2022 Investor Day New York Stock Exchange December 7, 2022

Ryan Martinez Vice President Investor Relations Welcome

Page 3 Cautionary Statement Regarding Forward-Looking Statements The Company’s 2022 Investor Day presentations and slides contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on, and include statements about, the Company’s current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, statements related to (i) the Company's financial outlook, goals, expectations, plans, position, strategies, and projected results of operations, including factors and assumptions underlying the Company's expectations and projections; (ii) the Company’s strategic priorities and initiatives, including the Company’s plans for focus areas in 2023; (iii) the Company’s Vision; (iv) the Company’s hiring plans and expectations; (v) the Company’s network and growth plans, expectations, and opportunities, and the associated utilization of its fleet, including with respect to the restoration of the Company’s network and maturation of new markets; (vi) the Company’s plans and expectations with respect to its revenue management system modernization; (vii) the Company’s goals related to diversity, equity, and inclusion, and environmental sustainability; (viii) the Company's plans and expectations regarding its fleet and fleet delivery schedule, including fleet retirements and modernization and other factors and assumptions underlying the Company's plans and expectations; (ix) the Company’s plans and expectations with respect to Southwest Business and Global Distribution Systems (GDS), including with respect to managed business revenues; (x) the Company’s plans, expectations, and goals with respect to capacity; (xi) the Company's expectations with respect to fuel costs, fuel efficiency, hedging gains, and the Company's related management of risks associated with changing jet fuel prices, including factors underlying the Company's expectations; (xii) the Company's plans, estimates, and assumptions related to repayment of debt obligations, interest expense, and capital spending; (xiii) the Company’s capital allocation priorities, including its goals and expectations with respect to dividends and share repurchases; (xiv) the Company’s plans and expectations with respect to Customer experience enhancements, including upgrades to WiFi hardware, larger bins, and seat power installations; (xv) the Company’s productivity goals, including factors and assumptions underlying the Company’s plans and expectations; (xvi) the Company’s plans for improving operating leverage; (xvii) the Company’s plans for improving operating quality; (xvii i) the Company’s plans for frontline staffing and tools; and (xix) the Company’s plans for driving value from the Southwest Business Model. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, fears of terrorism or war, socio-demographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) any negative developments related to the COVID-19 pandemic, including, for example, with respect to the duration, spread, severity, or any recurrence of the COVID-19 pandemic or any new variant strains of the underlying virus; the effectiveness, availability, and usage of COVID-19 vaccines; the impact of government mandates, directives, orders, regulations, and other governmental actions related to COVID-19 on the Company’s business plans and its ability to retain key Employees; the extent of the impact of COVID-19 on overall demand for air travel and the Company's related business plans and decisions; and the impact of the COVID-19 pandemic on the Company's access to capital; (iii) the Company's dependence on its workforce, including its ability to employ sufficient numbers of qualified Employees to effectively and eff iciently maintain its operations; (iv) the Company's ability to timely and effectively implement, transition, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives; (v) the Company’s dependence on Boeing with respect to the Company’s fleet delivery schedule, operations, strategies, and goals; (vi) the Company's dependence on other third parties, in particular with respect to its fuel supply; environmental sustainability initiatives and the production, transport, storage, blending, and distribution of sustainable aviation fuel; operational improvements; and corporate travel enhancements; and the impact on the Company's operations and results of operations of any third party delays or nonperformance; (vii) the impact of governmental regulations and other governmental actions on the Company’s business plans and operations; (viii) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (ix) the impact of legislative and regulatory activity related to environmental sustainability, in particular with respect to carbon emissions, sustainable aviation fuel tax credits, and compliance requirements; (x) the Company's ability to timely and effectively implement and maintain the necessary processes to support the utilization of sustainable aviation fuel; (xi) the continuation of government support for renewable fuels generally; (xii) the consequences of competition with other existing and new sources of aviation fuel, whether or not sustainable; (xiii) the Company's dependence on Boeing and the Federal Aviation Administration with respect to the certification of the Boeing MAX 7 aircraft; (xiv) the impact of labor matters on the Company’s business decisions, plans, and strategies; and (xv) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2022.

Bob Jordan Chief Executive Officer Presentation

Page 5 Proven Track Record We have an unmatched record of financial performance in the U.S. airline industry, emerging from the pandemic with an improved competitive position Southwest is restoring its route network and preparing for growth, with a goal to return to its superior pre-pandemic financial performance Southwest has improved its competitive position in the industry due to managing well through the pandemic Southwest has a proven track record of industry leadership, and its business model and Vision remain intact

Page 6 Strategic Priorities Support our Purpose and Vision Our five strategic priorities remain unchanged through 2026 Vision To be the world’s most loved, most efficient, and most profitable airline Purpose Connect People to what’s important in their lives through friendly, reliable, and low-cost air travel

