UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number 1-13412

Hudson Technologies, Inc.

(Exact name of registrant as specified in its charter)

| New York | 13-3641539 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| P.O. Box 1541 | |

| One Blue Hill Plaza | |

| Pearl River, New York | 10965 |

| (Address of Principal Executive Offices) | (Zip Code) |

| Registrant’s telephone number, including area code | (845) 735-6000 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common stock, $.01 par value | The NASDAQ Stock Market LLC (NASDAQ Capital Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer (do not check if a smaller reporting company) | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of registrant’s common stock held by non-affiliates at June 30, 2017 was approximately $307,604,835. As of March 1, 2018 there were 42,403,140 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant's Proxy Statement for its Annual Meeting of Stockholders to be held on June 8, 2018, are incorporated by reference in Part III of this Report. Except as expressly incorporated by reference, the Registrant's Proxy Statement shall not be deemed to be part of this Form 10-K.

Hudson Technologies, Inc.

Index

| 2 |

General

Hudson Technologies, Inc., incorporated under the laws of New York on January 11, 1991, is a refrigerant services company providing innovative solutions to recurring problems within the refrigeration industry. The Company’s operations consist of one reportable segment. The Company's products and services are primarily used in commercial air conditioning, industrial processing and refrigeration systems, and include refrigerant and industrial gas sales, refrigerant management services consisting primarily of reclamation of refrigerants and RefrigerantSide® Services performed at a customer's site, consisting of system decontamination to remove moisture, oils and other contaminants. In addition, the Company’s SmartEnergy OPS® service is a web-based real time continuous monitoring service applicable to a facility’s refrigeration systems and other energy systems. The Company’s Chiller Chemistry® and Chill Smart® services are also predictive and diagnostic service offerings. As a component of the Company’s products and services, the Company also participates in the generation of carbon offset projects. The Company operates principally through its wholly-owned subsidiaries, Hudson Technologies Company and Aspen Refrigerants, Inc., which was formerly known as Airgas-Refrigerants, Inc. prior to the recent acquisition described below. Unless the context requires otherwise, references to the “Company”, “Hudson”, “we", “us”, “our”, or similar pronouns refer to Hudson Technologies, Inc. and its subsidiaries.

The Company's executive offices are located at One Blue Hill Plaza, Pearl River, New York and its telephone number is (845) 735-6000. The Company maintains a website at www.hudsontech.com, the contents of which are not incorporated into this filing.

Recent Acquisition

On October 10, 2017, the Company and its wholly-owned subsidiary, Hudson Holdings, Inc. (“Holdings”) completed the acquisition (the “Acquisition”) from Airgas, Inc. (“Airgas”) of all of the outstanding stock of Airgas-Refrigerants, Inc., a Delaware corporation (“ARI”), and effective October 11, 2017, ARI’s name was changed to Aspen Refrigerants, Inc. At closing, Holdings paid net cash consideration to Airgas of approximately $209 million, which includes preliminary post-closing adjustments relating to: (i) changes in the net working capital of ARI as of the closing relative to a net working capital target, (ii) the actual amount of specified types of R-22 refrigerant inventory on hand at closing relative to a target amount thereof, and (iii) other consideration pursuant to the stock purchase agreement.

The cash consideration paid by Holdings at closing was financed with available cash balances, plus $80 million of borrowings under an enhanced asset-based lending facility of $150 million from PNC Bank and a new term loan of $105 million from funds advised by FS Investments and sub-advised by GSO Capital Partners LP.

ARI, which is operated as a wholly owned subsidiary, is a leading refrigerant distributor and distributes, reclaims and packages refrigerant gases for a variety of end uses. Potential benefits of the acquisition of ARI include (i) providing a broader customer network which will provide the Company with increased access to refrigerant for reclamation and strengthen the Company’s refrigerant distribution capabilities; (ii) adding incremental reclamation processing capacity to support the growth in reclamation; (iii) providing a broader customer base for the marketing and sale of the Company’s services offerings; and (iv) enhancing the Company’s geographic footprint in the United States.

Industry Background

The Company participates in an industry that is highly regulated, and changes in the regulations affecting our business could affect our operating results. Currently the Company purchases virgin, hydrochlorofluorocarbon (“HCFC”) and hydrofluorocarbon (“HFC”) refrigerants and reclaimable, primarily HCFC, HFC and chlorofluorocarbon (“CFC”) refrigerants from suppliers and its customers. Effective January 1, 1996, the Clean Air Act, as amended (the “Act”) prohibited the production of virgin CFC refrigerants and limited the production of virgin HCFC refrigerants. Effective January 2004, the Act further limited the production of virgin HCFC refrigerants and federal regulations were enacted which established production and consumption allowances for HCFC refrigerants and which imposed limitations on the importation of certain virgin HCFC refrigerants. Under the Act, production of certain virgin HCFC refrigerants is scheduled to be phased out during the period 2010 through 2020, and production of all virgin HCFC refrigerants is scheduled to be phased out by 2030. In October 2014, the EPA published a final rule providing further reductions in the production and consumption allowances for virgin HCFC refrigerants for the years 2015 through 2019 (the “Final Rule”). In the Final Rule, the EPA has established a linear annual phase down schedule for the production or importation of virgin HCFC-22 that started at approximately 22 million pounds in 2015 and reduces by approximately 4.5 million pounds each year and ends at zero in 2020.

HFC refrigerants are used as substitutes for CFC and HCFC refrigerants in certain applications. As a result of the increasing restrictions and limitations on the production and use of CFC and HCFC refrigerants, various sectors of the air conditioning and refrigeration industry have been replacing or modifying equipment that utilize CFC and HCFC refrigerants and have been transitioning to equipment that utilize HFC refrigerants and hydrofluoro-olefins (“HFO”). HFC refrigerants are not ozone depleting chemicals and are not currently regulated under the Act. However, certain HFC refrigerants are highly weighted greenhouse gases that are believed to contribute to global warming and climate change and, as a result, are now subject to various state and federal regulations relating to the sale, use and emissions of HFC refrigerants. The Company expects that HFC refrigerants eventually will be replaced by HFOs or other types of products with lower global warming potentials.

| 3 |

In October 2016, more than 200 countries, including the United States, agreed to amend the Montreal Protocol to phase down production of HFCs by 85% between now and 2047. The amendment establishes timetables for all developed and developing countries to freeze and then reduce production and use of HFCs, with the first reductions by developed countries starting in 2019. The amendment becomes effective January 1, 2019 as more than twenty countries have ratified the amendment. To date, the amendment has not been ratified by the United States.

The Act, and the federal regulations enacted under authority of the Act, have mandated and/or promoted responsible use practices in the air conditioning and refrigeration industry, which are intended to minimize the release of refrigerants into the atmosphere and encourage the recovery and re-use of refrigerants. The Act prohibits the venting of CFC, HFC and HCFC refrigerants, and prohibits and/or phases down the production of CFC and HCFC refrigerants.

The Act also mandates the recovery of CFC and HCFC refrigerants and also promotes and encourages re-use and reclamation of CFC and HCFC refrigerants. Under the Act, owners, operators and companies servicing cooling equipment utilizing CFC and HCFC refrigerants are responsible for the integrity of the systems regardless of the refrigerant being used. In November 2016, the EPA issued a final rule extending these requirements to HFCs and to certain other refrigerants that are approved by the EPA as alternatives for CFC and HCFC refrigerants (the “608 Rule”). In January 2017, petitions objecting to, and seeking review of the 608 Rule were filed by certain industry groups. Those petitions are still pending and are currently being held in abeyance until April 30, 2018.

