UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended | December 31, 2017 |

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________________________ to ____________________________

|

Commission File No. |

001-14124 |

| MILLER INDUSTRIES, INC. | ||

| (Exact name of registrant as specified in its charter) | ||

| Tennessee | 62-1566286 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 8503 Hilltop Drive, Ooltewah, Tennessee | 37363 | |

| (Address of principal executive offices) | (Zip Code) | |

| (423) 238-4171 | ||

| (Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

|

None |

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large Accelerated Filer ¨ | Accelerated Filer x | |

| Non-accelerated Filer ¨ | Smaller Reporting Company ¨ | |

| Emerging Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

The aggregate market value of the voting stock held by non-affiliates of the registrant (which for purposes hereof are all holders other than executive officers, directors and holders of more than 10% of the registrant’s Common Stock) as of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter) was $203,918,653 (based on 8,205,982 shares held by non-affiliates at $24.85 per share, the last sale price reported on the New York Stock Exchange on June 30, 2017).

At February 28, 2018 there were 11,384,296 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III (Items 10, 11, 12, 13 and 14) is incorporated herein by reference to the Registrant’s definitive proxy statement for its 2018 Annual Meeting of Shareholders which is to be filed pursuant to Regulation 14A.

TABLE OF CONTENTS

CERTAIN FACTORS AFFECTING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K, including but not limited to statements made in Part II–Item 7–“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” statements made with respect to future operating results, expectations of future customer orders and the availability of resources necessary for our business may be deemed to be forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “could,” “continue,” “future,” “potential,” “believe,” “project,” “plan,” “intend,” “seek,” “estimate,” “predict,” “expect,” “anticipate” and similar expressions, or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are made based on our management’s beliefs as well as assumptions made by, and information currently available to, our management. Our actual results may differ materially from the results anticipated in these forward-looking statements due to, among other things: the cyclical nature of our industry and changes in consumer confidence; economic and market conditions; our customers’ access to capital and credit to fund purchases; our dependence upon outside suppliers for our raw materials, including aluminum, steel, petroleum-related products and other purchased component parts; changes in price (including as a result of the imposition of tariffs) of aluminum, steel, petroleum-related products and other purchased component parts; delays in receiving supplies of such materials or parts; changes in fuel and other transportation costs, insurance costs and weather conditions; changes in government regulation; various political, economic and other uncertainties relating to our international operations, including restrictive taxation and foreign currency fluctuation; failure to comply with domestic and foreign anti-corruption laws; competitors could impede our ability to attract or retain customers; our ability to develop or acquire proprietary products and technology; assertions against us relating to intellectual property rights; problems hiring or retaining skilled labor; a disruption in our information technology systems or any violation of data protection laws; changes in the tax regimes and related government policies and regulations in the countries in which we operate; the effects of regulations relating to conflict minerals; the catastrophic loss of one of our manufacturing facilities; environmental and health and safety liabilities and requirements; loss of the services of our key executives; product warranty or product liability claims in excess of our insurance coverage; potential recalls of components or parts manufactured for us by suppliers or potential recalls of defective products; an inability to acquire insurance at commercially reasonable rates; and those other risks referenced herein, including those risks referred to in this report, in Part I, Item 1A–“Risk Factors” and those risks discussed in our filings with the Securities and Exchange Commission filed after this Annual Report. Such factors are not exclusive. We do not undertake to update any forward-looking statement that may be made from time to time by, or on behalf of, our company.

| 1 |

| ITEM 1. | BUSINESS |

General

Miller Industries is The World’s Largest Manufacturer of Towing and Recovery Equipment®, with executive offices in Ooltewah, Tennessee, domestic manufacturing operations in Tennessee and Pennsylvania, and foreign manufacturing operations in France and the United Kingdom.

In 1990, we began developing or acquiring several of the most well-recognized brands in the towing and recovery equipment manufacturing industry. Our strategy has been to diversify our line of products and increase our presence in the industry by combining internal growth and development with acquisitions of complementary products.

In this Annual Report on Form 10-K, the words “Miller Industries,” “the Company,” “we,” “our,” “ours” and “us” refer to Miller Industries, Inc. and its subsidiaries or any of them.

Towing and Recovery Equipment

We offer a broad range of towing and recovery equipment products that meet most customer design, capacity and cost requirements. We manufacture the bodies of wreckers and car carriers, which are installed on truck chassis manufactured by third parties. We frequently purchase the truck chassis for resale to our customers. Wreckers generally are used to recover and tow disabled vehicles and other equipment and range in type from the conventional tow truck to large recovery vehicles with rotating hydraulic booms and up to 75-ton lifting capacities. Car carriers are specialized flatbed vehicles with hydraulic tilt mechanisms that enable a towing operator to drive or winch a vehicle onto the bed for transport. Car carriers transport new or disabled vehicles and other equipment and are particularly effective over longer distances. We also manufacture vehicle transport trailers.

Our products primarily are sold through independent distributors that serve all 50 states, Canada and Mexico, and other foreign markets including Europe, the Pacific Rim, the Middle East, South America and Africa, and through prime contractors to governmental entities. Additionally, as a result of our ownership of Jige International S.A. in France and Boniface Engineering, Ltd. in the United Kingdom, we have substantial distribution capabilities in Europe. While most of our distributor agreements do not generally contain exclusivity provisions, management believes that approximately 85% of our independent distributors choose to sell our products on an exclusive basis. In addition to selling our products to towing operators, our independent distributors provide them with parts and service. We also utilize sales representatives to inform prospective purchasers about our current product lines in an effort to drive sales to independent distributors. Management believes the strength of our distribution network and the breadth of our product offerings are two key advantages over our competitors.

Product Lines

We manufacture a broad line of wrecker, car carrier and trailer bodies to meet a full range of customer design, capacity and cost requirements.

Wreckers. Wreckers are generally used to recover and tow disabled vehicles and other equipment and range in type from the conventional tow truck to large recovery vehicles with up to 75-ton lifting capacities. Wreckers are available with specialized features, including underlifts, L-arms, crossbars and scoops, which lift disabled vehicles by the tires or front axle to minimize front end damage to the towed vehicles. Certain heavy duty wrecker models offer rotating booms, which allow heavy duty wreckers to recover vehicles from any angle, and remote control devices for recovery equipment. In addition, certain light duty wreckers are equipped with automatic wheellift hookup devices that allow operators to engage a disabled or unattended vehicle without leaving the cab of the wrecker.

Our wreckers range in capacity from 4 to 75 tons, and are classified as either light duty or heavy duty, with wreckers of 16-ton or greater capacity being classified as heavy duty. Light duty wreckers are used to remove vehicles from accident scenes and vehicles illegally parked, abandoned or disabled, and for general recovery. Heavy duty wreckers are used in towing and recovery applications including overturned tractor trailers, buses, motor homes and other large vehicles.

| 2 |

Car Carriers. Car carriers are specialized flat-bed vehicles with hydraulic tilt mechanisms that enable a towing operator to drive or winch a vehicle onto the bed for transport. Car carriers are used to transport new or disabled vehicles and other equipment and are particularly effective for transporting vehicles or other equipment over longer distances. In addition to transporting vehicles, car carriers may also be used for other purposes, including transportation of industrial equipment. Most professional towing operators have car carriers in their fleets to complement their towing capabilities.

