UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-08544 | ||||||||

|

| |||||||||

|

FPA FUNDS TRUST | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA |

|

90025 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

(Name and address of agent for service) |

Copy to: | ||||||||

|

|

| ||||||||

|

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 |

MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 | ||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

(310) 473-0225 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

December 31 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

December 31, 2018 |

| |||||||

Item 1: Report to Shareholders.

FPA Crescent Fund

Annual Report

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

December 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Introduction

Dear Shareholders:

Stock markets around the world had a dismal 2018, particularly in the fourth quarter with December delivering the brunt of the decline. December 2018 was the worst December for the S&P 500 since 1931 — and that's after bouncing back 6.62% over the last four trading days of the year.

We are disappointed that your portfolio managers did not cover themselves in glory in 2018. The FPA Crescent Fund ("Fund") declined -10.52% in the last quarter of the year and -7.43% for the full year. In comparison, the S&P 500 and MSCI ACWI declined -13.52% and -12.75% respectively in the fourth quarter and -4.38% and -9.42% for the full year. The Fund, with its global exposure and value focus, outperformed the global and value indexes but lagged the U.S. market.

In the context of its global and value focus, the Fund thankfully did not wholly disappoint as shown in the following table of the Fund's 2018 performance relative to domestic and global equity indexes.

FPA Crescent Performance vs. Indexes1

|

Name |

2018 |

||||||

|

S&P 500 Growth |

-0.01 |

% |

|||||

|

S&P 500 |

-4.38 |

% |

|||||

|

FPA Crescent |

-7.43 |

% |

|||||

|

MSCI ACWI Growth |

-8.13 |

% |

|||||

|

S&P 500 Value |

-8.95 |

% |

|||||

|

MSCI ACWI |

-9.42 |

% |

|||||

|

MSCI ACWI Value |

-10.79 |

% |

|||||

The Fund's performance remains consistent with its stated long-term goals. During 2018, the Fund's downside capture was reasonable in the context of the overall market's drawdown and net risk exposure — the S&P 500 declined by more than 10% and then almost 20%, which was close to a bear market and bit more than general market "noise". This was especially true in light of our net risk exposure each quarter, which increased from 63% in the first quarter to 73% by the fourth, largely as a result of the greater number of bargains that developed amid December's volatility.

1 Source: FPA, Morningstar. Fund performance is shown net of all fees and expenses and includes the reinvestment of distributions. Comparison to indices is for illustrative purposes only. The Fund does not include outperformance of any index in its investment objectives. Please refer to page 1 for overall net performance of the Fund since inception. Past performance is no guarantee, nor is it indicative, of future results. Please see the end of this Commentary for important disclosures.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

FPA Crescent Performance During 2018 S&P 500 Drawdowns Greater than 10%2

|

Jan 27 to Feb 8 |

Sep 21 to Dec 24 |

||||||||||

|

FPA Crescent |

-6.03 |

% |

-14.67 |

% |

|||||||

|

S&P 500 |

-10.10 |

% |

-19.36 |

% |

|||||||

|

Crescent Downside Capture |

59.70 |

% |

75.77 |

% |

|||||||

|

FPA Crescent Net Risk (average) |

63.3 |

% |

70.2 |

% |

|||||||

Importantly, the Fund's 2018 drawdown was almost entirely mark-to-market; that is, the stocks we owned declined in price but we do not believe the intrinsic value or long-term earnings power of the underlying businesses was impaired.3 As long as these companies deliver on earnings in the coming years, we believe their stock prices should do just fine. We discuss specific examples in the Portfolio Commentary section.

Despite the aforementioned mediocre performance last year, we believe the Fund has achieved its stated goals this cycle, producing equity-like rates of return over the long-term while avoiding permanent impairment of capital.

FPA Crescent Achieved its Goals this Market Cycle4

| Name |

2007 Peak to 2018 Peak |

||||||

|

Cumulative Return |

|||||||

|

FPA Crescent |

109.47 |

% |

|||||

|

S&P 500 |

138.73 |

% |

|||||

|

Crescent as a percent of S&P 500 |

|||||||

|

Cumulative Return |

78.91 |

% |

|||||

|

Max Downside Capture |

50.45 |

% |

|||||

|

Crescent Net Risk (Average) |

61.3 |

% |

|||||

|

Volatility (Standard Deviation) |

65.08 |

% |

|||||

2 Source: FPA, Morningstar. Fund performance is shown net of all fees and expenses and includes the reinvestment of distributions. Comparison to indices is for illustrative purposes only. The Fund does not include outperformance of any index in its investment objectives. Please refer to page 1 for overall net performance of the Fund since inception. Net Risk is the percentage of portfolio exposed to Risk Assets. Risk Asset generally refers to assets that may have a significant degree of price volatility. Past performance is no guarantee, nor is it indicative, of future results. Please see the end of this Commentary for important disclosures.

3 We should mention, however, the bankruptcy filing of the California utility PG&E, an investment that has never accounted for more than 1% in the portfolio, may just be the beginning of the story, as it could take many years to achieve a resolution.

4 Source: Morningstar Direct, FPA. The 2007 peak to 2018 peak dates are 10/10/07 to 9/20/18. Max drawdown for the S&P 500 2007 peak to 2018 peak was -55.25%. The standard deviation of the S&P 500 over the time period was approximately 14%. Comparison to any index is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. Max downside capture ratio is used to evaluate how well an investment manager performed relative to an index during periods when that index has fallen. The ratio is calculated by dividing the manager's returns by the returns of the index during the down-market, and multiplying that factor by 100. Past performance is no guarantee, nor is it indicative, of future results.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

We took advantage of what we believed were attractive opportunities in 2018, finding possibilities to purchase good, growing businesses (albeit cyclical in some cases) at reasonable, if not good, prices. At the same time, we sold entirely or reduced positions in many of the companies that had helped drive past returns. We focus on where a company will be over the next five to seven years, consistent with a long-term holding period. Just because we believe in a certain outcome, however, doesn't mean 'Mr. Market' will see it our way immediately. In fact, 'Mr. Market' held quite a different view from our own in 2018, as on average, what we sold performed better than what we purchased.

The winners and losers for both the full year and Q4 2018 are listed here. In these periods, mark-to-market price changes in the bottom five detractors from the Fund's performance outweighed the benefit realized from the top five contributors. Other than the announcement that Transdigm plans to acquire Esterline Technologies and favorable developments in the restructuring of Puerto Rican municipal debt, there was no news that we believe to be substantive in driving both quarterly or annual winners and losers.

Winners and Losers5

| Winners |

Performance Contribution |

Losers |

Performance Contribution |

||||||||||||

|

Q4 2018 |

|||||||||||||||

|

Esterline Technologies |

0.42 |

% |

American International Group |

-0.76 |

% |

||||||||||

|

Broadcom |

0.15 |

% |

Baidu |

-0.74 |

% |

||||||||||

|

CMS Interest Rate Caps |

0.14 |

% |

Arconic |

-0.64 |

% |

||||||||||

|

iShares Russell 2000 ETF (short) |

0.11 |

% |

Citigroup |

-0.63 |

% |

||||||||||

|

Naspers/Tencent pair trade |

0.06 |

% |

United Technologies |

-0.59 |

% |

||||||||||

|

0.88 |

% |

-3.36 |

% |

||||||||||||

|

YTD 2018 |

|||||||||||||||

|

Esterline Technologies |

0.66 |

% |

American International Group |

-1.02 |

% |

||||||||||

|

Puerto Rico Municipal Bonds |

0.58 |

% |

Arconic |

-0.97 |

% |

||||||||||

|

Microsoft |

0.43 |

% |

Jefferies |

-0.79 |

% |

||||||||||

|

Cisco Systems |

0.41 |

% |

Baidu |

-0.74 |

% |

||||||||||

|

Broadcom |

0.37 |

% |

Citigroup |

-0.67 |

% |

||||||||||

|

2.45 |

% |

-4.19 |

% |

||||||||||||

5 Reflects the top contributors and top detractors to the Fund's performance based on contribution to return for the quarter and year-to-date. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The weights of the winners and losers within the portfolio as of December 31, 2018 were: Esterline Technologies (0.0%), Broadcom (2.6%), CMS Interest Rate Caps (0.3%), iShares Russell 2000 ETF (short) (0.0%), Naspers/Tencent pair trade (1.8%), American International Group (3.3%), Baidu (2.1%), Arconic (2.4%), Citigroup (2.0%), United Technologies (2.2%), Puerto Rico Municipal Bonds (2.4%), Microsoft (1.7%), Cisco Systems(0.0%), Jeffries (2.1%). The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter or year-to-date. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the quarter and year-to-date is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed. Past performance is no guarantee of future results.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The price of a company's stock can perform better or worse than its underlying business, sometimes for extended periods. Such was the environment last year that the businesses of the companies we own performed on average within the range of our expectations — the companies we held for the full year actually beat analyst expectations. But we believe their stock prices failed to reflect that performance.

