Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of July 2022

Commission File Number: 001-32294

TATA MOTORS LIMITED

(Translation of registrant’s name into English)

BOMBAY HOUSE

24, HOMI MODY STREET,

MUMBAI 400 001, MAHARASHTRA, INDIA

Telephone # 91 22 6665 8282 Fax # 91 22 6665 7799

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g 3-2(b): Not Applicable

Table of Contents

Table of Contents

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| Tata Motors Limited | ||

| By: | /s/ Mr Maloy Kumar Gupta | |

| Name: | Mr Maloy Kumar Gupta | |

| Title: | Company Secretary | |

Dated: July 29, 2022

Table of Contents

Table of Contents

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 |

Table of Contents

Group, Company, Jaguar Land Rover, JLR plc and JLR refers to Jaguar Land Rover Automotive plc and its subsidiaries. Note 2 to the accounts defines a series of alternative performance measures some of which are stated below, along with certain abbreviations.

| Adjusted EBITDA margin | measured as adjusted EBITDA as a percentage of revenue. | |

| Adjusted EBIT margin | measured as adjusted EBIT as a percentage of revenue. | |

| Net debt/cash | defined by the Company as cash and cash equivalents plus short-term deposits and other investments less total balance sheet borrowings. | |

| Q1 FY23 | 3 months ended 30 June 2022 | |

| Q1 FY22 | 3 months ended 30 June 2021 | |

| China JV | Chery Jaguar Land Rover Automotive Co., Ltd. | |

2

Table of Contents

Management’s discussion and analysis of financial condition and results of operations

Despite strong demand and a record order book, sales continued to be constrained by the global chip shortage, compounded by the new Range Rover Sport ramp up and the impact of Covid lockdowns in China, leading to a loss for the quarter.

Market environment and business developments

| • | Semiconductor supply continued to restrict production in the quarter |

| • | The ramp up of New Range Rover and Range Rover Sport production was slower than expected due to the timing of the run out of the prior Range Rover Sport and the two new being on an all-new platform (MLA) produced in a new facility in Solihull |

| • | Covid lock downs in China impacted on production in our China Joint Venture, global parts supply from China and also led to some temporary restrictions on some dealers opening in the market |

| • | Inflation remains at elevated levels, exacerbated by the Ukraine conflict and post Covid supply disruption, while central banks are responding globally with increases in interest rates Demand for our products, particularly Range Rover, Range Rover Sport and Defender, remains strong with an order book of 200,000 units |

| • | Financial performance is expected to improve significantly over the year with chip supply expected to improve through enhanced supplier engagement including long term partnership agreements, as well as ramping up New Range Rover and Range Rover Sport production |

| • | Revenue was £4.4 billion in Q1 FY23, down 11.3% from Q1 FY22 reflecting the impact of semiconductor production constraints and a weaker mix as volumes of Range Rover & Range Rover Sport were reduced due to the ramp up in production |

| • | Adjusted EBITDA1 was £279 million in Q1 FY23, down from £449 million on Q1 FY22 |

| • | Adjusted EBITDA1 margin was 6.3% in Q1 FY23, down from 9.0% in Q1 FY22 |

| • | Adjusted EBIT1 was £(196) million in Q1 FY23, down from £(46) million on Q1 FY22 |

| • | Loss after tax was £(482) million (including tax charge of £(113) million) for Q1 FY23, down from £(286) million in Q1 FY22 (including a tax charge of £(176) million) |

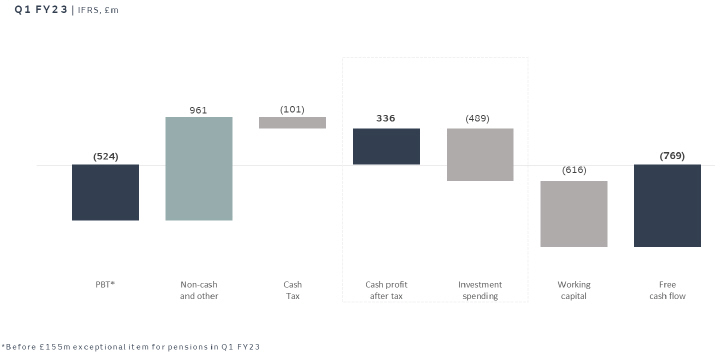

| • | Free cash flow1 in the quarter was £(769) million compared to £(996) million in Q1 FY22 |

| • | The loss before tax in the quarter was £(524) million before a £155m favourable pension related exceptional item1, compared to a loss of £(110) million in Q1 FY22. The year-on-year decline primarily reflects the following factors: |

| • | £(300) million unfavourable volume and mix offset by £126 million net pricing improvements |

| • | £(165) million increase in material and manufacturing costs, which includes £(161) million relating to inflation on commodity prices, other material costs and energy prices |

| • | £59 million improvement in structural costs primarily attributable to non-recurrence of one-off items in Q1 FY22 |

| • | £(134) million for FX and commodities, including £(236) million related to FX and commodity rate related revaluation |

| 1 | Please see note 2 of the financial statements for alternative performance measures |

3

Table of Contents

| • | Free cashflow2 turned negative in the quarter to £(769) million, primarily reflecting £(616) million of unfavourable working capital movements |

| • | Working capital movements in the quarter were £(616) million with £(358) million driven by increasing inventory as the level of goods in transit to markets increased |

| • | Investment spending of £(489) million in the quarter includes £(349) million spending, of which 25% was capitalised, and £(140) million of capital investments |

| 2 | Please see note 2 of the financial statements for alternative performance measures |

4

Table of Contents

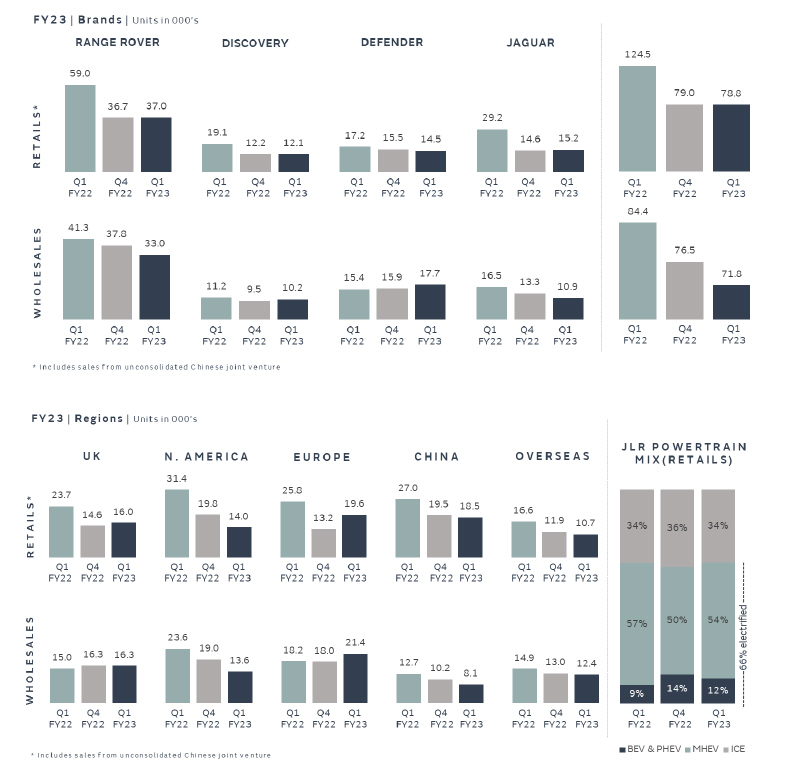

Sales volumes were constrained by production levels in the quarter driven by the global chip shortage, compounded by the New Range Rover and Range Rover Sport ramp up and the impact of Covid lockdowns in China.

Retail sales3 in Q1 FY23 were 78,825 units, broadly flat (183 units lower) compared with the last quarter ended 31 March 2022 and down 37% (46k units) from the same quarter a year ago ended 30 June 2021.

