit markets to fund the continuation and expansion of industrial business operations worldwide. The shortage of liquidity and credit combined with pressure on worldwide equity markets could continue to impact the worldwide economic climate. Unrest in the Middle East or other regions of the world may also impact demand for the Company’s products and services both domestically and internationally.

Demand for the Company’s products and services is dependent on oil and natural gas industry activity and expenditure levels that are directly affected by trends in oil and natural gas prices. Demand for the Company’s products and services is particularly sensitive to levels of exploration, development, and production activity of, and the corresponding capital spending by, oil and natural gas companies, including national oil companies. One indication of drilling and production activity and spending is rig count, which the Company monitors to gauge market conditions. Any prolonged reduction in oil and natural gas prices or drop in rig count could depress current levels of exploration, development, and production activity. Perceptions of longer-term lower oil and natural gas prices by oil and natural gas companies could similarly reduce or defer major expenditures given the long-term nature of many large-scale development projects. Lower levels of activity could result in a corresponding decline in the demand for the Company’s oil and natural gas well products and services, which could have a material adverse effect on the Company’s revenue and profitability.

The Company’s consumer and industrial customers would be adversely affected if economic activity decreased dramatically. The Company’s primary product is often used to replace less desirable solvents in numerous consumer and industrial applications and is often more expensive than other materials. As economic activity decreases, consumer and industrial companies not only consume less solvent, they also may relax their environmental preferences and purchase cheaper solvents. The Company’s revenue and profitability could be negatively impacted if demand softens because of weak economic activity.

Events in global credit markets can significantly impact the availability of credit and associated financing costs for many of the Company’s customers. Many of the Company’s customers finance their drilling and production programs through third-party lenders or public debt offerings. Lack of available credit or increased costs of borrowing could cause customers to reduce spending on drilling programs, thereby reducing demand and potentially resulting in lower prices for the Company’s products and services. Also, the credit and economic environment could significantly impact the financial condition of some customers over a prolonged period, leading to business disruptions and restricted ability to pay for the Company’s products and services. The Company’s forward-looking statements assume that the Company’s lenders, insurers, and other financial institutions will be able to fulfill their obligations under various credit agreements, insurance policies, and contracts. If any of the Company’s significant lenders, insurers and others are unable to perform under such agreements, and if the Company was unable to find suitable replacements at a reasonable cost, the Company’s results of operations, liquidity, and cash flows could be adversely impacted.

11

A continuing period of depressed oil and natural gas prices could result in further reductions in demand for the Company’s products and services and adversely affect the Company’s business, financial condition, and results of operations.

The markets for oil and natural gas have historically been volatile. Such volatility in oil and natural gas prices, or the perception by the Company’s customers of unpredictability in oil and natural gas prices, could adversely affect spending. The oil and natural gas markets may be volatile in the future. The demand for the Company’s products and services is, in large part, driven by general levels of exploration and production spending and drilling activity by its customers. Recent decreases in oil and natural gas prices have caused a decline in exploration and drilling activities, and a continuing period of depressed oil and gas prices or further decreases could cause further declines in exploration and production activities. This, in turn, could result in lower demand in the future for the Company’s products and services and could result in lower prices for the Company’s products and services. Further declines in oil or natural gas prices could adversely affect the Company’s business, financial condition, and results of operations.

New and existing competitors within the Company’s industries could have an adverse effect on results of operations.

The oil and natural gas industry is highly competitive. The Company’s principal competitors include numerous small companies capable of competing effectively in the Company’s markets on a local basis, as well as a number of large companies that possess substantially greater financial and other resources than does the Company. Larger competitors may be able to devote greater resources to developing, promoting and selling products and services. The Company may also face increased competition due to the entry of new competitors including current suppliers that decide to sell their products and services directly to the Company’s customers. As a result of this competition, the Company could experience lower sales or greater operating costs, which could have an adverse effect on the Company’s margins and results of operations.

Regulatory pressures, environmental activism, and legislation could result in reduced demand for the Company’s products and services, increase the Company’s costs, and adversely affect the Company’s business, financial condition, and results of operations.

Regulations restricting volatile organic compounds (“VOC”) exist in many states and/or communities which limit demand for certain products. Although citrus oil is considered a VOC, its health, safety, and environmental profile is preferred over other solvents (e.g., BTEX), which is currently creating new market opportunities around the world. Changes in the perception of citrus oils as a preferred VOC, increased consumer activism against hydraulic fracturing or other regulatory or legislative actions by governments could

potentially result in materially reduced demand for the Company’s products and services and could adversely affect the Company’s business, financial condition, and results of operations.

The Company’s industry has a high rate of employee turnover. Difficulty attracting or retaining personnel or agents could adversely affect the Company’s business.

