UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-08572

Bishop Street Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices)

c/o SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-262-9565

Date of fiscal year end: December 31, 2019

Date of reporting period: June 30, 2019

| Item 1. | Reports to Stockholders. |

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act or 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q or as an exhibit to its reports on Form N-PORT within sixty days after the end of the period. The Funds’ Forms N-Q and Form N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies (if any) relating to portfolio securities is available without charge, by calling 1-800-262-9565 or by visiting the Commission’s website at http://www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge, by calling 1-800-262-9565 or by visiting the Funds’ website at http://www.bishopstreetfunds.com or the website of the Securities and Exchange Commission.

| Schedule of Investments | ||||

| 2 | ||||

| 10 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 36 | ||||

| 38 | ||||

| High Grade Income Fund | (unaudited) |

Top Ten Holdings†

| Coupon Rate |

Maturity Date |

Percentage of Investments |

||||||||||||||

|

|

||||||||||||||||

| 1. | U.S. Treasury Bond | 4.375% | 05/15/41 | 3.2% | ||||||||||||

|

|

||||||||||||||||

| 2. | U.S. Treasury Bond | 3.125% | 05/15/48 | 2.9% | ||||||||||||

|

|

||||||||||||||||

| 3. | U.S. Treasury Bond | 6.000% | 02/15/26 | 2.7% | ||||||||||||

|

|

||||||||||||||||

| 4. | Amazon.com | 4.800% | 12/05/34 | 2.2% | ||||||||||||

|

|

||||||||||||||||

| 5. | GNMA, Ser 2012-91, Cl QL | 2.000% | 09/20/41 | 2.0% | ||||||||||||

|

|

||||||||||||||||

| 6. | FHLMC | 1.500% | 08/25/21 | 1.8% | ||||||||||||

|

|

||||||||||||||||

| 7. | U.S. Treasury Bond | 2.250% | 08/15/46 | 1.8% | ||||||||||||

|

|

||||||||||||||||

| 8. | FHLMC | 1.600% | 09/30/21 | 1.8% | ||||||||||||

|

|

||||||||||||||||

| 9. | FFCB | 2.000% | 06/01/21 | 1.6% | ||||||||||||

|

|

||||||||||||||||

| 10. | Home Depot | 5.875% | 12/16/36 | 1.6% | ||||||||||||

| † | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| Face |

Value (000) |

|||||||

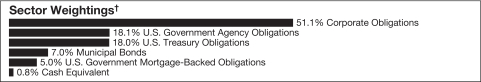

| CORPORATE OBLIGATIONS — 50.8% | ||||||||

| Communication Services — 5.1% |

||||||||

| Ameritech Capital Funding | ||||||||

| $ | 300 | 6.875%, 10/15/27 | $ | 358 | ||||

| CBS | ||||||||

| 175 | 3.500%, 01/15/25 | 179 | ||||||

| Comcast | ||||||||

| 300 | 3.150%, 03/01/26 | 311 | ||||||

| TWDC Enterprises 18 MTN | ||||||||

| 430 | 4.125%, 06/01/44 | 489 | ||||||

| 225 | 1.850%, 07/30/26 | 218 | ||||||

| Verizon Communications | ||||||||

| 280 | 4.329%, 09/21/28 | 310 | ||||||

|

|

|

|||||||

| 1,865 | ||||||||

|

|

|

|||||||

| Bishop Street Funds |

2

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Consumer Discretionary — 6.8% |