For more than a quarter century, the Fund has leaned into weakness. That is a hallmark of our past success, and we expect it to be no different in the future. We have never been able to dial in timing, however. We habitually buy and sell early which has led to Fund performance untethered from the benchmarks. The most glaring example of such divergence in the Fund's portfolio was the 1998/1999 tech bubble, when the Fund underperformed by 59.30% versus the S&P 500 during those two years. Some have suggested, only partly tongue in cheek, that once we decide to make an investment, we should consider waiting six months before we start to buy it.

Shares in a good, growing business purchased at a reasonable price should perform well over time. That doesn't mean they will perform well for all periods of time, and for the Fund's portfolio, 2018 was one such out-of-sync period. We wish we could guarantee our companies will continue to perform as expected and that the stock market will appropriately value them, but we can't. We are now midway through our third decade of operating with the same investment philosophy supported by a consistent research and portfolio management process, which we believe will allow the Fund to continue to perform well over time.

Eventually, we believe that fact trumps emotion and hope, and businesses receive a just valuation. In the interim, however, the inexplicable can frustrate and stymie both client and portfolio manager.

Given the Fund's positioning, which we discuss below, we are genuinely more encouraged than we have been in the past few years.

Portfolio Commentary

Last year was one of the Fund's more active periods on record. We took advantage of the inevitable return of volatility to eliminate and reduce certain positions while initiating and increasing others. We bought 18 new names and sold or reduced 23 names, some by more than half. The opportunities to put capital to work in 2018 allowed us to increase the Fund's net risk exposure by nearly 10 percentage points — from 63.3% to 73.1%.

The Fund's top 10 long positions, comprising roughly one-quarter of the Fund's holdings and almost 40% of its net risk exposure, have declined an average of 20% from their peaks making them relatively and absolutely attractively priced.

We believe these businesses have increased their intrinsic value per-share over the past year, and we expect them to make further progress in the years ahead, though the rate of that improvement will depend on economic conditions and management execution. But given current valuations, which we discuss below, we believe share prices should now at least keep up with business progress.

We invest on a bottoms-up basis but find it useful to group the portfolio into similar economic categories for the purposes of discussion. Below are a few of these categories.

Financials

The Fund had 14.1% net exposure to balance-sheet intensive Financials at year-end — but please keep in mind that Financials as a category inadequately distinguishes between the different types of companies in it, which include traditional banks, other types of lenders, investment banks, insurance companies, service providers/middle-men, etc. Each of these have different risk characteristics. A strong balance sheet would include well-underwritten loans and insurance policies and an appropriate amount of equity to support it, and we believe

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

the companies we own have such balance sheets, far stronger than the stock market currently appreciates. They are collectively valued at just 91% of their tangible book value as of year-end and 8.4x consensus 2019 earnings. Some of our bank holdings have strong franchises and we believe are likely to grow and earn excess returns through the cycle, for instance, Bank of America, Signature Bank and Wells Fargo. So we primarily value these on an earnings basis. Others, like AIG, Ally Financial, CIT and RBS, operate less differentiated businesses or are undergoing corporate turnarounds, and in these cases, we rely more heavily on tangible book value when thinking about value. At year-end, these companies traded at an average of 73% of tangible book value.

Jefferies Financial Group, our remaining balance sheet-intensive holding in this category, does not fit neatly in either group described above, though it serves as a good illustration of the type of financial investments we like. Jefferies operates a strong broker/dealer and a successful merchant bank. We like the owner/operator mindset of management, who have their money invested alongside ours. It has historically succeeded in creating value through timely investments through the merchant bank and by opportunistically repurchasing its shares at a sizeable discount to net asset value, or NAV. Last year, Jeffries met earnings expectations; enhanced NAV by reducing its stake in National Beef, and aggressively repurchased its shares at attractive prices. Despite those moves, Jefferies stock price declined 35% in the calendar year and now trades at just 65% of its tangible book value and an even larger discount to our low $30 assessment of NAV.

You should expect that we will increase our exposure to Financials in the event that their recent underperformance persists.

Industrials & Materials

The Fund has 21.9% of net exposure to businesses that have exposure to the industrial economy and materials. These companies range from mining to semi-conductors, and all trade in our view at inexpensive valuations based on mid-cycle earnings. As a group, they are trading at only about 11x 2019 consensus earnings expectations, or more than a 20% discount to the U.S. stock market. We believe these companies will grow on average at least as fast as the typical public company and that their economics are less susceptible to disruption by new competitors or technology. If the global economy is larger in five to seven years, we believe these companies should be worth appreciably more per-share, even with a recession along the way. On the downside, these companies would still be valued at slightly less than the stock market average even if their earnings declined by 25%, which we think is highly unlikely unless the rest of the companies in the stock market were to have earnings shortfalls.

Internet & Related (Including Cable)

In 2018, we initiated and increased stakes in a number of global internet platform companies that we believed offered good growth prospects at attractive prices, while we reduced our stake in others that were profitable investments and whose stock prices already reflected that success. This category represents 19.0% of the portfolio.

We sold down our Microsoft position, for example, which had appreciated markedly over the last eight years, and we bought a number of Asian internet platform companies at prices well below recent peaks. Our timing, though, made us look foolish over the short term. The Asian companies continued to trade poorly, declining more in the back half of the year than Microsoft. We believe these investments still have the same growth prospects but now at even more attractive prices. As a group, these investments trade at an average of around 16x earnings

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

net of cash (and lower still net of non-earning assets) as of year-end and are expected to grow their revenues by 18% in 2019.

Cable has had a taint to it for much of 2018 due to the twin fears of "cord cutting," which would displace the video business, and the development of 5G, which is supposed to allow wireless to make in-roads into broadband. We do not place much stock in either view. First, we do not believe that video is as profitable as industry segment reporting suggests. Video's free cash flow per subscriber will likely slowly erode, but we believe that will be more than offset by the latent pricing power of broadband, which is necessary for those who wish to cut the cord. Next, although 5G is something to consider, there is so far only one wireless company with any substantive investment in the technology, and it's too early to speak to its capability. Plus, cable infrastructure will still be required for the back-haul. We believe increasing demand for faster broadband makes cable a necessary and winning asset and that well-positioned cable companies will gain subscribers and the ability to increase pricing over time. We therefore purchased Charter Communications and Comcast, two geographically diversified cable companies with we think less risk of overbuilding and controlled by owner operators (although we are admittedly suspect of Comcast's purchase of Sky).

Others Including Credit

The Fund continues to maintain very low exposure to high-yield bonds, which account for just 4.7% of the portfolio. High debt levels, poor interest coverage, weak covenants, low yields, and a decade into a relatively decent economy have left us with few options that offer any reasonable margin of safety. We expect to once again be larger investors in credit when more attractive yields exist.