Wholesale volumes3 in Q1 FY23 were 71,815 units (excluding our China Joint Venture), down 6% compared to the last quarter ended 31 March 2022 and down 20% compared to the same quarter a year ago ended 30 June 2021.

| 3 | Please see note 2 of the financial statements for alternative performance measures |

5

Table of Contents

Total cash and cash equivalents, deposits and investments at 30 June 2022 were £3.7 billion (comprising £3.4 billion of cash and cash equivalents and £0.3 billion of short-term deposits and other investments). The cash and financial deposits include an amount of £384 million held in subsidiaries of Jaguar Land Rover outside of the United Kingdom. The cash in some of these jurisdictions may be subject to impediments to remitting cash to the UK other than through annual dividends.

The £1.5 billion forward start revolving facility maturing in March 2024 became effective on 04 July 2022 and is undrawn. This facility replaces the £2.015 billion revolving credit facility which was cancelled ahead of its scheduled maturity on 28 July 2022.

The following table shows details of the Company’s financing arrangements:

| £ millions |

Facility amount |

Amount outstanding |

Undrawn amount |

|||||||||

| £400m 3.875% Senior Notes due Mar 2023 |

400 | 400 | — | |||||||||

| $500m 5.625% Senior Notes due Feb 2023 |

412 | 412 | — | |||||||||

| $700m 7.750% Senior Notes due Oct 2025 |

577 | 577 | — | |||||||||

| $500m 4.500% Senior Notes due Oct 2027 |

412 | 412 | — | |||||||||

| $650m 5.875% Senior Notes due Jan 2028 |

535 | 535 | — | |||||||||

| €650m 2.200% Senior Notes due Jan 2024 |

559 | 559 | — | |||||||||

| €500m 5.875% Senior Notes due Nov 2024 |

430 | 430 | — | |||||||||

| €500m 6.875% Senior Notes due Nov 2026 |

430 | 430 | — | |||||||||

| €500m 4.500% Senior Notes due Jul 2028 |

430 | 430 | — | |||||||||

| $500m 5.500% Senior Notes due Jul 2029 |

412 | 412 | — | |||||||||

| €500m 4.500% Senior Notes due Jan 2026 |

430 | 430 | — | |||||||||

| $800m Syndicated Loan due Jan 2025 |

657 | 657 | — | |||||||||

| $200m Syndicated Loan due Oct 2022 |

164 | 164 | — | |||||||||

| China RMB 5,000m revolving facility due Jun 20231 |

615 | 615 | — | |||||||||

| UKEF amortising loan due Oct 2024 |

292 | 292 | — | |||||||||

| UKEF amortising loan due Dec 2026 |

563 | 563 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Subtotal |

7,318 | 7,318 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Finance lease obligations2 |

666 | 666 | — | |||||||||

| Other3 |

35 | 35 | — | |||||||||

| Prepaid costs |

(33 | ) | (33 | ) | — | |||||||

| Fair value adjustments4 |

(90 | ) | (90 | ) | — | |||||||

|

|

|

|

|

|

|

|||||||

| Total |

7,897 | 7,897 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Undrawn RCF (available from 04 July 2022) |

1,500 | — | 1,500 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total including RCF |

9,397 | 7,897 | 1,500 | |||||||||

|

|

|

|

|

|

|

|||||||

| 1 | The China RMB 5 billion 3-year syndicated revolving loan facility is subject to an annual confirmatory review in June each year |

| 2 | Lease obligations accounted for as debt under IFRS 16 |

| 3 | Primarily an advance as part of a sale and leaseback transaction |

| 4 | Fair value adjustments relate to hedging arrangements for the $500m 2027 Notes and €500m 2026 Notes |

6

Table of Contents

There are a number of potential risks which could have a material impact on the Group’s performance and could cause actual results to differ materially from expected and/or historical results, particularly those risks relating to continuing supply shortages of semiconductors, and those discussed on pages 36-39 of the Annual Report 2021/22 of the Group (available at www.jaguarlandrover.com/annual-report-2022) along with mitigating factors. The principal risks discussed in the Group’s Annual Report FY22 are competitive business efficiency, environmental regulations and compliance, supply chain disruptions, global economic and geopolitical environment, distribution channels/retailer performance, IT systems and security, manufacturing operations, brand positioning, rapid technology change and human capital.

There were no material acquisitions or disposals in Q1 FY23.

Off-balance sheet financial arrangements

At 30 June 2022, Jaguar Land Rover Limited (a subsidiary of the Company) had sold £354 million equivalent of receivables under a $499.975 million invoice discounting facility signed in March 2021.

At 30 June 2022, Jaguar Land Rover employed 37,020 people worldwide, including agency personnel, compared to 35,472 at 30 June 2021.

The following table provides information with respect to the current members of the Board of Directors of Jaguar Land Rover Automotive plc:

| Name | Position | Year appointed | ||

| Natarajan Chandrasekaran | Chairman and Director | 2017 | ||

| Thierry Bolloré | Chief Executive Officer and Director | 2020 | ||

| Prof Sir Ralf D Speth* | Vice Chairman and Director | 2020 | ||

| Mr P B Balaji | Director | 2017 | ||

| Hanne Sorensen | Director | 2018 | ||

| Charles Nichols | Director | 2022 | ||

| Al-Noor Ramji | Director | 2022 | ||

| * | Previously appointed as CEO and Director in 2010 and subsequently Vice Chairman and Director in 2020 |

Andrew M. Robb and Nasser Mukhtar Munjee resigned as directors during the quarter ended 30 June 2022.

7

Table of Contents

Condensed Consolidated Income Statement

| Three months ended | ||||||||||||

| £ millions |

Note | 30 June 2022 |

30 June 2021 |

|||||||||

| Revenue |

3 | 4,406 | 4,966 | |||||||||

| Material and other cost of sales |

(2,762 | ) | (3,149 | ) | ||||||||

| Employee costs |

4 | (570 | ) | (592 | ) | |||||||

| Other expenses |

9 | (1,009 | ) | (986 | ) | |||||||

| Exceptional items |

4 | 155 | — | |||||||||

| Engineering costs capitalised |

5 | 90 | 132 | |||||||||

| Other income |

6 | 52 | 53 | |||||||||

| Depreciation and amortisation |

(477 | ) | (485 | ) | ||||||||

| Foreign exchange and fair value adjustments |

7 | (149 | ) | 39 | ||||||||

| Finance income |

8 | 7 | 2 | |||||||||

| Finance expense (net) |

8 | (114 | ) | (80 | ) | |||||||

| Share of profit/(loss) of equity accounted investments |

2 | (10 | ) | |||||||||

|

|

|

|

|

|||||||||

| Loss before tax |

(369 | ) | (110 | ) | ||||||||

|

|

|

|

|

|||||||||

| Income tax expense |

14 | (113 | ) | (176 | ) | |||||||

|

|

|

|

|

|||||||||

| Loss for the period |

(482 | ) | (286 | ) | ||||||||

|

|

|

|

|

|||||||||

| Attributable to: |

||||||||||||

| Owners of the Company |

(482 | ) | (284 | ) | ||||||||

| Non-controlling interests |

— | (2 | ) | |||||||||

|

|

|

|

|

|||||||||

The notes on pages 13 to 31 are an integral part of these condensed consolidated financial statements.

