UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07175

Name of Registrant: Vanguard Tax-Managed Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 – December 31, 2014

Annual Report | December 31, 2014

Vanguard Tax-Managed Funds®

Vanguard Tax-Managed Balanced Fund

Vanguard Tax-Managed Capital Appreciation Fund

Vanguard Tax-Managed Small-Cap Fund

The mission continues

On May 1, 1975, Vanguard began operations, a fledgling company based on the simple but revolutionary idea that a mutual fund company should be managed solely in the interest of its investors.

Four decades later, that revolutionary spirit continues to animate the enterprise. Vanguard remains on a mission to give investors the best chance of investment success.

As we mark our 40th anniversary, we thank you for entrusting your assets to Vanguard and giving us the opportunity to help you reach your financial goals in the decades to come.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Tax-Managed Balanced Fund. | 9 |

| Tax-Managed Capital Appreciation Fund. | 68 |

| Tax-Managed Small-Cap Fund. | 89 |

| Your Fund’s After-Tax Returns. | 111 |

| About Your Fund’s Expenses. | 112 |

| Glossary. | 114 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. See the Glossary for definitions of investment terms used in this report.

About the cover: Since our founding, Vanguard has drawn inspiration from the enterprise and valor demonstrated by British naval hero Horatio Nelson and his command at the Battle of the Nile in 1798. The photograph displays a replica of a merchant ship from the same era as Nelson’s flagship, the HMS Vanguard.

Your Fund’s Total Returns

| Fiscal Year Ended December 31, 2014 | |

| Total | |

| Returns | |

| Vanguard Tax-Managed Balanced Fund | 9.81% |

| Tax-Managed Balanced Composite Index | 9.95 |

| Mixed-Asset Target Allocation Moderate Funds Average | 5.04 |

| For a benchmark description, see the Glossary. | |

| Mixed-Asset Target Allocation Moderate Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Vanguard Tax-Managed Capital Appreciation Fund | |

| Admiral™ Shares | 12.52% |

| Institutional Shares | 12.56 |

| Russell 1000 Index | 13.24 |

| Multi-Cap Core Funds Average | 9.58 |

| Multi-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Vanguard Tax-Managed Small-Cap Fund | |

| Admiral Shares | 6.23% |

| Institutional Shares | 6.26 |

| S&P SmallCap 600 Index | 5.76 |

| Small-Cap Core Funds Average | 3.92 |

| Small-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Institutional Shares are available to certain institutional investors who meet specific administrative, service, and account-size criteria. | |

| Your Fund’s Performance at a Glance | ||||

| December 31, 2013, Through December 31, 2014 | ||||

| Distributions Per Share | ||||

| Starting | Ending | |||

| Share | Share | Income | Capital | |

| Price | Price | Dividends | Gains | |

| Vanguard Tax-Managed Balanced Fund | $24.90 | $26.79 | $0.536 | $0.000 |

| Vanguard Tax-Managed Capital Appreciation Fund | ||||

| Admiral Shares | $93.70 | $103.82 | $1.616 | $0.000 |

| Institutional Shares | 46.56 | 51.59 | 0.822 | 0.000 |

| Vanguard Tax-Managed Small-Cap Fund | ||||

| Admiral Shares | $43.53 | $45.78 | $0.455 | $0.000 |

| Institutional Shares | 43.63 | 45.88 | 0.473 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

Despite recent volatility both domestically and internationally, the broad U.S. stock and bond markets posted strong results for the 12 months ended December 31, 2014. In this environment, returns for the Vanguard Tax-Managed Funds ranged from more than 6% for the Tax-Managed Small-Cap Fund to more than 12% for the Tax-Managed Capital Appreciation Fund. The Tax-Managed Balanced Fund—which is invested about 50% in stocks and about 50% in bonds—fell between the two, returning about 10%.

The funds’ returns were generally consistent with those of their benchmark indexes. Each of the funds significantly outpaced its peer group.

The funds continued to meet their tax-management objective, as they have since their inception.

You may wish to review the table later in this report that shows the funds’ after-tax returns for the past one, five, and ten years.

U.S. stocks finished strongly for the sixth straight year

U.S. stocks returned nearly 13% for the 12 months, posting gains for the sixth consecutive calendar year. Rising corporate

2

earnings, the growing U.S. economy, and generally accommodative global monetary policies lifted domestic markets even as Europe and China faced economic challenges, tensions flared in the Middle East and Ukraine, and concerns arose over stocks’ high valuations.

Although the Federal Reserve ended its stimulative bond-buying program in October, investors seemed reassured by the Fed’s promise to be “patient” as it decides when to increase short-term interest rates. Other central banks—including the Bank of Japan, the European Central Bank, and the People’s Bank of China—announced significant stimulus measures.

International stocks didn’t fare as well as their U.S. counterparts, returning about –3% in dollar terms. Their performance was hurt as many foreign currencies weakened against the U.S. dollar. Emerging-market stocks rose slightly, while stocks from the developed markets of Europe and the Pacific region retreated.

Defying analysts’ expectations, bond prices rose during the period

Bond prices received a boost from moves by many central banks along with various global economic, market, and geopolitical challenges that drew investors to perceived safe havens. In an unexpected rebound from the previous year, the broad U.S. bond market returned 5.97% for the period.

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended December 31, 2014 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 13.24% | 20.62% | 15.64% |

| Russell 2000 Index (Small-caps) | 4.89 | 19.21 | 15.55 |

| Russell 3000 Index (Broad U.S. market) | 12.56 | 20.51 | 15.63 |

| FTSE All-World ex US Index (International) | -3.31 | 9.41 | 4.75 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 5.97% | 2.66% | 4.45% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 9.05 | 4.30 | 5.16 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.03 | 0.04 | 0.06 |

| CPI | |||

| Consumer Price Index | 0.76% | 1.33% | 1.69% |

3

Even as the Fed pared back its bond purchases, prices climbed and yields fell. (Bond prices and yields move in opposite directions.) The yield of the 10-year Treasury note ended December at 2.19%, down from 2.97% at the close of December 2013.

Municipal bonds returned 9.05%, benefiting from increased demand and generally limited supply.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –3.08%.

Returns for money market funds and savings accounts remained minuscule, as the Fed kept its target for short-term interest rates to 0%–0.25%.

Large-cap companies trumped their smaller-cap counterparts

Vanguard’s three tax-managed domestic funds share a tax-efficient objective, while offering exposure to different areas of the market. The funds’ advisors—Vanguard’s Equity Investment Group and Fixed Income Group—use various portfolio management strategies to minimize the funds’ taxable gains, while deviating as little as possible from an indexing strategy.

The Tax-Managed Capital Appreciation Fund, which tracks the Russell 1000 Index and invests in large- and mid-cap stocks, was the trio’s top performer for the fiscal year. Although U.S. stocks of all sizes and styles posted gains, large-cap stocks returned significantly more than smaller-caps.

| Expense Ratios | |||

| Your Fund Compared With Its Peer Group | |||

| Admiral | Institutional | Peer Group | |

| Shares | Shares | Average | |

| Tax-Managed Balanced Fund | 0.12% | — | 0.91% |

| Tax-Managed Capital Appreciation Fund | 0.12 | 0.08% | 1.17 |

| Tax-Managed Small-Cap Fund | 0.12 | 0.08 | 1.32 |

The fund expense ratios shown are from the prospectus dated April 7, 2014, and represent estimated costs for the current fiscal year. For the fiscal year ended December 31, 2014, the funds’ expense ratios were: for the Tax-Managed Balanced Fund, 0.12%; for the Tax-Managed Capital Appreciation Fund, 0.12% for Admiral Shares and 0.08% for Institutional Shares; and for the Tax-Managed Small-Cap Fund, 0.12% for Admiral Shares and 0.08% for Institutional Shares. Peer group expense ratios are derived from data provided by Lipper, a Thomson Reuters Company, and capture information through year-end 2013.

Peer groups: For the Tax-Managed Balanced Fund, Mixed-Asset Target Allocation Moderate Funds; for the Tax-Managed Capital Appreciation

Fund, Multi-Cap Core Funds; and for the Tax-Managed Small-Cap Fund, Small-Cap Core Funds.

4

Eight of the fund’s nine market sectors advanced, with health care, technology, and financial stocks contributing most to performance. Together, these three sectors accounted for two-thirds of the fund’s total return.

In health care, pharmaceutical and biotech-nology firms benefited from new product development, mergers and acquisitions, and strategic alliances. Computer hardware and systems software companies led the way in technology, as demand for smartphones, mobile technologies, and cloud-based computing grew in the United States and overseas. Within the financial sector, low interest rates and the expanding economy propelled real estate investment trusts (REITs) to returns of nearly 30%.

Hurt by a slide in oil prices, energy was the only sector to decline for the period.

The Tax-Managed Balanced Fund, which seeks to hold half its assets in stocks and half in municipal bonds, was next in line. The fund’s equity portion, which also tracks the Russell 1000 Index, had similar results to the Capital Appreciation Fund.

| Total Returns | |

| Ten Years Ended December 31, 2014 | |

| Average | |

| Annual Return | |

| Tax-Managed Balanced Fund | 6.50% |

| Tax-Managed Balanced Composite Index | 6.73 |

| Mixed-Asset Target Allocation Moderate Funds Average | 5.21 |

| For a benchmark description, see the Glossary. | |

| Mixed-Asset Target Allocation Moderate Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Tax-Managed Capital Appreciation Fund Admiral Shares | 8.04% |

| Russell 1000 Index | 7.96 |

| Multi-Cap Core Funds Average | 6.73 |

| Multi-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Tax-Managed Small-Cap Fund Admiral Shares | 9.06% |

| S&P SmallCap 600 Index | 9.02 |

| Small-Cap Core Funds Average | 7.04 |

| Small-Cap Core Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

The Balanced Fund’s fixed income portion, which invests in intermediate-term municipal bonds, also posted strong results. As I mentioned, municipal bonds were boosted by an increase in demand, coupled with a limited supply.

The Tax-Managed Small-Cap Fund, which invests primarily in stocks of smaller companies and tracks the S&P SmallCap 600 Index, produced the group’s weakest result. Although its mandate differs, its performance was affected by trends similar to those I mentioned above. Technology, financials, and health care stocks were again top performers, but the smaller companies in these industries returned significantly less than the larger ones. The fund posted negative results in energy, materials, and telecommunication services.