Products and Services

From its inception, the Company has sold refrigerants, and has provided refrigerant reclamation and refrigerant management services that are designed to recover and reuse refrigerants, thereby protecting the environment from release of refrigerants to the atmosphere and the corresponding ozone depletion and global warming impact. The reclamation process allows the refrigerant to be re-used thereby eliminating the need to destroy or manufacture additional refrigerant and eliminating the corresponding impact to the environment associated with the destruction and manufacturing. The Company believes it is the largest refrigerant reclaimer in the United States. Additionally, the Company has created alternative solutions to reactive and preventative maintenance procedures that are performed on commercial and industrial refrigeration systems. These services, known as RefrigerantSide® Services, complement the Company’s refrigerant sales and refrigerant reclamation and management services. The Company has also developed SmartEnergy OPS® that identify inefficiencies in the operation of air conditioning and refrigeration systems and assists companies to improve the energy efficiency of their systems and save operating costs and improve system reliability. In addition, the Company is pursuing potential opportunities for the creation and monetization of verified emission reductions.

Refrigerant and Industrial Gas Sales

The Company sells reclaimed and virgin (new) refrigerants to a variety of customers in the air conditioning and refrigeration industry. The Company continues to sell reclaimed CFC based refrigerants, which are no longer manufactured. Virgin, non-CFC refrigerants, including HCFC and HFC refrigerants, are purchased by the Company from several suppliers and resold by the Company, typically at wholesale. Additionally, the Company regularly purchases used or contaminated refrigerants, some of which are CFC based, from many different sources, which refrigerants are then reclaimed using the Company's high speed proprietary reclamation equipment, its proprietary Zugibeast® system, and then are resold by the Company. With the acquisition of ARI, the Company has access to an expanded customer base and to a broader variety of the industry for the sale of its refrigerant and industrial gas products and for the purchase of contaminated refrigerants for reclamation and resale.

The Company also sells industrial gases to a variety of industry customers, predominantly to users in or involved with the US Military. In July 2016, the Company was awarded, as prime contractor, a five-year fixed price contract, including a five-year renewal option, awarded to it by the United States Defense Logistics Agency (“DLA”) for the management and supply of refrigerants, compressed gases, cylinders and related items to US Military Commands and Installations, Federal civilian agencies and Foreign Militaries. Primary users include the US Army, Navy, Air Force, Marine Corps and Coast Guard.

Refrigerant Management Services

The Company provides a complete offering of refrigerant management services, which primarily include reclamation of refrigerants, laboratory testing through the Company’s laboratory, which has been certified by the Air Conditioning, Heating and Refrigeration Institute (“AHRI”), and banking (storage) services tailored to individual customer requirements. The Company also separates “crossed” (i.e. commingled) refrigerants and provides re-usable cylinder refurbishment and hydrostatic testing services.

RefrigerantSide® Services

The Company provides decontamination and recovery services that are performed at a customer's site through the use of portable, high volume, high-speed proprietary equipment, including the patented Zugibeast® system. Certain of these RefrigerantSide® Services, which encompass system decontamination, and refrigerant recovery and reclamation, are also proprietary and are covered by process patents.

In addition to the decontamination and recovery services previously described, the Company also provides predictive and diagnostic services for its customers. The Company offers diagnostic services that are intended to predict potential problems in air conditioning and refrigeration systems before they occur. The Company’s Chiller Chemistry® offering integrates several fluid tests of an operating system and the corresponding laboratory results into an engineering report providing its customers with an understanding of the current condition of the fluids, the cause for any abnormal findings and the potential consequences if the abnormal findings are not remediated. Fluid Chemistry®, an abbreviated version of the Company’s Chiller Chemistry® offering, is designed to quickly identify systems that require further examination.

| 4 |

The Company has also been awarded several US patents for its SmartEnergy OPS®, which is a system for measuring, modifying and improving the efficiency of energy systems, including air conditioning and refrigeration systems, in industrial and commercial applications. This service is a web-based real time continuous monitoring service applicable to a facility’s chiller plant systems. The SmartEnergy OPS® offering enables customers to monitor and improve their chiller plant performance and proactively identify and correct system inefficiencies. SmartEnergy OPS® is able to identify specific inefficiencies in the operation of chiller plant systems and, when used with Hudson’s RefrigerantSide ® Services, can increase the efficiency of the operating systems thereby reducing energy usage and costs. Improving the system efficiency reduces power consumption thereby directly reducing CO 2 emissions at the power plants or onsite. Lastly, the Company’s ChillSmart® offering, which combines the system optimization with the Company’s Chiller Chemistry ® offering, provides a snapshot of a packaged chiller’s operating efficiency and health. ChillSmart® provides a very effective predictive maintenance tool and helps our customers to identify the operating chillers that cause higher operating costs.

The Company’s engineers who developed and support SmartEnergy OPS® are recognized as Energy Experts and Qualified Best Practices Specialists by the United States Department of Energy (“DOE”) in the areas of Steam and Process Heating under the DOE “Best Practices” program, and are the Lead International Energy Experts for steam, chillers and refrigeration systems for the United Nations Industrial Development Organization (“UNIDO”). The Company’s staff have trained more than 4,000 industrial plant personnel in the US and internationally and have developed, and are currently delivering, training curriculums in 12 different countries. The Company’s staff have completed more than 200 industrial ESAs in the US and internationally.

Carbon Offset Projects

CFC refrigerants are ozone depleting substances and are also highly weighted greenhouse gases that contribute to global warming and climate change. The destruction of CFC refrigerants may be eligible for verified emission reductions that can be converted and monetized into carbon offset credits that may be traded in the emerging carbon offset markets. The Company is pursuing opportunities to acquire CFC refrigerants and is developing relationships within the emerging environmental markets in order to develop opportunities for the creation and monetization of verified emission reductions from the destruction of CFC refrigerants.

In October 2015, the American Carbon Registry (“ACR”) established a methodology to provide, among other things, a quantification framework for the creation of carbon offset credits for the use of certified reclaimed HFC refrigerants. The Company is pursuing opportunities to acquire HFC refrigerants and is developing relationships within the emerging environmental markets in order to develop opportunities for the creation and monetization of verified emission reductions from the reclamation of HFC refrigerants.

