UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934, as amended

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

THE ADVISORS’ INNER CIRCLE FUND

THE ADVISORS’ INNER CIRCLE FUND II

BISHOP STREET FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

IMPORTANT PROXY INFORMATION FOR

THE ADVISORS’ INNER CIRCLE FUND

| Acadian Emerging Markets Portfolio | Edgewood Growth Fund | Sands Capital Global Growth Fund | ||

| AlphaOne Small Cap Opportunities Fund | FMC Select Fund | Sarofim Equity Fund | ||

| AlphaOne NextGen Technology Fund | FMC Strategic Value Fund | Thomson Horstmann & Bryant MicroCap Fund | ||

| AlphaOne VIMCO Small Cap Value Fund | Hamlin High Dividend Equity Fund | TS&W Equity Portfolio | ||

| AT Disciplined Equity Fund | Harvest Asian Bond Fund (formerly, Harvest Funds Intermediate Bond) |

Westwood Income Opportunity Fund | ||

| AT Mid Cap Equity Fund | Haverford Quality Growth Stock Fund | Westwood SMidCap Fund | ||

| AT Income Opportunities Fund | ICM Small Company Portfolio | Westwood LargeCap Value Fund | ||

| Cambiar International Equity Fund | Loomis Sayles Full Discretion Institutional Securitized Fund | Westwood SmallCap Fund | ||

| Cambiar Opportunity Fund | LSV Value Equity Fund | Westwood Low Volatility Equity Fund | ||

| Cambiar Small Cap Fund | LSV Conservative Value Equity Fund | Westwood SMidCap Plus Fund | ||

| Cambiar Global Ultra Focus Fund | LSV Small Cap Value Fund | Westwood Short Duration High Yield Fund | ||

| Cambiar SMID Fund | LSV U.S. Managed Volatility Fund | Westwood Global Equity Fund | ||

| Cambiar Global Equity Fund | LSV Global Managed Volatility Fund | Westwood Emerging Markets Fund | ||

| Cambiar International Small Cap Fund | LSV Global Value Fund | Westwood MLP and Strategic Energy Fund | ||

| Cornerstone Advisors Global Public Equity Fund | McKee International Equity Portfolio | Westwood Opportunistic High Yield Fund | ||

| Cornerstone Advisors Income Opportunities Fund | Rice Hall James Micro Cap Portfolio | Westwood Market Neutral Income Fund | ||

| Cornerstone Advisors Public Alternatives Fund | Rice Hall James Small Cap Portfolio | Westwood Strategic Convertibles Fund | ||

| Cornerstone Advisors Real Assets Fund | Rice Hall James SMID Cap Portfolio | Westwood Worldwide Income Opportunity Fund | ||

| Cornerstone Advisors Core Plus Bond Fund | ||||

| THE ADVISORS’ INNER CIRCLE FUND II | ||||

| Cardinal Small Cap Value Fund | Frost Credit Fund | Hancock Horizon Dynamic Asset Allocation Fund | ||

| Champlain Small Company Fund | Hancock Horizon International Small Cap Fund | Kopernik Global All-Cap Fund | ||

| Champlain Mid Cap Fund | Hancock Horizon Microcap Fund | Kopernik International Fund | ||

| Champlain Emerging Markets Fund | Hancock Horizon Burkenroad Small Cap Fund | LM Capital Opportunistic Bond Fund | ||

| Frost Growth Equity Fund | Hancock Horizon Diversified Income Fund | Reaves Utilities and Energy Infrastructure Fund | ||

| Frost Mid Cap Equity Fund | Hancock Horizon Diversified International Fund | RSQ International Equity Fund | ||

| Frost Value Equity Fund | Hancock Horizon Quantitative Long/Short Fund | RQSI Small Cap Hedged Equity Fund | ||

| Frost Low Duration Bond Fund | Hancock Horizon Louisiana Tax-Free Income Fund | Westfield Capital Large Cap Growth Fund | ||

| Frost Municipal Bond Fund | Hancock Horizon Mississippi Tax-Free Income Fund | Westfield Capital Dividend Growth Fund | ||

| Frost Total Return Bond Fund | Hancock Horizon U.S. Small Cap Fund | |||

| BISHOP STREET FUNDS | ||||

| Bishop Street Dividend Value Fund | Bishop Street High Grade Income Fund | Bishop Street Hawaii Municipal Bond Fund | ||

THE ADVISORS’ INNER CIRCLE FUND

THE ADVISORS’ INNER CIRCLE FUND II

BISHOP STREET FUNDS

One Freedom Valley Drive

Oaks, Pennsylvania 19456

Dear Shareholder:

Enclosed is a notice, proxy statement and proxy card for a Joint Special Meeting of Shareholders (the “Meeting”) of the series of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II and Bishop Street Funds (each a “Fund,” and together, the “Funds”). The Meeting is scheduled for March 26, 2018. If you are a shareholder of record of a Fund as of the close of business on January 19, 2018, you are entitled to vote at the Meeting, and any adjournment of the Meeting.

At the Meeting, shareholders of each Fund will be asked to elect eight Trustees to the Board of Trustees of the Fund. Information about the nominees is provided in the accompanying proxy statement.

The Board of Trustees of each Fund has unanimously approved the nominees and recommends that you vote “FOR” the election of all nominees.

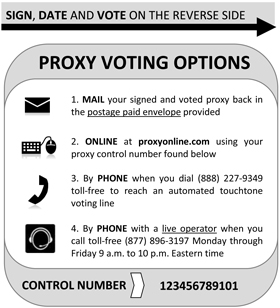

Your vote is important to us. Please take a few minutes to review this proxy statement and vote your shares today. We have enclosed a proxy card that we ask you to complete, sign, date and return as soon as possible, unless you plan to attend the Meeting and vote in person. You may also vote your shares by telephone or through the Internet. Please follow the enclosed instructions to utilize any of these voting methods.

If we do not receive your vote promptly, you may be contacted by a representative of the Funds, who will remind you to vote your shares.

Thank you for your attention and consideration of this important matter and for your investment in the Funds. If you need additional voting information, please call (877) 896-3197 Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Sincerely,

/s/ Michael Beattie

Michael Beattie

President

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE, SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

THE ADVISORS’ INNER CIRCLE FUND

THE ADVISORS’ INNER CIRCLE FUND II

BISHOP STREET FUNDS

One Freedom Valley Drive

Oaks, Pennsylvania 19456

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 26, 2018

Notice is hereby given that a Joint Special Meeting of Shareholders (the “Meeting”) of the series of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II and Bishop Street Funds (each a “Fund,” and together, the “Funds”), will be held at the offices of SEI Investments Company, One Freedom Valley Drive, Oaks, Pennsylvania 19456 on Monday, March 26, 2018, at 10:00 a.m., Eastern Time.

At the Meeting, shareholders of record of each Fund will be asked to elect eight Trustees to the Board of Trustees of the Fund, and to transact such other business, if any, as may properly come before the Meeting.

All Shareholders are cordially invited to attend the Meeting and vote in person. However, if you are unable to attend the Meeting, you are requested to mark, sign and date the enclosed proxy card and return it promptly in the enclosed, postage-paid envelope so that the Meeting may be held and a maximum number of shares may be voted. In addition, you can vote easily and quickly by Internet or by telephone. Your vote is important no matter how many shares you own. You may change your vote even though a proxy has already been returned by providing written notice to the Funds, by submitting a subsequent proxy by mail, Internet, or telephone, or by voting in person at the Meeting.

Shareholders of record of each Fund at the close of business on January 19, 2018 are entitled to notice of and to vote at the Meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the

Joint Special Meeting of Shareholders to Be Held on March 26, 2018.

The proxy statement is available at www.proxyonline.com/docs/SEI2018.pdf.

| By Order of the Board of Trustees |

| /s/ Michael Beattie |

| Michael Beattie President |

THE ADVISORS’ INNER CIRCLE FUND

THE ADVISORS’ INNER CIRCLE FUND II

BISHOP STREET FUNDS

One Freedom Valley Drive

Oaks, Pennsylvania 19456

PROXY STATEMENT

JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 26, 2018

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Trustees of the series of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II and Bishop Street Funds (each, a “Fund,” and together, the “Funds”), to be voted at a joint special meeting of shareholders of the Funds at the offices of SEI Investments, One Freedom Valley Drive, Oaks, Pennsylvania 19456, on Monday, March 26, 2018 at 10:00 a.m., Eastern Time, and at any adjournments thereof (such joint special meeting and any adjournment thereof are hereinafter referred to as the “Meeting”). Shareholders of record of each Fund at the close of business on January 19, 2018 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. This proxy statement and the accompanying notice of joint special meeting and proxy card are first being mailed to shareholders on or about February 12, 2018.

