The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying, prospectus supplement and prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Registration Statement No. 333-237342

Filed Pursuant to Rule 433

Subject To Completion, dated December 2, 2020

|

PRICING SUPPLEMENT R2547 dated December , 2020 (To Prospectus Supplement dated April 20, 2020 and Prospectus dated April 20, 2020) |

|

|

Bank of Montreal Medium-Term Notes ETF Linked Securities | |

|

Market Linked Securities—Leveraged

Upside Participation Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

|

n Linked to the SPDR® S&P® Biotech ETF n Unlike ordinary debt securities, the securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the securities provide for a maturity payment amount that may be greater than, equal to or less than the original offering price of the securities, depending on the performance of the Fund from its starting price to its ending price. The maturity payment amount will reflect the following terms: n If the price of the Fund increases, you will receive the original offering price plus 125% participation in the upside performance of the Fund, subject to a maximum return at maturity of 25.00% to 30.00% (to be determined on the pricing date) of the original offering price. As a result of the maximum return, the maximum maturity payment amount will be $1,250.00 to $1,300.00 n If the price of the Fund decreases but the decrease is not more than 10%, you will be repaid the original offering price n If the price of the Fund decreases by more than 10%, you will receive less than the original offering price and have 1-to-1 downside exposure to the decrease in the price of the Fund in excess of 10% n Investors may lose up to 90% of the original offering price n All payments on the securities are subject to the credit risk of Bank of Montreal, and you will have no ability to pursue the Fund or any securities held by the Fund for payment; if Bank of Montreal defaults on its obligations, you could lose some or all of your investment n No periodic interest payments or dividends n No exchange listing; designed to be held to maturity |

On the date of this preliminary pricing supplement, the estimated initial value of the securities is $930.80 per security. The estimated initial value of the securities on the pricing date may differ from this value but will not be less than $900.00 per security. However, as discussed in more detail in this pricing supplement, the actual value of the securities at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Value of the Securities” in this pricing supplement.

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Risk Factors” herein on page PRS-9.

The securities are the unsecured obligations of Bank of Montreal, and, accordingly, all payments on the securities are subject to the credit risk of Bank of Montreal. If Bank of Montreal defaults on its obligations, you could lose some or all of your investment. The securities are not savings accounts, deposits or other obligations of a depository institution and are not insured by the Federal Deposit Insurance Corporation, the Deposit Insurance Fund, the Canada Deposit Insurance Fund or any other governmental agency.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this pricing supplement or the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Original Offering Price |

Underwriting Discount(1)(2) |

Proceeds to Bank of Montreal | |

|

|

|

| |

| Per Security | $1,000.00 | Up to $31.50 | $968.50 |

| Total |

| (1) | Wells Fargo Securities, LLC is the agent for the distribution of the securities and is acting as principal. See “Terms of the Securities—Agent” and “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for further information. |

| (2) | In respect of certain securities sold in this offering, our affiliate, BMO Capital Markets Corp., may pay a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. |

Wells Fargo Securities

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Terms of the Securities |

| Issuer: | Bank of Montreal. | ||||||||

| Market Measure: | SPDR® S&P® Biotech ETF (the “Fund”). | ||||||||

| Pricing Date: |

December 30, 2020.* | ||||||||

| Issue Date: |

January 5, 2021.* (T+3) | ||||||||

| Original

Offering Price: |

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000. | ||||||||

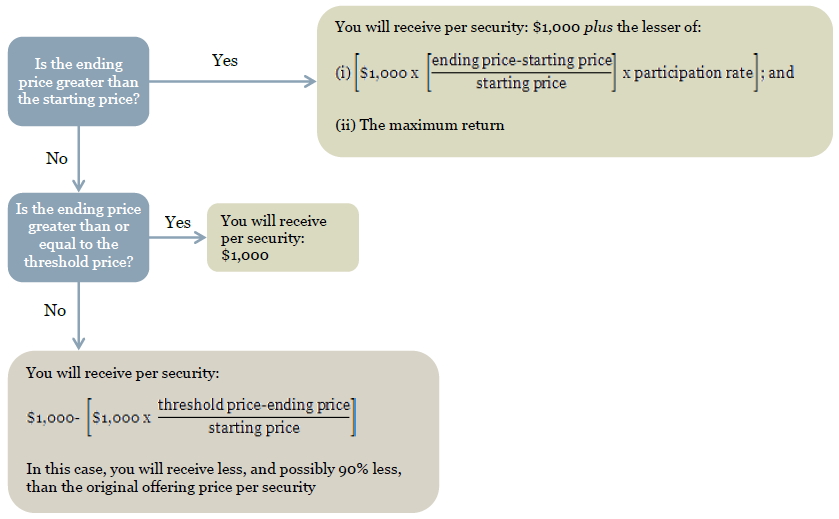

On the stated maturity date, you will be entitled to receive a cash payment per security in U.S. dollars equal to the maturity payment amount. The “maturity payment amount” per security will equal:

• if the ending price is greater than the starting price: $1,000 plus the lesser of:

| |||||||||

| (i) | $1,000 | × | ending price – starting price | × participation rate | ; and | ||||

| starting price | |||||||||

| Maturity

Payment Amount: |

(ii) the maximum return;

• if the ending price is less than or equal to the starting price, but greater than or equal to the threshold price: $1,000; or

• if the ending price is less than the threshold price: $1,000 minus:

| ||||||||

| $1,000 | × | threshold price – ending price | |||||||

| starting price | |||||||||

If the ending price is less than the threshold price, you will receive less, and possibly 90% less, than the original offering price of your securities at maturity.

| |||||||||

| All calculations with respect to the maturity payment amount will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.000005 would be rounded to 0.00001); and the maturity payment amount will be rounded to the nearest cent, with one-half cent rounded upward. | |||||||||

| Stated Maturity

Date: |

July 5, 2023*. If the calculation day is postponed, the stated maturity date will be the later of (i) July 5, 2023* and (ii) three business days after the calculation day as postponed. See “—Calculation Day” and “Additional Terms of the Securities—Market Disruption Events” for information about the circumstances that may result in a postponement of the calculation day. If the stated maturity date is not a business day, the payment required to be made on the securities on the stated maturity date will be made on the next succeeding business day with the same force and effect as if it had been made on the stated maturity date. The securities are not subject to redemption by Bank of Montreal or repayment at the option of any holder of the securities prior to the stated maturity date. | ||||||||

| Starting Price: | $ , the fund closing price of the Fund on the pricing date. | ||||||||

| Fund Closing Price: | The “fund closing price” on any trading day means the product of (i) the closing price of one share of the Fund (or one unit of any other security for which the fund closing price must be determined) on such trading day and (ii) the adjustment factor applicable to the Fund on such trading day. | ||||||||

| Closing Price: | The “closing price” for one share of the Fund (or one unit of any other security for which a closing price must be determined) on any trading day means the official closing price on such day published by the principal United States securities exchange registered under the Securities Exchange Act of 1934, as amended, on which the Fund (or any such other security) is listed or admitted to trading. | ||||||||

