UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

April 2022

Date of Report (Date of Earliest Event Reported)

Embotelladora Andina S.A.

(Exact name of registrant as specified in its charter)

Andina Bottling Company, Inc.

(Translation of Registrant´s name into English)

Avda. Miraflores 9153

Renca

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this Form 6-K is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934

Yes ¨ No x

EXECUTIVE SUMMARY

|

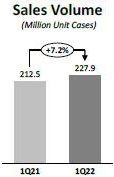

The quarter closed with Consolidated Sales Volume of 227.9 million unit cases*, increasing by 7.2% against the same quarter of the previous year. |

| Company figures reported are the following: |

| · | Consolidated Net Sales reached CLP 624,228 million in the quarter, a 22.6% increase against the same quarter of the previous year. |

| · | Consolidated Operating Income* reached CLP 95,418 million in the quarter, which represents a 20.6% increase against the same quarter of the previous year. |

| · | Consolidated Adjusted EBITDA* increased by 19.1% against the same quarter of the previous year, reaching CLP 121,377 million in the quarter. Adjusted EBITDA Margin reached 19.4%, a contraction of 58 basis points against the same quarter of the previous year. |

| · | Net Income attributable to the owners of the controller for the quarter reached CLP 32,998 million, which represents a 21.7% decrease regarding the same quarter of the previous year. |

| SUMMARY OF RESULTS FIRST QUARTER 2022 | ||||||||||||

| (Figures in million CLP) | 1Q21 | 1Q22 | Var % | |||||||||

| Sales

Volume (Million Unit Cases) | 212.5 | 227.9 | 7.2 | % | ||||||||

| Net Sales | 509,007 | 624,228 | 22.6 | % | ||||||||

| Operating Income* | 79,106 | 95,418 | 20.6 | % | ||||||||

| Adjusted EBITDA* | 101,925 | 121,377 | 19.1 | % | ||||||||

| Net income attributable to the owners of the controller | 42,119 | 32,998 | -21.7 | % | ||||||||

Comment of the Chief Executive Officer, Mr. Miguel Ángel Peirano

"We closed the first quarter of this year with consolidated Adjusted EBITDA growing 19.1% over the same quarter of the previous year, and with double-digit Adjusted EBITDA growth in our operations in Argentina and Paraguay, measured in local currency. Sales volume in Argentina, Chile and Paraguay continued with a healthy growth, with all categories showing growth. In the case of Brazil and isolating the negative effect of the exit of the Heineken and Amstel beer brands from our portfolio, sales volume also showed growth.

Recently, and in conjunction with the Coca-Cola system, in Brazil we signed a distribution agreement with Campari Group ("Campari") for the distribution of some of its products in that country. As we have been doing in recent years, we continue to add new categories to our business platform in order to become a total beverage company. We are confident that our partnership with Campari in Brazil will bring great benefits to both companies and to our consumers and customers. With the granularity of our logistics network and sales force, we will be able to significantly increase the presence of Campari products in our territory.

Our investment plan for this year is approximately USD 195 million, which will be allocated mainly to the purchase of returnable bottles, cases, cold equipment and trucks. In addition, in Chile we will invest in a new one-way line at the Renca plant and in a Pet recycling plant in conjunction with Embonor, which will enable us to manage the disposable containers that are generated and thus give this type of plastic a new use and comply with current regulations, which will require us to utilize 15% recycled plastic in our bottles by the year 2025. Finally, we are also making investments in Chile that will enable us to reduce water consumption per liter of beverage produced by 23%.

Lastly, I would like to comment that our 2021 Integrated Annual Report was recently published, in which you can find the 2030 goals that we have set in the Company's different sustainability pillars."

* The definitions used can be found in the Glossary on page 15 of this document.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -2- | |

BASIS OF PRESENTATION

Figures in the following analysis are set according to IFRS, in nominal Chilean pesos, for consolidated results as well as for the results of each of our operations. All variations regarding 2021 are nominal.

Since Argentina has been classified as a Hyperinflationary economy, pursuant to IAS 29, translation of figures from local to reporting currency was performed using the closing exchange rate for the translation to Chilean pesos. The local currency figures for both 2022 and 2021 referred to in the Argentina sections are all expressed in March 2022 currency.

Finally, a devaluation of local currencies regarding the U.S. dollar has a negative impact on our dollarized costs and a devaluation of local currencies regarding the Chilean peso has a negative impact upon consolidating figures.

When we refer to "Argentina", we mean our subsidiaries Embotelladora del Atlántico S.A. and Empaques Argentina S.A. When we refer to "Chile", we mean our subsidiaries Embotelladora Andina S.A., VJ S.A., Vital Aguas S.A. and Envases Central S.A.

CONSOLIDATED RESULTS: 1st Quarter 2022 vs. 1st Quarter 2021

| (Figures in million CLP) | 1Q21 | 1Q22 | Var % | |||||||||

| Net Sales | 509,007 | 624,228 | 22.6 | % | ||||||||

| Operating Income | 79,106 | 95,418 | 20.6 | % | ||||||||

| Adjusted EBITDA | 101,925 | 121,377 | 19.1 | % | ||||||||

| Net income attributable to the owners of the controller | 42,119 | 32,998 | -21.7 | % |

Consolidated Sales Volume during the quarter was 227.9 million unit cases, representing a 7.2% increase over the same period in 2021, explained by the volume increase of operations in Chile, Paraguay and Argentina, partially offset by the volume decrease of the operation in Brazil. Transactions reached 1,221.3 million in the quarter, representing a 5.4% increase against the same quarter of the previous year.

Consolidated Net Sales reached CLP 624,228 million, an increase of 22.6%, explained by the revenue growth in Argentina, Paraguay and Chile, partially offset by decreased net sales in Brazil.

Consolidated Costs of Sales increased by 22.4%, mainly explained by (i) greater volume sold in Argentina, Chile and Paraguay, (ii) a higher cost of PET resin in the four operations, and (iii) a higher cost of sugar in Brazil and Chile. This was offset by a lower cost of sales in Brazil, due to the reduction in beer sales.

Consolidated Distribution Costs and Administrative Expenses increased by 24.7%, which is mainly explained by (i) greater distribution expenses due to higher volumes and higher tariffs, and (ii) greater labor expenses. This was partially offset by higher other operating income in Argentina, which is classified under this item.

The above mentioned effects led to a consolidated Operating Income of CLP 95,418 million, a 20.6% increase. Operating Margin was 15.3%.

Consolidated Adjusted EBITDA reached CLP 121,377 million, increasing by 19.1%. Adjusted EBITDA Margin was 19.4%, a contraction of 58 basis points.

Net Income attributable to the owners of the controller for the quarter was CLP 32,998 million, a 21.7% decrease and Net Margin reached 5.3%, a contraction of 299 basis points.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -3- | |

ARGENTINA: 1st Quarter 2022 vs. 1st Quarter 2021

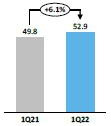

Sales Volume

(Million Unit Cases)

| 1Q21 | 1Q22 | Var % | 1Q21 | 1Q22 | Var % | |||||||||||||||||||

| (Figures in million CLP) | (Figures in million ARS of March 2022) | |||||||||||||||||||||||

| Net Sales | 102,592 | 152,351 | 48.5 | % | 19,906 | 21,463 | 7.8 | % | ||||||||||||||||

| Operating Income | 16,439 | 28,551 | 73.7 | % | 3,190 | 4,022 | 26.1 | % | ||||||||||||||||

| Adjusted EBITDA | 21,902 | 35,532 | 62.2 | % | 4,250 | 5,006 | 17.8 | % | ||||||||||||||||

Sales Volume for the quarter increased by 6.1%, reaching 52.9 million unit cases, explained by a volume increase in all categories. Transactions reached 244.9 million, representing an increase of 11.0%, due to the recovery of immediate consumption packaging.

Net Sales amounted to CLP 152,351 million, an increase of 48.5%. In local currency, they increased by 7.8%, which was mainly explained by the aforementioned increase in volume, and to a lesser extent by the increase in the average income per unit case sold, as a result of price increases.

