UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-8544 | ||||||||

|

| |||||||||

|

FPA FUNDS TRUST | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

11601 WILSHIRE BLVD., STE. 1200 |

|

90025 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 |

Copy to:

MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 | ||||||||

|

(Name and address of agent for service) |

| ||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

(310) 473-0225 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

December 31 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

December 31, 2016 |

| |||||||

Item 1: Report to Shareholders.

Annual Report

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

December 31, 2016

FPA Crescent Fund

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholders:

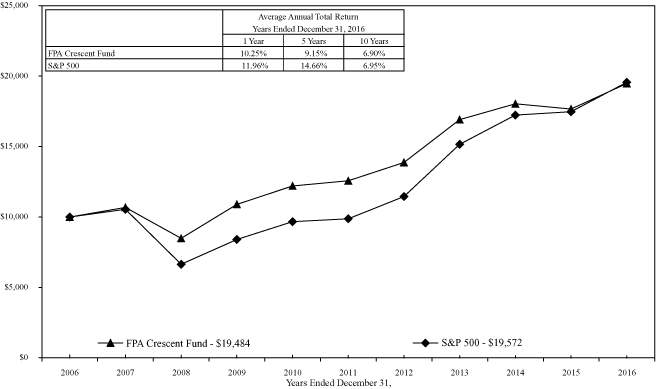

Performance

The markets continued to move higher in the fourth quarter after overcoming the initial misgivings surrounding the results of the U.S. election. The FPA Crescent Fund ("the Fund") returned 4.51% in the period and 10.25% for the full year. This compares to the 3.82% and 11.96%, respectively, for the S&P 500 and 1.19% and 7.86%, respectively, for the MSCI ACWI index.

As has been the case since the Fund's inception, Crescent outperformed its exposure in the quarter and full year.1 The alpha generated by our equity security selection, as shown in the table below, has helped the Fund meet its two-pronged goal of lower risk and equity-like returns despite maintaining large cash balances for extended periods.

FPA Crescent Long Equity Performance2

|

2016 |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

||||||||||||||||||||||||||||||||||

|

FPACX long equity |

15.19 |

% |

-1.04 |

% |

13.67 |

% |

39.62 |

% |

17.69 |

% |

6.25 |

% |

22.30 |

% |

38.39 |

% |

-38.27 |

% |

11.47 |

% |

|||||||||||||||||||||||

|

MSCI ACWI |

7.86 |

% |

-2.36 |

% |

4.16 |

% |

22.80 |

% |

16.13 |

% |

-7.35 |

% |

12.67 |

% |

34.63 |

% |

-42.19 |

% |

11.66 |

% |

|||||||||||||||||||||||

|

S&P 500 |

11.96 |

% |

1.38 |

% |

13.69 |

% |

32.39 |

% |

16.00 |

% |

2.11 |

% |

15.06 |

% |

26.46 |

% |

-37.00 |

% |

5.49 |

% |

|||||||||||||||||||||||

One of Crescent's secondary benchmarks, a balanced stock/bond blend (60% S&P 500/40% Barclays Aggregate Bond), has had a huge tailwind thanks to interest rates that steadily declined starting in 1982, through the Fund's inception in 1993 and up until 2016.

1 References to exposure in this context mean the Fund's non-cash/cash-equivalent assets.

2 Source: FPA and Morningstar Direct. Performance of the long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

The Barclays Aggregate Bond Index has compounded at 5.42%, far better than the return on our greater than 30% average cash balance since Crescent's inception thanks to this generational bond bull market. Despite what is a comparative headwind for the Fund, we have beaten the balanced benchmark from inception by 2.45%, although the Fund has lagged in the last five years by 0.54%.

We saw a reversal of this trend in Q4 with interest rates turning up, thereby causing bond prices to fall. The yield on the 10-year U.S. Treasury note increased from 1.60% at the end of Q3 to 2.45% at the end of Q4. A 0.85% increase in rates may not seem like much in basis points but a 53% increase in just three months wreaks havoc on a 10-year bond, causing a 7.3% decline in the value of its principal. As a result, the Barclays Aggregate Bond Index declined 2.98% in Q4 after having increased 5.80% for the first nine months of 2016.

FPA Crescent vs Balanced Benchmark

| 2016 |

FPACX |

60% S&P/40% Barclays Aggregate Bond |

S&P 500 |

Barclays Aggregate Bond |

|||||||||||||||

|

Q4 |

4.51 |

% |

1.10 |

% |

3.82 |

% |

-2.98 |

% |

|||||||||||

| 9 months |

5.50 |

% |

7.13 |

% |

7.84 |

% |

5.80 |

% |

|||||||||||

|

Full year |

10.25 |

% |

8.31 |

% |

11.96 |

% |

2.65 |

% |

|||||||||||

We don't know if the bull market in bonds has ended but given how low rates continue to be, it's hard to imagine the next decade will feature the same drop in interest rates (and rise in bond prices) that the last decade had. If, in fact, rates continue to rise from here — causing further losses in the bond market — Crescent's perpetual eschewing of interest rate risk should accrue to the benefit of our shareholders.

Morningstar nominated our team for 2016's U.S. Allocation/Alternatives Manager of the Year. Both longtime shareholders and Morningstar understand, though, that we judge our performance over full market cycles of which 2016 was just one calendar year. We appreciate their interim recognition nonetheless.

Portfolio

Our exposure to financial firms along with our investment in high-yield bonds both benefited 2016's performance as exhibited in the tables below.3 All but one of the winners were financials in the Q4 and full-year periods, the opposite of what we saw in Q1. The losers lacked a theme but it should be noted that our Naspers/Tencent arbitrage continued to suffer (see Q3 2014 commentary).

Performance Contribution Q4 2016

|

Winners |

Contribution |

Losers |

Contribution |

||||||||||||

|

Bank of America Corp. |

1.00 |

% |

Arconic Inc. |

-0.27 |

% |

||||||||||

|

Citigroup Inc. |

0.77 |

% |

Alcoa Inc. |

-0.16 |

% |

||||||||||

|

CIT Group Inc. |

0.49 |

% |

Thermo Fisher Scientific Inc. |

-0.14 |

% |

||||||||||

|

Leucadia National Corp. |

0.47 |

% |

Cisco Systems Inc. |

-0.10 |

% |

||||||||||

|

American International Group Inc. |

0.34 |

% |

Naspers/Tencent Pair Trade |

-0.09 |

% |

||||||||||

|

3.07 |

% |

-0.76 |

% |

||||||||||||

3 Reflects the top contributors and top detractors to the Fund's performance based on contribution to return for the quarter and year. Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

Performance Contribution Full-Year 2016

|

Winners |

Contribution |

Losers |

Contribution |

||||||||||||

|

Bank of America |

1.06 |

% |

Naspers/Tencent Pair Trade |

-0.51 |

% |

||||||||||

|

Aon PLC |

0.77 |

% |

Arconic Inc. |

-0.28 |

% |

||||||||||

|

Consol Energy Bonds (various issues) |

0.75 |

% |

Sound Holding FP Luxembourg |

-0.27 |

% |

||||||||||

|

Leucadia National Corp. |

0.71 |

% |

LPL Financial Holdings Inc. |

-0.14 |

% |

||||||||||

|

CIT Group Inc. |

0.70 |

% |

Legg Mason Inc. |

-0.14 |

% |

||||||||||

|

4.00 |

% |

-1.34 |

% |

||||||||||||

As lower-grade corporate bonds declined in price in late 2015 and early 2016, we quintupled our exposure. That sounds like a lot but, in truth, we took it from just ~1% to ~5%. The broader high-yield opportunity we hoped for didn't come to pass. Index yields traded above 10% for just one day in February 2016, and have subsequently declined to just 6.19% today.4 Our corporate bond investments outperformed the index, returning 41.87% in 2016 vs 17.49% for the BofA Merrill Lynch U.S. High Yield Index, and contributing 2.22% to Crescent's full year return.5

Our equity book was led by our overweight position in financials. The tale of our fluctuating financial exposure is emblematic of our approach to investing: Buy good businesses when others don't want to own them and avoid them when they're popular. Owning the unloved can be trying at times as these companies may be suffering from general economic weakness, industry malaise or internal missteps. Since we lack any ability to discern the bottom in a company's earnings or stock price, our initial purchases are generally early. That can be uncomfortable for the holder — or worse, the holder of the holder, like shareholders of a mutual fund, for example. The more removed one is from primary research, the less comfort understandably exists in observing a manager maintain a position while it's declining in price. Worse, if in that instance the manager were to increase its stake, a fund investor's discomfort may compound. We don't let our judgment become unduly influenced by stock price, preferring to focus instead on fundamentals.