We recently published a white paper titled Risk is Where You're Not Looking that discusses in greater detail the impending challenges likely to face the corporate debt market, which the equity markets are unlikely to exit unscathed when they emerge.

We own a number of other companies that do not fall into a neat little box but we believe offer attractive prospects for good returns over time. For example, Kinder Morgan, once a master limited partnership but now a C-Corp — and always a pipeline transportation and energy storage company — is a younger investment in our portfolio. We believe Kinder has differentiated infrastructure assets; a great management team led by Richard Kinder, owner of around $4 billion of its stock, and reasonable growth prospects. It's a bit like a utility with the toll it takes on the oil and gas that flow through its pipes and reside in its storage facilities, but with better management, less regulation, good capital allocation, and a higher dividend yield.

Closing Remarks

It may further an understanding of our portfolio positioning to discuss what we don't own, for example, REITS, utilities and consumer staples. Simply, we do not believe that the stock of the typical company in these sectors will offer reasonable risk-adjusted returns over the next decade, given a combination of current valuation and prospective growth.

Proctor & Gamble, or P&G, the storied consumer products company, is an example of a company we don't own. Like many consumer staples companies, its moat is still substantial but not what it once was. The result is earnings growth of less than 2% over the past seven years, but its stock inexplicably trades at 20.8x 2019 consensus earnings estimates. Nonetheless, the Fund would have been better off owning it rather than many of its existing positions last year, as P&G delivered a total return of 3.57%. Yet P&G's historic growth rate is lower than the Fund's portfolio companies, which more importantly in our eyes, trade more inexpensively and offer

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

better growth prospects. P&G is no better nor worse than a number of other consumer staples companies we could have discussed.

We find this illogical. Maybe the valuation disparity is due to expectations for a weaker economy that might allow consumer staples to outperform for a time. Or maybe it is due to passive investing, which makes indiscriminate purchases as a function of inflows. However, if the stock market didn't offer irrational moments, everyone would invest in passive vehicles, and we wouldn't be in business. We prefer our portfolio.

A stock can trade higher or lower than one might expect, but if the underlying business successfully grows over time and generates free cash flow that management then allocates intelligently, said stock should make its shareholders happy over a longer period. We are happy with what we own — more happy than we have been in a number of years — and as much as we look forward to looking back, we appreciate where we are in the moment.

Although we have increased the Fund's exposures, we still have a lot of capital, about 27%, held in reserve to take advantage of lower prices. To put more capital to work, we require a larger margin of safety than what the market currently offers. Either: 1) the cyclical companies we would like to own must price in attractive returns based on our low case estimates of long-term earnings; 2) shares of the high quality companies we would like to own, such as P&G, need to decline significantly in price to offer rewarding prospective returns; or 3) the yield on high-yield bonds needs to increase from a paltry 7% to at least 9% to 10%. When such attractive valuations might occur alas lies beyond our limited capabilities.

Respectfully submitted,

Steven Romick

Portfolio Manager

February 1, 2019

Post Script:

We are ever mindful of the Fund's tax efficiency and so prudently take long-term gains whenever possible. We estimate potential capital gain exposure in the Fund was just 9% at year-end 2018, with 115% of that in the form of long-term gains — a multi-year low.

Through February 1, the Fund is up 8.23% for the year, a bit more than the S&P 500 at 8.13%, despite only being 73% invested. This significant difference when compared to last year's performance only serves to highlight why we prefer to assess rolling five-year periods and full-market cycles when judging performance, rather than focusing on the short-term.6

6 Past performance is no guarantee, nor is it indicative, of future results and there is no assurance that account's investment objective will be achieved or that the strategies employed will be successful. As with any investment, there is always the potential for gain, as well as the possibility of loss.

7

FPA CRESCENT FUND

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

8

FPA CRESCENT FUND

HISTORICAL PERFORMANCE

(Unaudited)

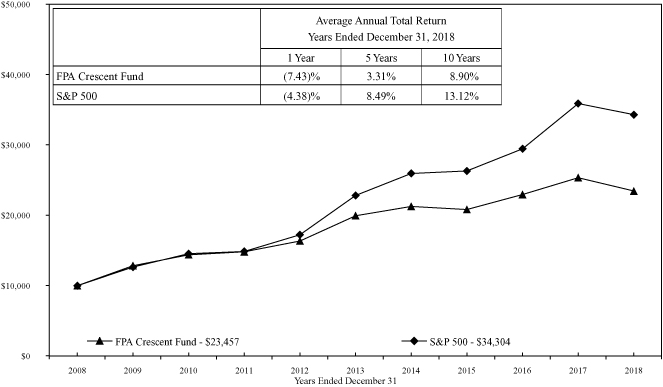

Change in Value of a $10,000 Investment in FPA Crescent Fund vs. S&P 500, Consumer Price Index and 60% S&P 500/40% BC Agg for the Ten Years Ended December 31, 2018

The Standard & Poor's 500 Composite Index (S&P 500) is an unmanaged index that is generally representative of the U.S. stock market. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The Barclays Capital U.S. Aggregate Bond Index (BC Agg) is a broadbased unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index (the index holds investment quality bonds); the blended benchmark is a hypothetical combination of unmanaged indices, reflecting a neutral mix of approximately 60% stocks and 40% bonds. The performance of the Fund is computed on a total return basis which includes reinvestment of all distributions. There can be no guarantee that the Consumer Price Index or other indexes will reflect the exact level of inflation at any given time. It is not possible to invest directly in an unmanaged index. Unless otherwise noted, index returns reflect the reinvestment of dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 24 and 28. The Prospectus details the Fund's objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