| Adjustment Factor: | The “adjustment factor” means, with respect to a share of the Fund (or one unit of any other security for which a fund closing price must be determined), 1.0, subject to adjustment in the event of certain events affecting the shares of the Fund. See “Additional Terms of the Securities—Anti-dilution Adjustments Relating to the Fund; Alternate Calculation” below. | ||||||||

| PRS-2 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Ending Price: | The “ending price” will be the fund closing price of the Fund on the calculation day. |

| Maximum Return: |

The “maximum return” will be determined on the pricing date and will be within the range of 25.00% to 30.00% of the original offering price per security ($250.00 to $300.00 per security). As a result of the maximum return, the maximum maturity payment amount will be $1,250.00 to $1,300.00 per security. |

| Threshold Price: | $ , which is equal to 90% of the starting price. |

| Participation Rate: | 125%. |

| Calculation Day: |

June 27, 2023*. If such day is not a trading day, the calculation day will be postponed to the next succeeding trading day. The calculation day is also subject to postponement due to the occurrence of a market disruption event. See “Additional Terms of the Securities—Market Disruption Events.” |

| Calculation Agent: | BMO Capital Markets Corp. (“BMOCM”). |

| Material Tax Consequences: |

For a discussion of the Canadian federal income tax considerations relating to an investment in the securities, please see the section of the prospectus supplement, “Certain Income Tax Consequences – Certain Canadian Income Tax Considerations.” For a discussion of the material U.S. federal income tax consequences of the ownership and disposition of the securities, see the section below, “Supplemental U.S. Federal Income Tax Considerations.” |

| Agent: |

Wells Fargo Securities, LLC (“WFS”) is the agent for the distribution of the securities. WFS will receive an underwriting discount of up to $31.50 per security. The agent may resell the securities to other securities dealers at the original offering price of the securities less a concession not in excess of $17.50 per security. Such securities dealers may include Wells Fargo Advisors (“WFA”) (the trade name of the retail brokerage business of WFS’s affiliates, Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC). In addition to the concession allowed to WFA, WFS will pay $0.75 per security of the underwriting discount to WFA as a distribution expense fee for each security sold by WFA.

In addition, in respect of certain securities sold in this offering, BMOCM may pay a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers.

The agent, BMOCM or one or more of their respective affiliates expects to realize hedging profits projected by their proprietary pricing models to the extent they assume the risks inherent in hedging our obligations under the securities. If WFS or any other dealer participating in the distribution of the securities or any of their affiliates conduct hedging activities for us in connection with the securities, that dealer or its affiliates will expect to realize a profit projected by its proprietary pricing models from such hedging activities. Any such projected profit will be in addition to any discount, concession or fee received in connection with the sale of the securities to you. |

| Denominations: | $1,000 and any integral multiple of $1,000. |

| CUSIP: |

06368E7E6 |

| No Conversion: | The securities will not be subject to conversion into our common shares or the common shares of any of our affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act (the “CDIC Act”). |

| ________________________ |

| * | To the extent that we make any change to the expected pricing date or expected issue date, the calculation day and stated maturity date may also be changed in our discretion to ensure that the term of the securities remains the same. |

| PRS-3 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Additional Information about the Issuer and the Securities |

You should read this pricing supplement together with the prospectus supplement dated April 20, 2020 and the prospectus dated April 20, 2020. This pricing supplement, together with the documents listed below, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours or the agent. Information in this pricing supplement supersedes information in the prospectus supplement and prospectus to the extent it is different from that information.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus supplement dated April 20, 2020: |

https://www.sec.gov/Archives/edgar/data/927971/000119312520112249/d908040d424b5.htm

| · | Prospectus dated April 20, 2020: |

https://www.sec.gov/Archives/edgar/data/927971/000119312520112240/d903160d424b2.htm

Our Central Index Key, or CIK, on the SEC website is 927971. As used in this pricing supplement, “we,” “us” or “our” refers to Bank of Montreal.

We have filed a registration statement (including a prospectus) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus in that registration statement and the other documents that we have filed with the SEC for more complete information about us and this offering. You may obtain these documents free of charge by visiting the SEC’s website at http://www.sec.gov. Alternatively, we will arrange to send to you the prospectus (as supplemented by the prospectus supplement if you request it by calling our agent toll-free at 1-877-369-5412.

| PRS-4 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Estimated Value of the Securities |

Our estimated initial value of the securities on the date of this preliminary pricing supplement, and that will be set forth on the cover page of the final pricing supplement relating to the securities, equals the sum of the values of the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the securities, valued using our internal funding rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the securities. |

The internal funding rate used in the determination of the initial estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value of these derivative transactions are derived from our internal pricing models. These models are based on factors such as the traded market prices of comparable derivative instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors. As a result, the estimated initial value of the securities on the pricing date will be determined based on market conditions at that time.

For more information about the estimated initial value of the securities, see “Risk Factors” below.

| PRS-5 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Investor Considerations |

The securities are not appropriate for all investors. The securities may be an appropriate investment for investors who:

| § | seek 125% leveraged exposure to the upside performance of the Fund if the ending price is greater than the starting price, subject to the maximum return at maturity of 25.00% to 30.00% (to be determined on the pricing date) of the original offering price; |

| § | desire to limit downside exposure to the Fund through the 10% buffer; |

| § | understand that if the ending price is less than the starting price by more than 10%, they will receive less, and possibly 90% less, than the original offering price per security at maturity; |

| § | are willing to forgo interest payments on the securities and dividends on shares of the Fund and the securities included in the index underlying the Fund (which we sometimes refer to as the “underlying index”); and |

| § | are willing to hold the securities until maturity. |

The securities may not be an appropriate investment for, investors who:

| § | seek a liquid investment or are unable or unwilling to hold the securities to maturity; |

| § | are unwilling to accept the risk that the ending price of the Fund may decrease by more than 10% from the starting price; |

| § | seek uncapped exposure to the upside performance of the Fund; |

| § | seek full return of the original offering price of the securities at stated maturity; |

| § | are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price and that may be as low as the lower estimated value set forth on the cover page; |

| § | seek current income; |

| § | are unwilling to accept the risk of exposure to the biotechnology sector securities represented by the Fund and its underlying index; |

| § | seek exposure to the Fund but are unwilling to accept the risk/return trade-offs inherent in the maturity payment amount for the securities; |

| § | are unwilling to accept the credit risk of Bank of Montreal to obtain exposure to the Fund generally, or to the exposure to the Fund that the securities provide specifically; or |

| § | prefer the lower risk of fixed income investments with comparable maturities issued by companies with comparable credit ratings. |

The considerations identified above are not exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the “Risk Factors” herein for risks related to an investment in the securities.

| PRS-6 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Determining Payment at Stated Maturity |