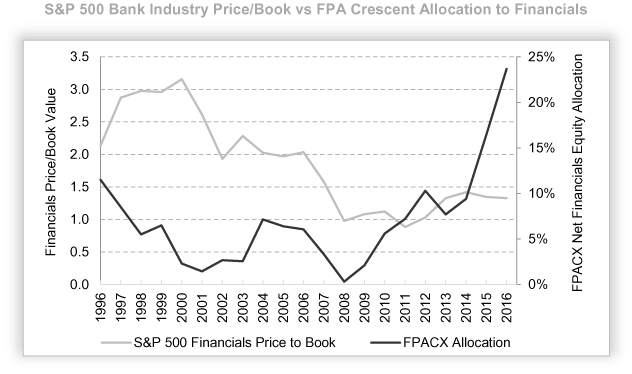

Going back to the Fund's inception, we have had an on/off affair with lenders (e.g., banks and thrifts). Using the S&P 500 Bank Industry Price/Book as a proxy for valuation, you can see that Crescent's exposure to financials has vacillated inversely. As lenders get cheaper (lower Price/Book), we buy. When they become more expensive (higher Price/Book), we sell. Therefore, when the bank index was at a high valuation in the late 1990s and early 2000s, Crescent's exposure was negligible but we reengaged when valuations were bottoming earlier this decade and our exposure has now increased to an all-time high.

4 Effective Yield for the BofA Merrill Lynch U.S. High Yield Index as of December 31, 2016.

5 Performance of the corporate bond segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

We lacked the foresight to build an entire position once the bottom had been reached in the financials or any other sector or asset class for that matter. As a result, we regularly endure periods of underperformance while waiting for our thesis to play out but our buying program generally continues as long as our opinion remains constant.

Lenders declined in price in 2015. We bought. They declined further. We bought some more. Early 2016 brought more of the same. Our investment in financials contributed to Crescent's performance lagging its exposure for a period of time. We had plenty of phone calls from shareholders questioning the wisdom of these investments. Those calls reached a crescendo in Q1 2016 when four of the five losers in the period were the same financials that round out the winners list in Q4. No surprise that Q1 was a bottom for the sector (and the market). Since we are closer to the investments than our shareholders, we can appreciate their discomfort. And yet discomfort is a kind of petri dish that cultures opportunity. Anxiety creates selling pressure and lower prices, which allows us to invest with a margin of safety.6 The comfort of going it alone is, for us, preferable to that of running with the crowd. In periods of such solitude, we hope we succeed in providing you a modicum of reassurance as we tried to do when we articulated our rationale for financials in our commentaries (particularly, Q1 and Q2 2016) and our conference calls.

Buying at a discount to a business's intrinsic value (as we did with the banks) offers downside protection but that doesn't mean we'll always make money. We can justify an investment if the upside case is much higher than the downside. Sometimes, though, the downside case materializes and we take a loss. We wouldn't characterize that as a mistake (though we can point to our share of blunders). Our long-formed habit of leaning into the wind will continue and Crescent's performance will disconnect from its benchmarks at times as a result.

6 Buying with a "margin of safety," a phrase popularized by Benjamin Graham and Warren Buffett, is when a security is purchased for less than its estimated value. This helps protect against permanent capital loss in the case of an unexpected event or analytical mistake. A purchase made with a margin of safety does not guarantee the security will not decline in price.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

What happens over short time frames should be entirely irrelevant. We instead maintain our focus on the longer term goal of achieving equity rates of return with less risk than the market and avoiding permanent impairment of capital. We appreciate that investment risk, like beauty, is in the eye of the beholder. We define it as losing money. For others, volatility, the institutionally accepted definition of risk, may be more appropriate. If we have $1,000 today and it drops to $750 next year, but then is worth $2,000 five years from now, we've compounded our capital at almost 15%. If, on the other hand, the 25% drop to $750 causes someone to sell, then they've unfortunately let price rather than value be their guide.

If volatility is your definition of risk, then we'd recommend not investing in stocks as there will invariably be a point in time that the markets will conspire against you and, in a meaningful correction, take prices down 20% or 30%...or more. We endeavor to create a portfolio that shouldn't bear the worst of such a downdraft. Market moves of smaller magnitudes, say 5%-10% up or down, are nothing more than noise. Crescent will do better or worse in these smaller moves over shorter time frames, consistent with its non-index hugging history.

Although there really isn't much wind to lean into at the moment, healthcare has underperformed, one of the few sectors to decline last year.

As you should have come to expect, we've spent a fair amount of time recently looking at various companies across the different subsectors (e.g., pharma, distributors, hospitals, medical equipment, insurance, etc.). Though the portfolio had negligible exposure to the healthcare industry at large over the past year, we are familiar with many of the participants and actually had in excess of 14% of the Fund invested in the sector as recently as 2014. Thus far, we have made a few purchases but they've been small and we'd prefer not to discuss them further at this time. However, the activity is yet another illustration of how the Fund opportunistically allocates capital across industries.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

We're always on the hunt for those businesses that other investors have placed in the penalty box. We are finding that today, however, there are numerous companies that we'd expect to be unloved or underappreciated but aren't. We'd love to be more invested. The reason that we aren't is that stocks aren't generally cheap — as we've regularly discussed these past few years. The reason half the book wasn't in financials is that Crescent doesn't seek to take such risks that are disproportionate to being able to achieve our risk-adjusted return objective. The reason that we haven't found more to do is a function of price, not diligence.

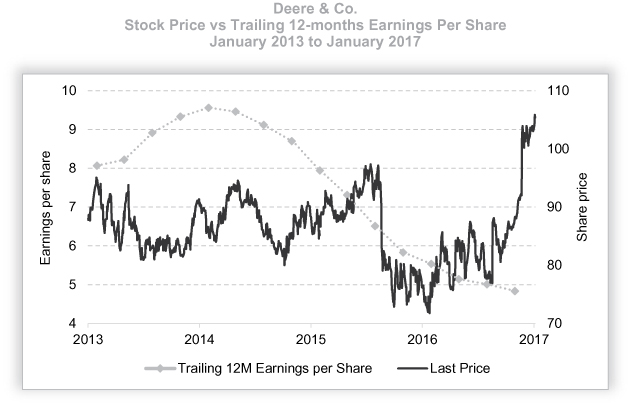

Take Deere, for example. A superior company long known for its wide range of high-quality agricultural equipment and leading U.S. market share, Deere has, nevertheless, not been immune to weaker farm economics. The U.S. has been challenged. Brazil has been horrible. What Deere hoped to accomplish in Eastern Europe changed when Putin's troops marched into Crimea. Success in the low horsepower Indian market has been slow coming. Deere's sales worldwide have declined almost 30% from their 2013 peak while earnings per share have plunged almost 50%. A chart of its stock price and earnings per share suggests something entirely different however. Its stock has hit a new, all-time high while earnings are back at 2010 levels. Where's the margin of safety in the purchase of shares now trading at 21.8x trailing twelve month earnings?7 Deere's mid-cycle earnings should be higher, which would make the normalized valuation not quite as dear but we miss when such companies would trade as if the bad times would last forever. We aren't picking on Deere. There's lots of stuff that crosses our desks that hasn't made much sense.

7 Bloomberg. Price as of January 5, 2017.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

For a spell, the stock prices of some companies will defy logic but that won't last forever. Eventually, fundamentals should prevail. In the interim, stock prices can trade anywhere. We hope to populate the Fund with quality companies whose current earnings fail to appropriately reflect longer-term prospects. Sadly, we're finding a lot of Deeres out there, which explains that for as long as we can remember, we went an entire quarter (Q3 2016) without initiating a new position.

Just because the market isn't rife with opportunity doesn't mean that stocks can't go higher. Some investors feel the need to "keep up", which can lead to certain sacrifices like rationalizing a lower business quality, accepting a weaker balance sheet, tolerating weak management with poor corporate governance or justifying a more expensive valuation. We won't, at least not intentionally. Despite the natural tension between doing something versus doing nothing at all, we will remain the same principled investors who have guided this Fund since its inception more than 23 years ago. We won't likely capture all of the upside in rising markets but we do hope to avoid all of the downside in declining ones.