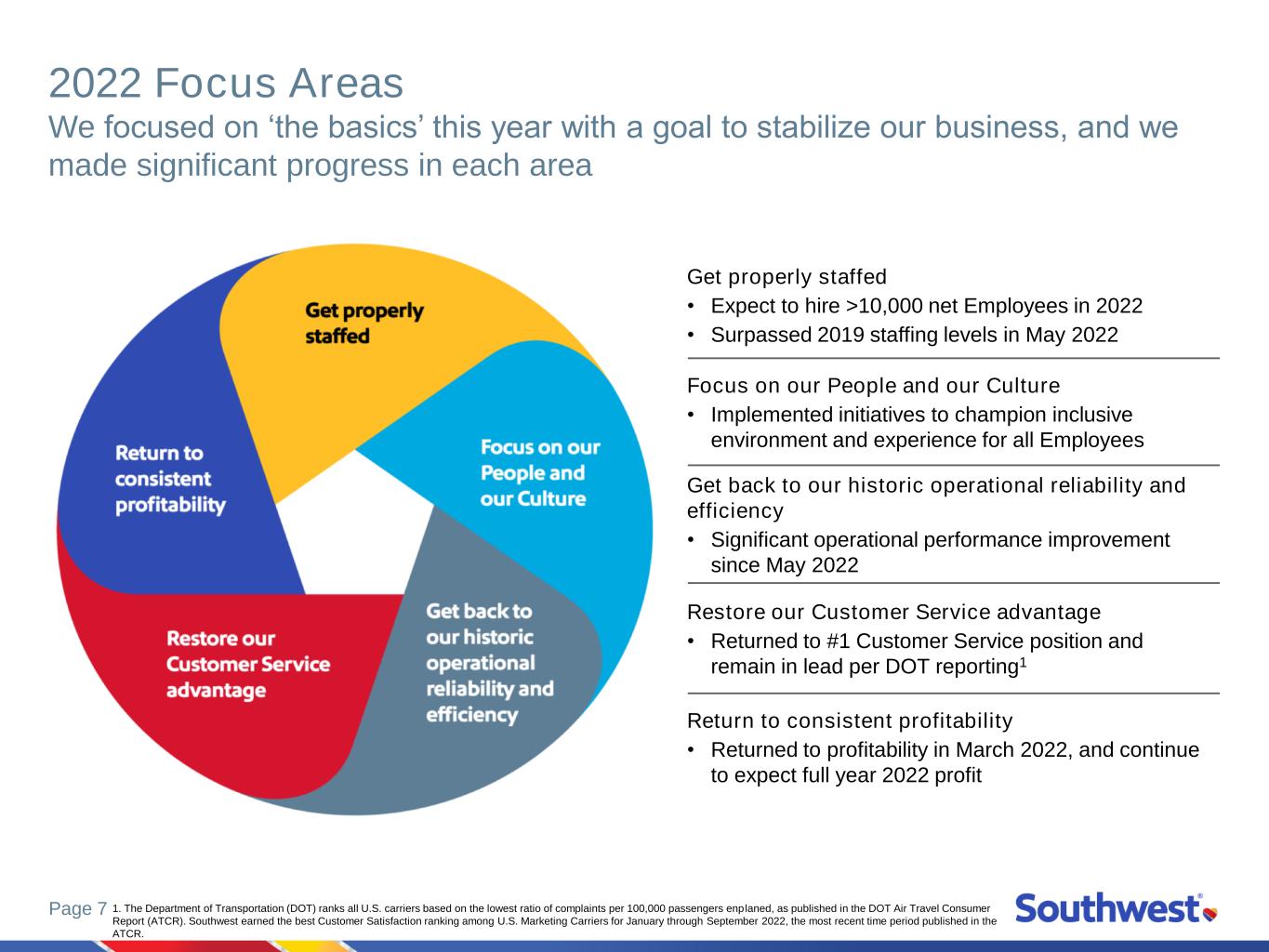

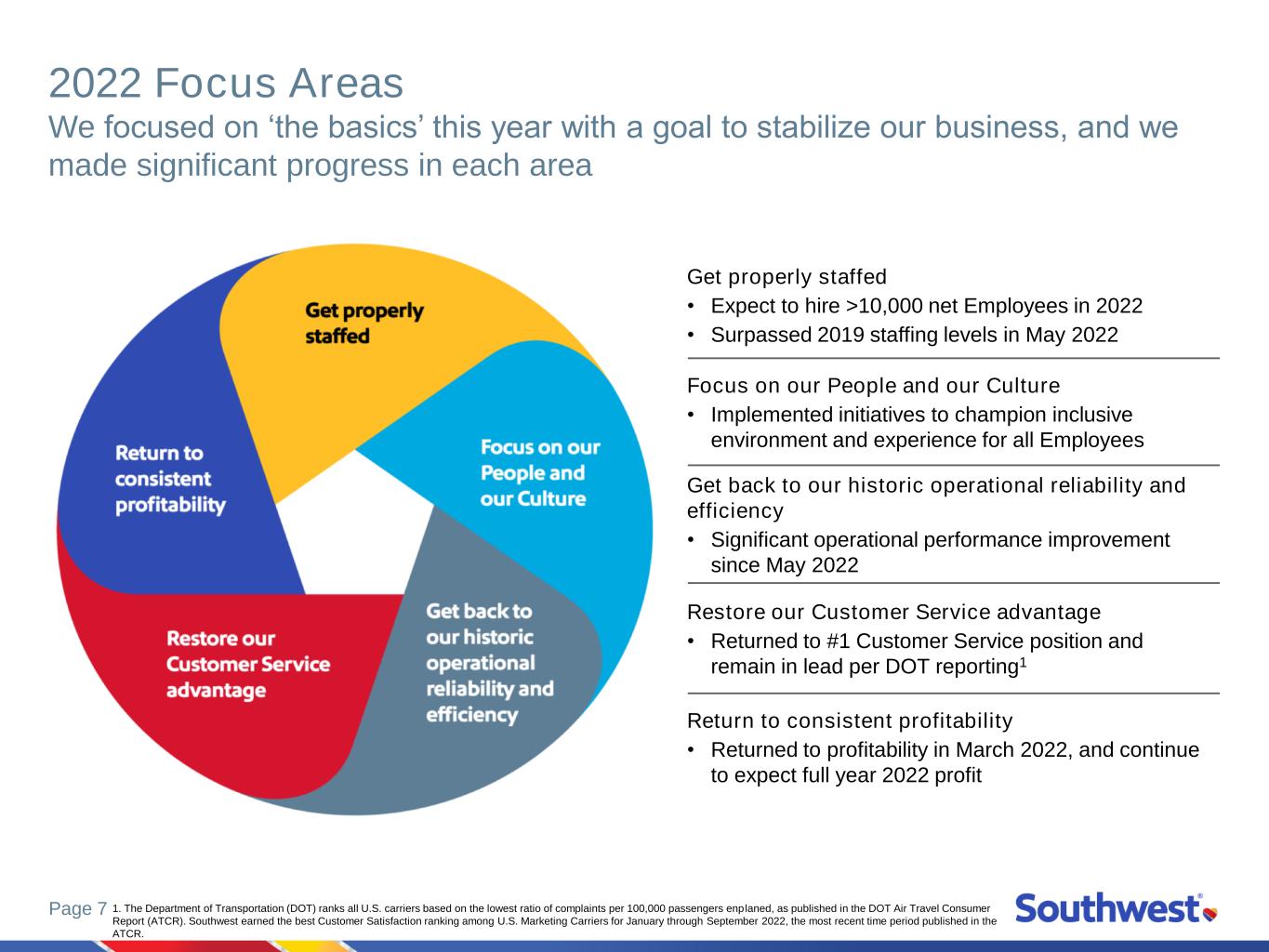

Page 7 2022 Focus Areas We focused on ‘the basics’ this year with a goal to stabilize our business, and we made significant progress in each area Get properly staffed • Expect to hire >10,000 net Employees in 2022 • Surpassed 2019 staffing levels in May 2022 Focus on our People and our Culture • Implemented initiatives to champion inclusive environment and experience for all Employees Get back to our historic operational reliability and efficiency • Significant operational performance improvement since May 2022 Restore our Customer Service advantage • Returned to #1 Customer Service position and remain in lead per DOT reporting1 Return to consistent profitability • Returned to profitability in March 2022, and continue to expect full year 2022 profit 1. The Department of Transportation (DOT) ranks all U.S. carriers based on the lowest ratio of complaints per 100,000 passengers enplaned, as published in the DOT Air Travel Consumer Report (ATCR). Southwest earned the best Customer Satisfaction ranking among U.S. Marketing Carriers for January through September 2022, the most recent time period published in the ATCR.