||||||||

| Amazon.com | ||||||||

| $ | 650 | 4.800%, 12/05/34 | $ | 799 | ||||

| George Washington University | ||||||||

| 225 | 4.363%, 09/15/43 | 255 | ||||||

| Home Depot | ||||||||

| 450 | 5.875%, 12/16/36 | 597 | ||||||

| Lowe’s | ||||||||

| 375 | 3.650%, 04/05/29 | 392 | ||||||

| McDonald’s MTN | ||||||||

| 200 | 4.600%, 05/26/45 | 221 | ||||||

| Starbucks | ||||||||

| 225 | 2.450%, 06/15/26 | 223 | ||||||

|

|

|

|||||||

| 2,487 | ||||||||

|

|

|

|||||||

| Consumer Staples — 2.1% |

||||||||

| Campbell Soup | ||||||||

| 125 | 4.250%, 04/15/21 | 129 | ||||||

| Coca-Cola | ||||||||

| 200 | 2.450%, 11/01/20 | 201 | ||||||

| General Mills | ||||||||

| 300 | 4.000%, 04/17/25 | 319 | ||||||

| Hershey | ||||||||

| 125 | 2.625%, 05/01/23 | 126 | ||||||

|

|

|

|||||||

| 775 | ||||||||

|

|

|

|||||||

| Energy — 4.8% |

||||||||

| Apache Corp | ||||||||

| 159 | 7.750%, 12/15/29 | 202 | ||||||

| BP Capital Markets PLC | ||||||||

| 300 | 3.814%, 02/10/24 | 317 | ||||||

| Kinder Morgan Energy Partners LP | ||||||||

| 150 | 4.300%, 05/01/24 | 160 | ||||||

| Occidental Petroleum | ||||||||

| 390 | 2.700%, 02/15/23 | 393 | ||||||

| Schlumberger Investment SA | ||||||||

| 400 | 3.650%, 12/01/23 | 421 | ||||||

| Shell International Finance BV | ||||||||

| 260 | 3.875%, 11/13/28 | 285 | ||||||

|

|

|

|||||||

| 1,778 | ||||||||

|

|

|

|||||||

| Financials — 10.9% |

||||||||

| Aflac | ||||||||

| 350 | 3.625%, 11/15/24 | 371 | ||||||

| June 30, 2019 | www.bishopstreetfunds.com |

3

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Financials — (continued) |

||||||||

| Bank of America MTN | ||||||||

| $ | 365 | 5.625%, 07/01/20 | $ | 377 | ||||

| 450 | 4.000%, 04/01/24 | 479 | ||||||

| Bank of New York Mellon MTN | ||||||||

| 500 | 4.150%, 02/01/21 | 515 | ||||||

| Capital One Financial | ||||||||

| 175 | 3.750%, 03/09/27 | 181 | ||||||

| Citigroup | ||||||||

| 100 | 3.875%, 10/25/23 | 106 | ||||||

| Discover Bank | ||||||||

| 200 | 4.200%, 08/08/23 | 212 | ||||||

| Goldman Sachs Group MTN | ||||||||

| 250 | 3.824%, VAR ICE LIBOR USD 3 Month+1.300% 11/23/24 | 250 | ||||||

| JPMorgan Chase | ||||||||

| 375 | 3.540%, VAR ICE LIBOR USD 3 Month+1.380% 05/01/28 | 390 | ||||||

| MetLife | ||||||||

| 250 | 3.048%, 12/15/22 | 256 | ||||||

| Morgan Stanley MTN | ||||||||

| 400 | 3.875%, 01/27/26 | 425 | ||||||

| US Bancorp MTN | ||||||||

| 450 | 3.000%, 03/15/22 | 460 | ||||||

|

|

|

|||||||

| 4,022 | ||||||||

|

|

|

|||||||

| Health Care — 4.0% |

||||||||

| AbbVie | ||||||||

| 500 | 2.900%, 11/06/22 | 503 | ||||||

| Celgene | ||||||||

| 250 | 3.875%, 08/15/25 | 268 | ||||||

| CVS Health | ||||||||

| 250 | 2.875%, 06/01/26 | 245 | ||||||

| Gilead Sciences | ||||||||

| 450 | 4.500%, 04/01/21 | 466 | ||||||

|

|

|

|||||||

| 1,482 | ||||||||

|

|

|

|||||||

| Industrials — 2.7% |

||||||||

| FedEx | ||||||||

| 125 | 2.625%, 08/01/22 | 126 | ||||||

| Norfolk Southern | ||||||||

| 150 | 2.900%, 06/15/26 | 152 | ||||||

| Raytheon | ||||||||

| 260 | 2.500%, 12/15/22 | 262 | ||||||

| Bishop Street Funds |

4

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Industrials — (continued) |

||||||||

| United Technologies | ||||||||

| $ | 450 | 3.100%, 06/01/22 | $ | 460 | ||||

|

|

|

|||||||

| 1,000 | ||||||||

|

|

|

|||||||

| Information Technology — 8.1% |

||||||||

| Apple | ||||||||

| 450 | 4.650%, 02/23/46 | 534 | ||||||

| Applied Materials | ||||||||

| 200 | 3.300%, 04/01/27 | 208 | ||||||

| Intel | ||||||||

| 500 | 3.300%, 10/01/21 | 514 | ||||||

| International Business Machines | ||||||||

| 360 | 3.500%, 05/15/29 | 377 | ||||||

| International Business Machines | ||||||||

| 350 | 8.375%, 11/01/19 | 357 | ||||||

| KLA-Tencor | ||||||||

| 200 | 4.650%, 11/01/24 | 219 | ||||||

| Microsoft | ||||||||

| 250 | 3.625%, 12/15/23 | 266 | ||||||

| NetApp | ||||||||

| 150 | 3.375%, 06/15/21 | 152 | ||||||

| QUALCOMM | ||||||||

| 365 | 3.250%, 05/20/27 | 372 | ||||||

|

|

|

|||||||

| 2,999 | ||||||||

|

|

|

|||||||

| Materials — 0.4% |

||||||||

| Sherwin-Williams | ||||||||

| 140 | 3.125%, 06/01/24 | 142 | ||||||

|

|

|

|||||||

| Transportation — 1.1% |

||||||||

| Burlington Northern Santa Fe LLC | ||||||||

| 345 | 4.450%, 03/15/43 | 396 | ||||||

|

|

|

|||||||

| Utilities — 4.8% |

||||||||

| Berkshire Hathaway Energy | ||||||||

| 400 | 6.125%, 04/01/36 | 535 | ||||||

| Duke Energy Florida LLC | ||||||||

| 325 | 3.100%, 08/15/21 | 330 | ||||||

| Sempra Energy | ||||||||

| 375 | 3.250%, 06/15/27 | 375 | ||||||

| Sierra Pacific Power | ||||||||

| 200 | 2.600%, 05/01/26 | 198 | ||||||

| Xcel Energy | ||||||||

| 300 | 3.300%, 06/01/25 | 310 | ||||||

|

|

|

|||||||

| 1,748 | ||||||||

|

|

|

|||||||

| TOTAL CORPORATE OBLIGATIONS (Cost $17,798) | 18,694 | |||||||

|

|

|

|||||||

| June 30, 2019 | www.bishopstreetfunds.com |

5

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 17.9% | ||||||||

| FFCB | ||||||||

| $ | 350 | 3.220%, 12/10/25 | $ | 374 | ||||

| 450 | 3.100%, 12/06/24 | 476 | ||||||

| 300 | 2.670%, 04/18/24 | 300 | ||||||

| 600 | 2.000%, 06/01/21 | 600 | ||||||

| 300 | 1.750%, 08/01/22 | 297 | ||||||

| 300 | 1.240%, 11/29/19 | 299 | ||||||

| FHLB | ||||||||

| 475 | 4.750%, 03/10/23 | 525 | ||||||

| 500 | 3.125%, 06/13/25 | 533 | ||||||

| 500 | 3.000%, 03/10/28 | 528 | ||||||

| 550 | 2.500%, 03/11/22 | 560 | ||||||

| 250 | 1.800%, 09/01/23 | 249 | ||||||

| FHLMC MTN | ||||||||

| 550 | 2.050%, 08/26/22 | 550 | ||||||

| 650 | 1.600%, 09/30/21 | 645 | ||||||

| 675 | 1.500%, 1.625%, 08/25/19, 08/25/21 (A) | 673 | ||||||

|

|

|

|||||||

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS (Cost $6,478) | 6,609 | |||||||

|

|

|

|||||||

| U.S. TREASURY OBLIGATIONS — 17.9% | ||||||||

| U.S. Treasury Bonds | ||||||||

| 800 | 6.000%, 02/15/26 | 1,006 | ||||||

| 250 | 5.375%, 02/15/31 | 336 | ||||||

| 250 | 4.750%, 02/15/37 | 342 | ||||||

| 300 | 4.500%, 08/15/39 | 405 | ||||||

| 875 | 4.375%, 05/15/41 | 1,168 | ||||||

| 950 | 3.125%, 05/15/48 | 1,066 | ||||||

| 100 | 3.000%, 08/15/48 | 110 | ||||||

| 700 | 2.250%, 08/15/46 | 661 | ||||||

| U.S. Treasury Notes | ||||||||

| 170 | 3.125%, 11/15/28 | 186 | ||||||

| 365 | 2.875%, 10/31/20 | 370 | ||||||

| 350 | 2.125%, 08/31/20 | 351 | ||||||

| 180 | 2.125%, 05/15/25 | 183 | ||||||

| 400 | 2.000%, 11/15/26 | 403 | ||||||

|

|

|

|||||||

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $6,270) | 6,587 | |||||||

|

|

|

|||||||

| MUNICIPAL BONDS — 7.0% | ||||||||

| California State, GO | ||||||||

| 260 | 6.509%, 04/01/39 | 282 | ||||||

| City of Seattle Washington, Ser B, GO | ||||||||

| 425 | 3.500%, 12/01/31 | 453 | ||||||

| Bishop Street Funds |

6

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| MUNICIPAL BONDS — (continued) | ||||||||

| Evansville, Redevelopment Authority, GO | ||||||||

| $ | 500 | 7.210%, 02/01/39 | $ | 526 | ||||

| Gwinnett County, Development Authority, RB | ||||||||

| 375 | 4.180%, 09/01/47 | 396 | ||||||

| Houston, Independent School District, GO | ||||||||

| 250 | 6.125%, 02/15/28 | 251 | ||||||

| Stockton, Public Financing Authority, Sub-Ser, RB, BAM Insured | ||||||||

| 250 | 7.942%, 10/01/19, Pre-Refunded @ 100 (B) | 253 | ||||||

| Texas State, GO | ||||||||

| 385 | 3.621%, 10/01/30 | 410 | ||||||

|

|

|

|||||||

| TOTAL MUNICIPAL BONDS (Cost $2,505) | 2,571 | |||||||

|

|

|

|||||||

| U.S. GOVERNMENT AGENCY MORTGAGE-BACKED OBLIGATIONS — 5.0% | ||||||||

| FHLMC, Ser 2015-4425, Cl BY | ||||||||

| 597 | 2.000%, 01/15/45 | 504 | ||||||

| FHLMC, Ser G12710 | ||||||||

| 32 | 5.500%, 07/01/22 | 34 | ||||||

| FNMA, Ser 2003-58, Cl D | ||||||||

| 33 | 3.500%, 07/25/33 | 34 | ||||||

| FNMA, Ser 2012-84, Cl JB | ||||||||

| 217 | 3.000%, 05/25/42 | 216 | ||||||

| FNMA, Ser 2013-92, Cl MT | ||||||||

| 38 | 4.000%, 07/25/41 | 40 | ||||||

| FNMA, Ser 889958 | ||||||||

| 18 | 5.000%, 10/01/23 | 18 | ||||||

| GNMA, Ser 2011-112, Cl JP | ||||||||

| 54 | 2.000%, 02/20/40 | 54 | ||||||

| GNMA, Ser 2012-91, Cl QL | ||||||||

| 765 | 2.000%, 09/20/41 | 725 | ||||||

| GNMA, Ser 2013-4, Cl CN | ||||||||

| 220 | 2.000%, 10/16/42 | 217 | ||||||

|

|

|

|||||||

| |

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED OBLIGATIONS (Cost $1,760) |

1,842 | ||||||

|

|

|

|||||||

| CASH EQUIVALENT — 0.8% | ||||||||

| 281,768 | BlackRock FedFund, Institutional Shares, 2.290% (C) (Cost $282) | 282 | ||||||

|

|

|

|||||||

| TOTAL INVESTMENTS (Cost $35,093) — 99.4% | $ | 36,585 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $36,793 (000).

| (A) | Step Bonds — Represents the current rate, the step rate, the step date and the final maturity date. |

| June 30, 2019 | www.bishopstreetfunds.com |

7

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(continued)

| (B) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (C) | The rate reported is the 7-day effective yield as of June 30, 2019. |

Cl — Class

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

GO — General Obligation

ICE — Intercontinental exchange

LIBOR — London Interbank Offered Rate

LLC — Limited Liability Corporation

LP — Limited Partnership

MTN — Medium Term Note

PLC — Public Limited Company

RB — Revenue Bond

Ser — Series

USD — U.S. Dollar

VAR — Variable

Cost figures are shown in thousands.

The following is a summary of the inputs used as of June 30, 2019, in valuing the Fund’s investments carried at value (000):

| High Grade Income Fund | ||||||||||||||||

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Corporate Obligations |

$ | — | $ | 18,694 | $ | — | $ | 18,694 | ||||||||

| U.S. Government Agency |

— | 6,609 | — | 6,609 | ||||||||||||

| U.S. Treasury Obligations |

— | 6,587 | — | 6,587 | ||||||||||||

| Municipal Bonds |

— | 2,571 | — | 2,571 | ||||||||||||

| U.S. Government Agency |

— | 1,842 | — | 1,842 | ||||||||||||

| Cash Equivalent |

282 | — | — | 282 | ||||||||||||

|

|

|

|||||||||||||||

| Total Investments in Securities |

$ | 282 | $ | 36,303 | $ | — | $ | 36,585 | ||||||||

|

|

|

|||||||||||||||

| Bishop Street Funds |

8

| High Grade Income Fund | (unaudited) |

Schedule of Investments

(concluded)

For the period ended June 30, 2019, there have been no transfers between Level 1, Level 2 and Level 3 assets and liabilities. Transfers, if any, between levels are considered to have occurred at the end of the period.

There were no Level 3 investments during the period ended June 30, 2019.

Amounts designated as “—” are $0.