9

FPA CRESCENT FUND

PORTFOLIO SUMMARY

December 31, 2018

|

Common Stocks |

67.8 |

% |

|||||||||

|

Internet Media |

7.5 |

% |

|||||||||

|

Aircraft & Parts |

6.2 |

% |

|||||||||

|

Diversified Banks |

5.1 |

% |

|||||||||

|

Semiconductor Devices |

4.8 |

% |

|||||||||

|

Banks |

4.3 |

% |

|||||||||

|

Investment Companies |

3.9 |

% |

|||||||||

|

Cable & Satellite |

3.8 |

% |

|||||||||

|

P&C Insurance |

3.3 |

% |

|||||||||

|

Cement & Aggregates |

3.2 |

% |

|||||||||

|

Infrastructure Software |

2.5 |

% |

|||||||||

|

Entertainment Content |

2.1 |

% |

|||||||||

|

Electrical Components |

1.9 |

% |

|||||||||

|

Insurance Brokers |

1.5 |

% |

|||||||||

|

Generic Pharmaceuticals |

1.5 |

% |

|||||||||

|

Internet Based Services |

1.5 |

% |

|||||||||

|

Home Improvement |

1.4 |

% |

|||||||||

|

Institutional Brokerage |

1.4 |

% |

|||||||||

|

Midstream — Oil & Gas |

1.4 |

% |

|||||||||

|

Chemicals Distribution |

1.4 |

% |

|||||||||

|

Mining Services |

1.3 |

% |

|||||||||

|

Consumer Finance |

1.2 |

% |

|||||||||

|

Containers & Packaging |

1.1 |

% |

|||||||||

|

Advertising & Marketing |

1.1 |

% |

|||||||||

|

E-Commerce Discretionary |

1.0 |

% |

|||||||||

|

Automobiles |

0.7 |

% |

|||||||||

|

Integrated Utilities |

0.6 |

% |

|||||||||

|

Application Software |

0.6 |

% |

|||||||||

|

Food & Drug Stores |

0.5 |

% |

|||||||||

|

Specialty Chemicals |

0.5 |

% |

|||||||||

|

Marine Shipping |

0.3 |

% |

|||||||||

|

Base Metals |

0.2 |

% |

|||||||||

|

Mortgage Finance |

0.0 |

% |

|||||||||

|

Closed End Fund |

2.0 |

% |

|||||||||

|

Limited Partnerships |

0.9 |

% |

|||||||||

|

Preferred Stocks |

0.3 |

% |

|||||||||

|

Warrants |

0.0 |

% |

|||||||||

|

Convertible Preferred Stock |

0.0 |

% |

|||||||||

|

Bonds & Debentures |

11.7 |

% |

|||||||||

|

U.S. Treasuries |

7.5 |

% |

|||||||||

|

Municipals |

2.4 |

% |

|||||||||

|

Corporate Bonds & Notes |

1.3 |

% |

|||||||||

|

Asset-Backed Securities |

0.3 |

% |

|||||||||

|

Corporate Bank Debt |

0.2 |

% |

|||||||||

|

Residential Mortgage-Backed Securities |

0.0 |

% |

|||||||||

|

Short-term Investments |

16.0 |

% |

|||||||||

|

Securities Sold Short |

(3.2 |

)% |

|||||||||

|

Other Assets And Liabilities, Net |

4.5 |

% |

|||||||||

|

Net Assets |

100.0 |

% |

|||||||||

10

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

December 31, 2018

|

COMMON STOCKS |

Shares |

Fair Value |

|||||||||

|

INTERNET MEDIA — 7.5% |

|||||||||||

|

Alphabet, Inc. (Class A) (a) |

244,867 |

$ |

255,876,220 |

||||||||

|

Alphabet, Inc. (Class C) (a) |

246,445 |

255,220,907 |

|||||||||

|

Baidu, Inc. (ADR) (China) (a) |

1,826,510 |

289,684,486 |

|||||||||

|

Facebook, Inc. (Class A) (a) |

1,712,860 |

224,538,817 |

|||||||||

|

$ |

1,025,320,430 |

||||||||||

|

AIRCRAFT & PARTS — 6.2% |

|||||||||||

|

Arconic, Inc. |

19,142,780 |

$ |

322,747,271 |

||||||||

|

Meggitt plc (Britain) |

37,569,760 |

225,682,749 |

|||||||||

|

United Technologies Corporation |

2,843,770 |

302,804,630 |

|||||||||

|

$ |

851,234,650 |

||||||||||

|

DIVERSIFIED BANKS — 5.1% |

|||||||||||

|

Bank of America Corporation |

11,365,730 |

$ |

280,051,587 |

||||||||

|

Citigroup, Inc. |

5,324,130 |

277,174,208 |

|||||||||

|

Royal Bank of Scotland Group plc (Britain) |

50,598,680 |

140,363,548 |

|||||||||

|

$ |

697,589,343 |

||||||||||

|

SEMICONDUCTOR DEVICES — 4.8% |

|||||||||||

|

Analog Devices, Inc. |

3,478,300 |

$ |

298,542,489 |

||||||||

|

Broadcom, Inc. |

1,391,931 |

353,940,215 |

|||||||||

|

$ |

652,482,704 |

||||||||||

|

BANKS — 4.3% |

|||||||||||

|

CIT Group, Inc. (b) |

7,889,850 |

$ |

301,944,559 |

||||||||

|

Signature Bank |

735,280 |

75,594,137 |

|||||||||

|

Wells Fargo & Co. |

4,652,820 |

214,401,946 |

|||||||||

|

$ |

591,940,642 |

||||||||||

|

INVESTMENT COMPANIES — 3.9% |

|||||||||||

|

Groupe Bruxelles Lambert SA (Belgium) |

2,837,130 |

$ |

247,234,803 |

||||||||

|

Jefferies Financial Group, Inc. |

16,408,210 |

284,846,526 |

|||||||||

|

$ |

532,081,329 |

||||||||||

|

CABLE & SATELLITE — 3.8% |

|||||||||||

|

Charter Communications, Inc. (Class A) (a) |

808,151 |

$ |

230,298,790 |

||||||||

|

Comcast Corp. (Class A) |

8,606,120 |

293,038,386 |

|||||||||

|

$ |

523,337,176 |

||||||||||

|

P&C INSURANCE — 3.3% |

|||||||||||

|

American International Group, Inc. |

11,345,560 |

$ |

447,128,520 |

||||||||

11

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

CEMENT & AGGREGATES — 3.2% |

|||||||||||

|

HeidelbergCement AG (Germany) |

3,190,943 |

$ |

195,597,749 |

||||||||

|

LafargeHolcim Ltd. (Switzerland) (a) |

5,741,202 |

236,931,071 |

|||||||||

|

$ |

432,528,820 |

||||||||||

|

INFRASTRUCTURE SOFTWARE — 2.5% |

|||||||||||

|

Microsoft Corporation |

2,307,750 |

$ |

234,398,168 |

||||||||

|

Oracle Corporation |

2,560,043 |

115,585,941 |

|||||||||

|

$ |

349,984,109 |

||||||||||

|

ENTERTAINMENT CONTENT — 2.1% |

|||||||||||

|

Naspers, Ltd. (N Shares) (South Africa) |

1,443,658 |

$ |

289,044,077 |

||||||||

|

ELECTRICAL COMPONENTS — 1.9% |

|||||||||||

|

TE Connectivity, Ltd. (Switzerland) |

3,460,697 |

$ |

261,732,514 |

||||||||

|

INSURANCE BROKERS — 1.5% |

|||||||||||

|

Aon plc (Britain) |

1,436,123 |

$ |

208,754,839 |

||||||||

|

GENERIC PHARMACEUTICALS — 1.5% |

|||||||||||

|

Mylan NV (a) |

7,538,520 |

$ |

206,555,448 |

||||||||

|

INTERNET BASED SERVICES — 1.5% |

|||||||||||

|

Expedia, Inc. |

1,142,570 |

$ |

128,710,511 |

||||||||

|

Naver Corp. (South Korea) |

671,403 |

73,582,992 |

|||||||||

|

$ |

202,293,503 |

||||||||||

|

HOME IMPROVEMENT — 1.4% |

|||||||||||

|

Mohawk Industries, Inc. (a) |

1,632,710 |

$ |

190,961,762 |

||||||||

|

INSTITUTIONAL BROKERAGE — 1.4% |

|||||||||||

|

LPL Financial Holdings, Inc. |

3,105,560 |

$ |

189,687,605 |

||||||||

|

MIDSTREAM — OIL & GAS — 1.4% |

|||||||||||

|

Kinder Morgan, Inc. |

12,293,830 |

$ |

189,079,105 |

||||||||

12

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

CHEMICALS DISTRIBUTION — 1.4% |

|||||||||||

|

Nexeo Solutions, Inc. (a)(b)(c) |

17,910,012 |

$ |

153,847,003 |

||||||||

|

Nexeo Solutions, Inc. (Founders Shares) (a)(b)(c)(d)(e) |

3,647,564 |

31,332,575 |

|||||||||

|

$ |