Economy/Markets

The general consensus appears to be that President-elect Trump will revive the animal spirits that will lift our economy and our stock market. His proposed lower corporate tax rates would make a pricey market less so. U.S. companies might also be able to repatriate foreign-domiciled cash at a low tax rate. There is an expectation that the additional cash from tax savings will be recycled back through the U.S. economy through higher or special dividends, share repurchases, capital investment and/or acquisitions.8

Moreover, there's talk of as much as a $1 trillion infrastructure spending program for the necessary rebuilding of U.S. roads, bridges, ports and other projects. All of these measures should be a stimulus but we don't know what the long-term effect will be on the already near $20 trillion in national debt.

On the other side of the ledger as a risk to the U.S. economy, Trump has spoken aggressively about protecting U.S. jobs. Subsequent action could start a trade war. We don't want to see the decades-long path to globalization reversed. Higher trade tariffs and barriers will lessen global trade and increase import prices and potentially increase domestic production costs due to diminishing economies of scale.

As former U.S. Treasury Secretary Lawrence Summers points out, "This is probably the largest transition ideologically and in terms of substantive policy that we've seen in the U.S. in the last three quarters of a century."9

We have no idea what comes next but we do know that the largest engine of our economy — the consumer — isn't firing on all cylinders and some broader trends are concerning: The mortgage refinance boom has ended thanks to rising interest rates, housing affordability has declined to an eight-year low, the growth rate of per-capita discretionary income has been slashed by more than half in two years, and gasoline prices have risen 27% since their February lows and appear headed higher.10 Although the case today, this could always be temporary.

We build a potentially treacherous environment into our models in the downside scenarios for our individual investments. Most things have a price at which we'd be buyers. Today, however, asset prices have had tremendous

8 World Bank and Goldman Sachs. Market capitalization of U.S. listed companies ~$25 trillion (World Bank). $1 trillion of cash held overseas. If $300 billion repatriated at 10% tax rate, then $270 billion would be available for share buybacks, dividends, acquisitions, and capital investment. $270 billion / $25 trillion = 1.1%.

9 Bloomberg television: "Bloomberg Surveillance," Tom Keene. January 3, 2017.

10 Housing affordability data from ATTOM Data Solutions. The affordability index is based on the percentage of average wages needed to make monthly house payments on a median-priced home with a 30-year fixed rate and a 3 percent down payment.

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

support globally from the indiscriminate buyer, the likes of which we have never seen, thanks to both quasi-government action and the trend towards passive investing. We lump central banks into the government category because we find it hard to find the distinction that divides the world's central bankers from the elected officials who appoint them.

The general attitude seems to be to flood economies with so much money that they have to get moving again. So far, the only thing really moving are asset prices and generally in one direction: up. Price distortions can't help but develop as a result.

The Bank of Japan (BOJ) was the biggest buyer of Japanese ETFs in 2016 for the second consecutive year, more than offsetting shares sold by foreign investors.11

The European Central Bank (ECB) has been aggressively buying corporate bonds since mid-year 2016. As of December 31, 2016, the ECB held about €51 billion of corporates, which equates to 7%-8% of an estimated €600-€700 billion eligible market. JP Morgan estimates that this could rise to more than 20% by year-end 2017.12

Our own U.S. Federal Reserve's balance sheet has almost quintupled since 2009, using its expanded capacity to now own $2.5 trillion worth of U.S. Treasury securities and $1.7 trillion of mortgage-backed securities.13

Low interest rates, the printing of money and artificial buying support have created pricing distortions. Deere might be one example but not anywhere near the most egregious. Consider that Henkel and Sanofi became the first public companies to sell new Euro bonds to investors for more than buyers will receive in return. Henkel found lenders willing to pay them 0.05% for a bond with a 2-year maturity. Sanofi did Henkel one better, also borrowing at -0.05% but for 3.5 years. When compared to the 2-year German Bund that had bond holders paying the German government 0.67%, both of these corporate issues seemed favorable at the time.14

As the U.S. stock market continues to perform well, more dollars continue to flow into passive funds such as ETFs and index funds. Buy programs are initiated to put these incremental dollars to work, ultimately influencing thousands of stock prices without regard to relative value of the underlying businesses.

A good example of this was the reaction of bank stocks immediately following the presidential election. Bank stocks deserved to rise, all else equal, given the likelihood of less restrictive governmental regulation and the benefits of rising interest rates for those institutions with asset-sensitive balance sheets. However, little distinction seemed to be made between those banks that would be helped by rising rates and those that would be hurt. The latter includes banks whose liabilities reprice faster than their assets and those with larger mortgage origination businesses that saw their stock prices rise in line with their more advantaged brethren.

We don't suggest that passive management is bad and that active management is good. They can both be effective tools, if used wisely. It's hard to argue with passive investing's lower fees, tax efficiency and market-matching performance. Passive investing, however, is only as good as an investor's ability to buy and hold those funds in periods of volatility. Excessive shareholder turnover could cause a typical investor to underperform the benchmark even in a passive fund. To the detriment of long-term returns, most investors have shown a greater propensity to sell into a bear market and then not return until the market has rebounded to levels above where they initially sold. In our view, these investors exchange the higher fees of actively-managed funds for an illusory peace of mind associated with passive investing.

11 Nikkei Asian Review. December 25, 2016.

12 JP Morgan. European Credit Outlook & Strategy 2017: Frankfurt Syndrome. November 17, 2016. Doctor, et al.

13 St. Louis Fed (https://fred.stlouisfed.org/series/WALCL).

14 The first euro corporate bond was state-owned German rail company Deutsche Bahn, priced to yield -0.006%.

8

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Continued

Many active managers offer little by way of differentiation, structuring portfolios that all too often mimic an index but at a higher fee. Such "closet" index funds are silly. Others, however, offer real differentiation both in terms of portfolio composition and downside protection. Crescent, for example, benefits from its unusual breadth, investing in different regions and asset classes and exhibiting a willingness to sit on the sidelines while waiting for better opportunities (hopefully to the benefit of our investors even if it might prove to the detriment of our business). We can act quickly when we find something attractive, which is particularly important when there's only a narrow window of time in which to take advantage of the opportunity. Our team's flexibility to invest in stocks and/or bonds, whether they be domestic or international, and/or in the periodic special situation opportunities we come across has translated into something differentiated — attractive risk-adjusted returns over full market cycles. As managers, we are definitely out of the proverbial closet. That makes it challenging to use just one index as a benchmark which is why we offer a number: a domestic and international stock index, a balanced benchmark and the rate of inflation.

Passive U.S. equity assets now total $5 trillion (up from $4 trillion at the end of 2015) and represent approximately 20% of U.S. market capitalization. Passive investing's market share will likely continue to increase as long as the stock market rise continues unabated. There is some natural limit to passive investing's penetration as without any research and indiscriminate buying there is no price discovery, fewer dollars available for IPOs and secondary offerings, and less of an ability to hold managements accountable. That, therefore, puts some theoretical upper threshold on passive share yet it could still be far larger than it is today.

Similarly, the influence of central banks is not infinite. Their balance sheets are already larger than they've ever been and there are only so many assets that can be purchased. For that, all they've been able to exhibit thus far is some control over the pricing of risk assets (and derivatively the financial system).

Closing

We like to ski when there's soft snow covering the slopes. When ski conditions are poor, you're more likely to get hurt. Investing is no different. Money can be made when the market is rising just like one can conceivably get down a mountain of icy slopes without breaking a bone but taking that risk is open to question. Give us some powder in the form of good valuations and you'll see us put some capital to work.

Low and negative interest rates, amongst the aforementioned artificial forces, have pulled forward spending, benefiting today's economy at the expense of tomorrow's. We suspect that will cause some market disruption...one day. That fallout could be toxic but should create the kinds of opportunities we seek but we need to be careful what we wish for too.

Investing other people's money is a great responsibility and is based on trust. We're not going to deliver market rates of return with less risk over time by investing the same as the market, which means that our returns when compared to the market will differ wildly at times — for better or worse. Here's to being different.