For more information on valuation inputs, see Note in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| June 30, 2019 | www.bishopstreetfunds.com |

9

| Hawaii Municipal Bond Fund | (unaudited) |

Top Ten Holdings†

| Coupon Rate |

Maturity Date |

Percentage of Investments |

||||||||||||||

|

|

||||||||||||||||

| 1. | Hawaii State, Department of Budget & Finance, Ser 2009 | 6.500% | 07/01/39 | 3.4% | ||||||||||||

|

|

||||||||||||||||

| 2. | Hawaii State, Department of Transportation, Airports Division Lease Revenue, AMT | 5.000% | 08/01/27 | 3.2% | ||||||||||||

|

|

||||||||||||||||

| 3. | Hawaii State, Department of Budget & Finance, Ser A | 5.000% | 07/01/35 | 2.7% | ||||||||||||

|

|

||||||||||||||||

| 4. | Hawaii State, Airports System Authority, Ser A, AMT | 5.000% | 07/01/45 | 2.7% | ||||||||||||

|

|

||||||||||||||||

| 5. | University of Hawaii, Ser F | 5.000% | 10/01/35 | 2.3% | ||||||||||||

|

|

||||||||||||||||

| 6. | Hawaii State, Department of Transportation, Airports Division Lease Revenue, AMT | 5.000% | 08/01/21 | 2.1% | ||||||||||||

|

|

||||||||||||||||

| 7. | Hawaii State, Airports System Authority, Ser A | 5.250% | 07/01/27 | 2.0% | ||||||||||||

|

|

||||||||||||||||

| 8. | Hawaii State, Airports System Revenue, Ser A, AMT | 5.000% | 07/01/41 | 1.8% | ||||||||||||

|

|

||||||||||||||||

| 9. | Honolulu City & County, Board of Water Supply, Ser A | 5.000% | 07/01/24 | 1.7% | ||||||||||||

|

|

||||||||||||||||

| 10. | Hawaii State, Airports System Authority, AMT | 5.000% | 07/01/24 | 1.7% | ||||||||||||

| † | Percentages based on total investments. Top ten holdings do not include short-term investments. |

Schedule of Investments

| Face |

Value (000) |

|||||||

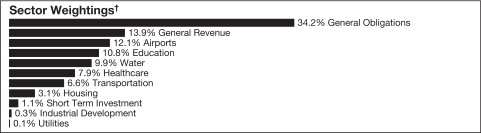

| MUNICIPAL BONDS — 98.4% | ||||||||

| Alaska — 0.5% |

||||||||

| Alaska State, Ser A, GO | ||||||||

| $ | 525 | 5.000%, 08/01/34 | $ | 612 | ||||

|

|

|

|||||||

| Bishop Street Funds |

10

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| California — 2.2% |

||||||||

| California State, GO | ||||||||

| $ | 700 | 5.000%, 09/01/31 | $ | 850 | ||||

| Orange County, Water District, Ser A, RB | ||||||||

| 1,000 | 5.000%, 08/15/31 | 1,142 | ||||||

| Sacramento City, Unified School District, GO | ||||||||

| 500 | 5.000%, 07/01/23 | 559 | ||||||

| University of California, Ser AF, RB | ||||||||

| 215 | 5.000%, 05/15/23, Pre-Refunded @ 100 (A) | 247 | ||||||

|

|

|

|||||||

| 2,798 | ||||||||

|

|

|

|||||||

| Florida — 0.1% |

||||||||

| Miami-Dade County, School Board, Ser D, COP | ||||||||

| 150 | 5.000%, 02/01/27 | 179 | ||||||

|

|

|

|||||||

| Hawaii — 91.1% |

||||||||

| Hawaii County, Ser A, GO | ||||||||

| 500 | 5.000%, 09/01/20 | 522 | ||||||

| 250 | 5.000%, 09/01/22 (B) | 279 | ||||||

| 300 | 5.000%, 09/01/26 | 366 | ||||||

| 100 | 5.000%, 09/01/27 | 122 | ||||||

| 500 | 5.000%, 09/01/30 | 601 | ||||||

| 285 | 5.000%, 09/01/33 | 346 | ||||||

| 1,500 | 4.000%, 09/01/35 | 1,643 | ||||||

| Hawaii County, Ser B, GO | ||||||||

| 200 | 5.000%, 09/01/22 | 223 | ||||||

| Hawaii County, Ser D, GO | ||||||||

| 450 | 5.000%, 09/01/25 | 544 | ||||||

| 300 | 5.000%, 09/01/27 | 365 | ||||||

| 300 | 3.000%, 09/01/32 | 311 | ||||||

| Hawaii State, Airports System Authority, Ser A, RB | ||||||||

| 250 | 5.250%, 07/01/23 | 260 | ||||||

| 2,500 | 5.250%, 07/01/27 | 2,596 | ||||||

| 1,000 | 5.250%, 07/01/28 | 1,038 | ||||||

| 900 | 5.250%, 07/01/30 | 933 | ||||||

| 420 | 5.000%, 07/01/39 | 432 | ||||||

| 3,000 | 5.000%, 07/01/45 | 3,396 | ||||||

| Hawaii State, Airports System Authority, RB, AMT | ||||||||

| 2,000 | 5.000%, 07/01/24 | 2,139 | ||||||

| 1,000 | 4.125%, 07/01/24 | 1,045 | ||||||

| Hawaii State, Airports System Revenue, Ser A, RB, AMT | ||||||||

| 1,000 | 5.000%, 07/01/38 | 1,193 | ||||||

| 2,000 | 5.000%, 07/01/41 | 2,269 | ||||||

| June 30, 2019 | www.bishopstreetfunds.com |

11

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Hawaii — (continued) |

||||||||

| Hawaii State, Airports System Revenue, COP, AMT Insured | ||||||||

| $ | 500 | 5.250%, 08/01/25 | $ | 569 | ||||

| Hawaii State, Department of Budget & Finance, Mid Pacific Institute, RB, AGC Insured | ||||||||

| 745 | 5.000%, 01/01/26 | 747 | ||||||

| Hawaii State, Department of Budget & Finance, Pacific Health Project, Ser A, RB | ||||||||

| 425 | 6.000%, 07/01/33 | 490 | ||||||

| 100 | 5.500%, 07/01/43 | 112 | ||||||

| Hawaii State, Department of Budget & Finance, RB | ||||||||

| 325 | 5.125%, 07/01/31 | 363 | ||||||

| 275 | 5.000%, 07/01/20 | 285 | ||||||

| 300 | 5.000%, 07/01/21 | 321 | ||||||

| 350 | 3.250%, 01/01/25 | 362 | ||||||

| Hawaii State, Department of Budget & Finance, Ser 2009, RB | ||||||||

| 4,260 | 6.500%, 07/01/39 | 4,278 | ||||||

| Hawaii State, Department of Budget & Finance, Ser A, RB | ||||||||

| 205 | 5.000%, 07/01/22 | 226 | ||||||

| 575 | 5.000%, 07/01/26 | 648 | ||||||

| 500 | 5.000%, 07/01/27 | 590 | ||||||

| 755 | 5.000%, 07/01/30 | 880 | ||||||

| 3,000 | 5.000%, 07/01/35 | 3,423 | ||||||

| 1,000 | 4.000%, 07/01/40 | 1,056 | ||||||

| Hawaii State, Department of Budget & Finance, Ser B, RB | ||||||||

| 775 | 5.000%, 07/01/28 | 869 | ||||||

| Hawaii State, Department of Hawaiian Home Lands, Kapolie Office Facilities, Ser A, COP, AGM Insured | ||||||||

| 500 | 5.000%, 11/01/26 | 617 | ||||||

| Hawaii State, Department of Hawaiian Home Lands, RB | ||||||||

| 500 | 5.000%, 04/01/27 | 617 | ||||||

| Hawaii State, Department of Transportation, Airports Division Lease Revenue, COP, AMT | ||||||||

| 2,525 | 5.000%, 08/01/21 | 2,695 | ||||||

| 3,675 | 5.000%, 08/01/27 | 4,126 | ||||||

| 1,000 | 5.000%, 08/01/28 | 1,119 | ||||||

| Hawaii State, Harbor System Revenue, Ser A, RB | ||||||||

| 2,000 | 5.625%, 07/01/40 | 2,080 | ||||||

| 220 | 5.000%, 07/01/25 | 228 | ||||||

| 1,125 | 4.250%, 07/01/21 | 1,156 | ||||||

| Hawaii State, Highway Revenue, Ser A, RB | ||||||||

| 700 | 5.000%, 01/01/23 | 787 | ||||||

| 215 | 5.000%, 01/01/25 | 252 | ||||||

| 1,450 | 5.000%, 01/01/30 | 1,683 | ||||||

| Bishop Street Funds |

12

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Hawaii — (continued) |

||||||||

| $ | 1,000 | 5.000%, 01/01/33 | $ | 1,152 | ||||

| 1,200 | 4.000%, 01/01/26 | 1,276 | ||||||

| 500 | 4.000%, 01/01/35 | 554 | ||||||

| 370 | 4.000%, 01/01/36 | 408 | ||||||

| Hawaii State, Housing Finance & Development, Kuhio Park Terrace Multi-Family Housing, Ser A, RB, FHLMC Insured | ||||||||

| 200 | 3.900%, 04/01/22 | 208 | ||||||

| 115 | 3.750%, 04/01/21 | 119 | ||||||

| 180 | 3.500%, 04/01/20 | 183 | ||||||

| Hawaii State, Housing Finance & Development, Rental Housing System, Ser B, RB, AGM Insured | ||||||||

| 2,000 | 6.500%, 07/01/33 | 2,006 | ||||||

| Hawaii State, Housing Finance & Development, Single-Family Housing, Ser B, RB, GNMA/FNMA/FHLMC Insured | ||||||||

| 295 | 3.450%, 01/01/22 | 303 | ||||||

| Hawaii State, Housing Finance & Development, Wilikina Apartments Project, Ser A, RB | ||||||||

