| OMB APPROVAL | ||

| OMB Number: 3235-0570 | ||

| Expires: July 31, 2022 | ||

| Estimated average burden | ||

| hours per response……20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01743

The Alger

Funds II

(Exact name of registrant as specified in charter)

360 Park Avenue South New York, New York

10010

(Address of principal executive offices) (Zip code)

Mr. Hal Liebes

Fred Alger Management, LLC.

360 Park Avenue South

New York, New York 10010

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-806-8800

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to Stockholders of any report to be transmitted to Stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT(S) TO STOCKHOLDERS.

Table of Contents

The Alger Funds II

| Shareholders’ Letter | 1 | |

| Fund Highlights | 12 | |

| Portfolio Summary | 20 | |

| Schedules of Investments | 21 | |

| Statements of Assets and Liabilities | 46 | |

| Statements of Operations | 50 | |

| Statements of Changes in Net Assets | 52 | |

| Financial Highlights | 56 | |

| Notes to Financial Statements | 73 | |

| Additional Information | 98 |

Optional Internet Availability of Alger Shareholder Reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund, or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by signing up for paperless delivery at www.icsdelivery.com/alger. If you own these shares through a financial intermediary, contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 1-866-345-5954 or fundreports.com. If you own these shares through a financial intermediary contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held within the Alger Fund Complex or your financial intermediary.

| Shareholders’ Letter (Unaudited) | April 30, 2020 |

Dear Shareholders,

Reasons for Optimism Surface as Pandemic Drives Market Volatility

At Alger, we see plenty of reasons for optimism regarding equity investing and the well-being of society as governments seek to curtail the spread of the coronavirus, but we acknowledge that the pandemic will continue to create both personal and economic hardships in the foreseeable future. During the recent months of uncertainty and fear, we have strived to support our shareholders by drawing upon our 55 years of investing experience to seek companies that are best positioned to potentially generate durable earnings growth, and we have shared our insights on managing equities during challenging times to help our clients manage their apprehensions.

In this letter, which discusses the six-month reporting period ended April 30, 2020, I provide additional perspectives on navigating markets during the pandemic and I explain why I believe equities, while continuing to be volatile, may produce additional gains.

A Challenging Time

From the start of the reporting period until February 19 of this year, the S&P 500 Index climbed 12.18%. The spread of the novel coronavirus worldwide, however, caused investor sentiment to plummet and from the February 19 historical market peak to March 23 the index dropped 33.79%. As countries issued stay-at-home orders and shut down businesses to contain the pandemic, economic data weakened considerably. In the U.S., the Congressional Budget Office eventually predicted that gross domestic product (GDP) will contract at nearly a 40% annual rate in the second quarter of this year and unemployment will climb from a 50-year low to a peak of 16% later this year. With 24% of S&P 500 companies reporting during the last week of the reporting period, FactSet Research estimated that first quarter 2020 earnings would decline 15.8%, the largest drop since the second quarter of 2009.

In March, the Federal Reserve (“the Fed”) responded aggressively to the pandemic by implementing two rate cuts that totaled 150 basis points, bringing the fed funds target rate to .0% - .25%. The Fed also unveiled a round of quantitative easing that could dwarf prior easing programs while U.S. legislators began creating programs initially valued at more than $2 trillion to support businesses, increase unemployment benefits and provide one-time payments to certain individuals. Hope that the stimulus plans could help mitigate the economic impact of the pandemic caused equities to bounce back and from March 24 until April 30, the S&P 500 Index recorded a 30.8% gain.

As the reporting period drew to a close, various U.S. states and certain countries began to re-open their economies as the rates of new coronavirus cases either stabilized or declined. For the six-month reporting period, the S&P 500 recorded a 3.16% loss. Volatility extended beyond the U.S. with the MSCI Emerging Markets Index declining 10.39% and the MSCI ACWI ex USA Index declining 13.02%. Broadly speaking, companies with strong balance sheets and innovative products that are experiencing growing demand as a result of the pandemic outperformed while “old economy” industries such as energy, manufacturing, brick and mortar retailers and certain travel companies including airlines, cruise ship operators and hotels performed worst.

- 1 -

Keeping Change in Perspective

At Alger, we believe history illustrates that companies with innovative products and services can dominate their industries by disrupting their respective industries and capturing market share. These types of companies can potentially reward investors by growing their earnings despite economic headwinds.

Consider the following examples:

| • | The “Spanish Flu” pandemic and recession, which lasted from 1918 to 1919 and claimed 50 million lives. During this period, automobile ownership grew at a double-digit rate. |

| • | The Great Depression, which lasted from 1929 through 1939. In 1937 DuPont introduced neoprene, which is a synthetic rubber. By 1939, every automobile and airplane manufactured in the U.S. included products made with the material. Hewlett-Packard and Polaroid were also born during the Great Depression. |

| • | The “Asian Flu” pandemic and recession, which occurred in the late 1950s. During this event television ownership increased 12% after the introduction of color TV. |

| • | The recession of the early 1990s. During this event, personal computer penetration grew. |

| • | The Global Financial Crisis and Great Recession of 2008. During this event, smartphone subscribers, digital advertising and online retail sales all increased. |

Pandemic Hastens Change

Today, internet connected devices, cloud computing, artificial intelligence, the Internet of Things, genetic sciences, medtech and healthcare advances, and other technologies are fostering innovation that is occurring at unprecedented levels. In many instances, the coronavirus pandemic is accelerating the already rapid pace at which new products and services disrupt their industries and capture market share. During the early months of the pandemic, credit card data showed that overall consumer spending declined substantially as shopping malls closed, but consumers’ online shopping has seen near exponential acceleration while people have been under stay-at-home orders.1 The increased adoption of ecommerce by consumers is comparable to the total growth in adoption that we believe would have occurred over the coming two years without the pandemic. This acceleration is occurring after decades of growth in online retailing, which increased 14.9% last year while overall retail sales increased only 3.8%. This strong growth trend of course benefits large online retailers such as Amazon.com, Inc. but it is also helping smaller retailers who have had the foresight to adopt and even primarily build their businesses online, rather than in physical stores, often using ecommerce software platforms from companies such as Shopify, Square and Hubspot.

- 2 -

The structure and rhythm of the American workplace (and indeed across the globe) may be forever changed as a result of the response to Covid-19. With offices shut down, many businesses have had to immediately expand remote working to the majority, if not all, of their employees. Many lessons will be learned from this mass shift to telecommuting. However, we believe that even after this healthcare crisis passes and offices re-open, there will be a shift in the perception and therefore the use of telecommuting. In particular, for many businesses and for many job roles, we believe both workers and employers are seeing efficiency gains while “working from home” and will adopt more flexible policies in the future to not only allow working from home but perhaps encourage it more broadly and frequently within their future workforce. The use of many of the new technologies that support online collaboration, videoconferencing, and business process management, even as workers are remote, is being tested now on an emergency and broad basis, and the technologies are proving themselves to be largely exceptional in their potential for changing how we work in the future. To support this massive shift, technology needs to not only provide collaborative workstations for employees, but also increased network capacity and security. Nearly every provider of internet bandwidth or data center computing power is reporting significant increases in demand. Additionally, security firms such as CrowdStrike that provide end-point protection against viruses, malware and other digital threats are experiencing increased demand for cloud-based security systems. In both government and commercial firms, the need for real-time communication with the public or their employees has driven the adoption of new communications platforms to manage the dialogue. Software company Everbridge, for example, announced during the first quarter of this year that it had processed more than 13 million messages related to the pandemic.

We have long been investors in the healthcare sector, which we view as one of the most dynamic and innovative sectors in the U.S., and indeed, the world. Today, we are seeing the valor of doctors and nurses in New York in particular, Alger’s home for over 55 years, and across the U.S. and the globe. We believe this crisis will bring benefits to healthcare systems worldwide as lessons learned from this pandemic will result in new investment in public health, strengthening our hospitals’ and service providers’ capacity to respond rapidly and flexibly to future crises, and by accelerating investment in innovations from the research lab, to testing and clinical treatments and processes, and finally to the delivery of healthcare services by our doctors and nurses on the frontline of patient care. Early growth trends like telemedicine have already proven critical in this crisis, and after it ends, we believe will have become the new way of delivering healthcare to people in the U.S. – that is a technology trend whose adoption “curve,” we believe, has the potential to go from birth to mainstream potentially faster than any we have seen before.

Going Forward

We believe market volatility will continue in the coming months due to declining earnings and heightened uncertainty. As the quarterly reporting season progressed in April, companies increasingly withdrew their guidance for fiscal year 2020 due to uncertainty regarding the future impacts of the pandemic. Analysts are projecting a substantial decline in earnings for calendar year 2020 but expect earnings growth to resume next year.

