Table of Contents

As filed with the Securities and Exchange Commission on October 3, 2013

Registration No. 333-189814

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT No. 1

to

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bank of Montreal

BMO Covered Bond Guarantor Limited Partnership

(Exact name of Registrant as specified in its charter)

CANADA

(State or other jurisdiction of incorporation or organization)

13-4941092

(I.R.S. Employer Identification No.)

100 King St. West

1 First Canadian Place

Toronto, Ontario

Canada M5X 1A1

(416) 867-6785

(Address and telephone number of Registrant’s principal executive offices)

Colleen Hennessy

Bank of Montreal

111 West Monroe Street, P.O. Box 755

Chicago, Illinois 60690

(312) 461-7745

(Name, address and telephone number of agent for service)

| Please send copies to: | ||

| Lawton M. Camp | Jerry R. Marlatt | |

| Allen & Overy LLP | Morrison & Foerster LLP | |

| 1221 Avenue of the Americas | 1290 Avenue of the Americas | |

| New York, New York 10020 | New York, New York 10104 | |

| (212) 610-6300 | (212) 468-8000 | |

Approximate date of commencement of proposed sale to the public: At such time or times on or after the effective date of this registration statement as the Registrants shall determine.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered (1) |

Proposed maximum aggregate price per security |

Proposed maximum aggregate offering price (2)(3) |

Amount of registration fee (1) | ||||

| Covered Bonds |

U.S. $10,000,000,000 | 100% | U.S. $10,000,000,000 | U.S. $1,288,000 | ||||

|

| ||||||||

|

| ||||||||

| (1) | This Registration Statement also includes an indeterminate amount of securities of the classes specified above that may be reoffered and resold on an ongoing basis after their initial sale in market-making transactions by affiliates of the Registrant. These securities consist of an indeterminate amount of such securities that are initially being registered, and will initially be offered and sold, under this Registration Statement. All such market-making reoffers and resales of these securities that are made pursuant to a registration statement after the effectiveness of this registration statement are being made solely pursuant to this Registration Statement. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act. |

| (3) | Separate consideration may not be received for registered securities that are issuable on exercise, conversion or exchange of other securities. |

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated October [—], 2013

Bank of Montreal

unconditionally and irrevocably guaranteed by

BMO Covered Bond Guarantor Limited Partnership

Covered Bonds

up to an aggregate initial offering price of U.S.$10,000,000,000

or the equivalent thereof in other currencies under the global registered covered bond program

This prospectus describes some of the general terms that may apply to these covered bonds and the related guarantee and the general manner in which they may be offered. We will give you the specific prices and other terms of the covered bonds we are offering in supplements to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest. We may sell the covered bonds to or through one or more dealers or agents. The names of the dealers or agents will be set forth in supplements to this prospectus.

Prospective investors should be aware that the acquisition of the covered bonds described herein may have tax consequences both in the United States and in Canada. Such consequences may not be described fully herein or in any applicable prospectus supplement.

Investing in the covered bonds involves risks. See “Risk Factors” beginning on page 25 of this prospectus.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that Bank of Montreal is a Canadian bank, that many of its officers and directors are residents of Canada, that BMO Covered Bond Guarantor Limited Partnership is a limited partnership existing under the laws of the Province of Ontario, that some or all of the dealers or experts named in the registration statement may be residents outside of the United States, and that all or a substantial portion of the assets of Bank of Montreal, BMO Covered Bond Guarantor Limited Partnership and such persons may be located outside the United States.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The covered bonds described herein will not constitute deposits that are insured under the Canada Deposit Insurance Corporation Act (Canada) or by the United States Federal Deposit Insurance Corporation.

THE COVERED BONDS HAVE NOT BEEN APPROVED OR DISAPPROVED BY CANADA MORTGAGE AND HOUSING CORPORATION (“CMHC”) NOR HAS CMHC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. THE COVERED BONDS ARE NEITHER INSURED NOR GUARANTEED BY CMHC OR THE GOVERNMENT OF CANADA OR ANY OTHER AGENCY THEREOF.

Arrangers for the Program

| Barclays | BMO Capital Markets |

The date of this prospectus is , 2013

Table of Contents

| Page | ||||

| 6 | ||||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 25 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 60 | ||||

| 63 | ||||

| 70 | ||||

| 114 | ||||

| 175 | ||||

| 190 | ||||

| 192 | ||||

| 196 | ||||

| DESCRIPTION OF THE CANADIAN REGISTERED COVERED BOND PROGRAMS REGIME |

200 | |||

| 203 | ||||

| 207 | ||||

| 223 | ||||

| 226 | ||||

| 231 | ||||

| 232 | ||||

| 233 | ||||

| 234 | ||||

i

Table of Contents

In this prospectus, unless the context otherwise indicates, the “Bank” means Bank of Montreal, and “Guarantor” means BMO Covered Bond Guarantor Limited Partnership, and “we”, “us” or “our” means the Bank and Guarantor collectively. In this prospectus and any prospectus supplement, currency amounts are stated in Canadian Dollars (“$”), unless specified otherwise.

This document is called a prospectus and is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration or continuous offering process. The registration statement containing this prospectus, including exhibits to the registration statement, provides additional information about us and the covered bonds and related guarantee offered under this prospectus. The registration statement can be accessed at the SEC’s website at www.sec.gov or inspected at the offices of the SEC.

This prospectus provides you with a general description of the covered bonds the Bank may offer and the Guarantor may guarantee. Each time the Bank offers covered bonds pursuant to this prospectus, it will provide a prospectus supplement containing specific information about the terms of the covered bonds being offered. A prospectus supplement may include a discussion of any risk factors or other special considerations applicable to those covered bonds or to us. A prospectus supplement may also add, update or change information in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. You should read both this prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You Can Find More Information” on page 7 of this prospectus.

The Bank may sell covered bonds to dealers who will sell the covered bonds to the public on terms fixed at the time of sale. In addition, the covered bonds may be sold by the Bank directly or through agents designated from time to time. If the Bank, directly or through agents, solicits offers to purchase the covered bonds, it reserves the sole right to accept and, together with any agents, to reject, in whole or in part, any of those offers.

Any prospectus supplement will contain the names of the dealers or agents, if any, together with the terms of offering, the compensation of those dealers and the net proceeds to us. Any dealers or agents participating in the offering may be deemed “underwriters” within the meaning of the Securities Act.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. In other words, in the case of a conflict or

1

Table of Contents

inconsistency between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the information contained in the document that was filed later. The making of a modifying or superseding statement will not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded to constitute a part of this prospectus.

The Bank incorporates by reference into this prospectus its annual report on Form 40-F for the fiscal year ended October 31, 2012 (the “2012 Annual Report”), the Bank’s reports filed on Form 6-K filed on February 26, 2013 and May 29, 2013, and each of the Bank’s reports on Form 6-K after that date in which the Bank states that such report is also incorporated by reference into one or more of the Bank’s registration statements filed under the U.S. Securities Act of 1933, as amended (the “Securities Act”). In addition, the Bank will incorporate by reference into this prospectus all documents that it has filed under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act and, to the extent, if any, the Bank designates therein, reports on Form 6-K it furnishes to the SEC after the date of this prospectus and prior to the termination of any offering contemplated in this prospectus.

The Guarantor will file ongoing disclosure regarding the Covered Bond Guarantee (as defined below) and the Portfolio in reports on Form 10-K, Form 8-K, and Form 10-D. The Guarantor incorporates by reference its annual report on Form 10-K filed after the date of this prospectus and each Form 10-D filed with the SEC. In addition, the Guarantor will incorporate by reference into this prospectus all documents that it has filed under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of every offering contemplated in this prospectus.

