Table of Contents

As filed with the Securities and Exchange Commission on September 29, 2017

Securities Act of 1933 File No. 033-78960

Investment Company Act of 1940 File No. 811-08510

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |||

| Pre-Effective Amendment No. | ☐ | |||

| Post-Effective Amendment No. 74 | ☒ |

and/or

REGISTRATION STATEMENT

UNDER

| THE INVESTMENT COMPANY ACT OF 1940 | ☒ | |||

| Amendment No. 77 |

MATTHEWS INTERNATIONAL FUNDS

(Exact Name of Registrant as Specified in Charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (415) 788-7553

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and Address of Agent for Service)

Copies To:

David Monroe, Vice President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

David A. Hearth, Esq.

Paul Hastings LLP

101 California Street, 48th Floor

San Francisco, CA 94111

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☐ | on pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☒ | on November 30, 2017 pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | on [ ], 2015 pursuant to paragraph (a)(2) of rule 485. |

If appropriate, check the following box:

| ☐ | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Table of Contents

Matthews Asia Funds | Prospectus

[November 30, 2017] | matthewsasia.com

INSTITUTIONAL CLASS SHARES

Asian Growth and Income Fund (MICSX)

Asia Dividend Fund (MIPIX)

China Dividend Fund (MICDX)

Asia Value Fund (MAVAX)

Asia Focus Fund (MIFSX)

Asia Growth Fund (MIAPX)

Pacific Tiger Fund (MIPTX)

Asia ESG Fund (MISFX)

Emerging Asia Fund (MIASX)

Asia Innovators Fund (MITEX)

China Fund (MICFX)

India Fund (MIDNX)

Japan Fund (MIJFX)

Korea Fund (MIKOX)

Asia Small Companies Fund (MISMX)

China Small Companies Fund (XXXXX)

The U.S. Securities and Exchange Commission (the “SEC”) has not approved or disapproved the Funds. Also, the SEC has not passed upon the adequacy or accuracy of this prospectus. Anyone who informs you otherwise is committing a crime.

Table of Contents

Matthews Asia Funds

matthewsasia.com

Contents

| FUND SUMMARIES |

||||

| ASIA GROWTH AND INCOME STRATEGIES |

||||

| 1 | ||||

| 5 | ||||

| 9 | ||||

| ASIA VALUE STRATEGY |

||||

| 13 | ||||

| ASIA GROWTH STRATEGIES |

||||

| 17 | ||||

| 21 | ||||

| 24 | ||||

| 28 | ||||

| 32 | ||||

| 36 | ||||

| 40 | ||||

| 44 | ||||

| 48 | ||||

| 51 | ||||

| ASIA SMALL COMPANY STRATEGIES |

||||

| 54 | ||||

| 58 | ||||

| 63 | ||||

| Additional Fund Information |

||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 82 | ||||

| 92 | ||||

| 98 | ||||

| 98 | ||||

| 98 | ||||

| 101 | ||||

| 101 | ||||

| 101 | ||||

| 102 | ||||

| 104 | ||||

| 107 | ||||

| 108 | ||||

| 108 | ||||

Please read this document carefully before you make any investment decision. If you have any questions, do not hesitate to contact a Matthews Asia Funds representative at 800.789.ASIA (2742) or visit matthewsasia.com.

Please keep this prospectus with your other account documents for future reference.

Table of Contents

| MATTHEWS ASIAN GROWTH AND INCOME FUND | 1 |

Table of Contents

| 2 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIAN GROWTH AND INCOME FUND | 3 |

Table of Contents

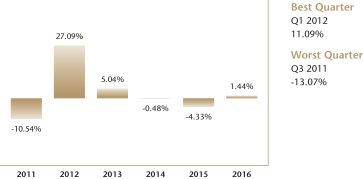

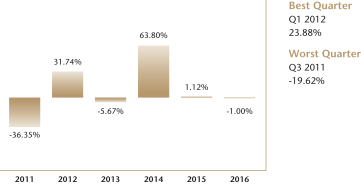

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Asian Growth and Income Fund |

||||||||||||

| Return before taxes |

1.44% | 5.21% | 2.75% | |||||||||

| Return after taxes on distributions1 |

-0.84% | 3.84% | 1.40% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

2.23% | 3.99% | 2.13% | |||||||||

| MSCI All Country Asia ex Japan Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | 5.13% | 1.66% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Robert Horrocks, PhD, is Chief Investment Officer at Matthews and has been a Portfolio Manager of the Asian Growth and Income Fund since 2009.

Lead Manager: Kenneth Lowe, CFA, has been a Portfolio Manager of the Asian Growth and Income Fund since 2011.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 4 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA DIVIDEND FUND | 5 |

Table of Contents

| 6 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA DIVIDEND FUND | 7 |

Table of Contents

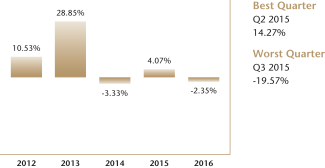

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Asia Dividend Fund |

||||||||||||

| Return before taxes |

4.33% | 7.98% | 5.12% | |||||||||

| Return after taxes on distributions1 |

3.70% | 7.19% | 4.41% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

2.99% | 6.23% | 4.03% | |||||||||

| MSCI All Country Asia Pacific Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.21% | 6.38% | 3.50% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Yu Zhang, CFA, has been a Portfolio Manager of the Asia Dividend Fund since 2011.

Lead Manager: Robert Horrocks, PhD, is Chief Investment Officer at Matthews and has been a Portfolio Manager of the Asia Dividend Fund since 2013.