At the Meeting, shareholders of record of each Fund will be asked to elect eight Trustees to the Board of Trustees of the Fund, and to transact such other business, if any, as may properly come before the Meeting.

Each full share of a Fund will be entitled to one vote at the Meeting, and each fraction of a share will be entitled to the fraction of a vote equal to the proportion of a full share represented by the fractional share. The number of shares of each Fund issued and outstanding as of the Record Date is included in Appendix A.

The Funds will pay all expenses related to conducting this proxy, including, but not limited to, preparation, printing and mailing of this proxy statement and its enclosures, legal fees, and solicitation costs.

In this proxy statement, the term “Board” refers to the Board of Trustees of the Funds, and the term “Trustee” includes each trustee of the Funds. A Trustee who is an “interested person,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Funds is referred to in this proxy statement as an “Interested Trustee.” A Trustee who is not an “interested person,” as defined in the 1940 Act, of the Funds is referred to in this proxy statement as an “Independent Trustee.” The Advisors’ Inner Circle Fund (“AIC”), The Advisors’ Inner Circle Fund II (“AIC II”) and Bishop Street Funds (“BSF”) are each referred to in this proxy statement as a “Trust,” and are collectively referred to in this proxy statement as the “Trusts.”

1

ELECTION OF TRUSTEES

It is proposed that Robert Nesher, N. Jeffrey Klauder, Joseph T. Grause, Jr., Mitchell A. Johnson, Betty L. Krikorian, Bruce Speca, George J. Sullivan, Jr. and Tracie E. Ahern (each, a “Nominee” and collectively, the “Nominees”) be elected at the Meeting to serve as Trustees of the Funds. All of the Nominees, with the exceptions of Mr. Klauder and Ms. Ahern, currently serve on the Board. Mr. Klauder has been nominated to succeed William M. Doran as an Interested Trustee, and Ms. Ahern has been nominated to succeed John K. Darr, as an Independent Trustee. Mr. Darr retired from the Board as of December 31, 2017. Mr. Doran is scheduled to retire from the Board prior to the Meeting.

Section 16(a) of the 1940 Act generally requires the trustees of an investment company to be elected by shareholder vote. Section 16(a) provides, however, that trustees may be appointed without the election of shareholders if, immediately after such appointment, at least two-thirds of the trustees then holding office have been elected by shareholders. Currently, five of the seven Trustees (Messrs. Nesher, Doran, Johnson and Sullivan, and Ms. Krikorian) have been elected by shareholders, while two of the seven Trustees (Messrs. Grause and Speca) have been appointed by the Board, but not elected by shareholders. Accordingly, a shareholder vote must be held in order for Mr. Klauder and Ms. Ahern to serve on the Board with Messrs. Nesher, Johnson, Sullivan, Grause and Speca, and Ms. Krikorian.

Each Nominee has consented to being named in this proxy statement and has agreed to serve as a Trustee if elected. The Board does not know of any reason why any Nominee would be unable to serve as a Trustee, but if any Nominee should become unable to serve prior to the Meeting, the proxy holders reserve the right to vote for another person of their choice as Trustee.

INFORMATION ABOUT THE NOMINEES

Set forth below are the names, years of birth, position with the Funds and length of time served, and the principal occupations and other directorships held during at least the last five years of each of the Nominees. There is no stated term of office for the Nominees. The business address of each Nominee is One Freedom Valley Drive, Oaks, Pennsylvania 19456.

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in the Past 5 Years |

Number of Funds Overseen or to be Overseen |

Other Directorships Held in the Past 5 Years | ||||||

| Nominees for Interested Trustees | ||||||||||

| Robert Nesher* (Born: 1946) |

Chairman of the Board of Trustees (since 1991) |

SEI employee 1974 to present; currently performs various services on behalf of SEI Investments for which Mr. Nesher is compensated. Vice Chairman of The Advisors’ Inner Circle Fund III, Winton Diversified Opportunities Fund (closed-end investment | 87 | Current Directorships: Trustee of The KP Funds, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. Director of SEI Structured Credit Fund, LP, SEI Global Master Fund plc, SEI Global Assets Fund plc, SEI Global Investments Fund plc, SEI Investments—Global Funds Services, Limited, SEI Investments Global, Limited, | ||||||

2

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in the Past 5 Years |

Number of Funds Overseen or to be Overseen |

Other Directorships Held in the Past 5 Years | ||||

| company), Gallery Trust, Schroder Series Trust and Schroder Global Series Trust. President, Chief Executive Officer and Trustee of SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Asset Allocation Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. President and Director of SEI Structured Credit Fund, LP. President, Chief Executive Officer and Director of SEI Alpha Strategy Portfolios, LP, 2007 to 2013. President and Director of SEI Opportunity Fund, L.P. to 2010. Vice Chairman of O’Connor EQUUS (closed-end investment company) to 2016. Vice Chairman of Winton Series Trust to 2017. President, Chief Executive Officer and Trustee of SEI Liquid Asset Trust to 2016. | SEI Investments (Europe) Ltd., SEI Investments—Unit Trust Management (UK) Limited, SEI Multi-Strategy Funds PLC and SEI Global Nominee Ltd.

Former Directorships: Director of SEI Opportunity Fund, L.P. to 2010. Director of SEI Alpha Strategy Portfolios, LP to 2013. Trustee of SEI Liquid Asset Trust to 2016. |

3

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in the Past 5 Years |

Number of Funds Overseen or to be Overseen |

Other Directorships Held in the Past 5 Years | ||||

| N. Jeffrey Klauder* (Born: 1952) |

N/A | Executive Vice President and General Counsel of SEI Investments since 2004. | 87 | Current Directorships: Director of SEI Private Trust Company; SEI Investments Management Corporation; SEI Trust Company; SEI Investments (South Africa), Limited; SEI Investments (Canada) Company; SEI Global Fund Services Ltd.; SEI Investments Global Limited; SEI Global Master Fund; SEI Global Investments Fund; and SEI Global Assets Fund. | ||||

| Nominees for Independent Trustees | ||||||||

| Joseph T. Grause, Jr. (Born: 1952) |

Trustee (since 2011) Lead Independent Trustee (since 2018) |

Self-Employed Consultant since 2012. Director of Endowments and Foundations, Morningstar Investment Management, Morningstar, Inc., 2010 to 2011. Director of International Consulting and Chief Executive Officer of Morningstar Associates Europe Limited, Morningstar, Inc., 2007 to 2010. Country Manager – Morningstar UK Limited, Morningstar, Inc., 2005 to 2007. | 87 | Current Directorships: Trustee of The KP Funds. Director of The Korea Fund, Inc. | ||||

| Mitchell A. Johnson (Born: 1942) |

Trustee (since 2005) |

Retired. Private Investor since 1994. | 87 | Current Directorships: Trustee of The KP Funds, SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Managed Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New | ||||

4

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in the Past 5 Years |

Number of Funds Overseen or to be Overseen |

Other Directorships Held in the Past 5 Years | ||||

| Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. Director of Federal Agricultural Mortgage Corporation (Farmer Mac) since 1997.

