SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a -16 or 15d -16 of

the Securities Exchange Act of 1934

Report on Form 6-K dated July 25, 2019

(Commission File No. 1-13202)

Nokia Corporation

Karaportti 7

FI-02610 Espoo

Finland

(Name and address of registrant’s principal executive office)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: | ||

|

|

|

|

|

Form 20-F: x |

|

Form 40-F: o |

|

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): | ||

|

|

|

|

|

Yes: o |

|

No: x |

|

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): | ||

|

|

|

|

|

Yes: o |

|

No: x |

|

|

|

|

|

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. | ||

|

|

|

|

|

Yes: o |

|

No: x |

Enclosures:

Financial Report for Q2 and Half Year 2019: Strong Q2 driven by end-to-end 5G demand and improved operational execution; Full year 2019 guidance maintained

|

|

HALF YEAR FINANCIAL REPORT |

|

|

|

|

|

July 25, 2019 |

Nokia Corporation Financial Report for Q2 and Half Year 2019

Nokia Corporation

Half Year Financial Report

July 25, 2019 at 08:00 (CET +1)

Nokia Corporation Financial Report for Q2 and Half Year 2019

Strong Q2 driven by end-to-end 5G demand and improved operational execution; Full year 2019 guidance maintained

This is a summary of the Nokia Corporation financial report for Q2 and half year 2019 published today. The complete financial report for Q2 and half year 2019 with tables is available at www.nokia.com/financials. Investors should not rely on summaries of our interim reports only, but should review the complete interim reports with tables.

RAJEEV SURI, PRESIDENT AND CEO, ON Q2 2019 RESULTS

Nokia delivered a strong second quarter, driven by 5G demand, a competitive end-to-end portfolio and strengthened operational execution. Given these compelling results, we are confirming our full-year 2019 guidance.

In the quarter, we saw good year-on-year growth, meaningful improvements in profitability, robust progress in our strategic expansion areas of Software and Enterprise and excellent momentum in our IP Routing business. We also continued to enhance our position in 5G, and now have 45 commercial 5G deals and 9 live networks.

Risks remain in the year, including execution demands in the second half, trade-related uncertainty and challenges in the China market. Given these risks, we will continue to focus on tight operational discipline, delivering on our EUR 700 million cost-savings program, improving working capital management and advancing the implementation of our strategy.

Overall, I am pleased with Nokia’s performance in the second quarter and our continued progress in executing our strategy.

Q2 2019 and January-June 2019 reported and non-IFRS results. Refer to note 1, “Basis of Preparation”, note 2, “Non-IFRS to reported reconciliation” and note 13, “Performance measures”, in the “Financial statement information” section for details.

|

EUR million (except for EPS in |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1- |

|

YoY |

|

Constant |

|

|

Net sales |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

|

Operating profit/(loss) |

|

(57 |

) |

(221 |

) |

|

|

|

|

(581 |

) |

(557 |

) |

|

|

|

|

|

Operating margin % |

|

(1.0 |

)% |

(4.2 |

)% |

320 |

bps |

|

|

(5.4 |

)% |

(5.4 |

)% |

0 |

bps |

|

|

|

EPS, diluted |

|

(0.03 |

) |

(0.05 |

) |

|

|

|

|

(0.11 |

) |

(0.11 |

) |

|

|

|

|

|

Operating profit/(loss) (non-IFRS) |

|

451 |

|

334 |

|

35 |

% |

|

|

391 |

|

573 |

|

(32 |

)% |

|

|

|

Operating margin % (non-IFRS) |

|

7.9 |

% |

6.3 |

% |

160 |

bps |

|

|

3.6 |

% |

5.6 |

% |

(200 |

)bps |

|

|

|

EPS, diluted (non-IFRS) |

|

0.05 |

|

0.03 |

|

67 |

% |

|

|

0.02 |

|

0.04 |

|

(50 |

)% |

|

|

|

Net cash and current financial investments(1) |

|

502 |

|

2 146 |

|

(77 |

)% |

|

|

502 |

|

2 146 |

|

(77 |

)% |

|

|

(1)Net cash and current financial investments does not include lease liabilities.

· Net sales in Q2 2019 were EUR 5.7bn, compared to EUR 5.3bn in Q2 2018. On a constant currency basis, net sales increased 5%. Our strong topline performance was driven by improved industry demand and the competitiveness of our end-to-end portfolio, with growth across four out of six regions and all customer types.

· Non-IFRS diluted EPS in Q2 2019 was EUR 0.05, compared to EUR 0.03 in Q2 2018, primarily driven by solid operational execution, which yielded gross profit improvements across Networks, Nokia Software and Nokia Technologies.

· Reported diluted EPS in Q2 2019 was negative EUR 0.03, compared to negative EUR 0.05 in Q2 2018, primarily driven by higher gross profit, partially offset by a net negative fluctuation in financial income and expenses.

· In Q2 2019, net cash and current financial investments decreased sequentially by approximately EUR 1.5bn. This decrease was primarily due to anticipated cash outflows including the payment of 2018 performance-related incentives to employees, payment of the quarterly dividend, as well as restructuring and associated cash outflows, which together totaled approximately EUR 900 million. In addition, approximately EUR 350 million of the decline was temporary in nature and is expected to reverse in the second half of 2019.

· Full year 2019 guidance maintained, with seasonality characterized by weaker first and third quarters and stronger second and fourth quarters, with a particularly weak Q1 and an expected particularly strong Q4.

DIVIDEND

Beginning with the distribution for the financial year 2018, Nokia has started paying dividends in quarterly instalments. Under the authorization by the Annual General Meeting held on May 21, 2019, the Board of Directors may resolve an aggregate maximum annual distribution of EUR 0.20 per share to be paid quarterly during the authorization period, unless the Board decides otherwise for a justified reason. On the same day, the Board resolved to distribute EUR 0.05 per share as the first instalment of the dividend.

On July 25, 2019, the Board resolved to distribute EUR 0.05 per share as the second instalment of the dividend. The dividend record date is on July 30, 2019 and the dividend is expected to be paid on or around August 8, 2019. The actual dividend payment date outside Finland will be determined by the practices of the intermediary banks transferring the dividend payments. Following this announced distribution, the Board’s remaining distribution authorization for the financial year 2018 is a maximum of EUR 0.10 per share.

The payment of the second instalment of the dividend, as well as the payment of the withholding taxes related to the first instalment of the dividend, are expected to total approximately EUR 300 million in Q3 2019.

OUTLOOK

|

Metric |

|

Full Year 2019 |

|

Full Year 2020 |

|

Non-IFRS diluted earnings per share |

|

EUR 0.25 - 0.29 |

|

EUR 0.37 - 0.42 |

|

Non-IFRS operating margin |

|

9 - 12% |

|

12 - 16% |

|

Recurring free cash flow(1) |

|

Slightly positive |

|

Clearly positive |

Annual distribution to shareholders: Over the long term, Nokia targets to deliver an earnings-based growing dividend by distributing approximately 40% to 70% of non-IFRS diluted EPS, taking into account Nokia’s cash position and expected cash flow generation. The annual distribution would be paid as quarterly dividends.

(1)Free cash flow = net cash from operating activities - capital expenditures + proceeds from sale of property, plant and equipment and intangible assets - purchase of non-current financial investments + proceeds from sale of non-current financial investments.