We are optimistic that an eventual recovery in earnings growth, low interest rates and a return to more normal conditions resulting from a potential coronavirus vaccine or new treatments for Covid-19 could support equity markets. Unlike most recessions, the current economic slowdown is being driven by a public health crisis rather than structural issues, such as toxic debt built upon a housing bubble that triggered the Global Financial Crisis. Regardless of the timing, we believe investors should take a long-term approach rather than try to time markets. We also think investors will be best served by using in-depth fundamental research to find companies that are gaining market share and producing durable earnings growth with innovative products and services and, more specifically, are able to benefit from the global economic dislocation occurring from the pandemic. Additionally, we believe innovative companies with strong balance sheets that can finance their own growth initiatives rather than rely on leverage may be best positioned to outperform. At Alger, we continue to seek companies that are benefiting from change as we seek to help our valued clients meet their financial needs.

- 3 -

Portfolio Matters

Alger Spectra Fund

The Alger Spectra Fund generated a 6.77% return for the fiscal six-month period ended

April 30, 2020, compared to the 5.21% return of the Russell 3000 Growth Index.

Contributors to Performance

During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Information Technology and the largest sector underweight was Consumer Staples. The Information Technology and Industrials sectors provided the greatest contributions to relative performance.

For the reporting period, the Fund’s average portfolio allocation to long positions, which was increased by leverage, was 106.04%. The Fund had a -6.52% allocation to short positions and a 0.48% allocation to cash.

Regarding individual long positions, Amazon.com, Inc.; Microsoft Corp.; Apple Inc.; Adobe, Inc.; and NVIDIA Corp. were among the top contributors to performance. Amazon.com continues to generate strong high unit volume growth by taking market share from brick and mortar retailing and by growing its cloud computing service. During the reporting period, consumer uptake of one-day shipping supported the acceleration of the company’s online retailing. Later in the reporting period, investors became excited about the significant revenue gains associated with coronavirus quarantining and social distancing that are accelerating the pace at which ecommerce is capturing market share from traditional retailers. Additionally, investors reacted favorably to the pandemic creating increased demand for Amazon.com’s cloud service, AWS.

Short position Cboe Global Markets Inc. also contributed to performance. Cboe Global Markets owns the Chicago Board Options Exchange and operates BATS Global Markets. The company faces potential competition from the Members Exchange, which seeks to put pressure on fees for U.S. equity transactions and market data. It is proposing transaction fees that will be 25%-50% cheaper than Cboe’s fees. The share price of Cboe declined significantly when the company’s clients reduced their exposure to capital markets in the face of heightened volatility. This risk-off posturing reduced trading volumes. As the share price declined, the short position contributed to performance.

Detractors from Performance

The Communication Services and Consumer Staples sectors were among the sectors that detracted from results. Regarding individual positions, Live Nation Entertainment, Inc.; Luckin Coffee, Inc., Sponsored ADR Cl. A; SVB Financial Group; TransDigm Group, Inc.; and Cintas Corp. were among the top detractors from performance. Live Nation Entertainment is the music industry’s largest concert promotor. Prior to the coronavirus pandemic, it was rapidly increasing the list of artists whose concerts it promotes and the volume of the company’s ticket sales was also growing significantly. In February, fears that the spread of the coronavirus could dramatically curtail live concerts sparked a selloff of Live Nation Entertainment stock that continued through the early portion of March. Investors’ fear materialized when Live Nation Entertainment was forced to cancel thousands of concerts in response to government stay-at-home orders and bans on events that attract large crowds of individuals. Live Nation Entertainment also announced that it would refund tickets for the cancelled events.

- 4 -

Short position Monster Beverage Corp. also detracted from performance. Monster Beverage sells energy drinks and beverage concentrates. We were short the shares because of the competitive threat resulting from Coca-Cola’s January launch of an energy drink. The new beverage captured market share from various providers of energy drinks but not Monster. As such, the share price increased, which resulted in the short position detracting from performance. We covered the short exposure.

Alger Dynamic Opportunities Fund

The Alger Dynamic Opportunities Fund returned 12.13% for the fiscal six-month period ended April 30, 2020, compared to the -3.16% return of the Fund’s benchmark, the S&P 500 Index.

During the reporting period, the average allocation to long positions was 83.95% and the average allocation to short positions was -35.43%. The Fund’s cash allocation, which was a residual of long position sales and short sale proceeds, was 51.48%. Based on the combined allocations of long and short positions, the Healthcare and Information Technology sectors were the largest sector weightings for the reporting period. Healthcare was the only sector overweighting and the Financials and Information Technology sectors were the largest underweightings.

Contributors to Performance

Long positions in aggregate, contributed to both absolute and relative performance. Short exposure also contributed to absolute and relative performance. Based on the net exposure of long and short positions, the Financials and Energy sectors provided the largest contributions to relative performance. Regarding long positions, Dermira, Inc.; Chegg, Inc.; Nevro Corp.; Trade Desk, Inc., Cl. A; and Amazon.com, Inc. were among the top contributors to performance. Shares of Amazon.com performed strongly in response to developments identified in the Alger Spectra Fund discussion.

Short exposure to Seritage Growth Properties, Cl. A also contributed to performance. Seritage Growth Properties is a publicly traded, self-administered and self-managed real estate investment trust, a portfolio of both wholly owned properties and joint venture properties. The company’s business model is predicated on finding tenants for big box, vacant retail spaces. The severe economic pullback brought on by the Covid-19 pandemic saw a significant drop in demand for brick and mortar retail properties. Additionally, some of the company’s new tenants include businesses like gyms, restaurants and movie theaters– most of which were shuttered due to the coronavirus lockdown. Furthermore, Seritage uses excessive leverage and can no longer cover interest expenses without selling properties, which could be difficult during an economic downturn. As the share price of Seritage Growth Properties declined, the short position contributed to performance.

- 5 -

Detractors from Performance

The Information Technology sector detracted from relative performance. Regarding individual long positions, Bed Bath & Beyond, Inc.; Ebix, Inc.; TransDigm Group, Inc.; Glaukos Corp.; and Portola Pharmaceuticals, Inc. were among the most significant detractors from performance. TransDigm Group designs, produces and supplies aircraft components in the U.S. and internationally. The company operates through three segments: Power & Control, Airframe and Non-Aviation. TransDigm had a strong first six weeks of the year with its share price climbing approximately 17% after the company delivered positive results in its early February earnings announcement. However, the subsequent and pervasive slowdown of the U.S. airline industry as a result of the Covid-19 pandemic has weighed particularly heavily across the aviation supply chain, including parts suppliers like TransDigm and resulting in shares of the company underperforming. Additionally, the announced resumption of 737 “Max-8” production by Boeing could bring new airframes online that will not require significant maintenance as they log initial airframe hours.

Short exposure to Patrick Industries, Inc. also detracted from results. Patrick Industries manufactures and distributes building products and materials for the recreational vehicle, marine, manufactured housing and industrial markets in the U.S. and Canada. Retail demand for recreational vehicles (RV) was favorable in the early months of 2020, which could imply that Patrick is positioned to grow organically due to RV wholesale gains this year. The company has also increased its operating margins guidance for this year. Those factors supported the performance of Patrick Industries shares and resulted in the short position detracting from performance.

Alger Emerging Markets Fund

The Alger Emerging Markets Fund returned -3.81% for the fiscal six-month period ended April 30, 2020, compared to the -10.39% return of its benchmark, the MSCI Emerging Markets Index.

Contributors to Performance

During the reporting period, the largest portfolio sector weightings were Consumer Discretionary and Information Technology. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials. The Consumer Staples and Energy sectors were the largest contributors to relative performance.

Among countries, China, Brazil, New Zealand, Russia and Chile were some of the top contributors to relative performance. Regarding individual positions, China Feihe Ltd.; Tencent Holdings Ltd.; Alibaba Group Holding Ltd.; a2 Milk Co. Ltd.; and Leeno Industrial, Inc. were among the top contributors to performance. South Korea-based Leeno Industrial is a specialist provider of back-end semiconductor test probes and medical equipment probes. Development of 5G-enabled products contributed to a 105% increase in test socket volume growth in the first quarter of 2020, leading to a strong sales and earnings beat as well as year-over-year sales and earnings growth of 57% and 67%, respectively.

Detractors from Performance

The Consumer Discretionary and Healthcare sectors were among sectors that detracted from results while Greece, India, Taiwan, Turkey, Indonesia were among countries that detracted from performance.