Co-Manager: Vivek Tanneeru has been a Portfolio Manager of the Asia Dividend Fund since 2014.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 8 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS CHINA DIVIDEND FUND | 9 |

Table of Contents

| 10 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS CHINA DIVIDEND FUND | 11 |

Table of Contents

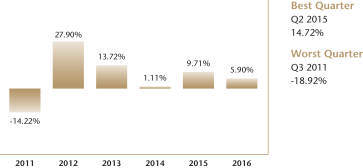

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews China Dividend Fund |

||||||||||||

| Return before taxes |

5.90% | 11.31% | 7.05% | |||||||||

| Return after taxes on distributions1 |

4.78% | 10.05% | 5.88% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

3.83% | 8.68% | 5.27% | |||||||||

| MSCI China Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 1.11% | 5.29% | 0.41% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Yu Zhang, CFA, has been a Portfolio Manager of the China Dividend Fund since 2012.

Co-Manager: Sherwood Zhang, CFA, has been a Portfolio Manager of the China Dividend Fund since 2014.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 12 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA VALUE FUND | 13 |

Table of Contents

| 14 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA VALUE FUND | 15 |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (11/30/15) |

|||||||

| Matthews Asia Value Fund |

||||||||

| Return before taxes |

7.72% | 5.82% | ||||||

| Return after taxes on distributions1 |

4.77% | 3.01% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

4.71% | 3.35% | ||||||

| MSCI All Country Asia ex Japan Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | 4.89% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Beini Zhou, CFA, has been a Portfolio Manager of the Asia Value Fund since its inception in 2015.

Co-Manager: Michael B. Han, CFA, has been a Portfolio Manager of the Asia Value Fund since its inception in 2015.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 16 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA FOCUS FUND | 17 |

Table of Contents

| 18 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA FOCUS FUND | 19 |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (4/30/13) |

|||||||

| Matthews Asia Focus Fund |

||||||||

| Return before taxes |

5.05% | -1.53% | ||||||

| Return after taxes on distributions1 |

4.71% | -1.81% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

3.23% | -1.12% | ||||||

| MSCI All Country Asia ex Japan Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | 0.88% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Kenneth Lowe, CFA, has been a Portfolio Manager of the Asia Focus Fund since its inception in 2013.

Co-Manager: S. Joyce Li, CFA, has been a Portfolio Manager of the Asia Focus Fund since 2017.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 20 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA GROWTH FUND | 21 |

Table of Contents

| 22 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Investments in convertible securities may also subject the Fund to currency risk and risks associated with foreign exchange rate. Convertible securities may trade less frequently and in lower volumes, making it difficult for the Fund to value those securities.

Risks Associated with Medium-Size Companies: Medium-size companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss.

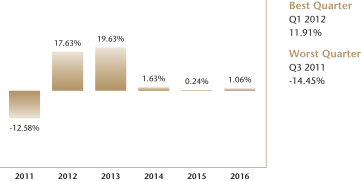

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Asia Growth Fund |

||||||||||||

| Return before taxes |

1.06% | 7.70% | 4.36% | |||||||||

| Return after taxes on distributions1 |

0.88% | 7.42% | 4.03% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

0.98% | 6.03% | 3.37% | |||||||||

| MSCI All Country Asia Pacific Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.21% | 6.38% | 3.50% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Taizo Ishida has been a Portfolio Manager of the Asia Growth Fund since 2007.

Co-Manager: Sharat Shroff, CFA, has been a Portfolio Manager of the Asia Growth Fund since 2007.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS ASIA GROWTH FUND | 23 |

Table of Contents

| 24 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS PACIFIC TIGER FUND | 25 |

Table of Contents

Risks Associated with China, Hong Kong and Taiwan

China: The Chinese government exercises significant control over China’s economy through its industrial policies (e.g., allocation of resources and other preferential treatment), monetary policy, management of currency exchange rates, and management of the payment of foreign currency-denominated obligations. Changes in these policies could adversely impact affected industries or companies. China’s economy, particularly its export-oriented industries, may be adversely impacted by trade or political disputes with China’s major trading partners, including the U.S. In addition, as its consumer class emerges, China’s domestically oriented industries may be especially sensitive to changes in government policy and investment cycles. China’s currency, which historically has been managed in a tight range relative to the U.S. dollar, may in the future be subject to greater uncertainty as Chinese authorities change the policies that determine the exchange rate mechanism.

Hong Kong: If China were to exert its authority so as to alter the economic, political or legal structures or the existing social policy of Hong Kong, investor and business confidence in Hong Kong could be negatively affected, which in turn could negatively affect markets and business performance and have an adverse effect on the Fund’s investments.

Taiwan: Although the relationship between China and Taiwan has been improving, there is the potential for future political or economic disturbances that may have an adverse impact on the values of investments in either China or Taiwan, or make investments in China and Taiwan impractical or impossible.

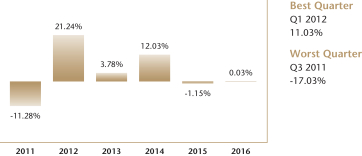

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Pacific Tiger Fund |

||||||||||||

| Return before taxes |

0.03% | 6.86% | 3.61% | |||||||||

| Return after taxes on distributions1 |

-0.55% | 5.90% | 2.82% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

0.62% | 5.45% | 2.91% | |||||||||

| MSCI All Country Asia ex Japan Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | 5.13% | 1.66% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| 26 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Sharat Shroff, CFA, has been a Portfolio Manager of the Pacific Tiger Fund since 2008.