Key drivers of Nokia’s outlook

Net sales and operating margin for Networks and Nokia Software are expected to be influenced by factors including:

· Our expectation that we will outperform our primary addressable market in full year 2019 and over the longer-term, driven by our strategy, which includes competing in 5G more effectively due to our strong end-to-end portfolio, focusing on targeted growth opportunities in attractive adjacent markets and building a strong network agnostic software business. On a constant currency basis, we expect our primary addressable market to grow slightly in full year 2019, and for growth to continue in full year 2020. (This is an update to our earlier commentary for our primary addressable market to be flattish in full year 2019 and to grow in full year 2020.);

· The slow start to 2019 and weak overall first half puts significant pressure on execution in the second half;

· The timing of completions and acceptances of certain projects, particularly related to 5G. Based on the evolving readiness of the 5G ecosystem and the staggered nature of 5G rollouts in lead countries, we expect full year 2019 will have seasonality characterized by a particularly weak first quarter, a strong second quarter, an expected soft third quarter and an expected particularly strong fourth quarter (This is an update, providing additional quarterly details);

· Competitive intensity could increase in some accounts as some competitors seek to take share in the early phases of 5G;

· Some customers are reassessing their vendors in light of security concerns, creating near-term pressure to invest in order to secure long-term benefits;

· Our expectation that we will improve our R&D productivity and reduce support function costs through the successful execution of our cost savings program;

· Potential mergers or acquisitions by our customers;

· Our product and regional mix; and

· Macroeconomic, industry and competitive dynamics.

Net sales and operating margin for Nokia Technologies is expected to be influenced by factors including:

· The timing and value of new and existing patent licensing agreements with smartphone vendors, automotive companies and consumer electronics companies;

· Results in brand and technology licensing;

· Costs to protect and enforce our intellectual property rights; and

· The regulatory landscape.

Additionally, our outlook is based on the following assumptions:

· Nokia’s recurring free cash flow is expected to improve over the longer-term due to lower cash outflows related to restructuring and network equipment swaps and improved operational results over time;

· Non-IFRS financial income and expenses to be an expense of approximately EUR 350 million in full year 2019 and over the longer-term (This is an update to earlier commentary for non-IFRS financial income and expenses to be an expense of approximately EUR 300 million.);

· Non-IFRS income taxes at a rate of approximately 28% in full year 2019 and approximately 25% over the longer-term, subject to the absolute level of profits, regional profit mix and changes to our operating model;

· Cash outflows related to income taxes of approximately EUR 450 million in full year 2019 and over the longer term until our US or Finnish deferred tax assets are fully utilized; and

· Capital expenditures of approximately EUR 700 million in full year 2019 and approximately EUR 600 million over the longer-term.

NOKIA FINANCIAL RESULTS

|

EUR million (except for EPS in EUR) |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1- |

|

Q1- |

|

YoY |

|

Constant |

|

|

Net sales |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

|

Networks |

|

4 393 |

|

4 081 |

|

8 |

% |

5 |

% |

8 336 |

|

7 864 |

|

6 |

% |

3 |

% |

|

Nokia Software |

|

678 |

|

612 |

|

11 |

% |

8 |

% |

1 221 |

|

1 153 |

|

6 |

% |

3 |

% |

|

Nokia Technologies |

|

383 |

|

361 |

|

6 |

% |

4 |

% |

753 |

|

726 |

|

4 |

% |

2 |

% |

|

Group Common and Other |

|

263 |

|

280 |

|

(6 |

)% |

(6 |

)% |

484 |

|

532 |

|

(9 |

)% |

(9 |

)% |

|

Non-IFRS exclusions |

|

(2 |

) |

(5 |

) |

(60 |

)% |

|

|

(27 |

) |

(9 |

) |

200 |

% |

|

|

|

Gross profit |

|

2 065 |

|

1 860 |

|

11 |

% |

|

|

3 646 |

|

3 666 |

|

(1 |

)% |

|

|

|

Operating profit/(loss) |

|

(57 |

) |

(221 |

) |

(74 |

)% |

|

|

(581 |

) |

(557 |

) |

4 |

% |

|

|

|

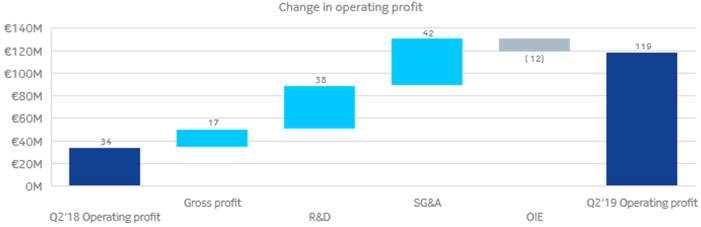

Networks |

|

119 |

|

34 |

|

250 |

% |

|

|

(135 |

) |

80 |

|

(269 |

)% |

|

|

|

Nokia Software |

|

137 |

|

40 |

|

243 |

% |

|

|

130 |

|

42 |

|

210 |

% |

|

|

|

Nokia Technologies |

|

324 |

|

292 |

|

11 |

% |

|

|

626 |

|

566 |

|

11 |

% |

|

|

|

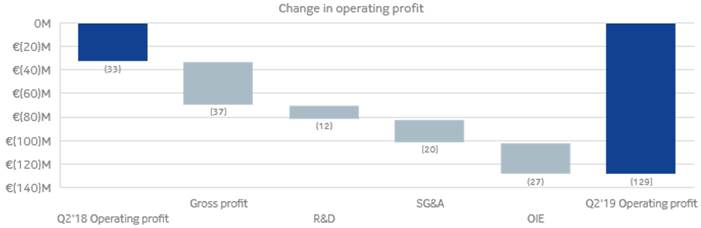

Group Common and Other |

|

(129 |

) |

(33 |

) |

|

|

|

|

(230 |

) |

(116 |

) |

|

|

|

|

|

Non-IFRS exclusions |

|

(508 |

) |

(555 |

) |

|

|

|

|

(972 |

) |

(1 129 |

) |

|

|

|

|

|

Operating margin % |

|

(1.0 |

)% |

(4.2 |

)% |

320 |

bps |

|

|

(5.4 |

)% |

(5.4 |

)% |

0 |

bps |

|

|

|

Gross profit (non-IFRS) |

|

2 117 |

|

2 038 |

|

4 |

% |

|

|

3 758 |

|

3 979 |

|

(6 |

)% |

|

|

|

Operating profit/(loss) (non-IFRS) |

|

451 |

|

334 |

|

35 |

% |

|

|

391 |

|

573 |

|

(32 |

)% |

|

|

|

Operating margin % (non-IFRS) |

|

7.9 |

% |

6.3 |

% |

160 |

bps |

|

|

3.6 |

% |

5.6 |

% |

(200 |

)bps |

|

|

|

Financial income and expenses |

|

(173 |

) |

(56 |

) |

209 |

% |

|

|

(228 |

) |

(164 |

) |

39 |

% |

|

|

|

Income taxes |

|

46 |

|

10 |

|

360 |

% |

|

|

188 |

|

104 |

|

81 |

% |

|

|

|

Profit/(loss) for the period |

|

(191 |

) |

(271 |

) |

(30 |

)% |

|

|

(632 |

) |

(625 |

) |

1 |

% |

|

|

|

EPS, diluted |

|

(0.03 |

) |

(0.05 |

) |

(40 |

)% |

|

|

(0.11 |

) |

(0.11 |

) |

0 |

% |

|

|

|

Financial income and expenses (non-IFRS) |

|

(86 |

) |

(84 |

) |

2 |

% |

|

|

(178 |

) |

(200 |

) |

(11 |

)% |

|

|

|

Income taxes (non-IFRS) |

|

(101 |

) |

(106 |

) |

(5 |

)% |

|

|

(60 |

) |

(143 |

) |

(58 |

)% |

|

|

|

Profit/(loss) for the period (non-IFRS) |

|

258 |

|

139 |

|

86 |

% |

|

|

142 |

|

223 |

|

(36 |

)% |

|

|

|

EPS, diluted (non-IFRS) |

|

0.05 |

|

0.03 |

|

67 |

% |

|

|

0.02 |

|

0.04 |

|

(50 |

)% |

|

|

Results are as reported and relate to continuing operations unless otherwise specified. The financial information in this report is unaudited. Non-IFRS results exclude costs related to the acquisition of Alcatel-Lucent and related integration, goodwill impairment charges, intangible asset amortization and other purchase price fair value adjustments, restructuring and associated charges and certain other items that may not be indicative of Nokia’s underlying business performance. For details, please refer to note 2, “Non-IFRS to reported reconciliation”, in the notes to the Financial statement information in this report. Change in net sales at constant currency excludes the effect of changes in exchange rates in comparison to euro, our reporting currency. For more information on currency exposures, please refer to note 1, “Basis of Preparation”, in the “Financial statement information” section in this report.