Long term, the funds have stayed competitive with their benchmarks

For the decade ended December 31, 2014, Vanguard’s domestic tax-managed funds posted average annual returns ranging from more than 6% for the Balanced Fund to about 9% for the Small-Cap Fund. These returns were in line with the funds’ benchmarks, and all three funds outpaced the average returns of their peers.

Vanguard’s Equity Investment Group and Fixed Income Group deserve credit for the funds’ success in delivering results in line with their indexes and meeting their tax-management objectives. Unlike many of their peers, our tax-managed funds have never distributed capital gains to shareholders. We believe the advisors will continue this record, as they manage each fund with tax consequences in mind.

| A note on expense ratios |

| The Expense Ratios table in each shareholder report’s Chairman’s Letter displays fund expense |

| ratios from the most recent prospectus. These figures include the funds’ actual operating |

| expenses. For some funds, the figures also include “acquired fund fees and expenses,” |

| which result from the funds’ holdings in business development companies (BDCs). |

| Although the Securities and Exchange Commission requires that BDC costs be included in a |

| fund’s expense ratio, these fees are not incurred by the fund. They have no impact on a fund’s |

| total return or on its tracking error relative to an index. A footnote to the Expense Ratios table |

| reports the fund’s actual expenses for the fiscal year, a more relevant tally of the operating |

| costs incurred by shareholders. |

To build for the long term, start with a solid foundation

As the leader of a major investment firm, I get asked a lot of questions on all kinds of topics, from the outlook for global markets to the best fund choices for an IRA. But a topic that almost never comes up—and one that I consider perhaps the most important—is setting investment goals.

At Vanguard, we believe that following four timeless, straightforward principles can help put you on the right track toward investment success:

• Goals. Create clear, appropriate investment goals.

• Balance. Develop a suitable asset allocation using broadly diversified funds.

• Cost. Minimize cost.

• Discipline. Maintain perspective and long-term discipline.

All four principles are essential, and the order in which they’re listed is intentional. Every good investment plan begins with a clearly defined goal, which sets the foundation for building your portfolio.

| Vanguard’s outlook for investors: Expect less and stay balanced |

| In Vanguard’s recently published market outlook, global chief economist Joe Davis and his |

| team discuss expected returns for various asset classes over the coming years. Although not |

| bearish, our outlook on global stocks and bonds is the most guarded since 2006. The report |

| cautions that, over the next decade, returns for a balanced portfolio are likely to be moderately |

| below long-run historical averages. |

| Our simulations indicate that the average annualized returns of a 60% equity/40% bond |

| portfolio for the decade ending 2024 are most likely to be centered in the 3%–5% range |

| after inflation, below the actual average after-inflation return of 5.6% for the same portfolio |

| since 1926. |

| Even so, Vanguard firmly believes that the principles for investing success—focusing on clear |

| goals, a suitable asset allocation, low costs, and long-term discipline—remain unchanged. |

| For more information about our expectations and the probability of various outcomes, |

| see Vanguard’s Economic and Investment Outlook, available at vanguard.com/research. |

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model (VCMM) regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM, derived from 10,000 simulations for U.S. equity returns and fixed income returns. Simulations as of September 30, 2014. Results from the model may vary with each use and over time. For more information, please see page 8.

7

(You can read more about our principles in Vanguard’s Principles for Investing Success, available at vanguard.com/ research.)

Setting an investment goal doesn’t have to be complicated. It can be as simple as saving for retirement or for a child’s college education. Being realistic about your goals—and how to meet them—can help you stick with your investment plan even when times get tough.

We’ve recently welcomed a new year, which for many means a new beginning. Now is a perfect time to revisit your investment plan and make any necessary adjustments to help you reach your long-term financial goals.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

January 15, 2015

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

8

Tax-Managed Balanced Fund

Fund Profile

As of December 31, 2014

| Equity and Portfolio Characteristics | |||

| DJ | |||

| U.S. | |||

| Total | |||

| Russell | Market | ||

| 1000 | FA | ||

| Fund | Index | Index | |

| Number of Stocks | 795 | 1,043 | 3,776 |

| Median Market Cap | $50.3B | $61.1B | $48.1B |

| Price/Earnings Ratio | 19.9x | 19.9x | 20.6x |

| Price/Book Ratio | 2.8x | 2.8x | 2.7x |

| Return on Equity | 18.4% | 18.5% | 17.8% |

| Earnings Growth | |||

| Rate | 16.2% | 15.5% | 15.4% |

| Dividend Yield | 1.6% | 1.9% | 1.9% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | 8% | — | — |

| Ticker Symbol | VTMFX | — | — |

| Expense Ratio1 | 0.12% | — | — |

| 30-Day SEC Yield | 1.59% | — | — |

| Short-Term Reserves | 0.0% | — | — |

| Fixed Income Characteristics | |||

| Barclays | Barclays | ||

| 1-15 Year | Municipal | ||

| Municipal | Bond | ||

| Fund | Index | Index | |

| Number of Bonds | 1,261 | 37,500 | 46,179 |

| Yield to Maturity | |||

| (before expenses) | 1.8% | 1.7% | 2.1% |

| Average Coupon | 4.2% | 4.8% | 4.8% |

| Average Duration | 4.7 years | 4.7 years | 6.1 years |

| Average Stated | |||

| Maturity | 9.1 years | 8.1 years | 13.4 years |

| Total Fund Volatility Measures | ||

| DJ | ||

| Tax-Managed | U.S. Total | |

| Balanced | Market | |

| Comp Index | FA Index | |

| R-Squared | 0.99 | 0.88 |

| Beta | 1.00 | 0.49 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. | ||

| Ten Largest Stocks (% of equity portfolio) | ||

| Apple Inc. | Computer | |

| Technology | 3.0% | |

| Exxon Mobil Corp. | Oil: Integrated | 1.7 |

| Microsoft Corp. | Computer Services | |

| Software & Systems | 1.7 | |

| Google Inc. | Computer Services | |

| Software & Systems | 1.5 | |

| Berkshire Hathaway Inc. | Insurance: Multi-Line | 1.4 |

| Johnson & Johnson | Pharmaceuticals | 1.3 |

| Procter & Gamble Co. | Personal Care | 1.2 |

| Wells Fargo & Co. | Banks: Diversified | 1.1 |

| General Electric Co. | Diversified | |

| Manufacturing | ||

| Operations | 1.1 | |

| JPMorgan Chase & Co. | Diversified Financial | |

| Services | 1.0 | |

| Top Ten | 15.0% | |

| Top Ten as % of Total Net Assets | 7.2% | |

| The holdings listed exclude any temporary cash investments and equity index products. | ||

Fund Asset Allocation

1 The expense ratio shown is from the prospectus dated April 7, 2014, and represents estimated costs for the current fiscal year. For the fiscal year ended December 31, 2014, the expense ratio was 0.12%.

9

Tax-Managed Balanced Fund

| Sector Diversification (% of equity exposure) | |||

| DJ | |||

| Russell | U.S. Total | ||

| 1000 | Market | ||

| Fund | Index | FA Index | |

| Consumer | |||

| Discretionary | 14.4% | 14.3% | 14.5% |

| Consumer Staples | 7.8 | 7.9 | 7.5 |

| Energy | 7.8 | 7.8 | 7.6 |

| Financial Services | 19.4 | 19.1 | 19.4 |

| Health Care | 13.9 | 13.9 | 13.9 |

| Materials & | |||

| Processing | 4.1 | 4.0 | 4.2 |

| Producer Durables | 11.0 | 11.3 | 11.3 |

| Technology | 16.4 | 16.4 | 16.4 |

| Utilities | 5.2 | 5.3 | 5.2 |

| Distribution by Credit Quality (% of fixed | |

| income portfolio) | |

| AAA | 18.7% |

| AA | 54.7 |

| A | 19.8 |

| BBB | 6.1 |

| BB | 0.2 |

| Not Rated | 0.5 |

| Credit-quality ratings are obtained from Moody's and S&P, and the higher rating for each issue is shown. For more information about these ratings, see the Glossary entry for Credit Quality. | |

Equity Investment Focus

Fixed Income Investment Focus

| Distribution by Stated Maturity | |

| (% of fixed income portfolio) | |

| Under 1 Year | 12.3% |

| 1 - 3 Years | 9.3 |

| 3 - 5 Years | 8.1 |

| 5 - 10 Years | 25.8 |

| 10 - 20 Years | 43.6 |

| 20 - 30 Years | 0.9 |

| Largest Area Concentrations (% of fixed income | |

| portfolio) | |

| California | 15.8% |

| New York | 13.7 |

| Texas | 7.8 |

| Pennsylvania | 6.2 |

| Illinois | 5.9 |

| New Jersey | 4.8 |

| Florida | 4.4 |

| Massachusetts | 4.0 |

| Ohio | 3.5 |

| Arizona | 3.3 |

| Top Ten | 69.4% |

| "Largest Area Concentration" figures exclude any fixed income futures contracts. | |

10

Tax-Managed Balanced Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

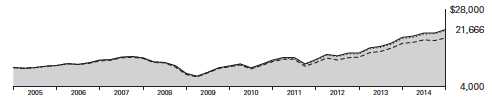

Cumulative Performance: December 31, 2004, Through December 31, 2014

Initial Investment of $10,000

| Average Annual Total Returns | |||||

| Periods Ended December 31, 2014 | |||||

| Final Value | |||||

| One | Five | Ten | of a $10,000 | ||

| Year | Years | Years | Investment | ||

| Tax-Managed Balanced Fund | 9.81% | 9.93% | 6.50% | $18,772 | |

| •••••••• | Tax-Managed Balanced Composite | ||||

| Index | 9.95 | 10.21 | 6.73 | 19,189 | |

| – – – – | Mixed-Asset Target Allocation | ||||

| Moderate Funds Average | 5.04 | 8.34 | 5.21 | 16,613 | |

| - - - - - - | Barclays Municipal Bond Index | 9.05 | 5.16 | 4.74 | 15,885 |

| Dow Jones U.S. Total Stock Market | |||||

| Float Adjusted Index | 12.47 | 15.72 | 8.09 | 21,779 | |

| For a benchmark description, see the Glossary. | |||||

| Mixed-Asset Target Allocation Moderate Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |||||

See Financial Highlights for dividend and capital gains information.

