UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

|

For the fiscal year ended

|

December 31, 2014

|

OR

| |

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________________________ to ____________________________

|

Commission File No.

|

001-14124

|

|

MILLER INDUSTRIES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

Tennessee

|

|

62-1566286

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

8503 Hilltop Drive, Ooltewah, Tennessee

|

|

37363

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

|

|

|

(423) 238-4171

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

| |

|

|

|

Common Stock, par value $.01 per share

|

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| |

Large Accelerated Filer ☐

|

Accelerated Filer ☒

|

| |

|

|

| |

Non-accelerated Filer ☐

|

Smaller Reporting Company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

The aggregate market value of the voting stock held by non-affiliates of the registrant (which for purposes hereof are all holders other than executive officers, directors and holders of more than 10% of the registrant’s Common Stock) as of June 30, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter) was $188,535,170 (based on 9,161,087 shares held by non-affiliates at $20.58 per share, the last sale price reported on the New York Stock Exchange on June 30, 2014).

At February 27, 2015 there were 11,307,150 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III (Items 10, 11, 12, 13 and 14) is incorporated herein by reference to the Registrant’s definitive proxy statement for its 2014 Annual Meeting of Shareholders which is to be filed pursuant to Regulation 14A.

TABLE OF CONTENTS

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

2

|

|

|

|

|

8

|

|

|

|

|

12

|

|

|

|

|

12

|

|

|

|

|

12

|

|

|

|

|

12

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

13

|

|

|

|

|

15

|

|

|

|

|

16

|

|

|

|

|

21

|

|

|

|

|

21

|

|

|

|

|

21

|

|

|

|

|

22

|

|

|

|

|

24

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

25

|

|

|

|

|

25

|

|

|

|

|

25

|

|

|

|

|

25

|

|

|

|

|

25

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

26

|

CERTAIN FACTORS AFFECTING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report, including but not limited to statements made in Part II–Item 7–“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” statements made with respect to future operating results, expectations of future customer orders and the availability of resources necessary for our business may be deemed to be forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “could,” “continue,” “future,” “potential,” “believe,” “project,” “plan,” “intend,” “seek,” “estimate,” “predict,” “expect,” “anticipate” and similar expressions, or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are made based on our management’s beliefs as well as assumptions made by, and information currently available to, our management. Our actual results may differ materially from the results anticipated in these forward-looking statements due to, among other things: the cyclical nature of our industry and changes in consumer confidence; economic and market conditions; our customer’s access to capital and credit to fund purchases, including the ability of our customers to secure floor plan financing; our dependence on outside suppliers of raw materials; changes in the cost of aluminum, steel and related raw materials; changes in fuel and other transportation costs, insurance costs and weather conditions; changes in government regulation; foreign currency fluctuation; competitors could impede our ability to attract or retain customers; our ability to develop or acquire proprietary products and technology; assertions against us relating to intellectual property rights; problems hiring or retaining skilled labor; the effects of new regulation relating to conflict minerals; the catastrophic loss of one or our manufacturing facilities; environmental and health and safety liabilities and requirements; loss of the services of our key executives; product warranty or product liability claims in excess of our insurance coverage; a disruption in our information technology systems; an inability to acquire insurance at commercially reasonable rates; and those other risks referenced herein, including those risks referred to in this report, in Part I, Item 1A–“Risk Factors” and those risks discussed in our filings with the Securities and Exchange Commission filed after this Annual Report. Such factors are not exclusive. We do not undertake to update any forward-looking statement that may be made from time to time by, or on behalf of, our company.

General

Miller Industries is The World’s Largest Manufacturer of Towing and Recovery Equipment®, with executive offices in Ooltewah, Tennessee, domestic manufacturing operations in Tennessee and Pennsylvania, and foreign manufacturing operations in France and the United Kingdom.

Since 1990, we have developed or acquired several of the most well-recognized brands in the towing and recovery equipment manufacturing industry. Our strategy has been to diversify our line of products and increase our presence in the industry by combining internal growth and development with acquisitions of complementary products.

In this Annual Report on Form 10-K, the words “Miller Industries,” “the Company,” “we,” “our,” “ours” and “us” refer to Miller Industries, Inc. and its subsidiaries or any of them.

Towing and Recovery Equipment

We offer a broad range of towing and recovery equipment products that meet most customer design, capacity and cost requirements. We manufacture the bodies of wreckers and car carriers, which are installed on truck chassis manufactured by third parties. We frequently purchase the truck chassis for resale to our customers. Wreckers generally are used to recover and tow disabled vehicles and other equipment and range in type from the conventional tow truck to large recovery vehicles with rotating hydraulic booms and up to 75-ton lifting capacities. Car carriers are specialized flatbed vehicles with hydraulic tilt mechanisms that enable a towing operator to drive or winch a vehicle onto the bed for transport. Car carriers transport new or disabled vehicles and other equipment and are particularly effective over longer distances. We also manufacture vehicle transport trailers.

Our products primarily are sold through independent distributors that serve all 50 states, Canada and Mexico, and other foreign markets including Europe, the Pacific Rim, the Middle East, South America and Africa, and through prime contractors to governmental entities. Additionally, as a result of our ownership of Jige in France and Boniface in the United Kingdom, we have substantial distribution capabilities in Europe. While most of our distributor agreements do not contain exclusivity provisions, management believes that approximately 85% of our independent distributors sell our products on an exclusive basis. In addition to selling our products to towing operators, our independent distributors provide parts and service. We also utilize sales representatives to exclusively market our products and provide expertise and sales assistance to our independent distributors. Management believes the strength of our distribution network and the breadth of our product offerings are two key advantages over our competitors.

Product Lines

We manufacture a broad line of wrecker, car carrier and trailer bodies to meet a full range of customer design, capacity and cost requirements.

Wreckers. Wreckers are generally used to recover and tow disabled vehicles and other equipment and range in type from the conventional tow truck to large recovery vehicles with up to 75-ton lifting capacities. Wreckers are available with specialized features, including underlifts, L-arms, crossbars and scoops, which lift disabled vehicles by the tires or front axle to minimize front end damage to the towed vehicles. Certain heavy duty wrecker models offer rotating booms, which allow heavy duty wreckers to recover vehicles from any angle, and remote control devices for operating wreckers. In addition, certain light duty wreckers are equipped with automatic wheellift hookup devices that allow operators to engage a disabled or unattended vehicle without leaving the cab of the wrecker.

