Exhibit 99.1

BANK OF MONTREAL

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED OCTOBER 31, 2018

Dated December 4, 2018

| Annual Information Form |

2018 Financial Statements |

Management’s Discussion and Analysis1 |

||||||||

| EXPLANATORY NOTES AND CAUTIONS |

2 | |||||||||

| Caution Regarding Forward-Looking Statements |

2 | 29 | ||||||||

| CORPORATE STRUCTURE |

3 | Note 26 | ||||||||

| GENERAL DEVELOPMENT OF THE BUSINESS |

3 | 25, 28, 43-61 | ||||||||

| Three-Year History |

3 | |||||||||

| DESCRIPTION OF THE BUSINESS |

3 | |||||||||

| Business |

3 | Note 25 | 25, 28, 43-61 | |||||||

| Supervision and Regulation in Canada |

4 | 69-71, 80, 106, 112-114 | ||||||||

| Supervision and Regulation in the United States |

4 | 69-71, 80, 112-114 | ||||||||

| International Supervision and Regulation |

5 | 69-71, 80, 112-114 | ||||||||

| Competition |

5 | |||||||||

| Environmental, Social and Governance Issues |

6 | 81, 115-116 | ||||||||

| DIVIDENDS |

6 | Note 16 | 75 | |||||||

| DESCRIPTION OF CAPITAL STRUCTURE |

6 | Note 16 and 19 | 71-75 | |||||||

| Description of Common Shares |

7 | Note 16 | ||||||||

| Description of Preferred Shares |

7 | Note 16 | ||||||||

| Certain Conditions of the Class A Preferred Shares as a Class |

7 | Note 16 | ||||||||

| Certain Conditions of the Class B Preferred Shares as a Class |

7 | |||||||||

| Restraints on Bank Shares under the Bank Act |

8 | |||||||||

| Ratings |

8 | Note 8 | ||||||||

| MARKET FOR SECURITIES |

9 | |||||||||

| Trading Price and Volume |

9 | |||||||||

| Prior Sales |

10 | Note 15 and 16 | 68 | |||||||

| DIRECTORS AND EXECUTIVE OFFICERS |

10 | |||||||||

| Board of Directors |

10 | |||||||||

| Board Committee Members |

11 | |||||||||

| Executive Officers |

11 | |||||||||

| Shareholdings of Directors and Executive Officers |

12 | |||||||||

| Additional Disclosure for Directors and Executive Officers |

12 | |||||||||

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

12 | Note 24 | ||||||||

| TRANSFER AGENT AND REGISTRAR |

12 | |||||||||

| INTERESTS OF EXPERTS |

13 | 141-142 | ||||||||

| AUDIT AND CONDUCT REVIEW COMMITTEE INFORMATION |

13 | |||||||||

| Composition of the Audit and Conduct Review Committee |

13 | |||||||||

| Shareholders’ Auditors Pre-Approval Policies and Procedures and Fees |

13 | 122 | ||||||||

| ADDITIONAL INFORMATION |

14 | |||||||||

| APPENDIX I: BANK OF MONTREAL AUDIT AND CONDUCT REVIEW COMMITTEE CHARTER |

I-1 | |||||||||

| APPENDIX II: CREDIT RATING CATEGORIES |

II-1 | |||||||||

1 As indicated, parts of the Bank’s Consolidated Financial Statements (2018 Financial Statements) and Management’s Discussion and Analysis (2018 MD&A) for the fiscal year ended October 31, 2018 are incorporated by reference into this Annual Information Form. The 2018 Financial Statements and the 2018 MD&A are available on SEDAR (www.sedar.com).

1

EXPLANATORY NOTES AND CAUTIONS

Unless specifically stated otherwise in this Annual Information Form:

| ● | all amounts are in Canadian dollars |

| ● | BMO Financial Group, the Bank, BMO, we, or our means Bank of Montreal and, as applicable, its subsidiaries |

| ● | information is as at October 31, 2018 |

Caution Regarding Forward-Looking Statements

Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements in this document may include, but are not limited to, statements with respect to our objectives and priorities for fiscal 2019 and beyond, our strategies or future actions, our targets, expectations for our financial condition or share price, the regulatory environment in which we operate and the results of or outlook for our operations or for the Canadian, U.S. and international economies, and include statements of our management. Forward-looking statements are typically identified by words such as “will”, “would”, “should”, “believe”, “expect”, “anticipate”, “project”, “intend”, “estimate”, “plan”, “goal”, “target”, “may” and “could”.

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, both general and specific in nature. There is significant risk that predictions, forecasts, conclusions or projections will not prove to be accurate, that our assumptions may not be correct, and that actual results may differ materially from such predictions, forecasts, conclusions or projections. We caution readers of this document not to place undue reliance on our forward-looking statements, as a number of factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements.

The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in which we operate; the Canadian housing market; weak, volatile or illiquid capital and/or credit markets; interest rate and currency value fluctuations; changes in monetary, fiscal, or economic policy and tax legislation and interpretation; the level of competition in the geographic and business areas in which we operate; changes in laws or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance, and the effect of such changes on funding costs; judicial or regulatory proceedings; the accuracy and completeness of the information we obtain with respect to our customers and counterparties; failure of third parties to comply with their obligations to us; our ability to execute our strategic plans and to complete and integrate acquisitions, including obtaining regulatory approvals; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations on these estimates; operational and infrastructure risks, including with respect to reliance on third parties; changes to our credit ratings; political conditions, including changes relating to or affecting economic or trade matters; global capital markets activities; the possible effects on our business of war or terrorist activities; outbreaks of disease or illness that affect local, national or international economies; natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; technological changes; information and cyber security, including the threat of hacking, identity theft and corporate espionage, as well as the possibility of denial of service resulting from efforts targeted at causing system failure and service disruption; and our ability to anticipate and effectively manage risks arising from all of the foregoing factors.

We caution that the foregoing list is not exhaustive of all possible factors. Other factors and risks could adversely affect our results. For more information, please see the discussion in the Risks That May Affect Future Results section on page 79 of the 2018 MD&A and the sections related to credit and counterparty, market, insurance, liquidity and funding, operational, model, legal and regulatory, business, strategic, environmental and social, and reputation risk, in the Enterprise-Wide Risk Management section on page 78 of the 2018 MD&A, all of which outline certain key factors and risks that may affect our future results. Investors and others should carefully consider these factors and risks, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. We do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by the organization or on its behalf, except as required by law. The forward-looking information contained or incorporated by reference in this document is presented for the purpose of assisting our shareholders in understanding our financial position as at and for the periods ended on the dates presented, as well as our strategic priorities and objectives, and may not be appropriate for other purposes.

Material economic assumptions underlying the forward-looking statements contained or incorporated by reference in this document are set out in the Economic Developments and Outlook section on page 30 of the 2018 MD&A. Assumptions about the performance of the Canadian and U.S. economies, as well as overall market conditions and their combined effect on our business, are material factors we consider when determining our strategic priorities, objectives and expectations for our business. In determining our expectations for economic growth, both broadly and in the financial services sector, we primarily consider historical economic data provided by governments, historical relationships between economic and financial variables, and the risks to the domestic and global economy.

2

CORPORATE STRUCTURE

Bank of Montreal started business in Montreal in 1817 and was incorporated in 1821 by an Act of Lower Canada as the first Canadian chartered bank. Since 1871, the Bank has been a chartered bank under the Bank Act (Canada) (the Bank Act), and is named in Schedule I of the Bank Act. The Bank Act is the charter of the Bank and governs its operations.

The Bank’s head office is 129 rue Saint Jacques, Montreal, Quebec, H2Y 1L6. Its executive offices are 100 King Street West, 1 First Canadian Place, Toronto, Ontario, M5X 1A1.

Bank of Montreal brands the organization’s member companies as BMO Financial Group. Note 26 to the 2018 Financial Statements lists the intercorporate relationships among Bank of Montreal and its significant subsidiaries. We incorporate this Note by reference. These subsidiaries are incorporated or organized under the laws of the state or country of their principal office, except for: BMO Financial Corp.; BMO Asset Management Corp.; BMO Capital Markets Corp.; BMO Harris Financial Advisors, Inc.; BMO Harris Financing, Inc. and CTC myCFO, LLC, which are incorporated under the laws of the State of Delaware, U.S. F&C Asset Management plc is incorporated under the laws of Scotland.