11

Tax-Managed Balanced Fund

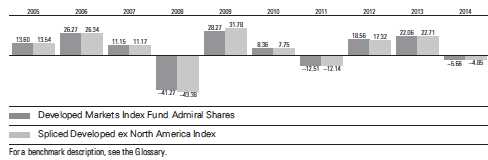

Fiscal-Year Total Returns (%): December 31, 2004, Through December 31, 2014

12

Tax-Managed Balanced Fund

Financial Statements

Statement of Net Assets

As of December 31, 2014

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Common Stocks (48.1%) | |||

| Consumer Discretionary (6.9%) | |||

| Walt Disney Co. | 81,166 | 7,645 | |

| Comcast Corp. Class A | 107,645 | 6,245 | |

| Wal-Mart Stores Inc. | 67,049 | 5,758 | |

| * | Amazon.com Inc. | 17,982 | 5,581 |

| Home Depot Inc. | 51,699 | 5,427 | |

| Twenty-First Century | |||

| Fox Inc. Class A | 95,951 | 3,685 | |

| * | eBay Inc. | 62,844 | 3,527 |

| Time Warner Inc. | 40,396 | 3,451 | |

| Lowe’s Cos. Inc. | 49,315 | 3,393 | |

| NIKE Inc. Class B | 33,894 | 3,259 | |

| Costco Wholesale Corp. | 22,617 | 3,206 | |

| * | Priceline Group Inc. | 2,668 | 3,042 |

| Starbucks Corp. | 32,863 | 2,696 | |

| McDonald’s Corp. | 28,474 | 2,668 | |

| TJX Cos. Inc. | 37,386 | 2,564 | |

| * | DIRECTV | 25,818 | 2,238 |

| Ford Motor Co. | 142,400 | 2,207 | |

| CBS Corp. Class B | 30,913 | 1,711 | |

| Target Corp. | 22,045 | 1,673 | |

| Johnson Controls Inc. | 33,600 | 1,624 | |

| * | Dollar General Corp. | 20,400 | 1,442 |

| * | AutoZone Inc. | 2,201 | 1,363 |

| Ross Stores Inc. | 14,304 | 1,348 | |

| Macy’s Inc. | 20,494 | 1,347 | |

| Yum! Brands Inc. | 17,905 | 1,304 | |

| * | O’Reilly Automotive Inc. | 6,662 | 1,283 |

| Marriott International Inc. | |||

| Class A | 16,183 | 1,263 | |

| Time Warner Cable Inc. | 8,243 | 1,253 | |

| * | DISH Network Corp. Class A | 16,305 | 1,188 |

| Royal Caribbean Cruises Ltd. | 14,147 | 1,166 | |

| Starwood Hotels & Resorts | |||

| Worldwide Inc. | 14,107 | 1,144 | |

| Harley-Davidson Inc. | 16,890 | 1,113 | |

| General Motors Co. | 31,600 | 1,103 | |

| Estee Lauder Cos. Inc. | |||

| Class A | 13,918 | 1,061 | |

| BorgWarner Inc. | 18,852 | 1,036 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Advance Auto Parts Inc. | 6,264 | 998 | |

| Tractor Supply Co. | 12,514 | 986 | |

| Signet Jewelers Ltd. | 7,400 | 974 | |

| Ralph Lauren Corp. Class A | 5,173 | 958 | |

| Newell Rubbermaid Inc. | 25,118 | 957 | |

| Wyndham Worldwide Corp. | 11,100 | 952 | |

| Hanesbrands Inc. | 8,400 | 938 | |

| PVH Corp. | 7,283 | 933 | |

| Polaris Industries Inc. | 6,100 | 923 | |

| Carnival Corp. | 19,950 | 904 | |

| DR Horton Inc. | 35,222 | 891 | |

| * | Jarden Corp. | 18,507 | 886 |

| * | Dollar Tree Inc. | 12,588 | 886 |

| PetSmart Inc. | 10,624 | 864 | |

| Expedia Inc. | 10,091 | 861 | |

| * | Sirius XM Holdings Inc. | 244,000 | 854 |

| Harman International | |||

| Industries Inc. | 7,907 | 844 | |

| Lear Corp. | 8,600 | 844 | |

| Fortune Brands Home | |||

| & Security Inc. | 18,025 | 816 | |

| Lennar Corp. Class A | 18,123 | 812 | |

| * | Bed Bath & Beyond Inc. | 10,400 | 792 |

| Scripps Networks | |||

| Interactive Inc. Class A | 10,468 | 788 | |

| * | WABCO Holdings Inc. | 7,296 | 764 |

| Gap Inc. | 17,685 | 745 | |

| * | Restaurant Brands | ||

| International Inc. | 18,711 | 730 | |

| Gentex Corp. | 19,985 | 722 | |

| Domino’s Pizza Inc. | 7,400 | 697 | |

| Kohl’s Corp. | 11,385 | 695 | |

| * | Michael Kors Holdings Ltd. | 9,200 | 691 |

| Service Corp. International | 29,800 | 676 | |

| * | NVR Inc. | 530 | 676 |

| CST Brands Inc. | 15,466 | 674 | |

| Dillard’s Inc. Class A | 5,213 | 653 | |

| Brinker International Inc. | 10,837 | 636 | |

| Aaron’s Inc. | 20,411 | 624 | |

| * | Hilton Worldwide | ||

| Holdings Inc. | 23,650 | 617 |

13

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Dunkin’ Brands Group Inc. | 14,392 | 614 | |

| DeVry Education Group Inc. | 12,900 | 612 | |

| Thor Industries Inc. | 10,400 | 581 | |

| John Wiley & Sons Inc. | |||

| Class A | 9,618 | 570 | |

| Big Lots Inc. | 14,000 | 560 | |

| * | Starz | 17,904 | 532 |

| Coach Inc. | 13,620 | 512 | |

| Family Dollar Stores Inc. | 6,266 | 496 | |

| * | TripAdvisor Inc. | 6,391 | 477 |

| * | Liberty Media Corp. | 13,608 | 477 |

| Viacom Inc. Class B | 6,227 | 469 | |

| * | Discovery | ||

| Communications Inc. | 13,841 | 467 | |

| * | Liberty Media Corp. Class A | 11,947 | 421 |

| Wendy’s Co. | 43,670 | 394 | |

| Comcast Corp. | 6,476 | 373 | |

| * | Liberty Ventures Class A | 9,144 | 345 |

| Las Vegas Sands Corp. | 5,400 | 314 | |

| * | News Corp. Class A | 19,237 | 302 |

| * | TRW Automotive | ||

| Holdings Corp. | 2,900 | 298 | |

| Omnicom Group Inc. | 3,800 | 294 | |

| * | Panera Bread Co. Class A | 1,500 | 262 |

| * | Discovery | ||

| Communications Inc. | |||

| Class A | 6,841 | 236 | |

| International Game | |||

| Technology | 13,267 | 229 | |

| Chico’s FAS Inc. | 13,300 | 216 | |

| * | Taylor Morrison Home | ||

| Corp. Class A | 9,600 | 181 | |

| * | MGM Resorts International | 8,013 | 171 |

| * | Outfront Media Inc. | 6,329 | 170 |

| * | Liberty Broadband Corp. | 3,402 | 170 |

| * | Tesla Motors Inc. | 700 | 156 |

| * | Murphy USA Inc. | 2,175 | 150 |

| * | Liberty Broadband Corp. | ||

| Class A | 2,986 | 150 | |

| * | Toll Brothers Inc. | 3,600 | 123 |

| * | Foster Wheeler AG | 7,228 | 96 |

| * | Liberty Interactive Corp. | ||

| Class A | 3,238 | 95 | |

| * | Netflix Inc. | 277 | 95 |

| * | Chipotle Mexican Grill Inc. | ||

| Class A | 100 | 68 | |

| * | AMC Networks Inc. Class A | 1,073 | 68 |

| * | Apollo Education Group Inc. | 2,000 | 68 |

| * | Fossil Group Inc. | 600 | 66 |

| * | LKQ Corp. | 1,900 | 53 |

| * | Charter Communications Inc. | ||

| Class A | 300 | 50 | |

| * | Norwegian Cruise Line | ||

| Holdings Ltd. | 1,000 | 47 | |

| * | Mohawk Industries Inc. | 300 | 47 |

| * | Visteon Corp. | 400 | 43 |

| * | Under Armour Inc. Class A | 600 | 41 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | CarMax Inc. | 600 | 40 |

| * | Liberty TripAdvisor | ||

| Holdings Inc. Class A | 1,484 | 40 | |

| * | Avis Budget Group Inc. | 600 | 40 |

| * | Ulta Salon Cosmetics | ||

| & Fragrance Inc. | 300 | 38 | |

| * | Madison Square | ||

| Garden Co. Class A | 500 | 38 | |

| * | Sally Beauty Holdings Inc. | 1,200 | 37 |

| * | Deckers Outdoor Corp. | 400 | 36 |

| * | Live Nation | ||

| Entertainment Inc. | 1,300 | 34 | |

| * | Tempur Sealy | ||

| International Inc. | 600 | 33 | |

| Lamar Advertising Co. Class A | 600 | 32 | |

| * | AutoNation Inc. | 500 | 30 |

| * | Hyatt Hotels Corp. Class A | 500 | 30 |

| Wynn Resorts Ltd. | 200 | 30 | |

| * | Sears Holdings Corp. | 900 | 30 |

| * | DreamWorks Animation | ||

| SKG Inc. Class A | 1,300 | 29 | |

| * | Urban Outfitters Inc. | 800 | 28 |

| * | HomeAway Inc. | 900 | 27 |

| * | Cabela’s Inc. | 500 | 26 |

| Lennar Corp. Class B | 680 | 25 | |

| * | Ascena Retail Group Inc. | 1,700 | 21 |

| * | zulily Inc. Class A | 800 | 19 |

| H&R Block Inc. | 500 | 17 | |

| * | Pandora Media Inc. | 900 | 16 |

| * | Liberty Broadband Rights | ||

| Expire 1/09/2015 | 1,277 | 12 | |

| Cablevision Systems | |||

| Corp. Class A | 394 | 8 | |

| 132,150 | |||

| Consumer Staples (3.8%) | |||

| Procter & Gamble Co. | 117,449 | 10,698 | |

| Coca-Cola Co. | 160,464 | 6,775 | |

| PepsiCo Inc. | 66,390 | 6,278 | |

| CVS Health Corp. | 54,092 | 5,210 | |

| Philip Morris | |||

| International Inc. | 52,594 | 4,284 | |

| * | Walgreens Boots | ||

| Alliance Inc. | 44,478 | 3,389 | |

| Colgate-Palmolive Co. | 46,570 | 3,222 | |

| Mondelez International Inc. | |||

| Class A | 85,637 | 3,111 | |

| Altria Group Inc. | 60,380 | 2,975 | |

| Archer-Daniels-Midland Co. | 37,973 | 1,975 | |

| Kroger Co. | 29,300 | 1,881 | |

| Mead Johnson Nutrition Co. | 13,513 | 1,359 | |

| Keurig Green Mountain Inc. | 9,629 | 1,275 | |

| * | Constellation Brands Inc. | ||

| Class A | 11,987 | 1,177 | |

| * | Monster Beverage Corp. | 10,838 | 1,174 |

| Hershey Co. | 11,200 | 1,164 | |

| Dr Pepper Snapple | |||

| Group Inc. | 15,232 | 1,092 | |

14

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Bunge Ltd. | 11,530 | 1,048 | |