8

Table of Contents

Condensed Consolidated Statement of Comprehensive Income and Expense

| Three months ended | ||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Loss for the period |

(482 | ) | (286 | ) | ||||

| Items that will not be reclassified subsequently to profit or loss: |

||||||||

| Remeasurement of net defined benefit obligation |

379 | (71 | ) | |||||

| Income tax related to items that will not be reclassified |

(95 | ) | 102 | |||||

|

|

|

|

|

|||||

| 284 | 31 | |||||||

|

|

|

|

|

|||||

| Items that may be reclassified subsequently to profit or loss: |

||||||||

| Loss on cash flow hedges (net) |

(651 | ) | (59 | ) | ||||

| Currency translation differences |

18 | 8 | ||||||

| Income tax related to items that may be reclassified |

161 | 3 | ||||||

|

|

|

|

|

|||||

| (472 | ) | (48 | ) | |||||

|

|

|

|

|

|||||

| Other comprehensive expense net of tax |

(188 | ) | (17 | ) | ||||

|

|

|

|

|

|||||

| Total comprehensive expense attributable to shareholder |

(670 | ) | (303 | ) | ||||

|

|

|

|

|

|||||

| Attributable to: |

||||||||

| Owners of the Company |

(670 | ) | (301 | ) | ||||

| Non-controlling interests |

— | (2 | ) | |||||

|

|

|

|

|

|||||

The notes on pages 13 to 31 are an integral part of these condensed consolidated financial statements.

9

Table of Contents

Condensed Consolidated Balance Sheet

| As at (£ millions) |

Note | 30 June 2022 |

31 March 2022 | 30 June 2021 |

||||||||||||

| Non-current assets |

||||||||||||||||

| Investments in equity accounted investees |

330 | 321 | 307 | |||||||||||||

| Other non-current investments |

32 | 30 | 24 | |||||||||||||

| Other financial assets |

11 | 229 | 185 | 278 | ||||||||||||

| Property, plant and equipment |

15 | 6,233 | 6,253 | 6,364 | ||||||||||||

| Intangible assets |

15 | 4,731 | 4,866 | 5,297 | ||||||||||||

| Right-of-use assets |

625 | 568 | 612 | |||||||||||||

| Pension asset |

23 | 987 | 434 | — | ||||||||||||

| Other non-current assets |

13 | 53 | 35 | 51 | ||||||||||||

| Deferred tax assets |

339 | 336 | 360 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total non-current assets |

13,559 | 13,028 | 13,293 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Current assets |

||||||||||||||||

| Cash and cash equivalents |

3,411 | 4,223 | 3,040 | |||||||||||||

| Short-term deposits and other investments |

280 | 175 | 680 | |||||||||||||

| Trade receivables |

836 | 722 | 606 | |||||||||||||

| Other financial assets |

11 | 358 | 394 | 512 | ||||||||||||

| Inventories |

12 | 3,131 | 2,781 | 2,754 | ||||||||||||

| Other current assets |

13 | 525 | 493 | 405 | ||||||||||||

| Current tax assets |

51 | 20 | 100 | |||||||||||||

| Assets classified as held for sale |

28 | 4 | 31 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

8,620 | 8,812 | 8,128 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total assets |

22,179 | 21,840 | 21,421 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Current liabilities |

||||||||||||||||

| Accounts payable |

5,291 | 5,144 | 4,814 | |||||||||||||

| Short-term borrowings |

19 | 1,839 | 1,779 | 1,178 | ||||||||||||

| Other financial liabilities |

16 | 1,103 | 870 | 717 | ||||||||||||

| Provisions |

17 | 964 | 989 | 1,218 | ||||||||||||

| Other current liabilities |

18 | 691 | 674 | 550 | ||||||||||||

| Current tax liabilities |

88 | 116 | 102 | |||||||||||||

| Liabilities directly associated with assets classified as held for sale |

— | — | 26 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

9,976 | 9,572 | 8,605 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Non-current liabilities |

||||||||||||||||

| Long-term borrowings |

19 | 5,392 | 5,248 | 4,968 | ||||||||||||

| Other financial liabilities |

16 | 1,325 | 871 | 678 | ||||||||||||

| Provisions |

17 | 1,100 | 1,112 | 1,175 | ||||||||||||

| Retirement benefit obligation |

23 | 26 | 25 | 445 | ||||||||||||

| Other non-current liabilities |

18 | 397 | 404 | 449 | ||||||||||||

| Deferred tax liabilities |

102 | 105 | 119 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

8,342 | 7,765 | 7,834 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

18,318 | 17,337 | 16,439 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Equity attributable to shareholders |

||||||||||||||||

| Ordinary shares |

1,501 | 1,501 | 1,501 | |||||||||||||

| Capital redemption reserve |

167 | 167 | 167 | |||||||||||||

| Other reserves |

21 | 2,193 | 2,835 | 3,307 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Equity attributable to shareholders |

3,861 | 4,503 | 4,975 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Non-controlling interests |

— | — | 7 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total equity |

3,861 | 4,503 | 4,982 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

22,179 | 21,840 | 21,421 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

The notes on pages 13 to 31 are an integral part of these condensed consolidated financial statements.

These condensed consolidated interim financial statements were approved by the JLR plc Board and authorised for issue on 28 July 2022.

Company registered number: 06477691

10

Table of Contents

Condensed Consolidated Statement of Changes in Equity

| £ millions |

Ordinary shares |

Capital redemption reserve |

Other reserves |

Total equity |

||||||||||||

| Balance at 1 April 2022 |

1,501 | 167 | 2,835 | 4,503 | ||||||||||||

| Loss for the period |

— | — | (482 | ) | (482 | ) | ||||||||||

| Other comprehensive expense for the period |

— | — | (188 | ) | (188 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive expense |

— | — | (670 | ) | (670 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Amounts removed from hedge reserve and recognised in inventory |

— | — | 35 | 35 | ||||||||||||

| Income tax related to amounts removed from hedge reserve and recognised in inventory |

— | — | (7 | ) | (7 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at 30 June 2022 |

1,501 | 167 | 2,193 | 3,861 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| £ millions |

Ordinary shares |

Capital redemption reserve |

Other reserves |

Equity attributable to shareholder |

Non- controlling interests |

Total equity |

||||||||||||||||||

| Balance at 1 April 2021 |

1,501 | 167 | 3,586 | 5,254 | 9 | 5,263 | ||||||||||||||||||

| Loss for the period |

— | — | (284 | ) | (284 | ) | (2 | ) | (286 | ) | ||||||||||||||

| Other comprehensive expense for the year |

— | — | (17 | ) | (17 | ) | — | (17 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive expense |

— | — | (301 | ) | (301 | ) | (2 | ) | (303 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Amounts removed from hedge reserve and recognised in inventory |

— | — | 27 | 27 | — | 27 | ||||||||||||||||||

| Income tax related to amounts removed from hedge reserve and recognised in inventory |

— | — | (5 | ) | (5 | ) | — | (5 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance at 30 June 2021 |

1,501 | 167 | 3,307 | 4,975 | 7 | 4,982 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The notes on pages 13 to 31 are an integral part of these condensed consolidated financial statements.