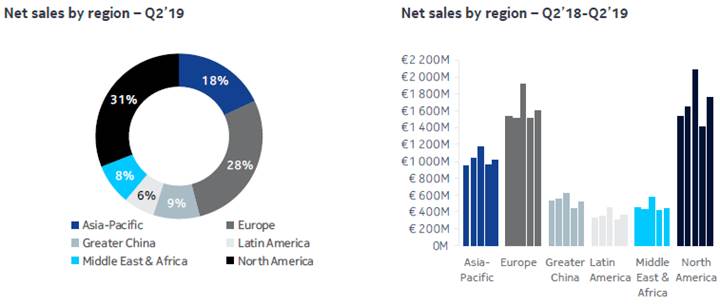

Net sales by region

|

EUR million |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1-Q2’18 |

|

YoY |

|

Constant |

|

|

Asia-Pacific |

|

1 012 |

|

932 |

|

9 |

% |

5 |

% |

1 975 |

|

1 842 |

|

7 |

% |

3 |

% |

|

Europe |

|

1 611 |

|

1 548 |

|

4 |

% |

4 |

% |

3 111 |

|

3 054 |

|

2 |

% |

1 |

% |

|

Greater China |

|

515 |

|

524 |

|

(2 |

)% |

0 |

% |

949 |

|

1 003 |

|

(5 |

)% |

(6 |

)% |

|

Latin America |

|

359 |

|

308 |

|

17 |

% |

15 |

% |

664 |

|

605 |

|

10 |

% |

8 |

% |

|

Middle East & Africa |

|

441 |

|

447 |

|

(1 |

)% |

(2 |

)% |

855 |

|

878 |

|

(3 |

)% |

(5 |

)% |

|

North America |

|

1 755 |

|

1 554 |

|

13 |

% |

7 |

% |

3 172 |

|

2 855 |

|

11 |

% |

4 |

% |

|

Total |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

Net sales by customer type

|

EUR million |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1-Q2’18 |

|

YoY |

|

Constant |

|

|

Communication service providers |

|

4 755 |

|

4 398 |

|

8 |

% |

6 |

% |

8 962 |

|

8 478 |

|

6 |

% |

2 |

% |

|

Enterprise |

|

318 |

|

295 |

|

8 |

% |

6 |

% |

577 |

|

540 |

|

7 |

% |

4 |

% |

|

Licensees |

|

383 |

|

352 |

|

9 |

% |

6 |

% |

753 |

|

701 |

|

7 |

% |

5 |

% |

|

Other(1) |

|

238 |

|

268 |

|

(11 |

)% |

(12 |

)% |

433 |

|

519 |

|

(17 |

)% |

(16 |

)% |

|

Total |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

(1) Includes net sales of Alcatel Submarine Networks (ASN) and Radio Frequency Systems (RFS), both of which are being managed as separate entities, and certain other items, such as eliminations of inter-segment revenues and certain items related to purchase price allocation. ASN and RFS net sales include also revenue from communications service providers and enterprise customers.

Our Nokia Enterprise business is performing well. Net sales to enterprise customers, excluding the third party integration business that we are exiting, grew 7% on a reported basis and 5% on a

constant currency basis in Q2 2019, and grew 8% on a reported basis and 5% on a constant currency basis in the first six months of 2019.

Nokia, Q2 2019 compared to Q2 2018, non-IFRS

Nokia non-IFRS net sales grew 7%. On a constant currency basis, Nokia non-IFRS net sales grew 5%.

Nokia non-IFRS net sales, excluding approximately EUR 30 million of one-time licensing net sales in Q2 2019 and EUR 10 million in Q2 2018, grew 7%, as our customers added network capacity in preparation for the continued rise in broadband traffic driven by 5G. Our strong topline performance in Q2 2019 reflected improved industry demand and the competitiveness of our end-to-end portfolio, with growth across four out of six regions and all customer types. In Q2 2019, we continued to make progress with our strategy to diversify and grow, with strong results in Nokia Software and continued solid performance with enterprise customers.

The strong growth in Nokia Software net sales was due to both applications and core networks benefitting from its improved go-to-market capabilities, as well as the timing of completions and acceptances of certain projects.

The growth in net sales to enterprise customers was primarily due to strong demand for our market-leading IP routing and optical networks portfolio and, to a lesser extent, strong percentage growth in private wireless networks for industrial and public sector applications. We continue to see strong momentum in industries like utilities, transportation, mining, manufacturing, as well as the public sector.

The increase in Nokia non-IFRS gross profit was driven by strong net sales and operational execution that was solid and broad-based across Networks, Nokia Software and Nokia Technologies, partially offset by lower gross profit in Group Common and other.

The increase in Nokia non-IFRS operating profit was driven by the higher non-IFRS gross profit, as well as continued progress related to Nokia’s cost savings program, partially offset by lower gains in Nokia’s venture fund investments and a net negative impact related to foreign exchange hedging.

Nokia, January-June 2019 compared to January-June 2018, reported

Nokia net sales grew 5% in the first six months of 2019 as our customers added network capacity in preparation for the continued rise in broadband traffic driven by 5G. On a constant currency basis, Nokia net sales grew 2% in the first six months of 2019.

Nokia net sales, excluding approximately EUR 70 million of one-time licensing net sales in the first six months of 2019 and EUR 20 million in the first six months of 2018, grew 4%.

Our strong topline performance in the first six months 2019 reflected improved industry demand and the competitiveness of our end-to-end portfolio, with growth across four out of six regions and all customer types. In the first six months of 2019, we continued to make progress with our strategy to diversify and grow, with strong results in Nokia Software and continued solid performance with enterprise customers.

The decrease in Nokia gross profit in the first six months of 2019 was driven by a particularly weak Q1 2019, partially offset by improved operational execution in Q2 2019.

The slight increase in Nokia operating loss in the first six months of 2019 was driven by lower gross profit and higher restructuring and associated charges, partially offset by continued progress related to Nokia’s cost savings program.

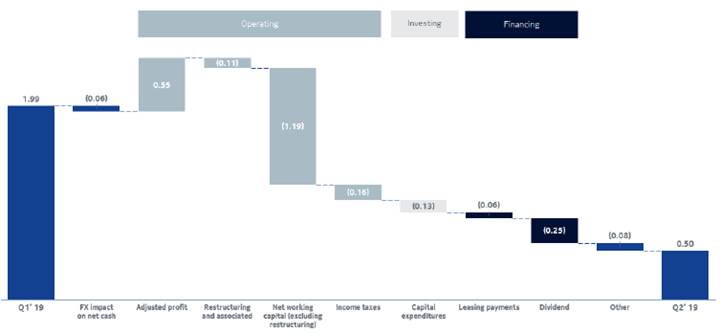

CASH AND CASH FLOW IN Q2 2019

During the second quarter of 2019 Nokia’s free cash flow was negative EUR 1 041 million driven by:

· Cash outflows related to net working capital, primarily due to the payment of 2018 performance-related incentives to employees, as well as: a) an increase in receivables, including EUR 350 million of timing related increases that are temporary in nature and expected to reverse in the second half of 2019, b) a decrease in accounts payable, reflecting lower purchase volumes during the quarter and c) elevated inventory levels, primarily due to our decision to ensure sufficient flexibility to deliver higher levels of equipment sales, particularly related to 5G, and an increase in work in progress inventories related to certain large 5G deployments;

· Continued cash outflows related to restructuring and network equipment swaps; and

· Income taxes and capital expenditures.