On the stated maturity date, you will receive a cash payment per security (the maturity payment amount) calculated as follows:

| PRS-7 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

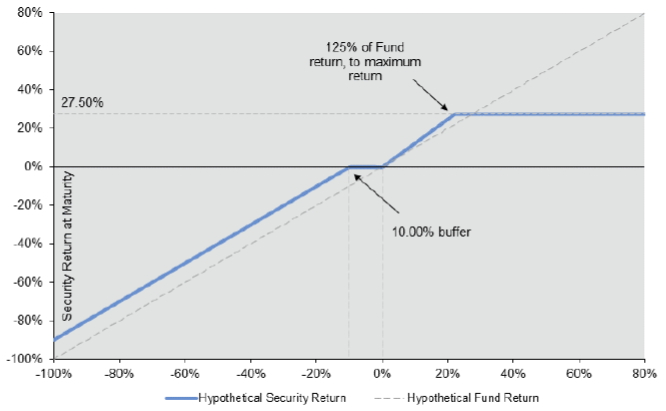

| Hypothetical Payout Profile |

The following profile is based on a hypothetical maximum return of 27.50% or $275.00 per security (the midpoint of the specified range for the maximum return), the participation rate of 125% and a threshold price equal to 90% of the starting price. This graph has been prepared for purposes of illustration only. Your actual return will depend on the actual ending price, the actual maximum return and whether you hold your securities to maturity.

| PRS-8 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Risk Factors |

The securities have complex features and investing in the securities will involve risks not associated with an investment in conventional debt securities. You should carefully consider the risk factors set forth below as well as the other information contained in this pricing supplement and the accompanying prospectus supplement and prospectus, including the documents they incorporate by reference. As described in more detail below, the value of the securities may vary considerably before the stated maturity date due to events that are difficult to predict and are beyond our control. You should reach an investment decision only after you have carefully considered with your advisors the suitability of an investment in the securities in light of your particular circumstances.

Risks Relating To The Terms And Structure Of The Securities

If The Ending Price Is Less Than The Threshold Price, You Will Receive Less, And Possibly 90% Less, Than The Original Offering Price Of Your Securities At Maturity.

We will not repay you a fixed amount on the securities on the stated maturity date. The maturity payment amount will depend on the direction of and percentage change in the ending price of the Fund relative to the starting price and the other terms of the securities. Because the price of the Fund will be subject to market fluctuations, the maturity payment amount you receive may be more or less, and possibly significantly less, than the original offering price of your securities.

If the ending price is less than the threshold price, the maturity payment amount that you receive at maturity will be reduced by an amount equal to the decline in the price of the Fund to the extent it is below the threshold price (expressed as a percentage of the starting price). The threshold price is 90% of the starting price. As a result, you may receive less, and possibly 90% less, than the original offering price per security at maturity even if the price of the Fund is greater than or equal to the starting price or the threshold price at certain times during the term of the securities.

Even if the ending price is greater than the starting price, the amount you receive at stated maturity may only be slightly greater than the original offering price, and your yield on the securities may be less than the yield you would earn if you bought a traditional interest-bearing debt security of ours or another issuer with a similar credit rating with the same stated maturity date.

No Periodic Interest Will Be Paid On The Securities.

No periodic payments of interest will be made on the securities. However, if the agreed-upon tax treatment is successfully challenged by the Internal Revenue Service, you may be required to recognize taxable income over the term of the securities. You should review the section of this pricing supplement entitled “Supplemental U.S. Federal Income Tax Considerations.”

Your Return Will Be Limited To The Maximum Return And May Be Lower Than The Return On A Direct Investment In The Fund.

The opportunity to participate in the possible increases in the price of the Fund through an investment in the securities will be limited because any positive return on the securities will not exceed the maximum return. Furthermore, the effect of the participation rate will be progressively reduced for all ending prices exceeding the ending price at which the maximum return is reached.

Your Return On The Securities Could Be Less Than If You Owned The Shares Of The Fund.

Your return on the securities will not reflect the return you would realize if you actually owned the shares of the Fund. This is in part because the maturity payment amount will be determined by reference to the closing price of the shares of the Fund, without taking into consideration the value of dividends and other payments paid on those shares. In addition, the maturity payment amount will not be greater than the original offering price plus the maximum return.

The Stated Maturity Date May Be Postponed If The Calculation Day Is Postponed.

The calculation day will be postponed if the originally scheduled calculation day is not a trading day or if the calculation agent determines that a market disruption event has occurred or is continuing on the calculation day. If such a postponement occurs, the stated maturity date will be the later of (i) the initial stated maturity date and (ii) three business days after the calculation day as postponed.

| PRS-9 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

Risks Relating To An Investment In Bank of Montreal’s Structured Debt Securities, Including The Securities

The Securities Are Subject To The Credit Risk Of Bank Of Montreal.

The securities are our obligations, and are not, either directly or indirectly, an obligation of any third party. Any amounts payable under the securities are subject to our creditworthiness and you will have no ability to pursue the Fund or any securities held by the Fund for payment. As a result, our actual and perceived creditworthiness may affect the value of the securities and, in the event we were to default on our obligations under the securities, you may not receive any amounts owed to you under the terms of the securities.

The Estimated Value Of The Securities On The Pricing Date, Based On Our Proprietary Pricing Models, Will Be Less Than The Original Offering Price.

Our initial estimated value of the securities is only an estimate, and is based on a number of factors. The original offering price of the securities may exceed our initial estimated value, because costs associated with offering, structuring and hedging the securities are included in the original offering price, but are not included in the estimated value. These costs include the underwriting discount and selling concessions, the profits that we and our affiliates and the agent and its affiliates expect to realize for assuming the risks in hedging our obligations under the securities, and the estimated cost of hedging these obligations. The initial estimated value may be as low as the amount indicated on the cover page of this pricing supplement.

The Terms Of The Securities Are Not Determined By Reference To The Credit Spreads For Our Conventional Fixed-Rate Debt.

To determine the terms of the securities, we will use an internal funding rate that represents a discount from the credit spreads for our conventional fixed-rate debt. As a result, the terms of the securities are less favorable to you than if we had used a higher funding rate.

The Estimated Value Of The Securities Is Not An Indication Of The Price, If Any, At Which WFS Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market.

Our initial estimated value of the securities as of the date of this preliminary pricing supplement is, and our estimated value as determined on the pricing date will be, derived using our internal pricing models. This value is based on market conditions and other relevant factors, which include volatility of the Fund, dividend rates and interest rates. Different pricing models and assumptions, including those used by the agent, its affiliates or other market participants, could provide values for the securities that are greater than or less than our initial estimated value. In addition, market conditions and other relevant factors after the pricing date are expected to change, possibly rapidly, and our assumptions may prove to be incorrect. After the pricing date, the value of the securities could change dramatically due to changes in market conditions, our creditworthiness, and the other factors set forth in this pricing supplement. These changes are likely to impact the price, if any, at which WFS or its affiliates or any other party (including us or our affiliates) would be willing to purchase the securities from you in any secondary market transactions. Our initial estimated value does not represent a minimum price at which WFS or any other party (including us or our affiliates) would be willing to buy your securities in any secondary market at any time.