11

Table of Contents

Condensed Consolidated Cash Flow Statement

| Three months ended | ||||||||||||

| £ millions |

Note | 30 June 2022 |

30 June 2021 |

|||||||||

| Cash flows from operating activities |

||||||||||||

| Cash used in operations |

26 | (334 | ) | (464 | ) | |||||||

| Income tax paid |

(101 | ) | (56 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net cash used in operating activities |

(435 | ) | (520 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash flows from investing activities |

||||||||||||

| Purchases of other investments |

— | (1 | ) | |||||||||

| Investment in other restricted deposits |

(6 | ) | (1 | ) | ||||||||

| Redemption of other restricted deposits |

12 | 8 | ||||||||||

| Movements in other restricted deposits |

6 | 7 | ||||||||||

| Investment in short-term deposits and other investments |

(268 | ) | (472 | ) | ||||||||

| Redemption of short-term deposits and other investments |

180 | 794 | ||||||||||

| Movements in short-term deposits and other investments |

(88 | ) | 322 | |||||||||

| Purchases of property, plant and equipment |

(130 | ) | (237 | ) | ||||||||

| Purchases of other assets acquired with view to resale |

(12 | ) | — | |||||||||

| Proceeds from sale of property, plant and equipment |

— | 3 | ||||||||||

| Net cash outflow relating to intangible asset expenditure |

(100 | ) | (145 | ) | ||||||||

| Finance income received |

6 | 2 | ||||||||||

| Disposal of subsidiaries (net of cash disposed) |

2 | — | ||||||||||

|

|

|

|

|

|||||||||

| Net cash used in investing activities |

(316 | ) | (49 | ) | ||||||||

|

|

|

|

|

|||||||||

| Cash flows from financing activities |

||||||||||||

| Finance expenses and fees paid |

(100 | ) | (99 | ) | ||||||||

| Proceeds from issuance of borrowings |

594 | 607 | ||||||||||

| Repayment of borrowings |

(656 | ) | (654 | ) | ||||||||

| Payments of lease obligations |

(18 | ) | (18 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net cash used in financing activities |

(180 | ) | (164 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net decrease in cash and cash equivalents |

(931 | ) | (733 | ) | ||||||||

| Cash and cash equivalents at beginning of period |

4,223 | 3,778 | ||||||||||

| Cash reclassified as held for sale |

— | (16 | ) | |||||||||

| Effect of foreign exchange on cash and cash equivalents |

119 | 11 | ||||||||||

|

|

|

|

|

|||||||||

| Cash and cash equivalents at end of period |

3,411 | 3,040 | ||||||||||

|

|

|

|

|

|||||||||

The notes on pages 13 to 31 are an integral part of these condensed consolidated financial statements.

12

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 1 | Accounting policies |

Basis of preparation

The financial information in these interim financial statements is unaudited and does not constitute statutory accounts as defined in Section 435 of the Companies Act 2006. The condensed consolidated interim financial statements of Jaguar Land Rover Automotive plc have been prepared in accordance with International Accounting Standard 34, ‘Interim Financial Reporting’ in accordance with the requirements of UK-adopted international accounting standards. The balance sheet and accompanying notes as at 30 June 2021 have been disclosed solely for the information of the users.

The condensed consolidated interim financial statements have been prepared on a historical cost basis except for certain financial instruments held at fair value as highlighted in note 20.

The condensed consolidated interim financial statements should be read in conjunction with the annual consolidated financial statements for the year ended 31 March 2022, which were prepared in accordance with UK-adopted international accounting standards.

The condensed consolidated interim financial statements have been prepared on the going concern basis as set out within the directors’ report of the Group’s Annual Report for the year ended 31 March 2022.

The accounting policies applied are consistent with those of the annual consolidated financial statements for the year ended

31 March 2022, as described in those financial statements.

Estimates and judgements

The preparation of interim financial statements requires management to make judgements, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities, income and expense. Actual results may differ from these estimates.

In preparing these condensed interim financial statements, the significant judgements made by management in applying the

Group’s accounting policies and the key sources of estimate uncertainty were the same as those applied to the consolidated financial statements for the year ended 31 March 2022.

Going concern

The Condensed Interim Financial Statements have been prepared on a going concern basis, which the Directors consider appropriate for the reasons set out below.

The Directors have assessed the financial position of the Group as at 30 June 2022, and the projected cash flows of the Group for the twelve-month period from the date of authorisation of the condensed, consolidated interim financial statements (the ‘going concern assessment period’).

The Group had available liquidity of £3.7 billion at 30 June 2022, entirely as cash. Notice to cancel the previous £2.0 billion revolving credit facility was issued on 29 June 2022 with the new £1.5 billion forward start facility becoming available for new drawings on 4 July 2022. Within the going concern assessment period there is a £1 billion minimum quarter-end liquidity covenant attached to the Group’s UKEF loans and forward start RCF facility.

The Group has assessed its projected cash flows over the going concern assessment period. This base case uses most of the same assumptions as the Group’s assessment as at 31 March 2022 including the Group’s expectations of the continued supply chain challenges related to semiconductor shortages and prevailing financial conditions including the impact of inflationary pressures on material costs. The assumptions have been adjusted to reflect the Group’s latest wholesale volume expectations for FY23, and extended to include twelve months from the date of authorisation of these condensed, consolidated interim financial statements.

The base case assumes an increase in wholesale volumes in the going concern assessment period compared to the previous twelve months, and management of supply to maximise production of higher margin products. Continued supplier engagement is expected to bring gradual improvements to supply through the rest of the financial year, although the situation remains uncertain.

Details of the scenarios and assumptions used in the assessment as at 31 March 2022 are set out in note 2 to the consolidated financial statements of the Group’s Annual Report for the year ended 31 March 2022.

The Group has also carried out a reverse stress test against the base case to determine the decline in wholesale volumes over a twelve-month period that would result in a liquidity level that breaches financing covenants. The reverse stress test assumes continued supply constraints resulting in demand that exceeds supply over the twelve-month period and assumes optimisation of supply to maximise production of higher margin products.

13

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 1 | Accounting policies (continued) |

Going concern (continued)

In order to reach a liquidity level that breaches covenants, it would require a sustained decline in wholesale volumes of more than 60% compared to the base case over a twelve-month period. The reverse stress test reflects the variable profit impact of the wholesale volume decline, and assumes all other assumptions are held in line with the base case. It does not reflect other potential upside measures that could be taken in such a reduced volume scenario; nor any new funding other than the £1.5 billion RCF facility which was available for new drawings from 4 July 2022.

The Group does not consider this scenario to be plausible given that the stress test volumes are significantly lower than the volumes achieved during both the peak of the COVID-19 pandemic and the worst quarter of semiconductor shortages. The Group has a strong order bank and is confident that it can significantly exceed reverse stress test volumes.

The Group has considered the impact of severe but plausible downside scenarios and the expected wholesale volumes under each of these scenarios is much higher than under the reverse stress test.

The Directors, after making appropriate enquiries and taking into consideration the risks and uncertainties facing the Group, consider that the Group has adequate financial resources to continue operating throughout the going concern assessment period, meeting its liabilities as they fall due. Accordingly, the Directors continue to adopt the going concern basis in preparing these consolidated financial statements.

14

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 2 | Alternative Performance Measures |

In reporting financial information, the Group presents alternative performance measures (‘APMs’) which are not defined or specified under the requirements of IFRS. The Group believes that these APMs, which are not considered to be a substitute for or superior to IFRS measures, provide stakeholders with additional helpful information on the performance of the business.

The APMs used by the Group are defined below.

| Alternative Performance |

Definition | |

| Adjusted EBITDA | Adjusted EBITDA is defined as profit before: income tax expense; exceptional items; finance expense (net of capitalised interest) and finance income; gains/losses on debt and unrealised derivatives, realised derivatives entered into for the purpose of hedging debt, and equity or debt investments held at fair value; foreign exchange gains/losses on other assets and liabilities, including short-term deposits and cash and cash equivalents; share of profit/loss from equity accounted investments; depreciation and amortisation. | |

| Adjusted EBIT | Adjusted EBIT is defined as for adjusted EBITDA but including share of profit/loss from equity accounted investments, depreciation and amortisation. | |

| Profit/(loss) before tax and exceptional items | Profit/(loss) before tax excluding exceptional items. | |

| Free cash flow | Net cash generated from operating activities less net cash used in automotive investing activities, excluding investments in consolidated entities and movements in financial investments, and after finance expenses and fees paid. Financial investments are those reported as cash and cash equivalents, short-term deposits and other investments, and equity or debt investments held at fair value. | |

| Total product and other investment | Cash used in the purchase of property, plant and equipment, intangible assets, investments in equity accounted investments and other trading investments, acquisition of subsidiaries and expensed research and development costs. | |

| Working capital | Changes in assets and liabilities as presented in note 26. This comprises movements in assets and liabilities excluding movements relating to financing or investing cash flows or non-cash items that are not included in adjusted EBIT or adjusted EBITDA. | |

| Total cash and cash equivalents, deposits and investments | Defined as cash and cash equivalents, short-term deposits and other investments, marketable securities and any other items defined as cash and cash equivalents in accordance with IFRS. | |

| Available liquidity | Defined as total cash and cash equivalents, deposits and investments plus committed undrawn credit facilities. | |

| Net debt | Total cash and cash equivalents, deposits and investments less total interest-bearing loans and borrowings. | |

| Retail sales | Jaguar Land Rover retail sales represent vehicle sales made by dealers to end customers and include the sale of vehicles produced by our Chinese joint venture, Chery Jaguar Land Rover Automotive Company Ltd. | |

| Wholesales | Wholesales represent vehicle sales made to dealers. The Group recognises revenue on wholesales. | |

The Group uses adjusted EBITDA as an APM to review and measure the underlying profitability of the Group on an ongoing basis for comparability as it recognises that increased capital expenditure year-on-year will lead to a corresponding increase in depreciation and amortisation expense recognised within the consolidated income statement.