Cost of Sales increased by 51.7%, while in local currency it increased by 10.1%, which is mainly explained by (i) the increase in volume sold, and (ii) the higher cost of Pet resin and aluminum.

Distribution Costs and Administrative Expenses increased by 31.8% in the reporting currency, while in local currency they decreased by 4.3%, which is mainly explained by higher other operating income classified under this item. This was partially offset by (i) higher distribution freight due to the higher volume sold and (ii) higher labor costs.

The aforementioned effects led to an Operating Income of CLP 28,551 million, an increase of 73.7% compared to the same period of the previous year. Operating Margin was 18.7%. In local currency, Operating Income increased by 26.1%.

Adjusted EBITDA amounted to CLP 35,532 million, an increase of 62.2%. Adjusted EBITDA margin was 23.3%, an expansion of 197 basis points. Adjusted EBITDA in local currency increased by 17.8%.

BRAZIL: 1st Quarter 2022 vs. 1st Quarter 2021

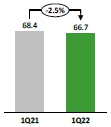

Sales Volume

(Million Unit Cases)

| 1Q21 | 1Q22 | Var % | 1Q21 | 1Q22 | Var % | |||||||||||||||||||

| (Figures in million CLP) | (Figures in million BRL) | |||||||||||||||||||||||

| Net Sales | 136,815 | 128,510 | -6.1 | % | 1,033 | 828 | -19.9 | % | ||||||||||||||||

| Operating Income | 18,362 | 15,796 | -14.0 | % | 139 | 101 | -27.2 | % | ||||||||||||||||

| Adjusted EBITDA | 23,732 | 22,102 | -6.9 | % | 179 | 142 | -20.9 | % | ||||||||||||||||

Sales Volume for the quarter reached 66.7 million unit cases, a decrease of 2.5%, explained by the volume decrease in the Beer category, partially offset by the increase in the Soft Drinks, Waters and Juices and Other Non-Alcoholic beverages categories. Transactions amounted to 364.7 million, representing a decrease of 12.7%.

Net Sales amounted to CLP 128,510 million, a decrease of 6.1%. In local currency, Net Sales decreased by 19.9%, which was mainly explained by the decrease in beer sales volume because we stopped commercializing the Amstel and Heineken brands, which was partially offset by the increase in the volume of soft drinks, juices and waters, as well as by price increases.

Cost of sales decreased by 11.1%, while in local currency it decreased by 24.2%, which is mainly explained by the decrease in beer volumes, which has a high unit cost. These effects were partially offset by a higher cost of raw materials, such as sugar, resin and aluminum.

Distribution Costs and Administrative Expenses increased by 17.0% in the reporting currency. In local currency, they increased by 0.2%, which is mainly explained by (i) higher distribution and freight expenses, and (ii) higher labor expenses. The increase in these costs was partially offset by (i) lower marketing expenses, and (ii) lower depreciation.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -4- | |

The aforementioned effects led to an Operating Income of CLP 15,796 million, a decrease of 14.0%. Operating Margin was 12.3%. In local currency, Operating Income decreased by 27.2%.

Adjusted EBITDA was CLP 22,102 million, a decrease of 6.9% compared to the previous year. Adjusted EBITDA margin was 17.2%, a contraction of 15 basis points. In local currency, Adjusted EBITDA decreased by 20.9%.

CHILE: 1st Quarter 2022 vs. 1st Quarter 2021

Sales Volume

(Million Unit Cases)

| 1Q21 | 1Q22 | Var % | ||||||||||

| (Figures in million CLP) | ||||||||||||

| Net Sales | 229,439 | 290,997 | 26.8 | % | ||||||||

| Operating Income | 34,565 | 37,993 | 9.9 | % | ||||||||

| Adjusted EBITDA | 44,171 | 47,757 | 8.1 | % | ||||||||

During the quarter, Sales Volume reached 87.6 million unit cases, an increase of 15.0%, explained by the volume increase in all categories. Transactions reached 492.8 million, representing an increase of 17.3%. Sales volume excluding the Wine category, which was not present in the previous year, grew by 14.2%.

Net sales reached CLP 290,997 million, an increase of 26.8%, which is mainly explained by the increase in volumes already mentioned, and by the increase in the average revenue per unit case sold, due to the incorporation of the wine category, as well as price increases in line with inflation. Net sales excluding the wine category, which was not present in the previous year, increased by 24.9%.

Cost of Sales increased by 31.7%, which is mainly explained by (i) the increase in sales in the Beer, wine and spirits category, which have a high cost per unit case, (ii) the higher sales volume in the other categories, and (iii) the increase in the cost of certain raw materials, particularly resin and sugar.

Distribution Costs and Administrative Expenses increased by 24.4%, which is mainly explained by (i) higher distribution and hauling expenses, as a consequence of the higher volume sold and higher tariffs, (ii) higher labor costs, and (iii) higher marketing expenses.

The aforementioned effects led to an Operating Income of CLP 37,993 million, 9.9% higher when compared to the previous year. Operating Margin was 13.1%.

Adjusted EBITDA reached CLP 47,757 million, an increase of 8.1%. Adjusted EBITDA Margin was 16.4%, a contraction of 284 basis points.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -5- | |

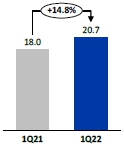

PARAGUAY: 1st Quarter 2022 vs. 1st Quarter 2021

Sales Volume

(Million Unit Cases)

| 1Q21 | 1Q22 | Var % | 1Q21 | 1Q22 | Var % | |||||||||||||||||||

| (Figures in million CLP) | (Figures in million PGY) | |||||||||||||||||||||||

| Net Sales | 40,725 | 53,127 | 30.5 | % | 377,734 | 458,523 | 21.4 | % | ||||||||||||||||

| Operating Income | 11,090 | 14,618 | 31.8 | % | 102,889 | 126,206 | 22.7 | % | ||||||||||||||||

| Adjusted EBITDA | 13,470 | 17,526 | 30.1 | % | 124,965 | 151,296 | 21.1 | % | ||||||||||||||||

During the quarter, Sales Volume reached 20.7 million unit cases, an increase of 14.8%, explained by the increase in volume in all categories. Transactions reached 119.0 million, an increase of 18.5%.

Net sales amounted to CLP 53,127 million, an increase of 30.5%. In local currency, Net Sales increased by 21.4%, which was mainly explained by the aforementioned increase in volume, and to a lesser extent by a higher average revenue per unit case sold.

Cost of Sales in the reporting currency increased by 32.8%. In local currency, it increased by 23.6%, which is mainly explained by the higher sales volume, as well as by a higher cost of resin.

Distribution Costs and Administrative Expenses increased by 22.6%, and in local currency they increased by 14.1%. This is mainly explained by (i) higher distribution expenses, due to higher volume sold and higher tariffs, and (ii) greater labor costs.

The aforementioned effects led to an Operating Income of CLP 14,618 million, 31.8% higher when compared to the previous year. Operating Margin reached 27.5%. In local currency, Operating Income increased by 22.7%.

Adjusted EBITDA reached CLP 17,526 million, an increase of 30.1%, and Adjusted EBITDA Margin was 33.0%, a contraction of 9 basis points. In local currency Adjusted EBITDA increased by 21.1%.

NON-OPERATING RESULTS FOR THE QUARTER

Net Financial Income and Expense account recorded an expense of CLP 2,309 million, which compares to an expense of CLP 9,073 million in the same quarter of the previous year, mainly as a result of higher financial income from portfolio management, as well as higher financial income in the operations.

Share of Profit or Loss of Investment in Associates using the Equity Method account went from an CLP 668 million profit to a CLP 513 million loss, which is mainly explained by lower results from investments in Brazil.

Other Income and Expenses account recorded a CLP 3,828 million loss, compared with a CLP 3,241 million loss in the same quarter of the previous year.

Results by Adjustment Units and Exchange Rate Differences account went from a CLP 4,739 million loss to a CLP 14,128 million loss. This loss is explained by a higher inflation recorded this quarter (2.37%) compared to the same quarter of the previous year (1.12%), which has a negative impact on restating the debt that the Company holds in UF.