| 1,000 | 5.000%, 05/01/34 | 1,029 | ||||||

| Hawaii State, Pacific Health, Pacific Health Project, Ser A, RB | ||||||||

| 710 | 4.625%, 07/01/20, Pre-Refunded @ 100 (A) | 733 | ||||||

| Hawaii State, Ser DT, GO | ||||||||

| 270 | 5.000%, 11/01/19 | 273 | ||||||

| Hawaii State, Ser DZ, GO | ||||||||

| 250 | 5.000%, 12/01/21, Pre-Refunded @ 100 (A) | 271 | ||||||

| 225 | 4.000%, 12/01/30 | 237 | ||||||

| 200 | 4.000%, 12/01/31 | 210 | ||||||

| Hawaii State, Ser EA, GO | ||||||||

| 435 | 5.000%, 12/01/21 | 473 | ||||||

| 1,700 | 5.000%, 12/01/22 | 1,851 | ||||||

| Hawaii State, Ser EE-2017, GO | ||||||||

| 400 | 5.000%, 11/01/22, Pre-Refunded @ 100 (A) | 448 | ||||||

| Hawaii State, Ser EF, GO | ||||||||

| 300 | 5.000%, 11/01/23 | 336 | ||||||

| 500 | 5.000%, 11/01/24 | 559 | ||||||

| Hawaii State, Ser EH, GO | ||||||||

| 45 | 5.000%, 08/01/23, Pre-Refunded @ 100 (A) | 52 | ||||||

| 125 | 5.000%, 08/01/24 | 143 | ||||||

| 300 | 5.000%, 08/01/29 | 341 | ||||||

| 295 | 5.000%, 08/01/30 | 334 | ||||||

| 95 | 5.000%, 08/01/32 | 107 | ||||||

| Hawaii State, Ser EH-2017, GO | ||||||||

| 85 | 5.000%, 08/01/23 (B) | 97 | ||||||

| June 30, 2019 | www.bishopstreetfunds.com |

13

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Hawaii — (continued) |

||||||||

| Hawaii State, Ser EO, GO | ||||||||

| $ | 1,000 | 5.000%, 08/01/29 | $ | 1,165 | ||||

| 1,000 | 5.000%, 08/01/30 | 1,162 | ||||||

| 1,000 | 5.000%, 08/01/33 | 1,153 | ||||||

| Hawaii State, Ser EP, GO | ||||||||

| 500 | 5.000%, 08/01/25 | 587 | ||||||

| Hawaii State, Ser FG, GO | ||||||||

| 880 | 5.000%, 10/01/30 | 1,074 | ||||||

| 200 | 5.000%, 10/01/31 | 242 | ||||||

| Hawaii State, Ser FK, GO | ||||||||

| 1,500 | 5.000%, 05/01/29 | 1,863 | ||||||

| Hawaii State, Ser FN-REF, GO | ||||||||

| 600 | 5.000%, 10/01/30 | 745 | ||||||

| Hawaii State, Ser FT, GO | ||||||||

| 1,000 | 5.000%, 01/01/31 | 1,244 | ||||||

| 250 | 3.375%, 01/01/36 | 262 | ||||||

| Hawaii State, Ser FW, GO | ||||||||

| 850 | 3.500%, 01/01/38 | 896 | ||||||

| Honolulu City & County, Board of Water Supply, Ser A, RB | ||||||||

| 500 | 5.000%, 07/01/19 | 500 | ||||||

| 600 | 5.000%, 07/01/23 | 664 | ||||||

| 2,400 | 5.000%, 07/01/24 | 2,680 | ||||||

| 500 | 5.000%, 07/01/25 | 553 | ||||||

| 600 | 5.000%, 07/01/27 | 699 | ||||||

| Honolulu Hawaii City & County, GO | ||||||||

| 250 | 4.000%, 09/01/33 | 286 | ||||||

| Honolulu Hawaii City & County, Ser A, GO | ||||||||

| 275 | 5.250%, 08/01/21, Pre-Refunded @ 100 (A) | 297 | ||||||

| 500 | 5.000%, 11/01/22 (B) | 561 | ||||||

| 1,000 | 5.000%, 10/01/23 | 1,151 | ||||||

| 1,000 | 5.000%, 10/01/27 | 1,206 | ||||||

| 800 | 5.000%, 10/01/31 | 950 | ||||||

| 1,500 | 5.000%, 10/01/37 | 1,750 | ||||||

| 1,175 | 5.000%, 09/01/38 | 1,437 | ||||||

| 1,100 | 5.000%, 09/01/42 | 1,330 | ||||||

| 325 | 4.000%, 08/01/21, Pre-Refunded @ 100 (A) | 343 | ||||||

| 500 | 4.000%, 09/01/36 | 564 | ||||||

| 700 | 4.000%, 09/01/39 | 782 | ||||||

| Honolulu Hawaii City & County, Ser B, GO | ||||||||

| 120 | 5.000%, 12/01/20 | 126 | ||||||

| 350 | 5.000%, 08/01/22 | 376 | ||||||

| 200 | 5.000%, 11/01/24 | 223 | ||||||

| 300 | 5.000%, 08/01/26 | 322 | ||||||

| 500 | 5.000%, 10/01/26 | 605 | ||||||

| Bishop Street Funds |

14

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Hawaii — (continued) |

||||||||

| $ | 500 | 5.000%, 10/01/28 | $ | 600 | ||||

| Honolulu Hawaii City & County, Ser C, GO | ||||||||

| 1,000 | 5.000%, 10/01/28 | 1,201 | ||||||

| Honolulu Hawaii City & County, Wastewater System Authority, Ser A, RB | ||||||||

| 250 | 5.000%, 07/01/21, Pre-Refunded @ 100 (A) | 268 | ||||||

| 100 | 5.000%, 07/01/22, Pre-Refunded @ 100 (A) | 111 | ||||||

| 500 | 4.000%, 07/01/42 | 552 | ||||||

| Honolulu Hawaii City & County, Wastewater System Authority, Ser B, RB | ||||||||

| 1,300 | 5.000%, 07/01/23 | 1,484 | ||||||

| Honolulu Hawaii City & County, Wastewater System Revenue, RB | ||||||||

| 1,000 | 5.000%, 07/01/31 | 1,178 | ||||||

| Honolulu Hawaii City & County, Wastewater System Revenue, Ser A, RB | ||||||||

| 255 | 5.000%, 07/01/21 | 274 | ||||||

| 150 | 5.000%, 07/01/22 | 166 | ||||||

| 500 | 5.000%, 07/01/36 | 592 | ||||||

| 1,200 | 4.000%, 07/01/38 | 1,336 | ||||||

| Honolulu Hawaii City & County, Wastewater System Revenue, Ser B, RB | ||||||||

| 325 | 4.000%, 07/01/33 | 361 | ||||||

| Kauai County, GO | ||||||||

| 250 | 5.000%, 08/01/37 | 301 | ||||||

| Kauai County, Ser A, GO | ||||||||

| 250 | 5.000%, 08/01/21 | 269 | ||||||

| 500 | 5.000%, 08/01/23 | 555 | ||||||

| 250 | 4.000%, 08/01/24 | 269 | ||||||

| 250 | 3.250%, 08/01/23 | 260 | ||||||

| Kauai County, Ser A, GO, NATL FGIC Insured | ||||||||

| 415 | 5.000%, 08/01/21 | 416 | ||||||

| Maui County, GO | ||||||||

| 250 | 5.000%, 06/01/20 | 259 | ||||||

| 150 | 5.000%, 06/01/21 | 161 | ||||||

| 1,100 | 3.000%, 09/01/33 | 1,141 | ||||||

| Maui County, RB | ||||||||

| 2,000 | 3.250%, 09/01/36 | 2,083 | ||||||

| University of Hawaii, Ser A, RB | ||||||||

| 100 | 6.000%, 10/01/19, Pre-Refunded @ 100 (A) | 101 | ||||||

| University of Hawaii, Ser B, RB | ||||||||

| 1,500 | 5.000%, 10/01/34 | 1,760 | ||||||

| 1,000 | 4.000%, 10/01/23 | 1,104 | ||||||

| June 30, 2019 | www.bishopstreetfunds.com |

15

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(continued)

| Face |

Value (000) |

|||||||

| Hawaii — (continued) |

||||||||

| University of Hawaii, Ser E, RB | ||||||||

| $ | 1,485 | 5.000%, 10/01/25 | $ | 1,790 | ||||

| 1,350 | 5.000%, 10/01/32 | 1,617 | ||||||

| University of Hawaii, Ser F, RB | ||||||||

| 2,425 | 5.000%, 10/01/35 | 2,937 | ||||||

|

|

|

|||||||

| 115,849 | ||||||||

|

|

|

|||||||

| Indiana — 0.5% |

||||||||

| Fort Wayne, Community School Building, RB | ||||||||

| 500 | 5.000%, 07/15/25 | 558 | ||||||

| Indiana State, Housing & Community Development Authority, Ser C, RB, GNMA/FNMA/FHLMC Insured | ||||||||

| 70 | 4.100%, 06/01/27 | 73 | ||||||

|

|

|

|||||||

| 631 | ||||||||

|

|

|

|||||||

| Kentucky — 0.9% |

||||||||

| Kentucky State, COP | ||||||||

| 1,000 | 5.000%, 04/15/38 | 1,179 | ||||||

|

|

|

|||||||

| New York — 0.9% |

||||||||

| New York City, Trust for Cultural Resources, Ser S, RB | ||||||||

| 1,000 | 5.000%, 07/01/41 | 1,139 | ||||||

|

|

|

|||||||

| Oklahoma — 1.8% |

||||||||

| Comanche County, Educational Facilities Authority, Ser A, RB | ||||||||

| 1,100 | 5.000%, 12/01/30 | 1,327 | ||||||

| Oklahoma City, Water Utilities Trust, RB | ||||||||

| 125 | 5.000%, 07/01/40 | 133 | ||||||

| Oklahoma State University, Ser A, RB | ||||||||

| 780 | 3.000%, 08/01/37 | 794 | ||||||

|

|

|

|||||||

| 2,254 | ||||||||

|

|

|

|||||||

| Tennessee — 0.4% |

||||||||

| Memphis, Ser A, GO | ||||||||

| 500 | 5.000%, 04/01/26 | 597 | ||||||

|

|

|

|||||||

| TOTAL MUNICIPAL BONDS (Cost $122,614) | 125,238 | |||||||

|

|

|

|||||||

| CASH EQUIVALENT — 1.1% |

| |||||||

| 1,403,302 | BlackRock FedFund, Institutional Shares, 2.290% (C) (Cost $1,403) | 1,403 | ||||||

|

|

|

|||||||

| TOTAL INVESTMENTS (Cost $124,017) — 99.5% | $ | 126,641 | ||||||

|

|

|

|||||||

Percentages are based on Net Assets of $127,222 (000).