Respectfully submitted,

Steven Romick

Co-Portfolio Manager

January 15, 2017

9

FPA CRESCENT FUND

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

10

FPA CRESCENT FUND

HISTORICAL PERFORMANCE

(Unaudited)

Change in Value of a $10,000 Investment in FPA Crescent Fund vs. S&P 500, Consumer Price Index and 60% S&P 500/40% BC Agg for the Ten Years Ended December 31, 2016

The Standard & Poor's 500 Composite Index (S&P 500) is an unmanaged index that is generally representative of the U.S. stock market. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The Barclays Capital U.S. Aggregate Bond Index (BC Agg) is a broadbased unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index (the index holds investment quality bonds); the blended benchmark is a hypothetical combination of unmanaged indices, reflecting a neutral mix of approximately 60% stocks and 40% bonds. The performance of the Fund is computed on a total return basis which includes reinvestment of all distributions. There can be no guarantee that the Consumer Price Index or other indexes will reflect the exact level of inflation at any given time. It is not possible to invest directly in an unmanaged index. Unless otherwise noted, index returns reflect the reinvestment of dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 31 and 35. The Prospectus details the Fund's objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpafunds.com, by email at crm@fpafunds.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

11

FPA CRESCENT FUND

PORTFOLIO SUMMARY

December 31, 2016

|

Common Stocks |

62.4 |

% |

|||||||||

|

Aircraft & Parts |

7.9 |

% |

|||||||||

|

Infrastructure Software |

6.1 |

% |

|||||||||

|

Diversified Banks |

5.7 |

% |

|||||||||

|

Internet Media |

4.5 |

% |

|||||||||

|

Investment Companies |

3.8 |

% |

|||||||||

|

P&C Insurance |

3.2 |

% |

|||||||||

|

Consumer Finance |

3.1 |

% |

|||||||||

|

Entertainment Content |

2.9 |

% |

|||||||||

|

Commercial Finance |

2.9 |

% |

|||||||||

|

Insurance Brokers |

2.8 |

% |

|||||||||

|

Semiconductor Devices |

2.4 |

% |

|||||||||

|

Communications Equipment |

2.1 |

% |

|||||||||

|

Electrical Components |

2.0 |

% |

|||||||||

|

Advertising & Marketing |

1.4 |

% |

|||||||||

|

Base Metals |

1.3 |

% |

|||||||||

|

Electrical Power Equipment |

1.2 |

% |

|||||||||

|

Integrated Oils |

1.1 |

% |

|||||||||

|

Specialty Chemicals |

1.1 |

% |

|||||||||

|

Other Common Stocks |

1.1 |

% |

|||||||||

|

Life Science Equipment |

1.0 |

% |

|||||||||

|

Food & Drug Stores |

0.9 |

% |

|||||||||

|

Containers & Packaging |

0.9 |

% |

|||||||||

|

Institutional Brokerage |

0.9 |

% |

|||||||||

|

Investment Management |

0.7 |

% |

|||||||||

|

Reinsurance |

0.6 |

% |

|||||||||

|

Household Products |

0.4 |

% |

|||||||||

|

Exploration & Production |

0.3 |

% |

|||||||||

|

Marine Shipping |

0.1 |

% |

|||||||||

|

Limited Partnerships |

0.4 |

% |

|||||||||

|

Preferred Stocks |

0.1 |

% |

|||||||||

|

Bonds & Debentures |

36.1 |

% |

|||||||||

|

U.S. Treasuries |

29.8 |

% |

|||||||||

|

Corporate Bonds & Notes |

4.6 |

% |

|||||||||

|

Asset-Backed Securities |

0.7 |

% |

|||||||||

|

Convertible Bonds |

0.4 |

% |

|||||||||

|

Residential Mortgage-Backed Securities |

0.4 |

% |

|||||||||

|

Corporate Bank Debt |

0.2 |

% |

|||||||||

|

Put Options Purchased |

0.1 |

% |

|||||||||

|

Short-term Investments |

1.8 |

% |

|||||||||

|

Securities Sold Short |

(5.1 |

)% |

|||||||||

|

Other Assets And Liabilities, Net |

4.2 |

% |

|||||||||

|

Net Assets |

100.0 |

% |

|||||||||

12

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

December 31, 2016

|

COMMON STOCKS |

Shares |

Fair Value |

|||||||||

|

AIRCRAFT & PARTS — 7.9% |

|||||||||||

|

Arconic, Inc. |

15,228,573 |

$ |

282,337,743 |

||||||||

|

Esterline Technologies Corporation*,§ |

2,863,871 |

255,457,293 |

|||||||||

|

Meggitt plc (Britain)§ |

41,729,847 |

235,848,142 |

|||||||||

|

United Technologies Corporation |

4,868,590 |

533,694,836 |

|||||||||

|

$ |

1,307,338,014 |

||||||||||

|

INFRASTRUCTURE SOFTWARE — 6.1% |

|||||||||||

|

Microsoft Corporation |

6,327,480 |

$ |

393,189,607 |

||||||||

|

Oracle Corporation |

15,945,530 |

613,105,629 |

|||||||||

|

$ |

1,006,295,236 |

||||||||||

|

DIVERSIFIED BANKS — 5.7% |

|||||||||||

|

Bank of America Corporation |

20,202,520 |

$ |

446,475,692 |

||||||||

|

Citigroup, Inc. |

8,308,010 |

493,745,034 |

|||||||||

|

$ |

940,220,726 |

||||||||||

|

INTERNET MEDIA — 4.5% |

|||||||||||

|

Alphabet, Inc. (Class A)* |

220,277 |

$ |

174,558,509 |

||||||||

|

Alphabet, Inc. (Class C)* |

220,881 |

170,480,373 |

|||||||||

|

Baidu, Inc. (ADR) (China)* |

1,282,010 |

210,775,264 |

|||||||||

|

Yahoo!, Inc.* |

4,847,270 |

187,443,931 |

|||||||||

|

$ |

743,258,077 |

||||||||||

|

INVESTMENT COMPANIES — 3.8% |

|||||||||||

|

Groupe Bruxelles Lambert SA (Belgium) |

2,851,023 |

$ |

239,250,127 |

||||||||

|

Leucadia National Corporation |

17,107,960 |

397,760,070 |

|||||||||

|

$ |

637,010,197 |

||||||||||

|

P&C INSURANCE — 3.2% |

|||||||||||

|

American International Group, Inc. |

8,092,730 |

$ |

528,536,196 |