185,179,578 |

||||||||||

|

MINING SERVICES — 1.3% |

|||||||||||

|

Glencore plc (Switzerland) (a) |

48,471,780 |

$ |

180,221,224 |

||||||||

|

CONSUMER FINANCE — 1.2% |

|||||||||||

|

Ally Financial, Inc. |

7,107,360 |

$ |

161,052,778 |

||||||||

|

CONTAINERS & PACKAGING — 1.1% |

|||||||||||

|

Owens-Illinois, Inc. (b) |

9,048,330 |

$ |

155,993,209 |

||||||||

|

ADVERTISING & MARKETING — 1.1% |

|||||||||||

|

WPP plc (Britain) |

14,231,167 |

$ |

154,877,637 |

||||||||

|

E-COMMERCE DISCRETIONARY — 1.0% |

|||||||||||

|

JD.com, Inc. (ADR) (China) (a) |

6,727,750 |

$ |

140,811,808 |

||||||||

|

AUTOMOBILES — 0.7% |

|||||||||||

|

Porsche Automobil Holding SE (Germany) |

1,568,623 |

$ |

92,254,299 |

||||||||

|

INTEGRATED UTILITIES — 0.6% |

|||||||||||

|

PG&E Corp. (a) |

3,601,370 |

$ |

85,532,538 |

||||||||

|

APPLICATION SOFTWARE — 0.6% |

|||||||||||

|

Nexon Co. Ltd. (Japan) (a) |

6,462,900 |

$ |

83,432,971 |

||||||||

|

FOOD & DRUG STORES — 0.5% |

|||||||||||

|

Jardine Strategic Holdings, Ltd. (Hong Kong) |

2,070,460 |

$ |

75,911,654 |

||||||||

|

SPECIALTY CHEMICALS — 0.5% |

|||||||||||

|

Axalta Coating Systems Ltd. (a) |

2,741,581 |

$ |

64,207,827 |

||||||||

13

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

MARINE SHIPPING — 0.3% |

|||||||||||

|

Sound Holding FP (Luxembourg) (a)(b)(c)(d)(e) |

1,146,250 |

$ |

37,504,746 |

||||||||

|

BASE METALS — 0.2% |

|||||||||||

|

Alcoa Corporation (a) |

928,730 |

$ |

24,685,643 |

||||||||

|

MORTGAGE FINANCE — 0.0% |

|||||||||||

|

Ditech Holding Corp. (a) |

8,401 |

$ |

840 |

||||||||

| TOTAL COMMON STOCKS — 67.8% (Cost $8,492,560,013) |

$ |

9,283,403,328 |

|||||||||

|

CLOSED END FUND — 2.0% |

|||||||||||

|

Altaba, Inc. (a) (Cost $195,040,158) |

4,777,600 |

$ |

276,814,144 |

||||||||

|

LIMITED PARTNERSHIPS — 0.9% |

|||||||||||

|

FPS LLC (a)(c)(d)(e) |

260,173 |

$ |

26,017,260 |

||||||||

|

GACP II L.P. (c)(d)(e) |

584,140 |

47,410,859 |

|||||||||

|

U.S. Farming Realty Trust, L.P. (c)(d)(e) |

350,000 |

35,842,205 |

|||||||||

|

U.S. Farming Realty Trust II, L.P. (c)(d)(e) |

120,000 |

11,796,930 |

|||||||||

| TOTAL LIMITED PARTNERSHIPS (Cost $110,438,372) |

$ |

121,067,254 |

|||||||||

|

PREFERRED STOCK — 0.3% |

|||||||||||

|

INDUSTRIALS — 0.2% |

|||||||||||

|

General Electric Co., 3M USD LIBOR + 3.330%, VRN — 5.00% 12/29/2049 (f) |

28,026,000 |

$ |

21,580,020 |

||||||||

|

INTEGRATED OILS — 0.1% |

|||||||||||

|

Surgutneftegas OJSC (Preference Shares) (Russia) |

32,078,286 |

$ |

18,103,330 |

||||||||

| TOTAL PREFERRED STOCK (Cost $43,301,150) |

$ |

39,683,350 |

|||||||||

|

WARRANTS — 0.0% |

|||||||||||

|

MORTGAGE FINANCE — 0.0% |

|||||||||||

|

Ditech Holding Corp. (a)(b) |

430,887 |

$ |

86 |

||||||||

|

Ditech Holding Corp. (a)(b) |

341,900 |

34 |

|||||||||

| TOTAL WARRANTS (Cost $0) |

$ |

120 |

|||||||||

14

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

CONVERTIBLE PREFERRED STOCK |

Shares or Principal Amount |

Fair Value |

|||||||||

|

MORTGAGE FINANCE — 0.0% |

|||||||||||

|

Ditech Holding Corp. (a)(b) (Cost $16,018,470) |

9,950 |

$ |

995 |

||||||||

|

BONDS & DEBENTURES — 11.7% |

|||||||||||

|

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 0.0% |

|||||||||||

|

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 0.0% |

|||||||||||

|

Stanwich Mortgage Loan Trust Series 2012-2 A — 0.00% 3/15/2047 (d)(e)(f)(g) |

$ |

454,902 |

$ |

193,333 |

|||||||

|

Stanwich Mortgage Loan Trust Series 2011-2 A — 0.00% 9/15/2050 (d)(e)(f)(g) |

987,460 |

528,492 |

|||||||||

|

Stanwich Mortgage Loan Trust Series 2012-4 A — 0.00% 6/15/2051 (d)(e)(f)(g) |

207,306 |

95,361 |

|||||||||

|

Stanwich Mortgage Loan Trust Series 2011-1 A — 0.668% 8/15/2050 (d)(e)(f)(g) |

856,812 |

451,908 |

|||||||||

|

Stanwich Mortgage Loan Trust Series 2010-2 A — 0.702% 2/28/2057 (d)(e)(f)(g) |

1,389,505 |

700,588 |

|||||||||

|

Stanwich Mortgage Loan Trust Series 2010-4 A — 1.939% 8/31/2049 (d)(e)(f)(g) |

239,008 |

120,699 |

|||||||||

|

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES (Cost $2,101,122) |

$ |

2,090,381 |

|||||||||

|

ASSET-BACKED SECURITIES — 0.3% |

|||||||||||

|

OTHER — 0.3% |

|||||||||||

|

Kamsarmax Shipping — 11.00% 9/10/2019 (c)(d)(e) |

$ |

7,302,153 |

$ |

7,302,153 |

|||||||

|

Northern Shipping — 7.80% 12/24/2019 (c)(d)(e) |

35,727,504 |

35,727,504 |

|||||||||

| TOTAL ASSET-BACKED SECURITIES (Cost $43,029,657) |

$ |

43,029,657 |

|||||||||

|

CORPORATE BONDS & NOTES — 1.3% |

|||||||||||

|

BASIC MATERIALS — 0.1% |

|||||||||||

|

Glencore Finance Canada, Ltd. — 4.25% 10/25/2022 (g) |

$ |

8,150,000 |

$ |

8,147,940 |

|||||||

|

Glencore Funding LLC — 2.875% 4/16/2020 (g) |

9,100,000 |

9,018,275 |

|||||||||

|

$ |

17,166,215 |

||||||||||

|

ENERGY — 0.3% |

|||||||||||

|

California Resources Corporation — 5.00% 1/15/2020 |

$ |

2,171,000 |

$ |

1,953,900 |

|||||||

|

California Resources Corporation — 5.50% 9/15/2021 |

8,984,000 |

6,903,395 |

|||||||||

|

California Resources Corporation — 6.00% 11/15/2024 |

2,171,000 |

1,351,448 |

|||||||||

|

California Resources Corporation 2nd Lien — 8.00% 12/15/2022 (g) |

35,750,000 |

24,220,625 |

|||||||||

|

Southwestern Energy Co. — 4.10% 3/15/2022 |

3,800,000 |

3,458,000 |

|||||||||

|

$ |

37,887,368 |

||||||||||

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

FINANCIAL — 0.0% |

|||||||||||

|

Ditech Holding Corp. PIK — 9.00% Cash or PIK 12/31/2024 |

$ |

25,264,114 |

$ |

2,131,660 |

|||||||

|

INDUSTRIAL — 0.9% |

|||||||||||

|

Bombardier, Inc. — 5.75% 3/15/2022 (g) |

$ |

13,800,000 |

$ |

12,937,500 |

|||||||

|

Bombardier, Inc. — 6.00% 10/15/2022 (g) |

12,670,000 |

11,878,125 |

|||||||||

|

Bombardier, Inc. — 6.125% 1/15/2023 (g) |

29,534,000 |

27,688,125 |

|||||||||

|

Bombardier, Inc. — 7.45% 5/1/2034 (g) |

5,800,000 |

5,205,500 |

|||||||||

|

Bombardier, Inc. — 7.50% 3/15/2025 (g) |

66,677,000 |

62,509,688 |

|||||||||

|

$ |

120,218,938 |

||||||||||

| TOTAL CORPORATE BONDS & NOTES (Cost $192,981,089) |

$ |

177,404,181 |

|||||||||

|

CORPORATE BANK DEBT — 0.2% |

|||||||||||

|

Hall of Fame TL, 3/20/2019 (c)(d)(e)(f) 1M USD LIBOR 11.000% — 16.504% |

$ |

4,784,300 |

$ |

4,784,300 |

|||||||

|

3M USD LIBOR 11.000% — 16.366% |

4,784,300 |

4,784,300 |

|||||||||