Summary of Revenues

The following is a summary of revenues by product category over the last three years:

| Years Ended December 31, | 2017 | 2016 | 2015 | |||||||||

| (in thousands) | ||||||||||||

| Product and related sales | $ | 136,016 | $ | 101,344 | $ | 75,154 | ||||||

| RefrigerantSide ® Services | 4,364 | 4,137 | 4,568 | |||||||||

| Total | $ | 140,380 | $ | 105,481 | $ | 79,722 | ||||||

Hudson's Network

Hudson operates from a network of facilities located in:

| Pearl River, New York | —Company headquarters and administrative offices |

| Champaign, Illinois | —Reclamation and separation of refrigerants and cylinder refurbishment center; RefrigerantSide® Service depot |

| Nashville, Tennessee | —Reclamation and separation of refrigerants and cylinder refurbishment center |

| Ontario, California | —Reclamation and cylinder refurbishment center |

| Catano, Puerto Rico | —Reclamation center and RefrigerantSide® Service depot |

| Auburn, Washington | —RefrigerantSide® Service depot |

| Baton Rouge, Louisiana | —RefrigerantSide® Service depot |

| Charlotte, North Carolina | —RefrigerantSide® Service depot |

| Escondido, California | —Refrigerants and Industrial Gases |

| Stony Point, New York | —RefrigerantSide® Service depot |

| Tulsa, Oklahoma | —Energy Services |

| Riverside, California | —Storage facility |

| 5 |

| Hampstead, New Hampshire | —Telemarketing office |

| Pottsboro, Texas | —Telemarketing office |

| Smyrna, Georgia | —Reclamation and separation of refrigerants and cylinder refurbishment center |

| Long Island City, New York | —Administrative, sales and marketing offices, and refrigerant storage & shipping |

| Lawrenceville, Georgia | —Administrative offices |

| Long Beach, California | —Telemarketing office |

Strategic Alliances

The Company believes that the international market for refrigerant reclamation, sales and services is equal in size to the United States market for those sales and services. The Company has Alliances in Europe and South Africa, and over time, the Company expects to introduce its technology and offerings to several other markets around the world.

Suppliers

The Company's financial performance and its ability to sell refrigerants is in part dependent on its ability to obtain sufficient quantities of virgin, non-CFC based refrigerants, and of reclaimable CFC and non-CFC based, refrigerants from manufacturers, wholesalers, distributors, bulk gas brokers and from other sources within the air conditioning, refrigeration and automotive aftermarket industries, and on corresponding demand for refrigerants. The Company's refrigerant sales include CFC based refrigerants, which are no longer manufactured. Additionally, the Company's refrigerant sales include non-CFC based refrigerants, including HCFC and HFC refrigerants, which are the most-widely used refrigerants. Effective January 1, 1996, the Act limited the production of virgin HCFC refrigerants, which production was further limited in January 2004. Federal regulations enacted in January 2004 established production and consumption allowances for HCFCs and imposed limitations on the importation of certain virgin HCFC refrigerants. Under the Act, production of certain virgin HCFC refrigerants is scheduled to be phased out during the period 2010 through 2020 and production of all virgin HCFC refrigerants is scheduled to be phased out by 2030. In October 2014, the EPA published the Final Rule providing further reductions in the production and consumption allowances for virgin HCFC refrigerants for the years 2015 through 2019. In the Final Rule, the EPA has established a linear annual phase down schedule for the production or importation of virgin HCFC-22 that started at approximately 22 million pounds in 2015 and is being reduced by approximately 4.5 million pounds each year and will end at zero in 2020.

In October 2016, more than 200 countries, including the United States, agreed to amend the Montreal Protocol to phase down production of HFCs by 85% between now and 2047. The amendment establishes timetables for all developed and developing countries to freeze and then reduce production and use of HFCs, with the first reductions by developed countries starting in 2019. The amendment becomes effective January 1, 2019 as more than twenty countries have ratified the amendment. To date, the amendment has not been ratified by the United States.

| 6 |

Customers

The Company provides its products and services to commercial, industrial and governmental customers, as well as to refrigerant wholesalers, distributors, contractors and to refrigeration equipment manufacturers. Agreements with larger customers generally provide for standardized pricing for specified services. The Company generates sales by purchase order on a real-time basis and therefore does not carry a backlog of sales.

For the year ended December 31, 2017, two customers each accounted for 10% or more of the Company’s revenues and, in the aggregate these two customers accounted for 33% of the Company’s revenues. At December 31, 2017, there were $2.7 million of outstanding receivables from these customers.

For the year ended December 31, 2016, two customers each accounted for 10% or more of the Company’s revenues and, in the aggregate these two customers accounted for 30% of the Company’s revenues. At December 31, 2016, there were no outstanding receivables from these customers.

For the year ended December 31, 2015, two customers each accounted for 10% or more of the Company’s revenues and, in the aggregate these two customers accounted for 33% of the Company’s revenues. At December 31, 2015, there were no outstanding receivables from these customers.

Marketing

Marketing programs are conducted through the efforts of the Company's executive officers, Company sales personnel, and third parties. Hudson employs various marketing methods, including direct mailings, technical bulletins, in-person solicitation, print advertising, response to quotation requests and the internet through the Company’s websites (www.hudsontech.com and www.ASPENRefrigerants.com). Information on the Company's websites are not part of this report.

The Company's sales personnel are compensated on a combination of a base salary and commission. The Company's executive officers devote significant time and effort to customer relationships.

Competition

The Company competes primarily on the basis of the performance of its proprietary high volume, high-speed equipment used in its operations, the breadth of services offered by the Company, including proprietary RefrigerantSide® Services and other on-site services, and price, particularly with respect to refrigerant sales.

The Company competes with numerous regional and national companies that market reclaimed and virgin refrigerants and provide refrigerant reclamation services. Certain of these competitors possess greater financial, marketing, distribution and other resources for the sale and distribution of refrigerants than the Company and, in some instances, serve a more extensive geographic area than the Company. Prior to the acquisition, ARI was a national competitor of Hudson in the sale of reclaimed and virgin refrigerants and in refrigerant reclamation services.

Hudson's RefrigerantSide® Services provide new and innovative solutions to certain problems within the refrigeration industry and, as such, the demand and market acceptance for these services are subject to uncertainty. Competition for these services primarily consists of traditional methods of solving the industry's problems. The Company’s marketing strategy is to educate the marketplace that its alternative solutions are available and that RefrigerantSide® Services are superior to traditional methods.

Insurance

The Company carries insurance coverage that it considers sufficient to protect the Company's assets and operations. The Company currently maintains general commercial liability insurance and excess liability coverage for claims up to $11,000,000 per occurrence and $12,000,000 in the aggregate. The Company attempts to operate in a professional and prudent manner and to reduce potential liability risks through specific risk management efforts, including ongoing employee training.

The refrigerant industry involves potentially significant risks of statutory and common law liability for environmental damage and personal injury. The Company, and in certain instances, its officers, directors and employees, may be subject to claims arising from the Company's on-site or off-site services, including the improper release, spillage, misuse or mishandling of refrigerants classified as hazardous or non-hazardous substances or materials. The Company may be held strictly liable for damages, which could be substantial, regardless of whether it exercised due care and complied with all relevant laws and regulations.

Hudson maintains environmental impairment insurance of $10,000,000 per occurrence, and $10,000,000 annual aggregate, for events occurring subsequent to November 1996.

| 7 |

Government Regulation

The business of refrigerant and industrial gas sales, reclamation and management is subject to extensive, stringent and frequently changing federal, state and local laws and substantial regulation under these laws by governmental agencies, including the EPA, the United States Occupational Safety and Health Administration (“OSHA”) and the United States Department of Transportation (“DOT”).

Among other things, these regulatory authorities impose requirements which regulate the handling, packaging, labeling, transportation and disposal of hazardous and non-hazardous materials and the health and safety of workers, and require the Company and, in certain instances, its employees, to obtain and maintain licenses in connection with its operations. This extensive regulatory framework imposes significant compliance burdens and risks on the Company.

Hudson and its customers are subject to the requirements of the Act, and the regulations promulgated thereunder by the EPA, which make it unlawful for any person in the course of maintaining, servicing, repairing, and disposing of air conditioning or refrigeration equipment, to knowingly vent or otherwise release or dispose of ozone depleting substances, and non-ozone depleting substitutes, used as refrigerants.