WFS has advised us that if it, WFA or any of their affiliates makes a secondary market in the securities at any time, the secondary market price offered by it, WFA or any of their affiliates will be affected by changes in market conditions and other factors described in the next risk factor. WFS has advised us that if it, WFA or any of their affiliates makes a secondary market in the securities at any time up to the issue date or during the 3-month period following the issue date, the secondary market price offered by it, WFA or any of their affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring and hedging the securities that are included in their original offering price. Because this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it, WFA or any of their affiliates offers during this period will be higher than it otherwise would be after this period, as any secondary market price offered after this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase in the secondary market price will decline steadily to zero over this 3-month period. WFS has advised us that, if you hold the securities through an account at WFS, WFA or any of their affiliates, WFS expects that this increase will also be reflected in the value indicated for the securities on your brokerage account statement. If you hold your securities through an account at a broker-dealer other than WFS, WFA or any of their affiliates, the value of the securities on your brokerage account statement may be different than if you held your securities at WFS, WFA or any of their affiliates.

Risks Relating To The Value of the Securities And Any Secondary Market

The Value Of The Securities Prior To Stated Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.

The value of the securities prior to stated maturity will be affected by the then-current price of the Fund, interest rates at that time and a number of other factors, some of which are interrelated in complex ways. The effect of any one factor may be offset or magnified by the effect of another factor. The following factors, which we refer to as the “derivative

| PRS-10 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

component factors,” are expected to affect the value of the securities. When we refer to the “value” of your security, we mean the value you could receive for your security if you are able to sell it in the open market before the stated maturity date.

| · | Fund Performance. The value of the securities prior to maturity will depend substantially on the then-current price of the Fund. The price at which you may be able to sell the securities before stated maturity may be at a discount, which could be substantial, from their original offering price, if the price of the Fund at such time is less than, equal to or not sufficiently above the starting price or threshold price. |

| · | Interest Rates. The value of the securities may be affected by changes in the interest rates in the U.S. markets. |

| · | Volatility Of The Fund. Volatility is the term used to describe the size and frequency of market fluctuations. The value of the securities may be affected if the volatility of the Fund changes. |

| · | Time Remaining To Maturity. The value of the securities at any given time prior to maturity will likely be different from that which would be expected based on the then-current price of the Fund. This difference will most likely reflect a discount due to expectations and uncertainty concerning the price of the Fund during the period of time still remaining to the stated maturity date. In general, as the time remaining to maturity decreases, the value of the securities will approach the amount that would be payable at maturity based on the then-current price of the Fund. |

| · | Dividend Yields On Securities Included In The Fund. The value of the securities may be affected by the dividend yields on securities held by the Fund (the amount of such dividends may influence the closing price of the shares of the Fund). |

In addition to the derivative component factors, the value of the securities will be affected by actual or anticipated changes in our creditworthiness. You should understand that the impact of one of the factors specified above, such as a change in interest rates, may offset some or all of any change in the value of the securities attributable to another factor, such as a change in the price of the Fund. Because numerous factors are expected to affect the value of the securities, changes in the price of the Fund may not result in a comparable change in the value of the securities. We anticipate that the value of the securities will always be at a discount to the original offering price plus the maximum return.

The Securities Will Not Be Listed On Any Securities Exchange And We Do Not Expect A Trading Market For The Securities To Develop.

The securities will not be listed or displayed on any securities exchange or any automated quotation system. Although the agent and/or its affiliates may purchase the securities from holders, they are not obligated to do so and are not required to make a market for the securities. There can be no assurance that a secondary market will develop. Because we do not expect that any market makers will participate in a secondary market for the securities, the price at which you may be able to sell your securities is likely to depend on the price, if any, at which the agent is willing to buy your securities. If a secondary market does exist, it may be limited. Accordingly, there may be a limited number of buyers if you decide to sell your securities prior to stated maturity. This may affect the price you receive upon such sale. Consequently, you should be willing to hold the securities to stated maturity.

Risks Relating To The Fund And The Underlying Index

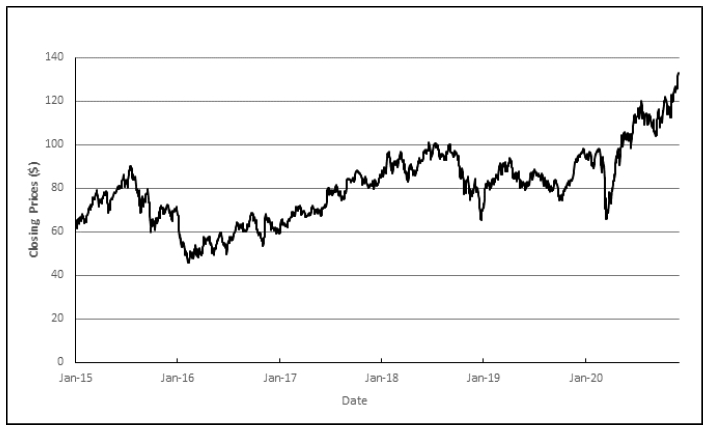

Historical Prices Of The Fund Or The Securities Included In The Fund Should Not Be Taken As An Indication Of The Future Performance Of The Fund During The Term Of The Securities.

The trading price of the shares of the Fund will determine the maturity payment amount payable to you at maturity. As a result, it is impossible to predict whether the ending price of the Fund will fall or rise compared to its starting price. The trading price of the shares of the Fund will be influenced by complex and interrelated political, economic, financial and other factors that can affect the markets in which the Fund and the securities comprising the Fund are traded and the values of the Fund and such securities. Accordingly, any historical prices of the Fund do not provide an indication of the future performance of the Fund.

The Policies of the Fund’s Investment Adviser and Changes That Affect The Underlying Index Could Affect The Amount Payable On The Securities And Their Market Value.

The policies of the Fund’s investment adviser (the “fund sponsor”) concerning the management of the Fund, additions, deletions or substitutions of the securities held by the Fund, and the manner in which changes affecting the applicable underlying index are reflected in the Fund could affect the market price of shares of the Fund and, therefore, the maturity payment amount and the market value of the securities before that date. The amount payable on the securities and their market value could also be affected if the Fund’s investment adviser changes these policies, for example, by changing the manner in which it manages the Fund, or if the Fund’s investment adviser discontinues or suspends maintenance of the Fund, in which case it may become difficult to determine the market value of the securities.

| PRS-11 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

We Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities Are Included In The Fund Or The Underlying Index.

Actions by any company whose securities are included in the Fund or the underlying index may have an adverse effect on the price of its security, the ending price and the value of the securities. Neither we nor WFS are affiliated with any of the other companies included in the Fund or the underlying index. These unaffiliated companies will not be involved in the offering of the securities and will have no obligations with respect to the securities, including any obligation to take our or your interests into consideration for any reason. These companies will not receive any of the proceeds of the offering of the securities and will not be responsible for, and will not have participated in, the determination of the timing of, prices for, or quantities of, the securities to be issued. These companies will not be involved with the administration, marketing or trading of the securities and will have no obligations with respect to any amounts to be paid to you on the securities.