Former Directorships: Director of SEI Alpha Strategy Portfolios, LP to 2013. Trustee of SEI Liquid Asset Trust to 2016. | ||||||||

| Betty L. Krikorian (Born: 1943) |

Trustee (since 2005) |

Vice President, Compliance, AARP Financial Inc., from 2008 to 2010. Self-Employed Legal and Financial Services Consultant since 2003. Counsel (in-house) for State Street Bank from 1995 to 2003. | 87 | Current Directorships: Trustee of The KP Funds. | ||||

| Bruce Speca (Born: 1956) |

Trustee (since 2011) |

Global Head of Asset Allocation, Manulife Asset Management (subsidiary of Manulife Financial), 2010 to 2011. Executive Vice President – Investment Management Services, John Hancock Financial Services (subsidiary of Manulife Financial), 2003 to 2010. | 87 | Current Directorships: Trustee of The KP Funds. Director of Stone Harbor Investments Funds, Stone Harbor Emerging Markets Income Fund (closed-end fund) and Stone Harbor Emerging Markets Total Income Fund (closed-end fund). | ||||

| George J. Sullivan, Jr. (Born: 1942) |

Trustee (since 1999) |

Retired since 2012. Self-Employed Consultant, Newfound Consultants Inc., 1997 to 2011. | 87 | Current Directorships: Trustee/Director of The KP Funds, SEI Structured Credit Fund, LP, SEI Daily Income Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. | ||||

5

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in the Past 5 Years |

Number of Funds Overseen or to be Overseen |

Other Directorships Held in the Past 5 Years | ||||

| Former Directorships: Director of SEI Opportunity Fund, L.P. to 2010. Director of SEI Alpha Strategy Portfolios, LP to 2013. Trustee of SEI Liquid Asset Trust to 2016. Trustee/Director of State Street Navigator Securities Lending Trust to 2017. Member of the independent review committee for SEI’s Canadian-registered mutual funds to 2017. | ||||||||

| Tracie E. Ahern (Born: 1968) |

N/A | Danesmead Partners – Principal (since 2016); Brightwood Capital Advisors LLC – Chief Operating Officer/Chief Financial Officer (2015 to 2016) and Advisor (2016); Soros Fund Management LLC - Chief Financial Officer (2007 to 2015). | 87 | None | ||||

| * | Messrs. Nesher and Klauder may be deemed to be “interested” persons, as that term is defined in the 1940 Act, of the Funds by virtue of their affiliation with SEI Investments Distribution Co. (the “Distributor”) and/or its affiliates. |

INDIVIDUAL NOMINEE QUALIFICATIONS

The Funds have concluded that each of the Nominees should serve on the Board because of their ability to review and understand information about the Funds provided to them by management, to identify and request other information they may deem relevant to the performance of their duties, to question management and other service providers regarding material factors bearing on the management and administration of the Funds, and to exercise their business judgment in a manner that serves the best interests of the Funds’ shareholders. The Funds have concluded that each of the Nominees should serve as a Trustee based on their own experience, qualifications, attributes and skills as described below.

The Funds have concluded that Mr. Nesher should serve as Trustee because of the experience he has gained in his various roles with SEI Investments, which he joined in 1974, his knowledge of and experience in the financial services industry, and the experience he has gained serving as a Trustee of the Funds since 1991.

The Funds have concluded that Mr. Klauder should serve as Trustee because of the experience he has gained in his various roles with SEI Investments, which he joined in 2004, his knowledge of and experience in the financial services industry, and the experience he gained serving as a partner of a large law firm.

6

The Funds have concluded that Mr. Grause should serve as Trustee because of the knowledge and experience he gained in a variety of leadership roles with different financial institutions, his knowledge of the mutual fund and investment management industries, his past experience as an interested trustee and chair of the investment committee for a multi-managed investment company, and the experience he has gained serving as a Trustee of the Funds since 2011.

The Funds have concluded that Mr. Johnson should serve as Trustee because of the experience he gained as a senior vice president, corporate finance, of a Fortune 500 company, his experience in and knowledge of the financial services and banking industries, the experience he gained serving as a director of other mutual funds, and the experience he has gained serving as a Trustee of the Funds since 2005.

The Funds have concluded that Ms. Krikorian should serve as Trustee because of the experience she gained serving as a legal and financial services consultant, in-house counsel to a large custodian bank and Vice President of Compliance of an investment adviser, her background in fiduciary and banking law, her experience in and knowledge of the financial services industry, and the experience she has gained serving as a Trustee of the Funds since 2005.

The Funds have concluded that Mr. Speca should serve as Trustee because of the knowledge and experience he gained serving as president of a mutual fund company and portfolio manager for a $95 billion complex of asset allocation funds, his over 25 years of experience working in a management capacity with mutual fund boards, and the experience he has gained serving as a Trustee of the Funds since 2011.

The Funds have concluded that Mr. Sullivan should serve as Trustee because of the experience he gained as a certified public accountant and financial consultant, his experience in and knowledge of public company accounting and auditing and the financial services industry, the experience he gained as an officer of a large financial services firm in its operations department, and the experience he has gained serving as a Trustee of the Funds since 1999.

The Funds have concluded that Ms. Ahern should serve as Trustee because of the experience she gained in numerous finance, accounting, tax, compliance and administration roles in the investment management industry, and her experience serving as a director of multiple hedge funds, private equity funds and non-profit organizations.

NOMINEE OWNERSHIP OF FUND SHARES

The following table shows the dollar range of Fund shares beneficially owned by each Nominee as of December 31, 2017.

|

|

Dollar Range of Fund Shares (Fund) |

Aggregate Dollar Range of Fund Shares | ||

| Interested Trustee Nominees | ||||

| Robert Nesher |

None | None | ||

| N. Jeffrey Klauder |

None | None | ||

| Independent Trustee Nominees | ||||

| Joseph T. Grause, Jr. |

Over $100,000 (Westwood Short Duration High Yield Fund) | Over $100,000 | ||

| Mitchell A. Johnson |

None | None | ||

| Betty L. Krikorian |

None | None | ||

| Bruce Speca |

None | None | ||

| George J. Sullivan, Jr. |

None | None | ||

| Tracie E. Ahern |

None | None | ||

7

NOMINEE COMPENSATION

The Funds paid the following fees to the Nominees during the year ended December 31, 2017:

| Name |

Aggregate Compensation from AIC |

Aggregate Compensation from AIC II |

Aggregate Compensation from BSF |

|||||||||

| Interested Trustee Nominees |

| |||||||||||

| Robert Nesher |

$ | 0 | $ | 0 | $ | 0 | ||||||

| Independent Trustee Nominees |

| |||||||||||

| Joseph T. Grause, Jr. |

$ | 114,340 | $ | 58,476 | $ | 7,553 | ||||||

| Mitchell A. Johnson |

$ | 114,340 | $ | 58,476 | $ | 7,553 | ||||||

| Betty L. Krikorian |

$ | 122,897 | $ | 63,200 | $ | 8,062 | ||||||

| Bruce Speca |

$ | 114,340 | $ | 58,476 | $ | 7,553 | ||||||

| George J. Sullivan, Jr. |

$ | 128,601 | $ | 66,349 | $ | 8,402 | ||||||

Each Trust would compensate Ms. Ahern for serving as an Independent Trustee, but would not compensate Mr. Klauder for serving as an Interested Trustee.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

There are currently seven members of the Board, five of whom are Independent Trustees. Robert Nesher, an Interested Trustee, serves as Chairman of the Board. Joseph T. Grause, Jr., an Independent Trustee, serves as the lead Independent Trustee. The Funds have determined that their leadership structure is appropriate given the specific characteristics and circumstances of the Funds. The Funds made this determination in consideration of, among other things, the fact that the Independent Trustees constitute more than two-thirds of the Board, the fact that the chairperson of each committee of the Board is an Independent Trustee, the amount of assets in the Funds, and the number of Funds (and classes of shares) overseen by the Board. The Board also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from Fund management.

The Board has two standing committees: the Audit Committee and the Governance Committee. The Audit Committee and the Governance Committee are chaired by an Independent Trustee and composed of all of the Independent Trustees.

In his role as lead Independent Trustee, Mr. Grause, among other things: (i) presides over Board meetings in the absence of the Chairman of the Board; (ii) presides over executive sessions of the Independent Trustees; (iii) along with the Chairman of the Board, oversees the development of agendas for Board meetings; (iv) facilitates communication between the Independent Trustees and management, and among the Independent Trustees; (v) serves as a key point person for dealings between the Independent Trustees and management; and (vi) has such other responsibilities as the Board or Independent Trustees determine from time to time.

Like most mutual funds, the day-to-day business of the Funds, including the management of risk, is performed by third party service providers, such as the Funds’ investment advisers and sub-advisers (each, an “Adviser,” and, together, the “Advisers”), the Distributor, and SEI Investments Global Funds Services (the “Administrator”). The Trustees are responsible for overseeing the Funds’ service providers

8

and, thus, have oversight responsibility with respect to risk management performed by those service providers. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of the Funds. The Funds and their service providers employ a variety of processes, procedures and controls to identify various possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each service provider is responsible for one or more discrete aspects of a Fund’s business (e.g., the Adviser is responsible for the day-to-day management of the Fund’s portfolio investments) and, consequently, for managing the risks associated with that business. The Board has emphasized to the Funds’ service providers the importance of maintaining vigorous risk management.

The Trustees’ role in risk oversight begins before the inception of a Fund, at which time certain of the Fund’s service providers present the Board with information concerning the investment objectives, strategies and risks of the Fund, as well as proposed investment limitations for the Fund. Additionally, the Adviser provides the Board with an overview of, among other things, its investment philosophy, brokerage practices and compliance infrastructure. Thereafter, the Board continues its oversight function as various personnel, including the Funds’ Chief Compliance Officer, as well as personnel of the Adviser and other service providers, such as the Fund’s independent accountants, make periodic reports to the Audit Committee or to the Board with respect to various aspects of risk management. The Board and the Audit Committee oversee efforts by management and service providers to manage risks to which the Funds may be exposed.