Page 8 2023 Focus Areas We are ready to move past ‘the basics’ of recovering from the pandemic as our business has stabilized, and we aim to thrive in 2023 Live our Southwest Way Values • We win when we support each other, serve others, and work together as a Team Build on our legendary Hospitality • Offer service our Employees are proud of and our Customers trust • This is how we create Customer loyalty Be consistently reliable and operate with excellence • Provide modern tools and procedures that enable an energetic pace, while keeping Safety our top focus Restore our network and fly the full fleet • Staff properly and show up to support each other and our Customers, which allows for better productivity Produce strong financial results and improve our low-cost edge • Win Customers and out-hustle the competition

Page 9 Strategic Initiatives Our strategic initiatives are performing in line with expectations, and we continue to expect significant financial benefits in 2022 and 2023 Win more Customers and grow revenue Maintain our low-cost advantage Southwest Business and Global Distribution System (GDS) participation New fare product and Revenue Management System (RMS) modernization New Chase co-brand credit card agreement Fleet modernization Currently expect EBIT contribution of ~$700M in 2022, and continue to estimate $1 billion to $1.5 billion EBIT contribution in 2023 New fare product launched in 2022 RMS expected in mid-2023 Agreement effective December 2021 New 737 MAX deliveries and 737-700 retirements Full GDS launch in 2021 Completed / OngoingPlanned launch in 2023

Page 10 Diversity, Equity, and Inclusion Our Diversity, Equity, and Inclusion (DEI) goals are aimed at strengthening our Culture, and our Board of Directors set a goal to increase diverse representation by 2025 Executive diversity Double the percentage of racial diversity and increase gender diversity of our Senior Management Committee (Executive group) by 2025 Senior Leadership diversity Measure progress in increasing diversity in Senior Leaders Hiring and development Evolve hiring and development practices to support diversity goals, including posting all open Leadership positions (Supervisor to Vice President) Community partners Engage breadth of community partners to leverage the Company’s relationships as we source diverse talent We made great progress toward our goals in 2022 and were named one of Forbes’ 2022 Best Employers for Diversity in America In 2020, we set the following Company goals: Key actions taken: • Formed cross-functional Executive Steering Committee to support strategic direction of DEI efforts and progress • Launched DEI Report • Expanded and increased our Diversity Council • Held Company-wide Inclusion Summit • Bolstered DEI talent pipeline and Leadership hiring requirements • Published Human Rights Policy • Refined our Supplier Diversity Program • Provided DEI Training for Employees and required Diversity Hiring training for Hiring Leaders