Income Tax went from CLP -19,382 million to CLP -40,426 million, which variation is mainly explained by the higher operating income and the negative tax effect of the exchange rate difference in Chile.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -6- | |

SUSTAINABILITY

To achieve our mission, we have developed a strategy that allows our stakeholders to be given a profitable and sustainable growth opportunity in the long term, based on the integration of our growth and business sustainability pillars, aligned with our vision and organizational values.

In our Integrated Report, which we have been publishing annually for the past four years, we report on our progress in the triple ESG dimension (Environmental, Social and Corporate Governance) in conjunction with the Company's financial management. To ensure that our priorities are in place, we updated our materiality study during the third quarter of 2021. The materiality process is a central aspect in defining priorities and our approach to sustainability integration, guiding us when prioritizing resources, determining the focus of operations and defining the aspects we must manage in order to achieve the greatest impact that allows us to move forward and respond to all our stakeholders.

At Coca-Cola Andina we are committed to identifying, managing and disclosing our material issues, as well as the risks and opportunities we recognize. A topic is considered material when its management and/or impacts are relevant to the business and/or influence the decision of stakeholders. 26 sub-material topics grouped into 9 categories and 3 dimensions (ASG) stand out:

We want to share with you the most relevant material topics for our stakeholders and the evolution of the specific indicators for managing each of them. It should be clarified that in the countries in which we operate the definition of the metrics are the same to make them comparable, the differences in the results are due not only to differences in the markets but also to structural differences of the businesses and countries, among others.

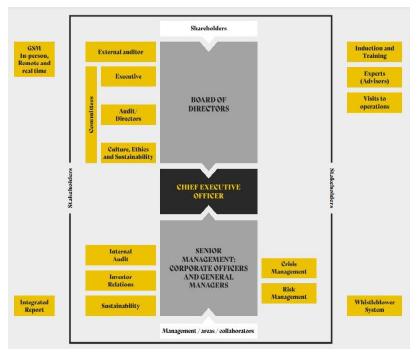

This quarter we present the Corporate Governance pillar:

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -7- | |

Having a clear framework of rights, obligations, roles and responsibilities among the different governing bodies of the company, the control bodies, the shareholders and the different stakeholders, contributes to strengthening the management of the companies, managing risks and improving decision-making capacity. Our Corporate Governance Model seeks to ensure that the Company's governance is conducted ethically and with integrity, always acting within the legal framework.

The objectives of the Corporate Governance Model are as follows:

ü To guarantee the generation of sustainable value, considering the interests of our main stakeholders: the community where we operate, our collaborators, suppliers, customers and investors.

ü Promote a culture of business ethics that mitigates potential irregularities.

ü Provide an effective framework for transparency, control and management of the Company's responsibility, through policies and standards that guide decisions.

ü To care for the corporate reputation in order to contribute to the creation of value in the long term.

ü Promote transparency and reliability of information.

ü Control management efficiency, process improvement and compliance.

The main elements of the Model include the following:

Board of Directors: the Company's Board of Directors meets monthly, according to a previously established agenda. Since April 2021 Coca-Cola Andina has a Diversity Policy in the Board of Directors, which aims to mitigate possible gender, social or cultural barriers that could somehow inhibit the natural diversity of skills, experiences, visions, characteristics and conditions that should prevail in the Company's Board of Directors, which allow to better ensure the sustainability of the business and add value in the long term. Additionally, the knowledge of the Board of Directors and the Company's executives is kept permanently updated through presentations made periodically by members of Management or third party experts in special matters such as the Law on Economic Crimes, Insider Trading, FCPA, etc.

Executive Committee: Its role is to supervise the general progress of the corporate business and to exercise control over operations on an ongoing basis and through periodic meetings, in addition to proposing guidelines for the administration of the corporate business.

Directors’ Committee/Audit Committee: is responsible for analyzing the financial statements; supporting financial oversight and accountability; ensuring that management develops reliable internal controls; ensuring that the Audit Department and independent auditors respectively fulfill their roles; and reviewing the Company's auditing practices.

Culture, Ethics and Sustainability Committee: Its duties and responsibilities include monitoring, identifying and adopting the necessary measures so that the activities of all Andina employees and executives adhere to the Company's values and principles. During 2021, and given the importance assigned to sustainability matters, this committee also monitored the progress of compliance with the goals related to the different material issues.

Corporate Office: Andina has a Regional Corporate Area that oversees operations under a matrix/functional structure. Among its duties is the control of operations through the development and implementation of management tools, corporate policies and reporting; providing guidelines through Risk Management models, Sustainability, Business Plans, etc.; managing the transfer of best practices between operations; evaluating new business opportunities; providing information about the Company to regulators and stakeholders, among others.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -8- | |

Risk Management Model: its purpose is to develop a culture and processes for managing risks relevant to the business, so that, if such uncertain events materialize, the impact is manageable, and plans are in place.

Internal Audit: The Internal Audit Department has 5 teams (one per operation and one corporate team dedicated to IT-related issues). Among its main duties is the performance of process audits, IT audits (Cybersecurity, Ethical Hacking, Business and Risk Impact Analysis), Fraud Prevention Program, SOX testing and corporate risks; the design of the Crime Prevention Model (FCPA, Law 20,393, Law 27,401, etc.); operational audits (Territorial Coverage: Inventories, Cash Counts, Cargo Raids, etc.), anonymous complaints and investigations (EthicsPoint), among others.

Anonymous whistleblower channel: is available on the Company's corporate website and is designed to receive, evaluate and investigate complaints from employees and third parties in general, in different matters, including violations of laws and regulations that prohibit and punish corruption and improper payments, such as those contained in Law No. 20,393, the U.S. Foreign Corrupt Practices Act (FCPA) and all similar laws that are applicable in the countries where the Company operates. The existence of this channel is permanently communicated within the Company, emphasizing the guarantee of anonymity for whistleblowers who use it. All members of the Board of Directors have unlimited, remote, immediate and permanent access to all complaints received through the Anonymous Whistleblower Channel.

CONSOLIDATED BALANCE

The following are the balances of Assets and Liabilities at the closing dates of these financial statements:

| 12.31.2021 | 03.31.2022 | Variation | ||||||||||

| million CLP | million CLP | million CLP | ||||||||||

| Assets | ||||||||||||

| Current assets | 990,986 | 1,033,287 | 42,301 | |||||||||

| Non-current assets | 1,955,121 | 1,900,980 | -54,141 | |||||||||

| Total Assets | 2,946,107 | 2,934,266 | -11,841 | |||||||||

| 12.31.2021 | 03.31.2022 | Variation | ||||||||||

| million CLP | million CLP | million CLP | ||||||||||

| Liabilities | ||||||||||||

| Current liabilities | 529,567 | 517,316 | -12,251 | |||||||||

| Non-current liabilities | 1,315,126 | 1,308,229 | -6,897 | |||||||||

| Total Liabilities | 1,844,693 | 1,825,545 | -19,148 | |||||||||

| 12.31.2021 | 03.31.2022 | Variation | ||||||||||

| million CLP | million CLP | million CLP | ||||||||||

| Equity | ||||||||||||

| Non-controlling interests | 25,270 | 26,021 | 751 | |||||||||

| Equity attributable to the owners of the controller | 1,076,144 | 1,082,700 | 6,556 | |||||||||

| Total Equity | 1,101,414 | 1,108,721 | 7,307 | |||||||||

At the end of March, with respect to the end of 2021, the Argentine peso and the Paraguayan guaraní depreciated with respect to the Chilean peso by 15.8% and 7.9%, respectively, generating a decrease in the asset, liability and equity accounts, due to the effect of translation of figures. On the other hand, at the end of March, with respect to the end of 2021, the Brazilian real appreciated with respect to the Chilean peso by 9.0%, generating an increase in the asset, liability and equity accounts, due to the effect of translation of figures.

Assets

Total assets decreased by CLP 11,841 million, 0.4% compared to December 2021.

Current assets increased by CLP 42,301 million, by 4.3% compared to December 2021, which is mainly explained by the increase in Cash and cash equivalents (CLP 85,426 million), mainly due to higher cash generation in our operations, added to the increase in Inventories (CLP 13,713 million) mainly of raw materials and finished products of alcoholic products in Chile, and by the increase in Other current non-financial assets (CLP 12,954 million). The above increases were partially offset by the decrease in Other current financial assets (CLP -69,937 million).