| Bishop Street Funds |

16

| Hawaii Municipal Bond Fund | (unaudited) |

Schedule of Investments

(concluded)

| (A) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (B) | Security is escrowed to maturity. |

| (C) | The rate reported is the 7-day effective yield as of June 30, 2019. |

AGC — American Guarantee Corporation

AGM — Assured Guaranty Municipal Corporation

AMT — Alternative Minimum Tax

COP — Certificate of Participation

FGIC — Financial Guarantee Insurance Corporation

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

GO — General Obligation

NATL — National Public Finance Guarantee Corporation

RB — Revenue Bond

Ser — Series

Cost figures are shown in thousands.

The following is a summary of the inputs used as of June 30, 2019, in valuing the Fund’s investments carried at value (000):

| Hawaii Municipal Bond Fund | ||||||||||||||||

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Municipal Bonds |

$ | — | $ | 125,238 | $ | — | $ | 125,238 | ||||||||

| Cash Equivalent |

1,403 | — | — | 1,403 | ||||||||||||

|

|

|

|||||||||||||||

| Total Investments in Securities |

$ | 1,403 | $ | 125,238 | $ | — | $ | 126,641 | ||||||||

|

|

|

|||||||||||||||

For the period ended June 30, 2019, there have been no transfers between Level 1, Level 2 and Level 3 assets and liabilities. Transfers, if any, between levels are considered to have occurred at the end of the period.

There were no Level 3 investments during the period ended June 30, 2019. Amounts designated as “—” are $0.

For more information on valuation inputs, see Note 2 in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| June 30, 2019 | www.bishopstreetfunds.com |

17

| Bishop Street Funds | (unaudited) |

Statements of Assets and Liabilities (000)

June 30, 2019

| High Grade Income Fund |

Hawaii Fund |

|||||||

| Assets: |

||||||||

| Investments, at Cost |

$ | 35,093 | $ | 124,017 | ||||

|

|

||||||||

| Investments, at Value |

$ | 36,585 | $ | 126,641 | ||||

| Dividends and Interest Receivable |

278 | 2,238 | ||||||

| Reclaim Receivable |

1 | — | ||||||

| Prepaid Expenses |

— | 5 | ||||||

|

|

||||||||

| Total Assets |

36,864 | 128,884 | ||||||

|

|

||||||||

| Liabilities: |

||||||||

| Income Distribution Payable |

22 | 203 | ||||||

| Advisory Fees Payable |

6 | 9 | ||||||

| Administrative Fees Payable |

5 | 12 | ||||||

| Shareholder Servicing Fees Payable |

3 | 10 | ||||||

| Chief Compliance Officer Fees Payable |

1 | 2 | ||||||

| Payable for Investment Securities Purchased |

— | 1,329 | ||||||

| Trustees Fees Payable |

— | 1 | ||||||

| Distribution Fees Payable, Class A |

— | 4 | ||||||

| Other Accrued Expenses Payable |

34 | 92 | ||||||

|

|

||||||||

| Total Liabilities |

71 | 1,662 | ||||||

|

|

||||||||

| Net Assets |

$ | 36,793 | $ | 127,222 | ||||

|

|

||||||||

| Paid-in Capital |

$ | 35,685 | $ | 124,770 | ||||

| Total Distributable Earnings |

1,108 | 2,452 | ||||||

|

|

||||||||

| Net Assets |

$ | 36,793 | $ | 127,222 | ||||

|

|

||||||||

| Class I Shares: |

||||||||

| Net Assets |

$ | 36,793 | $ | 110,014 | ||||

| Outstanding Shares of Beneficial Interest |

3,762 | 10,311 | ||||||

| Net Asset Value, Offering and Redemption Price |

$ | 9.78 | $ | 10.67 | ||||

|

|

||||||||

| Class A Shares: |

||||||||

| Net Assets |

N/A | $ | 17,208 | |||||

| Outstanding Shares of Beneficial Interest |

N/A | 1,613 | ||||||

| Net Asset Value, Offering and Redemption Price |

N/A | $ | 10.67 | |||||

|

|

||||||||

| Maximum Offering Price Per Shares — Class A ($10.67/ 97.00%) |

N/A | $ | 11.00 | |||||

|

|

||||||||

N/A — Not Applicable. Share class currently not offered.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| Bishop Street Funds |

18

| Bishop Street Funds | (unaudited) |

Statements of Operations (000)

For the six-month period ended June 30, 2019

| High Grade Income Fund |

Hawaii Municipal Bond Fund |

|||||||

| Investment Income: |

||||||||

| Interest Income |

$ | 566 | $ | 1,778 | ||||

| Dividend Income |

6 | 13 | ||||||

|

|

||||||||

| Total Investment Income |

572 | 1,791 | ||||||

|

|

||||||||

| Expenses: |

||||||||

| Investment Adviser Fees |

101 | 218 | ||||||

| Shareholder Servicing Fees |

46 | 155 | ||||||

| Administrative Fees |

37 | 124 | ||||||

| Chief Compliance Officer Fees |

1 | 4 | ||||||

| Distribution Fees, Class A |

— | 21 | ||||||

| Transfer Agent Fees |

21 | 49 | ||||||

| Audit Fees |

7 | 25 | ||||||

| Printing Fees |

6 | 22 | ||||||

| Legal Fees |

5 | 17 | ||||||

| Pricing Fees |

5 | 14 | ||||||

| Trustees’ Fees |

4 | 15 | ||||||

| Custody Fees |

2 | 3 | ||||||

| Registration Fees |

— | 6 | ||||||

| Miscellaneous Expenses |

4 | 13 | ||||||

|

|

||||||||

| Total Expenses |

239 | 686 | ||||||

|

|

||||||||

| Less Waivers: |

||||||||

| Investment Adviser Fees |

(64 | ) | (166 | ) | ||||

| Shareholder Servicing Fees |

(28 | ) | (93 | ) | ||||

| Administrative Fees |

(10 | ) | (64 | ) | ||||

|

|

||||||||

| Total Waivers |

(102 | ) | (323 | ) | ||||

|

|

||||||||

| Total Net Expenses |

137 | 363 | ||||||

|

|

||||||||

| Net Investment Income |

435 | 1,428 | ||||||

|

|

||||||||

| Net Realized Gain on Investments |

40 | 231 | ||||||

| Net Change in Unrealized Appreciation on Investments |

1,862 | 3,196 | ||||||

|

|

||||||||

| Net Realized and Unrealized Gain on Investments |

1,902 | 3,427 | ||||||

|

|

||||||||

| Increase in Net Assets Resulting from Operations |

$ | 2,337 | $ | 4,855 | ||||

|

|

||||||||

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| June 30, 2019 | www.bishopstreetfunds.com |

19

| Bishop Street Funds |

Statements of Changes in Net Assets (000)

For the six-month period ended June 30, 2019 (unaudited) and the year ended December 31, 2018

| High Grade Income Fund |

Hawaii Municipal Bond Fund |

|||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Investment Activities from Operations: |

||||||||||||||||

| Net Investment Income |

$ | 435 | $ | 1,037 | $ | 1,428 | $ | 3,252 | ||||||||

| Net Realized Gain (Loss) on Investments |

40 | (438 | ) | 231 | (403 | ) | ||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments |

1,862 | (1,349 | ) | 3,196 | (2,246 | ) | ||||||||||

|

|

||||||||||||||||

| Increase (Decrease) in Net Assets Resulting from Operations |

2,337 | (750 | ) | 4,855 | 603 | |||||||||||

|

|

||||||||||||||||

| Distributions: |

||||||||||||||||

| Class I Shares |

(433 | ) | (1,056 | ) | (1,329 | ) | (2,845 | ) | ||||||||

| Class A Shares |

— | — | (184 | ) | (400 | ) | ||||||||||

|

|

||||||||||||||||

| Total Distributions |

(433 | ) | (1,056 | ) | (1,513 | ) | (3,245 | ) | ||||||||

|

|

||||||||||||||||

| Capital Share Transactions: |

||||||||||||||||

| Class I Shares: |

||||||||||||||||

| Proceeds from Shares Issued |

782 | 2,643 | 6,919 | 14,721 | ||||||||||||

| Reinvestments of Cash Distributions |

287 | 712 | 191 | 416 | ||||||||||||

| Cost of Shares Redeemed |

(2,818 | ) | (15,604 | ) | (9,119 | ) | (21,024 | ) | ||||||||

|

|

||||||||||||||||

| Total Class I Capital Share Transactions |

(1,749 | ) | (12,249 | ) | (2,009 | ) | (5,887 | ) | ||||||||

|

|

||||||||||||||||

| Class A Shares: |

||||||||||||||||

| Proceeds from Shares Issued |

N/A | N/A | 139 | 210 | ||||||||||||

| Reinvestments of Cash Distributions |

N/A | N/A | 132 | 281 | ||||||||||||

| Cost of Shares Redeemed |

N/A | N/A | (642 | ) | (3,322 | ) | ||||||||||

|

|

||||||||||||||||

| Total Class A Capital Share Transactions |

N/A | N/A | (371 | ) | (2,831 | ) | ||||||||||

|

|

||||||||||||||||

| Net Decrease in Net Assets from Capital Share Transactions |

(1,749 | ) | (12,249 | ) | (2,380 | ) | (8,718 | ) | ||||||||

|

|

||||||||||||||||

| Total Increase (Decrease) in Net Assets |

155 | (14,055 | ) | 962 | (11,360 | ) | ||||||||||

|

|

||||||||||||||||

| Net Assets: |

||||||||||||||||

| Beginning of Period |

36,638 | 50,693 | 126,260 | 137,620 | ||||||||||||

|

|

||||||||||||||||

| End of Period |

$ | 36,793 | $ | 36,638 | $ | 127,222 | $ | 126,260 | ||||||||

|

|

||||||||||||||||

| Share Transactions: |

||||||||||||||||

| Class I Shares: |

||||||||||||||||

| Shares Issued |

82 | 283 | 655 | 1,418 | ||||||||||||

| Shares Issued in Lieu of Cash Distributions |

30 | 77 | 18 | 40 | ||||||||||||

| Shares Redeemed |

(294 | ) | (1,673 | ) | (868 | ) | (2,032 | ) | ||||||||

|

|

||||||||||||||||

| Total Class I Transactions |

(182 | ) | (1,313 | ) | (195 | ) | (574 | ) | ||||||||

|

|

||||||||||||||||

| Class A Shares: |

||||||||||||||||

| Shares Issued |

N/A | N/A | 14 | 20 | ||||||||||||

| Shares Issued in Lieu of Cash Distributions |

N/A | N/A | 12 | 27 | ||||||||||||

| Shares Redeemed |

N/A | N/A | (61 | ) | (320 | ) | ||||||||||

|

|

||||||||||||||||

| Total Class A Transactions |

N/A | N/A | (35 | ) | (273 | ) | ||||||||||

|

|

||||||||||||||||

| Net Decrease in Shares Outstanding from Share Transactions |

(182 | ) | (1,313 | ) | (230 | ) | (847 | ) | ||||||||

|

|

||||||||||||||||

N/A — Not applicable. Share class currently not offered.

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| Bishop Street Funds |

20

This page intentionally left blank.

| Bishop Street Funds |

For a share outstanding throughout the six-month period ended June 30, 2019 (unaudited) and the years ended December 31,

| Investment Activities | Total Investment Activities from Operations |

Dividends and Distributions from |

|||||||||||||||||||||||||||||||||

| Net Asset Value, Beginning of Period |

Net Investment Income (Loss)(1) |

Net Realized and Unrealized Gain (Loss) on Investments |

Net Investment Income |

Capital Gains |

Total Dividends and Distributions | ||||||||||||||||||||||||||||||

| HIGH GRADE INCOME FUND | |||||||||||||||||||||||||||||||||||

| Class I Shares: |

| ||||||||||||||||||||||||||||||||||

| 2019 |

$ | 9.29 | $ | 0.11 | $ | 0.49 | $ | 0.60 | $ | (0.11 | ) | $ | — | $ | (0.11 | ) | |||||||||||||||||||

| 2018 |

9.64 | 0.23 | (0.35 | ) | (0.12 | ) | (0.22 | ) | (0.01 | ) | (0.23 | ) | |||||||||||||||||||||||

| 2017 |

9.65 | 0.22 | 0.12 | 0.34 | (0.22 | ) | (0.13 | ) | (0.35 | ) | |||||||||||||||||||||||||

| 2016 |

9.80 | 0.22 | (0.07 | ) | 0.15 | (0.22 | ) | (0.08 | ) | (0.30 | ) | ||||||||||||||||||||||||

| 2015 |

10.05 | 0.23 | (0.19 | ) | 0.04 | (0.23 | ) | (0.06 | ) | (0.29 | ) | ||||||||||||||||||||||||

| 2014 |

9.78 | 0.23 | 0.33 | 0.56 | (0.23 | ) | (0.06 | ) | (0.29 | ) | |||||||||||||||||||||||||

| HAWAII MUNICIPAL BOND FUND | |||||||||||||||||||||||||||||||||||

| Class I Shares: |

| ||||||||||||||||||||||||||||||||||

| 2019 |

$ | 10.39 | $ | 0.12 | $ | 0.29 | $ | 0.41 | $ | (0.13 | ) | $ | — | $ | (0.13 | ) | |||||||||||||||||||

| 2018 |

10.58 | 0.26 | (0.19 | ) | 0.07 | (0.26 | ) | — | ^ | (0.26 | ) | ||||||||||||||||||||||||

| 2017 |

10.45 | 0.25 | 0.14 | 0.39 | (0.25 | ) | (0.01 | ) | (0.26 | ) | |||||||||||||||||||||||||

| 2016 |

10.80 | 0.27 | (0.30 | ) | (0.03 | ) | (0.26 | ) | (0.06 | ) | (0.32 | ) | |||||||||||||||||||||||

| 2015 |

10.88 | 0.29 | (0.01 | ) | 0.28 | (0.29 | ) | (0.07 | ) | (0.36 | ) | ||||||||||||||||||||||||

| 2014 |

10.52 | 0.29 | 0.38 | 0.67 | (0.29 | ) | (0.02 | ) | (0.31 | ) | |||||||||||||||||||||||||

| Class A Shares: |

| ||||||||||||||||||||||||||||||||||

| 2019 |

$ | 10.39 | $ | 0.11 | $ | 0.28 | $ | 0.39 | $ | (0.11 | ) | $ | — | $ | (0.11 | ) | |||||||||||||||||||

| 2018 |

10.58 | 0.23 | (0.20 | ) | 0.03 | (0.22 | ) | — | ^ | (0.22 | ) | ||||||||||||||||||||||||

| 2017 |

10.45 | 0.23 | 0.13 | 0.36 | (0.22 | ) | (0.01 | ) | (0.23 | ) | |||||||||||||||||||||||||

| 2016 |

10.80 | 0.24 | (0.29 | ) | (0.05 | ) | (0.24 | ) | (0.06 | ) | (0.30 | ) | |||||||||||||||||||||||

| 2015 |

10.88 | 0.26 | (0.01 | ) | 0.25 | (0.26 | ) | (0.07 | ) | (0.33 | ) | ||||||||||||||||||||||||

| 2014 |

10.52 | 0.26 | 0.38 | 0.64 | (0.26 | ) | (0.02 | ) | (0.28 | ) | |||||||||||||||||||||||||

| (1) | Per share net investment income calculated using average shares. |

| * | Annualized. |

| † | Total return is for the period indicated and has not been annualized. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Fee waivers are in effect; if they had not been in effect, performance would have been lower. |

| ^ | Amount less than 0.005. |

Amounts designated as “—” are either $0 or have been rounded to $0.

| Bishop Street Funds |

22

| Net Asset Value, End of Period |

Total Return† |

Net Assets End of Period (000) |

Ratio of Expenses to Average Net Assets |

Ratio of Expenses to Average Net Assets (Excluding Waivers) |

Ratio of Net Investments Income (Loss) to Average Net Assets |

Portfolio Turnover Rate | |||||||||||||||||||||||||||

| $ | 9.78 | 6.50 | % | $ | 36,793 | 0.76 | %* | 1.31 | %* | 2.35 | %* | 10 | % | ||||||||||||||||||||

| 9.29 | (1.21 | ) | 36,638 | 0.76 | 1.34 | 2.42 | 22 | ||||||||||||||||||||||||||

| 9.64 | 3.56 | 50,693 | 0.76 | 1.29 | 2.30 | 33 | |||||||||||||||||||||||||||

| 9.65 | 1.47 | 61,204 | 0.76 | 1.25 | 2.20 | 27 | |||||||||||||||||||||||||||

| 9.80 | 0.37 | 72,251 | 0.76 | 1.21 | 2.31 | 24 | |||||||||||||||||||||||||||

| 10.05 | 5.77 | 74,642 | 0.76 | 1.20 | 2.32 | 28 | |||||||||||||||||||||||||||

| $ | 10.67 | 3.96 | % | $ | 110,014 | 0.55 | %* | 1.07 | %* | 2.33 | %* | 15 | % | ||||||||||||||||||||

| 10.39 | 0.66 | 109,130 | 0.55 | 1.07 | 2.47 | 21 | |||||||||||||||||||||||||||

| 10.58 | 3.74 | 117,285 | 0.55 | 1.04 | 2.39 | 25 | |||||||||||||||||||||||||||

| 10.45 | (0.32 | ) | 120,894 | 0.55 | 1.02 | 2.45 | 26 | ||||||||||||||||||||||||||

| 10.80 | 2.61 | 127,712 | 0.55 | 0.98 | 2.64 | 28 | |||||||||||||||||||||||||||

| 10.88 | 6.36 | 132,540 | 0.55 | 0.99 | 2.66 | 27 | |||||||||||||||||||||||||||

| $ | 10.67 | 3.80 | % | $ | 17,208 | 0.80 | %* | 1.32 | %* | 2.08 | %* | 15 | % | ||||||||||||||||||||

| 10.39 | 0.34 | 17,130 | 0.80 | 1.32 | 2.21 | 21 | |||||||||||||||||||||||||||

| 10.58 | 3.46 | 20,335 | 0.80 | 1.29 | 2.14 | 25 | |||||||||||||||||||||||||||

| 10.45 | (0.57 | ) | 22,374 | 0.80 | 1.27 | 2.20 | 26 | ||||||||||||||||||||||||||

| 10.80 | 2.36 | 22,959 | 0.80 | 1.23 | 2.39 | 28 | |||||||||||||||||||||||||||

| 10.88 | 6.10 | 22,324 | 0.80 | 1.24 | 2.41 | 27 | |||||||||||||||||||||||||||

The accompanying notes are an integral part of the financial statements.