GENERAL DEVELOPMENT OF THE BUSINESS

Three-Year History

As at October 31, 2018, BMO was the eighth largest bank in North America by assets.

On December 1, 2015, BMO completed the acquisition of General Electric Capital Corporation’s (GE Capital) Transportation Finance business in the United States and Canada with net assets on closing of approximately $12.1 billion (U.S. $9.0 billion), and rebranded it BMO Transportation Finance. The acquisition built on our position as a market leader in commercial banking, and enhanced our business position in the United States by further diversifying net income, adding scale and enhancing profitability and margins. In fiscal 2017, BMO completed the integration of BMO Transportation Finance, allowing us to leverage the combined capabilities and suite of financial solutions to better meet our customers’ needs.

On October 28, 2016, BMO announced the appointments of Franklin J. Techar as Vice-Chair, BMO Financial Group, Darryl White as Chief Operating Officer, BMO Financial Group, Patrick Cronin as Group Head, BMO Capital Markets, Gilles Ouellette as Group Head, BMO Asset Management and Joanna Rotenberg as Group Head, BMO Wealth Management. Each of these appointments was effective November 1, 2016.

On April 7, 2017, BMO announced its intention to appoint Darryl White, Chief Operating Officer, BMO Financial Group, to the office of Chief Executive Officer, BMO Financial Group effective November 1, 2017, as successor to William Downe, who had announced his intention to retire effective October 31, 2017. Mr. White was appointed to the Bank’s board of directors on May 24, 2017. On October 31, 2017, Mr. Downe retired as Chief Executive Officer of the Bank and, on November 1, 2017, Mr. White became Chief Executive Officer.

On October 10, 2018, BMO announced the appointments of Patrick Cronin as Chief Risk Officer, BMO Financial Group and Dan Barclay as Group Head, BMO Capital Markets. Each of these appointments was effective November 1, 2018.

BMO has had common share buyback programs in place for several years. The 2018-2019 program expires on May 31, 2019. During the year ended October 31, 2018, the Bank repurchased and cancelled a total of 10 million common shares, 3 million of which were purchased pursuant to a specific share repurchase program agreement.

For additional information on the general development of BMO’s business and our strategies for the upcoming year, see pages 25, 28, and 43 to 61 of the 2018 MD&A, which we incorporate herein by reference.

This Three-Year History section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

DESCRIPTION OF THE BUSINESS

Business

BMO Financial Group is a highly diversified financial services provider based in North America. BMO offers a broad range of products and services directly and through Canadian and non-Canadian subsidiaries, offices, and branches. As at October 31, 2018, BMO had more than 12 million customers and more than 45,000 full-time equivalent employees. The Bank has approximately 1,500 bank branches in Canada and the United States and operates internationally in major financial markets and trading areas through its offices in 27 jurisdictions. BMO Financial Corp. (BFC) is based in Chicago and wholly-owned by Bank of Montreal. BFC operates primarily through its subsidiary BMO Harris Bank N.A. (BHB), which provides banking, financing, investing, and cash management services in select markets in the U.S. Midwest. BMO provides a full range of investment dealer services through entities, including BMO Nesbitt Burns Inc., a major fully integrated Canadian investment dealer, and BMO Capital Markets Corp., Bank of Montreal’s wholly-owned registered securities dealer in the United States.

3

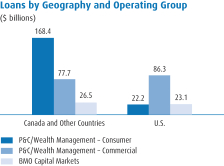

BMO conducts business through three operating groups: Personal and Commercial Banking (P&C), made up of Canadian P&C and U.S. P&C; Wealth Management; and BMO Capital Markets. Canadian P&C operates across Canada, offering a broad range of products and services, including banking, lending and treasury management. Operating predominately in the U.S. Midwest under the BMO Harris brand, U.S. P&C offers personal and commercial clients banking, lending, and treasury management products and services. Wealth Management serves a full range of clients from mainstream to ultra-high net worth and institutional, with a broad offering of wealth management products and services including insurance. Wealth Management is a global business with an active presence in markets across Canada, the United States, Europe, the Middle East and Africa (EMEA) and Asia. BMO Capital Markets is a North American-based financial services provider offering a complete range of products and services to corporate, institutional and government clients. These include equity and debt underwriting, institutional sales and trading, corporate lending and project financing, mergers and acquisitions advisory services, securitization, treasury management, risk management and equity and fixed income research. Corporate Services consists of Corporate Units and Technology and Operations (T&O). Corporate Units provide enterprise-wide expertise, governance and support in a variety of areas, including strategic planning, risk management, finance, legal and regulatory compliance, human resources, communications, marketing, real estate, procurement, data and analytics, and innovation. T&O manages, maintains and provides governance of information technology, cyber security and operations services for BMO Financial Group.

For additional information regarding BMO’s businesses, see pages 25, 28, and 43 to 61 of the 2018 MD&A and Note 25 to the 2018 Financial Statements. We incorporate these pages and Note by reference.

This Business section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

Supervision and Regulation in Canada

Bank of Montreal’s activities in Canada are governed by the Bank Act.

Under the Bank Act, a bank can operate its regular banking business as well as some additional activities, such as dealing with real property and various financial technology and information services. A bank is restricted when it undertakes certain activities, including fiduciary activities, dealing in securities, insurance activities, and personal property leasing. For example, other than for authorized types of insurance, a bank may not offer insurance products through its branch system or bank website.

The Bank Act grants a bank broad power to invest in the securities of other corporations and entities, but limits substantial investments. Under the Bank Act, a bank generally has a substantial investment in a body corporate when (1) the bank and entities controlled by the bank beneficially own more than 10% of the voting shares of the body corporate or (2) the bank and entities controlled by the bank beneficially own shares representing more than 25% of the total shareholders’ equity of the body corporate. A bank can have a substantial investment in entities that meet the substantial investment requirements as set out in Part IX of the Bank Act. In certain cases, the Minister of Finance or the Superintendent of Financial Institutions (Canada) (the Superintendent) must approve before making an investment.

The Superintendent is responsible to the Minister of Finance for administering the Bank Act. The Superintendent provides guidelines for disclosing a bank’s financial information. The Superintendent must also examine each bank annually to ensure compliance with the Bank Act and that each bank is in sound financial condition. The Superintendent’s examination report is submitted to the Minister of Finance.

The Bank’s Canadian trust, loan and insurance subsidiaries are federally regulated financial institutions governed by the Trust and Loan Companies Act (Canada) and the Insurance Companies Act (Canada), respectively, and under provincial laws in respect of their activities in the provinces. The Bank and its Canadian trust, loan and insurance subsidiaries are also subject to regulation by the Financial Consumer Agency of Canada (the FCAC). The FCAC enforces consumer-related provisions of the federal statutes which govern these financial institutions. Certain activities of the Bank and its subsidiaries acting as securities brokers, dealers, underwriters, advisors and investment fund managers are regulated in Canada under provincial securities legislation and, in some cases, by a self-regulatory organization (the Investment Industry Regulatory Organization of Canada or the Mutual Fund Dealers Association of Canada).

Under Canadian bank resolution powers, the Canada Deposit Insurance Corporation (CDIC) may, in circumstances where the Bank has ceased, or is about to cease, to be viable, assume temporary control or ownership of the Bank and may be granted broad powers by one or more orders of the Governor in Council (Canada), including the power to sell or dispose of all or a part of the assets of the Bank, and the power to carry out or cause the Bank to carry out a transaction or a series of transactions the purpose of which is to restructure the business of the Bank. As part of the Canadian bank resolution powers, certain provisions of, and regulations under the Bank Act, the Canada Deposit Insurance Corporation Act (CDIC Act) and certain other Canadian federal statutes pertaining to banks (collectively, the bail-in regime) provide for a bank recapitalization regime for banks designated by the Superintendent as domestic systemically important banks. Effective September 23, 2018, under the bail-in regime, subject to an order of the Governor in Council (Canada) having been issued, CDIC may, having assumed temporary control or ownership of the Bank, amongst other actions, carry out a conversion, by converting or causing the Bank to convert, in whole or in part – by means of a transaction or series of transactions and in one or more steps – the shares and liabilities of the Bank that are subject to the bail-in regime into common shares of the Bank or any of its affiliates. For a more detailed description of Canadian bank resolution powers and the consequent risk factors attaching to certain liabilities of the Bank, reference is made to https://www.bmo.com/ir/files/F18%20Files/Bail_In_TLAC_Disclosure.pdf. The information on our website does not form a part of this Annual Information Form.