The Group uses adjusted EBIT as an APM to review and measure the underlying profitability of the Group on an ongoing basis as this excludes volatility on unrealised foreign exchange transactions. Due to the significant level of debt and currency derivatives, unrealised foreign exchange distorts the financial performance of the Group from one period to another.

15

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 2 | Alternative Performance Measures (continued) |

Free cash flow is considered by the Group to be a key measure in assessing and understanding the total operating performance of the Group and to identify underlying trends.

Total product and other investment is considered by the Group to be a key measure in assessing cash invested in the development of future new models and infrastructure supporting the growth of the Group.

Working capital is considered by the Group to be a key measure in assessing short-term assets and liabilities that are expected to be converted into cash within the next 12-month period.

Total cash and cash equivalents, deposits and investments and available liquidity are measures used by the Group to assess liquidity and the availability of funds for future spend and investment.

Exceptional items are defined in note 4.

Reconciliations between these alternative performance measures and statutory reported measures are shown below and on the next page.

Adjusted EBIT and Adjusted EBITDA

| Three months ended | ||||||||||||

| £ millions |

Note | 30 June 2022 |

30 June 2021 |

|||||||||

| Adjusted EBITDA |

279 | 449 | ||||||||||

| Depreciation and amortisation |

(477 | ) | (485 | ) | ||||||||

| Share of profit/(loss) of equity accounted investments |

2 | (10 | ) | |||||||||

|

|

|

|

|

|||||||||

| Adjusted EBIT |

(196 | ) | (46 | ) | ||||||||

|

|

|

|

|

|||||||||

| Foreign exchange on debt, derivatives and balance sheet revaluation* |

26 | (114 | ) | (1 | ) | |||||||

| Unrealised (loss)/gain on commodities |

26 | (109 | ) | 14 | ||||||||

| Finance income |

8 | 7 | 2 | |||||||||

| Finance expense (net) |

8 | (114 | ) | (80 | ) | |||||||

| Fair value gain on equity investments |

26 | 2 | 1 | |||||||||

|

|

|

|

|

|||||||||

| Loss before tax and exceptional items |

(524 | ) | (110 | ) | ||||||||

|

|

|

|

|

|||||||||

| Exceptional items |

4 | 155 | — | |||||||||

|

|

|

|

|

|||||||||

| Loss before tax |

(369 | ) | (110 | ) | ||||||||

|

|

|

|

|

|||||||||

| * | FY22 comparatives have been represented to align with the FY23 presentation change to combine foreign exchange on debt, derivatives and balance sheet revaluation into a single line. This has not resulted in any change to reported ‘loss before tax and exceptional items’ or ‘loss before tax’. |

Free cash flow

| Three months ended | ||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Net cash used in operating activities |

(435 | ) | (520 | ) | ||||

| Purchases of property, plant and equipment |

(130 | ) | (237 | ) | ||||

| Net cash outflow relating to intangible asset expenditure |

(100 | ) | (145 | ) | ||||

| Proceeds from sale of property, plant and equipment |

— | 3 | ||||||

| Purchases of other assets acquired with view to resale |

(12 | ) | — | |||||

| Disposal of subsidiaries (net of cash disposed) |

2 | — | ||||||

| Finance expenses and fees paid |

(100 | ) | (99 | ) | ||||

| Finance income received |

6 | 2 | ||||||

|

|

|

|

|

|||||

| Free cash flow |

(769 | ) | (996 | ) | ||||

|

|

|

|

|

|||||

16

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 2 | Alternative Performance Measures (continued) |

Total product and other investment

| Three months ended | ||||||||||||

| £ millions |

Note | 30 June 2022 |

30 June 2021 |

|||||||||

| Purchases of property, plant and equipment |

130 | 237 | ||||||||||

| Net cash outflow relating to intangible asset expenditure |

100 | 145 | ||||||||||

| Engineering costs expensed |

5 | 259 | 188 | |||||||||

| Purchases of other investments |

— | 1 | ||||||||||

|

|

|

|

|

|||||||||

| Total product and other investment |

489 | 571 | ||||||||||

|

|

|

|

|

|||||||||

Total cash and cash equivalents, deposits and investments

| As at (£ millions) |

30 June 2022 |

31 March 2022 |

30 June 2021 |

|||||||||

| Cash and cash equivalents |

3,411 | 4,223 | 3,040 | |||||||||

| Short-term deposits and other investments |

280 | 175 | 680 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total cash and cash equivalents, deposits and investments |

3,691 | 4,398 | 3,720 | |||||||||

|

|

|

|

|

|

|

|||||||

Available liquidity

| As at (£ millions) |

Note | 30 June 2022 |

31 March 2022 |

30 June 2021 |

||||||||||||

| Cash and cash equivalents |

3,411 | 4,223 | 3,040 | |||||||||||||

| Short-term deposits and other investments |

280 | 175 | 680 | |||||||||||||

| Committed undrawn credit facilities* |

19 | — | 2,015 | 1,978 | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Available liquidity |

3,691 | 6,413 | 5,698 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| * | The £1.5 billion forward start revolving facility maturing in March 2024 became effective on 04 July 2022 and is undrawn. This facility replaces the £2.015 billion revolving credit facility which was cancelled ahead of its scheduled maturity on 28 July 2022. |

Net debt

| As at (£ millions) |

Note | 30 June 2022 |

31 March 2022 |

30 June 2021 |

||||||||||||

| Cash and cash equivalents |

3,411 | 4,223 | 3,040 | |||||||||||||

| Short-term deposits and other investments |

280 | 175 | 680 | |||||||||||||

| Interest-bearing loans and borrowings |

19 | (7,897 | ) | (7,597 | ) | (6,740 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||||

| Net debt |

(4,206 | ) | (3,199 | ) | (3,020 | ) | ||||||||||

|

|

|

|

|

|

|

|||||||||||

Retails and wholesales

| Three months ended | ||||||||

| Units |

30 June 2022 |

30 June 2021 |

||||||

| Retail sales |

78,825 | 124,537 | ||||||

|

|

|

|

|

|||||

| Wholesales* |

71,815 | 84,442 | ||||||

|

|

|

|

|

|||||

| * | Wholesale volumes exclude sales from Chery Jaguar Land Rover – Q1 FY23: 10,772 units, Q1 FY22: 12,699 units. |

17

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 3 | Disaggregation of revenue |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Revenue recognised for sales of vehicles, parts and accessories |

4,213 | 4,674 | ||||||

| Revenue recognised for services transferred |

74 | 75 | ||||||

| Revenue - other |

195 | 196 | ||||||

|

|

|

|

|

|||||

| Total revenue excluding realised revenue hedges |

4,482 | 4,945 | ||||||

|

|

|

|

|

|||||

| Realised revenue hedges |

(76 | ) | 21 | |||||

|

|

|

|

|

|||||

| Total revenue |

4,406 | 4,966 | ||||||

|

|

|

|

|

|||||

| 4 | Exceptional items |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Employee costs excluding exceptional items |