Our wreckers range in capacity from 4 to 75 tons, and are classified as either light duty or heavy duty, with wreckers of 16-ton or greater capacity being classified as heavy duty. Light duty wreckers are used to remove vehicles from accident scenes and vehicles illegally parked, abandoned or disabled, and for general recovery. Heavy duty wreckers are used in towing and recovery applications including overturned tractor trailers, buses, motor homes and other large vehicles.

Car Carriers. Car carriers are specialized flat-bed vehicles with hydraulic tilt mechanisms that enable a towing operator to drive or winch a vehicle onto the bed for transport. Car carriers are used to transport new or disabled vehicles and other equipment and are particularly effective for transporting vehicles or other equipment over longer distances. In addition to transporting vehicles, car carriers may also be used for other purposes, including transportation of industrial equipment. Most professional towing operators have car carriers in their fleets to complement their towing capabilities.

Transport Trailers. Our multi-vehicle transport trailers are specialized auto transport trailers with upper and lower decks and hydraulic ramps for loading vehicles. These trailers are used for moving multiple vehicles for auto auctions, car dealerships, leasing companies and other similar applications. These trailers are easy to load and transport 6 to 7 vehicles. The vehicles can be secured to transport quickly with ratchet and chain tie-downs that are mounted throughout the frame of the transport. Many professional towing operators have added auto transport trailers to their fleets to add to their service offerings.

Brand Names

We manufacture and market our wreckers, car carriers and trailers under ten separate brand names. Although certain brands overlap in terms of features, prices and distributors, each brand has its own distinctive image and customer base.

Century®. The Century® brand is our “top-of-the-line” brand and represents what management believes to be the broadest product line in the industry. The Century® line was started in 1974 and produces wreckers ranging from 8-ton light duty to 75-ton heavy duty models, and car carriers in lengths from 20 to 30 feet. Management believes that the Century® brand has a reputation as the industry’s leading product innovator.

Vulcan®. Our Vulcan® product line includes a range of premium light duty and heavy duty wreckers, ranging from 8-ton light duty to 50-ton heavy duty models, and car carriers. The Vulcan® line is sold through its own independent distribution network.

Challenger®. Our Challenger® products compete with the Century® and Vulcan® products and constitute a third premium product line. Challenger® products consist of heavy duty wreckers with capacities ranging from 25 to 75 tons. The Challenger® line was started in 1975 and is known for high performance heavy duty wreckers and aesthetic design.

Holmes®. Our Holmes® product line includes mid-priced wreckers with 4 to 16 ton capacities, a 16-ton rotator and a detachable towing unit (DTU). The Holmes® wrecker was first produced in 1916. Historically, the Holmes® name has been the most well-recognized and leading industry brand both domestically and internationally.

Champion®. The Champion® brand, which was introduced in 1991, includes car carriers which range in length from 19 to 21 feet. The Champion® product line, which is generally lower-priced, allows us to offer a full line of car carriers at various competitive price points.

Chevron™. Our Chevron™ product line is comprised primarily of premium car carriers. Chevron™ produces a range of premium single-car, multi-car and industrial carriers, as well as wreckers ranging from 8-ton to 16-ton models. The Chevron™ line is operated autonomously with its own independent distribution network.

Eagle®. Our Eagle® products consist of light duty wreckers with the “Eagle Claw®” hook-up system that allows towing operators to engage a disabled or unattended vehicle without leaving the cab of the tow truck. The “Eagle Claw®” hook-up system was originally developed for the repossession market. Since acquiring Eagle, we have upgraded the quality and features of the Eagle® product line and expanded its recovery capability.

Titan®. Our Titan® product line is comprised of premium multi-vehicle transport trailers which can transport up to 7 vehicles depending on configuration.

Jige™. Our Jige™ product line is comprised of a broad line of premium light duty and heavy duty wreckers and car carriers marketed primarily in Europe. Jige™ is a market leader best known for its innovative designs of car carriers and light duty wreckers necessary to operate within the narrow confines of European cities, as well as heavy duty wreckers.

Boniface™. Our Boniface™ product line is comprised primarily of premium heavy duty wreckers marketed primarily in Europe. Boniface™ produces heavy duty wreckers specializing in the long underlift technology required to tow modern European tour buses.

Product Development and Manufacturing

Our Holmes® and Century® brand names are associated with four of the major innovations in the industry: the rapid reverse winch; the tow sling; the hydraulic lifting mechanism; and the underlift with parallel linkage and L arms. Our engineering staff, in consultation with manufacturing personnel, uses computer-aided design and stress analysis systems to test new product designs and to integrate various product improvements. In addition to offering product innovations, we focus on developing or licensing new technology for our products. Research and development costs amounted to approximately $1.9 million, $1.3 million and $1.4 million for 2014, 2013 and 2012, respectively.

We manufacture wreckers, car carriers and trailers at seven manufacturing facilities located in the United States, France and the United Kingdom. The manufacturing process for our products consists primarily of cutting and bending sheet steel or aluminum into parts that are welded together to form the wrecker, car carrier body or trailer. In addition, during the past several years, we have also begun to produce wrecker bodies using composites and other non-metallic materials. After the frame is formed, components such as hydraulic cylinders, winches, valves and pumps, which are purchased by us from third-party suppliers, are attached to the frame to form the completed wrecker or car carrier body. The completed body is either installed by us, or shipped by common carrier to a distributor where it is then installed, on a truck chassis. Generally, the wrecker or car carrier bodies are painted and towing operators can select customized colors to coordinate with chassis colors or fleet colors. To the extent final painting is required before delivery, we either complete such painting or contract with independent paint shops for such services.

We purchase raw materials and component parts from a number of sources. Although we have no long-term supply contracts, management believes we have good relationships with our primary suppliers. In recent years prices have fluctuated significantly, but we have experienced no significant problems in obtaining adequate supplies of raw materials and component parts to meet the requirements of our production schedules. Management believes that the materials used in the production of our products are available at competitive prices from an adequate number of alternative suppliers. Accordingly, management does not believe that the loss of a single supplier would have a material adverse effect on our business.

Sales, Distribution and Marketing

The industry categorizes the towing and recovery market into three general product types: light duty wreckers; heavy duty wreckers; and car carriers. The light duty wrecker market consists primarily of professional wrecker operators, repossession towing services, local and national governmental entities and repair shop or salvage company owners. The heavy duty market includes professional wrecker operators serving the needs of commercial vehicle operators as well as governmental entities. The car carrier market has expanded to include equipment rental companies that offer delivery service and professional towing operators who desire to complement their existing towing capabilities. Management estimates that there are approximately 35,000 professional towing operators and many more service station, repair shop and salvage operators comprising the overall towing and recovery market.