Upon a new annual report and the related annual financial statements being filed by the Bank with, and, where required, accepted by, the SEC, the previous annual report will be deemed no longer incorporated by reference into this prospectus for purposes of future offers and sales of covered bonds under this prospectus.

Upon a new annual report being filed by the Guarantor with, and, where required, accepted by, the SEC, the previous annual report will be deemed no longer incorporated by reference into this prospectus for the purposes of further offers and sales of covered bonds under this prospectus.

All documents incorporated by reference, or to be incorporated by reference, have been filed with or furnished to, or will be filed with or furnished to, the SEC.

You may request a copy of these filings, other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing, at no cost, by writing to or telephoning us at the following address:

Bank of Montreal

Corporate Secretary’s Department

100 King Street West 1

First Canadian Place

Toronto, Ontario

Canada M5X 1A1

Telephone: (416) 867-6785

2

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

In addition to the continuous disclosure obligations under the securities laws of the provinces and territories of Canada, the Bank and the Guarantor are subject to the informational reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports and other information with the SEC. Under a multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure requirements of the provincial and territorial securities regulatory authorities of Canada, which requirements are different from those of the United States. These reports and other information, when filed or furnished by us in accordance with such requirements, can be inspected and copied by you at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You can get further information about the SEC’s Public Reference Room by calling 1-800-SEC-0330. The Bank’s and the Guarantor’s filings with the SEC are also available to the public through the SEC’s website at www.sec.gov. The Bank’s common shares are listed on the New York Stock Exchange, and reports and other information concerning the Bank can be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

The Bank and the Guarantor have filed with the SEC a registration statement on Form F-3 with respect to the covered bonds and related guarantee covered by this prospectus. This prospectus does not contain all of the information that is set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. Statements made in this prospectus as to the contents of any contract, agreement or other document referred to are not necessarily complete, and in each instance, you should refer to the exhibits that are a part of the registration statement for a copy of the contract, agreement or other document for a more complete description of the matter. For further information with respect to the Bank, the Guarantor, the covered bonds and the related guarantee, reference is made to the registration statement and the exhibits thereto, which are publicly available as described in the preceding paragraph.

Additional information with respect to the Bank, the Guarantor, the Portfolio and certain other matters, together with copies of each of the Transaction Documents and the Investor Reports filed by the Bank from time to time, is also available on the Bank’s website at www.bmo.com/home/about/banking/investor-relations/financial-information/covered-bonds and through the CMHC’s covered bond registry (the “Registry”) at www.cmhc-schl.gc.ca/coveredbonds. Information on or accessible through the Bank’s website does not form part of this prospectus and should not be relied upon.

FORWARD-LOOKING STATEMENTS

Our public communications often include oral or written forward-looking statements. Statements of this type are included in this document, and may be included in other filings with Canadian securities regulators or the SEC, or in other communications. All such statements by the Bank (but not the Guarantor) are made pursuant to the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements may involve, but are not limited to, comments with respect to our objectives and priorities for 2013 and beyond, our strategies or future actions, our targets, expectations for our financial condition or share price, and the results of or outlook for our operations or for the Canadian and U.S. economies.

3

Table of Contents

By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that predictions, forecasts, conclusions or projections will not prove to be accurate, that our assumptions may not be correct and that actual results may differ materially from such predictions, forecasts, conclusions or projections. We caution readers of this document not to place undue reliance on our forward-looking statements as a number of factors could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements.

The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: general economic and market conditions in the countries in which we operate; weak, volatile or illiquid capital and/or credit markets; interest rate and currency value fluctuations; changes in monetary, fiscal or economic policy; the degree of competition in the geographic and business areas in which we operate; changes in laws or in supervisory expectations or requirements, including capital, interest rate and liquidity requirements and guidance; judicial or regulatory proceedings; the accuracy and completeness of the information we obtain with respect to our customers and counterparties; our ability to execute our strategic plans and to complete and integrate acquisitions; critical accounting estimates and the effect of changes to accounting standards, rules and interpretations on these estimates; operational and infrastructure risks; changes to our credit ratings; general political conditions; global capital markets activities; the possible effects on our business of war or terrorist activities; disease or illness that affects local, national or international economies; natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; technological changes; and our ability to anticipate and effectively manage risks associated with all of the foregoing factors.

We caution that the foregoing list is not exhaustive of all possible factors. Other factors could adversely affect our results. For more information, please see the discussion in our 2012 Annual Report and the Bank’s reports filed on Form 6-K on February 26, 2013 and May 29, 2013, which are incorporated by reference herein and which outlines in detail certain key factors that may affect the Bank’s future results. When relying on forward-looking statements to make decisions with respect to the Bank, investors and others should carefully consider these factors, as well as other uncertainties and potential events, and the inherent uncertainty of forward-looking statements. The Bank does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by the Bank or on its behalf, except as required by law. The forward-looking information contained or incorporated by reference into this prospectus is presented for the purpose of assisting investors in understanding our operations, prospects, risks and other extreme factors that impact us specifically as of and for the periods ended on the dates presented, as well as certain strategic priorities and objectives, and may not be appropriate for other purposes.

PRESENTATION OF FINANCIAL INFORMATION

The Bank prepares its consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”), which replaced Canadian generally accepted accounting principles (“GAAP”) for publicly accountable enterprises beginning in 2011. IFRS became effective for the Bank for its interim and annual periods commencing November 1, 2011 (adoption date), and includes the preparation and reporting of one year of comparative figures, including an opening balance sheet as of November 1, 2010 (transition date). For additional information regarding the Bank’s adoption of IFRS, see Note 30 “Transition to International Financial Reporting Standards” in the Bank’s 2012 Annual Report.

4

Table of Contents

Additionally, we publish our consolidated financial statements in Canadian Dollars. In this prospectus and any applicable supplement, currency amounts are stated in Canadian Dollars ($), unless specified otherwise. As indicated in the table below, the Canadian Dollar has fluctuated in value compared to the U.S. Dollar over time.

The tables below set forth the high and low daily noon exchange rates, the average yearly rate and the rate at period end between Canadian Dollars and U.S. Dollars (in U.S. Dollars per Canadian Dollar) for the five-year period ended October 31, 2012 and the high and low daily noon exchange rates for the three months ended January 31, 2013, the three months ended April 30, 2013, the three months ended July 31, 2013 and for the period August 1, 2013 through October 2, 2013. On October 2, 2013, the daily noon exchange rate was U.S.$0.9679 = $1.00. Our reference to the “daily noon exchange rate” is the daily noon exchange rate as reported by the Bank of Canada.

| Year Ended October 31, |

High | Low | Average Rate(1) |

At Period End |

||||||||||||

| 2008 |

1.0905 | 0.7726 | 0.9718 | 0.8220 | ||||||||||||

| 2009 |

0.9716 | 0.7692 | 0.8603 | 0.9282 | ||||||||||||

| 2010 |

1.0039 | 0.9278 | 0.9605 | 0.9815 | ||||||||||||

| 2011 |

1.0583 | 0.9430 | 1.0164 | 1.0065 | ||||||||||||

| 2012 |

1.0299 | 0.9536 | 0.9968 | 1.0004 | ||||||||||||

| Three months ending |

High | Low | ||||||||||||||

| January 31, 2013 |

1.0164 | 0.9923 | ||||||||||||||

| April 30, 2013 |

1.0040 | 0.9696 | ||||||||||||||

| July 31, 2013 |

0.9977 | 0.9455 | ||||||||||||||

| Period of |

High | Low | ||||||||||||||

| August 1, 2013 through October 2, 2013 |

0.9768 | 0.9476 | ||||||||||||||

| (1) | The average of the daily noon exchange rates on the last business day of each full month during the relevant period. |