The Board is responsible for overseeing the nature, extent and quality of the services provided to a Fund by the Adviser and receives information about those services at its regular meetings. In addition, on an annual basis, in connection with its consideration of whether to renew the advisory agreement with the Adviser, the Board meets with the Adviser to review such services. Among other things, the Board regularly considers the Adviser’s adherence to the Fund’s investment restrictions and compliance with various Fund policies and procedures and with applicable securities regulations. The Board also reviews information about the Fund’s investments, including, for example, reports on the Adviser’s use of derivatives in managing the Fund, if any, as well as reports on the Fund’s investments in other investment companies, if any.

The Funds’ Chief Compliance Officer reports regularly to the Board to review and discuss compliance issues, and Fund and Adviser risk assessments. At least annually, the Funds’ Chief Compliance Officer provides the Board with a report reviewing the adequacy and effectiveness of the policies and procedures of the Funds and their service providers, including the Advisers. The report addresses the operation of the policies and procedures of the Funds and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report.

The Board receives reports from the Funds’ service providers regarding operational risks and risks related to the valuation and liquidity of portfolio securities. The Funds’ Fair Value Pricing Committee makes regular reports to the Board concerning investments for which market quotations are not readily available. Annually, the independent registered public accounting firms review with the Audit Committee their audits of the Funds’ financial statements, focusing on major areas of risk encountered by the Funds and noting any significant deficiencies or material weaknesses in the Funds’ internal controls. Additionally, in connection with its oversight function, the Board oversees Fund management’s implementation of disclosure controls and procedures, which are designed to ensure that information required to be disclosed by the Funds in their periodic reports with the SEC are recorded, processed, summarized, and reported within the required time periods. The Board also oversees the Funds’ internal controls over financial reporting, which comprise policies and procedures designed to provide reasonable assurance regarding the reliability of the Funds’ financial reporting and the preparation of the Funds’ financial statements.

9

From their review of these reports and discussions with the Advisers, the Chief Compliance Officer, the independent registered public accounting firms and other service providers, the Board and the Audit Committee learn in detail about the material risks of the Funds, thereby facilitating a dialogue about how management and the service providers identify and mitigate those risks.

The Board recognizes that not all risks that may affect the Funds can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Funds’ goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. Most of the Funds’ investment management and business affairs are carried out by or through the Advisers and other service providers, each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Funds’ and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, the Board’s ability to monitor and manage risk, as a practical matter, is subject to limitations.

BOARD MEETINGS AND COMMITTEES

During the fiscal years ended January 31, 2017, July 31, 2017, October 31, 2017 and December 31, 2017, the Board met seven, six, five and five times, respectively.

The Board has established the following standing committees:

Audit Committee. The Board has a standing Audit Committee that is composed of each of the Independent Trustees. The Audit Committee operates under a written charter approved by the Board. The principal responsibilities of the Audit Committee include: (i) recommending which firm to engage as each Fund’s independent registered public accounting firm and whether to terminate this relationship; (ii) reviewing each independent registered public accounting firm’s compensation, the proposed scope and terms of its engagement, and the firm’s independence; (iii) pre-approving audit and non-audit services provided by each Fund’s independent registered public accounting firm to the Fund and certain other affiliated entities; (iv) serving as a channel of communication between the independent registered public accounting firms and the Trustees; (v) reviewing the results of each external audit, including any qualifications in an independent registered public accounting firm’s opinion, any related management letter, management’s responses to recommendations made by the independent registered public accounting firm in connection with the audit, reports submitted to the Audit Committee by the internal auditing department of the Administrator that are material to the Funds, if any, and management’s responses to any such reports; (vi) reviewing each Fund’s audited financial statements and considering any significant disputes between Fund management and the independent registered public accounting firm that arose in connection with the preparation of those financial statements; (vii) considering, in consultation with the independent registered public accounting firms and the Funds’ senior internal accounting executive, if any, the independent registered public accounting firms’ reports on the adequacy of the internal financial controls; (viii) reviewing, in consultation with each Fund’s independent registered public accounting firm, major changes regarding auditing and accounting principles and practices to be followed when preparing each Fund’s financial statements; and (ix) other audit related matters. Mr. Sullivan serves as the Chairman of the Audit Committee. The Audit Committee meets periodically, as necessary, and met four times during each Fund’s last fiscal year.

10

Governance Committee. The Board has a standing Governance Committee (formerly the Nominating Committee) that is composed of each of the Independent Trustees. The Governance Committee operates under a written charter approved by the Board, a copy of which is attached hereto as Appendix B. The principal responsibilities of the Governance Committee include: (i) considering and reviewing Board governance and compensation issues; (ii) conducting a self-assessment of the Board’s operations; (iii) selecting and nominating all persons to serve as Independent Trustees; and (iv) reviewing shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the Governance Committee at the Funds’ office. Ms. Krikorian serves as the Chairperson of the Governance Committee. The Governance Committee meets periodically, as necessary. During the fiscal years ended January 31, 2017, July 31, 2017, October 31, 2017 and December 31, 2017, the Governance Committee met four, five, five and five times, respectively.

The Governance Committee reviews shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the Governance Committee at the Funds’ offices. When identifying and evaluating nominees, including those recommended by shareholders, the Governance Committee considers the complementary individual skills and experience of the individual nominee primarily in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Funds. The Committee has not adopted any specific minimum qualifications with respect to nominees and reviews each nominee’s qualifications on a case-by-case basis. The Independent Trustees recommended Ms. Ahern to the Governance Committee for nomination as an Independent Trustee.

SHAREHOLDER COMMUNICATIONS WITH TRUSTEES

Shareholders wishing to submit written communications to the Board or an individual Trustee should send their communications to SEI Investments, One Freedom Valley Drive, Oaks, Pennsylvania 19456.

REQUIRED VOTE

All Nominees receiving a plurality of the votes cast at the Meeting with respect to a Trust will be elected as Trustees of the Trust, provided that a majority of the shares of the Trust entitled to vote are present in person or by proxy at the Meeting. The election of Trustees for one Trust is not contingent on the election of Trustees for any other Trust.

Under a plurality vote, the Nominees who receive the highest number of votes will be elected, even if they receive approval from less than a majority of the votes cast. Because the Nominees are running unopposed, all eight Nominees are expected to be elected as Trustees, as all Nominees who receive votes in favor will be elected, while votes not cast or votes to withhold (or abstentions) will have no effect on the election outcome.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ALL NOMINEES.

ADDITIONAL INFORMATION

FUND OFFICERS

Set forth below are the names, years of birth, position with the Funds and length of time served, and the principal occupations for the last five years of each of the persons currently serving as executive officers of the Funds. There is no stated term of office for the officers of the Funds. Unless otherwise noted, the business address of each officer is SEI Investments, One Freedom Valley Drive, Oaks, Pennsylvania 19456. The Chief Compliance Officer is the only officer who receives compensation from the Funds for his services.

11

| Name and Year of Birth |

Position with Funds and Length of Time Served |

Principal Occupations in Past 5 Years | ||

| Michael Beattie (Born: 1965) | President (since 2011) |

Director of Client Service, SEI Investments, since 2004. | ||

| James Bernstein (Born: 1962) |

Vice President and Assistant Secretary (since 2017) |

Attorney, SEI Investments, since 2017.