We have developed a diverse network of independent distributors, consisting of approximately 80 distributors in North America, who serve all 50 states, Canada and Mexico, and numerous distributors that serve other foreign markets. In 2014, no single distributor accounted for more than 10% of our sales. Management believes our broad and diverse network of distributors provides us with the flexibility to adapt to market changes, lessens our dependence on particular distributors and reduces the impact of regional economic factors.

Our sales force services our network of independent distributors and consists of sales representatives whose responsibilities include providing administrative and sales support to the entire base of independent distributors. Sales representatives receive commissions on direct sales based on product type and brand and generally are assigned specific territories in which to promote sales of our products and to maintain customer relationships. To support sales and marketing efforts, we produce demonstrator models that are used by our sales representatives and independent distributors. In addition to providing services to our network of independent distributors, our sales force sells our products to various governmental entities, including the U.S. federal government and foreign governments, through prime contractors.

We routinely respond to requests for proposals or bid invitations in consultation with our local distributors. Our products have been selected by the United States General Services Administration as an approved source for certain federal and defense agencies. We intend to continue to pursue government contracting opportunities.

The towing and recovery equipment industry places heavy marketing emphasis on product exhibitions at national, regional and international trade shows. In order to focus our marketing efforts and to control marketing costs, we concentrate our efforts on the major trade shows each year, and we work with our network of independent distributors to concentrate on various regional shows.

Product Warranties and Insurance

We generally offer a 12-month limited manufacturer’s product and service warranty on our wrecker and car carrier products. Our warranty generally provides for repair or replacement of failed parts or components. Warranty service is usually performed by us or an authorized distributor. Management believes that we maintain adequate general liability and product liability insurance.

Backlog

We produce virtually all of our products to order. Our backlog is based upon customer purchase orders that we believe are firm. The level of backlog at any particular time, however, may not be an appropriate indicator of our future operating performance. Certain purchase orders may be subject to cancellation by the customer upon notification. Given our production and delivery schedules, management generally believes that the current backlog represents less than three months of production.

Competition

The towing and recovery equipment manufacturing industry is highly competitive for sales to distributors and towing operators. Management believes that competition in this industry focuses on product quality and innovation, reputation, technology, customer service, product availability and price. We compete on the basis of each of these criteria, with an emphasis on product quality and innovation and customer service. Management also believes that a manufacturer’s relationship with distributors is a key component of success in the industry. Accordingly, we have invested substantial resources and management time in building and maintaining strong relationships with distributors. Management also believes that our products are regarded as high quality within their particular price points. Our marketing strategy is to continue to compete primarily on the basis of quality and reputation rather than solely on the basis of price, and to continue to target the growing group of professional towing operators who as end-users recognize the quality of our products.

Traditionally, the capital requirements for entry into the towing and recovery manufacturing industry have been relatively low. Management believes a manufacturer’s capital resources and access to technological improvements have become a more integral component of success in recent years. Certain of our competitors may have greater financial and other resources and may provide more attractive dealer and retail customer financing alternatives than we do.

Employees

We employed approximately 890 people as of December 31, 2014. None of our employees are covered by a collective bargaining agreement, though our employees in France and the United Kingdom have certain similar rights provided by their respective government’s employment regulations. We consider our employee relations to be good.

Intellectual Property Rights

Our development of the underlift parallel linkage and L-arms is considered one of the most innovative developments in the wrecker industry. This technology is significant primarily because it allows the damage-free towing of newer aerodynamic vehicles made of lighter weight materials. This technology, particularly the L-arms, is used in a majority of commercial wreckers today. We hold a number of utility and design patents covering other of our products, including the Vulcan “scoop” wheel-retainer and the car carrier anti-tilt device. We have also obtained the rights to use and develop certain technologies owned or patented by others. Management believes that, until the patents on our technology expire, utilization of our patented technology without a license is an infringement of such patents. We have successfully litigated infringement lawsuits in which the validity of our patents on our technology was upheld, and successfully settled other lawsuits,

Our trademarks “Century®,” “Holmes®,” “Champion®,” “Challenger®,” “Formula I®,” “Pro Star®,” “Street Runner®,” “Vulcan®,” “Right Approach®” and “Extreme Angle®,” among others, are registered with the United States Patent and Trademark Office. Management believes that our trademarks are well-recognized by dealers, distributors and end-users in their respective markets and are associated with a high level of quality and value.

Government Regulations and Environmental Matters

Our operations are subject to federal, state and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. Management believes that we are in substantial compliance with all applicable federal, state and local provisions relating to the protection of the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past.

We are also subject to the additional diligence and disclosure requirements adopted by the Securities and Exchange Commission (the “SEC”) in 2012 related to certain minerals sourced from the Democratic Republic of Congo or adjoining countries in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The SEC rules impose these obligations with respect to “conflict minerals,” defined as tin, tantalum, tungsten and gold, which are necessary to the functionality of a product manufactured, or contracted to be manufactured, by an SEC reporting company. If any “conflict minerals” that are necessary to the functionality of a product manufactured by an SEC reporting company originated in the Democratic Republic of Congo or an adjoining country, the rules require the issuer to prepare and file a report addressing its efforts to exercise due diligence on the source of such “conflict minerals” and their chain of custody. We are actively working toward complying with the conflict minerals diligence and disclosure obligations required under the Dodd-Frank Act.

We are also subject to the Magnuson-Moss Warranty Federal Trade Commission Improvement Act which regulates the description of warranties on products. The description and substance of our warranties are also subject to a variety of federal and state laws and regulations applicable to the manufacturing of vehicle components. Management believes that continued compliance with various government regulations will not materially affect our operations.