LIMITATIONS ON THE ENFORCEMENT OF U.S. LAWS

AGAINST THE BANK, OUR MANAGEMENT AND OTHERS

The Bank is incorporated under the federal laws of Canada under the Bank Act (Canada) (the “Bank Act”). The Guarantor is an Ontario limited partnership. Substantially all of the Bank’s directors and executive officers, including many of the persons who signed the Registration Statement on Form F-3, of which this prospectus forms a part, and some or all of the experts named in this document, reside outside the United States, and all or a substantial portion of the Bank and the Guarantor’s assets and the assets of such persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon such persons, or to realize upon judgments rendered against the Bank or such persons by the courts of the United States predicated upon, among other things, the civil liability provisions of the federal securities laws of the United States. In addition, it may be difficult for you to enforce, in original actions brought in courts in jurisdictions located outside the United States, among other things, civil liabilities predicated upon such securities laws.

5

Table of Contents

The Bank has been advised by our Canadian counsel, Osler, Hoskin & Harcourt LLP, that a judgment of a United States court predicated solely upon civil liability under such laws and that would not be contrary to public policy would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that was recognized by a Canadian court for such purposes. The Bank has also been advised by such counsel, however, that there is some residual doubt whether an original action could be brought successfully in Canada predicated solely upon such civil liabilities.

6

Table of Contents

This summary highlights key information described in greater detail elsewhere, or incorporated by reference, in this prospectus. You should read carefully the entire prospectus and the documents incorporated by reference and any applicable prospectus supplement before making an investment decision.

Bank of Montreal

The Bank is among North America’s ten largest banks, as measured by assets and market capitalization and offers a broad range of credit and non-credit products and services directly and through Canadian and non-Canadian subsidiaries, offices and branches. As at October 31, 2012, the Bank had more than 12 million customers, approximately 46,000 full-time equivalent employees, maintained approximately 1,570 bank branches in Canada and the United States and operated internationally in major financial markets and trading areas through its offices in 24 other jurisdictions, including the United States. BMO Financial Corp. (“BMO Harris”) (formerly Harris Financial Corp.), based in Chicago and wholly-owned by Bank of Montreal, operates primarily through its subsidiary BMO Harris Bank N.A., which provides banking, financing, investing and cash management services in select markets in the U.S. Midwest. The Bank provides a full range of investment dealer services through entities including BMO Nesbitt Burns Inc., a major fully-integrated Canadian investment dealer, and BMO Capital Markets Corp., Bank of Montreal’s wholly-owned registered securities dealer in the United States.

BMO Covered Bond Guarantor Limited Partnership

The Guarantor is a limited partnership established under the laws of the Province of Ontario whose principal business is to provide a guarantee of the obligations of the Bank pursuant to covered bonds issued by the Bank, from time to time, pursuant to the Bank’s Global Registered Covered Bond Program (the “Program”) and certain ancillary activities with respect thereto.

The Global Registered Covered Bond Program

The Bank intends to issue, offer and sell covered bonds under the Program in the United States pursuant to this prospectus. These covered bonds will be issued under a trust deed governed by Ontario law (the “Trust Deed”). The Bond Trustee acts as the trustee under the Trust Deed. All Series of covered bonds under the Program will have the benefit of the covered bond guarantee (the “Covered Bond Guarantee”) issued by the Guarantor and be secured by a pledge of the Portfolio to the Bond Trustee. The Bank anticipates that it will continue to issue covered bonds by means other than this prospectus under the Trust Deed from time to time. On , the Bank was accepted as a registered issuer under Part I.1 of the National Housing Act (Canada) (the “NHA”) and the CMHC Guide in accordance with their terms and on , the Program was registered as a registered program under Part I.1 of the NHA and the CMHC Guide. All future covered bonds issued by the Bank under the Program will be covered bonds issued under its registered covered bond program pursuant to Part I.1 of the NHA and the CMHC Guide.

The Legislative Framework sets out certain statutory protections for holders of covered bonds under Canadian federal and provincial bankruptcy, insolvency and fraudulent conveyance laws. The CMHC Guide elaborates on the role and powers of CMHC as administrator of the Legislative Framework and sets out the conditions and restrictions applicable to registered covered bond issuers and registered covered bond programs.

The Portfolio

The assets in the “Portfolio” consist primarily of Canadian residential mortgage loans and home equity loans and their related security interest in residential property, cash and in some cases certain Substitution Assets up to a certain threshold amount. As required by the CMHC Guide, the Portfolio does not include any residential mortgages or home equity loans that are insured by a Prohibited Insurer such as CMHC.

7

Table of Contents

Global Public Sector Covered Bond Programme

The Bank has previously issued the equivalent of approximately $9.1 billion of covered bonds in a variety of currencies both outside and in the United States pursuant to the private placement exemptions under the Bank’s Global Public Sector Covered Bond Programme utilizing residential mortgage loans insured by the CMHC. $7.6 billion of these covered bonds remain outstanding as of the date of this prospectus, and such covered bonds are guaranteed by a different guarantor entity and are secured by a different cover pool.

The Guarantee

Pursuant to the Covered Bond Guarantee, the Guarantor has irrevocably and unconditionally guaranteed the due and punctual payment of the Guaranteed Amounts on the covered bonds of each Series issued by the Bank in accordance with the Trust Deed.

Program Structure Overview

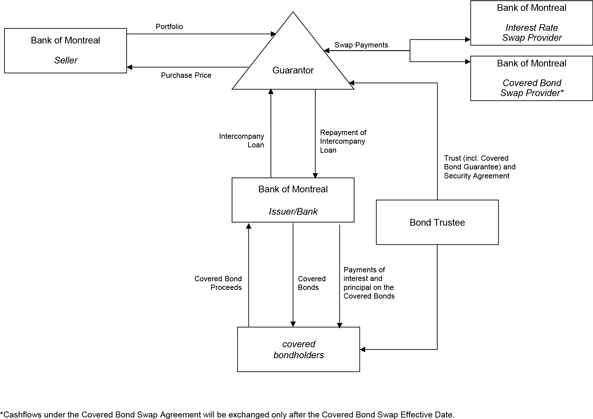

The Covered Bond Guarantee is secured by a pledge of certain assets of the Guarantor, which includes the Portfolio, to the Bond Trustee pursuant to the terms of the Security Agreement. The Guarantor purchased the initial loans and their Related Security included in the Portfolio from the Bank using amounts borrowed from the Bank under the Intercompany Loan. Proceeds from the Intercompany Loan may also be used to purchase Loans and their Related Security for the Portfolio and for other purposes as described in “Summary of the Principal Documents—Mortgage Sale Agreement.” The Guarantor and the Bank have entered into an Interest Rate Swap Agreement and a Covered Bond Swap Agreement. The Interest Rate Swap Agreement converts interest received on the Portfolio to an amount in excess of the interest rate payable on the Intercompany Loan and, for each Series, the Covered Bond Swap Agreement converts a certain portion of the Canadian Dollar payments from the Interest Rate Swap Agreement (or if not then in place for any reason, the Portfolio) to the currency and interest amounts payable on the related covered bonds. No cash flows will be exchanged under the Covered Bond Swap Agreement until after the occurrence of certain specified events.