||||||||

|

CONSUMER FINANCE — 3.1% |

|||||||||||

|

Ally Financial, Inc. |

9,942,850 |

$ |

189,113,007 |

||||||||

|

American Express Co. |

4,479,810 |

331,864,325 |

|||||||||

|

$ |

520,977,332 |

||||||||||

|

ENTERTAINMENT CONTENT — 2.9% |

|||||||||||

|

Naspers, Ltd. (N Shares) (South Africa) |

3,281,487 |

$ |

481,238,566 |

||||||||

|

COMMERCIAL FINANCE — 2.9% |

|||||||||||

|

CIT Group, Inc.§ |

11,225,440 |

$ |

479,101,779 |

||||||||

|

INSURANCE BROKERS — 2.8% |

|||||||||||

|

Aon plc (Britain) |

4,164,700 |

$ |

464,488,991 |

||||||||

13

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

COMMON STOCKS — Continued |

Shares |

Fair Value |

|||||||||

|

SEMICONDUCTOR DEVICES — 2.4% |

|||||||||||

|

Analog Devices, Inc. |

3,731,890 |

$ |

271,009,852 |

||||||||

|

QUALCOMM, Inc. |

1,815,560 |

118,374,512 |

|||||||||

|

$ |

389,384,364 |

||||||||||

|

COMMUNICATIONS EQUIPMENT — 2.1% |

|||||||||||

|

Cisco Systems, Inc. |

11,780,410 |

$ |

356,003,990 |

||||||||

|

ELECTRICAL COMPONENTS — 2.0% |

|||||||||||

|

TE Connectivity, Ltd. (Switzerland) |

4,875,610 |

$ |

337,782,261 |

||||||||

|

ADVERTISING & MARKETING — 1.4% |

|||||||||||

|

WPP plc (Britain) |

10,389,420 |

$ |

232,519,169 |

||||||||

|

BASE METALS — 1.3% |

|||||||||||

|

Alcoa Corporation |

4,810,740 |

$ |

135,085,579 |

||||||||

|

MMC Norilsk Nickel PJSC (ADR) (Russia) |

4,377,920 |

73,505,277 |

|||||||||

|

$ |

208,590,856 |

||||||||||

|

ELECTRICAL POWER EQUIPMENT — 1.2% |

|||||||||||

|

General Electric Co. |

6,349,230 |

$ |

200,635,668 |

||||||||

|

INTEGRATED OILS — 1.1% |

|||||||||||

|

Gazprom PJSC (ADR) (Russia) |

12,690,400 |

$ |

64,086,520 |

||||||||

|

Lukoil PJSC (ADR) (Russia) |

1,455,100 |

81,631,110 |

|||||||||

|

Rosneft Oil Co. PJSC (GDR) (Russia) |

5,711,200 |

37,122,800 |

|||||||||

|

$ |

182,840,430 |

||||||||||

|

SPECIALTY CHEMICALS — 1.1% |

|||||||||||

|

Nexeo Solutions, Inc.*,§,** |

17,691,717 |

$ |

164,709,885 |

||||||||

|

Nexeo Solutions, Inc. (Founders Shares)*,§,††,** |

2,431,709 |

10,639,909 |

|||||||||

|

$ |

175,349,794 |

||||||||||

|

LIFE SCIENCE EQUIPMENT — 1.0% |

|||||||||||

|

Thermo Fisher Scientific, Inc. |

1,134,900 |

$ |

160,134,390 |

||||||||

|

FOOD & DRUG STORES — 0.9% |

|||||||||||

|

Jardine Strategic Holdings, Ltd. (Hong Kong) |

2,674,240 |

$ |

88,784,768 |

||||||||

|

Lenta, Ltd. (GDR) (Russia)*,**,†† |

8,153,870 |

66,861,734 |

|||||||||

|

$ |

155,646,502 |

||||||||||

|

CONTAINERS & PACKAGING — 0.9% |

|||||||||||

|

Owens-Illinois, Inc.*,§ |

8,912,900 |

$ |

155,173,589 |

||||||||

14

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

COMMON STOCKS — Continued |

Shares or Principal Amount |

Fair Value |

|||||||||

|

INSTITUTIONAL BROKERAGE — 0.9% |

|||||||||||

|

LPL Financial Holdings, Inc. |

4,165,970 |

$ |

146,683,804 |

||||||||

|

INVESTMENT MANAGEMENT — 0.7% |

|||||||||||

|

Legg Mason, Inc. |

3,669,319 |

$ |

109,749,331 |

||||||||

|

REINSURANCE — 0.6% |

|||||||||||

|

Alleghany Corporation* |

153,351 |

$ |

93,255,810 |

||||||||

|

HOUSEHOLD PRODUCTS — 0.4% |

|||||||||||

|

Unilever NV (CVA) (Britain) |

1,756,570 |

$ |

72,325,753 |

||||||||

|

EXPLORATION & PRODUCTION — 0.3% |

|||||||||||

|

Occidental Petroleum Corporation |

620,540 |

$ |

44,201,064 |

||||||||

|

MARINE SHIPPING — 0.1% |

|||||||||||

|

Sound Holding FP (Luxembourg)§,††,** |

1,146,250 |

$ |

24,564,336 |

||||||||

|

OTHER COMMON STOCKS — 1.1% |

$ |

174,905,179 |

|||||||||

| TOTAL COMMON STOCKS — 62.4% (Cost $8,018,476,709) |

$ |

10,328,211,404 |

|||||||||

|

LIMITED PARTNERSHIPS — 0.4% |

|||||||||||

|

U.S. Farming Realty Trust, L.P.** |

350,000 |

$ |

40,557,405 |

||||||||

|

U.S. Farming Realty Trust II, L.P.** |

120,000 |

12,911,148 |

|||||||||

|

WLRS Fund I LLC§,††,** |

968 |

7,352,285 |

|||||||||

| TOTAL LIMITED PARTNERSHIPS — 0.4% (Cost $48,444,512) |

$ |

60,820,838 |

|||||||||

|

PREFERRED STOCK — 0.1% |

|||||||||||

|

INTEGRATED OILS — 0.1% |

|||||||||||

|

Surgutneftegas OJSC (Preference Shares) (Russia) (Cost $27,221,319) |

39,322,900 |

$ |

20,557,265 |

||||||||

|

BONDS & DEBENTURES |

|||||||||||

|

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 0.4% |

|||||||||||

|

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 0.4% |

|||||||||||

|

Stanwich Mortgage Loan Trust Series (2012-2 A) 0.00% 3/15/2047**,@,†† |

$ |

3,996,772 |

$ |

1,698,628 |

|||||||

|

Stanwich Mortgage Loan Trust Series (2011-2 A) 0.00% 9/15/2050**,@,†† |

5,778,920 |

3,092,901 |

|||||||||

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2012-4 A) 0.00% 6/15/2051**,@,†† |

$ |

8,123,327 |

$ |

3,736,730 |

|||||||

|

Stanwich Mortgage Loan Trust Series (2010-3 A) 0.301% 7/31/2038**,@,†† |

3,244,854 |

1,623,401 |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2011-1 A) 0.645% 8/15/2050**,@,†† |

8,934,816 |

4,712,481 |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2009-2 A) 0.958% 2/15/2049**,@,†† |

1,062,568 |

475,181 |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2010-1 A) 1.183% 9/30/2047**,@,†† |

1,102,548 |

557,669 |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2010-4 A) 1.498% 8/31/2049**,@,†† |