Executive Officers of the Registrant

Information relating to our executive officers as of the end of the period covered by this Annual Report is set forth below. William G. Miller, II is the son of William G. Miller. Other than Messrs. Miller and Miller II, there are no family relationships among the executive officers, directors or nominees for director, nor are there any arrangements or understandings between any of the executive officers and any other persons pursuant to which they were selected as executive officers.

|

Name

|

|

Age

|

|

Position

|

| |

|

|

|

|

|

William G. Miller

|

|

68

|

|

Chairman of the Board

|

| |

|

|

|

|

|

Jeffrey I. Badgley

|

|

62

|

|

Co-Chief Executive Officer

|

| |

|

|

|

|

|

William G. Miller, II

|

|

36

|

|

President and Co-Chief Executive Officer

|

| |

|

|

|

|

|

Frank Madonia

|

|

66

|

|

Executive Vice President, Secretary and General Counsel

|

| |

|

|

|

|

|

J. Vincent Mish

|

|

64

|

|

Executive Vice President, Chief Financial Officer and Treasurer

|

| |

|

|

|

|

|

Deborah Whitmire

|

|

49

|

|

Vice President and Corporate Controller

|

William G. Miller has served as Chairman of the Board since April 1994. Mr. Miller served as our Chief Executive Officer from April 1994 until June 1997, and as our Co-Chief Executive Officer from October 2003 until March 2011. In June 1997, he was named Co-Chief Executive Officer, a title he shared with Jeffrey I. Badgley until November 1997. Mr. Miller also served as our President from April 1994 to June 1996. He served as Chairman of Miller Group, Inc. from August 1990 through May 1994, as its President from August 1990 to March 1993, and as its Chief Executive Officer from March 1993 until May 1994. Prior to 1987, Mr. Miller served in various management positions for Bendix Corporation, Neptune International Corporation, Wheelabrator-Frye, Inc. and The Signal Companies, Inc.

Jeffrey I. Badgley has served as our Co-Chief Executive

Officer since December 2013, after serving as our Chief Executive Officer from March 2011 until December 2013, our President from

June 1996 until March 2011, our Co-Chief Executive Officer from October 2003 until March 2011 and our Chief Executive Officer from

November 1997 to October 2003. Mr. Badgley served as a director from 1996 to May 2014 and as Vice Chairman of the Board from March

2011 to May 2014. Mr. Badgley served as our Vice President from 1994 to 1996, and as our Chief Operating Officer from June 1996

to June 1997. In addition, Mr. Badgley has served as President of Miller Industries Towing Equipment Inc. since 1996. Mr. Badgley

served as Vice President—Sales of Miller Industries Towing Equipment Inc. from 1988 to 1996. He previously served as Vice

President—Sales and Marketing of Challenger Wrecker Corporation from 1982 until joining Miller Industries Towing Equipment

Inc.

William

G. Miller, II has served as a director since May 2014, our Co-Chief Executive Officer since December 2013 and

President since March 2011, after serving as a Regional Vice President of Sales of Miller Industries Towing Equipment Inc.

from November 2009 to February 2011. Mr. Miller II served as Vice President of Strategic Planning of the Company from October

2007 until November 2009. Mr. Miller II served as Light Duty General Manager from November 2004 to October 2007 and as a

Sales Representative of Miller Industries Towing Equipment Inc. from 2002 to 2004.

Frank Madonia has served as our Executive Vice President, Secretary and General Counsel since September 1998. From April 1994 to September 1998 Mr. Madonia served as our Vice President, General Counsel and Secretary. Mr. Madonia served as Secretary and General Counsel to Miller Industries Towing Equipment Inc. since its acquisition by Miller Group in 1990. From July 1987 through April 1994, Mr. Madonia served as Vice President, General Counsel and Secretary of Flow Measurement. Prior to 1987, Mr. Madonia served in various legal and management positions for United States Steel Corporation, Neptune International Corporation, Wheelabrator-Frye, Inc. and The Signal Companies, Inc.

J. Vincent Mish is a certified public accountant and has served as our Chief Financial Officer and Treasurer since June 1999, a position he also held from April 1994 through September 1996. In December 2002, Mr. Mish was appointed as our Executive Vice President. He also has served as President of the Financial Services Group since September 1996 and as a Vice President of Miller Industries since April 1994. Mr. Mish served as Vice President and Treasurer of Miller Industries Towing Equipment Inc. since its acquisition by Miller Group in 1990. From February 1987 through April 1994, Mr. Mish served as Vice President and Treasurer of Flow Measurement. Mr. Mish worked with Touche Ross & Company (now Deloitte and Touche) for over ten years before serving as Treasurer and Chief Financial Officer of DNE Corporation from 1982 to 1987. Mr. Mish is a member of the American Institute of Certified Public Accountants and the Tennessee and Michigan Certified Public Accountant societies.

Deborah Whitmire has served as our Vice President and Corporate Controller since January 2014, after serving as Corporate Controller to Miller Industries Towing Equipment Inc. from March 2005 to January 2014. From April 2000 to March 2005, she also served as Director of Finance – Manufacturing to Miller Industries Towing Equipment Inc. In addition, she served as Controller to Miller Industries Towing Equipment Inc. from October 1997 to April 2000 and Accounting Manager to Miller Industries Towing Equipment Inc. from October 1996 to October 1997.

Available Information

Our Internet website address is www.millerind.com. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission. Our Corporate Governance Guidelines and Code of Business Conduct and Ethics are also available on our website. Other corporate governance-related documents can be found at our website as well.

There are many factors that affect our business and the results of our operations, some of which are beyond our control. The following is a description of all known material risks that may cause the actual results of our operations in future periods to differ materially from those currently expected or desired. We encourage you to read this section carefully.

Our business is subject to the cyclical nature of our industry and changes in consumer confidence and in economic conditions in general. Adverse changes or continued uncertainty with respect to these factors may lead to a downturn in our business.

The towing and recovery industry is cyclical in nature and historically the industry has been affected by changes in consumer confidence and in economic conditions in general. Concerns over the slow economic recovery and continued volatility and disruption in domestic and international capital and credit markets have caused significant erosion in consumer confidence. As a result, the overall demand for our products from our commercial customers has been negatively affected, and the level of future sales of our products is uncertain. A prolonged economic downturn, and slow or negative growth in the domestic and global economy, may continue to have a material adverse effect on our business, financial condition and results of operations for the foreseeable future.

Our demand from our customers and towing operators is affected by the availability of capital and access to credit.

The ability of our customers and of towing operators to purchase our products is affected by the availability of capital and credit to them. Our independent distributor customers rely on floor plan financing in connection with the purchase of our products, and the availability of that financing on acceptable terms has a direct effect on the volume of their purchases. Additionally, in many cases, a towing operator’s decision to purchase our products from one of our distributors is dependent upon their ability to obtain financing upon acceptable terms. Volatility and disruption in the capital and credit markets, principally in the U.S. and Europe, has decreased the availability of capital to, and credit capacity of, our customers and towing operators. In addition, in the past, certain providers of floor plan financing have exited the market, which made floor plan financing increasingly difficult for our independent distributor customers to secure at those times. This reduced availability of capital and credit has negatively affected the ability and capacity of our customers and of towing operators to purchase towing and related equipment. This, in turn, has negatively impacted sales of our products. If customers are unable to access capital or credit, it could materially and adversely affect our ability to sell our products, and as a result, could negatively affect our business and operating results.