Risk Factors

An investment in the covered bonds involves risks. You should carefully consider all of the information set forth in this prospectus and any applicable prospectus supplement and, in particular, should evaluate the specific factors set forth under Risk Factors in deciding whether to invest in the covered bonds. For a discussion of important business and financial risks relating to the Bank, please see “Risk Factors” in our 2012 Annual Report and our reports filed on Form 6-K on February 26, 2013 and May 29, 2013, which are incorporated in this prospectus by reference (and in any of our annual or quarterly reports for a subsequent financial period that are so incorporated).

8

Table of Contents

Corporate Offices

The Bank’s corporate headquarters are located at 100 King Street West, 1 First Canadian Place, 68th Floor, Toronto, Ontario, Canada M5X 1A1 and the head office is located at 129 rue Saint Jacques, Montréal, Québec, Canada H2Y 1L6. The telephone number is 416-867-6656.

The Guarantor’s address is c/o BMO Covered Bond GP, Inc., Suite 6100, 100 King Street West, 1 First Canadian Place, Toronto, Ontario, Canada M5X 1A1. The telephone number is 416-867-6656.

9

Table of Contents

The following structure diagram provides an indicative summary of the principal features of the Program. The diagram must be read in conjunction with and is qualified in its entirety by the detailed information presented elsewhere in this prospectus and any applicable prospectus supplement.

10

Table of Contents

SUMMARY OF THE COVERED BOND PROGRAM

This section is a summary and does not describe every aspect of the covered bonds. This section summarizes the material terms of the covered bonds that are common to all Series of covered bonds and which are more fully described in this prospectus. References to “Conditions” in this summary refer to the Terms and Conditions described elsewhere in this prospectus. This summary is subject to and qualified in its entirety by reference to all the provisions of the Trust Deed and other Transaction Documents, including definitions of certain terms used in the Trust Deed and other Transaction Documents. In this summary, we describe the meaning of only some of the more important terms. This summary is also subject to and qualified by reference to the description of the particular terms of your Series or Tranche described in the applicable prospectus supplement. Those terms may vary from the terms described in this prospectus. The applicable prospectus supplement relating to each Series or Tranche of covered bonds will be attached to the front of this prospectus.

| Bank: |

Bank of Montreal (“BMO”). For a more detailed description of the Bank, see “Bank of Montreal.” |

| Guarantor: |

BMO Covered Bond Guarantor Limited Partnership. |

| Dealers: |

BMO Capital Markets Corp., Barclays Capital Inc. and any other dealer appointed from time to time by the Bank generally in respect of the Program or in relation to a particular Series or Tranche of covered bonds. |

| Seller: |

The Bank, any New Seller or other Limited Partner, who may from time to time accede to, and sell Loans and their Related Security to the Guarantor. |

| Servicer: |

The Bank, subject to replacement in accordance with the terms of the Servicing Agreement. |

| Cash Manager: |

The Bank, subject to replacement in accordance with the terms of the Cash Management Agreement. |

| Calculation Agent: |

Bank of New York Mellon, acting through its offices located at 101 Barclay Street 4E, New York, NY 10286. |

| Custodian: |

Computershare Trust Company of Canada, acting through its offices located at 100 University Avenue, 11th Floor, Toronto, Ontario Canada M5J 2Y1. |

| Registrar, Principal Paying Agent, Transfer Agent and Exchange Agent: |

Bank of New York Mellon, acting through its offices located at 101 Barclay Street 4E, New York, NY 10286. |

| Bond Trustee: |

Computershare Trust Company of Canada, acting through its offices located at 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario Canada M5J 2Y1. |

11

Table of Contents

| Cover Pool Monitor: |

KPMG LLP, acting through its offices at Bay Adelaide Centre, 333 Bay Street, Suite 4600, Toronto, Ontario, Canada M5H 2S5. |

| Interest Rate Swap Provider: |

The Bank, subject to replacement in accordance with the terms of the Interest Rate Swap Agreement. |

| Covered Bond Swap Provider: |

The Bank, subject to replacement in accordance with the terms of the Covered Bond Swap Agreement. |

| GDA Provider: |

The Bank, acting through its main branch in Toronto. |

| Account Bank: |

The Bank, acting through its main branch in Toronto. |

| Standby Account Bank: |

Royal Bank of Canada, acting through its offices at Royal Bank Plaza, South Tower, 200 Bay Street, Toronto, Ontario Canada M5J 2J5. |

| Standby GDA Provider: |

Royal Bank of Canada, acting through its offices at Royal Bank Plaza, South Tower, 200 Bay Street, Toronto, Ontario Canada M5J 2J5. |

| Intercompany Loan Provider: |

The Bank, acting through its main branch in Toronto. |

| Legislative Framework: |

The legislative framework established by Part I.1 of the NHA, including the CMHC Guide. |

| Issuance of Series: |

Covered bonds will be issued in series (each, a “Series”). Each Series may comprise one or more tranches (“Tranches” and each, a “Tranche”) issued on different issue dates. The covered bonds of each Series will all be subject to identical terms, except that the issue date and the amount of the first payment of interest may be different in respect of different Tranches. |

| The covered bonds will be issued by the Bank, as a CMHC registered issuer, under its CMHC registered covered bond program, which is registered pursuant to Part I.1 of the NHA. |

| Currency and Denomination: |

Unless otherwise specified in the applicable prospectus supplement, covered bonds will be issued in U.S.$ and in such denominations as may be agreed to between the Dealers and the Bank and as set forth in the applicable prospectus supplement. |

| Maturities: |

Such maturities as may be agreed between the Bank and the Dealers or covered bondholders, as the case may be, and as indicated in the prospectus supplement, subject to such minimum or maximum maturities as may be allowed or required from time to time by the relevant regulator (or equivalent body) or any laws or regulations applicable to the Bank or the relevant specified currency. |

12

Table of Contents

| Branch of Account: |

The head office of the Bank in Toronto, or such other branch as may be specified in the applicable prospectus supplement, any such branch being the “Branch of Account” for the purposes of the Bank Act, will take the deposits evidenced by the covered bonds, but without prejudice to the provisions of Condition 5 (Payments) as described in Terms and Conditions of the Covered Bonds. |

| Form of the Covered Bonds: |

The covered bonds will be issued in registered form as a global covered bond held through The Depository Trust Company or its successors (“DTC”). |

| Interest: |

Covered bonds may be interest bearing or non-interest bearing. Interest (if any) may accrue at a fixed or floating rate (detailed in a formula or otherwise) and may vary during the lifetime of the relevant Series. |

| Types of covered bonds: |

Unless otherwise specified in the prospectus supplement, the types of covered bonds that may be issued pursuant to this prospectus are (i) fixed rate covered bonds and (ii) floating rate covered bonds. |

| Fixed Rate Covered Bonds: |

Fixed rate covered bonds will bear interest at a fixed rate which will be payable on such date or dates as may be agreed between the Bank and the Dealers and on redemption and will be calculated on the basis of such day count basis as may be agreed between the Bank and the Dealers (as set out in the applicable prospectus supplement), provided that if an Extended Due for Payment Date is specified in the prospectus supplement, interest following the Original Due for Payment Date will continue to accrue and be payable on the unpaid amount in accordance with Condition 4 (Interest), at a rate of interest determined in accordance with Condition 4.1 (Interest on Fixed Rate Covered Bonds) (in the same manner as the rate of interest for floating rate covered bonds) even where the relevant covered bonds are fixed rate covered bonds. |

| Floating Rate Covered Bonds: |

Floating rate covered bonds will bear interest at a rate determined on such basis as may be agreed between the Bank and the Dealers, as set out in the applicable prospectus supplement. |

| Other provisions in relation to Floating Rate Covered Bonds: |

Floating Rate Covered Bonds may also have a Maximum Rate of Interest, a Minimum Rate of Interest or both (as indicated in the applicable prospectus supplement). Interest on Floating Rate Covered Bonds in respect of each Interest Period, as agreed prior to the issue by the Bank and the relevant Dealer(s), will be payable on such Interest Payment Dates, and will be calculated on a day count basis, in each case as may be agreed between the Bank and the relevant Dealer(s). |