Additional information about supervision and regulation in Canada is found under the headings “Regulatory Capital Requirements” and “Capital Regulatory Developments” in the Enterprise-Wide Capital Management section on pages 69 to 71, “Regulatory Requirements” in the Risks That May Affect Future Results section on page 80, “Regulatory Developments” in the Liquidity and Funding Risk section on page 106, and “Legal and Regulatory Risk” on pages 112 to 114 of the 2018 MD&A, which we incorporate herein by reference.

Supervision and Regulation in the United States

In the United States, the operations of Bank of Montreal and its subsidiaries are supervised, regulated, and examined by regulatory and government agencies at the federal and state level. As a foreign bank, Bank of Montreal is subject to various U.S. laws and regulations, including the United States International Banking Act of 1978, the United States Bank Holding Company Act of 1956, and related regulations. The Board of Governors of the Federal Reserve System, including the Federal Reserve Banks (the Federal Reserve), and state banking regulators oversee the Bank of Montreal’s branch and office operations in the United States. The U.S. Securities and Exchange Commission (the SEC), the Financial Industry Regulatory Authority, and state securities regulators regulate broker-dealer subsidiaries. The SEC and state securities regulators regulate registered investment advisor subsidiaries.

Bank of Montreal and its subsidiaries own two Federal Deposit Insurance Corporation (FDIC) insured depository institutions in the United States, BHB and BMO Harris Central N.A. (BHC). BHB provides banking, financing, investing, and cash management services in select markets in the U.S. Midwest. BHC provides limited cash management services. They are subject to examination by the Office of the Comptroller of the Currency (OCC). The Federal Reserve generally

4

needs to approve acquiring (a) more than 5% of voting shares, (b) control, or (c) all (or substantially all) of the assets of a bank holding company, bank, or savings association.

The Bank is also subject to the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). Dodd-Frank reforms include heightened consumer protection, revised regulation of over-the-counter derivatives markets, restrictions on proprietary trading and the ownership and sponsorship of private investment funds by banks and their affiliates (referred to as the Volcker Rule), imposition of heightened prudential standards, and broader application of leverage and risk-based capital requirements.

The Federal Reserve Board’s rule for strengthening supervision and regulation of foreign banking organizations (FBO Rule) implemented Dodd Frank’s enhanced prudential standards for the U.S. operations of non-U.S. banks, such as BMO. The rule established new requirements relating to an intermediate holding company structure, risk based capital and leverage requirements, capital stress testing requirements, U.S. risk management and risk governance, liquidity risk management and liquidity stress testing frameworks. We have certified our compliance with this rule. In May 2018, the U.S. Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCP), which made reforms to Dodd-Frank, including raising the threshold for heightened prudential standards from US$50 billion to US$250 billion in total consolidated assets. EGRRCP rulemaking will likely continue for at least the next year and may impact our U.S. operations, including with respect to any changes to the FBO Rule.

The OCC has issued guidelines that establish heightened standards for large national banks with average total consolidated assets of US$50 billion or more, including BHB. The guidelines set out minimum standards for the design and implementation of a bank’s risk governance framework and minimum standards for oversight of that framework by a bank’s board of directors. The framework must ensure the bank’s risk profile is easily distinguished and separate from that of its parent for risk management purposes. A bank’s board of directors is responsible for informed oversight of, and providing credible challenge to, management’s risk management recommendations and decisions. We comply with these guidelines.

Additional information about supervision and regulation in the United States is found under the headings “Regulatory Capital Requirements” and “Capital Regulatory Developments” in the Enterprise-Wide Capital Management section on pages 69 to 71, “Regulatory Requirements” in the Risks That May Affect Future Results section on page 80, and “Legal and Regulatory Risk” on pages 112 to 114 of the 2018 MD&A, which we incorporate herein by reference.

This Supervision and Regulation in the United States section contains forward-looking statements. Please see the Cautionary Statement on page 2.

International Supervision and Regulation

Outside Canada and the U.S., each of Bank of Montreal’s branches, agencies and subsidiaries must comply with the regulatory requirements of the country or jurisdiction where it conducts business. These include the Basel Committee on Banking Supervision capital, liquidity and prudential rules (Basel III), or local variations on Basel III, which are intended to strengthen the banking sector’s capital and liquidity frameworks. Since the first quarter of 2013, regulatory capital requirements for Bank of Montreal have been determined on a Basel III basis. Additional information about international supervision and regulation is found under the headings “Regulatory Capital Requirements”, “Regulatory Capital Ratios”, “Regulatory Capital Elements” and “Capital Regulatory Developments” in the Enterprise-Wide Capital Management section on pages 69 to 71, “Regulatory Requirements” in the Risks That May Affect Future Results section on page 80, and “Legal and Regulatory Risk” on pages 112 to 114 of the 2018 MD&A, which we incorporate herein by reference.

Competition

Canada’s financial services industry is highly competitive. It includes 35 domestic banks and 53 foreign bank subsidiaries, branches, and lending branches, as well as a multitude of trust companies, credit unions, online and full-service brokerages, investment dealers, life and property and casualty insurance companies, mutual fund dealers, and large monoline financial institutions, among others. Bank of Montreal competes with most of these companies in some form in our different businesses. However, our range of services compares to those of the other five major Canadian banks, and they are our direct competitors in almost all our businesses and markets in Canada. Bank of Montreal was the fourth largest chartered bank in Canada as measured by assets, equity, and market capitalization as at October 31, 2018. In North America, we are the eighth largest bank by assets, tenth largest by equity and by market capitalization as at October 31, 2018 for BMO. BMO is the second largest Canadian bank as measured by retail branches in Canada and the United States.

The financial services industry continues its rapid change, as technology enables new non-traditional entrants to compete in certain segments of banking, in some cases with reduced regulatory requirements and oversight. New entrants may leverage new technologies, advanced data and analytical tools, lower cost to serve and/or faster processes to challenge traditional banks, including new business models in retail payments, consumer and commercial lending, foreign exchange and low-cost investment advisory services. Failure to keep pace with these new technologies and competition may potentially impact our overall revenues and earnings if customers choose the services of these new market entrants. While we closely monitor technology disruptors, we also continue to adapt by increasing our investment in technology and innovation to keep pace with dynamic client expectations. This includes improving our mobile and internet banking capabilities, building new branch formats, and refining our credit decisioning, analytic and modelling data and tools and, where appropriate, bringing new and enhanced customer solutions to market. We further mitigate this risk by providing our customers with access to banking services across different channels, focusing on improving customer loyalty and trust, enhancing our advanced data and analytical tools, and leveraging current and future partnerships in order to deliver an exceptional customer experience with reduced costs and simplified processes. However, matching the pace of innovation exhibited by new and differently-situated competitors may require us and policy-makers to adapt at a faster pace.

The six major banks play a prominent role in the Canadian banking system, each maintaining an extensive and evolving branch network, augmented by automated banking machines, as well as telephone, internet, and mobile banking systems. The industry is considered mature with moderate growth, supported by an overall focus on productivity, investments in infrastructure and technology integration. Although the major banks offer similar products and services, they compete on offerings, pricing, service models and technology, as well as entering into partnerships and alliances, with a goal of gaining a strategic advantage and serving customers better. Increased competition is also evident in the drive for scale and operating efficiencies.

BMO’s Canadian P&C banking business is one of the top five in Canada in all core product areas, providing a full range of lending, deposit and treasury management products and services to eight million customers. Canadian P&C continues to focus on strengthening customer loyalty in order to generate growth in a competitive environment, as well as increasing digital capabilities to augment the customer experience. Personal Banking provides customers with a wide range of products and services, including chequing and savings accounts, credit cards, mortgages and everyday financial and investment advice. Our employees are focused on providing exceptional service to all of our customers every time they interact with us.

Canadian P&C’s award winning1 commercial bank possesses a strong competitive position in commercial lending, with a number two market share for business loans of up to $25 million. Commercial Banking provides small business and commercial banking customers with a broad suite of commercial products and

5

services, including business deposit accounts, commercial credit cards, business loans and commercial mortgages, cash management solutions, foreign exchange and specialized banking programs. Our Commercial bankers partner with our customers to help them grow and manage their business.