Transport Trailers. Our multi-vehicle transport trailers are specialized auto transport trailers with upper and lower decks and hydraulic ramps for loading vehicles. These trailers are used for moving multiple vehicles for auto auctions, car dealerships, leasing companies and other similar applications. These trailers are easy to load and transport 6 to 7 vehicles. The vehicles can be secured to transport quickly with ratchet and chain tie-downs that are mounted throughout the frame of the transport. Many professional towing operators have added auto transport trailers to their fleets to add to their service offerings.

Brand Names

We manufacture and market our wreckers, car carriers and trailers under ten separate brand names. Although certain brands overlap in terms of features, prices and distributors, each brand has its own distinctive image and customer base.

Century®. The Century® brand is our “top-of-the-line” brand and represents what management believes to be the broadest product line in the industry. The Century® line was started in 1974 and produces wreckers ranging from 8-ton light duty to 75-ton heavy duty models, and car carriers in lengths from 20 to 30 feet. Management believes that the Century® brand has a reputation as the industry’s leading product innovator.

Vulcan®. Our Vulcan® product line includes a range of premium light duty and heavy duty wreckers, ranging from 8-ton light duty to 75-ton heavy duty models, and car carriers.

Challenger®. Our Challenger® products compete with the Century® and Vulcan® products and constitute a third premium product line. Challenger® products consist of heavy duty wreckers with capacities ranging from 25 to 75 tons. The Challenger® line was started in 1975 and is known for high performance heavy duty wreckers and aesthetic design.

Holmes®. Our Holmes® product line includes mid-priced wreckers with 4 to 16 ton capacities, a 16-ton rotator and a detachable towing unit (DTU). The Holmes® wrecker was first produced in 1916. Historically, the Holmes® name has been the most well-recognized and leading industry brand both domestically and internationally.

Champion®. The Champion® brand, which was introduced in 1991, includes car carriers which range in length from 19 to 21 feet. The Champion® product line, which is generally lower-priced, allows us to offer a full line of car carriers at various competitive price points.

Chevron™. Our Chevron™ product line is comprised primarily of premium car carriers. Chevron™ produces a range of premium single-car, multi-car and industrial carriers, as well as wreckers ranging from 8-ton to 16-ton models.

Eagle®. Our Eagle® products consist of light duty wreckers with the “Eagle Claw®” hook-up system that allows towing operators to engage a disabled or unattended vehicle without leaving the cab of the tow truck. The “Eagle Claw®” hook-up system was originally developed for the repossession market. Since acquiring Eagle, we have upgraded the quality and features of the Eagle® product line and expanded its recovery capability.

Titan®. Our Titan® product line is comprised of premium multi-vehicle transport trailers which can transport up to 7 vehicles depending on configuration.

Jige™. Our Jige™ product line is comprised of a broad line of premium light duty and heavy duty wreckers and car carriers marketed primarily in Europe. Jige™ is a market leader best known for its innovative designs of car carriers and light duty wreckers necessary to operate within the narrow confines of European cities, as well as heavy duty wreckers.

Boniface™. Our Boniface™ product line is comprised primarily of premium heavy duty wreckers marketed primarily in Europe. Boniface™ produces heavy duty wreckers specializing in the long underlift technology required to tow modern European tour buses.

| 3 |

Product Development and Manufacturing

Our Holmes® and Century® brand names are associated with four of the major innovations in the industry: the rapid reverse winch; the tow sling; the hydraulic lifting mechanism; and the underlift with parallel linkage and L-arms. Our engineering staff, in consultation with manufacturing personnel, uses computer-aided design and stress analysis systems to test new product designs and to integrate various product improvements. In addition to offering product innovations, we focus on developing or licensing new technology for our products. Research and development costs amounted to approximately $1.9 million, $1.8 million and $1.6 million for 2017, 2016 and 2015, respectively.

We manufacture wreckers, car carriers and trailers at seven manufacturing facilities located in the United States, France and the United Kingdom. The manufacturing process for our products consists primarily of cutting and bending sheet steel or aluminum into parts that are welded together to form the wrecker, car carrier body or trailer. In addition, during the past several years, we have also begun to produce wrecker bodies using composites and other non-metallic materials. After the frame is formed, components such as hydraulic cylinders, winches, valves and pumps, which are purchased by us from third-party suppliers, are attached to the frame to form the completed wrecker or car carrier body. The completed body is either installed by us, or shipped by common carrier to a distributor where it is then installed, on a truck chassis. Generally, the wrecker or car carrier bodies are painted and towing operators can select customized colors to coordinate with chassis colors or customer fleet colors. To the extent final painting is required before delivery, we either complete such painting or contract with independent paint shops for such services.

We purchase raw materials and component parts from a number of sources. Although we have no long-term supply contracts, management believes we have good relationships with our primary suppliers. In recent years prices have fluctuated significantly, but we have experienced no significant problems in obtaining adequate supplies of raw materials and component parts to meet the requirements of our production schedules. Management believes that the materials used in the production of our products are available at competitive prices from an adequate number of alternative suppliers. Accordingly, management does not believe that the loss of a single supplier would have a material adverse effect on our business.

Sales, Distribution and Marketing

The industry categorizes the towing and recovery market into three general product types: light duty wreckers; heavy duty wreckers; and car carriers. The light duty wrecker market consists primarily of professional wrecker operators, repossession towing services, local and national governmental entities and repair shop or salvage company owners. The heavy duty market includes professional wrecker operators serving the needs of commercial vehicle operators as well as governmental entities. The car carrier market has expanded to include equipment rental companies that offer delivery service and professional towing operators who desire to complement their existing towing capabilities.

We have developed a diverse network of independent distributors, consisting of approximately 80 distributors in North America, who serve all 50 states, Canada and Mexico, and numerous distributors that serve other foreign markets. In 2017, no single distributor accounted for more than 10% of our sales. Management believes our broad and diverse network of distributors provides us with the flexibility to adapt to market changes, lessens our dependence on particular distributors and reduces the impact of regional economic factors.

Our sales force services our network of independent distributors and consists of sales representatives whose responsibilities include providing sales support to the entire base of independent distributors. Sales representatives receive commissions on direct sales based on product type and brand and generally are assigned specific territories in which to promote sales of our products and to maintain customer relationships. To support sales and marketing efforts, we produce demonstrator models that are used by our sales representatives and independent distributors. In addition to providing services to our network of independent distributors, our sales force sells our products to various governmental entities, including the U.S. federal government and foreign governments, through prime contractors.

We routinely respond to requests for proposals or bid invitations in consultation with our local distributors. Our products have been selected by the United States General Services Administration as an approved source for certain federal and defense agencies. We intend to continue to pursue U.S. government and foreign government contracting opportunities.

The towing and recovery equipment industry places heavy marketing emphasis on product exhibitions at national, regional and international trade shows. In order to focus our marketing efforts and to control marketing costs, we concentrate our efforts on the major trade shows each year, and we work with our network of independent distributors to concentrate on various regional shows.

| 4 |

Product Warranties and Insurance

We generally offer a 12-month limited manufacturer’s product and service warranty on our wrecker and car carrier products. Our warranty generally provides for repair or replacement of failed parts or components. Our independent distributor customers regularly perform any needed warranty repair work themselves, rather than shipping products back to us, and then invoice us for the cost of the parts and labor. Management believes that we maintain adequate general liability and product liability insurance.