- 6 -

Regarding individual positions, PT Media Nusantara Citra; HDFC Asset Management Co., Ltd.; Manappuram Finance Ltd.; CHUNBO CO., Ltd.; and Mavi Giyim Sanayi ve Ticaret A.S. were among the most significant detractors from performance. India’s leading asset manager, HDFC Asset Management, experienced a fall in assets under management quarter over quarter, due to the decline of markets and a negative mix shift (away from equities and towards cash/liquid investments) during the first three months of the year. Market share of actively managed equity funds also declined for the second straight quarter, largely stemming from underperformance in several fund categories.

Alger Responsible Investing Fund

The Alger Responsible Investing Fund returned 6.70% for the fiscal six-month period ended April 30, 2020, compared to the 6.09% return of the Russell 1000 Growth Index.

Contributors to Performance

During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Financials and the largest sector underweight was Healthcare. The Information Technology and Real Estate sectors provided the greatest contributions to relative performance.

Regarding individual positions, Amazon.com, Inc.; Microsoft Corp.; Apple, Inc.; Adobe, Inc.; and Vertex Pharmaceuticals, Inc. were among the top contributors to performance. Shares of Amazon.com performed strongly in response to developments identified in the Alger Spectra Fund discussion.

Detractors from Performance

The Communication Services and Utilities sectors were among the sectors that detracted from results. Regarding individual positions, Live Nation Entertainment, Inc.; Woodward, Inc.; Honeywell International, Inc.; Hexcel Corp.; and Boeing Co. were among the top detractors from performance. Shares of Live Nation Entertainment underperformed in response to developments identified in the Alger Spectra Fund discussion.

I thank you for putting your trust in Alger.

Sincerely,

Daniel C. Chung, CFA

Chief Investment Officer

Fred Alger Management, LLC

1Bank of America.

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the funds. This report is not authorized for distribution to prospective investors in a fund unless preceded or accompanied by an effective prospectus for the fund. Fund performance returns represent the six-month period return of Class A shares prior to the deduction of any sales charges and include the reinvestment of any dividends or distributions.

- 7 -

The performance data quoted represents past performance, which is not an indication or guarantee of future results.

Standardized performance results can be found on the following pages. The investment return and principal value of an investment in a fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com or call us at (800) 992-3863.

The views and opinions of the funds’ management in this report are as of the date of the Shareholders’ Letter and are subject to change at any time subsequent to this date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in the Fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including, without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a fund. Please refer to the Schedule of Investments for each fund which is included in this report for a complete list of fund holdings as of April 30, 2020. Securities mentioned in the Shareholders’ Letter, if not found in the Schedule of Investments, may have been held by the funds during the six-month fiscal period ended April 30, 2020.

Risk Disclosures

Alger Spectra Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks tend to be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. A significant portion of assets will be invested in technology and healthcare companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. Investments in the Consumer Discretionary Sector may be affected by domestic and international economies, consumer’s disposable income, consumer preferences and social trends. Foreign securities involve special risks including currency risk and risks related to political, social, or economic conditions. Short sales could increase market exposure, magnifying losses and increasing volatility. Leverage increases volatility in both up and down markets and its costs may exceed the returns of borrowed securities.

- 8 -

Alger Dynamic Opportunities Fund

Investing in the stock market involves risks, including the potential loss of principal. Growth stocks tend to be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. A significant portion of assets will be invested in technology companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. Cash positions may underperform relative to equity and fixed-income securities. Options and short sales could increase market exposure, magnifying losses and increasing volatility. Issue of convertible securities may be more sensitive to economic changes. Investing in companies of small capitalizations involve the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Leverage increases volatility in both up and down markets and its costs may exceed the returns of borrowed securities. Foreign securities involve special risks including currency risk and risks related to political, social, or economic conditions. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment.

Alger Emerging Markets Fund

Investing in the stock market involves certain risks, including the potential loss of principal. Growth stocks tend to be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. Foreign, Emerging Markets, and Frontier Markets securities involves special risks including currency fluctuations, less liquidity, inefficient trading, political instability, and increased volatility. Assets may be focused in a small number of holdings, making them susceptible to risks associated with a single economic, political or regulatory event than a more diversified portfolio. Investing in companies of small capitalizations involves the risk that such issuers may have limited product lines or financial resources, lack management depth, or have limited liquidity. Active trading may increase transaction costs, brokerage commissions, and taxes, which can lower the return on investment.

Alger Responsible Investing Fund

Investing in the stock market involves certain risks, including the potential loss of principal. Growth stocks tend to be more volatile than other stocks as their prices tend to be higher in relation to their companies’ earnings and may be more sensitive to market, political, and economic developments. The environmental, social and governance investment criteria may limit the number of investment opportunities available, and as a result, returns may be lower than vehicles not subject to such considerations. A significant portion of assets will be invested in technology companies, which may be significantly affected by competition, innovation, regulation, and product obsolescence, and may be more volatile than the securities of other companies. Consumer Discretionary Sector may be affected by domestic and international economies, consumer’s disposable income, consumer preferences and social trends.

For a more detailed discussion of the risks associated with a fund, please see the Prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges, and expenses.

For a prospectus or a summary prospectus containing this and other information about The Alger Funds II call us at (800) 992-3863 or visit us at www.alger.com. Read it carefully before investing.

Fred Alger & Company, LLC, Distributor. Member NYSE Euronext, SIPC.

- 9 -

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

| • | The S&P 500 Index: An index of large company stocks considered to be representative of the U.S. stock market. |

| • | The MSCI ACWI ex USA Index (gross) captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 26 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the US. |

| • | The Morgan Stanley Capital International (MSCI) Emerging Markets Index (gross) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. |

| • | The Russell 3000 Growth Index combines the large-cap Russell 1000 Growth, the small-cap Russell 2000 Growth and the Russell Microcap Growth Index. It includes companies that are considered more growth oriented relative to the overall market as defined by Russell's leading style methodology. The Russell 3000 Growth Index is constructed to provide a comprehensive, unbiased, and stable barometer of the growth opportunities within the broad market. |

| • | The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher growth earning potential as defined by Russell's leading style methodology. The Russell 1000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. |

| • | FactSet Research provides integrated software and data solutions for investment professionals. |

- 10 -

FUND PERFORMANCE AS OF 3/31/20 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | ||||||||||

| Alger Spectra Class A (Inception 7/28/69) | (5.68 | )% | 7.41 | % | 11.55 | % | ||||||

| Alger Spectra Class C (Inception 9/24/08) | (2.13 | )% | 7.75 | % | 11.31 | % | ||||||

| Alger Spectra Class I (Inception 9/24/08) | (0.47 | )% | 8.59 | % | 12.18 | % | ||||||

| 1 YEAR | 5 YEARS | SINCE

INCEPTION | ||||||||||

| Alger Spectra Class Y (Inception 12/03/18) | (0.08 | )% | n/a | 2.73 | % | |||||||

| Alger Spectra Class Z (Inception 12/29/10) | (0.17 | )% | 8.93 | % | 12.32 | % | ||||||

FUND PERFORMANCE AS OF 3/31/20 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| 1

YEAR | 5

YEARS | 10

YEARS | SINCE INCEPTION | |||||||||||||

| Alger Dynamic Opportunities Class A (Inception 11/2/09) | (5.98 | )% | 3.98 | % | 5.15 | % | 5.55 | % | ||||||||

| Alger Dynamic Opportunities Class C (Inception 12/29/10)‡ | (2.49 | )% | 4.30 | % | 4.91 | % | 5.29 | % | ||||||||

| Alger Dynamic Opportunities Class Z (Inception 12/29/10) | (0.51 | )% | 5.42 | % | n/a | 6.12 | % | |||||||||

| Alger Emerging Markets Class A (Inception 12/29/10) | (16.42 | )% | (1.68 | )% | n/a | (1.58 | )% | |||||||||

| Alger Emerging Markets Class C (Inception 12/29/10) | (13.34 | )% | (1.37 | )% | n/a | (1.79 | )% | |||||||||

| Alger Emerging Markets Class I (Inception 12/29/10) | (11.72 | )% | (0.58 | )% | n/a | (1.04 | )% | |||||||||

| Alger Emerging Markets Class Y (Inception 5/9/16) | (11.29 | )% | n/a | n/a | 3.51 | % | ||||||||||

| Alger Emerging Markets Class Z (Inception 2/28/14) | (11.29 | )% | (0.18 | )% | n/a | (0.18 | )% | |||||||||

| Alger Responsible Investing Class A (Inception 12/4/00) | (3.62 | )% | 7.18 | % | 8.99 | % | 3.34 | % | ||||||||

| Alger Responsible Investing Class C (Inception 9/24/08)* | 0.00 | % | 7.49 | % | 8.72 | % | 7.91 | % | ||||||||

| Alger Responsible Investing Class I (Inception 9/24/08)† | 1.71 | % | 8.34 | % | 9.59 | % | 8.75 | % | ||||||||

| Alger Responsible Investing Class Z (Inception 10/14/16) | 2.16 | % | n/a | n/a | 12.76 | % | ||||||||||

Alger Responsible Investing Fund Class A shares performance figures prior to January 12, 2007 are those of the Alger Green Institutional Fund and performance prior to October 19, 2006 represents the performance of the Alger Socially Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The predecessor fund followed different investment strategies and had a different portfolio manager. As of January 12, 2007, the Alger Green Institutional Fund became the Alger Green Fund. As of December 30, 2016 the Alger Green Fund became the Alger Responsible Investing Fund.