Non-current assets decreased by CLP 54,141 million, 2.8% compared to December 2021, mainly due to the decrease in Other non-current financial assets (CLP -72,664 million) explained by the decrease in mark to market cross currency swaps in Brazil and Chile. The previous decrease was partially offset by the increase in Property, plant and equipment (CLP 10,455 million), which is explained by the investments made (CLP 24,291 million), mainly productive, plus investments in packaging and cold equipment, and added to the positive effect of the translation of figures, partially offset by the Depreciation account.

Liability and Equity

Total liabilities decreased by CLP 19,148 million, 1.0% compared to December 2021.

Current liabilities decreased by CLP 12,251 million, 2.3% compared to December 2021, mainly due to the decrease in Trade and other current accounts payable (CLP -12,945 million), due to seasonal factors considering that December is the month with the highest sales of the year, and therefore, a month with high accounts payable to suppliers. In addition to the previous decrease, there was a decrease in Other non-financial current liabilities (CLP -11,905 million) due to the payment of interim dividends in January of this year.

On the other hand, non-current liabilities decreased by CLP 6,897 million, 0.5% compared to December 2021, mainly due to the decrease in Other non-current financial liabilities (CLP -17,989 million) mainly explained by the decrease in bond debt due to the appreciation of the Chilean peso against the US dollar, added to the payment of interest, partially offset by the increase in liabilities from the mark to market of the cross currency swaps of the bond placed in the US market in January 2020. The aforementioned decrease was partially offset by the increase in Other non-current provisions (CLP 6,787 million), mainly due to the negative effect of the translation of figures as a result of the appreciation of the Brazilian real, in addition to the increase in Other non-current non-financial liabilities (CLP 5,356 million).

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -9- | |

Equity increased by CLP 7,307 million, 0.7% compared to December 2021, explained by the increase in Retained earnings from profits obtained in the period (CLP 32,998 million) and the restatement of equity balances in our subsidiary in Argentina, in accordance with IAS 29 (CLP 24,111 million). The increase in Retained earnings was partially offset by the decrease in Other reserves (CLP -50,553 million), which decreased mainly due to the recognition of hedging derivatives and the effect of translation of figures of our foreign subsidiaries.

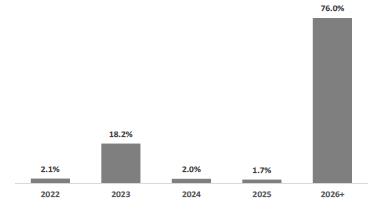

FINANCIAL ASSETS AND LIABILITIES

| CONSOLIDATED NET FINANCIAL DEBT | (USD million) | |||

| Total Financial Assets | 897 | |||

| Cash and Cash Equivalent (1) | 495 | |||

| Other current financial assets (1) | 159 | |||

| Valuation of Hedge Derivatives | 243 | |||

| Financial Debt | 1,315 | |||

| Bonds on the international market | 617 | |||

| Bonds on the local market (Chile) | 663 | |||

| Bank Debt and Others | 35 | |||

| Net Financial Debt | 418 | |||

(1) Financial Assets corresponding to Cash and Cash Equivalents and Other current financial assets are held invested in low-risk instruments such as time deposits, short-term fixed-income mutual funds and others.

| CURRENCY EXPOSURE (%) | ||||||||

| Total

Financial Assets | Financial

Debt (2) | |||||||

| CLP (Chile) | 43 | % | 31 | % | ||||

Unidad de Fomento (CLP indexed to inflation) | 14 | % | 40 | % | ||||

| BRL (Brazil) | 28 | % | 29 | % | ||||

| PGY (Paraguay) | 7 | % | 0 | % | ||||

| ARS (Argentina) | 7 | % | 0 | % | ||||

| USD (United States) | 1 | % | 1 | % | ||||

| Total | 100 | % | 100 | % | ||||

(2) Includes the effects of Cross Currency Swaps.

| RISK RATINGS | ||||

| Local rating agencies | Rating | |||

| ICR | AA+ | |||

| Fitch Chile | AA+ | |||

| International rating agencies | Rating | |||

| Standard & Poors | BBB | |||

| Fitch Ratings, Inc. | BBB+ |

| DEBT AMORTIZATION PROFILE |

CASH FLOW

| 03.31.2021 | 03.31.2022 | Variation | ||||||||||||||

| million CLP | million CLP | million CLP | % | |||||||||||||

| Cash flow | ||||||||||||||||

| Operating | 24,324 | 91,516 | 67,192 | 276.2 | % | |||||||||||

| Investment | -93,708 | 31,278 | 124,987 | -133.4 | % | |||||||||||

| Financing | -30,983 | -34,805 | -3,821 | 12.3 | % | |||||||||||

| Net Cash Flow for the period | -100,368 | 87,990 | 188,357 | -187.7 | % | |||||||||||

During the current period, the Company generated a positive net cash flow of CLP 87,990 million, which is explained as follows:

Operating activities generated a positive net cash flow of CLP 91,516 million, higher than the CLP 24,324 million recorded in the same period of 2021, which is mainly due to higher collections from the sale of goods, partially offset by higher payments to suppliers and tax payments.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -10- | |

Investing activities generated a positive cash flow of CLP 31,278 million, with a positive variation of CLP 124,987 million compared to the previous year, which is mainly explained by the purchase of financial instruments for CLP 80,400 million in 2021, of which in 2022 an amount of CLP 68,500 million has been redeemed, increasing cash and cash equivalents. This is partially offset by an increase in Capex.

Financing activities generated a negative cash flow of CLP 34,805 million, with a negative variation of CLP 3,821 million with respect to the previous year, which is mainly explained by higher dividend payments.

MAIN INDICATORS

| INDICATOR | Definition | Unit | Mar 22 | Dec 21 | Mar 21 | Mar 22 vs Dec 21 | Mar 22 vs Mar 21 | |||||||||||||||||

| LIQUIDITY | ||||||||||||||||||||||||

| Current liquidity | Current Asset Current Liability | Times | 2.0 | 1.9 | 2.6 | 6.7 | % | -21.7 | % | |||||||||||||||

| Acid ratio | Current Asset – Inventory Current Liability | Times | 1.6 | 1.5 | 2.1 | 6.0 | % | -23.7 | % | |||||||||||||||

| ACTIVITY | ||||||||||||||||||||||||

| Investment | Million CLP | 24,291 | 141,952 | 16,868 | -82.9 | % | 44.0 | % | ||||||||||||||||

| Inventory turnover | Cost of Sales Average Inventory | Times | 1.9 | 8.6 | 2.3 | -77.9 | % | -18.0 | % | |||||||||||||||

| INDEBTEDNESS | ||||||||||||||||||||||||

| Indebtedness ratio | Net Financial

Debt* Total Equity* | Times | 0.3 | 0.3 | 0.5 | 11.2 | % | -35.7 | % | |||||||||||||||

| Financial exp. coverage | Adjusted EBITDA (12M) Financial Expenses* (12M) – Financial Income* (12M) | Times | 9.8 | 8.2 | 9.0 | 19.9 | % | 9.5 | % | |||||||||||||||

| Net financial debt / Adjusted EBITDA | Net Financial Debt Adjusted EBITDA (12M) | Times | 0.8 | 0.7 | 1.2 | 6.7 | % | -33.1 | % | |||||||||||||||

| PROFITABILITY | ||||||||||||||||||||||||

| On Equity | Net Income Fiscal Year (12M) Average Equity | % | 13.5 | % | 16.4 | % | 13.8 | % | (2.9 | )pp | (0.3 | )pp | ||||||||||||

| On Total Assets | Net Income Fiscal Year (12M) Average Equity | % | 5.0 | % | 5.7 | % | 4.8 | % | (0.8 | )pp | 0.2 | pp | ||||||||||||

Liquidity

Current Liquidity showed a positive variation of 6.7% with respect to December 2021, explained by the 4.3% increase in current assets previously explained, in addition to the 2.3% decrease in current liabilities.