| Coca-Cola Enterprises Inc. | 21,786 | 963 | |

| Tyson Foods Inc. Class A | 24,010 | 963 | |

| Church & Dwight Co. Inc. | 12,055 | 950 | |

| JM Smucker Co. | 9,251 | 934 | |

| Molson Coors Brewing Co. | |||

| Class B | 12,400 | 924 | |

| McCormick & Co. Inc. | 11,947 | 888 | |

| Brown-Forman Corp. Class B | 10,088 | 886 | |

| Energizer Holdings Inc. | 6,365 | 818 | |

| Kimberly-Clark Corp. | 6,972 | 805 | |

| Hormel Foods Corp. | 14,892 | 776 | |

| Ingredion Inc. | 9,086 | 771 | |

| Whole Foods Market Inc. | 15,100 | 761 | |

| Safeway Inc. | 20,134 | 707 | |

| * | WhiteWave Foods Co. | ||

| Class A | 20,166 | 706 | |

| * | Pilgrim’s Pride Corp. | 16,300 | 534 |

| Clorox Co. | 3,500 | 365 | |

| Herbalife Ltd. | 9,027 | 340 | |

| General Mills Inc. | 5,114 | 273 | |

| Kraft Foods Group Inc. | 3,659 | 229 | |

| * | Hain Celestial Group Inc. | 1,000 | 58 |

| * | Sprouts Farmers Market Inc. | 1,400 | 48 |

| 71,786 | |||

| Energy (3.7%) | |||

| Exxon Mobil Corp. | 173,315 | 16,023 | |

| Chevron Corp. | 70,832 | 7,946 | |

| Schlumberger Ltd. | 55,167 | 4,712 | |

| EOG Resources Inc. | 29,356 | 2,703 | |

| ConocoPhillips | 32,992 | 2,278 | |

| Anadarko Petroleum Corp. | 26,690 | 2,202 | |

| Phillips 66 | 26,406 | 1,893 | |

| Halliburton Co. | 44,525 | 1,751 | |

| Occidental Petroleum Corp. | 20,404 | 1,645 | |

| Baker Hughes Inc. | 26,550 | 1,489 | |

| Pioneer Natural | |||

| Resources Co. | 9,569 | 1,424 | |

| Marathon Petroleum Corp. | 15,341 | 1,385 | |

| * | Cheniere Energy Inc. | 16,800 | 1,183 |

| Hess Corp. | 15,604 | 1,152 | |

| Apache Corp. | 17,514 | 1,098 | |

| Kinder Morgan Inc. | 24,883 | 1,053 | |

| * | Concho Resources Inc. | 10,400 | 1,037 |

| Cabot Oil & Gas Corp. | 33,504 | 992 | |

| * | FMC Technologies Inc. | 20,686 | 969 |

| * | Cameron International Corp. | 18,952 | 947 |

| EQT Corp. | 12,497 | 946 | |

| Noble Energy Inc. | 19,798 | 939 | |

| Cimarex Energy Co. | 8,376 | 888 | |

| * | Southwestern Energy Co. | 31,431 | 858 |

| Range Resources Corp. | 15,746 | 842 | |

| CONSOL Energy Inc. | 23,505 | 795 | |

| Devon Energy Corp. | 12,654 | 774 | |

| * | Whiting Petroleum Corp. | 22,900 | 756 |

| * | Dresser-Rand Group Inc. | 9,122 | 746 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Continental Resources Inc. | 18,028 | 691 |

| * | Newfield Exploration Co. | 24,827 | 673 |

| World Fuel Services Corp. | 14,300 | 671 | |

| ONEOK Inc. | 13,384 | 666 | |

| Superior Energy | |||

| Services Inc. | 32,721 | 659 | |

| * | Dril-Quip Inc. | 8,200 | 629 |

| * | NOW Inc. | 23,882 | 614 |

| * | Oil States International Inc. | 12,498 | 611 |

| Helmerich & Payne Inc. | 7,915 | 534 | |

| National Oilwell Varco Inc. | 7,929 | 520 | |

| * | Ultra Petroleum Corp. | 38,200 | 503 |

| HollyFrontier Corp. | 12,492 | 468 | |

| Valero Energy Corp. | 8,400 | 416 | |

| Nabors Industries Ltd. | 31,390 | 407 | |

| Murphy Oil Corp. | 6,700 | 338 | |

| * | WPX Energy Inc. | 23,400 | 272 |

| Marathon Oil Corp. | 8,482 | 240 | |

| Rowan Cos. plc Class A | 9,383 | 219 | |

| SM Energy Co. | 4,172 | 161 | |

| Patterson-UTI Energy Inc. | 8,502 | 141 | |

| QEP Resources Inc. | 6,298 | 127 | |

| Williams Cos. Inc. | 2,020 | 91 | |

| * | First Solar Inc. | 1,400 | 62 |

| Chesapeake Energy Corp. | 2,400 | 47 | |

| * | California Resources Corp. | 8,161 | 45 |

| * | SunPower Corp. Class A | 800 | 21 |

| * | Rice Energy Inc. | 900 | 19 |

| * | Gulfport Energy Corp. | 400 | 17 |

| * | Antero Resources Corp. | 400 | 16 |

| * | Seventy Seven Energy Inc. | 321 | 2 |

| Peabody Energy Corp. | 9 | — | |

| 71,306 | |||

| Financial Services (9.3%) | |||

| * | Berkshire Hathaway Inc. | ||

| Class B | 83,477 | 12,534 | |

| Wells Fargo & Co. | 184,759 | 10,128 | |

| JPMorgan Chase & Co. | 143,601 | 8,987 | |

| Bank of America Corp. | 431,517 | 7,720 | |

| Citigroup Inc. | 142,243 | 7,697 | |

| Visa Inc. Class A | 23,674 | 6,207 | |

| MasterCard Inc. Class A | 49,200 | 4,239 | |

| Goldman Sachs Group Inc. | 21,185 | 4,106 | |

| American International | |||

| Group Inc. | 72,100 | 4,038 | |

| American Express Co. | 40,059 | 3,727 | |

| Morgan Stanley | 78,760 | 3,056 | |

| Simon Property Group Inc. | 16,078 | 2,928 | |

| American Tower Corporation | 21,973 | 2,172 | |

| US Bancorp | 46,300 | 2,081 | |

| Charles Schwab Corp. | 65,505 | 1,978 | |

| Capital One Financial Corp. | 22,592 | 1,865 | |

| Allstate Corp. | 25,600 | 1,798 | |

| Aon plc | 17,900 | 1,697 | |

| Public Storage | 8,772 | 1,621 | |

| Equity Residential | 22,150 | 1,591 | |

15

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Discover Financial Services | 24,229 | 1,587 | |

| Crown Castle | |||

| International Corp. | 19,667 | 1,548 | |

| Vornado Realty Trust | 12,200 | 1,436 | |

| Ameriprise Financial Inc. | 10,680 | 1,412 | |

| Franklin Resources Inc. | 25,275 | 1,399 | |

| AvalonBay Communities Inc. | 8,500 | 1,389 | |

| Boston Properties Inc. | 10,181 | 1,310 | |

| SunTrust Banks Inc. | 30,529 | 1,279 | |

| Fidelity National | |||

| Information Services Inc. | 20,281 | 1,261 | |

| * | Fiserv Inc. | 17,542 | 1,245 |

| Weyerhaeuser Co. | 34,166 | 1,226 | |

| T. Rowe Price Group Inc. | 14,000 | 1,202 | |

| * | Alliance Data Systems Corp. | 4,187 | 1,198 |

| Moody’s Corp. | 12,400 | 1,188 | |

| General Growth | |||

| Properties Inc. | 41,900 | 1,179 | |

| Hartford Financial | |||

| Services Group Inc. | 27,900 | 1,163 | |

| PNC Financial Services | |||

| Group Inc. | 12,500 | 1,140 | |

| Essex Property Trust Inc. | 5,473 | 1,131 | |

| Travelers Cos. Inc. | 10,589 | 1,121 | |

| Host Hotels & Resorts Inc. | 46,699 | 1,110 | |

| Lincoln National Corp. | 19,030 | 1,097 | |

| Progressive Corp. | 40,197 | 1,085 | |

| Loews Corp. | 25,816 | 1,085 | |

| Intercontinental | |||

| Exchange Inc. | 4,771 | 1,046 | |

| State Street Corp. | 13,069 | 1,026 | |

| KeyCorp | 71,618 | 995 | |

| SL Green Realty Corp. | 8,159 | 971 | |

| * | CBRE Group Inc. Class A | 26,773 | 917 |

| Bank of New York | |||

| Mellon Corp. | 22,432 | 910 | |

| Regions Financial Corp. | 84,715 | 895 | |

| * | Affiliated Managers | ||

| Group Inc. | 4,184 | 888 | |

| Equifax Inc. | 10,958 | 886 | |

| MetLife Inc. | 16,240 | 878 | |

| CIT Group Inc. | 18,000 | 861 | |

| TD Ameritrade | |||

| Holding Corp. | 24,061 | 861 | |

| Federal Realty | |||

| Investment Trust | 6,419 | 857 | |

| Comerica Inc. | 18,100 | 848 | |

| * | E*TRADE Financial Corp. | 34,200 | 830 |

| Jones Lang LaSalle Inc. | 5,312 | 796 | |

| * | Markel Corp. | 1,151 | 786 |

| Everest Re Group Ltd. | 4,600 | 783 | |

| * | Arch Capital Group Ltd. | 13,250 | 783 |

| First Republic Bank | 15,000 | 782 | |

| Torchmark Corp. | 14,422 | 781 | |

| Fifth Third Bancorp | 38,275 | 780 | |

| Legg Mason Inc. | 14,354 | 766 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Reinsurance Group of | |||