Prior to September 24, 2019, Alger Emerging Markets Fund followed different investment strategies and was managed by different portfolio managers. Performance prior to this date reflects these prior management styles and does not reflect the Alger Emerging Markets Fund's current investment strategies and investment personnel.

| * | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, reduced to reflect the current maximum sales charge and the higher operating expenses of Class C shares. |

| † | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

| ‡ | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, reduced to reflect the current maximum sales charge and the higher operating expenses of Class C shares. |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Funds’ average annual total returns include changes in share price and reinvestment of dividends and capital gains.

- 11 -

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2020 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/20

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Spectra Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2020. Figures for the Alger Spectra Fund Class A and the Russell 3000 Growth Index include reinvestment of dividends. Figures for the Alger Spectra Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Spectra Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 12 -

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2020 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 4/30/20

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | Since

12/31/1974 | |||||||||||||

| Class A (Inception 7/28/69) | 2.80 | % | 10.66 | % | 13.12 | % | 15.56 | % | ||||||||

| Class C (Inception 9/24/08)* | 6.73 | % | 11.03 | % | 12.88 | % | 14.83 | % | ||||||||

| Class I (Inception 9/24/08)† | 8.55 | % | 11.87 | % | 13.76 | % | 15.71 | % | ||||||||

| Russell 3000 Growth Index | 9.47 | % | 12.76 | % | 14.10 | % | n/a | |||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since 12/3/2018 | |||||||||||||

| Class Y (Inception 12/3/18) | 8.91 | % | n/a | n/a | 13.29 | % | ||||||||||

| Russell 3000 Growth Index | 9.47 | % | n/a | n/a | 13.41 | % | ||||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since 12/29/2010 | |||||||||||||

| Class Z (Inception 12/29/10) | 8.83 | % | 12.22 | % | n/a | 13.90 | % | |||||||||

| Russell 3000 Growth Index | 9.47 | % | 12.76 | % | n/a | 13.89 | % | |||||||||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. Class A, C, and I historical performance is calculated from December 31, 1974, the first full calendar year that Fred Alger Management, LLC was the Fund's investment adviser. The Fund operated as a closed-end fund from August 23, 1978 to February 12, 1996, during which time the calculation of total return assumed dividends were reinvested at market value. Had dividends not been reinvested, performance would have been lower. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September 24, 2008, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum sales charge and the higher operating expenses of Class C shares. |

| † | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September 24, 2008, inception of the class, is that of the Fund's Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

- 13 -

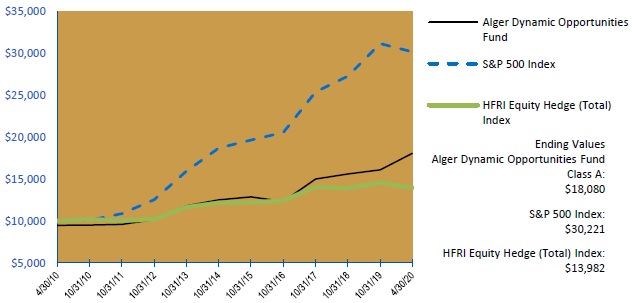

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2020 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A

— 10 years ended 4/30/20

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Dynamic Opportunities Fund Class A shares, with an initial 5.25% maximum sales charge, the S&P 500 Index (an unmanaged Index of Common Stocks) and the HFRI Equity Hedge (Total) Index (an unmanaged index of hedge funds) for the ten years ended April 30, 2020. Effective March 1, 2017, Weatherbie Capital, LLC, an indirect, wholly-owned subsidiary of Alger Group Holdings, LLC, the parent company of Fred Alger Management, LLC, began providing investment sub-advisory services for a portion of the assets of the Alger Dynamic Opportunities Fund. Figures for the Alger Dynamic Opportunities Fund Class A, the S&P 500 Index and the HFRI Equity Hedge (Total) Index include reinvestment of dividends. Figures for the Alger Dynamic Opportunities Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Dynamic Opportunities Fund Class C and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 14 -

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2020 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 4/30/20

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | Since

11/2/2009 | |||||||||||||

| Class A (Inception 11/2/09) | 0.69 | % | 5.79 | % | 6.10 | % | 6.31 | % | ||||||||

| Class C (Inception 12/29/10)* | 4.47 | % | 6.12 | % | 5.86 | % | 6.05 | % | ||||||||

| S&P 500 Index | 0.86 | % | 9.12 | % | 11.69 | % | 12.60 | % | ||||||||

| HFRI Equity Hedge (Total) Index | (4.44 | )% | 2.04 | % | 3.40 | % | 3.97 | % | ||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since

12/29/2010 | |||||||||||||

| Class Z (Inception 12/29/10) | 6.48 | % | 7.25 | % | n/a | 6.98 | % | |||||||||

| S&P 500 Index | 0.86 | % | 9.12 | % | n/a | 11.69 | % | |||||||||

| HFRI Equity Hedge (Total) Index | (4.44 | )% | 2.04 | % | n/a | 3.40 | % | |||||||||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

| * | Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, reduced to reflect the current maximum sales charge and the higher operating expenses of Class C shares. |

- 15 -

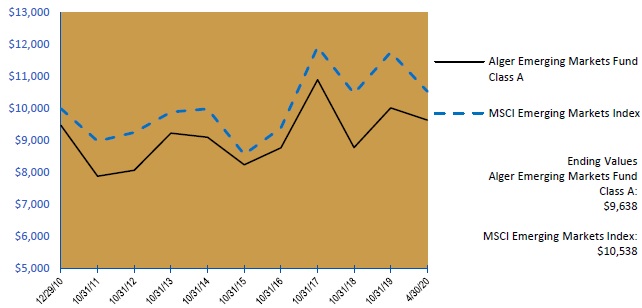

ALGER EMERGING MARKETS FUND

Fund Highlights Through April 30, 2020 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— From 12/29/10 to 4/30/20

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Emerging Markets Fund Class A shares, with an initial 5.25% maximum sales charge, and the MSCI Emerging Markets Index (an unmanaged index of common stocks) from December 29, 2010, the inception date of the Alger Emerging Markets Fund Class A, through April 30, 2020. Prior to September 24, 2019, Alger Emerging Markets Fund followed different investment strategies and was managed by different portfolio managers. Performance prior to this date reflects these prior management styles and does not reflect the Alger Emerging Markets Fund's current investment strategies and investment personnel. Figures for the Alger Emerging Markets Fund Class A and the MSCI Emerging Markets Index include reinvestment of dividends. Figures for the Alger Emerging Markets Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Emerging Markets Fund Class C, Class I, Class Y and Class Z shares will vary from the results shown above due to the operating expenses and current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 16 -

ALGER EMERGING MARKETS FUND

Fund Highlights Through April 30, 2020 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 4/30/20

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | Since

12/29/2010 | |||||||||||||

| Class A (Inception 12/29/10) | (9.45 | )% | (0.64 | )% | n/a | (0.39 | )% | |||||||||

| Class C (Inception 12/29/10) | (6.01 | )% | (0.32 | )% | n/a | (0.62 | )% | |||||||||

| Class I (Inception 12/29/10) | (4.25 | )% | 0.46 | % | n/a | 0.14 | % | |||||||||

| MSCI Emerging Markets Index | (11.65 | )% | 0.28 | % | n/a | 0.56 | % | |||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since 5/9/2016 | |||||||||||||

| Class Y (Inception 5/9/16) | (3.85 | )% | n/a | n/a | 6.34 | % | ||||||||||

| MSCI Emerging Markets Index | (11.65 | )% | n/a | n/a | 6.60 | % | ||||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since 2/28/2014 | |||||||||||||

| Class Z (Inception 2/28/14) | (3.89 | )% | 0.87 | % | n/a | 1.62 | % | |||||||||

| MSCI Emerging Markets Index | (11.65 | )% | 0.28 | % | n/a | 2.07 | % | |||||||||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Prior to September 24, 2019, Alger Emerging Markets Fund followed different investment strategies and was managed by different portfolio managers. Performance prior to this date reflects these prior management styles and does not reflect the Alger Emerging Markets Fund's current investment strategies and investment personnel. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 17 -