Pursuant to the Act, reclaimed refrigerant must satisfy the same purity standards as newly manufactured, virgin refrigerants in accordance with standards established by AHRI prior to resale to a person other than the owner of the equipment from which it was recovered. The EPA administers a certification program pursuant to which applicants certify to reclaim refrigerants in compliance with AHRI standards. The Company is one of only four certified refrigerant testing laboratories in the United States under AHRI’s laboratory certification program, which is a voluntary program that certifies the ability of a laboratory to test refrigerant in accordance with the AHRI 700 standard.

In addition, the EPA has established a mandatory certification program for air conditioning and refrigeration technicians. Hudson's technicians have applied for or obtained such certification.

The Company may also be subject to regulations adopted by the EPA which impose reporting requirements arising out of the importation of certain HCFCs, and arising out of the importation, purchase, production, use and/or emissions of certain greenhouse gases, including HFCs.

The Company is also subject to regulations adopted by the DOT which classify most refrigerants and industrial gases handled by the Company as hazardous materials or substances and imposes requirements for handling, packaging, labeling and transporting refrigerants and which regulate the use and operation of the Company’s commercial motor vehicles used in the Company’s business.

The Resource Conservation and Recovery Act of 1976, as amended ("RCRA"), requires facilities that treat, store or dispose of hazardous wastes to comply with certain operating standards. Before transportation and disposal of hazardous wastes off-site, generators of such waste must package and label their shipments consistent with detailed regulations and prepare a manifest identifying the material and stating its destination. The transporter must deliver the hazardous waste in accordance with the manifest to a facility with an appropriate RCRA permit. Under RCRA, impurities removed from refrigerants consisting of oils mixed with water and other contaminants are not presumed to be hazardous waste.

The Emergency Planning and Community Right-to-Know Act of 1986, as amended, requires the annual reporting by the Company of Emergency and Hazardous Chemical Inventories (Tier II reports) to the various states in which the Company operates and requires the Company to file annual Toxic Chemical Release Inventory Forms with the EPA.

The Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), establishes liability for clean-up costs and environmental damages to current and former facility owners and operators, as well as persons who transport or arrange for transportation of hazardous substances. Almost all states have similar statutes regulating the handling and storage of hazardous substances, hazardous wastes and non-hazardous wastes. Many such statutes impose requirements that are more stringent than their federal counterparts. The Company could be subject to substantial liability under these statutes to private parties and government entities, in some instances without any fault, for fines, remediation costs and environmental damage, as a result of the mishandling, release, or existence of any hazardous substances at any of its facilities.

The Occupational Safety and Health Act of 1970, as amended mandates requirements for a safe work place for employees and special procedures and measures for the handling of certain hazardous and toxic substances. State laws, in certain circumstances, mandate additional measures for facilities handling specified materials.

The Company is also subject to regulations adopted by the California Air Resources Board which impose certain reporting requirements arising out of the reclamation and sale of refrigerants that takes place within the State of California.

| 8 |

The Company believes that it is in material compliance with all applicable regulations material to its business operations.

Quality Assurance & Environmental Compliance

The Company utilizes in-house quality and regulatory compliance control procedures. Hudson maintains its own analytical testing laboratories, which are AHRI certified, to assure that reclaimed refrigerants comply with AHRI purity standards and employs portable testing equipment when performing on-site services to verify certain quality specifications. The Company employs twelve persons engaged full-time in quality control and to monitor the Company's operations for regulatory compliance.

Employees

On December 31, 2017, the Company had 262 full time employees including air conditioning and refrigeration technicians, chemists, engineers, sales and administrative personnel. None of the Company's employees are represented by a union. The Company believes it has good relations with its employees.

Patents and Proprietary Information

The Company holds several U.S. and foreign patents, as well as pending patent applications, related to certain RefrigerantSide® Services and supporting systems developed by the Company for systems and processes for measuring and improving the efficiency of refrigeration systems, and for certain refrigerant recycling and reclamation technologies. These patents will expire between August 2019 and April 2031.

The Company believes that patent protection is important to its business. There can be no assurance as to the breadth or degree of protection that patents may afford the Company, that any patent applications will result in issued patents or that patents will not be circumvented or invalidated. Technological development in the refrigerant industry may result in extensive patent filings and a rapid rate of issuance of new patents. Although the Company believes that its existing patents and the Company's equipment do not and will not infringe upon existing patents or violate proprietary rights of others, it is possible that the Company's existing patent rights may not be valid or that infringement of existing or future patents or violations of proprietary rights of others may occur. In the event the Company's equipment or processes infringe, or are alleged to infringe, patents or other proprietary rights of others, the Company may be required to modify the design of its equipment or processes, obtain a license or defend a possible patent infringement action. There can be no assurance that the Company will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action or that the Company will not become liable for damages.

The Company also relies on trade secrets and proprietary know-how, and employs various methods to protect its technology. However, such methods may not afford complete protection and there can be no assurance that others will not independently develop such know-how or obtain access to the Company's know-how, concepts, ideas and documentation. Failure to protect its trade secrets could have a material adverse effect on the Company.

SEC Filings

The Company makes available on its internet website copies of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments thereto, as soon as reasonably practicable after they are filed with the Securities and Exchange Commission.

There are many important factors, including those discussed below (and above as described under “Patents and Proprietary Information”), that have affected, and in the future could affect Hudson’s business including, but not limited to, the factors discussed below, which should be reviewed carefully together with the other information contained in this report. Some of the factors are beyond Hudson’s control and future trends are difficult to predict.

Our existing and future debt obligations could impair our liquidity and financial condition.

Our existing credit facilities, consisting of an asset-based lending facility of up to $150 million from PNC Bank and a term loan of $105 million from funds advised by FS Investments and sub-advised by GSO Capital Partners LP., are secured by substantially all of our assets and the PNC Bank facility contains formulas that limit the amount of our future borrowings under that facility. Moreover, the terms of our credit facilities also include negative covenants that, among other things, may limit our ability to incur additional indebtedness. If we violate any loan covenants and do not obtain a waiver from our lenders, our indebtedness under the credit facilities would become immediately due and payable, and the lenders could foreclose on their security, which could materially adversely affect our business and future financial condition and could require us to curtail or otherwise cease our existing operations.

| 9 |

We may not successfully integrate ARI into our operations.

Our recent acquisition of ARI substantially increased the size and complexity of our company and its operations. We may not be able to successfully integrate the assets, liabilities, customers, systems or management personnel of ARI into our operations and we may not be able to realize related revenue synergies and cost savings within expected time frames. We do not have prior experience integrating an acquisition of this size and complexity and therefore there can be no assurance that we will be able to successfully integrate ARI.

We may need additional financing to satisfy our future capital requirements, which may not be readily available to us.

Our capital requirements may be significant in the future. In the future, we may incur additional expenses in the development and implementation of our operations. Due to fluctuations in the price, demand and availability of new refrigerants, our existing credit facility with PNC Bank that expires in October 2022 may not in the future be sufficient to provide all of the capital that we need to acquire and manage our inventories of new refrigerant. As a result, we may be required to seek additional equity or debt financing in order to develop our RefrigerantSide® Services business, our refrigerant sales business and our other businesses. We have no current arrangements with respect to, or sources of, additional financing other than our existing credit facility and term loan. There can be no assurance that we will be able to obtain any additional financing on terms acceptable to us or at all. Our inability to obtain financing, if and when needed, could materially adversely affect our business and future financial condition and could require us to curtail or otherwise cease our existing operations.