| America Inc. Class A | 8,670 | 760 | |

| * | Signature Bank | 6,000 | 756 |

| Voya Financial Inc. | 17,600 | 746 | |

| * | Alleghany Corp. | 1,609 | 746 |

| Global Payments Inc. | 9,114 | 736 | |

| Zions Bancorporation | 25,651 | 731 | |

| Unum Group | 20,827 | 726 | |

| * | SVB Financial Group | 6,200 | 720 |

| East West Bancorp Inc. | 18,269 | 707 | |

| Apartment Investment | |||

| & Management Co. | |||

| Class A | 18,776 | 698 | |

| Equity LifeStyle | |||

| Properties Inc. | 13,400 | 691 | |

| Extra Space Storage Inc. | 11,700 | 686 | |

| WR Berkley Corp. | 13,343 | 684 | |

| Chubb Corp. | 6,600 | 683 | |

| Taubman Centers Inc. | 8,900 | 680 | |

| Assurant Inc. | 9,900 | 677 | |

| * | Popular Inc. | 19,500 | 664 |

| MSCI Inc. Class A | 13,834 | 656 | |

| NASDAQ OMX Group Inc. | 13,673 | 656 | |

| Raymond James | |||

| Financial Inc. | 11,434 | 655 | |

| City National Corp. | 8,000 | 646 | |

| Douglas Emmett Inc. | 22,734 | 646 | |

| Lazard Ltd. Class A | 12,825 | 642 | |

| * | Howard Hughes Corp. | 4,900 | 639 |

| SEI Investments Co. | 15,847 | 635 | |

| White Mountains | |||

| Insurance Group Ltd. | 998 | 629 | |

| * | Forest City Enterprises Inc. | ||

| Class A | 29,413 | 626 | |

| BlackRock Inc. | 1,742 | 623 | |

| Brown & Brown Inc. | 18,861 | 621 | |

| Tanger Factory Outlet | |||

| Centers Inc. | 16,700 | 617 | |

| First Horizon National Corp. | 45,440 | 617 | |

| Commerce Bancshares Inc. | 14,188 | 617 | |

| Post Properties Inc. | 10,400 | 611 | |

| FactSet Research | |||

| Systems Inc. | 4,299 | 605 | |

| StanCorp Financial | |||

| Group Inc. | 8,600 | 601 | |

| RenaissanceRe | |||

| Holdings Ltd. | 6,098 | 593 | |

| Associated Banc-Corp | 31,727 | 591 | |

| TCF Financial Corp. | 37,100 | 590 | |

| Assured Guaranty Ltd. | 22,194 | 577 | |

| Total System Services Inc. | 16,500 | 560 | |

| Leucadia National Corp. | 24,733 | 555 | |

| HCC Insurance Holdings Inc. | 10,264 | 549 | |

| Aflac Inc. | 8,800 | 538 | |

| DDR Corp. | 29,107 | 534 | |

| Huntington Bancshares Inc. | 50,700 | 533 |

16

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| American Homes 4 Rent | |||

| Class A | 31,300 | 533 | |

| Synovus Financial Corp. | 18,742 | 508 | |

| Allied World Assurance | |||

| Co. Holdings AG | 13,344 | 506 | |

| TFS Financial Corp. | 33,500 | 499 | |

| Prudential Financial Inc. | 5,512 | 499 | |

| Brixmor Property Group Inc. | 19,000 | 472 | |

| Ventas Inc. | 6,500 | 466 | |

| LPL Financial Holdings Inc. | 10,200 | 454 | |

| McGraw Hill Financial Inc. | 4,600 | 409 | |

| Prologis Inc. | 8,700 | 374 | |

| Hanover Insurance Group Inc. | 5,014 | 358 | |

| ACE Ltd. | 3,000 | 345 | |

| CNA Financial Corp. | 8,693 | 337 | |

| Retail Properties | |||

| of America Inc. | 19,700 | 329 | |

| Morningstar Inc. | 5,028 | 325 | |

| HCP Inc. | 7,300 | 321 | |

| Dun & Bradstreet Corp. | 2,500 | 302 | |

| CME Group Inc. | 2,895 | 257 | |

| * | MBIA Inc. | 26,875 | 256 |

| BOK Financial Corp. | 4,040 | 243 | |

| ProAssurance Corp. | 5,000 | 226 | |

| BB&T Corp. | 5,800 | 226 | |

| Annaly Capital | |||

| Management Inc. | 19,500 | 211 | |

| * | Realogy Holdings Corp. | 4,200 | 187 |

| Health Care REIT Inc. | 2,300 | 174 | |

| CBOE Holdings Inc. | 2,400 | 152 | |

| FNF Group | 3,247 | 112 | |

| Santander Consumer | |||

| USA Holdings Inc. | 5,400 | 106 | |

| Hospitality Properties Trust | 3,122 | 97 | |

| * | Genworth Financial Inc. | ||

| Class A | 10,500 | 89 | |

| Washington Prime | |||

| Group Inc. | 5,041 | 87 | |

| * | Synchrony Financial | 2,244 | 67 |

| * | Ocwen Financial Corp. | 3,700 | 56 |

| Navient Corp. | 2,200 | 48 | |

| * | Ally Financial Inc. | 1,600 | 38 |

| * | CoreLogic Inc. | 1,000 | 32 |

| * | Vantiv Inc. Class A | 900 | 31 |

| * | FleetCor Technologies Inc. | 200 | 30 |

| Interactive Brokers Group Inc. | 1,000 | 29 | |

| Marsh & McLennan Cos. Inc. | 500 | 29 | |

| Gaming and Leisure | |||

| Properties Inc. | 900 | 26 | |

| * | Zillow Inc. Class A | 200 | 21 |

| * | FNFV Group | 1,082 | 17 |

| Cullen/Frost Bankers Inc. | 200 | 14 | |

| * | Nationstar Mortgage | ||

| Holdings Inc. | 400 | 11 | |

| People’s United Financial Inc. | 400 | 6 | |

| 177,855 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Health Care (6.7%) | |||

| Johnson & Johnson | 112,644 | 11,779 | |

| Pfizer Inc. | 236,987 | 7,382 | |

| * | Gilead Sciences Inc. | 71,902 | 6,777 |

| Merck & Co. Inc. | 105,821 | 6,010 | |

| Amgen Inc. | 35,755 | 5,695 | |

| * | Celgene Corp. | 39,224 | 4,388 |

| UnitedHealth Group Inc. | 40,213 | 4,065 | |

| * | Biogen Idec Inc. | 11,821 | 4,013 |

| Bristol-Myers Squibb Co. | 64,460 | 3,805 | |

| * | Express Scripts | ||

| Holding Co. | 39,249 | 3,323 | |

| * | Actavis plc | 12,895 | 3,319 |

| AbbVie Inc. | 49,600 | 3,246 | |

| Allergan Inc. | 15,259 | 3,244 | |

| Thermo Fisher | |||

| Scientific Inc. | 21,267 | 2,665 | |

| Medtronic Inc. | 35,800 | 2,585 | |

| McKesson Corp. | 12,336 | 2,561 | |

| Abbott Laboratories | 54,800 | 2,467 | |

| * | Alexion Pharmaceuticals Inc. | 11,186 | 2,070 |

| * | Anthem Inc. | 15,626 | 1,964 |

| * | Regeneron | ||

| Pharmaceuticals Inc. | 4,650 | 1,908 | |

| Covidien plc | 18,400 | 1,882 | |

| Aetna Inc. | 21,155 | 1,879 | |

| Stryker Corp. | 19,549 | 1,844 | |

| * | Vertex Pharmaceuticals Inc. | 14,400 | 1,711 |

| Cigna Corp. | 16,362 | 1,684 | |

| Eli Lilly & Co. | 24,100 | 1,663 | |

| * | Illumina Inc. | 8,700 | 1,606 |

| Perrigo Co. plc | 9,100 | 1,521 | |

| * | HCA Holdings Inc. | 20,544 | 1,508 |

| Zoetis Inc. | 33,380 | 1,436 | |

| Humana Inc. | 10,000 | 1,436 | |

| * | Mylan Inc. | 24,956 | 1,407 |

| AmerisourceBergen | |||

| Corp. Class A | 15,306 | 1,380 | |

| Zimmer Holdings Inc. | 11,570 | 1,312 | |

| * | CareFusion Corp. | 17,695 | 1,050 |

| * | DaVita HealthCare | ||

| Partners Inc. | 13,800 | 1,045 | |

| CR Bard Inc. | 6,165 | 1,027 | |

| * | Hospira Inc. | 15,860 | 971 |

| * | Endo International plc | 13,469 | 971 |

| * | Mallinckrodt plc | 9,675 | 958 |

| Universal Health | |||

| Services Inc. Class B | 8,217 | 914 | |

| St. Jude Medical Inc. | 13,835 | 900 | |

| Agilent Technologies Inc. | 20,807 | 852 | |

| * | Intuitive Surgical Inc. | 1,590 | 841 |

| DENTSPLY International Inc. | 15,483 | 825 | |

| Cooper Cos. Inc. | 4,984 | 808 | |

| * | Laboratory Corp. of | ||

| America Holdings | 7,391 | 797 | |

| Omnicare Inc. | 10,893 | 794 | |

17

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | QIAGEN NV | 29,900 | 701 |