ALGER RESPONSIBLE INVESTING FUND

Fund Highlights Through April 30, 2020 (Unaudited)

HYPOTHETICAL $10,000 INVESTMENT IN CLASS A SHARES

— 10 years ended 4/30/20

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Responsible Investing Fund Class A shares, with an initial 5.25% maximum sales charge, the Russell 1000 Growth Index (an unmanaged index of common stocks) for the ten years ended April 30, 2020. Prior to December 30, 2016, the Fund followed different investment strategies under the name “Alger Green Fund” and was managed by a different portfolio manager. Accordingly, performance prior to that date does not reflect the Fund’s current investment strategies and investment personnel. Figures for the Alger Responsible Investing Fund Class A and the Russell 1000 Growth Index include reinvestment of dividends. Figures for the Alger Responsible Investing Fund Class A shares also include reinvestment of capital gains. Performance for the Alger Responsible Investing Fund Class C, Class I and Class Z shares will vary from the results shown above due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

- 18 -

ALGER RESPONSIBLE INVESTING FUND

Fund Highlights Through April 30, 2020 (Unaudited) (Continued)

PERFORMANCE COMPARISON AS OF 4/30/20

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | Since

12/4/2000 | |||||||||||||

| Class A (Inception 12/4/00) | 3.96 | % | 9.82 | % | 10.13 | % | 4.01 | % | ||||||||

| Russell 1000 Growth Index | 10.84 | % | 13.34 | % | 14.41 | % | 6.42 | % | ||||||||

PERFORMANCE COMPARISON AS OF 4/30/20

AVERAGE ANNUAL TOTAL RETURNS

| 1 YEAR | 5 YEARS | 10 YEARS | Since

9/24/2008 | |||||||||||||

| Class C (Inception 9/24/08) | 7.75 | % | 10.14 | % | 9.85 | % | 9.03 | % | ||||||||

| Class I (Inception 9/24/08) | 9.61 | % | 11.01 | % | 10.73 | % | 9.88 | % | ||||||||

| Russell 1000 Growth Index | 10.84 | % | 13.34 | % | 14.41 | % | 13.15 | % | ||||||||

| 1 YEAR | 5 YEARS | 10 YEARS | Since

10/14/2016 | |||||||||||||

| Class Z (Inception 10/14/16) | 10.11 | % | n/a | n/a | 16.56 | % | ||||||||||

| Russell 1000 Growth Index | 10.84 | % | n/a | n/a | 17.59 | % | ||||||||||

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. Performance figures prior to January 12, 2007, are those of the Alger Green Institutional Fund and performance prior to October 19, 2006, represents the performance of the Alger Socially Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The predecessor fund followed different investment strategies and had a different portfolio manager. As of January 12, 2007, the Alger Green Institutional Fund became the Alger Green Fund. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 19 -

PORTFOLIO SUMMARY†

April 30, 2020 (Unaudited)

SECTORS |

Alger Spectra Fund* | Alger

Dynamic Opportunities Fund* | Alger

Responsible Investing Fund | |||||||||

| Communication Services | 12.7 | % | 3.3 | % | 9.7 | % | ||||||

| Consumer Discretionary | 18.7 | 10.0 | 17.2 | |||||||||

| Consumer Staples | 0.6 | (0.9 | ) | 4.1 | ||||||||

| Energy | 0.0 | 0.1 | 0.0 | |||||||||

| Exchange Traded Funds | (0.6 | ) | 0.0 | 0.0 | ||||||||

| Financials | 3.7 | (0.7 | ) | 5.2 | ||||||||

| Healthcare | 14.2 | 15.4 | 10.5 | |||||||||

| Industrials | 5.7 | 6.8 | 4.5 | |||||||||

| Information Technology | 40.7 | 16.6 | 39.8 | |||||||||

| Market Indices | (0.1 | ) | (3.8 | ) | 0.0 | |||||||

| Materials | 3.1 | 0.2 | 2.3 | |||||||||

| Real Estate | 1.3 | 5.9 | 3.4 | |||||||||

| Utilities | 0.0 | 0.0 | 0.5 | |||||||||

| Short-Term Investments and Net Other Assets | 0.0 | 47.1 | 2.8 | |||||||||

| 100.0 | % | 100.0 | % | 100.0 | % | |||||||

COUNTRY | Alger

Emerging Markets Fund | |||

| Argentina | 0.6 | % | ||

| Brazil | 2.7 | |||

| Chile | 1.6 | |||

| China | 47.0 | |||

| Greece | 3.8 | |||

| India | 4.5 | |||

| Indonesia | 4.0 | |||

| New Zealand | 3.0 | |||

| Russia | 1.5 | |||

| South Korea | 21.1 | |||

| Taiwan | 2.5 | |||

| Turkey | 2.1 | |||

| United States | 3.2 | |||

| Cash and Net Other Assets | 2.4 | |||

| 100.0 | % | |||

* Includes short sales as a reduction of sector exposure.

† Based on net assets for each Fund.

- 20 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2020 (Unaudited)

| COMMON STOCKS—103.3% | SHARES | VALUE | ||||||

| AEROSPACE & DEFENSE—1.5% | ||||||||

| HEICO Corp., Cl. A | 412,632 | $ | 29,845,673 | |||||

| Mercury Systems, Inc.* | 548,486 | 48,903,012 | ||||||

| TransDigm Group, Inc. | 37,103 | 13,471,357 | ||||||

| 92,220,042 | ||||||||

| APPAREL ACCESSORIES & LUXURY GOODS—0.3% | ||||||||

| Lululemon Athletica, Inc.* | 64,402 | 14,392,559 | ||||||

| LVMH Moet Hennessy Louis Vuitton SE | 15,082 | 5,829,797 | ||||||

| 20,222,356 | ||||||||

| APPLICATION SOFTWARE—9.2% | ||||||||

| Adobe, Inc.* ,+ | 483,680 | 171,048,595 | ||||||

| Autodesk, Inc.* | 131,082 | 24,529,375 | ||||||

| Avalara, Inc.* | 398,457 | 35,610,102 | ||||||

| Cadence Design Systems, Inc.* | 635,426 | 51,552,111 | ||||||

| Coupa Software, Inc.* | 84,012 | 14,793,673 | ||||||

| Intuit, Inc. | 173,973 | 46,939,655 | ||||||

| Palantir Technologies, Inc., Cl. A*,@,(a) | 348,292 | 2,002,679 | ||||||

| RingCentral, Inc., Cl. A* | 96,664 | 22,090,624 | ||||||

| salesforce.com, Inc.* ,+ | 1,111,857 | 180,065,241 | ||||||

| 548,632,055 | ||||||||

| AUTO PARTS & EQUIPMENT—0.4% | ||||||||

| Aptiv PLC | 342,979 | 23,854,189 | ||||||

| AUTOMOBILE MANUFACTURERS—0.3% | ||||||||

| Tesla, Inc.* | 24,461 | 19,125,567 | ||||||

| AUTOMOTIVE RETAIL—0.1% | ||||||||

| Carvana Co., Cl. A* | 66,626 | 5,337,409 | ||||||

| BIOTECHNOLOGY—3.4% | ||||||||

| BioMarin Pharmaceutical, Inc.* | 177,187 | 16,304,748 | ||||||

| Genmab AS* | 73,247 | 17,604,222 | ||||||

| Gilead Sciences, Inc. | 355,492 | 29,861,328 | ||||||

| Sarepta Therapeutics, Inc.* | 248,934 | 29,344,340 | ||||||

| Vertex Pharmaceuticals, Inc.*,+ | 431,134 | 108,300,860 | ||||||

| 201,415,498 | ||||||||

| BUILDING PRODUCTS—0.3% | ||||||||

| Trex Co., Inc.* | 161,767 | 15,403,454 | ||||||

| CASINOS & GAMING—0.6% | ||||||||

| DraftKings, Inc., Cl. A* | 1,792,576 | 34,883,529 | ||||||

| CONSTRUCTION MATERIALS—0.4% | ||||||||

| Vulcan Materials Co. | 206,109 | 23,284,134 | ||||||

| DATA PROCESSING & OUTSOURCED SERVICES—9.2% | ||||||||

| Fidelity National Information Services, Inc. + | 728,071 | 96,025,284 | ||||||

| Fiserv, Inc.* | 543,723 | 56,036,092 | ||||||

| PayPal Holdings, Inc.* | 879,969 | 108,236,187 | ||||||

| Visa, Inc., Cl. A+ | 1,611,395 | 287,988,514 | ||||||

| 548,286,077 | ||||||||

| DIVERSIFIED SUPPORT SERVICES—1.0% | ||||||||

| Cintas Corp. + | 257,967 | 57,224,820 | ||||||

- 21 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—103.3% (CONT.) | SHARES | VALUE | ||||||