Prior Positions: Self-employed consultant, 2017. Associate General Counsel & Vice President, Nationwide Funds Group and Nationwide Mutual Insurance Company, from 2002 to 2016. Assistant General Counsel & Vice President, Market Street Funds and Provident Mutual Insurance Company, from 1999 to 2002. | ||

| John Bourgeois (Born: 1973) |

Assistant Treasurer (since 2017) |

Fund Accounting Manager, SEI Investments, since 2000. | ||

| Stephen Connors (Born: 1984) |

Treasurer, Controller and Chief Financial Officer (since 2015) |

Director, SEI Investments, Fund Accounting, since 2014. Audit Manager, Deloitte & Touche LLP, from 2011 to 2014. | ||

| Dianne M. Descoteaux (Born: 1977) |

Vice President and Secretary (since 2011) |

Counsel at SEI Investments since 2010. Associate at Morgan, Lewis & Bockius LLP, from 2006 to 2010. | ||

| Russell Emery (Born: 1962) |

Chief Compliance Officer (since 2006) |

Chief Compliance Officer of SEI Structured Credit Fund, LP since 2007. Chief Compliance Officer of SEI Alpha Strategy Portfolios, LP from 2007 to 2013. Chief Compliance Officer of The KP Funds, The Advisors’ Inner Circle Fund III, Winton Diversified Opportunities Fund (closed-end investment company), Gallery Trust, Schroder Series Trust, Schroder Global Series Trust, SEI Institutional Managed Trust, SEI Asset Allocation Trust, SEI Institutional International Trust, SEI Institutional Investments Trust, SEI Daily Income Trust, SEI Tax Exempt Trust, Adviser Managed Trust, New Covenant Funds, SEI Insurance Products Trust and SEI Catholic Values Trust. Chief Compliance Officer of SEI Opportunity Fund, L.P. to 2010. Chief Compliance Officer of O’Connor EQUUS (closed-end investment company) to 2016. Chief Compliance Officer of SEI Liquid Asset Trust to 2016. Chief Compliance Officer of Winton Series Trust to 2017. | ||

| Robert Morrow (Born: 1968) | Vice President (since 2017) |

Account Manager, SEI Investments, since 2007. | ||

| Bridget E. Sudall (Born: 1980) |

Anti-Money Laundering Compliance Officer and Privacy Officer (since 2015) | Senior Associate and AML Officer, Morgan Stanley Alternative Investment Partners, from 2011 to 2015. Investor Services Team Lead, Morgan Stanley Alternative Investment Partners, from 2007 to 2011. | ||

| Lisa Whittaker (Born: 1978) |

Vice President and Assistant Secretary (since 2013) |

Attorney, SEI Investments, since 2012. Associate Counsel and Compliance Officer, The Glenmede Trust Company, N.A., from 2011 to 2012. Associate, Drinker Biddle & Reath LLP, from 2006 to 2011. | ||

12

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

PricewaterhouseCoopers LLP (“PwC”), Ernst & Young LLP (“EY”), Deloitte and Touche LLP (“Deloitte”) and BBD, LLP (“BBD”) (each, an “Auditor,” and, together, the “Auditors”) serve as the independent registered public accounting firms for the Funds.

Representatives of the Auditors are not expected to be present at the Meeting, but have been given an opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence.

Audit Fees. Below are the aggregate fees billed by the Auditors in the Funds’ last two fiscal years for professional services rendered by the Auditors for the audit of the Funds’ annual financial statements and services normally provided by the Auditors in connection with statutory and regulatory filings.

| Fiscal Year End |

Trust |

Funds1 |

2016 | 2017 | ||||||||

| PwC | ||||||||||||

| October 31 | AIC | Loomis Sayles Full Discretion Institutional Securitized Fund McKee International Equity Portfolio Rice Hall James Micro Cap Portfolio2 Rice Hall James Small Cap Portfolio2 Rice Hall James SMID Cap Portfolio2 |

$ | 49,000 | $ | 101,400 | ||||||

| October 31 | AIC II | Cardinal Small Cap Value Fund Kopernik Global All-Cap Fund Kopernik International Fund RSQ International Equity Fund Westfield Capital Large Cap Growth Fund Westfield Capital Dividend Growth Fund |

$ | 140,400 | $ | 143,400 | ||||||

| December 31 | AIC | Harvest Asian Bond Fund Sarofim Equity Fund |

$ | 50,400 | $ | 51,400 | ||||||

| December 31 | BSF | Bishop Street Dividend Value Fund Bishop Street High Grade Income Fund Bishop Street Hawaii Municipal Bond Fund |

$ | 124,900 | $ | 78,200 | ||||||

| EY | ||||||||||||

| January 31 | AIC II | Hancock Horizon Burkenroad Small Cap Fund Hancock Horizon Diversified Income Fund Hancock Horizon Diversified International Fund Hancock Horizon Quantitative Long/Short Fund Hancock Horizon Louisiana Tax-Free Income Fund Hancock Horizon Mississippi Tax-Free Income Fund Hancock Horizon U.S. Small Cap Fund Hancock Horizon Dynamic Asset Allocation Fund Hancock Horizon International Small Cap Fund Hancock Horizon Microcap Fund |

$ | 322,705 | $ | 394,190 | ||||||

13

| April 30 | AIC | Cambiar International Equity Fund3 Cambiar Opportunity Fund3 Cambiar Small Cap Fund3 Cambiar Global Ultra Focus Fund3 Cambiar SMID Fund3 Cambiar Global Equity Fund3 Cambiar International Small Cap Fund3 |

$ | 169,925 | $ | 165,015 | ||||||

| July 31 | AIC II | Champlain Small Company Fund Champlain Mid Cap Fund Champlain Emerging Markets Fund4 Frost Growth Equity Fund Frost Mid Cap Equity Fund Frost Value Equity Fund Frost Low Duration Bond Fund Frost Municipal Bond Fund Frost Total Return Bond Fund Frost Credit Fund LM Capital Opportunistic Bond Fund Reaves Utilities and Energy Infrastructure Fund |

$ | 388,550 | $ | 414,870 | ||||||

| October 31 | AIC | AlphaOne Small Cap Opportunities Fund AT Disciplined Equity Fund AT Mid Cap Equity Fund AT Income Opportunities Fund Cambiar International Equity Fund3 Cambiar Opportunity Fund3 Cambiar Small Cap Fund3 Cambiar Global Ultra Focus Fund3 Cambiar SMID Fund3 Cambiar Global Equity Fund3 Cambiar International Small Cap Fund3 Edgewood Growth Fund FMC Select Fund FMC Strategic Value Fund Haverford Quality Growth Stock Fund LSV Value Equity Fund LSV Conservative Value Equity Fund LSV Small Cap Value Fund LSV U.S. Managed Volatility Fund LSV Global Managed Volatility Fund LSV Global Value Fund Sands Capital Global Growth Fund Thomson Horstmann & Bryant MicroCap Fund Westwood Income Opportunity Fund Westwood SMidCap Fund Westwood LargeCap Value Fund Westwood SmallCap Fund Westwood Low Volatility Equity Fund Westwood SMidCap Plus Fund Westwood Short Duration High Yield Fund Westwood Global Equity Fund Westwood Emerging Markets Fund Westwood MLP and Strategic Energy Fund Westwood Opportunistic High Yield Fund Westwood Market Neutral Income Fund Westwood Strategic Convertibles Fund Westwood Worldwide Income Opportunity Fund |

$ | 725,065 | $ | 896,975 | ||||||

| October 31 |

AIC II | RQSI Small Cap Hedged Equity Fund | $ | 21,880 | $ | 22,475 |

14

| December 31 | AIC | Hamlin High Dividend Equity Fund | $ | 21,945 | $ | 22,600 | ||||||

| Deloitte | ||||||||||||

| October 31 | AIC | Cornerstone Advisors Global Public Equity Fund Cornerstone Advisors Income Opportunities Fund Cornerstone Advisors Public Alternatives Fund Cornerstone Advisors Real Assets Fund Cornerstone Advisors Core Plus Bond Fund |

$ | 160,000 | $ | 162,500 | ||||||

| BBD | ||||||||||||

| October 31 | AIC | Acadian Emerging Markets Portfolio ICM Small Company Portfolio Rice Hall James Micro Cap Portfolio2 Rice Hall James Small Cap Portfolio2 Rice Hall James SMID Cap Portfolio2 TS&W Equity Portfolio |

$ | 141,000 | $ | 107,000 | ||||||

Audit-Related Fees. There were no fees billed by the Auditors in the Funds’ last two fiscal years for assurance and related services rendered by the Auditors that are reasonably related to the performance of the audit of the Funds’ financial statements, and are not reported under “Audit Fees” above.