Our dependence upon outside suppliers for our raw materials, including aluminum, steel, petroleum-related products and other purchased component parts, leaves us subject to changes in price and delays in receiving supplies of such materials or parts.

We are dependent upon outside suppliers for our raw material needs and other purchased component parts, and although we believe that these suppliers will continue to meet our requirements and specifications, and that alternative sources of supply are available, events beyond our control could have an adverse effect on the cost or availability of raw materials and component parts. Shipment delays, unexpected price increases or changes in payment terms from our suppliers of raw materials or component parts could impact our ability to secure necessary raw materials or component parts, or to secure such materials and parts at favorable prices. To partially offset price increases for raw materials and component parts, we have, from time to time, implemented general price increases and cost surcharges. While we have attempted to pass these increased costs on to our customers, there can be no assurance that we will be able to continue to do so. Additionally, demand for our products could be negatively affected by the unavailability of truck chassis, which are manufactured by third parties and are frequently supplied by us, or are purchased separately by our distributors or by towing operators. Although we believe that sources of our raw materials and component parts will continue to be adequate to meet our requirements and that alternative sources are available, shortages, price increases or delays in shipments of our raw materials and component parts could have a material adverse effect on our financial performance, competitive position and reputation.

Overall demand from our customers may be affected by increases in their fuel and insurance costs and changes in weather conditions.

In the past, our customers have experienced substantial increases in fuel and other transportation costs, and in the cost of insurance, and while many of these costs have remained stable since 2010, there can be no assurance that these costs will not continue to be volatile, or again increase, for our customers in the future. Additionally, our customers also have, from time to time, been subject to unpredictable and varying weather conditions which could, among other things, impact the cost and availability of fuel and other materials. Any of these factors could negatively affect the ability of our customers to purchase, and their capacity for purchasing, towing and related equipment, and, consequently, have a material negative effect upon our business and operating results.

Our international operations are subject to various political, economic and other uncertainties that could adversely affect our business results, including by restrictive taxation or other government regulation and by foreign currency fluctuation.

Historically, a significant portion of our net sales and production were outside the United States, primarily in Europe. As a result, our operations are subject to various political, economic and other uncertainties, including risks of restrictive taxation policies, changing political conditions and governmental regulations. Also, a substantial portion of our net sales derived outside the United States, as well as salaries of employees located outside the United States and certain other expenses, are denominated in foreign currencies, including the British pound and the Euro. We are, therefore, subject to risk of financial loss resulting from fluctuations in exchange rates of these currencies against the U.S. dollar.

Our competitors could impede our ability to attract or retain customers.

The towing and recovery equipment manufacturing industry is highly competitive. Capital requirements for entry into the towing and recovery manufacturing industry have been relatively low, which could result in an increase in the number of competitors entering the industry. Competition for sales exists domestically and internationally at the manufacturer, distributor and towing-operator levels and is based primarily on product quality and innovation, reputation, technology, customer service, product availability and price. Competition for sales also comes from the market for used towing and recovery equipment. Certain of our competitors may have substantially greater financial and other resources and may provide more attractive dealer and retail customer financing alternatives than us. If these competitors are able to make it more difficult for us to attract or retain customers, it could have a negative impact on our sales, revenue and financial performance.

Our future success depends upon our ability to develop or acquire proprietary products and technology and assertions against us relating to intellectual property rights could harm our business.

Historically, we have been able to develop or acquire patented and other proprietary product innovations which have allowed us to produce what management believes to be technologically advanced products relative to most of our competition. However, certain of our patents have expired, and others will expire in the next few years, and as a result, we may not have a continuing competitive advantage through proprietary products and technology. If we are unable to develop or acquire new products and technology in the future, our ability to maintain market share, and, consequently, our revenues and operating results, may be negatively affected.

Third parties may claim that our products infringe their patents or other intellectual property rights. If a competitor were to challenge our patents, or assert that our products or processes infringe its patent or other intellectual property rights, we could incur substantial litigation costs, be forced to design around their patents, pay substantial damages or even be forced to cease our operations, any of which could be expensive and/or have an adverse effect on our operating results. Third party infringement claims, regardless of their outcome, would not only consume our financial resources, but also would divert the time and effort of our management and could result in our customers or potential customers deferring or limiting their purchase or use of the affected products or services until resolution of the litigation.

We depend upon skilled labor to manufacture our products, and if we experience problems hiring and retaining skilled labor, our business may be negatively affected.

The timely manufacture and delivery of our products requires an adequate supply of skilled labor, and the operating costs of our manufacturing facilities can be adversely affected by high turnover in skilled positions. Accordingly, our ability to increase sales, productivity and net earnings will be limited to a degree by our ability to employ the skilled laborers necessary to meet our requirements. We must attract, train and retain skilled employees while controlling related labor costs and maintaining our core values. Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates and increases in healthcare and other insurance costs. There can be no assurance that we will be able to maintain an adequate skilled labor force necessary to efficiently operate our facilities. In addition, while our employees are not currently members of a union, there can be no assurance that the employees at any of our facilities will not choose to become unionized in the future.

Our sales to governmental entities through prime contractors are subject to special risks.

While

no one customer accounted for more than 10% of our consolidated net sales for 2012 and 2013 and 2014, a significant concentration

of our consolidated net sales were made to the U.S. federal government through prime contractors in the three prior years. Such

sales accounted for 26.8% of our consolidated net sales for 2011. At this time we do not expect to receive any new or follow-on

U.S. government-related orders in the near term. Our U.S. and other government business is subject to the following risks, among

others: (i) this business is susceptible to changes in government spending, which may reduce future revenues; (ii) most of our

contracts with governmental entities through prime contractors are fixed-price contracts, and our actual costs on any of these

contracts could exceed our projected costs, (iii) competition for the award of these contracts is intense, and we may not be successful

in bidding on future contracts, and (iv) the products we sell to governmental entities are subject to highly technical requirements,

and any failure to comply with these requirements could result in unanticipated retrofit costs, delayed acceptance of products,

late or reduced payment or cancellation of the contract. We continue to work to secure additional U.S. and other governmental

orders, but we cannot predict the success or timing of any such efforts.

