UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-08576

American High-Income Municipal Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street, 55th Floor

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

Brian C. Janssen

American High-Income Municipal Bond Fund

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

| American Funds Short-Term Tax-Exempt Bond Fund® Limited Term Tax-Exempt Bond Fund of America® The Tax-Exempt Bond Fund of America® American High-Income Municipal Bond Fund® The Tax-Exempt Fund of California® American Funds Tax-Exempt Fund of New York® |

|

Annual reports for the year ended July 31, 2023

Invest in

municipal bonds

for tax-advantaged

income

These six municipal bond funds are offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class F-2 shares. Class A share results are shown at net asset value unless otherwise indicated. If a sales charge had been deducted from Class A shares (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2023 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated October 1, 2023 (unaudited):

| Cumulative total returns | Average annual total returns | Gross expense | Net expense | |||||||||||||||||

| 1 year | 5 years | 10 years | ratios* | ratios* | ||||||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | ||||||||||||||||||||

| Class F-2 shares | 1.14 | % | 0.92 | % | 0.85 | % | 0.33 | % | 0.32 | % | ||||||||||

| Class A shares | –1.46 | 0.29 | 0.53 | 0.44 | 0.43 | |||||||||||||||

| Limited Term Tax-Exempt Bond Fund of America | ||||||||||||||||||||

| Class F-2 shares | 1.80 | 1.36 | 1.60 | 0.35 | 0.35 | |||||||||||||||

| Class A shares | –0.99 | 0.62 | 1.14 | 0.58 | 0.58 | |||||||||||||||

| The Tax-Exempt Bond Fund of America | ||||||||||||||||||||

| Class F-2 shares | 3.01 | 1.71 | 2.72 | 0.35 | 0.35 | |||||||||||||||

| Class A shares | –0.99 | 0.76 | 2.17 | 0.53 | 0.53 | |||||||||||||||

| American High-Income Municipal Bond Fund | ||||||||||||||||||||

| Class F-2 shares | 2.99 | 2.27 | 3.95 | 0.42 | 0.41 | |||||||||||||||

| Class A shares | –1.12 | 1.26 | 3.34 | 0.65 | 0.64 | |||||||||||||||

| The Tax-Exempt Fund of California | ||||||||||||||||||||

| Class F-2 shares | 3.55 | 1.56 | 2.78 | 0.38 | 0.38 | |||||||||||||||

| Class A shares | –0.50 | 0.62 | 2.24 | 0.57 | 0.57 | |||||||||||||||

| American Funds Tax-Exempt Fund of New York | ||||||||||||||||||||

| Class F-2 shares | 3.28 | 1.49 | 2.40 | 0.48 | 0.42 | |||||||||||||||

| Class A shares | –0.79 | 0.55 | 1.87 | 0.66 | 0.60 | |||||||||||||||

| * | Expense ratios are restated to reflect current fees. |

Past results are not predictive of results in future periods.

For other share class results, refer to capitalgroup.com. A summary of each fund’s 30-day yield can be found on page 5.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which they would have been lower. The investment adviser is currently reimbursing a portion of other expenses for American Funds Short-Term Tax-Exempt Bond Fund and American Funds Tax-Exempt Fund of New York. In addition, the investment adviser is currently waiving a portion of its management fee for American High-Income Municipal Bond Fund. Investment results and the net expense ratios reflect the waiver and reimbursements, without which the results would have been lower and the expense ratios would have been higher. The waiver and reimbursements will be in effect through at least October 1, 2024, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the waiver and/or reimbursements at that time. Refer to capitalgroup.com for more information.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

We are pleased to present this annual report for American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York. It covers the 12-month period ended July 31, 2023, the conclusion of the funds’ fiscal year.

Gross domestic product (GDP) grew over the last 12 months, but at lower levels each quarter. Higher-than-desirable inflation was a persistent tailwind. To combat inflationary forces and to help put the economy on more stable footing, the Federal Reserve raised the federal funds rate for six straight meetings before pausing momentarily in June. By the end of the fiscal year, rates rose to 5% from 3%.

The municipal market remained resilient despite the headwinds created by higher interest rates. Yields on AAA-rated bonds reached levels not seen since 2011. As a result, investor demand for municipal bonds increased, helping to create a constructive environment for municipal portfolios. Total annual returns for Capital Group’s municipal funds ranged from –0.26% for American High-Income Municipal Bond Fund to 0.69% for The Tax-Exempt Fund of New York.

Economic and market overview

At the start of the fiscal year, consumer spending remained resilient despite relatively high inflation and a volatile stock market that tipped into bear market territory. But high prices began to eat into consumer budgets in the latter half of the period, causing many consumers to pull back on spending.

Personal spending dynamics could impact the fiscal health of state and local governments, which are already navigating a transition from federal pandemic aid and facing slowing tax revenue gains attributable to moderating growth as well as inflationary spending pressures. Though the Fed paused its rate hikes at the end of this fiscal year, the central bank indicated it would raise rates further if needed to combat ongoing inflation.

Year-to-date gross tax-exempt issuance was $208 billion through July 31, according to Refinitiv, about $39 billion less than the same period in 2022. For the fiscal year, the Bloomberg High Yield Municipal Bond Index (a market value-weighted index composed of municipal bonds rated below BBB/Baa) fell by –0.2%, lagging the 0.93% gain of the Bloomberg Municipal Bond Index, a measure of the long-term investment-grade (bonds rated BBB/Baa and above) tax-exempt market.

Inside the funds

Due to an environment of higher interest rates and the possibility of recession, fund managers decided to maintain a higher cash position compared to recent years, enabling the funds to take advantage of opportunities that might present themselves despite volatile markets. Fund holdings have been underweight at the front end of the yield curve as valuations have remained less attractive. With an inverted municipal yield curve, curve positioning continues to be an area of focus.

| American Funds Tax-Exempt Funds | 1 |

Looking ahead

Credit fundamentals in the municipal market still look strong, but optimism is tempered by ongoing concerns over stubborn inflation, Federal Reserve movements and a potential recession. Longer term, fund managers will continue to monitor inflation’s impact across existing and prospective holdings while also balancing fundamental views when considering municipal bond valuations. The focus remains on identifying credits with attractive risk-adjusted potential returns.

Thank you for your support. We endeavor to be responsible custodians of your capital.

Sincerely,

Mark Marinella

President, American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America

Chad M. Rach

President, American High-Income Municipal Bond Fund

Jerome Solomon

President, American Funds Tax-Exempt Fund of New York

Karl J. Zeile

President, The Tax-Exempt Bond Fund of America and The Tax-Exempt Fund of California

September 12, 2023

For current information about the funds, refer to capitalgroup.com.

Past results are not predictive of results in future periods.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness.

| 2 | American Funds Tax-Exempt Funds |

For periods ended July 31, 2023, with all distributions reinvested.

| Cumulative total returns | Average annual total returns | |||||||||||||||

| 1 year | 5 years | 10 years | Lifetime (from Class A inception) | |||||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | ||||||||||||||||

| Class F-2 shares | 0.51 | % | 0.93 | % | 0.87 | % | 1.13 | % | ||||||||

| Class A shares (since 8/7/09) | 0.40 | 0.82 | 0.80 | 1.06 | ||||||||||||

| Bloomberg Municipal Short 1–5 Years Index | 0.22 | 1.09 | 1.16 | 1.46 | ||||||||||||

| Lipper Short Municipal Debt Funds Average | 1.17 | 0.84 | 0.77 | 0.98 | ||||||||||||

| Limited Term Tax-Exempt Bond Fund of America | ||||||||||||||||

| Class F-2 shares | 0.55 | 1.36 | 1.62 | 3.56 | ||||||||||||

| Class A shares (since 10/6/93) | 0.31 | 1.13 | 1.41 | 3.36 | ||||||||||||

| Bloomberg Municipal Short-Intermediate 1–10 years Index | 0.42 | 1.51 | 1.79 | 3.62 | ||||||||||||

| Lipper Short-Intermediate Municipal Debt Funds Average | 0.43 | 1.01 | 1.22 | 2.91 | ||||||||||||