13

Table of Contents

| Hard Bullet Covered Bonds: |

Hard Bullet Covered Bonds may be offered and will be subject to a Pre-Maturity Test. The intention of the Pre-Maturity Test is to test the liquidity of the Guarantor’s assets in respect of Hard Bullet Covered Bonds maturing within 12 months from the relevant Pre-Maturity Test Date when the Bank’s credit ratings have fallen below the Pre-Maturity Required Ratings. |

| Rating Agency Condition: |

Any issuance of covered bonds will be conditional upon satisfaction of the Rating Agency Condition. |

| Listing: |

Covered bonds will not be listed on any stock exchange unless otherwise specified in the applicable prospectus supplement. |

| Redemption: |

The applicable prospectus supplement relating to each Tranche of covered bonds will indicate either that the relevant covered bonds of such Tranche cannot be redeemed prior to their stated maturity (other than following an Issuer Event of Default or a Guarantor Event of Default or as indicated below) or that such covered bonds will be redeemable at the option of the Bank upon giving notice to the holders of the covered bonds, on a date or dates specified prior to such stated maturity and at a price or prices and on such other terms as may be agreed between the Bank and the Dealers (as set out in the applicable prospectus supplement). |

| Early redemption will be permitted for taxation reasons and illegality as described in Conditions 6.2 (Redemption for taxation reasons) and 6.5 (Redemption due to illegality or invalidity), but will otherwise be permitted only to the extent specified in the applicable prospectus supplement. |

| Extendable obligations under the Covered Bond Guarantee: |

The applicable prospectus supplement may also provide that (if a Notice to Pay has been served on the Guarantor) the Guarantor’s obligations under the Covered Bond Guarantee to pay the Guaranteed Amounts corresponding to the Final Redemption Amount of the applicable Series of covered bonds on their Final Maturity Date (subject to applicable grace periods) may be deferred until the Extended Due for Payment Date. |

| In such case, such deferral will occur automatically (i) if the Bank fails to pay the Final Redemption Amount of the relevant Series of covered bonds on their Final Maturity Date (subject to applicable grace periods) and (ii) if the Guaranteed Amounts equal to the Final Redemption Amount in respect of such Series of covered bonds are not paid in full by the Guarantor by the Extension Determination Date (for example, because the Guarantor has insufficient funds in accordance with the Priorities of Payments to pay in full the Guaranteed Amounts corresponding to the Final Redemption Amount of the relevant |

14

Table of Contents

| Series of covered bonds after payment of higher ranking amounts and taking into account amounts ranking pari passu in the Priorities of Payments). To the extent a Notice to Pay has been served on the Guarantor and the Guarantor has sufficient time and sufficient monies to pay in part the Final Redemption Amount, such partial payment will be made by the Guarantor on any Interest Payment Date up to and including the relevant Extended Due for Payment Date as described in Condition 6.1 (Final redemption) of the Terms and Conditions of the Covered Bonds. Interest will continue to accrue and be payable on the unpaid amount in accordance with Condition 4 (Interest) at a rate of interest determined in accordance with Condition 4 (Interest) (in the same manner as the rate of interest for floating rate covered bonds) of the Terms and Conditions of the Covered Bonds. The Guarantor will pay Guaranteed Amounts constituting Scheduled Interest on each Original Due for Payment Date and the Extended Due for Payment Date and any unpaid amounts in respect thereof will be due and payable on the Extended Due for Payment Date. |

| Taxation: |

Payments made by the Bank in respect of covered bonds will be made without withholding or deduction for, or on account of, any present or future taxes, duties, assessments or governmental charges of whatever nature imposed or levied by or on behalf of Canada or any province or territory thereof, or, in the case of covered bonds issued by a branch of the Bank located outside Canada, the country in which such branch is located, or any political subdivision thereof or any authority or agency therein or thereof having power to tax, unless the withholding or deduction of such taxes, duties, assessments or governmental charges is required by law. In that event, the Bank will (subject to customary exceptions) pay such additional amounts as will result in the holders of covered bonds receiving such amounts as they would have received in respect of such covered bonds had no such withholding or deduction been required. Under the Covered Bond Guarantee, the Guarantor will not be liable to pay any such additional amounts as a consequence of any applicable tax withholding or deduction, including such additional amounts which may become payable by the Bank under Condition 7 (Taxation) of the Terms and Conditions of the Covered Bonds. |

| If (i) any portion of interest payable on a covered bond is contingent or dependent on the use of, or production from, property in Canada or is computed by reference to revenue, profit, cash flow, commodity price or any other similar criteria or by reference to dividends paid or payable to shareholders of a corporation; (ii) the recipient of interest payable on a covered bond does not deal at arm’s length with the Bank or the Guarantor for purposes of the Income Tax Act (Canada) (“ITA”); (iii) interest is payable in respect of a covered bond owned by a person with whom the Bank or the Guarantor does not deal at arm’s length for purposes of the ITA; or (iv) the recipient of |

15

Table of Contents

| interest payable on a covered bond is a “specified shareholder” of the Bank or a non-resident person that does not deal at arm’s length with a specified shareholder of the Bank (in each case within the meaning of the ITA for purposes of the thin capitalization rules contained in subsection 18(4) of the ITA), such interest may be subject to Canadian nonresident withholding tax. A “specified shareholder” of the Bank is a person who owns, or is deemed to own, alone or together with persons with whom that person does not deal at arm’s length, shares entitled to 25% or more of the votes that could be cast at an annual shareholders’ meeting or shares having a fair market value of 25% or more of the fair market value of all the issued and outstanding shares of the Bank. Special rules, which are not discussed in this summary, may apply to a non-Canadian Holder that is an insurer that carries on an insurance business in Canada and elsewhere. Additional opinions from Canadian tax counsel may be required. See the discussion under the caption “Taxation—Canadian Taxation.” |

| ERISA: |

In general, a covered bond may be purchased by U.S. benefit plan investors as defined in Section 3(42) of the U.S. Employee Retirement Income Security Act of 1974, as amended (“ERISA”), subject to certain conditions (see “Benefit Plan Investor Considerations”). |

| Cross Default: |

If a Guarantor Acceleration Notice is served in respect of any covered bonds, then the obligation of the Guarantor to pay Guaranteed Amounts in respect of all covered bonds outstanding will be accelerated. If an Issuer Acceleration Notice is served in respect of any series of covered bonds, all outstanding covered bonds issued under the Program will accelerate against the Bank but will be subject to, and have the benefit of, the Guaranteed Amounts under the Covered Bond Guarantee. |

| Status of the Covered Bonds: |

The covered bonds will constitute deposit liabilities of the Bank for purposes of the Bank Act, however the covered bonds will not be insured under the Canada Deposit Insurance Corporation Act (Canada), and will constitute legal, valid and binding direct, unconditional, unsubordinated and unsecured obligations of the Bank and rank pari passu with all deposit liabilities of the Bank without any preference among themselves and at least pari passu with all other unsubordinated and unsecured obligations of the Bank, present and future, except as prescribed by law and in certain limited circumstances described in Conditions 9.1 (Issuer Events of Default) and 14 (Meetings of Covered Bondholders, Modification, Waiver and Substitution). |

| Governing Law and Jurisdiction: |

The covered bonds and the Transaction Documents (other than the Underwriting Agreement) will be governed by, and construed in accordance with the laws of the Province of Ontario and the laws of Canada applicable therein. The Underwriting Agreement will be governed by the laws of the State of New York. |

| Ontario courts have non-exclusive jurisdiction in the event of litigation in respect of the contractual documentation and the covered bonds governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein. |