|

MEC Filo TL 1, 1M USD LIBOR 9.000% — 11.504% 2/12/2021 (c)(d)(e)(f) |

19,202,100 |

19,202,100 |

|||||||||

| TOTAL CORPORATE BANK DEBT (Cost $28,770,700) |

$ |

28,770,700 |

|||||||||

|

MUNICIPALS — 2.4% |

|||||||||||

|

Commonwealth of Puerto Rico GO, Series 2014 A, (SER A), — 8.00% 7/1/2035 |

$ |

111,230,000 |

$ |

59,786,125 |

|||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2021 |

7,070,000 |

6,698,825 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2022 |

3,883,000 |

3,659,728 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2033 |

25,194,000 |

23,241,465 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.125% 7/1/2037 |

14,598,000 |

13,430,160 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.25% 7/1/2029 |

9,753,000 |

9,070,290 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.25% 7/1/2042 |

93,814,000 |

86,308,880 |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 5.75% 7/1/2037 |

16,607,000 |

15,569,062 |

|||||||||

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev., Series 2012 A, (SR LIEN-SER A), — 6.00% 7/1/2047 |

$ |

14,655,000 |

$ |

13,739,063 |

|||||||

|

Puerto Rico Public Buildings Auth. Rev., Series 2012 U, (REF-GOVT FACS-SER U), — 5.25% 7/1/2042 |

54,920,000 |

29,519,500 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2011 C, (SR LIEN-SER C), — 5.00% 8/1/2022 |

3,065,000 |

2,375,375 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., (FIRST SUB-SER A-1), — 5.00% 8/1/2043 |

2,480,000 |

1,150,100 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2011 C, (SR LIEN-SER C), — 5.00% 8/1/2046 |

3,305,000 |

2,561,375 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2009 A, (UNREFUNDED-FIRST SUB-SER A), — 5.25% 8/1/2019 |

10,925,000 |

5,066,469 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2009 A, (FIRST SUB-SER A), — 5.25% 8/1/2027 |

1,400,000 |

649,250 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 C, (FIRST SUB-SER C), — 5.25% 8/1/2041 |

22,200,000 |

10,295,250 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., (FIRST SUB-SER A-1), — 5.25% 8/1/2043 |

3,995,000 |

1,852,681 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., — 5.25% 8/1/2057 |

6,830,000 |

5,293,250 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 C, (FIRST SUB-SER C), — 5.375% 8/1/2036 |

1,085,000 |

503,169 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 A, (FIRST SUB-SER A), — 5.375% 8/1/2039 |

14,195,000 |

6,582,931 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 C, (FIRST SUB-SER C), — 5.50% 8/1/2040 |

3,920,000 |

1,817,900 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 A, (FIRST SUB-SER A), — 5.50% 8/1/2042 |

46,300,000 |

21,471,625 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2010 A, (FIRST SUB-SER A), — 5.625% 8/1/2030 |

3,315,000 |

1,537,331 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2009 A, (FIRST SUB-SER A), — 5.75% 8/1/2037 |

14,680,000 |

6,807,850 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2009 A, (FIRST SUB-SER A), — 6.00% 8/1/2042 |

9,025,000 |

4,185,344 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., Series 2009 A, (UNREFUNDED-FIRST SUB-SER A), — 6.125% 8/1/2029 |

1,735,000 |

804,606 |

|||||||||

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev., (CONV CAP APPREC-FIRST SUB-A), — 6.75% 8/1/2032 |

1,815,000 |

841,706 |

|||||||||

| TOTAL MUNICIPALS (Cost $246,587,479) |

$ |

334,819,310 |

|||||||||

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

U.S. TREASURIES — 7.5% |

|||||||||||

|

U.S. Treasury Notes — 0.875% 4/15/2019 |

$ |

140,000,000 |

$ |

139,403,908 |

|||||||

|

U.S. Treasury Notes — 0.875% 6/15/2019 |

145,000,000 |

143,921,939 |

|||||||||

|

U.S. Treasury Notes — 1.00% 3/15/2019 |

160,000,000 |

159,522,912 |

|||||||||

|

U.S. Treasury Notes — 1.125% 1/15/2019 |

73,500,000 |

73,452,629 |

|||||||||

|

U.S. Treasury Notes — 1.125% 2/28/2019 |

29,000,000 |

28,934,298 |

|||||||||

|

U.S. Treasury Notes — 1.25% 3/31/2019 |

199,000,000 |

198,398,861 |

|||||||||

|

U.S. Treasury Notes — 1.25% 4/30/2019 |

189,000,000 |

188,214,970 |

|||||||||

|

U.S. Treasury Notes — 1.50% 1/31/2019 |

100,000,000 |

99,908,850 |

|||||||||

| TOTAL U.S. TREASURIES (Cost $1,031,884,641) |

$ |

1,031,758,367 |

|||||||||

| TOTAL BONDS & DEBENTURES (Cost $1,545,354,688) |

$ |

1,617,872,596 |

|||||||||

|

TOTAL INVESTMENT SECURITIES — 82.7% (Cost $10,402,712,851) |

$ |

11,338,841,787 |

|||||||||

|

SHORT-TERM INVESTMENTS — 16.0% |

|||||||||||

|

Apple, Inc. |

|||||||||||

| — 2.351% 1/7/2019 |

81,100,000 |

81,068,776 |

|||||||||

| — 2.351% 1/10/2019 |

200,000,000 |

199,884,500 |

|||||||||

| — 2.453% 1/30/2019 |

70,800,000 |

70,662,550 |

|||||||||

| — 2.463% 2/7/2019 |

98,500,000 |

98,255,009 |

|||||||||

|

Chevron Corp. |

|||||||||||

| — 2.351% 1/8/2019 |

200,000,000 |

199,910,167 |

|||||||||

| — 2.359% 1/10/2019 |

125,000,000 |

124,927,500 |

|||||||||

| — 2.42% 1/15/2019 |

58,100,000 |

58,046,225 |

|||||||||

| — 2.42% 1/23/2019 |

186,500,000 |

186,228,746 |

|||||||||

|

Coca-Cola Co. (The) — 2.596% 2/6/2019 |

25,000,000 |

24,936,250 |

|||||||||

|

Exxon Mobil Corp. |

|||||||||||

| — 2.368% 1/7/2019 |

85,000,000 |

84,966,992 |

|||||||||

| — 2.369% 1/16/2019 |

100,000,000 |

99,902,917 |

|||||||||

| — 2.369% 1/18/2019 |

139,000,000 |

138,847,061 |

|||||||||

|

General Electric Co. |

|||||||||||

| — 2.839% 1/2/2019 |

50,000,000 |

49,996,111 |

|||||||||

| — 2.995% 1/2/2019 |

92,000,000 |

91,992,461 |

|||||||||

| — 3.043% 1/2/2019 |

50,000,000 |

49,995,833 |

|||||||||

| — 3.096% 1/10/2019 |

179,000,000 |

178,863,513 |

|||||||||

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

SHORT-TERM INVESTMENTS — Continued |

Shares or Principal Amount |

Fair Value |

|||||||||

|

Nestle Capital Corp. |

|||||||||||

| — 2.318% 1/3/2019 |

$ |

100,000,000 |

$ |

99,987,333 |

|||||||

| — 2.329% 1/17/2019 |

100,000,000 |

99,898,222 |

|||||||||

| — 2.409% 1/10/2019 |

49,200,000 |

49,170,849 |

|||||||||

|

Wal-Mart Stores, Inc. |

|||||||||||

| — 2.386% 1/2/2019 |

75,000,000 |

74,995,104 |

|||||||||

| — 2.398% 1/9/2019 |

75,000,000 |

74,960,667 |

|||||||||

|

State Street Bank Repurchase Agreement — 0.50% 1/2/2019 (Dated 12/31/2018, repurchase price of $50,419,401, collateralized by $50,120,000 principal amount U.S. Treasury Notes — 2.875% 2025, fair value $51,428,232) (h) |