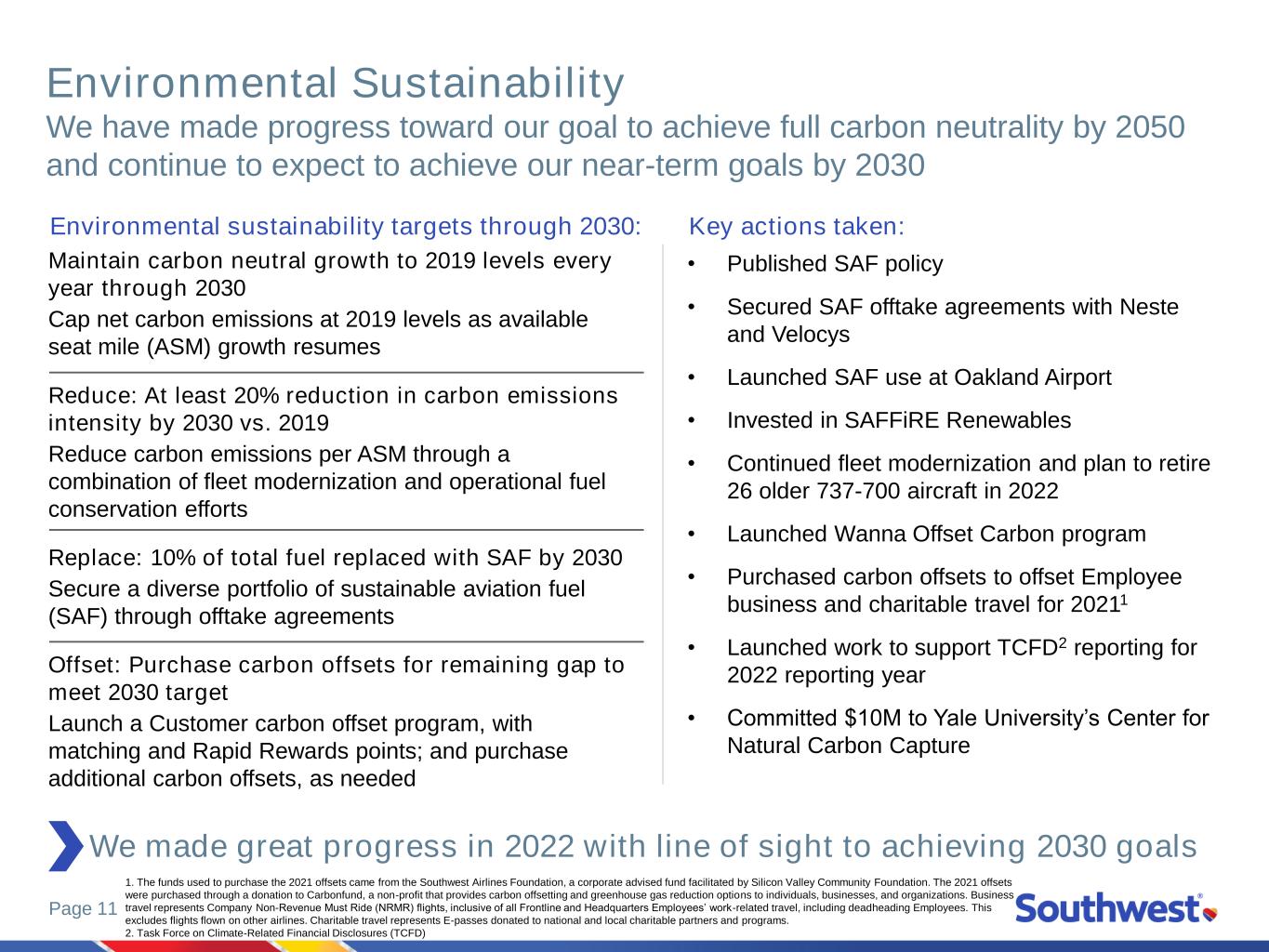

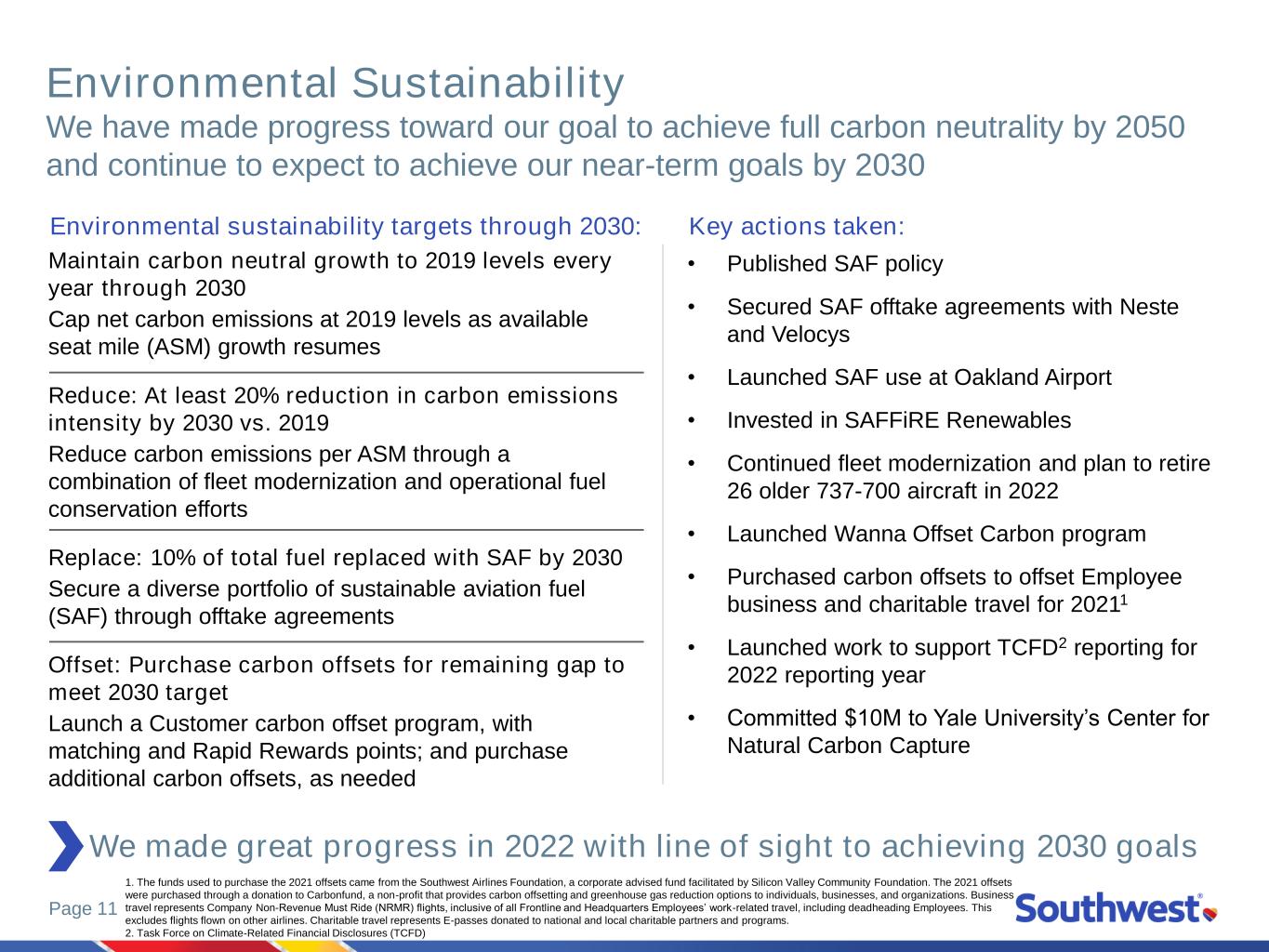

Page 11 Environmental Sustainability We have made progress toward our goal to achieve full carbon neutrality by 2050 and continue to expect to achieve our near-term goals by 2030 Maintain carbon neutral growth to 2019 levels every year through 2030 Cap net carbon emissions at 2019 levels as available seat mile (ASM) growth resumes Reduce: At least 20% reduction in carbon emissions intensity by 2030 vs. 2019 Reduce carbon emissions per ASM through a combination of fleet modernization and operational fuel conservation efforts Replace: 10% of total fuel replaced with SAF by 2030 Secure a diverse portfolio of sustainable aviation fuel (SAF) through offtake agreements Offset: Purchase carbon offsets for remaining gap to meet 2030 target Launch a Customer carbon offset program, with matching and Rapid Rewards points; and purchase additional carbon offsets, as needed Environmental sustainability targets through 2030: Key actions taken: • Published SAF policy • Secured SAF offtake agreements with Neste and Velocys • Launched SAF use at Oakland Airport • Invested in SAFFiRE Renewables • Continued fleet modernization and plan to retire 26 older 737-700 aircraft in 2022 • Launched Wanna Offset Carbon program • Purchased carbon offsets to offset Employee business and charitable travel for 20211 • Launched work to support TCFD2 reporting for 2022 reporting year • Committed $10M to Yale University’s Center for Natural Carbon Capture 1. The funds used to purchase the 2021 offsets came from the Southwest Airlines Foundation, a corporate advised fund facilitated by Silicon Valley Community Foundation. The 2021 offsets were purchased through a donation to Carbonfund, a non-profit that provides carbon offsetting and greenhouse gas reduction options to individuals, businesses, and organizations. Business travel represents Company Non-Revenue Must Ride (NRMR) flights, inclusive of all Frontline and Headquarters Employees’ work-related travel, including deadheading Employees. This excludes flights flown on other airlines. Charitable travel represents E-passes donated to national and local charitable partners and programs. 2. Task Force on Climate-Related Financial Disclosures (TCFD) We made great progress in 2022 with line of sight to achieving 2030 goals