The Company operates in an industry that has historically been highly competitive in securing qualified personnel with the required technical skills and experience. The Company’s services require skilled personnel able to perform physically demanding work. Due to industry volatility, the demanding nature of the work, and the need for industry specific knowledge and technical skills, current employees could choose to pursue employment opportunities outside the Company that offer a more desirable work environment and/or higher compensation than is offered by the Company. As a result of these competitive labor conditions, the Company may not be able to find qualified labor, which could limit the Company’s growth. In addition, the cost of attracting and retaining qualified personnel has increased over the past several years due to competitive pressures. In order to attract and retain qualified personnel, the Company may be required to offer increased wages and benefits. If the Company is unable to increase the prices of products and services to compensate for increases in compensation, or is unable to attract and retain qualified personnel, operating results could be adversely affected.

Severe weather could have an adverse impact on the Company’s business.

The Company’s business could be materially and adversely affected by severe weather conditions. Hurricanes, tropical storms, flash floods, blizzards, cold weather and other severe weather conditions could result in curtailment of services, damage to equipment and facilities, interruption in transportation of products and materials, and loss of productivity. If the Company’s customers are unable to operate or are required to reduce operations due to severe weather conditions, and as a result curtail purchases of the Company’s products and services, the Company’s business could be adversely affected.

A terrorist attack or armed conflict could harm the Company’s business.

Terrorist activities, anti-terrorist efforts, and other armed conflicts involving the U.S. could adversely affect the U.S. and global economies and could prevent the Company from meeting financial and other obligations. The Company could experience loss of business, delays or defaults in payments from payors, or disruptions of fuel supplies and markets if pipelines, production facilities, processing plants, or refineries are direct targets or indirect casualties of an act of terror or war. Such activities could reduce the overall demand for oil and natural gas which, in turn, could also reduce the demand for the Company’s products and services. Terrorist activities

12

and the threat of potential terrorist activities and any resulting economic downturn could adversely affect the Company’s results of operations, impair the ability to raise capital, or otherwise adversely impact the Company’s ability to realize certain business strategies.

Risks Related to the Company’s Securities

The market price of the Company’s common stock has been and may continue to be volatile.

The market price of the Company’s common stock has historically been subject to significant fluctuations. The following factors, among others, could cause the price of the Company’s common stock to fluctuate significantly due to:

• | variations in the Company’s quarterly results of operations; |

• | changes in market valuations of companies in the Company’s industry; |

• | fluctuations in stock market prices and volume; |

• | fluctuations in oil and natural gas prices; |

• | issuances of common stock or other securities in the future; |

• | additions or departures of key personnel; |

• | announcements by the Company or the Company’s competitors of new business, acquisitions, or joint ventures; and |

• | negative statements made by external parties, about the Company’s business, in public forums. |

The stock market has experienced unusual price and volume fluctuations in recent years that have significantly affected the price of common stock of companies within many industries including the oil and natural gas industry. Further changes can occur without regard to specific operating performance. The price of the Company’s common stock could fluctuate based upon factors that have little to do with the Company’s operational performance, and these fluctuations could materially reduce the Company’s stock price. The Company could be a defendant in a legal case related to a significant loss of value for the shareholders. This could be expensive and divert management’s attention and Company resources, as well as have an adverse effect on the Company’s business, financial condition, and results of operations.

An active market for the Company’s common stock may not continue to exist or may not continue to exist at current trading levels.

Trading volume for the Company’s common stock historically has been very volatile when compared to companies with larger market capitalizations. The Company cannot presume that an active trading market for the Company’s common stock will continue or be sustained. Sales of a significant number of shares of the Company’s common stock in the public market could lower the market price of the Company’s stock.

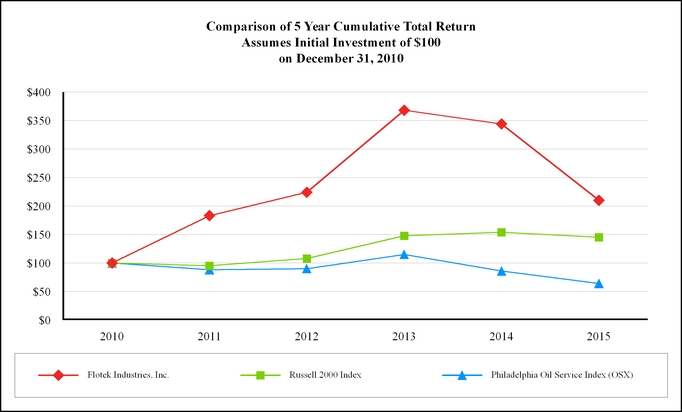

The Company has no plans to pay dividends on the Company’s common stock, and, therefore, investors will have to look to stock appreciation for return on investments.