Adverse weather or economic downturn could adversely impact our financial results.

Our business could be negatively impacted by adverse weather or economic downturns. Weather is a significant factor in determining market demand for the refrigerants sold by us, and to a lesser extent, our RefrigerantSide® Services. Unusually cool temperatures in the spring and summer tend to depress demand for, and price of, refrigerants we sell. Protracted periods of cooler than normal spring and summer weather could result in a substantial reduction in our sales which could adversely affect our financial position as well as our results of operations. An economic downturn could cause customers to postpone or cancel purchases of the Company’s products or services. Either or both of these conditions could have severe negative implications to our business that may exacerbate many of the risk factors we identified in this report but not limited, to the following:

Liquidity

These conditions could reduce our liquidity, which could have a negative impact on our financial condition and results of operations.

Demand

These conditions could lower the demand and/or price for our product and services, which would have a negative impact on our results of operations.

Financial Covenants

These conditions could impact our ability to meet our loan covenants which, if we are unable to obtain a waiver from our lenders, could materially adversely affect our business and future financial condition and could require us to curtail or otherwise cease our existing operations.

The nature of our business exposes us to potential liability.

The refrigerant recovery and reclamation industry involves potentially significant risks of statutory and common law liability for environmental damage and personal injury. We, and in certain instances, our officers, directors and employees, may be subject to claims arising from our on-site or off-site services, including the improper release, spillage, misuse or mishandling of refrigerants classified as hazardous or non-hazardous substances or materials. We may be strictly liable for damages, which could be substantial, regardless of whether we exercised due care and complied with all relevant laws and regulations. Our current insurance coverage may not be sufficient to cover potential claims, and adequate levels of insurance coverage may not be available in the future at a reasonable cost. A partially or completely uninsured claim against us, if successful and of sufficient magnitude would have a material adverse effect on our business and financial condition.

Our business and financial condition is substantially dependent on the sale and continued environmental regulation of refrigerants.

Our business and prospects are largely dependent upon continued regulation of the use and disposition of refrigerants. Changes in government regulations relating to the emission of refrigerants into the atmosphere could have a material adverse effect on us. Failure by government authorities to otherwise continue to enforce existing regulations or significant relaxation of regulatory requirements could also adversely affect demand for our services and products.

Our business is subject to significant regulatory compliance burdens.

The refrigerant reclamation and management business is subject to extensive, stringent and frequently changing federal, state and local laws and substantial regulation under these laws by governmental agencies, including the EPA, the OSHA and DOT. Although we believe that we are in material compliance with all applicable regulations material to our business operations, amendments to existing statutes and regulations or adoption of new statutes and regulations that affect the marketing and sale of refrigerant could require us to continually alter our methods of operation and/or discontinue the sale of certain of our products resulting in costs to us that could be substantial. We may not be able, for financial or other reasons, to comply with applicable laws, regulations and permit requirements, particularly as we seek to enter into new geographic markets. Our failure to comply with applicable laws, rules or regulations or permit requirements could subject us to civil remedies, including substantial fines, penalties and injunctions, as well as possible criminal sanctions, which would, if of significant magnitude, materially adversely impact our operations and future financial condition.

| 10 |

A number of factors could negatively impact the price and/or availability of refrigerants, which would, in turn, adversely affect our business and financial condition.

Refrigerant sales continue to represent a significant majority of our revenues. Therefore, our business is substantially dependent on the availability of both new and used refrigerants in large quantities, which may be affected by several factors including, without limitation: (i) commercial production and consumption limitations imposed by the Act and legislative limitations and ban on HCFC refrigerants; (ii) the amendment to the Montreal Protocol, if ratified, and any legislation and regulation enacted to implement the amendment, could impose limitations on production and consumption of HFC refrigerants; (iii) introduction of new refrigerants and air conditioning and refrigeration equipment; (iv) price competition resulting from additional market entrants; (v) changes in government regulation on the use and production of refrigerants; and (vi) reduction in price and/or demand for refrigerants. We do not maintain firm agreements with any of our suppliers of refrigerants and we do not hold allowances permitting us to purchase and import HCFC refrigerants from abroad. Sufficient amounts of new and/or used refrigerants may not be available to us in the future, particularly as a result of the further phase down of HCFC production, or may not be available on commercially reasonable terms. Additionally, we may be subject to price fluctuations, periodic delays or shortages of new and/or used refrigerants. Our failure to obtain and resell sufficient quantities of virgin refrigerants on commercially reasonable terms, or at all, or to obtain, reclaim and resell sufficient quantities of used refrigerants would have a material adverse effect on our operating margins and results of operations.

As a result of competition, and the strength of some of our competitors in the market, we may not be able to compete effectively.

The markets for our services and products are highly competitive. We compete with numerous regional and national companies which provide refrigerant recovery and reclamation services, as well as companies which market and deal in new and reclaimed alternative refrigerants, including certain of our suppliers, some of which possess greater financial, marketing, distribution and other resources than us. We also compete with numerous manufacturers of refrigerant recovery and reclamation equipment. Certain of these competitors have established reputations for success in the service of air conditioning and refrigeration systems. We may not be able to compete successfully, particularly as we seek to enter into new markets.

Issues relating to potential global warming and climate change could have an impact on our business.

Refrigerants are considered to be strong greenhouse gases that are believed to contribute to global warming and climate change and are now subject to various state and federal regulations relating to the sale, use and emissions of refrigerants. Current and future global warming and climate change or related legislation and/or regulations may impose additional compliance burdens on us and on our customers and suppliers which could potentially result in increased administrative costs, decreased demand in the marketplace for our products, and/or increased costs for our supplies and products. In addition, an amendment to the Montreal Protocol has established timetables for all developed and developing countries to freeze and then reduce production and use of HFCs by 85% between now and 2047, with the first reductions by developed countries starting in 2019. The amendment becomes effective January 1, 2019. To date, the amendment has not been ratified by the United States. It is unclear if the United States will ratify the amendment and, if it does ratify the amendment, it is unclear what legislation and/or regulations will be enacted to implement the amendment.

The loss of key management personnel would adversely impact our business.

Our success is largely dependent upon the efforts of our Chief Executive Officer and Chairman. The loss of his services would have a material adverse effect on our business and prospects.

We have the ability to designate and issue preferred stock, which may have rights, preferences and privileges greater than Hudson’s common stock and which could impede a subsequent change in control of us.

Our Certificate of Incorporation authorizes our Board of Directors to issue up to 5,000,000 shares of “blank check” preferred stock and to fix the rights, preferences, privileges and restrictions, including voting rights, of these shares, without further shareholder approval. The rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of holders of any additional preferred stock that may be issued by us in the future. Our ability to issue preferred stock without shareholder approval could have the effect of making it more difficult for a third party to acquire a majority of our voting stock, thereby delaying, deferring or preventing a change in control of us.

If our common stock were delisted from NASDAQ it could be subject to “penny stock” rules which would negatively impact its liquidity and our shareholders’ ability to sell their shares.

