UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

Investment Company Act file number: 811-08606

Deutsche DWS Asset Allocation Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 8/31 |

| Date of reporting period: | 8/31/2022 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| (a) |

Contents

| 4 |

|

| 5 |

|

| 11 |

|

| 15 |

|

| 16 |

|

| 24 |

|

| 26 |

|

| 27 |

|

| 29 |

|

| 35 |

|

| 51 |

|

| 53 |

|

| 56 |

|

| 57 |

|

| 62 |

|

| 68 |

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE

NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

| 2 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

3 |

| 4 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS Multi-Asset Conservative Allocation Fund |

–12.89% |

| S&P Target Risk Conservative Index |

–12.60% |

| DWS Multi-Asset Moderate Allocation Fund |

–12.45% |

| S&P Target Risk Moderate Index |

–12.94% |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

5 |

| Category |

Index |

Total Return |

| Large-Cap U.S. Stocks |

S&P® 500 Index |

–11.23% |

| Small-Cap U.S. Stocks |

Russell® 2000 Index |

–17.88% |

| Developed-Market International Stocks |

MSCI EAFE Index |

–19.80% |

| Emerging-Market Stocks |

MSCI Emerging Markets Index |

–21.80% |

| U.S. Investment-Grade Bonds |

Bloomberg U.S. Aggregate Bond Index |

–11.52% |

| U.S. High-Yield Bonds |

ICE BofA US High Yield Index |

–10.48% |

| Emerging-Market Bonds |

JP Morgan EMBI Global Diversified Index |

–20.82% |

| 6 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

7 |

| 8 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

9 |

| 10 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Class A |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| Unadjusted for Sales Charge |

–12.89% |

2.50% |

3.92% |

| Adjusted for the Maximum Sales Charge (max 5.75% load) |

–17.89% |

1.30% |

3.30% |

| S&P Target Risk Conservative

Index† |

–12.60% |

2.66% |

3.72% |

| Class C |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| Unadjusted for Sales Charge |

–13.55% |

1.74% |

3.14% |

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) |

–13.55% |

1.74% |

3.14% |

| S&P Target Risk Conservative

Index† |

–12.60% |

2.66% |

3.72% |

| Class S |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| No Sales Charges |

–12.68% |

2.76% |

4.17% |

| S&P Target Risk Conservative

Index† |

–12.60% |

2.66% |

3.72% |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

11 |

Yearly periods ended August 31

Yearly periods ended August 31| † |

S&P Target Risk Conservative Index emphasizes exposure to fixed income in order to produce a consistent income stream and avoid excessive volatility of returns. On October 19, 2015, the Fund changed from a fund-of-funds to a multi-asset allocation

fund. Performance would have been different if the Fund’s current investment strategy

had been in effect.

|

| |

Class A |

Class C |

Class S |

| Net Asset Value | |||

| 8/31/22 |

$12.34 |

$12.33 |

$12.32 |

| 8/31/21 |

$15.27 |

$15.26 |

$15.25 |

| Distribution Information as of 8/31/22 | |||

| Income Dividends, Twelve Months |

$.26

|

$.15 |

$.29 |

| Capital Gain Distributions |

$.84

|

$.84 |

$.84 |

| 12 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

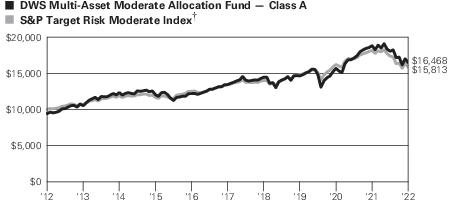

| Class A |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| Unadjusted for Sales Charge |

–12.45% |

4.17% |

5.74% |

| Adjusted for the Maximum Sales Charge (max 5.75% load) |

–17.48% |

2.94% |

5.11% |

| S&P Target Risk Moderate Index†

|

–12.94% |

3.32% |

4.69% |

| Class C |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| Unadjusted for Sales Charge |

–13.08% |

3.41% |

4.95% |

| Adjusted for the Maximum Sales Charge (max 1.00% CDSC) |

–13.08% |

3.41% |

4.95% |

| S&P Target Risk Moderate Index†

|

–12.94% |

3.32% |

4.69% |

| Class S |

1-Year |

5-Year |

10-Year |

| Average Annual Total Returns as of 8/31/22 | |||

| No Sales Charges |

–12.13% |

4.46% |

6.01% |

| S&P Target Risk Moderate Index†

|

–12.94% |

3.32% |

4.69% |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

13 |

Yearly periods ended August 31

Yearly periods ended August 31| † |

S&P Target Risk Moderate Index offers significant exposure to fixed income, while also increasing opportunities for higher returns through equities. On October 19, 2015, the Fund changed from a fund-of-funds to a multi-asset allocation

fund. Performance would have been different if the Fund’s current investment strategy

had been in effect.

|

| |

Class A |

Class C |

Class S |

| Net Asset Value | |||

| 8/31/22 |

$8.99

|

$8.97 |

$8.99 |

| 8/31/21 |

$11.26 |

$11.23 |

$11.25 |

| Distribution Information as of 8/31/22 | |||

| Income Dividends, Twelve Months |

$.21

|

$.13 |

$.24 |

| Capital Gain Distributions |

$.79

|

$.79 |

$.79 |

| 14 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Asset Allocation (As a % of Investment Portfolio) |