Nokia has established a free cash flow program to ensure company-wide focus on free cash flow and release of working capital, including project asset optimization, review of contract terms & conditions, as well as supply chain and inventory optimization. Senior leaders of Nokia have significant part of their incentives tied to free cash flow improvement targets in 2019 and beyond.

|

EUR million, at end of period |

|

Q2’19 |

|

Q1’19 |

|

QoQ |

|

Q4’18 |

|

YTD |

|

|

Total cash and current financial investments |

|

4 788 |

|

6 394 |

|

(25 |

)% |

6 873 |

|

(30 |

)% |

|

Net cash and current financial investments(1) |

|

502 |

|

1 991 |

|

(75 |

)% |

3 053 |

|

(84 |

)% |

(1) Net cash and current financial investments does not include lease liabilities. For details, please refer to note 7, “Net cash and current financial investments”, and note 13, “Performance measures”, in the “Financial statement information” section in this report.

During the second quarter 2019, Nokia’s total cash and current financial investments (“total cash”) decreased by EUR 1 606 million and Nokia’s net cash and current financial investments (“net cash”) decreased by EUR 1 489 million.

Approximately EUR 900 million of the decline in total cash and net cash was driven by the following three cash outflows, in line with our expectations: a) payment of 2018 performance-related incentives to employees, b) payment of the first quarterly instalment of the dividend and c) restructuring and associated cash outflows. In addition, approximately EUR 350 million of the decline in total cash and net cash was temporary in nature and is expected to reverse in the second half of 2019.

Foreign exchange rates had an approximately EUR 60 million negative impact on net cash.

In the second quarter 2019, net cash used in operating activities was EUR 916 million:

· Nokia’s adjusted profit before changes in net working capital was EUR 553 million in the second quarter 2019.

· In the second quarter 2019, Nokia generated a decrease in net cash related to net working capital of approximately EUR 1.3 billion. Excluding approximately EUR 110 million of restructuring and associated cash outflows, Nokia generated an approximately EUR 1.2 billion decrease in net cash related to net working capital due to a decrease in liabilities, an increase in receivables and an increase in inventories.

· The increase in receivables was approximately EUR 260 million, and was primarily due to the timing of approximately EUR 350 million of receivables. The EUR 350 million of timing related increases is temporary in nature and expected to reverse in the second half of 2019.

· The increase in inventories was approximately EUR 110 million, and was primarily due to our decision to ensure sufficient flexibility to deliver higher levels of equipment sales, particularly related to 5G, and an increase in work in progress inventories related to certain large 5G deployments.

· The decrease in liabilities was approximately EUR 830 million, and was primarily due to payment of 2018 performance-related incentives to employees, amounting to approximately EUR 530 million, and a decrease in accounts payable, amounting to approximately EUR 260 million.

· In addition, cash taxes amounted to an outflow of approximately EUR 160 million.

· The implementation of IFRS 16 positively impacted our net cash used in operating activities and negatively impacted our net cash from financing activities, both by approximately EUR 60 million.

In the second quarter 2019, net cash used in investing activities primarily related to capital expenditures of approximately EUR 130 million.

In the second quarter 2019, net cash used in financing activities primarily related to paying the first quarterly instalment of the dividend, amounting to approximately EUR 250 million and leasing payments of approximately EUR 60 million following the implementation of IFRS 16.

COST SAVINGS PROGRAM

We expect our most recent cost savings program to result in a net EUR 700 million reduction of non-IFRS operating expenses and production overheads in full year 2020 compared to full year 2018, of which EUR 500 million is expected to come from operating expenses and EUR 200 million is expected to come from cost of sales. The related restructuring charges are expected to total EUR 900 million.

The following table summarizes the financial information related to our cost savings program as of the end of the second quarter 2019.

|

In EUR million, approximately(1) |

|

Q2’19 |

|

|

Balance of restructuring and associated liabilities for prior programs |

|

660 |

|

|

+ Charges in the quarter |

|

200 |

|

|

- Cash outflows in the quarter |

|

110 |

|

|

= Ending balance of restructuring and associated liabilities |

|

750 |

|

|

of which restructuring provisions |

|

570 |

|

|

of which other associated liabilities |

|

180 |

|

|

|

|

|

|

|

Total expected restructuring and associated charges, related to our most recent cost savings program (rounded to the nearest EUR 50 million) |

|

900 |

|

|

- Cumulative recorded |

|

360 |

|

|

= Charges remaining to be recorded |

|

540 |

|

|

|

|

|

|

|

Total expected restructuring and associated cash outflows (rounded to the nearest EUR 50 million) |

|

1 550 |

|

|

- Cumulative recorded |

|

240 |

|

|

= Cash outflows remaining to be recorded |

|

1 310 |

|

(1)Balances related to previous restructuring and cost savings programs have been included as part of this cost savings program. At the beginning of Q1 2019, the balance of restructuring and associated liabilities related to prior cost savings programs was approximately EUR 630 million. This amount is included in the total expected restructuring and associated cash outflows of EUR 1 550 million, rounded to the nearest EUR 50 million, in addition to the approximately EUR 900 million of expected cash outflows related to our most recent cost savings program.

The below table includes future expectations related to our most recent cost savings program, as well as the remaining cash outflows related to our previous programs and network equipment swaps.

|

|

|

Expected amounts for |

| ||||||

|

In EUR million, approximately |

|

FY 2019 |

|

FY 2020 |

|

Beyond |

|

Total |

|

|

Recurring annual cost savings |

|

200 |

|

500 |

|

— |

|

700 |

|

|

- operating expenses |

|

150 |

|

350 |

|

— |

|

500 |

|

|

- cost of sales |

|

50 |

|

150 |

|

— |

|

200 |

|

|

Restructuring and associated charges |

|

550 |

|

350 |

|

— |

|

900 |

|

|

Restructuring and associated cash outflows |

|

700 |

|

350 |

|

500 |

|

1 550 |

|

|

Charges related to network equipment swaps |

|

150 |

|

— |

|

— |

|

150 |

|

|

Cash outflows related to network equipment swaps |

|

150 |

|

— |

|

— |

|

150 |

|

OPERATIONAL HIGHLIGHTS

Nokia showed strong momentum in the second quarter across its key markets and around the globe, particularly in 5G, where Nokia’s technology is now present in all regions in the world.

In the first pillar of our strategy, leading in high-performance, end-to-end networks with communication service providers:

Nokia signed multiple 5G commercial agreements during the period and the total number of 5G commercial agreements is now 45. Around half of those include portfolio beyond 5G New Radio. Nine of those networks are now live, and these include both mid-band and mmWave solutions. SoftBank Corp. in Japan selected Nokia as a strategic partner to drive its commercial 5G offering with the Nokia AirScale solution. Under a three-year deal, Zain Saudi Arabia will roll out its 5G network using Nokia’s end-to-end portfolio, including radio, microwave transport, security and turnkey services solutions. Nokia and U Mobile in Malaysia signed a three-year contract to deploy a Nokia Single RAN network as well as microwave and IP-based mobile transport technologies; the deal also includes the Nokia 7705 Service Aggregation Routers and 7750 Service Routers for mobile access and aggregation. Nokia and U Mobile also announced they will collaborate on a 5G live network trial later this year. In Denmark, Telia Company initiated its first live 5G tests in cooperation with Nokia and the TT-network. Nokia also announced that China Mobile will adopt its new AirScale mMIMO Adaptive Antenna, created specifically for the massive bandwidth and coverage requirements of the Chinese market as it transitions to 5G.