Acid Ratio showed an increase of 6.0% compared to December 2021, for the reasons explained above, added to the increase in inventories (7.2%) in the period, due to higher inventories of raw materials and finished products. Current assets excluding inventories showed an increase of 3.6% compared to December 2021.

Activity

At the end of March 2022, investments reached CLP 24,291 million, which represents an increase of 44.0% compared to the same period of 2021, mainly explained by higher productive investments.

Inventory turnover reached 1.9 times, showing a decrease of 18.0% compared to the same period of 2021, mainly explained by the increase in average inventory by 49.3% compared to the same period of 2021 previously mentioned, which was higher than the increase in cost of sales (22.4%).

* Definitions used are contained in the Glossary on page 15 of this document.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -11- | |

Indebtedness

Indebtedness Ratio reached 0.3 times at the end of March 2022, which is equivalent to an 11.2% increase compared to the end of December 2021. This is due to the increase in net debt by 11.9%, which was higher than the increase in total equity of 0.7%.

The Financial Expense Coverage indicator shows an increase of 19.9% when compared to December 2021, reaching 9.8 times. This is explained by the 12.5% decrease in net financial expenses (rolling 12 months), added to the 4.9% increase in Adjusted EBITDA for the period.

Net financial debt/Adjusted EBITDA was 0.8 times, representing an increase of 6.7% versus December 2021. This is due to the 11.9% increase in Net Financial Debt, which was higher than the 4.9% increase in Adjusted EBITDA for the period.

Profitability

Return on equity reached 13.5%, 2.9 percentage points lower than the indicator measured in December 2021. The result is due to the increase in average Equity (14.4%), added to the decrease in Net Income for the 12-month period (-5.9%).

Meanwhile, the Return on Total Assets was 5.0%, 0.8 percentage points lower than the indicator measured in December 2021, due to the increase in Average Assets (9.0%), added to the aforementioned decrease in Net Income rolling 12 months.

MACROECONOMIC INFORMATION

INFLATION

| Accumulated 3M22 | LTM | ||||||||

| Argentina* | 16.07 | % | 55.00 | % | |||||

| Brazil | 3.20 | % | 11.30 | % | |||||

| Chile | 3.43 | % | 9.40 | % | |||||

| Paraguay | 3.71 | % | 10.08 | % | |||||

* Official inflation reported by the National Institute of Statistics and Censuses of Argentina (INDEC). It should be mentioned that the inflation used to express Argentina's figures in accordance with IAS 29 corresponds to inflation estimated by the Central Bank of the Argentine Republic (in its Survey of Market Expectations report), which is also adjusted for the difference between the estimate (by the Central Bank) and the actual inflation of the previous month (INDEC).

| Local currency/USD | CLP/local currency | |||||||||||||||

| (Average exchange rate) | (Average exchange rate *) | |||||||||||||||

| EXCHANGE RATES USED | 1Q21 | 1Q22 | 1Q21 | 1Q22 | ||||||||||||

| Argentina | 88.6 | 106.6 | 7.8 | 7.1 | ||||||||||||

| Brazil | 5.47 | 5.23 | 132.35 | 154.51 | ||||||||||||

| Chile | 724 | 809 | N.A. | N.A. | ||||||||||||

| Paraguay | 6,726 | 6,977 | 0.11 | 0.12 | ||||||||||||

*Except Argentina, where the closing exchange rate is used, in accordance with IAS 29.

MARKET RISK ANALYSIS

The Company’s risk management is the responsibility of the office of the Chief Executive Officer, (through the areas of Corporate Management Control, Sustainability and Risks, which depends on the office of the Chief Financial Officer), as well as each of the management areas of Coca-Cola Andina. The main risks that the Company has identified and that could possibly affect the business are as follows:

Relationship with The Coca-Cola Company

A large part of the Company’s sales derives from the sale of products whose trademarks are owned by The Coca-Cola Company, which has the ability to exert an important influence on the business through its rights under the Licensing or Bottling Agreements. In addition, we depend on The Coca-Cola Company to renew these Bottling Agreements.

Non-alcoholic beverage business environment

Consumers, public health officials, and government officials in our markets are increasingly concerned about the public health consequences associated with obesity, which can affect demand for our products, especially those containing sugar.

The Company has developed a large portfolio of sugar-free products and has also made reformulations to some of its sugary products, significantly reducing sugar contents of its products.

Raw material prices and exchange rate

Many raw materials are used in the production of beverages and packaging, including sugar and PET resin, the prices of which may present great volatility. In the case of sugar, the Company sets the price of a part of the volume that it consumes with some anticipation, in order to avoid having large fluctuations of cost that cannot be anticipated.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -12- | |

In addition, these raw materials are traded in dollars; the Company has a policy of hedging in the futures market a portion of the dollars it uses to buy raw materials.

Instability in the supply of utilities and raw materials

In the countries in which we operate, our operations depend on a stable supply of utilities, fuel and raw materials. Power outages or water shut offs as well as the lack of raw materials may result in interruptions of our production. The Company has mitigation plans to reduce the effects of eventual interruptions in the supply of utilities and raw materials.

Economic conditions of the countries where we operate

The Company maintains operations in Argentina, Brazil, Chile and Paraguay. The demand for our products largely depends on the economic situation of these countries. Moreover, economic instability can cause depreciation of the currencies of these countries, as well as inflation, which may eventually affect the Company’s financial situation.

New tax laws or modifications to tax incentives

We cannot ensure that any government authority in any of the countries in which we operate will not impose new taxes or increase existing taxes on our raw materials, products or containers. Likewise, we cannot assure that these authorities are going to uphold and/or renew tax incentives that currently benefit some of our operations.

A devaluation of the currencies of the countries where we have our operations, regarding the Chilean peso, can negatively affect the results reported by the Company in Chilean pesos

The Company reports its results in Chilean pesos, while a large part of its revenues and Adjusted EBITDA comes from countries that use other currencies. Should currencies devaluate regarding the Chilean peso, this would have a negative effect on the results of the Company, upon the translation of results into Chilean pesos.

The imposition of exchange controls could restrict the entry and exit of funds to and from the countries in which we operate, which could significantly limit our financial capacity

The imposition of exchange controls in the countries in which we operate could affect our ability to repatriate profits, which could significantly limit our ability to pay dividends to our shareholders. Additionally, it may limit the ability of our foreign subsidiaries to finance payments of U.S. dollar denominated liabilities required by foreign creditors.

Civil unrest in Chile could have a material adverse effect on general economic conditions in Chile and our business and financial condition

Since October 18, 2019, there have been protests and demonstrations in Chile, seeking to reduce inequality, including claims about better pensions, improvement in health plans and reduced health care costs, reduction in the cost of public transportation, better wages, among others. Sometimes demonstrations have been violent, causing damage to public and private property.

We cannot predict the extent to which the Chilean economy will be affected by the civil unrest, nor can we predict if government policies enacted as a response to the civil unrest will have a negative impact on the Chilean economy and our business. Neither can we assure that demonstrations and vandalism will not cause damage to our logistics and production infrastructure. So far, the Company has not been affected in any material respect.

Our business is subject to risks arising from the COVID-19 pandemic

The COVID-19 pandemic has resulted in the countries where we operate taking extraordinary measures to contain the spread of COVID-19, including travel restrictions, closing borders, restrictions or bans on social gathering events, instructions to citizens to practice social distancing, non-essential business closure, quarantine implementation, and other similar actions. The impact of this pandemic has substantially increased uncertainty regarding the development of economies and is most likely to cause a global recession. We cannot predict how long this pandemic will last, or how long the restrictions imposed by the countries where we operate will last.

Since the impact of COVID-19 is very uncertain, we cannot accurately predict the extent of impact this pandemic will have on our business and our operations. There is a risk that our collaborators, contractors and suppliers may be restricted or prevented from carrying out their activities for an indefinite period of time, due to shutdowns mandated by the authorities. Although our operations have not been materially disrupted to date, eventually the pandemic and the measures taken by governments to contain the virus could affect the continuity of our operations. In addition, some measures taken by governments have negatively affected some of our sales channels, especially the closing of restaurants and bars, as well as the prohibition of social gathering events, which affects our sales volumes to these channels. We cannot predict the effect that the pandemic and these measures will have on our sales to these channels, nor whether these channels will recover once the pandemic is over. Nor can we predict how long our consumers will change their consumer spending pattern as a result of the pandemic.