Co-Manager: Rahul Gupta has been a Portfolio Manager of the Pacific Tiger Fund since 2015.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS PACIFIC TIGER FUND | 27 |

Table of Contents

| 28 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA ESG FUND | 29 |

Table of Contents

| 30 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURN FOR YEAR ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (4/30/2015) |

|||||||

| Matthews Asia ESG Fund |

||||||||

| Return before taxes |

-1.16% | -5.00% | ||||||

| Return after taxes on distributions1 |

-1.49% | -5.37% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

-0.30% | -3.78% | ||||||

| MSCI All Country Asia ex Japan Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | -8.86% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Vivek Tanneeru has been a Portfolio Manager of the Asia ESG Fund since its inception in 2015.

Co-Manager: Winnie Chwang has been a Portfolio Manager of the Asia ESG Fund since its inception in 2015.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS ASIA ESG FUND | 31 |

Table of Contents

| 32 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS EMERGING ASIA FUND | 33 |

Table of Contents

| 34 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (4/30/13) |

|||||||

| Matthews Emerging Asia Fund |

||||||||

| Return before taxes |

19.61% | 8.90% | ||||||

| Return after taxes on distributions1 |

19.23% | 8.81% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

11.80% | 7.07% | ||||||

| MSCI Emerging Markets Asia Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | 6.53% | 0.99% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Taizo Ishida has been a Portfolio Manager of the Emerging Asia Fund since its inception in 2013.

Lead Manager: Robert Harvey, CFA, has been a Portfolio Manager of the Emerging Asia Fund since its inception in 2013.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS EMERGING ASIA FUND | 35 |

Table of Contents

| 36 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA INNOVATORS FUND | 37 |

Table of Contents

| 38 | matthewsasia.com | 800.789.ASIA |

Table of Contents

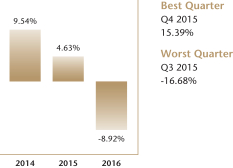

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark indices. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURN FOR YEAR ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (4/30/13) |

|||||||

| Matthews Asia Innovators Fund |

||||||||

| Return before taxes |

-8.92% | 7.51% | ||||||

| Return after taxes on distributions1 |

-11.04% | 5.82% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

-3.23% | 5.98% | ||||||

| MSCI All Country Asia ex Japan Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | 5.76% | 0.88% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Michael J. Oh, CFA, has been a Portfolio Manager of the Asia Innovators Fund since 2006.

Co-Manager: Lydia So, CFA, has been a Portfolio Manager of the Asia Innovators Fund since 2008.

Co-Manager: Robert Harvey, CFA, has been a Portfolio Manager of the Asia Innovators Fund since 2016.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS ASIA INNOVATORS FUND | 39 |

Table of Contents

| 40 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS CHINA FUND | 41 |

Table of Contents

companies, the Fund is subject to the risks associated with these industries. This makes the Fund more vulnerable to the price changes of securities issuers in science- and technology-related industries and to factors that affect these industries, relative to a fund that invests only limited amounts in these industries.

Risks Associated with China, Hong Kong and Taiwan

China: The Chinese government exercises significant control over China’s economy through its industrial policies (e.g., allocation of resources and other preferential treatment), monetary policy, management of currency exchange rates, and management of the payment of foreign currency- denominated obligations. Changes in these policies could adversely impact affected industries or companies. China’s economy, particularly its export-oriented industries, may be adversely impacted by trade or political disputes with China’s major trading partners, including the U.S. In addition, as its consumer class emerges, China’s domestically oriented industries may be especially sensitive to changes in government policy and investment cycles. China’s currency, which historically has been managed in a tight range relative to the U.S. dollar, may in the future be subject to greater uncertainty as Chinese authorities change the policies that determine the exchange rate mechanism.

Hong Kong: If China were to exert its authority so as to alter the economic, political or legal structures or the existing social policy of Hong Kong, investor and business confidence in Hong Kong could be negatively affected, which in turn could negatively affect markets and business performance and have an adverse effect on the Fund’s investments.

Taiwan: Although the relationship between China and Taiwan has been improving, there is the potential for future political or economic disturbances that may have an adverse impact on the values of investments in either China or Taiwan, or make investments in China and Taiwan impractical or impossible.

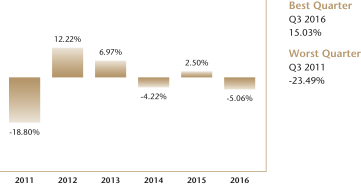

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews China Fund |

||||||||||||

| Return before taxes |

-5.06% | 2.27% | -1.80% | |||||||||

| Return after taxes on distributions1 |

-6.93% | 0.40% | -3.53% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

-1.09% | 1.85% | -1.19% | |||||||||

| MSCI China Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 1.11% | 5.29% | 0.41% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| 42 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Andrew Mattock, CFA, has been a Portfolio Manager of the China Fund since 2015.

Co-Manager: Henry Zhang, CFA, has been a Portfolio Manager of the China Fund since 2010.

Co-Manager: Winnie Chwang has been a Portfolio Manager of the China Fund since 2014.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS CHINA FUND | 43 |

Table of Contents

| 44 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS INDIA FUND | 45 |

Table of Contents

| 46 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews India Fund |

||||||||||||

| Return before taxes |

-1.00% | 15.30% | 3.96% | |||||||||

| Return after taxes on distributions1 |

-1.41% | 14.95% | 3.67% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

-0.22% | 12.35% | 3.07% | |||||||||

| S&P Bombay Stock Exchange 100 Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 2.32% | 8.97% | -0.47% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Sunil Asnani has been a Portfolio Manager of the India Fund since 2010.