50,418,000 |

50,418,000 |

|||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $2,187,914,786) |

$ |

2,187,914,786 |

|||||||||

| TOTAL INVESTMENTS — 98.7% (Cost $12,590,627,637) |

$ |

13,526,756,573 |

|||||||||

|

SECURITIES SOLD SHORT — (3.2)% |

|||||||||||

|

COMMON STOCKS SOLD SHORT — (3.2)% |

|||||||||||

|

Pennsylvania Real Estate Investment Trust |

(592,070 |

) |

$ |

(3,516,896 |

) |

||||||

|

SPDR S&P Regional Banking ETF |

(5,468,450 |

) |

(255,868,775 |

) |

|||||||

|

Tencent Holdings, Ltd. (China) |

(923,900 |

) |

(37,030,210 |

) |

|||||||

|

Utilities Select Sector SPDR Fund |

(1,064,940 |

) |

(56,356,625 |

) |

|||||||

|

Volkswagen AG (Preference Shares) (Germany) |

(428,086 |

) |

(68,260,658 |

) |

|||||||

|

WW Grainger, Inc. |

(71,003 |

) |

(20,048,407 |

) |

|||||||

| TOTAL COMMON STOCKS SOLD SHORT (Proceeds $498,885,336) |

$ |

(441,081,571 |

) |

||||||||

|

Other Assets and Liabilities, net — 4.5% |

621,564,631 |

||||||||||

|

NET ASSETS — 100.0% |

$ |

13,707,239,633 |

|||||||||

(a) Non-income producing security.

(b) Affiliated Security.

(c) Restricted securities. These restricted securities constituted 4.00% of total net assets at December 31, 2018. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

(d) These securities have been valued in good faith under policies adopted by authority of the Board of Trustees in accordance with the Fund's fair value procedures. These securities constituted 1.92% of total net assets as of December 31, 2018.

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

(e) Investments that have been valued based on significant unobservable inputs as of December 31, 2018 (Level 3) (See Note 8 of the Notes to Financial Statements).

(f) Variable/Floating Rate Security — The rate shown is based on the latest available information as of December 31, 2018. For Senior Loan Notes, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(h) Security pledged as collateral (See Note 9 of the Notes to Financial Statements).

At December 31, 2018 the Fund held forward foreign currency contracts and options, which are considered derivative instruments, as follows:

Forward Foreign Currency Contracts

|

Counterparty |

Currency Purchased |

Currency Sold |

Settlement Date |

Valuation at December 31, 2018 |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||||||

|

Barclays Bank PLC |

USD |

102,236,930 |

EUR |

88,725,000 |

3/21/2019 |

$ |

102,321,985 |

— |

$ |

(85,055 |

) |

||||||||||||||||

|

Total |

$ |

102,321,985 |

— |

$ |

(85,055 |

) |

|||||||||||||||||||||

Purchased Options

|

Description |

Pay/ Receive Floating Rate |

Floating Rate Index |

Exercise Rate |

Expiration Date |

Counter- party |

Notional Amount |

Premium |

Fair Value |

|||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.122] |

0.12 |

% |

6/24/2021 |

Barclays Bank PLC |

$ |

763,000,000 |

$ |

1,999,060 |

$ |

2,716,280 |

|||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.162] |

0.16 |

% |

6/24/2021 |

Barclays Bank PLC |

690,000,000 |

2,001,000 |

3,067,740 |

||||||||||||||||||||||||||

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

Description |

Pay/ Receive Floating Rate |

Floating Rate Index |

Exercise Rate |

Expiration Date |

Counter- party |

Notional Amount |

Premium |

Fair Value |

|||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.100] |

0.10 |

% |

7/8/2021 |

Barclays Bank PLC |

$ |

749,000,000 |

$ |

1,999,830 |

$ |

2,771,300 |

|||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.141] |

0.14 |

% |

7/8/2021 |

Barclays Bank PLC |

658,000,000 |

2,000,320 |

3,016,930 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.198] |

0.20 |

% |

6/30/2023 |

Barclays Bank PLC |

678,000,000 |

2,000,100 |

2,423,850 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.273] |

0.27 |

% |

6/30/2023 |

Barclays Bank PLC |

608,000,000 |

2,000,320 |

2,683,104 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.187] |

0.19 |

% |

7/10/2023 |

Barclays Bank PLC |

658,000,000 |

2,000,320 |

2,388,540 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.269] |

0.27 |

% |

7/10/2023 |

Barclays Bank PLC |

597,000,000 |

1,999,950 |

2,648,292 |

||||||||||||||||||||||||||

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

Description |

Pay/ Receive Floating Rate |

Floating Rate Index |

Exercise Rate |

Expiration Date |

Counter- party |

Notional Amount |

Premium |

Fair Value |

|||||||||||||||||||||||||||

|

Call — 30-Year Interest Rate Agreement (c)(e) |

Receive |

3-Month USD-LIBOR |

0.01 |

% |

5/22/2020 |

Barclays Bank PLC |

$ |

100,000,000 |

$ |

21,930,000 |

$ |

22,164,000 |

|||||||||||||||||||||||

|

Call — 30-Year Interest Rate Agreement (c)(e) |

Receive |

3-Month USD-LIBOR |

0.01 |

% |

7/13/2020 |

Barclays Bank PLC |

90,081,096 |

18,962,071 |

19,474,272 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.143] |

0.14 |

% |

9/28/2021 |

Goldman Sachs Inter- national |

3,345,901,000 |

8,750,000 |

12,072,011 |

||||||||||||||||||||||||||

|

Call — CMS Cap Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.182] |

0.18 |

% |

9/28/2021 |

Goldman Sachs Inter- national |

2,805,494,000 |

8,811,000 |

12,344,174 |

||||||||||||||||||||||||||

|

Call — 30-Year Interest Rate Swap (c)(e) |

Receive |

Maximum of [0, 10-Year — 2-Year — USD-ISDA Swap Rate — 0.145] |

0.15 |

% |

10/4/2021 |

Morgan Stanley |

3,125,230,200 |

8,281,777 |

12,066,514 |

||||||||||||||||||||||||||

|

Call — 30-Year Interest Rate Swap (c)(e) |

Receive |

Maximum of [0, 30-Year — 2-Year — USD-ISDA Swap Rate — 0.190] |

0.19 |

% |

10/4/2021 |

Morgan Stanley |

2,605,964,690 |

8,209,344 |

13,723,010 |

||||||||||||||||||||||||||

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2018

|

Description |

Pay/ Receive Floating Rate |

Floating Rate Index |

Exercise Rate |

Expiration Date |

Counter- party |

Notional Amount |

Premium |

Fair Value |

|||||||||||||||||||||||||||

|

Call — 30-Year Interest Rate Agreement (c)(e) |

Receive |

3-Month USD-LIBOR |

0.01 |

% |

7/15/2027 |

Morgan Stanley |

$ |

89,879,161 |

$ |

18,542,071 |

$ |

18,639,770 |

|||||||||||||||||||||||

|

$ |

109,487,163 |

$ |

132,199,787 |

||||||||||||||||||||||||||||||||

|

Description |

Exercise Price |

Expiration Date |

Counterparty |

Notional Amount |

Premium |

Fair Value |

|||||||||||||||||||||

|

Call — JPY FX (e) |

$ |

95.00 |

3/24/2022 |

Barclays Bank PLC |

$ |

194,350,000 |

$ |

14,624,838 |

$ |

16,920,111 |

|||||||||||||||||

See accompanying Notes to Financial Statements.