Additionally, a possible outbreak of other epidemics in the future, such as SARS, Zika or the Ebola virus, could also result in a similar impact on our business than COVID-19.

A more detailed analysis of business risks is available in the Company’s 20-F and Annual Report, available on our website.

| COCA-COLA ANDINA | |

| 3Q21 EARNINGS RELEASE | |

| www.koandina.com | |

| -13- | |

RECENT EVENTS

Resolutions of the General Shareholders’ Meeting

At the General Shareholders' Meeting held on April 13, 2022, it was agreed, among other matters, the following:

1. To approve the Annual Report, the Statements of Financial Position and the Financial Statements corresponding to Fiscal Year 2021, as well as the Report of the External Auditors of the Company with respect to the aforementioned Financial Statements;

2. To approve the distribution of earnings and the distribution of dividends;

3. Approve the statement regarding the Company's dividend policy and information on the procedures used in the distribution and payment of dividends;

4. Approve the remuneration of the directors, the members of the Ethics Committee, the Executive Committee, the Directors' Committee established in Article 50 bis of the Corporations Law and the members of the Audit Committee required by the Sarbanes & Oxley Act of the United States, the determination of its operating budget; as well as its annual management report and the report of the expenses incurred;

5. To appoint the firm PricewaterhouseCoopers Consultores Auditores SpA as External Auditors for Fiscal Year 2022;

6. Appoint the following companies as the Company's risk rating agencies for the year 2022: Fitch Chile Clasificadora de Riesgo Limitada and International Credit Rating Clasificadora de Riesgo Limitada, as local risk rating agencies; and Fitch Ratings, Inc. and S&P Global Ratings, as the Company's international risk rating agencies;

7. Approve the account on resolutions of the Board of Directors regarding operations referred to in Article 146 et seq. of Law No. 18,046 on Corporations, subsequent to the last shareholders' meeting; and,

8. Appoint the Diario Financiero as the newspaper where notices and calls to Meetings must be published.

Under number 2 above, the Meeting agreed to ratify the interim dividends paid out of fiscal year 2021 earnings, and to approve the distribution and payment of a Mixed Dividend No. 221, payable in pesos, local currency, amounting to CLP 189 (one hundred eighty-nine pesos) for each Series A share and CLP 207.9 (two hundred and seven point nine pesos) for each Series B share.

Mixed Dividend No. 221 considers:

| (i) | a final, additional dividend, amounting to CLP 29 (twenty-nine pesos) for each Series A share and CLP 31.9 (thirty-one point nine pesos) for each Series B share, to be paid out of a portion of the balance of fiscal year 2021 earnings; and | |

| (ii) | a final, contingent dividend of CLP 160 (one hundred and sixty pesos) per each Series A share and CLP 176 (one hundred and seventy-six pesos) per each Series B share, to be paid out of a portion of the Company's retained earnings account. |

This dividend was paid beginning April 26, 2022, to shareholders of record in the Shareholders' Registry at midnight on April 20, 2022.

Coca-Cola Andina announces distribution agreement with Campari Group in Brazil

The Company, together with the Coca-Cola system in Brazil, has signed a distribution agreement with Campari Group ("Campari") for the distribution of some of its products in Brazil. Such distribution will have different strategic actions to service each state or region, especially in terms of portfolio.

COVID-19 impact on our business

Due to the impact that COVID-19 has had on different countries around the world and its arrival in the region where we operate, Coca-Cola Andina is taking the necessary actions to protect its collaborators and ensure the operational continuity of the company.

Among the measures that have been taken to protect its collaborators are:

| · | Education campaign addressed to our employees on measures to be taken to prevent the spread of COVID-19. | |

| · | Every collaborator in an environment of potential contagion is returned home. | |

| · | New cleaning protocols in our facilities. | |

| · | Certain practices and work activities are modified, maintaining service to customers: | |

| o | We have proceeded to work from home in all positions where it is possible. | |

| · | Provide personal protection equipment to all our collaborators who must continue to work in plants and distribution centers, as well as truck drivers and helpers, including masks and alcohol gel. | |

| · | We developed a plan to promote and facilitate the voluntary vaccination of our own employees and direct third parties, monitoring the evolution of the vaccination status at a regional level on a weekly basis. | |

| · | In our plants and distribution centers, we established a preventive protocol for the application of PCR and COVID-19 antigen tests to detect and isolate infected people and identify close contacts. |

Since mid-March 2020, the governments of the countries where the Company operates have taken a number of steps to reduce the infection rate of COVID-19. These measures include the partial or total closing of schools, universities, restaurants and bars, malls, the prohibition of social gathering events, sanitary controls and health check points, and in some cases, total or partial quarantines for a part of the population. Governments in the countries where we operate have also announced economic stimulus measures for families and businesses, including restrictions on dismissals of workers in Argentina. To date, none of our plants have had to suspend their operations.

| COCA-COLA ANDINA | |

| 3Q21 EARNINGS RELEASE | |

| www.koandina.com | |

| -14- | |

As a result of the COVID-19 pandemic and the restrictions imposed and eliminated by the authorities in the four countries where we operate, we have seen great volatility in our sales across channels. During this quarter, at the consolidated level, we did not see relevant changes in the relative participation of our sales channels regarding the previous quarter. Because the pandemic and the measures governments take are changing very rapidly, we believe it is too early to draw conclusions about changes in the long-term consumption pattern, and how these may affect our operating and financial results in the future.

Due to the uncertainty regarding the evolution of the COVID-19 pandemic and the aforementioned government measures, including how long they will persist, and the effect they will have on our volumes and business in general, we cannot predict the effect that these trends will have on our financial situation. However, we consider that the Company will have no liquidity problems. To date, we do not anticipate significant provisions or write-offs.

GLOSSARY

Adjusted EBITDA: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial Statements submitted to Chile’s Financial Market Commission and determined in accordance with IFRS, plus Depreciation.

Currency-neutral of a quarter q for a Q year is calculated using the same ratio of local currencies to the Chilean peso as the q quarter of the Q-1 year. In the case of Argentina, given that it is a hyperinflationary economy, the result of the q quarter is also deflated by inflation of the last 12 months.

Financial Expenses: correspond to interest generated by the Company’s financial debt.

Financial Income: corresponds to the interest generated by the Company's cash.

Net Financial Debt: considers the consolidated financial liability that accrues interest, i.e.: (i) other current financial liabilities, plus (ii) other non-current financial liabilities, less (iii) the sum of cash and cash equivalent; plus other current financial assets; plus other non-current financial assets (to the extent that they correspond to the balances of assets for derivative financial instruments, taken to cover exchange rate risk and/or interest rate of financial liabilities).

Operating Income: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial Statements submitted to Chile Financial Market Commission and determined in accordance with IFRS.

Total Equity: corresponds to the equity attributable to the owners of the controller plus non-controlling interests.

Transactions: refers to the number of units sold, regardless of size.