Tammy Romo EVP & Chief Financial Officer Presentation

Page 13 Guidance metric 4Q 2022 Operating revenues (vs. 4Q 2019) Up 13% to 17% Managed business revenues (vs. 4Q 2019) Down 20% to 25% Available seat miles (ASMs, or capacity) (vs. 4Q 2019) Down ~2% Fuel costs per gallon1 $3.10 to $3.20 Non-fuel unit costs (CASM-X2) (vs. 4Q 2019) Up 14% to 18% Scheduled debt repayments (millions) ~$320 Interest expense (millions) ~$70 Strong leisure and business revenue trends continue in fourth quarter 2022, and we continue to expect strong profits and margins Fourth Quarter 2022 Guidance Update Our guidance remains unchanged with the exception of fuel costs, which are estimated to decline ~$.05 per gallon compared with previous guidance 1. Includes fuel taxes, fuel hedging premium expense of $0.03 per gallon, and favorable cash settlements from fuel derivative contracts of $0.37 per gallon. Based on market values as of November 30, 2022. Previous guidance of $3.15 to $3.25. 2. Cost per Available Seat Mile, excluding fuel and oil expense, profitsharing, and special items

Page 14 Guidance metric 1Q 2023 2023 Aircraft1 Not provided 841 Available seat miles (ASMs, or capacity) (vs. 2022) Up ~10% Up ~15% Fuel costs per gallon2 $3.00 to $3.10 $2.85 to $2.95 Non-fuel unit costs (CASM-X3) (vs. 2022) Flat to Up 2% Down 1% to 3% Scheduled debt repayments (millions) ~$20 ~$80 Interest expense (millions) ~$654 ~$2504 Capital spending (CapEx) (billions) Not provided $4.0 to $4.55 2023 Guidance Update We expect to make significant progress in 2023 toward our financial goals, with a focus on restoring our route network and growing profits, margins, and returns on invested capital Based on current bookings, strong leisure revenue trends are estimated to continue in first quarter 2023, and we also expect continued managed business revenue improvement. CASM-X trends are expected to improve from first half to second half 2023, with second half 2023 CASM-X estimated to decrease in the range of 4 percent to 6 percent, year-over-year 1. Aircraft on property, end of period; net of 27 retirements planned in 2023 2. Includes fuel taxes, fuel hedging premium expense of $0.06 and $0.06 per gallon, and favorable cash settlements from fuel derivative contracts of $0.16 and $0.13 per gallon for 1Q 2023 and full year 2023, respectively. Based on market values as of November 30, 2022 3. Cost per Available Seat Mile, excluding fuel and oil expense, profitsharing, and special items 4. Based on scheduled debt repayments and current interest rates, the Company currently expects 2023 interest income to more than offset 2023 interest expense 5. Represents current contractual payments to The Boeing Company (Boeing) for firm aircraft, in addition to ~$1.2 billion in non-aircraft CapEx

Page 15 1. Brent crude oil average market prices as of November 30, 2022, were approximately $87 and $85 for 1Q 2023 and 2023, respectively. 2. Based on the Company’s forecasted fuel consumption and available seat miles. We are currently 15 percent hedged for 2024 with hedging gains beginning at Brent crude prices of ~$70 per barrel. We intend to continue building multi-year fuel hedging protection with a goal to be at least 50 percent hedged beyond 2023 Fuel Hedging Protection In 2023, we will continue to maintain our multi-year fuel hedging program to provide insurance against material spikes in jet fuel prices Brent Crude 1Q 2023 2023 $70 $.01 $.02 Current Market1 $.16 $.13 $90 $.19 $.18 $100 $.29 $.27 $110 $.41 $.37 $120 $.53 $.48 Fair market value1 (in millions) ~$88 ~$387 Max percentage hedged2 56% 50% Estimated fuel hedging settlement gains (Brent crude price per barrel; hedging gains per gallon)

Page 16 Fleet Modernization Our Boeing order book supports growth and fleet modernization plans, and we have significant fleet flexibility Contractual Boeing order book As of December 7, 2022 We are currently planning for 66 MAX deliveries in 2022 and ~100 in 2023, with 26 and 27 planned retirements, respectively. This represents fewer deliveries than our contractual order book due to -7 certification delays and anticipated Boeing supply chain challenges -7 firm orders -8 firm orders -7 or -8 options Total 2022 14 100 -- 1141 2023 21 69 -- 90 2024 41 -- 45 86 2025 30 -- 56 86 2026 30 15 40 85 2027 15 15 6 36 2028+ 35 100 -- 135 Total 1862 2993 147 632 Note: Boeing 737-7 (-7); Boeing 737-8 (-8) 1. The Company has received a total of 50 -8 deliveries this year through November 30, 2022. While the Company is contractually scheduled to receive 114 MAX deliveries this year, a portion of its deliveries are expected to shift out of 2022 due to Boeing’s supply chain challenges and the current status of the -7 certification. 2. The delivery timing for the -7 is dependent on the Federal Aviation Administration (FAA) issuing required certifications and approvals to Boeing and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and the Company therefore offers no assurances that current estimations and timelines are correct. 3. The Company has flexibility to designate firm orders or options as -7s or -8s, upon written advance notification as stated in the contract.

Page 17 8.13 10.48 13.47 16.17 ULCC LegacyLCC -22% +22% +35% 32 1. ULCC airlines: Spirit, Allegiant, Frontier 2. LCC airlines: JetBlue, Alaska 3. Legacy airlines: American, Delta, United 4. Cost per Available Seat Mile, excluding fuel and oil expense, and transport related expenses. Source: DOT form 41 and T100 data, through June 30, 2022. Estimated unit costs have been stage-length adjusted to Southwest’s average 2019 stage-length, represents domestic mainline. Amounts may differ from airline public filings. Since 2019, our unit cost position improved against each industry group average: 4 pts versus ULCC, 6 pts versus LCC, and 3 pts versus Legacy Sustainable Cost Position Our industry cost position has improved, supported by a moat of business model advantages—all Boeing 737 fleet, point-to-point route network, and short turn times Pre-pandemic unit costs 2Q 2019, excluding fuel, stage-length adjusted4 Current unit costs 2Q 2022, excluding fuel, stage-length adjusted4 6.89 9.35 11.11 13.84 ULCC LegacyLCC -26% +16% +32% 21 13

Page 18 Financial Goals Our annual goals are to generate consistent profitability, grow the route network and revenue, and enhance Shareholder value by generating consistent returns on invested capital in excess of weighted average cost of capital Our 2023 goals are to grow profits, margins, and ROIC, year-over-year, and restore the route network to fully utilize our fleet by end-of-year Focus areas Annual goals Available seat miles (ASMs) Modest new market growth and leverage robust network to connect dots and add depth and breadth Non-fuel unit costs (CASM-X1) Maintain competitive cost position and manage inflationary increases Unit revenues (RASM2) Growth in excess of CASM growth Pre-tax margin Maintain industry-leading position After-tax return on invested capital (ROIC) Well above weighted average cost of capital (WACC) Balance Sheet Maintain adequate cash reserves, investment-grade rating, and modest leverage 1. Cost per Available Seat Mile, excluding fuel and oil expense, profitsharing, and special items 2. Revenue per Available Seat Mile (RASM)