| The Tax-Exempt Bond Fund of America | ||||||||||||||||

| Class F-2 shares | 0.66 | 1.72 | 2.85 | 5.95 | ||||||||||||

| Class A shares (since 10/3/79) | 0.48 | 1.55 | 2.69 | 5.80 | ||||||||||||

| Bloomberg Municipal Bond Index | 0.93 | 1.87 | 2.81 | — | * | |||||||||||

| Lipper General & Insured Municipal Debt Funds Average | –0.01 | 1.29 | 2.56 | 5.65 | ||||||||||||

| American High-Income Municipal Bond Fund | ||||||||||||||||

| Class F-2 shares | –0.26 | 2.29 | 4.15 | 5.11 | ||||||||||||

| Class A shares (since 9/26/94) | –0.49 | 2.05 | 3.94 | 4.91 | ||||||||||||

| Bloomberg Municipal Bond Index | 0.93 | 1.87 | 2.81 | 4.65 | ||||||||||||

| Bloomberg High Yield Municipal Bond Index | –0.20 | 2.85 | 4.46 | — | * | |||||||||||

| Lipper High Yield Municipal Debt Funds Average | –1.50 | 1.31 | 3.48 | 4.44 | ||||||||||||

| The Tax-Exempt Fund of California | ||||||||||||||||

| Class F-2 shares | 0.67 | 1.59 | 2.91 | 5.02 | ||||||||||||

| Class A shares (since 10/28/86) | 0.49 | 1.41 | 2.76 | 4.88 | ||||||||||||

| Bloomberg California Municipal Index | 1.05 | 1.80 | 2.96 | — | * | |||||||||||

| Lipper California Municipal Debt Funds Average | –0.22 | 1.12 | 2.84 | 4.88 | ||||||||||||

| American Funds Tax-Exempt Fund of New York | ||||||||||||||||

| Class F-2 shares | 0.69 | 1.49 | 2.55 | 2.82 | ||||||||||||

| Class A shares (since 11/1/10) | 0.51 | 1.31 | 2.41 | 2.69 | ||||||||||||

| Bloomberg New York Municipal Index | 1.41 | 1.76 | 2.73 | 2.78 | ||||||||||||

| Lipper New York Municipal Debt Funds Average | 0.46 | 1.24 | 2.51 | 2.45 | ||||||||||||

| * | This index did not exist at the fund’s inception. |

| American Funds Tax-Exempt Funds | 3 |

Past results are not predictive of results in future periods.

Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on the results of the original share class of the fund without a sales charge, adjusted for typical estimated expenses. Refer to capitalgroup.com for more information on specific expense adjustments and the actual dates of first sale.

Bloomberg Municipal Short 1–5 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. Bloomberg Short-Intermediate 1–10 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. Bloomberg Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. Bloomberg High Yield Municipal Bond Index is a market value-weighted index composed of municipal bonds rated below BBB/Baa. Bloomberg California Municipal Index is a market value-weighted index that includes only investment-grade (rated BBB/Baa and above) tax-exempt bonds of issuers within the state of California. Bloomberg New York Municipal Index is a market value-weighted index that includes only investment-grade (rated BBB/Baa and above) tax-exempt bonds of issuers within the state of New York.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

| 4 | American Funds Tax-Exempt Funds |

Fund results shown in this report, unless otherwise indicated, are for Class F-2 shares. Class A share results are shown at net asset value unless otherwise indicated. If a sales charge had been deducted from Class A shares (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

Funds’ 30-day yields

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class F-2 and Class A shares as of July 31, 2023. For Class A shares both results reflect the maximum sales charge (2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York). Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ.

| SEC 30-day yield | 12-month | |||||||||||

| Net | Gross | distribution rate | ||||||||||

| American Funds Short-Term Tax-Exempt Bond Fund | ||||||||||||

| Class F-2 shares | 2.78 | % | 2.77 | % | 1.93 | % | ||||||

| Class A shares | 2.59 | 2.58 | 1.77 | |||||||||

| Limited Term Tax-Exempt Bond Fund of America | ||||||||||||

| Class F-2 shares | 2.80 | 2.78 | 1.93 | |||||||||

| Class A shares | 2.50 | 2.48 | 1.65 | |||||||||

| The Tax-Exempt Bond Fund of America | ||||||||||||

| Class F-2 shares | 3.43 | 3.43 | 2.74 | |||||||||

| Class A shares | 3.12 | 3.12 | 2.47 | |||||||||

| American High-Income Municipal Bond Fund | ||||||||||||

| Class F-2 shares | 4.34 | 4.32 | 3.84 | |||||||||

| Class A shares | 3.96 | 3.95 | 3.48 | |||||||||

| The Tax-Exempt Fund of California | ||||||||||||

| Class F-2 shares | 3.34 | 3.34 | 2.76 | |||||||||

| Class A shares | 3.03 | 3.03 | 2.48 | |||||||||

| American Funds Tax-Exempt Fund of New York | ||||||||||||

| Class F-2 shares | 3.57 | 3.47 | 2.84 | |||||||||

| Class A shares | 3.27 | 3.17 | 2.56 | |||||||||

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the funds’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower and net expenses higher. Refer to capitalgroup.com for more information.

This report must be preceded or accompanied by a prospectus or summary prospectus for American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York.

| American Funds Tax-Exempt Funds | 5 |

American Funds Short-Term Tax-Exempt Bond Fund

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The fund registered a total return of 0.51% for the fiscal year, beating the 0.22% return posted by the Bloomberg Municipal Short 1–5 Years Index, a market value-weighted index that includes investment-grade (rated BBB/Baa and above) tax-exempt bonds with maturities of one to five years. The fund lagged the 1.17% return of the Lipper Short Municipal Debt Funds Average, a peer group measure. For the fiscal year, the fund paid a monthly dividend totaling about 19 cents a share.

The Federal Reserve Bank’s continued interest rate increases prompted managers to decrease the interest rate sensitivity of the portfolio with a strategy featuring a mix of shorter maturity bonds, cash and Treasury futures to help preserve shareholder principal. The portfolio benefited from having a relatively smaller allocation of bonds with two-year maturities compared to the benchmark’s holdings. A heavier weighting than its benchmark in the housing sector contributed to the fund’s relative returns, while holdings in the health care sector slightly detracted from results.

The fund uses derivatives to manage its exposure to interest rates and the yield curve. Instruments such as U.S. Treasury futures might be used when cash bonds are unavailable or not attractively priced.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | 0.51 | % | 0.93 | % | 0.87 | % | ||||||

| Class A shares* | –2.16 | 0.30 | 0.55 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| 6 | American Funds Tax-Exempt Funds |

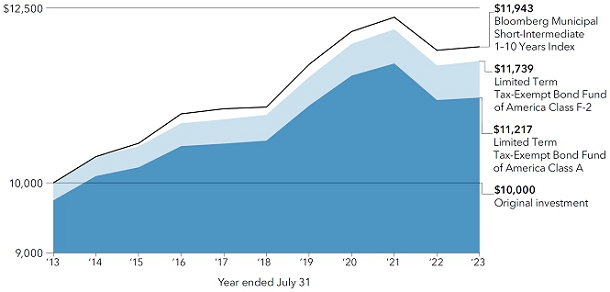

Limited Term Tax-Exempt Bond Fund of America

Limited Term Tax-Exempt Bond Fund of America seeks to provide current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The fund generated a total return of 0.55% for the fiscal year. This beat the 0.42% return posted by the Bloomberg Municipal Short-Intermediate 1–10 Years Index, a market value-weighted index that includes investment-grade (rated BBB/Baa and above) tax-exempt bonds with maturities of one to 10 years. The fund also outpaced the 0.43% return of the Lipper Short-Intermediate Municipal Debt Funds Average, a peer group measure. For the fiscal year, the fund paid a monthly dividend of about 29 cents a share.

The Federal Reserve Bank’s continued interest rate increases prompted managers to decrease the interest rate sensitivity of the portfolio with a strategy featuring a mix of shorter maturity bonds, cash and Treasury futures to help protect shareholder principal. As interest rates rose, municipal valuations became more attractive. As a result, managers started to take advantage of individual investment opportunities with a particular focus on the housing sector.

The fund uses derivatives to manage its exposure to interest rates and the yield curve. Instruments such as U.S. Treasury futures might be used when cash bonds are unavailable or not attractively priced.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | 0.55 | % | 1.36 | % | 1.62 | % | ||||||

| Class A shares* | –2.18 | 0.62 | 1.15 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 2.50% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| American Funds Tax-Exempt Funds | 7 |

The Tax-Exempt Bond Fund of America

The Tax-Exempt Bond Fund of America seeks to provide a high level of current income exempt from federal income tax, consistent with the preservation of capital.