Volume: expressed in Unit Cases (UCs), which is the conventional measurement used to measure sales volume in the Coca-Cola System worldwide.

| COCA-COLA ANDINA | |

| 3Q21 EARNINGS RELEASE | |

| www.koandina.com | |

| -15- | |

ADDITIONAL INFORMATION

| STOCK EXCHANGES WE TRADE ON | |||

ANDINA-A ANDINA-B

|

AKO/A AKO/B

|

||

| ESG INDICES IN WHICH WE PARTICIPATE | |||

Dow Jones Sustainability Index Chile Dow Jones Sustainability MILA Pacific Alliance Index. |

|

|

|

| NUMBER OF SHARES | |||

| TOTAL: 946,570,604 | SERIES A: 473,289,301 | SERIES B: 473,281,303 | SHARES PER ADR: 6 |

ABOUT COCA-COLA ANDINA

Coca-Cola Andina is among the three largest Coca-Cola bottlers in Latin America, servicing franchised territories with almost 55.3 million people, delivering 828.3 million unit cases or 4,703 million liters of soft drinks, juices, bottled water, beer and other alcoholic beverages during 2021. Coca-Cola Andina has the franchise to produce and commercialize Coca-Cola products in certain territories in Argentina (through Embotelladora del Atlántico), in Brazil (through Rio de Janeiro Refrescos), in Chile, (through Embotelladora Andina) and in all of Paraguay (through Paraguay Refrescos). The Chadwick Claro, Garcés Silva, Said Handal and Said Somavía families control Coca-Cola Andina in equal parts. The Company's value generation proposal is to become a Total Beverage Company, using existing resources efficiently and sustainably, developing a relationship of excellence with consumers of its products, as well as with its collaborators, customers, suppliers, the community in which it operates and with its strategic partner The Coca-Cola Company, in order to increase ROIC for shareholders in the long term. For more company information visit www.koandina.com.

This document may contain projections reflecting Coca-Cola Andina’s good faith expectation and are based on currently available information. However, the results that are finally obtained are subject to diverse variables, many of which are beyond the Company's control, and which could materially impact the current performance. Among the factors that could change the performance are the political and economic conditions on mass consumption, pricing pressures resulting from competitive discounts of other bottlers, weather conditions in the Southern Cone and other risk factors that would be applicable from time to time, and which are periodically informed in reports filed before the appropriate regulatory authorities, and which are available on our website.

| COCA-COLA ANDINA | |

| 1Q22 EARNINGS RELEASE | |

| www.koandina.com | |

| -16- | |

| Embotelladora Andina S.A. |

| First Quarter Results for the period ended March 31, 2022. Reported figures, IFRS GAAP. |

| (In nominal million Chilean pesos, except per share) |

| January-March 2022 | January-March 2021 | |||||||||||||||||||||||||||||||||||||||||||

| Chilean Operations | Brazilian Operations | Argentine Operations | Paraguay Operations | Total (1) | Chilean Operations | Brazilian Operations | Argentine Operations | Paraguay Operations | Total (1) | % Ch. | ||||||||||||||||||||||||||||||||||

| Volume total beverages (Million UC) | 87.6 | 66.7 | 52.9 | 20.7 | 227.9 | 76.2 | 68.4 | 49.8 | 18.0 | 212.5 | 7.2 | % | ||||||||||||||||||||||||||||||||

| Transactions (Million) | 492.8 | 364.7 | 244.9 | 119.0 | 1,221.3 | 420.3 | 417.7 | 220.5 | 100.4 | 1,158.9 | 5.4 | % | ||||||||||||||||||||||||||||||||

| Net sales | 290,997 | 128,510 | 152,351 | 53,127 | 624,228 | 229,439 | 136,815 | 102,592 | 40,725 | 509,007 | 22.6 | % | ||||||||||||||||||||||||||||||||

| Cost of sales | (190,352 | ) | (81,851 | ) | (78,314 | ) | (28,259 | ) | (378,019 | ) | (144,529 | ) | (92,072 | ) | (51,639 | ) | (21,276 | ) | (308,951 | ) | 22.4 | % | ||||||||||||||||||||||

| Gross profit | 100,645 | 46,660 | 74,036 | 24,868 | 246,208 | 84,910 | 44,743 | 50,953 | 19,449 | 200,056 | 23.1 | % | ||||||||||||||||||||||||||||||||

| Gross margin | 34.6 | % | 36.3 | % | 48.6 | % | 46.8 | % | 39.4 | % | 37.0 | % | 32.7 | % | 49.7 | % | 47.8 | % | 39.3 | % | ||||||||||||||||||||||||

| Distribution and administrative expenses | (62,652 | ) | (30,864 | ) | (45,485 | ) | (10,250 | ) | (149,251 | ) | (50,345 | ) | (26,382 | ) | (34,514 | ) | (8,359 | ) | (119,600 | ) | 24.8 | % | ||||||||||||||||||||||

| Corporate expenses (2) | (1,539 | ) | (1,350 | ) | 14.0 | % | ||||||||||||||||||||||||||||||||||||||

| Operating income (3) | 37,993 | 15,796 | 28,551 | 14,618 | 95,418 | 34,565 | 18,362 | 16,439 | 11,090 | 79,106 | 20.6 | % | ||||||||||||||||||||||||||||||||

| Operating margin | 13.1 | % | 12.3 | % | 18.7 | % | 27.5 | % | 15.3 | % | 15.1 | % | 13.4 | % | 16.0 | % | 27.2 | % | 15.5 | % | ||||||||||||||||||||||||

| Adjusted EBITDA (4) | 47,757 | 22,102 | 35,532 | 17,526 | 121,377 | 44,171 | 23,732 | 21,902 | 13,470 | 101,925 | 19.1 | % | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA margin | 16.4 | % | 17.2 | % | 23.3 | % | 33.0 | % | 19.4 | % | 19.3 | % | 17.3 | % | 21.3 | % | 33.1 | % | 20.0 | % | ||||||||||||||||||||||||

| Financial (expenses) income (net) | (2,309 | ) | (9,073 | ) | -74.6 | % | ||||||||||||||||||||||||||||||||||||||

| Share of (loss) profit of investments accounted for using the equity method | (513 | ) | 668 | -176.8 | % | |||||||||||||||||||||||||||||||||||||||

| Other income (expenses) (5) | (3,828 | ) | (3,241 | ) | 18.1 | % | ||||||||||||||||||||||||||||||||||||||

| Results by readjustement unit and exchange rate difference | (14,128 | ) | (4,739 | ) | 198.1 | % | ||||||||||||||||||||||||||||||||||||||

| Net income before income taxes | 74,640 | 62,721 | 19.0 | % | ||||||||||||||||||||||||||||||||||||||||

| Income tax expense | (40,426 | ) | (19,382 | ) | 108.6 | % | ||||||||||||||||||||||||||||||||||||||

| Net income | 34,213 | 43,339 | -21.1 | % | ||||||||||||||||||||||||||||||||||||||||

| Net income attributable to non-controlling interests | (1,216 | ) | (1,220 | ) | -0.3 | % | ||||||||||||||||||||||||||||||||||||||

| Net income attributable to equity holders of the parent | 32,998 | 42,119 | -21.7 | % | ||||||||||||||||||||||||||||||||||||||||

| Net margin | 5.3 | % | 8.3 | % | ||||||||||||||||||||||||||||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING | 946.6 | 946.6 | ||||||||||||||||||||||||||||||||||||||||||

| EARNINGS PER SHARE | 34.9 | 44.5 | ||||||||||||||||||||||||||||||||||||||||||

| EARNINGS PER ADS | 209.2 | 267.0 | -21.7 | % | ||||||||||||||||||||||||||||||||||||||||

| (1) Total may be different from the addition of the four countries because of intercountry eliminations. |

| (2) Corporate expenses partially reclassified to the operations. |

| (3) Operating Income considers Net Sales, Cost of Sales, Distribution Costs, and Administrative Expenses included in the Financial Statements filed with the Chilean Financial Market Comission and determined in accordance to IFRS. |

| (4) Adjusted EBITDA considers Net Sales, Cost of Sales, Distribution Costs, and Administrative Expenses included in the Financial Statements filed with the Chilean Financial Market Comission and determined in accordance to IFRS, plus Depreciation. |

| (5) Other income (expenses) includes the following lines of the income statement by function included in the published financial statements in the Financial Market Comission: "Other income", "Other expenses" and "Other (loss) gains". |

| -17- |

| Embotelladora Andina S.A. | |||||||||

| First Quarter Results for the period ended March 31, 2022. | |||||||||

| (In local nominal currency of each period, except Argentina (3)) | |||||||||

| January-March 2022 | January-March 2021 | |||||||||||||||||||||||||||||||

| Chile Million Ch$ | Brazil Million R$ | Argentina (3) Million AR$ | Paraguay Million G$ | Chile Million Ch$ | Brazil Million R$ | Argentina (3) Million AR$ | Paraguay Million G$ | |||||||||||||||||||||||||