| June 30, 2019 | www.bishopstreetfunds.com |

23

| Bishop Street Funds | (unaudited) |

June 30, 2019

The amounts included in the Notes to Financial Statements are in thousands unless otherwise noted.

| 1. | ORGANIZATION |

The Bishop Street Funds (the “Trust”) are registered under the Investment Company Act of 1940, as amended, as an open-end, management investment company. The Bishop Street Funds consist of a series of two funds (each a Fund, collectively the “Funds”) which includes High Grade Income Fund and the Hawaii Municipal Bond Fund. High Grade Income Fund is diversified while Hawaii Municipal Bond Fund is non-diversified. Class A Shares of the Hawaii Municipal Bond Fund are subject to a sales load as disclosed in the prospectus. The assets of each Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held. The Funds’ prospectus provides a description of each Fund’s investment objectives, policies and strategies.

The Dividend Value Fund ceased operations and liquidated during the second quarter of 2019.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Funds. The Funds are investment companies that apply the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the fair value of assets, the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Security Valuation

The Funds’ investments in equity securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (the “NASDAQ”)) including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded on valuation date (or at approximately 4:00 pm ET if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. Debt securities are priced based upon valuations provided by independent, third-party pricing agents, if available.

| Bishop Street Funds |

24

| (unaudited) |

Such values generally reflect the last reported sales price in the most advantageous market, if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the fair value for such securities. Such methodologies typically include matrix systems which reflect such factors as security prices, yields, maturities and ratings. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value provided that it is determined the amortized cost continues to approximate fair value. Should existing credit, liquidity or interest rate conditions in the relevant markets and issuer specific circumstances suggest that amortized cost does not approximate fair value, then the amortized cost method may not be used. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents.

If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with Fair Value Procedures established by the Funds’ Board of Trustees (the “Board”). The Funds’ Fair Value Procedures are implemented through a Fair Value Pricing Committee (the “Committee”) designated by the Funds’ Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security’s trading has been halted or suspended; the security has been delisted from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; or the security’s primary pricing source is not able or willing to provide a price. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurement under U.S. GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| • | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| June 30, 2019 | www.bishopstreetfunds.com |

25

| Bishop Street Funds | (unaudited) |

| • | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, etc.); and |

| • | Level 3 — Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the six month period ended June 30, 2019, there have been no changes to the Funds’ fair value methodologies.

Federal Income Taxes

It is each Fund’s intention to continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Sub-chapter M of the Internal Revenue Code of 1986, as amended, and to distribute substantially all of its income to shareholders. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Funds evaluate tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether it is “more-likely-than- not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Funds did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 open tax year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

Security Transactions and Investment Income

Security transactions are accounted for on trade date. Costs used in determining net realized capital gains and losses on the sale of securities are on the basis of specific identification. Interest income is recorded on the accrual basis from settlement date and dividend income is recorded on ex-dividend date.

Discounts and premiums are accreted or amortized using the effective interest method over the life of each security and are recorded as interest income. Realized gains (losses) on paydowns of mortgage-backed and asset-backed securities are recorded as an adjustment to interest income.

| Bishop Street Funds |

26

| (unaudited) |

Classes

Class-specific expenses are borne by the applicable class of shares. Income, realized and unrealized gains/losses and non-class-specific expenses are allocated to the respective class on the basis of relative daily net assets. Distribution fees are the only class-specific expense.

Expenses

Expenses that are directly related to one of the Funds are charged directly to that Fund. Other operating expenses of the Trust are prorated to each of the Funds on the basis of relative net assets.

Dividends and Distributions to Shareholders

Dividends from net investment income are declared daily and paid on a monthly basis for the High Grade Income and Hawaii Municipal Bond Funds. Any net realized capital gains will be distributed at least annually for all Funds. Distributions to shareholders are recorded on the ex-dividend date.

Front-End Sales Commission

Front-end sales commissions (the “sales charges”) are not recorded as expenses of the Hawaii Municipal Bond Fund. Sales charges are deducted from proceeds from the sales of Hawaii Municipal Bond Fund shares prior to investment in Class A shares.

Cash Overdraft Charges

Per the terms of the agreement with MUFG Union Bank, N.A., the custodian of the Funds (the “Custodian”), if a Fund has a cash overdraft on a given day, it will be assessed an overdraft charge of the Prime Rate plus 4.00%. Cash overdraft charges are included in miscellaneous expenses on the Statements of Operations. For the six month period ended June 30, 2019, there were no cash overdraft charges.

| 3. | INVESTMENT ADVISORY AGREEMENT |

Investment advisory services are provided to the Funds by Bishop Street Capital Management (the “Adviser”), a registered adviser and wholly owned subsidiary of First Hawaiian Bank. First Hawaiian Bank is a subsidiary of BancWest Corporation, itself a subsidiary of BNP Paribas. The Adviser is entitled to receive an annual fee of 0.55% of the average daily net assets of the High Grade Income Fund, and 0.35% of the average daily net assets of the Hawaii Municipal Bond Fund. The Adviser has contractually agreed, through April 30, 2020, to waive a portion of its advisory fee (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses (collectively, excluded expenses) to the extent necessary to keep operating expenses at or below certain percentages of the respective average daily net assets.

| June 30, 2019 | www.bishopstreetfunds.com |

27

| Bishop Street Funds | (unaudited) |

The contractual expense limitations are as follows:

| High Grade Income Fund, Class I Shares |

0.76% | |||

| Hawaii Municipal Bond Fund, Class I Shares |

0.55% | |||

| Hawaii Municipal Bond Fund, Class A Shares |

0.80% |

If at any point it becomes unnecessary for the Adviser to reduce fees and make expense reimbursements, the Board may permit the Adviser to retain the difference between the Total Annual Fund Operating Expenses and contractual expense limitations to recapture all or a portion of its prior expense reductions or reimbursements made during the preceding three year period during which this agreement was in place. During the six month period ended June 30, 2019, the Adviser did not recapture any previously waived fees.

As of June 30, 2019, fees which were previously waived by the Investment Manager which may be subject to possible future reimbursement to the Adviser were as follows:

| High |

Hawaii Municipal Bond Fund |

Total | Expires | |||||||||||||||||||

| 191 | 319 | 510 | 12/31/2019 | |||||||||||||||||||

| 186 | 338 | 524 | 12/31/2020 | |||||||||||||||||||

| 157 | 340 | 497 | 12/31/2021 | |||||||||||||||||||

| 64 | 166 | 230 | 12/31/2022 | |||||||||||||||||||

| 4. | ADMINISTRATIVE, CUSTODIAN, TRANSFER AGENT, DISTRIBUTION AND SHAREHOLDER SERVICES |

The Funds and the Administrator are parties to an Administration Agreement under which the Administrator provides administrative services to the Funds. For these services, the Administrator is paid an asset based fee which will vary depending on the number of share classes and the average daily net assets of the Funds. The Administrator has voluntarily agreed to waive 0.08% of its administrative fee on High Grade Income Fund’s average daily net assets excluding the Hawaii Municipal Bond Fund for which the Administrator is waiving 0.13% of its fee. These fee waivers are voluntary and may be discontinued at any time. For the six month period ended June 30, 2019, the Funds were charged as follows for these services: $37 in the High Grade Income Fund, and $124 in the Hawaii Municipal Bond Fund. For the six month period ended June 30, 2019, the Funds waived as follows for these services: $10 in the High Grade Income Fund, and $64 in the Hawaii Municipal Bond Fund. These fees and waivers are labeled as “Administrative Fees/Waivers” on the Statement of Operations.

| Bishop Street Funds |

28

| (unaudited) |

The Custodian plays no role in determining the investment policies of the Funds or which securities are to be purchased or sold by the Funds. These fees are labeled on the Statement of Operations as “Custody Fees.”

DST Systems, Inc. (“DST”) acts as the Transfer Agent of the Funds. As such, DST provides transfer agency, dividend disbursing and shareholder services to the Funds. These fees are disclosed on the Statement of Operations as “Transfer Agent Fees.” SEI Investments Distribution Co. (“SIDCO”), the “Distributer” a wholly owned subsidiary of SEI Investments Company, acts as the Trust’s Distributor pursuant to the distribution agreement. The Funds have adopted a Distribution Plan (the “Plan”) on behalf of Class A Shares pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan provides that Class A Shares will bear the cost of their distribution expenses. SIDCO, as compensation for its services under the Plan, receives a distribution fee, computed daily and payable monthly, of 0.25% of the average daily net assets attributable to each Fund’s Class A Shares. This fee is disclosed as “Distribution Fees, Class A” on the Statement of Operations.