Backlog

We produce virtually all of our products to order. Our backlog is based upon customer purchase orders that we believe are firm. The level of backlog at any particular time, however, may not be an appropriate indicator of our future operating performance. Certain purchase orders may be subject to cancellation by the customer upon notification. Given our production and delivery schedules, management generally believes that the current backlog represents less than four months of production.

Competition

The towing and recovery equipment manufacturing industry is highly competitive for sales to distributors and towing operators. Management believes that competition in this industry focuses on product quality and innovation, reputation, technology, customer service, product availability and price. We compete on the basis of each of these criteria, with an emphasis on product quality and innovation and customer service. Management also believes that a manufacturer’s relationship with distributors is a key component of success in the industry. Accordingly, we have invested substantial resources and management time in building and maintaining strong relationships with distributors. Management also believes that our products are regarded as high quality within their particular price points. Our marketing strategy is to continue to compete primarily on the basis of quality and reputation rather than solely on the basis of price, and to continue to target the growing group of professional towing operators who as end-users recognize the quality of our products.

Traditionally, the capital requirements for entry into the towing and recovery manufacturing industry have been relatively low. Management believes a manufacturer’s capital resources and access to technological improvements have become a more integral component of success in recent years. Certain of our competitors may have greater financial and other resources and may provide more attractive dealer and retail customer financing alternatives than we do.

Employees

We employed approximately 1,120 people as of December 31, 2017. None of our employees are covered by a collective bargaining agreement, though our employees in France and the United Kingdom have certain similar rights provided by their respective government’s employment regulations. We consider our employee relations to be good.

Intellectual Property Rights

Our development of the underlift parallel linkage and L-arms is considered one of the most innovative developments in the wrecker industry. This technology is significant primarily because it allows the damage-free towing of newer aerodynamic vehicles made of lighter weight materials. This technology, particularly the L-arms, is used in a majority of commercial wreckers today. We hold a number of utility and design patents covering other of our products. We have also obtained the rights to use and develop certain technologies owned or patented by others. Management believes that, until the patents on our technology expire, utilization of our patented technology without a license is an infringement of such patents. We have successfully litigated infringement lawsuits in which the validity of our patents on our technology was upheld, and successfully settled other lawsuits.

Our trademarks “Century®,” “Holmes®,” “Champion®,” “Challenger®,” “Pro Star®,” “Street Runner®,” “Vulcan®,” “Right Approach®” and “Extreme Angle®,” among others, are registered with the United States Patent and Trademark Office. Management believes that our trademarks are well-recognized by dealers, distributors and end-users in their respective markets and are associated with a high level of quality and value.

| 5 |

Government Regulations and Environmental Matters

Our operations are subject to federal, state and local laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. Management believes that we are in substantial compliance with all applicable federal, state and local provisions relating to the protection of the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past.

We act as a subcontractor for certain U.S. and other government programs. As a result, we are subject to extensive regulations and requirements of the U.S. and other government agencies and entities that govern these programs, including with respect to the award, administration and performance of contracts under such programs.

We are also subject to the additional diligence and disclosure requirements adopted by the Securities and Exchange Commission (the “SEC”) in 2012 related to certain minerals sourced from the Democratic Republic of Congo or adjoining countries in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The SEC rules impose these obligations with respect to “conflict minerals,” defined as tin, tantalum, tungsten and gold, which are necessary to the functionality of a product manufactured, or contracted to be manufactured, by an SEC reporting company. If any “conflict minerals” that are necessary to the functionality of a product manufactured by an SEC reporting company originated in the Democratic Republic of Congo or an adjoining country, the rules require the issuer to prepare and file a report addressing its efforts to exercise due diligence on the source of such “conflict minerals” and their chain of custody.

We are also subject to the Magnuson-Moss Warranty Federal Trade Commission Improvement Act which regulates the description of warranties on products. The description and substance of our warranties are also subject to a variety of federal and state laws and regulations applicable to the manufacturing of vehicle components. Management believes that continued compliance with various government regulations will not materially affect our operations.

Executive Officers of the Registrant

Information relating to our current executive officers is set forth below. William G. Miller, II is the son of William G. Miller. Other than Messrs. Miller and Miller II, there are no family relationships among the executive officers, directors or nominees for director, nor are there any arrangements or understandings between any of the executive officers and any other persons pursuant to which they were selected as executive officers.

| Name | Age | Position | ||

| William G. Miller | 71 | Chairman of the Board | ||

| Jeffrey I. Badgley | 65 | Co-Chief Executive Officer | ||

| William G. Miller, II | 39 | President and Co-Chief Executive Officer | ||

| Frank Madonia | 69 | Executive Vice President, Secretary and General Counsel | ||

| Deborah Whitmire | 52 | Executive Vice President, Chief Financial Officer and Treasurer | ||

| Josias W. Reyneke | 61 | Chief Information Officer |

William G. Miller has served as Chairman of the Board since April 1994. Mr. Miller served as our Chief Executive Officer from April 1994 until June 1997, and as our Co-Chief Executive Officer from October 2003 until March 2011. In June 1997, he was named Co-Chief Executive Officer, a title he shared with Jeffrey I. Badgley until November 1997. Mr. Miller also served as our President from April 1994 to June 1996. He served as Chairman of Miller Group, Inc. from August 1990 through May 1994, as its President from August 1990 to March 1993, and as its Chief Executive Officer from March 1993 until May 1994. Prior to 1987, Mr. Miller served in various management positions for Bendix Corporation, Neptune International Corporation, Wheelabrator-Frye, Inc. and The Signal Companies, Inc.

| 6 |

Jeffrey I. Badgley has served as our Co-Chief Executive Officer since December 2013, after serving as our Chief Executive Officer from March 2011 until December 2013, our President from June 1996 until March 2011, our Co-Chief Executive Officer from October 2003 until March 2011 and our Chief Executive Officer from November 1997 to October 2003. Mr. Badgley served as a director from 1996 to May 2014 and as Vice Chairman of the Board from March 2011 to May 2014. Mr. Badgley served as our Vice President from 1994 to 1996, and as our Chief Operating Officer from June 1996 to June 1997. In addition, Mr. Badgley has served as President of Miller Industries Towing Equipment Inc. since 1996. Mr. Badgley served as Vice President—Sales of Miller Industries Towing Equipment Inc. from 1988 to 1996. He previously served as Vice President—Sales and Marketing of Challenger Wrecker Corporation from 1982 until joining Miller Industries Towing Equipment Inc.

William G. Miller, II has served as a director since May 2014, our Co-Chief Executive Officer since December 2013 and President since March 2011, after serving as a Regional Vice President of Sales of Miller Industries Towing Equipment Inc. from November 2009 to February 2011. Mr. Miller II served as Vice President of Strategic Planning of the Company from October 2007 until November 2009. Mr. Miller II served as Light Duty General Manager from November 2004 to October 2007 and as a Sales Representative of Miller Industries Towing Equipment Inc. from 2002 to 2004.