| PerkinElmer Inc. | 16,000 | 700 | |

| Baxter International Inc. | 8,900 | 652 | |

| * | Quintiles Transnational | ||

| Holdings Inc. | 10,400 | 612 | |

| Hill-Rom Holdings Inc. | 12,822 | 585 | |

| Cardinal Health Inc. | 7,245 | 585 | |

| Bio-Techne Corp. | 6,200 | 573 | |

| * | Tenet Healthcare Corp. | 10,925 | 554 |

| Quest Diagnostics Inc. | 8,019 | 538 | |

| * | Varian Medical Systems Inc. | 6,100 | 528 |

| * | Cerner Corp. | 8,010 | 518 |

| Patterson Cos. Inc. | 9,300 | 447 | |

| * | Charles River Laboratories | ||

| International Inc. | 5,500 | 350 | |

| Becton Dickinson and Co. | 1,984 | 276 | |

| * | Edwards Lifesciences Corp. | 1,319 | 168 |

| * | Alkermes plc | 1,700 | 100 |

| * | Boston Scientific Corp. | 6,700 | 89 |

| * | Intercept Pharmaceuticals Inc. | 450 | 70 |

| * | Jazz Pharmaceuticals plc | 300 | 49 |

| * | Centene Corp. | 400 | 42 |

| * | Cubist Pharmaceuticals Inc. | 400 | 40 |

| * | Halyard Health Inc. | 871 | 40 |

| * | VCA Inc. | 800 | 39 |

| * | United Therapeutics Corp. | 300 | 39 |

| * | Alnylam Pharmaceuticals Inc. | 400 | 39 |

| * | Health Net Inc. | 700 | 37 |

| * | Pharmacyclics Inc. | 300 | 37 |

| * | Incyte Corp. | 500 | 37 |

| * | Catamaran Corp. | 700 | 36 |

| * | BioMarin Pharmaceutical Inc. | 400 | 36 |

| * | Sirona Dental Systems Inc. | 400 | 35 |

| * | Salix Pharmaceuticals Ltd. | 300 | 34 |

| * | Veeva Systems Inc. Class A | 1,300 | 34 |

| * | Align Technology Inc. | 600 | 34 |

| * | MEDNAX Inc. | 500 | 33 |

| * | Community Health | ||

| Systems Inc. | 600 | 32 | |

| * | Hologic Inc. | 1,200 | 32 |

| * | Covance Inc. | 300 | 31 |

| * | Alere Inc. | 800 | 30 |

| * | Premier Inc. Class A | 900 | 30 |

| * | Medivation Inc. | 300 | 30 |

| * | IDEXX Laboratories Inc. | 200 | 30 |

| * | Brookdale Senior Living Inc. | 800 | 29 |

| * | athenahealth Inc. | 200 | 29 |

| * | LifePoint Hospitals Inc. | 400 | 29 |

| * | Envision Healthcare | ||

| Holdings Inc. | 800 | 28 | |

| * | Henry Schein Inc. | 200 | 27 |

| * | Allscripts Healthcare | ||

| Solutions Inc. | 1,900 | 24 | |

| * | Myriad Genetics Inc. | 700 | 24 |

| * | Seattle Genetics Inc. | 600 | 19 |

| 127,399 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Materials & Processing (2.0%) | |||

| Monsanto Co. | 24,208 | 2,892 | |

| Precision Castparts Corp. | 8,302 | 2,000 | |

| PPG Industries Inc. | 7,550 | 1,745 | |

| Ecolab Inc. | 16,100 | 1,683 | |

| Praxair Inc. | 12,852 | 1,665 | |

| EI du Pont de | |||

| Nemours & Co. | 21,128 | 1,562 | |

| Sherwin-Williams Co. | 5,650 | 1,486 | |

| Sigma-Aldrich Corp. | 8,780 | 1,205 | |

| Dow Chemical Co. | 26,400 | 1,204 | |

| LyondellBasell Industries | |||

| NV Class A | 13,538 | 1,075 | |

| CF Industries Holdings Inc. | 3,912 | 1,066 | |

| Ingersoll-Rand plc | 15,400 | 976 | |

| Sealed Air Corp. | 21,500 | 912 | |

| Celanese Corp. Class A | 14,840 | 890 | |

| Ball Corp. | 13,018 | 887 | |

| Vulcan Materials Co. | 13,034 | 857 | |

| Airgas Inc. | 7,019 | 808 | |

| FMC Corp. | 13,998 | 798 | |

| * | WR Grace & Co. | 8,200 | 782 |

| * | Crown Holdings Inc. | 15,341 | 781 |

| Ashland Inc. | 6,198 | 742 | |

| Valspar Corp. | 8,000 | 692 | |

| Southern Copper Corp. | 23,700 | 668 | |

| Lennox International Inc. | 7,000 | 666 | |

| * | Hexcel Corp. | 15,600 | 647 |

| Eagle Materials Inc. | 8,500 | 646 | |

| NewMarket Corp. | 1,550 | 626 | |

| United States Steel Corp. | 22,682 | 607 | |

| Cytec Industries Inc. | 12,666 | 585 | |

| Silgan Holdings Inc. | 10,642 | 570 | |

| * | Owens-Illinois Inc. | 19,200 | 518 |

| Westlake Chemical Corp. | 7,800 | 477 | |

| Reliance Steel & | |||

| Aluminum Co. | 7,600 | 466 | |

| Martin Marietta | |||

| Materials Inc. | 4,086 | 451 | |

| Tahoe Resources Inc. | 31,199 | 433 | |

| Albemarle Corp. | 7,000 | 421 | |

| Valmont Industries Inc. | 3,311 | 421 | |

| Freeport-McMoRan Inc. | 17,694 | 413 | |

| Nucor Corp. | 7,400 | 363 | |

| Scotts Miracle-Gro Co. | |||

| Class A | 5,042 | 314 | |

| * | Armstrong World | ||

| Industries Inc. | 5,803 | 297 | |

| International Paper Co. | 4,943 | 265 | |

| Fastenal Co. | 4,725 | 225 | |

| Eastman Chemical Co. | 2,640 | 200 | |

| Air Products & | |||

| Chemicals Inc. | 1,200 | 173 | |

| Owens Corning | 3,600 | 129 | |

| Mosaic Co. | 2,600 | 119 | |

| Royal Gold Inc. | 800 | 50 | |

18

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | USG Corp. | 1,400 | 39 |

| Newmont Mining Corp. | 966 | 18 | |

| * | Veritiv Corp. | 94 | 5 |

| 37,520 | |||

| Producer Durables (5.3%) | |||

| General Electric Co. | 386,409 | 9,765 | |

| Union Pacific Corp. | 40,352 | 4,807 | |

| 3M Co. | 20,400 | 3,352 | |

| Honeywell International Inc. | 33,000 | 3,297 | |

| United Technologies Corp. | 28,576 | 3,286 | |

| Boeing Co. | 21,420 | 2,784 | |

| Danaher Corp. | 32,151 | 2,756 | |

| FedEx Corp. | 15,576 | 2,705 | |

| Delta Air Lines Inc. | 47,200 | 2,322 | |

| United Parcel Service Inc. | |||

| Class B | 19,000 | 2,112 | |

| Southwest Airlines Co. | 44,257 | 1,873 | |

| CSX Corp. | 47,000 | 1,703 | |

| * | United Continental | ||

| Holdings Inc. | 24,200 | 1,619 | |

| Automatic Data | |||

| Processing Inc. | 16,974 | 1,415 | |

| Cummins Inc. | 9,721 | 1,401 | |

| Accenture plc Class A | 15,600 | 1,393 | |

| General Dynamics Corp. | 9,191 | 1,265 | |

| Caterpillar Inc. | 13,500 | 1,236 | |

| Xerox Corp. | 84,755 | 1,175 | |

| Roper Industries Inc. | 7,410 | 1,159 | |

| Raytheon Co. | 10,049 | 1,087 | |

| Textron Inc. | 25,011 | 1,053 | |

| AMETEK Inc. | 19,900 | 1,047 | |

| Pall Corp. | 9,800 | 992 | |

| Kansas City Southern | 7,600 | 927 | |

| WW Grainger Inc. | 3,632 | 926 | |

| TransDigm Group Inc. | 4,710 | 925 | |

| * | Verisk Analytics Inc. Class A | 14,300 | 916 |

| * | Waters Corp. | 8,118 | 915 |

| Lockheed Martin Corp. | 4,703 | 906 | |

| Rockwell Collins Inc. | 10,300 | 870 | |

| * | United Rentals Inc. | 8,500 | 867 |

| * | Mettler-Toledo | ||

| International Inc. | 2,860 | 865 | |

| Expeditors International | |||

| of Washington Inc. | 19,366 | 864 | |

| Wabtec Corp. | 9,906 | 861 | |

| * | Stericycle Inc. | 6,554 | 859 |

| Robert Half International Inc. | 14,100 | 823 | |

| Flowserve Corp. | 13,613 | 814 | |

| JB Hunt Transport | |||

| Services Inc. | 9,610 | 810 | |

| American Airlines Group Inc. | 14,700 | 788 | |

| Xylem Inc. | 20,539 | 782 | |

| Towers Watson | |||

| & Co. Class A | 6,900 | 781 | |

| * | Quanta Services Inc. | 26,695 | 758 |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Spirit AeroSystems | ||