4,665,096 |

2,355,873 |

|||||||||

|

Stanwich Mortgage Loan Trust Series (2010-2 A) 1.621% 2/28/2057**,@,†† |

7,779,905 |

3,922,628 |

|||||||||

|

Sunset Mortgage Loan Co. LLC (2014-NPL1 A) 3.228% 8/16/2044**,@@ |

18,512,036 |

18,520,472 |

|||||||||

|

Sunset Mortgage Loan Co. LLC (2015-NPL1 A) 4.459% 9/18/2045**,@@ |

29,485,494 |

29,632,783 |

|||||||||

|

$ |

70,328,747 |

||||||||||

|

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES (Cost $69,869,318) |

$ |

70,328,747 |

|||||||||

|

ASSET-BACKED SECURITIES — 0.3% |

|||||||||||

|

RELP 10 — 9.50% 11/20/2017**,†† |

$ |

5,822,019 |

$ |

5,822,019 |

|||||||

|

RELP 11 — 10.00% 8/4/2018**,†† |

17,934,254 |

17,934,254 |

|||||||||

|

RELP 8 — 10.00% 10/19/2017**,†† |

10,620,434 |

10,620,434 |

|||||||||

|

RELP 9 — 9.00% 4/29/17**,†† |

10,320,000 |

10,320,000 |

|||||||||

|

$ |

44,696,707 |

||||||||||

|

OTHER — 0.4% |

|||||||||||

|

Ship Loan Participation — 7.80% 12/23/2019**,@,†† |

$ |

48,923,846 |

$ |

48,923,846 |

|||||||

|

Ship Loan Participation II — 11.00% 9/10/2018**,@,†† |

16,374,200 |

16,374,200 |

|||||||||

|

$ |

65,298,046 |

||||||||||

| TOTAL ASSET-BACKED SECURITIES (Cost $109,994,753) |

$ |

109,994,753 |

|||||||||

|

CORPORATE BONDS & NOTES — 4.6% |

|||||||||||

|

BASIC MATERIALS — 0.1% |

|||||||||||

|

Glencore Funding LLC — 4.625% 4/29/2024** |

$ |

4,700,000 |

$ |

4,794,000 |

|||||||

|

Glencore Funding LLC — 2.875% 4/16/2020** |

9,100,000 |

9,031,750 |

|||||||||

|

Glencore Finance Canada, Ltd. — 4.25% 10/25/2022** |

8,150,000 |

8,313,000 |

|||||||||

|

$ |

22,138,750 |

||||||||||

|

CONSUMER, CYCLICAL — 0.9% |

|||||||||||

|

Navistar International Corporation — 8.25% 11/1/2021 |

$ |

143,177,000 |

$ |

144,340,313 |

|||||||

|

ENERGY — 2.1% |

|||||||||||

|

California Resources Corporation — 5.00% 1/15/2020 |

$ |

2,171,000 |

$ |

1,780,220 |

|||||||

|

California Resources Corporation — 5.50% 9/15/2021 |

8,984,000 |

6,917,680 |

|||||||||

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

California Resources Corporation — 6.00% 11/15/2024 |

$ |

2,171,000 |

$ |

1,563,120 |

|||||||

|

California Resources Corporation 2nd Lien — 8.00% 12/15/2022** |

35,750,000 |

31,817,500 |

|||||||||

|

CONSOL Energy, Inc. — 5.875% 4/15/2022 |

196,666,000 |

193,838,926 |

|||||||||

|

CONSOL Energy, Inc. — 8.00% 4/1/2023 |

77,110,000 |

79,134,137 |

|||||||||

|

CONSOL Energy, Inc. — 8.25% 4/1/2020 |

5,650,000 |

5,635,875 |

|||||||||

|

Rice Energy, Inc. — 6.25% 5/1/2022 |

16,731,000 |

17,191,103 |

|||||||||

|

Southwestern Energy Co. — 4.10% 3/15/2022 |

3,800,000 |

3,588,625 |

|||||||||

|

$ |

341,467,186 |

||||||||||

|

FINANCIAL — 0.4% |

|||||||||||

|

iStar, Inc. — 5.85% 3/15/2017 |

$ |

4,964,000 |

$ |

4,976,410 |

|||||||

|

Springleaf Finance Corporation — 6.90% 12/15/2017 |

15,366,000 |

15,942,225 |

|||||||||

|

Springleaf Finance Corporation — 6.50% 9/15/2017 |

8,980,000 |

9,249,400 |

|||||||||

|

Walter Investment Management Corporation — 7.875% 12/15/2021 |

53,600,000 |

43,351,680 |

|||||||||

|

$ |

73,519,715 |

||||||||||

|

INDUSTRIAL — 1.1% |

|||||||||||

|

Bombardier, Inc. — 7.75% 3/15/2020** |

$ |

28,058,000 |

$ |

29,531,045 |

|||||||

|

Bombardier, Inc. — 4.75% 4/15/2019** |

4,893,000 |

4,917,465 |

|||||||||

|

Bombardier, Inc. — 5.75% 3/15/2022** |

13,800,000 |

12,972,000 |

|||||||||

|

Bombardier, Inc. — 6.125% 1/15/2023** |

29,534,000 |

28,027,766 |

|||||||||

|

Bombardier, Inc. — 6.00% 10/15/2022** |

12,670,000 |

11,909,800 |

|||||||||

|

Bombardier, Inc. — 7.50% 3/15/2025** |

82,750,000 |

81,757,000 |

|||||||||

|

Bombardier, Inc. — 7.45% 5/1/2034** |

5,800,000 |

5,089,500 |

|||||||||

|

$ |

174,204,576 |

||||||||||

| TOTAL CORPORATE BONDS & NOTES (Cost $592,654,351) |

$ |

755,670,540 |

|||||||||

|

CORPORATE BANK DEBT — 0.2% |

|||||||||||

|

Walter Investment Management Corporation — 4.75% 12/18/2020** (Cost $31,528,158) |

$ |

38,214,067 |

$ |

36,191,396 |

|||||||

|

CONVERTIBLE BONDS — 0.4% |

|||||||||||

|

Navistar International Corporation — 4.50% 10/15/2018 |

$ |

22,938,000 |

$ |

22,307,205 |

|||||||

|

Navistar International Corporation — 4.75% 4/15/2019 |

34,244,000 |

33,516,315 |

|||||||||

|

Walter Investment Management Corporation — 4.50% 11/1/2019 |

28,841,000 |

19,900,290 |

|||||||||

| TOTAL CONVERTIBLE BONDS (Cost $72,346,020) |

$ |

75,723,810 |

|||||||||

|

U.S. TREASURIES — 29.8% |

|||||||||||

|

U.S. Treasury Notes — 0.50% 1/31/2017 |

$ |

100,000,000 |

$ |

99,988,280 |

|||||||

|

U.S. Treasury Notes — 0.50% 3/31/2017 |

100,000,000 |

99,975,500 |

|||||||||

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

BONDS & DEBENTURES — Continued |

Principal Amount |

Fair Value |

|||||||||

|

U.S. Treasury Notes — 0.625% 2/15/2017 |

$ |

310,000,000 |

$ |

310,002,821 |

|||||||

|

U.S. Treasury Notes — 0.625% 8/31/2017 |

200,000,000 |

199,824,820 |

|||||||||

|

U.S. Treasury Notes — 0.625% 9/30/2017 |

274,000,000 |

273,575,958 |

|||||||||

|

U.S. Treasury Notes — 0.625% 11/30/2017 |

200,000,000 |

199,488,060 |

|||||||||

|

U.S. Treasury Notes — 0.75% 1/15/2017 |

230,000,000 |

229,993,123 |

|||||||||

|

U.S. Treasury Notes — 0.75% 3/15/2017 |

320,000,000 |

320,089,600 |

|||||||||

|

U.S. Treasury Notes — 0.75% 1/31/2018 |

275,000,000 |

274,387,685 |

|||||||||

|

U.S. Treasury Notes — 0.875% 1/31/2017 |

175,000,000 |

175,032,603 |

|||||||||

|

U.S. Treasury Notes — 0.875% 2/28/2017 |

100,000,000 |

100,041,200 |

|||||||||

|

U.S. Treasury Notes — 0.875% 4/15/2017 |

275,000,000 |

275,179,822 |

|||||||||

|

U.S. Treasury Notes — 0.875% 8/15/2017 |

210,000,000 |

210,168,231 |

|||||||||

|

U.S. Treasury Notes — 0.875% 10/15/2017 |

280,000,000 |

280,041,748 |

|||||||||

|

U.S. Treasury Notes — 0.875% 11/15/2017 |

290,000,000 |

289,969,927 |

|||||||||

|

U.S. Treasury Notes — 0.875% 1/15/2018 |

259,000,000 |

258,803,056 |

|||||||||

|

U.S. Treasury Notes — 1.00% 3/31/2017 |

175,000,000 |

175,180,215 |

|||||||||

|

U.S. Treasury Notes — 1.00% 9/15/2017 |

270,000,000 |

270,374,625 |

|||||||||

|

U.S. Treasury Notes — 1.00% 12/15/2017 |

250,000,000 |

250,219,725 |

|||||||||

|

U.S. Treasury Notes — 1.875% 10/31/2017 |

291,000,000 |

293,383,930 |

|||||||||

|

U.S. Treasury Notes — 2.25% 11/30/2017 |

75,000,000 |

75,894,803 |

|||||||||

|

U.S. Treasury Notes — 3.50% 2/15/2018 |

260,000,000 |

267,115,654 |

|||||||||

| TOTAL U.S. TREASURIES (Cost $4,932,247,789) |

$ |

4,928,731,386 |

|||||||||

| TOTAL BONDS & DEBENTURES — 36.1% (Cost $5,808,640,389) |

$ |

5,976,640,632 |

|||||||||

|

PUT OPTIONS PURCHASED — 0.1% |

|||||||||||

|

JPY Put-Strike $95; expires 03/24/22; $194,350,000*(Barclays Capital Counterparty)†† (Cost $14,624,838) |

$ |

194,350,000 |

$ |

24,962,703 |

|||||||

|

TOTAL INVESTMENT SECURITIES — 99.1% (Cost $13,917,407,767) |

$ |

16,411,192,842 |

|||||||||

|

SHORT-TERM INVESTMENTS — 1.8% |

|||||||||||

|

Johnson & Johnson — 0.60% 1/12/2017 (Cost $199,963,333) |

$ |

200,000,000 |

$ |

199,963,333 |

|||||||

|

State Street Bank Repurchase Agreement — 0.03% 1/3/2017 (Dated 12/30/2016, repurchase price of $ 97,175,324, collateralized by $99,415,000 principal amount U.S. Treasury Note — 1.50% 2020, fair value $99,118,743) |

97,175,000 |

97,175,000 |

|||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $297,138,333) |

$ |

297,138,333 |

|||||||||

| TOTAL INVESTMENTS — 100.9% (Cost $14,214,546,100) |

$ |

16,708,331,175 |

|||||||||

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

December 31, 2016

|

SECURITIES SOLD SHORT |

Shares |

Fair Value |

|||||||||

|

COMMON STOCKS SOLD SHORT — (4.1)% |

|||||||||||

|

Care Capital Properties, Inc. |

(15,450 |

) |

$ |

(386,250 |

) |

||||||

|

Pennsylvania Real Estate Investment Trust |

(600,700 |

) |

(11,389,272 |

) |

|||||||

|

Pitney Bowes, Inc. |

(401,000 |

) |

(6,091,190 |

) |

|||||||

|

Tencent Holdings, Ltd. (China) |

(23,897,100 |

) |

(584,599,893 |

) |

|||||||

|

Ventas, Inc. |

(61,800 |

) |

(3,863,736 |

) |

|||||||

| WW Grainger, Inc. |

(96,049 |

) |

(22,307,380 |

) |

|||||||

|

Yahoo Japan Corporation (Japan) |

(10,340,200 |

) |

(39,724,063 |

) |

|||||||

|

OTHER COMMON STOCKS SOLD SHORT — (1.0%) |

$ |

(171,830,120 |

) |

||||||||

| TOTAL COMMON STOCKS SOLD SHORT (Proceeds $681,145,396) |

$ |

(840,191,904 |

) |

||||||||

|

Other Assets and Liabilities, net — 4.2% |

686,895,868 |

||||||||||

|

NET ASSETS — 100.0% |

$ |

16,555,035,139 |

|||||||||

* Non-income producing security.

§ Affiliated Security.