Frank Madonia has served as our Executive Vice President, Secretary and General Counsel since September 1998. From April 1994 to September 1998 Mr. Madonia served as our Vice President, General Counsel and Secretary. Mr. Madonia served as Secretary and General Counsel to Miller Industries Towing Equipment Inc. since its acquisition by Miller Group in 1990. From July 1987 through April 1994, Mr. Madonia served as Vice President, General Counsel and Secretary of Flow Measurement. Prior to 1987, Mr. Madonia served in various legal and management positions for United States Steel Corporation, Neptune International Corporation, Wheelabrator-Frye, Inc. and The Signal Companies, Inc.

Deborah Whitmire has served as our Executive Vice President, Chief Financial Officer and Treasurer since January 2017, after serving as our Vice President and Corporate Controller from January 2014 to December 2016 and Corporate Controller to Miller Industries Towing Equipment Inc. from March 2005 to January 2014. From April 2000 to March 2005, she also served as Director of Finance – Manufacturing to Miller Industries Towing Equipment Inc. In addition, she served as Controller to Miller Industries Towing Equipment Inc. from October 1997 to April 2000 and Accounting Manager to Miller Industries Towing Equipment Inc. from October 1996 to October 1997.

Josias W. Reyneke has served as our Chief Information Officer since January 2017, after serving as our Vice President of Operations to Miller Industries Towing Equipment Inc. from July 2011 to December 2016. From 2002 to 2011, Mr. Reyneke served as Director of Management Information Systems and Materials of Miller Industries Towing Equipment Inc. Mr. Reyneke joined Miller Industries Towing Equipment Inc. as a consultant in 1997 to assist with the implementation of an enterprise resource planning system and was subsequently offered the position of Director of Management Information Systems in 1998, a position he held until 2002. Prior to 1998, Mr. Reyneke also served in various management positions for SE Technologies, Wheels of Africa and Toyota South Africa.

Available Information

Our Internet website address is www.millerind.com. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to those reports, as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission. Our Corporate Governance Guidelines and Code of Business Conduct and Ethics are also available on our website. Other corporate governance-related documents can be found at our website as well.

| 7 |

| ITEM 1A. | RISK FACTORS |

There are many factors that affect our business and the results of our operations, some of which are beyond our control. The following is a description of all known material risks that may cause the actual results of our operations in future periods to differ materially from those currently expected or desired. We encourage you to read this section carefully.

Our business is subject to the cyclical nature of our industry and changes in consumer confidence and in economic conditions in general. Adverse changes or continued uncertainty with respect to these factors may lead to a downturn in our business.

The towing and recovery industry is cyclical in nature. In recent years, the overall demand for our products and resulting revenues have been positively affected by recovering economic conditions and improving consumer sentiment. However, historically, the overall demand for our products and our resulting revenues have at times been negatively affected by wavering levels of consumer confidence; volatility and disruption in domestic and international capital and credit markets and the resulting decrease in the availability of financing for our customers and towing operators and the overall effects of global economic conditions. We remain concerned about the continuing effects of these factors on the towing and recovery industry, and we continue to monitor our overall cost structure to see that it remains in line with business conditions. A prolonged economic downturn, and slow or negative growth in the domestic and global economy, could have a material adverse effect on our business, financial condition and results of operations for the foreseeable future.

Our demand from our customers and towing operators is affected by the availability of capital and access to credit.

The ability of our customers and of towing operators to purchase our products is affected by the availability of capital and credit to them. Our independent distributor customers rely on floor plan financing in connection with the purchase of our products, and the availability of that financing on acceptable terms has a direct effect on the volume of their purchases. Additionally, in many cases, a towing operator’s decision to purchase our products from one of our distributors is dependent upon their ability to obtain financing upon acceptable terms. Volatility and disruption in the capital and credit markets, principally in the U.S. and Europe, in the past has decreased the availability of capital to, and credit capacity of, our customers and towing operators. In addition, in the past, certain providers of floor plan financing have exited the market, which made floor plan financing increasingly difficult for our independent distributor customers to secure at those times. This reduced availability of capital and credit has negatively affected the ability and capacity of our customers and of towing operators to purchase towing and related equipment. This, in turn, has negatively impacted sales of our products. If customers are unable to access capital or credit, it could materially and adversely affect our ability to sell our products, and as a result, could negatively affect our business and operating results.

Our dependence upon outside suppliers for our raw materials, including aluminum, steel, petroleum-related products and other purchased component parts, leaves us subject to changes in price (including as a result of the imposition of tariffs) and delays in receiving supplies of such materials or parts.

We are dependent upon outside suppliers for our raw material needs and other purchased component parts, and events beyond our control could have an adverse effect on the cost or availability of raw materials and component parts. Steel, aluminum, fuel and other commodity prices have historically experienced high volatility depending on market conditions and global demand. Price increases or changes in payment terms from our suppliers of raw materials or component parts could impact our ability to secure necessary raw materials or component parts, or to secure such materials and parts at favorable prices. In addition, pricing of raw materials, such as steel and aluminum, may be impacted by the level of tariffs imposed on imports. President Trump has indicated an intention to impose tariffs on imported steel of 25% and on imported aluminum of 10%. The Company uses a substantial amount of imported steel and aluminum in its products. Details regarding the applicability of any tariffs that may be enacted have not been established at this time. If these tariffs are enacted and apply to materials imported by the Company, then the price of such imported materials will increase substantially and the price of U.S. made steel and aluminum can also be expected to increase substantially. In this case, the Company would consider attempting to offset these increases through price increases and cost surcharges to the extent possible, as it has historically done to offset other price increases. However, it is uncertain how much of any price increases (including as a result of new tariffs) could be offset in this manner. In any event, price increases require a long lead time for the Company to implement with its customers while the higher material costs would be felt much sooner. As a result, there is a substantial risk that the Company’s financial performance and competitive position could be materially adversely impacted by the imposition of these tariffs and by higher prices generally.

Demand for our products also could be negatively affected by supply delays of truck chassis and other component parts used in our products. Our third party suppliers’ ability to supply us with truck chassis and component parts is limited by their available capacity to manufacture the component parts we require. We have experienced supply delays and limitations for component parts during the latter part of 2017. If these delays continue or worsen, our customers may reduce their purchase levels with us and/or seek alternative solutions to meet their demand. At this time, we believe that sources of our raw materials and component parts will continue to be adequate to meet our requirements and that alternative sources are available. However, shortages, price increases or delays in shipments of our raw materials and component parts could have a material adverse effect on our financial performance, competitive position and reputation.

| 8 |

Overall demand from our customers may be affected by increases in their fuel and insurance costs and changes in weather conditions.

In the past, our customers have experienced substantial increases in fuel and other transportation costs, and in the cost of insurance. Our customers also have, from time to time, been subject to unpredictable and varying weather conditions which could, among other things, impact the cost and availability of fuel and other materials. Any of these factors could negatively affect our customers’ capacity for purchasing, towing and related equipment, and, consequently, have a material negative effect upon our business and operating results.

Our international operations are subject to various political, economic and other uncertainties that could adversely affect our business results, including by restrictive taxation or other government regulation and by foreign currency fluctuation.