| Holdings Inc. Class A | 17,600 | 757 | |

| Allegion plc | 13,433 | 745 | |

| Huntington Ingalls | |||

| Industries Inc. | 6,569 | 739 | |

| Manitowoc Co. Inc. | 32,800 | 725 | |

| Emerson Electric Co. | 11,700 | 722 | |

| Ryder System Inc. | 7,700 | 715 | |

| Lincoln Electric Holdings Inc. | 10,323 | 713 | |

| Nordson Corp. | 8,950 | 698 | |

| Cintas Corp. | 8,650 | 678 | |

| Carlisle Cos. Inc. | 7,500 | 677 | |

| Oshkosh Corp. | 13,847 | 674 | |

| Pentair plc | 10,087 | 670 | |

| * | AECOM Technology Corp. | 21,934 | 666 |

| AGCO Corp. | 14,737 | 666 | |

| Regal-Beloit Corp. | 8,600 | 647 | |

| Fluor Corp. | 10,658 | 646 | |

| Air Lease Corp. Class A | 18,500 | 635 | |

| Triumph Group Inc. | 9,400 | 632 | |

| Con-way Inc. | 12,665 | 623 | |

| * | WESCO International Inc. | 8,119 | 619 |

| ITT Corp. | 15,069 | 610 | |

| Toro Co. | 9,518 | 607 | |

| Landstar System Inc. | 8,185 | 594 | |

| Republic Services Inc. | |||

| Class A | 14,710 | 592 | |

| Babcock & Wilcox Co. | 19,119 | 579 | |

| CH Robinson Worldwide Inc. | 7,611 | 570 | |

| Trinity Industries Inc. | 19,100 | 535 | |

| ADT Corp. | 14,600 | 529 | |

| Waste Connections Inc. | 12,000 | 528 | |

| Donaldson Co. Inc. | 13,286 | 513 | |

| Alliant Techsystems Inc. | 4,386 | 510 | |

| Deere & Co. | 5,600 | 495 | |

| SPX Corp. | 5,597 | 481 | |

| AO Smith Corp. | 8,400 | 474 | |

| Stanley Black & Decker Inc. | 4,927 | 473 | |

| * | B/E Aerospace Inc. | 8,111 | 471 |

| * | Keysight Technologies Inc. | 13,903 | 469 |

| * | Jacobs Engineering | ||

| Group Inc. | 10,195 | 456 | |

| National Instruments Corp. | 14,511 | 451 | |

| MSC Industrial Direct | |||

| Co. Inc. Class A | 5,300 | 431 | |

| * | Navistar International Corp. | 12,650 | 424 |

| L-3 Communications | |||

| Holdings Inc. | 3,289 | 415 | |

| Copa Holdings SA Class A | 3,938 | 408 | |

| IDEX Corp. | 4,729 | 368 | |

| ManpowerGroup Inc. | 5,250 | 358 | |

| Illinois Tool Works Inc. | 3,700 | 350 | |

| Chicago Bridge | |||

| & Iron Co. NV | 8,088 | 340 | |

| Covanta Holding Corp. | 14,400 | 317 | |

| Paychex Inc. | 6,600 | 305 |

19

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Norfolk Southern Corp. | 2,700 | 296 | |

| Eaton Corp. plc | 3,900 | 265 | |

| FLIR Systems Inc. | 8,000 | 258 | |

| Lexmark International Inc. | |||

| Class A | 5,300 | 219 | |

| * | KLX Inc. | 5,155 | 213 |

| Joy Global Inc. | 4,200 | 195 | |

| KBR Inc. | 10,782 | 183 | |

| Kennametal Inc. | 3,000 | 107 | |

| * | Middleby Corp. | 1,000 | 99 |

| * | Spirit Airlines Inc. | 600 | 45 |

| * | Old Dominion Freight Line Inc. | 500 | 39 |

| * | HD Supply Holdings Inc. | 1,300 | 38 |

| * | CoStar Group Inc. | 200 | 37 |

| * | IHS Inc. Class A | 300 | 34 |

| * | Kirby Corp. | 400 | 32 |

| * | Genpact Ltd. | 1,700 | 32 |

| * | Zebra Technologies Corp. | 400 | 31 |

| * | Genesee & Wyoming Inc. | ||

| Class A | 300 | 27 | |

| * | Restaurant Brands | ||

| International LP | 189 | 7 | |

| 101,318 | |||

| Technology (7.9%) | |||

| Apple Inc. | 252,718 | 27,895 | |

| Microsoft Corp. | 333,556 | 15,494 | |

| * | Facebook Inc. Class A | 92,700 | 7,232 |

| * | Google Inc. Class C | 13,402 | 7,055 |

| * | Google Inc. Class A | 13,122 | 6,963 |

| Oracle Corp. | 152,290 | 6,848 | |

| Intel Corp. | 181,400 | 6,583 | |

| International Business | |||

| Machines Corp. | 33,103 | 5,311 | |

| Cisco Systems Inc. | 183,415 | 5,102 | |

| QUALCOMM Inc. | 67,900 | 5,047 | |

| EMC Corp. | 103,936 | 3,091 | |

| * | Yahoo! Inc. | 54,466 | 2,751 |

| Hewlett-Packard Co. | 68,473 | 2,748 | |

| * | salesforce.com inc | 34,912 | 2,071 |

| * | Adobe Systems Inc. | 28,196 | 2,050 |

| * | Cognizant Technology | ||

| Solutions Corp. Class A | 35,696 | 1,880 | |

| Applied Materials Inc. | 69,980 | 1,744 | |

| Avago Technologies Ltd. | |||

| Class A | 16,735 | 1,683 | |

| Corning Inc. | 71,577 | 1,641 | |

| Intuit Inc. | 17,524 | 1,616 | |

| Texas Instruments Inc. | 28,546 | 1,526 | |

| SanDisk Corp. | 14,600 | 1,431 | |

| * | Micron Technology Inc. | 39,500 | 1,383 |

| Western Digital Corp. | 12,200 | 1,351 | |

| Symantec Corp. | 48,039 | 1,232 | |

| Broadcom Corp. Class A | 28,143 | 1,219 | |

| Amphenol Corp. Class A | 22,392 | 1,205 | |

| * | Autodesk Inc. | 18,108 | 1,088 |

| Skyworks Solutions Inc. | 14,900 | 1,083 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| NetApp Inc. | 25,271 | 1,048 | |

| Lam Research Corp. | 13,000 | 1,031 | |

| * | SBA Communications | ||

| Corp. Class A | 9,211 | 1,020 | |

| Altera Corp. | 26,452 | 977 | |

| NVIDIA Corp. | 48,300 | 968 | |

| Motorola Solutions Inc. | 14,167 | 950 | |

| * | Citrix Systems Inc. | 14,628 | 933 |

| Activision Blizzard Inc. | 43,960 | 886 | |

| Computer Sciences Corp. | 13,800 | 870 | |

| Analog Devices Inc. | 15,396 | 855 | |

| Xilinx Inc. | 18,129 | 785 | |

| * | Teradata Corp. | 17,736 | 775 |

| * | Synopsys Inc. | 17,700 | 769 |

| Avnet Inc. | 17,000 | 731 | |

| Brocade Communications | |||

| Systems Inc. | 61,300 | 726 | |

| * | SunEdison Inc. | 37,200 | 726 |

| Teradyne Inc. | 34,400 | 681 | |

| * | VeriSign Inc. | 11,628 | 663 |

| IAC/InterActiveCorp | 10,600 | 644 | |

| * | Ingram Micro Inc. | 22,800 | 630 |

| DST Systems Inc. | 6,430 | 605 | |

| Sabre Corp. | 27,900 | 566 | |

| Dolby Laboratories Inc. | |||

| Class A | 12,800 | 552 | |

| * | Tech Data Corp. | 8,600 | 544 |

| Amdocs Ltd. | 11,100 | 518 | |

| * | Twitter Inc. | 13,400 | 481 |

| * | Cadence Design | ||

| Systems Inc. | 24,100 | 457 | |

| * | Atmel Corp. | 52,800 | 443 |

| Juniper Networks Inc. | 19,100 | 426 | |

| * | CommScope | ||

| Holding Co. Inc. | 18,254 | 417 | |

| Solera Holdings Inc. | 7,390 | 378 | |

| AVX Corp. | 25,300 | 354 | |

| Linear Technology Corp. | 4,900 | 223 | |

| * | NCR Corp. | 6,800 | 198 |

| Maxim Integrated | |||

| Products Inc. | 5,500 | 175 | |

| * | ON Semiconductor Corp. | 16,000 | 162 |

| CA Inc. | 5,007 | 152 | |

| CDK Global Inc. | 3,058 | 125 | |

| * | Arrow Electronics Inc. | 1,900 | 110 |

| * | Freescale | ||

| Semiconductor Ltd. | 2,600 | 66 | |

| * | Palo Alto Networks Inc. | 400 | 49 |

| * | F5 Networks Inc. | 300 | 39 |

| * | Groupon Inc. Class A | 4,600 | 38 |

| * | IPG Photonics Corp. | 500 | 37 |

| * | JDS Uniphase Corp. | 2,600 | 36 |

| * | Gartner Inc. | 400 | 34 |

| * | Stratasys Ltd. | 400 | 33 |

| * | Rackspace Hosting Inc. | 700 | 33 |

| * | NetSuite Inc. | 300 | 33 |

20

Tax-Managed Balanced Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | AOL Inc. | 700 | 32 |

| * | EchoStar Corp. Class A | 600 | 32 |

| * | IMS Health Holdings Inc. | 1,200 | 31 |

| * | Fortinet Inc. | 1,000 | 31 |

| * | Riverbed Technology Inc. | 1,500 | 31 |

| * | SolarWinds Inc. | 600 | 30 |

| * | VeriFone Systems Inc. | 800 | 30 |

| * | Splunk Inc. | 500 | 29 |

| * | Electronic Arts Inc. | 600 | 28 |

| * | Red Hat Inc. | 400 | 28 |

| * | ARRIS Group Inc. | 900 | 27 |

| * | ServiceNow Inc. | 400 | 27 |

| * | Tableau Software Inc. | ||

| Class A | 300 | 25 | |

| * | Akamai Technologies Inc. | 400 | 25 |

| * | ANSYS Inc. | 300 | 25 |

| * | Workday Inc. Class A | 300 | 25 |

| Equinix Inc. | 102 | 23 | |

| * | LinkedIn Corp. Class A | 100 | 23 |

| * | Informatica Corp. | 600 | 23 |

| * | Rovi Corp. | 1,000 | 23 |

| * | PTC Inc. | 600 | 22 |

| * | Zynga Inc. Class A | 7,300 | 19 |

| * | FireEye Inc. | 600 | 19 |

| * | VMware Inc. Class A | 200 | 17 |

| * | Yelp Inc. Class A | 300 | 16 |

| 150,916 | |||

| Utilities (2.5%) | |||

| Verizon | |||

| Communications Inc. | 169,200 | 7,915 | |

| AT&T Inc. | 216,766 | 7,281 | |

| Duke Energy Corp. | 32,430 | 2,709 | |

| NextEra Energy Inc. | 23,497 | 2,498 | |

| Southern Co. | 41,900 | 2,058 | |

| Sempra Energy | 15,029 | 1,674 | |

| * | Level 3 | ||

| Communications Inc. | 31,510 | 1,556 | |

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Exelon Corp. | 40,100 | 1,487 | |