Our common stock is currently listed on the NASDAQ Capital Market. We must comply with numerous NASDAQ Marketplace rules in order to continue the listing of our common stock on NASDAQ. There can be no assurance that we can continue to meet the rules required to maintain the NASDAQ listing of our common stock. If we are unable to maintain our listing on NASDAQ, the market liquidity of our common stock may be severely limited.

| 11 |

Our management has significant control over our affairs.

Currently, our officers and directors collectively own approximately 14% of our outstanding common stock. Accordingly, our officers and directors are in a position to significantly affect major corporate transactions and the election of our directors. There is no provision for cumulative voting for our directors.

We may fail to successfully integrate any additional acquisitions made by us into our operations.

As part of our business strategy, we may look for opportunities to grow by acquiring other product lines, technologies or facilities that complement or expand our existing business. We may be unable to identify additional suitable acquisition candidates or negotiate acceptable terms. In addition, we may not be able to successfully integrate any assets, liabilities, customers, systems or management personnel we may acquire into our operations and we may not be able to realize related revenue synergies and cost savings within expected time frames. There can be no assurance that we will be able to successfully integrate any prior or future acquisition.

Our information technology systems, processes, and sites may suffer interruptions, failures, or attacks which could affect our ability to conduct business.

Our information technology systems provide critical data connectivity, information and services for internal and external users. These include, among other things, processing transactions, summarizing and reporting results of operations, complying with regulatory, legal or tax requirements, storing project information and other processes necessary to manage the business. Our systems and technologies, or those of third parties on which we rely, could fail or become unreliable due to equipment failures, software viruses, cyber threats, terrorist acts, natural disasters, power failures or other causes. Cybersecurity threats are evolving and include, but are not limited to, malicious software, cyber espionage, attempts to gain unauthorized access to our sensitive information, including that of our customers, suppliers, and subcontractors, and other electronic security breaches that could lead to disruptions in mission critical systems, unauthorized release of confidential or otherwise protected information, and corruption of data. Although we utilize various procedures and controls to monitor and mitigate these threats, there can be no assurance that these procedures and controls will be sufficient to prevent security threats from materializing. If any of these events were to materialize, the costs related to cyber or other security threats or disruptions may not be fully insured or indemnified and could have a material adverse effect on our reputation, operating results, and financial condition.

Item 1B. Unresolved Staff Comments

None.

The Company’s headquarters are located in a multi-tenant building in Pearl River, New York, which houses the Company’ executive officers, its accounting and administrative staff, and its information technology staff and equipment, and maintains administrative and sales offices for ARI in Long Island City, New York. The Company’s key reclamation, processing and cylinder refurbishment facilities are located in Champaign, Illinois, in Smyrna, Georgia and in Nashville, Tennessee. The Company also sells industrial gases out of facilities located in Escondido, California and in Champaign, Illinois. The Company maintains smaller reclamation and cylinder refurbishing facilities in Ontario, California and in Cantano, Puerto Rico. The Company also maintains four smaller service depots for the performance of its RefrigerantSide® Services and maintains three sales and telemarketing offices.

Hudson’s key operational facilities are as follows:

| Location | Owned or Leased | Description | ||

| Pearl River, New York | Leased | Company headquarters and administrative offices | ||

| Champaign, Illinois | Owned | Reclamation and separation of refrigerants and cylinder refurbishment | ||

| Champaign, Illinois | Leased | Refrigerant packaging, cylinder refurbishment, RefrigerantSide® Service depot, refrigerant and industrial gases storage | ||

| Nashville, Tennessee | Leased | Reclamation and separation of refrigerants and cylinder refurbishment center | ||

| Smyrna, Georgia | Leased | Reclamation and separation of refrigerants and cylinder refurbishment center | ||

| Smyrna, Georgia | Owned | Refrigerant Storage | ||

| Long Island City, New York | Leased | Administrative, sales and marketing offices, refrigerant storage & shipping | ||

| Escondido, California | Leased | Refrigerants and Industrial gases | ||

| Tulsa, Oklahoma | Leased | Energy Services |

| 12 |

On April 1, 1999, the Company reported a release of approximately 7,800 lbs. of R-11 refrigerant (the “1999 Release”), at its former leased facility in Hillburn, NY (the “Hillburn Facility”), which the Company vacated in June 2006.

Since September 2000, last modified in March 2013, the Company signed an Order on Consent with the New York State Department of Environmental Conservation (“DEC”) whereby the Company agreed to operate a remediation system to reduce R-11 refrigerant levels in the groundwater under and around the Hillburn Facility and agreed to perform periodic testing at the Hillburn Facility until remaining groundwater contamination has been effectively abated. The Company accrued, as an expense in its consolidated financial statements, the costs that the Company believes it will incur in connection with its compliance with the Order of Consent through December 31, 2018. There can be no assurance that additional testing will not be required or that the Company will not incur additional costs and such costs in excess of the Company’s estimate may have a material adverse effect on the Company financial condition or results of operations. The Company has exhausted all insurance proceeds available for the 1999 Release under all applicable policies.

In May 2000 the Hillburn Facility, as a result of the 1999 Release, was nominated by EPA for listing on the National Priorities List (“NPL”) pursuant to CERCLA. In September 2003, the EPA advised the Company that it had no current plans to finalize the process for listing of the Hillburn Facility on the NPL.

During the years ended December 31, 2017, 2016 and 2015 the Company incurred no additional remediation costs in connection with the matters above. The remaining liability on our Balance Sheet as of December 31, 2017 is approximately $90,000. There can be no assurance that the ultimate outcome of the 1999 Release will not have a material adverse effect on the Company's financial condition and results of operations. There can be no assurance that the EPA will not change its current plans and seek to finalize the process of listing the Hillburn Facility on the NPL, or that the ultimate outcome of such a listing will not have a material adverse effect on the Company's financial condition and results of operations.

Item 4. Mine Safety Disclosures

Not Applicable.

| 13 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company's common stock trades on the NASDAQ Capital Market under the symbol “HDSN”. The following table sets forth, for the periods indicated, the range of the high and low sale prices for the common stock as reported by NASDAQ.

| High | Low | |||||||

| 2017 | ||||||||

| - First Quarter | $ | 8.20 | $ | 6.13 | ||||

| - Second Quarter | $ | 8.74 | $ | 6.35 | ||||

| - Third Quarter | $ | 9.44 | $ | 7.71 | ||||

| - Fourth Quarter | $ | 7.83 | $ | 5.49 | ||||

| 2016 | ||||||||

| - First Quarter | $ | 3.69 | $ | 2.64 | ||||

| - Second Quarter | $ | 3.95 | $ | 3.09 | ||||

| - Third Quarter | $ | 6.72 | $ | 3.26 | ||||

| - Fourth Quarter | $ | 8.50 | $ | 5.55 | ||||

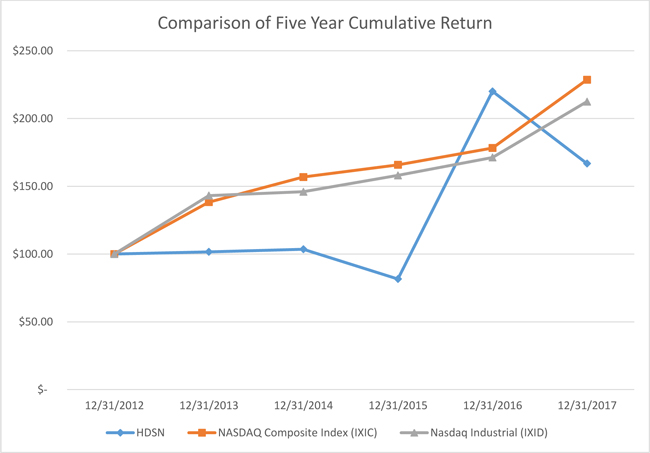

Stock Price Performance Graph

The following graph illustrates a comparison of the total cumulative stockholder return on our common stock since December 31, 2012, to two indices: the NASDAQ Composite Index and the Nasdaq Industrial Index. The stockholder return shown in the graph below is not necessarily indicative of future performance, and we do not make or endorse any predictions as to future stockholder returns.