1 In 2018, the Bank was named the Best Commercial Bank in Canada by World Finance Magazine for the fourth consecutive year.

In Canada, Wealth Management competes with domestic banks, insurance companies, trust companies, global private banks, investment counselling firms, and mutual fund companies. Wealth Management’s Canadian businesses have strong brand recognition and market position. Wealth Management has a strong market share in each of its full-service brokerage, online brokerage, and private banking businesses and investment funds. In the United States, Wealth Management competes primarily in U.S. personal wealth and asset management, with our strategic presence in the Chicago and Milwaukee area and in select high-growth wealth markets across the country. In EMEA and Asia, Wealth Management competes primarily in asset management through BMO Global Asset Management.

BMO Capital Markets operates in a highly competitive environment and our businesses face a diverse range of competitors. With approximately 2,700 professionals in 33 locations around the world, including 19 offices in North America, BMO Capital Markets works proactively with clients to provide innovative ideas and tailored financial solutions. Our success is based on a highly integrated, client-focused North American capital markets business with a well-diversified platform and business mix – by sector, geography, product and currency. This includes a strong, scalable and relevant U.S. business, and strong risk management and regulatory compliance practices.

Competition in the United States is more complex than in Canada, given the market’s size and activity, as well as personal and commercial banking competitors at the community, regional, and national level, plus other financial service providers. U.S. P&C operations are primarily based in the six states of the U.S. Midwest (Illinois, Wisconsin, Indiana, Minnesota, Missouri and Kansas). In addition, our personal business serves customers in Arizona and Florida, while our commercial business provides targeted nationwide coverage for key specialty sectors. The personal and commercial banking environment is vibrant and competitive, and with a rising rate environment, there is added pressure on deposit market share. Indicators of sustainable economic growth within our footprint include unemployment rates that are at historic lows, higher consumer and commercial spending amid lower income taxes, encouraging credit growth and a healthy housing market. Financial conditions reflect improved business spend, driven by economic growth and the benefit from corporate tax reform. The main risks to the U.S. economic outlook relate to trade protectionism, geopolitical tensions and the possibility of rising inflation. The commercial business remains the engine of our growth, as our main priorities are to build out a presence in new markets, accelerate growth in existing markets and deepen our relationships with our current customers. We’re committed to achieving growth in loans that leads our peer group by investing in talent and enhancing the customer experience. We’re also committed to the development of our personal banking business through the adoption of digital solutions and progressive product offerings as we align our strategic initiatives with market trends and consumer needs. Our initiatives include operational efficiencies, market penetration efforts, online mobility and product offering enhancements. To support these initiatives as they begin to drive customer adoption and growth, we’re investing in competitive digital capabilities that address the needs of our current and potential customers.

Consolidation has been underway in the financial services industry in Canada and the United States in recent years. This affects trust companies, mutual fund managers, life insurers, and credit unions. Canadian federal government policy discourages large banks from merging. It is uncertain whether this will change in the near future but further consolidation and increased competition in the financial services industry overall is likely.

This Competition section contains forward-looking statements. Please see the Caution Regarding Forward-Looking Statements on page 2.

Environmental, Social and Governance Issues

The Bank publishes an Environmental, Social and Governance Report and Public Accountability Statement, outlining how the Bank is addressing environmental, social, and governance issues. This report and other related information is available on the Bank’s website, www.bmo.com. Additional information about our environmental and social risks is under the heading “Risks that May Affect Future Results – Other Factors that May Affect Future Results – Environmental Events” and “Environmental and Social Risk” in the Enterprise-Wide Risk Management section on page 81 and pages 115-116 of the 2018 MD&A, which we incorporate herein by reference.

DIVIDENDS

You can find information about the Bank’s dividends paid or payable per share on the common shares and each outstanding series of preferred shares in each of the three most recently completed years in Note 16 of the 2018 Financial Statements and under the heading “Outstanding Shares and NVCC Capital Instruments” on page 75 of the 2018 MD&A, which Note and page we incorporate herein by reference.

We cannot declare dividends on our preferred or common shares if paying those dividends would contravene the capital adequacy, liquidity, or other regulations under the Bank Act. Also, we cannot pay common share dividends unless we have paid all dividends declared and payable on the Bank’s preferred shares or set aside sufficient funds to do so. The Board of Directors determines the amount and payment of future dividends. The determination by the Board of Directors depends on the Bank’s operations, financial condition, cash requirements, future regulatory restrictions on the payment of dividends, and other factors the Board of Directors finds relevant. You can find information about our dividends and our dividend payout range on page 75 of the 2018 MD&A, which we incorporate herein by reference.

DESCRIPTION OF CAPITAL STRUCTURE

The following summarizes certain provisions of our common and preferred shares. This summary is qualified in its entirety by the actual terms and conditions of such shares. For more detail on the Bank’s capital structure, see pages 71 to 75 of the 2018 MD&A and Notes 16 and 19 of the 2018 Financial Statements. We incorporate those pages and Notes by reference.

6

Description of Common Shares

The authorized capital of the Bank includes an unlimited number of common shares without nominal or par value for unlimited consideration. The holders of common shares are entitled to:

| (i) | Vote at all Bank shareholders’ meetings, except for meetings where only holders of a specified class or series of shares are entitled to vote. |

| (ii) | Receive dividends as and when declared by the Board of Directors, subject to the preference of the Bank’s holders of preferred shares. |

| (iii) | Receive the remaining property of the Bank if it is liquidated, dissolved, or wound up, only after paying the Bank’s holders of preferred shares and paying all outstanding debt. |

Description of Preferred Shares

The authorized capital of the Bank includes an unlimited number of Class A Preferred Shares and Class B Preferred Shares without nominal or par value, in series, for unlimited consideration. Class B Preferred shares may be issued in a foreign currency. The following describes certain general terms and conditions of the preferred shares.

Certain Conditions of the Class A Preferred Shares as a Class

Issuable in Series

From time to time, the Board of Directors may resolve to issue Class A Preferred Shares in one or more series with rights, privileges, restrictions, and conditions, which the Board of Directors may also decide. As at December 3, 2018, there were no outstanding Class A Preferred Shares.

The Class A Preferred Shares of each series rank equally to all other series of Class A and Class B Preferred Shares and are entitled to preference over the common shares and over any other shares ranking junior to the Class A Preferred Shares and the Class B Preferred Shares with respect to the payment of dividends and in the distribution of property in the event of the liquidation, dissolution or winding up of the Bank.

Creating and Issuing Shares

Under the Bank Act, we need approval from the holders of Class A Preferred Shares to create any other class of shares with equal or superior rank to Class A Preferred Shares. Shareholders must give this approval as set out below in “Shareholder Approvals.” The Bank Act and other laws may also require other forms of approval.

We do not require shareholder approval to create or issue additional Class A Preferred Shares or shares of equal rank if, on the date they are created or issued, we have declared and paid or set apart for payment all dividends payable on cumulative and non-cumulative Class A Preferred Shares, including for the most recently completed fiscal period.

Voting Rights

The holders of the Class A Preferred Shares only have voting rights as a class on certain matters (see below) or as the law requires.

Shareholder Approvals

Holders of the Class A Preferred Shares can give their approval if 66 2/3% or more holders casting vote in favour of doing so at a meeting where the majority of Class A Preferred Shares is represented, or if no quorum is present at such a meeting, at an adjourned meeting at which no quorum requirements apply.

Certain Conditions of the Class B Preferred Shares as a Class

Issuable in Series

From time to time, the Board of Directors may resolve to issue Class B Preferred Shares in one or more series with rights, privileges, restrictions, and conditions, which the Board of Directors may also decide.

The Class B Preferred Shares of each series rank equally to all the other series of Class B and Class A Preferred Shares and are entitled to preference over the common shares and any other shares ranking junior to the Class A Preferred Shares and the Class B Preferred Shares with respect to the payment of dividends and in the distribution of property in the event of the liquidation, dissolution or winding up of the Bank.

Creating and Issuing Shares

Under the Bank Act, we need approval from holders of Class B Preferred Shares to create any other class of shares with equal or superior rank to Class B Preferred Shares. The Bank Act or other laws may also require other forms of approval.