Co-Manager: Sharat Shroff, CFA, has been a Portfolio Manager of the India Fund since 2006.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS INDIA FUND | 47 |

Table of Contents

| 48 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS JAPAN FUND | 49 |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Japan Fund |

||||||||||||

| Return before taxes |

0.51% | 11.54% | 9.71% | |||||||||

| Return after taxes on distributions1 |

0.34% | 11.40% | 9.34% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

0.66% | 9.25% | 7.72% | |||||||||

| MSCI Japan Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 2.73% | 8.45% | 5.78% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Kenichi Amaki has been a Portfolio Manager of the Japan Fund since 2010.

Co-Manager: Taizo Ishida has been a Portfolio Manager of the Japan Fund since 2006.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| 50 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS KOREA FUND | 51 |

Table of Contents

| 52 | matthewsasia.com | 800.789.ASIA |

Table of Contents

prove to be a material risk for any investments in South Korea. South Korea is dependent on foreign sources for its energy needs. A significant increase in energy prices could have an adverse impact on South Korea’s economy. The South Korean government has historically exercised and continues to exercise substantial influence over many aspects of the private sector. The South Korean government from time to time has informally influenced the prices of certain products, encouraged companies to invest or to concentrate in particular industries and induced mergers between companies in industries experiencing excess capacity.

Risks Associated with Medium-Size Companies: Medium-size companies may be subject to a number of risks not associated with larger, more established companies, potentially making their stock prices more volatile and increasing the risk of loss.

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURNS FOR YEARS ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | 5 years | Since Inception (10/29/10) |

||||||||||

| Matthews Korea Fund |

||||||||||||

| Return before taxes |

-6.31% | 7.97% | 6.75% | |||||||||

| Return after taxes on distributions1 |

-8.13% | 6.87% | 5.72% | |||||||||

| Return after taxes on distributions and sale of Fund shares1 |

-1.70% | 6.40% | 5.49% | |||||||||

| Korea Composite Stock Price Index2 |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | 0.98% | 2.38% | 1.37% | |||||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| 2 | Korea Composite Stock Price Index performance data may be readjusted periodically by the Korea Exchange due to certain factors, including the declaration of dividends. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Michael J. Oh, CFA, has been a Portfolio Manager of the Korea Fund since 2007.

Co-Manager: Michael B. Han, CFA, has been a Portfolio Manager of the Korea Fund since 2008.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS KOREA FUND | 53 |

Table of Contents

| 54 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS ASIA SMALL COMPANIES FUND | 55 |

Table of Contents

| 56 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Past Performance

The bar chart below shows the Fund’s performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURN FOR YEAR ENDED 12/31

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016

| 1 year | Since Inception (4/30/13) |

|||||||

| Matthews Asia Small Companies Fund |

||||||||

| Return before taxes |

-1.24% | 0.06% | ||||||

| Return after taxes on distributions1 |

-1.28% | 0.02% | ||||||

| Return after taxes on distributions and sale of Fund shares1 |

-0.44% | 0.17% | ||||||

| MSCI All Country Asia ex Japan Small Cap Index |

||||||||

| (reflects no deduction for fees, expenses or taxes) | -2.05% | -1.17% | ||||||

| 1 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Lydia So, CFA, has been a Portfolio Manager of the Asia Small Companies Fund since its inception in 2008.

Co-Manager: Kenichi Amaki has been a Portfolio Manager of the Asia Small Companies Fund since 2013.

Co-Manager: Beini Zhou, CFA, has been a Portfolio Manager of the Asia Small Companies Fund since 2014.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS ASIA SMALL COMPANIES FUND | 57 |

Table of Contents

| 58 | matthewsasia.com | 800.789.ASIA |

Table of Contents

| MATTHEWS CHINA SMALL COMPANIES FUND | 59 |

Table of Contents

| 60 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Past Performance

The bar chart below shows the performance for each full calendar year since its inception and how it has varied from year to year, reflective of the Fund’s volatility and some indication of risk. Also shown are the best and worst quarters for this time period. The table below shows the Fund’s performance over certain periods of time, along with performance of its benchmark index. The information presented below is past performance, before and after taxes, and is not a prediction of future results. Both the bar chart and performance table assume reinvestment of all dividends and distributions. For the Fund’s most recent month-end performance, please visit matthewsasia.com or call 800.789.ASIA (2742).

ANNUAL RETURN FOR YEAR ENDED 12/31 (FOR INVESTOR CLASS SHARES)1

AVERAGE ANNUAL TOTAL RETURNS FOR PERIODS ENDED DECEMBER 31, 2016 (FOR INVESTOR CLASS SHARES)1

| 1 year | 5 years | Since Inception (5/31/11) |

||||||||||

| Matthews China Small Companies Fund |

||||||||||||

| Return before taxes |

-2.35% | 6.95% | -0.25% | |||||||||

| Return after taxes on distributions2 |

-3.34% | 6.19% | -0.89% | |||||||||

| Return after taxes on distributions and sale of Fund shares2 |

-0.40% | 5.43% | -0.20% | |||||||||

| MSCI China Small Cap Index |

||||||||||||

| (reflects no deduction for fees, expenses or taxes) | -5.95% | 7.20% | -1.48% | |||||||||

| 1 | Return information is for Investor Class shares not presented in this Prospectus. Institutional Class shares would have substantially similar annual returns because the shares represent the same portfolio of securities and the annual returns would differ only to the extent that Institutional Class shares do not have the same expenses. |

| 2 | After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Investment Advisor

Matthews International Capital Management, LLC (“Matthews”)

Portfolio Managers

Lead Manager: Tiffany Hsiao, CFA has been a Portfolio Manager of the China Small Companies Fund since 2015.