The above Stock Price Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

| 14 |

The number of record holders of the Company's common stock was approximately 141 as of March 9, 2018. The Company believes that there are in excess of 7,000 beneficial owners of its common stock.

To date, the Company has not declared or paid any cash dividends on its common stock. The payment of dividends, if any, in the future is within the discretion of the Board of Directors and will depend upon the Company's earnings, its capital requirements and financial condition, borrowing covenants, and other relevant factors. The Company presently intends to retain all earnings, if any, to finance the Company's operations and development of its business and does not expect to declare or pay any cash dividends on its common stock in the foreseeable future. In addition, the Company has a credit facility with PNC Bank National Association (“PNC”) and a separate term loan that, among other things, restrict the Company's ability to declare or pay any cash dividends on its capital stock.

| 15 |

Item 6. Selected Financial Data

The following selected financial data, with respect to our financial position and results of operations for each of the five fiscal years in the period ended December 31, 2017, set forth below, has been derived from, should be read in conjunction with and is qualified in its entirety by reference to, our consolidated financial statements and notes thereto, included either elsewhere in this report or in reports we have filed previously with the SEC. The selected financial data presented below should also be read in conjunction with ITEM 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

| For the Year Ended | ||||||||||||||||||||

| (Amounts in thousands, except per share data) | 2017 * | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

| Selected Statement of Operations Data: | ||||||||||||||||||||

| Revenues | $ | 140,380 | $ | 105,481 | $ | 79,722 | $ | 55,810 | $ | 58,634 | ||||||||||

| Gross profit | $ | 37,984 | $ | 31,086 | $ | 18,489 | $ | 6,446 | $ | (730 | ) | |||||||||

| Operating income (loss) | $ | 15,132 | $ | 18,947 | $ | 8,181 | $ | (985 | ) | $ | (8,485 | ) | ||||||||

| Net income (loss) | $ | 11,157 | $ | 10,637 | $ | 4,763 | $ | (720 | ) | $ | (5,842 | ) | ||||||||

| Net income (loss) per share - Basic | $ | 0.27 | $ | 0.31 | $ | 0.15 | $ | (0.02 | ) | $ | (0.24 | ) | ||||||||

| Net income (loss) per share- Diluted | $ | 0.26 | $ | 0.30 | $ | 0.14 | $ | (0.02 | ) | $ | (0.24 | ) | ||||||||

| Weighted average number of shares- Basic | 41,764 | 34,104 | 32,547 | 29,123 | 24,826 | |||||||||||||||

| Weighted average number of shares- Diluted | 42,767 | 35,417 | 33,936 | 29,123 | 24,826 | |||||||||||||||

| Selected Balance Sheet Data: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 5,002 | $ | 33,931 | $ | 1,258 | $ | 935 | $ | 669 | ||||||||||

| Inventory | $ | 172,485 | $ | 68,601 | $ | 61,897 | $ | 37,017 | $ | 33,967 | ||||||||||

| Total assets | $ | 321,444 | $ | 122,470 | $ | 85,011 | $ | 59,935 | $ | 52,368 | ||||||||||

| Debt- short and long-term | $ | 167,360 | $ | 351 | $ | 24,866 | $ | 10,709 | $ | 20,038 | ||||||||||

| Stockholders’ Equity | $ | 123,453 | $ | 112,017 | $ | 49,425 | $ | 43,999 | $ | 28,086 | ||||||||||

*- 2017 includes the operating results of ARI from October 10, 2017, which is the acquisition date, through December 31, 2017. No ARI results are included in prior periods.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Certain statements, contained in this section and elsewhere in this Form 10-K, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, changes in the laws and regulations affecting the industry, changes in the demand and price for refrigerants (including unfavorable market conditions adversely affecting the demand for, and the price of refrigerants), the Company's ability to source refrigerants, regulatory and economic factors, seasonality, competition, litigation, the nature of supplier or customer arrangements that become available to the Company in the future, adverse weather conditions, possible technological obsolescence of existing products and services, possible reduction in the carrying value of long-lived assets, estimates of the useful life of its assets, potential environmental liability, customer concentration, the ability to obtain financing, the ability to meet financial covenants under our financing facilities, any delays or interruptions in bringing products and services to market, the timely availability of any requisite permits and authorizations from governmental entities and third parties as well as factors relating to doing business outside the United States, including changes in the laws, regulations, policies, and political, financial and economic conditions, including inflation, interest and currency exchange rates, of countries in which the Company may seek to conduct business, the Company’s ability to successfully integrate ARI and any other assets it acquires from third parties into its operations, and other risks detailed in the this report and in the Company’s other subsequent filings with the Securities and Exchange Commission (“SEC”). The words “believe”, “expect”, “anticipate”, “may”, “plan”, “should” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.

Critical Accounting Policies

The Company's discussion and analysis of its financial condition and results of operations are based upon its consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. Several of the Company's accounting policies involve significant judgments, uncertainties and estimates. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions. To the extent that actual results differ from management's judgments and estimates, there could be a material adverse effect on the Company. On a continuous basis, the Company evaluates its estimates, including, but not limited to, those estimates related to its allowance for doubtful accounts, inventory reserves, and valuation allowance for the deferred tax assets relating to its net operating loss carry forwards (“NOLs”), goodwill and intangible assets and commitments and contingencies. With respect to accounts receivable, the Company estimates the necessary allowance for doubtful accounts based on both historical and anticipated trends of payment history and the ability of the customer to fulfill its obligations. For inventory, the Company evaluates both current and anticipated sales prices of its products to determine if a write down of inventory to net realizable value is necessary. In determining the Company’s valuation allowance for its deferred tax assets, the Company assesses its ability to generate taxable income in the future. Goodwill represents the excess of the purchase price over the fair value of the net assets acquired in business combinations accounted for under the purchase method of accounting. The Company tests for any impairment of goodwill annually. Intangibles with determinable lives are amortized over the estimated useful lives of the assets currently ranging from 2 to 13 years. The Company reviews these useful lives annually to determine that they reflect future realizable value. The Company utilizes both internal and external sources to evaluate potential current and future liabilities for various commitments and contingencies. In the event that the assumptions or conditions change in the future, the estimates could differ from the original estimates.

| 16 |

Overview

Sales of refrigerants continue to represent a significant majority of the Company’s revenues. The Company’s refrigerant sales are primarily HCFC and HFC based refrigerants and to a lesser extent CFC based refrigerants that are no longer manufactured. Currently the Company purchases virgin HCFC and HFC refrigerants and reclaimable HCFC, HFC and CFC refrigerants from suppliers and its customers. Effective January 1, 1996, the Clean Air Act (the “Act”) prohibited the production of virgin CFC refrigerants and limited the production of virgin HCFC refrigerants, which production was further limited in January 2004. Federal regulations enacted in January 2004 established production and consumption allowances for HCFCs and imposed limitations on the importation of certain virgin HCFC refrigerants. Under the Act, production of certain virgin HCFC refrigerants is scheduled to be phased out during the period 2010 through 2020, and production of all virgin HCFC refrigerants is scheduled to be phased out by 2030. In October 2014, the EPA published the Final Rule providing further reductions in the production and consumption allowances for virgin HCFC refrigerants for the years 2015 through 2019. In the Final Rule, the EPA has established a linear annual phase down schedule for the production or importation of virgin HCFC-22 that started at approximately 22 million pounds in 2015 and is being reduced by approximately 4.5 million pounds each year and ends at zero in 2020.