We And Our Affiliates Have No Affiliation With The Fund Sponsor Or The Underlying Index Sponsor And Have Not Independently Verified Their Public Disclosure Of Information.

We and our affiliates are not affiliated in any way with the fund sponsor or the underlying index sponsor (collectively, the “sponsors”) and have no ability to control or predict their actions, including any errors in or discontinuation of disclosure regarding their methods or policies relating to the management or the calculation of the Fund or the underlying index. We have derived the information about the sponsors, the Fund and the underlying index contained in this pricing supplement from publicly available information, without independent verification. You, as an investor in the securities, should make your own investigation into the Fund, the underlying index and the sponsors. The sponsors are not involved in the offering of the securities made hereby in any way and have no obligation to consider your interests as an owner of the securities in taking any actions that might affect the value of the securities.

An Investment Linked To The Shares Of The Fund Is Different From An Investment Linked To The Underlying Index.

The performance of the shares of the Fund may not exactly replicate the performance of the underlying index because the Fund may not invest in all of the securities included in the underlying index and because the Fund will reflect transaction costs and fees that are not included in the calculation of the underlying index. The Fund may also hold securities or derivative financial instruments not included in the underlying index. The Fund may not fully replicate the performance of the underlying index due to the temporary unavailability of certain securities in the secondary market or due to other extraordinary circumstances. In addition, because the shares of the Fund are traded on a securities exchange and are subject to market supply and investor demand, the value of a share of the Fund may differ from the net asset value per share of the Fund. As a result, the performance of the Fund may not correlate perfectly with the performance of the underlying index, and the return on the securities based on the performance of the Fund will not be the same as the return on securities based on the performance of the underlying index.

There Are Risks Associated With The Fund.

Although the shares of the Fund are listed for trading on a United States securities exchange and a number of similar products have been traded on such securities exchanges for varying periods of time, there is no assurance that an active trading market will continue for the shares of the Fund or that there will be liquidity in the trading market.

In addition, the Fund is subject to management risk, which is the risk that the fund sponsor’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. For example, the fund sponsor may elect to invest certain Fund assets in shares of equity securities that are not included in the underlying index. The Fund is also not actively managed and may be affected by a general decline in market segments relating to the underlying index. Further, the fund sponsor invests in securities included in, or representative of, the underlying index regardless of their investment merits, and the fund sponsor does not attempt to take defensive positions in declining markets.

Further, under continuous listing standards adopted by the relevant securities exchange, the Fund will be required to confirm on an ongoing basis that the securities included in the underlying index satisfy the applicable listing requirements. In the event that the underlying index does not comply with the applicable listing requirements, the Fund would be required to rectify such non-compliance by requesting that the underlying index sponsor modify such underlying index, transitioning to a new underlying index or obtaining relief from the SEC. There can be no assurance that the underlying index sponsor would modify the underlying index or that relief would be obtained from the SEC and, therefore, non-compliance with the continuous listing standards may result in the Fund being delisted. If the Fund were delisted, the calculation agent would select a successor fund or, if no successor fund is available, would determine the fund closing price of the Fund on any date of determination.

These risks may adversely affect the price of the shares of the Fund and, consequently, the value of the securities.

| PRS-12 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

You Will Not Have Any Shareholder Rights With Respect To The Shares Of The Fund.

You will not become a holder of shares of the Fund or a holder of securities included in the underlying index as a result of owning a security. You will not have any voting rights, any right to receive dividends or other distributions or any other rights with respect to such shares or securities. You will have no right to receive delivery of any shares or securities at maturity.

The Securities Are Subject To Risks Relating To Biotech Companies And Companies In The Healthcare Sector.

Biotech companies invest heavily in research and development, which may not necessarily lead to commercially successful products. These companies are also subject to significant governmental regulation, which may delay or inhibit the release of new products. Many biotech companies are dependent upon their ability to use and enforce intellectual property rights and patents. Any impairment of such rights may have adverse financial consequences. Biotech stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Biotech companies can be significantly affected by technological change and obsolescence, product liability lawsuits and consequential high insurance costs.

Companies in the health care sector are subject to extensive government regulation and their profitability can be significantly affected by restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure (including price discounting), limited product lines and an increased emphasis on the delivery of healthcare through outpatient services. Companies in the health care sector are heavily dependent on obtaining and defending patents, which may be time consuming and costly, and the expiration of patents may also adversely affect the profitability of these companies. Health care companies are also subject to extensive litigation based on product liability and similar claims. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. Many new products in the health care sector require significant research and development and may be subject to regulatory approvals, all of which may be time consuming and costly with no guarantee that any product will come to market.

The Fund Is Concentrated In The Biotechnology Industry And Does Not Provide Diversified Exposure.

The Fund, because it is concentrated in the biotechnology industry, may be adversely affected not only by the performance of the companies in the biotechnology industry in which it invests but also may be more susceptible to any single economic, market, political or regulatory occurrence affecting the biotechnology industry. As a result, the Fund will be more susceptible to the risks associated with these companies than a Fund that invests in companies in multiple industries.

Anti-Dilution Adjustments Relating To The Shares Of The Fund Do Not Address Every Event That Could Affect Such Shares.

An adjustment factor, as described herein, will be used to determine the ending price of the Fund. The adjustment factor will be adjusted by the calculation agent for certain events affecting the shares of the Fund. However, the calculation agent will not make an adjustment for every event that could affect such shares. If an event occurs that does not require the calculation agent to adjust the adjustment factor, the value of the securities may be adversely affected.

Risks Relating To Conflicts Of Interest

Our Economic Interests And Those Of Any Dealer Participating In The Offering Are Potentially Adverse To Your Interests.