Tax Fees. Below are the aggregate fees billed by the Auditors in the Funds’ last two fiscal years for professional services rendered by the Auditors for tax compliance, tax advice, and tax planning (“Tax Services”).

| Fiscal Year End |

Trust |

Funds1 |

2016 | 2017 | ||||||||

| PwC | ||||||||||||

| October 31 | AIC | Loomis Sayles Full Discretion Institutional Securitized Fund McKee International Equity Portfolio Rice Hall James Micro Cap Portfolio2 Rice Hall James Small Cap Portfolio2 Rice Hall James SMID Cap Portfolio2 |

$ | 25,000 | $ | 30,000 | ||||||

| October 31 | AIC II | Cardinal Small Cap Value Fund Kopernik Global All-Cap Fund Kopernik International Fund RSQ International Equity Fund Westfield Capital Large Cap Growth Fund Westfield Capital Dividend Growth Fund |

$ | 220,000 | $ | 121,700 | ||||||

| Deloitte | ||||||||||||

| October 31 | AIC | Cornerstone Advisors Global Public Equity Fund Cornerstone Advisors Income Opportunities Fund Cornerstone Advisors Public Alternatives Fund Cornerstone Advisors Real Assets Fund Cornerstone Advisors Core Plus Bond Fund |

$ | 82,450 | $ | 82,450 | ||||||

Below are the aggregate fees billed by the Auditors in the Funds’ last two fiscal years that were required to be approved by the Audit Committee for Tax Services rendered to the Service Providers that relate directly to the operations or financial reporting of the Funds.

| Fiscal Year End |

Trust |

Funds1 |

2016 | 2017 | ||||||||

| PwC | ||||||||||||

| October 31 | AIC | Loomis Sayles Full Discretion Institutional Securitized Fund McKee International Equity Portfolio Rice Hall James Micro Cap Portfolio2 Rice Hall James Small Cap Portfolio2 Rice Hall James SMID Cap Portfolio2 |

$ | 110,000 | $ | 120,500 | ||||||

15

All Other Fees. There were no fees billed by the Auditors in the Funds’ last two fiscal years for products and services provided by the Auditors, other than the services reported above.

None of the services described above were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

Aggregate Non-Audit Fees. Below are the aggregate non-audit fees billed by the Auditors in the Funds’ last two fiscal years for services rendered to the Funds and the Service Providers.

| Fiscal Year End |

Trust |

Funds1 |

2016 | 2017 | ||||||||

| PwC | ||||||||||||

| October 31 | AIC | Loomis Sayles Full Discretion Institutional Securitized Fund McKee International Equity Portfolio Rice Hall James Micro Cap Portfolio2 Rice Hall James Small Cap Portfolio2 Rice Hall James SMID Cap Portfolio2 |

$ | 135,000 | $ | 150,500 | ||||||

| October 31 | AIC II | Cardinal Small Cap Value Fund Kopernik Global All-Cap Fund Kopernik International Fund RSQ International Equity Fund Westfield Capital Large Cap Growth Fund Westfield Capital Dividend Growth Fund |

$ | 220,000 | $ | 121,700 | ||||||

| EY | ||||||||||||

| July 31 | AIC II | Champlain Small Company Fund Champlain Mid Cap Fund Champlain Emerging Markets Fund4 Frost Growth Equity Fund Frost Mid Cap Equity Fund Frost Value Equity Fund Frost Low Duration Bond Fund Frost Municipal Bond Fund Frost Total Return Bond Fund Frost Credit Fund LM Capital Opportunistic Bond Fund Reaves Utilities and Energy Infrastructure Fund |

$ | 11,750 | $ | 11,500 | ||||||

| October 31 | AIC | AlphaOne Small Cap Opportunities Fund AT Disciplined Equity Fund AT Mid Cap Equity Fund AT Income Opportunities Fund Cambiar International Equity Fund3 Cambiar Opportunity Fund3 Cambiar Small Cap Fund3 Cambiar Global Ultra Focus Fund3 Cambiar SMID Fund3 Cambiar Global Equity Fund3 Cambiar International Small Cap Fund3 Edgewood Growth Fund FMC Select Fund |

$ | 62,500 | $ | 62,500 | ||||||

16

| FMC Strategic Value Fund Haverford Quality Growth Stock Fund LSV Value Equity Fund LSV Conservative Value Equity Fund LSV Small Cap Value Fund LSV U.S. Managed Volatility Fund LSV Global Managed Volatility Fund LSV Global Value Fund Sands Capital Global Growth Fund Thomson Horstmann & Bryant MicroCap Fund Westwood Income Opportunity Fund Westwood SMidCap Fund Westwood LargeCap Value Fund Westwood SmallCap Fund Westwood Low Volatility Equity Fund Westwood SMidCap Plus Fund Westwood Short Duration High Yield Fund Westwood Global Equity Fund Westwood Emerging Markets Fund Westwood MLP and Strategic Energy Fund Westwood Opportunistic High Yield Fund Westwood Market Neutral Income Fund Westwood Strategic Convertibles Fund Westwood Worldwide Income Opportunity Fund |

||||||||||||

| Deloitte | ||||||||||||

| October 31 | AIC | Cornerstone Advisors Global Public Equity Fund Cornerstone Advisors Income Opportunities Fund Cornerstone Advisors Public Alternatives Fund Cornerstone Advisors Real Assets Fund Cornerstone Advisors Core Plus Bond Fund |

$ | 82,450 | $ | 82,450 | ||||||

All non-audit services rendered by the Auditors to the Funds and the Service Providers in the last two fiscal years were pre-approved by the Audit Committee. In pre-approving the non-audit services, the Audit Committee considered whether the provision of the non-audit services is compatible with maintaining the Auditors’ independence.

| 1 | Fee information is provided with respect to the listed Funds, as well as terminated funds that were in the same Trust, and had the same independent registered public accounting firm and fiscal year end, as the listed Funds. |

| 2 | On May 16, 2016, BBD replaced PwC as the independent registered public accounting firm of the Funds. |

| 3 | On August 15, 2017, the fiscal year ends of the Funds changed from April 30 to October 31. |

| 4 | On November 16, 2015, the New Sheridan Developing World Fund, a series of ALPS Series Trust, reorganized into the Fund. |

Audit Committee Pre-Approval Policies and Procedures. The Audit Committee has adopted, and the Board has ratified, an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the Auditors of the Funds may be pre-approved. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence and whether the provision of such services by the Auditor would impair the Auditor’s independence.

17

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

The Policy states that the Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly scheduled meeting.

The Policy provides that all requests or applications for proposed services to be provided by an Auditor must be submitted to the Funds’ Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services: (1) require specific pre-approval; (2) are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or (3) have been previously pre-approved in connection with the Auditor’s annual engagement letter for the applicable year or otherwise. Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the Auditor.

Except for matters as to which an engagement letter would be impractical because of timing issues or because the matter is small, all services to be provided pursuant to the Policy shall be provided by an Auditor pursuant to an engagement letter with the Funds that (1) is in writing and signed by the Auditor or its authorized representative, (2) sets forth the particular services to be provided by the Auditor and the total fees to be paid to the Auditor for those services, and (3) includes a confirmation by the Auditor that any contemplated non-audit services are not within a category of services the provision of which would impair the Auditor’s independence under applicable SEC regulations.

In addition, the Policy states that the Audit Committee has determined to take additional measures on an annual basis to meet its responsibility to oversee the work of the Auditors and to assure the Auditors’ independence from the Funds, such as reviewing a formal written statement from an Auditor delineating all relationships between the Auditor and the Funds, and discussing with the Auditor its methods and procedures for ensuring independence.

OWNERSHIP OF THE FUNDS

Appendix C sets forth the persons who owned of record, or were known by the Funds to own beneficially, more than 5% of the shares of any class of the Funds as of the Record Date. On that date, the Nominees and officers of the Funds, together as a group, beneficially owned less than 1% of each class of each Fund’s outstanding shares.

The information as to beneficial ownership is based on statements furnished to the Funds by the Nominees and officers of the Funds, and/or on the records of the Funds’ transfer agents.

SERVICE PROVIDERS

The names and addresses of the Advisers are included in Appendix D. The Distributor and the Administrator are located at One Freedom Valley Drive, Oaks, Pennsylvania 19456.

ANNUAL AND SEMI-ANNUAL REPORTS TO SHAREHOLDERS

For a free copy of a Fund’s most recent annual and/or semi-annual report, shareholders of the Fund may call (877) 446-3863 or write to the Fund at: One Freedom Valley Drive, Oaks, Pennsylvania 19456.

18

SUBMISSION OF SHAREHOLDER PROPOSALS

The Trusts are organized as voluntary associations under the laws of the Commonwealth of Massachusetts. As such, the Funds are not required to, and do not, hold annual meetings. Nonetheless, the Board may call a special meeting of shareholders for action by shareholder vote as may be required by the 1940 Act or as required or permitted by the Declaration of Trust and By-Laws of a Trust. Shareholders of a Fund who wish to present a proposal for action at a future meeting should submit a written proposal to the Fund for inclusion in a future proxy statement. Submission of a proposal does not necessarily mean that such proposal will be included in the Fund’s proxy statement since inclusion in the proxy statement is subject to compliance with certain federal regulations. Shareholders retain the right to request that a meeting of the shareholders be held for the purpose of considering matters requiring shareholder approval.