16

Table of Contents

| Terms and Conditions: |

A prospectus supplement will be prepared in respect of each Tranche of covered bonds. The terms and conditions applicable to each Tranche will be those described under Terms and Conditions of the Covered Bonds as supplemented, modified or replaced by the applicable prospectus supplement. |

| Clearing System: |

DTC and/or, in relation to any covered bonds, any other clearing system as may be specified in the applicable prospectus supplement. |

| Non-U.S. Selling Restrictions: |

There will be specific restrictions on offers, sales and deliveries of covered bonds and on the distribution of offering material in Canada, Japan, the EEA, the United Kingdom, France, Australia and Italy, as well as such other restrictions as may be required in connection with a particular issue of covered bonds as set out in the applicable prospectus supplement. |

| Covered Bond Guarantee: |

Payment of interest and principal in respect of the covered bonds when Due for Payment will be irrevocably guaranteed by the Guarantor. The obligations of the Guarantor to make payment in respect of the Guaranteed Amounts when Due for Payment are subject to the condition that a Covered Bond Guarantee Activation Event has occurred. The obligations of the Guarantor under the Covered Bond Guarantee will accelerate against the Guarantor upon the service of a Guarantor Acceleration Notice. The obligations of the Guarantor under the Covered Bond Guarantee constitute direct obligations of the Guarantor secured against the assets of the Guarantor, including the Portfolio. |

| Payments made by the Guarantor under the Covered Bond Guarantee will be made subject to, and in accordance with, the applicable Priorities of Payments. |

| Security: |

To secure its obligations under the Covered Bond Guarantee and the Transaction Documents to which it is a party, the Guarantor has granted a first ranking security interest over all of its present and future acquired assets, including the Portfolio, in favor of the Bond Trustee (for itself and on behalf of the other Secured Creditors) pursuant to the terms of the Security Agreement. |

| Intercompany Loan: |

Under the terms of the Intercompany Loan Agreement, the Bank will make available to the Guarantor an interest-bearing Intercompany Loan, comprised of a Guarantee Loan and a revolving Demand Loan, in a combined aggregate amount equal to the Total Credit Commitment, subject to increases and decreases as described below. The Intercompany Loan will be denominated in Canadian Dollars. The interest rate on the Intercompany Loan will be a Canadian Dollar floating rate determined by the Bank from time to time, subject to a maximum of the floating rate received by the Guarantor pursuant to the Interest Rate Swap Agreement, less a minimum spread and an amount for certain expenses of the Guarantor. |

17

Table of Contents

| The balance of the Guarantee Loan and Demand Loan will fluctuate with the issuances and redemptions of covered bonds and the requirements of the Asset Coverage Test. |

| To the extent the Portfolio increases or is required to be increased to meet the Asset Coverage Test, the Bank may increase the Total Credit Commitment to enable the Guarantor to acquire Loans and their Related Security from the Seller. |

| The balance of the Guarantee Loan and the Demand Loan will be disclosed in each Investor Report. |

| Guarantee Loan: |

The Guarantee Loan is in an amount equal to the balance of outstanding covered bonds at any relevant time plus that portion of the Portfolio required in accordance with the Asset Coverage Test as over-collateralization for the covered bonds in excess of the amount of then outstanding covered bonds (see “Summary of the Principal Documents—Guarantor Agreement—Asset Coverage Test”). |

| Demand Loan: |

The Demand Loan is a revolving credit facility, the outstanding balance of which is equal to the difference between the balance of the Intercompany Loan and the balance of the Guarantee Loan at any relevant time. At any time prior to a Demand Loan Repayment Event, the Guarantor may borrow any withdrawn or committed amount or re-borrow any amount repaid by the Guarantor under the Intercompany Loan for a permitted purpose provided, among other things, (i) such drawing does not result in the Intercompany Loan exceeding the Total Credit Commitment; and (ii) no Issuer Event of Default or Guarantor Event of Default has occurred and is continuing. |

| The Proceeds of the Intercompany Loan: |

The Guarantor will use the initial advance under the Intercompany Loan to purchase Loans and their Related Security for inclusion in the Portfolio from the Seller in accordance with the terms of the Mortgage Sale Agreement and may use additional advances (i) to purchase additional Loans and their Related Security pursuant to the terms of the Mortgage Sale Agreement; and/or (ii) to invest in Substitution Assets in an amount not exceeding the prescribed limit under the CMHC Guide; and/or (iii) subject to complying with the Asset Coverage Test and the CMHC Guide, to make Capital Distributions to the Limited Partner; and/or (iv) to make deposits of the proceeds in the Guarantor Accounts (including, without limitation, to fund the Reserve Fund and the Pre-Maturity Liquidity Ledger, in each case to an amount not exceeding the prescribed limit). |

18

Table of Contents

| Capital Contribution: |

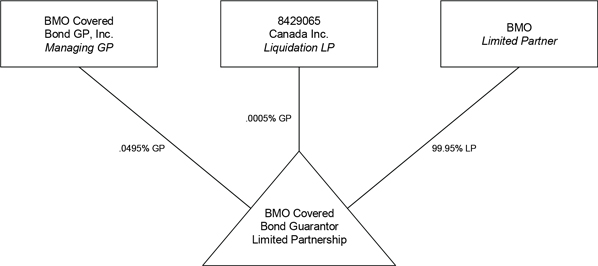

The Limited Partner may from time to time make Capital Contributions to the Guarantor including Capital Contributions of Loans and their Related Security. The Managing GP and the Liquidation GP respectively hold 99 percent and 1 percent of the 0.05 percent general partner interest in the Guarantor. The Limited Partner holds the substantial economic interest in the Guarantor (99.95 percent). |

| Consideration: |

Under the terms of the Mortgage Sale Agreement, the Seller will sell Loans and their Related Security to the Guarantor for the Portfolio on a fully-serviced basis for cash consideration equal to the Fair Market Value of such Loans on their Purchase Date, or if so determined by the Limited Partner, the Limited Partner may make Capital Contributions of Loans and their Related Security on a fully-serviced basis to the Guarantor in exchange for additional interests in the capital of the Guarantor. |

| Interest Rate Swap Agreement: |

The Guarantor has entered into the Interest Rate Swap Agreement with the Interest Rate Swap Provider to provide a hedge against possible variances in the rates of interest payable on the Loans in the Portfolio (which may, for instance, include variable rates of interest or fixed rates of interest), the amounts payable on the Intercompany Loan and (following the Covered Bond Swap Effective Date) the Covered Bond Swap Agreement. |

| Covered Bond Swap Agreement: |

To provide a hedge against currency risks arising, following the Covered Bond Swap Effective Date, in respect of amounts received by the Guarantor under the Interest Rate Swap Agreement and amounts payable in respect of its obligations under the Covered Bond Guarantee, the Guarantor will enter into the Covered Bond Swap Agreement (which may include a new ISDA Master Agreement schedule and confirmation(s) and credit support annex, if applicable, for each Tranche and/or Series of covered bonds) with the Covered Bond Swap Provider. |

19

Table of Contents

Investment in the covered bonds is subject to various risks including those risks inherent in conducting the business of a diversified financial institution. Before deciding whether to invest in the covered bonds, you should consider carefully the risks described in the documents incorporated by reference in this prospectus (including subsequently filed documents incorporated by reference) and, if applicable, those described in a prospectus supplement, as the case may be, relating to a specific offering of covered bonds.