You should be aware of the following ways in which our economic interests and those of WFS or any other dealer participating in the distribution of the securities, which we refer to as a “participating dealer,” are potentially adverse to your interests as an investor in the securities. In engaging in certain of the activities described below, our affiliates or any participating dealer or its affiliates may take actions that may adversely affect the value of and your return on the securities, and in so doing they will have no obligation to consider your interests as an investor in the securities. Our affiliates or any participating dealer or its affiliates may realize a profit from these activities even if investors do not receive a favorable investment return on the securities.

| · | The calculation agent is our affiliate and may be required to make discretionary judgments that affect the return you receive on the securities. BMOCM, which is our affiliate, will be the calculation agent for the securities. As calculation agent, BMOCM will determine the ending price of the Fund and may be required to make other determinations that affect the return you receive on the securities at maturity. In making these determinations, the calculation agent may be required to make discretionary judgments, including determining whether a market disruption event has occurred on the scheduled calculation day, which may result in postponement of the calculation day; determining the ending price of the Fund if the calculation day is postponed to the last day to which it may be postponed and a market disruption event occurs on that day; adjusting the adjustment factor and other terms of the securities in certain circumstances; if the Fund undergoes a liquidation event, selecting a successor fund or, if no successor fund is available, determining the ending price of the Fund; and determining whether to adjust the ending price of the Fund on the calculation day in the event of certain changes in or modifications to the Fund. In making these discretionary judgments, the fact that BMOCM is our affiliate may cause it to have economic interests that are adverse to your interests as an investor in the securities, and BMOCM’s determinations as calculation agent may adversely affect your return on the securities. |

| PRS-13 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| · | The estimated value of the securities was calculated by our affiliate and is therefore not an independent third-party valuation. BMOCM calculated the estimated value of the securities set forth on the cover page of this pricing supplement, which involved discretionary judgments by BMOCM. Accordingly, the estimated value of the securities set forth on the cover page of this pricing supplement is not an independent third-party valuation. |

| · | Research reports by our affiliates or any participating dealer or its affiliates may be inconsistent with an investment in the securities and may adversely affect the price of the Fund. Our affiliates or any participating dealer in the offering of the securities or its affiliates may, at present or in the future, publish research reports on the Fund, the underlying index or the companies whose securities are included in the Fund or the underlying index. This research is modified from time to time without notice and may, at present or in the future, express opinions or provide recommendations that are inconsistent with purchasing or holding the securities. Any research reports on the Fund, the underlying index or the companies whose securities are included in the Fund or the underlying index could adversely affect the price of the Fund and, therefore, adversely affect the value of and your return on the securities. You are encouraged to derive information concerning the Fund from multiple sources and should not rely on the views expressed by us or our affiliates or any participating dealer or its affiliates. In addition, any research reports on the Fund, the underlying index or the companies whose securities are included in the Fund or the underlying index published on or prior to the pricing date could result in an increase in the price of the Fund on the pricing date, which would adversely affect investors in the securities by increasing the price at which the Fund must close on the calculation day in order for investors in the securities to receive a favorable return. |

| · | Business activities of our affiliates or any participating dealer or its affiliates with the companies whose securities are included in the Fund may adversely affect the price of the Fund. Our affiliates or any participating dealer or its affiliates may, at present or in the future, engage in business with the companies whose securities are included in the Fund or the underlying index, including making loans to those companies (including exercising creditors’ remedies with respect to such loans), making equity investments in those companies or providing investment banking, asset management or other advisory services to those companies. These business activities could adversely affect the price of the Fund and, therefore, adversely affect the value of and your return on the securities. In addition, in the course of these business activities, our affiliates or any participating dealer or its affiliates may acquire non-public information about one or more of the companies whose securities are included in the Fund or the underlying index. If our affiliates or any participating dealer or its affiliates do acquire such non-public information, we and they are not obligated to disclose such non-public information to you. |

| · | Hedging activities by our affiliates or any participating dealer or its affiliates may adversely affect the price of the Fund. We expect to hedge our obligations under the securities through one or more hedge counterparties, which may include our affiliates or any participating dealer or its affiliates. Pursuant to such hedging activities, our hedge counterparties may acquire shares of the Fund, securities included in the Fund or the underlying index or listed or over-the-counter derivative or synthetic instruments related to the Fund or such securities. Depending on, among other things, future market conditions, the aggregate amount and the composition of such positions are likely to vary over time. To the extent that our hedge counterparties have a long hedge position in shares of the Fund or any of the securities included in the Fund or the underlying index, or derivative or synthetic instruments related to the Fund or such securities, they may liquidate a portion of such holdings at or about the time of the calculation day or at or about the time of a change in the securities included in the Fund or the underlying index. These hedging activities could potentially adversely affect the price of the Fund and, therefore, adversely affect the value of and your return on the securities. |

| · | Trading activities by our affiliates or any participating dealer or its affiliates may adversely affect the price of the Fund. Our affiliates or any participating dealer or its affiliates may engage in trading in the shares of the Fund, the securities included in the Fund or the underlying index and other instruments relating to the Fund or such securities on a regular basis as part of their general broker-dealer and other businesses. Any of these trading activities could potentially adversely affect the price of the Fund and, therefore, adversely affect the value of and your return on the securities. |

| · | A participating dealer or its affiliates may realize hedging profits projected by its proprietary pricing models in addition to any selling concession and/or fee, creating a further incentive for the participating dealer to sell the securities to you. If any participating dealer or any of its affiliates conducts hedging activities for us in connection with the securities, that participating dealer or its affiliates will expect to realize a projected profit from such hedging activities. If a participating dealer receives a concession and/or fee for the sale of the securities to you, this projected hedging profit will be in addition to the concession and/or fee, creating a further incentive for the participating dealer to sell the securities to you. |

| PRS-14 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

Risks Relating To Tax Matters

The Tax Consequences Of An Investment In The Securities Are Uncertain.

The tax treatment of the notes is uncertain. We do not plan to request a ruling from the Internal Revenue Service or from any Canadian authorities regarding the tax treatment of the securities, and the Internal Revenue Service or a court may not agree with the tax treatment described in this pricing supplement.

Since the Fund is an exchange-traded fund, while the matter is not entirely clear, there exists a substantial risk that an investment in the securities is a “constructive ownership transaction” to which Section 1260 of the Code applies. If Section 1260 of the Code applies, all or a portion of any long-term capital gain recognized by a United States holder in respect of the securities could be recharacterized as ordinary income, in which case certain interest charges would apply. See the section entitled “Supplemental U.S. Federal Income Tax Considerations – Potential Application of Section 1260 of the Code.”

The Internal Revenue Service has issued a notice indicating that it and the Treasury Department are actively considering whether, among other issues, a holder should be required to accrue interest over the term of an instrument such as “prepaid forward contracts” and other similar instruments even though that holder will not receive any payments with respect to the securities until maturity and whether all or part of the gain a holder may recognize upon sale or maturity of an instrument such as the securities could be treated as ordinary income. Any Treasury Regulations or other guidance promulgated after consideration of these issues could apply on a retroactive basis.