VOTING AND OTHER MATTERS

If you wish to participate in the Meeting, you may vote by mail, Internet or telephone, or in person. Your vote is important no matter how many shares you own. You may change your vote even though a proxy has already been returned by providing written notice to the Funds, by submitting a subsequent proxy by mail, Internet or telephone, or by voting in person at the Meeting. For additional voting information, shareholders should call (877) 896-3197 Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

The solicitation of proxies will be largely by mail, but may include telephonic, Internet or oral communication by officers and service providers of the Funds, who will not be paid for these services, and/or AST Fund Solutions, LLC, a professional proxy solicitor (“AST”) that has been retained by the Funds for solicitation services for an estimated fee of $950,000, plus out-of-pocket expenses. Pursuant to this arrangement, AST has agreed to contact shareholders, banks, brokers, and proxy intermediaries to solicit votes for the Meeting.

All proxy cards that are properly executed and received in time to be voted at the Meeting will be voted at the Meeting or any adjournment thereof according to the instructions on the proxy card. If no contrary direction is given on an executed proxy card, it will be voted FOR the election of all Nominees.

If your shares are held of record by a broker-dealer and you wish to vote in person at the Meeting, you should obtain a legal proxy from your broker of record and present it to the Inspector of Elections at the Meeting. The presence in person or by proxy of shareholders holding a majority of the total number of votes eligible to be cast by all shareholders of a Trust as of the Record Date constitutes a quorum for the transaction of business at the Meeting with respect to the Trust. For purposes of determining the presence of a quorum, abstentions or broker non-votes will be counted as present; however, they will have no effect on the election outcome.

As used above, “broker non-votes” relate to shares that are held of record by a broker-dealer for a beneficial owner who has not given instructions to such broker-dealer. The Funds may request that selected brokers or nominees, in their discretion, submit broker non-votes if doing so is necessary to obtain a quorum.

If a quorum is not present at the Meeting with respect to a Trust, the Meeting may be adjourned with respect to the Trust to permit further solicitation of proxies. The Funds will bear the costs of any adjournment and additional solicitations.

19

No business other than the matter described above is expected to come before the Meeting, but should any other business properly come before the Meeting, the persons named in the enclosed proxy will vote thereon in their discretion.

SHAREHOLDERS WHO DO NOT EXPECT TO BE PRESENT AT THE MEETING AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO VOTE BY MAIL, TELEPHONE OR INTERNET AS EXPLAINED IN THE INSTRUCTIONS ON THE PROXY CARD.

| By Order of the Board of Trustees |

| /s/ Michael Beattie |

| Michael Beattie President |

20

APPENDIX A

FUND SHARES ISSUED AND OUTSTANDING

THE ADVISORS’ INNER CIRCLE FUND

| Fund |

Class |

Shares Issued and Outstanding | ||||

| Acadian Emerging Markets Portfolio | Investor Class Shares | 34,296,713.9450 | ||||

| Y Class Shares | 8.3220 | |||||

| I Class Shares | 21,068,991.3500 | |||||

| AlphaOne Small Cap Opportunities Fund | Investor Class Shares | 113,837.2630 | ||||

| Institutional Class Shares | 12,191,698.9020 | |||||

| AlphaOne NextGen Technology Fund | Institutional Class Shares | 25,014.0000 | ||||

| AlphaOne VIMCO Small Cap Value Fund | Institutional Class Shares | 146,045.7460 | ||||

| AT Disciplined Equity Fund | Institutional Class Shares | 47,496,450.4280 | ||||

| AT Mid Cap Equity Fund | Institutional Class Shares | 39,404,350.2000 | ||||

| AT Income Opportunities Fund | Institutional Class Shares | 29,529,231.2210 | ||||

| Cambiar International Equity Fund | Institutional Class Shares | 69,760,382.4060 | ||||

| Investor Class Shares | 65,054,427.5640 | |||||

| Cambiar Opportunity Fund | Institutional Class Shares | 7,893,842.6200 | ||||

| Investor Class Shares | 6,049,229.2610 | |||||

| Cambiar Small Cap Fund | Institutional Class Shares | 6,571,760.4770 | ||||

| Investor Class Shares | 4,415,034.7590 | |||||

| Cambiar Global Ultra Focus Fund | Investor Class Shares | 5,446,042.2630 | ||||

| Cambiar SMID Fund | Institutional Class Shares | 217,076.1050 | ||||

| Investor Class Shares | 1,975,502.7750 | |||||

| Cambiar Global Equity Fund | Investor Class Shares | 1,071,398.6180 | ||||

| Cambiar International Small Cap Fund | Institutional Class Shares | 197,586.3380 | ||||

| Cornerstone Advisors Global Public Equity Fund | Institutional Class Shares | 82,062,585.7710 | ||||

| Cornerstone Advisors Income Opportunities Fund | Institutional Class Shares | 22,941,339.3750 | ||||

| Cornerstone Advisors Public Alternatives Fund | Institutional Class Shares | 54,589,158.0290 | ||||

| Cornerstone Advisors Real Assets Fund | Institutional Class Shares | 26,178,622.8920 | ||||

| Cornerstone Advisors Core Plus Bond Fund | Institutional Class Shares | 43,999,395.9680 | ||||

| Edgewood Growth Fund | Institutional Class Shares | 363,539,151.5140 | ||||

| Retail Shares | 12,979,950.9670 | |||||

| FMC Select Fund | 7,884,043.1960 | |||||

| FMC Strategic Value Fund | 3,907,053.8850 | |||||

| Hamlin High Dividend Equity Fund | Institutional Class Shares | 37,285,225.4680 | ||||

| Investor Class Shares | 691,424.7140 | |||||

| Harvest Asian Bond Fund | Institutional Class Shares | 1,221,880.9730 | ||||

| Class A Shares | 1,389,976.1710 | |||||

| Haverford Quality Growth Stock Fund | 11,460,310.0490 | |||||

| ICM Small Company Portfolio | Institutional Class Shares | 23,275,412.7250 | ||||

A-1

| Loomis Sayles Full Discretion Institutional Securitized Fund | Institutional Class Shares | 38,746,721.5120 | ||||

| LSV Value Equity Fund | Institutional Class Shares | 74,349,887.8750 | ||||

| Investor Class Shares | 4,471,202.3400 | |||||

| LSV Conservative Value Equity Fund | Institutional Class Shares | 9,073,744.4380 | ||||

| Investor Class Shares | 9,558.4760 | |||||

| LSV Small Cap Value Fund | Institutional Class Shares | 21,757,986.0970 | ||||

| Investor Class Shares | 2,475,551.9860 | |||||

| LSV U.S. Managed Volatility Fund | Institutional Class Shares | 6,700,718.4160 | ||||

| Investor Class Shares | 558,405.7520 | |||||

| LSV Global Managed Volatility Fund | Institutional Class Shares | 751,405.8090 | ||||

| Investor Class Shares | 13,615.0320 | |||||

| LSV Global Value Fund | Institutional Class Shares | 383,100.2140 | ||||

| Investor Class Shares | 39,369.5180 | |||||

| McKee International Equity Portfolio | Institutional Class Shares | 14,764,419.0680 | ||||

| Rice Hall James Micro Cap Portfolio | Institutional Class Shares | 1,491,291.6040 | ||||

| Rice Hall James Small Cap Portfolio | Institutional Class Shares | 5,482,248.7420 | ||||

| Rice Hall James SMID Cap Portfolio | Investor Class Shares | 199,389.8750 | ||||

| Sands Capital Global Growth Fund | Institutional Class Shares | 51,598,771.6630 | ||||

| Investor Class Shares | 390,478.2620 | |||||

| Sarofim Equity Fund | 7,797,623.033 | |||||

| Thomson Horstmann & Bryant MicroCap Fund | Institutional Class Shares | 4,455,838.4570 | ||||

| Investor Class Shares | 41,600.7370 | |||||

| TS&W Equity Portfolio | 3,125,121.0240 | |||||

| Westwood Income Opportunity Fund | A Class Shares | 5,863,049.0770 | ||||

| Institutional Shares | 167,266,066.8420 | |||||

| Westwood SMidCap Fund | Institutional Shares | 21,370,115.4510 | ||||

| Westwood LargeCap Value Fund | A Class Shares | 152,701.7380 | ||||

| Institutional Shares | 16,101,295.8980 | |||||

| Westwood SmallCap Fund | Institutional Shares | 13,786,171.6710 | ||||

| Westwood Low Volatility Equity Fund | Institutional Shares | 4,188,180.3020 | ||||

| Westwood SMidCap Plus Fund | Institutional Shares | 10,273,836.2600 | ||||

| Westwood Short Duration High Yield Fund | A Class Shares | 57,076.6000 | ||||

| Institutional Shares | 8,183,260.3780 | |||||

| Westwood Global Equity Fund | Institutional Shares | 1,315,445.3470 | ||||

| Westwood Emerging Markets Fund | A Class Shares | 72,212.8700 | ||||

| Institutional Shares | 35,168,475.5290 | |||||

A-2

| Westwood MLP and Strategic Energy Fund | Institutional Shares | 2,108,125.3600 | ||||

| Westwood Opportunistic High Yield Fund | Institutional Shares | 84,324.8590 | ||||

| Ultra Shares | 136,478.5230 | |||||

| Westwood Market Neutral Income Fund | Institutional Shares | 664,131.0650 | ||||

| Ultra Shares | 2,431,443.7800 | |||||

| Westwood Strategic Convertibles Fund | Institutional Shares | 675,084.5530 | ||||

| Westwood Worldwide Income Opportunity Fund | Institutional Shares | 470,392.8880 | ||||