The fund generated a 0.66% total return for the fiscal year, which lagged the 0.93% return of the Bloomberg Municipal Bond Index, a market value-weighted index designed to represent the long-term investment grade (bonds rated BBB/Baa and above) tax-exempt bond market. The fund’s return surpassed the –0.01% total return of the Lipper General & Insured Municipal Debt Funds Average, a peer group measure. For the fiscal year, the fund paid a monthly dividend totaling about 33 cents a share.

Managers started the fiscal year with a portfolio that was relatively less sensitive to interest rates. As rates moved up through the first half of the fiscal year, managers added bonds that were more sensitive to interest rates by reducing the portfolio’s cash position and buying longer maturity bonds and Treasury futures. Given the prolonged inverted yield curve (when short-term bonds yield more than long-term bonds), the portfolio benefited from having a relatively smaller allocation of bonds with maturities of two to 10 years. Allocation to the housing sector was a detractor from returns.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | 0.66 | % | 1.72 | % | 2.85 | % | ||||||

| Class A shares* | –3.33 | 0.78 | 2.30 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| 8 | American Funds Tax-Exempt Funds |

American High-Income Municipal Bond Fund

American High-Income Municipal Bond Fund seeks to provide a high level of current income exempt from regular federal income tax.

The fund fell 0.26% for the fiscal year, lagging the 0.20% decline posted by the Bloomberg High Yield Municipal Bond Index (a market value-weighted index composed of municipal bonds rated below BBB/Baa). By comparison, the Bloomberg Municipal Bond Index, a measure of the investment-grade municipal market, beat both with a return of 0.93%. The fund did fare better than the Lipper High Yield Municipal Debt Funds Average (a peer group measure), which declined 1.50% for the period. For the fiscal year, the fund paid a monthly dividend totaling about 56 cents a share.

At the start of the fiscal year, the portfolio was less sensitive to interest rates compared to the benchmark. As rates moved up through the first half of the fiscal year, managers employed a strategy that reduced cash position and bought longer maturity bonds and Treasury futures to capture opportunities created by those market conditions. The fund was helped by an underweight position (compared to the benchmark) in bonds with maturities of two to 10 years, but allocations to the transportation sector detracted from returns.

The fund uses derivatives to manage its exposure to interest rates and the yield curve. Instruments such as U.S. Treasury futures might be used when cash bonds are unavailable or not attractively priced.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | –0.26 | % | 2.29 | % | 4.15 | % | ||||||

| Class A shares* | –4.24 | 1.28 | 3.55 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| American Funds Tax-Exempt Funds | 9 |

The Tax-Exempt Fund of California

The Tax-Exempt Fund of California seeks to provide a high level of current income exempt from regular federal and California state income taxes. Its secondary objective is preservation of capital.

The fund generated a total return of 0.67% for the 12 months ended July 31, trailing the 1.05% return of the Bloomberg California Municipal Index, a market value-weighted index that includes only investment-grade (rated BBB/Baa and above) tax-exempt bonds of issuers within the state of California. The fund bested the Lipper California Municipal Debt Funds Average, a peer group measure, which fell 0.22%. For the fiscal year, the fund paid a monthly dividend totaling about 45 cents a share.

As the Federal Reserve continued its series of hikes during the second half of the fiscal year, managers began to reduce the fund’s cash position and add longer maturity bonds and Treasury futures to the portfolio in an effort to add securities that would give the portfolio more interest rate exposure. Managers employed this strategy in part to preserve shareholder capital as well as to mitigate risks from any potential future reduction of rates by the Fed.

Overall, the portfolio benefited from having a relatively smaller allocation of bonds with maturities of five- to 10-years. Security selection in education, however, detracted from those returns.

The fund uses derivatives to manage its exposure to interest rates and the yield curve. Instruments such as U.S. Treasury futures might be used when cash bonds are unavailable or not attractively priced.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | 0.67 | % | 1.59 | % | 2.91 | % | ||||||

| Class A shares* | –3.27 | 0.64 | 2.37 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| 10 | American Funds Tax-Exempt Funds |

American Funds Tax-Exempt Fund of New York

American Funds Tax-Exempt Fund of New York seeks to provide a high level of current income exempt from regular federal, New York state and New York City income taxes. Its secondary objective is preservation of capital.

The fund recorded a total return of 0.69% for the fiscal year, lagging the 1.41% posted by Bloomberg New York Municipal Index, a market value-weighted index that includes only investment-grade (rated BBB/Baa and above) tax-exempt bonds of issuers within the state of New York. The fund’s result topped the 0.46% return of the Lipper New York Municipal Debt Funds average, a peer group measure. For the fiscal year, the fund paid a monthly dividend totaling about 28 cents a share.

During a fiscal year dominated by interest rate increases by the Federal Reserve, the portfolio’s mix of securities that were more sensitive to interest rates meant that relative results lagged those compared to the benchmark. Select holdings in the health care sector detracted from fund returns while education bonds proved supportive.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the fund has lagged the index. Bloomberg source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Refinitiv Lipper. Lipper categories are dynamic and averages may have few funds, especially over longer periods. Refer to the Quarterly Statistical Update, available at capitalgroup.com, for the number of funds included in the Lipper category for each fund’s lifetime.

How a hypothetical $10,000 investment has grown

(with all distributions reinvested)

The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a hypothetical $1,000 investment

For periods ended July 31, 2023

| 1 year | 5 years | 10 years | ||||||||||

| Class F-2 shares | 0.69 | % | 1.49 | % | 2.55 | % | ||||||

| Class A shares* | –3.29 | 0.55 | 2.01 | |||||||||

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

| American Funds Tax-Exempt Funds | 11 |

| American Funds Short-Term Tax-Exempt Bond Fund | |

| Investment portfolio July 31, 2023 | |

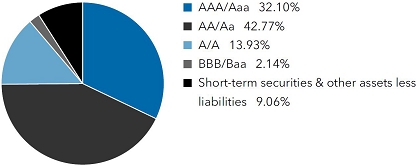

| Portfolio quality summary* | Percent of net assets |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| Bonds, notes & other debt instruments 90.94% | Principal amount (000) | Value (000) | ||||||

| Alabama 3.55% | ||||||||

| City of Alabaster, Board of Education, Special Tax School Warrants, Series 2014-A, Assured Guaranty Municipal insured, 5.00% 9/1/2028 (preref. 9/1/2024) | USD | 500 | $ | 509 | ||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds, Series 2022-B-1, 5.25% 2/1/2053 (put 6/1/2029) | 9,995 | 10,498 | ||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds, Series 2022-B-1, 4.00% 4/1/2053 (put 10/1/2027) | 6,000 | 5,925 | ||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds (Project No. 6), Series 2021-B, 4.00% 10/1/2052 (put 12/1/2026) | 4,500 | 4,456 | ||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Bonds (Project No. 7), Series 2021-C-1, 4.00% 10/1/2052 (put 12/1/2026) | 1,840 | 1,817 | ||||||

| Black Belt Energy Gas Dist., Gas Project Rev. Ref. Bonds, Series 2023-D-1, 5.50% 6/1/2049 (put 2/1/2029) | 3,350 | 3,529 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Prepay Rev. Bonds (Project No. 4), Series 2019-A, 4.00% 12/1/2049 (put 12/1/2025) | 13,965 | 13,904 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Prepay Rev. Bonds (Project No. 5), Series 2020-A-1, 4.00% 10/1/2049 (put 10/1/2026) | 2,875 | 2,858 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2022-D-1, 4.00% 7/1/2052 (put 6/1/2027) | 10,080 | 10,045 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2022-F, 5.50% 11/1/2053 (put 12/1/2028) | 440 | 464 | ||||||