We do not require shareholder approval to create or issue additional Class B Preferred Shares or shares of equal rank if, on the date they are created or issued, we have declared and paid or set apart for payment all dividends payable on cumulative and non-cumulative Class B Preferred Shares, including for the most recently completed fiscal period. As at December 3, 2018, none of the outstanding Class B Preferred Shares have the right to cumulative dividends.

7

Voting Rights

The holders of the Class B Preferred Shares only have voting rights as a class on certain matters (see below) or as the law requires.

Shareholder Approvals

Holders of the Class B Preferred Shares can give their approval if 66 2/3% or more holders casting vote in favour of doing so at a meeting where the majority of Class B Preferred Shares is represented, or if no quorum is present at such meeting, at an adjourned meeting at which no quorum requirements apply.

Contingent Conversion of Certain Series of Class B Preferred Shares

Upon the occurrence of certain specified trigger events relating to the viability of the Bank, the Class B Preferred Shares Series 27 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 29 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 31 (Non-Viability Contingent Capital) (NVCC)), Class B Preferred Shares Series 33 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 35 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 36 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 38 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 40 (Non-Viability Contingent Capital (NVCC)), Class B Preferred Shares Series 42 (Non-Viability Contingent Capital (NVCC)) and Class B Preferred Shares Series 44 (Non-Viability Contingent Capital (NVCC)) will immediately and automatically be converted into common shares of the Bank. The number of common shares into which such Class B Preferred Shares would be converted upon the occurrence of such a trigger event will be determined in accordance with a pre-determined conversion formula specified at the time of issuance of such Class B Preferred Shares.

Restraints on Bank Shares under the Bank Act

The Bank Act restricts the beneficial ownership of shares of a bank. No person may be a major shareholder of a bank if the bank has equity of $12 billion or more, which applies to the Bank. A major shareholder is defined as a person, or group of persons under common control or acting jointly or in concert, that beneficially owns more than 20% of any class of voting shares or more than 30% of any class of non-voting shares of the bank.

In addition, no person may have a significant interest in any class of shares of a bank, including the Bank, unless the person first receives the approval of the Minister of Finance. A person has a significant interest in a class of shares of a bank when the person, or group of persons under common control or acting jointly or in concert, beneficially owns more than 10% of any class of shares of the bank.

Governments and their agents are also restricted from acquiring shares of a bank, except for certain cases that require the Minister of Finance’s consent.

Ratings

The following table sets out ratings the Bank has received for its outstanding securities from the rating agencies, which are current as at December 3, 2018.

|

S&P

|

Moody’s

|

DBRS

|

Fitch

| |||||||||||||

| Rating

|

Rank1

|

Rating

|

Rank1

|

Rating

|

Rank1

|

Rating

|

Rank1

| |||||||||

|

Short-term instruments

|

A-1 | 1 of 6 | P-1 | 1 of 4 | R-1 (high) | 1 of 6 | F1+ | 1 of 6 | ||||||||

|

Senior debt4 |

A- | 3 of 10 | A2 | 3 of 9 | AA (low) | 2 of 10 | AA- | 2 of 10 | ||||||||

|

Long Term Deposits / Legacy Senior Debt5 |

A+ | 3 of 10 | Aa2 | 2 of 9 | AA | 2 of 10 | AA- | 2 of 10 | ||||||||

|

Subordinated debt

Subordinated debt – NVCC2 |

A-

BBB+ |

3 of 10

4 of 10 |

Baa1

Baa1 |

4 of 9

4 of 9 |

A (high)

A (low) |

3 of 10

3 of 10 |

A+

A+ |

3 of 10

3 of 10 | ||||||||

|

Preferred shares3

Preferred shares – NVCC2,3

|

BBB

BBB- |

4 of 10

4 of 10 |

Baa3

Baa3 |

4 of 9

4 of 9 |

Pfd-2 (high)

Pfd-2 |

2 of 6

2 of 6 |

N/A

N/A |

N/A

N/A | ||||||||

|

Trend/Outlook

|

Stable | -- | Stable | -- | Stable | -- | Stable | -- | ||||||||

Notes: 1 Rank, according to each rating agency’s public website, refers to the assigned ratings ranking of all major assignable ratings for each debt or share class, 1 being the highest. Each assignable major rating may be modified further (+/-, high/low) to show relative standing within the major rating categories.

2 Non-viability contingent capital or NVCC.

3 It is the practice of S&P to present an issuer’s preferred share ratings on both the global rating scale and on the Canadian national scale when listing the ratings for a particular issuer.

4 Subject to conversion under the Bank Recapitalization (“Bail-In”) Regime. Defined as “Junior Senior Unsecured” by Moody’s, “Bail-in Eligible Senior Debt” by S&P, “Bail-in Eligible Debt” by Fitch, and “Bailinable Senior Debt” by DBRS.

5 Long Term Deposits / Legacy Senior Debt Includes: (a) Senior debt issued prior to September 23, 2018; and (b) Senior debt issued on or after September 23, 2018 which is excluded from the Bank Recapitalization (“Bail-In”) Regime. Defined as “Senior Unsecured” by Moody’s and S&P; and “Legacy Senior” by Fitch and DBRS.

8

A definition of the categories of each rating as at December 3, 2018 from each rating agency’s website is outlined in Appendix II to this Annual Information Form. Further information may be obtained from the applicable rating agency. S&P, Moody’s DBRS and Fitch each have a stable outlook on BMO’s long-term credit ratings.

On April 19, 2018, following the finalization of the Bail-In Regime in Canada, DBRS changed the trend to Stable from Negative on the long-term issuer ratings, senior debt ratings and deposit ratings of Bank of Montreal; ratings of legacy subordinated debt were downgraded by one notch for all Canadian domestic systemically important banks.

On July 16, 2018, Moody’s took various actions on its ratings of Canadian banks following the introduction of a bank resolution framework. The actions included an upgrade to the ratings for BMO’s senior unsecured debt and junior subordinated bank debt (NVCC). The outlook was changed to Stable from Negative.

On August 14, 2018, S&P upgraded its stand-alone credit profile on BMO to ‘a’ from ‘a-‘, to reflect improvements in its assessment of BMO’s risk position. S&P affirmed its ‘A+/A-1’ long-term and short-term issuer credit ratings on BMO and its operating subsidiaries, and the outlook remains Stable. At the same time, S&P raised its ratings on BMO’s subordinated debt and additional Tier 1 instruments by one notch, reflecting improvements in the bank’s stand-alone creditworthiness.

All of the rating agencies have also assigned provisional ratings to senior unsecured debt subject to the Bail-In Regime. Moody’s, S&P, Fitch and DBRS have assigned provisional ratings of A2, A-, AA- and AA (low) respectively.

The credit ratings that external rating agencies assign to some of our securities are important in the raising of both capital and funding to support our business operations. Maintaining strong credit ratings allows the Bank to access the capital markets at competitive pricing levels. Should our credit ratings experience a downgrade, our cost of funds would likely increase and our access to funding and capital through capital markets could be reduced. A material downgrade of our ratings could also have other consequences, including those set out in Note 8 of the 2018 Financial Statements.

Credit ratings are not recommendations to purchase, hold, or sell securities and do not address the market price or suitability of a specific security for a particular investor. Credit ratings may not reflect the potential impact of all risks on the value of securities. In addition, real or anticipated changes in the rating assigned to a security will generally affect the market value of that security. We cannot know for certain that a rating will remain in effect for any given period of time or that a rating agency will not revise or withdraw it entirely in the future.

The Bank paid fees to credit rating agencies to obtain its credit ratings. The Bank may also pay fees for other services from credit rating agencies in the ordinary course of business.

MARKET FOR SECURITIES

Trading Price and Volume

The outstanding common shares of the Bank are listed for trading on the Toronto Stock Exchange (TSX) and on the New York Stock Exchange (NYSE) under the trading symbol BMO. The outstanding preferred shares of the Bank set out below are listed on the TSX with the following trading symbols: BMO.PR.Q for the Class B Preferred Shares Series 25, BMO.PR.A for the Class B Preferred Shares Series 26, BMO. PR.S for the Class B Preferred Shares Series 27 (Non-Viability Contingent Capital (NVCC)), BMO.PR.T for the Class B Preferred Shares Series 29 (Non-Viability Contingent Capital (NVCC)), BMO. PR.W for the Class B Preferred Shares Series 31 (Non-Viability Contingent Capital (NVCC)), BMO.PR.Y for the Class B Preferred Shares Series 33 (Non-Viability Contingent Capital (NVCC)), BMO.PR.Z for the Class B Preferred Shares Series 35 (Non-Viability Contingent Capital (NVCC)), BMO.PR.B for the Class B Preferred Shares Series 38 (Non-Viability Contingent Capital (NVCC)), BMO.PR.C for the Class B Preferred Shares Series 40 (Non-Viability Contingent Capital (NVCC)), BMO.PR.D for the Class B Preferred Shares Series 42 (Non-Viability Contingent Capital (NVCC)) and BMO.PR.E for the Class B Preferred Shares Series 44 (Non-Viability Contingent Capital (NVCC)).