Please read carefully the section entitled “Supplemental U.S. Federal Income Tax Considerations” in this pricing supplement. You should consult your tax advisor about your own tax situation.

| PRS-15 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Hypothetical Returns |

The following table illustrates, for a hypothetical maximum return of 27.50% or $275.00 per security (the midpoint of the specified range for the maximum return) and a range of hypothetical ending prices of the Fund:

| • | the hypothetical percentage change from the hypothetical starting price to the hypothetical ending price; |

| • | the hypothetical maturity payment amount payable at stated maturity per security; and |

| • | the hypothetical pre-tax total rate of return. |

|

Hypothetical ending price |

Hypothetical percentage change from the hypothetical hypothetical ending price |

Hypothetical maturity payment payable at stated maturity per security |

Hypothetical pre-tax total rate of return |

| $170.00 | 70.00% | $1,275.00 | 27.50% |

| $160.00 | 60.00% | $1,275.00 | 27.50% |

| $150.00 | 50.00% | $1,275.00 | 27.50% |

| $140.00 | 40.00% | $1,275.00 | 27.50% |

| $130.00 | 30.00% | $1,275.00 | 27.50% |

| $122.00 | 22.00% | $1,275.00 | 27.50% |

| $120.00 | 20.00% | $1,250.00 | 25.00% |

| $110.00 | 10.00% | $1,125.00 | 12.50% |

| $105.00 | 5.00% | $1,062.50 | 6.25% |

| $100.00(1) | 0.00% | $1,000.00 | 0.00% |

| $95.00 | -5.00% | $1,000.00 | 0.00% |

| $90.00 | -10.00% | $1,000.00 | 0.00% |

| $89.00 | -11.00% | $990.00 | -1.00% |

| $80.00 | -20.00% | $900.00 | -10.00% |

| $75.00 | -25.00% | $850.00 | -15.00% |

| $50.00 | -50.00% | $600.00 | -40.00% |

| $25.00 | -75.00% | $350.00 | -65.00% |

| (1) | The hypothetical starting price of $100.00 has been chosen for illustrative purposes only and does not represent the actual starting price. The actual starting price will be determined on the pricing date and will be set forth under “Terms of the Securities” above. For historical data regarding the actual closing prices of the Fund, see the historical information set forth herein. |

The above figures are for purposes of illustration only and may have been rounded for ease of analysis. The actual amount you receive at stated maturity and the resulting pre-tax rate of return will depend on the actual starting price, ending price and maximum return.

| PRS-16 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Hypothetical Payments at Stated Maturity |

Set forth below are four examples of payment at stated maturity calculations, reflecting a hypothetical maximum return of 27.50% or $275.00 per security (the midpoint of the specified range for the maximum return) and assuming a hypothetical starting price and hypothetical ending prices as indicated in the examples. The terms used for purposes of these hypothetical examples do not represent the actual starting price or threshold price. The hypothetical starting price of $100.00 has been chosen for illustrative purposes only and does not represent the actual starting price. The actual starting price and threshold price will be determined on the pricing date and will be set forth under “Terms of the Securities” above. For historical data regarding the actual closing prices of the Fund, see the historical information set forth herein. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis.

Example 1. Maturity payment amount is greater than the original offering price and reflects a return that is less than the maximum return:

Hypothetical starting price: $100.00

Hypothetical ending price: $110.00

Because the hypothetical ending price is greater than the hypothetical starting price, the maturity payment amount per security would be equal to the original offering price of $1,000 plus a positive return equal to the lesser of:

| (i) |

|

$1,000 | × | $110.00 – $100.00 | × 125% | = $125.00; | and | ||||

| $100.00 |

(ii) the maximum return of $275.00

On the stated maturity date, you would receive $1,125.00 per security.

Example 2. Maturity payment amount is greater than the original offering price and reflects a return equal to the maximum return:

Hypothetical starting price: $100.00

Hypothetical ending price: $150.00

Because the hypothetical ending price is greater than the hypothetical starting price, the maturity payment amount per security would be equal to the original offering price of $1,000 plus a positive return equal to the lesser of:

| (i) |

|

$1,000 | × | $150.00 – $100.00 | × 125% |

= $625.00; |

and |

||||

| $100.00 |

(ii) the maximum return of $275.00

On the stated maturity date, you would receive $1,275.00 per security, which is the maximum maturity payment amount.

In addition to limiting your return on the securities, the maximum return limits the positive effect of the participation rate. If the ending price is greater than the starting price, you will participate in the performance of the Fund at a rate of 125% up to a certain point. However, the effect of the participation rate will be progressively reduced for ending prices that are greater than 122.00% of the starting price (assuming a maximum return of 27.50% or $275.00 per security, the midpoint of the specified range for the maximum return) since your return on the securities for any ending price greater than 122.00% of the starting price will be limited to the maximum return.

| PRS-17 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

Example 3. Maturity payment amount is equal to the original offering price:

Hypothetical starting price: $100.00

Hypothetical ending price: $95.00

Hypothetical threshold price: $90.00, which is 90.00% of the hypothetical starting price

Since the hypothetical ending price is less than the hypothetical starting price, but not by more than 10%, you would not lose any of the original offering price of your securities.

On the stated maturity date, you would receive $1,000.00 per security.

Example 4. Maturity payment amount is less than the original offering price:

Hypothetical starting price: $100.00

Hypothetical ending price: $50.00

Hypothetical threshold price: $90.00, which is 90% of the hypothetical starting price

Since the hypothetical ending price is less than the hypothetical starting price by more than 10%, you would lose a portion of the original offering price of your securities and receive the maturity payment amount equal to:

| $1,000 - |

|

$1,000 | × | $90.00 – $50.00 | = $600.00 | |||

| $100.00 |

On the stated maturity date, you would receive $600.00 per security.

To the extent that the starting price, ending price and maximum return differ from the values assumed above, the results indicated above would be different.

| PRS-18 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| Additional Terms of the Securities |

Bank of Montreal will issue the securities as part of a series of senior unsecured debt securities, as described in more detail in the prospectus supplement. Information included in this pricing supplement supersedes information in the prospectus supplement and prospectus to the extent that it is different from that information.

Certain Definitions

A “trading day” means a day, as determined by the calculation agent, on which the relevant stock exchange and each related futures or options exchange with respect to the Fund or any successor thereto, if applicable, are scheduled to be open for trading for their respective regular trading sessions.

The “relevant stock exchange” for the Fund means the primary exchange or quotation system on which the shares (or other applicable securities) of the Fund are traded, as determined by the calculation agent.

The “related futures or options exchange” for the Fund means each exchange or quotation system where trading has a material effect (as determined by the calculation agent) on the overall market for futures or options contracts relating to the Fund.

Calculation Agent

BMOCM, our wholly owned subsidiary, will act as calculation agent for the securities and may appoint agents to assist it in the performance of its duties. Pursuant to a calculation agent agreement, we may appoint a different calculation agent without your consent and without notifying you.

The calculation agent will determine the maturity payment amount you receive at stated maturity. In addition, the calculation agent will, among other things:

| · | determine whether a market disruption event has occurred; |

| · | determine the fund closing price of the Fund under certain circumstances; |

| · | determine if adjustments are required to the fund closing price of the Fund under various circumstances; and |

| · | if the Fund undergoes a liquidation event, select a successor fund (as defined below) or, if no successor fund is available, determine the fund closing price. |

All determinations made by the calculation agent will be at the sole discretion of the calculation agent and, in the absence of manifest error, will be conclusive for all purposes and binding on us and you. The calculation agent will have no liability for its determinations.