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2023-B, 5.25% 12/1/2053 (put 12/1/2026) | 2,080 | 2,227 | ||||||

| Energy Southeast, Energy Supply Rev. Bonds (A Cooperative Dist.), Series 2023-A-1, 5.50% 11/1/2053 (put 1/1/2031) | 2,500 | 2,692 | ||||||

| Federal Aid Highway Fin. Auth., Special Obligation Rev. Bonds, Series 2017-A, 5.00% 9/1/2029 (preref. 9/1/2027) | 1,000 | 1,084 | ||||||

| Federal Aid Highway Fin. Auth., Special Obligation Rev. Bonds, Series 2016-A, 5.00% 9/1/2033 (preref. 9/1/2026) | 1,500 | 1,594 | ||||||

| Federal Aid Highway Fin. Auth., Special Obligation Rev. Bonds, Series 2017-A, 5.00% 9/1/2035 (preref. 9/1/2027) | 2,410 | 2,614 | ||||||

| Federal Aid Highway Fin. Auth., Special Obligation Rev. Bonds, Series 2016-A, 5.00% 9/1/2036 (preref. 9/1/2026) | 4,500 | 4,781 | ||||||

| City of Hoover, G.O. Warrants, Series 2016, 4.00% 7/1/2033 (preref. 7/1/2026) | 1,000 | 1,031 | ||||||

| Housing Fin. Auth., Multi Family Housing Rev. Bonds (ECG Monrovia Project), Series 2022-A, 2.00% 10/1/2025 (put 10/1/2024) | 2,050 | 2,009 | ||||||

| Housing Fin. Auth., Multi Family Housing Rev. Bonds (Peppertree Place Project), Series 2022-C, 3.25% 11/1/2025 (put 11/1/2024) | 1,575 | 1,564 | ||||||

| County of Jefferson, Limited Obligation Rev. Ref. Bonds, Series 2017, 5.00% 9/15/2023 | 1,500 | 1,502 | ||||||

| South East Gas Supply Dist., Gas Supply Rev. Bonds (Project No. 2), Series 2018-A, 4.00% 6/1/2049 (put 6/1/2024) | 490 | 489 | ||||||

| Southeast Energy Auth., Commodity Supply Rev. Bonds (Project No. 2), Series 2021-B-1, 4.00% 12/1/2051 (put 12/1/2031) | 450 | 438 | ||||||

| Southeast Energy Auth., Commodity Supply Rev. Bonds (Project No. 4), Series 2022-B-1, 5.00% 5/1/2053 (put 8/1/2028) | 2,390 | 2,467 | ||||||

| 78,497 | ||||||||

| Alaska 0.87% | ||||||||

| City of Anchorage, Electric Rev. Ref. Bonds, Series 2014-A, 5.00% 12/1/2041 (preref. 12/1/2024) | 1,000 | 1,023 | ||||||

| Housing Fin. Corp., General Mortgage Rev. Bonds, Series 2020-A, 3.25% 12/1/2044 | 3,210 | 3,107 | ||||||

| Housing Fin. Corp., General Mortgage Rev. Bonds, Series 2016-A, 3.50% 6/1/2046 | 245 | 242 | ||||||

| Housing Fin. Corp., General Mortgage Rev. Bonds, Series 2022-C, 5.75% 12/1/2052 | 1,275 | 1,357 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2022-B, 5.00% 6/1/2026 | 550 | 575 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2022-B, 5.00% 12/1/2026 | 725 | 766 | ||||||

| 12 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Alaska (continued) | ||||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2022-B, 5.00% 6/1/2027 | USD | 590 | $ | 629 | ||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2022-B, 5.00% 12/1/2027 | 600 | 646 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2014-A, 5.00% 12/1/2032 (preref. 12/1/2023) | 1,120 | 1,126 | ||||||

| Housing Fin. Corp., State Capital Project Bonds, Series 2014-A, 5.00% 12/1/2033 (preref. 12/1/2023) | 540 | 543 | ||||||

| International Airport System, Rev. Ref. Bonds, Series 2021-C, AMT, 5.00% 10/1/2026 | 1,500 | 1,563 | ||||||

| International Airport System, Rev. Ref. Bonds, Series 2021-C, AMT, 5.00% 10/1/2027 | 4,060 | 4,287 | ||||||

| International Airport System, Rev. Ref. Bonds, Series 2021-C, AMT, 5.00% 10/1/2029 | 3,185 | 3,446 | ||||||

| 19,310 | ||||||||

| Arizona 1.02% | ||||||||

| Bullhead City, Excise Taxes Rev. Obligations, Series 2021-2, 0.75% 7/1/2025 | 650 | 606 | ||||||

| Industrial Dev. Auth., Education Rev. Bonds (GreatHearts Arizona Projects), Series 2021-A, 5.00% 7/1/2025 | 145 | 150 | ||||||

| Industrial Dev. Auth., Hospital Rev. Bonds (Phoenix Children’s Hospital), Series 2021-A, 5.00% 2/1/2026 | 1,200 | 1,248 | ||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 8/1/2023 | 1,875 | 1,875 | ||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 8/1/2024 | 1,445 | 1,470 | ||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 11/1/2024 | 825 | 843 | ||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 8/1/2025 | 1,675 | 1,734 | ||||||

| Industrial Dev. Auth., Rev. Bonds (Lincoln South Beltway Project), Series 2020, 5.00% 11/1/2025 | 1,500 | 1,561 | ||||||

| County of Maricopa, Industrial Dev. Auth., Rev. Bonds (Banner Health), Series 2023-A, 5.00% 1/1/2053 (put 5/15/2028) | 6,695 | 7,204 | ||||||

| County of Maricopa, Industrial Dev. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2001, AMT, 3.375% 12/1/2031 (put 6/3/2024) | 900 | 895 | ||||||

| City of Phoenix Civic Improvement Corp., Airport Rev. Bonds, Series 2019-B, AMT, 5.00% 7/1/2025 | 2,025 | 2,070 | ||||||

| City of Phoenix Civic Improvement Corp., Water System Rev. Ref. Bonds, Series 2014-B, 5.00% 7/1/2024 | 155 | 157 | ||||||

| City of Phoenix Civic Improvement Corp., Water System Rev. Ref. Bonds, Series 2014-B, 5.00% 7/1/2026 | 830 | 842 | ||||||

| County of Pima, Sewer System Rev. and Rev. Ref. Obligations, Series 2022, 5.00% 7/1/2027 | 1,115 | 1,202 | ||||||

| Board of Regents of the Arizona State University System, Rev. Bonds, Series 2020-A, 5.00% 7/1/2026 | 300 | 318 | ||||||

| County of Yavapai, Industrial Dev. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2002, AMT, 1.30% 6/1/2027 | 450 | 404 | ||||||

| 22,579 | ||||||||

| California 9.31% | ||||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2018-A, 2.625% 4/1/2045 (put 4/1/2026) | 2,000 | 1,945 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2017-G, 2.00% 4/1/2053 (put 4/1/2024) | 5,200 | 5,131 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2021-D, (SIFMA Municipal Swap Index + 0.30%) 4.28% 4/1/2056 (put 4/1/2027)1 | 1,200 | 1,166 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Bonds, Series 2021-C, (SIFMA Municipal Swap Index + 0.45%) 4.43% 4/1/2056 (put 4/1/2026)1 | 730 | 719 | ||||||

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2014-S-6, 5.00% 10/1/2054 (preref. 10/1/2024) | 1,540 | 1,574 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2017-A, 5.00% 11/1/2026 | 3,815 | 4,080 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-A, 5.00% 11/1/2027 | 3,620 | 3,837 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-B-2, 0.55% 11/1/2049 (put 11/1/2026) | 945 | 840 | ||||||

| Trustees of the California State University, Systemwide Rev. Bonds, Series 2016-B-3, 4.00% 11/1/2051 (put 11/1/2023) | 1,550 | 1,550 | ||||||

| Carlsbad Unified School Dist., G.O. Bonds, 2018 Election, Series 2021-B, 2.00% 8/1/2023 | 205 | 205 | ||||||

| Carlsbad Unified School Dist., G.O. Bonds, 2018 Election, Series 2021-B, 2.00% 8/1/2024 | 195 | 192 | ||||||

| Coachella Valley Water Dist., Drinking Water System Rev. Notes, Series 2022-A, 1.375% 6/1/2025 | 3,000 | 2,857 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2021-B-1, 4.00% 2/1/2052 (put 8/1/2031) | 1,160 | 1,154 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2023-B-1, 5.00% 7/1/2053 (put 8/1/2029) | 9,390 | 9,855 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2021-B-1, 5.00% 12/1/2053 (put 8/1/2029) | 3,795 | 3,962 | ||||||