Historically, a portion of our net sales occur outside the United States, primarily in Europe. In addition, we have manufacturing operations at two facilities located in the Lorraine region of France and manufacturing operations in Norfolk, England. As a result, our operations are subject to various political, economic and other uncertainties, including risks of restrictive taxation policies, changing political conditions and governmental regulations. This includes, for example, the uncertainty surrounding the implementation and effect of the United Kingdom's June 23, 2016 referendum in which voters approved the United Kingdom's exit from the European Union, commonly referred to as “Brexit,” including changes to the legal and regulatory framework that apply to the United Kingdom and its relationship with the European Union. On March 29, 2017, the UK notified the European Union of its intention to withdraw pursuant to Article 50 of the Lisbon Treaty. The terms of the withdrawal are subject to a negotiation period that could last at least two years from the withdrawal notification date. Also, a portion of our net sales derived outside the United States, as well as salaries of employees located outside the United States and certain other expenses, are denominated in foreign currencies, including the British pound and the Euro. We are, therefore, subject to risk of financial loss resulting from fluctuations in exchange rates of these currencies against the U.S. dollar. Brexit has caused, and may continue to result in, significant volatility in global stock markets and currency exchange rate fluctuations of the U.S. dollar relative to other foreign currencies in which we conduct business. In addition, political unrest, terrorist acts, military conflict and disease outbreaks have increased the risks of doing business abroad in general.

Failure to comply with domestic and foreign anti-corruption laws could have an adverse effect on our business.

Our international operations require us to comply with a number of U.S. and international laws and regulations, including those involving anti-bribery and anti-corruption. Failure to comply with the Foreign Corrupt Practices Act (“FCPA”), the U.K. Bribery Act, and other foreign anti-bribery laws could have an adverse effect on our business. Violations of these laws, or allegations of such violations, could result in our incurring significant fees and having fines and criminal sanctions imposed on us or our employees, and could adversely impact our business with government entities.

Our competitors could impede our ability to attract or retain customers.

The towing and recovery equipment manufacturing industry is highly competitive. Capital requirements for entry into the towing and recovery manufacturing industry have been relatively low, which could result in an increase in the number of competitors entering the industry. Competition for sales exists domestically and internationally at the manufacturer, distributor and towing-operator levels and is based primarily on product quality and innovation, reputation, technology, customer service, product availability and price. Competition for sales also comes from the market for used towing and recovery equipment. Certain of our competitors may have substantially greater financial and other resources and may provide more attractive dealer and retail customer financing alternatives than us. If these competitors are able to make it more difficult for us to attract or retain customers, it could have a negative impact on our sales, revenue and financial performance.

| 9 |

Our future success depends upon our ability to develop or acquire proprietary products and technology and assertions against us relating to intellectual property rights could harm our business.

Historically, we have been able to develop or acquire patented and other proprietary product innovations which have allowed us to produce what management believes to be technologically advanced products relative to most of our competition. However, certain of our patents have expired, and others will expire in the next few years, and as a result, we may not have a continuing competitive advantage through proprietary products and technology. If we are unable to develop or acquire new products and technology in the future, our ability to maintain market share, and, consequently, our revenues and operating results, may be negatively affected.

Third parties may claim that our products infringe their patents or other intellectual property rights. If a competitor were to challenge our patents, or assert that our products or processes infringe its patent or other intellectual property rights, we could incur substantial litigation costs, be forced to design around their patents, pay substantial damages or even be forced to cease our operations, any of which could be expensive and/or have an adverse effect on our operating results. Third party infringement claims, regardless of their outcome, would not only consume our financial resources, but also would divert the time and effort of our management and could result in our customers or potential customers deferring or limiting their purchase or use of the affected products or services until resolution of the litigation.

We depend upon skilled labor to manufacture our products, and if we experience problems hiring and retaining skilled labor, our business may be negatively affected.

The timely manufacture and delivery of our products requires an adequate supply of skilled labor, and the operating costs of our manufacturing facilities can be adversely affected by high turnover in skilled positions. Accordingly, our ability to increase sales, productivity and net earnings will be limited to a degree by our ability to employ the skilled laborers necessary to meet our requirements. We must attract, train and retain skilled employees while controlling related labor costs and maintaining our core values. Our ability to control labor costs is subject to numerous external factors, including prevailing wage rates and increases in healthcare and other insurance costs. There can be no assurance that we will be able to maintain an adequate skilled labor force necessary to efficiently operate our facilities. In addition, while our employees are not currently members of a union, there can be no assurance that the employees at any of our facilities will not choose to become unionized in the future.

A disruption in our information technology ("IT") systems or any violation of data protection laws could adversely impact our business and operations.

We rely on the accuracy, capacity and security of our IT systems and our ability to update these systems in response to the changing needs of our business. We use our IT systems to collect and store confidential and sensitive data, including information about our business, our customers and our employees. Our IT systems may be disrupted or fail for a number of reasons, including natural disasters, such as fires; power loss; software “bugs”, hardware defects or human error; or hacking, computer viruses, malware, ransomware or other cyber attacks.

As technology continues to evolve, we anticipate that we will collect and store even more data in the future and that our systems will increasingly use remote communication features that are susceptible to both willful and unintentional security breaches. We have incurred costs and expect to incur significant additional costs in order to implement security measures that we feel are appropriate to protect our IT systems. Despite these efforts, future attacks could result in our systems or data being breached and/or damaged by computer viruses or unauthorized physical or electronic access. Such a breach could result in theft of our intellectual property or trade secrets and/or unauthorized access to controlled data and personal information stored in connection with our human resources function. In the event of a breach in security that allows third parties access to personal information, we are subject to a variety of ever-changing laws on a global basis that may require us to provide notification to the data owners, and that may subject us to lawsuits, fines and other means of regulatory enforcement or harm employee morale.

Any disruption, outage or breach of our IT systems could result in interruption of our business operations, damage to our reputation and a loss of confidence in our security measures, all of which could adversely affect our business. To the extent that any data is lost or destroyed or any confidential information is inappropriately disclosed or used, it could adversely affect our competitive position or customer relationships, harm our business and possibly lead to significant claims, liability, or fines based upon alleged breaches of contract or applicable laws. Regulators globally are also imposing greater monetary fines for privacy violations. For example, in 2016, the European Union adopted a new law governing data practices and privacy called the General Data Protection Regulation (“GDPR”), which becomes effective in May 2018. The law establishes new requirements regarding the handling of personal data, and non-compliance with the GDPR may result in monetary penalties of up to 4% of worldwide revenue. The GDPR and other changes in laws or regulations associated with the enhanced protection of certain types of sensitive data, such as healthcare data or other personal information, could increase our cost of providing our products and services.

| 10 |

Changes in the tax regimes and related government policies and regulations in the countries in which we operate could adversely affect our results and our effective tax rate.

As a result of our international operations, we are subject to various taxes in both U.S. and non-U.S. jurisdictions. Due to economic and political conditions, tax laws, regulations and rates in these various jurisdictions may be subject to significant change. Our future effective income tax rate could be affected by changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets or changes in tax laws or their interpretation. Changes to long-standing tax principles in the countries in which we operate could adversely affect our effective tax rate or result in higher cash tax liabilities. Increases in our effective tax rate or tax liabilities could have a material adverse effect on us.

The effects of regulations relating to conflict minerals may adversely affect our business.