Risks relating to the covered bonds generally

The covered bonds may not be a suitable investment for all investors

The purchase of covered bonds involve substantial risks and are suitable only for investors who have the knowledge and experience in financial and business matters necessary to enable them to evaluate the risks and the merits of an investment in the covered bonds. Prior to making an investment decision, prospective investors should consider carefully, in light of their own financial circumstances and investment objectives, (i) all the information set forth in this prospectus and, in particular, the considerations set forth below and (ii) all the information set forth in the applicable prospectus supplement. Prospective investors should make such inquiries as they deem necessary without relying on us or any arranger or dealer.

Each potential investor in the covered bonds must determine the suitability of its investment in light of its own circumstances. In particular, each potential investor should:

| • | have sufficient knowledge and experience to make a meaningful evaluation of the covered bonds, the merits and risks of investing in the covered bonds and the information contained in this prospectus or incorporated herein by reference or any applicable supplement; |

| • | have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular financial situation, an investment in the covered bonds and the impact the covered bonds will have on its overall investment portfolio; |

| • | have sufficient financial resources and liquidity to bear all of the risks of an investment in the covered bonds, including covered bonds with principal or interest payable in one or more currencies, or where the currency for principal or interest payments is different from the currency in which the potential investor’s financial activities are principally denominated; |

| • | understand thoroughly the terms of the covered bonds and be familiar with the behavior of any relevant indices and financial markets; and |

| • | be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic, interest rate and other factors that may affect its investment and its ability to bear the applicable risks. |

Covered bonds are complex financial instruments. Sophisticated institutional investors generally do not purchase complex financial instruments as stand-alone investments. They

20

Table of Contents

purchase complex financial instruments as a way to reduce risk or enhance yield with an understood, measured, appropriate addition of risk to their overall portfolios. A potential investor should not invest in covered bonds, which are complex financial instruments, unless it has the expertise (either alone or with a financial adviser) to evaluate how the covered bonds will perform under changing conditions, the resulting effect on the value of the covered bonds and the impact this investment will have on the potential investor’s overall investment portfolio.

Certain issues of covered bonds involve a high degree of risk and potential investors should be prepared to sustain a loss of all or part of their investment.

The covered bonds will constitute unsecured and uninsured deposit obligations of the Bank

The covered bonds will constitute deposit liabilities of the Bank for purposes of the Bank Act, however the covered bonds will not be insured under the Canada Deposit Insurance Corporation Act (Canada), and will constitute legal, valid and binding direct, unconditional, unsubordinated and unsecured obligations of the Bank and rank pari passu with all deposit liabilities of the Bank without any preference among themselves and at least pari passu with all other unsubordinated and unsecured obligations of the Bank, present and future, except as prescribed by law and in certain limited circumstances described in Conditions 9.1 (Issuer Events of Default) and 14 (Meetings of Covered Bondholders, Modification, Waiver and Substitution). If the Bank enters into any bankruptcy, liquidation, rehabilitation or other winding-up proceedings and there is a default in payment under any of the Bank’s secured or unsecured indebtedness or if there is an acceleration of any of the Bank’s indebtedness, the value of the covered bonds may decline. Further, the occurrence of an Issuer Event of Default alone does not constitute a Guarantor Event of Default and does not entitle the Bond Trustee to accelerate payment of the Guaranteed Amounts. The Guarantor has no obligation to pay the Guaranteed Amounts payable under the Covered Bond Guarantee until service on the Guarantor of (i) a Notice to Pay following service of an Issuer Acceleration Notice on the Bank following the occurrence of an Issuer Event of Default, or (ii) a Guarantor Acceleration Notice following the occurrence of a Guarantor Event of Default However, failure by the Guarantor to pay amounts when Due for Payment under the Covered Bond Guarantee constitutes a Guarantor Event of Default (subject to any applicable grace periods) and following service of a Guarantor Acceleration Notice, the covered bonds will become immediately due and payable against the Bank and the obligations of the Guarantor under the Covered Bond Guarantee will be accelerated.

The covered bonds are obligations of the Bank and the Guarantor only and do not extend to any of their affiliates or the other parties to the Program, including the Bond Trustee

The payment obligations in relation to the covered bonds will be solely obligations of the Bank and, subject to the terms of the Covered Bond Guarantee, obligations of the Guarantor. Accordingly, the payment obligations under the covered bonds will not be obligations of, or guaranteed by, any other affiliate of the Bank. In particular, the covered bonds will not be obligations of, and will not be guaranteed by, any of the Arrangers, the Dealers, the Bond Trustee, the Cash Manager, the Custodian, any Swap Provider, any of their agents, any company in the same group of companies as such entities or any other party to the Transaction Documents relating to the Program. Any failure by the Bank or the Guarantor to pay any amount due under the covered bonds will not result in any liability whatsoever in respect of such failure being accepted by any of the Arrangers, any of the Dealers, the Bond Trustee, the Custodian, any Swap Provider, any of their agents, the Partners, any company in the same group of companies as such entities or any other party to the Transaction Documents relating to the Program.

21

Table of Contents

The obligations under the Covered Bond Guarantee may be subject to an Extended Due for Payment Date and payment on the Final Redemption Amount may be deferred beyond the Final Maturity Date

The prospectus supplement for a Series of covered bonds may specify that they are subject to an Extended Due for Payment Date. If specified in the applicable prospectus supplement, in circumstances where neither the Bank nor the Guarantor has sufficient funds available to pay in full the Final Redemption Amount due on a Series of covered bonds on the relevant Final Maturity Date or within the relevant grace period, then the Final Maturity Date of the relevant Series of covered bonds may be deferred to an Extended Due for Payment Date. If payment has been deferred as discussed below, failure by the Guarantor to make payment in respect of all or any portion of the Final Redemption Amount on the Final Maturity Date (or such later date within any applicable grace period) will not constitute a Guarantor Event of Default.

If and to the extent that the Guarantor has sufficient funds available to partially redeem the relevant Series of covered bonds, either on the Final Maturity Date or on the applicable Original Due for Payment Dates for that Series of covered bonds up to and including the Extended Due for Payment Date, then (assuming that the Guarantee Acceleration Notice and Notice to Pay for the relevant amount have been served on the Guarantor within the relevant timeframes) the Guarantor will make such partial redemption in accordance with the Guarantee Priorities of Payments and as described in Condition 6.1 (Final redemption) of the Terms and Conditions of the Covered Bonds.

Interest will continue to accrue and be payable on the unpaid amount of the relevant Series of covered bonds in accordance with Condition 4 (Interest) of the Terms and Conditions of the Covered Bonds, and at the rate of interest specified in the applicable prospectus supplement and the Guarantor will pay Guaranteed Amounts constituting Scheduled Interest on each Original Due for Payment Date and the Extended Due for Payment Date.

Failure by the Guarantor to pay Guaranteed Amounts corresponding to the unpaid portion of the Final Redemption Amount or the balance thereof, as the case may be, on the Extended Due for Payment Date and/or pay Guaranteed Amounts constituting Scheduled Interest on any Original Due for Payment Date or the Extended Due for Payment Date will in each case (subject to any applicable grace period) constitute a Guarantor Event of Default.