The Company has created and developed a service offering known as RefrigerantSide® Services. RefrigerantSide® Services are sold to contractors and end-users whose refrigeration systems are used in commercial air conditioning and industrial processing. These services are offered in addition to refrigerant sales and the Company's traditional refrigerant management services, which consist primarily of reclamation of refrigerants. The Company has created a network of service depots that provide a full range of the Company's RefrigerantSide® Services to facilitate the growth and development of its service offerings.

The Company focuses its sales and marketing efforts for its RefrigerantSide® Services on customers who the Company believes most readily appreciate and understand the value that is provided by its RefrigerantSide® Services offering. In pursuing its sales and marketing strategy, the Company offers its RefrigerantSide® Services to customers in the following industries: petrochemical, pharmaceutical, industrial power, manufacturing, commercial facility and property management and maritime. The Company may incur additional expenses as it further develops and markets its RefrigerantSide® Services offering.

In July 2016 the Company was awarded, as prime contractor, a five-year contract, including a five-year renewal option, by the DLA for the management, supply, and sale of refrigerants, compressed gases, cylinders and related terms.

Recent Acquisition

On October 10, 2017, the Company and its wholly-owned subsidiary, Holdings, completed the Acquisition of ARI and effective October 11, 2017, ARI’s name was changed to Aspen Refrigerants, Inc. At closing, Holdings paid net cash consideration to Airgas of approximately $209 million, which includes preliminary post-closing adjustments relating to: (i) changes in the net working capital of ARI as of the closing relative to a net working capital target, (ii) the actual amount of specified types of R-22 refrigerant inventory on hand at closing relative to a target amount thereof, and (iii) other consideration pursuant to the stock purchase agreement.

The cash consideration paid by Holdings at closing was financed with available cash balances, plus $80 million of borrowings under an enhanced asset-based lending facility of $150 million from PNC Bank and a new term loan of $105 million from funds advised by FS Investments and sub-advised by GSO Capital Partners LP.

Results of Operations

Year ended December 31, 2017 as compared to the year ended December 31, 2016

Revenues for the year ended December 31, 2017 were $140.4 million, an increase of $34.9 million or 33.1% from the $105.5 million reported during the comparable 2016 period. Included in the increase in revenues of $34.9 million is $14.8 million from ARI revenue subsequent to the acquisition date of October 10, 2017. The remaining increase in revenues of $20.1 million results from an increase in Hudson’s historical businesses. The increase in Hudson’s historical refrigerant and related revenue is primarily related to an increase in the selling price per pound of certain refrigerants sold, which accounted for an increase in revenues of $16.2 million, as well as an increase in the number of pounds of certain refrigerants sold, which accounted for an increase in revenues of $3.9 million.

Cost of sales for the year ended December 31, 2017 was $102.4 million or 73% of sales. The cost of sales for the year ended December 31, 2016 was $74.4 million or 71% of sales. The increase in the cost of sales percentage from 71% for the year ended December 31, 2016 to 73% for the year ended December 31, 2017 is primarily due to the increase in the cost per pound of certain refrigerants sold for the twelve month period ended December 31, 2017 compared to the same period in 2016. In addition, subsequent to the acquisition of ARI during the fourth quarter of 2017, the Company recorded approximately $0.8 million of amortization relating to the step-up of basis of newly acquired inventories.

Selling, general and administrative (“SG&A”) expenses for the year ended December 31, 2017 were $21.7 million, an increase of $10.0 million from the $11.7 million reported during the comparable 2016 period. The increase in SG&A is primarily due to $6.3 million of nonrecurring acquisition and related fees relating to the acquisition of ARI, which was consummated on October 10, 2017; and $4.0 million of additional operating expense relating to the ARI operations.

| 17 |

Amortization expense for the year ended December 31, 2017 was $1.1 million, an increase of $0.6 million from the $0.5 million reported during the comparable 2016 period. The variance is almost entirely due to increased amortization expense of other intangible assets, such as customer relationships, relating to the ARI acquisition during the fourth quarter of 2017.

Other expense for the year ended December 31, 2017 was $3.1 million, compared to the $1.7 million reported during the comparable 2016 period. The $1.4 million difference is mainly due to a $2.0 million increase in interest expense relating to additional borrowings as a result of the ARI acquisition, offset by the $0.6 million reduction in Other expense, namely the absence of any 2017 earnout-related expense from prior acquisitions, which existed in 2016.

Income tax expense for the year ended December 31, 2017 was $0.8 million compared to income tax expense for the year ended December 31, 2016 of $6.6 million. In 2017, there were two key drivers of a reduction in income tax expense: (1) approximately $1.4 million from the effect of new federal tax legislation enacted during the fourth quarter of 2017, and (2) approximately $2.4 million of excess tax benefits associated with the exercise of stock options in 2017. For 2017 and 2016, income tax expense was reported for federal and state income taxes using statutory rates applied to adjusted pre-tax income.

Net income for the year ended December 31, 2017 was $11.2 million, an increase of $0.6 million from the $10.6 million net income reported during the comparable 2016 period, primarily due to the increase in revenues and a lower effective tax rate, partially offset by an increase in operating expenses and other expenses.

Year ended December 31, 2016 as compared to the year ended December 31, 2015

Revenues for the year ended December 31, 2016 were $105.5 million, an increase of $25.8 million or 32% from the $79.7 million reported during the comparable 2015 period. The increase in revenues was attributable to an increase in refrigerant revenues of $26.2 million, offset by a reduction in services revenues of $0.4 million. The increase in refrigerant revenue is primarily related to an increase in the selling price per pound of certain refrigerants sold, which accounted for an increase in revenues of $17.6 million, as well as an increase in the number of pounds of certain refrigerants sold, which accounted for an increase in revenues of $8.6 million.

Cost of sales for the year ended December 31, 2016 was $74.4 million or 71% of sales. The cost of sales for the year ended December 31, 2015 was $61.2 million or 77% of sales. The decrease in the cost of sales percentage from 77% for the year ended December 31, 2015 to 71% for the year ended December 31, 2016 is primarily due to the increase in the selling price per pound of certain refrigerants sold and to a lesser extent, increases in volume sold for the year ended December 31, 2016 compared to the same period in 2015.

Operating expenses for the year ended December 31, 2016 were $12.1 million, an increase of $1.8 million from the $10.3 million reported during the comparable 2015 period. The increase in operating expenses is primarily due to an increase in non-cash, non-recurring stock compensation expense and professional fees in 2016 when compared to 2015.