THE ADVISORS’ INNER CIRCLE FUND II

| Fund |

Class |

Shares Issued and Outstanding | ||||

| Cardinal Small Cap Value Fund | Institutional Class Shares | 4,803,711.591 | ||||

| Champlain Small Company Fund | Advisor Shares | 31,256,467.9670 | ||||

| Institutional Shares | 45,454,698.7980 | |||||

| Champlain Mid Cap Fund | Advisor Shares | 35,624,387.4470 | ||||

| Institutional Shares | 75,755,620.1470 | |||||

| Champlain Emerging Markets Fund | Advisor Shares | 355,200.8370 | ||||

| Frost Growth Equity Fund | Institutional Class Shares | 18,046,445.8950 | ||||

| Investor Class Shares | 3,276,290.3640 | |||||

| Frost Mid Cap Equity Fund | Institutional Class Shares | 1,048,398.8090 | ||||

| Investor Class Shares | 73,691.0280 | |||||

| Frost Value Equity Fund | Institutional Class Shares | 8,572,431.1760 | ||||

| Investor Class Shares | 3,287,719.9420 | |||||

| Frost Low Duration Bond Fund | Institutional Class Shares | 26,072,380.0720 | ||||

| Investor Class Shares | 2,706,662.9180 | |||||

| Frost Municipal Bond Fund | Institutional Class Shares | 15,929,592.9570 | ||||

| Investor Class Shares | 410,612.9660 | |||||

| Frost Total Return Bond Fund | Institutional Class Shares | 203,479,545.2310 | ||||

| Investor Class Shares | 33,653,888.1240 | |||||

| Frost Credit Fund | Institutional Class Shares | 17,720,568.8770 | ||||

| Investor Class Shares | 1,499,390.7890 | |||||

| Hancock Horizon Burkenroad Small Cap Fund | Institutional Class Shares | 2,714,177.609 | ||||

| Investor Class Shares | 6,930,121.852 | |||||

| Class D Shares | 461,322.326 | |||||

| Hancock Horizon Diversified Income Fund | Institutional Class Shares | 3,512,320.566 | ||||

| Investor Class Shares | 407,509.830 | |||||

| Class C Shares | 37,023.814 | |||||

| Hancock Horizon Diversified International Fund | Institutional Class Shares | 10,164,336.191 | ||||

| Investor Class Shares | 302,479.926 | |||||

| Class C Shares | 4,657.387 | |||||

| Hancock Horizon Quantitative Long/Short Fund | Institutional Class Shares | 6,622,812.548 | ||||

| Investor Class Shares | 1,683,428.956 | |||||

| Class C Shares | 196,399.690 | |||||

| Hancock Horizon Louisiana Tax-Free Income Fund | Institutional Class Shares | 225,137.941 | ||||

| Investor Class Shares | 183,384.929 | |||||

| Class C Shares | 1,002.311 | |||||

A-3

| Hancock Horizon Mississippi Tax-Free Income Fund | Institutional Class Shares | 545,664.610 | ||||

| Investor Class Shares | 354,824.412 | |||||

| Class C Shares | 1,945.281 | |||||

| Hancock Horizon U.S. Small Cap Fund | Institutional Class Shares | 1,622,660.070 | ||||

| Investor Class Shares | 77,706.203 | |||||

| Class C Shares | 9,828.879 | |||||

| Hancock Horizon Dynamic Asset Allocation Fund | Institutional Class Shares | 315,562.242 | ||||

| Investor Class Shares | 33,361.483 | |||||

| Class C Shares | 21,093.355 | |||||

| Hancock Horizon International Small Cap Fund | Institutional Class Shares | 935,293.751 | ||||

| Investor Class Shares | 28,496.477 | |||||

| Class C Shares | 13.334 | |||||

| Hancock Horizon Microcap Fund | Institutional Class Shares | 729,027.279 | ||||

| Investor Class Shares | 38,143.777 | |||||

| Class C Shares | 2,737.152 | |||||

| Kopernik Global All-Cap Fund | Class A Shares | 6,725,003.3860 | ||||

| Class I Shares | 104,217,979.9750 | |||||

| Kopernik International Fund | Class I Shares | 8,023,399.5850 | ||||

| LM Capital Opportunistic Bond Fund | Institutional Class Shares | 1,058,304.951 | ||||

| Reaves Utilities and Energy Infrastructure Fund | Institutional Class Shares | 4,781,362.4280 | ||||

| RSQ International Equity Fund | Institutional Class Shares | 3,039,732.7760 | ||||

| Investor Class Shares | 176,025.4300 | |||||

| RQSI Small Cap Hedged Equity Fund | Institutional Shares | 7,474,559.6790 | ||||

| Retail Shares | 1,969.8010 | |||||

| Westfield Capital Large Cap Growth Fund | Institutional Class Shares | 7,971,273.7450 | ||||

| Investor Class Shares | 19,553.5510 | |||||

| Westfield Capital Dividend Growth Fund | Institutional Class Shares | 10,158,808.1300 | ||||

| Investor Class Shares | 43,415.7030 | |||||

BISHOP STREET FUNDS

| Fund |

Class |

Shares Issued and Outstanding | ||||

| Bishop Street Dividend Value Fund | Class I Shares | 2,632,552.4880 | ||||

| Bishop Street High Grade Income Fund | Class I Shares | 5,243,315.0340 | ||||

| Bishop Street Hawaii Municipal Bond Fund | Class I Shares | 11,088,776.7920 | ||||

| Class A Shares | 1,884,292.1020 | |||||

A-4

APPENDIX B

GOVERNANCE COMMITTEE CHARTER

(the “Charter”)

| I. | Governance Committee: Membership |

The Governance Committee (the “Committee”) shall be composed entirely of “Independent Trustees” (members of the Board of Trustees (the “Board”) who are not interested persons of the Trusts as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended), and consist of all the Independent Trustees with one Independent Trustee elected as chair of the Committee (the “Chair”). Matters to be addressed “periodically” under the terms of this Charter shall be addressed at least annually, normally in conjunction with the annual self-assessment required by Section V.C. hereof.

| II. | Board: Selection and Tenure |

| A. | The Committee shall periodically review the composition of the Board, including its size and the balance of its members’ skills, experience and background. |

| B. | The Committee shall periodically review and make recommendations with regard to the tenure of the Independent Trustees, including term limits and/or age limits. |

| C. | The Committee shall periodically review and make recommendations with respect to adoption of and administration of any policy for retirement from Board membership. |

| III. | Board: Nominations and Functions |

| A. | The Committee shall select and nominate all persons to serve as Independent Trustees. The Committee shall evaluate candidates’ qualifications for Board membership and the independence of such candidates from the investment advisers and other principal service providers for the funds of the Trusts. Persons selected must be independent in terms of both the letter and the spirit of the 1940 Act. The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, e.g., business, financial or family relationships with investment advisers or service providers. |

| B. | The Committee also may consider proposals for “interested” Trustee candidates to the Board. |

| C. | The Committee may adopt from time to time specific, minimum qualifications that the Committee believes a candidate must meet before being considered as a candidate for Board membership and shall comply with any rules adopted from time to time by the U.S. Securities and Exchange Commission regarding investment company nominating committees and the nomination of persons to be considered as candidates for Board membership. |

B-1