8/31/22 |

8/31/21 |

| Fixed Income — Bond Funds |

5% |

23% |

| Fixed Income — Exchange-Traded Funds |

45% |

31% |

| Fixed Income — Money Market Funds |

19% |

4% |

| Equity — Equity Funds |

24% |

31% |

| Equity — Exchange-Traded Funds |

6% |

10% |

| Short-Term U.S. Treasury Obligations |

1% |

1% |

| |

100% |

100% |

| Asset Allocation (As a % of Investment Portfolio) |

8/31/22 |

8/31/21 |

| Fixed Income — Bond Funds |

4% |

14% |

| Fixed Income — Exchange-Traded Funds |

26% |

18% |

| Fixed Income — Money Market Funds |

13% |

1% |

| Equity — Equity Funds |

44% |

48% |

| Equity — Exchange-Traded Funds |

12% |

18% |

| Short-Term U.S. Treasury Obligations |

1% |

1% |

| |

100% |

100% |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

15 |

| |

Shares |

Value ($) | |

| Equity — Equity Funds 27.9% |

| ||

| DWS Core Equity Fund “Institutional” (a) |

|

274,706 |

7,906,034 |

| DWS Emerging Markets Equity Fund “Institutional” (a) |

|

79,433 |

1,376,567 |

| DWS ESG Core Equity Fund “Institutional” (a) |

|

366,828 |

6,298,439 |

| DWS RREEF Global Infrastructure Fund “Institutional” (a) |

|

41,513 |

701,159 |

| DWS RREEF Real Estate Securities Fund “Institutional” (a) |

|

85,439 |

1,802,768 |

| DWS Small Cap Core Fund “S” (a) |

|

33,134 |

1,414,139

|

| Total Equity — Equity Funds (Cost $13,767,926) |

|

|

19,499,106 |

| Equity — Exchange-Traded Funds 7.1% |

| ||

| iShares Core MSCI Europe ETF |

|

16,073 |

702,872 |

| iShares MSCI Japan ETF |

|

39,589 |

2,121,574 |

| iShares MSCI Pacific ex Japan ETF |

|

16,220 |

676,861 |

| SPDR S&P Emerging Asia Pacific ETF |

|

14,212 |

1,429,301

|

| Total Equity — Exchange-Traded Funds (Cost $5,016,847) |

|

|

4,930,608 |

| Fixed Income — Bond Funds 5.8% |

| ||

| DWS Enhanced Commodity Strategy Fund “Institutional” (a) |

|

76,907 |

755,999 |

| DWS High Income Fund “Institutional” (a) |

|

781,900 |

3,291,799

|

| Total Fixed Income — Bond Funds (Cost $3,817,487) |

|

|

4,047,798 |

| Fixed Income — Exchange-Traded Funds 51.2% |

| ||

| iShares GNMA Bond ETF |

|

215,927 |

9,798,767 |

| iShares iBoxx $ Investment Grade Corporate Bond ETF |

|

27,500 |

3,004,925 |

| iShares JP Morgan USD Emerging Markets Bond ETF |

|

47,915 |

4,087,150 |

| iShares TIPS Bond ETF |

|

21,366 |

2,433,801 |

| iShares U.S. Treasury Bond ETF |

|

216,377 |

5,106,497 |

| Vanguard Intermediate-term Corporate Bond ETF |

|

84,318 |

6,714,243 |

| Vanguard Total International Bond ETF |

|

94,161 |

4,632,721

|

| Total Fixed Income — Exchange-Traded Funds

(Cost $37,543,900) |

|

|

35,778,104 |

| 16 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| |

Principal

Amount ($) |

Value ($) | |

| Short-Term U.S. Treasury Obligations 0.7% |

| ||

| U.S. Treasury Bills, 2.004% (b), 4/20/2023 (c) (Cost $459,021) |

|

465,000 |

455,907 |

| |

Shares |

Value ($) | |

| Fixed Income — Money Market Funds 21.6% |

| ||

| DWS Central Cash Management Government Fund, 2.09% (a) (d), 1/1/2030 (Cost $15,047,011) |

|

15,047,011 |

15,047,011 |

| |

|

% of

Net Assets |

Value ($) |

| Total Investment Portfolio (Cost $75,652,192) |

|

114.3 |

79,758,534 |

| Other Assets and Liabilities, Net |

|

(14.3) |

(9,952,228) |

| Net Assets |

|

100.0 |

69,806,306 |

| Value ($)

at 8/31/2021 |

Pur-

chases

Cost

($) |

Sales

Proceeds

($) |

Net

Real-

ized

Gain/

(Loss)

($) |

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

Income

($) |

Capital

Gain

Distri-

butions

($) |

Number of

Shares at

8/31/2022 |

Value ($)

at 8/31/2022 |

| Equity — Equity Funds 27.9% | ||||||||

| DWS Core Equity Fund “Institutional” (a) | ||||||||

| 13,017,129 |

3,512,121 |

6,210,400 |

1,342,869 |

(3,755,685) |

82,528 |

1,455,493 |

274,706 |

7,906,034 |

| DWS Emerging Markets Equity Fund “Institutional” (a) | ||||||||

| 822,340 |

906,507 |

80,400 |

(27,005) |

(244,875) |

14,607 |

— |

79,433 |

1,376,567 |

| DWS ESG Core Equity Fund “Institutional” (a) | ||||||||

| 7,724,881 |

2,528,103 |

2,281,900 |

(51,713) |

(1,620,932) |

63,372 |

845,431 |

366,828 |

6,298,439 |

| DWS RREEF Global Infrastructure Fund “Institutional” (a) | ||||||||

| 913,882 |

260,442 |

430,900 |

21,752 |

(64,017) |

11,791 |

39,151 |

41,513 |

701,159 |

| DWS RREEF Real Estate Securities Fund “Institutional” (a) | ||||||||

| 1,802,474 |

1,392,106 |

1,053,700 |

17,514 |

(355,626) |

22,256 |

124,649 |

85,439 |

1,802,768 |

| DWS Small Cap Core Fund “S” (a) | ||||||||

| 1,762,409 |

1,607,547 |

1,725,900 |

183,791 |

(413,708) |

— |

41,949 |

33,134 |

1,414,139 |

| Fixed Income — Bond Funds 5.8% | ||||||||

| DWS Emerging Markets Fixed Income Fund “Institutional” (a) | ||||||||

| 3,934,625 |

856,767 |

3,542,719 |

(1,031,364) |

(217,309) |

190,566 |

— |

— |

— |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

17 |

| Value ($)

at 8/31/2021 |

Pur-

chases

Cost

($) |

Sales

Proceeds

($) |

Net

Real-

ized

Gain/

(Loss)

($) |

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

Income

($) |

Capital

Gain

Distri-

butions

($) |

Number of

Shares at

8/31/2022 |

Value ($)

at 8/31/2022 |

| DWS Enhanced Commodity Strategy Fund “Institutional” (a) | ||||||||

| 907,496 |

1,077,720 |

1,185,900 |

98,660 |

(141,977) |

286,219 |

— |

76,907 |

755,999 |

| DWS GNMA Fund “Institutional” (a) | ||||||||

| 9,234,362 |

2,554,975 |

10,898,696 |

(940,040) |

49,399 |

113,775 |

— |

— |

— |

| DWS High Income Fund “Institutional” (a) | ||||||||

| 5,524,298 |

979,974 |

2,566,400 |

(29,760) |

(616,313) |

230,874 |

— |

781,900 |

3,291,799 |

| Fixed Income — Money Market Funds 21.6% | ||||||||

| DWS Central Cash Management Government Fund, 2.09% (a) (d) | ||||||||

| 3,491,260 |

35,557,940 |

24,002,189 |

— |

— |

21,454 |

— |

15,047,011 |

15,047,011 |

| 49,135,156 |

51,234,202 |

53,979,104 |

(415,296) |

(7,381,043) |

1,037,442 |

2,506,673 |

16,786,871 |

38,593,915 |

| (a) |

Affiliated fund managed by DWS Investment Management Americas, Inc. |

| (b) |

Annualized yield at time of purchase; not a coupon rate. |

| (c) |

At August 31, 2022, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts. |

| (d) |

The rate shown is the annualized seven-day yield at period end. |

| MSCI: Morgan Stanley Capital International |

| S&P: Standard & Poor’s |

| SPDR: Standard & Poor’s Depositary Receipt |

| TIPS:

Treasury Inflation-Protected Securities |

| Futures |

Currency |

Expiration

Date |

Contracts |

Notional

Amount ($) |

Notional

Value ($) |

Unrealized

Appreciation/

(Depreciation) ($) |

| 10 Year U.S.