To address the critical security needs of 5G end-to-end networks, Nokia unveiled DFSEC 2.0, an enhanced security program, and established the “Future X Security” Laboratory, an advanced security testing and verification laboratory. In addition, researchers at Nokia Bell Labs and AMBER, the SFI Centre for Advanced Materials and BioEngineering Research, announced a new formula for battery composition that makes batteries more powerful by packing 2.5 times the battery life than anything currently on the market. Nokia also announced its 5G virtual testing environment, designed to make 5G deployments faster and more cost-efficient.

After Q2 closed, Nokia announced that China Unicom chose Nokia’s optical fronthaul solution to power its 4G and 5G networks in Beijing, supporting the operator’s commitment to deliver 5G in the 2019 timeframe. In addition, Nokia announced that Taiwan Star Telecom will deploy Nokia’s AirScale eNodeB solution, IP routing, packet core and policy and charging solution to expand its LTE services and prepare for 5G migration.

In Optical, TIM (Telecom Italia) achieved a wavelength speed of 550 Gb/s using the Nokia “Photonic Service Engine 3” (PSE-3), a new European record for data transmission over a long-distance backbone network. Nokia and Polish service provider Netia conducted the first field trial of the PSE-3 super coherent technology over a live production network.

In Fixed Access, India’s Netplus will deploy Nokia’s GPON technology to meet growing demand for more capacity, faster speeds and superior quality of broadband services. Nokia announced that Altibox will deploy its Gainspeed Unified Cable Access solution to significantly increase network capacity.

Nokia announced that Cellcom Israel will deploy Sensing as a Service, creating the first real-time and dense environmental data offering in Israel. Environmental sensors will be placed on existing radio base station sites, and Cellcom Israel’s customers in enterprise, transport, healthcare, cities and utilities can subscribe to the data for monetization opportunities.

In the second pillar of our strategy, expanding network sales to select vertical markets needing high-performing, secure networks:

Nokia signed a two-year co-operation agreement with Kalmar and Ukkoverkot to build a wireless digitalization infrastructure for port and terminal R&D in the move toward increasingly intelligent cargo handling solutions. Deutsche Telekom announced the conclusion of its field test with Nokia and the Hamburg Port Authority, which tested new features of the 5G standard with different applications in the Port of Hamburg.

SP Telecom and Nokia are collaborating to enable faster go-to-market solutions for 5G deployment in Singapore, with the addition of Nokia’s FP4-based Service Router, optical transport, cloud software solutions and service automation and network orchestration application suite into SP Telecom’s infrastructure.

Cleco selected Nokia to modernize its microwave communications network, which supports 290,000 customers through Cleco’s retail and wholesale power business in Louisiana and Mississippi.

In the Middle East and Africa (MEA), Gulf Bridge International chose Nokia’s Nuage Networks SD-WAN 2.0 solution to provide connectivity for its customers with international operations.

At Hannover Messe 2019, Nokia showcased the second generation of its Factory in a Box in collaboration with several industry ecosystem partners. The proof of concept demonstrates how Industry 4.0 solutions can be packed, transported and brought back into service in a matter of hours, including full over-the-air connectivity. After the quarter ended, Nokia’s 5G “factory of the future” in Oulu, Finland was selected by McKinsey and the World Economic Forum as an Advanced 4th Industrial Revolution Lighthouse.

Nokia announced it has joined ConectarAGRO, an initiative of eight agribusiness and high technology companies, to bring access for over 500,000 Brazilian farmers to IoT and Agriculture 4.0 technologies.

Etteplan, Nokia and Ukkoverkot announced that they will join forces to provide industrial customers with solutions based on private LTE/4G or NR 5G radio networks. Daiwabo Information System was signed as Nokia’s first distributor in Japan, and will sell Nokia’s IP, optical, LTE and other wireless solutions through its network of about 19,000 sales partners.

In the third pillar of our strategy, developing a strong software business at scale:

Ooredoo Qatar selected Nokia to build a 5G cloud native core network to support delivery of enhanced mobile broadband services. The Nokia AirFrame, CloudBand, voice and Cloud Packet Core VNFs and Nuage Networks software-defined network solution are being deployed in the core network.

Nokia announced that Ooredoo Algeria successfully deployed North Africa’s first virtualized Mobile Gateway, a crucial step for the migration of core network elements to the cloud and the transformation of the core network to support next generation mobile network technology. In addition, Vodafone Egypt is deploying the Nokia Subscriber Data Management over telco cloud for faster rollout of LTE services.

In the fourth pillar of our strategy, now focused primarily on licensing:

Nokia announced that Jenni Lukander would succeed Maria Varsellona as president of Nokia Technologies and become a GLT member, effective 1 August. In addition, Nokia announced an agreement with GE Licensing to enable commercialization of breakthrough technologies in new markets.

RISKS AND FORWARD-LOOKING STATEMENTS

It should be noted that Nokia and its businesses are exposed to various risks and uncertainties and certain statements herein that are not historical facts are forward-looking statements. These forward-looking statements reflect Nokia’s current expectations and views of future developments and include statements regarding: A) expectations, plans or benefits related to our strategies and growth management; B) expectations, plans or benefits related to future performance of our businesses and any expected future dividends; C) expectations and targets regarding financial performance, results, the timing of receivables, operating expenses, taxes, currency exchange rates, hedging, cost savings and competitiveness, as well as results of operations including targeted synergies and those related to market share, prices, net sales, income and margins; D) expectations, plans or benefits related to changes in organizational and operational structure; E) expectations regarding market developments, general economic conditions and structural change globally and in national and regional markets, such as China; F) our ability to integrate acquired businesses into our operations and achieve the targeted business plans and benefits, including targeted benefits, synergies, cost savings and efficiencies; G) expectations, plans or benefits related to any future collaboration or to business collaboration agreements or patent license agreements or arbitration awards, including income to be received under any collaboration or partnership, agreement or award; H) timing of the deliveries of our products and services, including our short term and longer term expectations around the rollout of 5G and our ability to capitalize on such rollout; and the overall readiness of the 5G ecosystem; I) expectations and targets regarding collaboration and partnering arrangements, joint ventures or the creation of joint ventures, and the related administrative, legal, regulatory and other conditions, as well as our expected customer reach; J) outcome of pending and threatened litigation, arbitration, disputes, regulatory proceedings or investigations by authorities; K) expectations regarding restructurings, investments, capital structure optimization efforts, uses of proceeds from transactions, acquisitions and divestments and our ability to achieve the financial and operational targets set in connection with any such restructurings, investments, capital structure optimization efforts, divestments and acquisitions, including our current cost savings program; L) expectations, plans or benefits related to future capital expenditures, temporary incremental expenditures or other R&D expenditures to develop or rollout of software and other new products, including 5G; and M) statements preceded by or including “believe”, “expect”, “expectations”, “commit”, “anticipate”, “foresee”, “see”, “target”, “estimate”, “designed”, “aim”, “plan”, “intend”, “influence”, “assumption”, “focus”, “continue”, “project”, “should”, “is to”, “will” or similar expressions. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. These statements are based on management’s best assumptions and beliefs in light of the information currently available to it. These forward-looking statements are only predictions based upon our current expectations and views of future events and developments and are subject to risks and uncertainties that are difficult to