Co-Manager: Kenichi Amaki has been a Portfolio Manager of the China Small Companies Fund since 2015.

For important information about the Purchase and Sale of Fund Shares; Tax Information; and Payments to Broker-Dealers and Other Financial Intermediaries, please turn to page 62.

| MATTHEWS CHINA SMALL COMPANIES FUND | 61 |

Table of Contents

Important Information

Purchase and Sale of Fund Shares

You may purchase and sell Fund shares directly through the Funds’ transfer agent by calling 800.789.ASIA (2742) or online at matthewsasia.com. Fund shares may also be purchased and sold through various securities brokers and benefit plan administrators or their sub-agents. You may purchase and redeem Fund shares by electronic bank transfer, check, or wire. The minimum initial and subsequent investment amounts for various types of accounts offered by the Funds are shown below.

| Minimum Initial Investment | Subsequent Investments | |

| $100,000 | $100 |

Minimum amount may be lower for purchases through certain financial intermediaries and different minimums may apply for retirement plans and other arrangements subject to criteria set by Matthews. The minimum investment requirements do not apply to Trustees, officers and employees of the Funds and Matthews, and their immediate family members.

Tax Information

The Funds’ distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Tax-deferred arrangements may be taxed later upon withdrawal from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), Matthews may pay the intermediary for the sale of Fund shares and related services. Shareholders who purchase or hold Fund shares through an intermediary may inquire about such payments from that intermediary. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 62 | matthewsasia.com | 800.789.ASIA |

Table of Contents

The financial highlights tables are intended to help you understand the Funds’ financial performance for the past 5 years or, if shorter, the period of the applicable Funds’ operations. Certain information reflects financial results for a single Fund share. The total returns in the tables represent the rate that an investor would have earned (or lost) on an investment in a Fund (assuming reinvestment of all dividends and distributions). This information has been audited by [ ], the Funds’ independent registered public accounting firm, whose report, along with the Funds’ financial statements, are included in the Funds’ annual report, which is available upon request.

Matthews Asian Growth and Income Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net Asset Value, beginning of year | $16.02 | $18.00 | $18.90 | $18.60 | $15.06 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)1 |

0.34 | 0.42 | 0.42 | 0.44 | 0.45 | |||||||||||||||

| Net realized gain (loss) and unrealized appreciation/ |

(0.07) | (1.19) | (0.50) | 0.48 | 3.58 | |||||||||||||||

| Total from investment operations |

0.27 | (0.77) | (0.08) | 0.92 | 4.03 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.50) | (0.45) | (0.38) | (0.50) | (0.49) | |||||||||||||||

| Net realized gains on investments |

(0.87) | (0.76) | (0.44) | (0.12) | — | |||||||||||||||

| Total distributions |

(1.37) | (1.21) | (0.82) | (0.62) | (0.49) | |||||||||||||||

| Paid-in capital from redemption fees | — | — | 2 | — | 2 | — | 2 | — | 2 | |||||||||||

| Net Asset Value, end of year | $14.92 | $16.02 | $18.00 | $18.90 | $18.60 | |||||||||||||||

| Total return* |

1.44% | (4.33%) | (0.48%) | 5.04% | 27.09% | |||||||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||||||

| Net assets, end of year (in 000s) | $809,254 | $823,619 | $1,182,690 | $1,120,218 | $856,876 | |||||||||||||||

| Ratio of expenses to average net assets before any reimbursement or waiver or recapture of expenses by Advisor and Administrator |

0.94% | 0.92% | 0.92% | 0.93% | 0.97% | |||||||||||||||

| Ratio of expenses to average net assets after any reimbursement or waiver or recapture of expenses by Advisor and Administrator |

0.94% | 0.92% | 0.92% | 0.93% | 0.97% | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 2.06% | 2.34% | 2.19% | 2.30% | 2.69% | |||||||||||||||

| Portfolio turnover3 | 15.64% | 16.48% | 16.79% | 15.27% | 17.43% | |||||||||||||||

1 Calculated using the average daily shares method.

2 Less than $0.01 per share.

3 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| FINANCIAL HIGHLIGHTS | 63 |

Table of Contents

Matthews Asia Dividend Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | ||||||||||||||||||||

| 20161 | 20151 | 20141 | 2013 | 2012 | ||||||||||||||||

| Net Asset Value, beginning of year | $15.35 | $15.26 | $15.59 | $14.57 | $12.48 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)2 |

0.30 | 0.32 | 0.32 | 0.34 | 0.37 | |||||||||||||||

| Net realized gain (loss) and unrealized appreciation/ |

0.38 | 0.29 | (0.33) | 1.30 | 2.29 | |||||||||||||||

| Total from investment operations |

0.68 | 0.61 | (0.01) | 1.64 | 2.66 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.31) | (0.29) | (0.25) | (0.62) | (0.57) | |||||||||||||||

| Net realized gains on investments |

(0.11) | — | (0.07) | — | — | |||||||||||||||

| Return of capital |

(0.09) | (0.23) | — | — | — | |||||||||||||||

| Total distributions |

(0.51) | (0.52) | (0.32) | (0.62) | (0.57) | |||||||||||||||

| Paid-in capital from redemption fees | — | — | 3 | — | 3 | — | 3 | — | 3 | |||||||||||

| Net Asset Value, end of year | $15.52 | $15.35 | $15.26 | $15.59 | $14.57 | |||||||||||||||

| Total return* |

4.33% | 3.93% | (0.18%) | 11.43% | 21.70% | |||||||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (in 000s) | $2,034,276 | $2,045,713 | $2,107,371 | $2,124,214 | $922,561 | |||||||||||||||

| Ratio of expenses to average net assets before any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