** Restricted securities. These restricted securities constituted 4.66% of total net assets at December 31, 2016, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

†† These securities have been valued in good faith under policies adopted by authority of the Board of Trustee in accordance with the Fund's fair value procedures. These securities constituted 1.62% of total net assets at December 31, 2016.

@ Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on December 31, 2016.

@@ Step Coupon — Coupon rate increases in increments to maturity. Rate disclosed is as of December 31, 2016.

As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

See notes to financial statements.

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

December 31, 2016

|

Issuer |

Acquisition Date(s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

Bombardier, Inc. 7.50% 3/15/2025 |

09/25/2015, 09/28/2015, 09/29/2015, 12/10/2015, 12/11/2015, 12/21/2015, 01/07/2016, 01/21/2016, 01/29/2016, 02/01/2016, 02/02/2016, 02/08/2016, 02/16/2016 |

$ |

59,312,146 |

$ |

81,757,000 |

0.49 |

% |

||||||||||||

|

Bombardier, Inc. 7.75% 3/15/2020 |

08/19/2015, 08/20/2015, 08/24/2015 |

23,362,585 |

29,531,045 |

0.18 |

% |

||||||||||||||

|

Bombardier, Inc. 6.125% 1/15/2023 |

09/28/2015,09/29/2015, 01/05/2016, 02/01/2016 |

21,337,682 |

28,027,766 |

0.17 |

% |

||||||||||||||

|

Bombardier, Inc. 5.75% 3/15/2022 |

09/28/2015, 12/28/2015, 01/29/2016 |

10,285,810 |

12,972,000 |

0.08 |

% |

||||||||||||||

|

Bombardier, Inc. 6.00% 10/15/2022 |

09/28/2015, 09/29/2015, 01/20/2016, 02/03/2016, 02/16/2016 |

8,646,366 |

11,909,800 |

0.07 |

% |

||||||||||||||

|

Bombardier, Inc. 7.45% 5/1/2034 |

11/10/2015, 12/01/2015 |

4,111,170 |

5,089,500 |

0.03 |

% |

||||||||||||||

|

Bombardier, Inc. 4.75% 4/15/2019 |

08/19/2015 |

4,162,603 |

4,917,465 |

0.03% | |||||||||||||||

|

California Resources Corporation 2nd Lien 8.00% 12/15/2022 |

01/07/2015, 01/12/2015, 01/15/2015, 08/28/2015 |

36,080,214 |

31,817,500 |

0.19 |

% |

||||||||||||||

|

Glencore Finance Canada, Ltd. 4.25% 10/25/2022 |

09/28/2015, 01/21/2016, 02/03/2016 |

5,555,033 |

8,313,000 |

0.05 |

% |

||||||||||||||

|

Glencore Funding LLC 2.875% 4/16/2020 |

09/28/2015, 01/20/2016 |

6,900,778 |

9,031,750 |

0.06% | |||||||||||||||

|

Glencore Funding LLC 4.625% 4/29/2024 |

09/28/2015, 01/13/2016 |

3,078,500 |

4,794,000 |

0.03% | |||||||||||||||

|

Lenta, Ltd. (GDR) (Russia) |

10/21/2015 |

57,892,477 |

66,861,734 |

0.40 |

% |

||||||||||||||

|

Nexeo Solutions, Inc. |

06/09/2016 |

155,231,992 |

164,709,885 |

1.00 |

% |

||||||||||||||

|

Nexo Solutions, Inc. (Founders Shares) |

06/09/2016 |

13,179,863 |

10,639,909 |

0.06% | |||||||||||||||

|

RELP 10 9.50% 11/20/2017 |

1/15/2016, 02/15/2016, 2/23/2016, 03/15/2016, 03/22/2016, 04/12/16, 04/15/2016, 05/09/2016, 5/15/2016, 05/31/2016, 06/15/2016, 07/01/2016, 07/15/2016, 07/25/2016, 08/22/2016, 09/15/2016, 09/30/2016, 10/15/2016, 11/11/2016 |

5,822,019 |

5,822,019 |

0.04 |

% |

||||||||||||||

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2016

|

Issuer |

Acquisition Date(s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

RELP 11 10.00% 8/4/2018 |

04/01/2016, 05/01/2016, 06/01/2016, 07/01/2016, 08/01/2016, 09/01/2016, 10/01/2016, 11/01/2016, 12/01/2016 |

$ |

17,934,254 |

$ |

17,934,254 |

0.11 |

% |

||||||||||||

|

RELP 8 10.00% 10/19/2017 |

02/03/2016, 03/01/2016, 03/23/2016, 04/01/2016, 05/01/2016, 06/01/2016, 07/01/2016, 08/01/2016, 09/01/2016, 09/23/2016, 10/03/2016, 10/19/2016 |

10,620,434 |

10,620,434 |

0.06 |

% |

||||||||||||||

|

RELP 9 9.00% 4/29/2017 |

4/27/2016, 5/31/2016, 6/28/2016 |

10,320,000 |

10,320,000 |

0.06 |

% |

||||||||||||||

|

Ship Loan Participation 7.80% 12/23/2019 |

12/22/2014 |

48,923,846 |

48,923,846 |

0.30% | |||||||||||||||

|

Ship Loan Participation II 11.00% 9/10/2018 |

11/29/2016 |

16,374,200 |

16,374,200 |

0.10% | |||||||||||||||

|

Sound Holding FP (Luxembourg) |

68,431,400 |

24,564,336 |

0.15 |

% |

|||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2011-1 A 0.645% 8/15/2050 |

05/11/2011, 10/03/2013 |

4,711,006 |

4,712,481 |

0.03% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2010-2 A 1.621% 2/28/2057 |

05/21/2010 |

4,183,529 |

3,922,628 |

0.02% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2012-4 A 0.00% 6/15/2051 |

05/10/2012 |

3,607,262 |

3,736,730 |

0.02% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2011-2 A 0.00% 9/15/2050 |

06/10/2011 |

3,091,219 |

3,092,901 |

0.02% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2010-4 A 1.498% 8/31/2049 |

08/04/2010 |

2,171,837 |

2,355,873 |

0.01% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2012-2 A 0.00% 3/15/2047 |

02/10/2012 |

1,538,914 |

1,698,628 |

0.01% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2010-3 A 0.301% 7/31/2038 |

06/02/2010 |

1,551,412 |

1,623,401 |

0.01% | |||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2010-1 A 1.183% 9/30/2047 |

04/22/2010 |

578,249 |

557,669 |

0.00% | |||||||||||||||

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

December 31, 2016

|

Issuer |

Acquisition Date(s) |

Cost |

Fair Value |

Fair Value as a % of Net Assets |

|||||||||||||||

|

Stanwich Mortgage Loan Trust Series 2009-2 A 0.958% 2/15/2049 |

11/30/2009, 01/21/2010 |

$ |

438,813 |

$ |

475,181 |

0.00 |

% |

||||||||||||

|

Sunset Mortgage Loan Co. LLC 2015-NPL1 A 4.459% 9/18/2045 |

10/02/2015 |

29,485,114 |

29,632,783 |

0.18% | |||||||||||||||

|

Sunset Mortgage Loan Co. LLC 2014-NPL1 A 3.228% 8/16/2044 |

08/21/2014, 08/28/2015 |

18,511,963 |

18,520,472 |

0.11% | |||||||||||||||

|

U.S. Farming Realty Trust II, L.P. |

11,534,007 |

12,911,148 |

0.08 |

% |

|||||||||||||||

|

U.S. Farming Realty Trust, L.P. |

28,405,190 |

40,557,405 |

0.25 |

% |

|||||||||||||||

|

WLRS Fund I LLC |

6/9/2016 |

8,505,315 |

7,352,285 |

0.04 |

% |

||||||||||||||

|

Walter Investment Management Corporation 7.875% 12/15/2021 |

5/12/2016, 6/9/2016, 6/15/2016, 6/20/2016, 6/21/2016 |

31,528,158 |

36,191,396 |

0.22 |

% |

||||||||||||||

|

TOTAL RESTRICTED SECURITIES |

$ |

737,405,360 |

$ |

772,272,424 |

4.66 |

% |

|||||||||||||

See notes to financial statements.