| EDUCATION SERVICES—0.8% | ||||||||

| Bright Horizons Family Solutions, Inc.* | 433,966 | $ | 50,535,341 | |||||

| ELECTRICAL COMPONENTS & EQUIPMENT—0.6% | ||||||||

| AMETEK, Inc. | 409,531 | 34,347,365 | ||||||

| ELECTRONIC MANUFACTURING SERVICES—0.4% | ||||||||

| Flex Ltd.* | 2,611,359 | 25,486,864 | ||||||

| ENVIRONMENTAL & FACILITIES SERVICES—0.9% | ||||||||

| Waste Connections, Inc. | 613,188 | 52,678,981 | ||||||

| FINANCIAL EXCHANGES & DATA—3.0% | ||||||||

| Intercontinental Exchange, Inc. | 1,018,864 | 91,137,385 | ||||||

| S&P Global, Inc. | 227,315 | 66,576,017 | ||||||

| Tradeweb Markets, Inc., Cl. A | 453,132 | 23,635,365 | ||||||

| 181,348,767 | ||||||||

| FOOD DISTRIBUTORS—0.3% | ||||||||

| US Foods Holding Corp.* | 905,560 | 19,469,540 | ||||||

| FOOTWEAR—1.3% | ||||||||

| NIKE, Inc., Cl. B | 909,123 | 79,257,343 | ||||||

| HEALTHCARE EQUIPMENT—4.9% | ||||||||

| Boston Scientific Corp.* ,+ | 2,730,916 | 102,354,732 | ||||||

| Danaher Corp. + | 657,617 | 107,494,075 | ||||||

| DexCom, Inc.* | 162,462 | 54,457,262 | ||||||

| Intuitive Surgical, Inc.* | 51,919 | 26,524,379 | ||||||

| 290,830,448 | ||||||||

| HEALTHCARE SERVICES—1.1% | ||||||||

| 1Life Healthcare, Inc.* | 461,701 | 11,390,164 | ||||||

| Cigna Corp. | 142,962 | 27,989,100 | ||||||

| Guardant Health, Inc.* | 348,099 | 26,789,699 | ||||||

| 66,168,963 | ||||||||

| HEALTHCARE TECHNOLOGY—0.7% | ||||||||

| Veeva Systems, Inc., Cl. A* | 207,365 | 39,565,242 | ||||||

| HOME IMPROVEMENT RETAIL—1.0% | ||||||||

| Lowe's Cos., Inc. | 589,918 | 61,793,910 | ||||||

| INDUSTRIAL GASES—1.1% | ||||||||

| Air Products & Chemicals, Inc. | 299,426 | 67,544,517 | ||||||

| INTERACTIVE MEDIA & SERVICES—10.0% | ||||||||

| Alphabet, Inc., Cl. C*,+ | 217,617 | 293,491,342 | ||||||

| Facebook, Inc., Cl. A*,+ | 1,309,436 | 268,054,644 | ||||||

| Pinterest, Inc., Cl. A* | 1,667,256 | 34,445,509 | ||||||

| 595,991,495 | ||||||||

| INTERNET & DIRECT MARKETING RETAIL—11.5% | ||||||||

| Alibaba Group Holding Ltd.#,* ,+ | 1,173,259 | 237,784,401 | ||||||

| Altaba, Inc.*,(a) | 606,454 | 13,857,474 | ||||||

| Amazon.com, Inc.* ,+ | 175,771 | 434,857,454 | ||||||

| 686,499,329 | ||||||||

- 22 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—103.3% (CONT.) | SHARES | VALUE | ||||||

| INTERNET SERVICES & INFRASTRUCTURE—1.7% | ||||||||

| Shopify, Inc., Cl. A* | 30,353 | 19,191,898 | ||||||

| Twilio, Inc., Cl. A* | 290,501 | $ | 32,623,262 | |||||

| VeriSign, Inc.* | 226,797 | 47,511,704 | ||||||

| 99,326,864 | ||||||||

| IT CONSULTING & OTHER SERVICES—0.2% | ||||||||

| Grid Dynamics Holdings, Inc.* | 1,277,732 | 10,209,079 | ||||||

| LEISURE FACILITIES—0.6% | ||||||||

| Vail Resorts, Inc. | 214,848 | 36,739,008 | ||||||

| LIFE SCIENCES TOOLS & SERVICES—0.5% | ||||||||

| Thermo Fisher Scientific, Inc. | 85,540 | 28,628,527 | ||||||

| MANAGED HEALTHCARE—2.6% | ||||||||

| UnitedHealth Group, Inc. + | 522,531 | 152,824,642 | ||||||

| METAL & GLASS CONTAINERS—1.1% | ||||||||

| Ball Corp. | 970,900 | 63,681,331 | ||||||

| MOVIES & ENTERTAINMENT—1.7% | ||||||||

| Live Nation Entertainment, Inc.* | 489,522 | 21,964,852 | ||||||

| Netflix, Inc.* | 190,416 | 79,946,158 | ||||||

| 101,911,010 | ||||||||

| PHARMACEUTICALS—1.6% | ||||||||

| Aerie Pharmaceuticals, Inc.* | 867,002 | 13,213,110 | ||||||

| GW Pharmaceuticals PLC#,* | 315,699 | 31,614,098 | ||||||

| Novartis AG# | 585,954 | 49,647,883 | ||||||

| 94,475,091 | ||||||||

| PROPERTY & CASUALTY INSURANCE—1.1% | ||||||||

| The Progressive Corp. | 881,575 | 68,145,748 | ||||||

| RAILROADS—0.7% | ||||||||

| Union Pacific Corp. | 270,990 | 43,301,492 | ||||||

| RESEARCH & CONSULTING SERVICES—1.3% | ||||||||

| CoStar Group, Inc.* | 74,755 | 48,460,677 | ||||||

| TransUnion | 378,480 | 29,820,439 | ||||||

| 78,281,116 | ||||||||

| RESTAURANTS—2.1% | ||||||||

| Chipotle Mexican Grill, Inc., Cl. A* | 10,848 | 9,530,510 | ||||||

| Shake Shack, Inc., Cl. A* | 541,612 | 29,523,270 | ||||||

| Starbucks Corp. | 1,116,229 | 85,648,252 | ||||||

| 124,702,032 | ||||||||

| SEMICONDUCTOR EQUIPMENT—1.1% | ||||||||

| Lam Research Corp. | 258,600 | 66,015,408 | ||||||

| SEMICONDUCTORS—4.3% | ||||||||

| Micron Technology, Inc.* | 409,551 | 19,613,397 | ||||||

| NVIDIA Corp. | 401,022 | 117,210,710 | ||||||

| NXP Semiconductors NV | 551,099 | 54,872,927 | ||||||

| Taiwan Semiconductor Manufacturing Co., Ltd.# | 399,250 | 21,212,153 | ||||||

| Universal Display Corp. | 282,116 | 42,351,254 | ||||||

| 255,260,441 | ||||||||

- 23 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—103.3% (CONT.) | SHARES | VALUE | ||||||

| SOFT DRINKS—0.5% | ||||||||

| The Coca-Cola Co. | 696,538 | $ | 31,964,129 | |||||

| SPECIALTY CHEMICALS—0.9% | ||||||||

| The Sherwin-Williams Co. + | 99,196 | 53,205,759 | ||||||

| SYSTEMS SOFTWARE—9.9% | ||||||||

| Crowdstrike Holdings, Inc., Cl. A* | 920,802 | 62,301,463 | ||||||

| Microsoft Corp. + | 2,955,827 | 529,713,756 | ||||||

| 592,015,219 | ||||||||

| TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—5.8% | ||||||||

| Apple, Inc. + | 1,189,541 | 349,487,146 | ||||||

| TRUCKING—0.3% | ||||||||

| Lyft, Inc., Cl. A* | 598,513 | 19,649,182 | ||||||

| WIRELESS TELECOMMUNICATION SERVICES—1.0% | ||||||||

| T-Mobile US, Inc.* | 681,461 | 59,832,276 | ||||||

| TOTAL

COMMON STOCKS (Cost $4,143,488,955) | 6,171,062,735 | |||||||

| PREFERRED STOCKS—0.2% | SHARES | VALUE | ||||||

| APPLICATION SOFTWARE—0.2% | ||||||||

| Palantir Technologies, Inc., Cl. B*,@,(a) | 1,420,438 | 8,167,518 | ||||||

| Palantir Technologies, Inc., Cl. D*,@,(a) | 185,062 | 1,064,107 | ||||||

| 9,231,625 | ||||||||

| BIOTECHNOLOGY—0.0% | ||||||||

| Prosetta Biosciences, Inc., Series D*,@,(a),(b) | 2,912,012 | 2,300,489 | ||||||