predict because they relate to events and depend on circumstances that will occur in the future. Factors, including risks and uncertainties that could cause these differences include, but are not limited to: 1) our strategy is subject to various risks and uncertainties and we may be unable to successfully implement our strategic plans, sustain or improve the operational and financial performance of our business groups, correctly identify or successfully pursue business opportunities or otherwise grow our business; 2) general economic and market conditions and other developments in the economies where we operate, including the timeline for the deployment of 5G and our ability to successfully capitalize on that deployment; 3) competition and our ability to effectively and profitably invest in existing and new high-quality products, services, upgrades and technologies and bring them to market in a timely manner; 4) our dependence on the development of the industries in which we operate, including the cyclicality and variability of the information technology and telecommunications industries and our own R&D capabilities and investments; 5) our dependence on a limited number of customers and large multi-year agreements, as well as external events impacting our customers including mergers and acquisitions; 6) our ability to maintain our existing sources of intellectual property-related revenue through our intellectual property, including through licensing, establish new sources of revenue and protect our intellectual property from infringement; 7) our ability to manage and improve our financial and operating performance, cost savings, competitiveness and synergies generally, expectations and timing around our ability to recognize any net sales and our ability to implement changes to our organizational and operational structure efficiently; 8) our global business and exposure to regulatory, political or other developments in various countries or regions, including emerging markets and the associated risks in relation to tax matters and exchange controls, among others; 9) our ability to achieve the anticipated benefits, synergies, cost savings and efficiencies of acquisitions; 10) exchange rate fluctuations, as well as hedging activities; 11) our ability to successfully realize the expectations, plans or benefits related to any future collaboration or business collaboration agreements and patent license agreements or arbitration awards, including income to be received under any collaboration, partnership, agreement or arbitration award; 12) Nokia Technologies’ ability to protect its IPR and to maintain and establish new sources of patent, brand and technology licensing income and IPR-related revenues, particularly in the smartphone market, which may not materialize as planned, 13) our dependence on IPR technologies, including those that we have developed and those that are licensed to us, and the risk of associated IPR-related legal claims, licensing costs and restrictions on use; 14) our exposure to direct and indirect regulation, including economic or trade policies, and the reliability of our governance, internal controls and compliance processes to prevent regulatory penalties in our business or in our joint ventures; 15) our reliance on third-party solutions for data storage and service distribution, which expose us to risks relating to security, regulation and cybersecurity breaches; 16) inefficiencies, breaches, malfunctions or disruptions of information technology systems, or our customers’ security concerns; 17) our exposure to various legal frameworks regulating corruption,

fraud, trade policies, and other risk areas, and the possibility of proceedings or investigations that result in fines, penalties or sanctions; 18) adverse developments with respect to customer financing or extended payment terms we provide to customers; 19) the potential complex tax issues, tax disputes and tax obligations we may face in various jurisdictions, including the risk of obligations to pay additional taxes; 20) our actual or anticipated performance, among other factors, which could reduce our ability to utilize deferred tax assets; 21) our ability to retain, motivate, develop and recruit appropriately skilled employees; 22) disruptions to our manufacturing, service creation, delivery, logistics and supply chain processes, and the risks related to our geographically-concentrated production sites; 23) the impact of litigation, arbitration, agreement-related disputes or product liability allegations associated with our business; 24) our ability to re-establish investment grade rating or maintain our credit ratings; 25) our ability to achieve targeted benefits from, or successfully implement planned transactions, as well as the liabilities related thereto; 26) our involvement in joint ventures and jointly-managed companies; 27) the carrying amount of our goodwill may not be recoverable; 28) uncertainty related to the amount of dividends and equity return we are able to distribute to shareholders for each financial period; 29) pension costs, employee fund-related costs, and healthcare costs; 30) our ability to successfully complete and capitalize on our order backlogs and continue converting our sales pipeline into net sales; and 31) risks related to undersea infrastructure, as well as the risk factors specified on pages 60 to 75 of our 2018 annual report on Form 20-F published on March 21, 2019 under “Operating and financial review and prospects-Risk factors” and in our other filings or documents furnished with the U.S. Securities and Exchange Commission. Other unknown or unpredictable factors or underlying assumptions subsequently proven to be incorrect could cause actual results to differ materially from those in the forward-looking statements. We do not undertake any obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent legally required.

This financial report was authorized for issue by management on July 25, 2019.

· Nokia plans to publish its third quarter and January-September 2019 results on October 24, 2019.

Media Enquiries:

Nokia

Communications

Tel. +358 (0) 10 448 4900

Email: press.services@nokia.com

Jon Peet, Vice President, Corporate Communications

Investor Enquiries:

Nokia Investor Relations

Tel. +358 4080 3 4080

Email: investor.relations@nokia.com

About Nokia

We create the technology to connect the world. We develop and deliver the industry’s only end-to-end portfolio of network equipment, software, services and licensing that is available globally. Our customers include communications service providers whose combined networks support 6.1 billion subscriptions, as well as enterprises in the private and public sector that use our network portfolio to increase productivity and enrich lives.

Through our research teams, including the world-renowned Nokia Bell Labs, we are leading the world to adopt end-to-end 5G networks that are faster, more secure and capable of revolutionizing lives, economies and societies. Nokia adheres to the highest ethical business standards as we create technology with social purpose, quality and integrity. www.nokia.com

![]()

Financial Report for Q2 and Half Year 2019

Strong Q2 driven by end-to-end 5G demand and improved operational execution; Full year 2019 guidance maintained

Rajeev Suri, President and CEO, on Q2 2019 results

Nokia delivered a strong second quarter, driven by 5G demand, a competitive end-to-end portfolio and strengthened operational execution. Given these compelling results, we are confirming our full-year 2019 guidance.

In the quarter, we saw good year-on-year growth, meaningful improvements in profitability, robust progress in our strategic expansion areas of Software and Enterprise and excellent momentum in our IP Routing business. We also continued to enhance our position in 5G, and now have 45 commercial 5G deals and 9 live networks.

Risks remain in the year, including execution demands in the second half, trade-related uncertainty and challenges in the China market. Given these risks, we will continue to focus on tight operational discipline, delivering on our EUR 700 million cost-savings program, improving working capital management and advancing the implementation of our strategy.

Overall, I am pleased with Nokia’s performance in the second quarter and our continued progress in executing our strategy.

Q2 2019 and January-June 2019 reported and non-IFRS results. Refer to note 1, “Basis of Preparation”, note 2, “Non-IFRS to reported reconciliation” and note 13, “Performance measures”, in the “Financial statement information” section for details.

|

EUR million (except for EPS in |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1- |

|

YoY |

|

Constant |

|

|

Net sales |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

|

Operating profit/(loss) |

|

(57 |

) |

(221 |

) |

|

|

|

|

(581 |

) |

(557 |

) |

|

|

|

|

|

Operating margin % |

|

(1.0 |

)% |

(4.2 |

)% |

320 |

bps |

|

|

(5.4 |

)% |

(5.4 |

)% |

0 |

bps |

|

|

|

EPS, diluted |

|

(0.03 |

) |

(0.05 |

) |

|

|

|

|

(0.11 |

) |

(0.11 |

) |

|

|

|

|

|

Operating profit/(loss) (non-IFRS) |

|

451 |

|

334 |

|

35 |

% |

|

|

391 |

|

573 |

|

(32 |

)% |

|

|

|

Operating margin % (non-IFRS) |

|

7.9 |

% |

6.3 |

% |

160 |

bps |

|

|

3.6 |

% |

5.6 |

% |

(200 |

)bps |

|

|

|

EPS, diluted (non-IFRS) |

|

0.05 |

|

0.03 |

|

67 |

% |

|

|

0.02 |

|

0.04 |

|

(50 |

)% |

|

|

|

Net cash and current financial investments(1) |

|

502 |

|

2 146 |

|

(77 |

)% |

|

|

502 |

|

2 146 |

|

(77 |

)% |

|

|

(1)Net cash and current financial investments does not include lease liabilities.

· Net sales in Q2 2019 were EUR 5.7bn, compared to EUR 5.3bn in Q2 2018. On a constant currency basis, net sales increased 5%. Our strong topline performance was driven by improved industry demand and the competitiveness of our end-to-end portfolio, with growth across four out of six regions and all customer types.

July 25, 2019

· Non-IFRS diluted EPS in Q2 2019 was EUR 0.05, compared to EUR 0.03 in Q2 2018, primarily driven by solid operational execution, which yielded gross profit improvements across Networks, Nokia Software and Nokia Technologies.