In 2012, the SEC adopted rules under the Dodd-Frank Wall Street Reform and Consumer Protection Act to improve transparency and accountability concerning the supply of certain minerals, known as “conflict minerals”, originating from the Democratic Republic of Congo and adjoining countries. These rules could adversely affect the sourcing, availability and pricing of such minerals if they are found to be used in the manufacture of our products, as the number of suppliers who provide conflict-free minerals may be limited. In addition, we have incurred and expect to incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. The Company's supply chain is complex. As a result, we have encountered and continue to expect significant difficulty in determining the country of origin or the source and chain of custody for all “conflict minerals” used in our products and disclosing that our products are “conflict free” (meaning that they do not contain “conflict minerals” that directly or indirectly finance or benefit armed groups in the Democratic Republic of the Congo or an adjoining country). We may face reputational challenges from customers, investors or others if we are unable to verify the origins for all “conflict minerals” used in our products. In such event, we may also face difficulties in satisfying customers who may require that all of the components of our products be certified as conflict mineral free.

Our sales to U.S. and other governmental entities through prime contractors are subject to special risks.

We act as a subcontractor for certain U.S. and other government programs. As a result, we are subject to extensive regulations and requirements of the U.S. and other government agencies and entities that govern these programs, including with respect to the award, administration and performance of contracts under such programs. Our U.S. and other government business is subject to the following risks, among others: (i) this business is susceptible to changes in government spending, which may reduce future revenues; (ii) most of our contracts with governmental entities through prime contractors are fixed-price contracts, and our actual costs on any of these contracts could exceed our projected costs, (iii) competition for the award of these contracts is intense, and we may not be successful in bidding on future contracts, and (iv) the products we sell to governmental entities are subject to highly technical requirements, and any failure to comply with these requirements could result in unanticipated retrofit costs, delayed acceptance of products, late or reduced payment or cancellation of the contract. We continue to work to secure additional U.S. and other governmental orders, but we cannot predict the success or timing of any such efforts.

The catastrophic loss of one of our manufacturing facilities could harm our business, financial condition and results of operations.

While we manufacture our products in several facilities and maintain insurance covering our facilities, including business interruption insurance to mitigate losses resulting from any production interruption or shutdown caused by an insured loss, a catastrophic loss of the use of all or a portion of any one of our manufacturing facilities due to accident, labor issues, weather conditions, natural disaster, civil unrest or otherwise, whether short or long-term, could materially harm our business, financial condition and results of operations. Any recovery under our insurance policies may not offset the lost sales or increased costs that may be experienced during the disruption of operations.

Environmental and health and safety liabilities and requirements could require us to incur material costs.

We are subject to various U.S. and foreign laws and regulations relating to environmental protection and worker health and safety, including those governing discharges of pollutants into the ground, air and water; the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances and waste materials; and the investigation and cleanup of contaminated properties. In certain cases, these regulatory requirements may limit the productive capacity of our operations.

Environmental and health-related requirements are complex, subject to change and have tended to become more and more stringent. Future developments could cause us to incur various expenditures and could also subject us to fines or sanctions, obligations to investigate or remediate contamination or restore natural resources, liability for third party property damage or personal injury claims and the imposition of new permitting requirements and/or the modification or revocation of our existing operating permits, among other effects. These and other developments could materially harm our business, financial condition and results of operation.

| 11 |

Any loss of the services of our key executives could have a material adverse impact on our operations.

Our success is highly dependent on the continued services of our management team. The loss of services of one or more key members of our senior management team could have a material adverse effect on us.

A product warranty or product liability claim in excess of our insurance coverage, or an inability to acquire or maintain insurance at commercially reasonable rates, could have a material adverse effect upon our business.

We are subject to various claims, including product warranty and product liability claims arising in the ordinary course of business, and may at times be a party to various legal proceedings incidental to our business. We maintain reserves and liability insurance coverage at levels based upon commercial norms and our historical claims experience. If we manufacture poor quality products or receive defective materials, we may incur unforeseen costs in excess of what we have reserved in our financial statements. A successful product warranty, product liability or other claim brought against us in excess of our insurance coverage, or the inability of us to acquire or maintain insurance at commercially reasonable rates, could have a material adverse effect upon our business, operating results and financial condition. In addition, we are subject to potential recalls of components or parts manufactured by suppliers which we purchase and incorporate into our towing and recovery equipment products, as well as potential recalls of our products from customers to cure manufacturing defects or in the event of a failure to comply with applicable regulatory standards or customers’ order specifications. Moreover, the adverse publicity that may result from a product liability claim, perceived or actual defect with our products or a product recall could have a material adverse effect on our ability to market our products successfully.

Our stock price may fluctuate greatly as a result of the general volatility of the stock market.

From time to time, there may be significant volatility in the market price for our common stock. Our quarterly operating results, changes in earnings estimated by analysts, if any, changes in general conditions in our industry or the economy or the financial markets or other developments affecting us, including our ability to pay dividends, could cause the market price of our common stock to fluctuate substantially.

Our charter and bylaws contain anti-takeover provisions that may make it more difficult or expensive to acquire us in the future or may negatively affect our stock price.

Our charter and bylaws contain restrictions that may discourage other persons from attempting to acquire control of us, including, without limitation, prohibitions on shareholder action by written consent and advance notice requirements regarding amendments to certain provisions of our charter and bylaws. In addition, our charter authorizes the issuance of up to 5,000,000 shares of preferred stock. The rights and preferences for any series of preferred stock may be set by the board of directors, in its sole discretion and without shareholder approval, and the rights and preferences of any such preferred stock may be superior to those of common stock and thus may adversely affect the rights of holders of common stock.

The requirements and restrictions imposed by our current credit facility could restrict our ability to operate our business and failure to comply with these requirements and restrictions could adversely affect our business.

Our current credit facility contains customary representations and warranties, events of default, and financial, affirmative and negative covenants for loan agreements of this kind. In addition, covenants under our current credit facility restrict our ability to pay cash dividends if the Company would be in violation of the minimum tangible net worth test or the leverage ratio test in the current loan agreement as a result of the dividend, among various restrictions. We have been in compliance with these covenants throughout 2017 and anticipate that we will continue to be in compliance during 2018. If we fail to comply with the requirements of our current credit facility, such non-compliance would result in an event of default. If not waived by the bank, such event of default would result in the acceleration of any amounts due under the current credit facility. During 2017, we borrowed a total of $20 million under our credit facility, of which we had repaid $15 million at December 31, 2017. The borrowings under the credit facility were primarily used to finance our capital expenditure projects for our Pennsylvania manufacturing operations and at our Ooltewah, Tennessee and Greeneville, Tennessee facilities. As of December 31, 2017 and March 6, 2018, we had $10 million in outstanding borrowings under our credit facility.

We cannot assure you that we will declare dividends on our common stock.