0.94% | 0.93% | 0.93% | 0.93% | 0.97% | |||||||||||||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

0.93% | 0.92% | 0.93% | 0.93% | 0.97% | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 1.91% | 1.98% | 2.02% | 2.17% | 2.72% | |||||||||||||||

| Portfolio turnover4 | 39.76% | 35.98% | 20.06% | 14.06% | 9.17% | |||||||||||||||

1 Consolidated Financial Highlights.

2 Calculated using the average daily shares method.

3 Less than $0.01 per share.

4 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| 64 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Matthews China Dividend Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net Asset Value, beginning of year | $13.79 | $13.37 | $13.74 | $12.34 | $10.06 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)1 |

0.29 | 0.28 | 0.28 | 0.33 | 0.22 | |||||||||||||||

| Net realized gain (loss) and unrealized appreciation/ |

0.51 | 1.04 | (0.13) | 1.32 | 2.53 | |||||||||||||||

| Total from investment operations |

0.80 | 1.32 | 0.15 | 1.65 | 2.75 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.30) | (0.30) | (0.38) | (0.26) | (0.48) | |||||||||||||||

| Net realized gains on investments |

(0.20) | (0.60) | (0.14) | — | — | |||||||||||||||

| Total distributions |

(0.50) | (0.90) | (0.52) | (0.26) | (0.48) | |||||||||||||||

| Paid-in capital from redemption fees | — | — | 2 | — | 2 | 0.01 | 0.01 | |||||||||||||

| Net Asset Value, end of year | $14.09 | $13.79 | $13.37 | $13.74 | $12.34 | |||||||||||||||

| Total return* |

5.90% | 9.71% | 1.11% | 13.72% | 27.90% | |||||||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (in 000s) | $27,758 | $15,406 | $30,662 | $24,790 | $201 | |||||||||||||||

| Ratio of expenses to average net assets before any reimbursement or waiver or recapture of expenses by Advisor and Administrator |

1.06% | 1.00% | 1.01% | 1.08% | 1.29% | |||||||||||||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.06% | 1.00% | 1.01% | 1.08% | 1.29% | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 2.09% | 1.89% | 2.06% | 2.54% | 1.87% | |||||||||||||||

| Portfolio turnover3 | 72.96% | 79.91% | 25.43% | 20.52% | 21.40% | |||||||||||||||

1 Calculated using the average daily shares method.

2 Less than $0.01 per share.

3 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| FINANCIAL HIGHLIGHTS | 65 |

Table of Contents

Matthews Asia Value Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout the period presented.

| Year Ended Dec. 31, 2016 |

Period

Ended Dec. 31, 20151 |

|||||||

| Net Asset Value, beginning of period | $9.83 | $10.00 | ||||||

| Income (loss) from investment operations: | ||||||||

| Net investment income (loss)2 |

0.10 | 0.02 | ||||||

| Net realized gain (loss) and unrealized appreciation/ |

0.67 | (0.15) | ||||||

| Total from investment operations |

0.77 | (0.13) | ||||||

| Less distributions from: | ||||||||

| Net investment income |

(0.71) | (0.04) | ||||||

| Net realized gains on investments |

(0.04) | — | ||||||

| Total distributions |

(0.75) | (0.04) | ||||||

| Net Asset Value, end of period | $9.85 | $9.83 | ||||||

| Total return* |

7.72% | (1.30%) | 3 | |||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||

| Net assets, end of period (in 000s) | $155 | $143 | ||||||

| Ratio of expenses to average net assets before any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

11.26% | 36.17% | 4 | |||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.25% | 1.25% | 4 | |||||

| Ratio of net investment income (loss) to average net assets | 1.01% | 2.41% | 4 | |||||

| Portfolio turnover5 | 19.60% | 10.80% | 3 | |||||

1 Commenced operations on November 30, 2015.

2 Calculated using the average daily shares method.

3 Not annualized.

4 Annualized.

5 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| 66 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Matthews Asia Focus Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout the period presented.

| Year Ended Dec. 31, | Period

Ended Dec. 31, 20131 |

|||||||||||||||

| 2016 | 2015 | 2014 | ||||||||||||||

| Net Asset Value, beginning of period | $8.69 | $10.04 | $9.66 | $10.00 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||

| Net investment income (loss)2 |

0.13 | 0.13 | 0.10 | 0.05 | ||||||||||||

| Net realized gain (loss) and unrealized appreciation/depreciation |

0.31 | (1.33) | 0.36 | (0.30) | ||||||||||||

| Total from investment operations |

0.44 | (1.20) | 0.46 | (0.25) | ||||||||||||

| Less distributions from: | ||||||||||||||||

| Net investment income |

(0.14) | (0.10) | (0.08) | (0.09) | ||||||||||||

| Net realized gains on investments |

— | 0.05 | — | — | ||||||||||||

| Total distributions |

(0.14) | (0.15) | (0.08) | (0.09) | ||||||||||||

| Paid-in capital from redemption fees | — | — | 3 | — | 3 | — | 3 | |||||||||

| Net Asset Value, end of period | $8.99 | $8.69 | $10.04 | $9.66 | ||||||||||||

| Total return* |

5.05% | (11.96%) | 4.77% | (2.48%) | 4 | |||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||

| Net assets, end of period (in 000s) | $5,397 | $5,700 | $7,148 | $2,118 | ||||||||||||

| Ratio of expenses to average net assets before any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