Treasury Note |

USD |

12/20/2022 |

29 |

3,407,682 |

3,390,281 |

(17,401) |

| Euro Stoxx 50

Index |

EUR |

9/16/2022 |

11 |

384,103 |

389,117 |

5,014 |

| Total net unrealized depreciation |

(12,387) | |||||

| 18 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| EUR |

Euro |

| USD |

United

States Dollar |

| Assets |

Level 1 |

Level 2 |

Level 3 |

Total |

| Equity — Equity Funds |

$19,499,106

|

$ — |

$—

|

$19,499,106 |

| Equity — Exchange-Traded Funds |

4,930,608 |

— |

— |

4,930,608 |

| Fixed Income — Bond Funds |

4,047,798 |

— |

— |

4,047,798 |

| Fixed Income — Exchange-Traded Funds |

35,778,104 |

— |

— |

35,778,104 |

| Short- Term U.S. Treasury Obligations |

— |

455,907 |

— |

455,907 |

| Fixed Income — Money Market Funds |

15,047,011 |

— |

— |

15,047,011 |

| Derivatives (a) |

|

|

|

|

| Futures Contracts |

5,014 |

— |

— |

5,014 |

| Total |

$79,307,641 |

$455,907 |

$—

|

$79,763,548 |

| Liabilities |

Level 1 |

Level 2 |

Level 3 |

Total |

| Derivatives (a) |

|

|

|

|

| Futures Contracts |

$

(17,401) |

$

— |

$—

|

$ (17,401) |

| Total |

$(17,401) |

$— |

$—

|

$(17,401) |

| (a) |

Derivatives include unrealized appreciation (depreciation) on open futures contracts.

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

19 |

| |

Shares |

Value ($) | |

| Equity — Equity Funds 47.3% |

| ||

| DWS Core Equity Fund “Institutional” (a) |

|

246,425 |

7,092,111 |

| DWS Emerging Markets Equity Fund “Institutional” (a) |

|

37,778 |

654,695 |

| DWS RREEF Global Infrastructure Fund “Institutional” (a) |

|

26,055 |

440,076 |

| DWS RREEF Real Estate Securities Fund “Institutional” (a) |

|

56,502 |

1,192,195 |

| DWS Small Cap Core Fund “S” (a) |

|

21,226 |

905,923 |

| Total Equity — Equity Funds (Cost $6,090,520) |

|

|

10,285,000 |

| Equity — Exchange-Traded Funds 12.3% |

| ||

| iShares Core MSCI Europe ETF |

|

12,580 |

550,123 |

| iShares MSCI Japan ETF |

|

4,014 |

215,110 |

| iShares MSCI Pacific ex Japan ETF |

|

8,244 |

344,022 |

| SPDR S&P Emerging Asia Pacific ETF |

|

6,564 |

660,142 |

| Xtrackers MSCI Japan Hedged Equity ETF (a) |

|

18,282 |

903,862 |

| Total Equity — Exchange-Traded Funds (Cost $2,606,274) |

|

|

2,673,259 |

| Fixed Income — Bond Funds 4.3% |

| ||

| DWS Emerging Markets Fixed Income Fund “Institutional” (a) |

|

7 |

47 |

| DWS Enhanced Commodity Strategy Fund “Institutional” (a) |

|

35,238 |

346,388 |

| DWS High Income Fund “Institutional” (a) |

|

140,147

|

590,020 |

| Total Fixed Income — Bond Funds (Cost $840,883) |

|

|

936,455 |

| Fixed Income — Exchange-Traded Funds 28.2% |

| ||

| iShares 7-10 Year Treasury Bond ETF, “B” |

|

10,593 |

1,069,257 |

| iShares Core International Aggregate Bond ETF |

|

13,933 |

692,610 |

| iShares GNMA Bond ETF |

|

36,061 |

1,636,448 |

| iShares JP Morgan USD Emerging Markets Bond ETF |

|

6,591 |

562,212 |

| iShares TIPS Bond ETF |

|

3,789 |

431,605 |

| Vanguard Intermediate-term Corporate Bond ETF |

|

21,684 |

1,726,697

|

| Total Fixed Income — Exchange-Traded Funds

(Cost $6,229,858) |

|

|

6,118,829 |

| |

Principal

Amount ($) |

Value ($) | |

| Short-Term U.S. Treasury Obligations 1.4% |

| ||

| U.S. Treasury Bills, 2.006% (b), 4/20/2023 (c) (Cost $306,010) |

|

310,000 |

303,938 |

| 20 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| |

Shares |

Value ($) | |

| Fixed Income — Money Market Funds 14.3% |

| ||

| DWS Central Cash Management Government Fund, 2.09% (a) (d), 1/1/2030 (Cost $3,109,525) |

|

3,109,525 |

3,109,525 |

| |

|

% of

Net Assets |

Value ($) |

| Total Investment Portfolio (Cost $19,183,070) |

|

107.8 |

23,427,006 |

| Other Assets and Liabilities, Net |

|

(7.8) |

(1,697,826) |

| Net Assets |

|

100.0 |

21,729,180 |

| Value ($)

at 8/31/2021 |

Pur-

chases

Cost

($) |

Sales

Proceeds

($) |

Net

Real-

ized

Gain/

(Loss)

($) |

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

Income

($) |

Capital

Gain

Distri-

butions

($) |

Number of

Shares at

8/31/2022 |

Value ($)

at 8/31/2022 |

| Exchange-Traded Funds 4.2% | ||||||||

| Xtrackers MSCI Japan Hedged Equity ETF (a) | ||||||||

| — |

910,030 |

— |

— |

(6,168) |

— |

— |

18,282 |

903,862 |

| Equity — Equity Funds 47.3% | ||||||||

| DWS Core Equity Fund “Institutional” (a) | ||||||||

| 9,675,627 |

2,460,929 |

3,088,300 |

279,892 |

(2,236,037) |

66,144 |

1,122,385 |

246,425 |

7,092,111 |

| DWS Emerging Markets Equity Fund “Institutional” (a) | ||||||||

| 278,490 |

469,493 |

— |

— |

(93,288) |

4,493 |

— |

37,778 |

654,695 |

| DWS RREEF Global Infrastructure Fund “Institutional” (a) | ||||||||

| 569,216 |

240,943 |

345,900 |

15,537 |

(39,720) |

7,406 |

24,437 |

26,055 |

440,076 |

| DWS RREEF Real Estate Securities Fund “Institutional” (a) | ||||||||

| 1,524,923 |

825,422 |

909,140 |

27,169 |

(276,179) |

16,403 |

85,419 |

56,502 |

1,192,195 |

| DWS Small Cap Core Fund “S” (a) | ||||||||

| 864,399 |

697,781 |

513,800 |

188,407 |

(330,864) |

— |

20,481 |

21,226 |

905,923 |

| Fixed Income — Bond Funds 4.3% | ||||||||

| DWS Emerging Markets Fixed Income Fund “Institutional” (a) | ||||||||

| 535,656 |

91,124 |

466,600 |

(132,990) |

(27,143) |

25,324 |

— |

7 |

47 |

| DWS Enhanced Commodity Strategy Fund “Institutional” (a) | ||||||||

| 423,577 |

619,801 |

649,900 |

20,531 |

(67,621) |

133,622 |

— |

35,238 |

346,388 |

| DWS GNMA Fund “Institutional” (a) | ||||||||

| 1,591,280 |

420,507 |

1,858,126 |

(157,531) |

3,870 |

19,507 |

— |

— |

— |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

21 |

| Value ($)

at 8/31/2021 |

Pur-

chases

Cost

($) |

Sales

Proceeds

($) |

Net

Real-

ized

Gain/

(Loss)