Market Disruption Events

A “market disruption event” means any of the following events as determined by the calculation agent in its sole discretion:

| (A) | The occurrence or existence of a material suspension of or limitation imposed on trading by the relevant stock exchange or otherwise relating to the shares (or other applicable securities) of the Fund or any successor fund on the relevant stock exchange at any time during the one-hour period that ends at the close of trading on such day, whether by reason of movements in price exceeding limits permitted by such relevant stock exchange or otherwise. |

| (B) | The occurrence or existence of a material suspension of or limitation imposed on trading by any related futures or options exchange or otherwise in futures or options contracts relating to the shares (or other applicable securities) of the Fund or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day, whether by reason of movements in price exceeding limits permitted by the related futures or options exchange or otherwise. |

| (C) | The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, shares (or other applicable securities) of the Fund or any successor fund on the relevant stock exchange at any time during the one-hour period that ends at the close of trading on that day. |

| (D) | The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to shares (or other applicable securities) of the Fund or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day. |

| (E) | The closure of the relevant stock exchange or any related futures or options exchange with respect to the Fund or any successor fund prior to its scheduled closing time unless the earlier closing time is announced by the relevant stock exchange or related futures or options exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such relevant stock exchange or related futures or options exchange, as applicable, and (2) the submission deadline for orders to be entered into the relevant stock exchange or related futures or options exchange, as applicable, system for execution at the close of trading on that day. |

| PRS-19 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| (F) | The relevant stock exchange or any related futures or options exchange with respect to the Fund or any successor fund fails to open for trading during its regular trading session. |

For purposes of determining whether a market disruption event has occurred:

| (1) | “close of trading” means the scheduled closing time of the relevant stock exchange with respect to the Fund or any successor fund; and |

| (2) | the “scheduled closing time” of the relevant stock exchange or any related futures or options exchange on any trading day for the Fund or any successor fund means the scheduled weekday closing time of such relevant stock exchange or related futures or options exchange on such trading day, without regard to after hours or any other trading outside the regular trading session hours. |

If a market disruption event occurs or is continuing on the calculation day, then the calculation day will be postponed to the first succeeding trading day on which a market disruption event has not occurred and is not continuing; however, if such first succeeding trading day has not occurred as of the eighth trading day after the originally scheduled calculation day, that eighth trading day shall be deemed to be the calculation day. If the calculation day has been postponed eight trading days after the originally scheduled calculation day and a market disruption event occurs or is continuing on such eighth trading day, the calculation agent will determine the closing price of the Fund on such eighth trading day based on its good faith estimate of the value of the shares (or other applicable securities) of the Fund as of the close of trading on such eighth trading day.

Anti-Dilution Adjustments Relating to the Fund

The calculation agent will adjust the adjustment factor as specified below if any of the events specified below occurs with respect to the Fund and the effective date or ex-dividend date, as applicable, for such event is after the pricing date and on or prior to the calculation day.

The adjustments specified below do not cover all events that could affect the Fund, and there may be other events that could affect the Fund for which the calculation agent will not make any such adjustments, including, without limitation, an ordinary cash dividend. Nevertheless, the calculation agent may, in its sole discretion, make additional adjustments to any terms of the securities upon the occurrence of other events that affect or could potentially affect the market price of, or shareholder rights in, the Fund, with a view to offsetting, to the extent practical, any such change, and preserving the relative investment risks of the securities. In addition, the calculation agent may, in its sole discretion, make adjustments or a series of adjustments that differ from those described herein if the calculation agent determines that such adjustments do not properly reflect the economic consequences of the events specified in this pricing supplement or would not preserve the relative investment risks of the securities. All determinations made by the calculation agent in making any adjustments to the terms of the securities, including adjustments that are in addition to, or that differ from, those described in this pricing supplement, will be made in good faith and a commercially reasonable manner, with the aim of ensuring an equitable result. In determining whether to make any adjustment to the terms of the securities, the calculation agent may consider any adjustment made by the Options Clearing Corporation or any other equity derivatives clearing organization on options contracts on the Fund.

For any event described below, the calculation agent will not be required to adjust the adjustment factor unless the adjustment would result in a change to such adjustment factor then in effect of at least 0.10%. The adjustment factor resulting from any adjustment will be rounded up or down, as appropriate, to the nearest one-hundred thousandth.

| (A) | Stock Splits and Reverse Stock Splits |

If a stock split or reverse stock split has occurred with respect to the Fund, then once such split has become effective, the adjustment factor will be adjusted to equal the product of the prior adjustment factor and the number of securities which a holder of one share (or other applicable security) of the Fund before the effective date of such stock split or reverse stock split would have owned or been entitled to receive immediately following the applicable effective date.

| (B) | Stock Dividends |

If a dividend or distribution of shares (or other applicable securities) of the Fund has been made by the Fund ratably to all holders of record of such shares (or other applicable security), then the adjustment factor will be adjusted on the ex-dividend date to equal the prior adjustment factor plus the product of the prior adjustment factor and the number of shares (or other applicable security) of the Fund which a holder of one share (or other applicable security) of the Fund before the ex-dividend date would have owned or been entitled to receive immediately following that date; provided, however, that no adjustment will be made for a distribution for which the number of shares of the Fund paid or distributed is based on a fixed cash equivalent value. For example, if a one-for-one share dividend is made as to the Fund, its adjustment factor will be changed from 1 to 2.

| PRS-20 |

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk Securities Linked to the SPDR® S&P® Biotech ETF due July 5, 2023 |

| (C) | Extraordinary Dividends |

If an extraordinary dividend (as defined below) has occurred with respect to the Fund, then the adjustment factor will be adjusted on the ex-dividend date to equal the product of the prior adjustment factor and a fraction, the numerator of which is the closing price per share (or other applicable security) of the Fund on the trading day preceding the ex-dividend date, and the denominator of which is the amount by which the closing price per share (or other applicable security) of the Fund on the trading day preceding the ex-dividend date exceeds the extraordinary dividend amount (as defined below).

For purposes of determining whether an extraordinary dividend has occurred:

| (1) | “extraordinary dividend” means any cash dividend or distribution (or portion thereof) that the calculation agent determines, in its sole discretion, is extraordinary or special; and |

| (2) | “extraordinary dividend amount” with respect to an extraordinary dividend for the shares of the Fund will equal the amount per share (or other applicable security) of the Fund of the applicable cash dividend or distribution that is attributable to the extraordinary dividend, as determined by the calculation agent in its sole discretion. |

A distribution on the securities of the Fund described below under the section entitled “—Reorganization Events” below that also constitutes an extraordinary dividend will only cause an adjustment pursuant to that “—Reorganization Events” section.

| (D) | Other Distributions |

If the Fund declares or makes a distribution to all holders of the shares (or other applicable security) of the Fund of any non-cash assets, excluding dividends or distributions described under the section entitled “—Stock Dividends” above, then the calculation agent may, in its sole discretion, make such adjustment (if any) to the adjustment factor as it deems appropriate in the circumstances. If the calculation agent determines to make an adjustment pursuant to this paragraph, it will do so with a view to offsetting, to the extent practical, any change in the economic position of a holder of the securities that results solely from the applicable event.

| (E) | Reorganization Events |