Page 19 Capital Allocation Priorities Our investment-grade balance sheet continues to be an enduring strength and remains top in the U.S. airline industry • Cash balance of $13.5B1 • Long-term minimum cash target of ~$6B plus revolver • Earmarking cash for step-up in debt repayments scheduled in 2025 and 2026 • 2023 capital spending (CapEx) in the range of $4.0B to $4.5B • 2024 through 2026 average CapEx of ~$4B • Continue investing in the business to restore the route network, scale for future growth, and replace 737-700 fleet • Repaid ~$2.6B of debt in 20221 • Modest scheduled debt obligations in 2023 and 2024 • ~$3.4B of scheduled debt payments in 2025 and 20261 • Current leverage of 46%1; long-term goal in the low-to-mid 30% range Maintain adequate cash reserves 1 Reduce debt and leverage 3 Invest in the business to fund growth 2 Enhance Shareholder returns 4 • Reinstated and declared quarterly dividend of $.18 per share, or $.72 per share annualized • Dividend reflects solid results since March 2022, and a solid plan for 2023 • Continue to evaluate longer-term plans to utilize excess cash and free cash flow 1. As of November 30, 2022.

Ryan Green EVP & Chief Commercial Officer Presentation

Page 21 Revenue and Customer Initiatives We have several areas of focus for 2023 designed to drive revenue performance Network restoration New market maturation Southwest Business and GDS New fare product Revenue management system modernization Co-brand and loyalty Inflight Customer Experience enhancements Enhanced flexibility Portfolio of revenue initiatives is expected to provide significant financial value 2 3 4 5 6 Focus on lower risk capacity additions as we restore and mature the network 1 7 8 Initiatives focused on the Customer Experience to further strengthen our product offering R E V E N U E C U S T O M E R

Page 22 Network Restoration Network restoration is a priority in 2023 as we rebuild a robust post-pandemic network in key Southwest markets through lower-risk capacity growth Historical and projected trips Pre-pandemic through year-end 2023 Full network restoration in 2023 plus new markets added during the pandemic result in ~115 percent of pre-pandemic trips by year-end 2023 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Mar '20 YE '22 YE '23 Same-Store New Markets + Hawaii ~85% Same-Store Restored % Restored ~85% ~90% ~100% December ‘22 Summer ‘23 December ‘23 Depth: Adding frequencies Breadth: Connecting dots Trips per day Monday schedule 74% 26% 62% 38% 2023 capacity growth Carryover from 2022 Rebuild core markets ~35% ~65%

Page 23 Hawaii service December 2022 New Market Maturation We are focused on maturing new markets that launched during the pandemic, and shifting capacity growth to restoring core markets We have made great progress increasing Customer awareness and improving revenue performance in new markets; however, the percentage of ASMs in development is expected to remain elevated in 2023 and 2024 Percent of system ASMs in development 2022 and 2023 vs. 2019, by quarter 4% 3% 3% 3% 17% 15% 14% 13%13% 13% 12% 11% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 1Q 2Q 3Q 4Q 2019 2022 2023

Page 24 Southwest Business and GDS We have invested in People, processes, and technology to grow our presence in the corporate travel space, and have grown our passenger share by 10 percent We expect to continue realizing the planned EBIT contribution from our GDS initiative in 2023, and we have significantly improved our BTN survey score among Corporate Travel Managers over the past five years Southwest vs industry Business Travel News (BTN) survey results; Scores range from 0 (lowest) to 5 (highest) 3.25 3.75 4.25 4.75 2017 2018 2019 2020 2021 2022 Delta American United Southwest ARC Share: Business1 agencies only 33% 41% 35% 30% 33% 29% 29% 28% 25% 22% 22% 23% 9% 7% 7% 8% 1% 6% 10% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1 Q 1 9 2 Q 1 9 3 Q 1 9 4 Q 1 9 1 Q 2 0 2 Q 2 0 3 Q 2 0 4 Q 2 0 1 Q 2 1 2 Q 2 1 3 Q 2 1 4 Q 2 1 1 Q 2 2 2 Q 2 2 3 Q 2 2 4 Q 2 2 % o f P a x Travel period AA DL UA Other Southwest 1. Data from Airline Reporting Corporation (ARC) and includes top corporate travel agencies; domestic bookings only (US origin to US destination); Carriers included: Southwest, Delta (DL), American (AA), United (UA), Alaska (AS), and JetBlue (B6); data through November 20, 2022

Page 25 Attributes Rapid Rewards® Pts / $ 12 10 8 6 Funds Flexibility Refundable Transferable Flight Credit Refundable Transferable Flight Credit Transferable Flight Credit Flight Credit Same-Day Standby Fare Diff Same-Day Change Fare Diff Priority/Express Lanes N/A N/A Auto-Boarding Assign A1-15 EarlyBird Auto-assign $ $ Premium Drink $ $ $ New Fare Product With the May launch of our new fare product, Wanna Get Away Plus™, we now provide Customers even more flexibility, choice, and rewards for modest buy-ups We have seen a decrease in Customers purchasing Wanna Get Away, replaced by purchases of higher-priced fare products Fare Product Offerings Wanna Get Away Plus Likelihood to repurchase1 85% Customers have an 85% likelihood to repurchase the Wanna Get Away Plus fare after trying 1. Internal Company research ®®

Page 26 Revenue Management System Revenue Management System modernization creates the opportunity for incremental revenue by improving forecasting and optimization science Upgrade optimization science Quickly adapt forecast to recent trends Improve workflow to drive analyst effectiveness Modernize forecasting science Revenue Management System We are currently evaluating two production pilots and plan to make our final selection in mid-2023

Page 27 +32% 32% more acquisitions than pre-pandemic Co-Brand and Loyalty In addition to our Chase agreement benefits, we are seeing momentum in acquiring new Cardmembers and increased spend per Cardmember, with very low attrition Co-brand acquisition performance1 Spend per Cardmember 2022 Spend per Cardmember 2019 Spend per Cardmember $ The improved economics from the December 2021 co-brand credit card agreement are driving value, and we are also experiencing an increased rate of acquisitions and retail spend $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 $2,200 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1. Co-Brand Acquisitions 3Q22 versus 3Q19