($) |

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

Income

($) |

Capital

Gain

Distri-

butions

($) |

Number of

Shares at

8/31/2022 |

Value ($)

at 8/31/2022 |

| DWS High Income Fund “Institutional” (a) | ||||||||

| 1,227,671 |

43,972 |

562,000 |

(2,140) |

(117,483) |

43,972 |

— |

140,147 |

590,020 |

| Fixed Income — Money Market Funds 14.3% | ||||||||

| DWS Central Cash Management Government Fund, 2.09% (a) (d) | ||||||||

| 415,717 |

11,429,192 |

8,735,384 |

— |

— |

6,312 |

— |

3,109,525 |

3,109,525 |

| 17,106,556 |

18,209,194 |

17,129,150 |

238,875 |

(3,190,633) |

323,183 |

1,252,722 |

3,691,185 |

15,234,842 |

| (a) |

Affiliated fund managed by DWS Investment Management Americas, Inc. |

| (b) |

Annualized yield at time of purchase; not a coupon rate. |

| (c) |

At August 31, 2022, this security has been pledged, in whole or in part, to cover initial margin requirements for open futures contracts. |

| (d) |

The rate shown is the annualized seven-day yield at period end. |

| MSCI: Morgan Stanley Capital International |

| S&P: Standard & Poor’s |

| SPDR: Standard & Poor’s Depositary Receipt |

| TIPS:

Treasury Inflation-Protected Securities |

| Futures |

Currency |

Expiration

Date |

Contracts |

Notional

Amount ($) |

Notional

Value ($) |

Unrealized

Appreciation/

(Depreciation) ($) |

| 10 Year U.S.

Treasury Note |

USD |

12/20/2022 |

4 |

470,025 |

467,625 |

(2,400) |

| Euro Stoxx 50

Index |

EUR |

9/16/2022 |

3 |

104,251 |

106,123 |

1,872 |

| S&P 500 E-Mini Index |

USD |

9/16/2022 |

1 |

187,659 |

197,825 |

10,166 |

| Total net unrealized appreciation |

9,638 | |||||

| EUR |

Euro |

| USD |

United

States Dollar |

| 22 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Assets |

Level 1 |

Level 2 |

Level 3 |

Total |

| Equity — Equity Funds |

$10,285,000

|

$ — |

$—

|

$10,285,000 |

| Equity — Exchange-Traded Funds |

2,673,259 |

— |

— |

2,673,259 |

| Fixed Income — Bond Funds |

936,455 |

— |

— |

936,455 |

| Fixed Income — Exchange-Traded Funds |

6,118,829 |

— |

— |

6,118,829 |

| Short- Term U.S. Treasury Obligations |

— |

303,938 |

— |

303,938 |

| Fixed Income — Money Market Funds |

3,109,525 |

— |

— |

3,109,525 |

| Derivatives (a) |

|

|

|

|

| Futures Contracts |

12,038 |

— |

— |

12,038 |

| Total |

$23,135,106 |

$303,938 |

$—

|

$23,439,044 |

| Liabilities |

Level 1 |

Level 2 |

Level 3 |

Total |

| Derivatives (a) |

|

|

|

|

| Futures Contracts |

$

(2,400) |

$

— |

$—

|

$ (2,400) |

| Total |

$(2,400) |

$— |

$—

|

$(2,400) |

| (a) |

Derivatives include unrealized appreciation (depreciation) on open futures contracts.

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

23 |

| Assets |

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund |

| Investments in non-affiliated securities and Underlying Funds, at value (Cost $43,019,768, $8,232,112) |

$

41,164,619 |

$ 8,192,164

|

| Investments in affiliated Underlying Funds, at value (Cost $32,632,424, $10,950,958) |

38,593,915 |

15,234,842 |

| Cash |

10,000 |

10,000 |

| Receivable for investments sold |

3,542,719 |

2,672,272 |

| Receivable for Fund shares sold |

2,653 |

1,593 |

| Interest receivable |

10,222 |

3,025 |

| Other assets |

15,525 |

29,190 |

| Total assets |

83,339,653 |

26,143,086 |

| Liabilities |

|

|

| Payable for investments purchased |

13,401,302 |

4,321,544 |

| Payable for Fund shares redeemed |

4,766 |

5,082 |

| Payable for variation margin on futures contracts |

7,176 |

2,723 |

| Accrued management fee |

298 |

— |

| Accrued Trustees' fees |

1,316 |

769 |

| Other accrued expenses and payables |

118,489 |

83,788 |

| Total liabilities |

13,533,347 |

4,413,906 |

| Net assets, at value |

$69,806,306 |

$21,729,180 |

| Net Assets Consist of |

|

|

| Distributable earnings (loss) |

3,478,239 |

4,528,050 |

| Paid-in capital |

66,328,067 |

17,201,130 |

| Net assets, at value |

$69,806,306 |

$21,729,180 |

| 24 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

Net

Asset Value |

DWS

Multi-Asset

Conservative

Allocation

Fund |

DWS

Multi-Asset

Moderate

Allocation

Fund |

Class

A |

||

Net

assets applicable to shares outstanding |

29,479,834 |

15,103,992 |

Shares

outstanding of beneficial interest, $.01 par value,

unlimited number of shares authorized |

2,389,065 |

1,679,709 |

Net

Asset Value and

redemption price per share |

$ 12.34 |

$ 8.99 |

Maximum

offering price per share (100 ÷ 94.25 of net asset

value) |

$ 13.09 |

$ 9.54 |

Class

C |

||

Net

assets applicable to shares outstanding |

1,080,378 |

953,818 |

Shares

outstanding of beneficial interest, $.01 par value,

unlimited number of shares authorized |

87,634 |

106,338 |

Net

Asset Value, offering

and redemption price

(subject

to contingent deferred sales charge)

per

share |

$ 12.33 |

$ 8.97 |

Class

S |

||

Net

assets applicable to shares outstanding |

39,246,094 |

5,671,370 |

Shares

outstanding of beneficial interest, $.01 par value,

unlimited number of shares authorized |

3,185,326 |

631,061 |

Net

Asset Value, offering

and redemption price

per

share |

$ 12.32 |

$ 8.99 |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

25 |

| Investment Income |

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund |

| Income: |

|

|

| Dividends |

$ 901,675 |

$ 245,838 |

| Income distributions from affiliated Underlying Funds |

1,037,442 |

323,183 |

| Total income |

1,939,117 |

569,021 |

| Expenses: |

|

|

| Management fee |

80,141 |

26,156 |

| Administration fee |

75,701 |

24,003 |

| Services to shareholders |

116,897 |

44,781 |

| Distribution and service fees |

90,975 |

53,469 |

| Custodian fee |

4,557 |

5,199 |

| Audit fee |

49,364 |

48,634 |

| Legal fees |

18,017 |

18,204 |

| Tax fees |

7,880 |

7,880 |

| Reports to shareholders |

24,741 |

19,307 |

| Registration fees |

45,180 |

45,369 |

| Trustees' fees and expenses |

5,165 |

3,096 |

| Other |

7,032 |

4,718 |

| Total expenses before expense reductions |

525,650 |

300,816 |

| Expense reductions |

(117,124) |

(159,988) |

| Total expenses after expense reductions |

408,526 |

140,828 |

| Net investment income |

1,530,591 |

428,193 |

| Realized and Unrealized Gain (Loss) |

|

|

| Net realized gain (loss) from: |

|

|

| Sale of affiliated Underlying Funds |

(415,296) |

238,875 |

| Sale of non-affiliated Underlying Funds |

(1,868,264) |

(616,797) |

| Capital gain distributions from affiliated Underlying Funds |

2,506,673 |

1,252,722 |

| Futures |

(254,284) |

(120,555) |

| |

(31,171) |

754,245 |

| Change in net unrealized appreciation (depreciation) on: |

|

|

| Affiliated Underlying Funds |

(7,381,043) |

(3,190,633) |

| Non-affiliated Underlying Funds |

(4,486,790) |

(1,150,641) |

| Futures |

(72,240) |

(19,223) |

| Foreign currency |

(32,514) |

(9,508) |

| |

(11,972,587) |

(4,370,005) |

| Net gain (loss) |

(12,003,758) |

(3,615,760) |

| Net increase (decrease) in net assets resulting from operations |

$ (10,473,167) |

$ (3,187,567) |

| 26 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS Multi-Asset Conservative Allocation Fund | ||