| Community Choice Fncg. Auth., Clean Energy Project Rev. Green Bonds, Series 2023-D, 5.50% 5/1/2054 (put 8/1/2028) | 1,500 | 1,583 | ||||||

| East Side Union High School Dist., G.O. Bonds, 2014 Election, Series 2023-D, 5.00% 8/1/2026 | 3,600 | 3,829 | ||||||

| East Side Union High School Dist., G.O. Bonds, 2014 Election, Series 2023-D, 5.00% 8/1/2027 | 2,555 | 2,782 | ||||||

| American Funds Tax-Exempt Funds | 13 |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| California (continued) | ||||||||

| Educational Facs. Auth., Rev. Bonds (University of Southern California), Series 2009-C, 5.25% 10/1/2024 (escrowed to maturity) | USD | 165 | $ | 169 | ||||

| County of El Dorado, Community Facs. Dist. No. 1992-1 (El Dorado Hills Dev.), Special Tax Rev. Ref. Bonds, Series 2012, 5.00% 9/1/2025 | 1,560 | 1,562 | ||||||

| City of Fontana, Public Facs. Fin. Auth., Special Tax Rev. Ref. Bonds, Series 2021-A, 4.00% 9/1/2023 | 160 | 160 | ||||||

| Fresno Unified School Dist., G.O. Bonds, 2010 Election, Series 2013-C, 5.50% 8/1/2046 | 5,000 | 5,000 | ||||||

| Fresno Unified School Dist., G.O. Bonds, 2016 Election, Series 2021-D, 2.00% 8/1/2024 | 135 | 133 | ||||||

| G.O. Rev. Ref. Bonds, Series 2022, 5.00% 9/1/2024 | 5,000 | 5,105 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 9/1/2027 | 4,505 | 4,901 | ||||||

| G.O. Rev. Ref. Bonds, Series 2021, 5.00% 12/1/2027 | 1,285 | 1,406 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019, 5.00% 4/1/2029 | 120 | 135 | ||||||

| G.O. Rev. Ref. Bonds, Series 2018-C, 5.00% 8/1/2030 | 2,005 | 2,232 | ||||||

| G.O. Rev. Ref. Bonds, Series 2016, 4.00% 9/1/2031 | 1,305 | 1,347 | ||||||

| Golden State Tobacco Securitization Corp., Enhanced Tobacco Settlement Asset-Backed Bonds, Series 2017-A-1, 5.00% 6/1/2028 (preref. 6/1/2027) | 1,570 | 1,702 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Providence St. Joseph Health), Series 2019-B, 5.00% 10/1/2039 (put 10/1/2027) | 1,000 | 1,056 | ||||||

| Health Facs. Fncg. Auth., Rev. Bonds (Stanford Health Care), Series 2021-A, 3.00% 8/15/2054 (put 8/15/2025) | 5,285 | 5,271 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Lucile Salter Packard Children’s Hospital at Stanford), Series 2022-A, 5.00% 5/15/2024 | 405 | 410 | ||||||

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (Lucile Salter Packard Children’s Hospital at Stanford), Series 2022-A, 5.00% 5/15/2025 | 690 | 711 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Bonds (Brightline West Passenger Rail Project), Series 2020-A, AMT, 3.65% 1/1/2050 (put 1/31/2024)2 | 4,600 | 4,581 | ||||||

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (Los Angeles County Museum of Art Project), Series 2021-B, 4.68% 12/1/2050 (put 6/1/2026)1 | 945 | 920 | ||||||

| City of Inglewood, Successor Agcy. to the Redev. Agcy., Tax Allocation Bonds (Merged Redev. Project), Series 2017-A, BAM insured, 5.00% 5/1/2028 | 1,490 | 1,593 | ||||||

| City of Irvine, Reassessment Dist. No. 12-1, Limited Obligation Improvement Bonds, Series 2015, 5.00% 9/2/2029 | 1,600 | 1,648 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2022-C, AMT, 5.00% 5/15/2026 | 3,500 | 3,645 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 5/15/2027 | 1,230 | 1,304 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 5/15/2028 | 1,250 | 1,343 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. and Rev. Ref. Bonds, Series 2022-C, AMT, 5.00% 5/15/2028 | 1,350 | 1,451 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2020-C, AMT, 5.00% 5/15/2026 | 3,605 | 3,755 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2015-D, AMT, 5.00% 5/15/2027 | 1,005 | 1,030 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2018-D, AMT, 5.00% 5/15/2027 | 2,000 | 2,121 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2022-A, AMT, 5.00% 5/15/2027 | 2,475 | 2,625 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2019-F, AMT, 5.00% 5/15/2028 | 3,615 | 3,885 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Bonds, Series 2022-G, AMT, 5.00% 5/15/2028 | 2,100 | 2,257 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Ref. Bonds, Series 2018-B, AMT, 5.00% 5/15/2027 | 1,000 | 1,061 | ||||||

| City of Los Angeles, Dept. of Airports, Los Angeles International Airport, Rev. Ref. Green Bonds, Series 2023-A, AMT, 5.00% 5/15/2028 | 750 | 806 | ||||||

| City of Los Angeles, Dept. of Water and Power, Power System Rev. Bonds, Series 2023-A, 5.00% 7/1/2027 | 5,480 | 5,969 | ||||||

| City of Los Angeles, Wastewater System Rev. Ref. Bonds, Series 2022-C, 5.00% 6/1/2026 | 500 | 530 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Mortgage Rev. Bonds (Long Beach Senior Housing), Series 2022, 2.00% 2/1/2026 (put 2/1/2025) | 1,240 | 1,194 | ||||||

| County of Los Angeles, Dev. Auth., Multi Family Housing Rev. Bonds (Cantamar Villas), Series 2021-D-1, 0.30% 2/1/2025 (put 2/1/2024) | 2,070 | 2,024 | ||||||

| County of Los Angeles, Metropolitan Transportation Auth., Measure R Sales Tax Rev. Ref. Green Bonds, Series 2020-A, 5.00% 6/1/2024 | 120 | 122 | ||||||

| 14 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| California (continued) | ||||||||

| County of Los Angeles, Metropolitan Transportation Auth., Measure R Sales Tax Rev. Ref. Green Bonds, Series 2020-A, 5.00% 6/1/2027 | USD | 1,000 | $ | 1,087 | ||||

| Los Angeles Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Bonds, Series 2020-C, 5.00% 7/1/2025 | 2,100 | 2,183 | ||||||

| Los Angeles Unified School Dist., G.O. Dedicated Unlimited Ad Valorem Property Tax Bonds, Series 2020-C, 5.00% 7/1/2026 | 1,295 | 1,378 | ||||||

| Municipal Fin. Auth., Multi Family Housing Rev. Bonds (Walnut Apartments), Series 2021-A, 0.45% 12/1/2024 (put 12/1/2023) | 940 | 926 | ||||||

| Municipal Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2019-A, AMT, 2.40% 10/1/2044 (put 10/1/2029) | 5,280 | 4,766 | ||||||

| Municipal Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2017-A, AMT, 0.70% 12/1/2044 (put 12/1/2023) | 1,150 | 1,134 | ||||||

| New Haven Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, Series 2008-C, Assured Guaranty insured, 0% 8/1/2029 | 7,650 | 6,238 | ||||||

| Northern California Energy Auth., Commodity Supply Rev. Bonds, Series 2018, 4.00% 7/1/2049 (put 7/1/2024) | 6,000 | 6,014 | ||||||

| Port of Oakland, Rev. Ref. Bonds, Series 2021-H, AMT, 5.00% 5/1/2028 | 2,770 | 2,940 | ||||||

| Port of Oakland, Rev. Ref. Bonds, Series 2021-H, AMT, 5.00% 5/1/2029 | 615 | 662 | ||||||

| Public Fin. Auth., Rev. Bonds (Henry Mayo Newhall Memorial Hospital), Series 2021-A, 4.00% 10/15/2023 | 155 | 155 | ||||||

| Public Works Board, Lease Rev. Bonds (Dept. of Corrections, Various State Prisons), Series 2017-D, 5.00% 9/1/2027 | 2,000 | 2,174 | ||||||

| Public Works Board, Lease Rev. Bonds (Various Capital Projects), Series 2016-C, 4.00% 11/1/2031 | 1,560 | 1,604 | ||||||

| Rialto Unified School Dist., G.O. Bonds, 2022 Election, Series 2023, BAM insured, 0% 8/1/2030 | 340 | 269 | ||||||