Page 28 Inflight Customer Experience Enhancements To further strengthen our brand, we are investing in a cabin experience tailored to our Customers’ needs WiFi upgrades In-seat power installations Larger bin installations Upgrades to WiFi hardware are expected to continue through 3Q 2023; larger bin installations are expected to begin in early 2023; and in-seat power installations are expected to begin in mid-2023 Inflight enhancements

Page 29 Program feature engagement effectiveness1 80% 80% of Corporate Travel Managers think “Flight Credits Don’t Expire” is extremely or very effective in driving program engagement Enhanced Flexibility Flexibility has become more important to our Customers, and flight credits that don’t expire further strengthens our competitive position Flexible policies2 Domestic airlines Southwest offers unmatched flexibility with two free checked bags3; no change4 or cancellation5 fees on all fare types; points that don’t expire; and flight credits that don’t expire, which extends flexibility even further Two bags fly free® No change fees No cancel fees Points / Miles don’t expire Flight credits don’t expire 1. Internal Company research 2. On all fare types, all loyalty statuses, and all credit card member types 3. Baggage weight and size limits apply 4. A fare difference may apply 5. Failure to cancel a reservation at least 10 minutes prior to scheduled departure may result in forfeited travel funds

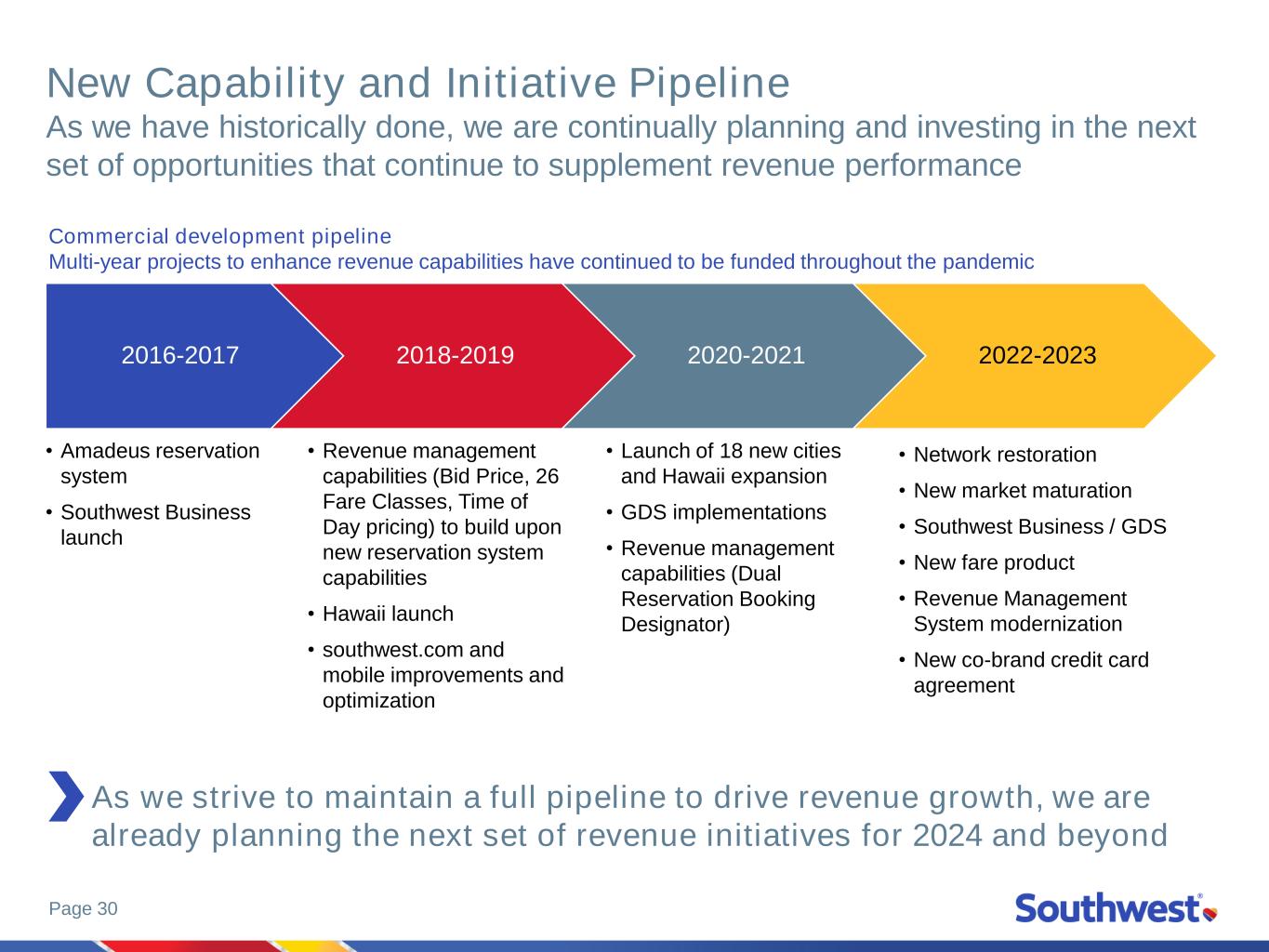

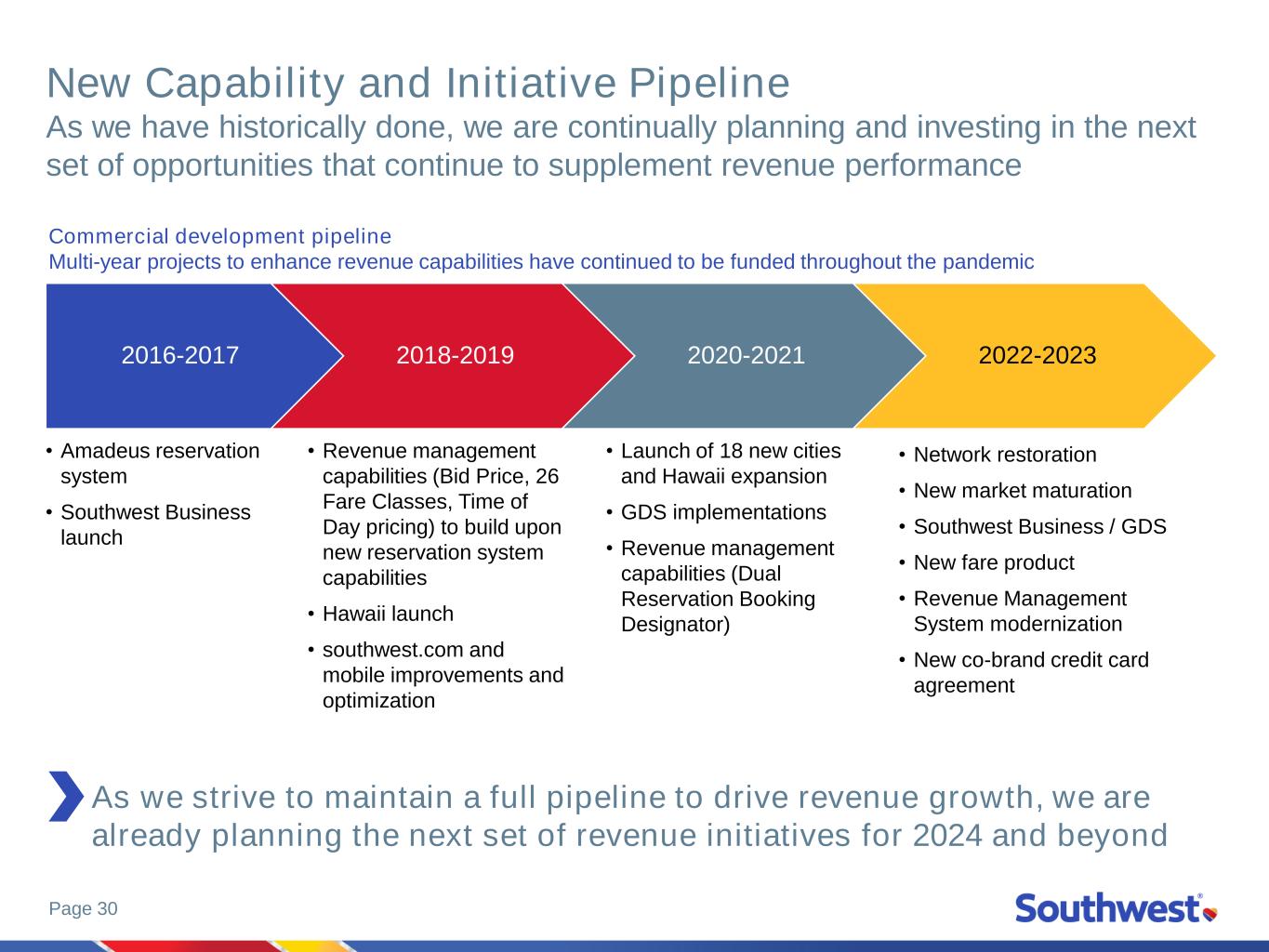

Page 30 New Capability and Initiative Pipeline As we have historically done, we are continually planning and investing in the next set of opportunities that continue to supplement revenue performance Commercial development pipeline Multi-year projects to enhance revenue capabilities have continued to be funded throughout the pandemic 2016-2017 2018-2019 2020-2021 2022-2023 • Network restoration • New market maturation • Southwest Business / GDS • New fare product • Revenue Management System modernization • New co-brand credit card agreement • Amadeus reservation system • Southwest Business launch • Revenue management capabilities (Bid Price, 26 Fare Classes, Time of Day pricing) to build upon new reservation system capabilities • Hawaii launch • southwest.com and mobile improvements and optimization • Launch of 18 new cities and Hawaii expansion • GDS implementations • Revenue management capabilities (Dual Reservation Booking Designator) As we strive to maintain a full pipeline to drive revenue growth, we are already planning the next set of revenue initiatives for 2024 and beyond

Andrew Watterson Chief Operating Officer Presentation

Page 32 1. Aircraft on property 2. Excludes contractors; part-time Employees counted as 0.5 fulltime equivalent Employees (FTEs); aircraft on property 3. Includes common use, preferential use, and exclusive use gates 210M+ ASMs per aircraft1 ~80 FTEs per aircraft2 6+ Average trips per gate3 80+ ASMs per gallon Productivity Goals By the end of 2023, we expect to achieve 3 of the 4 productivity goals set last year, and we intend to leverage business model advantages to drive additional improvements Unexpected Challenges • Growing pains coming out of the pandemic • Unplanned fleet mix changes • Additional headcount required to support operational reliability While we do not expect to achieve our People productivity goal in 2023, each of our operations focus areas are aimed at improving overall efficiency