Covered bonds issued under the Program will rank pari passu with each other and will accelerate at the same time

Covered bonds issued under the Program (except for the first issue of the covered bonds) will either be fungible with an existing Series of covered bonds or have different terms from an existing Series of covered bonds (in which case they will constitute a new Series). All covered bonds issued under the Program from time to time will rank pari passu with each other in all respects and, as obligations of the Bank, pari passu with covered bonds issued previously under the Bank’s Global Public Sector Covered Bond Programme. Following the occurrence of an Issuer Event of Default and service by the Bond Trustee of an Issuer Acceleration Notice, all outstanding covered bonds issued under the Program will accelerate against the Bank but will be subject to, and have the benefit of, the Guaranteed Amounts under the Covered Bond Guarantee (following a Notice to Pay having been served by the Bond Trustee on the Guarantor).

Following the occurrence of a Guarantor Event of Default and service by the Bond Trustee of a Guarantor Acceleration Notice, all outstanding covered bonds will accelerate against the Bank (if not already accelerated following service of an Issuer Acceleration Notice) and the obligations of the Guarantor under the Covered Bond Guarantee will accelerate.

22

Table of Contents

All covered bonds issued under the Program will share pari passu in the Security granted by the Guarantor under the Security Agreement on a pro rata basis. Accordingly, the holders of each Series of covered bonds issued under the Program will be required to share recovery proceeds from the Security with all other holders of each other Series of the covered bonds issued under the Program on a pro rata and pari passu basis. However, holders of covered bonds issued under the Program will not share in the security granted under the Bank’s Global Public Sector Covered Bond Programme, which is guaranteed by a different guarantor entity and secured by a different pool.

Credit ratings assigned to the covered bonds may not reflect all risks

The credit rating assigned to the covered bonds may not reflect the potential impact of all risks related to structure, market, and other factors that may affect the value of the covered bonds. The ratings assigned to the covered bonds with respect to Fitch address the following: the likelihood of full and timely payment to covered bondholders of all payments of interest on each Interest Payment Date; and the likelihood of ultimate payment of principal in relation to covered bonds on (a) their applicable Final Maturity Date, or (b) if the covered bonds are subject to an Extended Due for Payment Date in respect of the Covered Bond Guarantee in accordance with the applicable prospectus supplement, the applicable Extended Due for Payment Date. With respect to DBRS Limited and its successors (“DBRS”), the ratings assigned to the covered bonds address the risk that the issuer will fail to satisfy its financial obligations in accordance with the terms under which the covered bonds have been issued and are based on quantitative and qualitative considerations relating to the issuer and the relevant ranking of claims. With respect to Moody’s, the ratings assigned to the covered bonds address the expected loss posed to investors.

Any Rating Agency may lower or withdraw its credit rating if, in the sole judgment of the Rating Agency, the credit quality of the covered bonds has declined or is in question. If any rating assigned to the covered bonds is lowered or withdrawn, the market value of the covered bonds may be reduced. A downgrade or potential downgrade in these ratings, the assignment of new ratings that are lower than existing ratings, or a downgrade or potential downgrade in the ratings assigned to the Bank or any other securities of the Bank could reduce the number of potential investors in the covered bonds and adversely affect the price and liquidity of the covered bonds. A rating is based upon information furnished by the Bank or obtained by the rating agency from its own sources and is subject to revision, suspension or withdrawal by the rating agency at any time. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time.

Modifications, waivers and substitution under the covered bonds may, in certain circumstances, be made without consent of the covered bondholders

The Terms and Conditions contain provisions for calling meetings of covered bondholders to consider matters affecting their interests generally. These provisions permit defined majorities to bind all covered bondholders including covered bondholders who did not attend and vote at the relevant meeting and covered bondholders who voted in a manner contrary to the majority. Except to the extent the Trust Indenture Act applies, an individual covered bondholder may not be in a position to affect the outcome of the resolutions adopted by the meetings of covered bondholders.

23

Table of Contents

The Terms and Conditions of the covered bonds also provide that the Bond Trustee may, without the consent of covered bondholders, (a) agree to any modification, waiver or authorization, of any breach, or proposed breach, of any of the provisions of the covered bonds, (b) determine that any Issuer Event of Default or Guarantor Event of Default will not be treated as such, (c) agree to the substitution of another company as principal debtor under any covered bonds in place of the Bank or the Guarantor or (d) agree to any modification which is of a formal, minor or technical nature or to correct a manifest error or an error which, in the opinion of the Bond Trustee, is proven, in the circumstances described in Condition 14 (Meetings of Covered Bondholders, Modification, Waiver and Substitution) of the Terms and Conditions of the Covered Bonds. The covered bondholders will not be in a position to give instructions to the Bond Trustee in relation to the matters set out above.

The Guarantor’s ability to make payments under the Covered Bond Guarantee will depend primarily on the Portfolio

The Guarantor’s ability to meet its obligations under the Covered Bond Guarantee will depend primarily on the realizable value of Loans and Substitution Assets in the Portfolio, the amount of Revenue Receipts and Principal Receipts generated by the Portfolio and the timing thereof, amounts received from, and payable to, the Swap Providers and the receipt by it of credit balances and interest on credit balances in the GDA Account and the other Guarantor Accounts. The Guarantor will not have any other source of funds available to meet its obligations under the Covered Bond Guarantee. In addition, the Security granted pursuant to the Security Agreement may not be sufficient to meet the claims of all the Secured Creditors, including the covered bondholders. Following enforcement of the Security, Secured Creditors may still have an unsecured claim against the Bank for the deficiency, which will rank pari passu with the other deposit obligations of the Bank. However, there can be no assurance that the Bank will have sufficient funds to pay that shortfall.

If there is a call on the Covered Bond Guarantee, the claims of covered bondholders will be limited to the Guarantor’s available funds from time to time, which may be limited due to a lack of liquidity in respect of the Portfolio

If there is a call on the Covered Bond Guarantee and sale of the Portfolio, the proceeds from the sale of the Portfolio will depend on market conditions at the time of sale. If market conditions are unfavorable, the sale of the Portfolio may result in proceeds that are less than the amount due on the covered bonds. Furthermore, the maturities of the Loans in the Portfolio may not match those of the covered bonds which may require the Guarantor to sell Loans in order to pay principal on those covered bonds. Any such sale of Loans exposes investors to market risk, as the then current market value of the Loans may be less than the principal amount on the covered bonds. In addition, should an Issuer Event of Default or other Registered Title Event occur, there may be a delay in any and all borrowers switching payments to the new Servicer or the Guarantor.

There is no tax gross-up under the Covered Bond Guarantee

All payments of principal and interest in respect of the covered bonds will be made by the Bank without withholding or deduction for, or on account of, taxes imposed by any governmental or other taxing authority (subject to customary exceptions), unless such withholding or deduction is required by law. In the event that any such withholding or deduction is imposed by a tax jurisdiction specified under the Terms and Conditions, the Bank will, save in certain limited circumstances provided in the Terms and Conditions, be required to pay additional amounts to

24

Table of Contents

cover the amounts so deducted. By contrast, under the terms of the Covered Bond Guarantee, the Guarantor will not be liable to pay any such additional amounts payable by the Bank under the Terms and Conditions, or to pay any additional amounts in respect of any amount withheld or deducted for, or on account of, taxes from a payment by the Guarantor under the Covered Bond Guarantee.