| City of Sacramento, Community Facs. Dist. No. 4 (North Natomas), Special Tax Rev. Ref. Bonds, Series 2013-E, 5.25% 9/1/2025 | 1,565 | 1,567 | ||||||

| City of Sacramento, Municipal Utility Dist., Electric Rev. Ref. Bonds, Series 2023-D, 5.00% 8/15/2049 (put 7/13/2023) | 5,245 | 5,944 | ||||||

| Sacramento Unified School Dist., G.O. Rev. Ref. Bonds, Series 2014, BAM insured, 5.00% 7/1/2024 | 1,300 | 1,321 | ||||||

| Sacramento Unified School Dist., G.O. Rev. Ref. Bonds, Series 2022, BAM insured, 5.00% 7/1/2027 | 685 | 743 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 3.00% 9/1/2023 | 850 | 850 | ||||||

| City of San Diego, Community Facs. Dist. No. 2 (Santaluz), Improvement Area No. 1, Special Tax Rev. Ref. Bonds, Series 2021, 3.00% 9/1/2024 | 115 | 114 | ||||||

| County of San Diego, Regional Airport Auth., Airport Rev. Ref. Bonds, Series 2020-C, AMT, 5.00% 7/1/2024 | 1,000 | 1,010 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Rev. Bonds, Series 2022-A, AMT, 5.00% 5/1/2025 | 5,990 | 6,112 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Rev. Bonds, Series 2018-G, AMT, 5.00% 5/1/2027 | 780 | 819 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Rev. Bonds, Series 2023-A-2, AMT, 5.00% 5/1/2029 | 2,115 | 2,286 | ||||||

| City and County of San Francisco, Airport Commission, San Francisco International Airport, Special Facs. Lease Rev. Bonds (SFO Fuel Co., LLC), Series 2019-A, AMT, 5.00% 1/1/2026 | 1,500 | 1,547 | ||||||

| City and County of San Francisco, G.O. Rev. Ref. Bonds, Series 2020-R-2, 5.00% 6/15/2024 | 2,785 | 2,832 | ||||||

| City and County of San Francisco, Public Utilities Commission, Wastewater Rev. Green Bonds, Series 2023-C, 4.00% 10/1/2048 (put 10/1/2029) | 5,150 | 5,441 | ||||||

| Santa Margarita Water Dist., Community Facs. Dist. No. 99-1 (Talega), Special Tax Rev. Ref. Bonds, Series 2014-B, 5.00% 9/1/2029 | 1,150 | 1,171 | ||||||

| Southern California Public Power Auth., Rev. Ref. Green Bonds (Milford Wind Corridor Phase II Project), Series 2021-1, 5.00% 7/1/2025 | 115 | 120 | ||||||

| Statewide Communities Dev. Auth., Pollution Control Rev. Ref. Bonds (Southern California Edison Co.), Series 2006-D, 2.625% 11/1/2033 (put 12/1/2023) | 330 | 328 | ||||||

| Statewide Communities Dev. Auth., Rev. Ref. Bonds (Enloe Medical Center), Series 2015, 5.00% 8/15/2028 (preref. 2/15/2026) | 250 | 263 | ||||||

| City of Tustin, Community Facs. Dist. No. 06-1 (Tustin Legacy / Columbus Villages), Special Tax Rev. Ref. Bonds, Series 2015-A, 5.00% 9/1/2030 | 2,750 | 2,817 | ||||||

| City of Tustin, Community Facs. Dist. No. 2014-1 (Tustin Legacy / Standard Pacific), Special Tax Bonds, Series 2015-A, 5.00% 9/1/2027 | 200 | 205 | ||||||

| Regents of the University of California, Limited Project Rev. Bonds, Series 2022-S, 5.00% 5/15/2026 | 470 | 498 | ||||||

| Val Verde Unified School Dist., G.O. Bonds, 2012 Election, Series 2013-A, BAM insured, 5.00% 8/1/2042 (preref. 8/1/2023) | 1,500 | 1,500 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2016-B, 3.50% 12/1/2045 | 365 | 362 | ||||||

| Dept. of Veterans Affairs, Home Purchase Rev. Bonds, Series 2022-A, 5.50% 12/1/2052 | 1,665 | 1,785 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2019-CS, 4.00% 12/1/2049 | 1,730 | 1,720 | ||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2020-CT, 3.00% 12/1/2050 | 4,060 | 3,944 | ||||||

| American Funds Tax-Exempt Funds | 15 |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| California (continued) | ||||||||

| Dept. of Veterans Affairs, Veterans G.O. Bonds, Series 2022-CU, 5.50% 12/1/2052 | USD | 375 | $ | 419 | ||||

| Walnut Valley Unified School Dist., G.O. Bonds, Capital Appreciation Bonds, 2007 Election, Series 2011-B, BAM insured, 0% 8/1/2031 | 1,030 | 759 | ||||||

| Dept. of Water Resources, Water System Rev. Bonds (Central Valley Project), Series 2016-AW, 5.00% 12/1/2033 (preref. 12/1/2026) | 230 | 246 | ||||||

| Dept. of Water Resources, Water System Rev. Bonds (Central Valley Project), Series 2017-AX, 5.00% 12/1/2033 (preref. 12/1/2027) | 245 | 269 | ||||||

| William S. Hart Union High School Dist., G.O. Bonds, Capital Appreciation Bonds, 2001 Election, Series 2005-B, Assured Guaranty Municipal insured, 0% 9/1/2025 | 5,000 | 4,650 | ||||||

| 205,597 | ||||||||

| Colorado 2.03% | ||||||||

| Certs. of Part., Series 2021-A, 5.00% 12/15/2025 | 1,000 | 1,043 | ||||||

| Board of Governors of the Colorado State University System, System Enterprise Rev. and Rev. Ref. Bonds, Series 2016-B, 5.00% 3/1/2041 (preref. 3/1/2027) | 1,530 | 1,644 | ||||||

| City and County of Denver, Airport System Rev. Bonds, Series 2022-A, AMT, 5.00% 11/15/2027 | 6,305 | 6,700 | ||||||

| City and County of Denver, Airport System Rev. Bonds, Series 2022-A, AMT, 5.00% 11/15/2028 | 4,500 | 4,842 | ||||||

| City and County of Denver, Airport System Rev. Bonds, Series 2022-B, 5.00% 11/15/2028 | 125 | 138 | ||||||

| City and County of Denver, Dept. of Aviation, Airport System Rev. Bonds, Series 2018-A, AMT, 5.00% 12/1/2027 | 1,500 | 1,588 | ||||||

| City and County of Denver, Dept. of Aviation, Airport System Rev. Bonds, Series 2022-A, AMT, 5.00% 11/15/2029 | 2,000 | 2,176 | ||||||

| E-470 Public Highway Auth., Rev. Bonds, Series 2021-B, (USD-SOFR x 0.67 + 0.35%) 3.901% 9/1/2039 (put 9/1/2024)1 | 645 | 643 | ||||||

| Health Facs. Auth., Hospital Rev. Bonds (Sanford), Series 2019-A, 5.00% 11/1/2028 | 1,000 | 1,089 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2017-C, Class I, 4.00% 5/1/2048 | 665 | 660 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2018-B-1, Class I, 4.00% 11/1/2048 | 590 | 585 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2018-C, Class I, 4.25% 11/1/2048 | 455 | 454 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2019-C, Class I, 4.25% 5/1/2049 | 3,350 | 3,341 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2019-E, Class I, 4.25% 5/1/2049 | 965 | 963 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2021-E, Class I, 3.00% 11/1/2051 | 1,950 | 1,877 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2021-L, Class I, 3.25% 11/1/2051 | 1,955 | 1,892 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2022-B, Class I, 3.25% 5/1/2052 | 5,680 | 5,494 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2022-E, Class I, 5.25% 11/1/2052 | 5,425 | 5,612 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2023-I, Class III, 6.00% 5/1/2053 | 2,880 | 3,153 | ||||||

| Regents of the University of Colorado, University Enterprise Rev. and Rev. Ref. Bonds, Series 2019-C, 2.00% 6/1/2054 (put 10/15/2024) | 1,000 | 976 | ||||||