| Edison International | 21,508 | 1,408 | |

| Dominion Resources Inc. | 17,408 | 1,339 | |

| PG&E Corp. | 24,535 | 1,306 | |

| NiSource Inc. | 25,200 | 1,069 | |

| American Electric | |||

| Power Co. Inc. | 16,500 | 1,002 | |

| Wisconsin Energy Corp. | 18,432 | 972 | |

| Public Service | |||

| Enterprise Group Inc. | 22,200 | 919 | |

| American Water | |||

| Works Co. Inc. | 16,628 | 886 | |

| * | Calpine Corp. | 39,910 | 883 |

| NRG Energy Inc. | 32,224 | 868 | |

| * | T-Mobile US Inc. | 29,700 | 800 |

| OGE Energy Corp. | 22,086 | 784 | |

| ITC Holdings Corp. | 18,810 | 761 | |

| UGI Corp. | 19,878 | 755 | |

| Xcel Energy Inc. | 21,000 | 754 | |

| National Fuel Gas Co. | 10,501 | 730 | |

| Energen Corp. | 11,230 | 716 | |

| Aqua America Inc. | 25,378 | 678 | |

| Questar Corp. | 26,333 | 666 | |

| CMS Energy Corp. | 19,027 | 661 | |

| AES Corp. | 47,369 | 652 | |

| Telephone & Data | |||

| Systems Inc. | 23,330 | 589 | |

| Alliant Energy Corp. | 7,713 | 512 | |

| Consolidated Edison Inc. | 6,400 | 423 | |

| AGL Resources Inc. | 6,000 | 327 | |

| MDU Resources Group Inc. | 9,950 | 234 | |

| * | United States Cellular Corp. | 2,615 | 104 |

| 47,976 | |||

| Total Common Stocks | |||

| (Cost $492,273) | 918,226 | ||

| Face | Market | |||

| Maturity | Amount | Value• | ||

| Coupon | Date | ($000) | ($000) | |

| Tax-Exempt Municipal Bonds (51.2%) | ||||

| Alabama (0.2%) | ||||

| Alabama 21st Century Authority | ||||

| Tobacco Settlement Revenue | 5.000% | 6/1/20 | 500 | 577 |

| Alabama Incentives Financing | ||||

| Authority Special Obligation Revenue | 5.000% | 9/1/32 | 380 | 425 |

| Alabama Public School & College Authority | ||||

| Capital Improvement Revenue | 5.000% | 12/1/17 (Prere.) | 500 | 562 |

| Alabama Public School & College Authority | ||||

| Capital Improvement Revenue | 5.000% | 12/1/17 (Prere.) | 500 | 562 |

| Jefferson County AL Sewer Revenue | 5.000% | 10/1/23 | 500 | 561 |

| Jefferson County AL Sewer Revenue | 0.000% | 10/1/25 (4) | 500 | 305 |

| 2,992 |

21

| Tax-Managed Balanced Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value• | ||

| Coupon | Date | ($000) | ($000) | |

| Alaska (0.0%) | ||||

| Alaska Housing Finance Corp. General | ||||

| Housing Revenue | 5.000% | 12/1/29 | 500 | 579 |

| Arizona (1.7%) | ||||

| Arizona Board Regents Arizona State | ||||

| University System COP | 5.000% | 7/1/22 (14) | 1,500 | 1,647 |

| Arizona Board Regents Arizona State | ||||

| University System Revenue | 5.875% | 7/1/24 | 100 | 116 |

| Arizona COP | 5.000% | 10/1/18 (4) | 500 | 568 |

| Arizona Health Facilities Authority Revenue | ||||

| (Banner Health) | 5.000% | 1/1/25 | 500 | 553 |

| Arizona School Facilities Board COP | 5.500% | 9/1/23 | 500 | 576 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/23 | 1,955 | 2,403 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/24 | 2,000 | 2,483 |

| Arizona Transportation Board Excise Tax Revenue | ||||

| (Maricopa County Regional Area) | 5.000% | 7/1/17 (Prere.) | 500 | 554 |

| Arizona Transportation Board Excise Tax Revenue | ||||

| (Maricopa County Regional Area) | 5.000% | 7/1/20 (Prere.) | 500 | 594 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/22 | 2,005 | 2,428 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/32 | 500 | 583 |

| Chandler AZ GO | 5.000% | 7/1/23 | 1,000 | 1,237 |

| Glendale AZ Industrial Development Authority | ||||

| Revenue (Midwestern University) | 5.000% | 5/15/30 | 275 | 304 |

| Maricopa County AZ School District No. 28 | ||||

| (Kyrene Elementary) GO | 1.000% | 7/1/19 | 900 | 960 |

| Mesa AZ Excise Tax Revenue | 5.000% | 7/1/27 | 2,500 | 2,739 |

| Phoenix AZ Civic Improvement Corp. | ||||

| Airport Revenue | 5.000% | 7/1/24 | 300 | 349 |

| Phoenix AZ Civic Improvement Corp. | ||||

| Water System Revenue | 5.000% | 7/1/15 (Prere.) | 500 | 512 |

| Phoenix AZ Civic Improvement Corp. | ||||

| Water System Revenue | 5.000% | 7/1/26 | 2,500 | 3,073 |

| Pima County AZ Sewer Revenue | 5.000% | 7/1/20 | 500 | 589 |

| Regional Public Transportation Authority | ||||

| Arizona Excise Tax Revenue (Maricopa County | ||||

| Public Transportation) | 5.250% | 7/1/24 | 1,000 | 1,261 |

| Salt River Project Arizona Agricultural | ||||

| Improvement & Power District Revenue | 5.000% | 1/1/28 | 750 | 858 |

| Salt River Project Arizona Agricultural | ||||

| Improvement & Power District Revenue | 5.000% | 12/1/28 | 500 | 592 |

| Salt River Project Arizona Agricultural | ||||

| Improvement & Power District Revenue | 5.000% | 12/1/29 | 2,000 | 2,350 |

| Salt River Project Arizona Agricultural | ||||

| Improvement & Power District Revenue | 5.000% | 1/1/35 | 2,000 | 2,083 |

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/24 | 870 | 1,033 |

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/28 | 510 | 610 |

| University Medical Center Corp. Arizona | ||||

| Hospital Revenue | 5.000% | 7/1/19 | 500 | 556 |

| Yavapai County AZ Industrial Development | ||||

| Authority Hospital Facility Revenue | ||||

| (Northern Arizona Healthcare System) | 5.250% | 10/1/22 | 500 | 590 |

| 32,201 | ||||

22

| Tax-Managed Balanced Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value• | ||

| Coupon | Date | ($000) | ($000) | |

| California (8.1%) | ||||

| ABAG Finance Authority for Nonprofit | ||||

| Corps. California Revenue (Episcopal | ||||

| Senior Communities) | 5.000% | 7/1/22 | 500 | 570 |

| ABAG Finance Authority for Nonprofit | ||||

| Corps. California Revenue (Jackson Laboratory) | 5.000% | 7/1/21 | 760 | 887 |

| Alameda CA Corridor Transportation | ||||

| Authority Revenue | 5.300% | 10/1/23 (2) | 200 | 216 |

| Alameda CA Corridor Transportation | ||||

| Authority Revenue | 0.000% | 10/1/30 (2) | 740 | 365 |

| Alameda CA Corridor Transportation | ||||

| Authority Revenue | 0.000% | 10/1/32 (14) | 1,650 | 792 |

| Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/16 (Prere.) | 500 | 529 |

| Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) | 5.000% | 10/1/30 | 500 | 570 |

| Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/31 | 1,000 | 1,162 |

| Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) | 5.000% | 4/1/31 | 500 | 584 |

| 1 Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) PUT | 0.640% | 4/1/20 | 1,000 | 1,000 |

| 1 Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) PUT | 0.740% | 4/1/21 | 1,000 | 1,001 |

| 1 Bay Area Toll Authority California Toll Bridge | ||||

| Revenue (San Francisco Bay Area) PUT | 0.940% | 5/1/23 | 1,000 | 1,003 |

| Brea CA Public Financing Authority | ||||

| Tax Allocation Revenue | 7.000% | 9/1/23 | 1,105 | 1,238 |

| California Department of Water Resources | ||||

| Power Supply Revenue | 5.000% | 5/1/16 | 500 | 531 |

| California Department of Water Resources | ||||

| Power Supply Revenue | 5.000% | 5/1/17 | 500 | 551 |

| California Department of Water Resources | ||||

| Power Supply Revenue | 5.000% | 5/1/18 | 165 | 187 |

| California Department of Water Resources | ||||

| Power Supply Revenue | 5.000% | 5/1/18 | 500 | 568 |

| California Department of Water Resources | ||||

| Power Supply Revenue | 5.000% | 5/1/20 | 575 | 685 |

| California Department of Water Resources Water | ||||

| System Revenue (Central Valley Project) | 5.000% | 6/1/18 (Prere.) | 480 | 546 |

| California Department of Water Resources Water | ||||

| System Revenue (Central Valley Project) | 5.000% | 12/1/24 | 500 | 636 |

| California Department of Water Resources Water | ||||

| System Revenue (Central Valley Project) | 5.000% | 12/1/28 | 20 | 23 |

| California Economic Recovery GO | 5.000% | 7/1/18 | 500 | 571 |

| California Economic Recovery GO | 5.000% | 7/1/19 (ETM) | 500 | 587 |

| California Economic Recovery GO | 5.000% | 7/1/19 (Prere.) | 500 | 586 |

| California Economic Recovery GO | 5.250% | 7/1/19 (Prere.) | 315 | 372 |

| California Economic Recovery GO | 5.250% | 7/1/21 | 185 | 217 |

| California Economic Recovery GO | 5.000% | 7/1/22 | 500 | 533 |

| California Educational Facilities Authority Revenue | ||||

| (University of San Francisco) | 6.125% | 10/1/30 | 500 | 611 |

| California GO | 6.000% | 2/1/16 | 500 | 531 |

| California GO | 5.000% | 11/1/16 | 350 | 379 |

| California GO | 5.000% | 3/1/17 | 500 | 547 |

| California GO | 6.000% | 4/1/18 | 500 | 581 |

23

| Tax-Managed Balanced Fund | ||||

| Face | Market | |||

| Maturity | Amount | Value• | ||

| Coupon | Date | ($000) | ($000) | |

| California GO | 5.000% | 9/1/18 | 500 | 538 |

| California GO | 5.000% | 11/1/18 (14) | 500 | 561 |

| California GO | 5.000% | 6/1/19 (14) | 500 | 553 |

| California GO | 5.000% | 2/1/20 | 500 | 588 |

| California GO | 5.000% | 9/1/21 | 500 | 603 |

| California GO | 5.000% | 10/1/21 | 250 | 270 |