· Reported diluted EPS in Q2 2019 was negative EUR 0.03, compared to negative EUR 0.05 in Q2 2018, primarily driven by higher gross profit, partially offset by a net negative fluctuation in financial income and expenses.

· In Q2 2019, net cash and current financial investments decreased sequentially by approximately EUR 1.5bn. This decrease was primarily due to anticipated cash outflows including the payment of 2018 performance-related incentives to employees, payment of the quarterly dividend, as well as restructuring and associated cash outflows, which together totaled approximately EUR 900 million. In addition, approximately EUR 350 million of the decline was temporary in nature and is expected to reverse in the second half of 2019.

· Full year 2019 guidance maintained, with seasonality characterized by weaker first and third quarters and stronger second and fourth quarters, with a particularly weak Q1 and an expected particularly strong Q4.

Dividend

Beginning with the distribution for the financial year 2018, Nokia has started paying dividends in quarterly instalments. Under the authorization by the Annual General Meeting held on May 21, 2019, the Board of Directors may resolve an aggregate maximum annual distribution of EUR 0.20 per share to be paid quarterly during the authorization period, unless the Board decides otherwise for a justified reason. On the same day, the Board resolved to distribute EUR 0.05 per share as the first instalment of the dividend.

On July 25, 2019, the Board resolved to distribute EUR 0.05 per share as the second instalment of the dividend. The dividend record date is on July 30, 2019 and the dividend is expected to be paid on or around August 8, 2019. The actual dividend payment date outside Finland will be determined by the practices of the intermediary banks transferring the dividend payments. Following this announced distribution, the Board’s remaining distribution authorization for the financial year 2018 is a maximum of EUR 0.10 per share.

The payment of the second instalment of the dividend, as well as the payment of the withholding taxes related to the first instalment of the dividend, are expected to total approximately EUR 300 million in Q3 2019.

Outlook

|

Metric |

|

Full Year 2019 |

|

Full Year 2020 |

|

|

Non-IFRS diluted earnings per share |

|

EUR 0.25 - 0.29 |

|

EUR 0.37 - 0.42 |

|

|

Non-IFRS operating margin |

|

9 - 12% |

|

12 - 16% |

|

|

Recurring free cash flow(1) |

|

Slightly positive |

|

Clearly positive |

|

Annual distribution to shareholders: Over the long term, Nokia targets to deliver an earnings-based growing dividend by distributing approximately 40% to 70% of non-IFRS diluted EPS, taking into account Nokia’s cash position and expected cash flow generation. The annual distribution would be paid as quarterly dividends.

(1)Free cash flow = net cash from operating activities - capital expenditures + proceeds from sale of property, plant and equipment and intangible assets - purchase of non-current financial investments + proceeds from sale of non-current financial investments.

Key drivers of Nokia’s outlook

Net sales and operating margin for Networks and Nokia Software are expected to be influenced by factors including:

· Our expectation that we will outperform our primary addressable market in full year 2019 and over the longer-term, driven by our strategy, which includes competing in 5G more effectively due to our strong end-to-end portfolio, focusing on targeted growth opportunities in attractive adjacent markets and building a strong network agnostic software business. On a constant currency basis, we expect our primary addressable market to grow slightly in full year 2019, and for growth to continue in full year 2020. (This is an update to our earlier commentary for our primary addressable market to be flattish in full year 2019 and to grow in full year 2020.);

· The slow start to 2019 and weak overall first half puts significant pressure on execution in the second half;

· The timing of completions and acceptances of certain projects, particularly related to 5G. Based on the evolving readiness of the 5G ecosystem and the staggered nature of 5G rollouts in lead countries, we expect full year 2019 will have seasonality characterized by a particularly weak first quarter, a strong second quarter, an expected soft third quarter and an expected particularly strong fourth quarter (This is an update, providing additional quarterly details);

· Competitive intensity could increase in some accounts as some competitors seek to take share in the early phases of 5G;

· Some customers are reassessing their vendors in light of security concerns, creating near-term pressure to invest in order to secure long-term benefits;

· Our expectation that we will improve our R&D productivity and reduce support function costs through the successful execution of our cost savings program;

· Potential mergers or acquisitions by our customers;

· Our product and regional mix; and

· Macroeconomic, industry and competitive dynamics.

Net sales and operating margin for Nokia Technologies is expected to be influenced by factors including:

· The timing and value of new and existing patent licensing agreements with smartphone vendors, automotive companies and consumer electronics companies;

· Results in brand and technology licensing;

· Costs to protect and enforce our intellectual property rights; and

· The regulatory landscape.

Additionally, our outlook is based on the following assumptions:

· Nokia’s recurring free cash flow is expected to improve over the longer-term due to lower cash outflows related to restructuring and network equipment swaps and improved operational results over time;

· Non-IFRS financial income and expenses to be an expense of approximately EUR 350 million in full year 2019 and over the longer-term (This is an update to earlier commentary for non-IFRS financial income and expenses to be an expense of approximately EUR 300 million.);

· Non-IFRS income taxes at a rate of approximately 28% in full year 2019 and approximately 25% over the longer-term, subject to the absolute level of profits, regional profit mix and changes to our operating model;

· Cash outflows related to income taxes of approximately EUR 450 million in full year 2019 and over the longer term until our US or Finnish deferred tax assets are fully utilized; and

· Capital expenditures of approximately EUR 700 million in full year 2019 and approximately EUR 600 million over the longer-term.

Nokia financial results

|

EUR million (except for EPS in EUR) |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1- |