| TOTAL

PREFERRED STOCKS (Cost $23,705,752) | 11,532,114 | |||||||

| REAL ESTATE INVESTMENT TRUST—1.3% | SHARES | VALUE | ||||||

| SPECIALIZED—1.3% | ||||||||

| Crown Castle International Corp. | 503,888 | 80,334,864 | ||||||

| (Cost $57,827,582) | 80,334,864 | |||||||

| Total

Investments (Cost $4,225,022,289) | 104.8 | % | $ | 6,262,929,713 | ||||

| Affiliated Securities (Cost $13,104,054) | 2,300,489 | |||||||

| Unaffiliated Securities (Cost $4,211,918,235) | 6,260,629,224 | |||||||

| Securities Sold Short (Proceeds $289,380,344) | (4.8 | )% | (287,759,515 | ) | ||||

| Other Assets in Excess of Liabilities | 0.0 | % | 438,072 | |||||

| NET ASSETS | 100.0 | % | $ | 5,975,608,270 | ||||

- 24 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| + | All or a portion of this security is held as collateral for securities sold short. |

| # | American Depositary Receipts. |

| (a) | Security is valued in good faith at fair value determined using significant unobservable inputs pursuant to procedures established by the Board. |

| (b) | Deemed an affiliate of the Fund in accordance with Section 2(a)(3) of the Investment Company Act of 1940. See Note 11 - Affiliated Securities. |

| * | Non-income producing security. |

| @ | Restricted security - Investment in security not registered under the Securities Act of 1933. Sales or transfers of the investment may be restricted only to qualified buyers. |

| Security | Acquisition Date(s) | Acquisition Cost | % of net

assets (Acquisition Date) | Market Value | % of net

assets as of 4/30/2020 | |||||||||||||

| Altaba, Inc. | 10/24/18 | $ | 1,704,939 | 0.03 | % | $ | 2,216,062 | 0.04 | % | |||||||||

| Altaba, Inc. | 10/25/18 | 2,562,470 | 0.04 | % | 3,314,895 | 0.05 | % | |||||||||||

| Altaba, Inc. | 10/29/18 | 2,492,386 | 0.04 | % | 3,357,373 | 0.06 | % | |||||||||||

| Altaba, Inc. | 10/30/18 | 1,640,707 | 0.03 | % | 2,251,730 | 0.04 | % | |||||||||||

| Altaba, Inc. | 10/31/18 | 591,342 | 0.01 | % | 772,559 | 0.01 | % | |||||||||||

| Altaba, Inc. | 11/6/18 | 2,386,078 | 0.04 | % | 1,944,855 | 0.03 | % | |||||||||||

| Palantir Technologies, Inc., Cl. A | 10/7/14 | 2,266,336 | 0.05 | % | 2,002,679 | 0.03 | % | |||||||||||

| Palantir Technologies, Inc., Cl. B | 10/7/14 | 9,379,767 | 0.22 | % | 8,167,518 | 0.14 | % | |||||||||||

| Palantir Technologies, Inc., Cl. D | 10/14/14 | 1,221,931 | 0.03 | % | 1,064,107 | 0.02 | % | |||||||||||

| Prosetta Biosciences, Inc., Series D | 2/6/15 | 13,104,054 | 0.28 | % | 2,300,489 | 0.04 | % | |||||||||||

| Total | $ | 27,392,267 | 0.46 | % | ||||||||||||||

See Notes to Financial Statements.

- 25 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments - Securities Sold Short April 30, 2020 (Unaudited)

| COMMON STOCKS—(4.8)% | SHARES | VALUE | ||||||

| AEROSPACE & DEFENSE—(0.2)% | ||||||||

| HEICO Corp. | (109,646 | ) | $ | (9,604,990 | ) | |||

| AIR FREIGHT & LOGISTICS—(0.4)% | ||||||||

| CH Robinson Worldwide, Inc. | (95,160 | ) | (6,746,844 | ) | ||||

| FedEx Corp. | (70,869 | ) | (8,984,063 | ) | ||||

| United Parcel Service, Inc., Cl. B | (56,748 | ) | (5,371,766 | ) | ||||

| (21,102,673 | ) | |||||||

| AIRLINES—(0.2)% | ||||||||

| American Airlines Group, Inc. | (1,058,197 | ) | (12,708,946 | ) | ||||

| APPAREL RETAIL—(0.1)% | ||||||||

| Hennes & Mauritz AB, Cl. B | (561,013 | ) | (7,667,918 | ) | ||||

| APPLICATION SOFTWARE—(0.3)% | ||||||||

| Alteryx, Inc., Cl. A | (47,805 | ) | (5,410,570 | ) | ||||

| SAP SE# | (124,522 | ) | (14,760,838 | ) | ||||

| (20,171,408 | ) | |||||||

| AUTOMOBILE MANUFACTURERS—0.0% | ||||||||

| Ford Motor Co. | (425,192 | ) | (2,164,227 | ) | ||||

| CONSTRUCTION MACHINERY & HEAVY TRUCKS—0.0% | ||||||||

| Trinity Industries, Inc. | (142,320 | ) | (2,745,353 | ) | ||||

| DIVERSIFIED BANKS—(0.1)% | ||||||||

| SPDR S&P Regional Banking ETF | (169,596 | ) | (6,466,695 | ) | ||||

| EXCHANGE TRADED FUNDS—(0.6)% | ||||||||

| Industrial Select Sector SPDR Fund | (403,866 | ) | (25,932,236 | ) | ||||

| VanEck Vectors Semiconductor ETF | (46,799 | ) | (6,256,559 | ) | ||||

| (32,188,795 | ) | |||||||

| FINANCIAL EXCHANGES & DATA—(0.3)% | ||||||||

| Cboe Global Markets, Inc. | (58,377 | ) | (5,801,506 | ) | ||||

| FactSet Research Systems, Inc. | (39,035 | ) | (10,734,625 | ) | ||||

| (16,536,131 | ) | |||||||

| GENERAL MERCHANDISE STORES—(0.2)% | ||||||||

| Target Corp. | (121,169 | ) | (13,297,086 | ) | ||||

| HEALTHCARE EQUIPMENT—(0.2)% | ||||||||

| iShares 20+ Year Treasury Bond ETF | (85,347 | ) | (14,230,759 | ) | ||||

| HEALTHCARE FACILITIES—(0.1)% | ||||||||

| HCA Healthcare, Inc. | (49,997 | ) | (5,493,670 | ) | ||||

| HEALTHCARE SERVICES—(0.1)% | ||||||||

| LHC Group, Inc. | (58,297 | ) | (7,578,027 | ) | ||||

| INDUSTRIAL CONGLOMERATES—(0.1)% | ||||||||

| General Electric Co. | (1,131,864 | ) | (7,696,675 | ) | ||||

| IT CONSULTING & OTHER SERVICES—(0.1)% | ||||||||

| Accenture PLC, Cl. A | (32,481 | ) | (6,015,156 | ) | ||||

| LIFE SCIENCES TOOLS & SERVICES—(0.2)% | ||||||||

| Waters Corp. | (74,754 | ) | (13,978,998 | ) | ||||

| MARKET INDICES—(0.1)% | ||||||||

| iShares Russell 2000 ETF | (48,316 | ) | (6,296,058 | ) | ||||

- 26 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments - Securities Sold Short April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—(4.8)% (CONT.) | SHARES | VALUE | ||||||

| PACKAGED FOODS & MEATS—(0.2)% | ||||||||

| Campbell Soup Co. | (60,685 | ) | $ | (3,033,036 | ) | |||

| McCormick & Co., Inc. | (36,932 | ) | (5,792,415 | ) | ||||

| (8,825,451 | ) | |||||||

| PAPER PACKAGING—(0.4)% | ||||||||

| Amcor PLC | (1,024,536 | ) | (9,190,088 | ) | ||||

| Packaging Corp. of America | (117,347 | ) | (11,341,588 | ) | ||||

| (20,531,676 | ) | |||||||

| SEMICONDUCTORS—(0.3)% | ||||||||

| Texas Instruments, Inc. | (156,664 | ) | (18,183,990 | ) | ||||

| SYSTEMS SOFTWARE—(0.6)% | ||||||||

| iShares Expanded Tech-Software Sector ETF | (97,410 | ) | (23,460,225 | ) | ||||

| Teradata Corp. | (439,797 | ) | (10,814,608 | ) | ||||

| (34,274,833 | ) | |||||||

| TOTAL

COMMON STOCKS (Proceeds $289,380,344) | $ | (287,759,515 | ) | |||||

| Total Securities

Sold Short (Proceeds $289,380,344) | $ | (287,759,515 | ) | |||||

# American Depositary Receipts.

See Notes to Financial Statements.