Our board of directors approved a dividend policy in 2011 to consider and pay quarterly dividends on our common stock subject to our ability to satisfy all applicable statutory requirements and our continued financial strength. While we currently intend to pay a quarterly dividend on shares of our common stock, to the extent that we have sufficient funds available for such purpose, the declaration, amount and payment of any future dividends on shares of common stock will be at the sole discretion of our board of directors and we may reduce or discontinue entirely the payment of such dividends at any time. Our board of directors may take into account general and economic conditions, our financial condition and operating results, capital requirements, restrictions in financing agreements and such other factors as our board of directors may deem relevant from time to time.

| 12 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We operate four manufacturing facilities in the United States. The facilities are located in Ooltewah (Chattanooga), Tennessee; Hermitage, Pennsylvania; and two in Greeneville, Tennessee. The Ooltewah plant, containing approximately 315,000 square feet (plus approximately 16,000 square feet under construction and 51,000 square feet of leased property), produces light and heavy duty wreckers; the Hermitage plant, containing approximately 243,000 square feet (plus approximately 36,000 square feet of leased property), produces car carriers; and the Greeneville plants, containing an aggregate of approximately 210,000 square feet, produce car carriers, heavy duty wreckers and trailers.

During 2017, the Company substantially completed the consolidation and expansion of its Pennsylvania manufacturing operations to increase capacity and improve operating efficiencies. The manufacturing operations of the two primary Pennsylvania locations were consolidated at one expanded location. In June 2017, the Company sold the vacated plant location. A portion of the sold facility was leased from the buyer through November 2017, while production of certain equipment and storage of raw materials was relocated to the other Pennsylvania and Tennessee locations. Also in process are several capital projects involving machinery and equipment and building improvements at the Company’s Ooltewah, Tennessee and Greeneville, Tennessee facilities. In addition, the Company began construction on an administrative building at its Ooltewah, Tennessee facility in June 2017. For a discussion of these capital projects, see “Liquidity and Capital Resources” in Item 7–“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” of this Annual Report on Form 10-K.

We also have two manufacturing facilities and one storage facility located in the Lorraine region of France, which have, in the aggregate, approximately 205,000 square feet, and manufacturing operations in Norfolk, England, with approximately 48,000 square feet.

| ITEM 3. | LEGAL PROCEEDINGS |

We are, from time to time, a party to litigation arising in the normal course of our business. Litigation is subject to various inherent uncertainties, and it is possible that some of these matters could be resolved unfavorably to us, which could result in substantial damages against us. We have established accruals for matters that are probable and reasonably estimable and maintain product liability and other insurance that management believes to be adequate. Management believes that any liability that may ultimately result from the resolution of these matters in excess of available insurance coverage and accruals will not have a material adverse effect on our consolidated financial position or results of operations.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| 13 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Our common stock is traded on the New York Stock Exchange under the symbol “MLR.” The following table sets forth the quarterly range of high and low sales prices for the common stock for the periods indicated.

| Price Range of Common Stock | ||||||||

| Period | High | Low | ||||||

| Year Ending December 31, 2016 | ||||||||

| First Quarter | $ | 21.77 | $ | 19.10 | ||||

| Second Quarter | 22.71 | 19.84 | ||||||

| Third Quarter | 22.79 | 20.38 | ||||||

| Fourth Quarter | 27.70 | 21.55 | ||||||

| Year Ending December 31, 2017 | ||||||||

| First Quarter | $ | 27.80 | $ | 23.55 | ||||

| Second Quarter | 26.75 | 23.65 | ||||||

| Third Quarter | 27.95 | 24.25 | ||||||

| Fourth Quarter | 28.85 | 24.80 | ||||||

As of February 28, 2018, there were approximately 461 registered holders of record of our common stock. The number of record holders does not include persons who held our common stock in nominee or “street name” accounts through brokers.

The Company has paid consecutive quarterly cash dividends since May 2011. Dividend payments made for 2017, 2016 and 2015 were as follows:

| Payment | Record Date | Payment Date | Dividend (per share) | Amount (in thousands) | ||||||||

| Q1 2015 | March 20, 2015 | March 23, 2015 | $ | 0.16 | $ | 1,809 | ||||||

| Q2 2015 | June 15, 2015 | June 19, 2015 | 0.16 | 1,814 | ||||||||

| Q3 2015 | September 14, 2015 | September 21, 2015 | 0.16 | 1,815 | ||||||||

| Q4 2015 | December 7, 2015 | December 11, 2015 | 0.16 | 1,815 | ||||||||

| Total for 2015 | $ | 0.64 | $ | 7,253 | ||||||||

| Q1 2016 | March 21, 2016 | March 28, 2016 | $ | 0.17 | $ | 1,929 | ||||||

| Q2 2016 | June 13, 2016 | June 20, 2016 | 0.17 | 1,929 | ||||||||

| Q3 2016 | September 12, 2016 | September 19, 2016 | 0.17 | 1,928 | ||||||||

| Q4 2016 | December 5, 2016 | December 12, 2016 | 0.17 | 1,929 | ||||||||

| Total for 2016 | $ | 0.68 | $ | 7,715 | ||||||||

| Q1 2017 | March 27, 2017 | April 3, 2017 | $ | 0.18 | $ | 2,043 | ||||||

| Q2 2017 | June 13, 2017 | June 20, 2017 | 0.18 | 2,048 | ||||||||

| Q3 2017 | September 11, 2017 | September 18, 2017 | 0.18 | 2,048 | ||||||||

| Q4 2017 | December 4, 2017 | December 11, 2017 | 0.18 | 2,049 | ||||||||

| Total for 2017 | $ | 0.72 | $ | 8,188 | ||||||||

| 14 |

Any future determination as to the payment of cash dividends will depend upon such factors as earnings, capital requirements, our financial condition, restrictions in financing agreements and other factors deemed relevant by our board of directors. Covenants under our current credit facility restrict the payment of cash dividends if the Company would be in violation of the minimum tangible net worth test or the leverage ratio test in the current loan agreement as a result of the dividend, among various other restrictions.

Sales of Unregistered Securities

We did not sell any unregistered securities during the year ended December 31, 2017.

Performance Graph

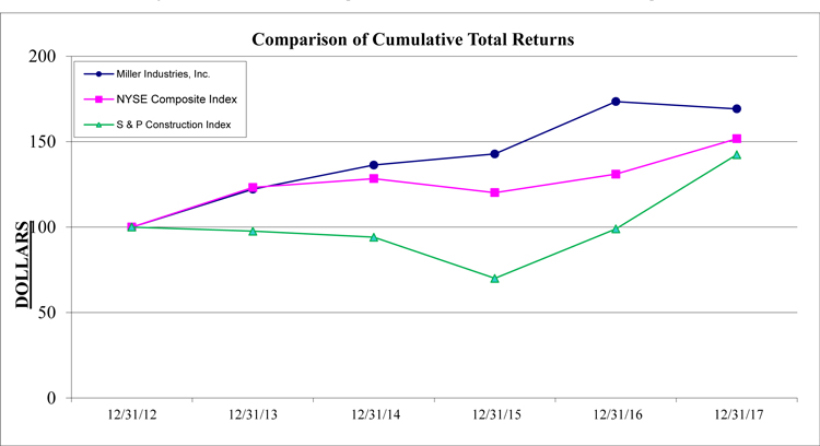

The following line graph compares the percentage change in the cumulative shareholder return of our common stock with The New York Stock Exchange Composite Index and the Standard & Poor’s Construction Index over the period of time from December 31, 2012 through December 31, 2017. The respective returns assume reinvestment of dividends paid.