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

December 31, 2018

|

Issuer |

Acquisition Date (s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

CMS CAP SWAPTION 0.100 JUL21 0.100 CALL Barclays Bank PLC .100% 07/08/2021 |

07/06/2018 |

$ |

1,999,830 |

$ |

2,771,300 |

0.02 |

% |

||||||||||||

|

CMS CAP SWAPTION 0.122 JUN21 0.122 CALL Barclays Bank PLC .122% 06/24/2021 |

06/22/2018 |

1,999,060 |

2,716,280 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.141 JUL21 0.141 CALL Barclays Bank PLC .141% 07/08/2021 |

07/06/2018 |

2,000,320 |

3,016,930 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.162 JUN21 0.162 CALL Barclays Bank PLC .162% 06/24/2021 |

06/22/2018 |

2,001,000 |

3,067,740 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.187 JUL23 0.187 CALL Barclays Bank PLC .187% 07/10/2023 |

07/06/2018 |

2,000,320 |

2,388,540 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.198 JUN23 0.198 CALL Barclays Bank PLC .198% 06/30/2023 |

06/28/2018 |

2,000,100 |

2,423,850 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.269 JUL23 0.269 CALL Barclays Bank PLC .269% 07/10/2023 |

07/06/2018 |

1,999,950 |

2,648,292 |

0.02 |

% |

||||||||||||||

|

CMS CAP SWAPTION 0.273 JUN23 0.273 CALL Barclays Bank PLC .273% 06/30/2023 |

06/28/2018 |

2,000,320 |

2,683,104 |

0.02 |

% |

||||||||||||||

|

CMS ENERGY CORP 0.143 OCT20 0.143 CALL Goldman Sachs International .143% 09/28/2021 |

09/28/2018 |

8,750,000 |

12,072,011 |

0.09 |

% |

||||||||||||||

|

CMS ENERGY CORP 0.182 NOV20 0.182 CALL Goldman Sachs International .182% 09/28/2021 |

09/28/2018 |

8,811,000 |

12,344,174 |

0.09 |

% |

||||||||||||||

|

CMS ENERGY CORP 0.145 MAR21 0.145 CALL Morgan Stanley .145% 10/04/2021 |

10/03/2018 |

8,281,777 |

12,066,514 |

0.09 |

% |

||||||||||||||

|

CMS ENERGY CORP 0.190 MAR21 0.190 CALL Morgan Stanley .190% 10/04/2021 |

10/03/2018 |

8,209,344 |

13,723,010 |

0.10 |

% |

||||||||||||||

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2018

|

Issuer |

Acquisition Date (s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

Call-Strike $0.0000.10; expires 05/22/2020; $100,000,000(Barclays Capital Counterparty) Barclays Bank PLC 05/22/2020 |

05/22/2017 |

$ |

21,930,000 |

$ |

22,164,000 |

0.16 |

% |

||||||||||||

|

Call-Strike $0.0000.10; expires 07/13/2020; $90,081,096.000 Barclays Bank PLC 07/13/2020 |

07/13/2017 |

18,962,071 |

19,474,272 |

0.14 |

% |

||||||||||||||

|

Call-Strike $0.0000.10; expires 07/15/2027; $89,879,161.000 Morgan Stanley & Co. International PLC 07/15/2027 |

07/13/2017 |

18,542,071 |

18,639,770 |

0.14 |

% |

||||||||||||||

|

FPS LLC |

10/17/2018, 12/10/2018, 12/17/2018 |

26,017,260 |

26,017,260 |

0.19 |

% |

||||||||||||||

|

GACP II L.P. |

01/12/2018, 02/27/2018, 04/13/2018, 05/17/2018, 06/21/2018, 06/28/2018, 11/27/2018 |

45,557,010 |

47,410,859 |

0.35 |

% |

||||||||||||||

|

Hall of Fame TL, 03/20/2019 |

03/20/2018 |

9,568,600 |

9,568,600 |

0.07 |

% |

||||||||||||||

|

Kamsarmax Shipping — 11.00% 09/10/2019 |

09/08/2015, 11/29/2016, 06/07/2017, 09/08/2017 |

7,302,153 |

7,302,153 |

0.05 |

% |

||||||||||||||

|

MEC Filo TL 1, 1M USD LIBOR 9.000% — 11.504% 02/12/2021 |

06/29/2018 |

19,202,100 |

19,202,100 |

0.14 |

% |

||||||||||||||

|

Nexeo Solutions, Inc. |

06/09/2016 |

156,526,500 |

153,847,003 |

1.12 |

% |

||||||||||||||

|

Nexeo Solutions, Inc. (Founders Shares) |

06/09/2016 |

20,390,669 |

31,332,575 |

0.23 |

% |

||||||||||||||

|

Northern Shipping — 7.80% 12/24/2019 |

12/22/2014 |

35,727,504 |

35,727,504 |

0.26 |

% |

||||||||||||||

|

Sound Holding FP (Luxembourg) |

10/07/2013 |

68,546,025 |

37,504,746 |

0.27 |

% |

||||||||||||||

25

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2018

|

Issuer |

Acquisition Date (s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

U.S. Farming Realty Trust, L.P. |

12/24/2012, 04/29/2013, 06/17/2013, 10/28/2013, 01/14/2014, 04/22/2014, 06/25/2014, 09/09/2014, 10/08/2014, 12/18/2014, 06/18/2015, 06/18/2015, 07/29/2015, 07/29/2015 |

$ |

27,527,690 |

$ |

35,842,205 |

0.26 |

% |

||||||||||||

|

U.S. Farming Realty Trust II, L.P. |

11/26/2010, 01/31/2011, 03/09/2011, 04/15/2011, 05/10/2011, 06/27/2011, 08/15/2011, 10/17/2011, 10/28/2011, 11/28/2011, 01/03/2012, 01/26/2012, 04/05/2012, 07/13/2012, 12/07/2012, 08/01/2013 |

11,336,412 |

11,796,930 |

0.09 |

% |

||||||||||||||

|

TOTAL RESTRICTED SECURITIES |

$ |

537,189,086 |

$ |

547,751,722 |

4.00 |

% |

|||||||||||||

See accompanying Notes to Financial Statements.

26

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

|

ASSETS |

|||||||

|

Investment securities — at fair value (identified cost $9,704,110,626) |

$ |

10,658,218,580 |

|||||

|

Investments in affiliates at fair value (identified cost $698,602,225) |

680,623,207 |

||||||

|

Short-term investments — at amortized cost (maturities 60 days or less) |

2,187,914,786 |

||||||

|

Purchased options, at value (premiums received $124,112,001) |

149,119,898 |

||||||

|

Cash |

457 |

||||||

|

Deposits for securities sold short |

504,761,918 |

||||||

|

Receivable for: |

|||||||

| Investment securities sold |

163,159,919 |

||||||

|

Investment affiliates sold |

3,491,771 |

||||||

|

Capital Stock sold |

31,218,278 |

||||||

|

Dividends and interest |

19,765,441 |

||||||

|

Total assets |

14,398,274,255 |

||||||

|

LIABILITIES |

|||||||

|

Payable for: |

|||||||

|

Securities sold short, at fair value (proceeds $498,885,336) |

441,081,571 |

||||||

|

Capital Stock repurchased |

107,673,236 |

||||||

|

Investment securities purchased |

64,307,091 |

||||||

|

Due to broker — OTC derivatives collateral |

63,991,158 |

||||||

|

Advisory fees |

12,544,139 |

||||||

|