The Trust has adopted and entered into a shareholder service plan and agreement with SIDCO. Each Fund pays to SIDCO a shareholder servicing fee not to exceed an annual rate of 0.25% of the average daily net asset value of all shares of each fund, which is computed daily and paid monthly. Under the shareholder service plan, SIDCO may perform, or may compensate other service providers for performing various shareholder and administrative services. SIDCO may also retain as profit any difference between the fee it receives and amount it pays to third parties. For the year, SIDCO paid the entire amount of fees received under the shareholder service plan to First Hawaiian Bank, the Parent Company of Bishop Street Capital Management, for shareholder services performed by First Hawaiian Bank on behalf of SIDCO for the benefit of certain shareholders to the Funds. SIDCO has voluntarily agreed to waive 0.15% of its shareholder servicing fee to the extent necessary to keep operating expenses at or below certain percentages of the respective average daily net assets. These fees and waivers are represented as “Shareholder Servicing Fees/Waivers” on the Statement of Operations.

| 5. | TRANSACTIONS WITH AFFILIATES |

Certain officers of the Trust are also officers of SEI Investments Global Funds Services (the “Administrator”), a wholly owned subsidiary of SEI Investments Company, and/or SIDCO. Such officers are paid no fees by the Trust other than the Chief Compliance Officer (“CCO”) as described below, for serving as officers of the Trust.

A portion of the services provided by the CCO and his staff, who are employees of the Administrator, are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s Advisers and service providers as required by SEC regulations. The

| June 30, 2019 | www.bishopstreetfunds.com |

29

| Bishop Street Funds | (unaudited) |

CCO’s services and expenses have been approved by and are reviewed by the Board. These fees are disclosed on the Statement of Operations as “Chief Compliance Officer Fees.”

| 6. | INVESTMENT TRANSACTIONS |

The cost of security purchases and the proceeds from the sale and maturities of securities, other than short-term investments, for the six month period ended June 30, 2019 are presented below for the Funds.

| High Grade Income Fund |

Hawaii Municipal Bond Fund |

|||||||

| Purchases |

||||||||

| U.S. Government Securities |

$ | 877 | $ | — | ||||

| Other |

2,623 | 19,046 | ||||||

| Sales and Maturities |

||||||||

| U.S. Government Securities |

$ | 843 | $ | — | ||||

| Other |

4,788 | 20,146 | ||||||

| 7. | FEDERAL TAX INFORMATION |

The timing and characterization of certain income and capital gains distributions are determined annually in accordance with Federal tax regulations which may differ from U.S. GAAP.

As a result, net investment income (loss) and net realized gain (loss) on investment transactions for the reporting period may differ from distributions during such period. These book/tax differences may be temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital and undistributed earnings, in the period that the differences arise. The permanent differences are primarily attributed to investments in paydown gains and losses and REIT adjustments.

The tax character of dividends and distributions declared during the years ended December 31, 2018 and 2017 were as follows:

| Ordinary Income |

Tax Exempt Income |

Long Term Capital Gain |

Total | |||||||||||||

| High Grade Income Fund |

|

|||||||||||||||

| 2018 |

$ | 1,029 | $ | — | $ | 27 | $ | 1,056 | ||||||||

| 2017 |

1,314 | — | 659 | 1,973 | ||||||||||||

| Hawaii Municipal Bond Fund |

||||||||||||||||

| 2018 |

$ | 13 | $ | 3,221 | $ | 11 | $ | 3,245 | ||||||||

| 2017 |

1 | 3,277 | 81 | 3,359 | ||||||||||||

| Bishop Street Funds |

30

| (unaudited) |

As of December 31, 2018, the components of Accumulated Losses on a tax basis were as follows:

| High Grade Income Fund |

Hawaii Municipal Bond Fund |

|||||||

| Undistributed Ordinary Income |

$ | 2 | $ | 4 | ||||

| Capital Loss Carryforwards |

(340 | ) | (363 | ) | ||||

| Post October Losses |

(89 | ) | (41 | ) | ||||

| Unrealized Depreciation |

(370 | ) | (491 | ) | ||||

| Other Temporary Differences |

1 | 1 | ||||||

|

|

|

|

|

|||||

| Total Accumulated Losses |

$ | (796 | ) | $ | (890 | ) | ||

|

|

|

|

|

|||||

Post-October losses represent losses realized on investment transactions from November 1, 2018 through December 31, 2018 that, in accordance with Federal income tax regulations, the Funds may defer and treat as having arisen in the following fiscal year.

For Federal income tax purposes, capital losses incurred may be carried forward and applied against future capital gains. Under the Regulated Investment Company Modernization Act of 2010, Funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Additionally, post enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

Capital loss carryforwards, all of which are not subject to expiration are as follows:

| Short-Term Loss |

Long-Term Loss |

Total | ||||||||||

| High Grade Income Fund |

$ | 58 | $ | 282 | $ | 340 | ||||||

| Hawaii Municipal Bond Fund |

93 | 270 | 363 | |||||||||

For Federal income tax purposes, the cost of securities owned at June 30, 2019, and the net realized gains or losses on securities sold for the period were not materially different from amounts reported for financial reporting purposes. These differences are primarily due to wash sales which cannot be used for Federal income tax purposes in the current year and have been deferred for use in future years. The Federal tax cost and

| June 30, 2019 | www.bishopstreetfunds.com |

31

| Bishop Street Funds | (unaudited) |

aggregate gross unrealized appreciation and depreciation for the investments (including foreign currency and derivatives, if applicable) held by the Funds at June 30, 2019, were as follows:

| High Grade Income Fund |

Hawaii Municipal Bond Fund |

|||||||

| Federal Tax Cost |

$ | 35,093 | $ | 124,017 | ||||

|

|

|

|

|

|||||

| Gross Unrealized Appreciation |

1,578 | 3,332 | ||||||

| Gross Unrealized Depreciation |

(86 | ) | (708 | ) | ||||

|

|

|

|

|

|||||

| Net Unrealized Appreciation |

$ | 1,492 | $ | 2,624 | ||||

|

|

|

|

|

|||||

| 8. | RISKS |

The High Grade Income Fund and Hawaii Municipal Bond Fund invest primarily in debt instruments. The issuers’ ability to meet their obligations may be affected by economic developments in that state. In addition, each Funds’ investments in debt securities are subject to “credit risk,” which is the risk that an issuer will be unable, or will be perceived to be unable, to repay its obligations at maturity and “interest rate risk” which is the potential for fluctuations in bond prices due to changing interest rates. Funds that invest primarily in high quality debt securities generally are subject to less credit risk than funds that invest in lower quality debt securities.

Certain debt securities are backed by credit enhancements from various financial institutions and financial guarantee assurance agencies. These credit enhancements reinforce the credit quality of the individual securities; however, if any of the financial institutions or financial guarantee assurance agencies’ credit quality should deteriorate, it could cause the individual security’s credit quality to change. Additionally, if any of the Funds concentrate their credit enhancements in any one financial institution, the risk of credit quality deterioration increases. The following tables provide detail on the approximate percentage of High Grade Income Fund’s and Hawaii Municipal Bond Fund’s investments in securities with these types of enhancements, as well as the name of the entity providing the largest proportion of enhancements in the Funds.

| High Grade Income Fund | ||

| % of investments in securities with credit enhancements or liquidity enhancements |

0.69% | |

| Largest % of investments in securities with credit enhancements or liquidity enhancements from a single institution |

0.69% (Assured

Guaranty |

| Bishop Street Funds |

32

| (unaudited) |

| Hawaii Municipal Bond Fund | ||

| % of investments in securities with credit enhancements or liquidity enhancements |

3.24% | |

| Largest % of investments in securities with credit enhancements or liquidity enhancements from a single institution |

1.58% (Assured Guaranty |

The value of asset-backed securities may be affected by the credit risk of the servicing agent for the pool, the originator of the loans or receivables, or the financial institution(s) providing the credit support. In addition to credit risk, asset-backed securities and other securities with early redemption features are subject to pre-payment risk. During periods of declining interest rates, prepayment of loans underlying asset-backed securities can be expected to accelerate or an issuer may retire an outstanding bond early to reduce interest costs. A Fund’s ability to maintain positions in such securities will be affected by reductions in the principal amount of such securities resulting from prepayments, and its ability to reinvest the returns of principal at comparable yields is subject to the general prevailing interest rates at that time.

The market value of the Funds’ investments in fixed income securities may change in response to interest rate changes and other factors. During periods of falling interest rates, the values of fixed income securities generally rise. Conversely, during periods of rising interest rates, the values of such securities generally decline. Changes by recognized rating agencies in the ratings of any fixed income security and in the ability of an issuer to make payments of interest and principal may also affect the value of these investments.

In the normal course of business, the Funds enter into contracts that provide general indemnifications. The Funds’ maximum exposure under these arrangements is dependent on future claims that may be made against the Funds and, therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

| 9. | LINE OF CREDIT |

Through June 30, 2019, the Funds, which are not jointly liable, had entered into an agreement which enabled them to participate in a $5 million unsecured committed revolving line of credit on a first come, first served basis, with MUFG Union Bank, N.A. (the “Bank”). The proceeds from the borrowings were used to finance the Funds’ short term general working capital requirements, including the funding of shareholder redemptions.

| June 30, 2019 | www.bishopstreetfunds.com |