(570 | ) | (592 | ) | ||||

| Impact of: |

||||||||

| Past service credit |

155 | — | ||||||

|

|

|

|

|

|||||

| Including exceptional items |

(415 | ) | (592 | ) | ||||

|

|

|

|

|

|||||

The exceptional item recognised in the three months ended 30 June 2022 is comprised of a pension past service credit of £155 million due to a change in inflation index from RPI to CPI. There was no exceptional item recognised in the three months ended 30 June 2021.

| 5 | Engineering costs capitalised |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Total engineering costs incurred |

349 | 320 | ||||||

| Engineering costs expensed |

(259 | ) | (188 | ) | ||||

|

|

|

|

|

|||||

| Engineering costs capitalised |

90 | 132 | ||||||

|

|

|

|

|

|||||

| Interest capitalised in engineering costs capitalised |

5 | 13 | ||||||

| Research and development grants capitalised |

(3 | ) | 10 | |||||

|

|

|

|

|

|||||

| Total internally developed intangible additions |

92 | 155 | ||||||

|

|

|

|

|

|||||

| 6 | Other income |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Grant income |

24 | 5 | ||||||

| Commissions |

6 | 5 | ||||||

| Other |

22 | 43 | ||||||

|

|

|

|

|

|||||

| Total other income |

52 | 53 | ||||||

|

|

|

|

|

|||||

| 7 | Foreign exchange and fair value adjustments |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Foreign exchange loss and fair value adjustments on loans |

(254 | ) | (5 | ) | ||||

| Foreign exchange gain on economic hedges of loans |

148 | 21 | ||||||

| Foreign exchange (loss)/gain on derivatives |

(13 | ) | 1 | |||||

| Other foreign exchange gain/(loss) |

50 | (13 | ) | |||||

| Realised gain on commodities |

27 | 20 | ||||||

| Unrealised (loss)/gain on commodities |

(109 | ) | 14 | |||||

| Fair value gain on equity investments |

2 | 1 | ||||||

|

|

|

|

|

|||||

| Foreign exchange and fair value adjustments |

(149 | ) | 39 | |||||

|

|

|

|

|

|||||

18

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 8 | Finance income and expense |

| Three months ended | ||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Finance income |

7 | 2 | ||||||

|

|

|

|

|

|||||

| Total finance income |

7 | 2 | ||||||

|

|

|

|

|

|||||

| Interest expense on lease liabilities |

(12 | ) | (11 | ) | ||||

| Total interest expense on financial liabilities measured at amortised cost other than lease liabilities |

(101 | ) | (83 | ) | ||||

| Interest income on derivatives designated as a fair value hedge of financial liabilities |

— | 2 | ||||||

| Unwind of discount on provisions |

(8 | ) | — | |||||

| Interest capitalised |

7 | 12 | ||||||

|

|

|

|

|

|||||

| Total finance expense (net) |

(114 | ) | (80 | ) | ||||

|

|

|

|

|

|||||

The capitalisation rate used to calculate borrowing costs eligible for capitalisation during the three month period ended 30 June 2022 was 5.0% (three month period ended 30 June 2021: 4.6%).

| 9 | Other expenses |

| Three months ended | ||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| Stores, spare parts and tools |

23 | 24 | ||||||

| Freight cost |

152 | 116 | ||||||

| Works, operations and other costs |

513 | 539 | ||||||

| Power and fuel |

38 | 21 | ||||||

| Product warranty |

169 | 179 | ||||||

| Publicity |

114 | 107 | ||||||

|

|

|

|

|

|||||

| Total other expenses |

1,009 | 986 | ||||||

|

|

|

|

|

|||||

| 10 | Allowances for trade and other receivables |

| Three months ended |

||||||||

| £ millions |

30 June 2022 |

30 June 2021 |

||||||

| At beginning of period |

4 | 6 | ||||||

| Charged during the period |

1 | 1 | ||||||

|

|

|

|

|

|||||

| At end of period |

5 | 7 | ||||||

|

|

|

|

|

|||||

19

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 11 | Other financial assets |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Non-current |

||||||||||||

| Restricted cash |

11 | 10 | 9 | |||||||||

| Derivative financial instruments |

149 | 98 | 190 | |||||||||

| Warranty reimbursement and other receivables |

56 | 63 | 71 | |||||||||

| Other |

13 | 14 | 8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current other financial assets |

229 | 185 | 278 | |||||||||

|

|

|

|

|

|

|

|||||||

| Current |

||||||||||||

| Restricted cash |

7 | 13 | 3 | |||||||||

| Derivative financial instruments |

106 | 185 | 304 | |||||||||

| Warranty reimbursement and other receivables |

77 | 72 | 72 | |||||||||

| Accrued income |

57 | 39 | 37 | |||||||||

| Other |

111 | 85 | 96 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current other financial assets |

358 | 394 | 512 | |||||||||

|

|

|

|

|

|

|

|||||||

| 12 | Inventories |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Raw materials and consumables |

140 | 135 | 109 | |||||||||

|

Work-in-progress |

623 | 488 | 412 | |||||||||

| Finished goods |

2,347 | 2,129 | 2,211 | |||||||||

| Inventory basis adjustment |

21 | 29 | 22 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total inventories |

3,131 | 2,781 | 2,754 | |||||||||

|

|

|

|

|

|

|

|||||||

| 13 | Other assets |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Non-current |

||||||||||||

| Prepaid expenses |

26 | 24 | 25 | |||||||||

| Research and development credit |

18 | 2 | 15 | |||||||||

| Other |

9 | 9 | 11 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current other assets |

53 | 35 | 51 | |||||||||

|

|

|

|

|

|

|

|||||||

| Current |

||||||||||||

| Recoverable VAT |

196 | 204 | 134 | |||||||||

| Prepaid expenses |

252 | 208 | 165 | |||||||||

| Research and development credit |

60 | 63 | 86 | |||||||||

| Other |

17 | 18 | 20 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current other assets |

525 | 493 | 405 | |||||||||

|

|

|

|

|

|

|

|||||||

| 14 | Taxation |

Recognised in the income statement

Income tax for the three month periods ending 30 June 2022 and 30 June 2021 is charged at the estimated effective tax rate expected to apply for the applicable financial year ends and adjusted for relevant deferred tax amounts where applicable.

Despite a loss in the three month period ending 30 June 2022, a tax charge of £113 million was incurred as a result of inability to recognise UK deferred tax assets arising in the period due to the group’s current UK loss profile and non-recognition of UK deferred tax assets relating to pension and hedging movements in other reserves, £14 million of which arises in consequence of the recently announced increase in future UK corporation tax rate to 25% from 1 April 2023 (currently 19%).