| 44,870 | ||||||||

| Connecticut 1.33% | ||||||||

| Town of East Hartford, Housing Auth., Multi Family Housing Rev. Bonds (Summerfield Townhouses Project), Series 2022-A, 4.25% 2/1/2027 (put 2/1/2025) | 3,000 | 3,003 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Hartford Healthcare Issue), Series 2021-A, 5.00% 7/1/2028 | 925 | 992 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Stamford Hospital Issue), Series 2022-M, 5.00% 7/1/2025 | 160 | 163 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2003-X-2, 0.25% 7/1/2037 (put 2/9/2024) | 265 | 260 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2014-A, 2.80% 7/1/2048 (put 2/10/2026) | 5,000 | 4,897 | ||||||

| Health and Educational Facs. Auth., Rev. Bonds (Yale University Issue), Series 2010-A-3, 0.25% 7/1/2049 (put 2/9/2024) | 2,280 | 2,236 | ||||||

| Higher Education Supplemental Loan Auth., Rev. Bonds (Chesla Loan Program), Series 2021-B, AMT, 5.00% 11/15/2027 | 750 | 786 | ||||||

| Higher Education Supplemental Loan Auth., Rev. Bonds (Chesla Loan Program), Series 2021-B, AMT, 5.00% 11/15/2028 | 545 | 578 | ||||||

| Higher Education Supplemental Loan Auth., Rev. Bonds (Chesla Loan Program), Series 2021-B, AMT, 5.00% 11/15/2029 | 560 | 600 | ||||||

| Higher Education Supplemental Loan Auth., Rev. Bonds (Chesla Loan Program), Series 2021-B, AMT, 5.00% 11/15/2030 | 440 | 475 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2018-A-2, AMT, 4.00% 11/15/2041 | 1,405 | 1,385 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2018-E-1, 4.25% 5/15/2042 | 895 | 892 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2019-F-1, 3.50% 11/15/2043 | 655 | 641 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2014-C-1, 4.00% 11/15/2044 | 75 | 75 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2016-A-1, 4.00% 11/15/2045 | 200 | 199 | ||||||

| 16 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Connecticut (continued) | ||||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2016-E-1, 3.50% 11/15/2046 | USD | 255 | $ | 252 | ||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-A-1, 4.00% 11/15/2047 | 1,985 | 1,971 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-C-1, 4.00% 11/15/2047 | 1,015 | 1,008 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2017-D-1, 4.00% 11/15/2047 | 1,210 | 1,201 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2021-B-1, 3.00% 11/15/2049 | 1,510 | 1,451 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2022-C-4, (SIFMA Municipal Swap Index + 0.625%) 4.61% 5/15/2051 (put 11/15/2024)1 | 3,860 | 3,859 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2022-A-1, 3.50% 11/15/2051 | 765 | 746 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-A, 3.50% 11/15/2044 | 255 | 254 | ||||||

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-C-1, 3.50% 11/15/2045 | 335 | 332 | ||||||

| Special Tax Obligation Bonds (Transportation Infrastructure Purposes), Series 2022-A, 5.00% 7/1/2028 | 1,000 | 1,102 | ||||||

| 29,358 | ||||||||

| Delaware 0.22% | ||||||||

| G.O. Bonds, Series 2014-B, 4.00% 7/1/2024 | 1,000 | 1,007 | ||||||

| G.O. Bonds, Series 2021, 5.00% 2/1/2031 | 130 | 152 | ||||||

| G.O. Rev. Ref. Bonds, Series 2019-A, 5.00% 10/1/2028 | 3,400 | 3,783 | ||||||

| 4,942 | ||||||||

| District of Columbia 1.51% | ||||||||

| G.O. Bonds, Series 2023-A, 5.00% 1/1/2027 | 2,525 | 2,699 | ||||||

| G.O. Bonds, Series 2015-A, 5.00% 6/1/2032 | 2,930 | 3,019 | ||||||

| Housing Fin. Agcy., Collateralized Multi Family Housing Rev. Bonds (Kenilworth 166 Apartments Project), Series 2021, 1.25% 6/1/2025 (put 12/1/2024) | 7,395 | 7,111 | ||||||

| Housing Fin. Agcy., Collateralized Multi Family Housing Rev. Bonds (Paxton Project), Series 2022, 4.00% 9/1/2040 (put 9/1/2025) | 1,000 | 1,003 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. and Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 10/1/2025 | 4,000 | 4,110 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. and Rev. Ref. Bonds, Series 2017-A, AMT, 5.00% 10/1/2026 | 1,000 | 1,044 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. and Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 10/1/2026 | 1,500 | 1,566 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. and Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 10/1/2028 | 3,410 | 3,663 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2021-A, AMT, 5.00% 10/1/2023 | 1,915 | 1,919 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2019-A, AMT, 5.00% 10/1/2024 | 1,000 | 1,015 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2020-A, AMT, 5.00% 10/1/2025 | 1,000 | 1,027 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2022-A, AMT, 5.00% 10/1/2025 | 900 | 925 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2022-A, AMT, 5.00% 10/1/2026 | 2,000 | 2,089 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2020-B, AMT, 5.00% 10/1/2027 | 1,000 | 1,061 | ||||||

| Metropolitan Washington DC Airports Auth., Airport System Rev. Ref. Bonds, Series 2022-A, AMT, 5.00% 10/1/2027 | 490 | 520 | ||||||

| Rev. Ref. Bonds (National Public Radio, Inc. Issue), Series 2016, 5.00% 4/1/2028 (preref. 4/1/2026) | 230 | 242 | ||||||

| Rev. Ref. Bonds (National Public Radio, Inc. Issue), Series 2016, 5.00% 4/1/2029 (preref. 4/1/2026) | 225 | 237 | ||||||

| Water and Sewer Auth., Public Utility Rev. Bonds, Series 2014-C, 5.00% 10/1/2025 | 150 | 153 | ||||||

| 33,403 | ||||||||

| Florida 4.19% | ||||||||

| County of Alachua, Health Facs. Auth., Health Facs. Rev. Ref. Bonds, Series 2019-B-1, 4.00% 12/1/2023 | 450 | 450 | ||||||

| County of Broward, Airport System Rev. Bonds, Series 2017, AMT, 5.00% 10/1/2023 | 1,100 | 1,103 | ||||||

| County of Broward, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Solaris Apartments), Series 2021-B, 0.70% 1/1/2025 (put 7/1/2024) | 1,555 | 1,499 | ||||||

| Central Florida Expressway Auth., Rev. Ref. Bonds, Series 2021, Assured Guaranty Municipal insured, 5.00% 7/1/2024 | 885 | 898 | ||||||

| American Funds Tax-Exempt Funds | 17 |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Florida (continued) | ||||||||

| City of Daytona Beach, Housing Auth., Multi Family Housing Rev. Bonds (The WM at the River Project), Series 2021-B, 1.25% 12/1/2025 (put 12/1/2024) | USD | 1,415 | $ | 1,357 | ||||

| Board of Education, Lottery Rev. Ref. Bonds, Series 2016-B, 5.00% 7/1/2027 | 3,175 | 3,342 | ||||||

| Board of Education, Public Education Capital Outlay Bonds, Series 2018-B, 5.00% 6/1/2027 | 1,940 | 2,097 | ||||||

| Fin. Auth., Econ. Dev. Rev. Ref. Bonds (Republic Services, Inc. Project), Series 2010-A, AMT, 4.05% 5/1/2034 (put 12/1/2022) | 8,835 | 8,833 | ||||||

| Greater Orlando Aviation Auth., Airport Facs. Rev. Bonds, Series 2019-A, AMT, 5.00% 10/1/2023 | 1,500 | 1,502 | ||||||

| Greater Orlando Aviation Auth., Airport Facs. Rev. Bonds, Series 2016-A, AMT, 5.00% 10/1/2029 (preref. 10/1/2026) | 1,000 | 1,049 | ||||||

| Greater Orlando Aviation Auth., Airport Facs. Rev. Bonds, Series 2017-A, AMT, 5.00% 10/1/2030 (preref. 10/1/2027) | 1,025 | 1,097 | ||||||

| County of Hillsborough, Aviation Auth., Tampa International Airport Rev. Bonds, Series 2022-A, AMT, 5.00% 10/1/2027 | 6,750 | 7,159 | ||||||