| 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | |||||||||||||||||||

| Miller Industries, Inc. | 100 | 122 | 136 | 143 | 173 | 169 | ||||||||||||||||||

| NYSE Composite Index | 100 | 123 | 128 | 120 | 131 | 152 | ||||||||||||||||||

| S&P Construction Index | 100 | 98 | 94 | 70 | 99 | 142 | ||||||||||||||||||

| 15 |

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table presents selected statements of income data and selected balance sheet data on a consolidated basis. We derived the selected historical consolidated financial data from our audited consolidated financial statements and related notes. You should read this data together with Item 7–“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes that are a part of this Annual Report on Form 10-K.

| Years Ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| (In thousands except per share data) | ||||||||||||||||||||

| Statements of Income Data: | ||||||||||||||||||||

| Net Sales | $ | 615,101 | $ | 601,119 | $ | 540,966 | $ | 492,776 | $ | 404,170 | ||||||||||

| Costs of operations | 548,000 | 536,840 | 483,353 | 439,791 | 361,734 | |||||||||||||||

| Gross Profit | 67,101 | 64,279 | 57,613 | 52,985 | 42,436 | |||||||||||||||

| Operating Expenses: | ||||||||||||||||||||

| Selling, general, and administrative expenses | 35,561 | 32,318 | 31,491 | 28,496 | 28,323 | |||||||||||||||

| Non-operating Expenses: | ||||||||||||||||||||

| Interest expense, net | 1,588 | 1,161 | 919 | 554 | 369 | |||||||||||||||

| Other expense (income) | (387 | ) | (277 | ) | 340 | 437 | (119 | ) | ||||||||||||

| Total expenses | 36,762 | 33,202 | 32,750 | 29,487 | 28,573 | |||||||||||||||

| Income before income taxes | 30,339 | 31,077 | 24,863 | 23,498 | 13,863 | |||||||||||||||

| Income tax provision | 7,323 | 11,155 | 8,887 | 8,660 | 5,175 | |||||||||||||||

| Net income | 23,016 | 19,922 | 15,976 | 14,838 | 8,688 | |||||||||||||||

| Net loss attributable to noncontrolling interests | –‒ | –‒ | –‒ | 66 | 542 | |||||||||||||||

| Net income attributable to Miller Industries, Inc. | $ | 23,016 | $ | 19,922 | $ | 15,976 | $ | 14,904 | $ | 9,230 | ||||||||||

| Basic income per common share | $ | 2.02 | $ | 1.76 | $ | 1.41 | $ | 1.32 | $ | 0.82 | ||||||||||

| Diluted income per common share | $ | 2.02 | $ | 1.75 | $ | 1.41 | $ | 1.31 | $ | 0.82 | ||||||||||

| Weighted average shares outstanding: | ||||||||||||||||||||

| Basic | 11,368 | 11,346 | 11,324 | 11,297 | 11,233 | |||||||||||||||

| Diluted | 11,385 | 11,374 | 11,360 | 11,354 | 11,324 | |||||||||||||||

| December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Working capital (1) | $ | 125,734 | $ | 119,797 | $ | 121,046 | $ | 126,713 | $ | 120,821 | ||||||||||

| Total assets | 317,238 | 297,438 | 268,356 | 262,355 | 226,669 | |||||||||||||||

| Long-term obligations (2) | 10,606 | 5,000 | — | — | — | |||||||||||||||

| Common shareholders’ equity | 203,100 | 184,602 | 173,862 | 168,454 | 161,713 | |||||||||||||||

| December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Other Data: | ||||||||||||||||||||

| Cash dividend per common share | $ | 0.72 | $ | 0.68 | $ | 0.64 | $ | 0.60 | $ | 0.56 | ||||||||||

| (1) | Working capital consists of current assets less current liabilities. |

| (2) | Long-term obligations consist of outstanding balances on credit facility and other long-term loans, including current portions. Noncurrent taxes payable and deferred income tax liability are excluded. |

| 16 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion of our results of operations and financial condition should be read in conjunction with the Consolidated Financial Statements and Notes thereto. Unless the context indicates otherwise, all dollar amounts in this Management’s Discussion and Analysis of Financial Condition and Results of Operations are in thousands.

Executive Overview

Miller Industries, Inc. is The World’s Largest Manufacturer of Towing and Recovery Equipment®, with domestic manufacturing subsidiaries in Tennessee and Pennsylvania, and foreign manufacturing subsidiaries in France and the United Kingdom. We offer a broad range of equipment to meet our customers’ design, capacity and cost requirements under our Century®, Vulcan®, Challenger®, Holmes®, Champion®, Chevron™, Eagle®, Titan®, Jige™ and Boniface™ brand names.

Our management focuses on a variety of key indicators to monitor our overall operating and financial performance. These indicators include measurements of revenue, operating income, gross margin, net income, earnings per share, capital expenditures and cash flow.

We derive revenues primarily from product sales made through our network of domestic and foreign independent distributors. Our revenues are sensitive to a variety of factors including general economic conditions as well as demand for, and price of, our products, our technological competitiveness, our reputation for providing quality products and reliable service, competition within our industry, and the cost of raw materials (including aluminum, steel and petroleum-related products).

Our industry is cyclical in nature. In recent years, the overall demand for our products and resulting revenues have been positively affected by favorable economic conditions, such as lower fuel prices, and positive consumer sentiment in our industry. However, historically, the overall demand for our products and our resulting revenues have at times been negatively affected by:

| ● | wavering levels of consumer confidence; |

| ● | volatility and disruption in domestic and international capital and credit markets and the resulting decrease in the availability of financing, including floor plan financing, for our customers and towing operators; |

| ● | significant periodic increases in fuel and insurance costs and their negative effect on the ability of our customers to purchase towing and related equipment; and |

| ● | the overall effects of global economic conditions. |

We remain concerned about the continuing effects of these factors on the towing and recovery industry, and we continue to monitor our overall cost structure to see that it remains in line with business conditions.

In addition, we have been and will continue to be affected by changes in the prices that we pay for raw materials, particularly aluminum, steel, petroleum-related products and other raw materials, which represent a substantial part of our total cost of operations. In the past, as we have determined necessary, we have implemented price increases to offset higher costs. We also developed alternatives to some of the components used in our production process that incorporate these raw materials, and our suppliers have implemented these alternatives in the production of our component parts. We continue to monitor raw material prices and availability in order to more favorably position the Company in this dynamic market.

As of December 31, 2017 and March 6, 2018, the Company owed $10,000 under the credit facility. The borrowings under the credit facility were primarily used to finance our capital expenditure projects for our Pennsylvania manufacturing operations and at our Ooltewah, Tennessee and Greeneville, Tennessee facilities. As of December 31, 2017, the Company also owed $606 under a fixed rate loan to its French subsidiary, Jige International S.A. These borrowings are being used primarily for capital expenditure projects at our operating facilities in France.

Critical Accounting Policies

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require us to make estimates. Certain accounting policies are deemed “critical,” as they require management’s highest degree of judgment, estimations and assumptions. A discussion of critical accounting policies, the judgments and uncertainties affecting their application and the likelihood that materially different amounts would be reported under different conditions or using different assumptions follows:

| 17 |

Accounts Receivable