22

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2016

|

ASSETS |

|||||||

|

Investment securities — at fair value (identified cost $12,546,565,005) |

$ |

15,078,345,624 |

|||||

| Investments in affiliates at fair value (cost $1,370,842,762) |

1,332,847,218 |

||||||

|

Short-term investments — at amortized cost (maturities 60 days or less) |

297,138,333 |

||||||

|

Cash |

711 |

||||||

|

Deposits for securities sold short |

689,695,542 |

||||||

|

Receivable for: |

|||||||

|

Dividends and interest |

40,235,998 |

||||||

|

Capital Stock sold |

17,422,533 |

||||||

|

Investment securities sold |

1,377,503 |

||||||

|

Total assets |

17,457,063,462 |

||||||

|

LIABILITIES |

|||||||

|

Payable for: |

|||||||

|

Securities sold short, at fair value (proceeds $681,145,396) |

840,191,904 |

||||||

|

Investment securities purchased |

31,724,073 |

||||||

|

Advisory fees |

14,108,653 |

||||||

|

Capital Stock repurchased |

11,935,760 |

||||||

|

Accrued expenses and other liabilities |

3,010,335 |

||||||

|

Unrealized loss on forward foreign currency contracts |

1,057,598 |

||||||

|

Total liabilities |

902,028,323 |

||||||

|

NET ASSETS |

$ |

16,555,035,139 |

|||||

|

SUMMARY OF SHAREHOLDERS' EQUITY |

|||||||

|

Capital Stock — no par value; unlimited authorized shares; 507,665,676 outstanding shares |

$ |

14,070,206,368 |

|||||

| Undistributed net realized gain |

155,619,700 |

||||||

| Accumulated net investment loss |

(3,708,493 |

) |

|||||

|

Unrealized appreciation of investments |

2,332,917,564 |

||||||

|

NET ASSETS |

$ |

16,555,035,139 |

|||||

|

NET ASSET VALUE |

|||||||

|

Offering and redemption price per share |

$ |

32.61 |

|||||

See notes to financial statements.

23

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2016

|

INVESTMENT INCOME |

|||||||

|

Dividends (net of foreign taxes withheld of $5,660,032) |

$ |

170,019,952 |

|||||

|

Dividends from affiliates |

15,416,888 |

||||||

|

Interest |

124,160,795 |

||||||

|

Total investment income |

309,597,635 |

||||||

|

EXPENSES |

|||||||

|

Advisory fees |

166,345,010 |

||||||

|

Short sale dividend expense |

3,493,274 |

||||||

|

Transfer agent fees and expenses |

7,122,335 |

||||||

|

Administrative services fees |

854,055 |

||||||

|

Reports to shareholders |

813,405 |

||||||

|

Professional fees |

780,069 |

||||||

|

Custodian fees |

377,983 |

||||||

|

Trustee fees and expenses |

262,912 |

||||||

|

Legal fees |

185,617 |

||||||

|

Filing fees |

134,095 |

||||||

|

Audit and tax services fees |

100,494 |

||||||

|

Other |

266,425 |

||||||

|

Total expenses |

180,735,674 |

||||||

|

Net expenses |

180,735,674 |

||||||

|

Net investment income |

128,861,961 |

||||||

|

NET REALIZED AND UNREALIZED GAIN (LOSS) |

|||||||

|

Net realized gain (loss) on: |

|||||||

| Investments |

680,886,634 |

||||||

|

Investment securities sold short |

35,939,456 |

||||||

|

Foreign currency transactions |

6,621,244 |

||||||

|

Net change in unrealized appreciation (depreciation) of: |

|||||||

|

Investments |

801,514,746 |

||||||

|

Investment securities sold short |

(98,182,212 |

) |

|||||

| Translation of foreign currency denominated amounts |

(1,639,847 |

) |

|||||

|

Net realized and unrealized gain |

1,425,140,021 |

||||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ |

1,554,001,982 |

|||||

See notes to financial statements.

24

FPA CRESCENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Year Ended December 31, 2016 |

Year Ended December 31, 2015 |

||||||||||

|

INCREASE (DECREASE) IN NET ASSETS |

|||||||||||

|

Operations: |

|||||||||||

|

Net investment income |

$ |

128,861,961 |

$ |

104,183,149 |

|||||||

| Net realized gain |

723,447,334 |

1,092,702,105 |

|||||||||

| Net change in unrealized appreciation (depreciation) |

701,692,687 |

(1,604,582,792 |

) |

||||||||

|

Net increase (decrease) in net assets resulting from operations |

1,554,001,982 |

(407,697,538 |

) |

||||||||

|

Distributions to shareholders from: |

|||||||||||

|

Net investment income |

(141,761,297 |

) |

(174,473,519 |

) |

|||||||

|

Net realized capital gains |

(660,533,612 |

) |

(920,345,451 |

) |

|||||||

|

Total distributions |

(802,294,909 |

) |

(1,094,818,970 |

) |

|||||||

|

Capital Stock transactions: |

|||||||||||

|

Proceeds from Capital Stock sold |

2,320,886,124 |

3,699,309,179 |

|||||||||

|

Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions |

702,052,272 |

953,708,643 |

|||||||||

|

Cost of Capital Stock repurchased |

(5,339,447,889 |

)* |

(5,014,500,133 |

)* |

|||||||

|

Net decrease from Capital Stock transactions |

(2,316,509,493 |

) |

(361,482,311 |

) |

|||||||

|

Total change in net assets |

(1,564,802,420 |

) |

(1,863,998,819 |

) |

|||||||

|

NET ASSETS |

|||||||||||

|

Beginning of Year |

18,119,837,559 |

19,983,836,378 |

|||||||||

|

End of Year |

$ |

16,555,035,139 |

$ |

18,119,837,559 |

|||||||

|

CHANGE IN CAPITAL STOCK OUTSTANDING |

|||||||||||

|

Shares of Capital Stock sold |

73,991,731 |

111,132,546 |

|||||||||

|

Shares issued to shareholders upon reinvestment of dividends and distributions |

21,525,181 |

30,821,683 |

|||||||||

|

Shares of Capital Stock repurchased |

(171,324,508 |

) |

(150,701,016 |

) |

|||||||

|

Change in Capital Stock outstanding |

(75,807,596 |

) |

(8,746,787 |

) |

|||||||

* Net of redemption fees of $7,860,248 and $1,973,970 for the year ended December 31, 2016 and year ended December 31, 2015, respectively.

See notes to financial statements.

25

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Year

|

Year Ended December 31, |

|||||||||||||||||||||||

|

2016 |

2015 |

2014 |

2013 |

2012 |

|||||||||||||||||||

|

Per share operating performance: |

|||||||||||||||||||||||

|

Net asset value at beginning of year |

$ |

31.06 |

$ |

33.74 |

$ |

32.96 |

$ |

29.29 |

$ |

26.78 |

|||||||||||||

|

Income from investment operations: |

|||||||||||||||||||||||

|

Net investment income* |

$ |

0.24 |

$ |

0.18 |

$ |

0.25 |

$ |

0.14 |

$ |

0.12 |

|||||||||||||

|

Net realized and unrealized gain (loss) on investment securities |

2.93 |

(0.89 |

) |

1.94 |

6.02 |

2.63 |

|||||||||||||||||

|

Total from investment operations |

$ |

3.17 |

$ |

(0.71 |

) |

$ |

2.19 |

$ |

6.16 |

$ |

2.75 |

||||||||||||

|

Less distributions: |

|||||||||||||||||||||||

|

Dividends from net investment income |

$ |

(0.29 |

) |

$ |

(0.31 |

) |

$ |

(0.31 |

) |

$ |

(0.21 |

) |

$ |

(0.12 |

) |

||||||||

|

Distributions from net realized capital gains |

(1.34 |

) |

(1.66 |

) |

(1.10 |

) |

(2.28 |

) |

(0.12 |

) |

|||||||||||||

|

Total distributions |

$ |

(1.63 |

) |

$ |

(1.97 |

) |

$ |

(1.41 |

) |

$ |

(2.49 |

) |

$ |

(0.24 |

) |

||||||||

|

Redemption fees |

$ |

0.01 |

— |

** |

— |

** |

— |

** |

— |

** |

|||||||||||||

|

Net asset value at end of year |

$ |

32.61 |

$ |

31.06 |

$ |

33.74 |

$ |

32.96 |

$ |

29.29 |

|||||||||||||

|

Total investment return |

10.25 |

% |

(2.06 |

)% |

6.64 |

% |

21.95 |

% |

10.33 |

% |

|||||||||||||

|

Ratios/supplemental data: |

|||||||||||||||||||||||

|

Net assets, end of year (in $000's) |

$ |

16,555,035 |

$ |

18,119,838 |

$ |

19,983,836 |

$ |

15,903,874 |

$ |

9,916,697 |

|||||||||||||

|

Ratio of expenses to average net assets |

1.09 |

%‡ |

1.11 |

%‡ |

1.20 |

%‡ |

1.23 |

%‡ |

1.26 |

%‡ |