| |

Years Ended August 31, | |

| Increase (Decrease) in Net Assets |

2022 |

2021 |

| Operations: |

|

|

| Net investment income |

$ 1,530,591 |

$ 1,090,209 |

| Net realized gain (loss) |

(31,171) |

4,721,024 |

| Change in net unrealized appreciation (depreciation) |

(11,972,587) |

4,698,068 |

| Net increase (decrease) in net assets resulting from operations |

(10,473,167) |

10,509,301 |

| Distributions to shareholders: |

|

|

| Class A |

(2,536,819) |

(1,264,743) |

| Class C |

(76,684) |

(54,681) |

| Class S |

(3,544,841) |

(1,804,137) |

| Total distributions |

(6,158,344) |

(3,123,561) |

| Fund share transactions: |

|

|

| Proceeds from shares sold |

4,556,369 |

4,883,881 |

| Reinvestment of distributions |

5,980,124 |

3,010,924 |

| Payments for shares redeemed |

(8,968,265) |

(10,579,866) |

| Net increase (decrease) in net assets from Fund share transactions |

1,568,228 |

(2,685,061) |

| Increase (decrease) in net assets |

(15,063,283) |

4,700,679 |

| Net assets at beginning of period |

84,869,589 |

80,168,910 |

| Net assets at end of period |

$69,806,306 |

$84,869,589 |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

27 |

| DWS Multi-Asset Moderate Allocation Fund | ||

| |

Years Ended August 31, | |

| Increase (Decrease) in Net Assets |

2022 |

2021 |

| Operations: |

|

|

| Net investment income |

$ 428,193 |

$ 221,002 |

| Net realized gain (loss) |

754,245 |

1,623,964 |

| Change in net unrealized appreciation (depreciation) |

(4,370,005) |

2,771,848 |

| Net increase (decrease) in net assets resulting from operations |

(3,187,567) |

4,616,814 |

| Distributions to shareholders: |

|

|

| Class A |

(1,680,170) |

(701,769) |

| Class C |

(101,729) |

(60,361) |

| Class S |

(608,991) |

(255,284) |

| Total distributions |

(2,390,890) |

(1,017,414) |

| Fund share transactions: |

|

|

| Proceeds from shares sold |

3,099,797 |

3,115,446 |

| Reinvestment of distributions |

2,362,008 |

999,925 |

| Payments for shares redeemed |

(5,201,866) |

(4,618,595) |

| Net increase (decrease) in net assets from Fund share transactions |

259,939 |

(503,224) |

| Increase (decrease) in net assets |

(5,318,518) |

3,096,176 |

| Net assets at beginning of period |

27,047,698 |

23,951,522 |

| Net assets at end of period |

$21,729,180 |

$27,047,698

|

| 28 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS Multi-Asset Conservative Allocation Fund — Class A | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$15.27 |

$13.97 |

$13.42 |

$13.20 |

$12.93 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.25 |

.17 |

.23 |

.30 |

.22 |

| Net realized and unrealized gain (loss) |

(2.08) |

1.67 |

.60 |

.18 |

.27 |

| Total from investment operations |

(1.83) |

1.84 |

.83 |

.48 |

.49 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.26) |

(.22) |

(.28) |

(.26) |

(.22) |

| Net realized gains |

(.84) |

(.32) |

— |

— |

— |

| Total distributions |

(1.10) |

(.54) |

(.28) |

(.26) |

(.22) |

| Net asset value, end of period |

$12.34 |

$15.27 |

$13.97 |

$13.42 |

$13.20 |

| Total Return (%)b,c,d |

(12.89) |

13.46 |

6.38 |

3.69 |

3.80 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

29 |

35 |

33 |

35 |

36 |

| Ratio of expenses before expense reductions (%)e |

.81 |

.79 |

.83 |

.81 |

.82 |

| Ratio of expenses after expense reductions (%)e |

.65 |

.67 |

.62 |

.66 |

.73 |

| Ratio of net investment income (%) |

1.83 |

1.20 |

1.70 |

2.30 |

1.70 |

| Portfolio turnover rate (%) |

70 |

39 |

108 |

31 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| d |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| e |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

29 |

| DWS Multi-Asset Conservative Allocation Fund — Class C | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$15.26 |

$13.95 |

$13.41 |

$13.19 |

$12.92 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.15 |

.07 |

.13 |

.21 |

.13 |

| Net realized and unrealized gain (loss) |

(2.09) |

1.67 |

.60 |

.17 |

.26 |

| Total from investment operations |

(1.94) |

1.74 |

.73 |

.38 |

.39 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.15) |

(.11) |

(.19) |

(.16) |

(.12) |

| Net realized gains |

(.84) |

(.32) |

— |

— |

— |

| Total distributions |

(.99) |

(.43) |

(.19) |

(.16) |

(.12) |

| Net asset value, end of period |

$12.33 |

$15.26 |

$13.95 |

$13.41 |

$13.19 |

| Total Return (%)b,c,d |

(13.55) |

12.70 |

5.59 |

2.84 |

3.02 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

1 |

1 |

2 |

2 |

3 |

| Ratio of expenses before expense reductions (%)e |

1.62 |

1.61 |

1.64 |

1.60 |

1.55 |

| Ratio of expenses after expense reductions (%)e |

1.40 |

1.42 |

1.37 |

1.41 |

1.48 |

| Ratio of net investment income (%) |

1.07 |

.48 |

.95 |

1.61 |

.97 |

| Portfolio turnover rate (%) |

70 |

39 |

108 |

31 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| d |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| e |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| 30 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS Multi-Asset Conservative Allocation Fund — Class S | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$15.25 |

$13.95 |

$13.40 |

$13.18 |

$12.91 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.29 |

.21 |

.26 |

.33 |

.25 |

| Net realized and unrealized gain (loss) |

(2.09) |

1.66 |

.61 |

.18 |

.27 |

| Total from investment operations |

(1.80) |

1.87 |

.87 |

.51 |

.52 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.29) |

(.25) |

(.32) |

(.29) |

(.25) |

| Net realized gains |

(.84) |

(.32) |

— |

— |

— |

| Total distributions |

(1.13) |

(.57) |

(.32) |

(.29) |

(.25) |

| Net asset value, end of period |

$12.32 |

$15.25 |

$13.95 |

$13.40 |

$13.18 |

| Total Return (%)b,c |

(12.68) |

13.76 |

6.65 |

3.96 |

4.06 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

39 |

48 |

45 |

46 |

48 |

| Ratio of expenses before expense reductions (%)d |

.55 |

.53 |

.55 |

.55 |

.54 |

| Ratio of expenses after expense reductions (%)d |

.40 |

.42 |

.37 |

.41 |

.48 |

| Ratio of net investment income (%) |

2.08 |

1.45 |

1.94 |

2.55 |

1.95 |

| Portfolio turnover rate (%) |

70 |

39 |

108 |

31 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return would have been lower had certain expenses not been reduced. |

| c |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| d |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