- 27 -

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2020 (Unaudited)

| COMMON STOCKS—76.0% | SHARES | VALUE | ||||||

| AEROSPACE & DEFENSE—3.5% | ||||||||

| HEICO Corp.+ | 17,246 | $ | 1,510,750 | |||||

| Kratos Defense & Security Solutions, Inc.* ,+ | 80,862 | 1,214,547 | ||||||

| TransDigm Group, Inc.+ | 7,687 | 2,790,996 | ||||||

| 5,516,293 | ||||||||

| AIR FREIGHT & LOGISTICS—0.3% | ||||||||

| XPO Logistics, Inc.*,+ | 7,825 | 522,241 | ||||||

| ALTERNATIVE CARRIERS—0.4% | ||||||||

| Bandwidth, Inc., Cl. A* | 6,984 | 569,615 | ||||||

| APPAREL ACCESSORIES & LUXURY GOODS—0.5% | ||||||||

| Canada Goose Holdings, Inc.*,+ | 13,173 | 314,177 | ||||||

| Ralph Lauren Corp., Cl. A | 3,639 | 268,485 | ||||||

| Under Armour, Inc., Cl. A* | 22,336 | 232,741 | ||||||

| 815,403 | ||||||||

| APPLICATION SOFTWARE—9.6% | ||||||||

| Altair Engineering, Inc., Cl. A*,+ | 3,650 | 120,414 | ||||||

| Avalara, Inc.*,+ | 16,281 | 1,455,033 | ||||||

| Bill.com Holdings, Inc.* | 3,154 | 185,739 | ||||||

| Cerence, Inc.* | 5,705 | 120,718 | ||||||

| Ebix, Inc.+ | 36,699 | 768,110 | ||||||

| Envestnet, Inc.* | 5,624 | 351,612 | ||||||

| Everbridge, Inc.*,+ | 12,893 | 1,436,022 | ||||||

| Five9, Inc.* | 6,188 | 573,442 | ||||||

| Globant SA* | 1,743 | 201,613 | ||||||

| HubSpot, Inc.* | 9,513 | 1,604,177 | ||||||

| Intuit, Inc. | 2,651 | 715,266 | ||||||

| LivePerson, Inc.* | 4,308 | 103,134 | ||||||

| Palantir Technologies, Inc., Cl. A*,@,(a) | 6,606 | 37,985 | ||||||

| Paylocity Holding Corp.*,+ | 29,603 | 3,390,431 | ||||||

| Pluralsight, Inc., Cl. A* | 45,156 | 742,365 | ||||||

| RingCentral, Inc., Cl. A* | 1,657 | 378,674 | ||||||

| SPS Commerce, Inc.*,+ | 25,883 | 1,436,765 | ||||||

| The Trade Desk, Inc., Cl. A*,+ | 6,281 | 1,837,695 | ||||||

| 15,459,195 | ||||||||

| ASSET MANAGEMENT & CUSTODY BANKS—0.9% | ||||||||

| Hamilton Lane, Inc., Cl. A | 22,800 | 1,478,580 | ||||||

| AUTOMOBILE MANUFACTURERS—0.5% | ||||||||

| Tesla, Inc.* | 1,056 | 825,665 | ||||||

| BIOTECHNOLOGY—4.6% | ||||||||

| ACADIA Pharmaceuticals, Inc.*,+ | 51,086 | 2,467,964 | ||||||

| Alexion Pharmaceuticals, Inc.* | 3,586 | 385,387 | ||||||

| BioMarin Pharmaceutical, Inc.* | 7,592 | 698,616 | ||||||

| Forte Biosciences, Inc.*,@,(a) | 292,568 | 315,066 | ||||||

| Genmab AS#,* | 12,345 | 300,354 | ||||||

| MediciNova, Inc.* | 10,697 | 55,090 | ||||||

| Moderna, Inc.* | 13,171 | 605,734 | ||||||

| Natera, Inc.* | 2,688 | 99,564 | ||||||

- 28 -

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—76.0% (CONT.) | SHARES | VALUE | ||||||

| BIOTECHNOLOGY—4.6% (CONT.) | ||||||||

| Portola Pharmaceuticals, Inc.*,+ | 10,763 | $ | 76,202 | |||||

| Puma Biotechnology, Inc.* | 95,517 | 959,946 | ||||||

| Sarepta Therapeutics, Inc.* | 1,126 | 132,733 | ||||||

| Ultragenyx Pharmaceutical, Inc.* | 13,583 | 820,821 | ||||||

| Vertex Pharmaceuticals, Inc.* | 1,465 | 368,008 | ||||||

| 7,285,485 | ||||||||

| CASINOS & GAMING—0.6% | ||||||||

| DraftKings, Inc., Cl. A* | 46,017 | 895,491 | ||||||

| CONSTRUCTION MATERIALS—0.5% | ||||||||

| Vulcan Materials Co. | 6,892 | 778,589 | ||||||

| CONSUMER FINANCE—0.1% | ||||||||

| LendingTree, Inc.* | 793 | 197,750 | ||||||

| DATA PROCESSING & OUTSOURCED SERVICES—1.3% | ||||||||

| Fiserv, Inc.* | 4,229 | 435,841 | ||||||

| NIC, Inc. | 14,480 | 350,850 | ||||||

| PayPal Holdings, Inc.* | 4,770 | 586,710 | ||||||

| Visa, Inc., Cl. A | 3,838 | 685,928 | ||||||

| 2,059,329 | ||||||||

| DISTRIBUTORS—0.5% | ||||||||

| Pool Corp. | 3,936 | 833,094 | ||||||

| DIVERSIFIED SUPPORT SERVICES—0.4% | ||||||||

| Copart, Inc.* | 7,945 | 636,474 | ||||||

| EDUCATION SERVICES—4.8% | ||||||||

| Bright Horizons Family Solutions, Inc.* | 6,888 | 802,108 | ||||||

| Chegg, Inc.*,+ | 159,260 | 6,808,365 | ||||||

| 7,610,473 | ||||||||

| ELECTRICAL COMPONENTS & EQUIPMENT—0.4% | ||||||||

| Sunrun, Inc.*,+ | 46,242 | 648,775 | ||||||

| ELECTRONIC EQUIPMENT & INSTRUMENTS—0.2% | ||||||||

| Novanta, Inc.* | 2,879 | 250,156 | ||||||

| ELECTRONIC MANUFACTURING SERVICES—0.0% | ||||||||

| IPG Photonics Corp.* | 270 | 34,919 | ||||||

| ENVIRONMENTAL & FACILITIES SERVICES—3.2% | ||||||||

| Casella Waste Systems, Inc., Cl. A*,+ | 43,632 | 2,023,652 | ||||||

| Waste Connections, Inc.+ | 36,190 | 3,109,083 | ||||||

| 5,132,735 | ||||||||

| FINANCIAL EXCHANGES & DATA—0.2% | ||||||||

| MarketAxess Holdings, Inc. | 747 | 339,892 | ||||||

| FOOD DISTRIBUTORS—0.9% | ||||||||

| US Foods Holding Corp.*,+ | 67,809 | 1,457,894 | ||||||

| GENERAL MERCHANDISE STORES—0.9% | ||||||||

| Ollie's Bargain Outlet Holdings, Inc.* | 22,238 | 1,510,183 | ||||||

| HEALTHCARE DISTRIBUTORS—0.5% | ||||||||

| PetIQ, Inc., Cl. A* | 26,482 | 757,385 | ||||||

- 29 -

THE ALGER FUNDS II | ALGER DYNAMIC OPPORTUNITIES FUND

Schedule of Investments April 30, 2020 (Unaudited) (Continued)

| COMMON STOCKS—76.0% (CONT.) | SHARES | VALUE | ||||||

| HEALTHCARE EQUIPMENT—7.5% | ||||||||

| Cantel Medical Corp. | 17,489 | $ | 647,093 | |||||

| DexCom, Inc.*,+ | 1,101 | 369,055 | ||||||

| Glaukos Corp.*,+ | 35,956 | 1,319,226 | ||||||

| Hologic, Inc.* | 7,466 | 374,047 | ||||||

| Insulet Corp.*,+ | 11,094 | 2,215,694 | ||||||

| Intuitive Surgical, Inc.*,+ | 1,201 | 613,567 | ||||||

| Masimo Corp.* | 886 | 189,524 | ||||||