20

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 15 | Capital expenditure |

Capital expenditure on property, plant and equipment in the three month period to 30 June 2022 was £198 million (three month period to 30 June 2021: £114 million) and on intangible assets (excluding research and development expenditure credits) was £102 million (three month period to 30 June 2021: £167 million). There were no material disposals or changes in the use of assets.

| 16 | Other financial liabilities |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Current |

||||||||||||

| Lease obligations |

62 | 62 | 64 | |||||||||

| Interest accrued |

104 | 95 | 80 | |||||||||

| Derivative financial instruments |

659 | 445 | 185 | |||||||||

| Liability for vehicles sold under a repurchase arrangement |

265 | 267 | 388 | |||||||||

| Other |

13 | 1 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current other financial liabilities |

1,103 | 870 | 717 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-current |

||||||||||||

| Lease obligations |

604 | 508 | 530 | |||||||||

| Derivative financial instruments |

694 | 338 | 147 | |||||||||

| Other |

27 | 25 | 1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current other financial liabilities |

1,325 | 871 | 678 | |||||||||

|

|

|

|

|

|

|

|||||||

| 17 | Provisions |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Current |

||||||||||||

| Product warranty |

606 | 604 | 642 | |||||||||

| Legal and product liability |

302 | 252 | 282 | |||||||||

| Provision for residual risk |

12 | 12 | 23 | |||||||||

| Provision for environmental liability |

4 | 3 | 4 | |||||||||

| Other employee benefits obligations |

— | — | 2 | |||||||||

| Restructuring |

40 | 118 | 265 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total current provisions |

964 | 989 | 1,218 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-current |

||||||||||||

| Product warranty |

1,007 | 1,026 | 1,029 | |||||||||

| Legal and product liability |

45 | 40 | 80 | |||||||||

| Provision for residual risk |

17 | 19 | 38 | |||||||||

| Provision for environmental liability |

27 | 23 | 23 | |||||||||

| Other employee benefits obligations |

4 | 4 | 5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total non-current provisions |

1,100 | 1,112 | 1,175 | |||||||||

|

|

|

|

|

|

|

|||||||

21

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 17 | Provisions (continued) |

| £ millions |

Product warranty |

Legal and product liability |

Residual risk |

Environmental liability |

Other employee benefits obligations |

Restructuring | Total | |||||||||||||||||||||

| Balance at 1 April 2022 |

1,630 | 292 | 31 | 26 | 4 | 118 | 2,101 | |||||||||||||||||||||

| Provisions made during the period |

185 | 104 | 1 | 5 | 1 | 7 | 303 | |||||||||||||||||||||

| Provisions used during the period |

(180 | ) | (85 | ) | — | — | (1 | ) | (80 | ) | (346 | ) | ||||||||||||||||

| Unused amounts reversed in the period |

(30 | ) | — | (4 | ) | — | — | (5 | ) | (39 | ) | |||||||||||||||||

| Impact of unwind of discounting |

8 | — | — | — | — | — | 8 | |||||||||||||||||||||

| Foreign currency translation |

— | 36 | 1 | — | — | — | 37 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at 30 June 2022 |

1,613 | 347 | 29 | 31 | 4 | 40 | 2,064 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Product warranty provision

The Group offers warranty cover in respect of manufacturing defects, which become apparent in the stipulated policy period dependent on the market in which the vehicle purchase occurred. The estimated liability for product warranty is recognised when products are sold or when new warranty programmes are initiated. These estimates are established using historical information on the nature, frequency and average cost of warranty claims and management estimates regarding possible future warranty claims, customer goodwill and recall complaints. The discount on the warranty provision is calculated using a risk-free discount rate as the risks specific to the liability, such as inflation, are included in the base calculation. The timing of outflows will vary as and when a warranty claim will arise, being typically up to eight years.

Legal and product liability provision

A legal and product liability provision is maintained in respect of compliance with regulations and known litigations that impact the Group. The provision primarily relates to motor accident claims, consumer complaints, retailer terminations, employment cases, personal injury claims and compliance with emission regulations. The timing of outflows will vary as and when claims are received and settled, which is not known with certainty.

Residual risk provision

In certain markets, the Group is responsible for the residual risk arising on vehicles sold by retailers on leasing arrangements. The provision is based on the latest available market expectations of future residual value trends. The timing of the outflows will be at the end of the lease arrangements, being typically up to three years.

Environmental liability provision

This provision relates to various environmental remediation costs such as asbestos removal and land clean-up. The timing of when these costs will be incurred is not known with certainty.

Other employee benefits obligations

This provision relates to the LTIP scheme for certain employees and other amounts payable to employees.

Restructuring provision

The restructuring provision includes amounts for third party obligations arising from Group restructuring programmes. This includes amounts payable to employees following the announcement of the Group’s Reimagine strategy in the year ended 31 March 2021 as well as other Group restructuring programmes. Amounts are also included in relation to legal and constructive obligations made to third parties in connection with cancellations under the group’s Reimagine strategy.

The estimated liability for restructuring activities is recognised when the group has reason to believe there is a legal or constructive obligation arising from restructuring actions taken. The amount provided at the reporting date is calculated based on currently available facts and certain estimates for third party obligations. These estimates are established using historical experience based on the settlement costs for similar liabilities, with proxies being used where no direct comparison exists.

The amounts and timing of outflows will vary as and when restructuring obligations are progressed with third parties.

22

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 18 | Other liabilities |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||||

| Current |

||||||||||||||

| Liabilities for advances received |

170 | 122 | 113 | |||||||||||

| Ongoing service obligations |

297 | 286 | 310 | |||||||||||

| VAT |

82 | 95 | 3 | |||||||||||

| Other taxes payable |

129 | 161 | 111 | |||||||||||

| Other |

13 | 10 | 13 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Total current other liabilities |

691 | 674 | 550 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Non-current |

||||||||||||||

| Ongoing service obligations |

388 | 395 | 439 | |||||||||||

| Other |

9 | 9 | 10 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Total non-current other liabilities |

397 | 404 | 449 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| 19 | Interest bearing loans and borrowings |

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||||

| Short-term borrowings |

||||||||||||||

| Bank loans |

615 | 599 | 584 | |||||||||||

| Current portion of long-term EURO MTF listed debt |

811 | 779 | 399 | |||||||||||

| Current portion of long-term loans |

413 | 401 | 195 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Short-term borrowings |

1,839 | 1,779 | 1,178 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Long-term borrowings |

||||||||||||||

| EURO MTF listed debt |

4,108 | 3,953 | 3,931 | |||||||||||

| Bank loans |

1,249 | 1,260 | 1,003 | |||||||||||

| Other unsecured |

35 | 35 | 34 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Long-term borrowings |

5,392 | 5,248 | 4,968 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Lease obligations |

666 | 570 | 594 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Total debt |

7,897 | 7,597 | 6,740 | |||||||||||

|

|

|

|

|

|

|

|||||||||

Undrawn facilities

As at 30 June 2022, the Group has a fully undrawn revolving credit facility of £nil (31 March 2022: £2,015 million, 30 June 2021: £1,935 million). The £1.5 billion forward start revolving facility maturing in March 2024 became effective on 04 July 2022 and is undrawn. This facility replaces the £2.015 billion revolving credit facility which was cancelled ahead of its scheduled maturity on 28 July 2022.

The Group’s fleet buyback facility matured in December 2021 and had £43 million undrawn as at 30 June 2021.

23

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 20 | Financial instruments |

The condensed consolidated interim financial statements have been prepared on a historical cost basis except for certain financial instruments held at fair value. These financial instruments are classified as either level 2 fair value measurements, as defined by IFRS 13, being those derived from inputs other than quoted prices which are observable, or level 3 fair value measurements, being those derived from significant unobservable inputs. There have been no changes in the valuation techniques used or transfers between fair value levels from those set out in note 35 to the annual consolidated financial statements for the year ended 31 March 2022.