31 |

| DWS Multi-Asset Moderate Allocation Fund — Class A | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$11.26 |

$9.78 |

$9.66 |

$10.07 |

$9.88 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.17 |

.09 |

.13 |

.17 |

.13 |

| Net realized and unrealized gain (loss) |

(1.44) |

1.81 |

.56 |

(.10) |

.61 |

| Total from investment operations |

(1.27) |

1.90 |

.69 |

.07 |

.74 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.21) |

(.08) |

(.23) |

(.13) |

(.13) |

| Net realized gains |

(.79) |

(.34) |

(.34) |

(.35) |

(.42) |

| Total distributions |

(1.00) |

(.42) |

(.57) |

(.48) |

(.55) |

| Net asset value, end of period |

$8.99 |

$11.26 |

$9.78 |

$9.66 |

$10.07 |

| Total Return (%)b,c,d |

(12.45) |

20.00 |

7.12 |

1.27 |

7.60 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

15 |

19 |

16 |

19 |

20 |

| Ratio of expenses before expense reductions (%)e |

1.24 |

1.18 |

1.30 |

1.25 |

1.16 |

| Ratio of expenses after expense reductions (%)e |

.60 |

.74 |

.68 |

.70 |

.66 |

| Ratio of net investment income (%) |

1.71 |

.86 |

1.34 |

1.79 |

1.27 |

| Portfolio turnover rate (%) |

67 |

39 |

87 |

36 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| d |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| e |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| 32 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS Multi-Asset Moderate Allocation Fund — Class C | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$11.23 |

$9.75 |

$9.63 |

$10.03 |

$9.84 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.10 |

.01 |

.06 |

.10 |

.05 |

| Net realized and unrealized gain (loss) |

(1.44) |

1.81 |

.55 |

(.09) |

.61 |

| Total from investment operations |

(1.34) |

1.82 |

.61 |

.01 |

.66 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.13) |

(.00)* |

(.15) |

(.06) |

(.05) |

| Net realized gains |

(.79) |

(.34) |

(.34) |

(.35) |

(.42) |

| Total distributions |

(.92) |

(.34) |

(.49) |

(.41) |

(.47) |

| Net asset value, end of period |

$8.97 |

$11.23 |

$9.75 |

$9.63 |

$10.03 |

| Total Return (%)b,c,d |

(13.08) |

19.14 |

6.30 |

.59 |

6.79 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

1 |

2 |

2 |

2 |

3 |

| Ratio of expenses before expense reductions (%)e |

2.05 |

1.95 |

2.02 |

1.96 |

1.85 |

| Ratio of expenses after expense reductions (%)e |

1.35 |

1.48 |

1.43 |

1.45 |

1.41 |

| Ratio of net investment income (%) |

.99 |

.11 |

.61 |

1.06 |

.55 |

| Portfolio turnover rate (%) |

67 |

39 |

87 |

36 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return does not reflect the effect of any sales charges. |

| c |

Total return would have been lower had certain expenses not been reduced. |

| d |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| e |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| * |

Amount is less than $.005. |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

33 |

| DWS Multi-Asset Moderate Allocation Fund — Class S | |||||

| |

Years Ended August 31, | ||||

| |

2022 |

2021 |

2020 |

2019 |

2018 |

| Selected Per Share Data | |||||

| Net asset value, beginning of period |

$11.25 |

$9.78 |

$9.66 |

$10.07 |

$9.87 |

| Income (loss) from investment operations: |

|

|

|

|

|

| Net investment incomea |

.19 |

.12 |

.15 |

.19 |

.15 |

| Net realized and unrealized gain (loss) |

(1.42) |

1.80 |

.56 |

(.10) |

.63 |

| Total from investment operations |

(1.23) |

1.92 |

.71 |

.09 |

.78 |

| Less distributions from: |

|

|

|

|

|

| Net investment income |

(.24) |

(.11) |

(.25) |

(.15) |

(.16) |

| Net realized gains |

(.79) |

(.34) |

(.34) |

(.35) |

(.42) |

| Total distributions |

(1.03) |

(.45) |

(.59) |

(.50) |

(.58) |

| Net asset value, end of period |

$8.99 |

$11.25 |

$9.78 |

$9.66 |

$10.07 |

| Total Return (%)b,c |

(12.13) |

20.20 |

7.41 |

1.54 |

7.99 |

| Ratios to Average Net Assets and Supplemental Data | |||||

| Net assets, end of period ($ millions) |

6 |

7 |

6 |

6 |

6 |

| Ratio of expenses before expense reductions (%)d |

1.00 |

.94 |

1.03 |

.97 |

.87 |

| Ratio of expenses after expense reductions (%)d |

.35 |

.49 |

.43 |

.45 |

.41 |

| Ratio of net investment income (%) |

1.94 |

1.10 |

1.59 |

2.05 |

1.53 |

| Portfolio turnover rate (%) |

67 |

39 |

87 |

36 |

45 |

| a |

Based on average shares outstanding during the period. |

| b |

Total return would have been lower had certain expenses not been reduced. |

| c |

Total return would have been lower if the Advisor had not reduced some Underlying DWS Funds’ expenses. |

| d |

The Fund invests in other Funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. This ratio does not include these indirect fees and expenses. |

| 34 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

35 |

| 36 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

37 |

| Undistributed ordinary income* |

$ 196,802 |

| Capital loss carryforwards |

$ (284,000) |

| Net unrealized appreciation (depreciation) on investments |

$ 3,608,291 |

| |

Years Ended August 31, | |

| |

2022 |

2021 |

| Distributions from ordinary income* |

$

2,915,762 |

$ 1,323,656 |

| Distributions from long-term capital gains |

$

3,242,582 |

$ 1,799,905 |

| * |

For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| 38 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Undistributed ordinary income* |

$ 115,957 |

| Undistributed long-term capital gains |

$ 289,230 |

| Net unrealized appreciation (depreciation) on investments |

$ 4,135,792 |

| |

Years Ended August 31, | |

| |

2022 |

2021 |

| Distributions from ordinary income* |

$ 953,802 |

$ 196,011 |

| Distributions from long-term capital gains |

$

1,437,088 |

$ 821,403 |

| * |

For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

39 |

| 40 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Assets Derivative |

|

|

|

|

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund |

| Equity Contracts (a) |

|

|

|

|

$

5,014 |

$ 12,038 |

| Each of the above derivatives is located in the following Statements of Assets and Liabilities accounts: | ||||||

| (a) |

Includes cumulative appreciation of futures contracts as disclosed in the Investment Portfolio. Unsettled variation margin is disclosed separately within the Statements of Assets and Liabilities. |

| Liabilities Derivative |

|

|

|

|

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund |

| Interest Rate Contracts (a) |

$

(17,401) |

$ (2,400) | ||||

| Each of the above derivatives is located in the following Statements of Assets and Liabilities accounts: | ||||||

| (a) |

Includes cumulative depreciation of futures contracts as disclosed in the Investment Portfolio. Unsettled variation margin is disclosed separately within the Statements of Assets and Liabilities. |

| Realized Gain (Loss) |

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund | |||||

| Equity Contracts (a) |

|

|

|

|

|

$

(156,997) |

$ (94,165) |

| Interest Rate Contracts (a) |

(97,287) |

(26,390) | |||||

| |

|

|

|

|

|

$(254,284) |

$(120,555) |

| Each of the above derivatives is located in the following Statements of Operations accounts: | |||||||

| (a) |

Net realized gain (loss) from futures contracts |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