Page 33 Operations Focus Areas As we move beyond the pandemic, we are leveraging the strengths of our business model to drive efficient growth, operational reliability, and an enhanced experience for our Employees and Customers Aircraft productivity Operating leverage Operating quality Frontline staffing & tools Increase asset utilization Pursue efficient growth Further strengthen operational Reliability and Hospitality Get properly staffed and better equip our Employees These focus areas will reinforce and build upon each other to improve our productivity, while also enhancing the quality of our product

Page 34 Aircraft Productivity We plan to increase our asset utilization while speeding up the tempo of the operation Aircraft productivity Increase asset utilization Turn execution Flight scheduling Maintenance optimization Block execution Overnight flying Planned 2023 delivery

Page 35 Operating leverage Pursue efficient growth Operating Leverage (1 of 2) We have many opportunities to pursue efficient growth across the core of our network by aligning network restoration plans with staffing and facility capacity; we also have several initiatives designed to improve operating leverage Targeted flight adds Growth in core cities Service modernization NG1 engine maintenance Planned 2023 delivery 1. Boeing 737 Next Generation (NG) aircraft

Page 36 Several of our large airports have consistently high flight activity across the day… …while many have valleys that represent opportunities for efficient growth Operating Leverage (2 of 2) We have significant growth opportunities in our largest airports within existing flight volume peaks, enabling better utilization of existing ground staff and facilities LAS DAL BWI ATL HOU PHX DEN MCO LAX MDW OAK STL

Page 37 Operating quality Further strengthen operational Reliability and Hospitality Operating Quality We intend to lessen the impact of irregular events and reduce the causes of disruption Originator performance Transfer operations Station command centers Network design & recovery Planned 2023 delivery

Page 38 Frontline staffing & tools Get properly staffed and better equip our Employees Frontline Staffing and Tools We intend to rapidly close gaps and increase investment in the Frontline Employee experience Targeted staffing levels Training and proficiency Mobility / digital tools Continuous improvement Planned 2023 delivery

Page 39 Driving Value from the Southwest Business Model Our operations focus areas are expected to continue to build upon and enhance the key operational strengths of our business model The simplicity of our operating model The power of our People The strength of our point-to- point network Flexibility driven by the scale of our operation The strength of our brand Aircraft productivity Operating leverage Operating quality Frontline staffing & tools Key operational strengths Operations focus areas

10 minutesBreak

Bob Jordan Tammy Romo Ryan Green Andrew Watterson Q&A Panel

Page 42 Thank you for attending!