The following table sets out the reported high and low trading prices in Canadian dollars and the trading volumes of the common and preferred shares of Bank of Montreal on the TSX for the given periods. Prices are based on the reported data from the TSX Historical Data Access. The Class B Preferred Shares Series 16 (BMO.PR.M) and the Class B Preferred Shares Series 17 (BMO.PR.R) were redeemed by the Bank on August 25, 2018.

| BMO Common |

PR.M Series 16 |

PR.R Series 17 |

PR.Q Series 25 |

PR.A Series 26 |

PR.S Series 27 |

PR.T Series 29 |

PR.W Series 31 |

PR.Y Series 33 |

PR.Z Series 35 |

PR.B Series 38 |

PR.C Series 40 |

PR.D Series 42 |

PR.E Series 44 |

|||||||||||||||||||||||||||||||||||||||||||

| November 2017 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - High Price ($) |

100.00 | 24.96 | 24.98 | 22.79 | 22.59 | 24.04 | 23.35 | 23.41 | 24.92 | 25.40 | 26.47 | 25.94 | 25.75 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Low Price ($) |

97.51 | 24.72 | 24.55 | 22.34 | 22.10 | 23.70 | 22.95 | 22.80 | 24.40 | 25.10 | 26.08 | 25.35 | 25.25 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Volume |

21,343,615 | 447,688 | 68,430 | 115,368 | 12,809 | 332,286 | 270,684 | 383,788 | 45,738 | 69,616 | 165,697 | 521,034 | 279,647 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| December 2017 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - High Price ($) |

101.62 | 25.08 | 25.07 | 23.94 | 23.28 | 24.00 | 23.38 | 23.15 | 25.10 | 25.49 | 26.37 | 25.95 | 25.59 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Low Price ($) |

98.61 | 24.88 | 24.74 | 22.25 | 22.38 | 23.03 | 22.31 | 22.25 | 24.06 | 25.10 | 25.90 | 25.25 | 25.00 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Volume |

24,355,569 | 149,078 | 17,816 | 101,896 | 24,158 | 364,439 | 364,974 | 159,955 | 135,638 | 49,477 | 784,350 | 158,506 | 289,015 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| January 2018 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - High Price ($) |

105.55 | 25.28 | 25.08 | 23.44 | 23.43 | 24.71 | 24.25 | 24.00 | 25.34 | 25.49 | 26.46 | 25.90 | 25.59 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Low Price ($) |

100.04 | 24.86 | 24.89 | 22.66 | 22.73 | 23.89 | 23.30 | 23.16 | 24.44 | 25.00 | 26.04 | 25.26 | 25.15 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Volume |

30,215,256 | 226,456 | 217,007 | 130,419 | 45,624 | 329,238 | 683,200 | 166,754 | 81,272 | 195,495 | 412,647 | 286,343 | 349,357 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| February 2018 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - High Price ($) |

101.35 | 24.95 | 24.85 | 22.93 | 22.88 | 24.40 | 23.94 | 23.57 | 24.86 | 25.10 | 26.49 | 25.57 | 25.42 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Low Price ($) |

93.60 | 24.66 | 24.68 | 22.28 | 22.49 | 23.58 | 23.18 | 22.92 | 24.27 | 24.76 | 25.75 | 25.15 | 24.90 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Volume |

32,985,346 | 594,430 | 233,757 | 96,055 | 13,511 | 170,388 | 320,233 | 434,421 | 50,317 | 132,010 | 135,200 | 315,865 | 332,189 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| March 2018 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - High Price ($) |

99.92 | 24.82 | 24.97 | 22.60 | 22.98 | 23.98 | 23.56 | 23.26 | 24.55 | 24.87 | 26.30 | 25.42 | 25.25 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Low Price ($) |

95.58 | 24.75 | 24.66 | 22.16 | 22.45 | 23.47 | 22.99 | 22.70 | 24.10 | 24.42 | 25.94 | 25.10 | 24.98 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| - Volume |

33,321,359 | 25,591 | 21,115 | 77,609 | 12,700 | 198,153 | 149,977 | 148,767 | 109,982 | 67,269 | 454,126 | 372,238 | 253,797 | n.a. | ||||||||||||||||||||||||||||||||||||||||||

| April 2018 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9

| - High Price ($) |

98.59 | 25.05 | 25.04 | 22.95 | 23.10 | 23.66 | 23.03 | 22.78 | 24.55 | 25.05 | 26.26 | 25.59 | 25.55 | n.a. | ||||||||||||||

| - Low Price ($) |

94.67 | 24.70 | 24.80 | 22.20 | 22.45 | 23.10 | 22.57 | 22.42 | 24.03 | 24.47 | 25.83 | 25.18 | 25.00 | n.a. | ||||||||||||||

| - Volume |

22,724,888 | 136,682 | 37,355 | 236,947 | 15,960 | 253,421 | 453,247 | 179,848 | 42,910 | 51,103 | 176,444 | 274,428 | 153,576 | n.a. | ||||||||||||||

| May 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

102.29 | 24.95 | 25.00 | 23.31 | 23.60 | 24.14 | 23.67 | 23.50 | 24.89 | 25.07 | 26.45 | 25.63 | 25.39 | n.a. | ||||||||||||||

| - Low Price ($) |

96.97 | 24.76 | 24.80 | 22.55 | 23.01 | 23.30 | 22.69 | 22.50 | 24.19 | 24.65 | 25.95 | 25.17 | 25.05 | n.a. | ||||||||||||||

| - Volume |

31,037,783 | 203,788 | 378,234 | 211,579 | 12,639 | 724,572 | 285,792 | 140,792 | 55,470 | 40,890 | 193,714 | 95,867 | 249,445 | n.a. | ||||||||||||||

| June 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

103.89 | 25.14 | 25.10 | 23.11 | 23.42 | 23.70 | 23.34 | 23.10 | 24.88 | 25.35 | 26.27 | 25.42 | 25.09 | n.a. | ||||||||||||||

| - Low Price ($) |

99.78 | 24.90 | 24.76 | 22.62 | 23.10 | 23.23 | 23.05 | 22.84 | 24.52 | 24.82 | 26.08 | 25.08 | 24.82 | n.a. | ||||||||||||||

| - Volume |

28,311,180 | 67,442 | 112,900 | 37,942 | 7,830 | 447,445 | 137,203 | 234,400 | 31,908 | 57,070 | 164,694 | 229,456 | 221,594 | n.a. | ||||||||||||||

| July 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

104.68 | 25.20 | 25.15 | 23.26 | 23.57 | 23.77 | 23.48 | 23.31 | 24.88 | 25.34 | 26.47 | 25.55 | 25.39 | n.a. | ||||||||||||||

| - Low Price ($) |

101.31 | 25.12 | 24.96 | 22.70 | 23.12 | 23.23 | 23.02 | 22.84 | 24.36 | 24.96 | 26.08 | 25.10 | 24.93 | n.a. | ||||||||||||||

| - Volume |

18,980,616 | 45,035 | 398,120 | 57,230 | 12,904 | 147,335 | 258,354 | 253,072 | 356,578 | 36,146 | 113,117 | 581,387 | 211,752 | n.a. | ||||||||||||||

| August 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

107.93 | 24.99 | 25.00 | 23.70 | 24.00 | 23.87 | 23.35 | 23.27 | 24.74 | 25.50 | 26.29 | 25.55 | 25.50 | n.a. | ||||||||||||||

| - Low Price ($) |

102.26 | 24.97 | 24.97 | 22.95 | 23.25 | 23.50 | 23.10 | 22.98 | 24.50 | 24.89 | 26.09 | 25.27 | 25.11 | n.a. | ||||||||||||||