41 |

| Change in Net Unrealized Appreciation (Depreciation) |

|

|

|

|

|

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset

Moderate

Allocation Fund |

| Equity Contracts (a) |

|

|

|

|

|

$ (50,281) |

$ (16,823) |

| Interest Rate Contracts (a) |

(21,959) |

(2,400) | |||||

| |

|

|

|

|

|

$ (72,240) |

$ (19,223) |

| Each of the above derivatives is located in the following Statements of Operations accounts: | |||||||

| (a) |

Change in net unrealized appreciation (depreciation) on futures contracts |

| 42 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| |

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset Moderate

Allocation Fund |

| Class A |

1.13% |

1.23% |

| Class C |

1.88% |

1.98% |

| Class S |

.88% |

.98% |

| |

DWS

Multi-Asset

Conservative

Allocation Fund |

DWS

Multi-Asset Moderate

Allocation Fund |

| Class A |

1.09% |

1.06% |

| Class C |

1.84% |

1.81% |

| Class S |

.84% |

.81% |

| |

DWS

Multi-Asset Conservative

Allocation Fund |

| Class A |

1.05% |

| Class C |

1.80% |

| Class S |

.80% |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

43 |

| DWS Multi-Asset Conservative Allocation Fund | |

| Class A |

$ 51,451

|

| Class C |

2,611 |

| Class S |

63,062 |

| |

$ 117,124 |

| DWS Multi-Asset Moderate Allocation Fund | |

| Class A |

$ 111,530 |

| Class C |

8,289 |

| Class S |

40,169 |

| |

$ 159,988 |

| Administration Fee |

Total

Aggregated |

Unpaid at

August 31, 2022 |

| DWS Multi-Asset Conservative Allocation Fund |

$75,701 |

$5,926 |

| DWS Multi-Asset Moderate Allocation Fund |

$24,003 |

$1,861 |

| 44 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Services to Shareholders |

Total

Aggregated |

Unpaid at

August 31, 2022 |

| DWS Multi-Asset Conservative Allocation Fund |

|

|

| Class A |

$

19,159 |

$ 3,209 |

| Class C |

730 |

120 |

| Class S |

38,309 |

6,361 |

| |

$ 58,198 |

$ 9,690 |

| DWS Multi-Asset Moderate Allocation Fund |

|

|

| Class A |

10,090 |

1,714 |

| Class C |

653 |

122 |

| Class S |

6,205 |

1,045 |

| |

$ 16,948 |

$ 2,881 |

| Sub-Recordkeeping |

Total

Aggregated |

| DWS Multi-Asset Conservative Allocation Fund |

|

| Class A |

$ 27,178 |

| Class C |

1,641 |

| Class S |

14,600 |

| |

$ 43,419 |

| DWS Multi-Asset Moderate Allocation Fund |

|

| Class A |

17,549 |

| Class C |

1,984 |

| Class S |

3,435 |

| |

$ 22,968 |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

45 |

| Distribution Fee |

Total

Aggregated |

Unpaid at

August 31, 2022 |

| DWS Multi-Asset Conservative Allocation Fund |

|

|

| Class C |

$

8,936 |

$ 709 |

| DWS Multi-Asset Moderate Allocation Fund |

|

|

| Class C |

8,830 |

630 |

| Service Fee |

Total

Aggregated |

Unpaid at

August 31, 2022 |

Annual

Rate |

| DWS Multi-Asset Conservative Allocation Fund |

|

|

|

| Class A |

$

79,095 |

$

12,590 |

.24% |

| Class C |

2,944 |

642 |

.25% |

| |

$ 82,039 |

$ 13,232 |

|

| DWS Multi-Asset Moderate Allocation Fund |

|

|

|

| Class A |

41,791 |

7,588 |

.24% |

| Class C |

2,848 |

472 |

.24% |

| |

$ 44,639 |

$ 8,060 |

|

| 46 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Other Service Fees |

Total

Aggregated |

Unpaid at

August 31, 2022 |

| DWS Multi-Asset Conservative Allocation Fund |

$923

|

$233 |

| DWS Multi-Asset Moderate Allocation Fund |

$1,123 |

$433 |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

47 |

| |

Year Ended

August 31, 2022 |

Year Ended

August 31, 2021 | ||

| |

Shares |

Dollars |

Shares |

Dollars |

| Shares sold | ||||

| Class A |

152,374 |

$ 2,033,579 |

156,697 |

$ 2,267,414 |

| Class C |

25,187 |

350,085 |

9,709 |

137,313 |

| Class S |

155,436 |

2,172,705 |

169,600 |

2,479,154 |

| |

|

$ 4,556,369 |

|

$ 4,883,881 |

| Shares issued to shareholders in reinvestment of distributions | ||||

| Class A |

174,270 |

$ 2,475,558 |

86,423 |

$ 1,231,000 |

| Class C |

5,368 |

76,489 |

3,839 |

54,599 |

| Class S |

241,942 |

3,428,077 |

121,342 |

1,725,325 |

| |

|

$ 5,980,124 |

|

$ 3,010,924 |

| Shares redeemed | ||||

| Class A |

(257,949) |

$ (3,510,628) |

(314,122) |

$ (4,555,186) |

| Class C |

(33,061) |

(470,020) |

(55,603) |

(821,612) |

| Class S |

(363,665) |

(4,987,617) |

(360,388) |

(5,203,068) |

| |

|

$ (8,968,265) |

|

$ (10,579,866) |

| Net increase (decrease) | ||||

| Class A |

68,695 |

$ 998,509 |

(71,002) |

$ (1,056,772) |

| Class C |

(2,506) |

(43,446) |

(42,055) |

(629,700) |

| Class S |

33,713 |

613,165 |

(69,446) |

(998,589) |

| |

|

$ 1,568,228 |

|

$ (2,685,061)

|

| 48 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| |

Year Ended

August 31, 2022 |

Year Ended

August 31, 2021 | ||

| |

Shares |

Dollars |

Shares |

Dollars |

| Shares sold | ||||

| Class A |

246,788 |

$ 2,484,444 |

197,028 |

$ 2,081,950 |

| Class C |

7,622 |

78,270 |

23,194 |

246,546 |

| Class S |

53,325 |

537,083 |

75,266 |

786,950 |

| |

|

$ 3,099,797 |

|

$ 3,115,446 |

| Shares issued to shareholders in reinvestment of distributions | ||||

| Class A |

158,516 |

$ 1,653,325 |

68,244 |

$ 687,895 |

| Class C |

9,726 |

101,729 |

5,976 |

60,361 |

| Class S |

58,305 |

606,954 |

25,017 |

251,669 |

| |

|

$ 2,362,008 |

|

$ 999,925 |

| Shares redeemed | ||||

| Class A |

(411,211) |

$ (4,098,514) |

(256,455) |

$ (2,678,435) |

| Class C |

(46,219) |

(483,962) |

(89,359) |

(938,519) |

| Class S |

(62,869) |

(619,390) |

(95,148) |

(1,001,641) |

| |

|

$ (5,201,866) |

|

$ (4,618,595) |

| Net increase (decrease) | ||||

| Class A |

(5,907) |

$ 39,255 |

8,817 |

$ 91,410 |

| Class C |

(28,871) |

(303,963) |

(60,189) |

(631,612) |

| Class S |

48,761 |

524,647 |

5,135 |

36,978 |

| |

|

$ 259,939 |

|

$ (503,224)