2.29% | 1.91% | 1.94% | 3.32% | 5 | |||||||||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.25% | 1.25% | 1.31% | 1.50% | 5 | |||||||||||

| Ratio of net investment income (loss) to average net assets | 1.37% | 1.30% | 0.96% | 0.79% | 5 | |||||||||||

| Portfolio turnover6 | 21.10% | 23.60% | 24.12% | 16.23% | 4 | |||||||||||

1 Commenced operations on April 30, 2013.

2 Calculated using the average daily shares method.

3 Less than $0.01 per share.

4 Not annualized.

5 Annualized.

6 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| FINANCIAL HIGHLIGHTS | 67 |

Table of Contents

Matthews Asia Growth Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net Asset Value, beginning of year | $21.24 | $21.19 | $21.26 | $18.08 | $15.37 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)1 |

0.10 | 0.16 | 0.16 | 0.15 | 0.17 | |||||||||||||||

| Net realized gain (loss) and unrealized appreciation/ |

0.13 | (0.11) | 0.19 | 3.39 | 2.54 | |||||||||||||||

| Total from investment operations |

0.23 | 0.05 | 0.35 | 3.54 | 2.71 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.28) | — | (0.42) | (0.36) | — | |||||||||||||||

| Total distributions |

(0.28) | — | (0.42) | (0.36) | — | |||||||||||||||

| Paid-in capital from redemption fees | — | — | 2 | — | 2 | — | 2 | — | 2 | |||||||||||

| Net Asset Value, end of year | $21.19 | $21.24 | $21.19 | $21.26 | $18.08 | |||||||||||||||

| Total return* |

1.06% | 0.24% | 1.63% | 19.63% | 17.63% | |||||||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (in 000s) | $195,949 | $249,886 | $287,262 | $227,852 | $147,142 | |||||||||||||||

| Ratio of expenses to average net assets | 0.96% | 0.91% | 0.91% | 0.93% | 0.98% | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 0.47% | 0.72% | 0.74% | 0.73% | 1.02% | |||||||||||||||

| Portfolio turnover3 | 13.61% | 29.51% | 22.24% | 10.77% | 44.76% | |||||||||||||||

1 Calculated using the average daily shares method.

2 Less than $0.01 per share.

3 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| 68 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Matthews Pacific Tiger Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | ||||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Net Asset Value, beginning of year | $23.52 | $26.56 | $24.97 | $24.41 | $20.32 | |||||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income (loss)1 |

0.16 | 0.44 | 0.18 | 0.21 | 0.21 | |||||||||||||||

| Net realized gain (loss) and unrealized appreciation/ |

(0.14) | (0.80) | 2.82 | 0.71 | 4.10 | |||||||||||||||

| Total from investment operations |

0.02 | (0.36) | 3.00 | 0.92 | 4.31 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income |

(0.17) | (0.47) | (0.18) | (0.20) | (0.20) | |||||||||||||||

| Net realized gains on investments |

(0.47) | (2.21) | (1.23) | (0.16) | (0.02) | |||||||||||||||

| Total distributions |

(0.64) | (2.68) | (1.41) | (0.36) | (0.22) | |||||||||||||||

| Paid-in capital from redemption fees | — | — | 2 | — | 2 | — | 2 | — | 2 | |||||||||||

| Net Asset Value, end of year | $22.90 | $23.52 | $26.56 | $24.97 | $24.41 | |||||||||||||||

| Total return* |

0.03% | (1.15%) | 12.03% | 3.78% | 21.24% | |||||||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $4,207,508 | $3,964,547 | $5,049,643 | $4,679,039 | $3,770,568 | |||||||||||||||

| Ratio of expenses to average net assets before any reimbursement or waiver or recapture of expenses by Advisor and Administrator | 0.91% | 0.91% | 0.92% | 0.92% | 0.95% | |||||||||||||||

| Ratio of expenses to average net assets after any reimbursement or waiver or recapture of expenses by Advisor and Administrator | 0.90% | 0.89% | 0.91% | 0.92% | 0.95% | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 0.65% | 1.61% | 0.68% | 0.83% | 0.95% | |||||||||||||||

| Portfolio turnover3 | 5.73% | 12.56% | 11.38% | 7.73% | 6.53% | |||||||||||||||

1 Calculated using the average daily shares method.

2 Less than $0.01 per share.

3 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| FINANCIAL HIGHLIGHTS | 69 |

Table of Contents

Matthews Asia ESG Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout the period presented.

| Year Ended Dec. 31, 2016 |

Period

Ended Dec. 31, 20151 |

|||||||

| Net Asset Value, beginning of period | $9.17 | $10.00 | ||||||

| Income (loss) from investment operations: | ||||||||

| Net investment income (loss)2 |

0.09 | 0.05 | ||||||

| Net realized gain (loss) and unrealized appreciation/depreciation |

(0.19) | (0.77) | ||||||

| Total from investment operations |

(0.10) | (0.72) | ||||||

| Less distributions from: | ||||||||

| Net investment income |

(0.15) | (0.11) | ||||||

| Total distributions |

(0.15) | (0.11) | ||||||

| Net Asset Value, end of period | $8.92 | $9.17 | ||||||

| Total return* |

(1.16%) | (7.14%) | 3 | |||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||

| Net assets, end of period (in 000s) | $3,382 | $1,686 | ||||||

| Ratio of expenses to average net assets before any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