| - Volume |

26,588,582 | 76,315 | 359,727 | 268,049 | 29,636 | 114,377 | 415,311 | 389,001 | 63,037 | 67,616 | 183,284 | 455,240 | 229,247 | n.a. | ||||||||||||||

| September 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

109.00 | n.a. | n.a. | 23.68 | 24.52 | 23.86 | 23.35 | 23.22 | 24.70 | 25.40 | 26.27 | 25.56 | 25.55 | 25.15 | ||||||||||||||

| - Low Price ($) |

105.51 | n.a. | n.a. | 23.41 | 23.93 | 23.39 | 22.93 | 22.69 | 24.39 | 25.00 | 25.93 | 25.27 | 25.04 | 24.90 | ||||||||||||||

| - Volume |

24,532,187 | n.a. | n.a. | 174,642 | 27,463 | 487,613 | 501,575 | 138,720 | 171,270 | 27,526 | 119,327 | 200,162 | 307,788 | 2,796,859 | ||||||||||||||

| October 2018 |

||||||||||||||||||||||||||||

| - High Price ($) |

107.64 | n.a. | n.a. | 23.51 | 24.40 | 23.99 | 23.99 | 23.57 | 24.96 | 25.10 | 26.29 | 25.99 | 25.95 | 25.48 | ||||||||||||||

| - Low Price ($) |

97.39 | n.a. | n.a. | 23.03 | 23.91 | 22.25 | 22.03 | 21.95 | 23.50 | 24.12 | 25.45 | 24.96 | 24.50 | 24.71 | ||||||||||||||

| - Volume |

36,190,464 | n.a. | n.a. | 105,156 | 33,575 | 208,892 | 527,672 | 208,805 | 64,534 | 56,538 | 154,299 | 492,885 | 423,175 | 1,489,319 |

Prior Sales

From time to time, the Bank issues principal at risk notes, securities for which the amount payable at maturity is determined by reference to the price, value or level of an underlying interest such as a stock index, an exchange traded fund or a notional portfolio of equities or other securities. For information about the Bank’s issuances of subordinated indebtedness since October 31, 2017, see the “Subordinated Debt” section on page 68 of our 2018 MD&A and Note 15 of our 2018 financial statements, which section and note are incorporated herein by reference.

DIRECTORS AND EXECUTIVE OFFICERS

Board of Directors

As at December 3, 2018, the following were directors of the Bank.

| DIRECTOR NAME AND PRINCIPAL OCCUPATION | MUNICIPALITY OF RESIDENCE | DIRECTOR SINCE | ||

| Jan Babiak Corporate Director |

Nashville, Tennessee USA |

October 23, 2012 | ||

| Sophie Brochu, C.M. President and Chief Executive Officer Énergir, a diversified energy company |

Bromont, Québec Canada |

March 22, 2011 | ||

| Craig Broderick Senior Director Goldman, Sachs & Co., a global investment bank |

Greenwich, Connecticut | August 27, 2018 | ||

| George A. Cope, C.M. President and Chief Executive Officer BCE and Bell Canada, communications companies |

Toronto, Ontario Canada |

July 25, 2006 | ||

| Christine Edwards Capital Partner Winston & Strawn LLP, a law firm |

Lake Forest, Illinois U.S.A. |

August 1, 2010 | ||

| Dr. Martin S. Eichenbaum Charles Moskos Professor of Economics Northwestern University |

Glencoe, Illinois U.S.A. |

March 31, 2015 | ||

| Ronald H. Farmer Managing Director Mosaic Capital Partners, a management and holding company |

Markham, Ontario Canada |

November 25, 2003 | ||

| David Harquail Chief Executive Officer Franco-Nevada Corporation, a royalty and streaming company |

Toronto, Ontario | April 5, 2018 | ||

| Linda S. Huber Corporate Director |

New York, New York U.S.A. |

April 4, 2017 |

10

| DIRECTOR NAME AND PRINCIPAL OCCUPATION | MUNICIPALITY OF RESIDENCE | DIRECTOR SINCE | ||

| Eric R. La Flèche President and Chief Executive Officer Metro Inc., a food retailer and distributor |

Montreal, Québec Canada |

March 20, 2012 | ||

| Lorraine Mitchelmore Corporate Director |

Calgary, Alberta Canada |

March 31, 2015 | ||

| Philip S. Orsino, O.C., F.C.A. President and Chief Executive Officer Brightwaters Strategic Solutions Inc., a consulting and advisory services company |

Toronto, Ontario Canada |

July 1, 1999 | ||

| J. Robert S. Prichard, O.C., O.Ont., FRSC Chairman of the Board, Bank of Montreal Non-Executive Chair, Torys LLP, a law firm |

Toronto, Ontario Canada |

July 18, 2000 | ||

| Darryl White Chief Executive Officer BMO Financial Group |

Toronto, Ontario Canada |

May 24, 2017 | ||

| Don M. Wilson III Corporate Director |

Vero Beach, Florida U.S.A |

March 28, 2008 |

A director of the Bank holds office until the next annual meeting of shareholders or until a successor is elected or appointed, unless their seat is vacated before they can do so.

Since November 1, 2013, the directors have held the principal occupations above, or other positions with the same, predecessor, or associated firms except for Mr. Broderick who before January 2018 was Chief Risk Officer of Goldman Sachs & Co., Ms. Huber who before July 2018 was the Executive Vice-President and Chief Financial Officer of Moody’s Corporation, Mr. Orsino, who, before April 2014, was the President and Chief Executive Officer of Jeld-Wen Inc., Ms. Mitchelmore, who before July 2018 was the President and Chief Executive Officer of Enlighten Innovations Inc. and before January 2016, was the President, Canada Country Chair & Executive Vice President, Heavy Oil, Shell Canada Limited and Mr. White who, from November 2016 until October 2017 was Chief Operating Officer of the Bank, from November 2014 until October 2016, was Group Head, BMO Capital Markets, and, from April 2012 until October 2014, was Global Head, Investment and Corporate Banking.

Board Committee Members

There are four committees of the Board of Directors made up of the following members:

Audit and Conduct Review Committee: Jan Babiak (Chair), Sophie Brochu, Dr. Martin S. Eichenbaum, David Harquail, Linda S. Huber and Philip Orsino.

Governance and Nominating Committee: Christine Edwards (Chair), Jan Babiak, George Cope, Ronald Farmer, Robert Prichard, and Don Wilson III.

Human Resources Committee: Ronald Farmer (Chair), George Cope, Christine Edwards, Lorraine Mitchelmore, Robert Prichard and Don Wilson III.

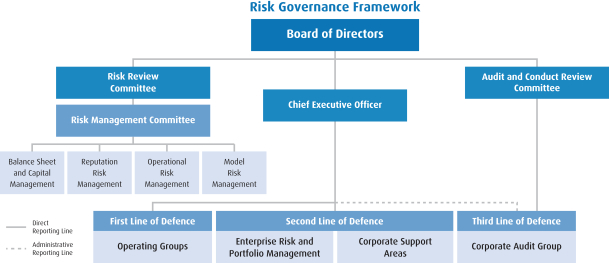

Risk Review Committee: Don Wilson III (Chair), Craig Broderick, Christine Edwards, Dr. Martin S. Eichenbaum, Ronald Farmer, Linda Huber, Eric La Flèche, Lorraine Mitchelmore, Philip Orsino and Robert Prichard.