The effects of new regulations relating to conflict minerals may adversely affect our business.

On August 22, 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the SEC adopted new requirements for companies that use certain minerals and metals, known as conflict minerals, in their products, whether or not these products are manufactured by third parties. These requirements will require companies to perform due diligence, and disclose and report whether or not such minerals originate from the Democratic Republic of Congo and adjoining countries. We will have to perform due diligence to determine whether such minerals are used in the manufacture of our products. However, the implementation of these new requirements could adversely affect the sourcing, availability and pricing of such minerals if they are found to be used in the manufacture of our products. In addition, we will incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. The Company’s supply chain is complex, and, as a result, we expect significant difficulty in verifying the origins for all “conflict minerals” used in our products and certifying that our products are “conflict free.” We may face reputational challenges from customers, investors or others if we are unable to verify the origins for all “conflict minerals” used in our products. In such event, we may also face difficulties in satisfying customers who require that all of the components of our products are certified as conflict mineral free.

The catastrophic loss of one of our manufacturing facilities could harm our business, financial condition and results of operations.

While we manufacture our products in several facilities and maintain insurance covering our facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of one of our manufacturing facilities due to accident, labor issues, weather conditions, natural disaster, civil unrest or otherwise, whether short or long-term, could materially harm our business, financial condition and results of operations.

Environmental and health and safety liabilities and requirements could require us to incur material costs.

We are subject to various U.S. and foreign laws and regulations relating to environmental protection and worker health and safety, including those governing discharges of pollutants into the ground, air and water; the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances and waste materials; and the investigation and cleanup of contaminated properties. In certain cases, these regulatory requirements may limit the productive capacity of our operations.

Environmental and health-related requirements are complex, subject to change and have tended to become more and more stringent. Future developments could cause us to incur various expenditures and could also subject us to fines or sanctions, obligations to investigate or remediate contamination or restore natural resources, liability for third party property damage or personal injury claims and the imposition of new permitting requirements and/or the modification or revocation of our existing operating permits, among other effects. These and other developments could materially harm our business, financial condition and results of operation.

Any loss of the services of our key executives could have a material adverse impact on our operations.

Our success is highly dependent on the continued services of our management team. The loss of services of one or more key members of our senior management team could have a material adverse effect on us.

A product warranty or product liability claim in excess of our insurance coverage, or an inability to acquire or maintain insurance at commercially reasonable rates, could have a material adverse effect upon our business.

We are subject to various claims, including product warranty and product liability claims arising in the ordinary course of business, and may at times be a party to various legal proceedings incidental to our business. We maintain reserves and liability insurance coverage at levels based upon commercial norms and our historical claims experience. If we manufacture poor quality products or receive defective materials, we may incur unforeseen costs in excess of what we have reserved in our financial statements. A successful product warranty, product liability or other claim brought against us in excess of our insurance coverage, or the inability of us to acquire or maintain insurance at commercially reasonable rates, could have a material adverse effect upon our business, operating results and financial condition.

A disruption in our information technology (“IT”) systems could adversely impact our business and operations.

We rely on the accuracy, capacity and security of our IT systems and our ability to update these systems in response to the changing needs of our business. We have incurred costs and may incur significant additional costs in order to implement security measures that we feel are appropriate to protect our IT systems. Nevertheless, future attacks could result in our systems or data being breached and/or damaged by computer viruses or unauthorized physical or electronic access. Such a breach could result in not only business disruption, but also theft of our intellectual property or trade secrets and/or unauthorized access to controlled data and personal information stored in connection with our human resources function. Any interruption, outage or breach of our IT systems could adversely affect our business operations. To the extent that any data is lost or destroyed or any confidential information is inappropriately disclosed or used, it could adversely affect our competitive position or customer relationships, harm our business and possibly lead to claims, liability, or fines based upon alleged breaches of contract or applicable laws.

Our stock price may fluctuate greatly as a result of the general volatility of the stock market.

From time to time, there may be significant volatility in the market price for our common stock. Our quarterly operating results, changes in earnings estimated by analysts, if any, changes in general conditions in our industry or the economy or the financial markets or other developments affecting us, including our ability to pay dividends, could cause the market price of our common stock to fluctuate substantially.

Our charter and bylaws contain anti-takeover provisions that may make it more difficult or expensive to acquire us in the future or may negatively affect our stock price.

Our charter and bylaws contain restrictions that may discourage other persons from attempting to acquire control of us, including, without limitation, prohibitions on shareholder action by written consent and advance notice requirements regarding amendments to certain provisions of our charter and bylaws. In addition, our charter authorizes the issuance of up to 5,000,000 shares of preferred stock. The rights and preferences for any series of preferred stock may be set by the board of directors, in its sole discretion and without shareholder approval, and the rights and preferences of any such preferred stock may be superior to those of common stock and thus may adversely affect the rights of holders of common stock.

The requirements and restrictions imposed by our current credit facility restrict our ability to operate our business, and failure to comply with these requirements and restrictions could adversely affect our business.

Our current credit facility contains customary representations and warranties, events of default, and financial, affirmative and negative covenants for loan agreements of this kind. In addition, covenants under our current credit facility restrict our ability to pay cash dividends if the Company would be in violation of the minimum tangible net worth test or the leverage ratio test in the current loan agreement as a result of the dividend, among various restrictions. If we fail to comply with the requirements of our current credit facility, such non-compliance would result in an event of default. If not waived by the bank, such event of default would result in the acceleration of any amounts due under the current credit facility, and may permit the bank to foreclose on our assets.

None.

We operate four manufacturing facilities in the United States. The facilities are located in Ooltewah (Chattanooga), Tennessee; Hermitage, Pennsylvania; Mercer, Pennsylvania; and Greeneville, Tennessee. The Ooltewah plant, containing approximately 302,000 square feet, produces light and heavy duty wreckers; the Hermitage plant, containing approximately 134,000 square feet, produces car carriers; the Mercer plant, containing approximately 110,000 square feet, produces car carriers and light duty wreckers; and the Greeneville plant, containing approximately 136,000 square feet (plus 40,000 square feet of leased property), produces car carriers, heavy duty wreckers and trailers. We

intend to consolidate our two manufacturing properties located in Pennsylvania into a single facility.