|

Q1- |

|

YoY |

|

Constant |

|

|

Net sales |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

|

Networks |

|

4 393 |

|

4 081 |

|

8 |

% |

5 |

% |

8 336 |

|

7 864 |

|

6 |

% |

3 |

% |

|

Nokia Software |

|

678 |

|

612 |

|

11 |

% |

8 |

% |

1 221 |

|

1 153 |

|

6 |

% |

3 |

% |

|

Nokia Technologies |

|

383 |

|

361 |

|

6 |

% |

4 |

% |

753 |

|

726 |

|

4 |

% |

2 |

% |

|

Group Common and Other |

|

263 |

|

280 |

|

(6 |

)% |

(6 |

)% |

484 |

|

532 |

|

(9 |

)% |

(9 |

)% |

|

Non-IFRS exclusions |

|

(2 |

) |

(5 |

) |

(60 |

)% |

|

|

(27 |

) |

(9 |

) |

200 |

% |

|

|

|

Gross profit |

|

2 065 |

|

1 860 |

|

11 |

% |

|

|

3 646 |

|

3 666 |

|

(1 |

)% |

|

|

|

Operating profit/(loss) |

|

(57 |

) |

(221 |

) |

(74 |

)% |

|

|

(581 |

) |

(557 |

) |

4 |

% |

|

|

|

Networks |

|

119 |

|

34 |

|

250 |

% |

|

|

(135 |

) |

80 |

|

(269 |

)% |

|

|

|

Nokia Software |

|

137 |

|

40 |

|

243 |

% |

|

|

130 |

|

42 |

|

210 |

% |

|

|

|

Nokia Technologies |

|

324 |

|

292 |

|

11 |

% |

|

|

626 |

|

566 |

|

11 |

% |

|

|

|

Group Common and Other |

|

(129 |

) |

(33 |

) |

|

|

|

|

(230 |

) |

(116 |

) |

|

|

|

|

|

Non-IFRS exclusions |

|

(508 |

) |

(555 |

) |

|

|

|

|

(972 |

) |

(1 129 |

) |

|

|

|

|

|

Operating margin % |

|

(1.0 |

)% |

(4.2 |

)% |

320 |

bps |

|

|

(5.4 |

)% |

(5.4 |

)% |

0 |

bps |

|

|

|

Gross profit (non-IFRS) |

|

2 117 |

|

2 038 |

|

4 |

% |

|

|

3 758 |

|

3 979 |

|

(6 |

)% |

|

|

|

Operating profit/(loss) (non-IFRS) |

|

451 |

|

334 |

|

35 |

% |

|

|

391 |

|

573 |

|

(32 |

)% |

|

|

|

Operating margin % (non-IFRS) |

|

7.9 |

% |

6.3 |

% |

160 |

bps |

|

|

3.6 |

% |

5.6 |

% |

(200 |

)bps |

|

|

|

Financial income and expenses |

|

(173 |

) |

(56 |

) |

209 |

% |

|

|

(228 |

) |

(164 |

) |

39 |

% |

|

|

|

Income taxes |

|

46 |

|

10 |

|

360 |

% |

|

|

188 |

|

104 |

|

81 |

% |

|

|

|

Profit/(loss) for the period |

|

(191 |

) |

(271 |

) |

(30 |

)% |

|

|

(632 |

) |

(625 |

) |

1 |

% |

|

|

|

EPS, diluted |

|

(0.03 |

) |

(0.05 |

) |

(40 |

)% |

|

|

(0.11 |

) |

(0.11 |

) |

0 |

% |

|

|

|

Financial income and expenses (non-IFRS) |

|

(86 |

) |

(84 |

) |

2 |

% |

|

|

(178 |

) |

(200 |

) |

(11 |

)% |

|

|

|

Income taxes (non-IFRS) |

|

(101 |

) |

(106 |

) |

(5 |

)% |

|

|

(60 |

) |

(143 |

) |

(58 |

)% |

|

|

|

Profit/(loss) for the period (non-IFRS) |

|

258 |

|

139 |

|

86 |

% |

|

|

142 |

|

223 |

|

(36 |

)% |

|

|

|

EPS, diluted (non-IFRS) |

|

0.05 |

|

0.03 |

|

67 |

% |

|

|

0.02 |

|

0.04 |

|

(50 |

)% |

|

|

Results are as reported and relate to continuing operations unless otherwise specified. The financial information in this report is unaudited. Non-IFRS results exclude costs related to the acquisition of Alcatel-Lucent and related integration, goodwill impairment charges, intangible asset amortization and other purchase price fair value adjustments, restructuring and associated charges and certain other items that may not be indicative of Nokia’s underlying business performance. For details, please refer to note 2, “Non-IFRS to reported reconciliation”, in the notes to the Financial statement information in this report. Change in net sales at constant currency excludes the effect of changes in exchange rates in comparison to euro, our reporting currency. For more information on currency exposures, please refer to note 1, “Basis of Preparation”, in the “Financial statement information” section in this report.

Amounts related to licensing and Nokia Bell Labs allocated 85% to Networks and 15% to Nokia Software

Nokia is providing additional adjusted financial disclosure for its Networks and Nokia Software reportable segments, with amounts related to licensing and Nokia Bell Labs allocated 85% to Networks and 15% to Nokia Software. In addition to Nokia’s primary financial disclosures, this reflects Nokia’s strategy, organizational structure and the way it evaluates operational performance and allocates resources, is in accordance with industry practice and improves comparability with peer companies.

If we would report amounts related to licensing and Nokia Bell Labs as part of Networks and Nokia Software, our Q2 2019 Networks operating margin would have been 7.4% instead of 2.7%, and our Q2 2019 Nokia Software operating margin would have been 24.2% instead of 20.2%.

|

|

|

Q2’19 |

|

Allocations |

|

Q2’19 |

|

Q2’18 |

| ||

|

|

|

Before |

|

Licensing |

|

Nokia Bell Labs |

|

After |

|

After allocations |

|

|

Net sales (EUR million) |

|

|

|

|

|

|

|

|

|

|

|

|

Networks |

|

4 393 |

|

326 |

|

3 |

|

4 721 |

|

4 382 |

|

|

Nokia Software |

|

678 |

|

57 |

|

|

|

736 |

|

665 |

|

|

Nokia Technologies |

|

383 |

|

(383 |

) |

|

|

0 |

|

9 |

|

|

Group Common and Other |

|

263 |

|

|

|

(3 |

) |

260 |

|

278 |

|

|

Eliminations |

|

(21 |

) |

|

|

|

|

(21 |

) |

(15 |

) |

|

Non-IFRS total |

|

5 696 |

|

0 |

|

0 |

|

5 696 |

|

5 318 |

|

|

Operating Profit (EUR million) |

|

|

|

|

|

|

|

|

|

|

|

|

Networks |

|

119 |

|

275 |

|

(46 |

) |

348 |

|

244 |

|

|

Nokia Software |

|

137 |

|

49 |

|

(8 |

) |

178 |

|

77 |

|

|

Nokia Technologies |

|

324 |

|

(324 |

) |

|

|

0 |

|

(5 |

) |

|

Group Common and Other |

|

(129 |

) |

|

|

54 |

|

(75 |

) |

17 |

|

|

Non-IFRS total |

|

451 |

|

0 |

|

0 |

|

451 |

|

334 |

|

|

Operating Margin % |

|

|

|

|

|

|

|

|

|

|

|

|

Networks |

|

2.7 |

% |

|

|

|

|

7.4 |

% |

5.6 |

% |

|

Nokia Software |

|

20.2 |

% |

|

|

|

|

24.2 |

% |

11.6 |

% |

|

Nokia Technologies |

|

84.6 |

% |

|

|

|

|

|

|

|

|

|

Group Common and Other |

|

(49.0 |

)% |

|

|

|

|

(28.8 |

)% |

6.1 |

% |

|

Non-IFRS total |

|

7.9 |

% |

|

|

|

|

7.9 |

% |

6.3 |

% |

Net sales by region

|

EUR million |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1-Q2’18 |

|

YoY |

|

Constant |

|

|

Asia-Pacific |

|

1 012 |

|

932 |

|

9 |

% |

5 |

% |

1 975 |

|

1 842 |

|

7 |

% |

3 |

% |

|

Europe |

|

1 611 |

|

1 548 |

|

4 |

% |

4 |

% |

3 111 |

|

3 054 |

|

2 |

% |

1 |

% |

|

Greater China |

|

515 |

|

524 |

|

(2 |

)% |

0 |

% |

949 |

|

1 003 |

|

(5 |

)% |

(6 |

)% |

|

Latin America |

|

359 |

|

308 |

|

17 |

% |

15 |

% |

664 |

|

605 |

|

10 |

% |

8 |

% |

|

Middle East & Africa |

|

441 |

|

447 |

|

(1 |

)% |

(2 |

)% |

855 |

|

878 |

|

(3 |

)% |

(5 |

)% |

|

North America |

|

1 755 |

|

1 554 |

|

13 |

% |

7 |

% |

3 172 |

|

2 855 |

|

11 |

% |

4 |

% |

|

Total |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |

Net sales by customer type

|

EUR million |

|

Q2’19 |

|

Q2’18 |

|

YoY |

|

Constant |

|

Q1-Q2’19 |

|

Q1-Q2’18 |

|

YoY |

|

Constant |

|

|

Communication service providers |

|

4 755 |

|

4 398 |

|

8 |

% |

6 |

% |

8 962 |

|

8 478 |

|

6 |

% |

2 |

% |

|

Enterprise |

|

318 |

|

295 |

|

8 |

% |

6 |

% |

577 |

|

540 |

|

7 |

% |

4 |

% |

|

Licensees |

|

383 |

|

352 |

|

9 |

% |

6 |

% |

753 |

|

701 |

|

7 |

% |

5 |

% |

|

Other(1) |

|

238 |

|

268 |

|

(11 |

)% |

(12 |

)% |

433 |

|

519 |

|

(17 |

)% |

(16 |

)% |

|

Total |

|

5 694 |

|

5 313 |

|

7 |

% |

5 |

% |

10 726 |

|

10 237 |

|

5 |

% |

2 |

% |