3.36% | 8.90% | 4 | |||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.25% | 1.25% | 4 | |||||

| Ratio of net investment income (loss) to average net assets | 0.97% | 0.75% | 4 | |||||

| Portfolio turnover5 | 16.10% | 21.72% | 3 | |||||

1 Commenced operations on April 30, 2015.

2 Calculated using the average daily shares method.

3 Not annualized.

4 Annualized.

5 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| 70 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Matthews Emerging Asia Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout the period presented.

| Year Ended Dec. 31, | Period

Ended Dec. 31, 20131 |

|||||||||||||||

| 2016 | 2015 | 2014 | ||||||||||||||

| Net Asset Value, beginning of period | $11.29 | $11.60 | $9.92 | $10.00 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||

| Net investment income (loss)2 |

0.21 | 0.07 | 0.06 | 0.01 | ||||||||||||

| Net realized gain (loss) and unrealized appreciation/depreciation and foreign capital gains taxes |

1.99 | (0.34) | 1.69 | (0.07) | ||||||||||||

| Total from investment operations |

2.20 | (0.27) | 1.75 | (0.06) | ||||||||||||

| Less distributions from: | ||||||||||||||||

| Net investment income |

(0.15) | (0.01) | (0.07) | — | 3 | |||||||||||

| Net realized gains on investments |

(0.13) | (0.03) | — | — | ||||||||||||

| Return of capital |

— | — | — | (0.02) | ||||||||||||

| Total distributions |

(0.28) | (0.04) | (0.07) | (0.02) | ||||||||||||

| Paid-in capital from redemption fees | 0.01 | — | 3 | — | 3 | — | 3 | |||||||||

| Net Asset Value, end of period | $13.22 | $11.29 | $11.60 | $9.92 | ||||||||||||

| Total return* |

19.61% | (2.33%) | 17.68% | (0.55%) | 4 | |||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||

| Net assets, end of period (in 000s) | $95,724 | $55,278 | $21,350 | $2,017 | ||||||||||||

| Ratio of expenses to average net assets before any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.62% | 1.57% | 1.59% | 2.21% | 5 | |||||||||||

| Ratio of expenses to average net assets after any reimbursement, waiver or recapture of expenses by Advisor and Administrator |

1.25% | 1.25% | 1.33% | 1.75% | 5 | |||||||||||

| Ratio of net investment income (loss) to average net assets | 1.72% | 0.65% | 0.55% | 0.19% | 5 | |||||||||||

| Portfolio turnover6 | 34.90% | 12.14% | 8.21% | 1.66% | 4 | |||||||||||

1 Commenced operations on April 30, 2013.

2 Calculated using the average daily shares method.

3 Less than $0.01 per share.

4 Not annualized.

5 Annualized.

6 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| FINANCIAL HIGHLIGHTS | 71 |

Table of Contents

Matthews Asia Innovators Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.

| Year Ended Dec. 31, | Period

Ended Dec. 31, 20131 |

|||||||||||||||

| 2016 | 2015 | 2014 | ||||||||||||||

| Net Asset Value, beginning of period | $12.34 | $13.61 | $12.58 | $10.09 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||

| Net investment income (loss)2 |

0.01 | (0.02) | 0.03 | 0.04 | ||||||||||||

| Net realized gain (loss) and unrealized appreciation/depreciation |

(1.08) | 0.63 | 1.17 | 2.48 | ||||||||||||

| Total from investment operations |

(1.07) | 0.61 | 1.20 | 2.52 | ||||||||||||

| Less distributions from: | ||||||||||||||||

| Net investment income |

— | — | (0.09) | (0.03) | ||||||||||||

| Net realized gains on investments |

(1.13) | (1.88) | (0.08) | — | ||||||||||||

| Total distributions |

(1.13) | (1.88) | (0.17) | (0.03) | ||||||||||||

| Paid-in capital from redemption fees | — | — | 3 | — | 3 | — | 3 | |||||||||

| Net Asset Value, end of period | $10.14 | $12.34 | $13.61 | $12.58 | ||||||||||||

| Total return* |

(8.92%) | 4.63% | 9.54% | 24.99% | 4 | |||||||||||

| *The total return represents the rate that an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all dividends and distributions. | ||||||||||||||||

| RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||

| Net assets, end of period (in 000s) | $16,545 | $36,770 | $61,088 | $49,236 | ||||||||||||

| Ratio of expenses to average net assets | 1.01% | 0.97% | 0.95% | 1.00% | 5 | |||||||||||

| Ratio of net investment income (loss) to average net assets | 0.06% | (0.16%) | 0.21% | 0.56% | 5 | |||||||||||

| Portfolio turnover6 | 92.25% | 72.85% | 62.99% | 62.04% | 4 | |||||||||||

1 Institutional Class commenced operations on April 30, 2013.

2 Calculated using the average daily shares method.

3 Less than $0.01 per share.

4 Not annualized.

5 Annualized.

6 The portfolio turnover rate is calculated on the Fund as a whole without distinguishing between classes of shares issued.

| 72 | matthewsasia.com | 800.789.ASIA |

Table of Contents

Matthews China Fund

The table below sets forth financial data for a share of beneficial interest outstanding throughout each period presented.