We also have manufacturing operations at two facilities located in the Lorraine region of France, which have, in the aggregate, approximately 180,000 square feet, and manufacturing operations in Norfolk, England, with approximately 48,000 square feet.

We are, from time to time, a party to litigation arising in the normal course of our business. Litigation is subject to various inherent uncertainties, and it is possible that some of these matters could be resolved unfavorably to us, which could result in substantial damages against us. We have established accruals for matters that are probable and reasonably estimable and maintain product liability and other insurance that management believes to be adequate. Management believes that any liability that may ultimately result from the resolution of these matters in excess of available insurance coverage and accruals will not have a material adverse effect on our consolidated financial position or results of operations.

Not applicable.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Our common stock is traded on the New York Stock Exchange under the symbol “MLR.” The following table sets forth the quarterly range of high and low sales prices for the common stock for the periods indicated.

| |

|

|

|

|

|

|

| |

|

Price Range of Common Stock

|

|

|

Period

|

|

High

|

|

|

Low

|

|

|

Year Ended December 31, 2013

|

|

|

|

|

|

|

|

First Quarter

|

|

$ |

17.23 |

|

|

$ |

14.91 |

|

|

Second Quarter

|

|

|

16.93 |

|

|

|

14.73 |

|

|

Third Quarter

|

|

|

17.25 |

|

|

|

15.30 |

|

|

Fourth Quarter

|

|

|

19.16 |

|

|

|

16.42 |

|

|

Year Ended December 31, 2014

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$ |

20.00 |

|

|

$ |

16.89 |

|

|

Second Quarter

|

|

|

20.67 |

|

|

|

18.42 |

|

|

Third Quarter

|

|

|

21.44 |

|

|

|

16.86 |

|

|

Fourth Quarter

|

|

|

21.36 |

|

|

|

16.19 |

|

|

Year Ending December 31, 2015

|

|

|

|

|

|

|

|

|

|

First Quarter (through February 28, 2015)

|

|

$ |

22.37 |

|

|

$ |

19.50 |

|

The approximate number of holders of record and beneficial owners of common stock as of December 31, 2014 was 540 and 2,250 respectively.

Prior to March 2010, we had never declared cash dividends on our common stock. On March 8, 2010, our board of directors adopted a dividend policy to consider and pay annual cash dividends subject to our ability to satisfy all applicable statutory and regulatory requirements and our continued financial strength. On May 10, 2011, the Company’s board of directors approved a dividend policy to consider and pay quarterly dividends on its common stock subject to the Company’s ability to satisfy all applicable statutory requirements and the Company’s continued financial strength, replacing the previous policy of paying annual cash dividends. Dividend payments made for 2014, 2013 and 2012 were as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

Payment

|

Record Date

|

Payment Date

|

|

Dividend

(per share)

|

|

|

Amount

(in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Q1 2012

|

March 19, 2012

|

March 26, 2012

|

|

$

|

0.13

|

|

|

$

|

1,437

|

|

|

Q2 2012

|

June 18, 2012

|

June 25, 2012

|

|

|

0.13

|

|

|

|

1,439

|

|

|

Q3 2012

|

September 17, 2012

|

September 24, 2012

|

|

|

0.13

|

|

|

|

1,439

|

|

|

Q4 2012

|

December 10, 2012

|

December 17, 2012

|

|

|

0.13

|

|

|

|

1,447

|

|

|

Total for 2012

|

|

|

|

$

|

0.52

|

|

|

$

|

5,762

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Q1 2013

|

March 18, 2013

|

March 24, 2013

|

|

$

|

0.14

|

|

|

$

|

1,569

|

|

|

Q2 2013

|

June 17, 2013

|

June 24, 2013

|

|

|

0.14

|

|

|

|

1,573

|

|

|

Q3 2013

|

September 16, 2013

|

September 23, 2013

|

|

|

0.14

|

|

|

|

1,575

|

|

|

Q4 2013

|

December 9, 2013

|

December 16, 2013

|

|

|

0.14

|

|

|

|

1,577

|

|

|

Total for 2013

|

|

|

|

$

|

0.56

|

|

|

$

|

6,294

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Q1 2014

|

March 17, 2014

|

March 24, 2014

|

|

$

|

0.15

|

|

|

$

|

1,692

|

|

|

Q2 2014

|

June 16, 2014

|

June 23, 2014

|

|

|

0.15

|

|

|

|

1,695

|

|

|

Q3 2014

|

September 15, 2014

|

September 22, 2014

|

|

|

0.15

|

|

|

|

1,696

|

|

|

Q4 2014

|

December 8, 2014

|

December 15, 2014

|

|

|

0.15

|

|

|

|

1,695

|

|

|

Total for 2014

|

|

|

|

$

|

0.60

|

|

|

$

|

6,778

|

|

Any future determination as to the payment of cash dividends will depend upon such factors as earnings, capital requirements, our financial condition, restrictions in financing agreements and other factors deemed relevant by our board of directors. Covenants under our current credit facility restrict the payment of cash dividends if the Company would be in violation of the minimum tangible net worth test or the leverage ratio test in the current loan agreement as a result of the dividend, among various other restrictions.

Sales of Unregistered Securities

We did not sell any unregistered securities during the year ended December 31, 2014.

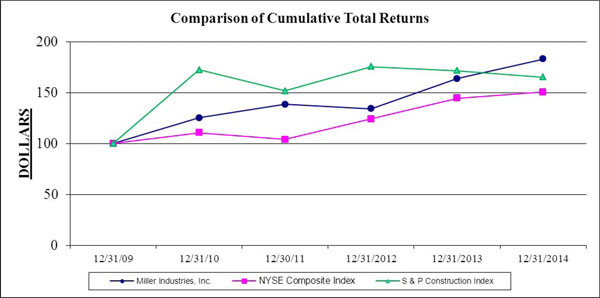

Performance Graph

The following line graph compares the percentage change in the cumulative shareholder return of our common stock with The New York Stock Exchange Composite Index and the Standard & Poor’s Construction Index over the period of time from December 31, 2009 through December 31, 2014. The respective returns assume reinvestment of dividends paid.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

12/31/09

|

|

|

12/31/10

|

|

|

12/31/11

|

|

|

12/30/12

|

|

|

12/30/13

|

|

|

|

12/31/14

|

|

|

Miller Industries, Inc.