| County of Hillsborough, Aviation Auth., Tampa International Airport Rev. Bonds, Series 2015-A, AMT, 5.00% 10/1/2040 (preref. 10/1/2024) | 3,310 | 3,361 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2017-1, 4.00% 7/1/2048 | 745 | 741 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2018-1, 4.00% 7/1/2049 | 785 | 779 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2018-2, 4.25% 1/1/2050 | 2,280 | 2,273 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2020-2, 3.00% 7/1/2051 | 350 | 338 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2020-1, 3.50% 7/1/2051 | 715 | 700 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2021-2, 3.00% 7/1/2052 | 4,575 | 4,390 | ||||||

| Housing Fin. Corp., Homeowner Mortgage Rev. Bonds, Series 2022-1, 3.50% 7/1/2052 | 875 | 854 | ||||||

| Housing Fin. Corp., Multi Family Mortgage Rev. Bonds (The Canopy at West River Towers 1 & 2), Series 2022-A-2, 3.25% 5/1/2026 (put 5/1/2025) | 4,155 | 4,105 | ||||||

| JEA, Water and Sewer System Rev. Bonds, Series 2020-A, 5.00% 10/1/2023 | 630 | 632 | ||||||

| JEA, Water and Sewer System Rev. Bonds, Series 2020-A, 5.00% 10/1/2024 | 600 | 612 | ||||||

| JEA, Water and Sewer System Rev. Bonds, Series 2020-A, 5.00% 10/1/2025 | 1,540 | 1,600 | ||||||

| JEA, Water and Sewer System Rev. Bonds, Series 2020-A, 5.00% 10/1/2025 | 280 | 291 | ||||||

| County of Lee, Airport Rev. Bonds, Series 2021-B, AMT, 5.00% 10/1/2029 | 350 | 378 | ||||||

| County of Miami-Dade, Expressway Auth., Toll System Rev. Ref. Bonds, Series 2014-B, BAM insured, 5.00% 7/1/2026 | 1,000 | 1,012 | ||||||

| County of Miami-Dade, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Platform 3750), Series 2021, 0.25% 8/1/2024 (put 8/1/2023) | 1,580 | 1,580 | ||||||

| County of Miami-Dade, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Quail Roost Transit Village I), Series 2023, 5.00% 9/1/2026 (put 9/1/2025) | 1,000 | 1,019 | ||||||

| County of Miami-Dade, Multi Family Housing Rev. Bonds (Council Towers Seniors Apartment Homes Project), Series 2023, 5.00% 2/1/2024 | 1,865 | 1,873 | ||||||

| County of Miami-Dade, Seaport Rev. Ref. Bonds, Series 2022-A, AMT, 5.00% 10/1/2030 | 2,670 | 2,919 | ||||||

| County of Orange, Health Facs. Auth., Health Care Facs. Rev. Bonds (Presbyterian Retirement Communities Project), Series 2016, 5.00% 8/1/2047 | 3,495 | 3,600 | ||||||

| County of Orange, Health Facs. Auth., Hospital Rev. Bonds (Orlando Health Obligated Group), Series 2023-A, 5.00% 10/1/2031 | 1,600 | 1,820 | ||||||

| County of Orange, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Dunwoodie Place Apartments), Series 2021-A, 0.20% 9/1/2024 (put 9/1/2023) | 2,160 | 2,152 | ||||||

| County of Orange, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Stratford Point Apartments), Series 2021-B, 0.55% 1/1/2025 (put 7/1/2024) | 2,335 | 2,247 | ||||||

| Orlando Utilities Commission, Utility System Rev. Ref. Bonds, Series 2020-A, 5.00% 10/1/2027 | 1,000 | 1,087 | ||||||

| County of Palm Beach, Housing Fin. Auth., Multi Family Housing Rev. Bonds (Christian Manor), Series 2022, 1.25% 2/1/2025 (put 2/1/2024) | 2,480 | 2,433 | ||||||

| County of Pinellas, Housing Fin. Auth., Multi Family Mortgage Backed Bonds (Jordan Park Apartments), Series 2021-B, 0.65% 1/1/2025 (put 7/1/2024) | 1,225 | 1,180 | ||||||

| County of Polk, Utility System Rev. and Rev. Ref. Bonds, Series 2013, BAM insured, 5.00% 10/1/2043 (preref. 10/1/2023) | 1,670 | 1,675 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 7/1/2024 | 100 | 101 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 7/1/2025 | 75 | 77 | ||||||

| City of Tampa, Hospital Rev. Bonds (H. Lee Moffitt Cancer Center Project), Series 2020-B, 5.00% 7/1/2026 | 100 | 104 | ||||||

| Dept. of Transportation, Right-of-Way Acquisition and Bridge Construction Bonds, Series 2022-A, 5.00% 7/1/2026 | 1,641 | 1,739 | ||||||

| Dept. of Transportation, Right-of-Way Acquisition and Bridge Construction Bonds, Series 2016-A, 5.00% 7/1/2027 | 315 | 334 | ||||||

| Dept. of Transportation, Right-of-Way Acquisition and Bridge Construction Bonds, Series 2018-B, 5.00% 7/1/2027 | 445 | 482 | ||||||

| Dept. of Transportation, Turnpike Rev. Ref. Bonds, Series 2023-A, 5.00% 7/1/2025 | 10,065 | 10,413 | ||||||

| 18 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund (continued)

| Bonds, notes & other debt instruments (continued) | Principal amount (000) | Value (000) | ||||||

| Florida (continued) | ||||||||

| Dept. of Transportation, Turnpike Rev. Ref. Bonds, Series 2023-A, 5.00% 7/1/2026 | USD | 1,515 | $ | 1,602 | ||||

| Dept. of Transportation Fncg. Corp., Rev. Bonds, Series 2020, 5.00% 7/1/2024 | 590 | 599 | ||||||

| Dept. of Transportation Fncg. Corp., Rev. Bonds, Series 2022, 5.00% 7/1/2026 | 1,000 | 1,059 | ||||||

| 92,547 | ||||||||

| Georgia 3.43% | ||||||||

| City of Atlanta, Airport General Rev. Ref. Bonds, Series 2014-B, 5.00% 1/1/2026 | 1,200 | 1,206 | ||||||

| City of Atlanta, Airport General Rev. Ref. Bonds, Series 2021-B, 5.00% 7/1/2027 | 430 | 462 | ||||||

| City of Atlanta, Airport General Rev. Ref. Bonds, Series 2021-C, AMT, 5.00% 7/1/2028 | 665 | 712 | ||||||

| City of Atlanta, Urban Residential Fin. Auth., Multi Family Housing Rev. Bonds (Sylvan Hills Senior Apartments Project), Series 2020, 0.41% 12/1/2025 (put 12/1/2023) | 785 | 774 | ||||||

| County of Bartow, Dev. Auth., Pollution Control Rev. Bonds (Georgia Power Co. Plant Bowen Project), Series 1997-1, 1.80% 9/1/2029 | 560 | 469 | ||||||

| County of Burke, Dev. Auth., Pollution Control Rev. Bonds (Oglethorpe Power Corp. Vogtle Project), Series 2013-A, 1.50% 1/1/2040 (put 2/3/2025) | 1,175 | 1,114 | ||||||

| City of Columbus, Dev. Auth., Multi Family Housing Rev. Bonds (Highland Terrance Phase II Project), Series 2021-B, 0.34% 4/1/2025 (put 4/1/2024) | 2,000 | 1,942 | ||||||

| County of Dawson, Dev. Auth., Multi Family Housing Rev. Bonds (Peaks of Dawsonville Project), Series 2021, 0.28% 10/1/2023 | 3,500 | 3,481 | ||||||

| County of Dekalb, Housing Auth., Multi Family Housing Rev. Bonds (Columbia Village Project), Series 2021-A, 0.34% 8/1/2024 (put 8/1/2023) | 2,420 | 2,420 | ||||||

| G.O. Bonds, Series 2020-A, 5.00% 8/1/2023 | 790 | 790 | ||||||

| G.O. Bonds, Series 2015-A, 5.00% 2/1/2027 | 1,000 | 1,027 | ||||||

| G.O. Rev. Ref. Bonds, Series 2016-E, 5.00% 12/1/2027 | 500 | 535 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2014-A-1, 4.00% 6/1/2044 | 70 | 70 | ||||||

| Housing and Fin. Auth., Single Family Mortgage Bonds, Series 2015-A-1, 3.50% 6/1/2045 | 15 | 15 | ||||||