| Nominal | Nominal | IAS29 | Nominal | Nominal | Nominal | IAS 29 | Nominal | |||||||||||||||||||||||||

| Total beverages volume (Million UC) | 87.6 | 66.7 | 52.9 | 20.7 | 76.2 | 68.4 | 49.8 | 18.0 | ||||||||||||||||||||||||

| Transactions (Million) | 492.8 | 364.7 | 244.9 | 119.0 | 420.3 | 417.7 | 220.5 | 100.4 | ||||||||||||||||||||||||

| Net sales | 290,997 | 827.7 | 21,463.0 | 458,523 | 229,439 | 1,033.4 | 19,906.3 | 377,734 | ||||||||||||||||||||||||

| Cost of sales | (190,352 | ) | (526.9 | ) | (11,032.8 | ) | (243,886 | ) | (144,529 | ) | (695.3 | ) | (10,019.7 | ) | (197,318 | ) | ||||||||||||||||

| Gross profit | 100,645 | 300.8 | 10,430.2 | 214,637 | 84,910 | 338.1 | 9,886.7 | 180,416 | ||||||||||||||||||||||||

| Gross margin | 34.6 | % | 36.3 | % | 48.6 | % | 46.8 | % | 37.0 | % | 32.7 | % | 49.7 | % | 47.8 | % | ||||||||||||||||

| Distribution and administrative expenses | (62,652 | ) | (199.8 | ) | (6,407.9 | ) | (88,431 | ) | (50,345 | ) | (199.4 | ) | (6,696.9 | ) | (77,528 | ) | ||||||||||||||||

| Operating income (1) | 37,993 | 101.0 | 4,022.3 | 126,206 | 34,565 | 138.7 | 3,189.8 | 102,889 | ||||||||||||||||||||||||

| Operating margin | 13.1 | % | 12.2 | % | 18.7 | % | 27.5 | % | 15.1 | % | 13.4 | % | 16.0 | % | 27.2 | % | ||||||||||||||||

| Adjusted EBITDA (2) | 47,757 | 141.8 | 5,005.7 | 151,296 | 44,171 | 179.3 | 4,249.8 | 124,965 | ||||||||||||||||||||||||

| Adjusted EBITDA margin | 16.4 | % | 17.1 | % | 23.3 | % | 33.0 | % | 19.3 | % | 17.3 | % | 21.3 | % | 33.1 | % | ||||||||||||||||

| (1) Operating Income considers Net Sales, Cost of Sales, Distribution Costs, and Administrative Expenses included in the Financial Statements filed with the Chilean |

| Financial Market Comission and determined in accordance to IFRS. |

| (2) Adjusted EBITDA considers Net Sales, Cost of Sales, Distribution Costs, and Administrative Expenses included in the Financial Statements filed with the Chilean |

| Financial Market Comission and determined in accordance to IFRS, plus Depreciation. |

| (3) Argentina 2022 figures are presented in accordance to IAS 29, in March 2022 currency. 2021 figures are also presented in accordance to IAS 29, in March 2022 currency. |

| -18- |

| Embotelladora Andina S.A. | ||||||||||||

| Consolidated Balance Sheet | ||||||||||||

| (In million Chilean pesos) | ||||||||||||

| Variation % | ||||||||||||||||||||

| ASSETS | 03-31-2022 | 12-31-2021 | 03-31-2021 | 12-31-2021 | 03-31-2021 | |||||||||||||||

| Cash + Time deposits + market. Securit. | 515,271 | 499,783 | 430,153 | 3.1 | % | 19.8 | % | |||||||||||||

| Account receivables (net) | 274,784 | 274,910 | 189,891 | 0.0 | % | 44.7 | % | |||||||||||||

| Inventories | 205,063 | 191,350 | 137,600 | 7.2 | % | 49.0 | % | |||||||||||||

| Other current assets | 38,168 | 24,943 | 15,311 | 53.0 | % | 149.3 | % | |||||||||||||

| Total Current Assets | 1,033,287 | 990,986 | 772,954 | 4.3 | % | 33.7 | % | |||||||||||||

| Property, plant and equipment | 1,715,303 | 1,677,828 | 1,404,348 | 2.2 | % | 22.1 | % | |||||||||||||

| Depreciation | (988,469 | ) | (961,449 | ) | (807,505 | ) | 2.8 | % | 22.4 | % | ||||||||||

| Total Property, Plant, and Equipment | 726,834 | 716,379 | 596,843 | 1.5 | % | 21.8 | % | |||||||||||||

| Investment in related companies | 94,894 | 91,489 | 86,058 | 3.7 | % | 10.3 | % | |||||||||||||

| Goodwill | 122,589 | 118,043 | 96,002 | 3.9 | % | 27.7 | % | |||||||||||||

| Other long term assets | 956,663 | 1,029,209 | 878,239 | -7.0 | % | 8.9 | % | |||||||||||||

| Total Other Assets | 1,174,145 | 1,238,741 | 1,060,299 | -5.2 | % | 10.7 | % | |||||||||||||

| TOTAL ASSETS | 2,934,266 | 2,946,107 | 2,430,096 | -0.4 | % | 20.7 | % | |||||||||||||

| Variation % | ||||||||||||||||||||

| LIABILITIES & SHAREHOLDERS' EQUITY | 03-31-2022 | 12-31-2021 | 03-31-2021 | 12-31-2021 | 03-31-2021 | |||||||||||||||

| Short term bank liabilities | 8 | 27 | 781 | -70.8 | % | -99.0 | % | |||||||||||||

| Current portion of bonds payable | 16,046 | 25,383 | 14,517 | -36.8 | % | 10.5 | % | |||||||||||||

| Other financial liabilities | 25,995 | 22,353 | 19,616 | 16.3 | % | 32.5 | % | |||||||||||||

| Trade accounts payable and notes payable | 379,110 | 383,513 | 230,532 | -1.1 | % | 64.4 | % | |||||||||||||

| Other liabilities | 96,158 | 98,292 | 37,464 | -2.2 | % | 156.7 | % | |||||||||||||

| Total Current Liabilities | 517,316 | 529,567 | 302,912 | -2.3 | % | 70.8 | % | |||||||||||||

| Long term bank liabilities | 4,000 | 4,000 | 4,000 | 0.0 | % | 0.0 | % | |||||||||||||

| Bonds payable | 992,687 | 1,020,662 | 925,526 | -2.7 | % | 7.3 | % | |||||||||||||

| Other financial liabilities | 26,373 | 16,387 | 66,417 | 60.9 | % | -60.3 | % | |||||||||||||

| Other long term liabilities | 285,170 | 274,077 | 240,763 | 4.0 | % | 18.4 | % | |||||||||||||

| Total Long Term Liabilities | 1,308,229 | 1,315,126 | 1,236,706 | -0.5 | % | 5.8 | % | |||||||||||||

| Minority interest | 26,021 | 25,270 | 22,166 | 3.0 | % | 17.4 | % | |||||||||||||

| Stockholders' Equity | 1,082,700 | 1,076,144 | 868,312 | 0.6 | % | 24.7 | % | |||||||||||||

| TOTAL LIABILITIES & SHAREHOLDERS' EQUITY | 2,934,266 | 2,946,107 | 2,430,096 | -0.4 | % | 20.7 | % | |||||||||||||

Financial Highlights

(In million Chilean pesos)

| Accumulated | ||||||||||||

| ADDITIONS TO FIXED ASSETS | 03-31-2022 | 12-31-2021 | 03-31-2021 | |||||||||

| Chile | 7,952 | 57,245 | 6,096 | |||||||||

| Brazil | 9,729 | 30,882 | 2,901 | |||||||||

| Argentina | 4,604 | 31,723 | 6,491 | |||||||||

| Paraguay | 2,006 | 22,102 | 1,379 | |||||||||

| Total | 24,291 | 141,952 | 16,868 | |||||||||

| -19- |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Santiago, Chile.

| EMBOTELLADORA ANDINA S.A. | ||

| By: | /s/ Andrés Wainer | |

| Name: Andrés Wainer | ||

| Title: Chief Financial Officer | ||

| Santiago, April 26, 2022 | ||