|

|

|

100

|

|

|

|

125

|

|

|

|

139

|

|

|

|

134

|

|

|

|

164

|

|

|

|

183

|

|

|

NYSE Composite Index

|

|

|

100

|

|

|

|

111

|

|

|

|

104

|

|

|

|

124

|

|

|

|

145

|

|

|

|

151

|

|

|

S&P Construction Index

|

|

|

100

|

|

|

|

173

|

|

|

|

152

|

|

|

|

176

|

|

|

|

172

|

|

|

|

166

|

|

The following table presents selected statements of income data and selected balance sheet data on a consolidated basis. We derived the selected historical consolidated financial data from our audited consolidated financial statements and related notes. You should read this data together with Item 7–“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes that are a part of this Annual Report on Form 10 K.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Years Ended December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

(In thousands except per share data)

|

|

|

Statements of Income Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$ |

492,776 |

|

|

|

404,170 |

|

|

$ |

342,663 |

|

|

$ |

412,659 |

|

|

$ |

306,897 |

|

|

Costs of operations

|

|

|

439,791 |

|

|

|

361,734 |

|

|

|

302,606 |

|

|

|

342,557 |

|

|

|

260,566 |

|

|

Gross Profit

|

|

|

52,985 |

|

|

|

42,436 |

|

|

|

40,057 |

|

|

|

70,102 |

|

|

|

46,331 |

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses

|

|

|

28,496 |

|

|

|

28,323 |

|

|

|

27,507 |

|

|

|

31,407 |

|

|

|

26,665 |

|

|

Interest expense, net

|

|

|

554 |

|

|

|

369 |

|

|

|

712 |

|

|

|

728 |

|

|

|

305 |

|

|

Other expense (income)

|

|

|

437 |

|

|

|

(119 |

) |

|

|

(815 |

) |

|

|

(161 |

) |

|

|

71 |

|

|

Total operating expenses

|

|

|

29,487 |

|

|

|

28,573 |

|

|

|

27,404 |

|

|

|

31,974 |

|

|

|

27,041 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

23,498 |

|

|

|

13,863 |

|

|

|

12,653 |

|

|

|

38,128 |

|

|

|

19,290 |

|

|

Income tax provision

|

|

|

8,660 |

|

|

|

5,175 |

|

|

|

3,531 |

|

|

|

15,120 |

|

|

|

7,583 |

|

|

Net income

|

|

|

14,838 |

|

|

|

8,688 |

|

|

|

9,122 |

|

|

|

23,008 |

|

|

|

11,707 |

|

|

Net loss attributable to noncontrolling interests

|

|

|

66 |

|

|

|

542 |

|

|

–‒

|

|

|

–‒

|

|

|

–‒

|

|

|

Net income attributable to Miller Industries, Inc.

|

|

$ |

14,904 |

|

|

$ |

9,230 |

|

|

$ |

9,122 |

|

|

$ |

23,008 |

|

|

$ |

11,707 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per common share

|

|

$ |

1.32 |

|

|

|

0.82 |

|

|

$ |

0.82 |

|

|

$ |

1.98 |

|

|

$ |

1.00 |

|

|

Diluted income per common share

|

|

$ |

1.31 |

|

|

|

0.82 |

|

|

$ |

0.82 |

|

|

$ |

1.92 |

|

|

$ |

0.96 |

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

11,297 |

|

|

|

11,233 |

|

|

|

11,068 |

|

|

|

11,600 |

|

|

|

11,671 |

|

|

Diluted

|

|

|

11,354 |

|

|

|

11,324 |

|

|

|

11,258 |

|

|

|

11,984 |

|

|

|

12,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31,

|

|

|

|

Balance Sheet Data:

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010 |

|

|

Working capital

|

|

$

|

126,713

|

|

|

|

120,821

|

|

|

$

|

115,178

|

|

|

$

|

109,760

|

|

|

$

|

106,831

|

|

|

Total assets

|

|

|

262,355

|

|

|

|

226,669

|

|

|

|

202,351

|

|

|

|

211,842

|

|

|

|

199,876

|

|

|

Long-term obligations, less current portion

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

5

|

|

|

Common shareholders’ equity

|

|

|

168,454

|

|

|

|

161,713

|

|

|

|

157,490

|

|

|

|

152,651

|

|

|

|

150,568

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31,

|

|

|

Other Data:

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Cash dividend per common share

|

|

$

|

0.60

|

|

|

$

|

0.56

|

|

|

$

|

0.52

|

|

|

$

|

0.48

|

|

|

$

|

0.10

|

|

The following discussion of our results of operations and financial condition should be read in conjunction with the Consolidated Financial Statements and Notes thereto. Unless the context indicates otherwise, all dollar amounts in this Management’s Discussion and Analysis of Financial Condition and Results of Operations are in thousands.

Executive Overview

Miller Industries, Inc. is The World’s Largest Manufacturer of Towing and Recovery Equipment®, with domestic manufacturing subsidiaries in Tennessee and Pennsylvania, and foreign manufacturing subsidiaries in France and the United Kingdom. We offer a broad range of equipment to meet our customers’ design, capacity and cost requirements under our Century®, Vulcan®, Challenger®, Holmes®, Champion®, Chevron™, Eagle®, Titan®, Jige™ and Boniface™ brand names.

Our management focuses on a variety of key indicators to monitor our overall operating and financial performance. These indicators include measurements of revenue, operating income, gross margin, net income, earnings per share, capital expenditures and cash flow.

We derive revenues primarily from product sales made through our network of domestic and foreign independent distributors. Our revenues are sensitive to a variety of factors including general economic conditions as well as demand for, and price of, our products, our technological competitiveness, our reputation for providing quality products and reliable service, competition within our industry, and the cost of raw materials (including aluminum, steel and petroleum-related products).

Our industry is cyclical in nature. In recent years, the overall demand for our products and resulting revenues have been positively affected by recovering economic conditions and improving consumer sentiment. However, historically, the overall demand for our products and our resulting revenues have at times been negatively affected by:

|

|

●

|

wavering levels of consumer confidence;

|

|

|

●

|

volatility and disruption in domestic and international capital and credit markets and the resulting decrease in the availability of financing, including floor plan financing, for our customers and towing operators;

|

|

|

●

|

significant periodic increases in fuel and insurance costs and their negative effect on the ability of our customers to purchase towing and related equipment; and

|

|

|

●

|

the overall effects of the global economic downturn.

|

We remain concerned about the continuing effects of these factors on the towing and recovery industry, and we continue to monitor our overall cost structure to see that it remains in line with business conditions.