The tables below show the carrying amounts and fair value of each category of financial assets and liabilities, other than those with carrying amounts that are reasonable approximations of fair values.

| 30 June 2022 | 31 March 2022 | 30 June 2021 | ||||||||||||||||||||||

| As at (£ millions) |

Carrying value |

Fair value | Carrying value |

Fair value | Carrying value |

Fair value | ||||||||||||||||||

| Cash and cash equivalents |

3,411 | 3,411 | 4,223 | 4,223 | 3,040 | 3,040 | ||||||||||||||||||

| Short-term deposits and other investments |

280 | 280 | 175 | 175 | 680 | 680 | ||||||||||||||||||

| Trade receivables |

836 | 836 | 722 | 722 | 606 | 606 | ||||||||||||||||||

| Other non-current investments |

32 | 32 | 30 | 30 | 24 | 24 | ||||||||||||||||||

| Other financial assets - current |

358 | 358 | 394 | 394 | 512 | 512 | ||||||||||||||||||

| Other financial assets - non-current |

229 | 229 | 185 | 185 | 278 | 278 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total financial assets |

5,146 | 5,146 | 5,729 | 5,729 | 5,140 | 5,140 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Accounts payable |

5,291 | 5,291 | 5,144 | 5,144 | 4,814 | 4,814 | ||||||||||||||||||

| Short-term borrowings |

1,839 | 1,818 | 1,779 | 1,778 | 1,178 | 1,188 | ||||||||||||||||||

| Long-term borrowings |

5,392 | 4,822 | 5,248 | 5,216 | 4,968 | 5,220 | ||||||||||||||||||

| Other financial liabilities - current |

1,103 | 1,103 | 870 | 870 | 717 | 717 | ||||||||||||||||||

| Other financial liabilities - non-current |

1,325 | 1,252 | 871 | 901 | 678 | 759 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total financial liabilities |

14,950 | 14,286 | 13,912 | 13,909 | 12,355 | 12,698 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 21 | Reserves |

The movement in reserves is as follows:

| £ millions |

Translation reserve |

Hedging reserve |

Cost of hedging reserve |

Retained earnings |

Total other reserves |

|||||||||||||||

| Balance at 1 April 2022 |

(333 | ) | (454 | ) | 19 | 3,603 | 2,835 | |||||||||||||

| Loss for the period |

— | — | — | (482 | ) | (482 | ) | |||||||||||||

| Remeasurement of defined benefit obligation |

— | — | — | 379 | 379 | |||||||||||||||

| Loss on effective cash flow hedges |

— | (713 | ) | (14 | ) | — | (727 | ) | ||||||||||||

| Income tax related to items recognised in other comprehensive income |

— | 171 | 4 | (95 | ) | 80 | ||||||||||||||

| Cash flow hedges reclassified to profit and loss |

— | 80 | (4 | ) | — | 76 | ||||||||||||||

| Income tax related to items reclassified to profit or loss |

— | (15 | ) | 1 | — | (14 | ) | |||||||||||||

| Amounts removed from hedge reserve and recognised in inventory |

— | 32 | 3 | — | 35 | |||||||||||||||

| Income tax related to amounts removed from hedge reserve and recognised in inventory |

— | (7 | ) | — | — | (7 | ) | |||||||||||||

| Currency translation differences |

18 | — | — | — | 18 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at 30 June 2022 |

(315 | ) | (906 | ) | 9 | 3,405 | 2,193 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

24

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 21 | Reserves (continued) |

| £ millions |

Translation reserve |

Hedging reserve |

Cost of hedging reserve |

Retained earnings |

Total other reserves |

|||||||||||||||

| Balance at 1 April 2021 |

(357 | ) | 136 | 1 | 3,806 | 3,586 | ||||||||||||||

| Loss for the period |

— | — | — | (284 | ) | (284 | ) | |||||||||||||

| Remeasurement of defined benefit obligation |

— | — | (71 | ) | (71 | ) | ||||||||||||||

| Loss on effective cash flow hedges |

— | (37 | ) | (2 | ) | — | (39 | ) | ||||||||||||

| Income tax related to items recognised in other comprehensive income |

— | — | — | 102 | 102 | |||||||||||||||

| Cash flow hedges reclassified to profit and loss |

— | (18 | ) | (2 | ) | — | (20 | ) | ||||||||||||

| Income tax related to items reclassified to profit or loss |

— | 3 | — | — | 3 | |||||||||||||||

| Amounts removed from hedge reserve and recognised in inventory |

— | 24 | 3 | — | 27 | |||||||||||||||

| Income tax related to amounts removed from hedge reserve and recognised in inventory |

— | (4 | ) | (1 | ) | — | (5 | ) | ||||||||||||

| Currency translation differences |

8 | — | — | — | 8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance at 30 June 2021 |

(349 | ) | 104 | (1 | ) | 3,553 | 3,307 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 22 | Dividends |

During the three-month periods ended 30 June 2022 and 30 June 2021, no ordinary share dividends were proposed or paid.

| 23 | Employee benefits |

The Group has pension arrangements providing employees with defined benefits related to pay and service as set out in the rules of each scheme. The following table sets out the disclosure pertaining to employee benefits of the JLR Automotive Group plc which operates defined benefit pension schemes.

| Three months ended | ||||||||

| £ millions | 30 June 2022 | 30 June 2021 | ||||||

| Change in present value of defined benefit obligation |

||||||||

| Defined benefit obligation at beginning of period |

7,522 | 8,432 | ||||||

| Current service cost |

25 | 33 | ||||||

| Past service credit |

(155 | ) | — | |||||

| Interest expense |

50 | 44 | ||||||

| Actuarial (gains)/losses arising from: |

||||||||

| Changes in demographic assumptions |

— | 26 | ||||||

| Changes in financial assumptions |

(1,537 | ) | 337 | |||||

| Experience adjustments |

105 | — | ||||||

| Member contributions |

— | 1 | ||||||

| Benefits paid |

(130 | ) | (113 | ) | ||||

|

|

|

|

|

|||||

| Defined benefit obligation at end of period |

5,880 | 8,760 | ||||||

|

|

|

|

|

|||||

| Change in fair value of scheme assets |

||||||||

| Fair value of schemes’ assets at beginning of period |

7,931 | 8,046 | ||||||

| Interest income |

54 | 43 | ||||||

| Remeasurement (loss)/gain on the return of plan assets, excluding amounts included in interest income |

(1,053 | ) | 292 | |||||

| Administrative expenses |

(7 | ) | (1 | ) | ||||

| Employer contributions |

46 | 47 | ||||||

| Member contributions |

— | 1 | ||||||

| Benefits paid |

(130 | ) | (113 | ) | ||||

|

|

|

|

|

|||||

| Fair value of schemes’ assets at end of period |

6,841 | 8,315 | ||||||

|

|

|

|

|

|||||

25

Table of Contents

Notes (forming part of the condensed consolidated interim financial statements)

| 23 | Employee benefits (continued) |

The principal assumptions used in accounting for the pension schemes are set out below:

| Three months ended |

30 June 2022 | 30 June 2021 | ||||||

| Discount rate |

3.9 | % | 1.9 | % | ||||

| Expected rate of increase in benefit revaluation of covered employees |

2.0 | % | 2.1 | % | ||||

| RPI inflation rate |

3.0 | % | 3.0 | % | ||||

| CPI inflation rate |

2.5 | % | 2.3 | % | ||||

Amounts recognised in the condensed consolidated balance sheet consist of:

| As at (£ millions) |

30 June 2022 | 31 March 2022 | 30 June 2021 | |||||||||

| Present value of defined benefit obligations |

(5,880 | ) | (7,522 | ) | (8,760 | ) | ||||||

| Fair value of schemes’ assets |

6,841 | 7,931 | 8,315 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net Asset |

961 | 409 | (445 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Non-current assets |

987 | 434 | — | |||||||||

| Non-current liabilities |

(26 | ) | (25 | ) | (445 | ) | ||||||

For the valuations at 30 June 2022 and at 31 March 2022 the mortality assumptions used are the SAPS base table, in particular S2PxA tables and the Light table for members of the Jaguar Executive Pension Plan. For the Jaguar Pension Plan, scaling factors of 101 per cent to 115 per cent have been used for male members and scaling factors of 103 per cent to 118 per cent have been used for female members. For the Land Rover Pension Scheme, scaling factors of 105 per cent to 117 per cent have been used for male members and scaling factors of 100 per cent to 116 per cent have been used for female members. For the Jaguar Executive Pension Plan, an average scaling factor of 93 per cent to 97 per cent has been used for male members and a scaling factor of 91 per cent to 96 per cent has been used for female members. At each date there is an allowance for future improvements in line with the CMI (2021) projections and an allowance for long-term improvements of 1.25 per cent per annum and a smoothing parameter of 7.5.