Executive Officers

At December 1, 2018, the following were executive officers of the Bank:

| EXECUTIVE OFFICER NAME | PRINCIPAL OCCUPATION | MUNICIPALITY OF RESIDENCE | ||

| Darryl White |

Chief Executive Officer | Toronto, Ontario Canada | ||

| Dan Barclay |

Group Head, BMO Capital Markets | Toronto, Ontario Canada | ||

| David R. Casper |

Chief Executive Officer, BMO Financial Corporation and Group Head, North America Commercial Banking | Northbrook , Illinois U.S.A. | ||

| Patrick Cronin |

Chief Risk Officer | Toronto, Ontario Canada | ||

| Simon A. Fish |

General Counsel | Toronto, Ontario Canada | ||

| Thomas E. Flynn |

Chief Financial Officer | Toronto, Ontario Canada | ||

| Cameron Fowler |

President, North American Personal and Business Banking | Toronto, Ontario Canada | ||

| Ernie Johannson |

Group Head, U.S. Personal and Business Banking | Toronto, Ontario Candida | ||

| Gilles G. Ouellette |

Group Head, BMO Asset Management and Vice-Chair, International | Toronto, Ontario Canada | ||

| Catherine Roche |

Head, Marketing and Strategy | Toronto,

Ontario |

11

| EXECUTIVE OFFICER NAME | PRINCIPAL OCCUPATION | MUNICIPALITY OF RESIDENCE | ||

| Joanna Rotenberg |

Group Head, BMO Wealth Management | Toronto, Ontario Canada | ||

| Richard Rudderham |

Chief Human Resources Officer | West Vancouver, British Columbia Canada | ||

| Steve Tennyson |

Chief Technology Officer & Operations Officer | Toronto, Ontario Canada |

All the executive officers named above have held their present positions or other senior positions with Bank of Montreal or its subsidiaries for the past five years, except for Catherine Roche who, prior to May 2016, was Partner and Managing Director at the Boston Consulting Group.

Shareholdings of Directors and Executive Officers

To the knowledge of the Bank, as at October 31, 2018, the directors and executive officers of Bank of Montreal, as a group, beneficially owned, directly or indirectly, or exercised control or direction over an aggregate of 318,887 common shares of Bank of Montreal, representing less than 0.1% of Bank of Montreal’s issued and outstanding common shares.

Additional Disclosure for Directors and Executive Officers

To the Bank’s knowledge, no director or executive officer of the Bank:

| (a) | is, as at October 31, 2018, or was, within the 10 years before, a director, chief executive officer or chief financial officer of any company (including the Bank): |

| (i) | subject to an order (including a cease trade order or an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days), that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | subject to an order (including a cease trade order or an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation for a period of more than 30 consecutive days) that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; |

| (b) | is, as at October 31, 2018, or has been, within the 10 years before, a director or executive officer of any company (including the Bank), that while that person was acting in that capacity or within a year of the person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has, within the 10 years before October 31, 2018, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director or executive officer. |

To the Bank’s knowledge, none of our directors or executive officers have been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

A description of certain legal proceedings to which the Bank is a party appears under the heading “Legal Proceedings” in Note 24 of the 2018 Financial Statements.

In the ordinary course of business, the Bank and its subsidiaries may be assessed fees or fines by a Canadian securities regulatory authority in relation to administrative matters, including late filings or reporting, which may be considered penalties or sanctions pursuant to Canadian securities regulations but which are not, individually or in the aggregate, material to the Bank. In addition, the Bank and its subsidiaries are subject to numerous regulatory authorities around the world, and accordingly fees, administrative penalties, settlement agreements and sanctions may be categorized differently by certain regulators. Any such penalties imposed under these categories against the Bank and its subsidiaries in the 2018 fiscal year, however, are not material, nor would they likely be considered important to a reasonable investor in making an investment decision. Since November 1, 2017, the Bank and its subsidiaries have not entered into any material settlement agreements with a court relating to securities legislation or with a securities regulatory authority.

TRANSFER AGENT AND REGISTRAR

The registrar and transfer agent for the Bank’s common and preferred shares is Computershare Trust Company of Canada. This agent has transfer facilities in Montreal, Toronto, Calgary and Vancouver. In addition, Computershare Investor Services PLC and Computershare Trust Company, N.A. serve as transfer agents and registrars for the common shares in Bristol, United Kingdom and Canton, Maine, respectively.

12

INTERESTS OF EXPERTS

The Bank’s Shareholders’ Auditors are KPMG LLP, who have prepared the Shareholders’ Auditors’ Reports on pages 141 and 142 of the 2018 Financial Statements. KPMG LLP have confirmed that they are independent with respect to the Bank and within the meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable legislation or regulation, and that they are independent accountants with respect to the Bank under all relevant United States professional and regulatory standards.

AUDIT AND CONDUCT REVIEW COMMITTEE INFORMATION

Composition of the Audit and Conduct Review Committee

The following six members make up the Bank’s Audit and Conduct Review Committee: Jan Babiak (Chair), Sophie Brochu, Dr. Martin S. Eichenbaum, David Harquail, Linda S. Huber and Philip Orsino. The Committee’s responsibilities and duties are set out in the Committee’s charter. We include the charter in Appendix I to this Annual Information Form.

The Board of Directors has determined that the members of the Audit and Conduct Review Committee reflect a high level of financial literacy and expertise. Each member of the Audit and Conduct Review Committee is “independent” and “financially literate” according to the definitions under Canadian and United States securities laws and the NYSE corporate governance listing standards, and each of Ms. Babiak, Ms. Huber and Mr. Orsino is an “Audit Committee Financial Expert” as defined under United States securities laws. The Board bases these decisions on each Committee member’s education and experience. The following paragraphs describe the relevant education and experience of each Committee member:

Ms. Babiak holds a B.B.A. in accounting from the University of Oklahoma and an M.B.A. from Baldwin Wallace University. She is a Chartered Accountant in the United Kingdom and a Certified Public Accountant in the United States. Ms. Babiak serves on the boards of other public and private companies and was formerly a Managing Partner at Ernst & Young LLP.

Ms. Brochu is a graduate in economics from Université Laval and is the President and Chief Executive Officer of Énergir (formerly Gaz Metro), part of Valener Inc., a publicly traded company. Ms. Brochu also serves on the board of another Canadian public company. Ms. Brochu is a member of the Order of Canada.

Dr. Eichenbaum received a B.Comm from McGill University and a Doctorate in Economics from the University of Minnesota. He serves on the advisory council of the Global Markets Institute at Goldman Sachs. He completed a four-year term as co-editor of the American Economic Review in 2015. He has served as a consultant to the Federal Reserve Banks in Atlanta and Chicago and the International Monetary Fund.

Mr. Harquail is Chief Executive Officer of Franco-Nevada Corporation, a publicly traded company. He is also the current Chair of the World Gold Council which works to stimulate the demand for gold on behalf of the leading gold producers. Mr. Harquail has over 35 years of experience on public and non-profit boards and task force advisories. He is currently active on the United Way Toronto & York Region Campaign Cabinet. Mr. Harquail holds a B.A.Sc. in Geological Engineering from the University of Toronto, an MBA from McGill University and is a registered Professional Engineer in Ontario. He is also a major benefactor of the School of Earth Sciences and its Mineral Exploration Research Centre (MERC) at Laurentian University in Sudbury as well as the Centre for Neuromodulation at Sunnybrook Health Sciences Centre in Toronto.

Ms. Huber was formerly Executive Vice President and Chief Financial Officer of Moody’s Corporation, with executive responsibility for the corporation’s global finance, information technology, communications and corporate services functions, as well as the The Moody’s Foundation. Before joining Moody’s in 2005, Ms. Huber served in several senior roles in financial services, including Executive Vice President and Chief Financial Officer at U.S. Trust Company, a subsidiary of Charles Schwab & Company, Inc.; Managing Director at Freeman & Co.; Vice President of Corporate Strategy and Development and Vice President and Assistant Treasurer at PepsiCo. Ms. Huber holds an M.B.A. from the Stanford Graduate School of Business and a B.S. (with high honors) in business and economics from Lehigh University.

Mr. Orsino has a B.A. from University of Toronto and is a Fellow of the Chartered Professional Accountants of Canada. He is the President and Chief Executive Officer of Brightwaters Strategic Solutions Inc., a consulting and advisory services company. He was formerly the President and Chief Executive Officer of Jeld-Wen Inc., a global integrated manufacturer of building products until April 2014, and was also formerly the President and Chief Executive Officer of Masonite International Corporation until October 2005, which was listed on the TSX and NYSE. Mr. Orsino was appointed an Officer of the Order of Canada in 2004 and received the 2003 Canada’s Outstanding CEO of the Year Award.

Shareholders’ Auditors Pre-Approval Policies and Procedures and Fees

For information about the fees paid to KPMG LLP, in the years ended October 31, 2018 and 2017, and the related pre-approval policies and procedures, see page 122 of the 2018 MD&A, which we incorporate herein by reference.

13

ADDITIONAL INFORMATION

You can find additional information about Bank of Montreal on the Bank’s web site at www.bmo.com/investorrelations, on SEDAR (System for Electronic Document Analysis and Retrieval) at www.sedar.com, and on the SEC’s web site at www.sec.gov/edgar.