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

49 |

| 50 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

51 |

| 52 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

53 |

| Actual Fund Return |

Class A |

Class C |

Class S |

| Beginning Account Value 3/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 8/31/22 |

$914.00

|

$910.50

|

$915.00 |

| Expenses Paid per $1,000* |

$3.18

|

$6.79

|

$1.98 |

| Hypothetical 5% Fund Return |

Class A |

Class C |

Class S |

| Beginning Account Value 3/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 8/31/22 |

$1,021.88

|

$1,018.10

|

$1,023.14 |

| Expenses Paid per $1,000* |

$3.36

|

$7.17

|

$2.09 |

| * |

Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 365. |

| Annualized Expense Ratios** |

Class A |

Class C |

Class S |

| DWS Multi-Asset Conservative Allocation Fund |

.66% |

1.41% |

.41% |

| ** |

The Fund invests in other funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. These ratios do not include these indirect fees and expenses. |

| 54 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Actual Fund Return |

Class A |

Class C |

Class S |

| Beginning Account Value 3/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 8/31/22 |

$912.70

|

$909.70

|

$914.50 |

| Expenses Paid per $1,000* |

$2.80

|

$6.40

|

$1.59 |

| Hypothetical 5% Fund Return |

Class A |

Class C |

Class S |

| Beginning Account Value 3/1/22 |

$1,000.00

|

$1,000.00

|

$1,000.00 |

| Ending Account Value 8/31/22 |

$1,022.28

|

$1,018.50

|

$1,023.54 |

| Expenses Paid per $1,000* |

$2.96

|

$6.77

|

$1.68 |

| * |

Expenses are equal to the Fund’s annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 184 (the number of days in the most recent six-month period), then divided by 365. |

| Annualized Expense Ratios** |

Class A |

Class C |

Class S |

| DWS Multi-Asset Moderate Allocation Fund |

.58% |

1.33% |

.33% |

| ** |

The Fund invests in other funds and indirectly bears its proportionate share of fees and expenses incurred by the Underlying Funds in which the Fund is invested. These ratios do not include these indirect fees and expenses. |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

55 |

| 56 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

57 |

| 58 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

59 |

| 60 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

Based on all of the information considered and the conclusions reached, the Board determined that the continuation of the Agreement is in the best interests of each Fund. In making this determination, the Board did not give particular weight to any single factor identified above. The Board considered these factors over the course of numerous meetings, certain of which were in executive session with only the Independent Trustees and counsel present. It is possible that individual Independent Trustees may have weighed these factors differently in reaching their individual decisions to approve the continuation of the Agreement.

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

61 |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Keith R. Fox,

CFA (1954) Chairperson

since 2017, and Board Member

since 1996 |

Managing General Partner, Exeter Capital Partners (a series of private investment funds) (since 1986). Directorships: Progressive International Corporation (kitchen goods designer and distributor); former Chairman, National Association of Small Business Investment Companies; Former Directorships: ICI Mutual Insurance Company; BoxTop Media Inc. (advertising); Sun Capital Advisers Trust (mutual funds) |

70 |

— |

| 62 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| John W.

Ballantine (1946) Board

Member since 1999 |

Retired; formerly, Executive Vice President and Chief Risk Management Officer, First Chicago NBD Corporation/The First National Bank of Chicago (1996–1998); Executive Vice President and Head of International Banking (1995–1996); Not-for-Profit Directorships: Window to the World Communications (public media); Life Director of Harris Theater for Music and Dance (Chicago); Life Director of Hubbard Street Dance Chicago; Former Directorships: Director and Chairman of the Board, Healthways, Inc.2 (population wellbeing and wellness services) (2003–2014); Stockwell Capital Investments PLC (private equity); Enron Corporation; FNB Corporation; Tokheim Corporation; First Oak Brook Bancshares, Inc.; Oak Brook Bank; Portland General Electric2 (utility company (2003–2021); and Prisma Energy International; Former Not-for-Profit Directorships: Public Radio International; Palm Beach Civic Assn. |

70 |

— |

| Dawn-Marie

Driscoll (1946) Board Member

since 1987 |

Advisory Board and former Executive Fellow, Hoffman Center for Business Ethics, Bentley University; formerly: Partner, Palmer & Dodge (law firm) (1988–1990); Vice President of Corporate Affairs and General Counsel, Filene’s (retail) (1978–1988); Directorships: Trustee and former Chairman of the Board, Southwest Florida Community Foundation (charitable organization); Former Directorships: ICI Mutual Insurance Company (2007–2015); Sun Capital Advisers Trust (mutual funds) (2007–2012), Investment Company Institute (audit, executive, nominating committees) and Independent Directors Council (governance, executive committees) |

70 |

— |

| DWS

Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund |

| |

63 |

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Richard J.

Herring (1946) Board Member

since 1990 |

Jacob Safra Professor of International Banking and Professor of Finance, The Wharton School, University of Pennsylvania (since July 1972); formerly: Director, The Wharton Financial Institutions Center (1994–2020); Vice Dean and Director, Wharton Undergraduate Division (1995–2000) and Director, The Lauder Institute of International Management Studies (2000–2006); Member FDIC Systemic Risk Advisory Committee since 2011, member Systemic Risk Council since 2012 and member of the Advisory Board at the Yale Program on Financial Stability since 2013; Former Directorships: Co-Chair of the Shadow Financial Regulatory Committee (2003–2015), Executive Director of The Financial Economists Roundtable (2008–2015), Director of The Thai Capital Fund (2007–2013), Director of The Aberdeen Singapore Fund (2007–2018), Director, The Aberdeen Japan Fund (2007-2021) and Nonexecutive Director of Barclays Bank DE (2010–2018) |

70 |

— |

| William

McClayton (1944) Board

Member since 2004 |

Private equity investor (since October 2009);

formerly: Managing Director, Diamond

Management & Technology Consultants, Inc.

(global consulting firm) (2001–2009); Senior

Partner, Arthur Andersen LLP (accounting)

(1966–2001); Former Directorships: Board of

Managers, YMCA of Metropolitan Chicago;

Trustee, Ravinia Festival |

70 |

— |

| Chad D. Perry

(1972) Board Member or

Advisory Board Member

since 20213 |

Executive Vice President, General Counsel and Secretary, Tanger Factory Outlet Centers, Inc.2 (since 2011); formerly Executive Vice President and Deputy General Counsel, LPL Financial Holdings Inc.2 (2006–2011); Senior Corporate Counsel, EMC Corporation (2005–2006); Associate, Ropes & Gray LLP (1997–2005) |

214 |

Director - Great

Elm Capital Corp. (business

development company) (since

2022) |

| 64 |

| |

DWS Multi-Asset Conservative Allocation Fund DWS Multi-Asset Moderate Allocation Fund

|

| Name, Year of Birth, Position with the Trust/ Corporation and Length of Time Served1

|

Business Experience and Directorships During the Past Five Years |

Number of Funds in DWS Fund Complex Overseen |

Other Directorships Held by Board Member |

| Rebecca W.

Rimel (1951) Board Member

since 1995 |